In this article

When there are reversal operations for credit or debit notes, or simply to rectify previously recorded transactions whose amounts are subject to VAT, the VAT must also be reversed in the reversal transaction.

For the transaction:

- Reverse in the Debit and in the Credit column the accounts that were used in the previous transaction, to which the credit note refers.

To reverse the VAT there are two possibilities:

- Put the minus sign in front of the VAT code (e.g. -V81).

- Use one of the codes that refer to discounts, already set in the VAT Codes table.

With these procedures the VAT amount will be adjusted.

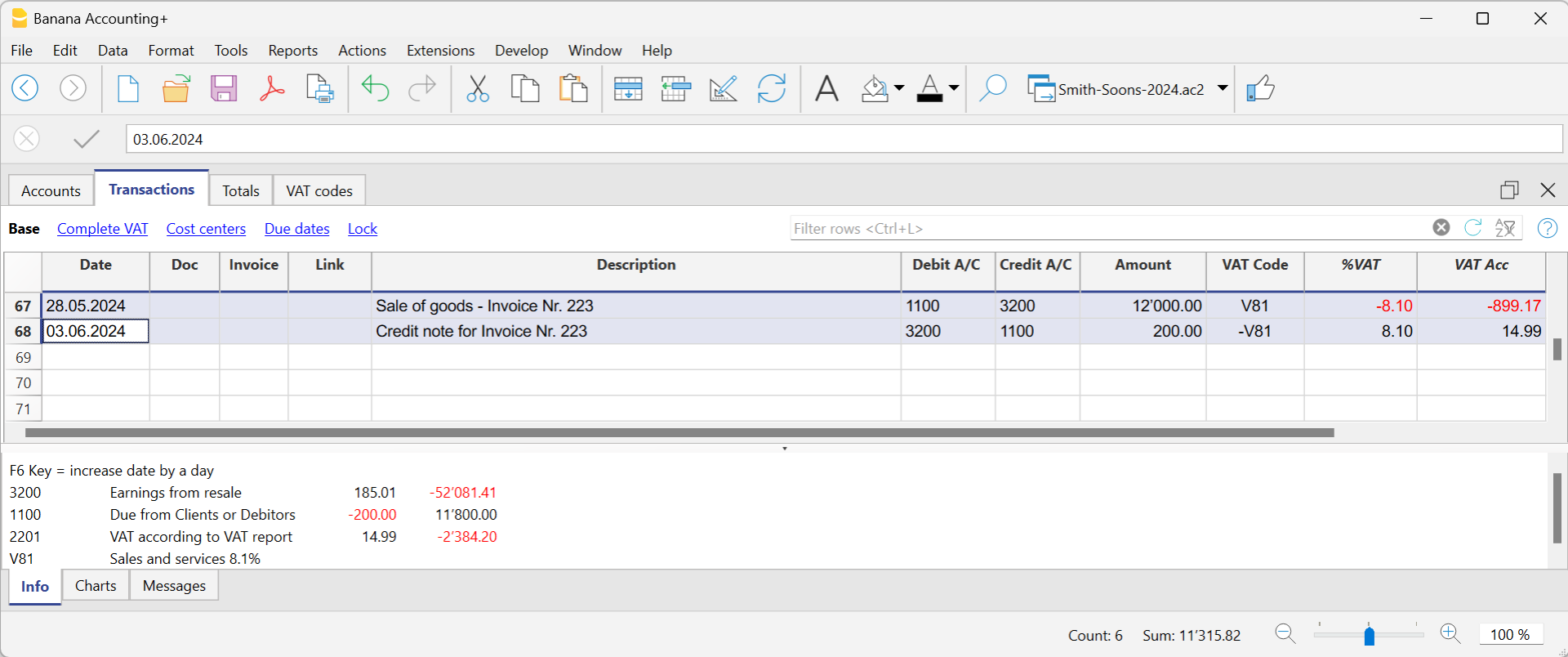

Example of a credit note on a sale

When a client finds a defect on a sold product, usually a credit note on his behalf is being issued. The credit note implies a decrease of the income and as a result a recovery of the VAT (Sales tax).

For example, we enter a sale amount of 12'000 including a 8.1% VAT. We then issue on the client's behalf a credit note of CHF 200.- for a product defect.

