Documentación Banana Contabilidad+

Extensa documentación, una gran cantidad de tutoriales en línea y explicaciones de cada una de las funciones del programa (en Inglés pero también en Alemán, Francés, Italiano) se pueden encontrar en la sección de Documentación.

Para recibir soporte técnico (también disponible en Español), accede a: Contacto y soporte

Cómo empezar

Documentaciones de las versiones anteriores:

- Documentación de Banana Contabilidad 9

- Documentación de Banana Contabilidad 8

- Documentación de Banana Contabilidad 7 y de las versiones anteriores

Index

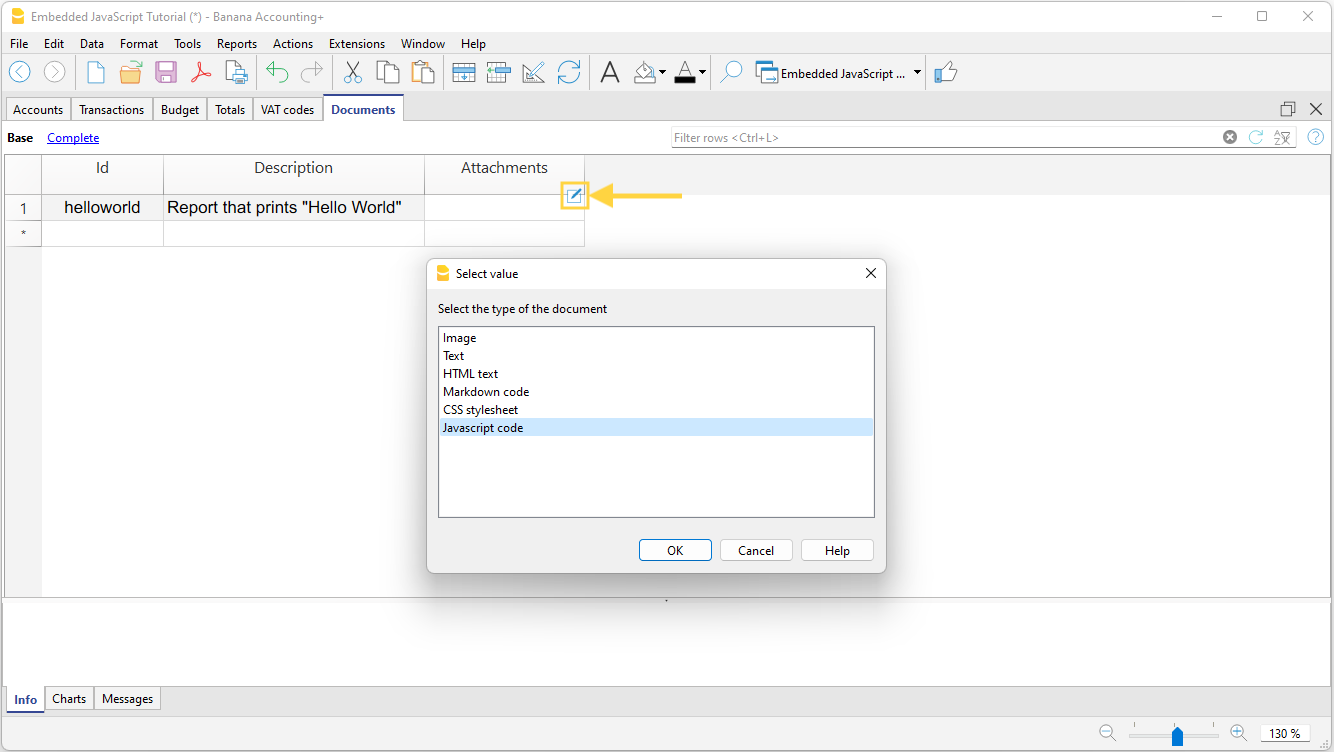

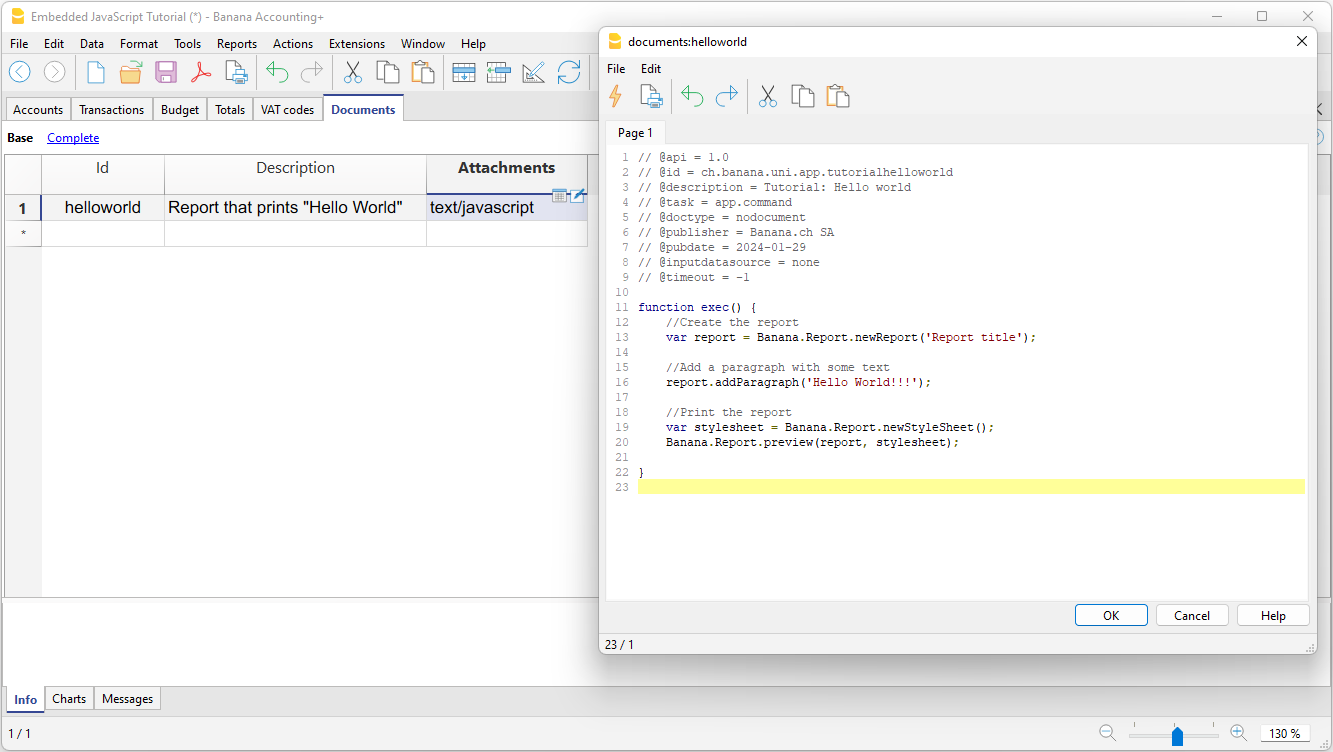

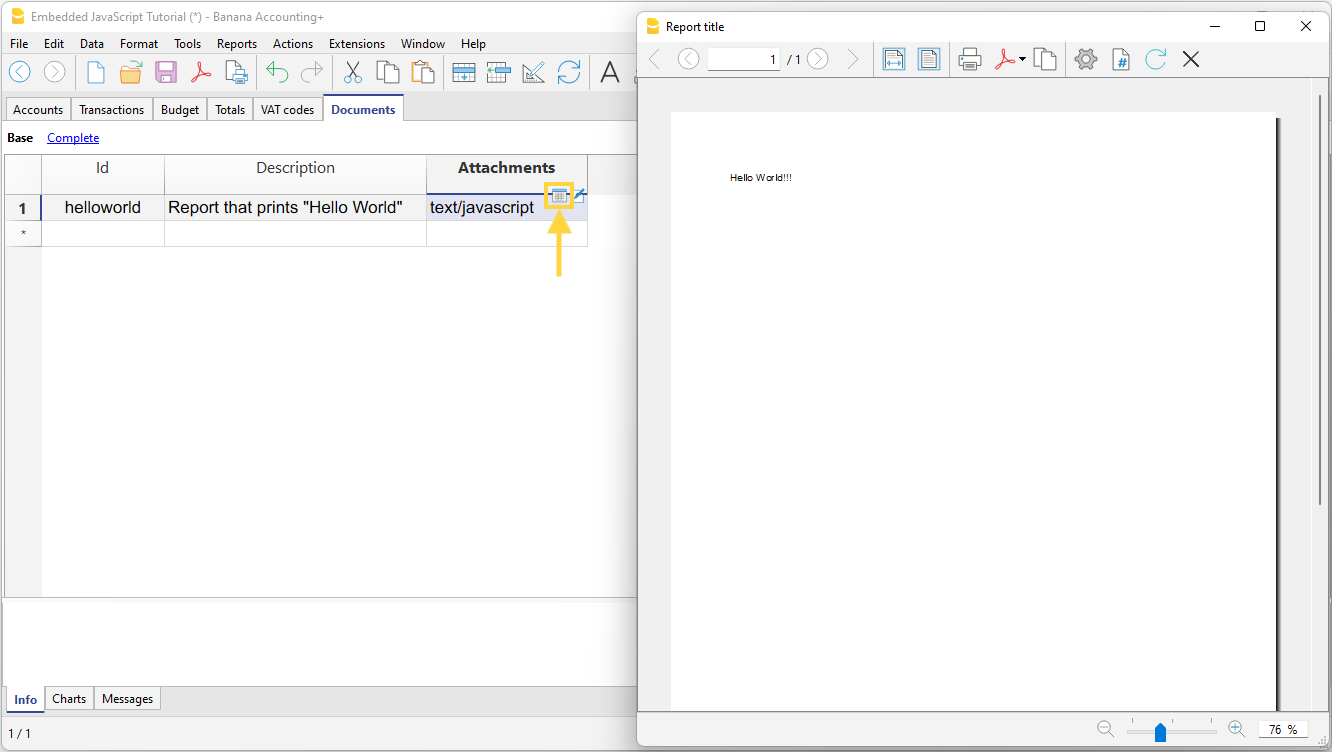

hello world

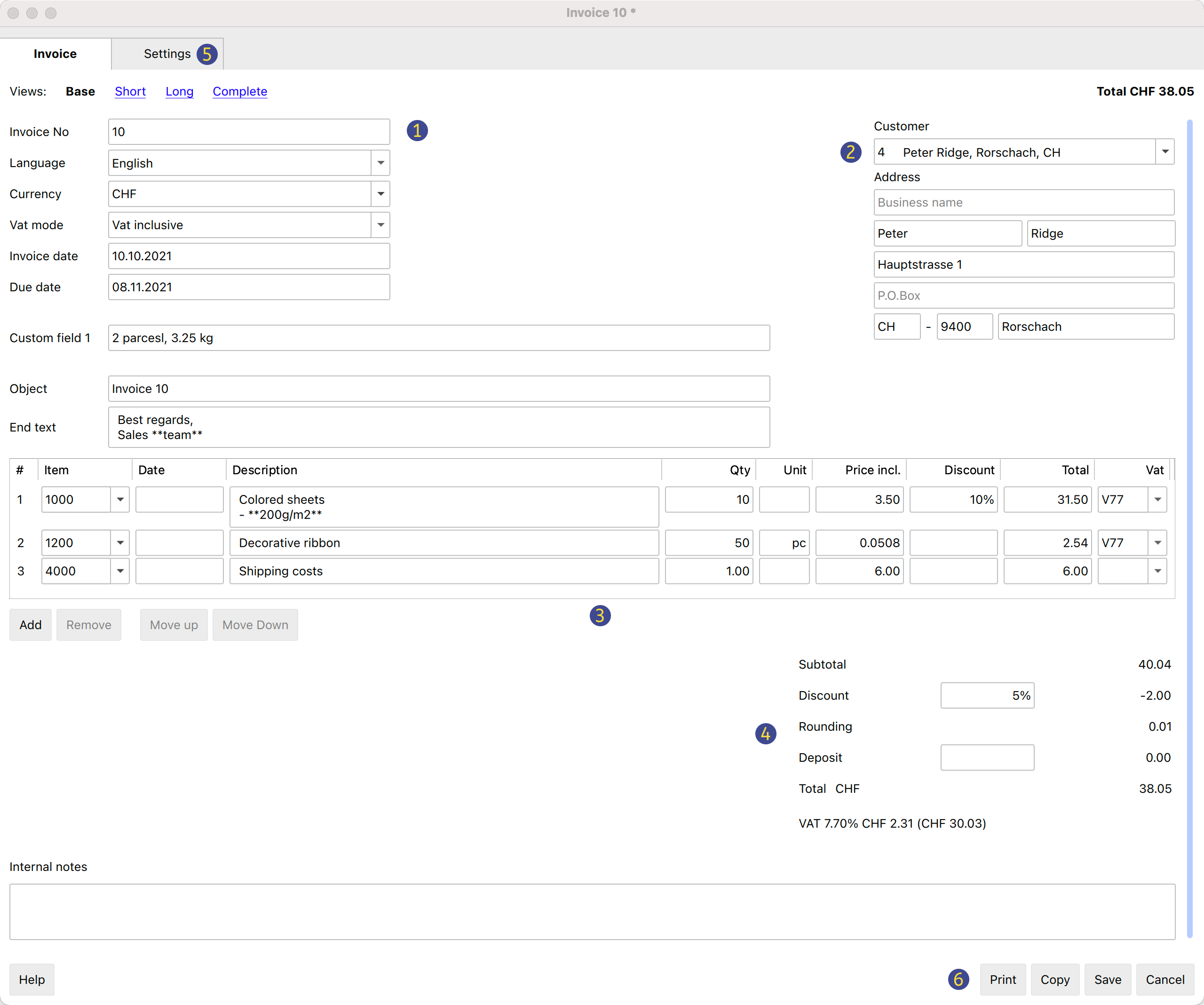

La interfaz de Banana Contabilidad Plus

¿Es nuevo en Banana Contabilidad Plus? No hay problema. En esta página le mostramos brevemente lo que encontrará en la pantalla principal y cómo funcionan los distintos elementos.

A primera vista, Banana Contabilidad es similar a Excel, basado en tablas, y su modo de uso es muy práctico e intuitivo. Pero pronto descubrirá que Banana Contabilidad Plus ofrece mucho más.

- ▶ Vídeo: La interfaz de Banana Contabilidad Plus

- Consejos y comandos para introducir datos rápidamente

1. La barra de menús

La barra de menús cambia según la aplicación que esté abierta. Cada menú contiene comandos específicos. Los menús en las aplicaciones contables son: Archivo, Modificar, Datos, Formato, Herramientas, Informes, Acciones, Extensiones, Ventanas, Ayuda.

Desde el menú Ayuda puede gestionar los datos de la suscripción a Banana Contabilidad Plus.

Advertencia: En los sistemas operativos Mac, la barra de menús se encuentra en la parte superior, a la derecha del logotipo de Apple con forma de manzana.

Novedad: En el menú Ventana dispone de varios comandos, que le permiten, entre otras cosas:

- Cambiar la disposición de las ventanas de datos (en paralelo o en cascada)

- Elegir diferentes configuraciones desde el comando Apariencia:

- Elegir qué elementos de la interfaz mostrar, para adaptarlos a pantallas pequeñas.

- Elegir el tema de visualización.

- Hacer visible el menú Desarrollo.

2. La barra de herramientas

La barra de herramientas proporciona acceso rápido a los cuadros de diálogo y comandos más utilizados.

Basta con pasar el ratón por encima del icono deseado y esperar un momento para ver una descripción de su función.

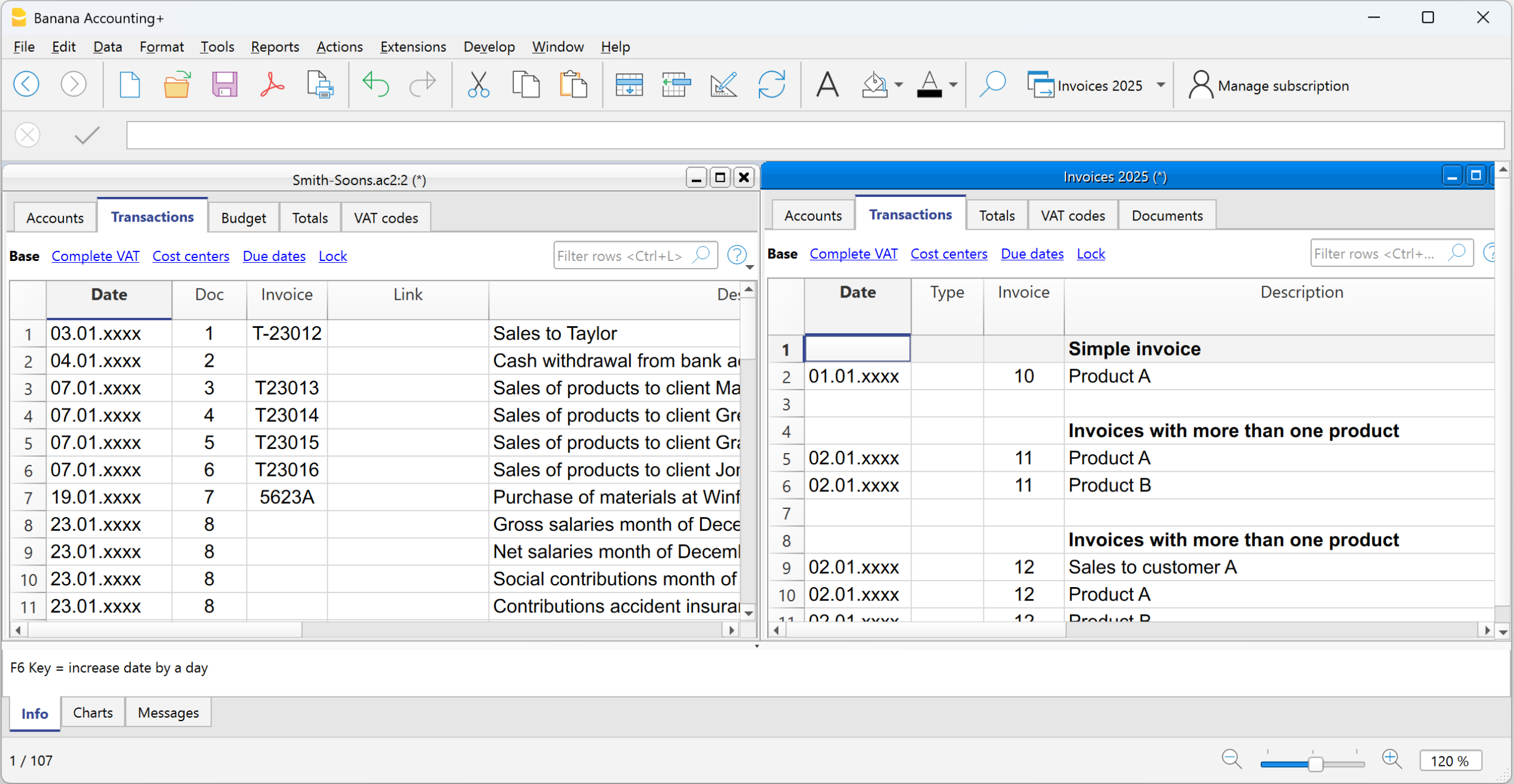

Novedad: Si tiene varios archivos abiertos, ahora puede ver fácilmente con cuál está trabajando y cambiar entre ellos de manera muy sencilla desde la barra de herramientas.

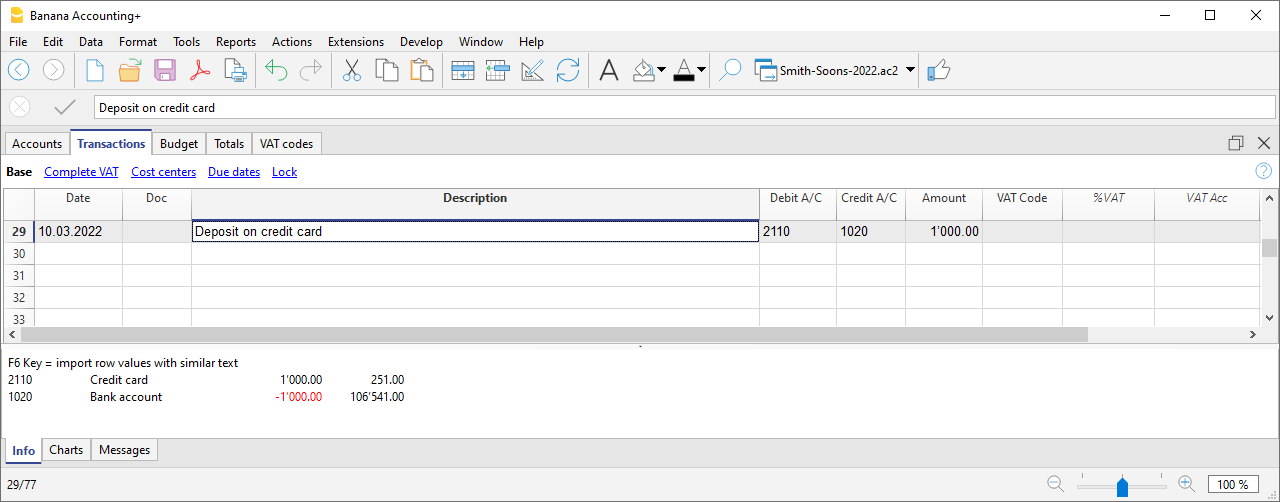

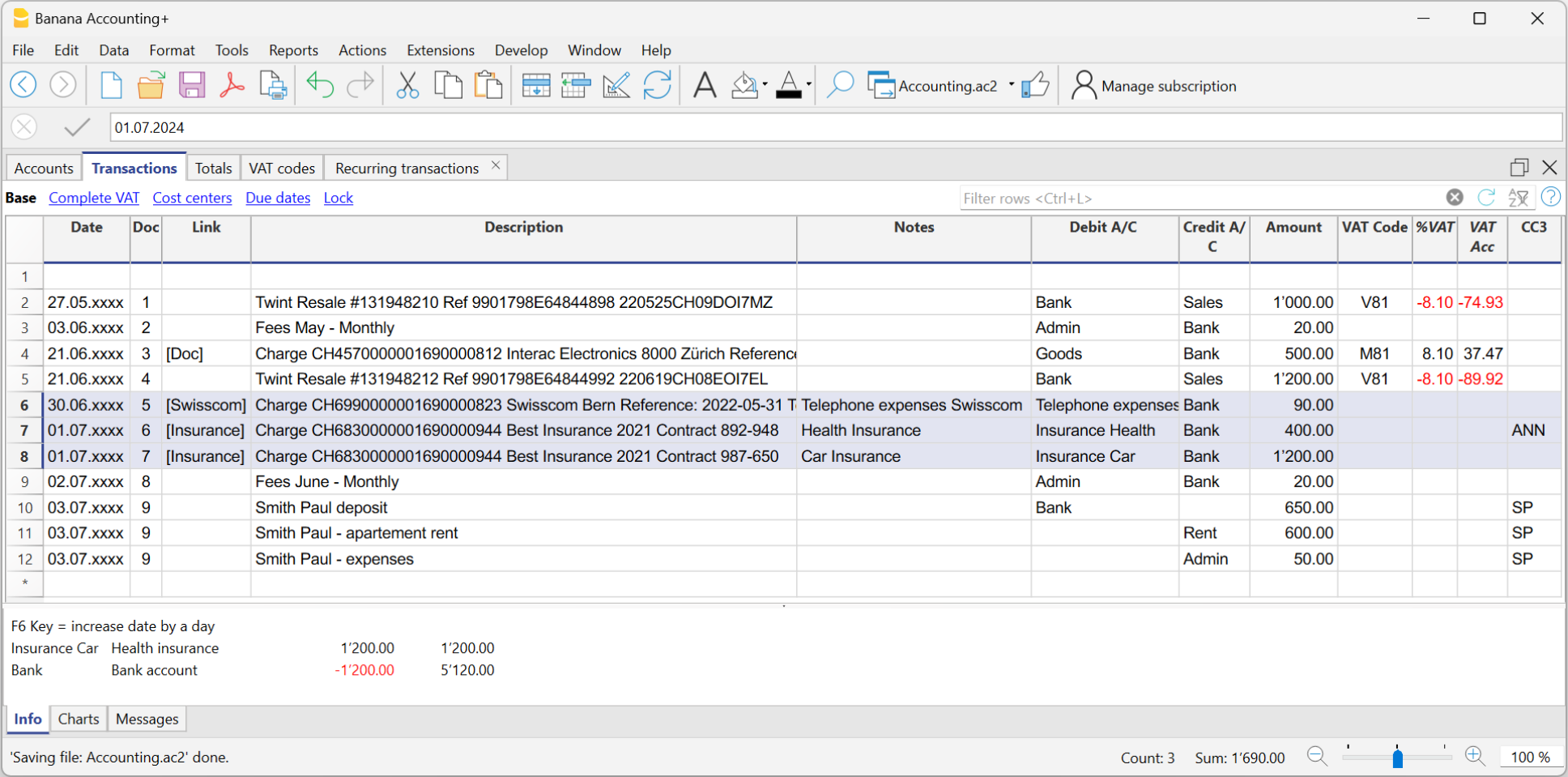

3. Área de introducción de texto

Normalmente, los textos se escriben directamente en la celda, pero también aparecen en el área situada debajo de la barra de herramientas, donde también pueden editarse. Varias funciones aceleran y automatizan su introducción.

