In this article

The corporate financing plan presents the expected evolution of the accounts relative to the origin of third party and own capital.

With Banana Accounting, thanks to the forecasting with the double-entry method, you have complete forecasts that you can arrange in different ways. The program also calculates forecasts over several years.

The structure of the accounts is identical to the one used for accounting. When printing, you can indicate whether to select which values to display, the final ones only, the forecasted ones or both together.

When a budget movement is changed, the forecasts are immediately updated. You can run simulations, assign a payment, add a new debit, change sales and see how liabilities accounts evolve.

For the Corporate financing plan, you have the same options as for the Liquidity Planing and the Provisional Profit and Loss Account.

Using formulas

The formulas allow you to automate calculation of depreciation and interest.Formulas are particularly useful when making forecasts over multiple years.

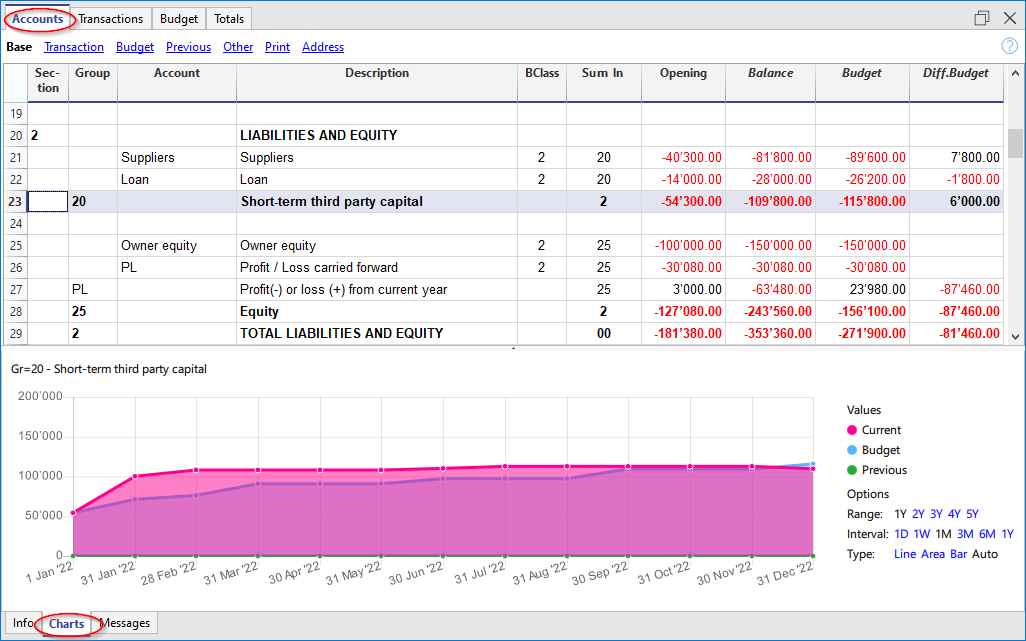

Chart of Accounts

In the Budget column of the Chart of Accounts the forecast values for all accounts and balance groups are displayed, and therefore, also for all those relating to funding. With a glance you get an instant view of the values referring to the accounting period.

If you require more details on third party capital, you may add accounts or groups.

Evolution graphs

When you open the Charts window, positioning the cursor on an account or a group you will see the graph representing the evolution of the financing of the company.

In the legend are visible Current, Previous and Budget. By clicking on each one it is possible to hide or make visible the respective graphs.

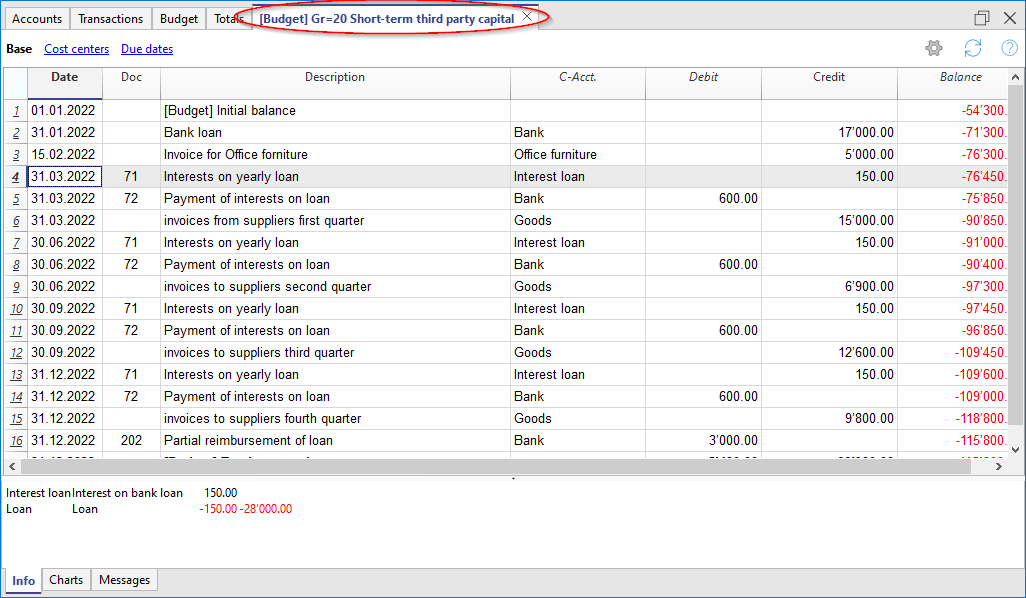

Account card with Budget for third party capital data

Using the Budget Account card command you have the opportunity to see on a day-to-day basis, how each account payable evolves, debt amortization, interest expense and understand the impact they have on financing.

