In this article

Segments are used to systematically separate costs and revenues by unit, department, or branch. Using segments, you can generate an Income Statement divided by unit, department, or branch, without having to create specific accounts for each unit.

For example, a museum can use segments to track revenue, staff costs, and setup expenses for each individual exhibition.

In transactions, segments follow the account, unlike Cost Centers, which are specific to each entry and used for less structured categorizations (e.g., all expenses for an event or purchases for a specific purpose).

You can use both cost centers and segments simultaneously.

Segment Features

- Segments are accounts preceded by a colon ":".

- Account codes may use numbers or letters.

- Up to 10 segment levels are supported.

- The level is determined by the number of colons preceding the code:

- :LU → level 1 segment

- ::P1 → level 2 segment

- :::10 → level 3 segment

- Each level can include an unlimited number of segments.

- Segment levels are independent of one another.

- Segments do not have a class (BClasse) or a currency code.

- Calculations related to segments are made in the base currency.

- In transactions, the segment follows the debit or credit account.

There cannot be entries for segments without an associated account. - Account cards can be generated for transactions involving specific segments.

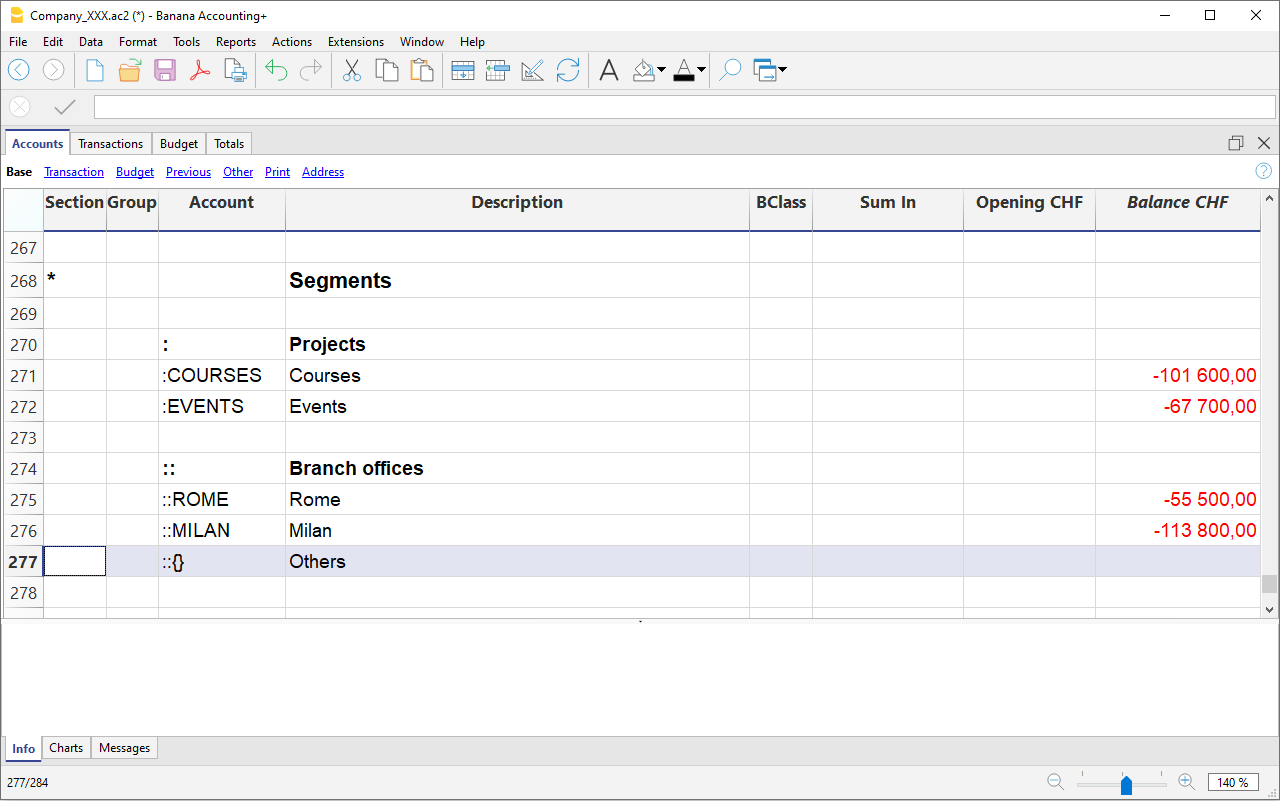

Segment Level Titles

Segment level titles are used to indicate what a specific segment level refers to.