In the transaction of the credit note issued to the customer:

- The accounts of the sale, to which the credit note refers, have been reversed

- For VAT recovery on the credit note, the VAT code of the sales is recorded, preceded by the minus sign.

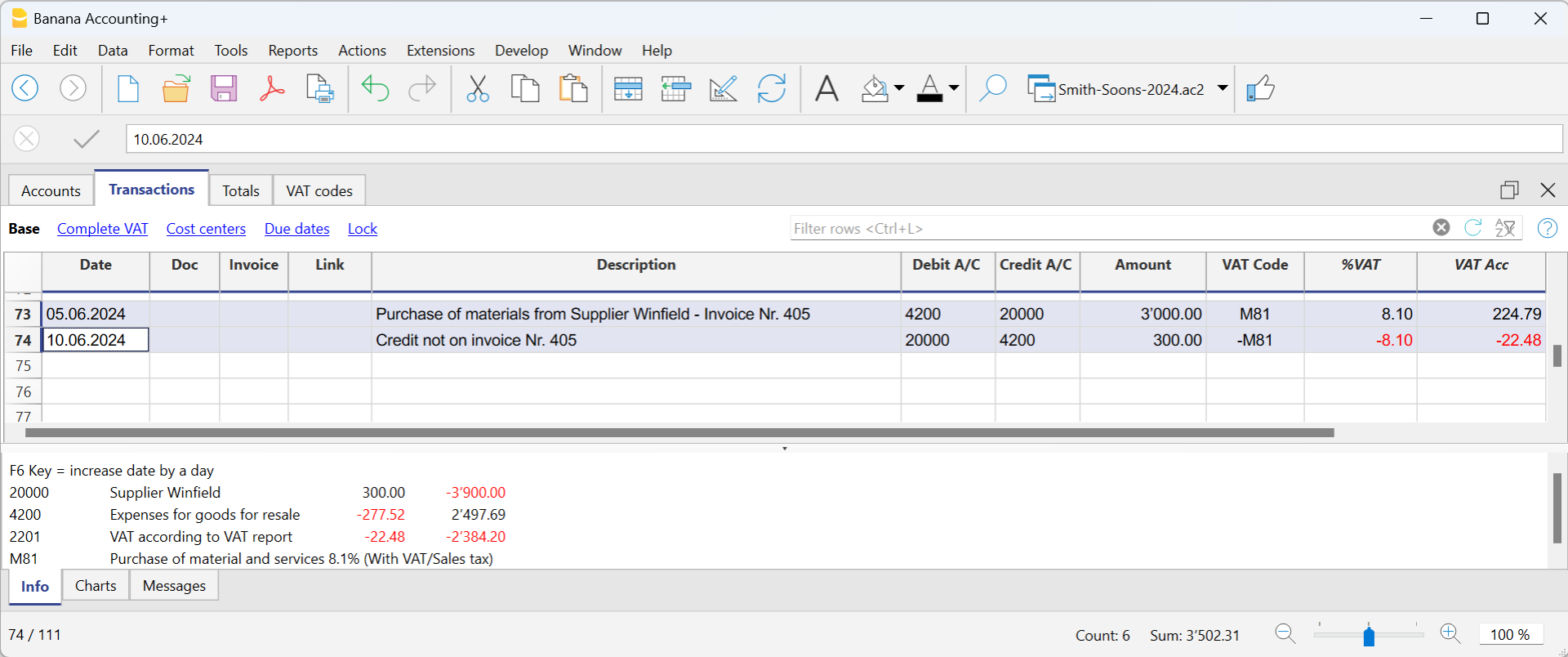

Example of a credit note on a purchase

When we receive a credit note from a supplier, the procedure for the transaction is similar:

- The accounts used for the purchase are reversed.

- Enter the same VAT code used for the purchase, preceded by the minus sign.

For example, we record an invoice for the purchase of goods for CHF 3'000 including a 8.1% VAT. We then receive a credit note of CHF 300.- from our supplier for a product defect.

In the transaction of the credit note received from the supplier:

- The accounts of the purchase, to which the credit note refers, have been reversed.

- For VAT recovery on the credit note, the VAT code of the purchases is recorded, preceded by the minus sign.