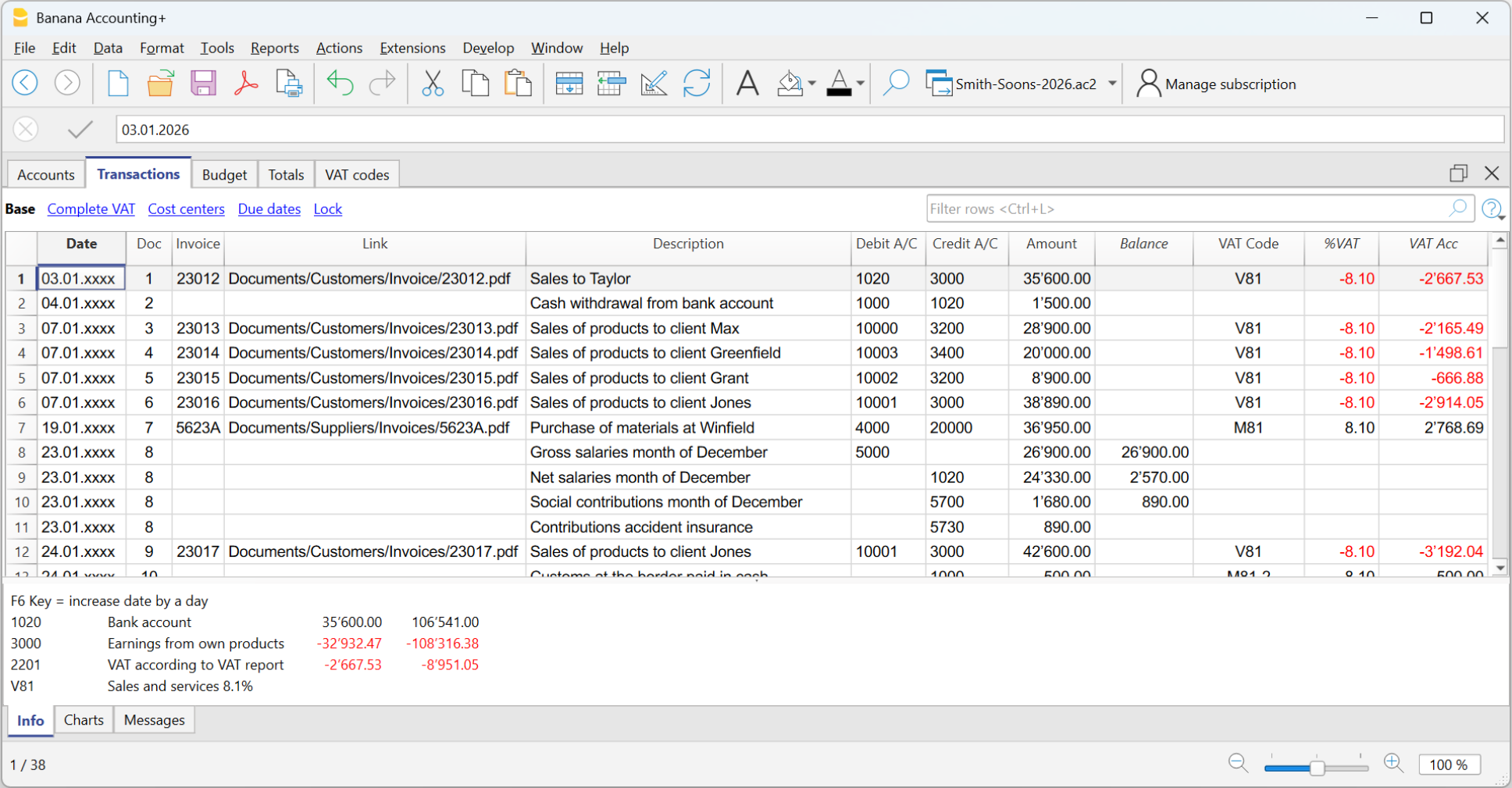

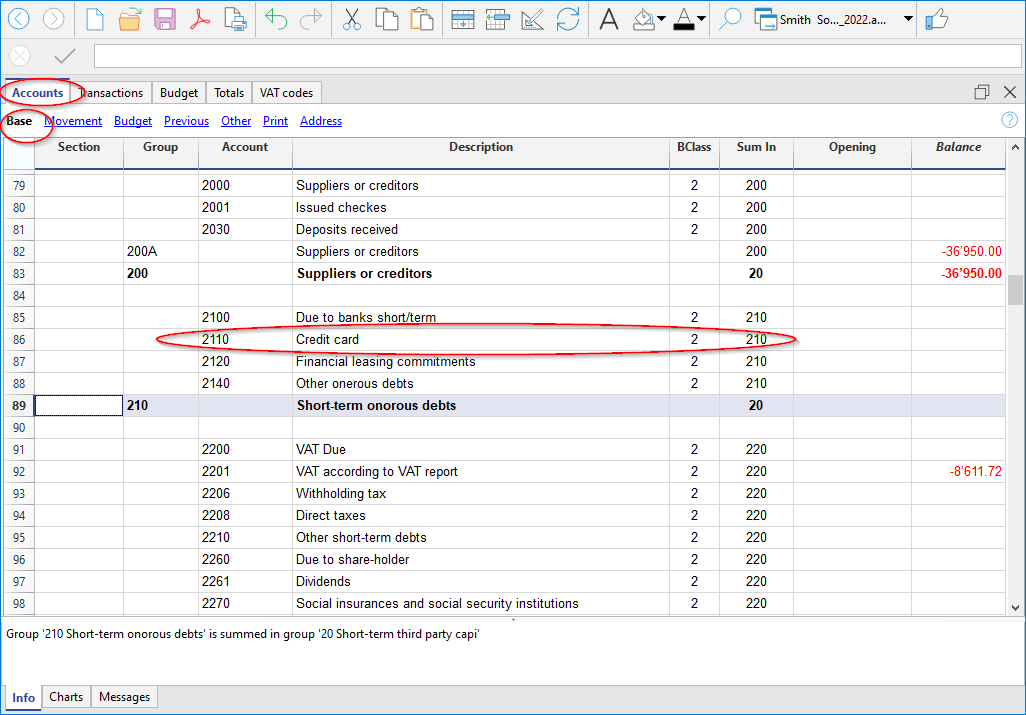

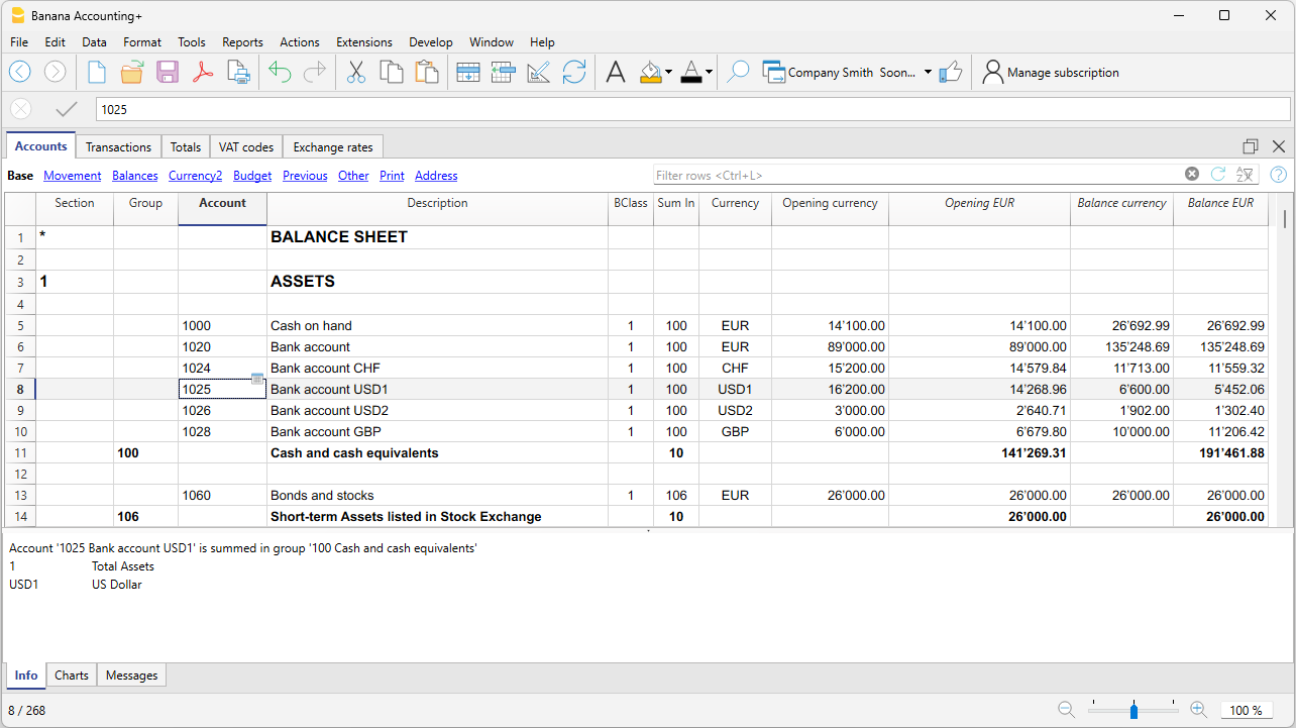

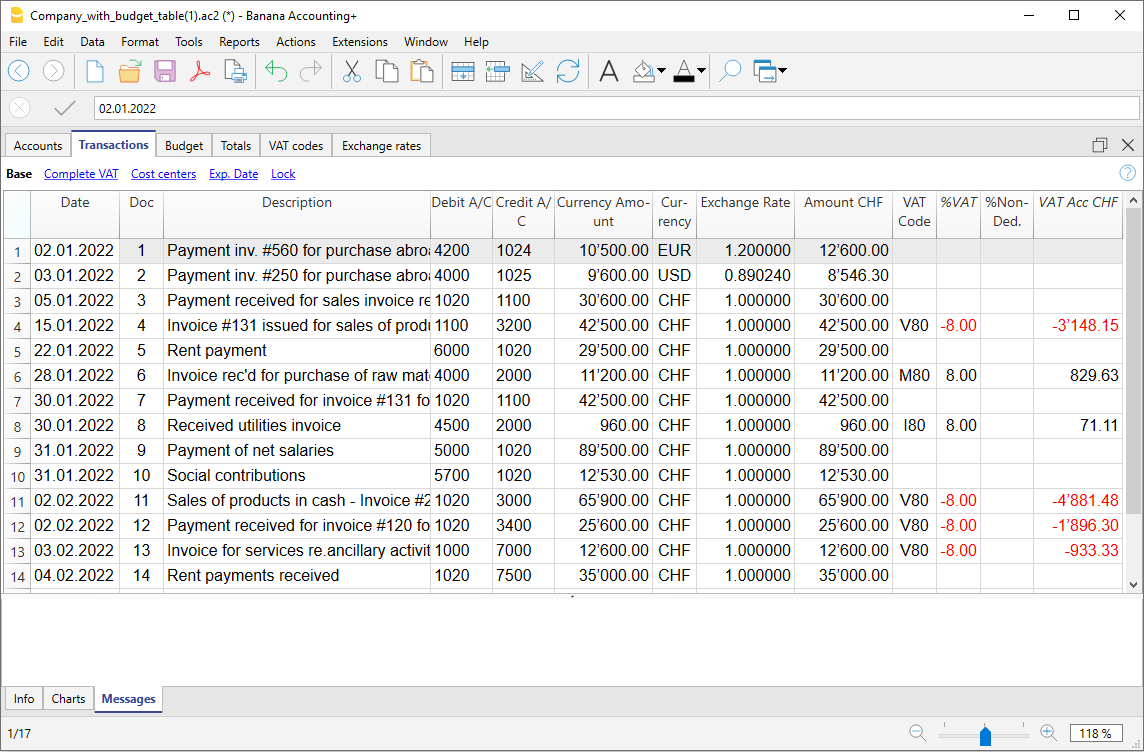

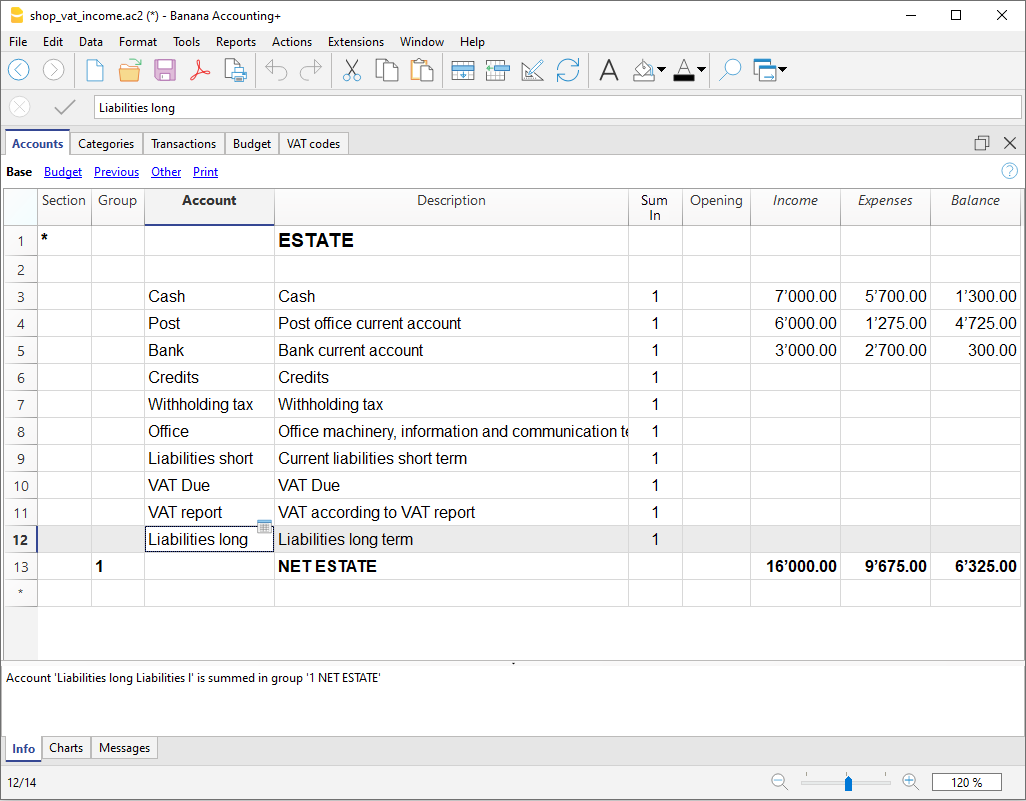

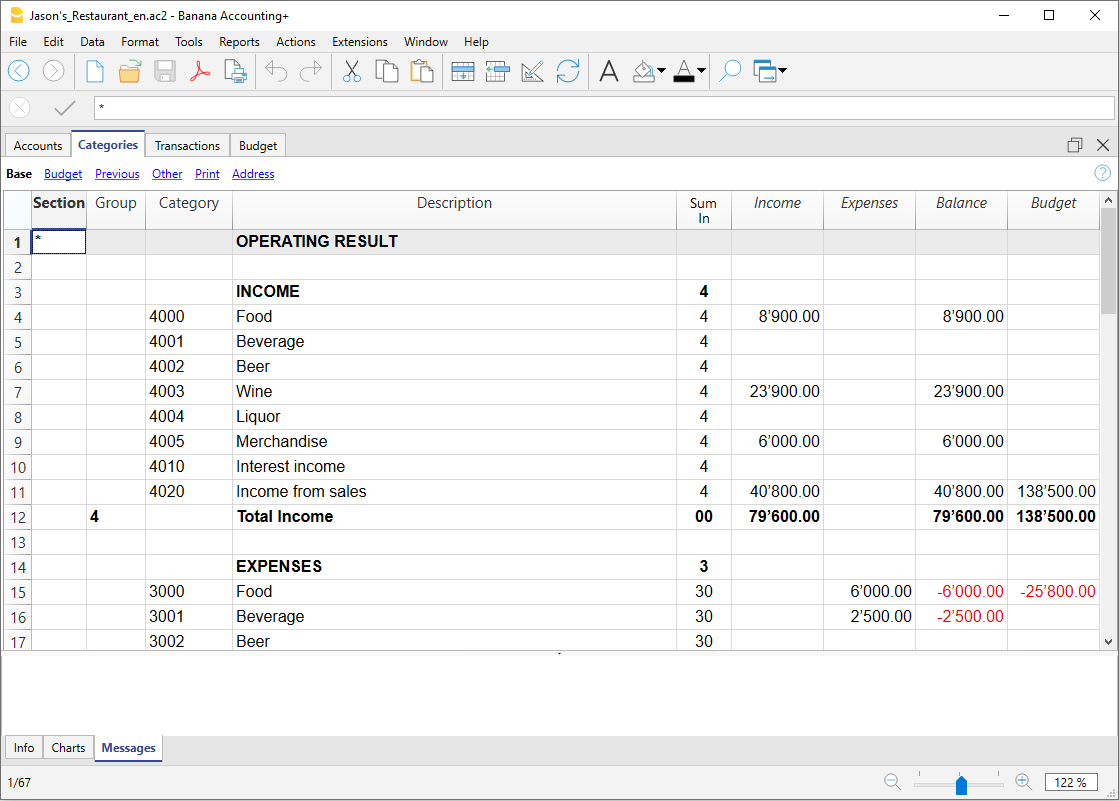

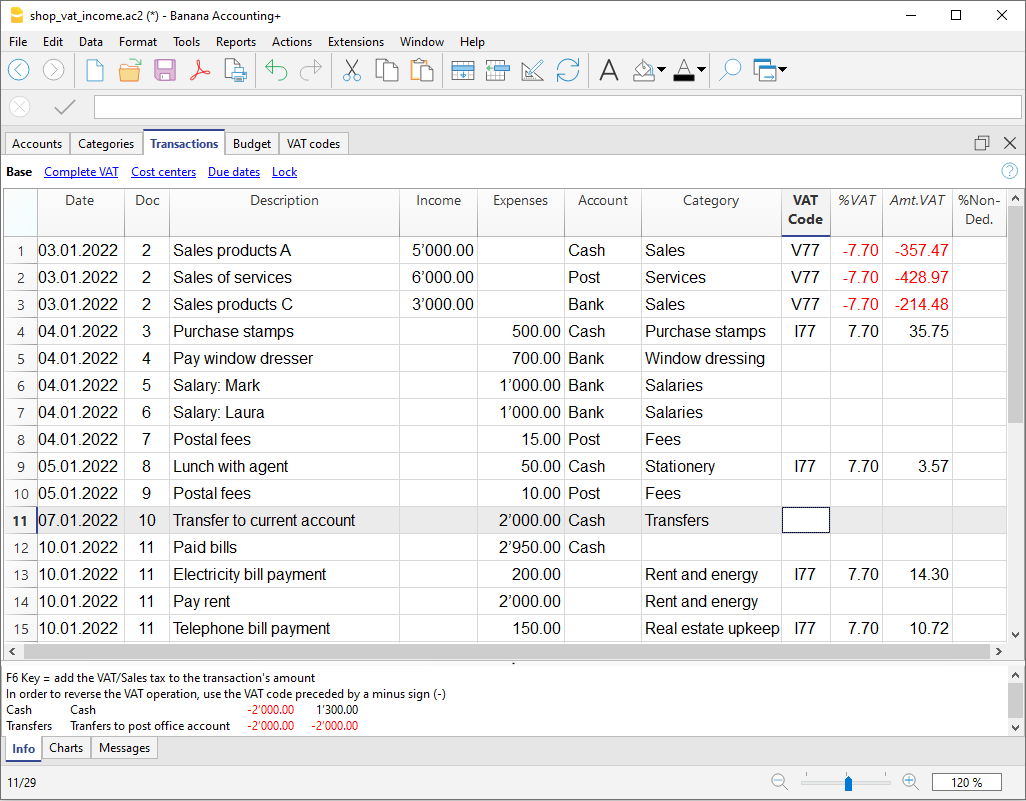

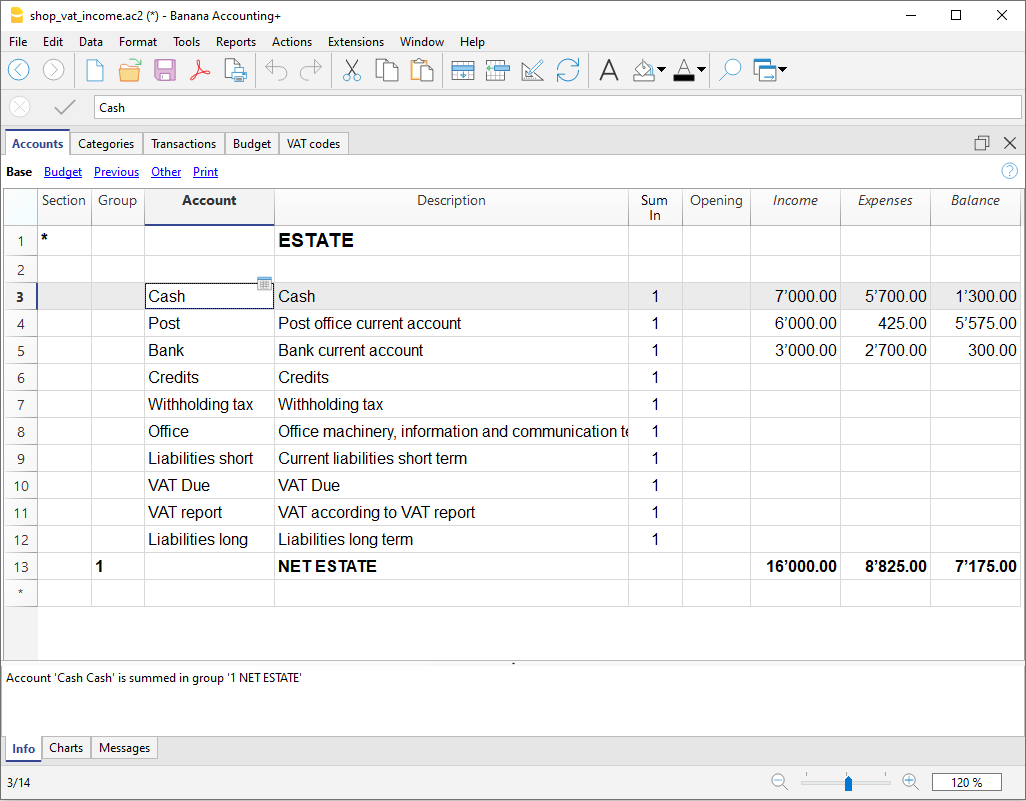

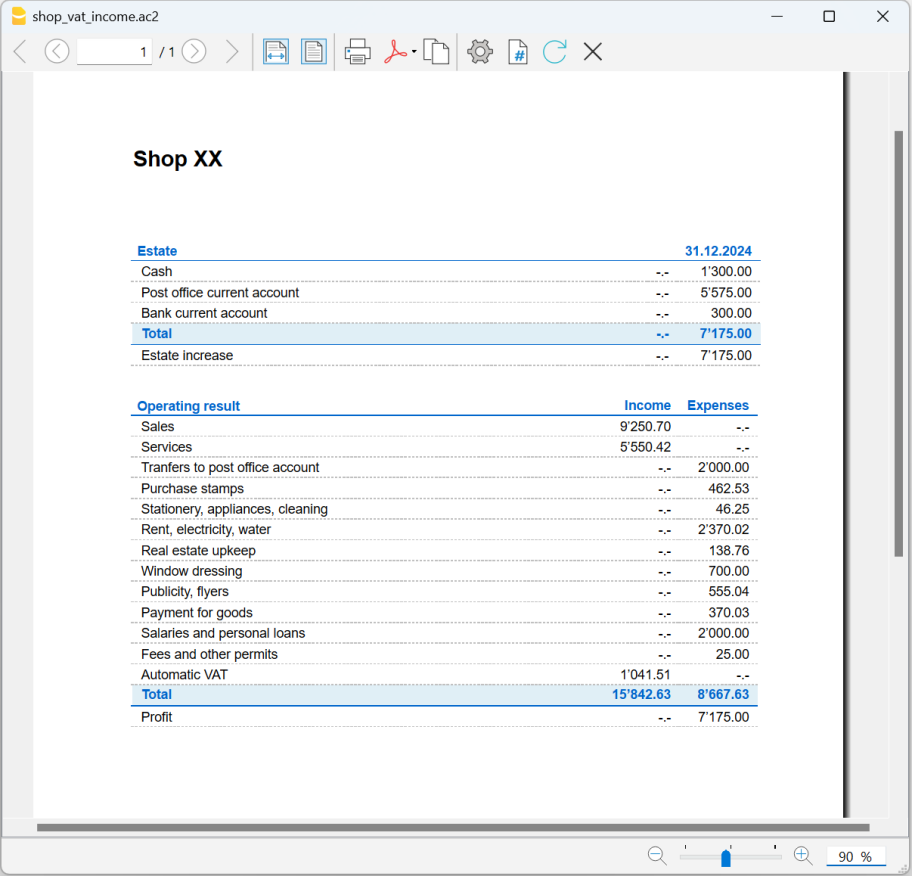

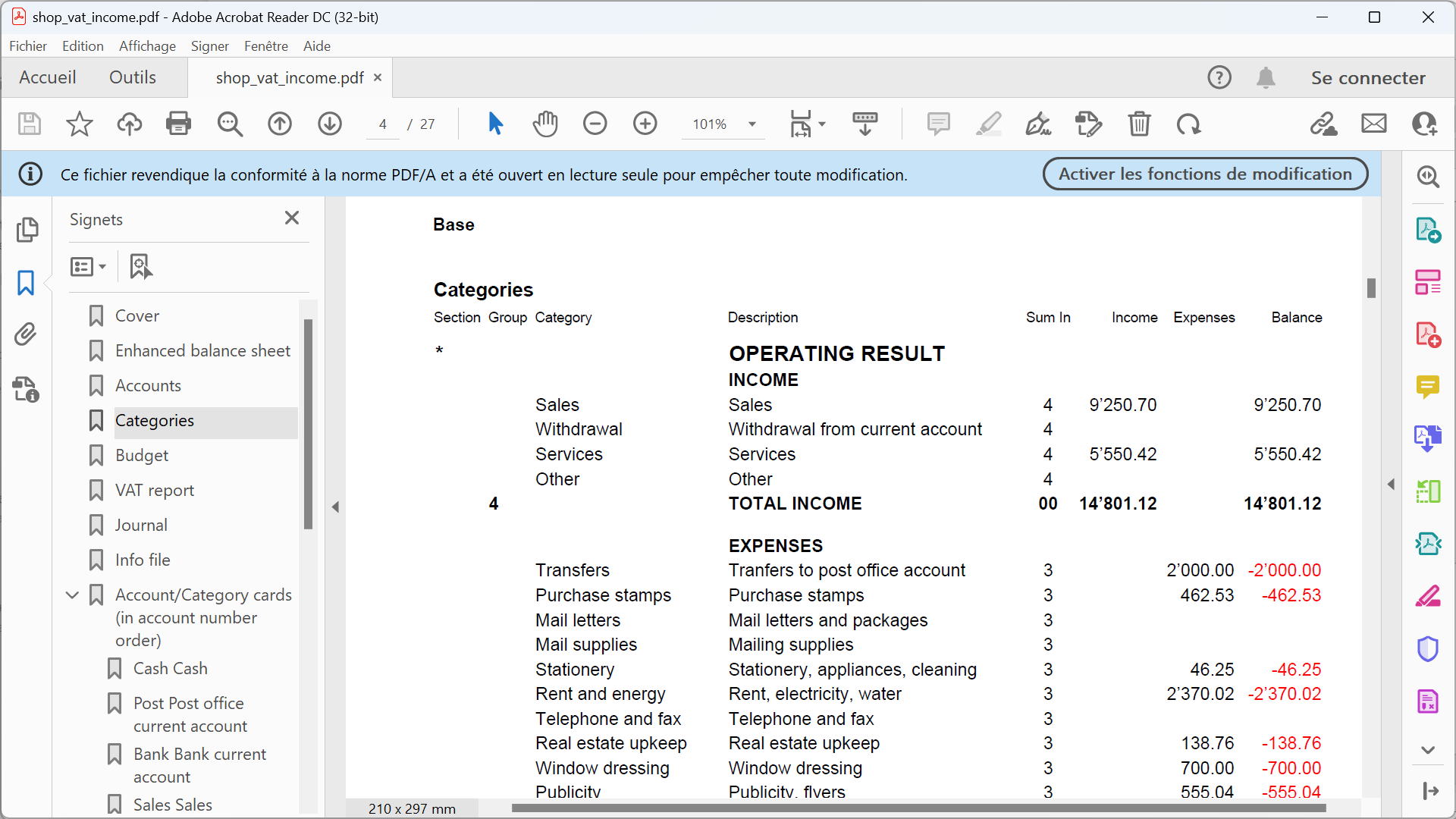

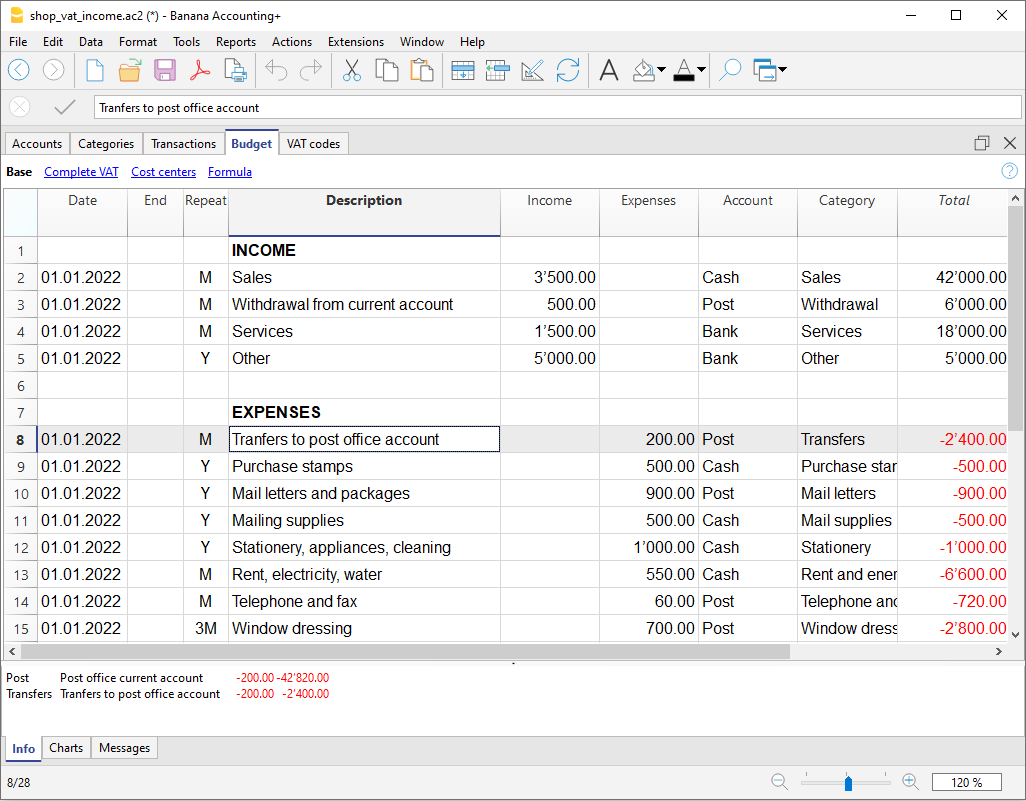

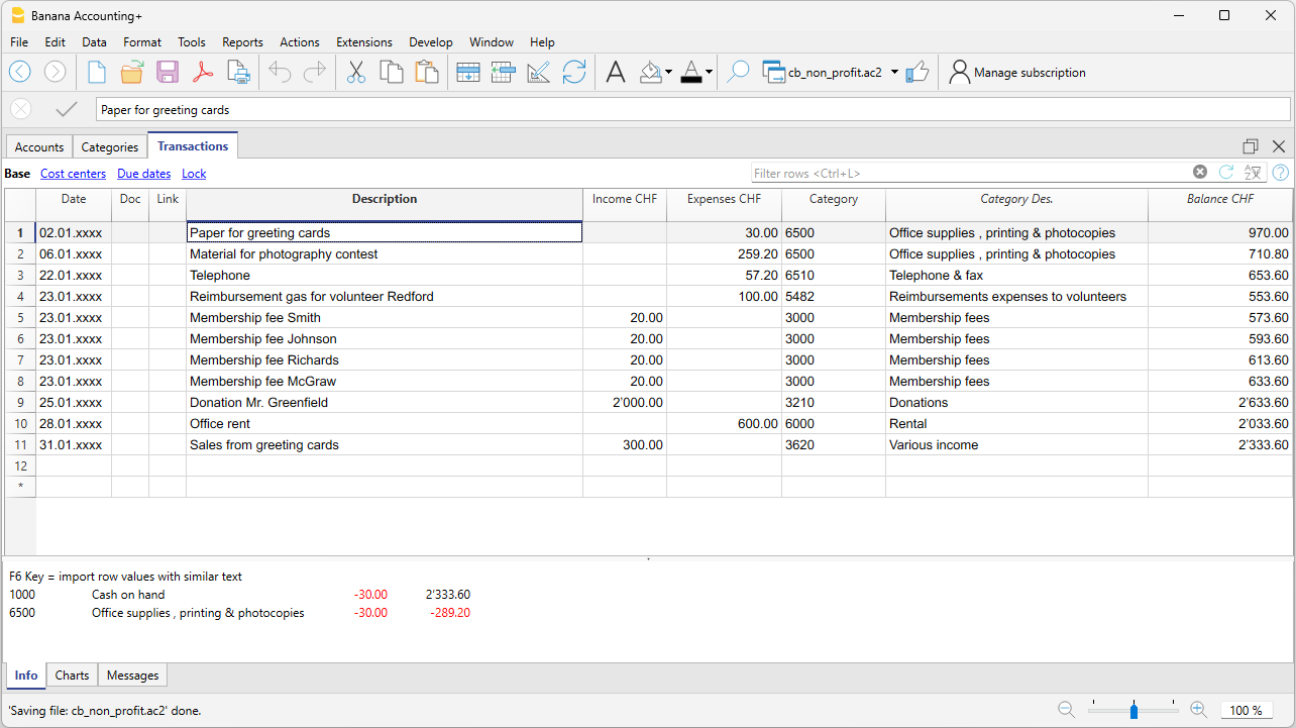

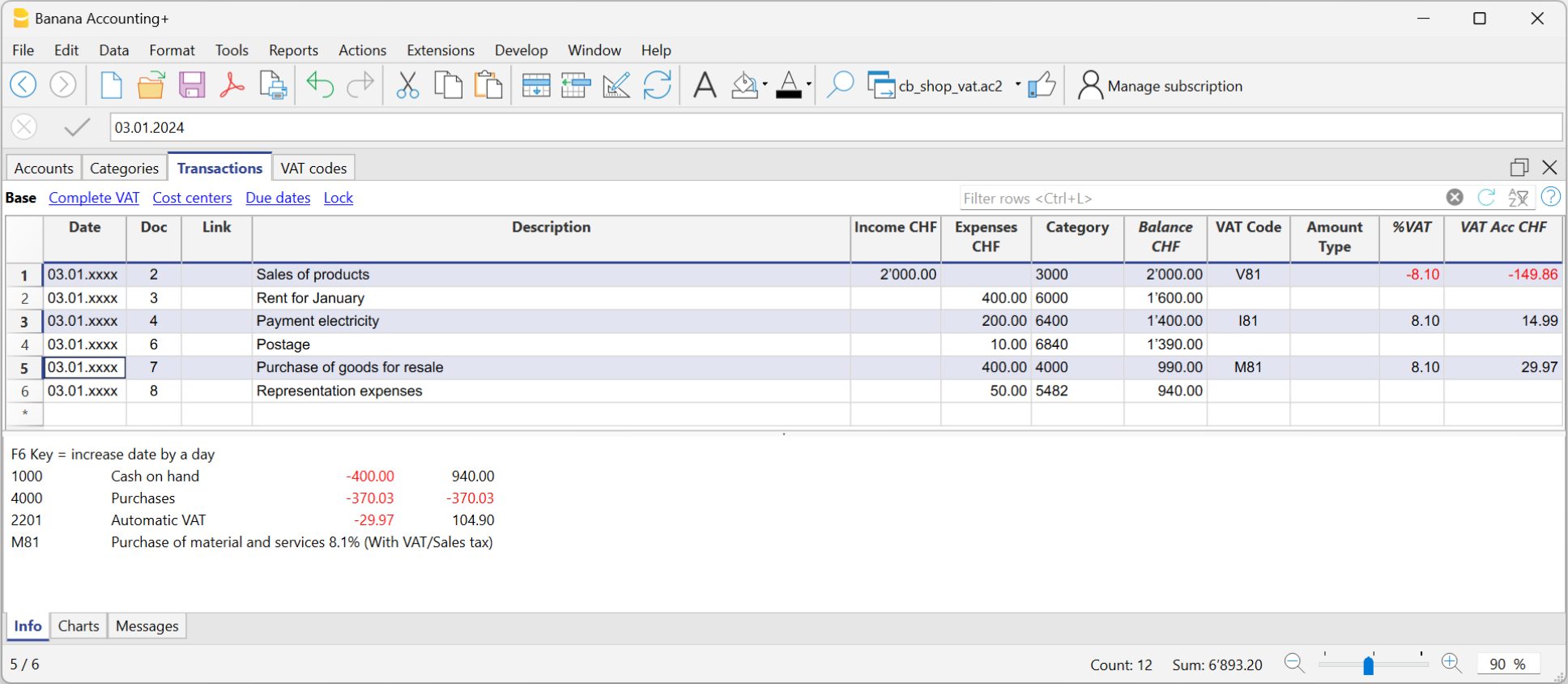

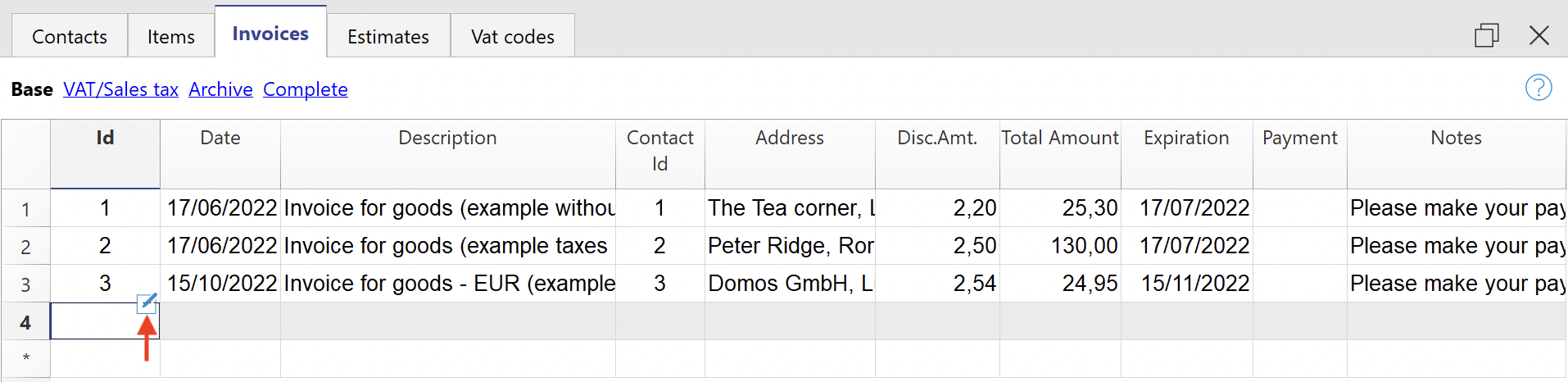

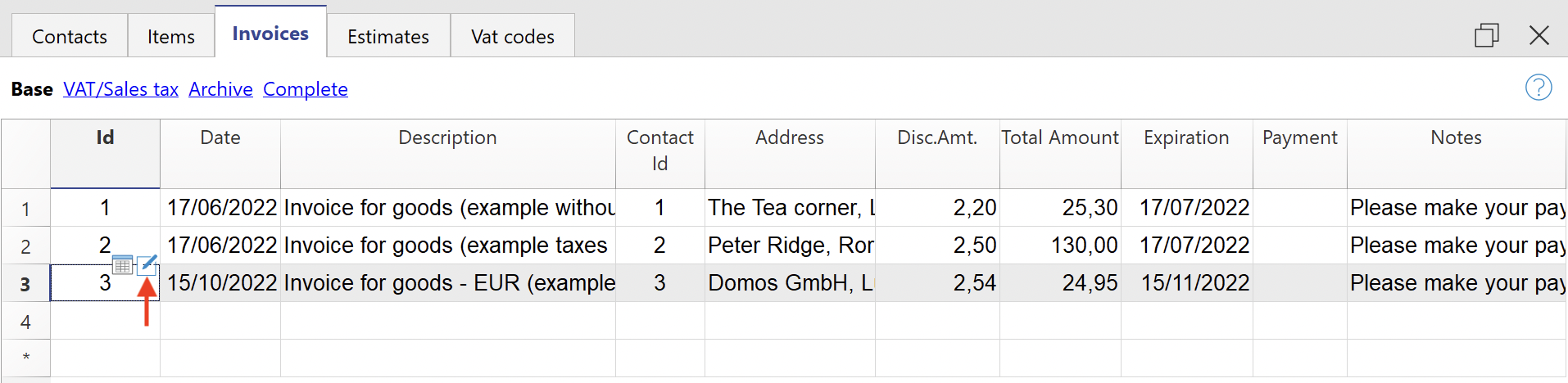

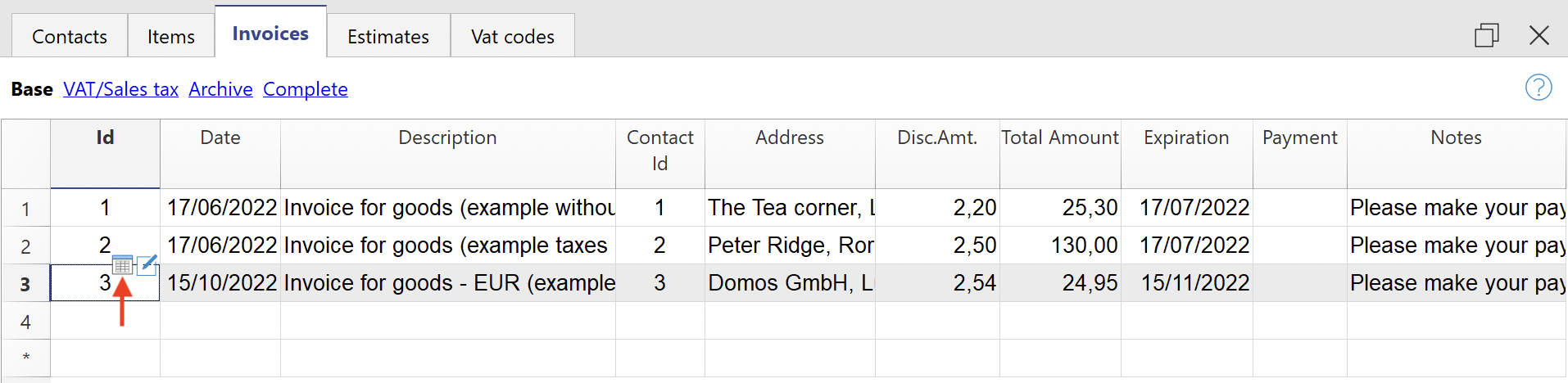

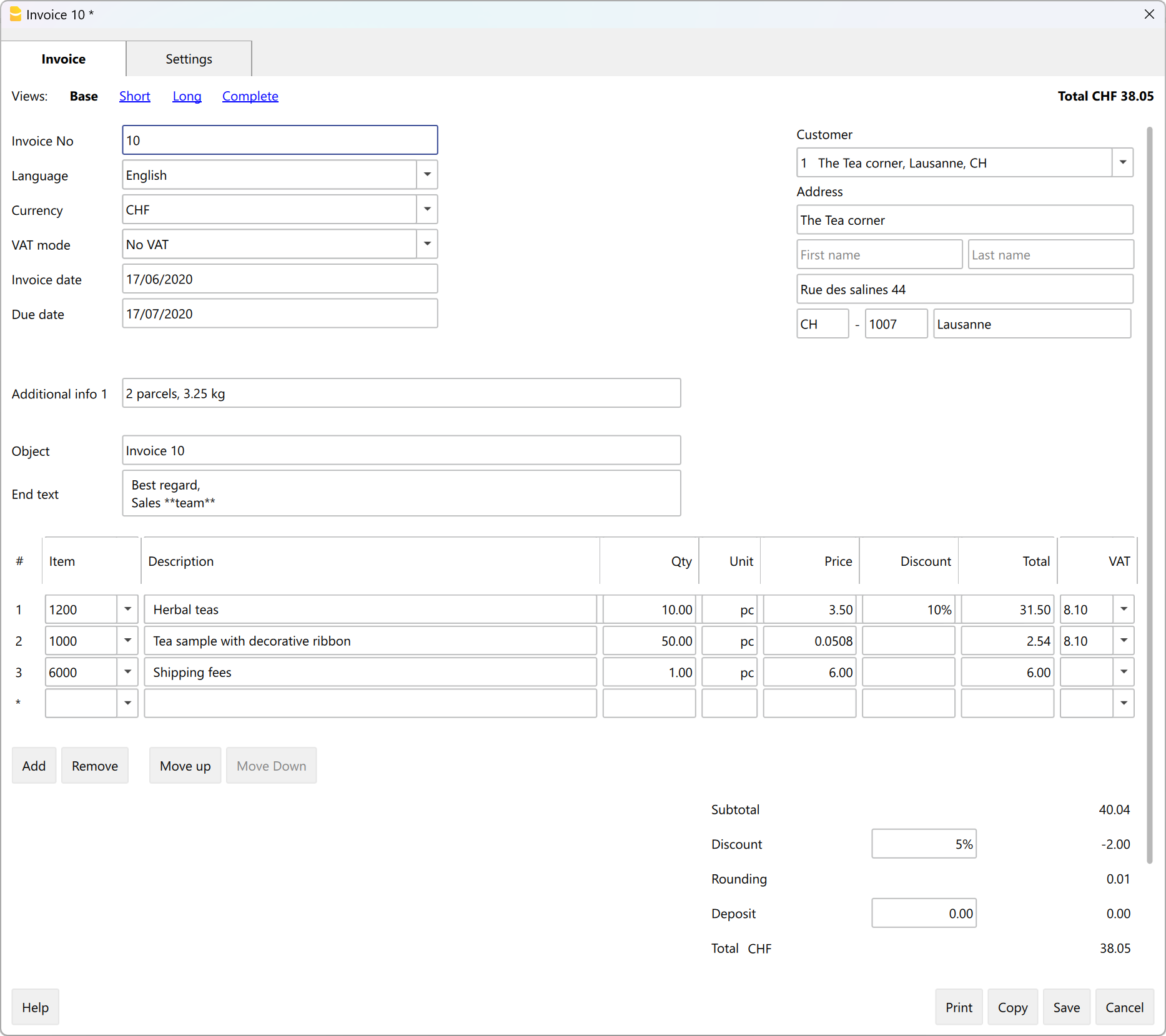

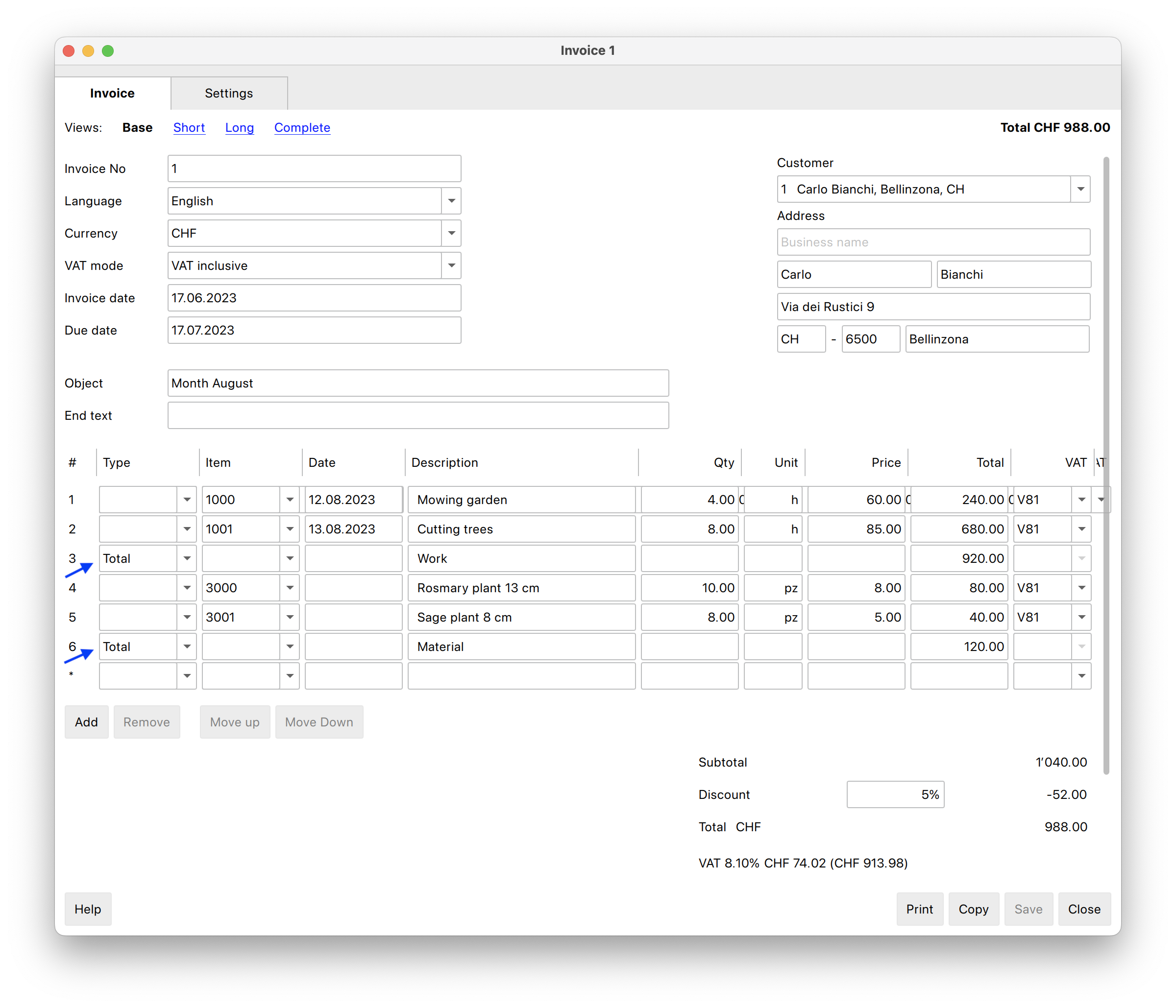

4. Las tablas

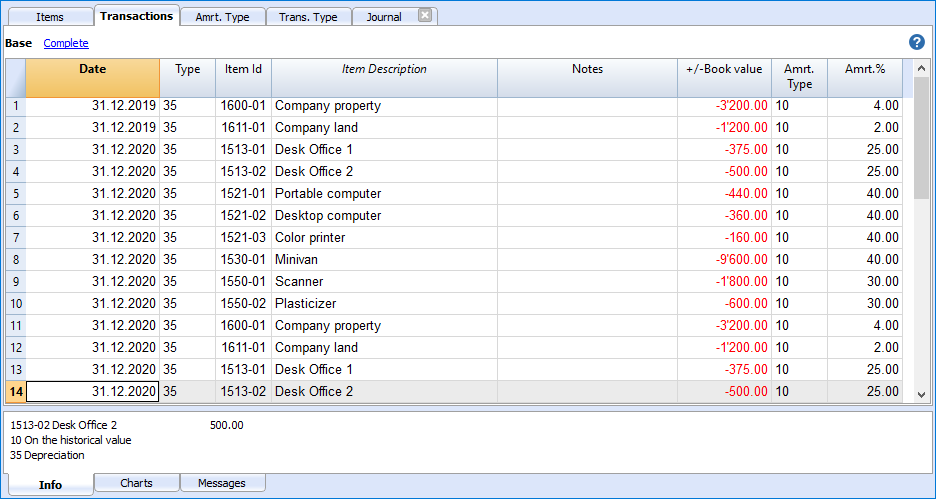

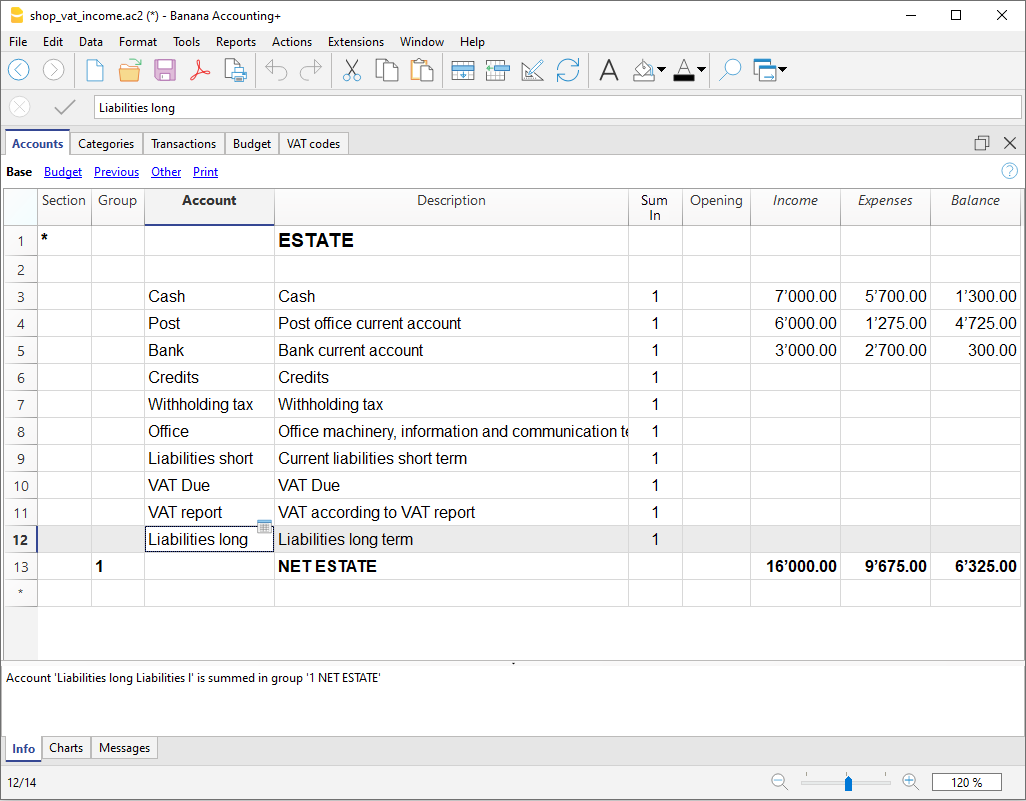

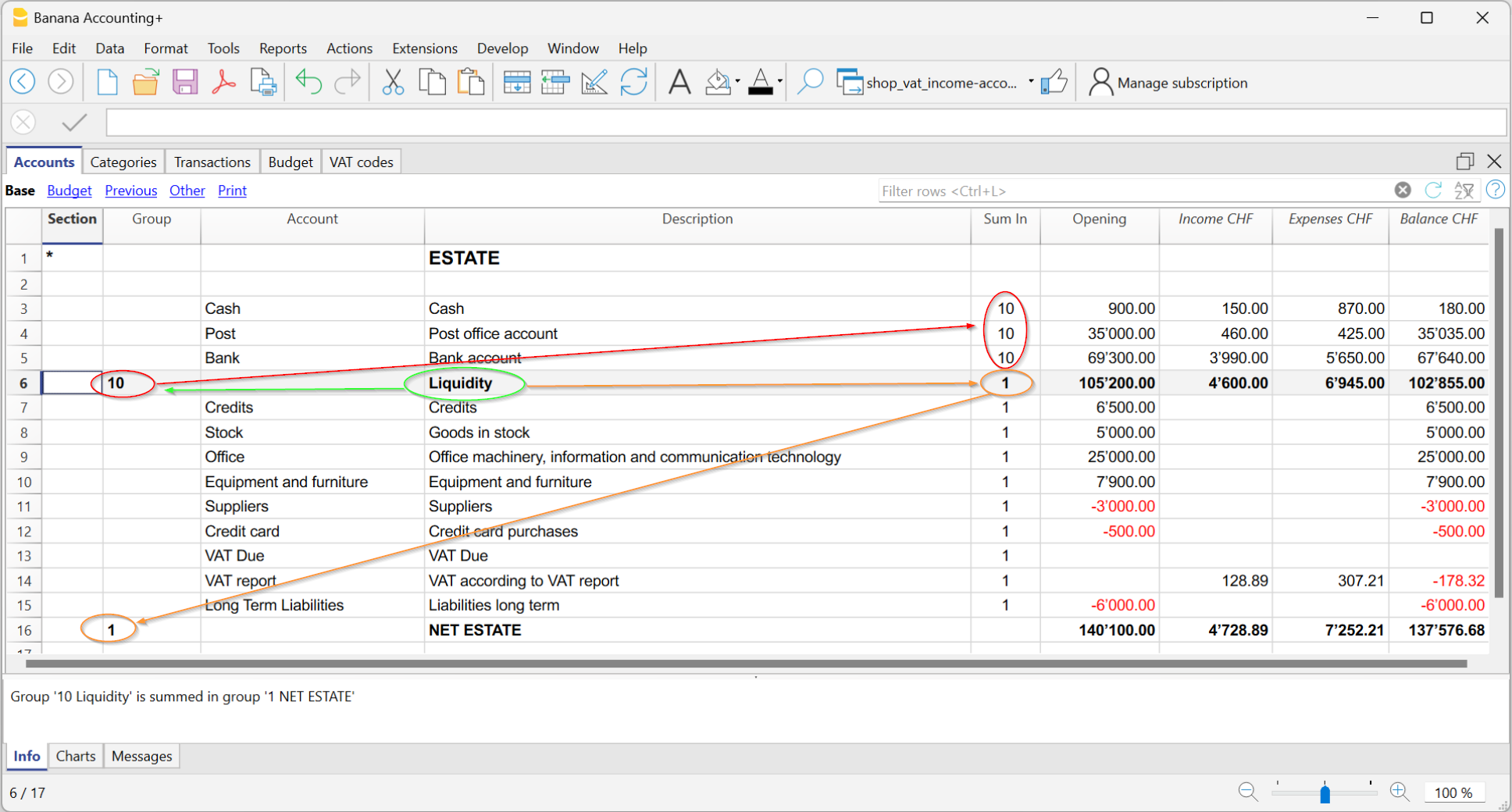

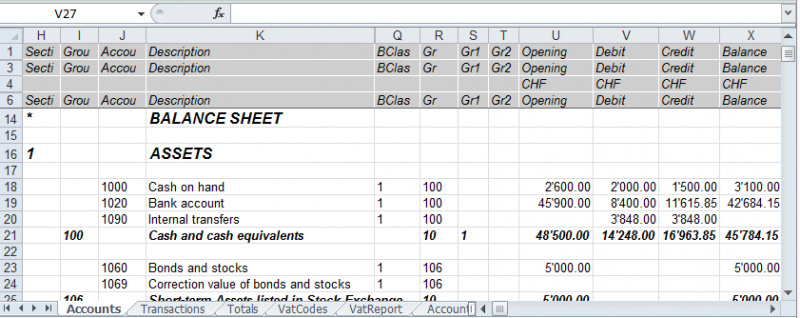

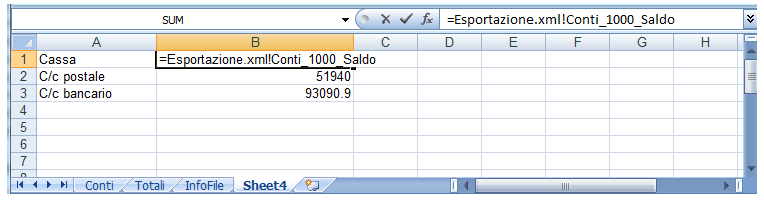

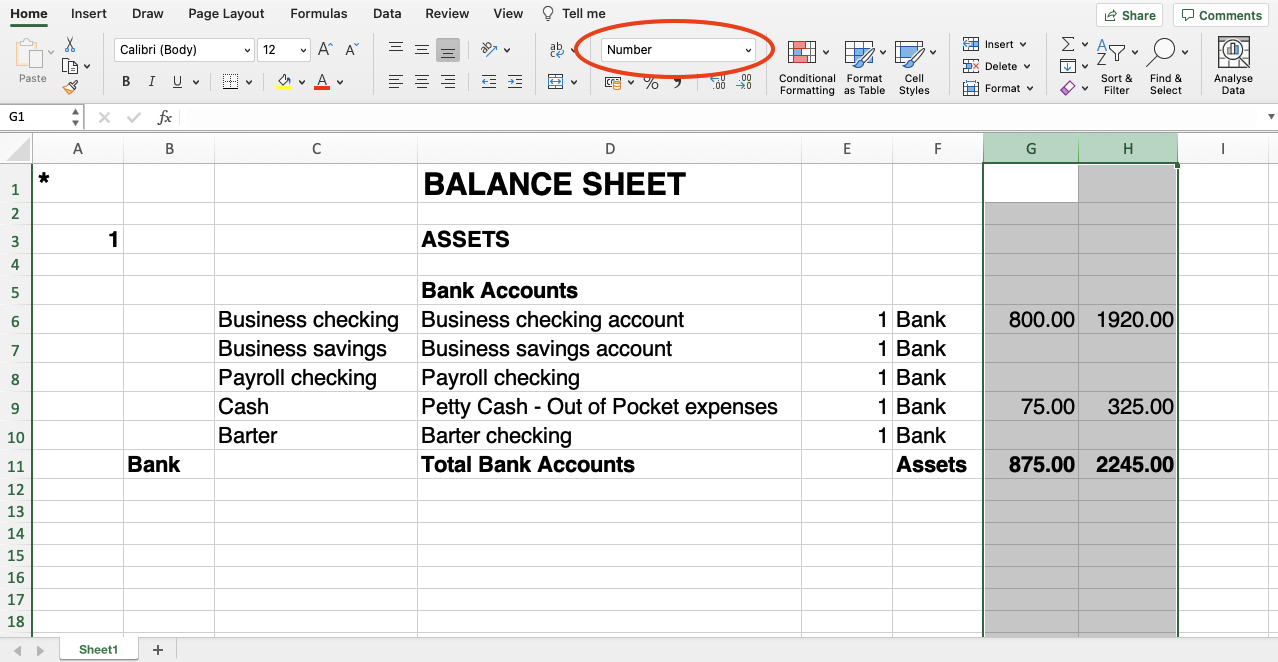

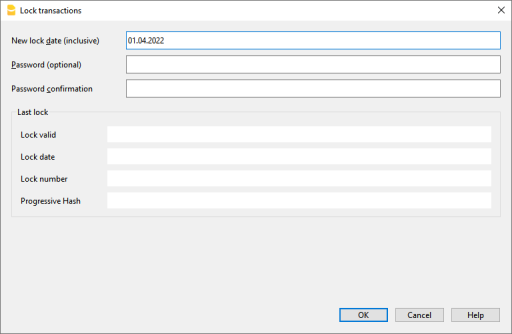

Cada archivo consta de varias tablas que muestran diferentes contenidos contables o de aplicación. Pase de una tabla a otra simplemente tocando el nombre de la tabla con el ratón. Las tablas varían según la aplicación que esté abierta. Trabajar con tablas permite tener siempre los datos ordenados y agrupados según el contenido.

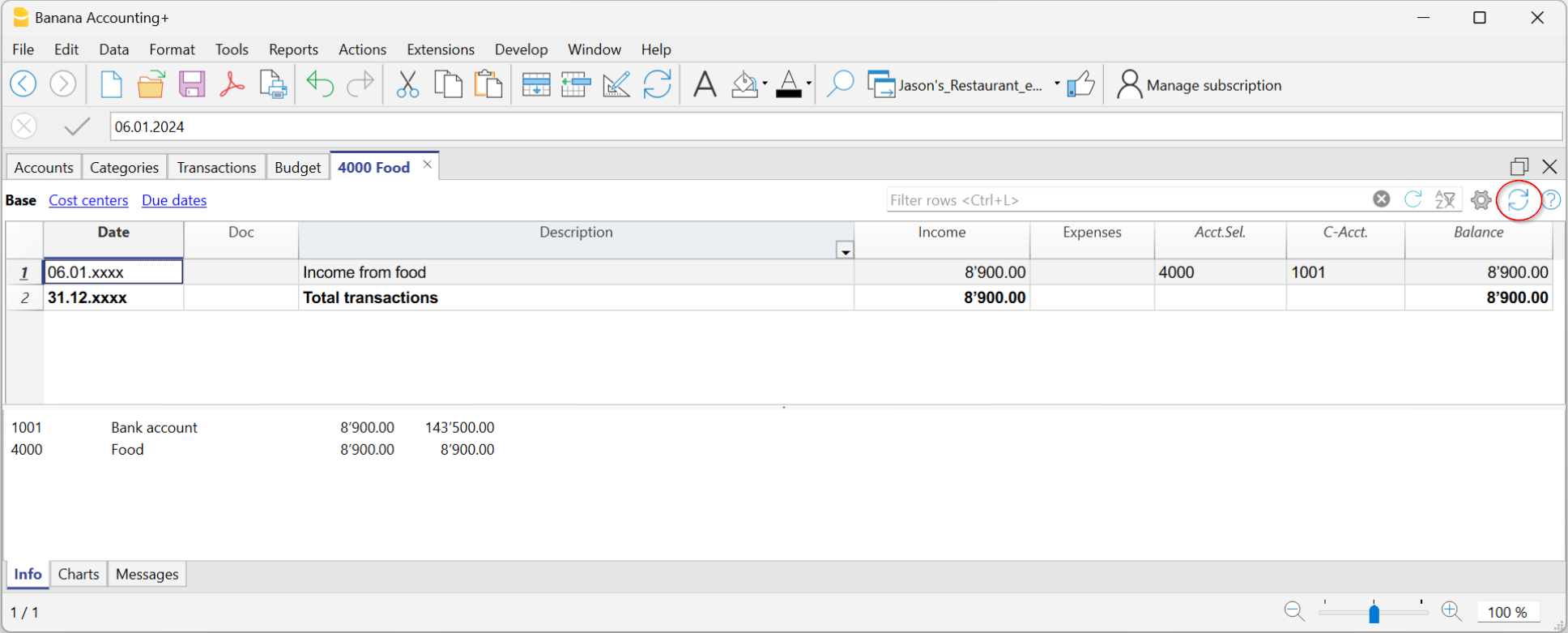

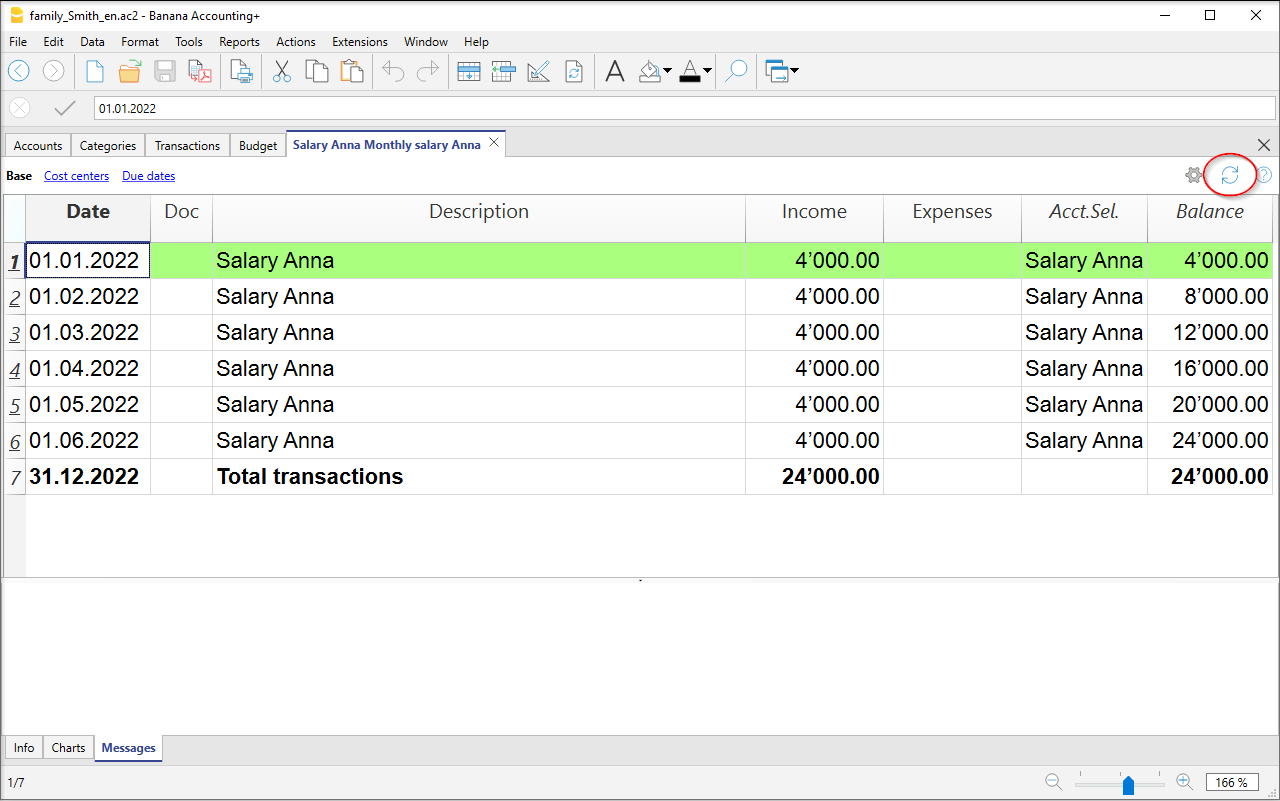

Existen tablas principales (fijas) y tablas auxiliares (que aparecen tras ciertos comandos). Las tablas auxiliares (es decir, generadas por el usuario) deben actualizarse si hay un cambio o adición de datos, simplemente haciendo clic en el icono en la parte superior derecha de la tabla ![]()

Además de los diversos informes disponibles, Banana Contabilidad Plus permite imprimir todo lo que ve en pantalla en cualquier tabla (ver Configuración de página - último párrafo). Para más información, visite la página Impresiones/Previsualización.

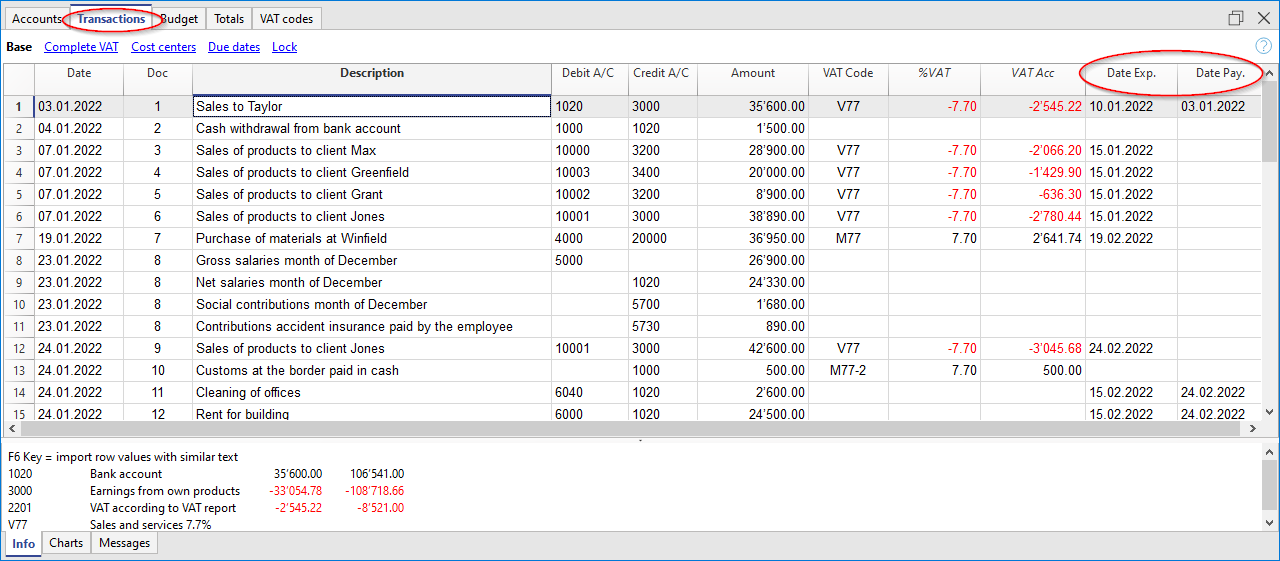

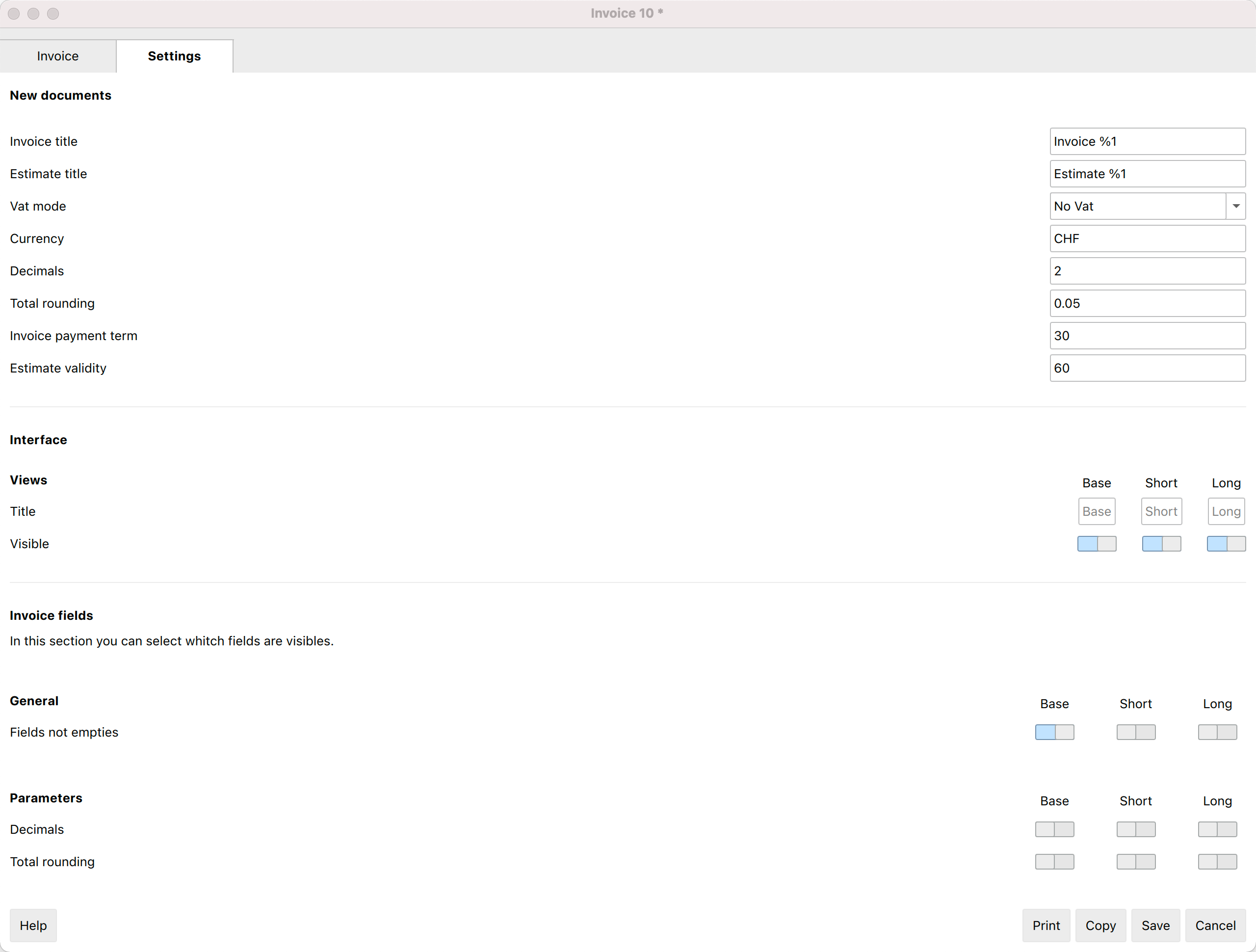

5. Las vistas

Las vistas son diferentes formas de visualizar los datos de una misma tabla, mostrando solo ciertas columnas. Son muy útiles cuando se quiere mostrar los datos de forma diferente, sin alterar la configuración básica. Pase de una vista a otra simplemente tocando el nombre de la vista con el ratón.

Las vistas se encuentran en el área situada debajo de las tablas y pueden personalizarse con el comando Configuración de tablas. También existe la posibilidad de crear nuevas.

6. El filtro

La función Filtrar filas, disponible en el plan Avanzado de Banana Contabilidad Plus, permite buscar, encontrar y modificar al instante transacciones introducidas previamente. Junto con Ordenar filas temporalmente, representa una innovación importante para acelerar el control contable.

Para más información, visite la página Filtrar y ordenar filas temporalmente.

7. Ayuda contextual

En Banana Contabilidad Plus, la ayuda contextual le ofrece asistencia inmediata relacionada exactamente con lo que está haciendo. Esto se realiza de varias formas complementarias:

- A - La ventana de mensajes de error, que el programa muestra cuando detecta un posible error:

- Si pulsa OK se le muestra cada mensaje individual.

- Si pulsa Ayuda se le lleva a la página que explica el mensaje de error con posibles soluciones.

- Si pulsa No avisar, todos los mensajes de error se guardan en la ventana Mensajes de error.

- B - Símbolo de signo de interrogación en la parte superior derecha de la tabla

Un clic en el símbolo le lleva a nuestra página de Documentación, donde puede encontrar información detallada sobre el uso de la tabla y todas las demás funciones del programa.

- C - Símbolo de signo de interrogación en la parte inferior

de la ventana de Información o Mensajes

de la ventana de Información o Mensajes

Al hacer clic en este símbolo se accede a la página que explica el mensaje de error y las posibles soluciones. - D - Botón de Ayuda en los cuadros de diálogo

Al hacer clic en este botón se muestra la página de explicación en línea del cuadro de diálogo abierto o del mensaje de error.

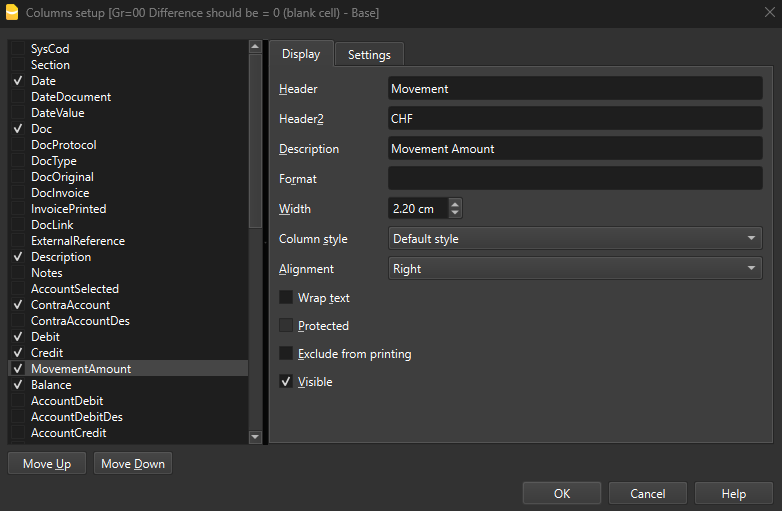

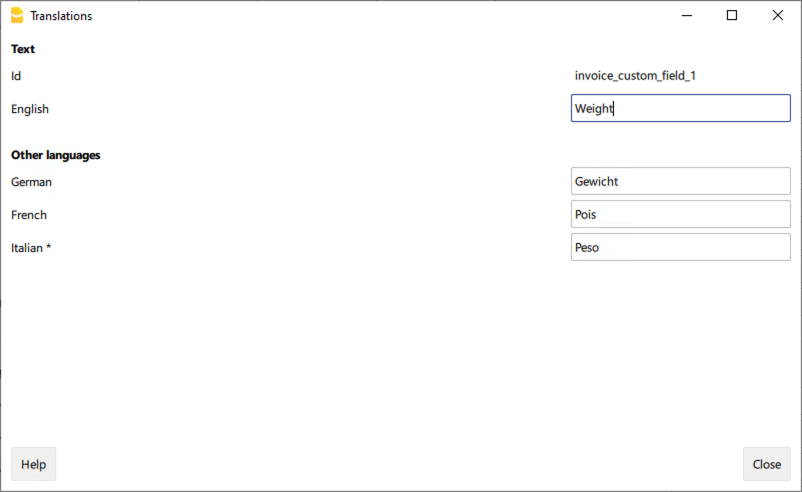

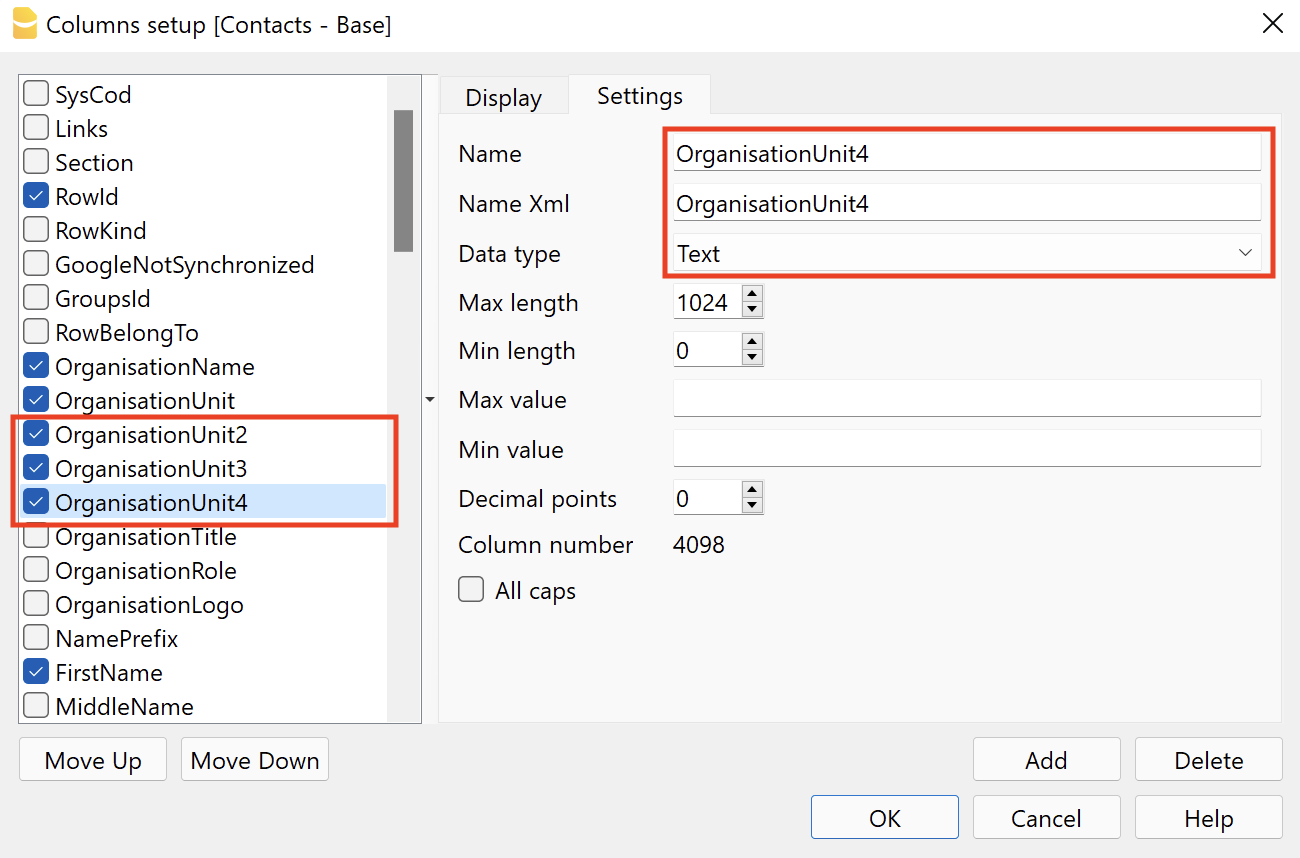

8. Las columnas

Las columnas son los elementos verticales de la tabla. Cada columna tiene su propio encabezado. La disposición, tamaño, descripción, formato, ancho, estilo y alineación de las columnas pueden personalizarse mediante las funciones del menú Datos > Configuración de columnas.