- A segment consisting only of separators ":", "::", ":::", etc., allows you to specify a description for the level.

- Enter the segment level explanation in the Description column.

For example:

":" "Projects"

"::" "Branches"

Setting up Segments

Segments must be set up in the Accounts table, in the Account column, at the end of the chart of accounts.

- Enter an asterisk in the Section column to define the segment section.

- In the Description column, type the segment title.

- Enter segments using :

- In the Account column, prefix the segment identifier with a single colon for first-level segments.

- Second-level (and possibly third-level) segments are prefixed with :: or :::, depending on the level.

- Optionally, enter a description for the segment.

Unassigned Segment {}

If in the transactions you enter the debit or credit account without specifying a segment, the amount is recorded in the "empty" or unassigned segment.

In the chart of accounts, you can define a description for the unassigned segment of the level by following the colon with the text ":{}".

The unassigned segment symbol "{}" is useful for indicating in account cards and scripting that you want to see entries not assigned to any segment.

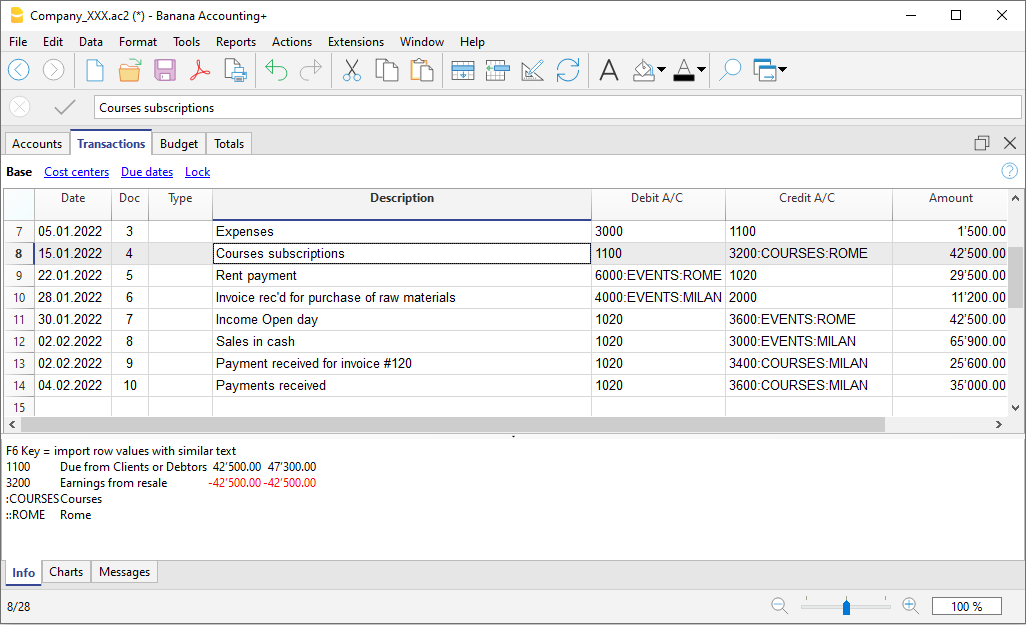

Transactions

Segments are recorded in the Transactions table, immediately following the main account.

When a segment includes multiple levels, you must follow the main account with the first-level segment, then the second-level one, and so on.

