In this article

With Banana Accounting Plus, you can also print invoices in foreign currency.

Invoices in foreign currency to be sent to foreign clients.

Required settings:

- Open one of our multi-currency accounting templates.

- Set up in the Accounts table, in the customer ledger, the customer with the foreign currency. Invoices are printed in the currency of the customer's account.

- If you want to send invoices in different currencies to the same customer, you must create accounts in different currencies for the same customer (Accounts table).

- Use the UNI11 layout for printing invoices to be sent abroad.

Invoices in foreign currency with VAT in base currency

It is not normally possible to enter a foreign currency invoice with VAT in base currency. This can be overcome with the following procedures:

Invoices in foreign currencies with VAT using Cash principle

- Open one of our multi-currency accounting templates with VAT with cost centres CC3.

- Set up in the Accounts table, customers in foreign currencies as CC3 cost centres (;).

If you wish to send invoices in different currencies to the same customer, you must create accounts in different currencies for the same customer (Accounts table). - In the Transactions table, you must enter the invoice data on several rows:

- In the first row:

- In the Amount column enter the amount net of VAT (without entering any debit or credit account).

- In the column CC3 enter the customer's cost centre account in foreign currency.

- In the second line:

- In the Amount column enter the VAT amount in foreign currency (without entering any debit or credit account), manually calculating the VAT amount in foreign currency.

- In column CC3 enter the customer's cost centre account in foreign currency.

- In the first row:

- For printing invoices with Swiss QR code use layout CH10.

To register the receipt:

- In the Debit column enter the liquidity account.

- In the Debit column enter the revenue account.

- In the VAT Code column enter the VAT code of the sale.

- In the column CC3 enter the customer's cost centre account in foreign currency with a negative sign.

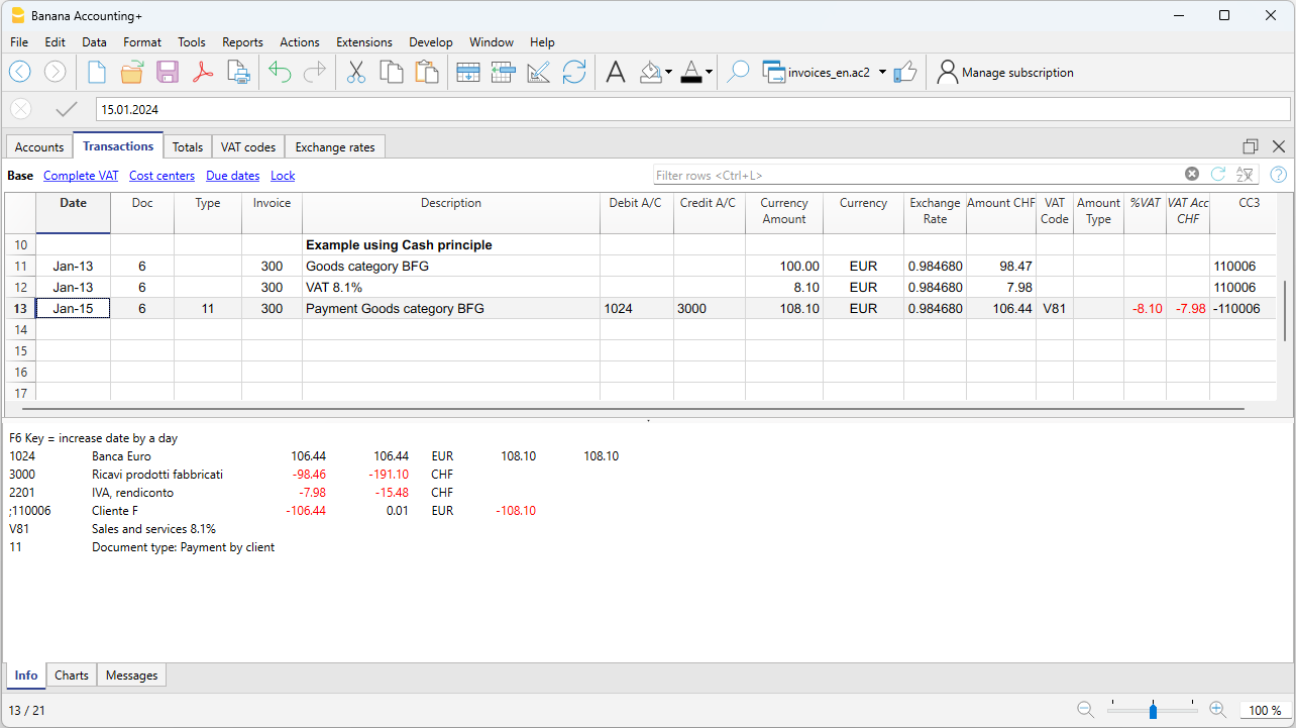

Example: Invoice entry in foreign currency (EUR) with VAT on receipts in base currency (CHF):

Invoices in foreign currencies with VAT on turnover

- Open one of our multi-currency accounting templates with VAT and a customer ledger.

