In this article

On this page, you will find all the information you need to enter, modify, and restore initial balances (or opening balances) in Banana Accounting.

Opening balances when starting an accounting

When using Banana Accounting for the first time, the opening balances need to be inserted manually in order to create the opening balance sheet.

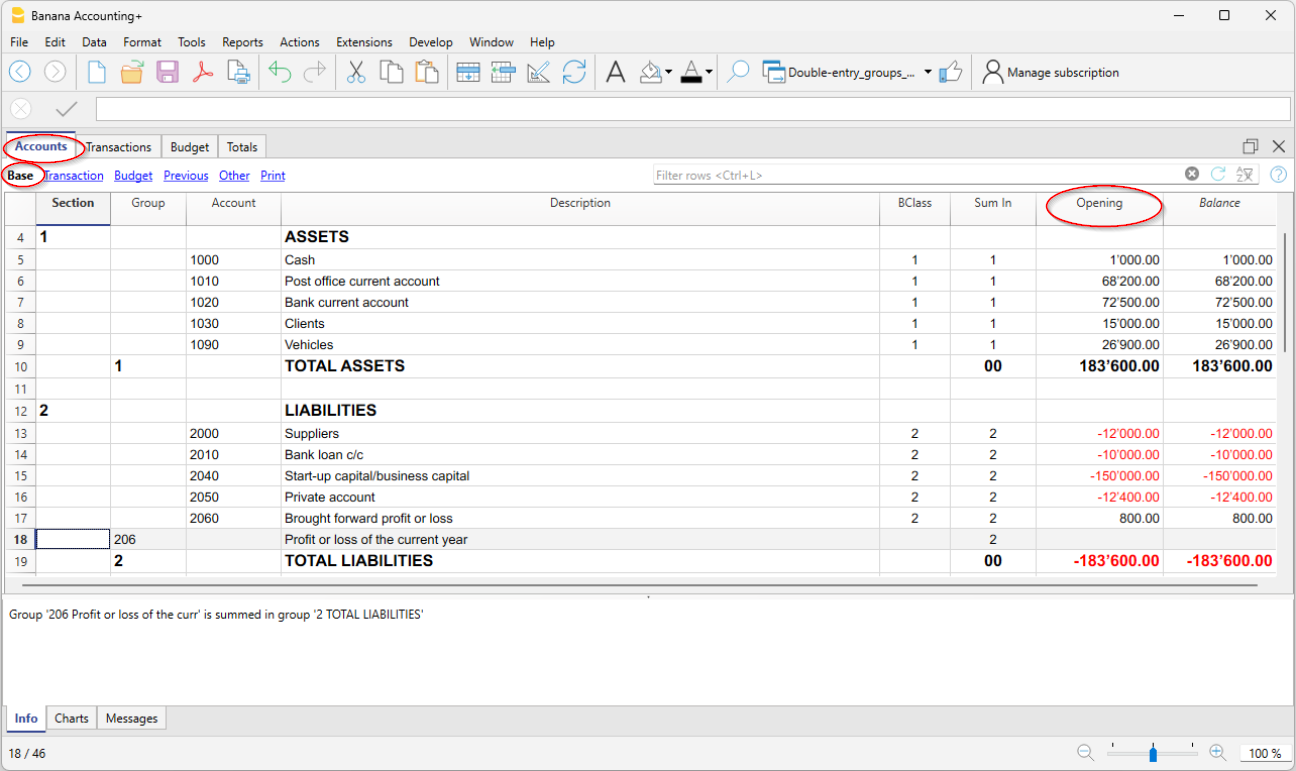

- Position yourself in the Accounts table, Base view, Opening column.

- Enter the opening balances of the Assets and Liabilities accounts manually. Liabilities are to be entered preceded by the minus sign.

- Check if the total Assets equal the total Liabilities so that your accounting squares. If there are differences in the opening balances you need to check and correct them.