Using "-" as a segment separator

In transactions, the dash "-" can be used as a segment separator instead of the colon ":".

- In the file properties (basic data), activate the option Use dash (-) as segment separator.

- In the transactions, use the dash as separator.

- If using "-" as a separator, do not use accounts that contain dashes.

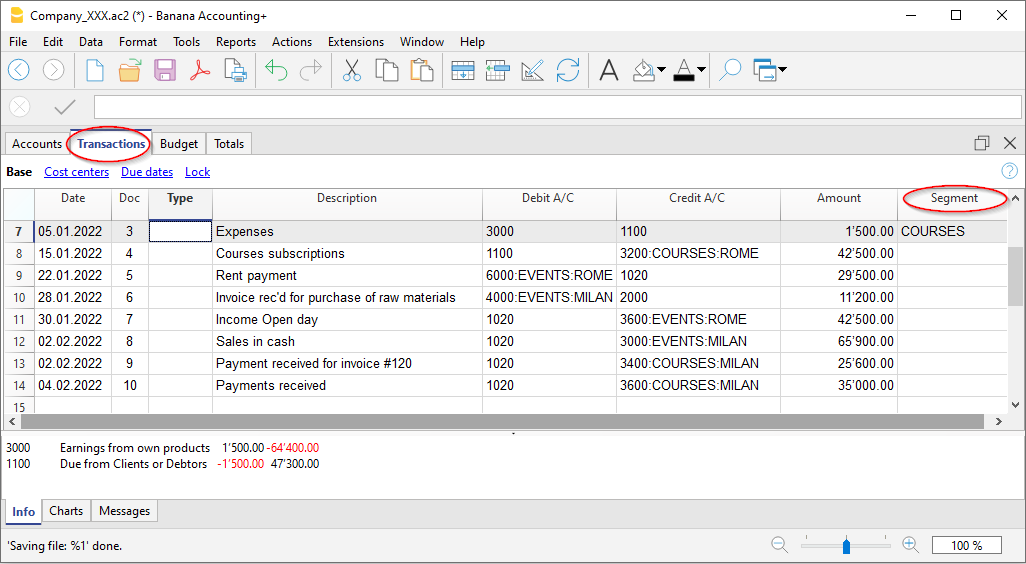

Segment Column

This column allows you to enter segments independently of the account.

- The Segment column is hidden by default; to use it, make it visible via the Data > Columns setup menu.

- Segments entered in the Segment column are applied to the accounts used in the transaction (columns Debit, Credit, VAT Account), if those accounts do not already specify a segment.

- You can use the Segment column along with segments directly in the Debit and Credit columns.

- When using the Segment column, the amount is recorded on the segment both in debit and credit, so the balance of the segment in the accounts table will be zero.