The Account card command allows you to specify if you want to see current or budgeted movements.

- Select budget movements.

- Indicate the account or group of loans.

- Set up the Period

If you indicate a period that exceed the accounting period, the program will automatically generate Forecasts over several years. - If you indicate a group, you will see the movements of all the accounts belonging to that group.

- When you are in the Budget table, you can access the account card with a click on the icon next to the account.

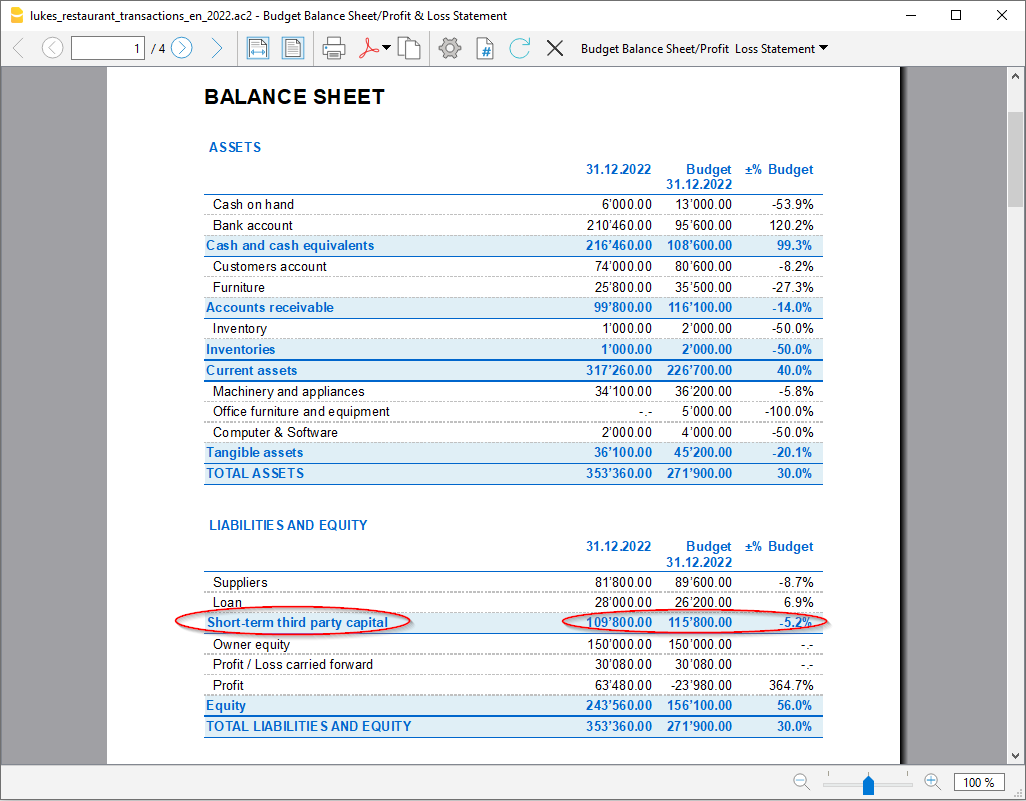

Enhanced Balance sheet with groups

Through Enhanced Balance Sheet with groups you can choose which data columns to display and the reference period, to see the evolution of the funding of the company by day, week, month, quarter, semester, year, etc.

- In Sections options you can indicate the Budget data to be displayed.

- Choose the Third party capital group. You can also select to display the accounts of each individual funding account.

- Set up the Period.

If a period that exceeds the accounting period, is indicated, the program will automatically switch to budgeting over several years. - Indicate the subdivision by period required.

- If you think you will use this print setting again, create a Customization.

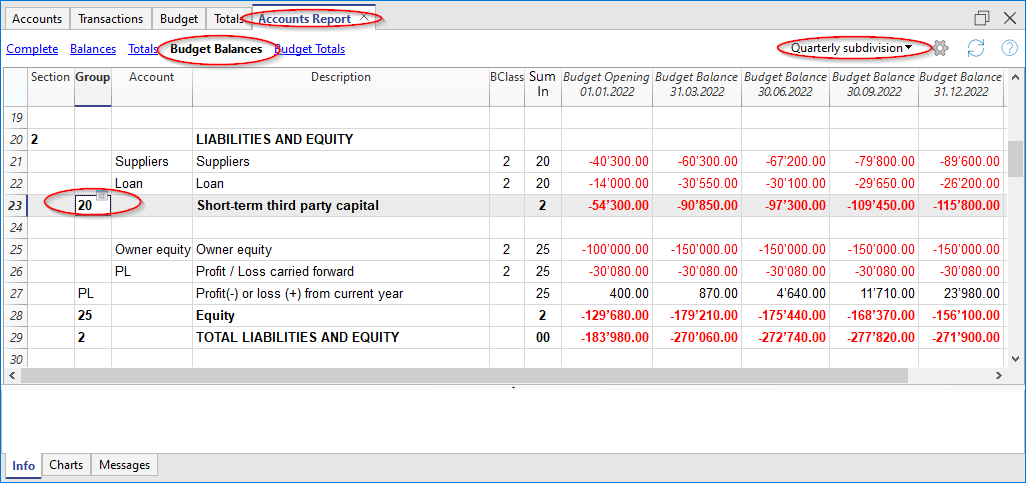

Accounting Report for Third party capital Budget

The Accounting Report is similar to the one for Enhanced balance sheet with groups, with the difference that the display takes place in columns, as in the Accounts table.

You can therefore use it to get an instant view of the evolution of third party accounts.