In this article

The integrated invoicing feature of Banana Accounting Plus uses the customer invoice recording system directly in the Transactions table. It allows you to create prints, including customizable ones, based on customer transaction records.

You can print both invoices for Switzerland with a QR payment slip and international invoices for other countries, even in foreign currency without a QR payment slip.

Creating invoices

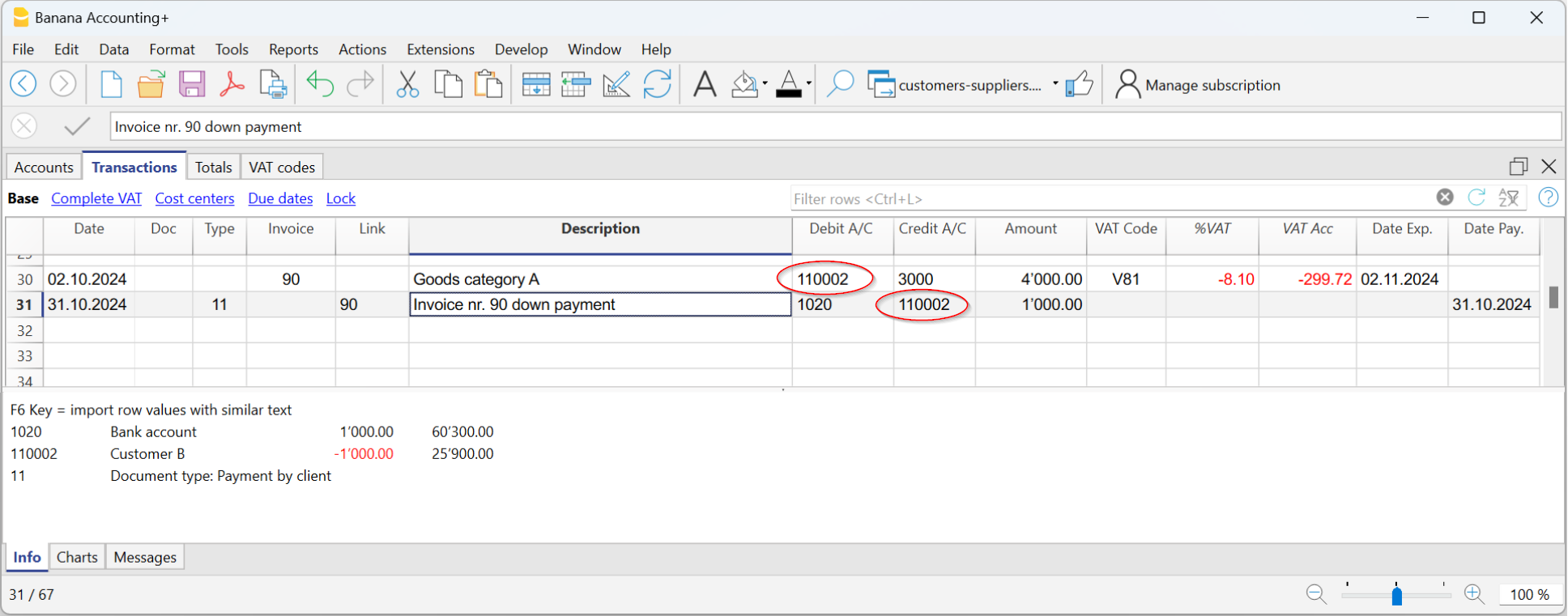

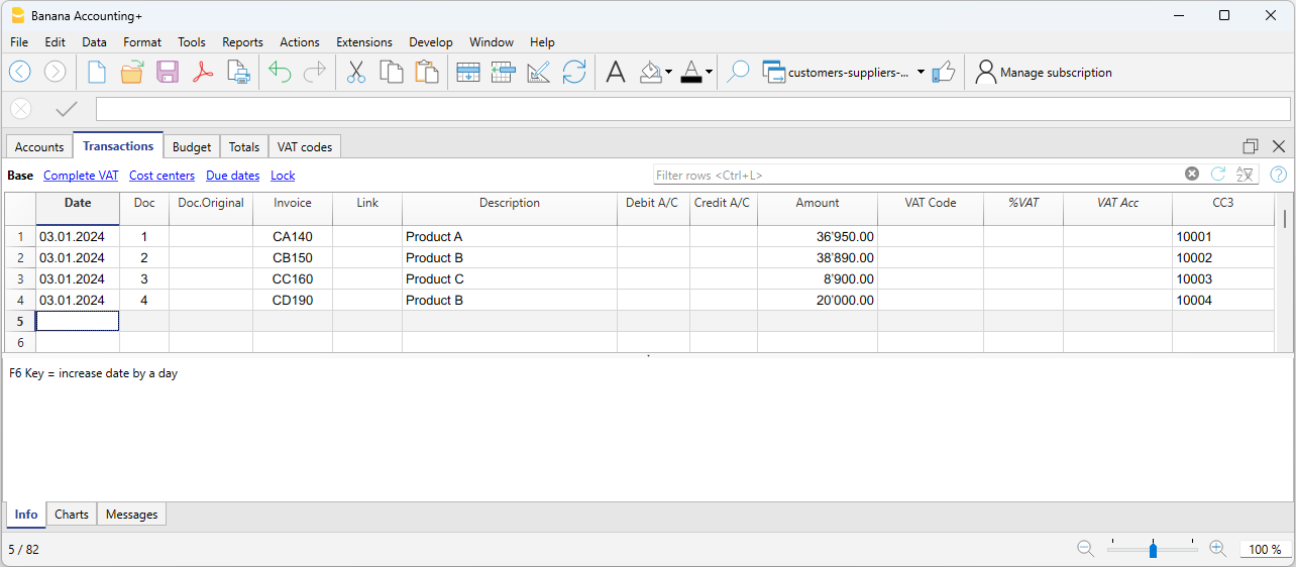

The Transactions table is the heart of Banana Accounting and is also used to issue invoices. Nothing could be simpler: To create an invoice, enter a normal transaction that charges the customer.

Banana Accounting also allows you to create invoices in foreign currency.

The main columns for invoicing:

- Date - Invoice date

- Invoice - The invoice number.

- Description - Description of the item to be invoiced.

If there is more than one item to be invoiced, use another row that has the same customer number. - Debit - Customer account.

- Credit - Profit account.

- Amount - Invoice amount

You can also indicate the quantity, the unit price and the programme calculates the amount. - VAT code- VAT code of the profit

Advantages

With Banana Accounting's integrated invoicing you simplify your administrative work, reducing the time needed to manage invoices, customers and accounting transactions:

- Invoice transactions are always the same for both invoicing and accounting, reducing the possibility of errors and omissions.

- Banana Accounting automatically generates the related accounting documents, such as VAT registers, customer accounts, receipts registers.

- You have a more accurate and real-time view of your customers with constantly updated balances.

- Lots of automation to make your work easy and with immediate professional results:

- Automatic retrieval of addresses from contacts so that the data do not have to be re-entered on the invoice.

- No manual calculations. All calculations are automatic, always accurate and up-to-date.

- Setting of the language, currency, number of decimals and rounding for each individual invoice.

- Deadline display.

- Invoice archiving for a tidy history that is always available for tax audits.

Differences with the Estimates and Invoices application

Integrated invoicing is an additional feature included in all accounting applications: double-entry, Income / Expense, Multicurrency, Cash Manager.

Integrated invoicing is ideal for billing services or sales without the need for many structured details on the invoice.

- The elements and details for invoices (such as quantities, prices, units, etc.) are recorded solely in the Transactions table. In the Estimates and Invoices application, there is a Invoices table with an Invoice Dialog where various columns and options are available to detail the various items and data to be inserted. In this aspect, the Estimates and Invoices application is much more flexible and comprehensive because it allows for greater customization.

- In the Transactions table, in addition to the data for invoicing, by entering the Debit and Credit account, the registration remains accounted for in the accounting file without the need to register the invoice subsequently. This is ideal for managing revenue accounting.