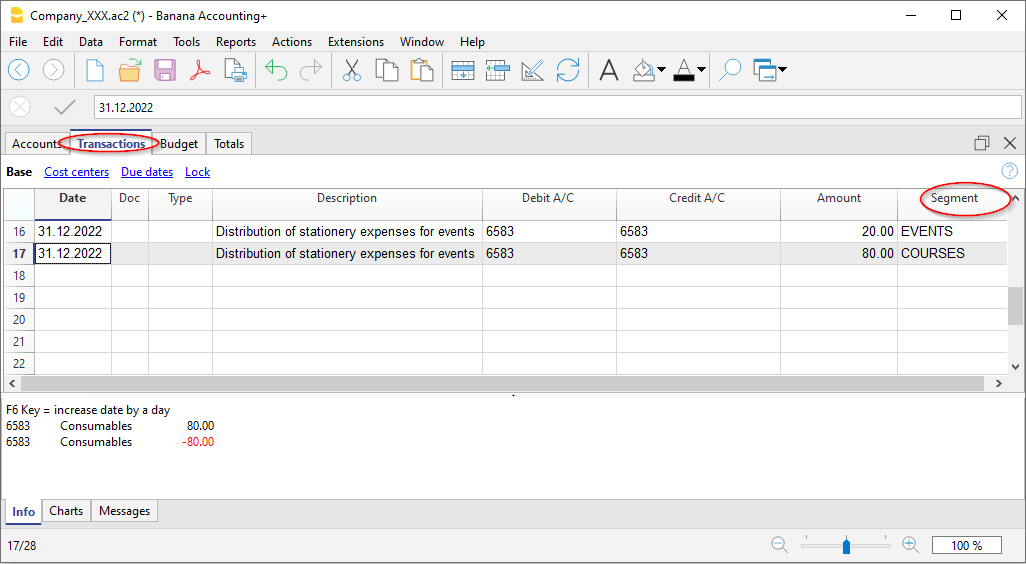

Movements between Segments

Usually, cost allocation is done for each individual accounting entry. However, in some cases, it's better to register costs to an account and only allocate them to segments at the end of the year. This applies, for example, to administrative costs that are distributed as a percentage across different company departments.

Here's how to proceed:

- During the year, enter transactions using the Debit and Credit columns, but leave the segment blank or assign the full amount to a single segment.

For example, all office supply costs may be recorded without a segment. - At the end of the year, enter allocation transactions for distributing the respective portion of each segment to a specific expense or income account:

- In the entry, use the same account in both the Debit and Credit columns.

- Indicate the source segment (which can be empty) and the destination segment.

- For example, to allocate office supply expenses to different departments:

- Create one transaction for each department.

- In each row, the credit account has no segment.

- The debit account includes the segment of the corresponding department.

- The amount is the portion of expenses to be allocated to that department.

- These entries assign each department its portion of unallocated expenses.

Opening Balances for Segments

Segments with an opening balance should preferably be entered as transactions, so that they can be associated with an account. If you enter the initial segment balance in the Opening column (Accounts table), it is assigned to the unallocated "{}" segment.

To assign opening balances to specific segments and accounts, you must enter opening transactions in the Transactions table.

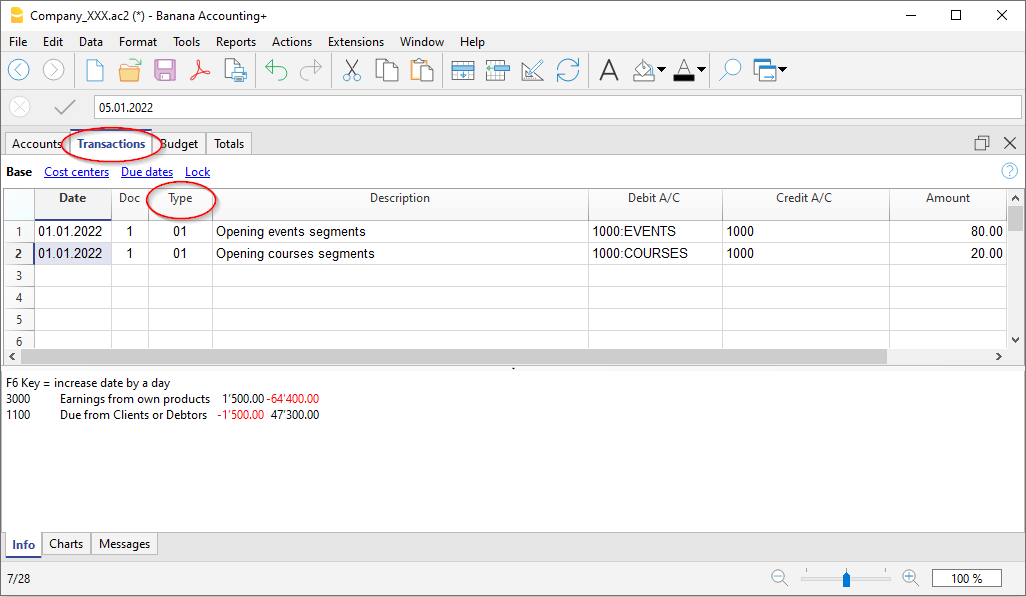

- In the DocType (Type) column, enter value 01.