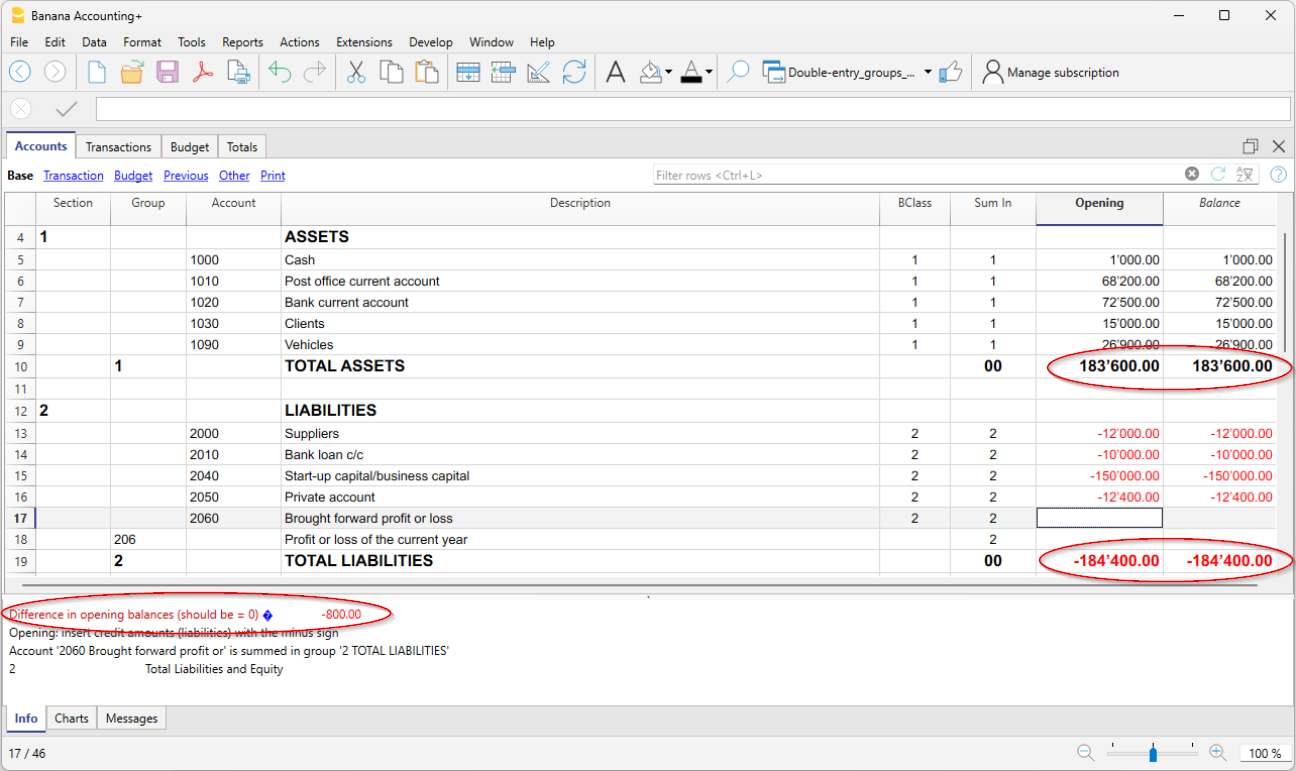

Difference in opening balances

At the opening of the accounting year, the Assets accounts (positive) must balance with the Liabilities accounts (negative). If this is not the case, the accounts do not balance and error messages are displayed in the information window at the bottom; in this case, the reasons must be checked and corrected, until the message Difference in opening balances disappears. For more information and solutions see:

Opening balances of Cost Centers

In the Accounts table, the Opening column can also be used to enter the opening balances of the Cost Centers.

Opening balances for Segments

To enter the opening balances of the segments, opening transactions must be entered instead.

More details are available on the Segments page.

Opening balances for an already started accounting

If you start a new accounting, taking over work already done with other programs, there are two possibilities:

- Start accounting from the beginning of the year, by entering the opening balances for the beginning of the year (Accounts table, Opening column) and the transactions (Transactions table) that have already been previously recorded with other programs (also see Transferring data from other software). Thus you will have all the accounting details in one file.

- Starting from the date when the accounting is resumed:

- Enter the opening balances (Accounts table, Opening column), taking over the values of the other accounting.

In addition to entering the opening balances of the Assets and Liabilities accounts, it is also necessary to enter those of the Expenses (positive amounts) and Revenues (negative amounts). - The operating result up to that point must be disclosed in the Profit / Loss carried forward account.

If it is a profit, the opening balance must be entered in negative, if it is a loss as a positive. - Check that the sums of the opening balances are zero, so that the program does not signal any differences.

- Enter the new entries in the Transactions table.

- Enter the opening balances (Accounts table, Opening column), taking over the values of the other accounting.

Opening balances as opening transactions

Opening balances can also be entered as opening transactions in the Transactions table.

For each opening transaction, proceed as follows:

- Indicate the accounting start date as the transaction date.

- In the Doc Type column, enter the code "01".

- Indicate the debit or credit account and the amount.

- The total of the opening debit balances must match those in credit.