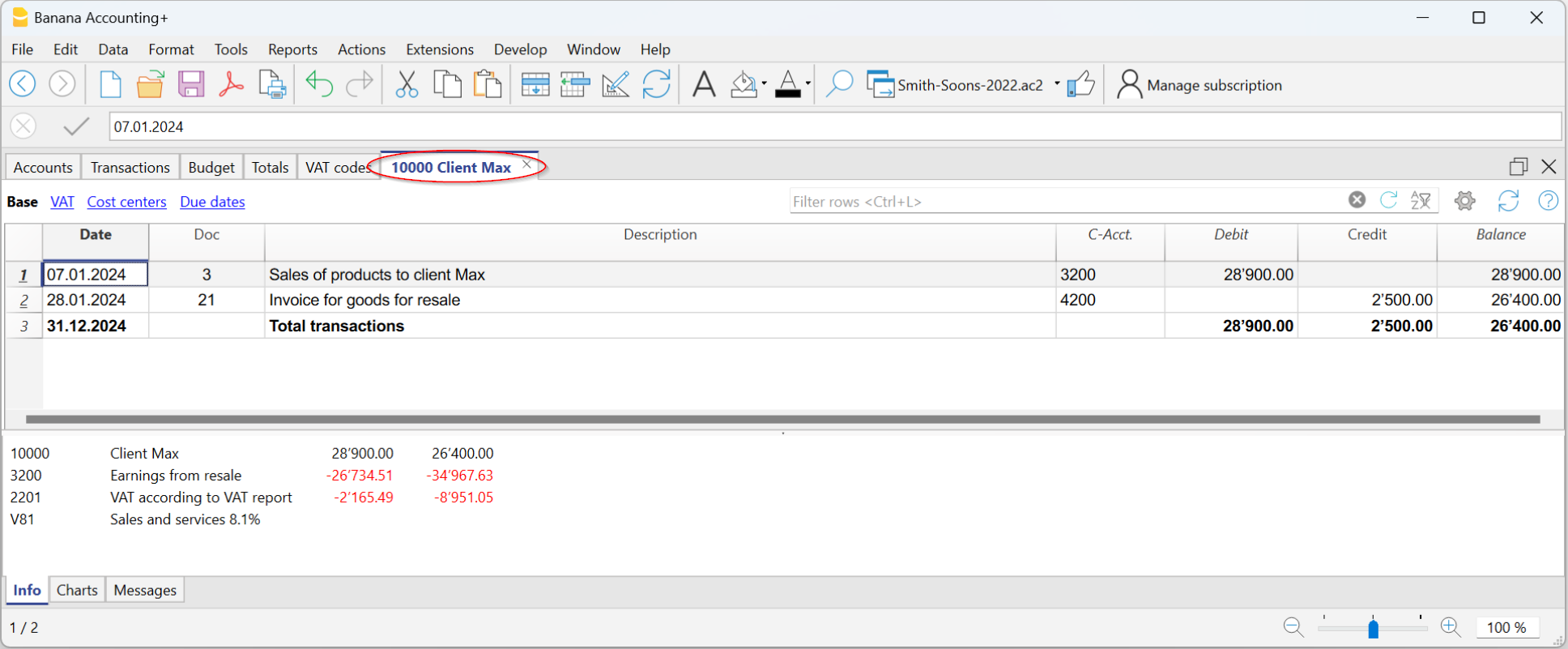

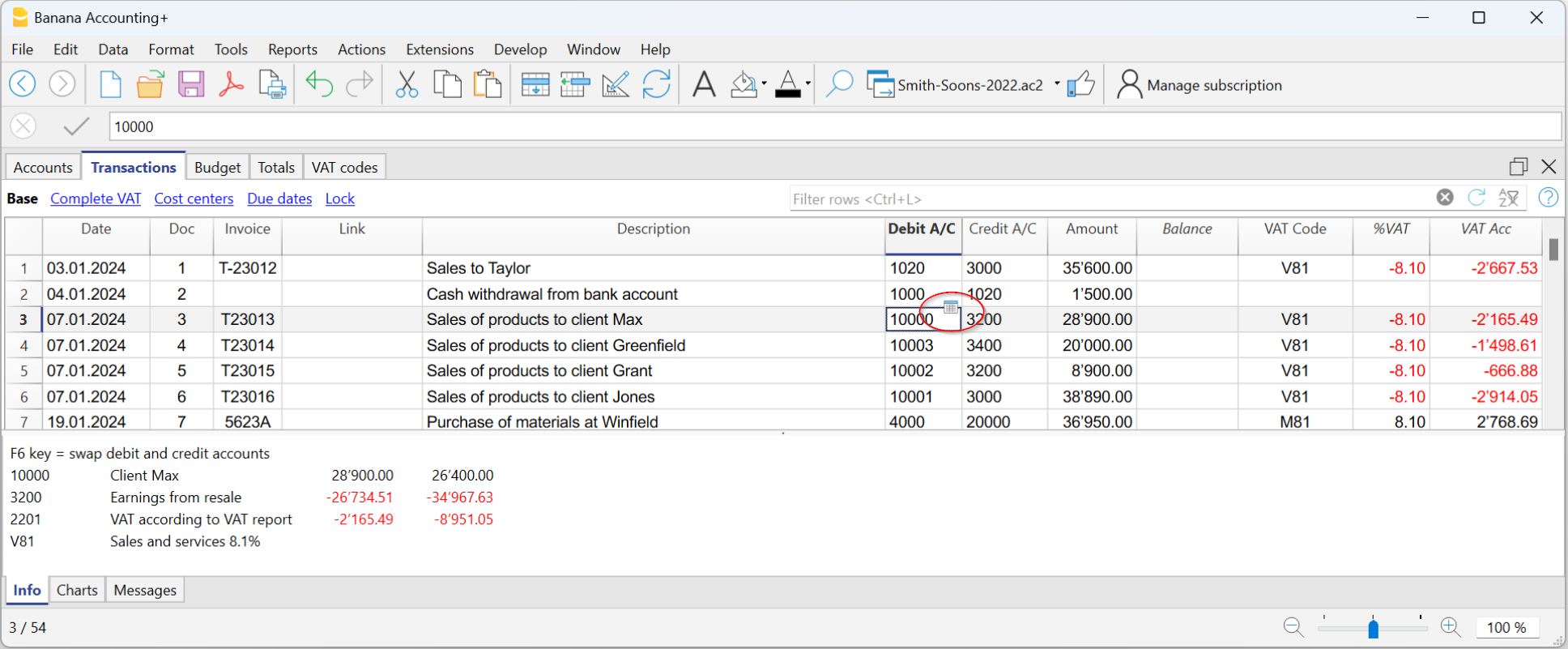

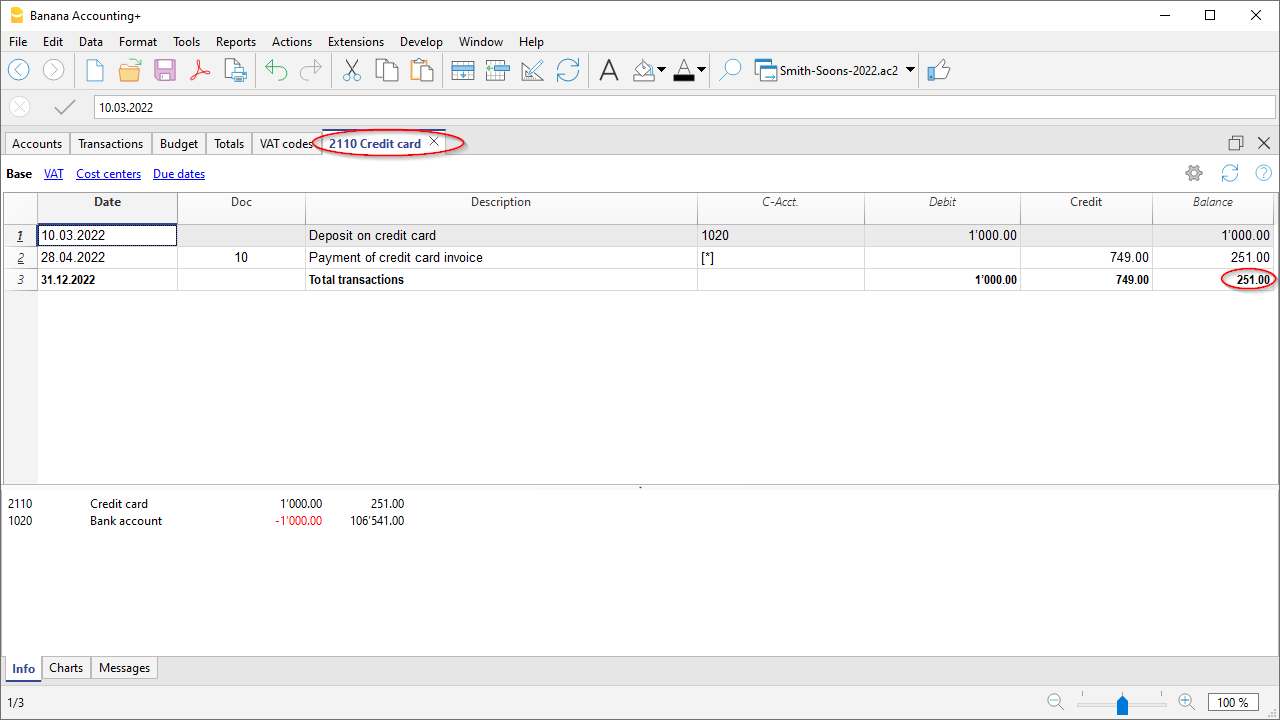

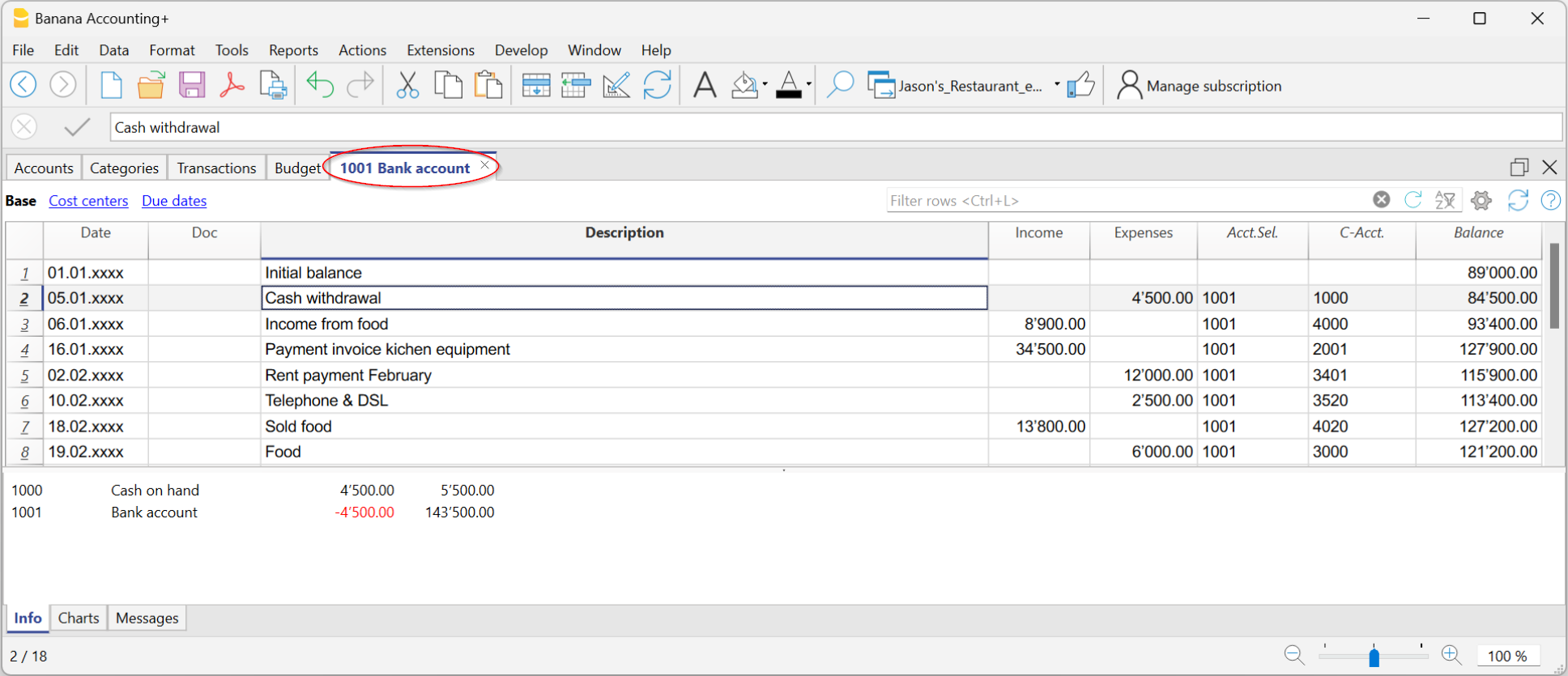

En algunas columnas los datos son introducidos por el usuario, mientras que en otras el programa introduce los datos automáticamente, por lo que no pueden ser modificados por el usuario (por ejemplo, las columnas de la ficha de cuenta).

También puede añadir nuevas columnas a través de Datos > Configuración de columnas, pero si contienen valores no serán procesados por el programa.

9. Buscar y reemplazar

La función Buscar y reemplazar se activa desde el menú Datos y permanece visible hasta que se cierra manualmente. Es muy práctica para encontrar y cambiar textos rápida y fácilmente en la tabla. No debe confundirse con el comando Renombrar (solo en el plan Advanced), que cambia el nombre de una cuenta, código de IVA u otro, en todo el archivo.

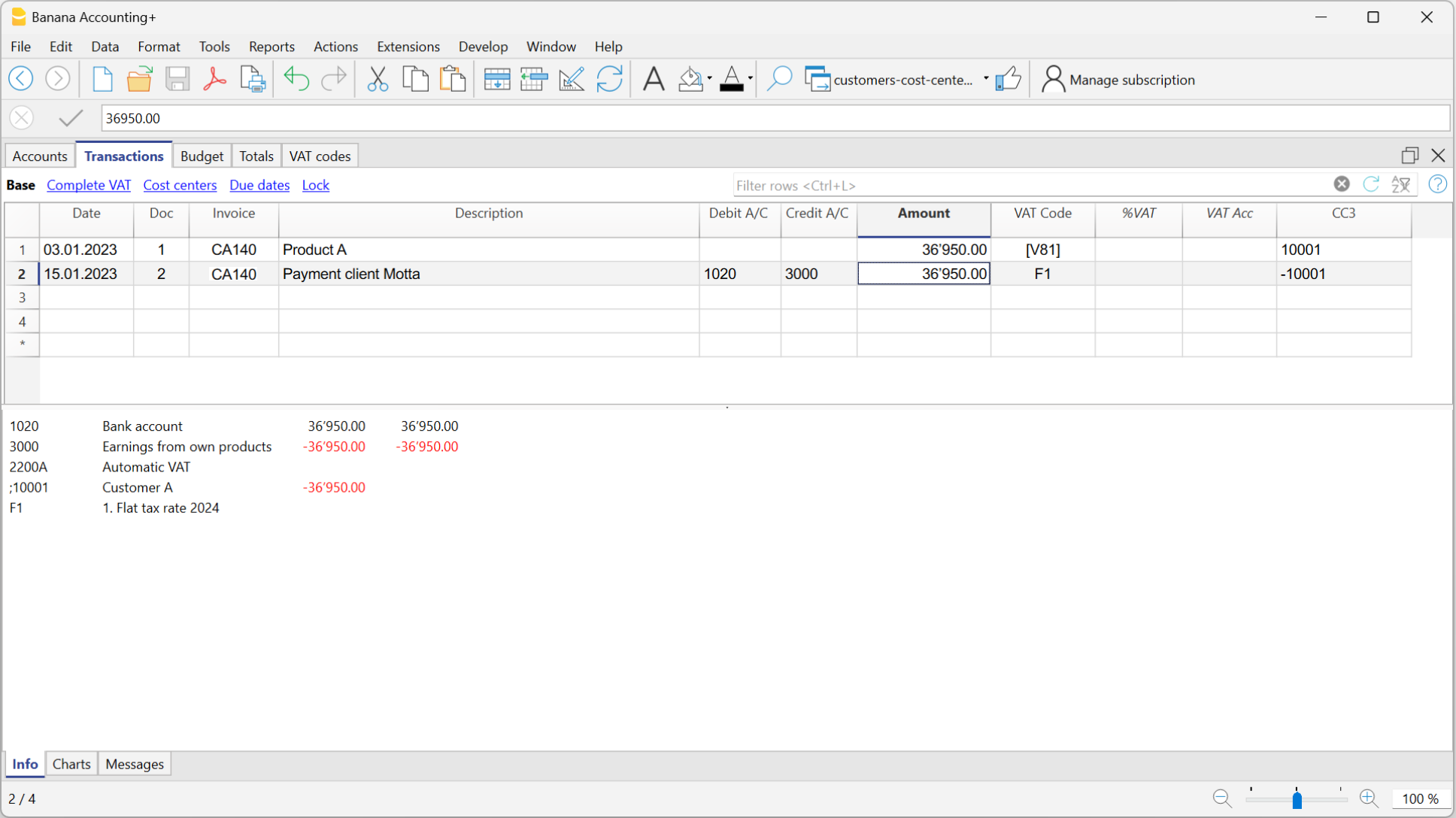

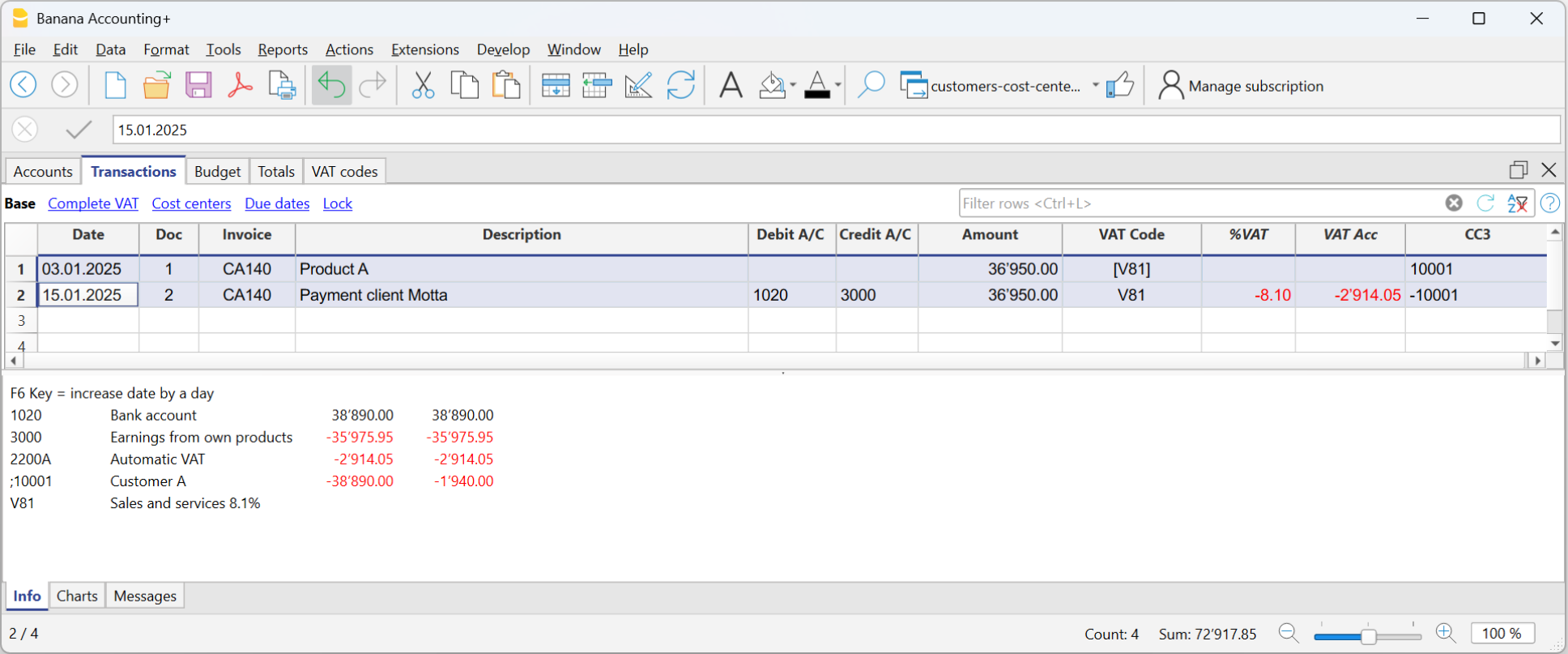

10. Las ventanas de información

Esta es el área situada en la parte inferior de la pantalla, donde se muestra información útil sobre la tabla y la casilla en la que se encuentra. Esta área se divide en tres ventanas muy útiles que proporcionan información inmediata:

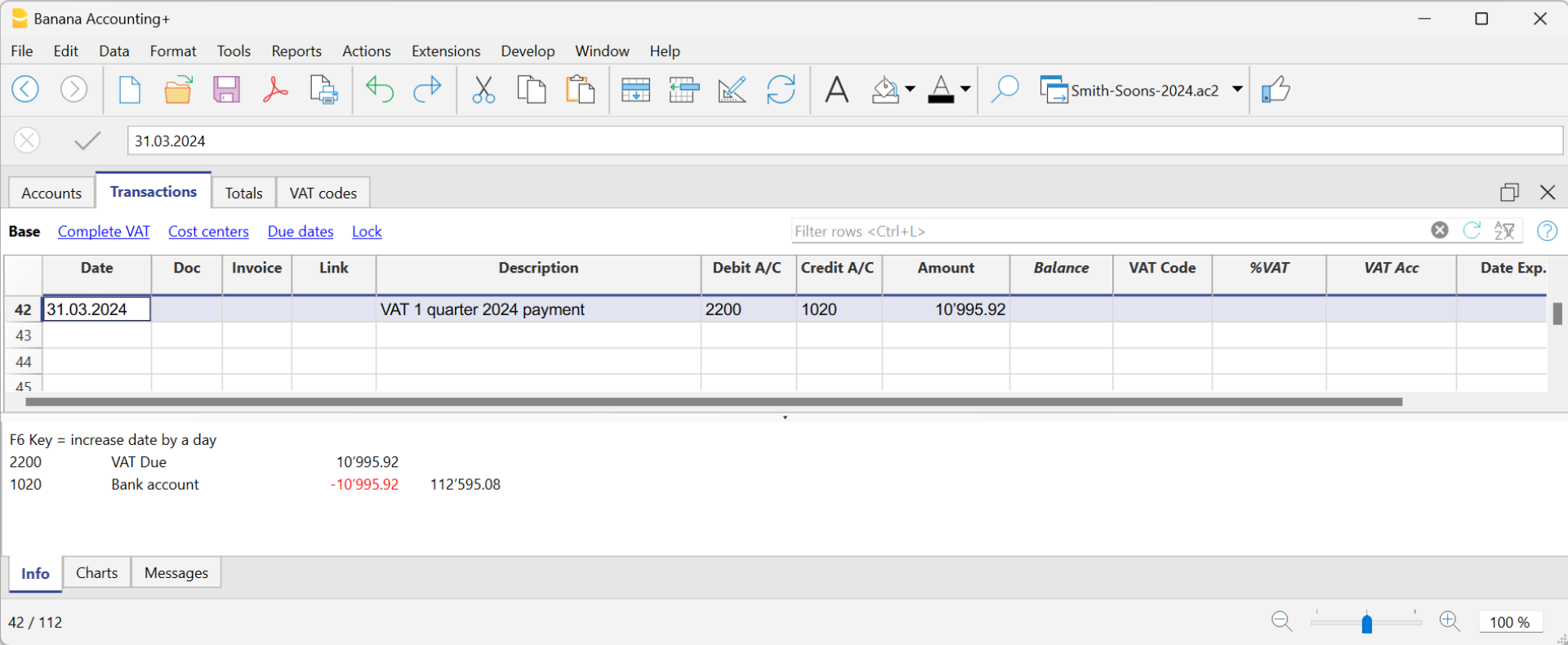

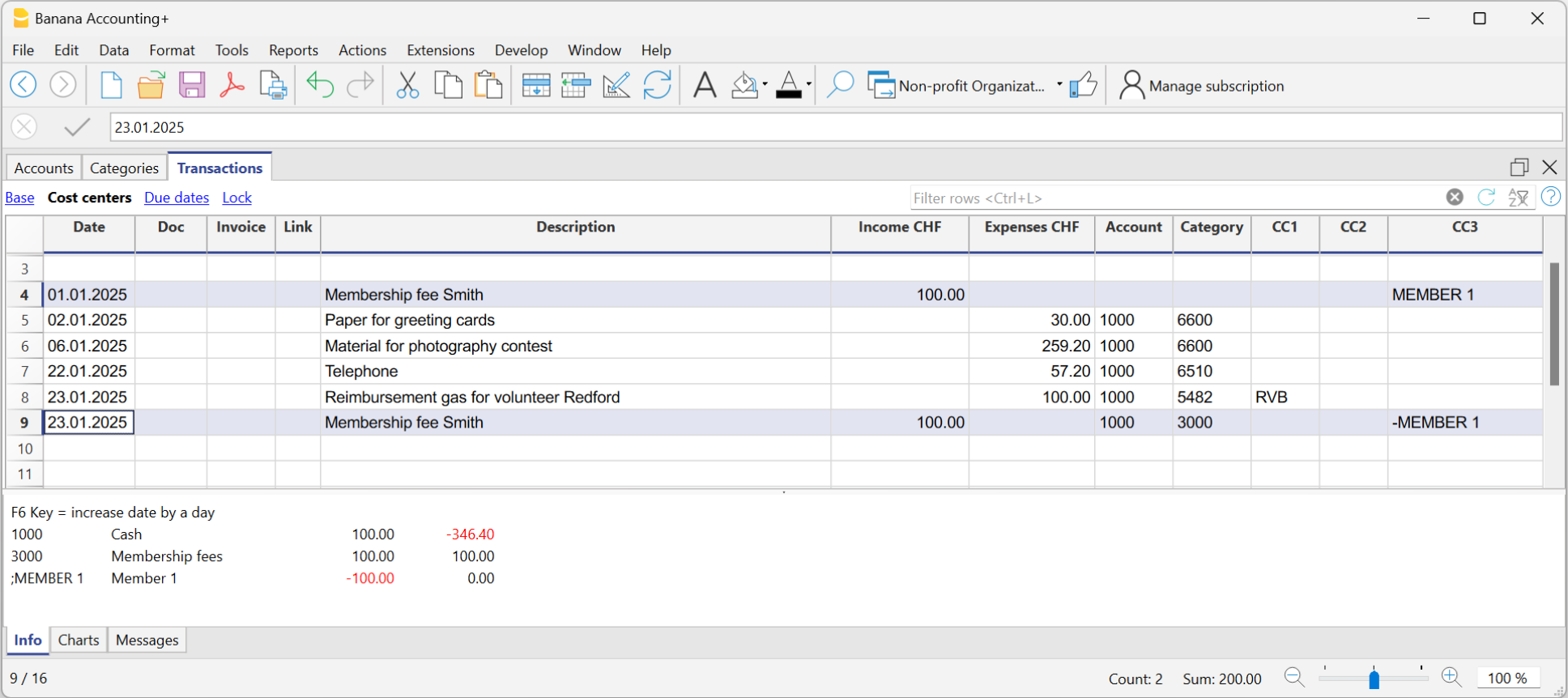

- La ventana Información informa sobre el contenido de la fila y la celda en la que se encuentra (por ejemplo, nombre y saldo de la cuenta, código de IVA y descripción del código utilizado).

- La ventana Mensajes, informa sobre los mensajes de error.

- La ventana Gráficos, muestra el gráfico del contenido de la celda o fila en la que se encuentra (por ejemplo, si está en una cuenta, aparece el gráfico con la evolución de la cuenta).

Pase de una ventana a otra simplemente tocando el nombre de la ventana con el ratón.

La ventana Información

La ventana Información muestra la información referente a la celda y la línea en la que se encuentra: los nombres y códigos de las cuentas involucradas en el apunte, los importes y los saldos restantes. Cuando hay un error, la diferencia se muestra en rojo.

- Al hacer clic en el símbolo del signo de interrogación

se accede a la página donde se explica el error.

se accede a la página donde se explica el error.

La ventana Mensajes

Cuando el programa detecta errores, aparece un cuadro de diálogo para informarlos:

- Pulse OK para ver cada mensaje individualmente.

- Si pulsa No avisar, todos los mensajes de error se guardan en la ventana Mensajes de error.

- Pulsando Ayuda accede a la página que explica el error con posibles soluciones (Ayuda contextual).

La ventana Mensajes contiene una lista de errores que han sido detectados por el programa.

- Desde la ventana Mensajes, haga doble clic sobre el mensaje de error para ir a la línea que generó el error.

- Al hacer clic en el símbolo del signo de interrogación

accede a la página que explica el mensaje.

accede a la página que explica el mensaje.

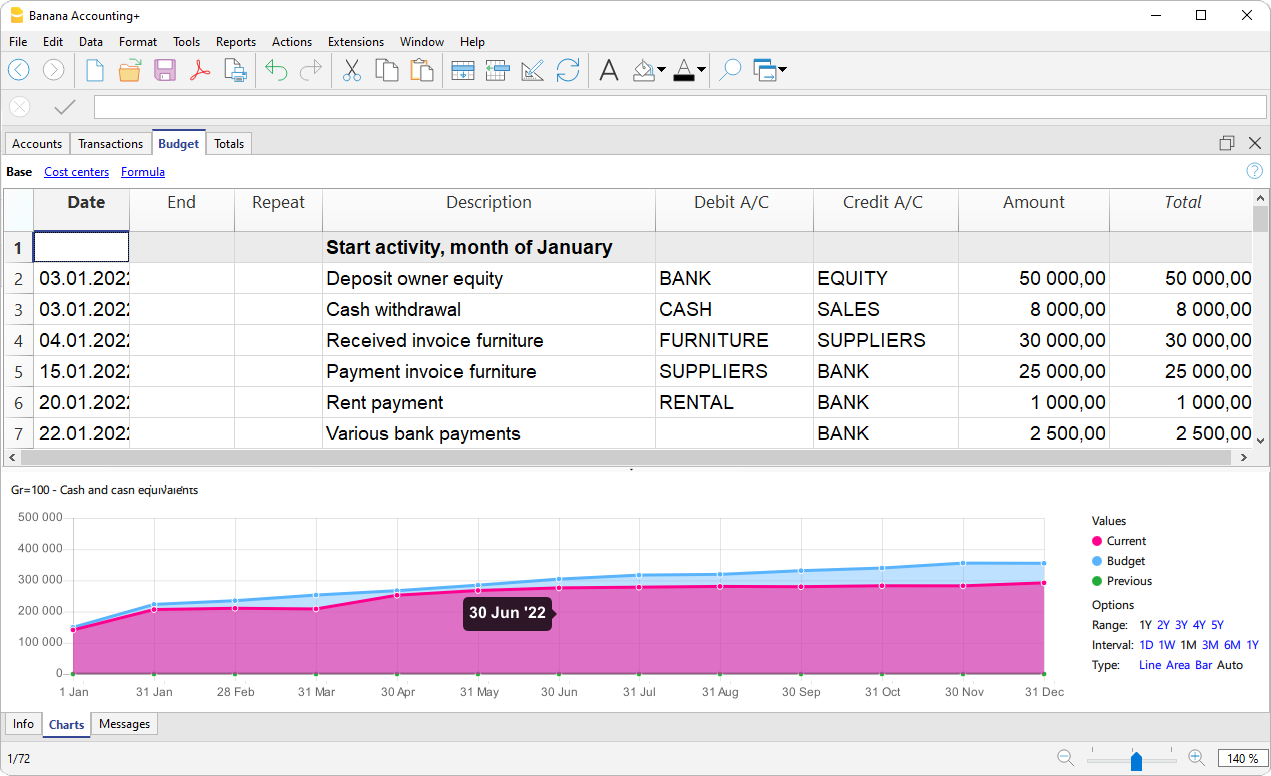

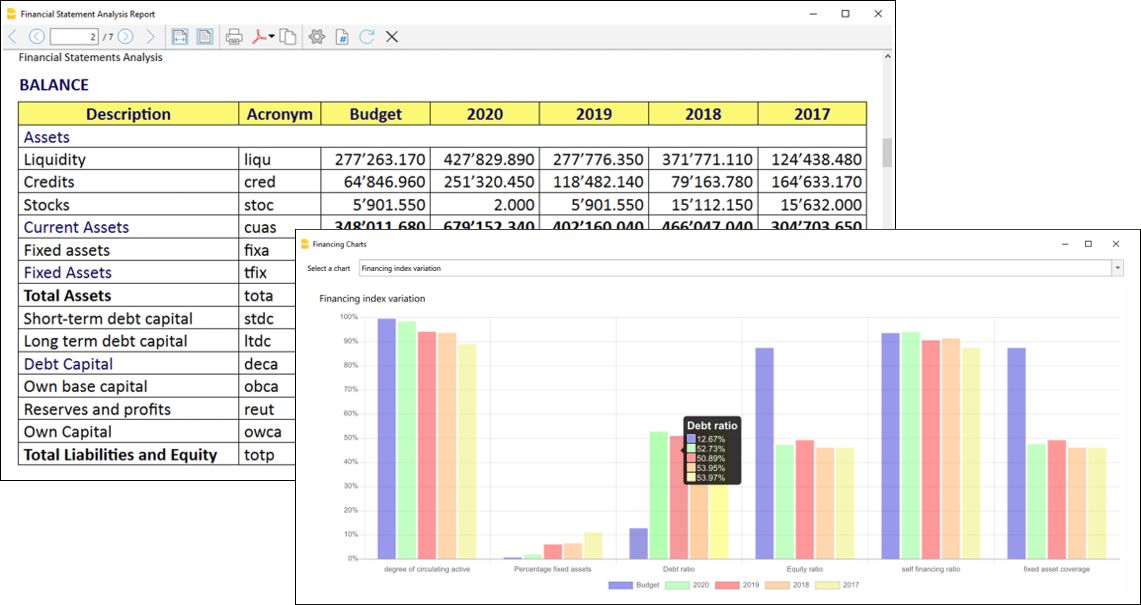

La ventana Gráficos

Al seleccionar una cuenta o un grupo, se obtiene el gráfico en la ventana Gráficos en la parte inferior. El gráfico proporciona inmediatamente la evolución de la situación, incluida una comparación entre la situación prevista y la real. Tiene una visión inmediata a lo largo del tiempo sin necesidad de consultar los importes.

Con el plan Advanced de Banana Contabilidad Plus, ahora también es posible copiar, exportar e imprimir gráficos, así como copiar al portapapeles los datos que generaron el gráfico. Más información en la página de Gráficos.

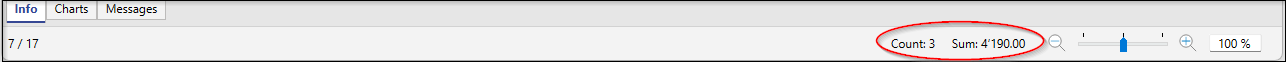

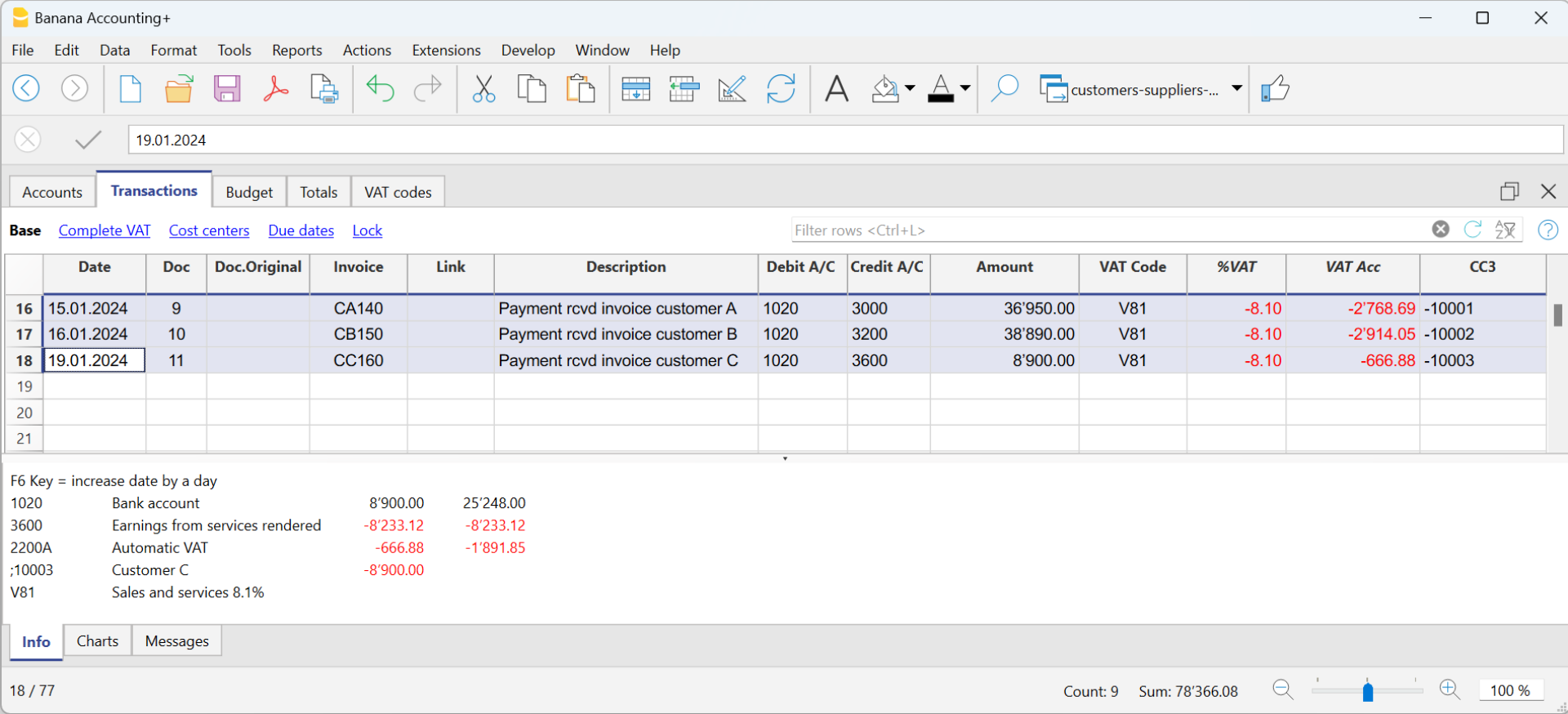

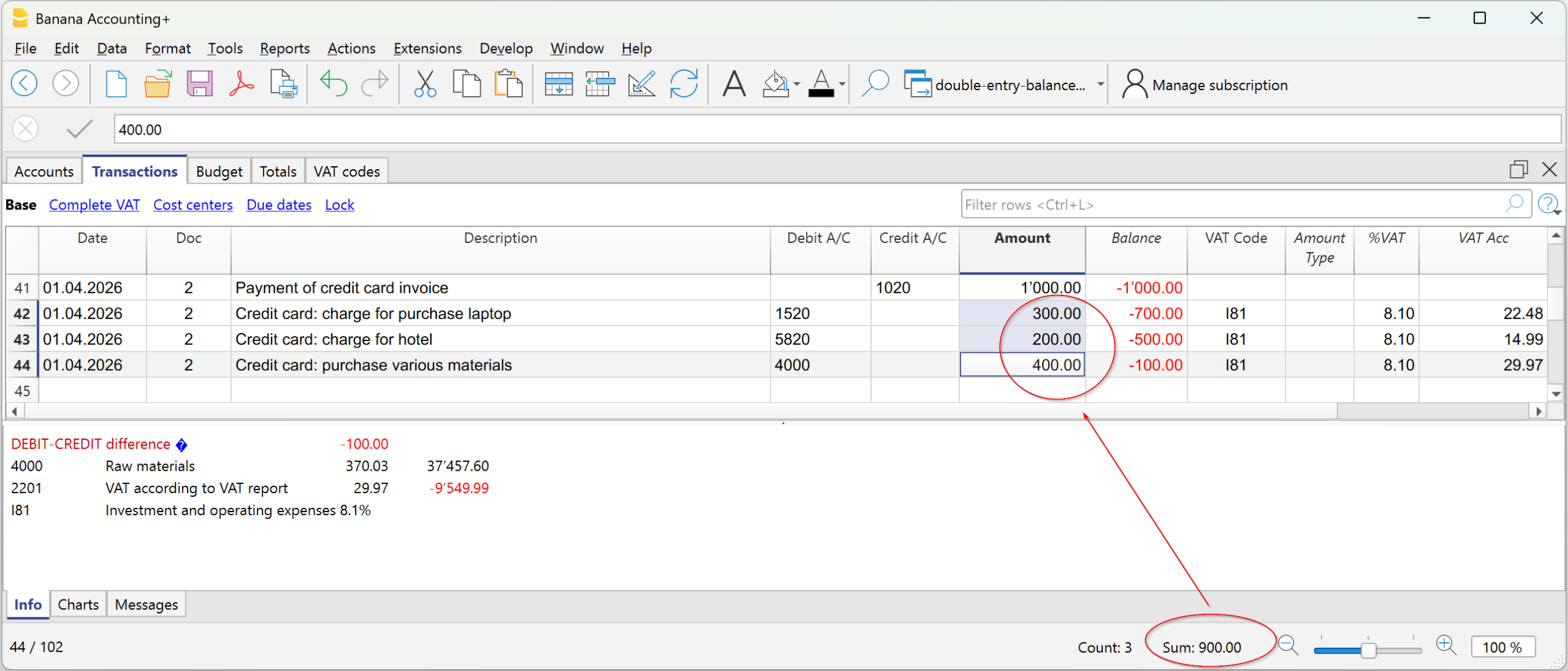

11. La barra de estado

Está situada en la parte inferior de la ventana del programa y contiene la siguiente información:

- Número de línea de la celda seleccionada/número de filas en la tabla.

- Si el Filtro está activo, también se indica el número de filas visibles.

- Si se seleccionan varias celdas de tipo numérico o contador de tiempo, se obtiene:

- Conteo: Número de celdas seleccionadas que contienen números.

- Suma: Suma de los valores de las celdas seleccionadas.

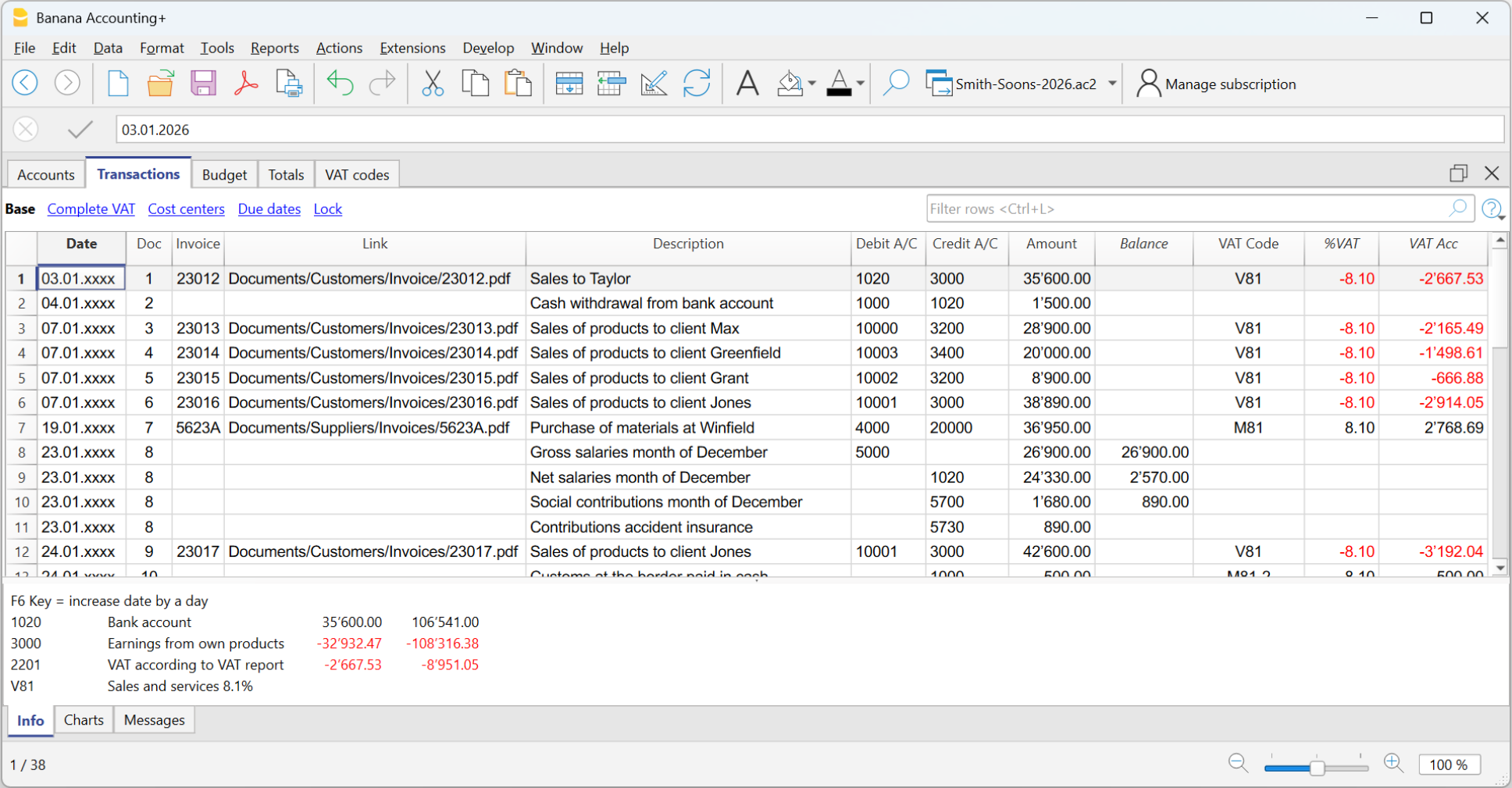

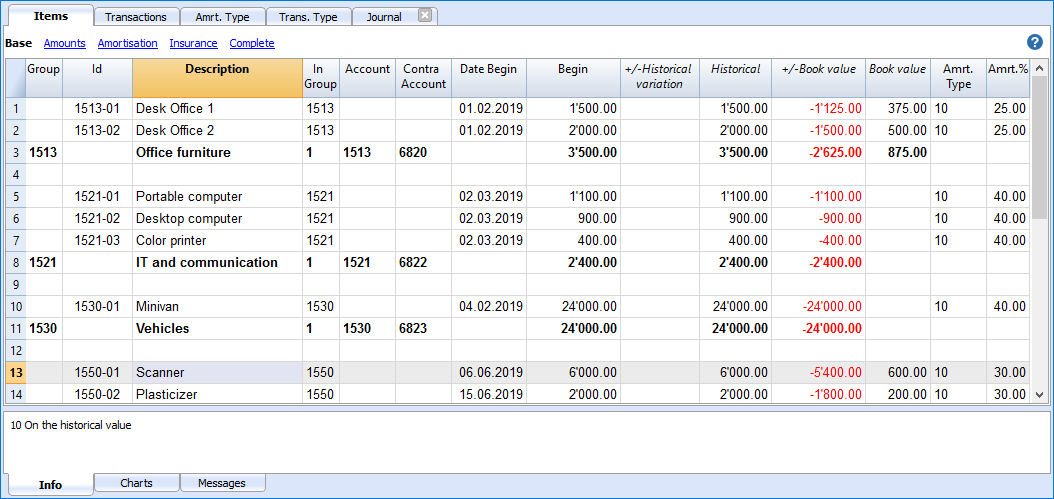

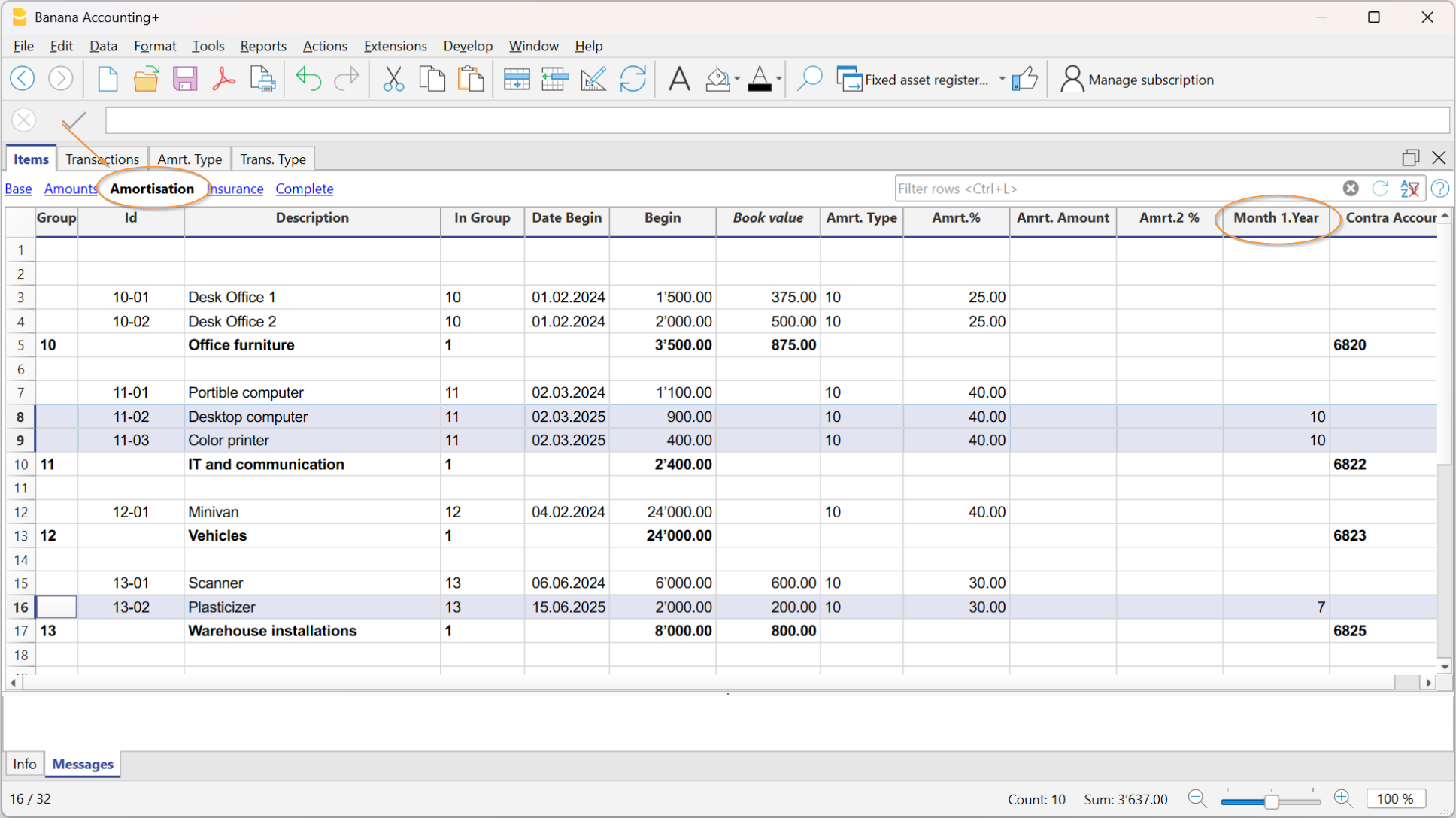

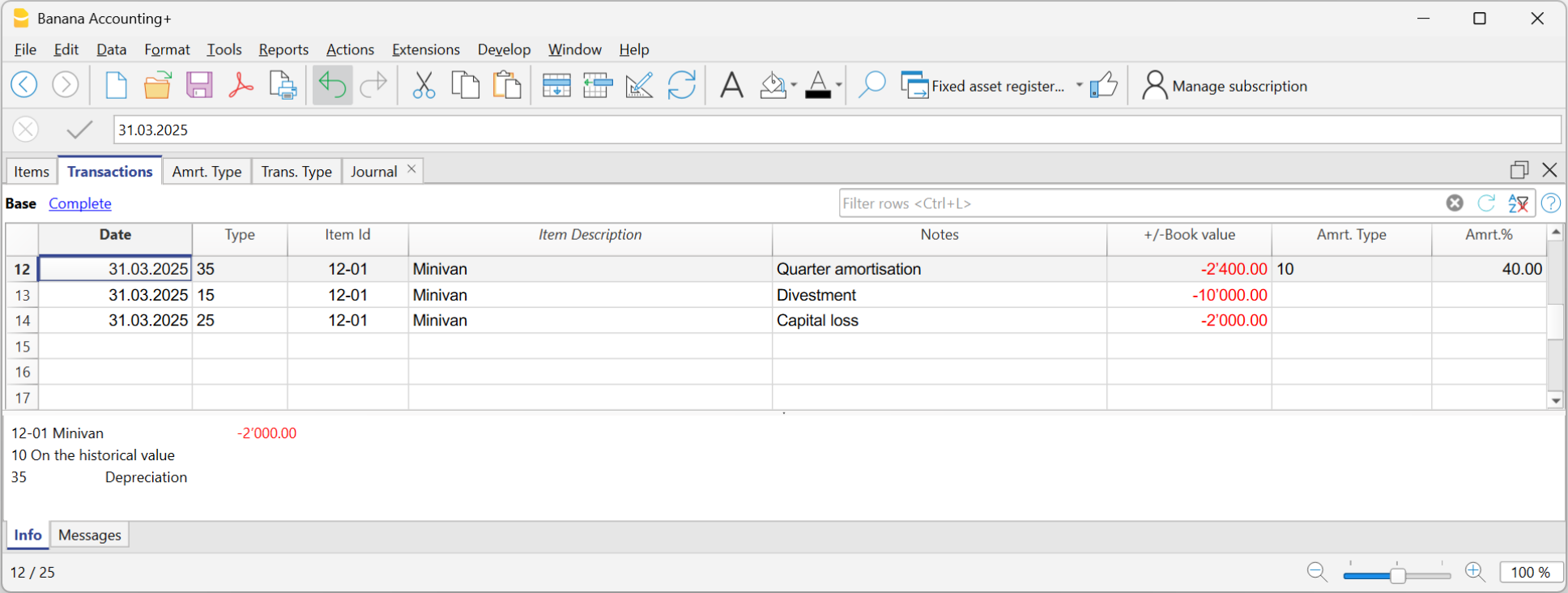

En la imagen superior, se seleccionaron 3 celdas numéricas (1'500 + 1'500 + 1'910) y de hecho el total es 4'910 en la barra de estado.

- Zoom

- Para agrandar o reducir el tamaño de las tablas.

- Para cambiar el tamaño del texto de los menús, utilice la configuración del sistema operativo.

- Ver también Opciones del programa.