- The date must match the accounting start date.

With the segment opening entry, the amount is removed from the “empty” segment and assigned to the specific segment.

If the balance to be allocated is negative (credit), the account without a segment must be in the Debit column and the one with the segment in the Credit column.

Example of Segment Opening Transaction

Suppose account 1000 has an opening balance of 100.00 (without a segment, so assigned to the empty segment) and you want to assign 80.00 to segment 01 and 20.00 to segment 02, proceed as follows:

- The opening entries have the accounting start date and DocType value 01.

- The first entry has 1000:Events in the Debit column and 1000 in the Credit column. Amount: 80.00.

- The second entry has 1000:Courses in the Debit column and 1000 in the Credit column. Amount: 20.00.

Create New Year Command

The Create New Year or Carry Forward Opening Balances commands automatically generate opening entries for all segment levels.

If you don’t want to carry forward opening balances for a segment level, delete the automatically generated opening transactions.

Segment Account Card and Balance

Attention: do not interpret the segment movement as a standalone value.

The value shown for a Segment in the Balance or Movement column of the Accounts Table or the Categories Table should not be interpreted as an independent or standalone accounting value disconnected from the main account or category.

A segment is a subdivision of the total values of an account or category. It does not represent a separate accounting movement. As a result, the same movement may appear duplicated or zeroed out depending on how it's recorded.

- The amount recorded for a segment always follows the corresponding account or category.

- From an accounting perspective, it must always be considered in relation to a specific account or category.

- Typically, segments are used to subdivide the balance sheet or income statement into detailed columns without creating separate accounts for each entity.