In Estimates and Invoices, the data is not accounted for, so it is necessary to register the invoice in the accounting file. - In integrated invoicing, it's not possible to create offers. However, it is possible to create and print an invoice with the title "Estimate" (instead of "Invoice.")

The Estimates and Invoices application is specific for creating also Estimates.

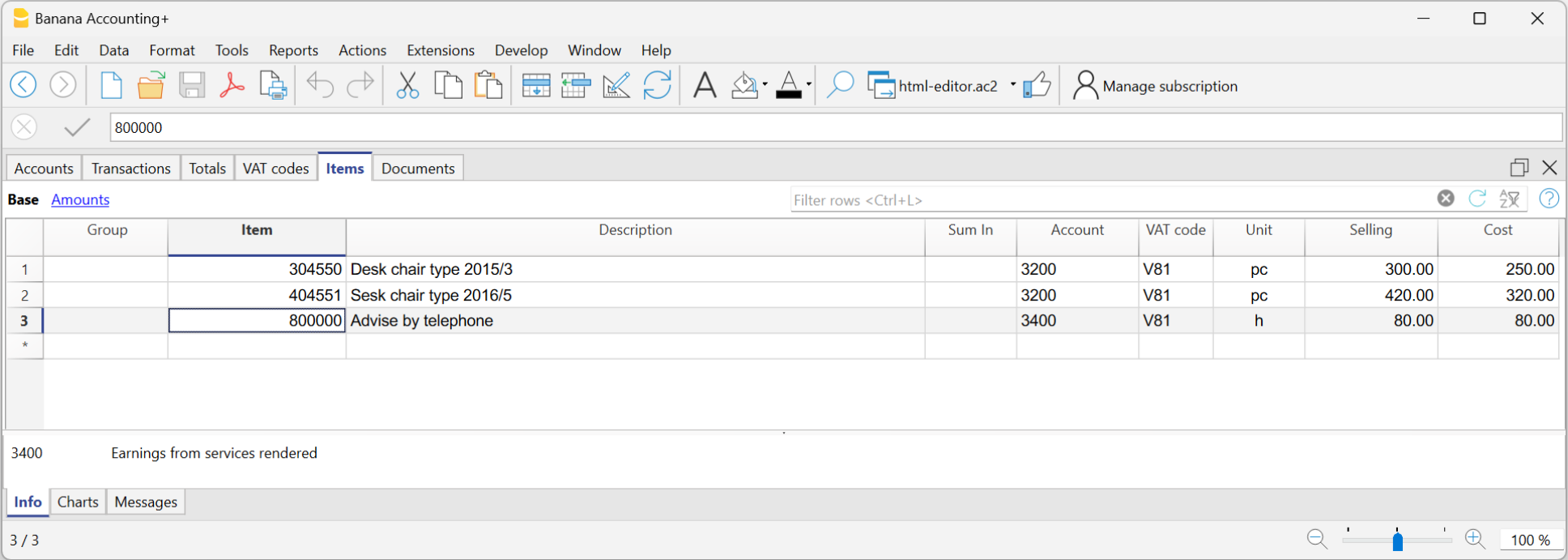

Items Table

The Items Table allows you to manage the article catalogue, keep track of available quantities, sales and purchase prices.

Data for managing articles or services to be invoiced are entered in this table. Each article is assigned an ID, and groupings of articles and services in the same category can be created.

Various columns are available for complete and detailed information:

- Article (IdArticle): the code of the article.

- Description: the description of the article.

- Group membership

- Account (for accounting)

- VAT code of the sale

- Unit: an abbreviation to define the type to which the quantity refers (pieces, hours...)

- Sale: the unit sales price.

- Purchase cost.

The Items table is linked to the Items columns of the Transactions table.

The use of the Articles table speeds up the entry of invoice data into the Transactions table. By entering the ID (article code), the programme automatically takes over the description, unit and unit price. By entering the Quantity, the total price to be invoiced is calculated and entered.

Print invoice with Swiss QR Bulletin

After entering the invoice data in the Transactions table, you can create and print invoices with the Print Layouts.

