In this article

The VAT Summary is a document or a section of an accounting ledger where transactions subject to Value Added Tax (VAT) are summarized for a specific period (monthly, quarterly, or yearly).

Main elements of the VAT summary

- VAT payable: total amount of VAT due on issued or collected invoices (sales).

- VAT receivable: total amount of VAT recoverable on received or paid invoices (purchases).

- VAT to be paid or credited: Difference between VAT due and VAT recoverable.

- If VAT payable > VAT receivable: The company must pay VAT to the State.

- If VAT receivable > VAT payable: The company has a VAT credit that can be offset or claimed for a refund.

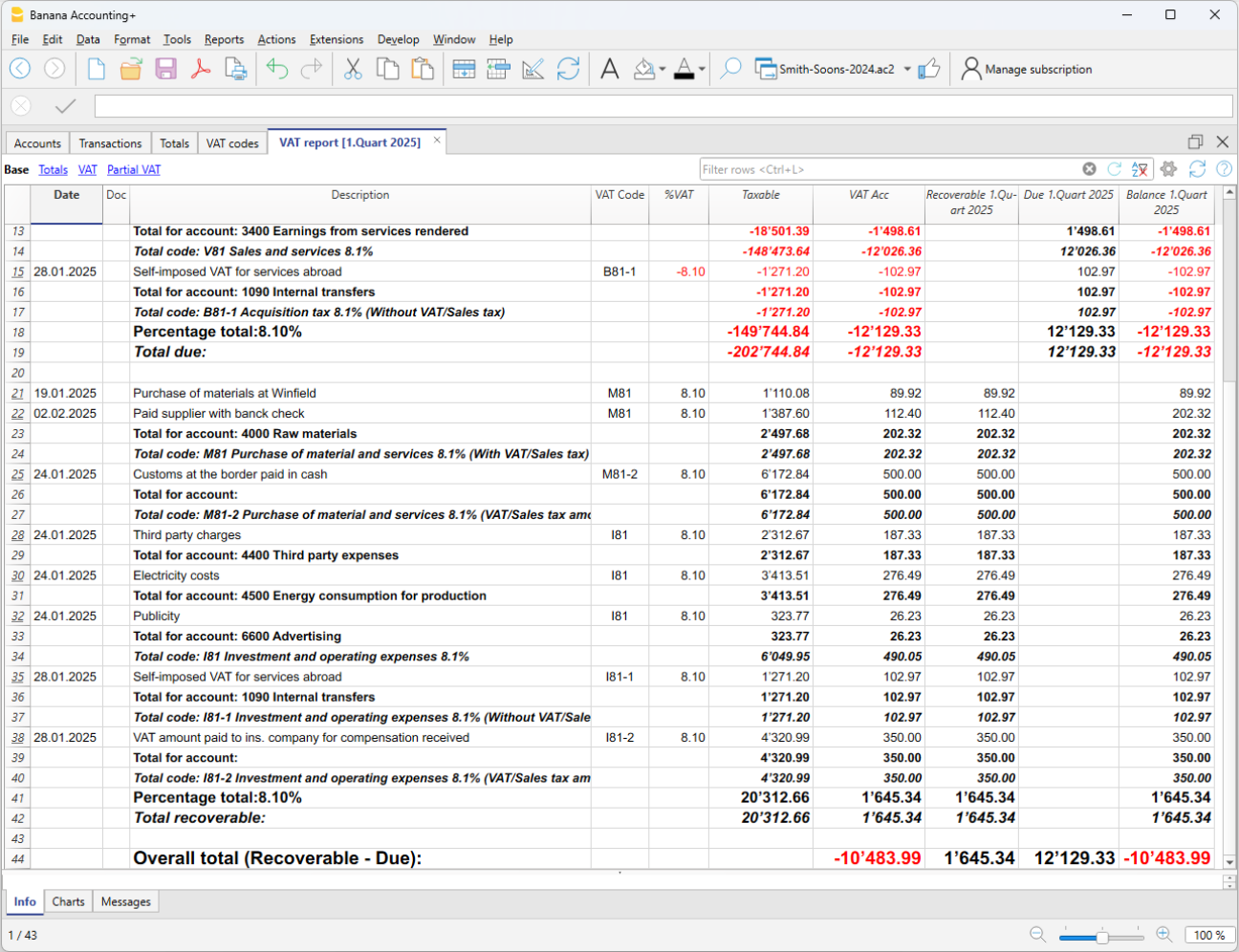

The VAT Summary in Banana Accounting Plus is a journal that records VAT transactions and balances, based on the set parameters and selected options.