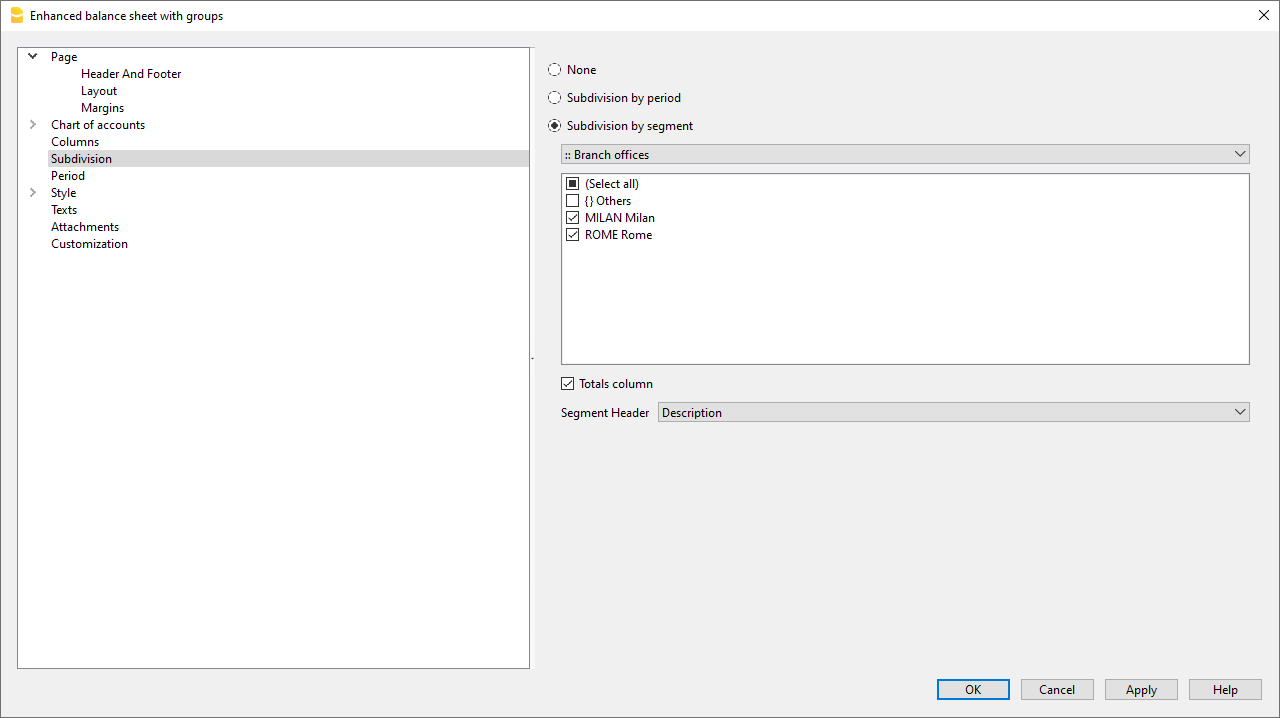

To activate this feature, go to the menu Report > Accounting Report or Report with groups > Subdivision Section and enable Subdivision by Segment.

Segment Card Results in Double-entry Accounting

In double-entry accounting, the segment follows the account used in the Debit or Credit column, or both. Depending on how it's entered, the segment card shows different results:

- If in the Transactions table the segment is used in either the Debit or Credit column, the segment card displays the transaction amount.

- If the segment is used in both Debit and Credit, the segment card will show the amount on both sides, so the balance is zero.

- If the segment is entered in the Segment column, the amount appears in both Debit and Credit columns in the card, again resulting in a zero balance.

- In the Accounts table, the segment balance is the total of the transactions of accounts using that segment.

The segment card will only show a balance if the segment is used exclusively with Profit & Loss or Balance Sheet accounts.

Segment Card Results in Income & Expense Accounting

In income and expense accounting, the segment follows the account or category. Depending on how it's recorded, the segment card behaves as follows:

- If in the Transactions table the segment is entered after the category, the card shows the registered amount.

- If the segment is used in both the account and the category, the movement appears twice in the segment card (duplicated).

- If the segment is entered in the Segment column, the amount again appears twice (once for the account, once for the category).

- In these last two cases, the segment balance in the Accounts or Categories table may be double the recorded amount.