From the Menu, Reports > Customers > Print Invoices:

- Choose CH10 Invoice layout with Swiss QR Code for Switzerland

- Customise your printing. More customisation is possible with the Advanced plan.

- Preview the invoice. You can save it as a PDF and send it electronically or print it.

If you use this layout, the bulletin with Swiss QR will be printed on the invoice and the reference data will appear on the statements. You can import customer payment data from the bank with the Bank statement extension Camt ISO 20022 Switzerland (Banana+). You have invoice receipts under control.

It is possible to print the invoice with a QR bulletin even without an amount and without an address, leaving an empty box to manually insert the data. More information is available on the QR-Code Customization page, section Include/Exclude from printing.

With the same registration, from the Print Invoices dialogue box, under Preferences Layout > Print as you can also choose to print Delivery Notes, Offers and Reminders.

Print International Invoices

After entering the invoice data in the Transactions table, you can create and print invoices with the Print Layouts.

From the Menu, Reports > Customers > Print Invoices:

- Choose the Layout 11 programmable Invoice

- Customise your printing. More customisation is possible with the Advanced plan.

- Preview the invoice. You can save it as a PDF and send it electronically or print it.

With the same registration, from the Print Invoices dialogue box, under Preferences Layout > Print as you can also choose to print Delivery Notes, Offers and Reminders.