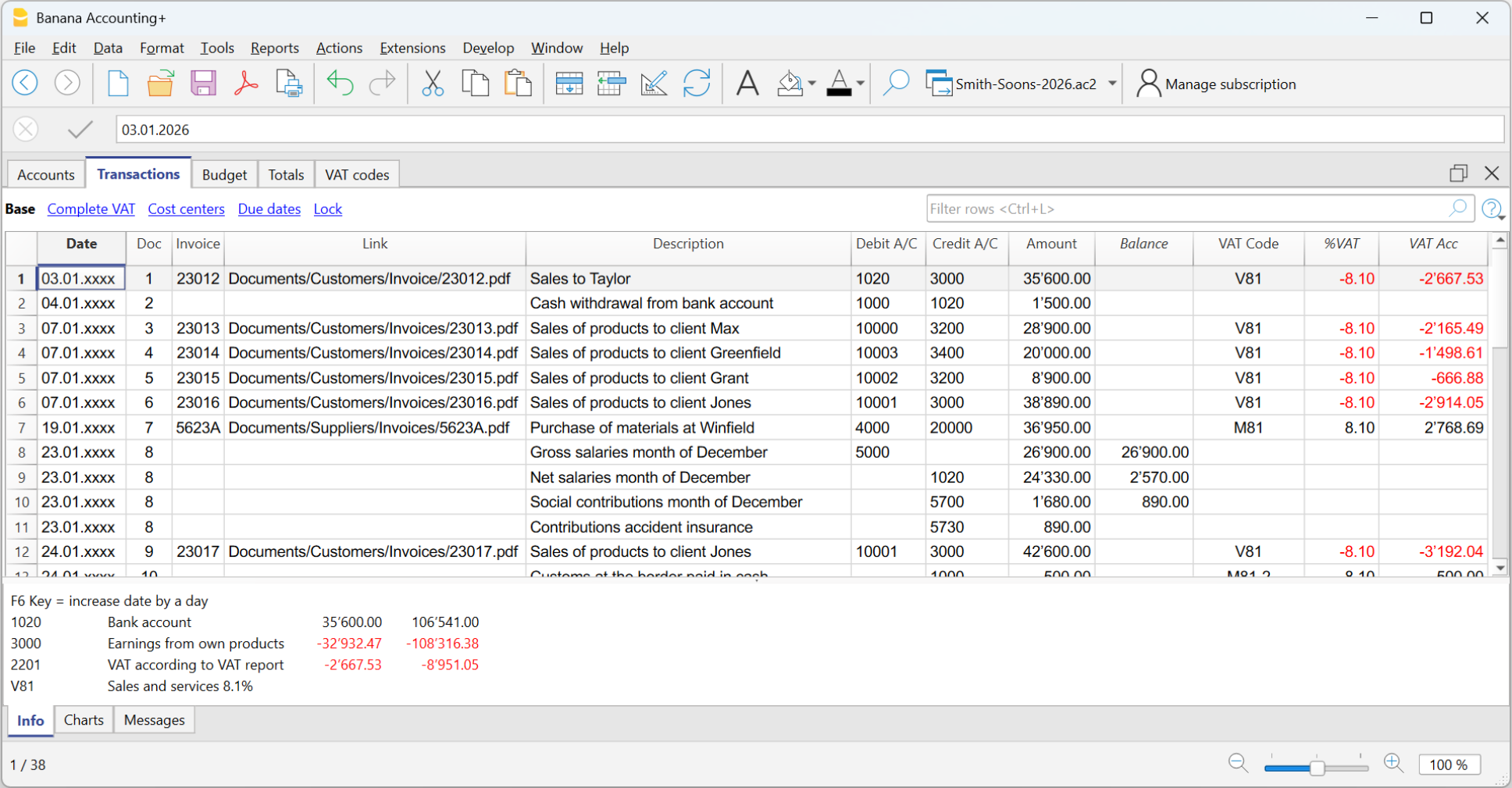

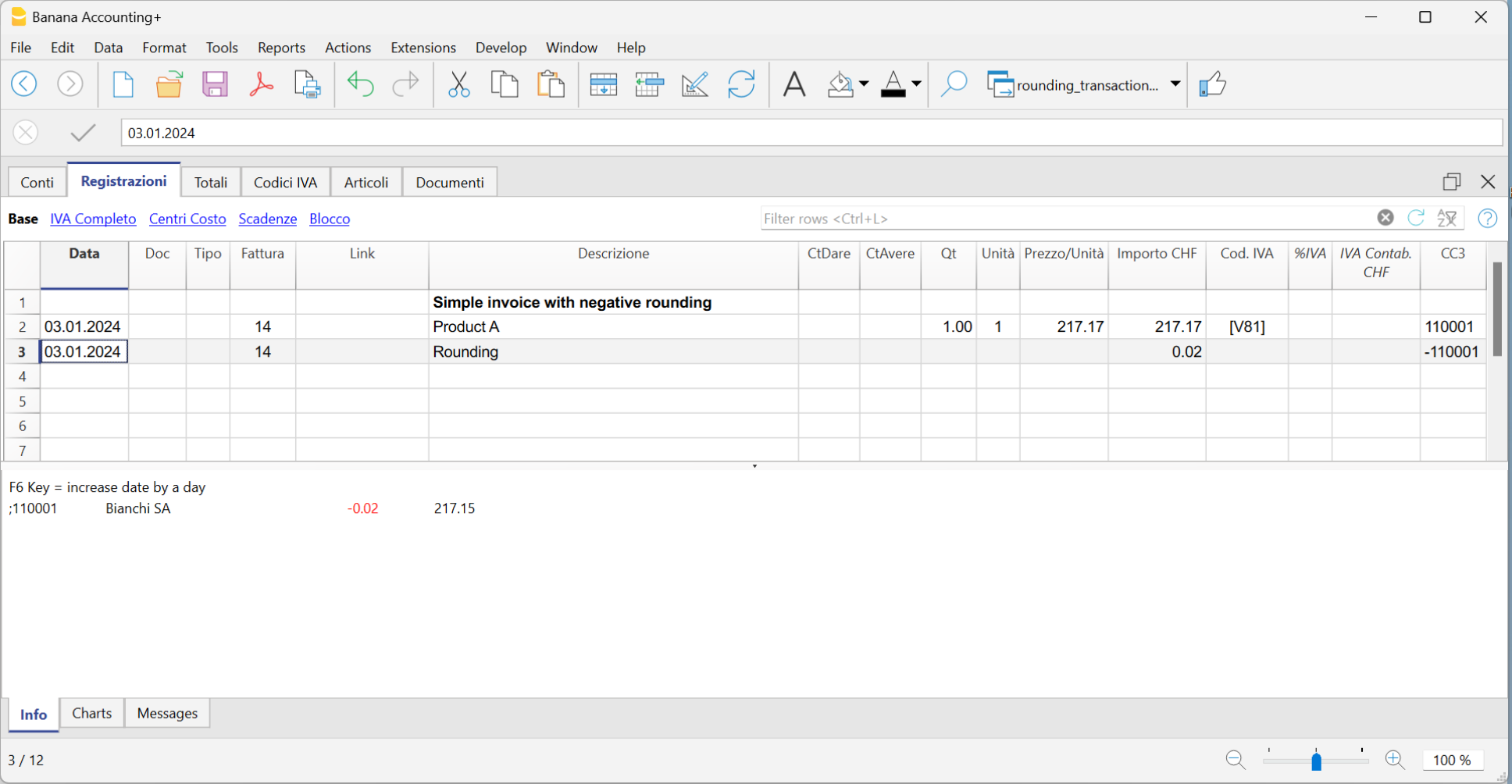

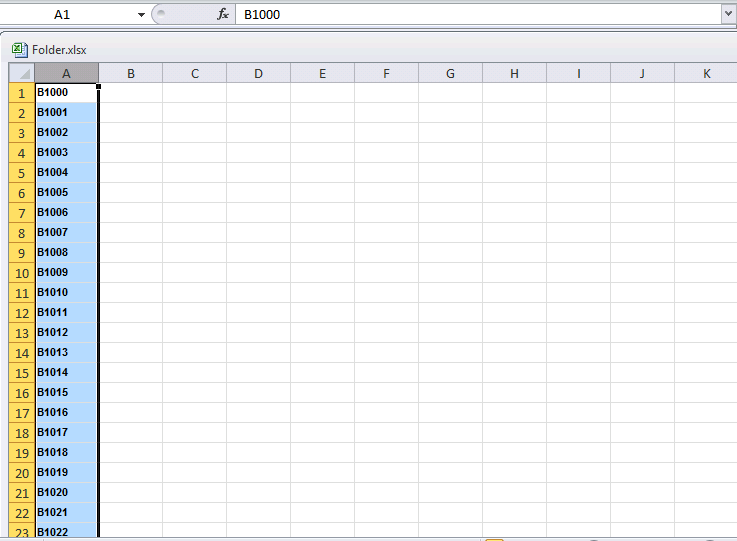

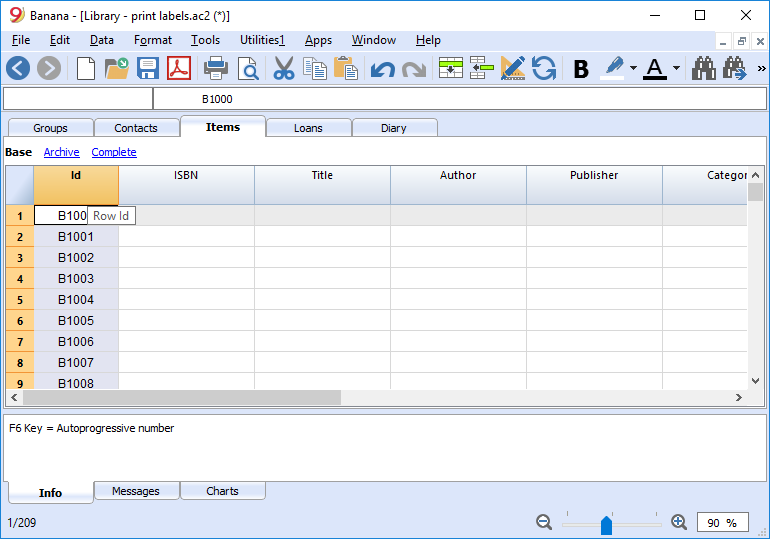

Fast Entry

In Banana Accounting Plus several practical functions allow you to speed up and automate the following operations:

Here are the most frequently used functions for fast data entry:

Copy, Cut and Paste

Use these functions to copy, cut and paste data from one cell to another, one row to another, one table to another, Excel to Banana, etc. See the functions in the Edit menu.

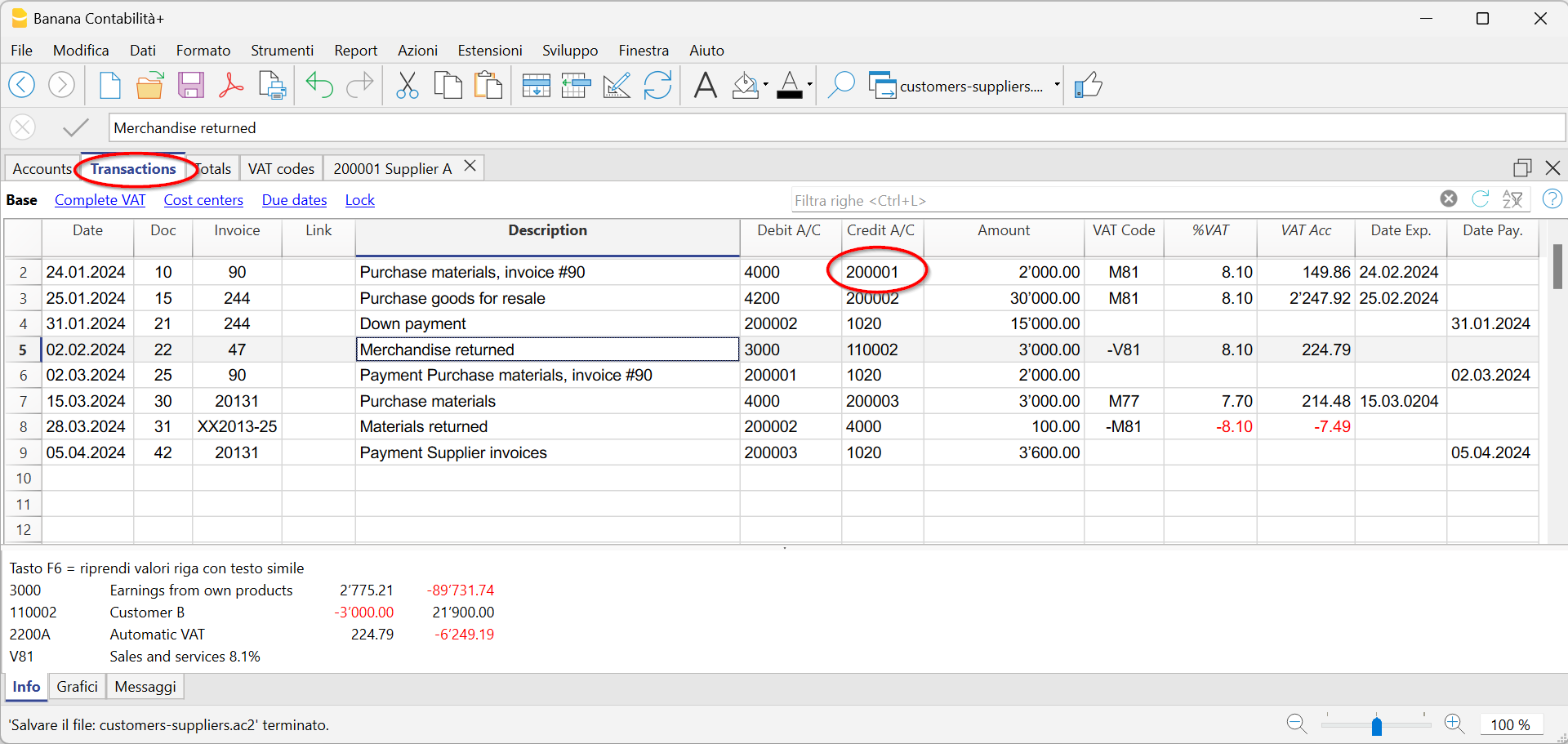

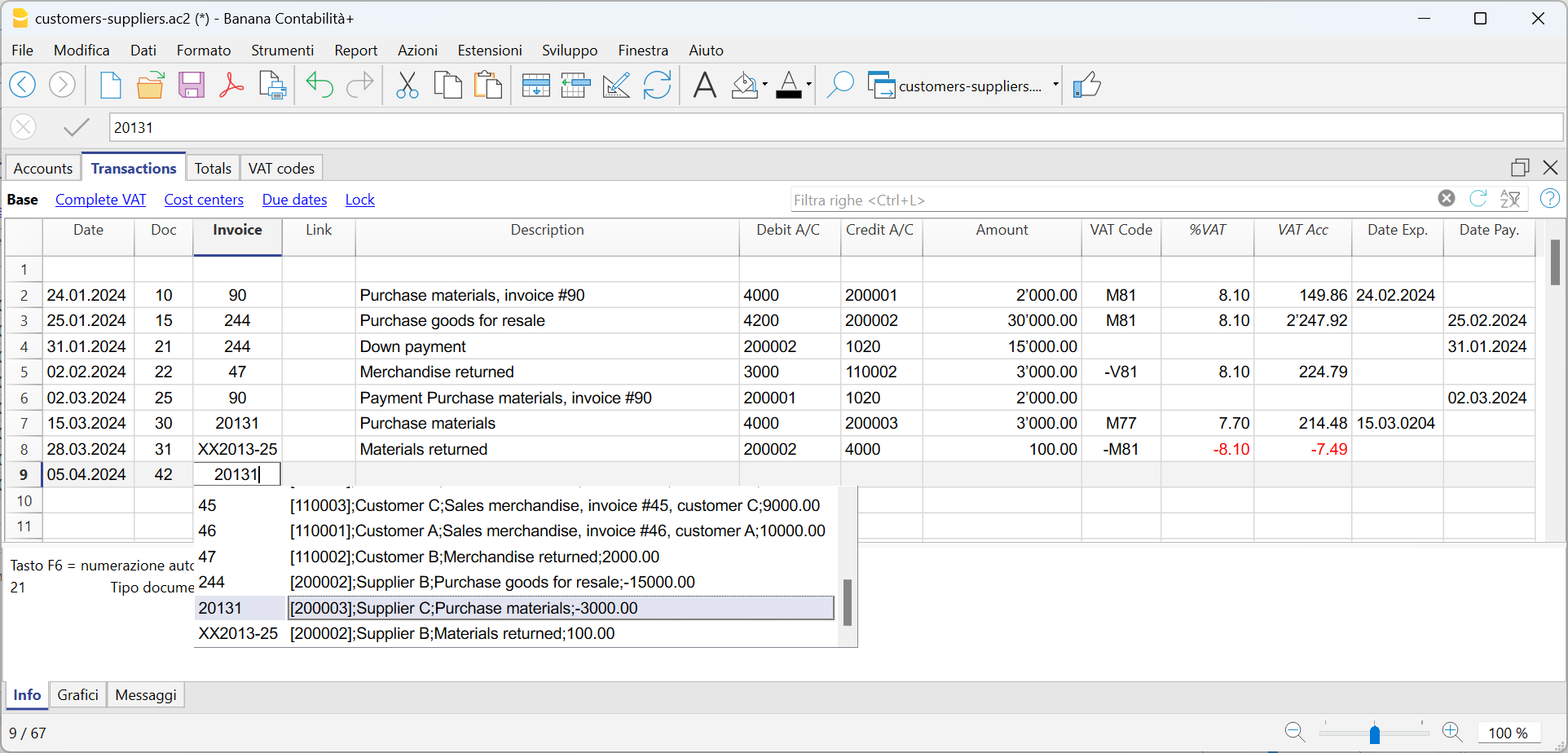

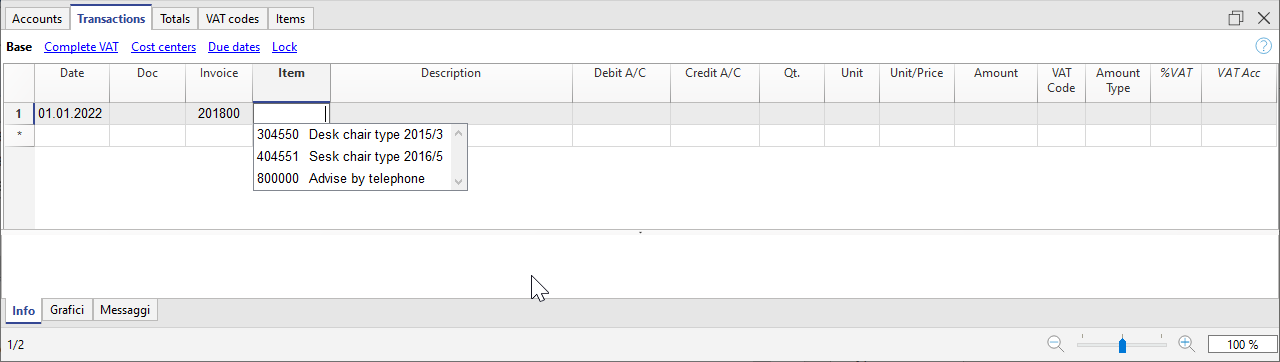

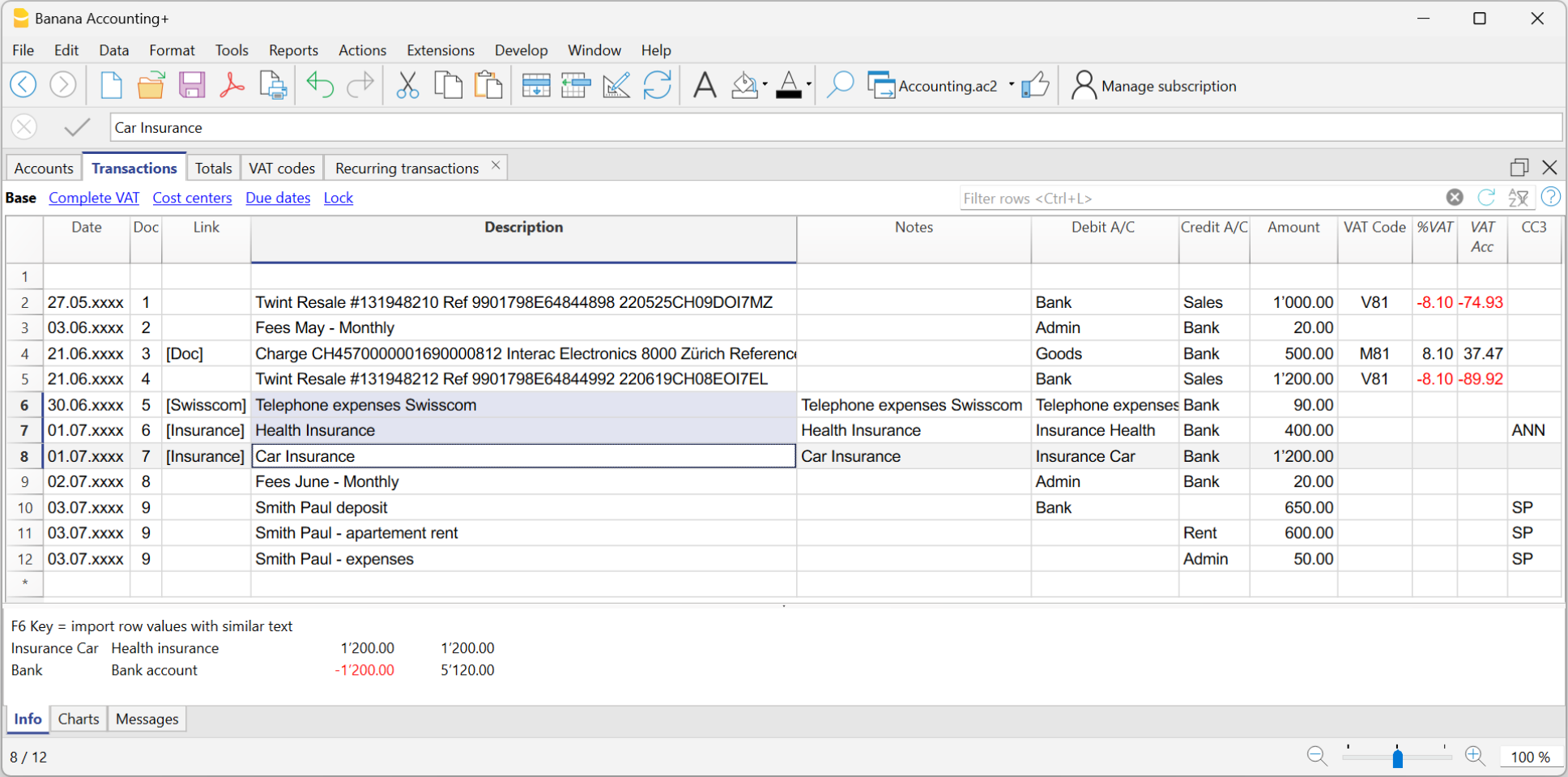

Texts, accounts and amounts auto-completion

Auto-completion makes data entry much easier and faster. As soon as you type the first few characters, the programme suggests how to complete based on already existing data (accounts, VAT codes, dates or texts you have already entered).

In the menu Tools → Program Options → Editor → Smart fill rows limit , you can limit the number of values that are suggested or even deactivate the functionality.

You can use one of the following keys to accept the value that is proposed:

- Enter key, accept the choice and move to the next editable cell, either to the right or below, depending on the settings you have chosen.

- Ctrl+ Down Arrow key, accepts the chosen value and moves to the cell below.

- Tabulator key, accepts and moves to the cell to the right.

- Shift+Tabulator key, accepts and switches to the cell to the left.

- F6 key (or Cmd+6 for Mac) accepts the text and executes the associated command (see explanation below).

Important:

To deactivate auto-completion of the previous year, the Smart fill with transactions from previous year option must be deactivated, from the menu File → File and accounting properties → Options.

Input and shortcut keys

You can speed up your data entry with various shortcut keys or by entering the dot '.', which takes on different functions depending on which column you are in.

Here are the most common ones:

- On a Date column, the dot "." inserts today's date.

- On a Time column, the dot '.' inserts the current time (e.g. in the Time Sheet).

- F4 key (or Cmd+4 on Apple computers): copies data from the cell above.

You can find the complete list of keyboard shortcuts in the menu Help → Keyboard Shortcuts.

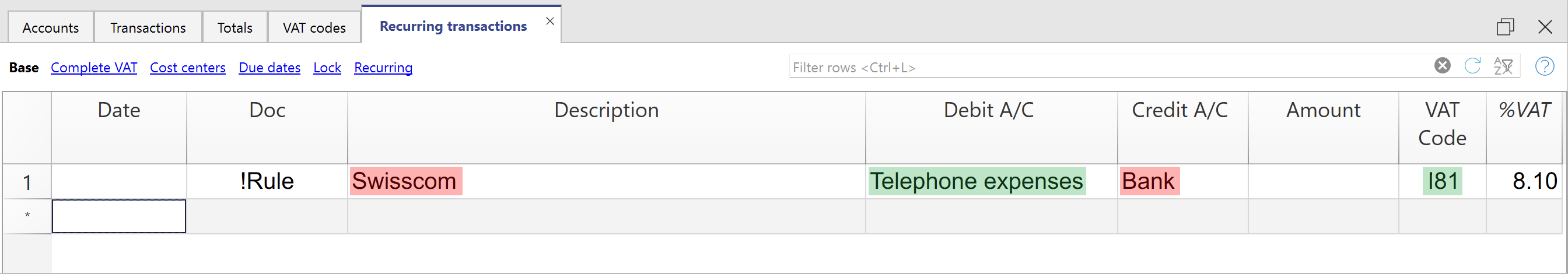

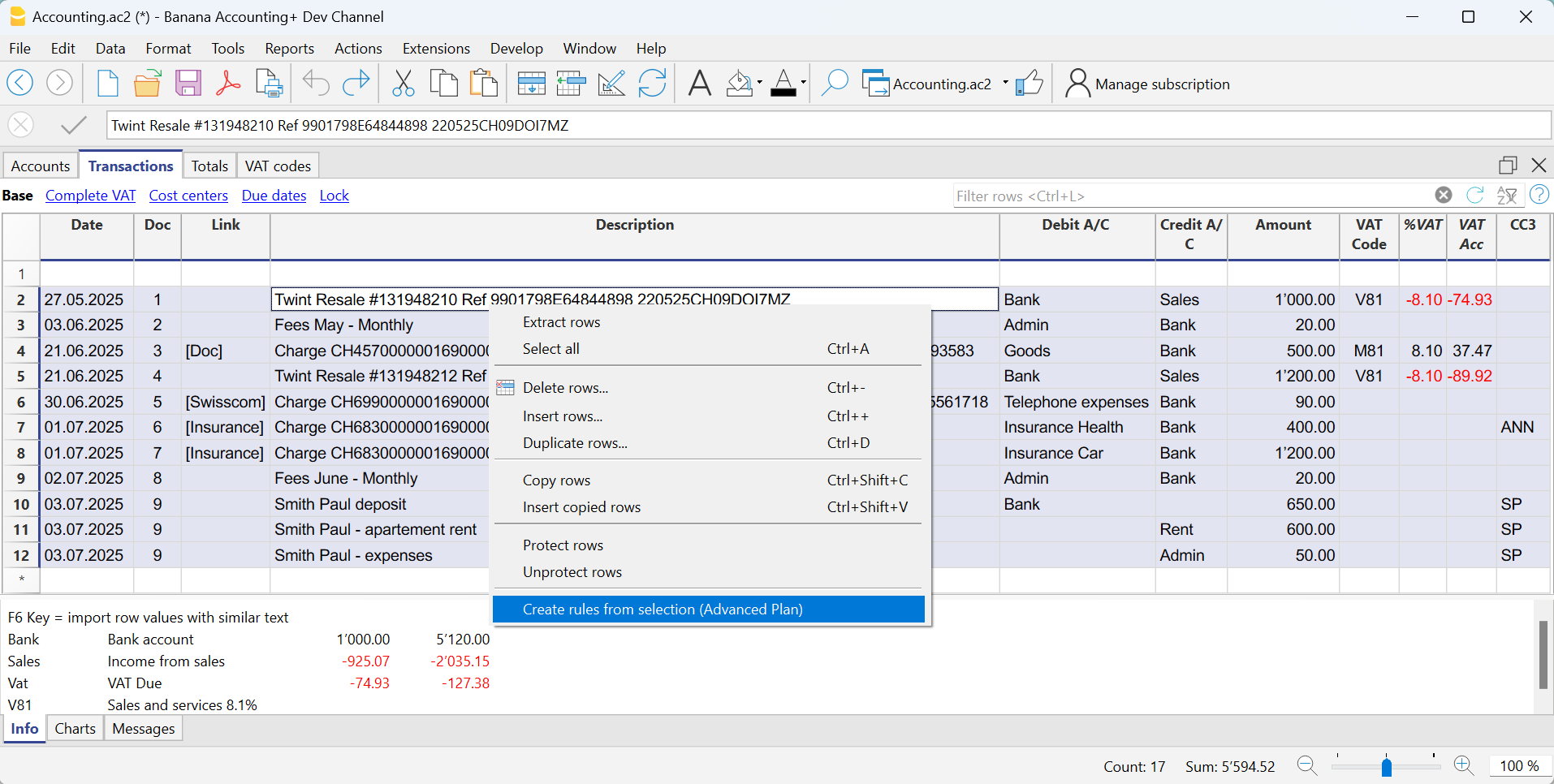

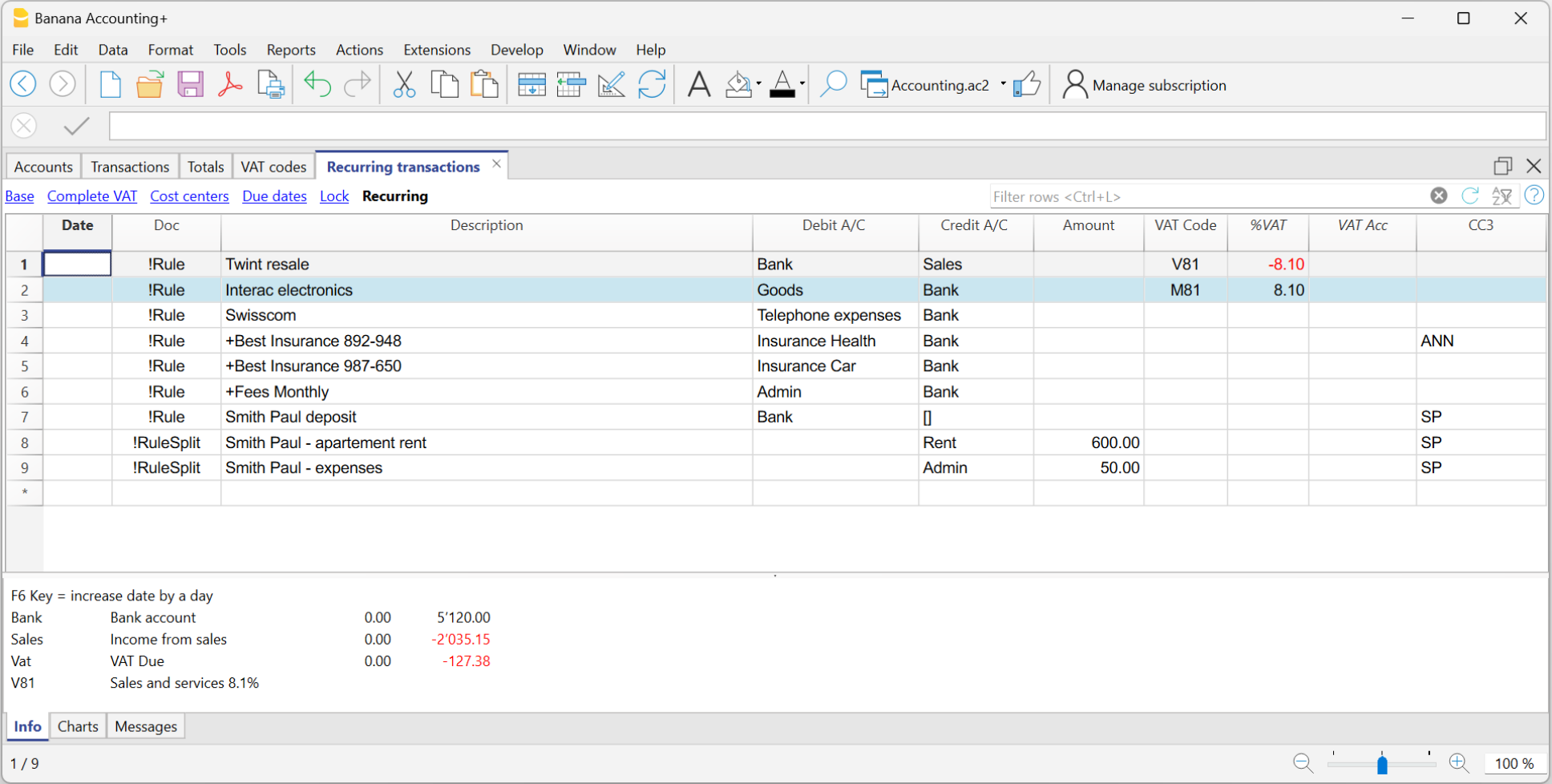

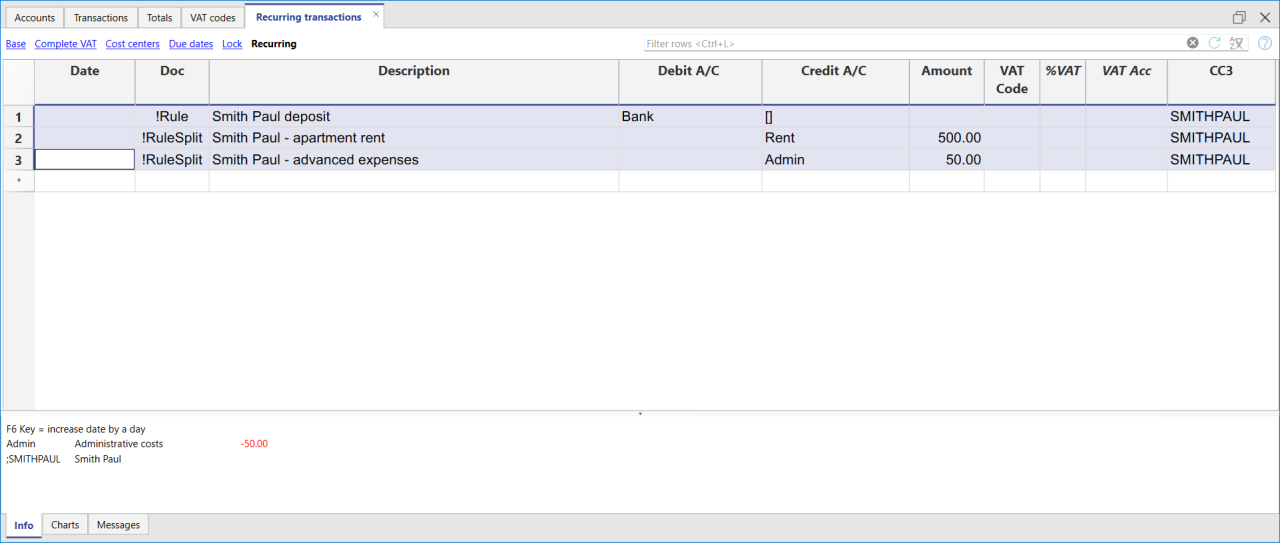

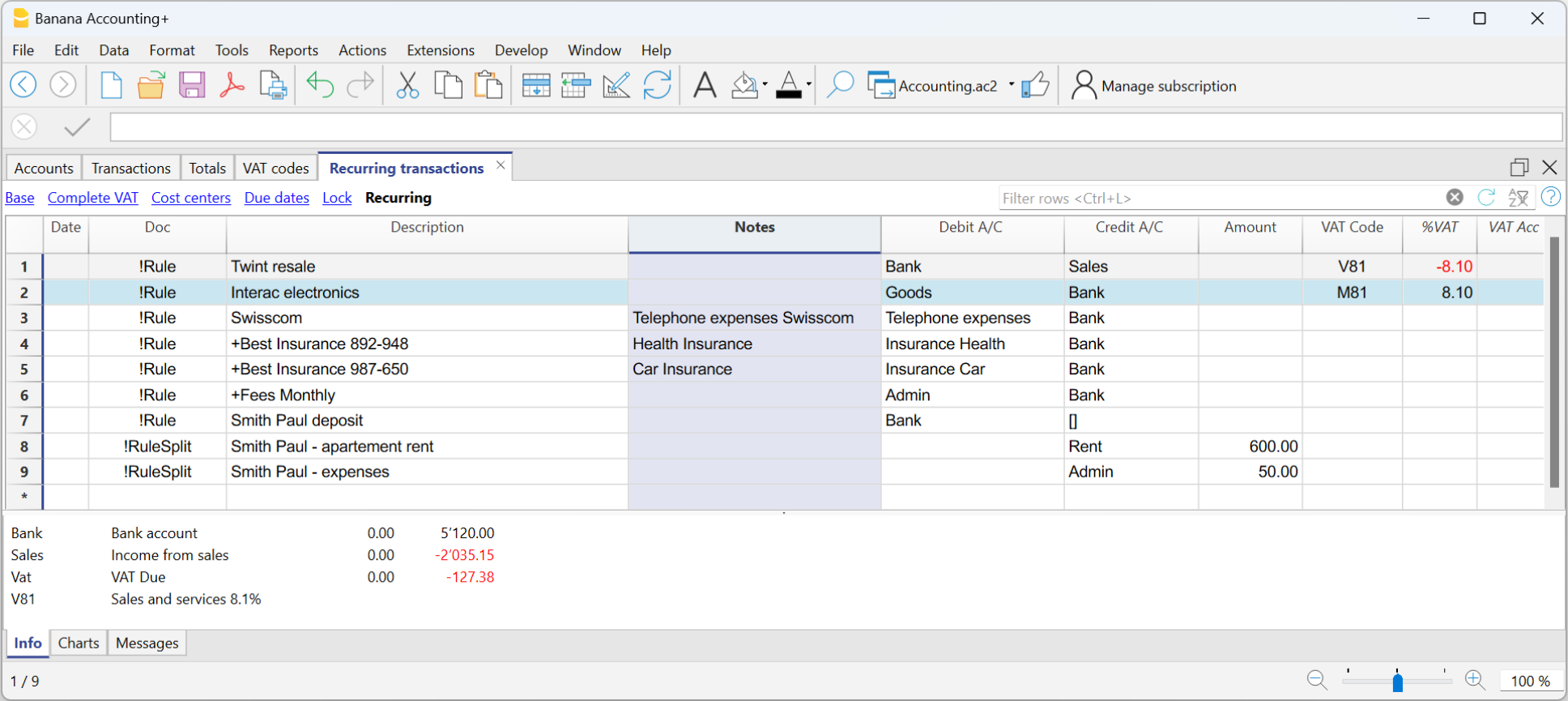

Recurring transactions

Do you have transactions that keep on repeating or almost the same every month? You can write them in the Recurring transactions table and automatically recall them in the Transactions table when you need them.

See how to enter Recurring transactions.

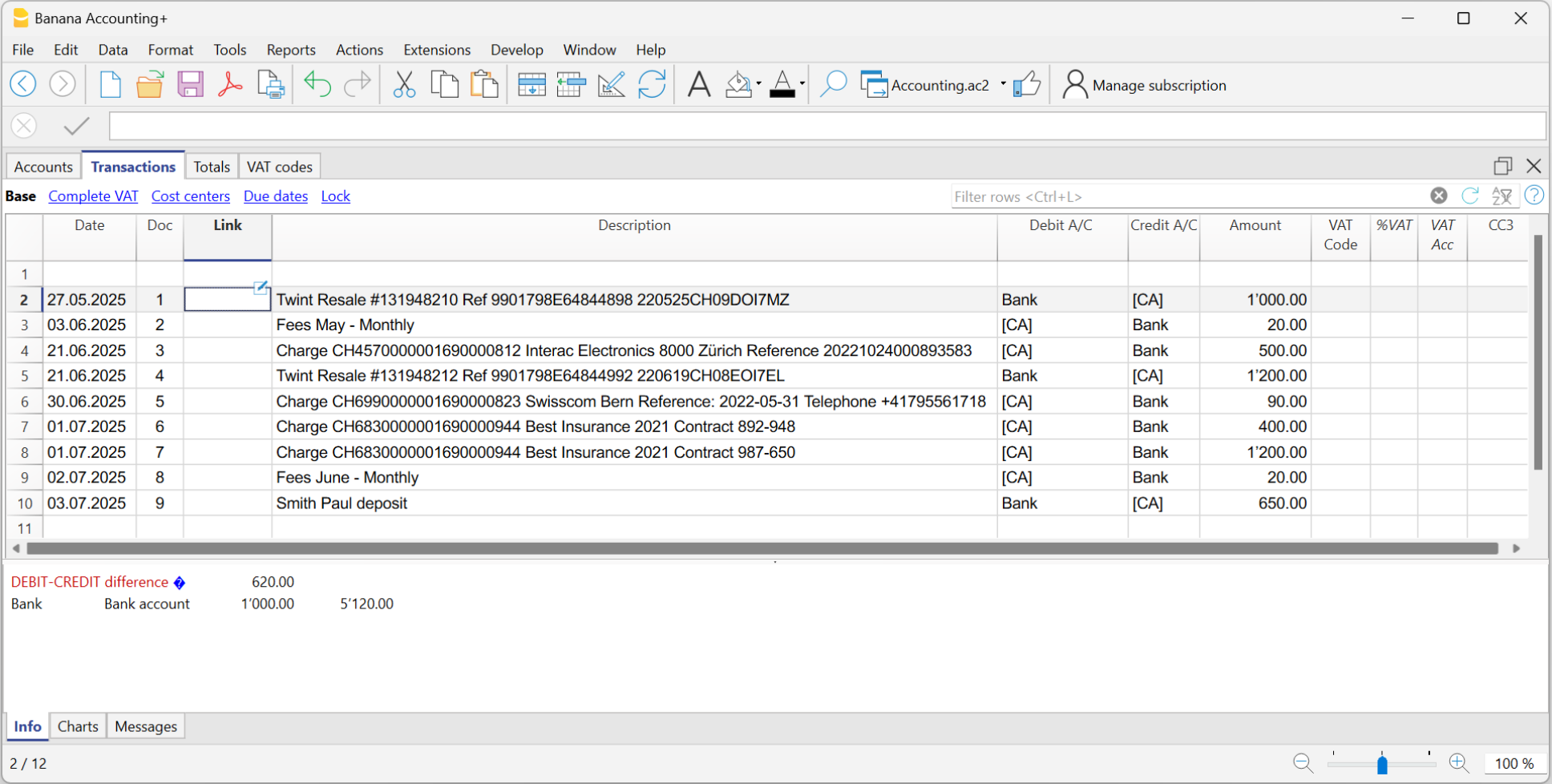

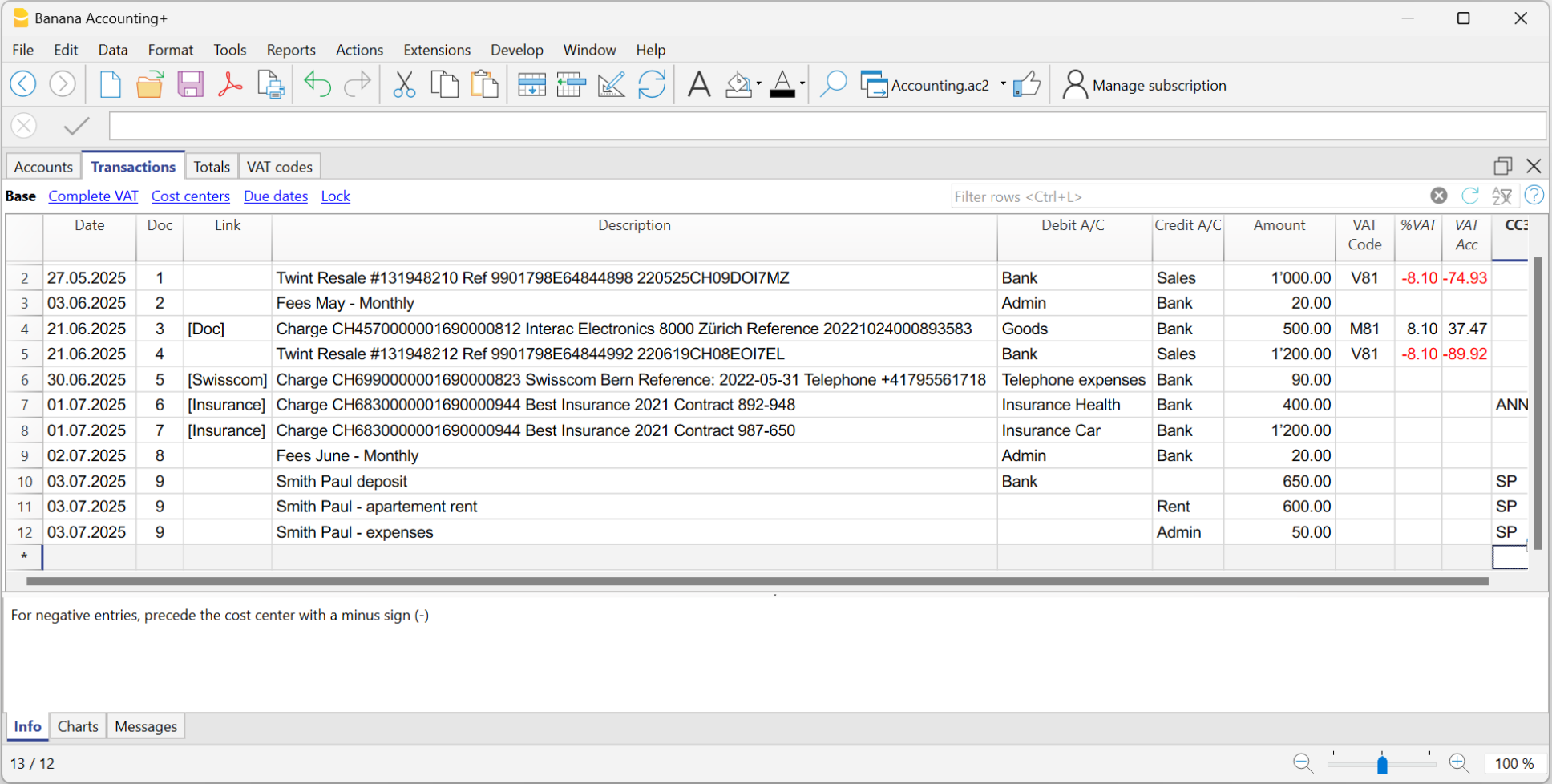

Import bank statements

Automatically import data from bank, postal, credit card, or PayPal statements.

See all available options

Integrated calculator

You can quickly enter formulas in unprotected cells, then press the Enter key and the programme performs the calculation and enters the final result. This function allows you to make immediate calculations, for example when you need to quote a value from a paper document or need to calculate a percentage. The integrated calculator is useful in all tables and in all columns of the Amount type .

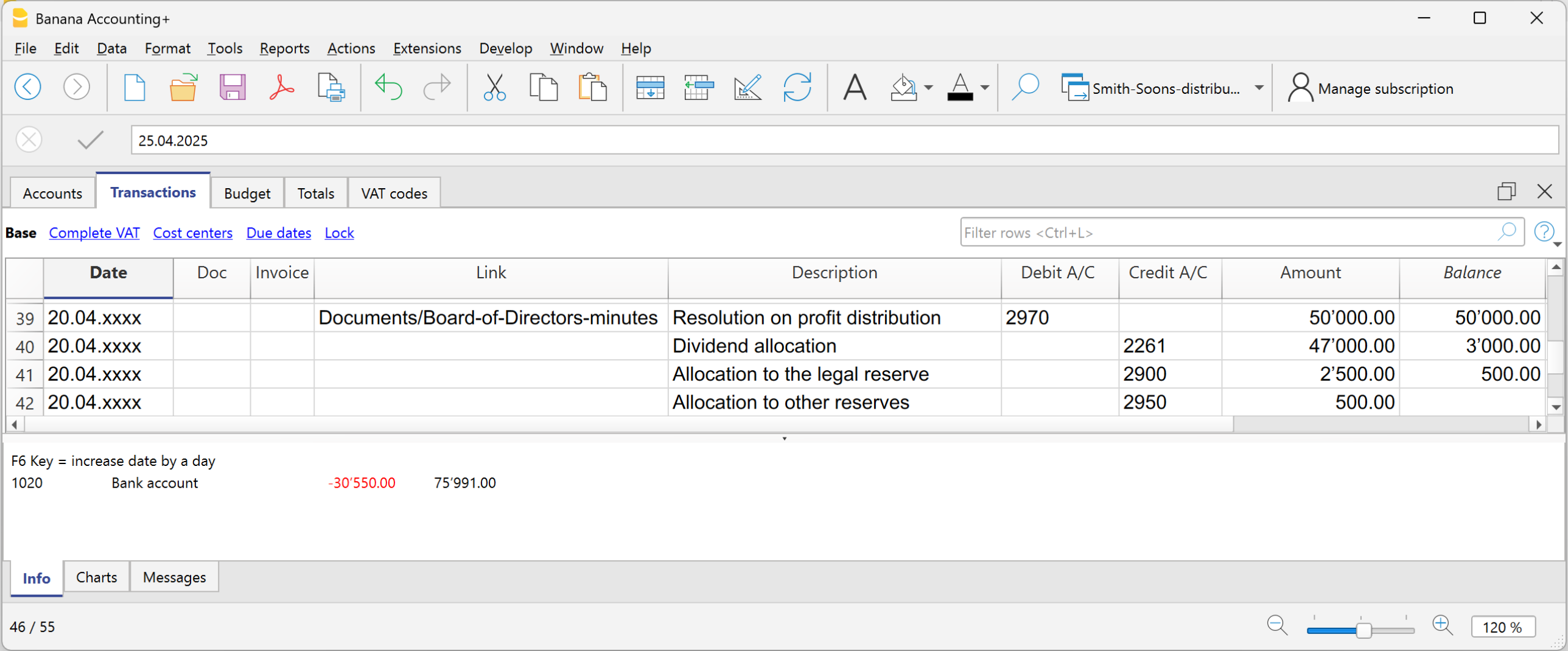

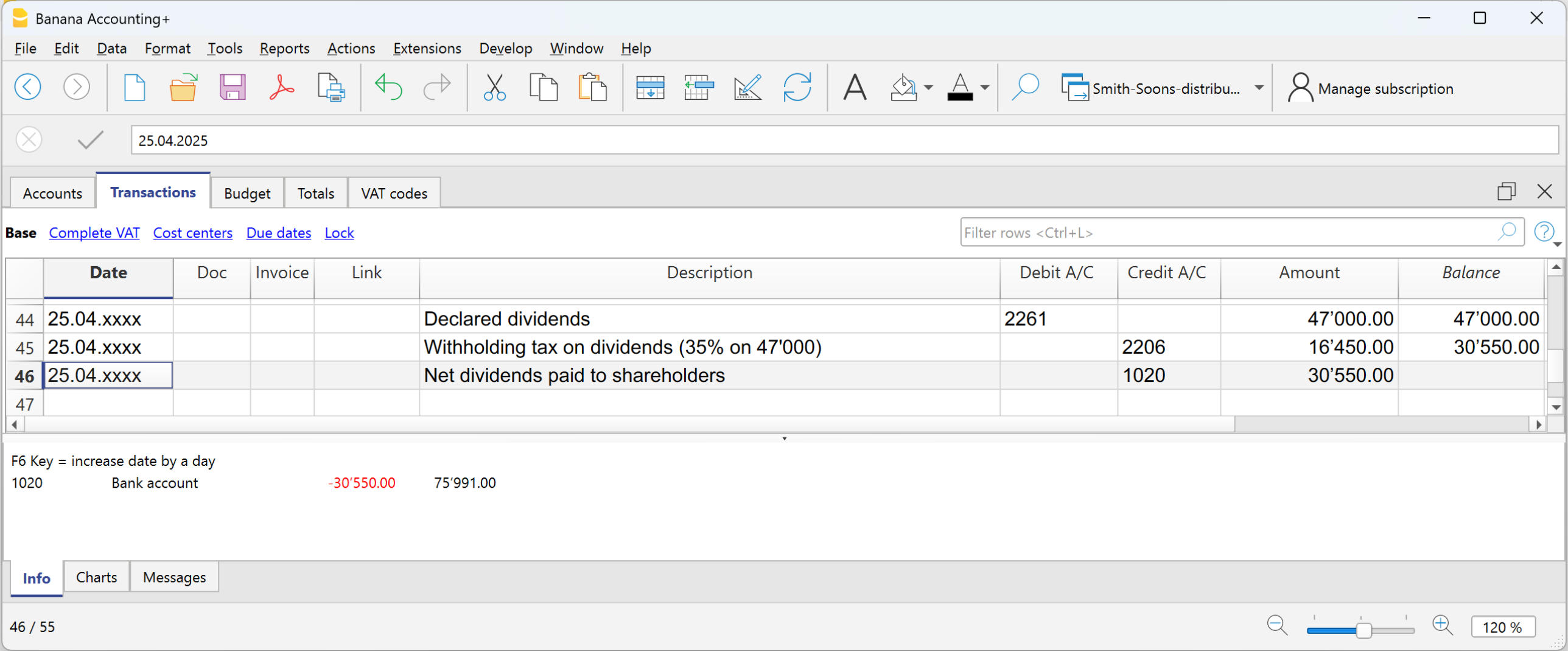

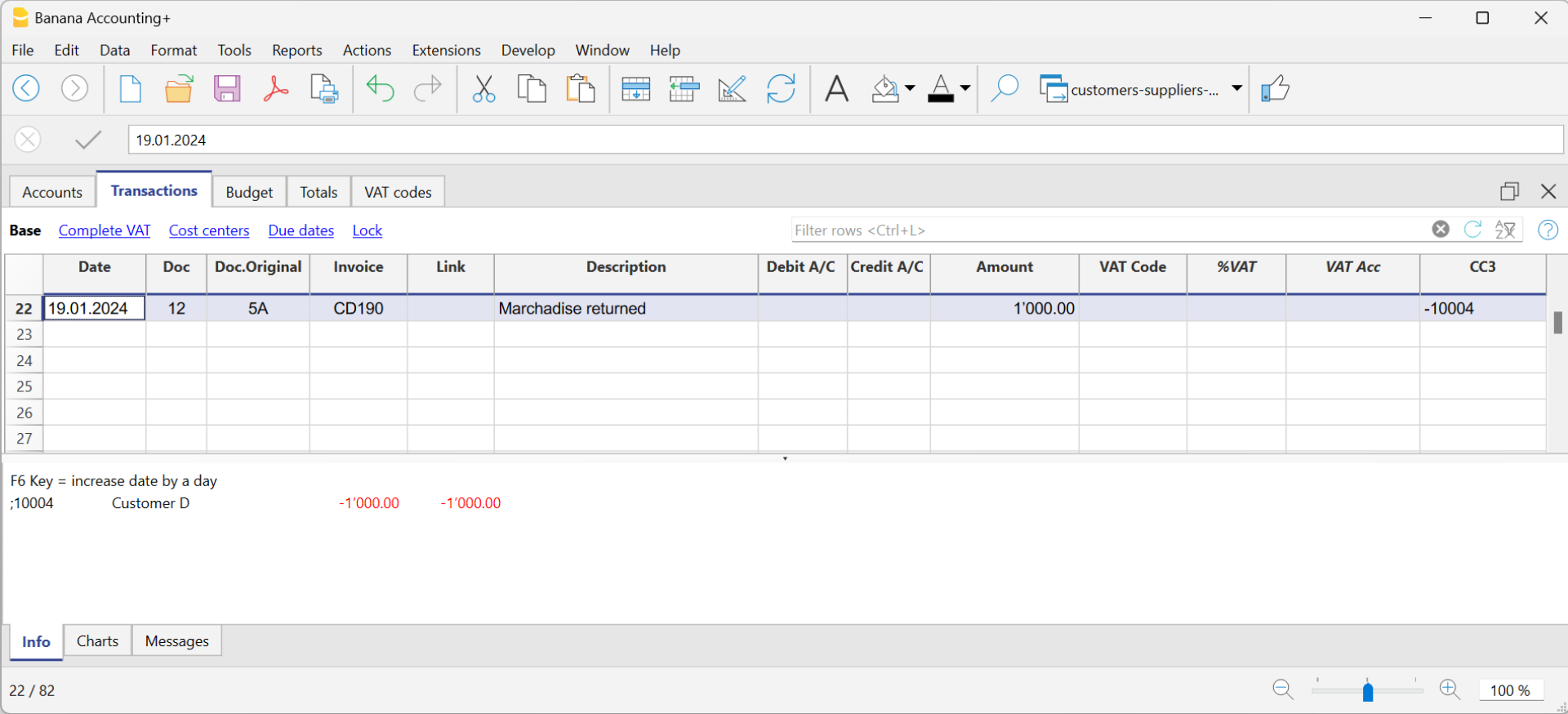

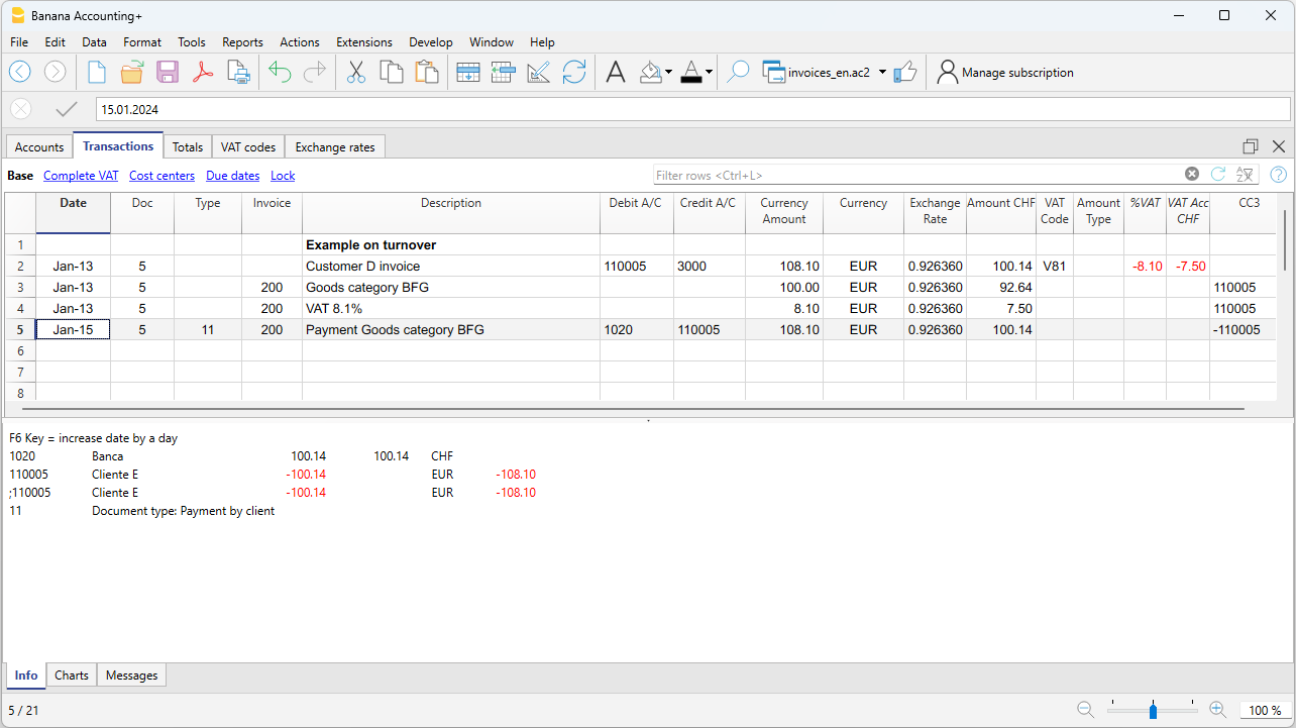

Execute Command (F6 key)

Some columns are associated with actions that are activated with the menu Edit → Execute Command, or with the corresponding key (F6 or Cmd+6 on Apple computers) indicated in the information window. This function makes it possible to retrieve data or rows quickly without having to retype the contents. Examples of actions:

- Doc column: resumption of recurring transactions or sequence number.