Opening balances entered as transactions are used when preparing reports. The opening balance of the transactions is added to the amount entered in the Opening column of the Accounts table.

Balances of the previous year

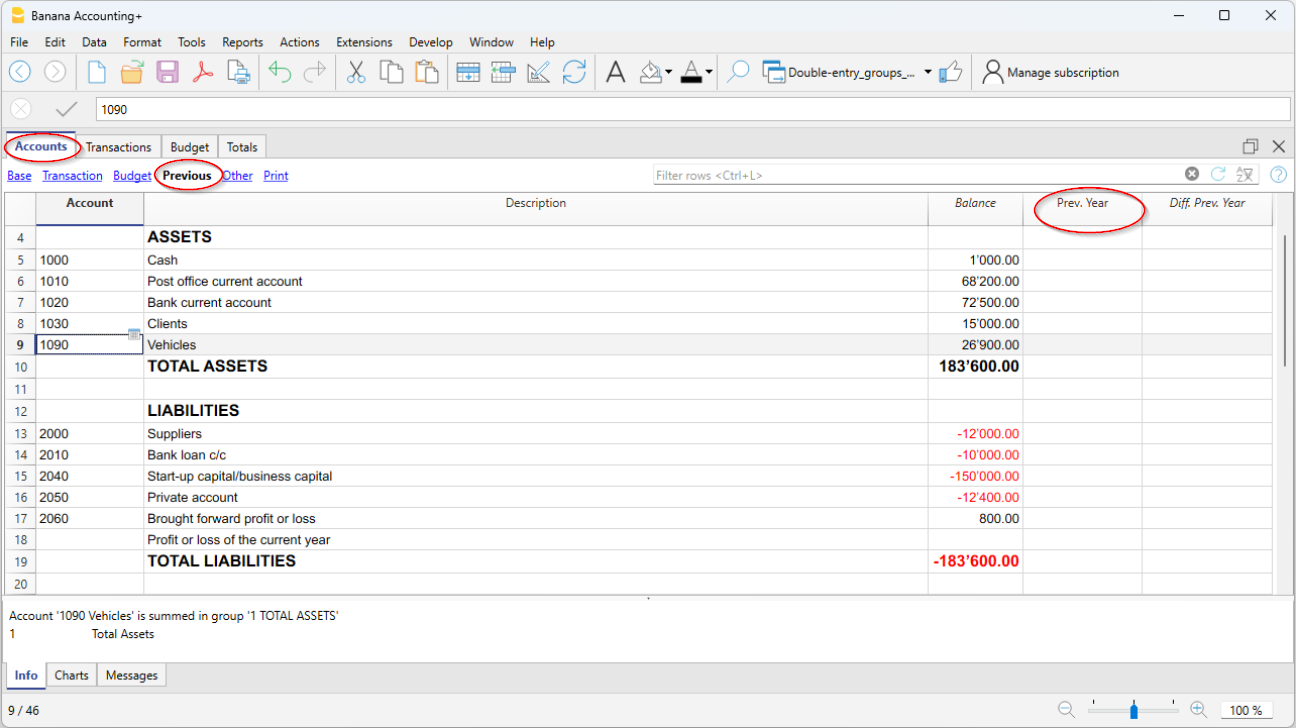

If you start a new accounting by taking over an existing accounting and you want the previous year's values to appear on the printouts, it is necessary to enter the previous year's balances in the Previous view, Previous Year (Prior) column of the Accounts table:

- Enter the closing balances of the previous year of the Assets accounts.

- Enter the closing balances of the previous year of the Liabilities accounts (insert the minus sign in front of the amount).

- Enter the last year's closing balances of the Expenses.

- Enter the final balances of the previous year of Revenues (insert the minus sign in front of the amount).

Create new year

When you start the new year, the program automatically carries over the opening balances to the following year.

Consult the Create New Year lesson.

If for some particular need, opening balances need to be changed, these can be modified manually in the Opening column of the Accounts table. After each modification, make sure that there are no accounting differences. Anyway, we recommend carrying over the opening balances with the Create new year command or, if the accounting for the new year has already been created, use the Update opening balances command.

The account card is in automatic and it is not possible to directly enter the opening balance or make changes.

To change an opening balance of an account card, you need to go to the Accounts table, Opening column, whereas to correct movements, you need to change the entry in the Transactions table.

Print opening balances

To print the opening balances:

- To print the contents of the table, use the Print / Preview command, by selecting the rows of the Balance Sheet.

- You can also use the Accounting printouts and set the printout for the Balance Sheet part and the opening column only.