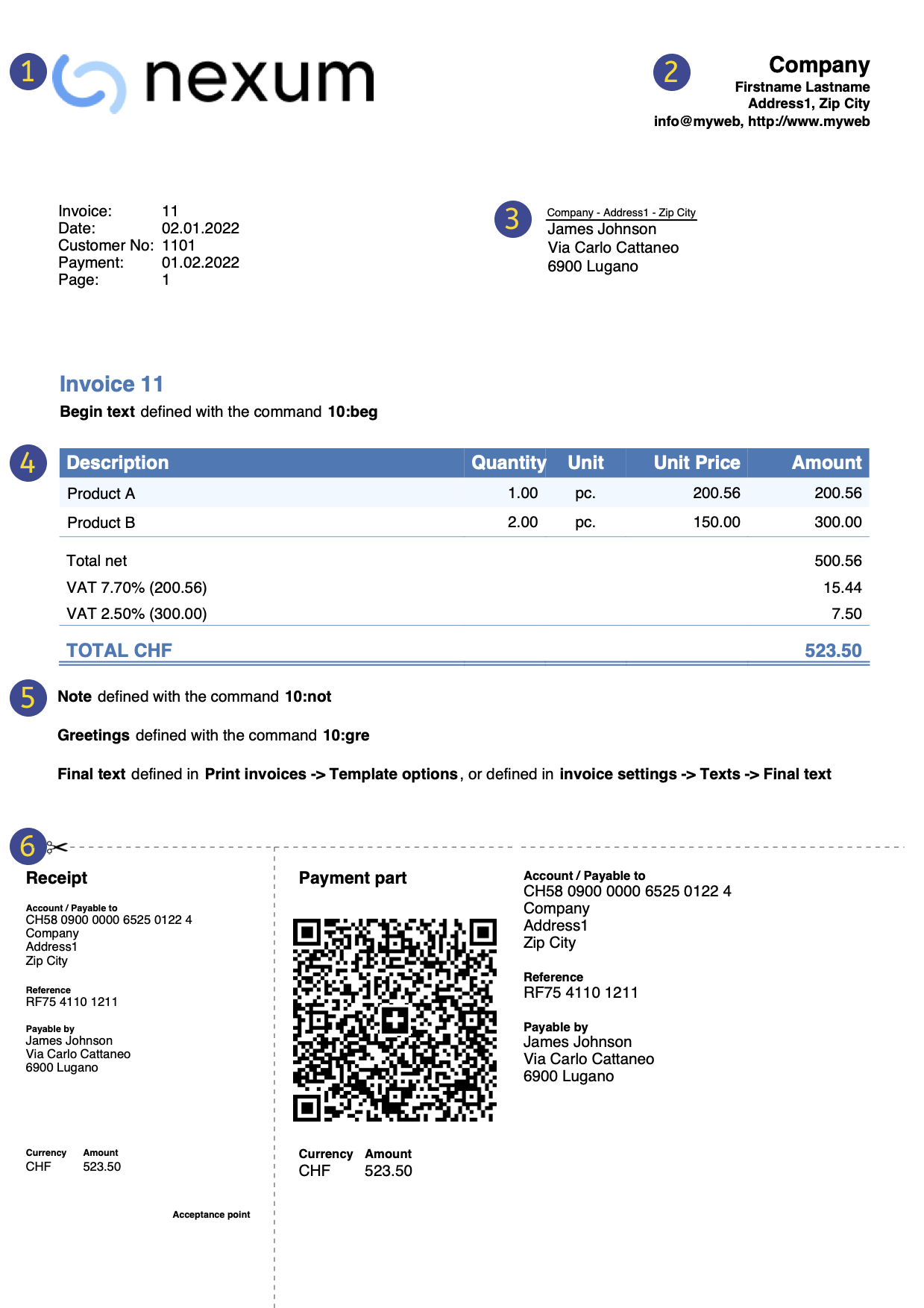

Invoice Structure

In this image you can see how the invoice is structured:

| LogoInsert a personalized logo from menu file → Logo setup | |||

HeadingThe heading of the invoice will be identical to the one entered | ||||

Customer AddressThe customer's address will be retrieved from Accounts table, see Setting up customer accounts. | ||||

Invoice dataThe contents of the invoice must be entered in the Transactions table, learn how to enter invoices. | ||||

Free textsInsert begin text, notes and greetings using the Column Type, and ending texts from menu Reports→ Clients → Print Invoices → Option layout. | ||||

Settings Swiss QR-CodeSettings can only be defined for Switzerland and with the [CH10] Swiss QR Code layout . |

Customer Management

Customer Management allows you to record, organise and manage customer information, keeping track of customer transactions and payments, payment due dates and contact information. You can track customer payments, update the payment status of issued invoices as well as enter and print invoices.

In Banana Accounting the customer data is set up in the Accounts table.

In order to create invoices, it is necessary to:

- Define the Customer Register

- Create invoices, entering the transactions in the Transactions table, debiting the customer's account.

With a range of functions you can manage the:

- Invoice collections by entering them in the Transactions table:

Creating an invoice from a profit centre

When the customer ledger is set up with profit centres (cash method management), the profit centre column CC3 is used in the invoice transactions.

In the appropriate columns of the Transactions table indicate:

- The date.

- The invoice number.

- The description of the invoice item, which you want to appear on the invoice.

If there is more than one item to be invoiced, use another row with the same customer number. - In the Debit account do not record any account

- In the Credit account do not record any account

- The amount. You can also enter the quantity and the unit price and the programme will calculate the amount.

- In column CC3 enter the customer's profit centre account (Accounts table).

Features currently not available

These features, although requested by some users, are not available at the moment:

- Automated invoice sending by email.

- Creation of estimates.

The programme allows you to print an invoice with the indication 'Estimate'. - Creation of delivery notes.

The programme allows an invoice to be printed with the indication 'Delivery Note'. - Link with Inventory application.

- Link with Timesheet.

- Creation of invoices in foreign currency with VAT in base currency (e.g. invoices in EUR with VAT in CHF).

- Automatically add reminder fees to the invoice.

Alternatively, you can insert a line in the invoice indicating the invoice date and number, and specify in the description the text related to the reminder fees along with the desired amount.

If you want to issue invoices separately from accounting (useful for cash accounting) and also prepare estimates, you may use:

This also allows you to add additional information more easily.

Full list of features currently not available in Banana+

Insights

- Invoice printing and VAT (based on turnover and cash received)

- Set customer language in invoices

- Due dates and payment terms

- All extensions with QR invoicing

Related topics:

- Example file in Income/Expense accounting

- Example file invoices in Double-entry accounting

- Example file invoices using Cost centers

Useful for registering invoice with VAT on the cash-in basis (with customer and supplier accounts as cost centres CC3) or if you want to exclude invoice details from the balance sheet accounts.