- Description column: resumption of similar row data.

Wrap text

When the text of a line is very long, the Calculate Line Height command from the Format menu allows you to display it completely, adjusting the line height. For more information see the Format Menu page.

Here are the most frequently used functions for checking and detecting possible errors:

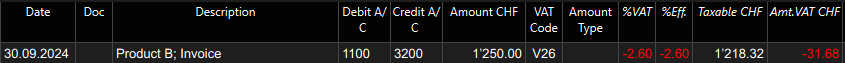

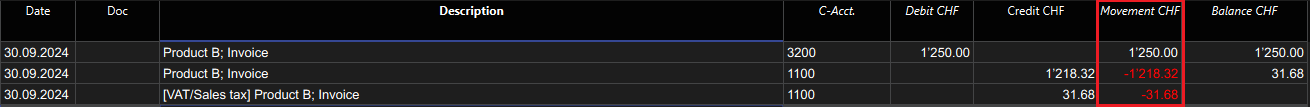

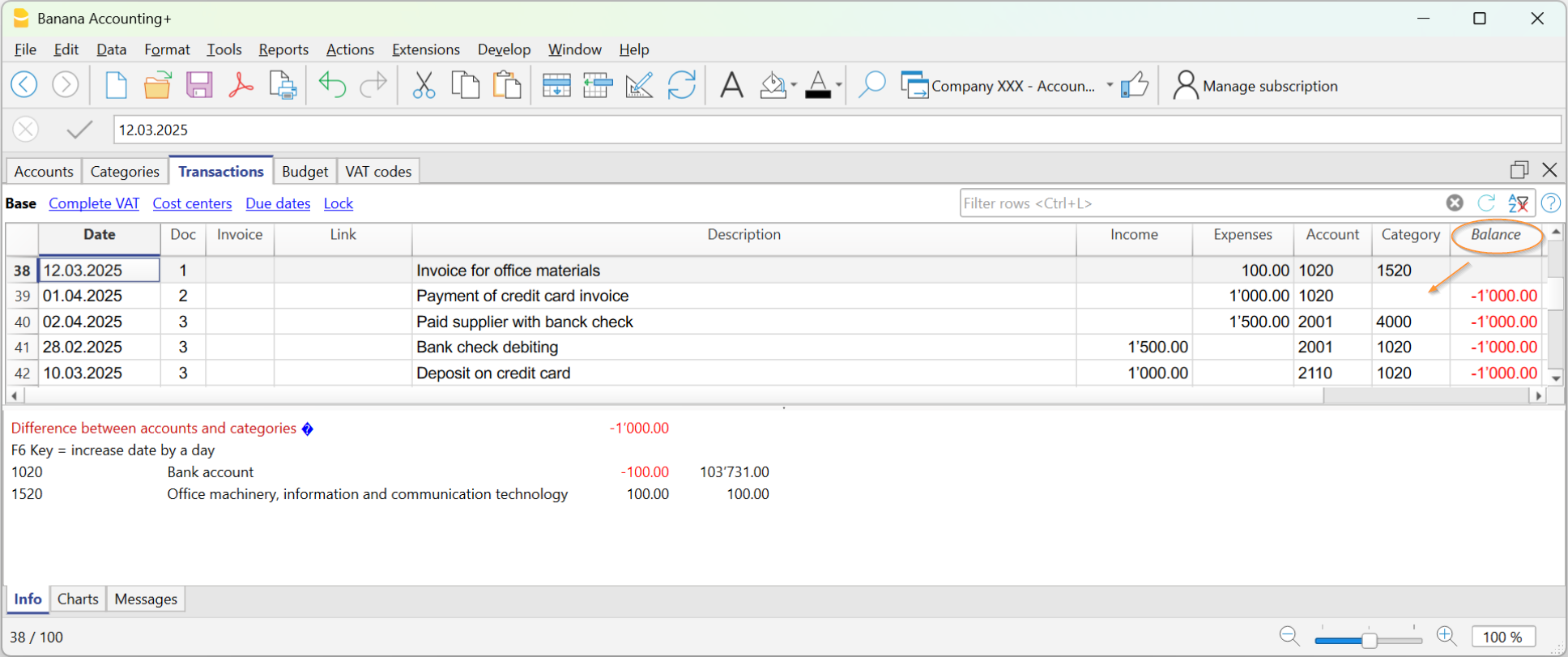

The Balance Column

In Banana Accounting Plus the possibility has been introduced to activate, in the Transactions table, the Balance column, which verifies in real time the difference between Debit and Credit accounts and immediately shows any differences.

Watch the Balance Column Video

The Balance column page

Check accounting and recalculate accounting command

The Check Accounting command from the Actions menu, rechecks all transactions and immediately reports any errors or differences.

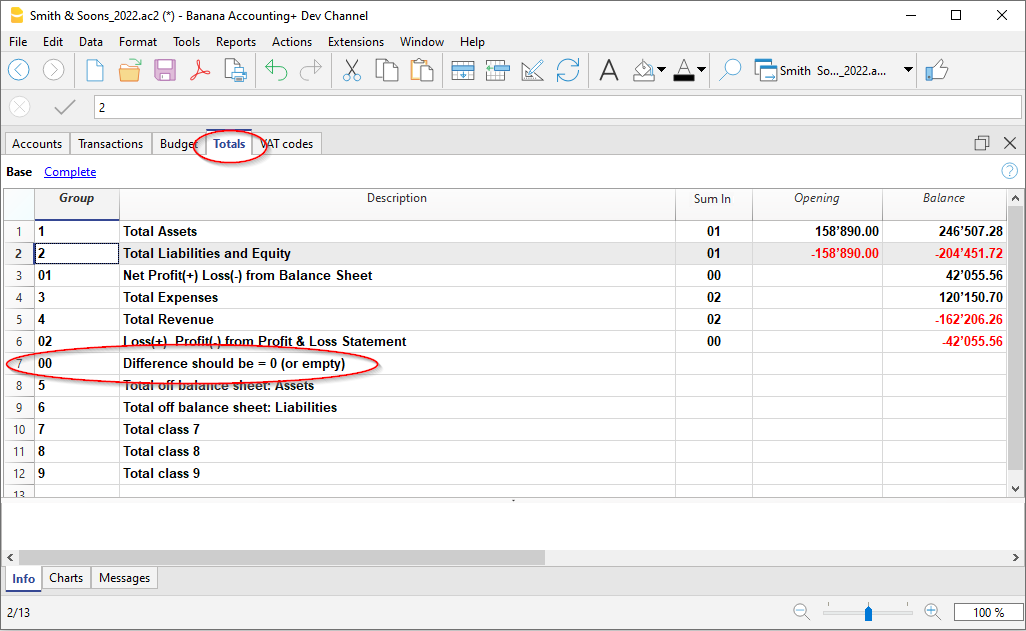

Totals Table

The Totals table gives you a concise overview of how your business is doing, as it shows the totals of the main groups and is used to check the balancing of accounts. See the explanations on the Totals table.

Temporary Filter & Sort rows

This double feature allows to Temporary Filter and Sort rows. It helps to temporary sort and filter table rows quickly ,without changing its permanent content or order. These are very useful functions to immediately search for data, both text and amounts.

Once the sorting criteria or filter is lifted the table rows go back to their original order. More info...

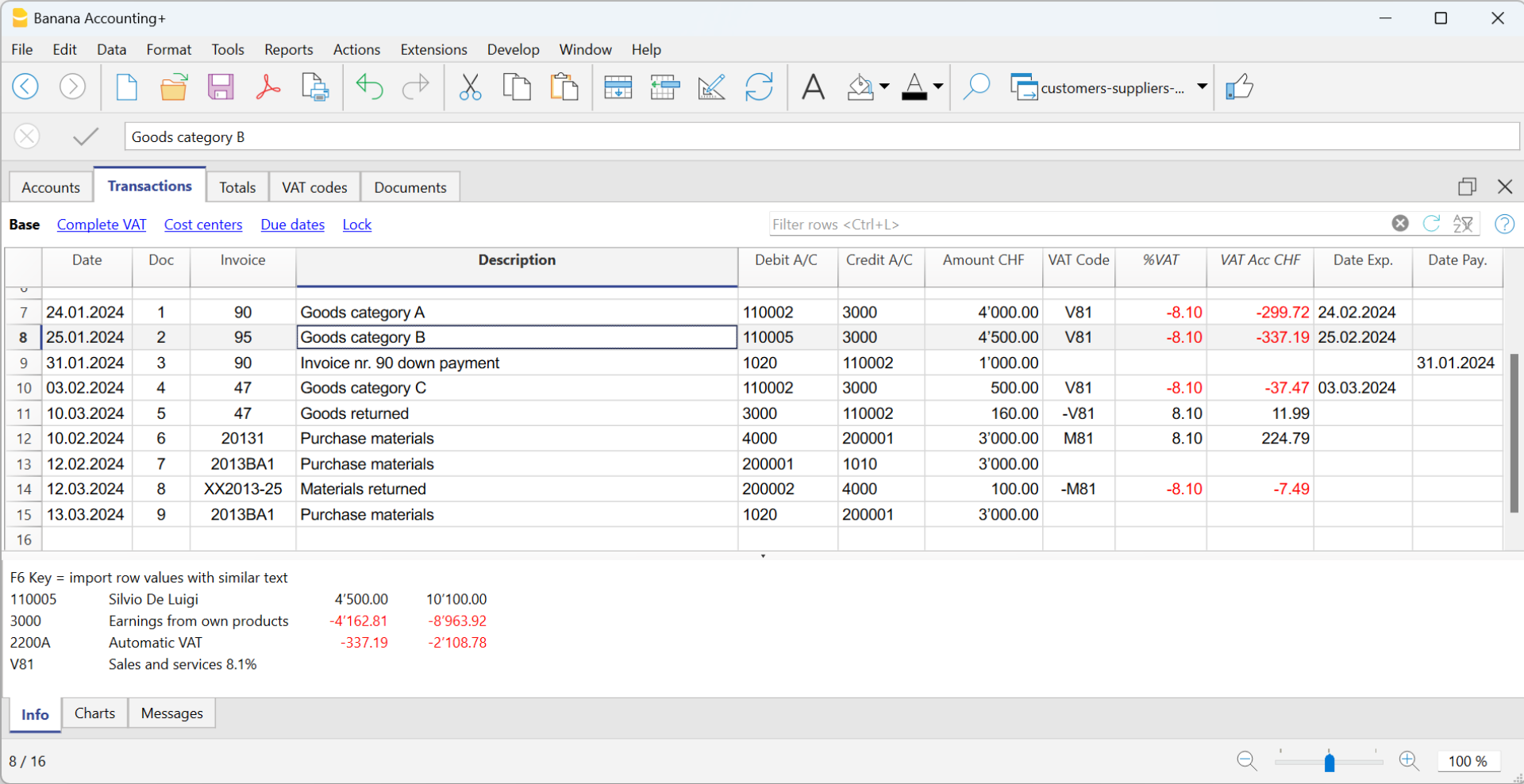

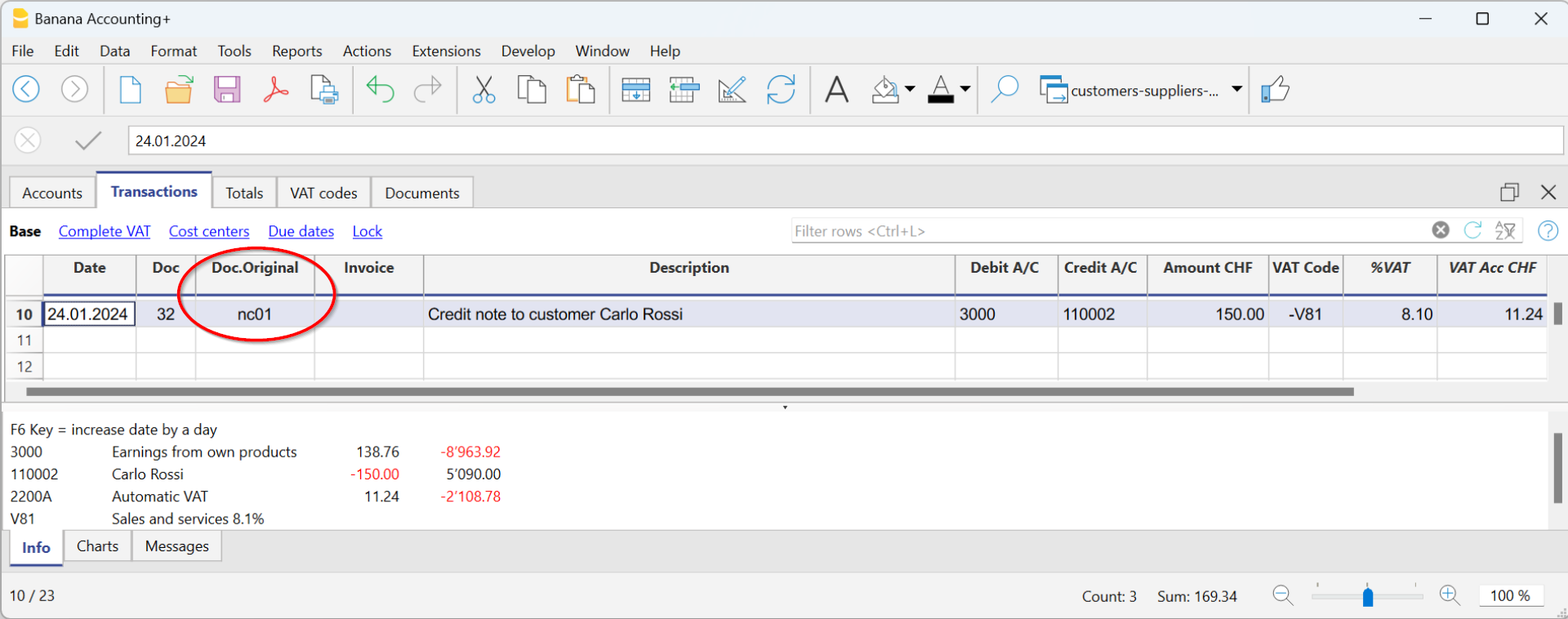

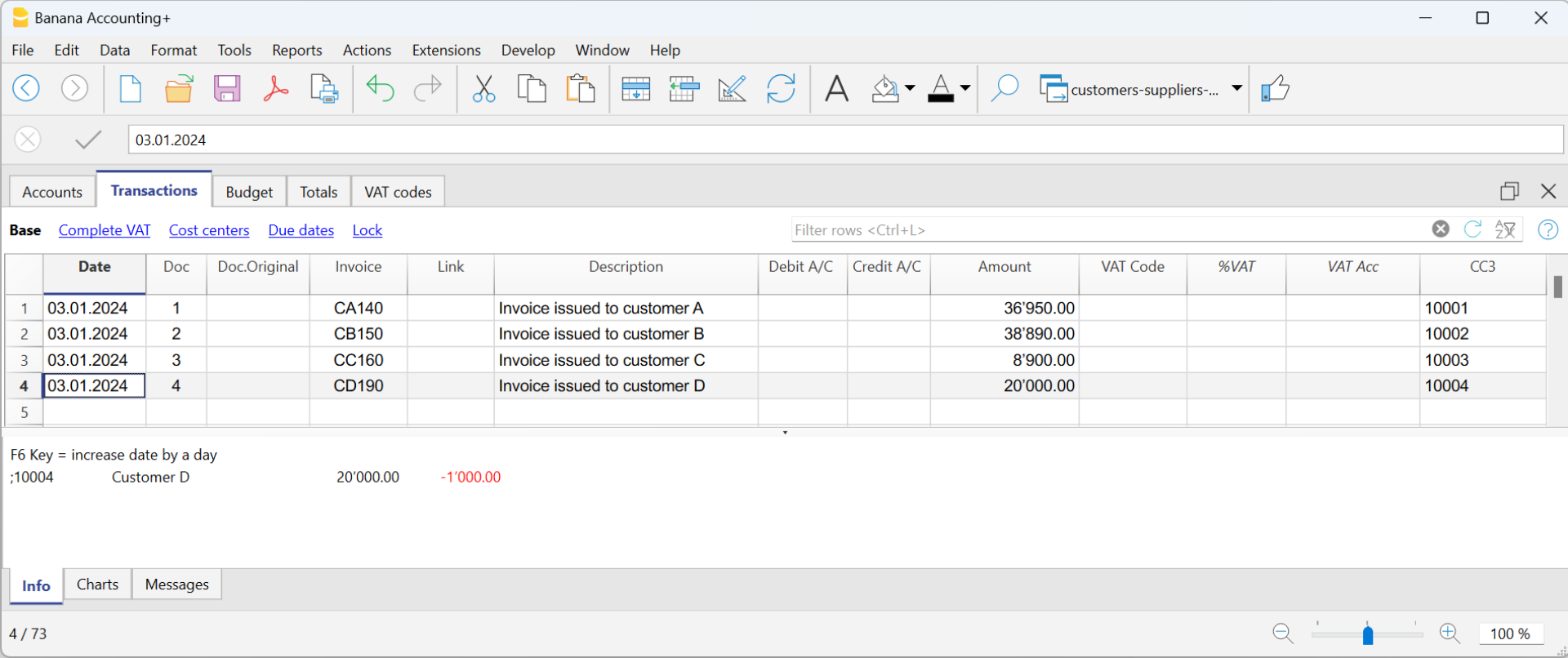

La función Filtrar filas temporal

La función Filtrar filas temporal de Banana Contabilidad Plus permite filtrar temporalmente las filas de una tabla, sin modificar su disposición permanente. Es una función muy útil para buscar inmediatamente (y modificar) datos, tanto textos como importes.

Una vez eliminado el Filtro, las filas de la tabla vuelven a su orden original.

Para cambiar el orden de las filas de una tabla de forma definitiva es necesario usar el menú Datos > Ordenar Filas.

La función Filtrar filas temporal está disponible solo en el plan Advanced de Banana Contabilidad Plus.

La función Filtrar Filas permite visualizar únicamente las filas de la tabla que incluyen la palabra clave introducida como criterio de búsqueda. Implica un notable ahorro de tiempo por los siguientes motivos:

- Búsqueda inmediata: encuentra en pocos segundos los registros deseados.

- Modificación directa: puedes intervenir de inmediato en las filas filtradas.

- Disponible en todas las tablas: Cuentas, Registros, Cambios y otras.

- Facilidad de uso: basta con introducir una palabra clave en el campo del filtro.

- Restablecimiento sencillo: al eliminar el filtro, vuelves al orden inicial de la tabla.

El texto resaltado en verde es solo con fines explicativos; no aparece en el software.

Funciones y sintaxis del Filtro

El filtro permite encontrar las filas simplemente introduciendo un texto como criterio de búsqueda. Cuando se introduce el texto a buscar, el programa filtra todas las filas que contienen el texto especificado, separado por espacios.

Aquí algunos ejemplos de Filtro:

- factura mario

Muestra las filas que contienen las palabras "mario" y "factura" en cualquier posición. - mar fac

Dependiendo del número de filas presentes, es posible obtener el mismo resultado introduciendo un texto abreviado. - "factura mario"

Búsqueda de texto que incluye espacios: si se introduce el texto entre comillas, el programa lo considerará como una sola palabra. - "!~Mario"

Normalmente la búsqueda incluye tanto mayúsculas como minúsculas.

Es posible especificar que la búsqueda sea solo por mayúsculas o minúsculas introduciendo un carácter especial.

El espacio siempre se considera como un separador para el comando Y.

- El espacio significa que las condiciones son aditivas.

- Nunca incluyas espacios en la búsqueda salvo que estén entre comillas, por ejemplo: "factura mario ".

- Ejemplos:

- factura mario

El programa considera las filas que contienen ambas palabras "mario" y "factura".- "factura mario"

El programa considera el texto entre comillas como una sola palabra, incluyendo el espacio. Por lo tanto, buscará todas las filas que contengan exactamente "factura mario" (en ese orden).

La función Filtrar filas temporal de Banana Contabilidad Plus permite filtrar temporalmente las filas de una tabla, sin modificar su disposición permanente. Es una función muy útil para buscar inmediatamente (y modificar) datos, tanto textos como importes.

Una vez eliminado el Filtro, las filas de la tabla vuelven a su orden original.

Para cambiar el orden de las filas de una tabla de forma definitiva es necesario usar el menú Datos > Ordenar Filas.

La función Filtrar filas temporal está disponible solo en el plan Advanced de Banana Contabilidad Plus.

La función Filtrar Filas permite visualizar únicamente las filas de la tabla que incluyen la palabra clave introducida como criterio de búsqueda. Implica un notable ahorro de tiempo por los siguientes motivos:

- Búsqueda inmediata: encuentra en pocos segundos los registros deseados.

- Modificación directa: puedes intervenir de inmediato en las filas filtradas.

- Disponible en todas las tablas: Cuentas, Registros, Cambios y otras.

- Facilidad de uso: basta con introducir una palabra clave en el campo del filtro.

- Restablecimiento sencillo: al eliminar el filtro, vuelves al orden inicial de la tabla.

El texto resaltado en verde es solo con fines explicativos; no aparece en el software.

Funciones y sintaxis del Filtro

El filtro permite encontrar las filas simplemente introduciendo un texto como criterio de búsqueda. Cuando se introduce el texto a buscar, el programa filtra todas las filas que contienen el texto especificado, separado por espacios.

Aquí algunos ejemplos de Filtro:

- factura mario

Muestra las filas que contienen las palabras "mario" y "factura" en cualquier posición. - mar fac

Dependiendo del número de filas presentes, es posible obtener el mismo resultado introduciendo un texto abreviado. - "factura mario"

Búsqueda de texto que incluye espacios: si se introduce el texto entre comillas, el programa lo considerará como una sola palabra. - "!~Mario"

Normalmente la búsqueda incluye tanto mayúsculas como minúsculas.

Es posible especificar que la búsqueda sea solo por mayúsculas o minúsculas introduciendo un carácter especial.

El espacio siempre se considera como un separador para el comando Y.

- El espacio significa que las condiciones son aditivas.

- Nunca incluyas espacios en la búsqueda salvo que estén entre comillas, por ejemplo: "factura mario ".

- Ejemplos:

- factura mario

El programa considera las filas que contienen ambas palabras "mario" y "factura".- "factura mario"

El programa considera el texto entre comillas como una sola palabra, incluyendo el espacio. Por lo tanto, buscará todas las filas que contengan exactamente "factura mario" (en ese orden).

Caracteres especiales

Es posible utilizar casi todos los caracteres en la búsqueda.

Solo el signo de exclamación "!" y la barra vertical "|" al inicio de una secuencia de texto tienen un significado particular.

- "|" para indicar O

Al menos uno de los elementos precedidos por "|" debe estar presente en la fila.

En el caso siguiente, la búsqueda mostrará las filas que incluyen "mario" y "factura" o "parcela".

mario |invoice |parcela

La barra vertical es el carácter Alt-124. Si no lo encuentras en el teclado, busca en Google- "Distribución de teclado windows/mac españa/suiza/usa" y revisa la sección de imágenes.

- Especificador de comando "!".

Cualquier texto precedido por el signo de exclamación se considera un comando y tiene un significado particular.

Por ejemplo, para excluir un texto, utiliza la secuencia de comandos "!-".

mario !-factura

Sintaxis avanzada para la búsqueda con el Filtro

La sintaxis avanzada de la búsqueda es solo experimental: podría estar sujeta a cambios y mejoras.

El carácter "!" al inicio de un texto indica que se trata de un comando especial de búsqueda.

- !

Cuando se coloca antes o después de un espacio, inicia una secuencia de comandos. - !!

Se considera como un simple "!" y no como una secuencia de comandos. - !-

El signo menos "-" se utiliza para excluir contenidos y puede combinarse con cualquier otro operador.

!-mario !-1000 !-=1000 !-^pago !-~10 - !~

La tilde "~" debe colocarse inmediatamente después de "!" o "!-".

Con "~" la búsqueda distingue entre mayúsculas y minúsculas.

!~mario

!-~mario

Caracteres de comando

Son los caracteres que siguen inmediatamente al inicio del comando "!", "!-", "!~" o "!-~".

Pueden usarse también con el "-" para excluir y con "~" para que la búsqueda distinga mayúsculas y minúsculas.

- !=

Encuentra exactamente el texto especificado en la celda.

!=1000

Puede usarse con varios valores separados por el carácter "|".

!=1000|2000|30000

Celda vacía.

Desde la versión 10.1.16 selecciona celdas con valores vacíos.

!= - !+

Contiene el texto especificado. Equivalente a la búsqueda normal, pero permite combinaciones con otros caracteres.

!-+mario excluye filas que contienen "mario".

!~+mario excluye filas con "mario" distinguiendo mayúsculas y minúsculas. - !<>

Distinto del texto proporcionado.

!<>1000 - !.

Caracteres comodín (*,?) para una búsqueda con caracteres especiales.

!.100*

!.100*|2?0* - !^

Empieza con el texto especificado.

^mar

^mar|hom - !$

Termina con el texto especificado.

!$rio - !_

Búsqueda por palabra completa.

!_100

!_100|200 - !:

Expresión regular.

!:\bmario\b

Mayor, Menor e Intervalos

Caracteres usados para comparar valores numéricos o fechas.

- Fecha en formato yyyy-mm-dd

2024-12-31 - Importe con el "." como separador decimal y sin separador de miles.

1999.99

Comandos de comparación:

- !> Mayor que.

!>100 - !>= Mayor o igual que.

!>=100 - !< Menor que.

!<100 - !<= Menor o igual que.

!<=100 - !<> Distinto de.

- !>< Intervalo exclusivo.

!><99.99|200 - !>=< Intervalo inclusivo.

!>=<100|199.99

Especificación de columnas

Permite especificar la columna en la que ejecutar la búsqueda.

- !descripción!

Búsqueda en la columna "descripción".

!descripción!mario

!descripción!=

!des*!mario

!des*;doc!mario

!descripción:xml!mario

!debit*!=1000

Mostrar filas con color

- !_co! o !_color! Muestra filas con un color.

- !_co!2 Muestra filas con color estilo 2.

- !_co!2|3 Muestra filas con color estilo 2 o 3.

Mostrar filas con formato

- !_fo! Muestra filas con un formato específico.

- !_fo!b Muestra filas en negrita.

- !_fo!i Muestra filas en cursiva.

Mostrar filas con errores

- !_er! Muestra filas con errores o avisos.

- !_er!e Muestra filas con errores.

- !_er!w Muestra filas con avisos.

Combinación de filtros

- 2022 !des*!mario !debit*!=1000

Muestra filas con "2022", "mario" en columnas "des" y "1000" exacto en columnas "debit". - |!PeriodTotal_?_C:xml!<> |!PeriodEnd_?_C:xml!<>

Muestra las filas con un importe, en columnas cuyo nombre XML empieza con PeriodTotal_ y termina con _C

o bien cuyo nombre XML empieza con PeriodEnd_ y termina con _C

Motivación de la sintaxis del Filtro

La sintaxis avanzada de búsqueda puede parecer extraña, pero queríamos una sintaxis que

- No interfiriera con la búsqueda natural, de modo que el usuario pudiera realizar la mayoría de búsquedas de forma intuitiva, combinando los textos exactamente como está acostumbrado en las aplicaciones para smartphone.

- No fuera específica de un idioma, utilizando únicamente símbolos.

- Soportara todas las posibles búsquedas, de forma que pudiera usarse para expresar filtros similares a los de Excel.

- Abriera la posibilidad de incluir comandos específicos de Banana, como color, errores, etc.

Evaluamos varias otras sintaxis de búsqueda, pero todas utilizaban caracteres comunes como el signo menos "-" o el "+", o bien otros como "\", "(", "*", "?", que se usan frecuentemente en contabilidad.

Por ello decidimos crear una sintaxis especial en la que el signo de exclamación "!" se usa como indicador de comando. El "!" normalmente se usa al final de una frase, por lo que es poco probable que interfiera con la búsqueda.

¡Todos los comentarios y sugerencias son bienvenidos!

GPT de Banana Contabilidad Plus generador de comandos para usar el Filtro

El generador de comandos GPT para la sintaxis avanzada de búsqueda (Filtro) es solo experimental: podría estar sujeto a cambios y mejoras.

Este GPT de Banana Contabilidad fue creado utilizando ChatGPT y está diseñado para generar una sintaxis avanzada de búsqueda para filtrar las filas en la tabla Registros.

Requisitos

Para usar este GPT, es necesario:

- Descargar e instalar la última versión de Banana Contabilidad Plus

- Tener una cuenta ChatGPT.

- Para usar este GPT, necesitas una suscripción ChatGPT Plus. Sin ella, puedes probar el servicio gratuitamente hasta un máximo de diez solicitudes. Después, deberás actualizar a ChatGPT Plus o esperar algunas horas antes de poder hacer más solicitudes.

Cómo funciona

- Abre el GPT de Banana Contabilidad Plus desde este enlace:

- En el campo Mensaje al final, introduce una frase que describa lo que quieres buscar dentro de la tabla Registros con el Filtro. En general, cuanto más específicas sean las solicitudes, mejores serán los resultados.

- El GPT procesará tu solicitud y devolverá el resultado correspondiente.

Según el input proporcionado al GPT, se generará una cadena de texto que contiene el comando necesario para filtrar las filas en la tabla Registros. - Copia la cadena de texto generada.

- Pega la cadena copiada en el Filtro de la tabla Registros en Banana Contabilidad Plus.

Ejemplos de mensajes para insertar en el GPT

A continuación se muestran ejemplos de mensajes que puedes introducir en el chat del GPT, junto con los resultados generados:

- "Encuentra todos los registros del tercer trimestre de 2024"

- Resultado: "!date:xml!>=2024-07-01 !date:xml!<=2024-09-30"

- "Busca las filas con un importe de 450.00"

- Resultado: "!amount:xml!=450.00"

- "Busca las filas con un importe mayor de 200"

- Resultado: "!amount:xml!>200"

- "Busca las filas con el valor 3001 en la columna Cuenta Haber"

- Resultado: "!accountcredit:xml!=3001"

- "Dame las filas con el valor 1020 en la columna Cuenta Haber y un importe entre 1500 y 4000"

- Resultado: "!accountcredit:xml!=1020 !amount:xml!>=<1500|4000"

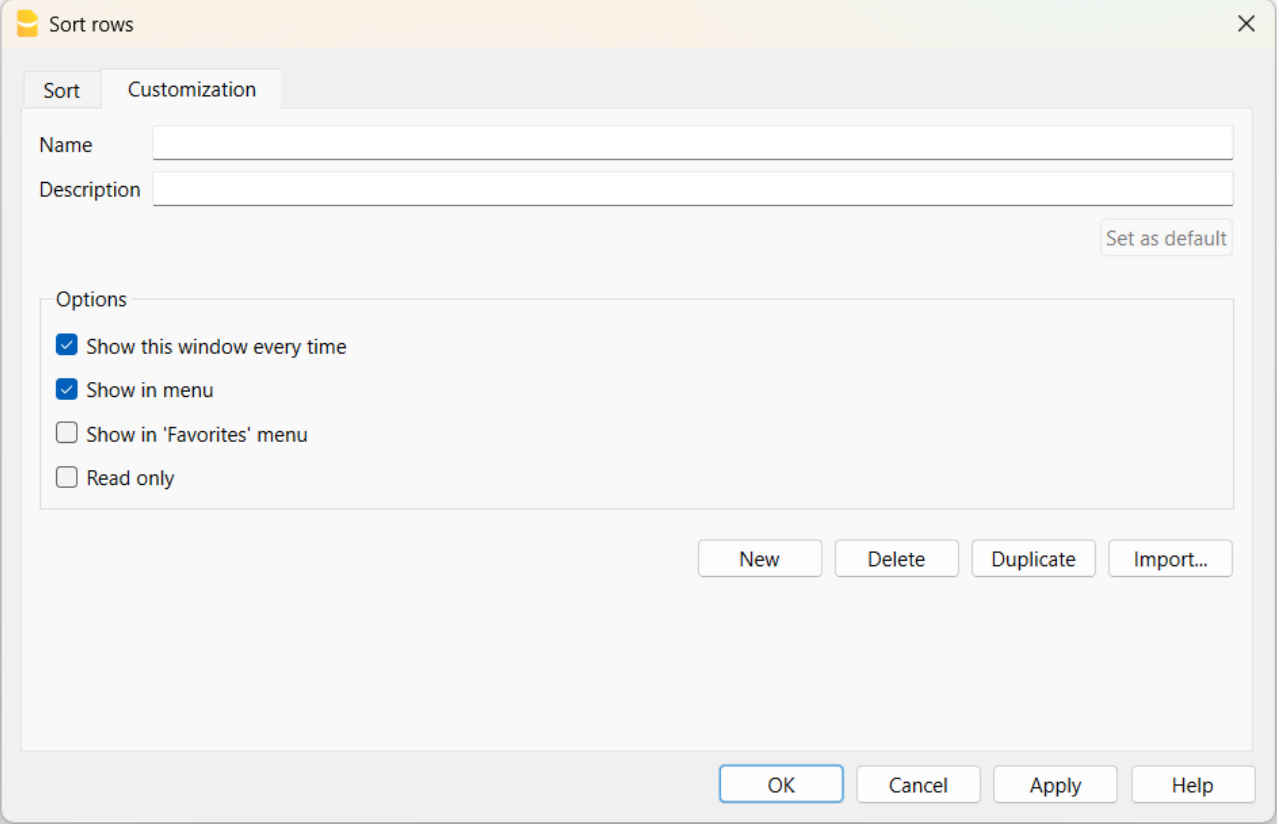

La función Ordenar filas temporal

La función Ordenar filas temporal de Banana Contabilidad Plus permite ordenar temporalmente las filas de una tabla, sin modificar su disposición permanente. Es una función muy útil para buscar inmediatamente datos, tanto textos como importes.

Una vez eliminada la función, las filas de la tabla vuelven a su orden original.

Para cambiar el orden de las filas de una tabla de forma definitiva es necesario usar el menú Datos > Ordenar Filas.

La función Ordenar filas temporal es una de las nuevas funcionalidades. Les rogamos nos envíen sus comentarios sobre cómo mejorarla. Está disponible solo en el plan Advanced de Banana Contabilidad Plus.

Esta herramienta permite ordenar rápidamente el contenido según la columna desde la cual se aplica la función Ordenar:

- Haga clic con el botón derecho del ratón en el encabezado de la columna donde necesite un ordenamiento.

- Sitúese sobre la pequeña flecha y seleccione el criterio de orden ascendente o descendente.

Ventajas

- Puede ordenar las filas visualizadas, en sentido ascendente o descendente, según la columna deseada.

- A diferencia de Excel, cuando elimina el ordenamiento de visualización, las filas vuelven al orden original sin necesidad de usar el comando Deshacer.

En el encabezado de la columna elegida para ordenar los datos aparecerá una flecha.

Nota importante

La función Ordenar filas temporal es diferente del comando Ordenar filas (del menú Datos):

- Ordenar filas temporal es un ordenamiento de filas en pantalla de forma temporal, concebido para agilizar la revisión y modificación de los datos introducidos previamente. Es posible eliminar fácilmente los criterios de ordenamiento para volver al orden original de las filas. Esta función está disponible solo con el plan Advanced.

- El comando Ordenar filas (del menú Datos) modifica de forma permanente el orden de las filas de la tabla y solo puede deshacerse con el comando Deshacer. Este comando está disponible para todos los planes.

Edit Menu

The Edit menu contains a series of practical data editing commands.

Also see Keyboard shortcut.

Undo / Redo operation

These simple commands allow you to cancel or restore the last operation made. To set the maximum number of undo operations, you need to set it in the Tools menu > Program Options > Editor > Max number of Undo Operations.

Copy, Cut and Paste

All rows of Banana Accounting tables and the data they contain (except data in protected tables and cells) can be copied, cut and pasted exactly as in Excel.

- Select the line or the area of data to be copied

- In the Edit menu, select the Copy or Cut command

- Move to the row or the area where the information should be copied

- From the Edit menu, select Paste

The user can also copy/paste by using the icons ![]() or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

There are also the following commands:

- Copy rows, Delete rows and Paste rows: in this case they refer to a full row or rows and not to a cell selection. For this purpose the commands Copy, Cut and Paste should not be used.

- Copy rows copies the cells to the clipboard with the column header, very useful for filtering in Excel.

Select all

This command selects all the rows and columns of the active table.

It's the equivalent to clicking at the top left hand side of the table.

Copy row from above (F4 or Cmd + 4)

This command is very practical and allows you to copy the contents of the cell above to the one you are in. Applicable to a single cell, several cells or an entire row.

Execute command (F6 or Cmd + 6)

This command performs various practical functions depending on the cell in which you are located. More information on the Interface page.

Insert blank rows... (Ctrl and + key)

This command inserts blank rows above the selected row:

- Position the cursor below the line where the empty rows are to be inserted

- From the Edit menu, select the Insert rows command

- In the window that appears, type the number of rows to be inserted

- Confirm with OK.

Add rows...

To insert blank rows below the selected row, follow these steps:

- Move the cursor above the row where additional rows need to be inserted

- From the Edit menu, select the Add rows command

- In the window that appears, key in the number of rows to insert

- Confirm by clicking on OK

There is another procedure to add blank rows:

- Move the cursor above the row where additional rows need to be inserted

- Click on the following icon

on the Tool bar, one time for each row that you want to add. This procedure is recommended when the amount of rows to be added is rather limited. The sequence for the shortcut key is: Ctrl+Enter.

on the Tool bar, one time for each row that you want to add. This procedure is recommended when the amount of rows to be added is rather limited. The sequence for the shortcut key is: Ctrl+Enter.

Duplicate rows...

This command duplicates the selected row(s).

After duplication, the rows remain selected and can be moved with the Move Up and Move Down command.

Copy rows ... (Ctrl + Shift + C)

This command copies all row data, including non-visible columns, to a temporary space, so that they can be resumed with the command Insert copied rows

In addition, the command copies cell values to the clipboard/clipboard with the column header, which is very useful for filtering data in Excel or other programmes. If you have selected only a few cells, it copies the contents, but always with the corresponding column header.

The column header makes it easier to process data in Excel or with other programmes.

You can also make copies with the header with the Preview command.

Delete rows... (Ctrl and - key)

In order to delete one or more rows, select the row or rows that need to be deleted and from the Edit menu, click on the Delete rows command.

The deleted lines are copied and saved in memory and can be reinserted with the command Insert copied lines.

This feature of copying lines before they are deleted is very useful for functioning like the Cut command in an Excel spreadsheet.

Move Row Up (Alt + Up)

Moves the selected row one position up.

Move Row Down (Alt + Down)

Moves the selected row one position down.

Protect/Unprotect rows

Using the Protect rows command, from the Edit menu, the user activates rows protection to avoid making any changes by mistake.

Protected rows have light grey row numbers. The protected rows cannot be edited until, by using the Unprotect rows command, the protection is being removed.

To protect Rows:

- Select the desired row(s) to protect

- From the Edit menu, select the Protect rows command

- Confirm the number of rows to be protected by clicking on OK.

To Unprotect Rows:

All rows in system columns are protected and cannot be unprotected.

For example, it is not possible to unprotect rows in account tabs or rows where the program performs automatic calculations.

File Menu

When using Banana Accounting, each accounting management is saved as a different file.

Banana Accounting files are compatible with versions from all operating systems and with synchronization systems.

- New...

- Open...

- Close / Close all

- File and accounting properties

- Save/Save as/Save all

- Create Pdf dossier

- Export file

- Page setup

- Logo setup

- Print/Print preview

- Create Pdf...

- Send file via email

- Open file location

- Recent files / Favorite files

Close / Close all

These commands allow you to close the active file or all open files of Banana Accounting.

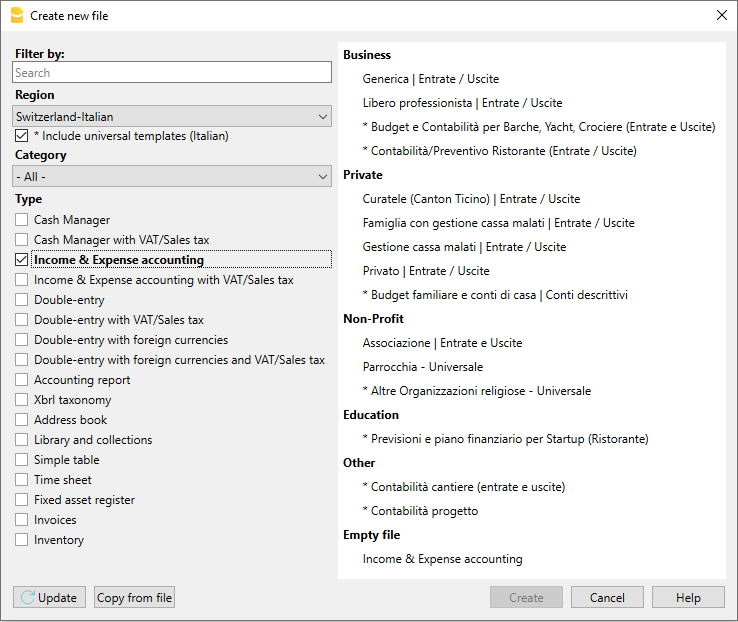

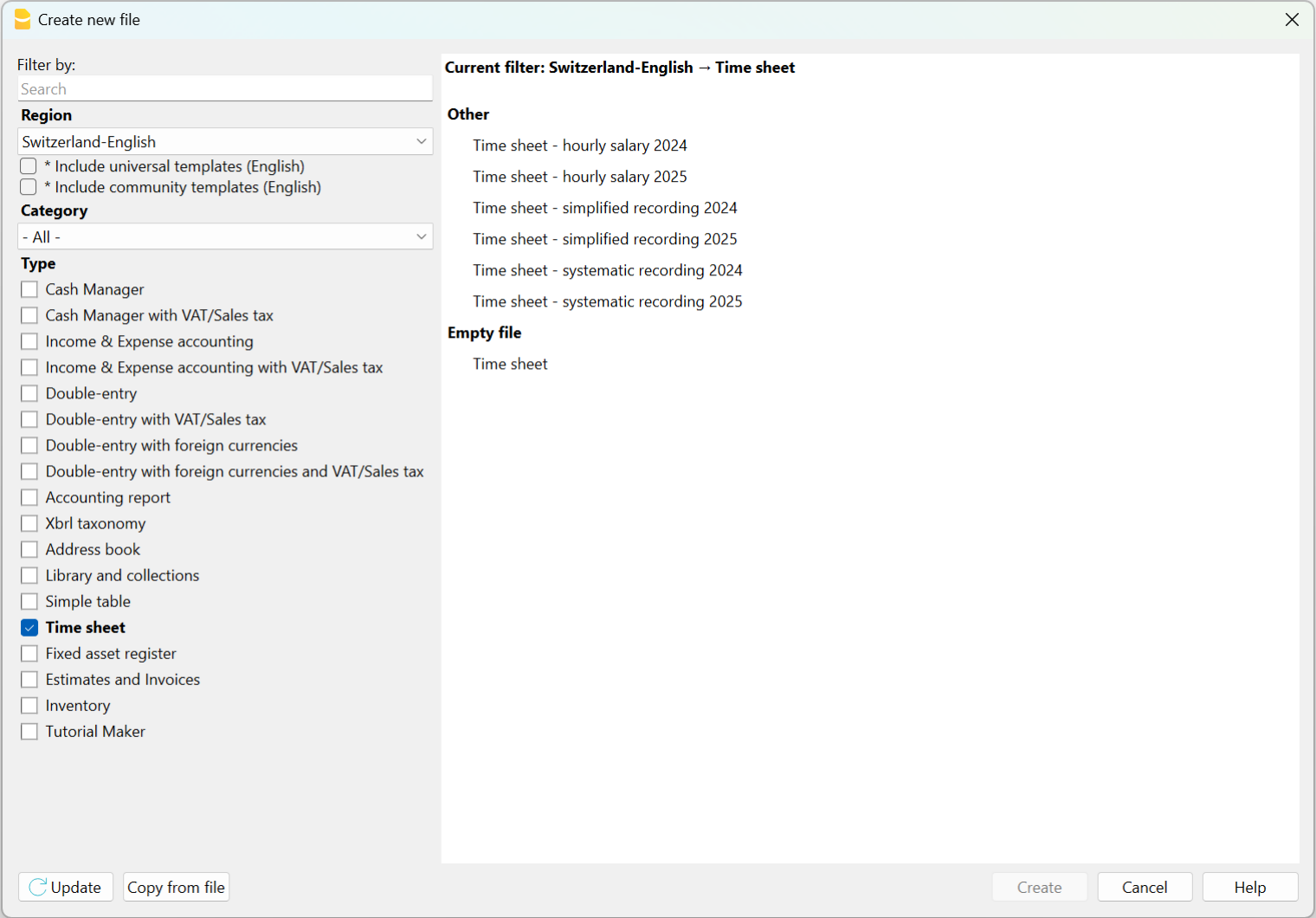

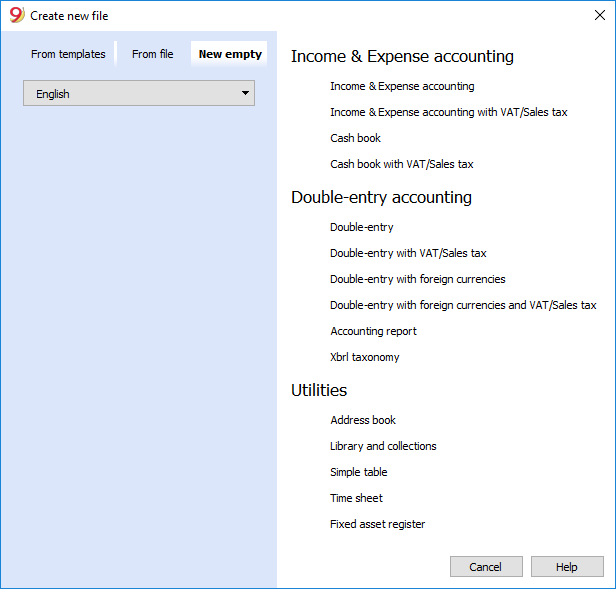

Create a new file

To create a new file, go to the File menu and click on the New command.

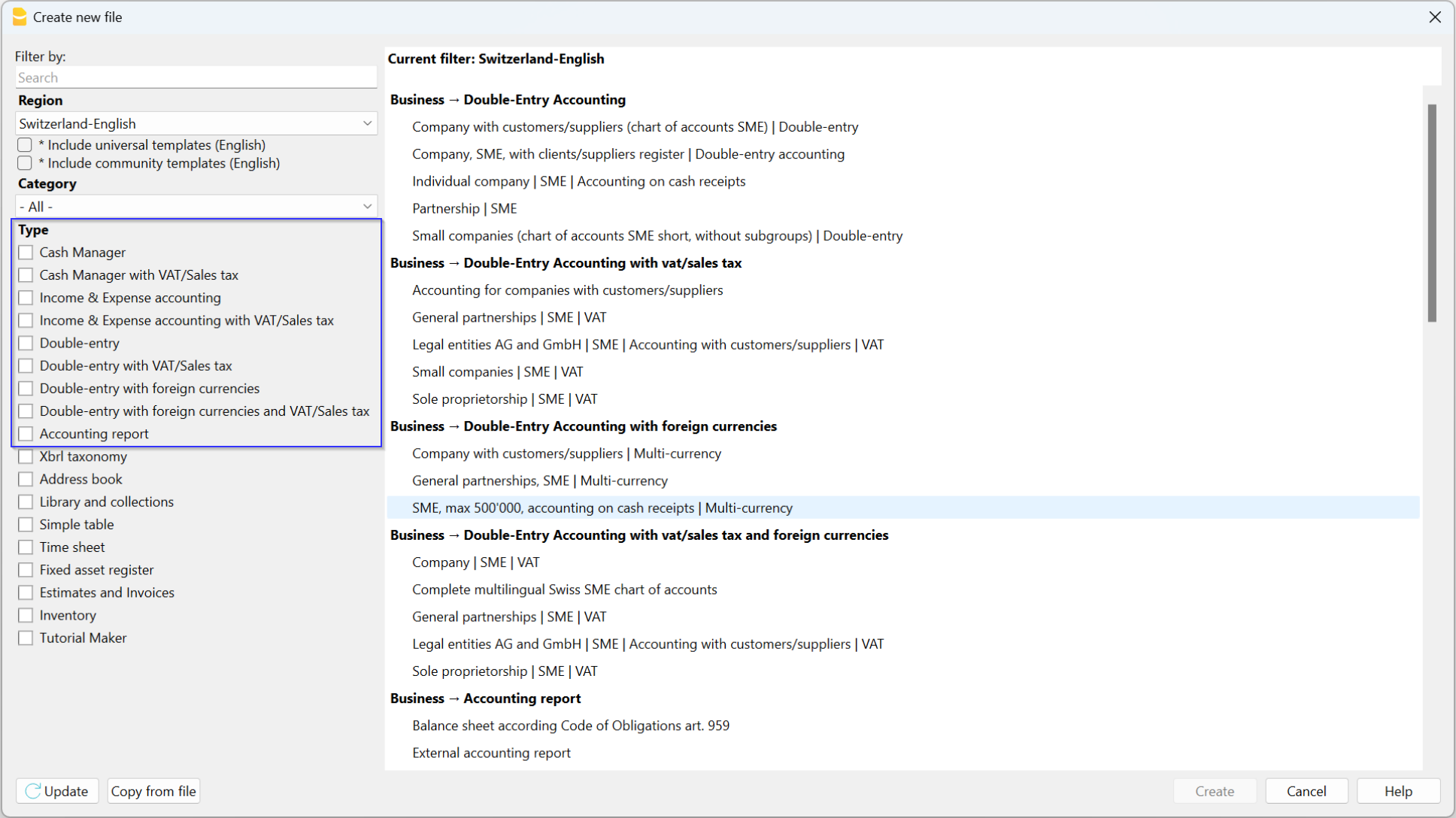

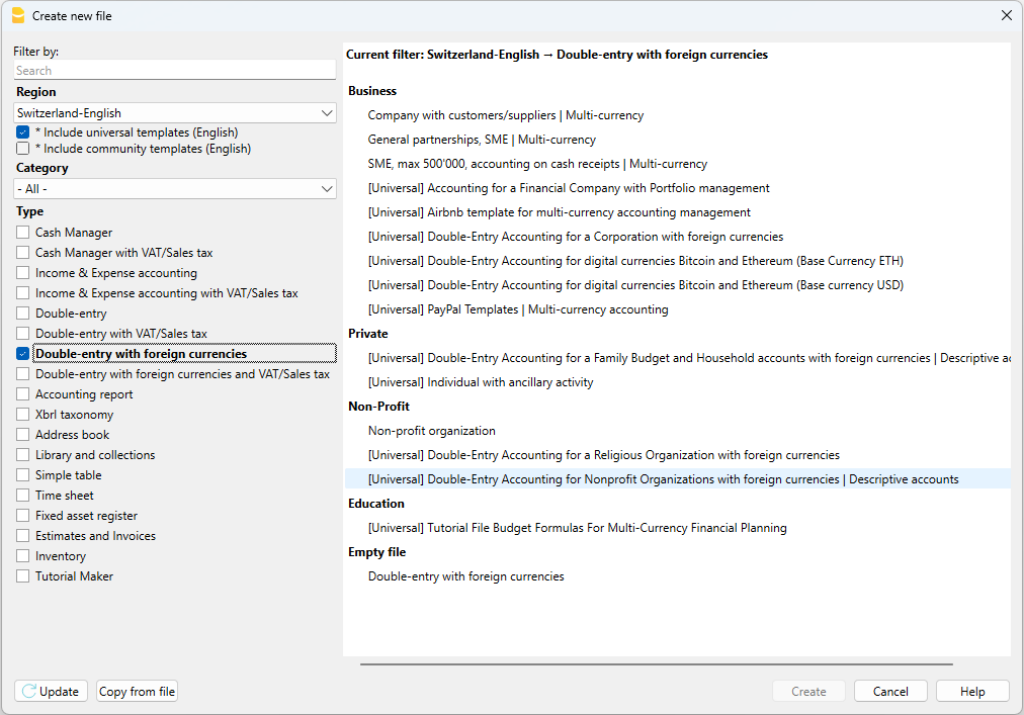

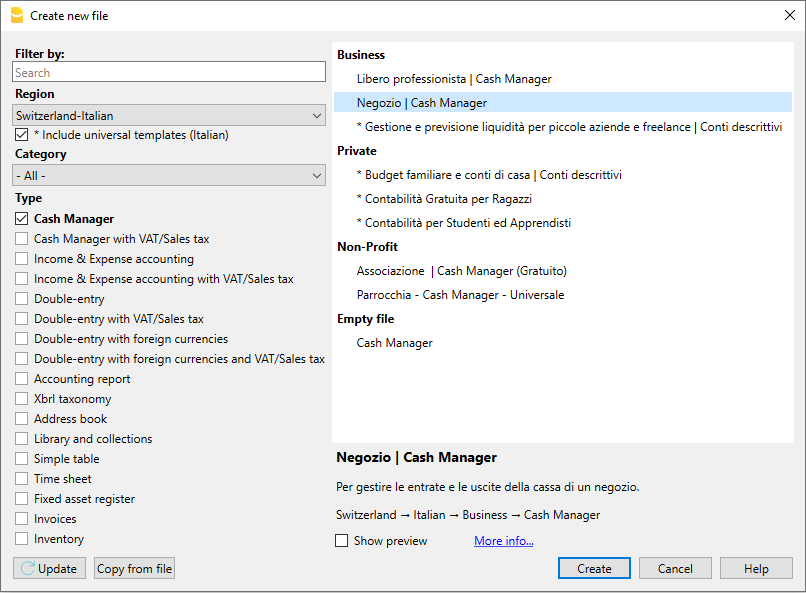

This command opens the window for creating a new file. From the same window you can access all available templates. We recommend that you start from an existing template and customize it with your data. The window that appears offers the possibility to create a new file in three different ways:

- Using an existing Template (recommended choice)

- Copy data from an existing File

- Use a New empty File

Please note: those who have subscribed to the Professional plan of Banana Accounting Plus, while creating a new file, see the message: Active plan: Professional Plan. The functions of the Advanced Plan are available up to 70 transaction rows. This message can be ignored and automatically disappears once the 70 transaction rows are exceeded.