It is automatically generated by the program through the Reports > VAT Summary menu and can be saved and archived in PDF format. All transactions with a VAT code, depending on the selected options, can be broken down by account, VAT code, and percentage.

There are two main groups:

- Total Due

- Total Recoverable

The difference between these two totals results in the VAT to be paid or recovered with respect to the FTA (Federal Tax Administration).

Below is an example of a VAT summary table for the first quarter of 2025:

For users who do not wish to use automated solutions for managing and submitting VAT data online, the VAT Summary is essential for calculating the VAT amounts to be manually entered into the Swiss paper VAT return or the FTA online portal.

If you wish to have a fully automated Swiss VAT return and electronic VAT data transmission, we recommend using the new VAT extensions, available in the Advanced plan of Banana Accounting Plus.

Comparison between VAT summary and VAT extension

To better understand the differences between the VAT Summary and the VAT Extension, below are their main features:

VAT Summary

- Available in all plans of Banana Accounting Plus, in all accounting applications with VAT management.

- It is an integral part of accounting because it represents a ledger where all VAT transactions are recorded.

- It is particularly important as it provides details that allow monitoring of sales.

- Serves as a basis for manually preparing the VAT declaration and settlement.

- It is a support tool for auditors and tax inspections, facilitating the verification of VAT records.

- In case of tax audits, it provides all the details necessary to verify VAT transactions.

- Does not allow automatic preparation of the VAT form. Everything must be manually reported.

- The user must identify and manually sum the amounts to be reported in the various sections of the VAT return.

- Does not provide automatic submission of data to the Federal Tax Administration (FTA).

VAT Extension

- Available only with the Advanced plan of Banana Accounting Plus.

- A set of advanced features to automate VAT management and data submission to the FTA.

- Filters, calculates, and automatically fills in VAT amounts in the correct sections of the VAT return.

- Always performs calculations according to predefined rules, reducing the risk of errors.

- Automatically generates an XML file for electronic submission of VAT data to the FTA portal.

- Creates a PDF file with a facsimile of the VAT return, facilitating documentation and archiving.

At the end of the return, there is a section where any calculation and rounding differences are reported.

Thanks to the VAT Extension, VAT management becomes simpler, faster, and free from manual errors, improving administrative efficiency.

The Advanced plan includes the two VAT calculation and reporting methods:

The VAT summery dialog

The VAT report is obtained by clicking on the menu Reports > VAT report

When activated, the following options allow you to include the following data in the VAT report:

Include movements

All transactions with VAT are included.

Include totals for accounts

The totals of transactions with VAT are included, grouped by single account.

Include totals by codes

The totals of transactions with VAT are included, grouped by single VAT code.

Include totals by percentages

The totals of transactions with VAT for each individual rate are included.

Include unused codes

Also included are the unused codes present in the VAT Codes table.

Use own grouping (group and Gr)

Transactions with VAT are grouped according to the grouping of the VAT Codes table.

Order registration by

This function allows you to sort the recordings based on the selected option (date, doc.,

description, etc ....).

Partial Report

By specifying a code or a group and checking the appropriate boxes, the total of transactions with VAT is obtained:

- just the code indicated (by selecting from the list)

- just the indicated group (by selecting from the list).

Other sections

Information for the other sections is available on the following web pages:

VAT Report / transactions with totals by code

The overall total in the last row of the VAT report has to correspond with the amount for the end of period of the Automatic VAT account, Balance column, on the condition that both of them refer to the same period.

The data of the VAT report can also be transferred to and elaborated by other programs (f.i. Excel, XSLT) and be presented in formats that are similar to the forms of the tax authority

For Switzerland, one can automatically obtain a document similar to the form that has to be sent to the VAT office. This form shows the amount to enter for each number. Please consult (in German, French, or Italian) Swiss VAT Report.