In this article

The Accounts table is made up of all the items of what you own (cash, assets, receivables) and what you owe (debts, loans, taxes).

In accounting terms:

- what you own → Asset accounts or Assets.

- what you owe → Liability accounts or Liabilities.

The difference between what you own and what you owe is your net worth, meaning what remains after subtracting debts from your assets.

- Net worth = Assets − Liabilities

With the Accounts table, you can always keep your financial situation under control in a simple and organized way.

- You can immediately see how much liquidity you have

- The amount of your receivables and debts

- The amount of your net worth

Structure of the Accounts table

The Accounts table at the structural level is mainly composed of the following elements:

- The asset and liability accounts in the Accounts column

- The totalization groups in the Group column

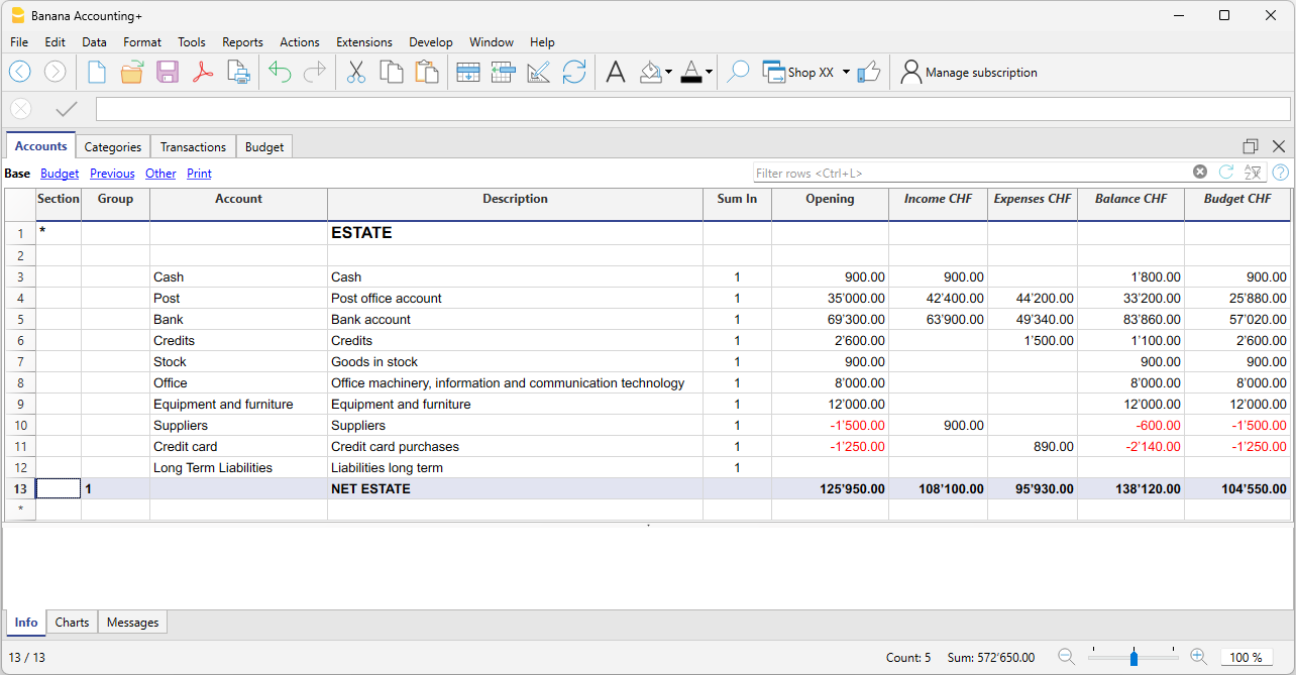

In the example below, in the Accounts table, all accounts are grouped in Group 1 (Total assets). The asset accounts are added to the liability accounts and the difference determines the Net Worth. - The opening balances must be entered the first time the file is created in the Opening column.

The final balances of the asset accounts are always carried forward as opening balances in the file for the following year.

Positive asset accounts (Assets)

Positive asset accounts represent the goods and values you own, so they are the resources available to you.

Some examples of positive asset accounts:

- Cash on hand or in the bank.

- Invoices to be collected from customers (money they owe you).

- Goods in stock.

- Assets such as equipment, furniture, computers, cars.

The amounts are positive.