Start with one of our templates

This will generate a new File based on one of the existing templates. There are multiple templates suitable for every legal form and business.

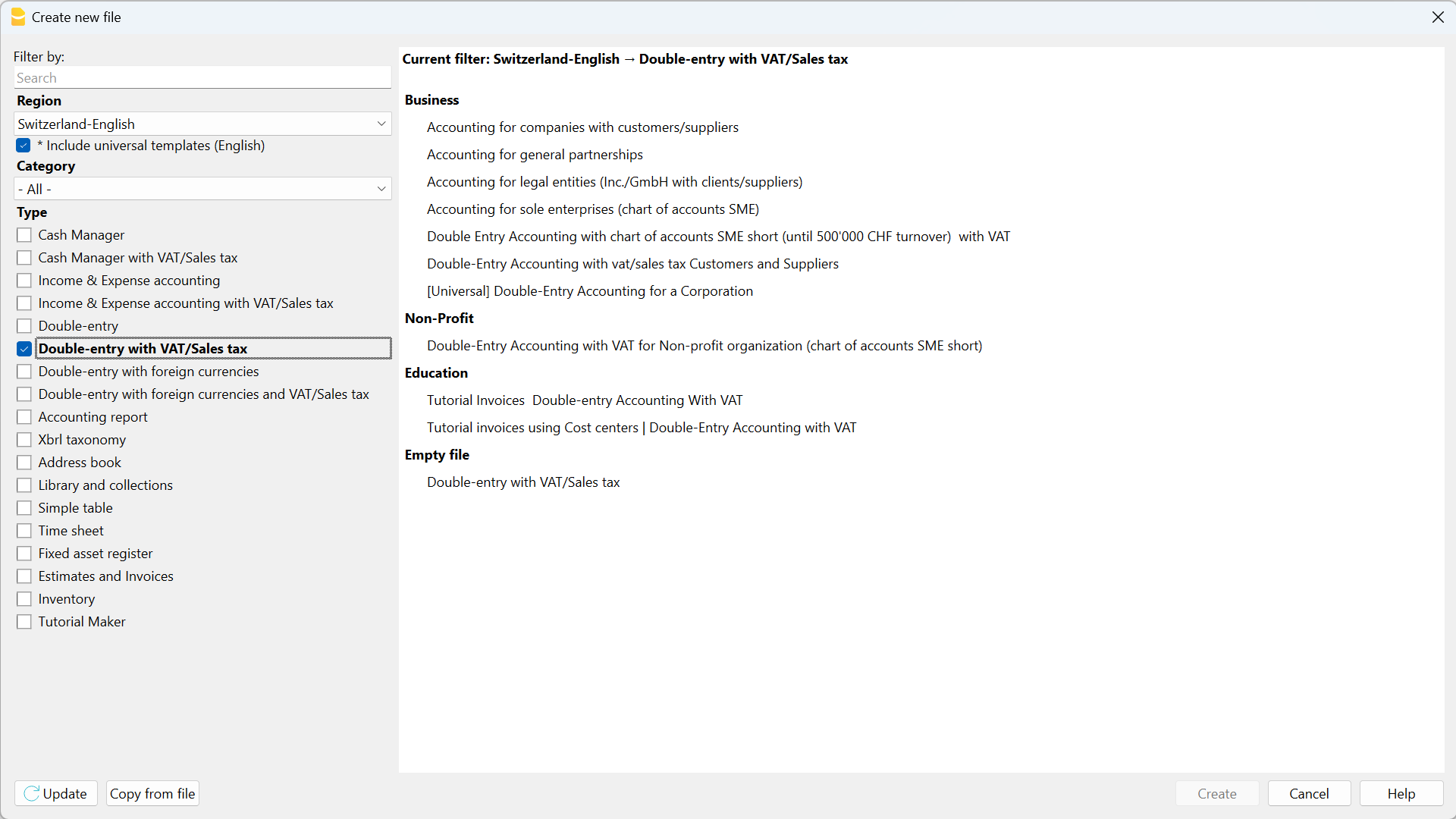

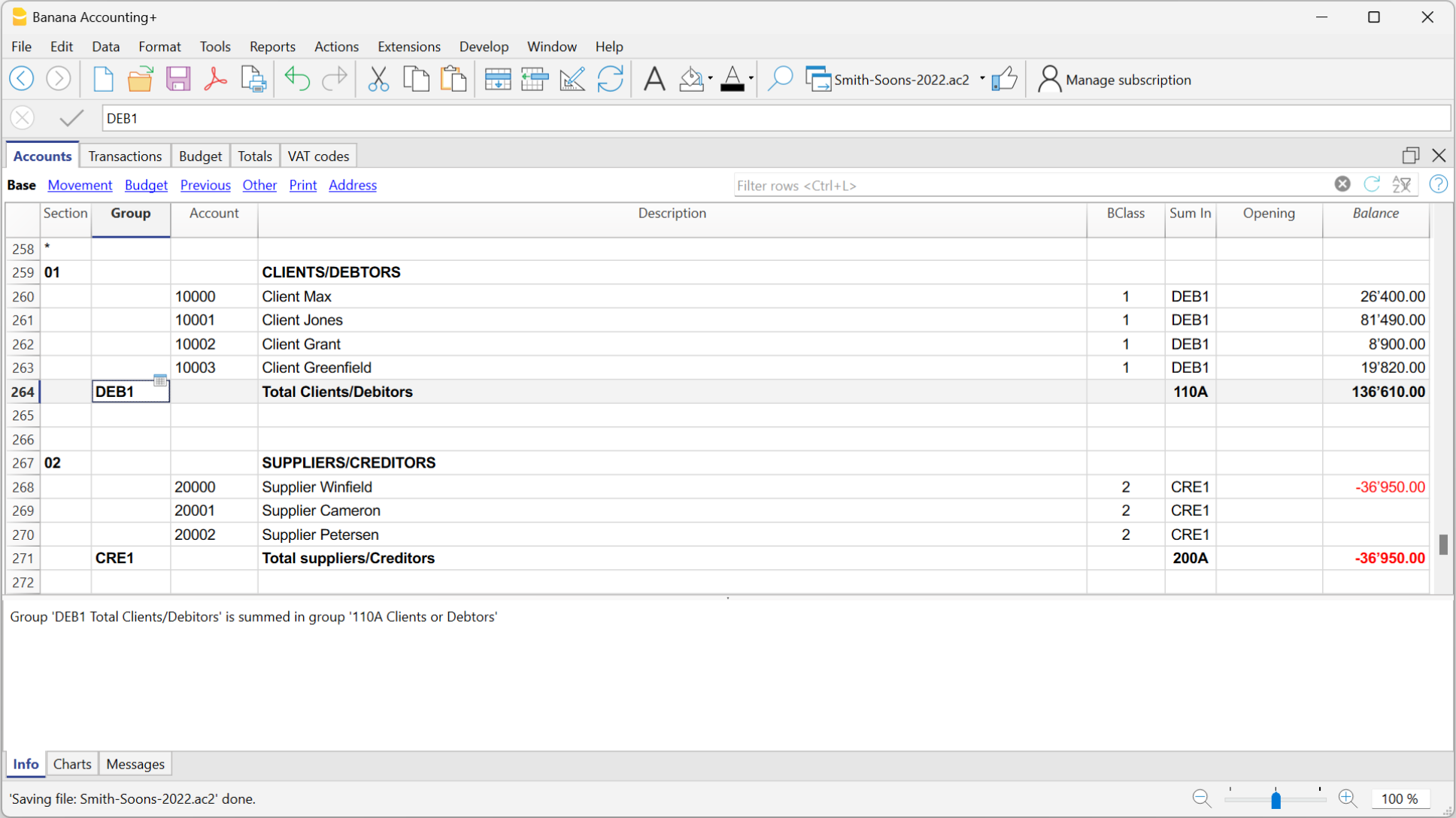

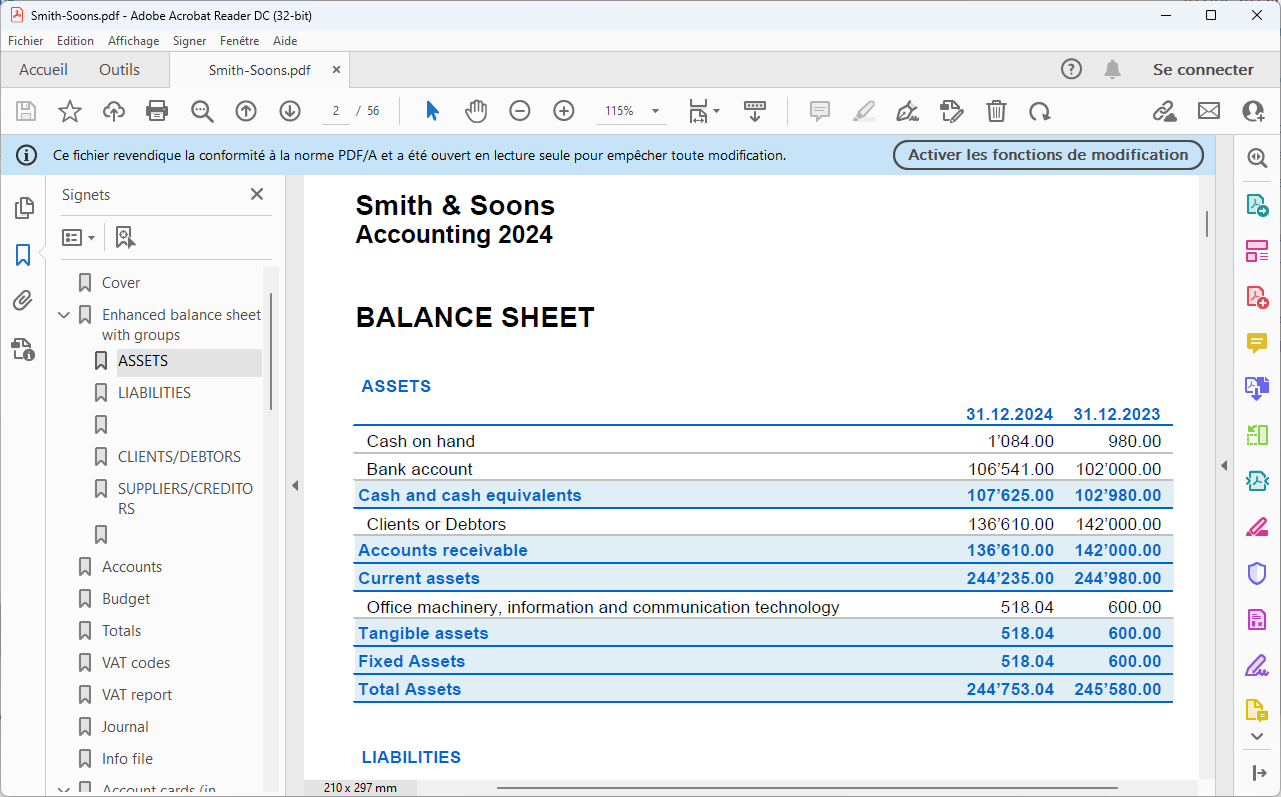

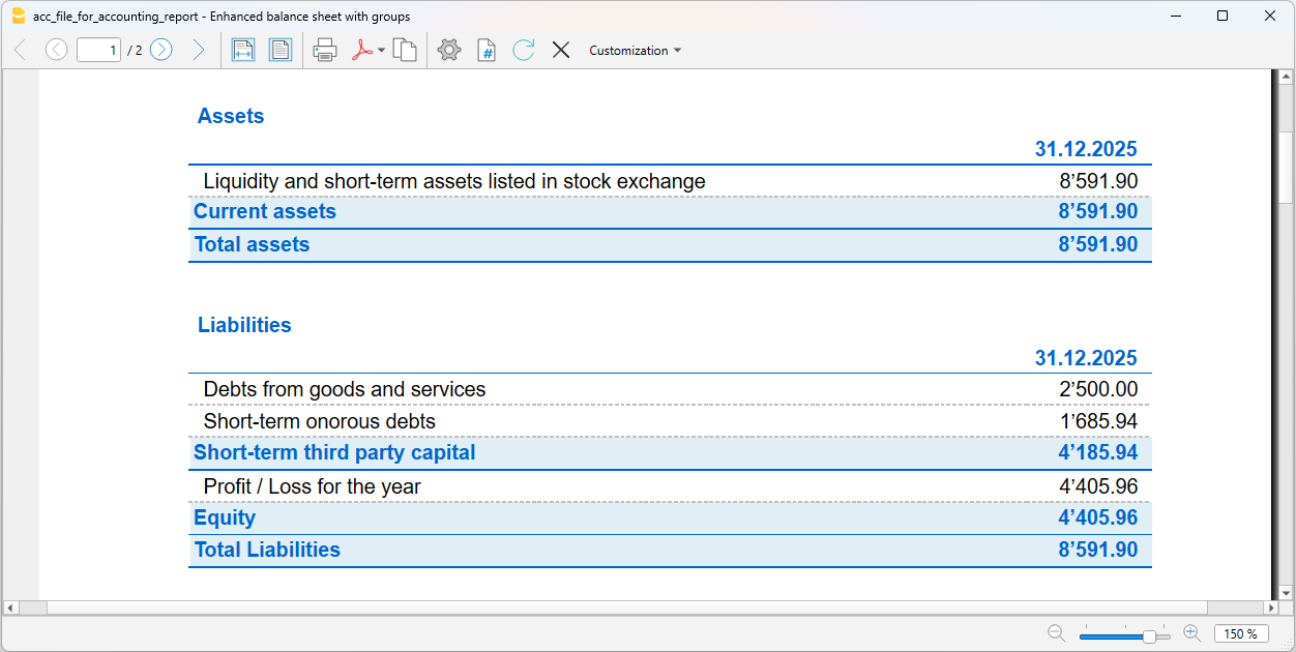

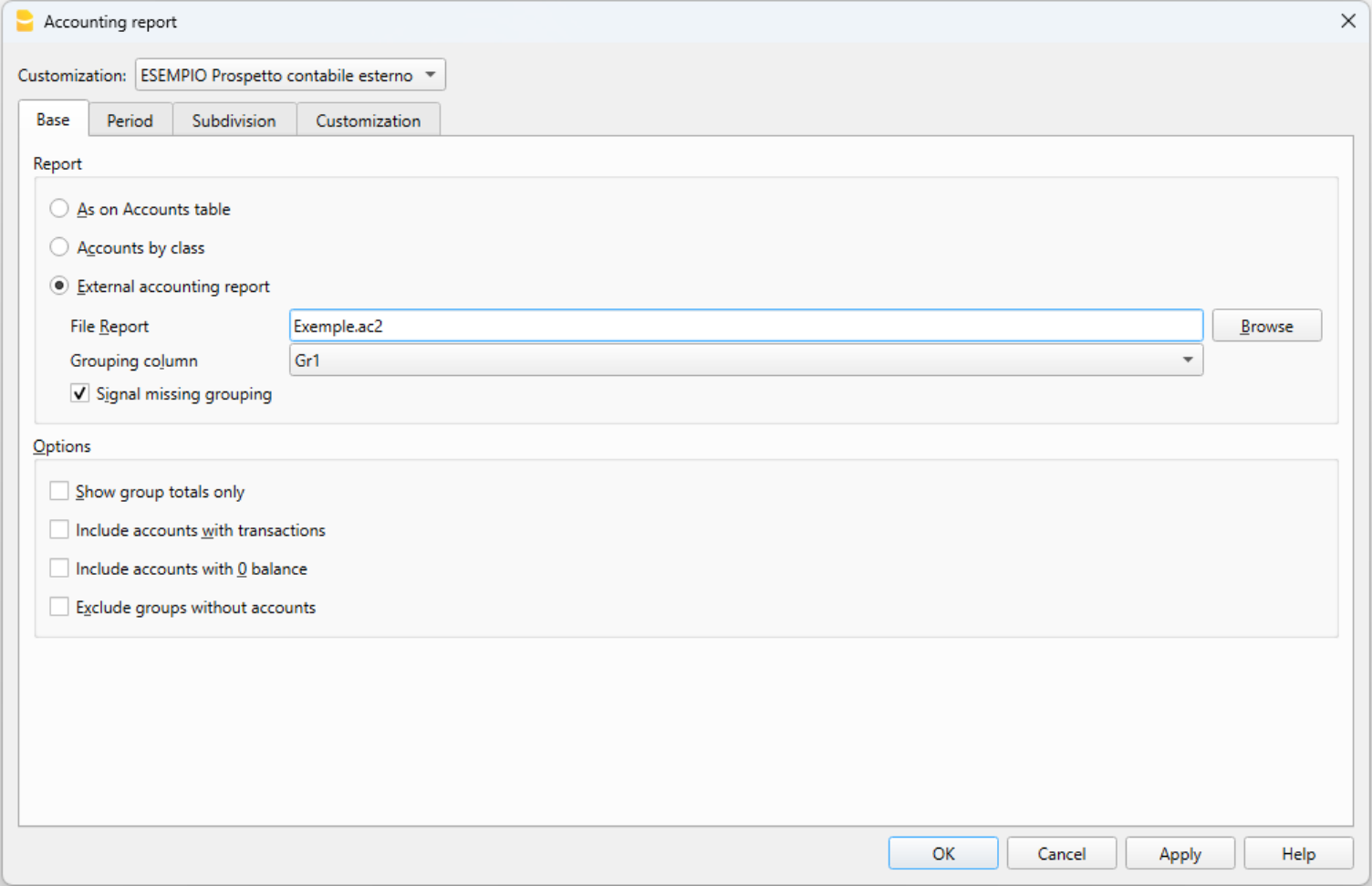

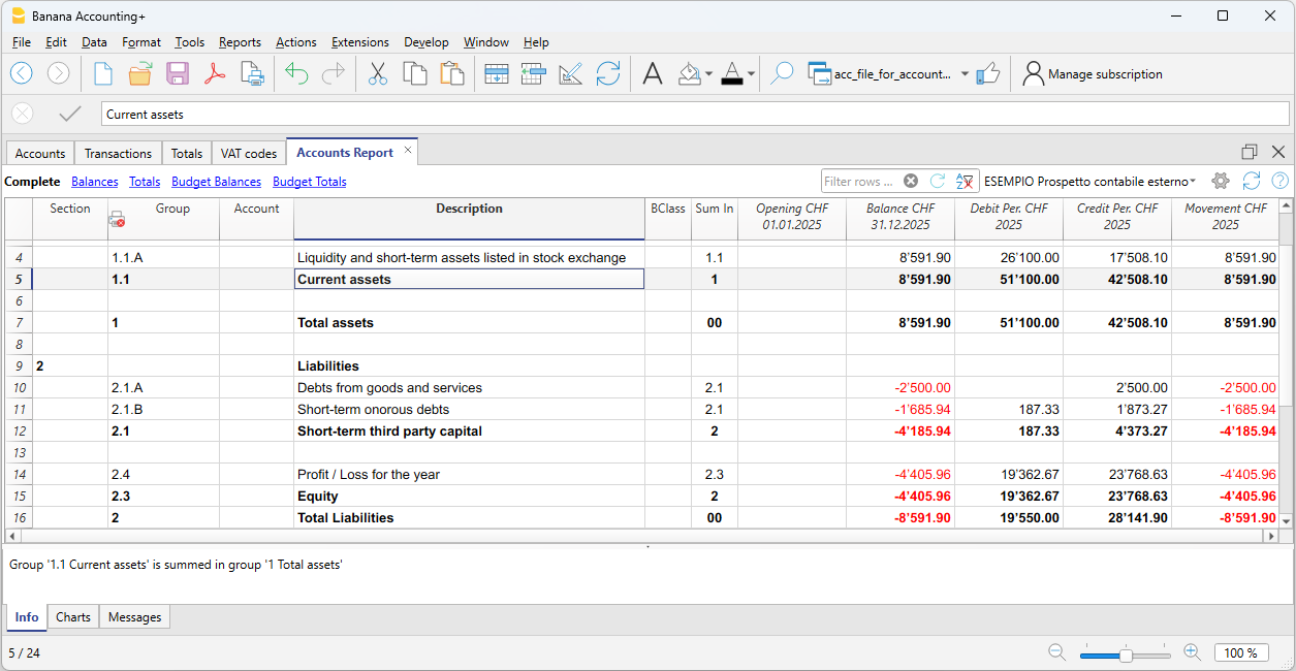

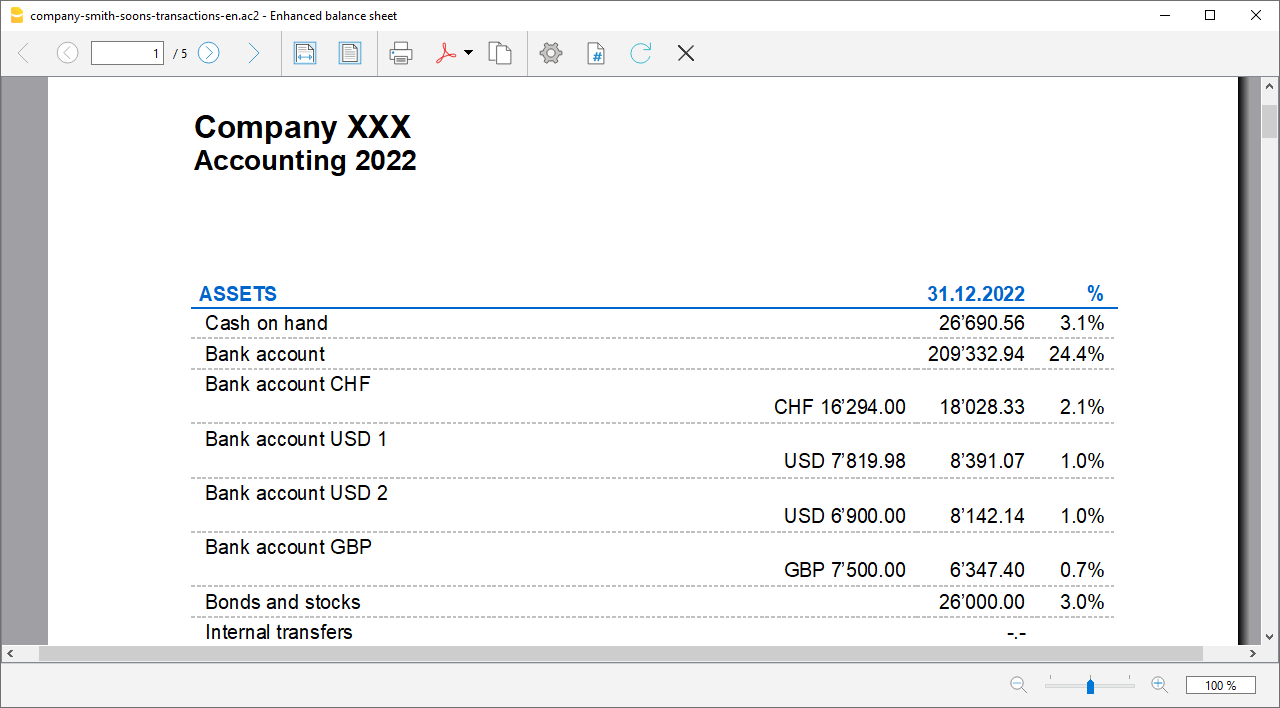

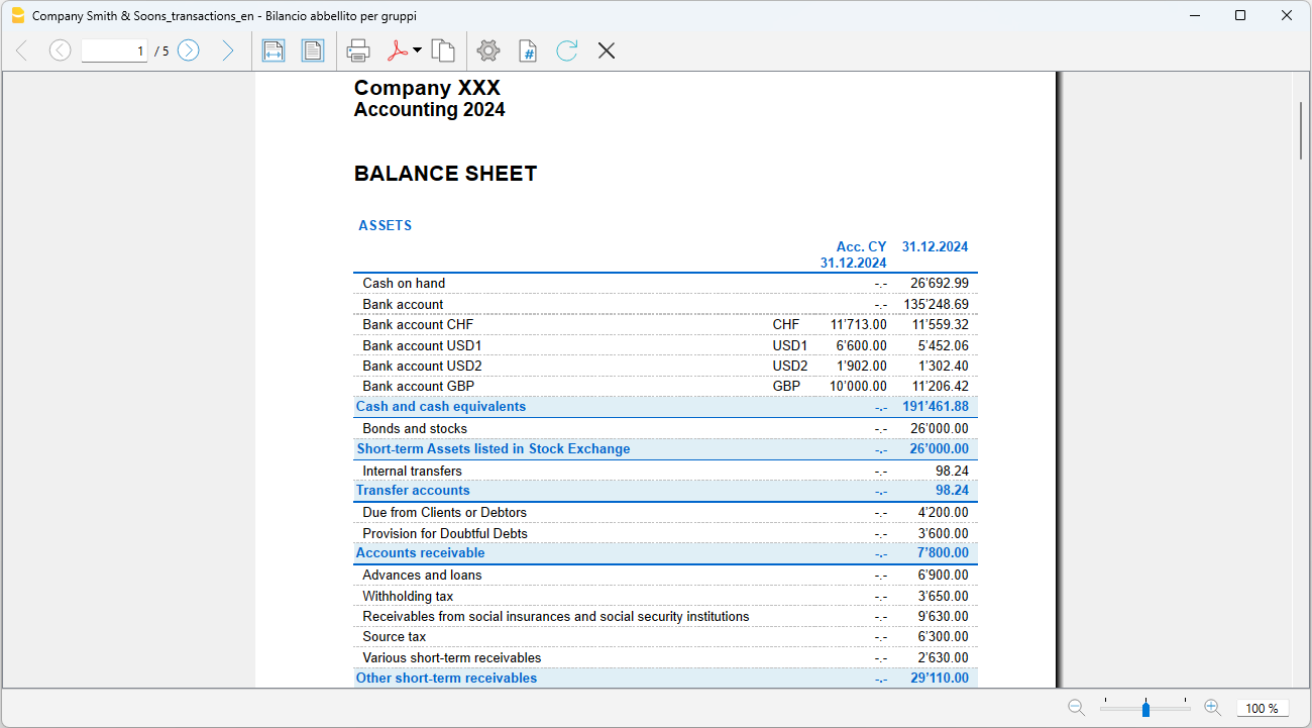

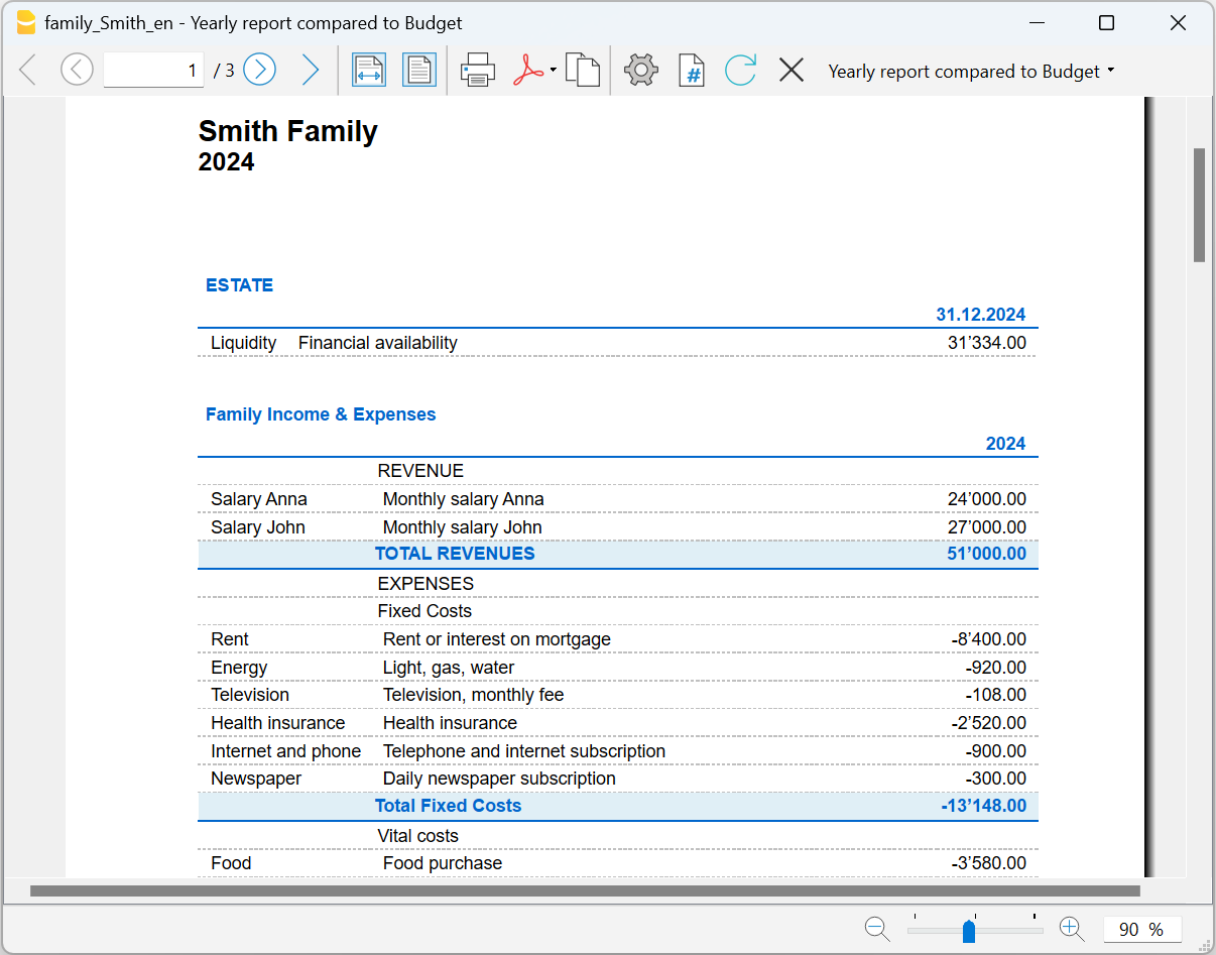

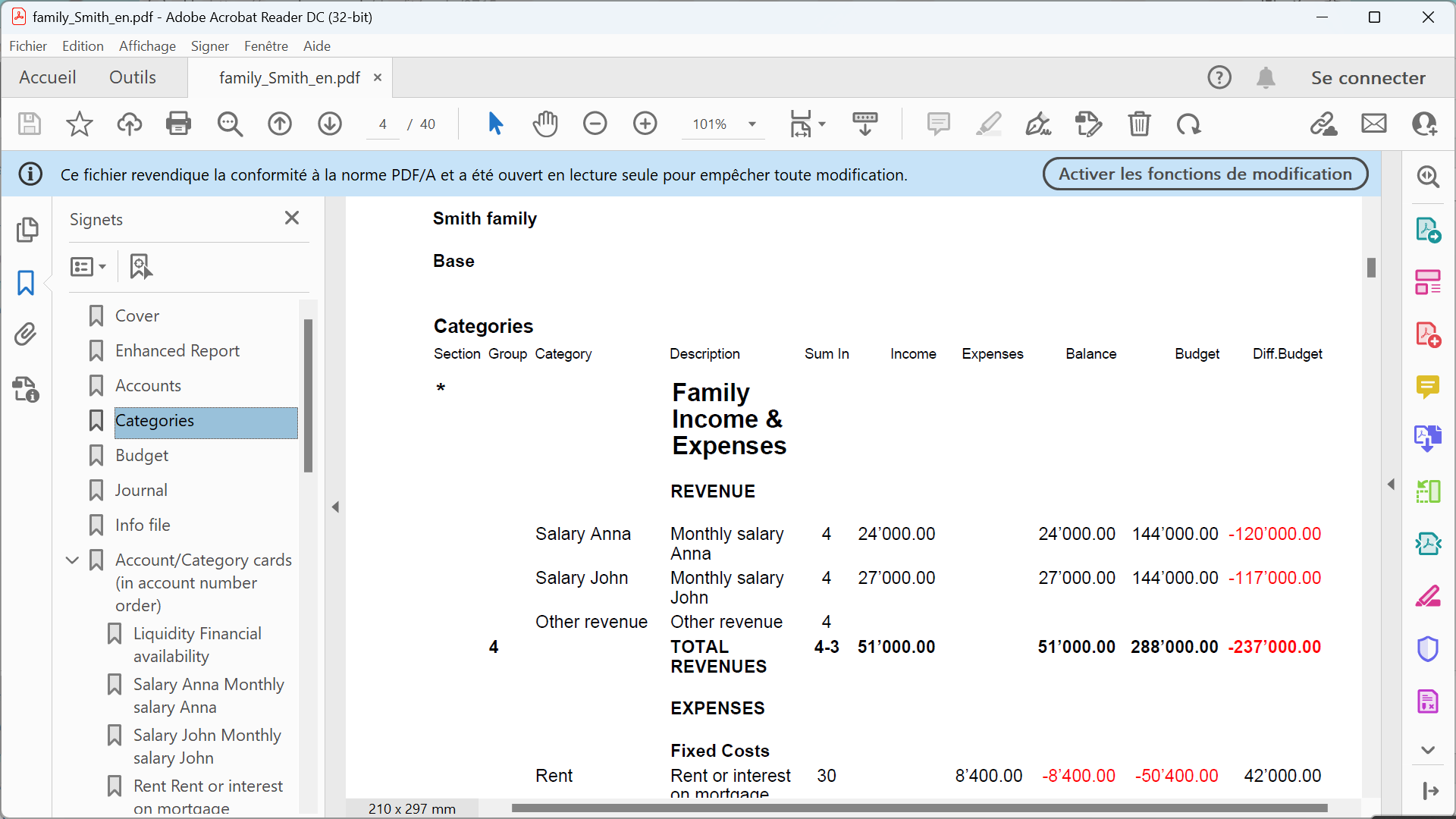

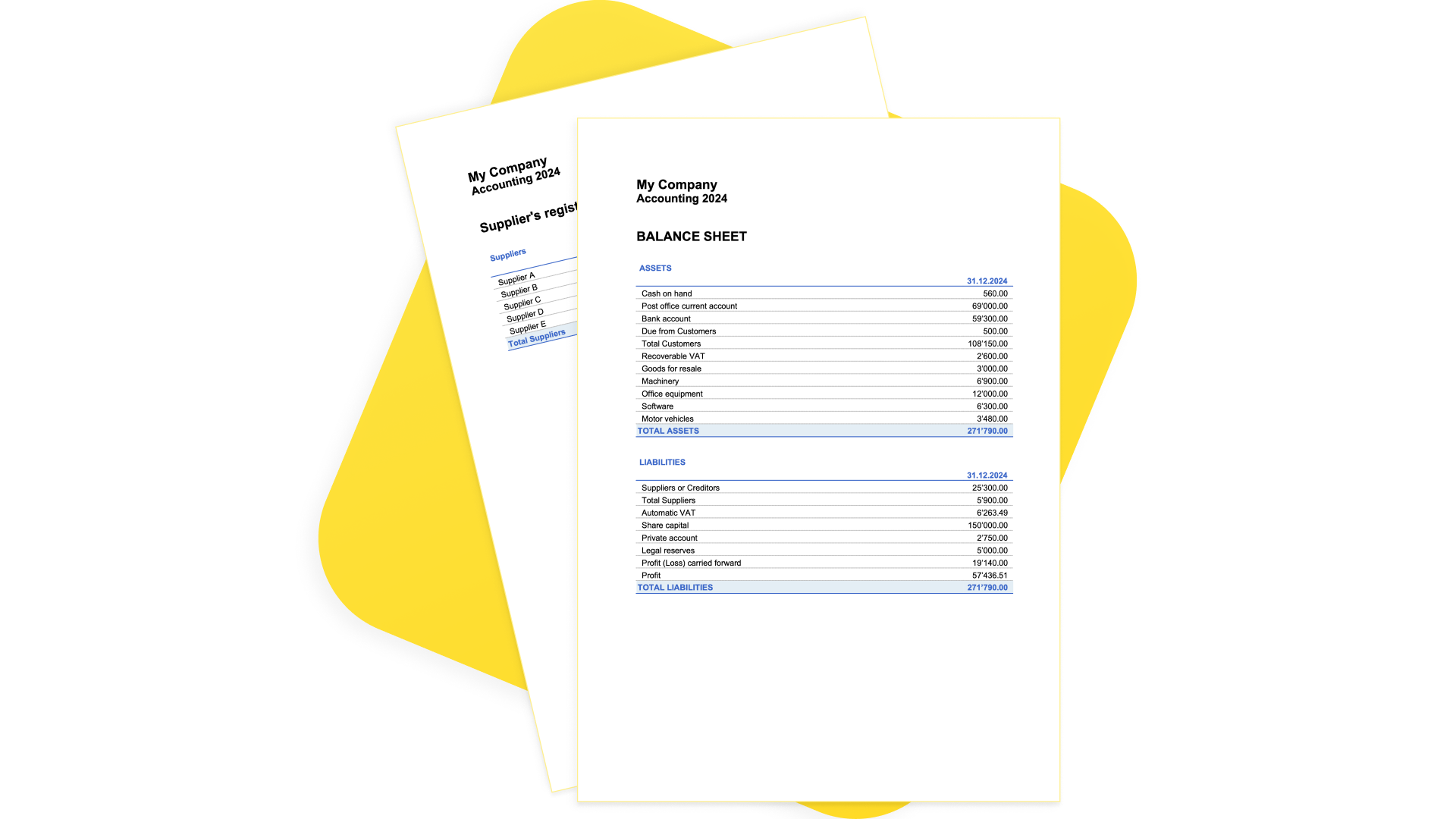

According to the selected Region, the models available in the language of the nation are displayed. The image shows the templates in English language for Switzerland.

- File menu > New

- In the Region field, select your country/language

- In the Category field, select your activity's category (business, private, non profit, ...)

- In the Type field, choose the type of file you want to create (Cash Manager, income/expense accounting, double-entry accounting, ...)

- You can also search for a template by entering a keyword in the Filter by box.

- On the right side of the window, select the template that most closely matches your needs.

- Click on the file and confirm with the Create button to open the selected template.

All the files with the VAT option have the VAT Codes table adjusted to the new rates.

The chart of accounts can be adapted to your requirements (change of account description, insert or delete groups, sub-groups, etc.)

Save the file with a name

Once you have opened the template with Banana you can save it with your own name by choosing the File menu > Save as command:

- Select the destination folder

It is useful to create an “Accounting” folder for each year, so that you can save the accounting file and also the documents for that year. We recommend that you also consult the page Organize your work. - Select a file name. We recommend a name containing the company name and the accounting year (for example smith_company_2025).

- The software will add the .ac2 extension, typical for the Banana Accounting files.

Adapting a template

- Edit the File properties

- Adapt your Chart of accounts

- Enter your bank accounts.

- Enter or edit the accounts to fit it to your requirements.

While going along with your work, you will still be able to add or edit accounts, if new needs arise.

Start with a Tutorial

Tutorials are existing templates, which contain within them example accounting data (opening balances, entries, budgets, ...). A tutorial is not available for all templates.

The tutorial files are useful for understanding how to structure accounting within a certain template. The example data entered are for demonstration purposes only and can be changed, deleted or replaced with your own data at any time.

When you select a template and it has a tutorial file, the button Create from Tutorial automatically appears next to the template detail description.

Start from an existing File

Starting from an existing file or template, without modifying the existing file.

There are several possibilities to copy data:

- Open the file that is to be your template via the Browse button and indicate the path to locate your file.

- Create a copy of the open file, using the File > Save As command.

- Else, you may create a copy of the open file via the Tools > Create File Copy command. Choose which data to keep in the dialog window. If none of the three options are activated, a file is created with the chart of accounts only.

- Save the file in the folder where you wish to keep the data (normally in the documents folder). Enter the company name and the accounting year as file name, for example smith_company_xxxx.ac2.

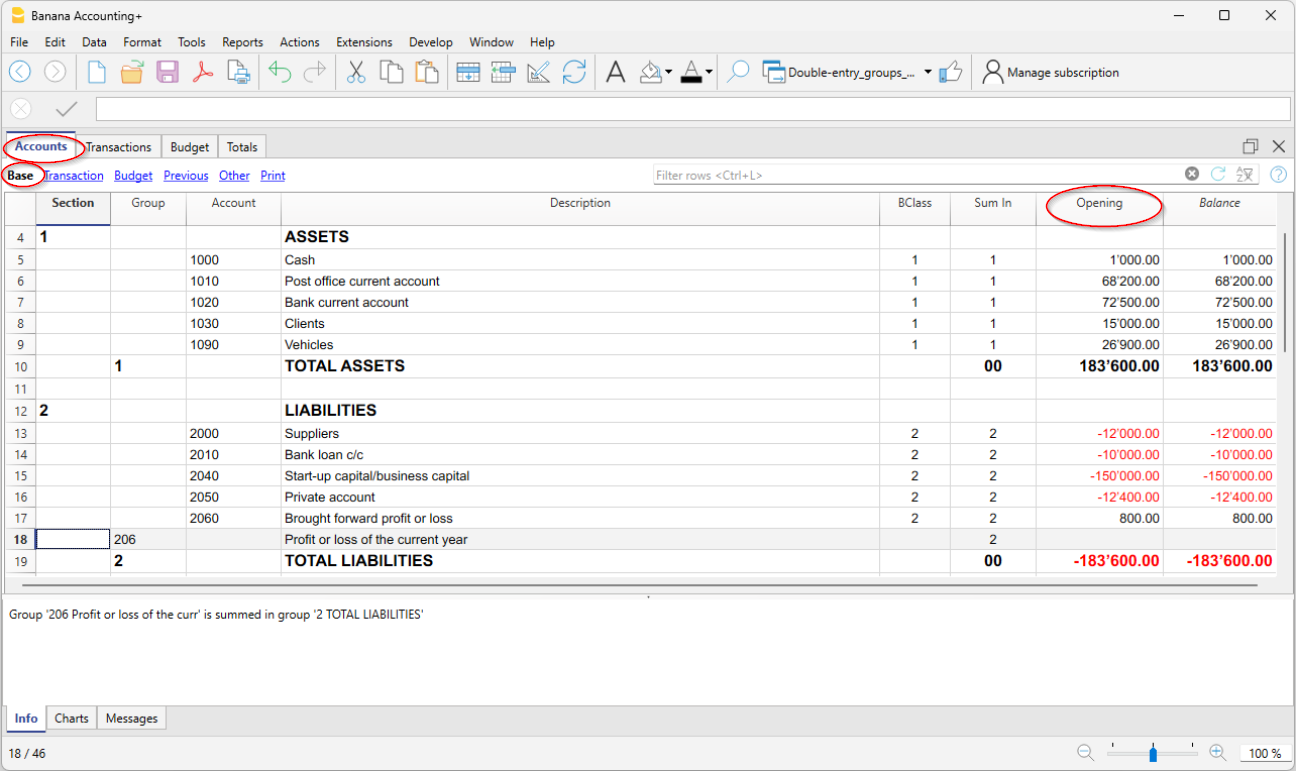

- If you are taking over an existing accounting file, you will also need to enter the opening balances in the Opening column.

- If you are working in a multi-currency file, you need to update the opening exchange rates.

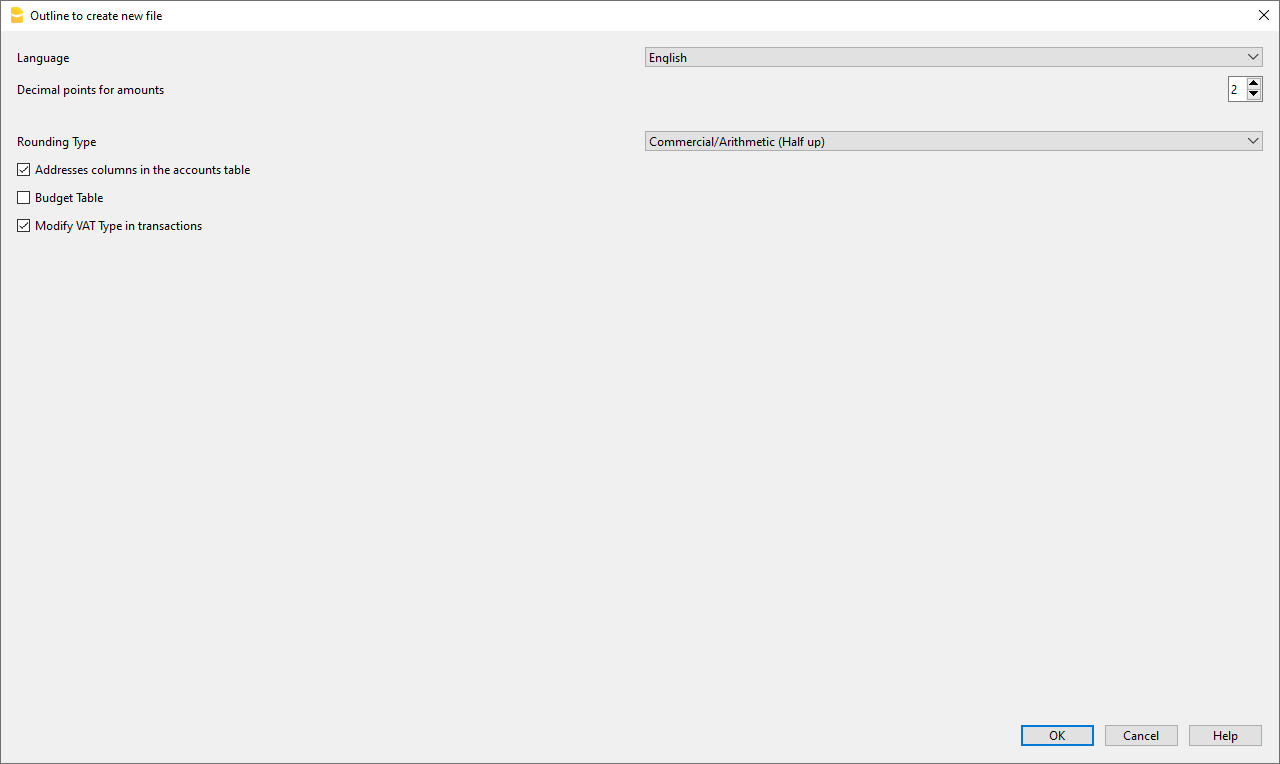

Starting from a new empty file

You will be starting from scratch, so you will need to set up the basic accounting data and the entire Chart of Accounts (not recommended).

- Menu File > New.

- Select your country/language

- Select your category

- Select your Accounting template

- On the bottom of the list click on New empty.

- Setup the Outline to create new file

- Setup the File and accounting properties

- Save with File Name.

- Create the Chart of Accounts structure

Related documents

- Income and expenses accounting and Cashbook

- Double-entry accounting

- Double-entry accounting with multi currency

- Utilities documents

Transferring to a new year

When transferring to a new year, there is a specific procedure to follow, in order to create a new year's file and automatically carry forward the opening balances.

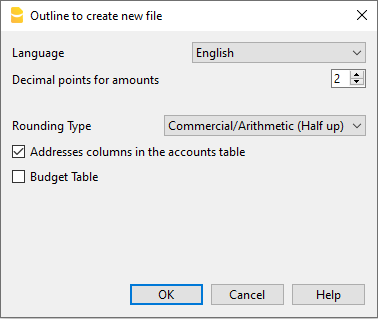

New file settings

When the program creates a file with new characteristics, you need to setup the outline of the new file.

Outline to create new file

Language

The language used for the columns headers of the various tables.

Decimals and rounding

Decimal points for amounts

In order to avoid accounting differences, the number of decimal points for the amounts is fixed for each file. Two decimal points are normally used, but there are currencies where decimal points are not required so 0 needs to be inserted.

For other currencies that use multiple decimals such as the Tunisian Dinar or crypto currencies such as Bitcoin (9 decimal places), Ethereum (18 decimal places) the appropriate number must be indicated.

Accounting can be managed with amounts of up to 27 decimal places.

Decimal points for amounts in foreign currency

When using a multi-currency accounting, the number of decimals for the amounts in foreign currency must be defined. For example, if the accounting is in EUR and you are managing crypto currencies such as Ethereum, you must enter 18.

Generally, the number of decimals must not be less than the number of decimals in the base currency.

Rounding type

The rounding is applied to amounts with decimals that go beyond the set number of decimals.

If 2 decimals are set, this is the type used to round the digits over two decimals.

Depending on the methods used, the following amounts: 1.005; 1,015; 1,025; 1,035 will be rounded in a different way.

- Commercial/Arithmetic (Half up) rounding to the next whole number: 1.01; 1.02; 1.03; 1.04.. In accounting, this is most commonly used.

- Banking (Half average) rounding up or down towards the nearest even number: 1.01; 1.02; 1.03; 1.04.

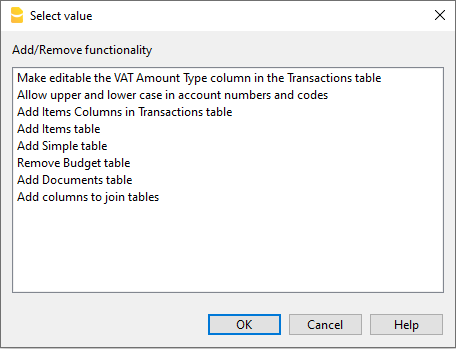

Functionalities to be included

For more information on the functions to be included see:

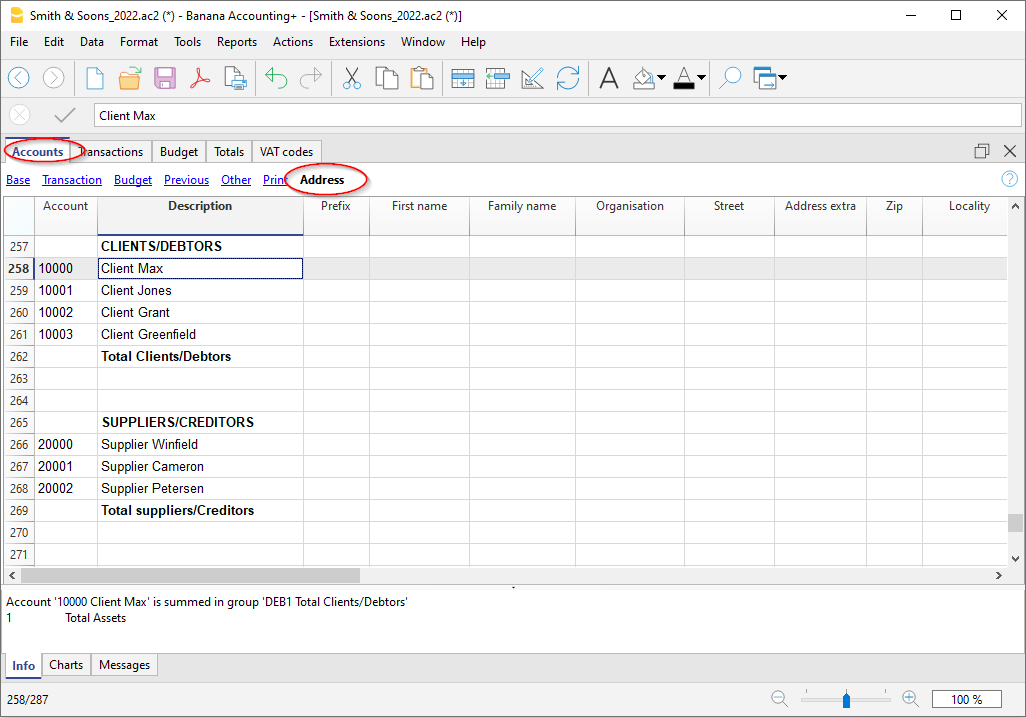

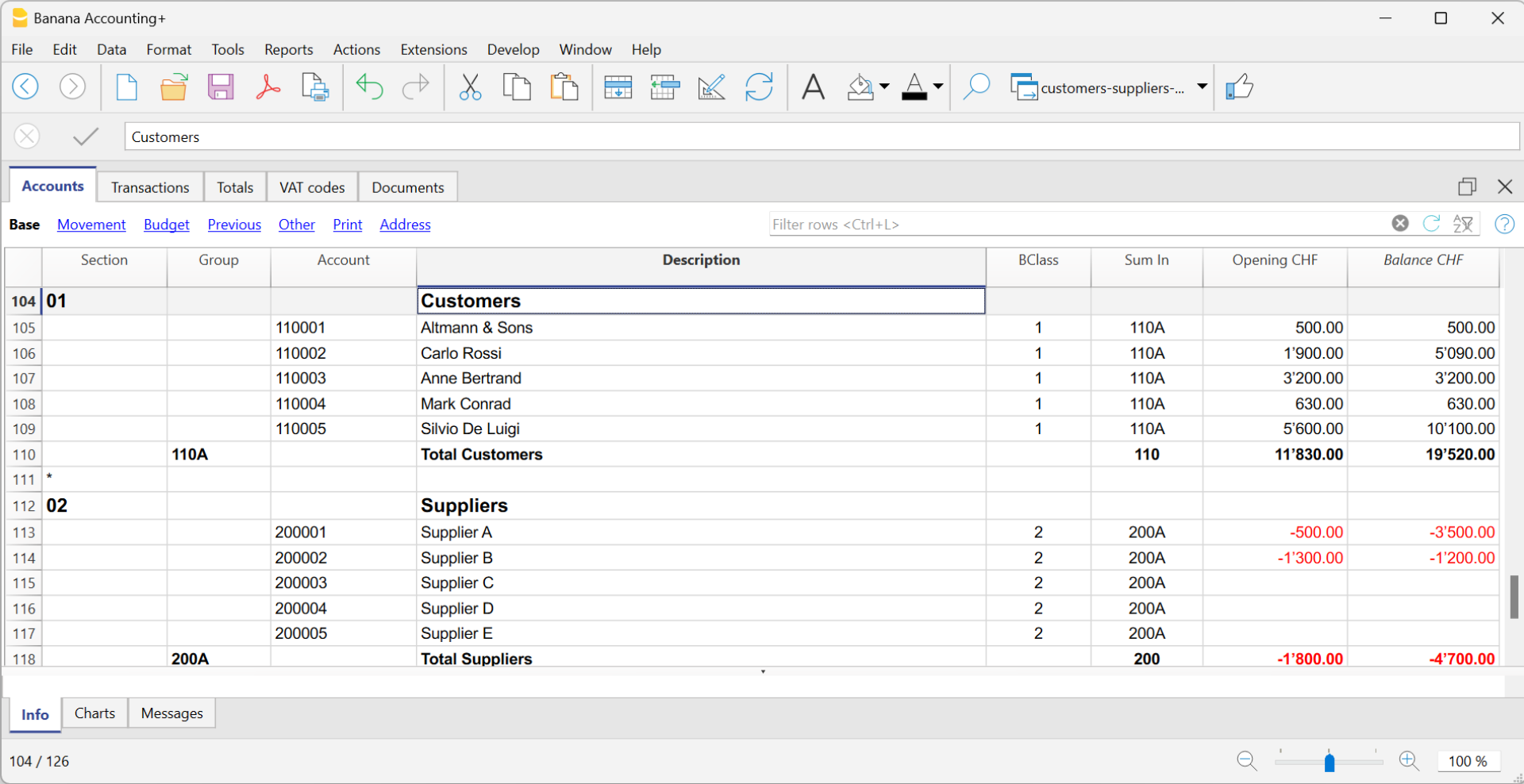

Address fields in accounts table

When this option is activated, the Address view is created in the Accounts table. In this view, the user can enter the addresses of clients, suppliers and members.

