In this article

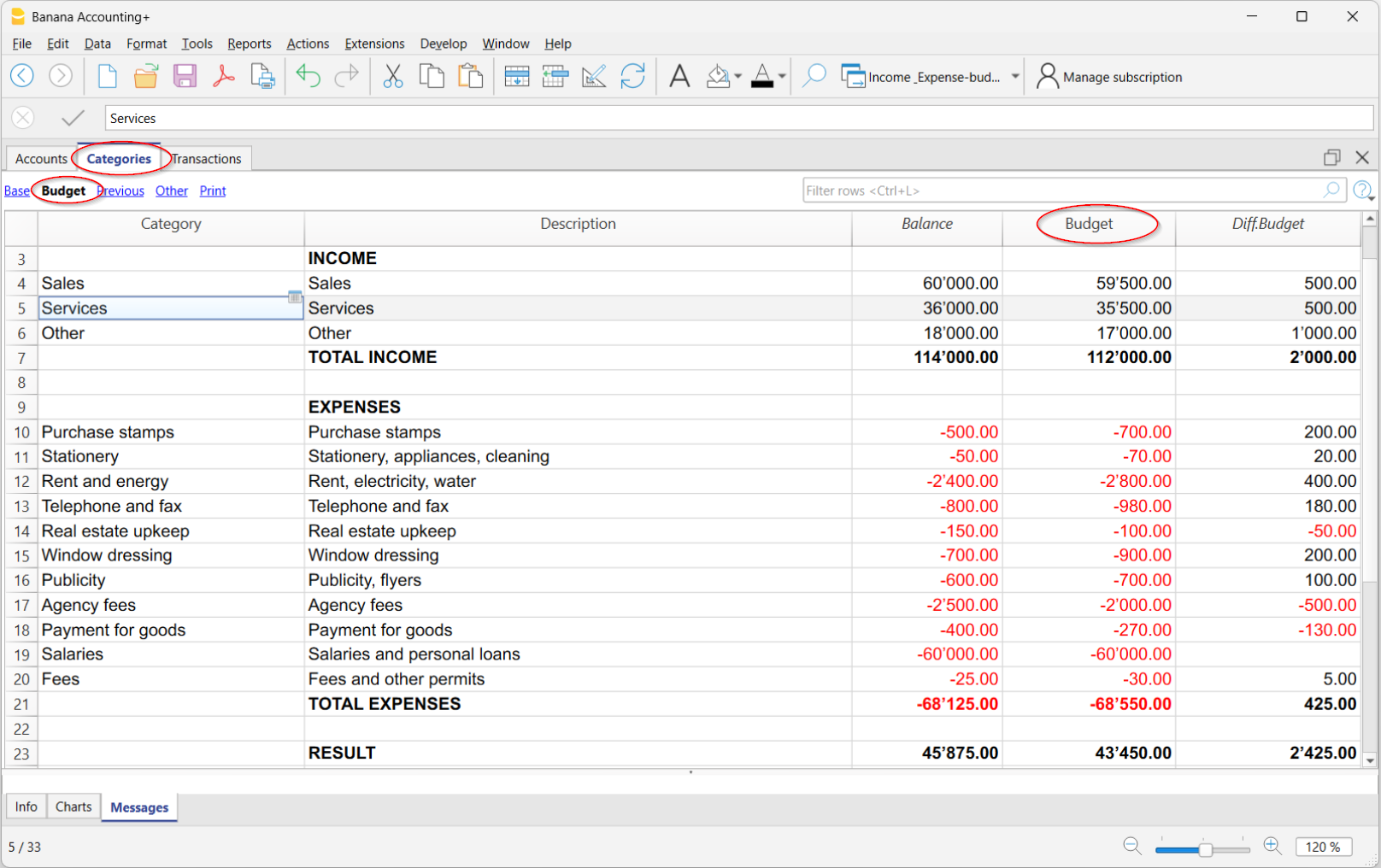

This is an annual budget, set in the Budget column of the Categories table.

The Budget column is active only if the Budget table has not been activated. If the Budget table is already active, you need to deactivate it.

In addition to the Budget column, there is the Budget Diff. column, visible in the Budget view. It shows the difference between the expected and actual values. It updates automatically as accounting transactions are recorded.