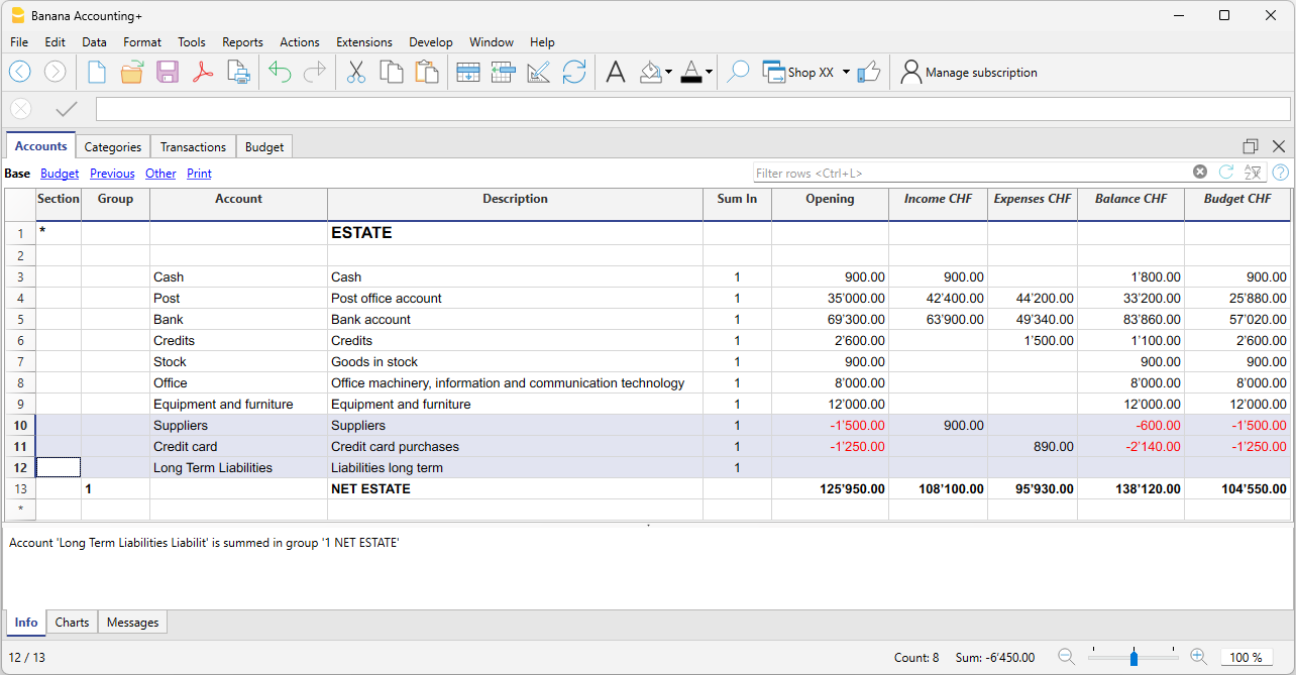

Negative asset accounts (Liabilities)

These accounts indicate debts and obligations to be settled, such as:

- Debts to suppliers

- Loans to be repaid

- Taxes to be paid

- Contributions still due

These are therefore amounts you owe to third parties. The amounts are negative and shown in red.

Net Worth

Net worth is the difference between positive and negative asset accounts. It represents what actually remains after subtracting your debts from what you own.

- Net Worth = Positive asset accounts − Negative asset accounts

The value of your net worth reflects your financial strength and your ability to carry on operations without relying on external financing.

A positive net worth indicates that the entity (business or individual) has a book value greater than its debts. A negative net worth means that the value of the negative accounts exceeds the positive ones, signaling potential financial difficulties.

Columns of the Accounts table

In the Accounts table, you can view the account balances, the columns for incoming and outgoing transactions, and the budget. You therefore get an immediate and constantly updated view of your financial situation. Asset values are shown as positive amounts, while liabilities (debts) are shown as negative.

As you enter income and expenses (in the Transactions table), you immediately see the updated balances of the various accounts in the Accounts table.

Below are the main columns of the Accounts table. The column display changes depending on the selected view.

You can add additional columns, both system and custom, via the menu Data > Columns setup.

Section

An asterisk is entered to indicate a section change. For example, to separate Total assets from cost centers.

The values entered in the Sections table are essential for displaying the enhanced Balance Sheet with groups.

More details about Sections are available on the web page Sections.