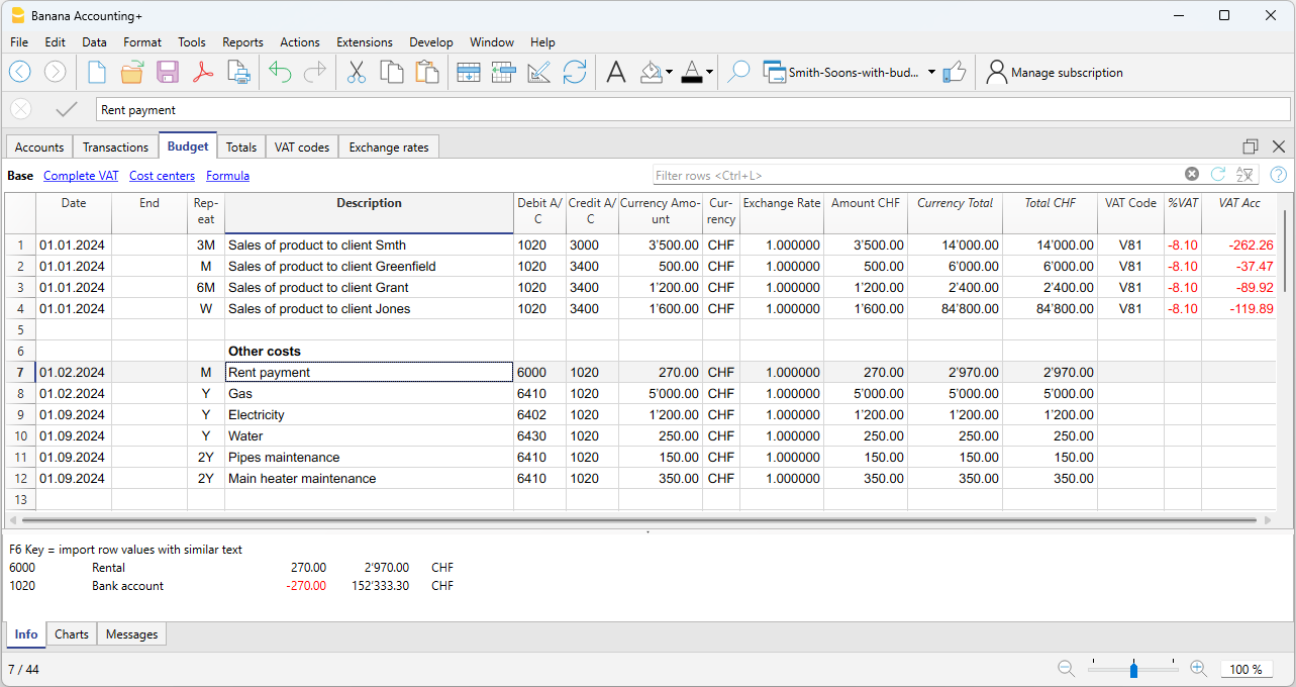

Budget Table

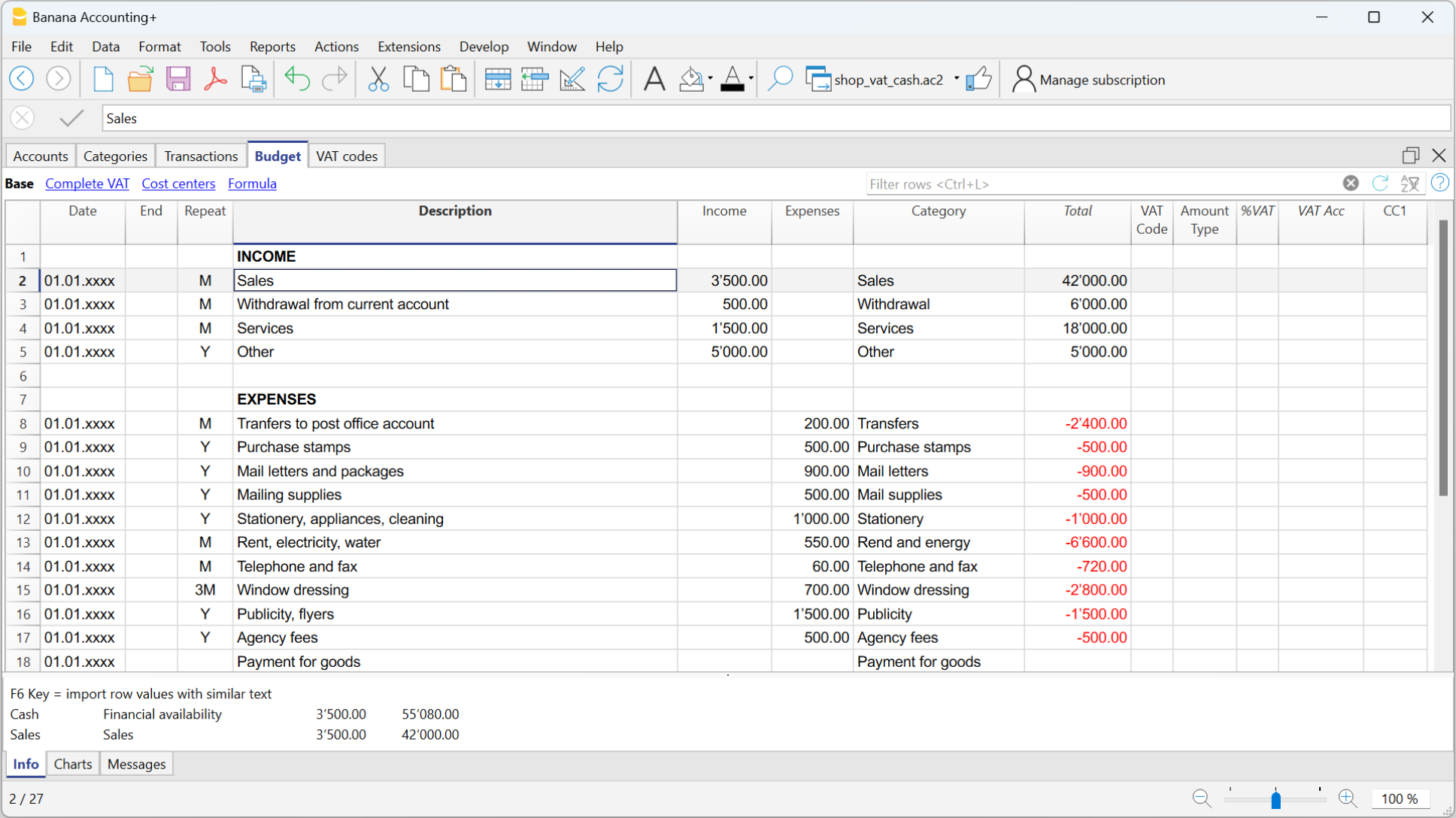

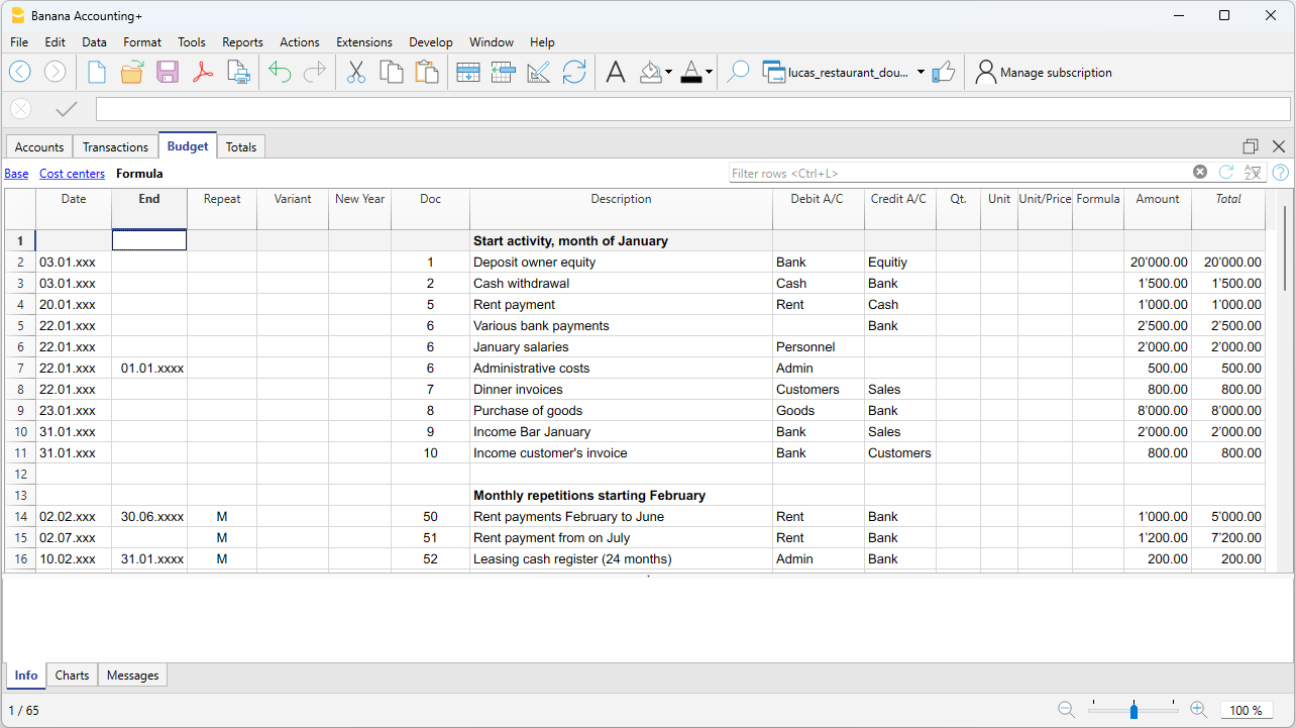

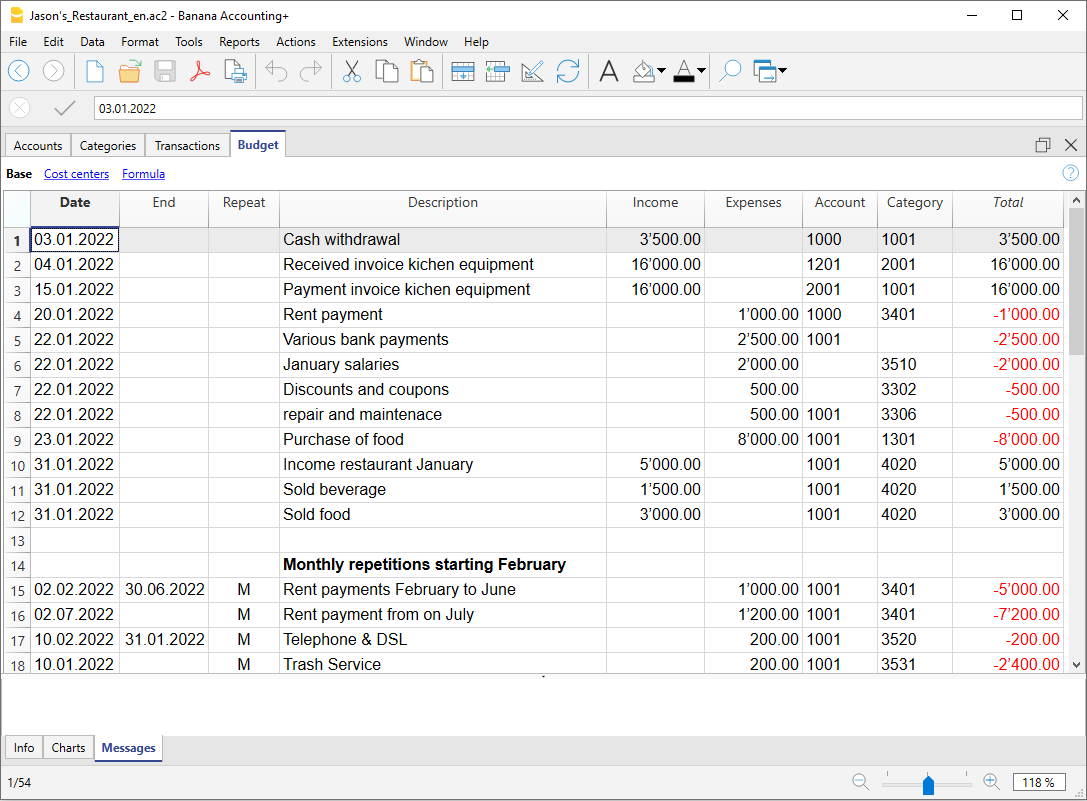

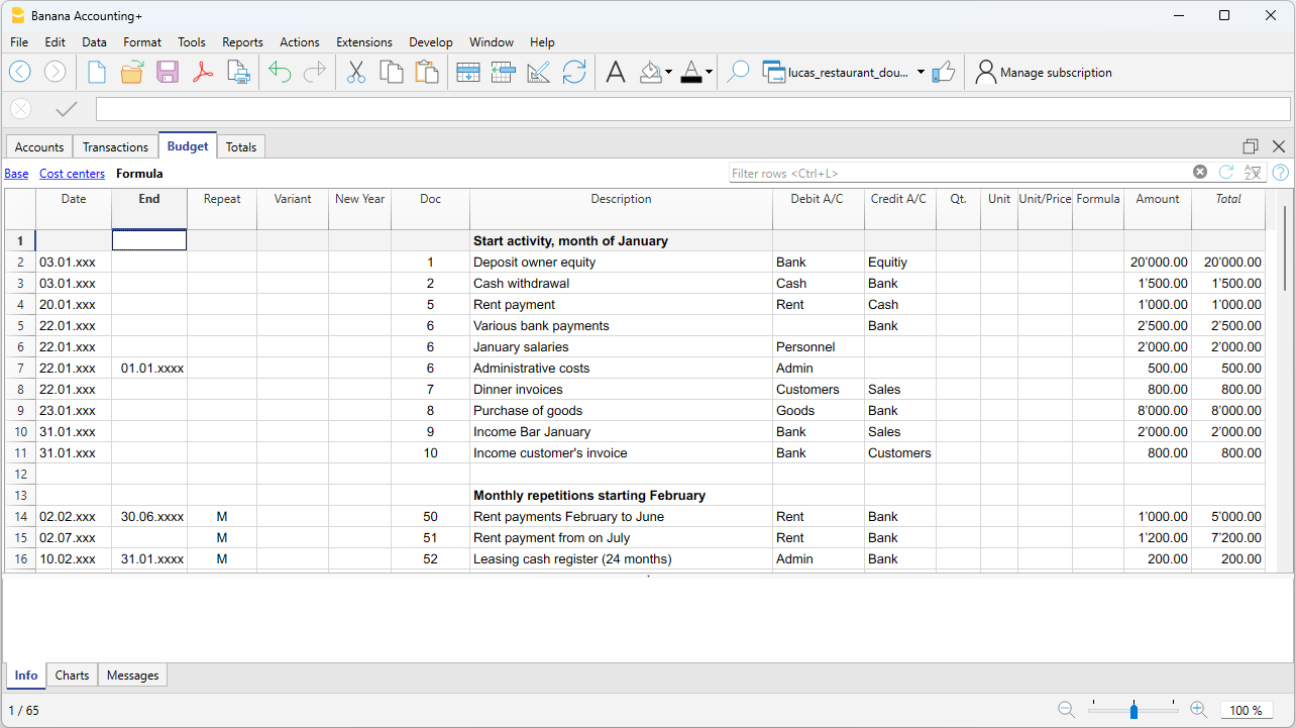

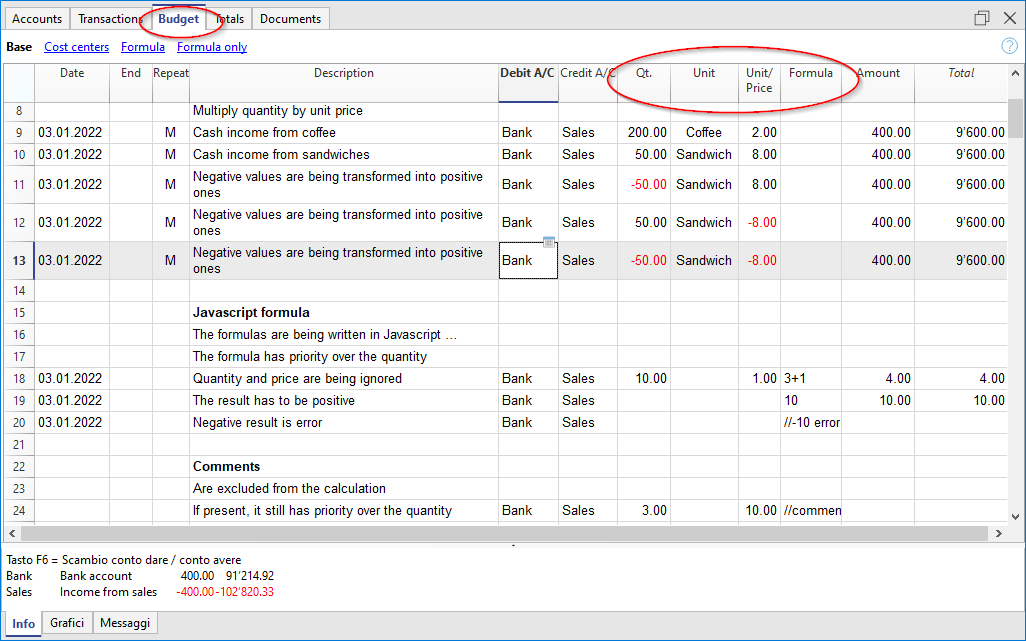

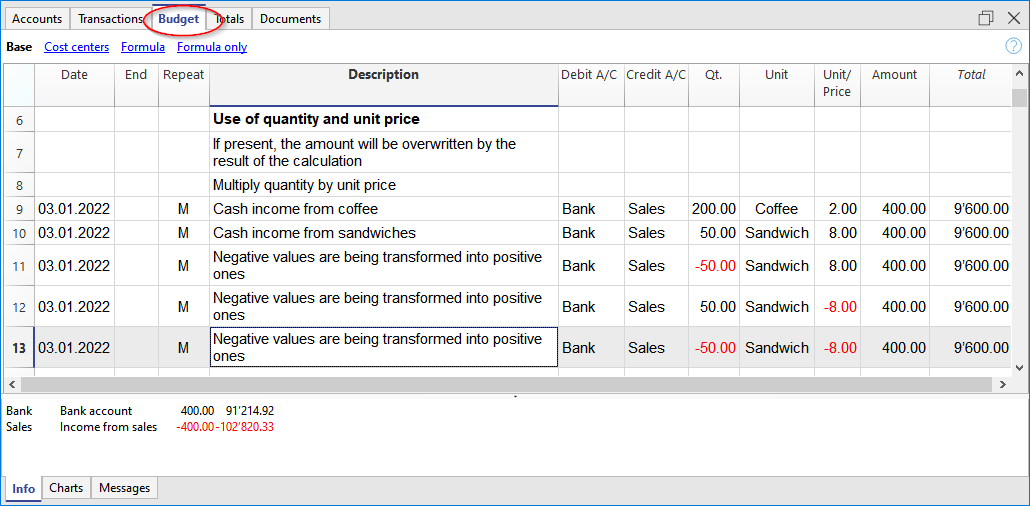

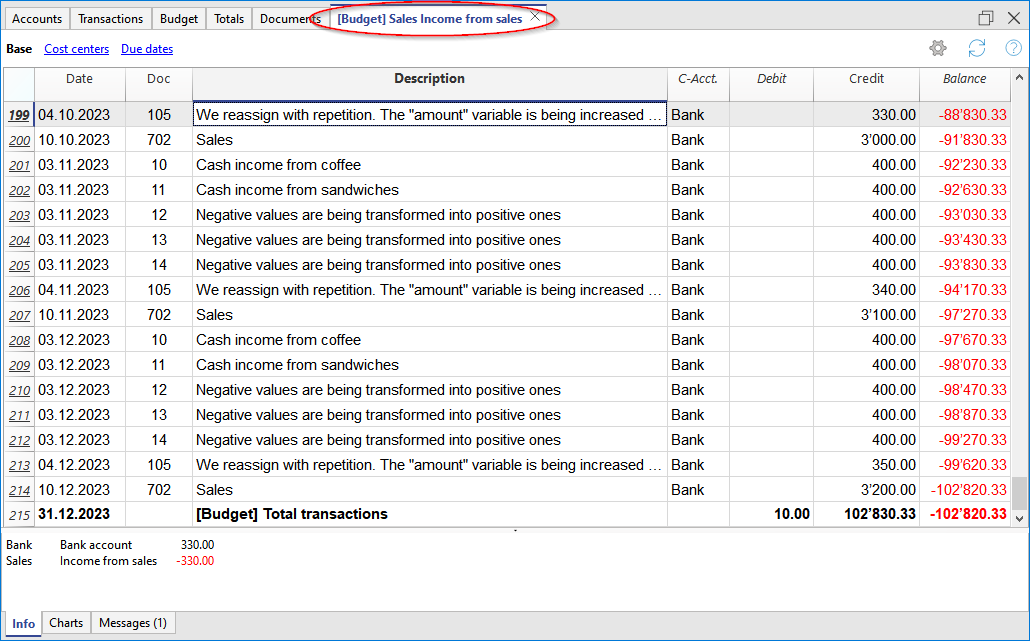

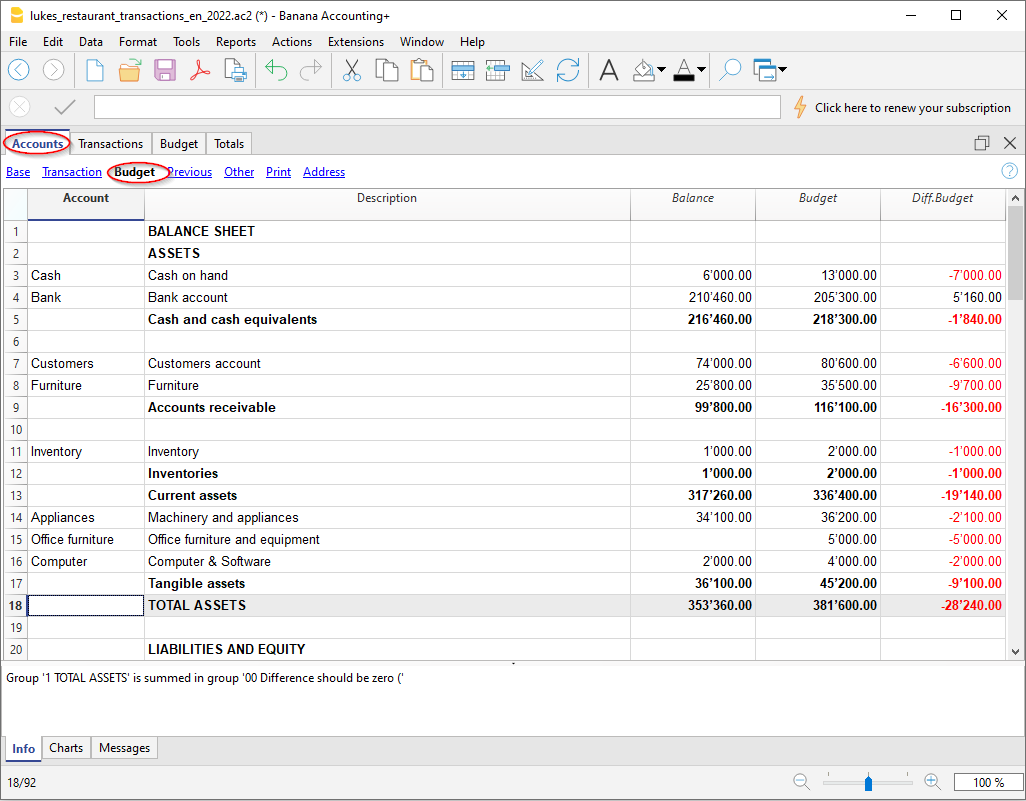

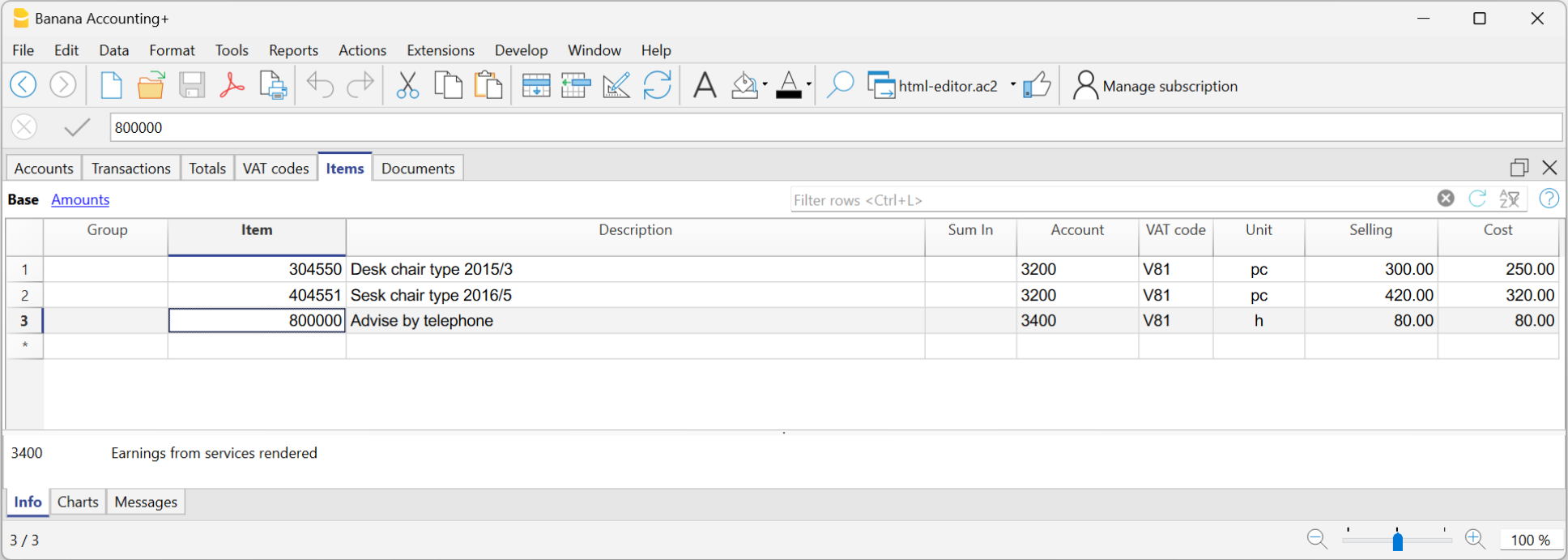

When this option is activated a Budget Table is created, where the user can enter his budget transactions.

Accounting files, in different languages can thus be created, and with different decimal points. In order to change the language or the decimal points once the accounting file has been created, the accounting type must be converted via Tools → Convert to new file from the menu.

Accounting with multiple languages

With Banana Accounting Plus, you can create accounting files in different languages, and present the Balance Sheet and Profit & Loss Statement in the language you need.

The available languages are: English, Italian, German, French, Spanish, Portuguese, Chinese, Dutch.

The different languages

- Program language

The one used for the interface, menu dialogues, etc.

You can change it from the Tools menu → Program options.

See red box 1 and 3 in the image above. - Documentation in different languages

You have a complete documentation in different languages, easily accessible by clicking on the help button. - Accounting file language

See red box 2 in the image above.When you create an accounting file, the columns are set in the creation language.

- The language of the column and table header

You can change it at your convenience. For example, instead of using the term VAT, you can use the abbreviation that best suits your country's requirement. - The content in any language

In the cells you can enter texts in any language. - Additional columns for other languages.

You can add columns to have the Balance Sheet and the Profit & Loss Statement in different languages. You can create columns for other languages in the Transactions table and also in all other tables. - Views in different languages

You can easily switch between different languages and just print the output in the desired language. - Balance Sheet and Profit & Loss Statement in different languages

You can customize the printout, and just choose to show the required columns in the final reports.

How to change the file creation language

Each document on Banana Accounting Plus is a separate file. The language of the file is separate from that of the program and is defined when the file is created. (File menu → New).

Column names and headers are assigned at the time the file is created, the creation language is then used.

To change the language of the file and columns, you need to re-create a new file:

- From the Tools menu → Convert to new file command

- In the open dialog box, select the file type equivalent to your existing file and click OK

- In the next window choose the new language of the file and the type of rounding, then click OK

The program creates a new file identical to your previous one, with the new language settings. This new file must be saved with a new name.

Change the current language of the file

The current language is the one the program uses to display the wordings, such as "Opening balance" in the account card or the dates in the reports.

Normally, it will be the same as the creation language, but it may be changed in File properties → Other.

Change the column headings

You can change the column header with the Data menu → Columns setup.

Add columns for different languages

In the Accounts table and also in the other tables (Transactions, VAT codes), you can add additional columns where you can enter the descriptions in other languages.

- From the Data menu →Tables setup → Add new column command

- Use the name of the language (e.g. German, Chinese, etc.) as the column name.

- In the newly created columns, for each row, complete the description in the language that has been added.

Create Views for each language

Create a view for each language to have printout only with the desired language.

- Data menu → Tables setup command

- Create a View for each language.

In each table you can have different views for different languages, or the views that include columns of different languages. - Customize your printout in the language you require. If you want to print in different languages you can create one Customization print for each language so you don't have to change the settings each time, but have them already set up.

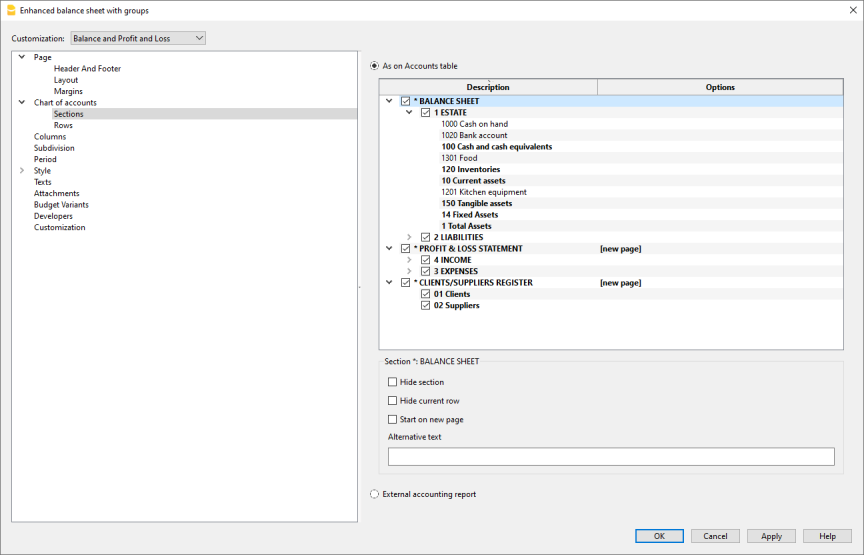

Enhanced Balance Sheet for each language

Once you've added the language column to the Accounts table, you can have it appear in the Enhanced Balance Sheet report as well.

- Open the Enhanced Balance Sheet with groups.

- Choose the Customization you want to print.

- In the Customization section with the Duplicate command Create a new Customization for your language.

As customization name, give the name of the language. - Go to the Columns section:

- Advanced button for the Balance Sheet columns

- Add button

In the section of the Accounts table:- Make the column of the language you are interested in visible.

- Hide the Description column of the default language.

- Repeat the operation also for the Profit and Loss columns.

- Next time when you open the Enhanced balance sheet with groups, you will have your language already set up.

- Include the Customization in the Favorites menu.

This allows you to access your report faster.

The predefined texts of the report (date etc.) are displayed in the current accounting language. It may be necessary to change the current language from time to time.

Extensions

If you have specific needs in different languages, they can be programmed as Extensions.

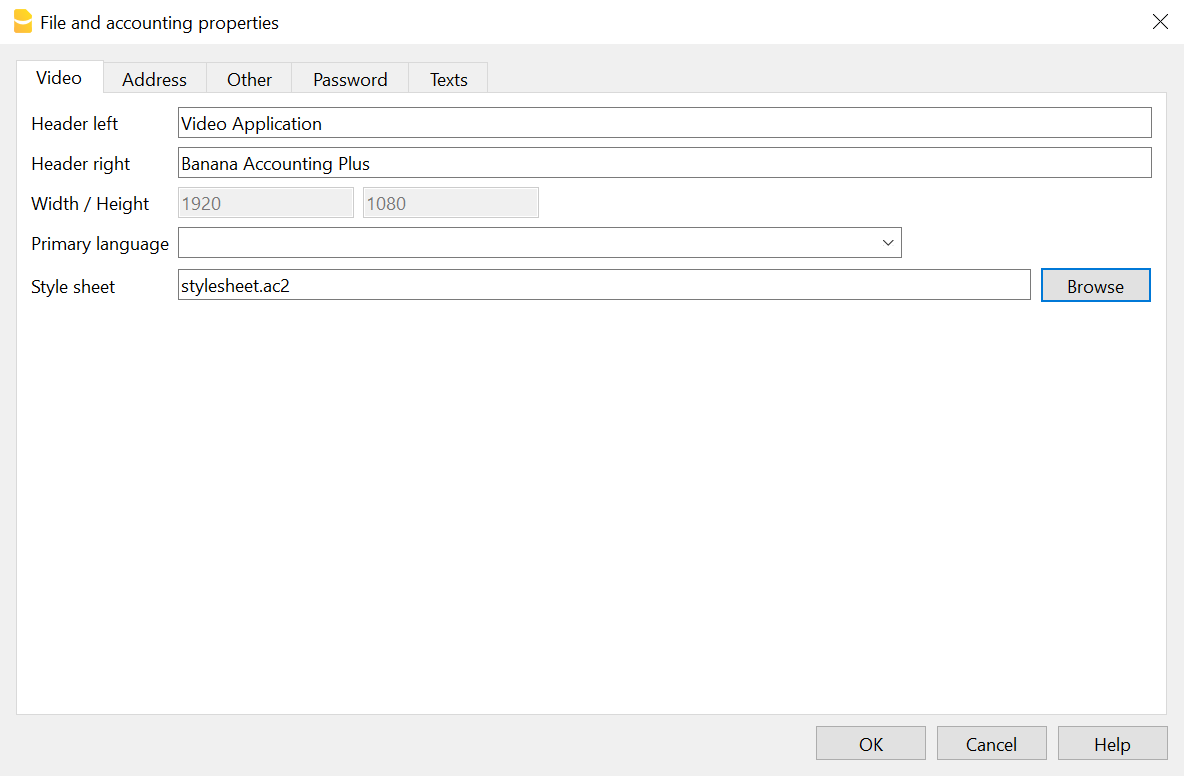

File properties

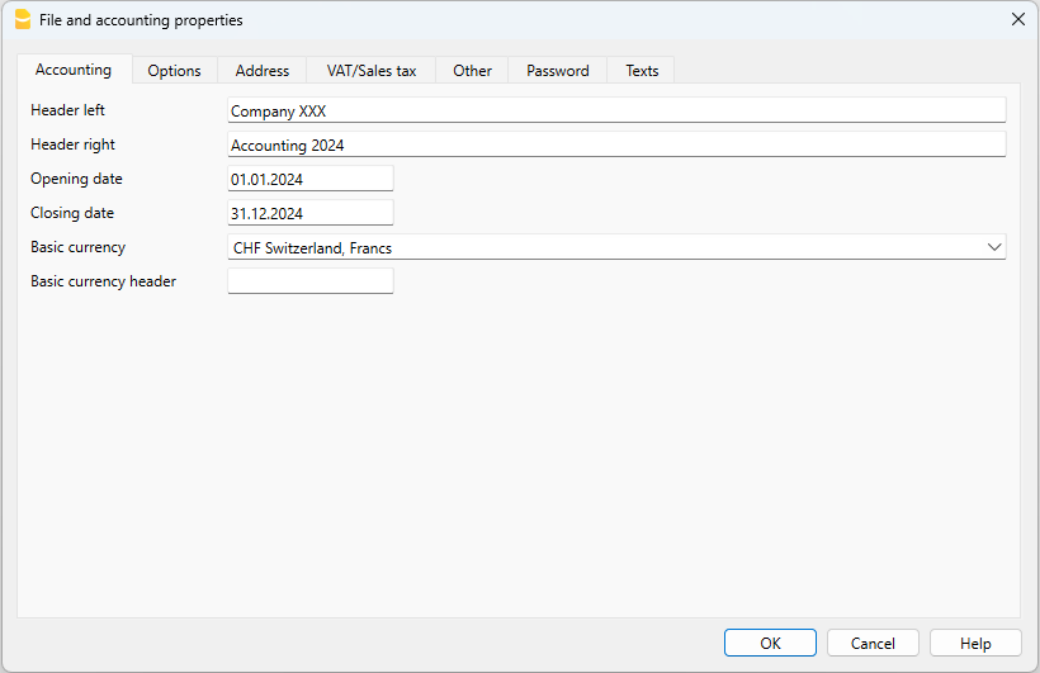

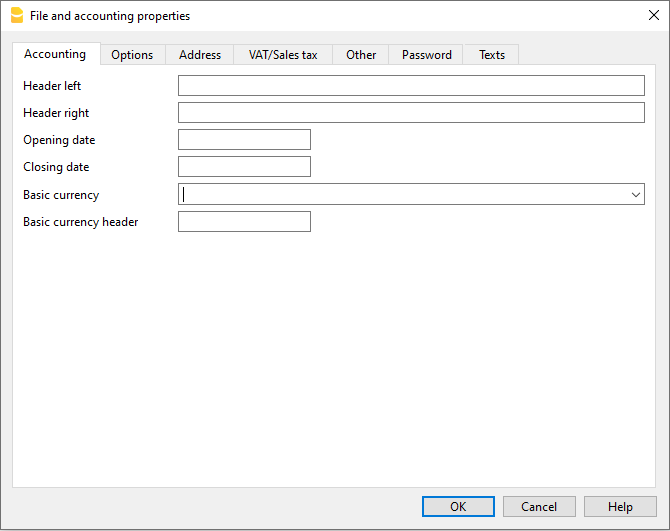

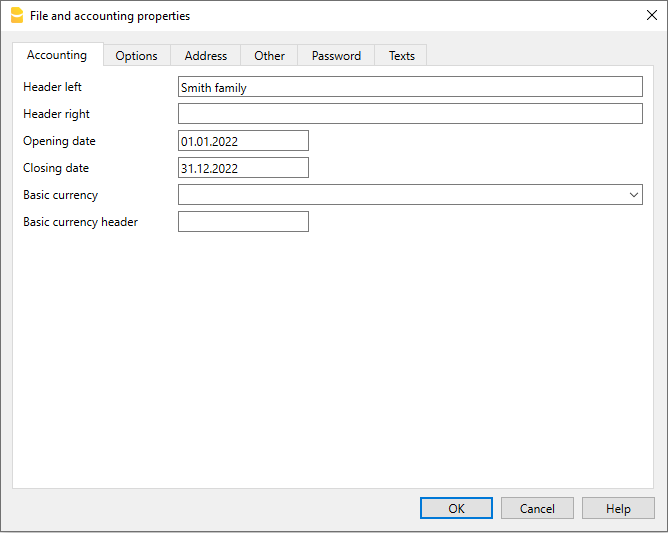

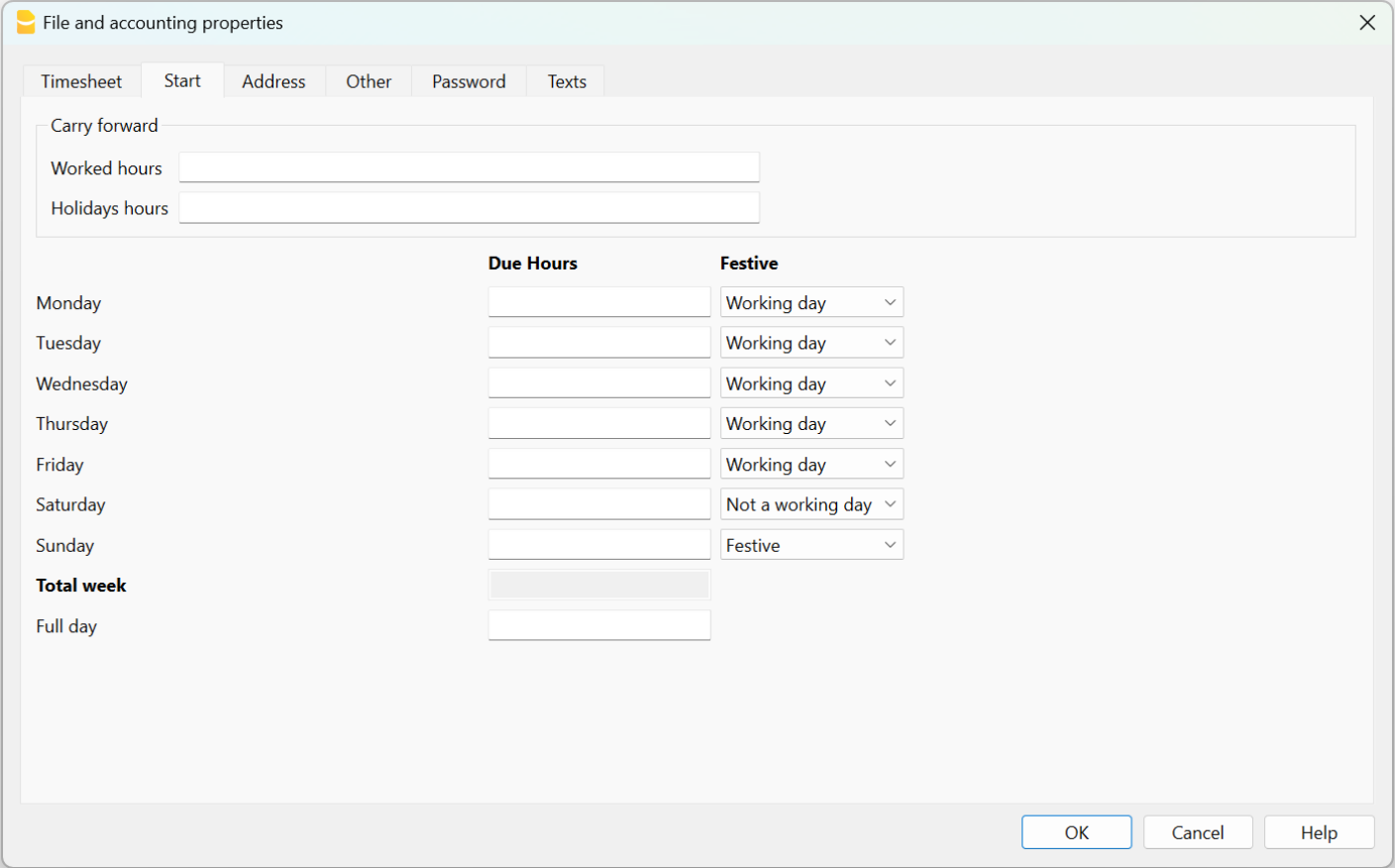

When a new file is created, the basic data need to be entered in the File menu > File and accounting properties.

The file properties (Base data) can vary depending on the chosen accounting type.

For the explanations of the different tabs please refer to the menu on the left.

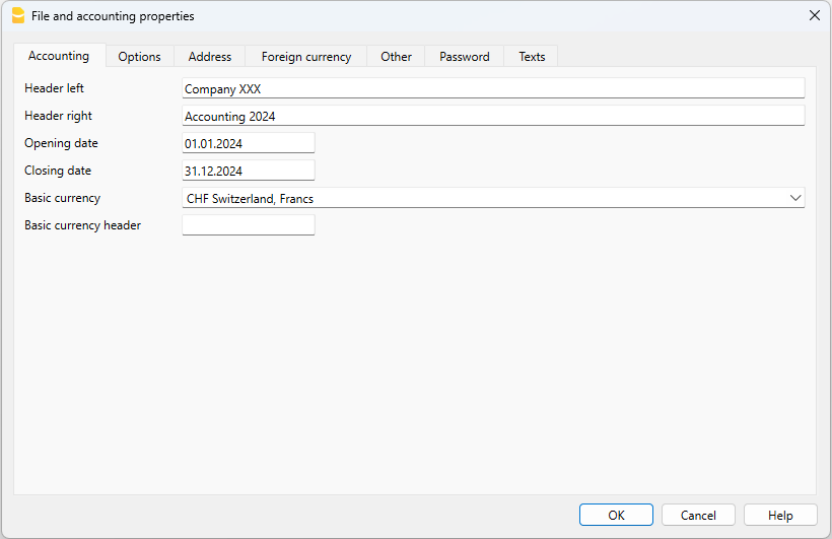

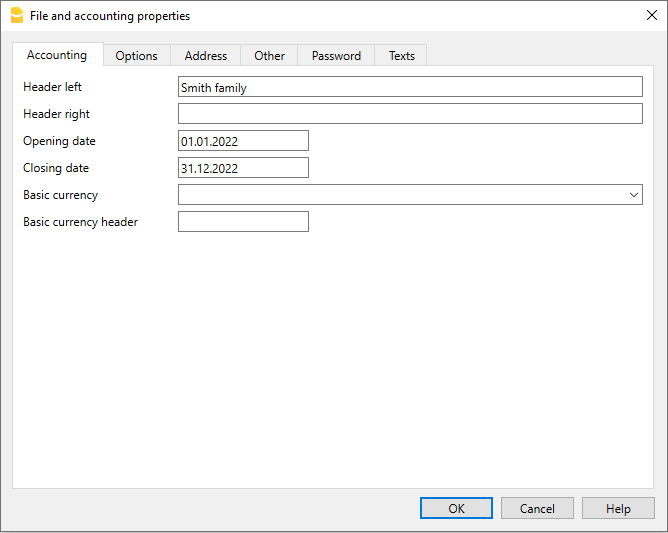

Accounting Tab

Access this section via the File > File and accounting properties > Accounting section.

Left and right headers

These are the two empty cells at the top where any desired text can be inserted which will be used as a header for print-outs (left and right).

Opening date

The opening date is the date when the accounting begins. It can also be left blank. If a date prior to the opening date is inserted when entries are made, the program will give an error message.

Closing date

This is the closing date of the accounting. It can also be left blank. If a date greater than the closing date is inserted when entries are made, the program will give an error message.

Base currency

The code of the currency in which the accounting is being handled. You can enter any currency code, even the one that are not in the list. When the code of the basic currency is being changed, the program changes the column headers for the amounts in basic currency using the new code.

In the multi-currency accounting files it is mandatory to select the basic currency, which will work as the functional currency, the one used for the calculation of the Balance sheet and Profit & Loss statement.

Changing the Basic currency symbol

If you change the basic currency symbol the program will not change the existing amounts. We advise you to change your basic currency symbol only if you don't have yet entered any opening balances and any transactions.

Accounting file WITHOUT foreign currencies

You can replace the basic currency symbol with the new symbol.

Accounting file WITH foreign currencies

To change the currency code in accounting with foreign currencies refer to the following page Change the basic currency.

Options Tab

This section is accessed via File > File and accounting properties > Options section.

Transaction date required

If this option is activated and then a transaction is entered without a date, there will be an error message.

Recalculate totals manually (F9)

If this option is activated, the program will not automatically recalculate the principal groups of the accounting file, but the user needs to use the F9 key.

File from previous year

By using the Browse button, the user can select a file from the previous year.

Smart fill with transactions from previous year

If this cell is checked, the program keeps the transactions from the previous year in memory, and offers them as Smart Fill while the user inputs new entries.

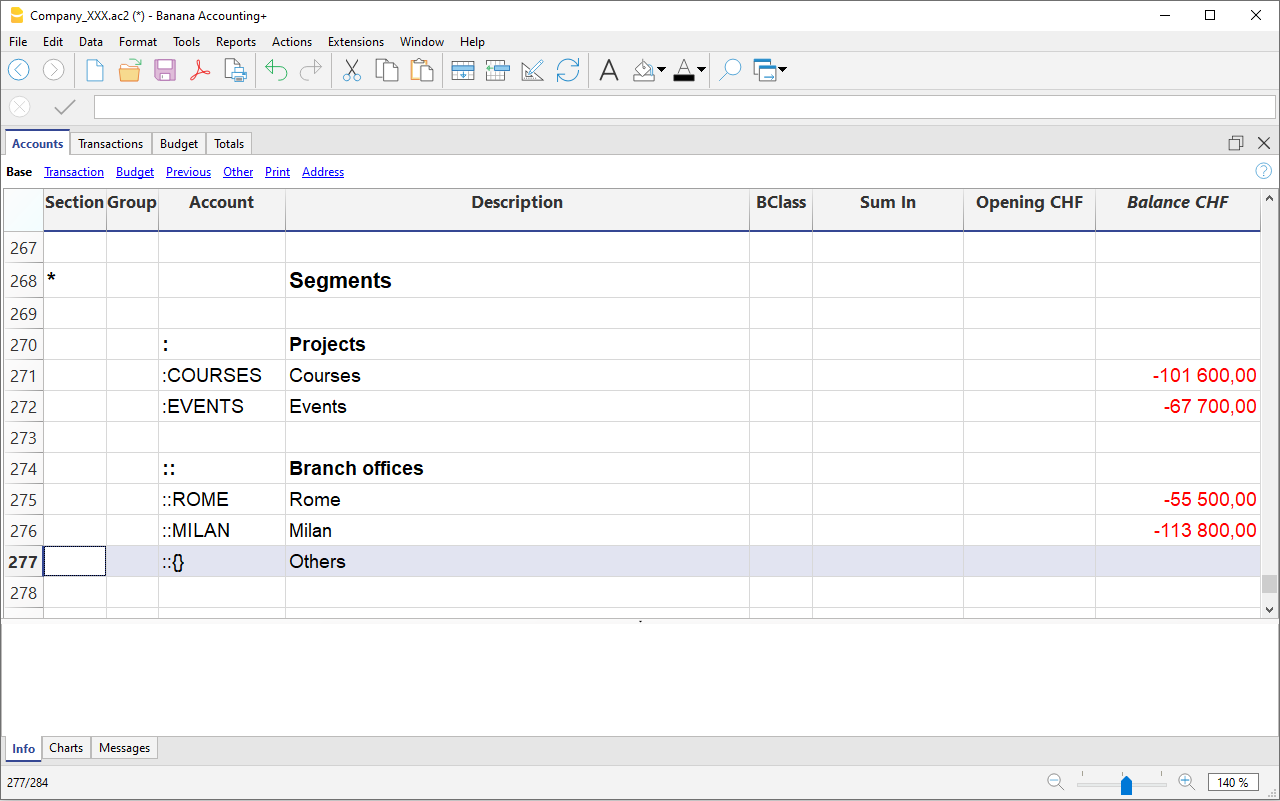

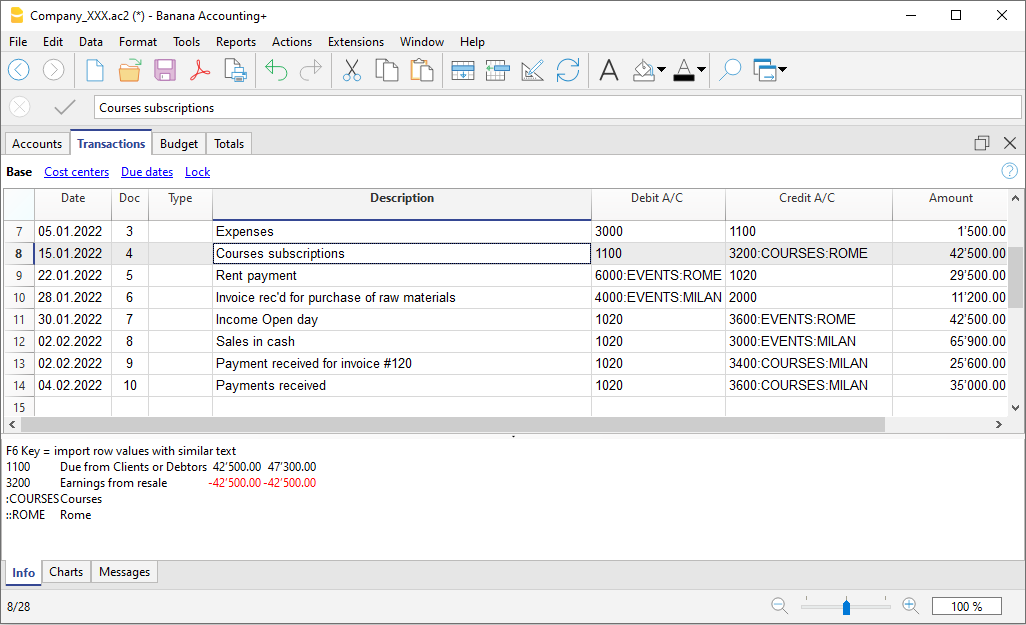

Use the minus sign (-) as segments separator

When this option is activated, the segments have to be entered in the Transactions table with the minus (-) sign preceding the segment code. When this option is deactivated, the segments need to be entered with the colon sign (:), as in the chart of accounts. The colon needs to always precede the segment code.

Records (+/-) cost centers according to the category

This function is only active for Income & Expenses accounting and Cash Manager. By activating this box, the amount is entered in the cost center (positive or negative) according to the category.

If, instead, this option is not active, in order to enter a negative value, it is necessary to enter a minus sign before the cost center (-CC).

Related document: Text input, edit and Smart fill

Address Tab

This section is accessed via the File > File and accounting properties > Address tab.

In this section it is possible to enter data concerning the company or person whose accounting is managed.

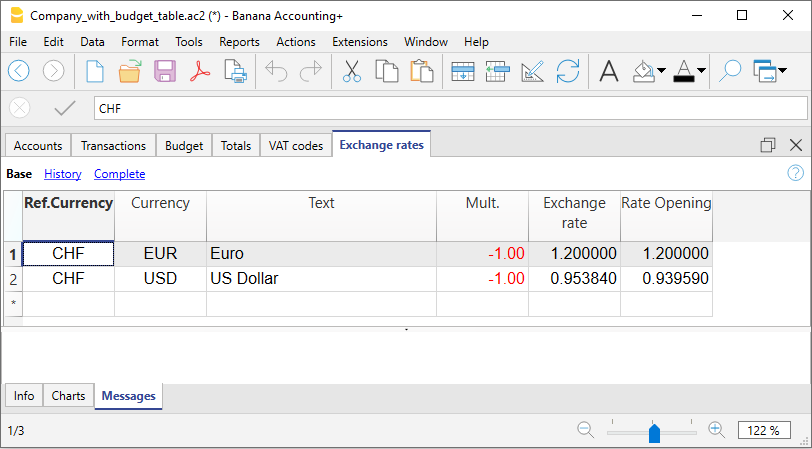

Foreign currency

This section is accessed via the File > File and accounting properties menu >Foreign currency section.

For the explanations of the different tabs please refer to the corresponding page Starting a multi-currency accounting.

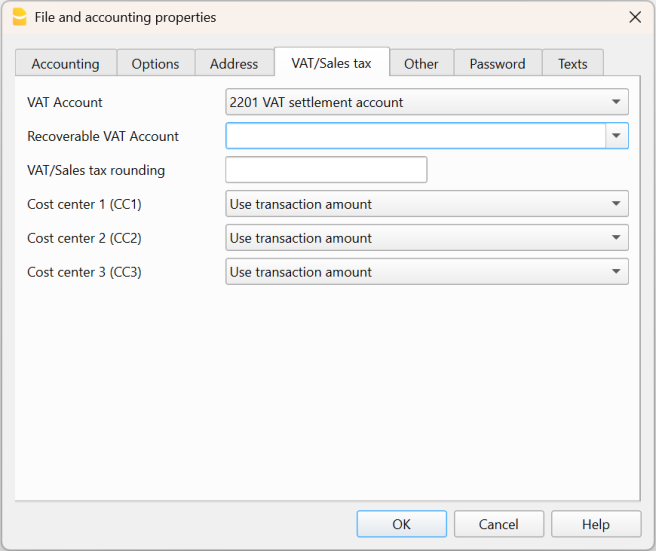

VAT/Sales tax

This section is accessed via the File > File and accounting properties menu > VAT tab.

For the explanations of the different tabs please visit the corresponding page File properties (VAT/Sales tax tab).

Other Tab

This section is accessed via the File → File and accounting properties menu → Other tab.

Current language

There are some file texts that the program generates automatically, (e.g. the lines of the Totals table, the transactions on the account card, and the printout of the Enhanced balance sheet); in this tab, the user can indicate the language for these texts (usually the same as the creation language).

Creation language

This is the language chosen and selected when the user creates an accounting file; this language is used for the column headers. If the user wants to change the creation language, then it is necessary to convert the file to a new one using the Tools menu → Convert to new file command.