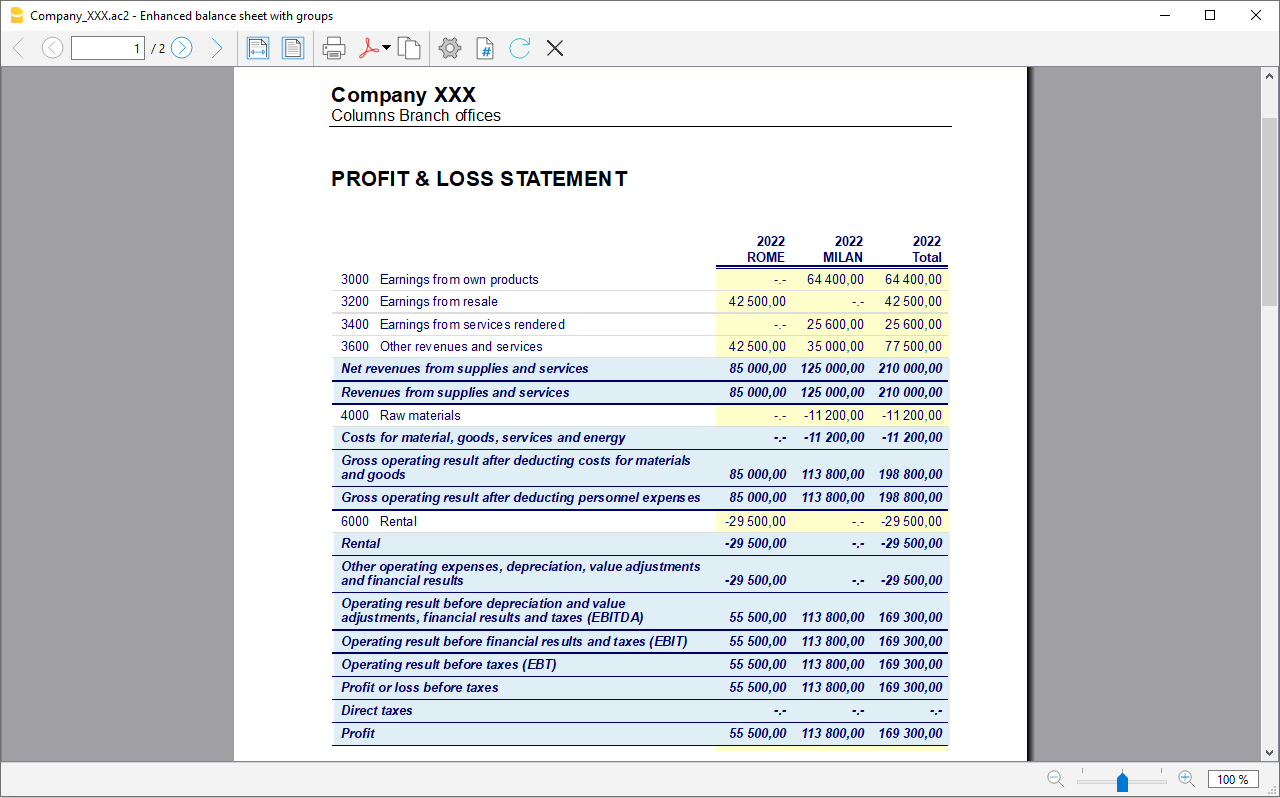

Reports

Segment-based reports can be generated from several accounting documents:

- Enhanced Balance Sheet by Groups

- Accounting Report

- Account Card

- Multi-level report

To generate reports that combine accounts and segments (e.g., all expenses for branch LU of P1), use Banana Extensions.

Subdivision Report by Level

In the Enhanced Balance Sheet by Groups, in the Subdivision section, specify the segment level you want to use.