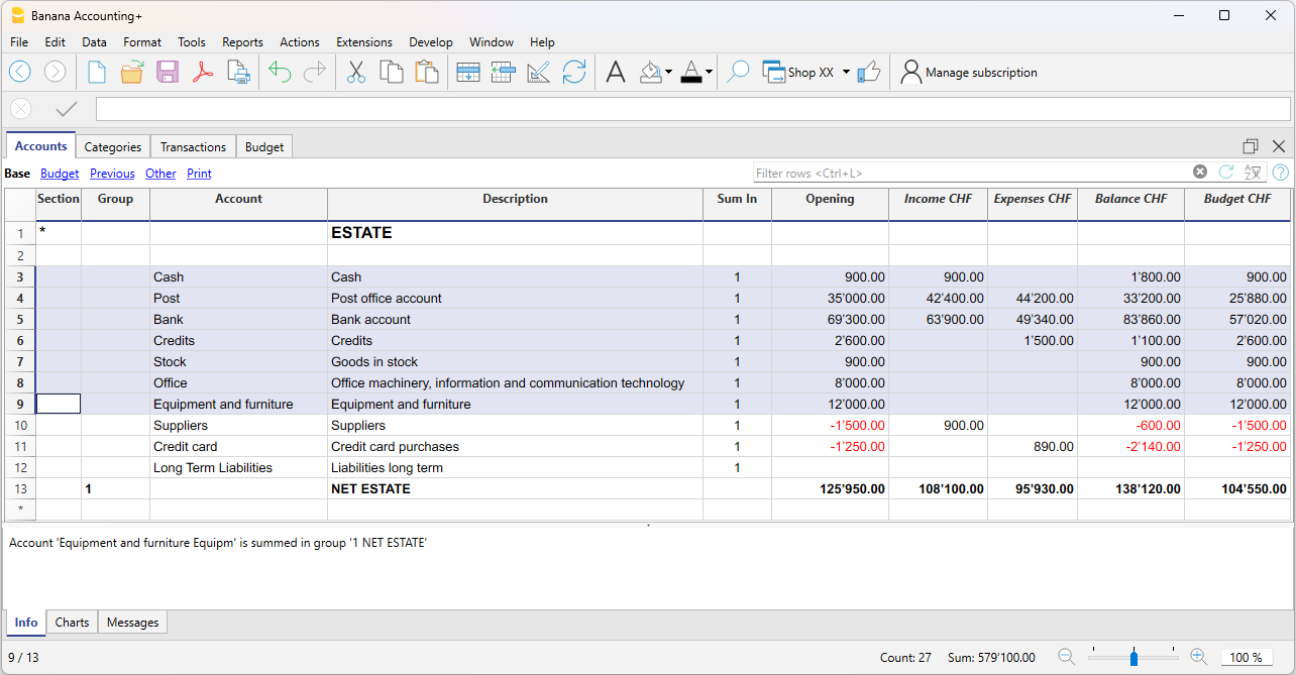

Group

Values are entered here that summarize the categories sharing the same grouping in the Sum in column. These are essential for totalization.

Account

Enter the account number or code to manage (cash, bank, post).

Description

Enter a description for the account. This description is automatically used in the Account Description column of the Transactions table (if visible).

Sum in (Gr)

Enter the code of a group so that the program can total the row’s amount into that group.

The "Sum in" header was introduced in Banana Plus and replaces the "Gr" used in previous versions.

Opening

This shows the opening balances. These must be entered manually only the first time you open Banana Accounting or use a new file. Later, at the beginning of a new year with automatic opening, this column is automatically filled with the closing balances from the previous year.

Income

This column is protected and shows the balance of incoming transactions. After each entry, the balance is updated automatically.

Expenses

This column is protected and shows the balance of outgoing transactions. After each entry, the balance is updated automatically.

Balance

This column is protected and shows the total balance between income and expenses. After each entry, the balance is updated automatically.

Sections

The Sections available in the Accounts and/or Categories table allow you to define the group of accounts and categories you want to print using the Report > Enhanced Statement with Groups command.

- Sections are indicated in the Sections column of the Accounts table and the Categories table.

- A * (asterisk) marks the start of a section.

- A ** (double asterisk) marks the start of a subsection.

- A # marks the beginning of the notes section.

- A section ends when a new one begins.

- Unlike double-entry accounting, in income and expense accounting you cannot use numeric sections.

- If no section is indicated, the first time the command is used, the program will insert it automatically:

- In the Accounts table: "Balance Sheet"

- In the Categories table: "Operating Result"

- It is useful to create separate sections if you have cost centers, segments, or customer/supplier ledgers. This allows you to print reports focused only on what you need.

Personalizing the Accounts table

In the Accounts table, you can customize the asset accounts according to your needs:

- You can change the account numbers

- You can change the descriptions

- In the Opening column, enter the initial balance of your accounts.

For more information, visit the following pages:

Account for allocating results from previous years

In Income/Expense accounting, the total line that groups income and expenses directly represents the net worth (equity). For this reason, there is no need to create a specific dedicated account.

Viewing results from previous years

If you want to display the amount of results from previous years, you need to:

- Add an account "Results from previous years".

- Manually enter the amount in the Opening column (in the Accounts table) at the beginning of each new year.