- In the Accounts table, set the customers in foreign currencies both as a ledger (Accounts) and as CC3 cost centres (;).

- In the Transactions table, you must enter the invoice data on several rows:

- In the first line enter the invoice issue normally:

- The date, the description, in the Debit account the customer account in foreign currency and in the Debit account the revenue, the amount before VAT and the VAT code of the sale.

- The invoice number does not have to be entered.

- In the second line:

- In the Amount column enter the invoice amount net of VAT (without entering any debit or credit account).

- In column CC3 enter the customer's cost centre account in foreign currency.

- Where the columns Quantity, Unit and Unit Price are used, the unit price must be net of VAT.

- In the third line:

- In the Amount column enter the VAT amount in foreign currency (without entering any debit or credit account), manually calculating the VAT amount in foreign currency.

- In column CC3 enter the customer's cost centre account in foreign currency.

- In the first line enter the invoice issue normally:

Rows with cost centres are simply used to search invoices in foreign currency with VAT.

To register the receipt:

- In the Debit column enter the liquidity account.

- In the Debit column enter the customer's foreign currency account.

- In the column CC3 enter the customer's cost centre account in foreign currency with a negative sign.

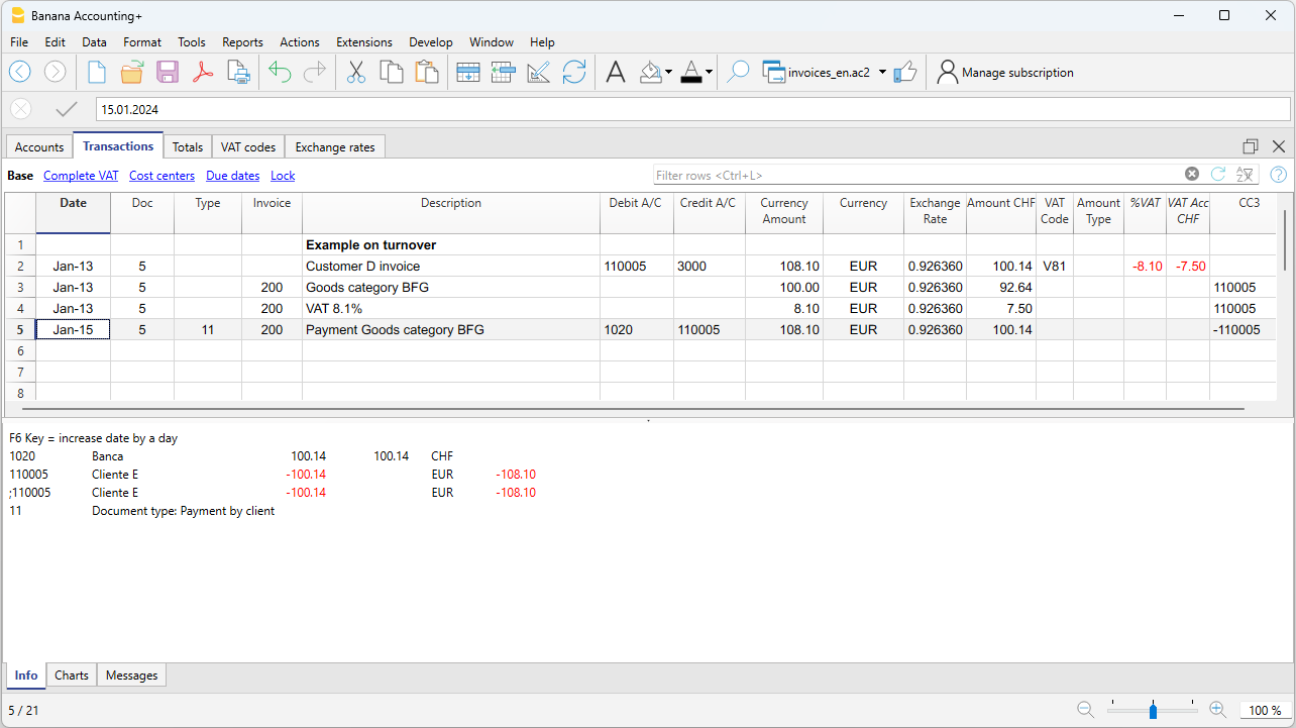

Example: Invoice entry in foreign currency (EUR) with VAT on turnover in base currency (CHF):