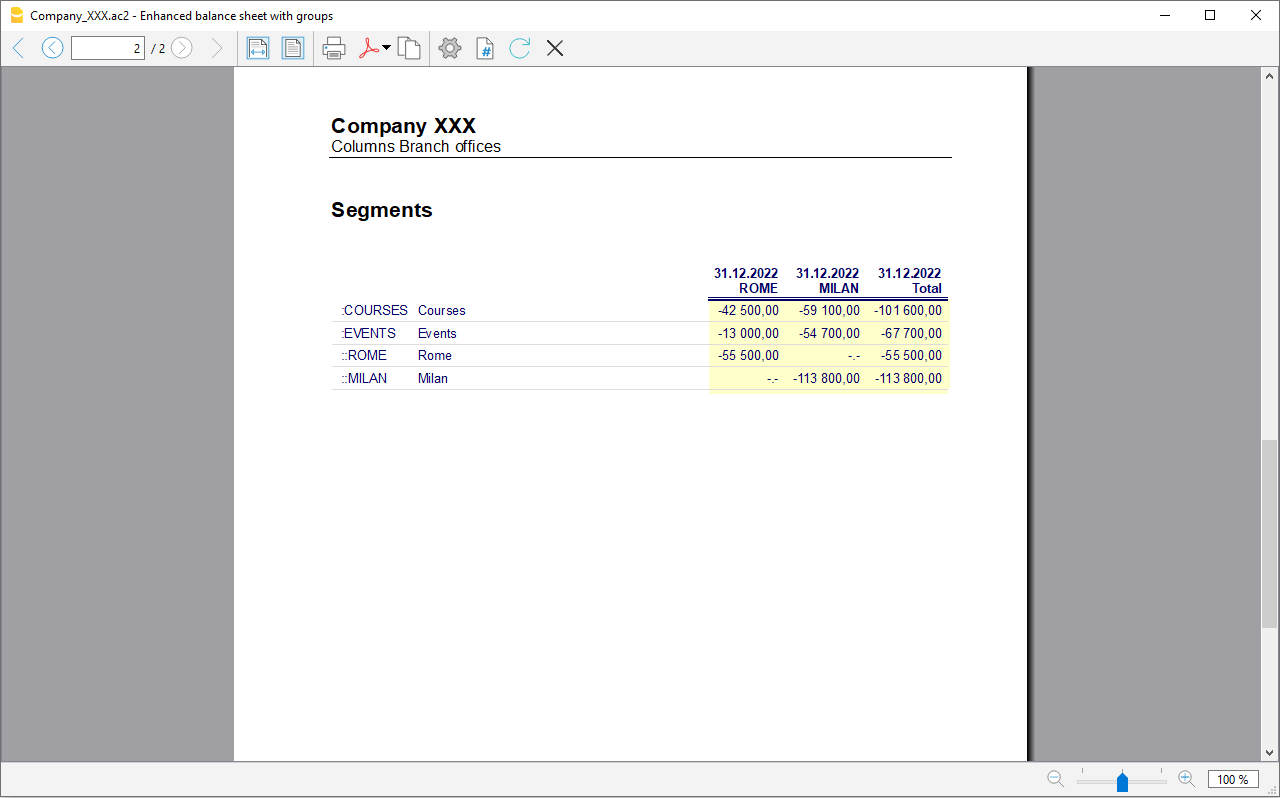

Summary Report

This is a summary of all segments defined in the chart of accounts, with optional breakdown by period or by segment.

Unassigned Segment Report

The "empty" segment aggregates all entries without a specified segment. You can define a title for this segment in the accounts table. Also, enable the option Segment Header: Description in the Subdivision section.

Differences Between Segments and Cost Centers

Segments are assigned to part of the business activity for external reporting and strategic analysis. They are used to analyze profit and other financial metrics across different business areas, markets, customers, and other dimensions for evaluating performance.

Cost and profit centers are units where costs or revenues are assigned and accumulated to monitor a specific business area (departments, divisions, projects, operations, or even specific machinery) for internal control and management purposes.

- Objective: segments focus on assessing overall financial performance, while cost centers focus on cost tracking and management.

- Focus: segments are typically used for external reporting and strategic decisions, while cost centers are used for internal detailed cost analysis.

- Structure: segments are based on strategic criteria like product lines or markets, while cost centers can be any internal operational unit incurring costs.

- Accounting: segments are more relevant to financial and managerial accounting; cost centers are primarily used in analytical accounting.

Differences in Setup and Transactions

In Banana Accounting, the setup and registration of cost/profit centers and segments differ:

Accounts Table

- Segments can be defined up to 10 levels, each with unlimited segment codes. Entered in the Account column of the Accounts table, with colons (:, ::, :::) before the code.

- You can define up to 3 cost/profit centers (CC1, CC2, CC3), each with unlimited codes. They are entered in the Account column using punctuation (comma, dot, semicolon) before the account number or code.

Transactions Table

- Segments are recorded in the Debit and Credit columns after the main account (e.g., 4000:P1). Alternatively, they can be entered in the Segment column.

- Cost/profit centers are entered only in the CC1, CC2, CC3 columns of the Cost Centers view. Enter the code without punctuation.

Reports

- With Segments, you can generate a Balance Sheet with level subdivision, showing profit/loss per segment.

- In the Accounts table, totals of segment groups are visible, and you can view account cards by segment. You can also generate Accounting Reports.

- Segments also support multi-level reporting combining accounts and segments, but require specific extensions. Cost centers do not support Balance Sheet or accounting reports.

- With cost/profit centers, account cards can be generated per center.

- In the Accounts table, group totals for cost/profit centers can be displayed.