Extensions

It is possible to indicate extensions of Banana Accounting. When the file is opened, the program will automatically install the extensions. They can be used for templates or files that are combined with extensions. Other users who open the file receive directions or commands to install the necessary extensions.

The list shows all extensions that can be installed.

Extensions' keywords

Enter a keyword contained in the Banana Accounting extension. Usually these keywords are specified in the installation instructions of the extensions; most extensions don't use keywords to restrict viewing to certain files.

If a script has the @docproperties attribute, the command will be visible in the Extensions menu only for those Banana files that have set the same keyword in the Extensions field. To set multiple keywords, you need to separate them with the ; (example: datev; donations).

Password Tab

This section is accessed via the File → File and accounting properties menu → Password tab.

Files can be protected by using a password.

Enter a password for a file without a password

Confirm old password

Leave the cell empty.

New password

Enter the password.

Confirm new password

Enter the same password that you entered in the New Password box

Change an existing password

- Enter the existing password.

- Enter the new password twice.

- Confirm with OK.

Password compatibility with old versions

Activate this option if you want your password to be compatible with the previous Banana Accounting versions.

This option not recommended because the password is saved in a less secure mode.

How to cancel a password

- Enter the existing password.

- Leave the boxes for the new password empty.

- Confirm with OK.

Forgotten password

For information about a forgotten password, please refer to the Questions and Answers page, Password unlock paragraph.

Note

Using a password does not give a high level of protection. In order to render the data truly inaccessible to third parties, it is necessary to have the appropriate cryptographic software.

Text Tab

This section is accessed via the File → File and accounting properties menu → Texts tab.

In this tab it is possible to enter different keys in order to save extra information, such as the accountant name, for example. These keys and the resulting texts can be taken over and used in scripts.

Key

In this field, input the reference text (e.g.: accountant name).

Value

In this field, it is necessary to input the value related to the key (e.g.: Ocean Avenue, ...).

Add

This button saves the newly entered data.

Remove

This button removes the selected Key.

Save file

Banana Accounting files are not saved within the program itself, but on the drive selected by the user, just like any other file, such as Word or Excel. Banana accounting files have the extension ".ac2", while the program has the extension ".exe" (Windows), ".dmg" (Mac), or ".deb, .rpm, .run, .tgz" (Linux).

Where and how to save files

Banana Accounting files are saved on your computer or on an external drive, such as: external disk, USB stick, Google Drive, Dropbox, or other Cloud services.

To save the file, choose from the menu File > Save As:

- Open the destination folder

- Give your file a name.

By default, .ac2 files are saved in the Documents folder, but you can change the destination folder. Once you've saved the file with a name, use the Save command to save your changes. Each time you save, the previous file is overwritten.

Banana Accounting can save files to any drive that is recognized by the operating system, such as a rewritable disk. From non-rewritable media (CD or DVD), Banana Accounting can only read files.

Saving when closing the program

Every time the accounting data is updated and the work has not yet been saved, a warning message appears when closing the program:

- "The current document xxx.ac2 has been modified. Do you want to save it anyway?"

If you use the Do not Save button, all data will be lost. You must click the Save button to save your changes.

If you want automatic saving when closing files, you can activate the option from the menu:

Tools > Program Options > File Management and enable the Automatically save when you close the program option.

Make sure the data is correct, otherwise it will be saved as is.

Saving a shared file

When multiple users need to use the same file, they cannot use it at the same time. The first user to open the file can save it. The other users open the file in read-only mode.

- Only one user at a time can save the same file.

- Saving is only possible if the file is not in use by others.

Managing files for different accounting entities

To manage multiple accounting files, before saving, we recommend:

- Creating a folder for each company

- Creating a subfolder for each fiscal year.

See also: Organizing work.

Saving and recovering data in case of crash

Banana Accounting automatically saves your work in a temporary file at regular intervals. The time interval between one auto-save and the next can be customized via the menu:

This temporary file is deleted each time the file is saved normally by the user.

In the event of a computer crash or power failure, when restarting the program, if Banana detects an undeleted temporary save file, a window appears as explained on the page File Auto-Recovery.

In this window, the user has the option to confirm recovery. If accepted, the file will be opened and can then be saved manually.

Saving the file with a password

Each file saved on the device and in the selected folder can be protected by a password for added security.

Files are saved in the same way as those without a password.

File compatibility across different operating systems

Files created with Banana Accounting have the extension “*.ac2”, regardless of the operating system used. A file can be saved in Windows, opened and edited on Mac, and then reopened in Linux or Windows.

Therefore, .ac2 files are compatible with:

- Windows

- Mac

- Linux

.ac2 files can also be sent via email and opened with Banana Accounting regardless of the operating system used.

Copying or moving files

*.ac2 files can be copied or moved:

- From one folder to another

- Use Windows Explorer or Mac Finder to locate the folder where the files were saved.

- Copy and move them to the new destination folder (once pasted, if needed, they can be deleted from the previous folder).

- From one computer to another

- By sending an email (as attachments) and saving them on the new computer.

- Files can be saved on a USB stick or an external drive and then moved to the new computer:

- Open the file you want to save.

- From the File menu > Save As, select the desired destination drive.

- You can also copy by opening Explorer and dragging the file to the selected drive.

Saving to Cloud systems

Banana Accounting Plus does not have its own Cloud, but it allows you to work with your own. The program is installed on your computer and runs locally.

As for accounting files, they belong exclusively to you and you can save them wherever you want, including on services like Dropbox and Google Drive that keep files synchronized with cloud storage services.

In the cloud, Banana Accounting overwrites the *.ac2 files and deletes the *.ac2.bak file. The deleted files list in the cloud contains previous versions of the *.ac2.bak file.

Viewing changes

Banana Accounting, Android version, works directly with the Dropbox server. If you make changes on your PC, you usually need to wait a few seconds to see the updates on the server and thus in the Banana Accounting file.

To ensure that the file is properly synchronized with the server from your computer, the file should be marked with a green checkmark.

If you do not see the synchronization symbols (green, red, blue), you need to update the Dropbox application installed on your PC.

Another way to check the synchronization status from your PC is to click the Dropbox icon in the lower taskbar:

Additionally, on Android synchronization does not occur while working with the app. You need to close and reopen it.

Warning:

Banana Accounting cannot detect if files are opened and modified simultaneously on multiple computers. Therefore, it may happen that one person deletes some data while another adds new entries. Only the most recently saved copy of the file is retained. It is important to avoid working on the same file at the same time.

Deleting and renaming files

Banana Accounting does not have a delete or rename function for files; to do this, you must use the appropriate function of the operating system (Windows Explorer or Finder on Mac).

Related resources:

How to minimize the risks of data loss

Security copies (backups)

- For Mac use the "Time machine" function.

- For Windows use the "File History" function.

- Dropbox, OneDrive, iCloud, Google Drive offer the possibility to keep previous versions of your files.

.bak files

The standard format for Banana Accounting files is the .ac2 format. When you save your .ac2 file and the save operation is successful, Banana Accounting:

- Replaces the content of the existing file with the updated accounting data.

- Automatically creates a .bak file with the previous data, but not from the most recent save.

Save operation behavior:

- The data is saved in a temporary file.

- If the save operation is successful:

- The original .ac2 file is renamed by adding the ".bak" extension to the filename.

- Any existing ".bak" file is deleted.

- The new data is saved in the .ac2 file.

The .bak file represents the state of the accounting data at the moment the file is first opened during the current session, even if subsequent saves are made. The goal is to preserve the file as it was before it was opened.

The Create backup copy (.bak) option is enabled by default, but it can be disabled from the menu Tools > Program Options > File Handling

Recovering data from a *.bak file

Important: to update your accounting, only use the file with the ".ac2" extension and do not open the file with the ".bak" extension, otherwise it will be overwritten and all recent changes will be lost. Use it only to recover data.

Recommended recovery procedure:

- Locate the ".bak" file using the File Manager

- Rename the ".bak" file by removing the ".bak" extension, leaving only ".ac2"

- Open the renamed file with Banana Accounting

If the file does not appear in the folder:

- Open the folder where the accounting file is located.

- Open the file with the extension .bak. If it does not appear in the folder, select File type> All files (*.*) in the window below.

- Once the file is opened, save it as a file. Usually it is given the same name as the lost file.

Automatic saving

While in use, Banana Accounting automatically saves changes to a temporary file.

- When the program is closed or a manual save is performed, the temporary file is deleted.

- In case of an unexpected computer shutdown, the program will offer to recover unsaved data upon restart.

Damaged .ac2 file

Events such as hardware failures, viruses, or errors in file transmission via email can damage documents.

- It is always advisable to have backup copies.

- If a file is damaged, our Support Service can evaluate, for a fee, the possibility of recovering the data.

Recover autosave file

This dialog appears when the program closes unexpectedly, and it was not possible to save changes made to the file.

When the program is reopened, it detects that the autosave file (temporary file) has not been canceled, and then asks if you want to retrieve the file.

You can choose from the following options:

- Recover

- The autosave file is copied replacing the original file

- The original file is renamed as indicated in the dialog window

- Don't recover

- The program deletes the autosave file.

- The program opens the original file.

- Ignore

- The program keeps the autosave file and doesn't open any file.

- Next time you open this file, the program will warn you that an autosave file with unsaved changes was found

If the program stops working

If the program is closed normally, it asks whether to save the modified data, and the autosave file is deleted.

The program may however unexpectedly shut down for a number of reasons:

- A power outage or another event that caused an immediate arrest of the operating system

- A problem that led to the crash of the program

- Due to another program or to a situation of the operating system or driver that caused the program to stop.

Try to restart your computer and use the program without other programs.- A flaw in the operating system or a faulty program can cause an interruption of Banana Accounting.

- A computer fault (memory error)

- A virus or some other problem

- A problem in the Banana Accounting software

Usually when, repeating the same command always causes the program to crash.

If the program stops in completely different situations, it is more likely that the problem is due to a computer or operating system (see above)- First of all, make sure that you have the latest version of the program.

Install the updates if necessary. The problem could have been solved in the meantime

- First of all, make sure that you have the latest version of the program.

- Due to another program or to a situation of the operating system or driver that caused the program to stop.

Contact technical support

Countercheck the situation in which the program stops.

- It is important to understand in what situations the program stops, so that technicians can replicate the problem.

- When you contact the technical service:

- Describe the problem and how it can be reproduced - describe the error.

- Enter your system details (you can copy them under Tools menu > Program Options > Info System.

- If the problem occurs in relation to a file, send a copy of the file (removing confidential data).

Local copy of your work

One of the key points of any Desktop application is saving files. The user's work and the data entered must not be lost. Even in the case of a computer crash, the amount of work lost must be minimized.

A new strategy for saving files has been introduced with Banana Accounting+. From the user's point of view nothing has changed, but internally important improvements have been made to make the data saving process even more secure and solid, and to optimize it for use on cloud and mobile disks.

How it works

With the new implementation of the file saving and recovery process, Banana Accounting creates a local copy of the open file and then works on the local copy present in the device (pc, mobile, tablet) until the user saves the document. At this point Banana Accounting returns and saves the modifications in the source file. In the meantime, Banana Accounting regularly saves the modifications made to the document in the local copy.

Banana Accounting proceeds as follows:

- The user selects the file to be opened (source file)

- Banana Accounting create a local copy of the source file

- Banana Accounting blocks the opening of the source file to prevent modifications from multiple users

- Banana Accounting reads the local copy

- Banana Accounting regularly saves (by default every 2 minutes) the modifications made to the document in the local copy

- As soon as the user clicks on the Save button, Banana Accounting returns and saves the modifications in the source file.

- When the file is closed, Banana Accounting unlocks the source file and deletes the local copy.

- If the application cannot close or correctly save the modifications in the source file (electricity interruption or other causes), the local copy remains on the device and the its content can be recovered at the next Banana Accounting launch.

- If the file is temporarily not accessible (example if it is on a disconnected network disk or a USB pen), the user can keep working and the document modifications are saved in the local copy until when the source file is accessible again.

In other words the local copy is both a working document and a recovery document.

Advantages

The autosave feature is always active, so the work that could be lost (with the default settings for file recovery) corresponds at most to the work of the last two minutes.

Access to the file doesn't have to be continuous. Even if a file is temporarily inaccessible (e.g.: the file resides on a network disk or a disconnected USB pen), the user can continue working, and changes to the document are saved in the local copy until the source file is accessible again.

The local copy is not synchronized in the cloud. For this reason, the performance of the application is improved and the amount of data sent to the cloud is minimized.

This process is implemented in the same way on all operating systems: Windows, MacOS, iOS, Linux, Android and WebAssembly, regardless of where the file is saved.

Data recovery

In case of an interruption of the application, the local copy remains on the user's device. The next time the Banana Accounting is started, the application informs the user that changes have been found that have not been saved in the source file.

At this point the user has 3 choices:

- Open the recovered file

The user can decide whether to save the recovered file or to abandon the changes - Ignore the message

The user can later decide what to do - Cancel de recovered file

The recovered file will be canceled

The local copy remains on the user's device as long as the document remains in use or the changes have not been correctly returned to the source file. Once the file has been closed, the local copy is deleted.

The local copies are saved in a folder hidden under the system's user data. The user does not need to access this folder, access to this folder is not recommended. In case our support requires you to open this folder, you can access it through the menu Tools > Program Options > Advanced > System Info > Working copies path > Open path.

Keep in mind

This implementation:

- It does not replace a good backup policy.

- It does not replace a version control system.

Although this implementation is very secure and robust, we cannot guarantee that it will work 100% smoothly in all cases. For this reason, we encourage our customers to adopt a good backup policy and version control system.

Several operating systems provide backup and versioning functions. We ask you to browse the documentation of your operating system....

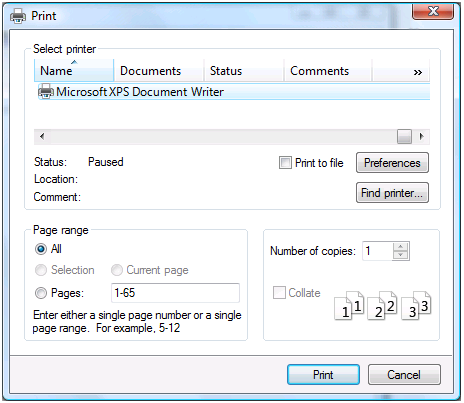

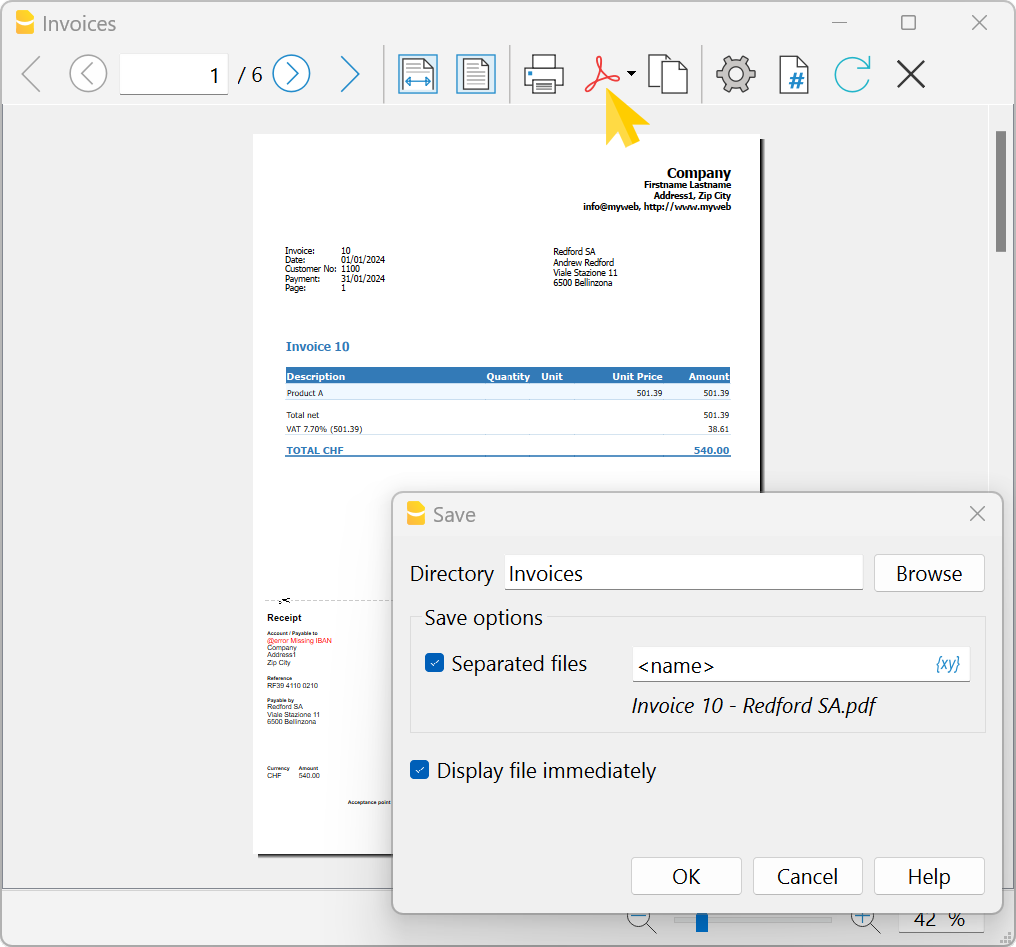

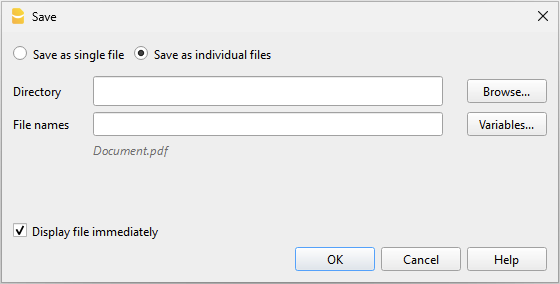

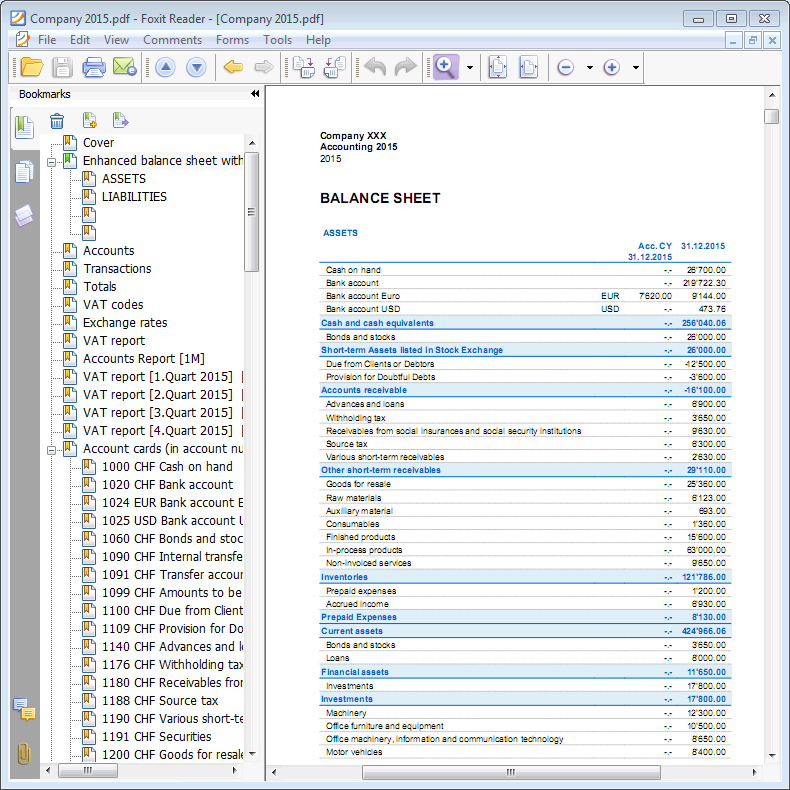

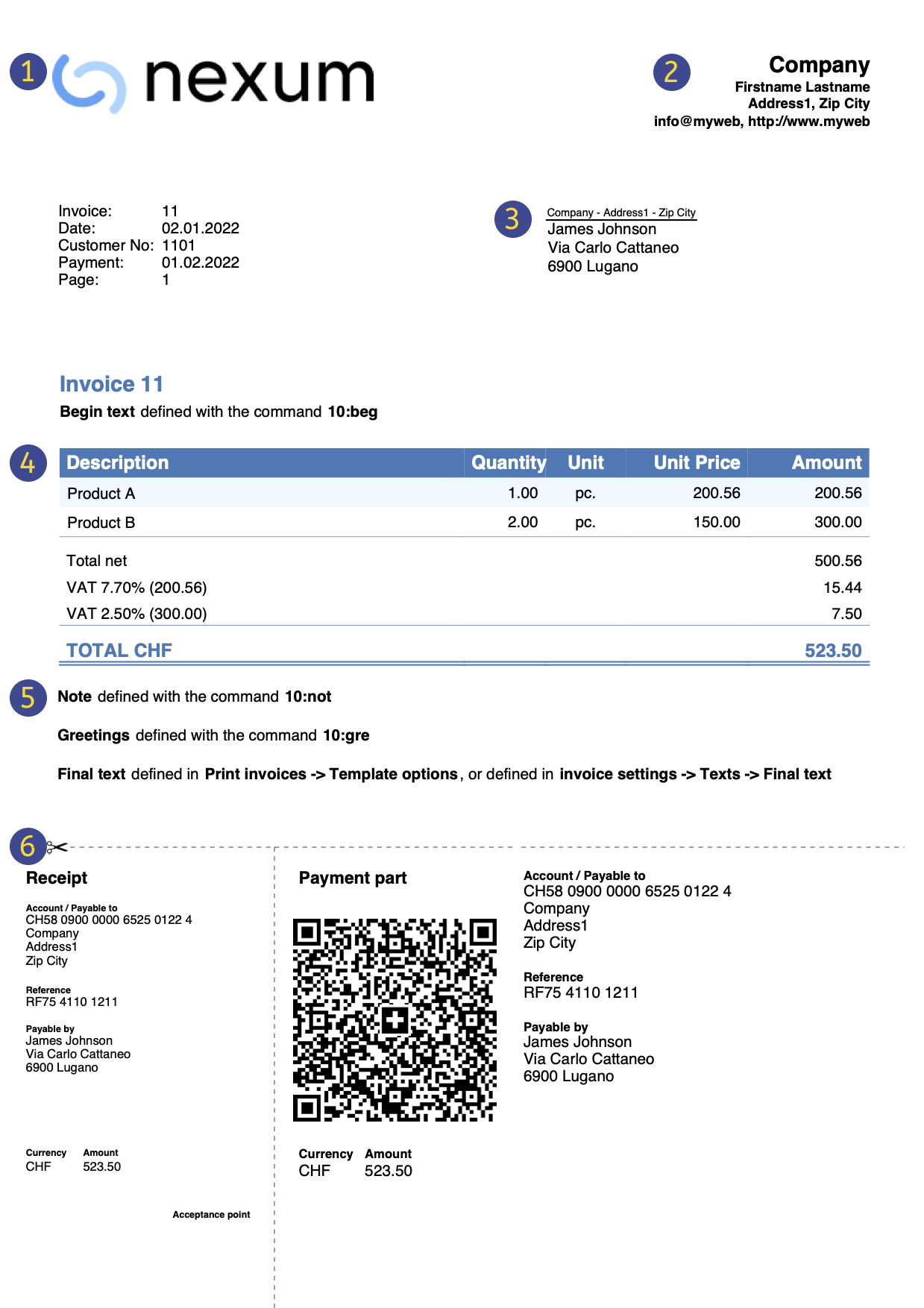

Create PDF

The Create PDF command is activated from the menu File > Create PDF and it prints in a PDF format everything that you see on screen.

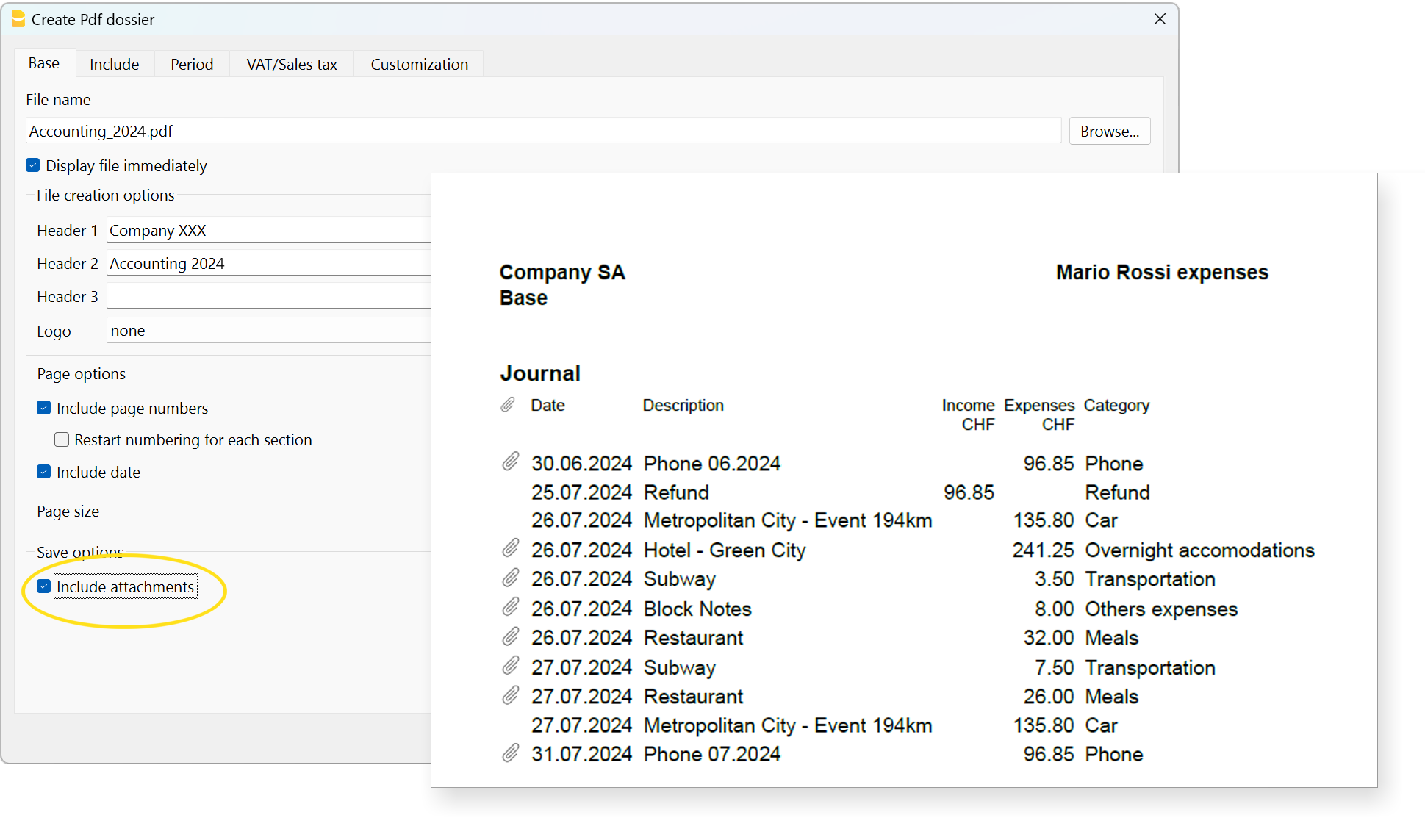

There is also a different command from the menu File > Create PDF dossier, that gives you the possibility to choose which contents of your Banana Accounting Plus file you want to include in your Pdf dossier.

Saving options

Saving options are only available with the Advanced plan of Banana Accounting Plus.

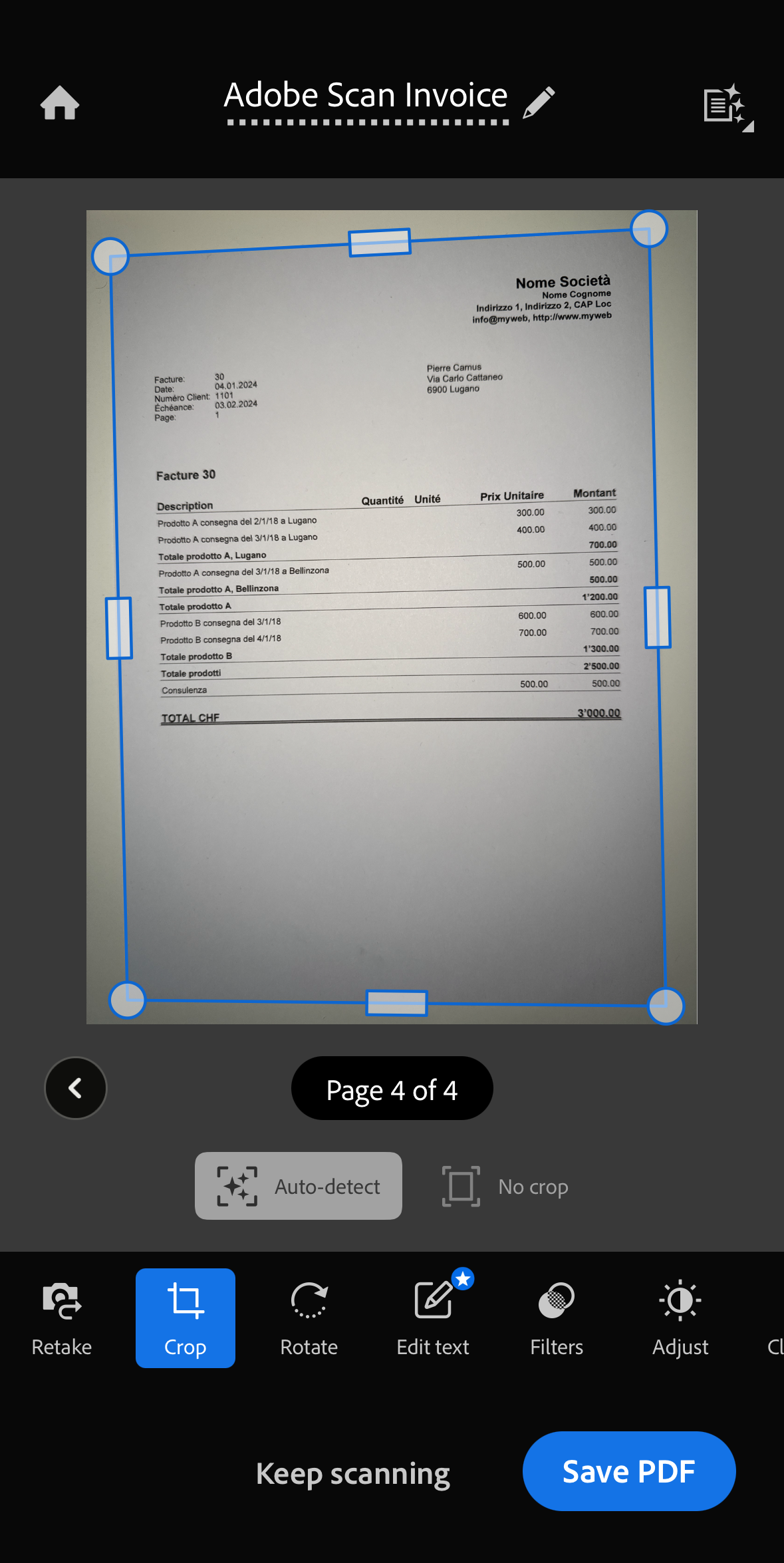

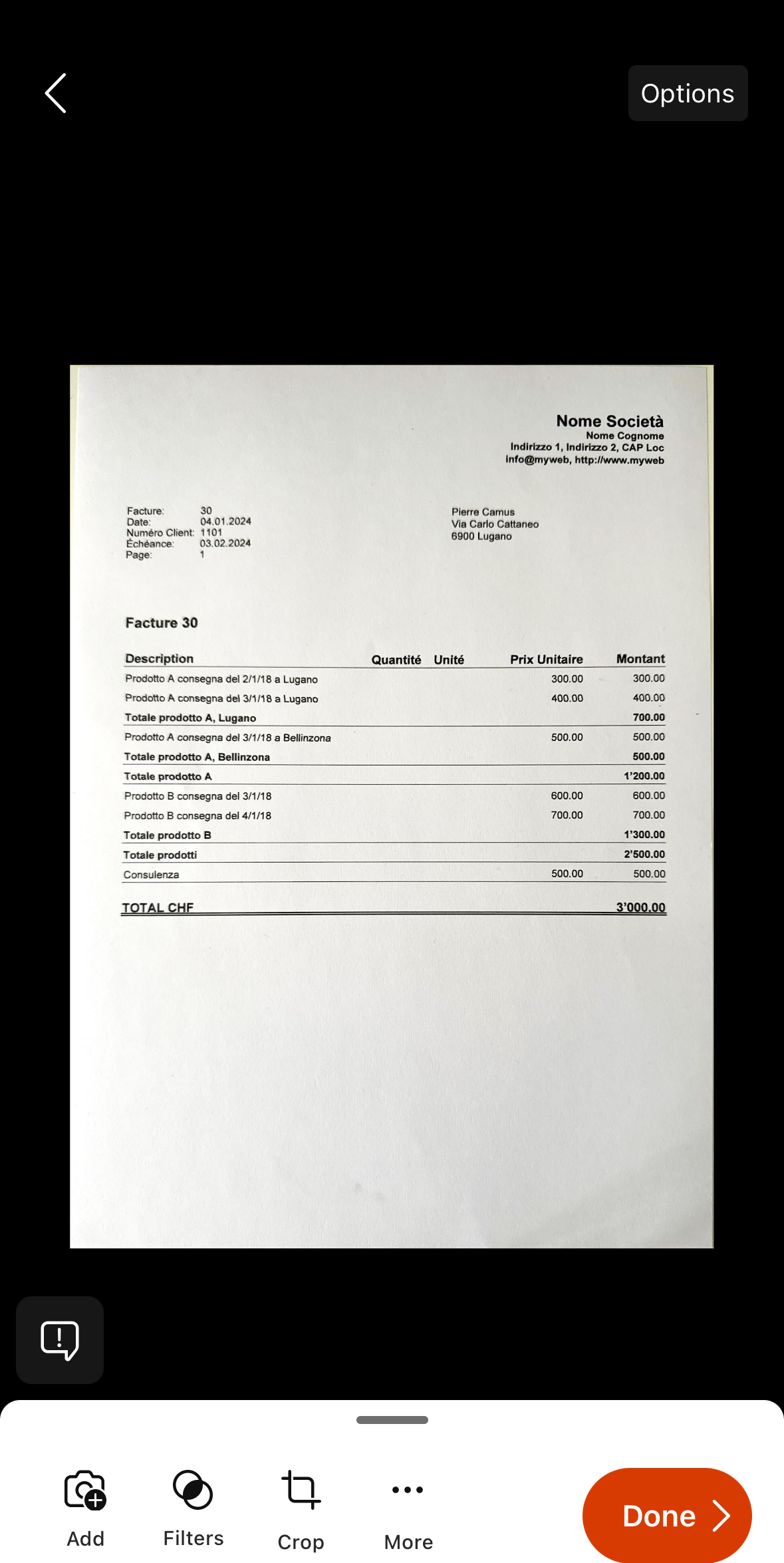

Include attachments

Save the attachments within the PDF file. Attachments refer to local files that have been inserted in the Link columns of various tables. In the created PDF file, a symbol will be placed next to each attachment. By clicking on the symbol, the attachment will be opened and displayed. Please note that the ability to open the attached files is only available in PDF readers like Adobe Acrobat Reader, Foxit, and others. If the PDF file is opened in a web browser, it might not be possible to open the attachments.

This option is only visible if the document(s) contain Link elements.

Technical notes

- In print and print preview (physical printer and virtual pdf printer of the operating system) all fonts supported by the operating system are possible.

- In Windows pdf export only TrueType fonts that have Unicode cmap mapping and contain the following tables "OS/2", "cmap", "cvt ", "fpgm", "glyf", "head", "hhea", "hmtx", "loca", "maxp", "name", "post", "prep".

Error creating Pdf file: %1 - If the program fails to load the indicated font, it replaces it with a default one (Helvetica or Arial depending on the operating system) and a message is displayed to the user that it is unable to use the PDF font.

Open and find a file

To open a file, choose the Open command from the File menu, or use the corresponding icon in the toolbar.

- Accounting files can be opened if they are located on the local computer or accessible through a network drive.

- If they were sent via email, you must first move them to a folder on the computer.

- Only one person at a time can open the file to make changes. If changes are made to a protected file, or one already in use, you must choose a different file name to save it.

- The program notifies that the file has been opened in read-only mode ( the file cannot be changed or saved) in the following cases:

- The file has already been opened by the same user or in another session.

- The file is on non-rewritable media (CD-ROM).

- The file is in a temporary folder that is not writable.

- The file is write-protected or the user does not have permission to modify the file.

- If the file is password-protected, the password dialog will appear.

When the previous accounting year is protected by a password and you want to run the Enhanced Balance Sheet with Groups command, the program will ask for the password of the previous year.

Otherwise, it is necessary to follow one of the recommendations provided in the notes on the page Enter password.

Opening multiple files in the same instance of Banana Accounting

To open multiple files at the same time, go to File > Open and select the desired file. Repeat this operation for each file you want to open.

The files are displayed layered in the same window. To switch from one file to another, use the Next window command available in the toolbar.

Opening multiple files in separate instances of Banana Accounting

It is possible to open multiple files in different instances of Banana Accounting:

- Windows

- Open the first Banana file as usual.

- To open additional files, right-click the program icon in the taskbar at the bottom, select Banana Accounting, and open a file. Repeat this operation for all the files you want to open.

- Mac

- Open the first Banana file as usual.

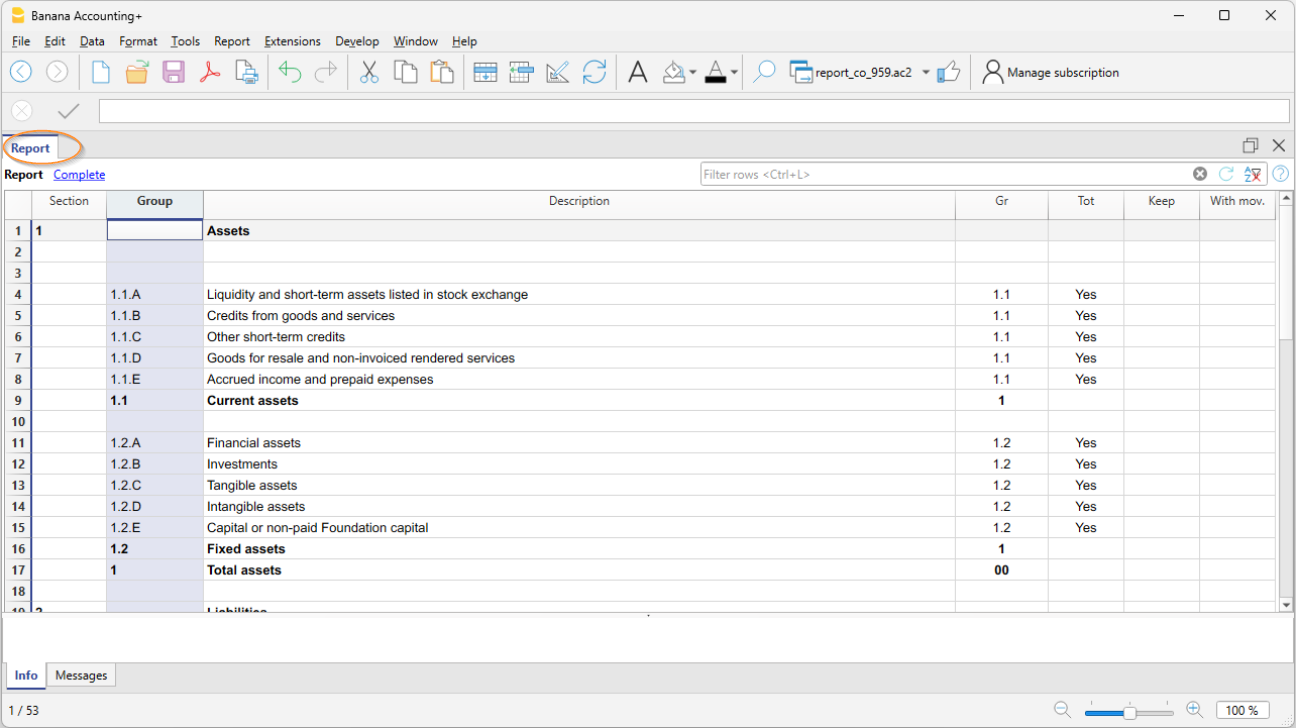

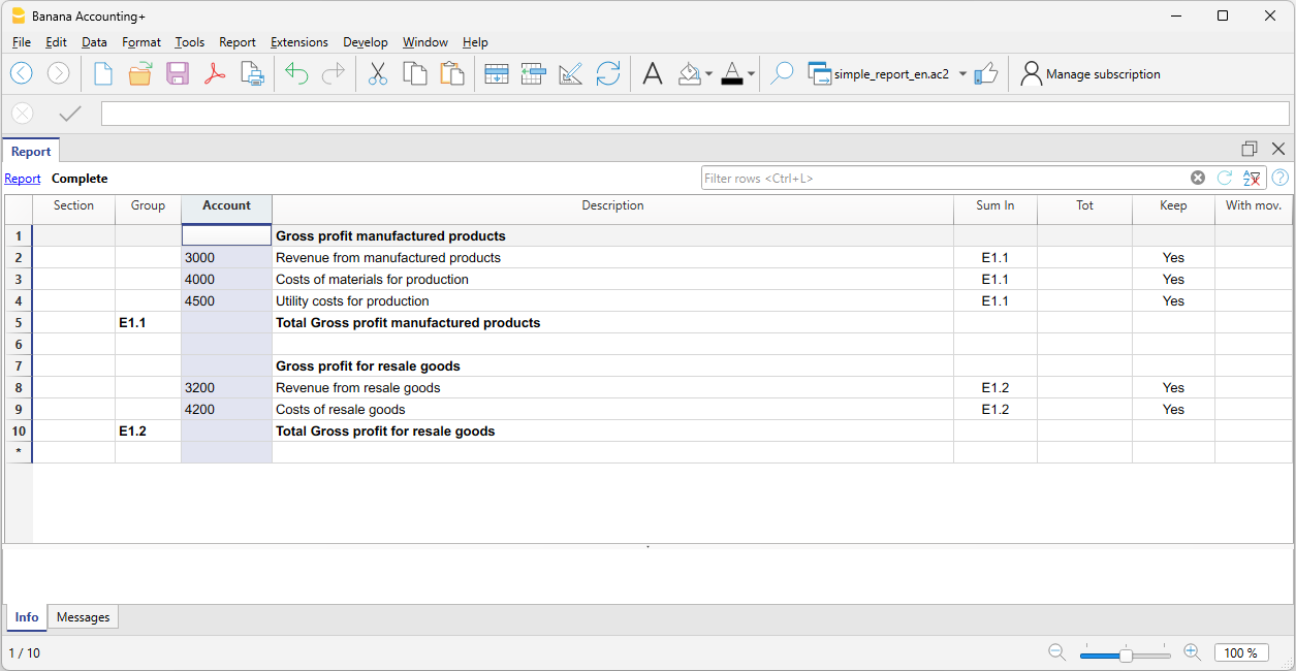

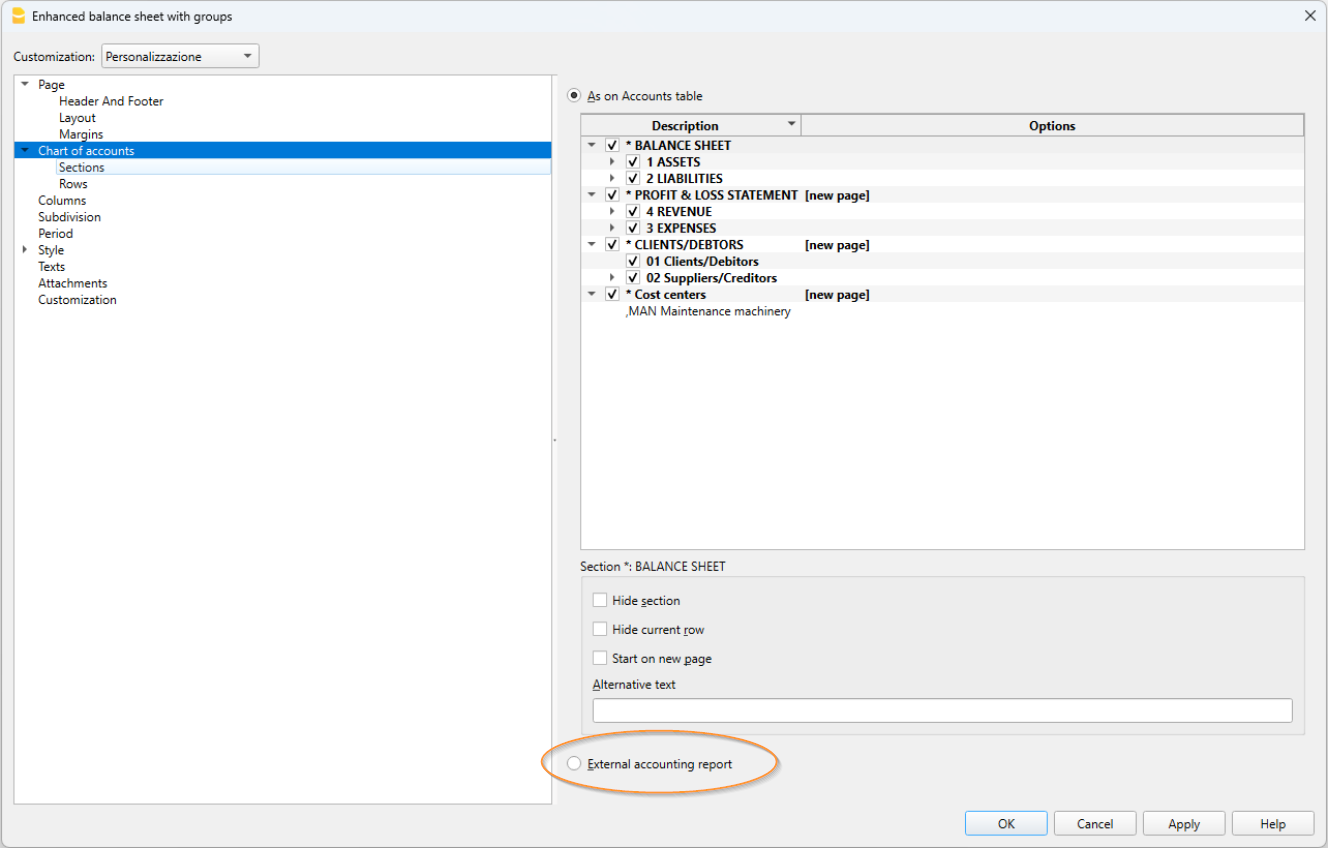

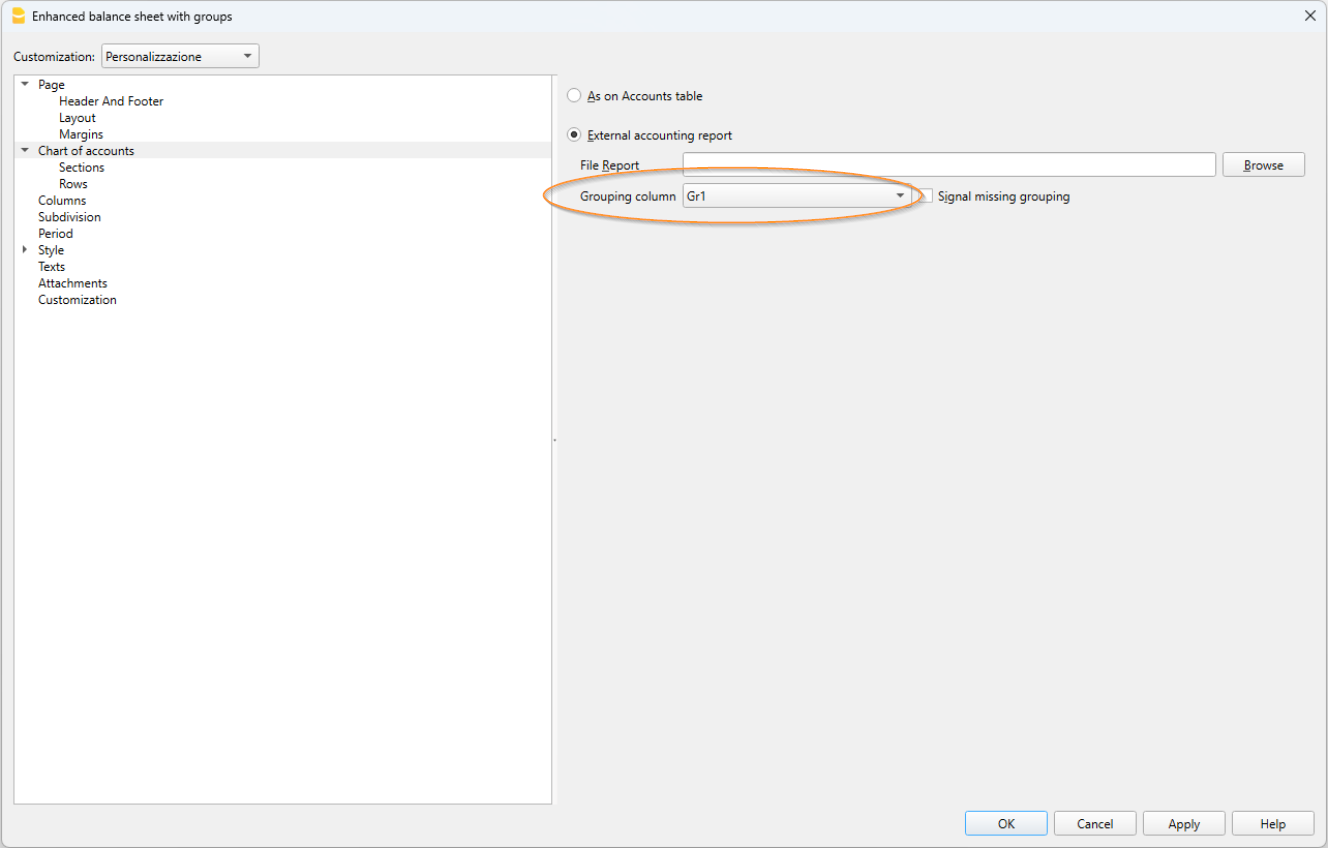

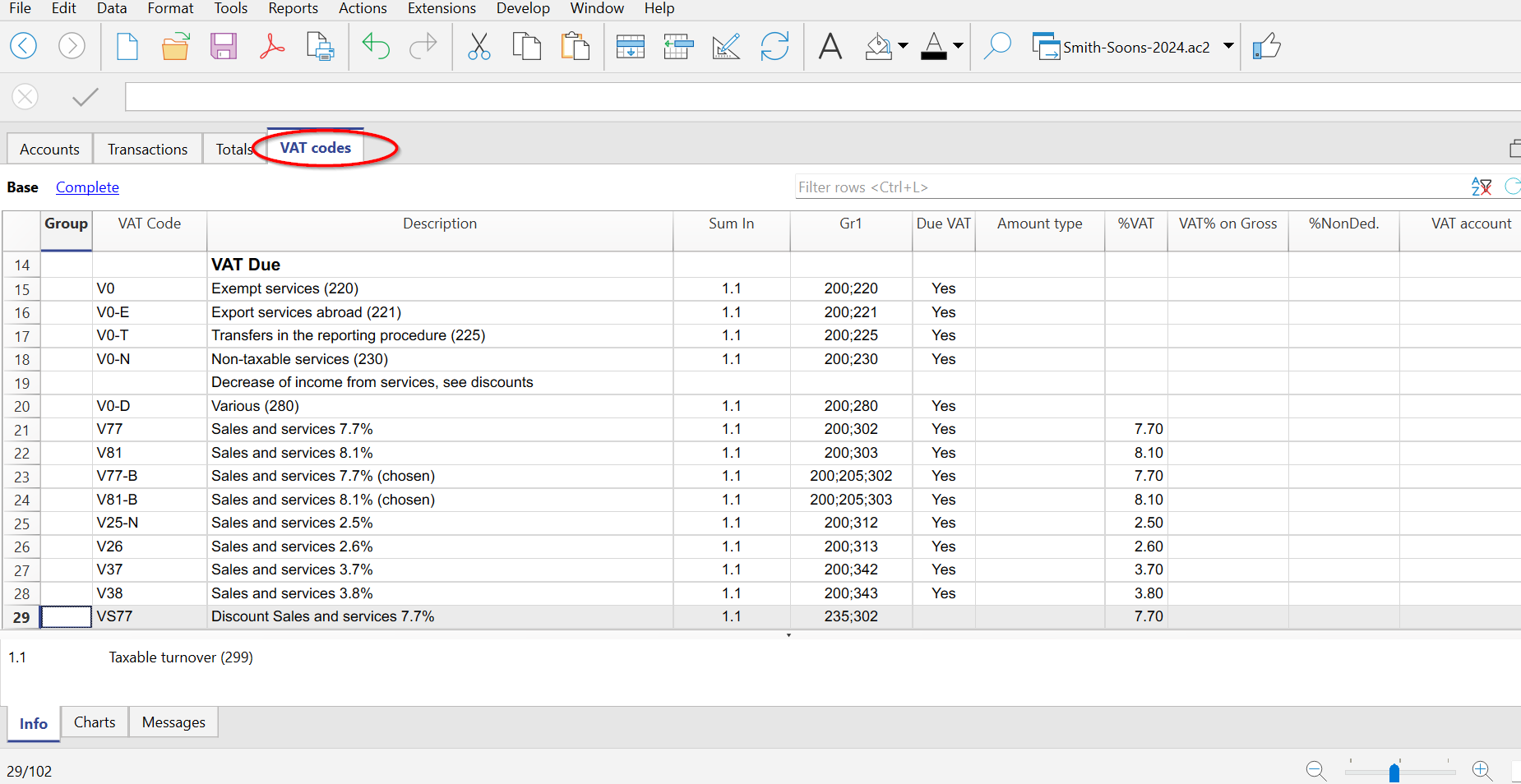

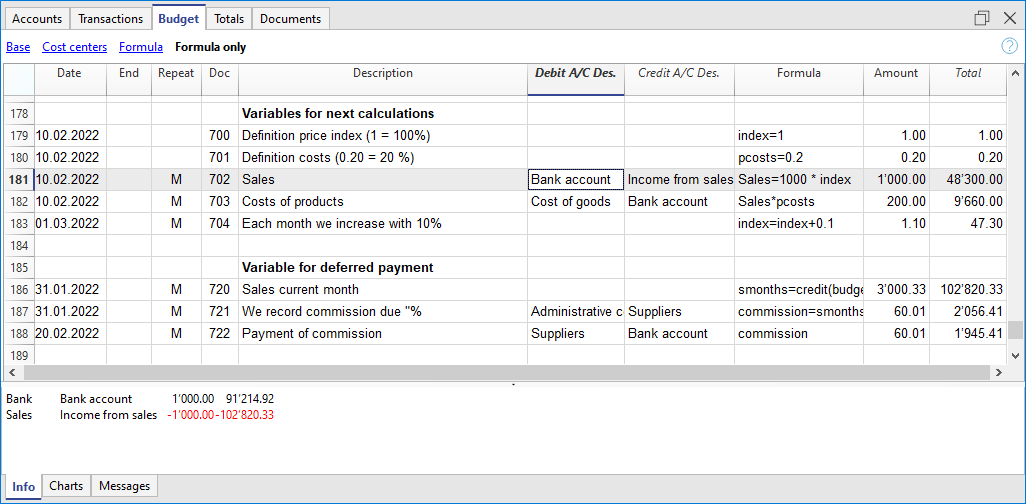

- To open additional files, open the Terminal and type the following command: "open -n -a BananaPlus", then open a file. Repeat this operation for all the files you want to open.