Deactivate the Budget table

If you want to use the Budget column in the Categories table to set the annual budget, the Budget Table must not be active.

If it is active, to deactivate it, go to the menu:

- Tools > Add/Remove Functionalities

- Select Remove Budget Table.

Once the table is removed, you can directly enter the budget amounts in the Budget column of the Accounts table.

Budget Printing

You can print the Budget using one of the following methods:

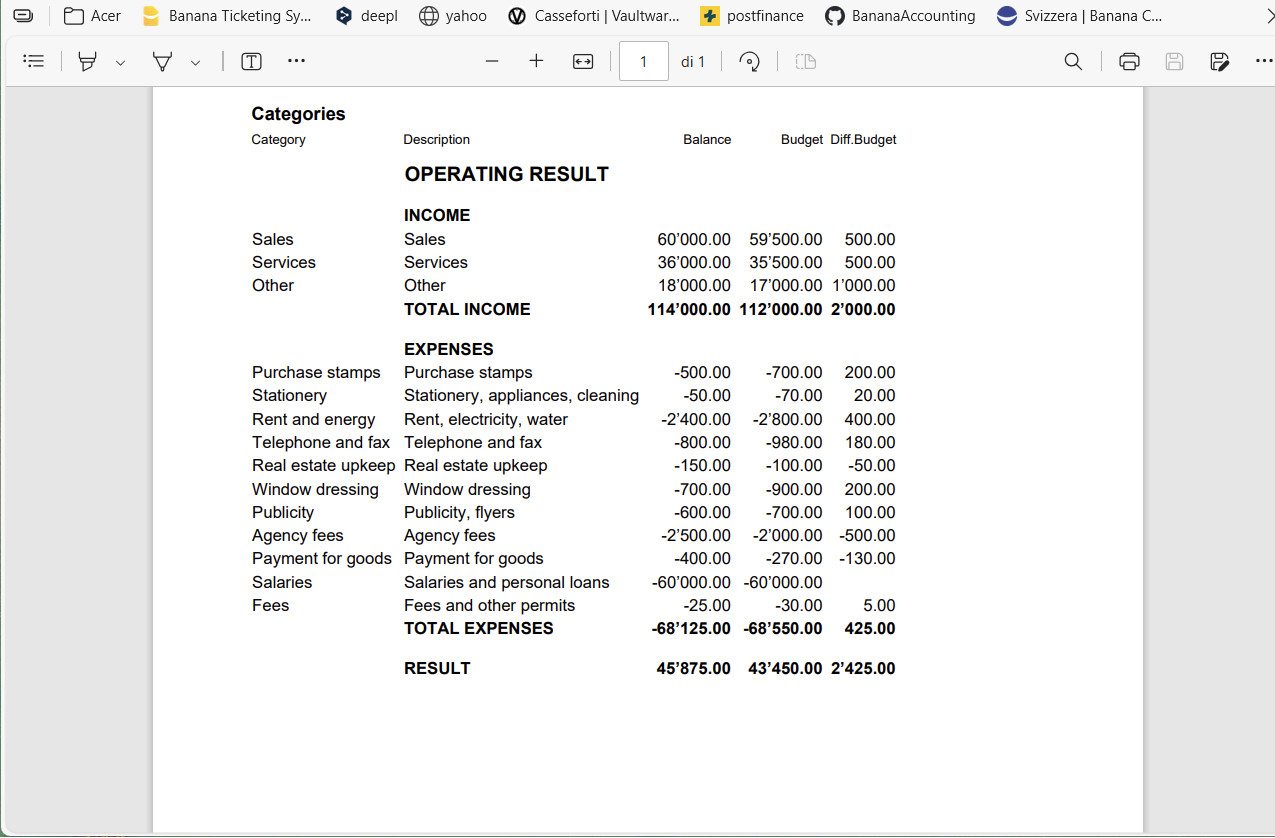

- Directly from the Categories table:

To print, go to the Categories table and select the Budget or Print view. From the menu File > Create Pdf, the program displays the PDF ready to print.- Budget View

The printout shows the columns as they appear in the Categories table. - Print View

The printout appears like the Categories table but without the Sum In column and other grouping columns. In this case, you need to show the Budget columns using the menu Data > Columns setup.

- Budget View

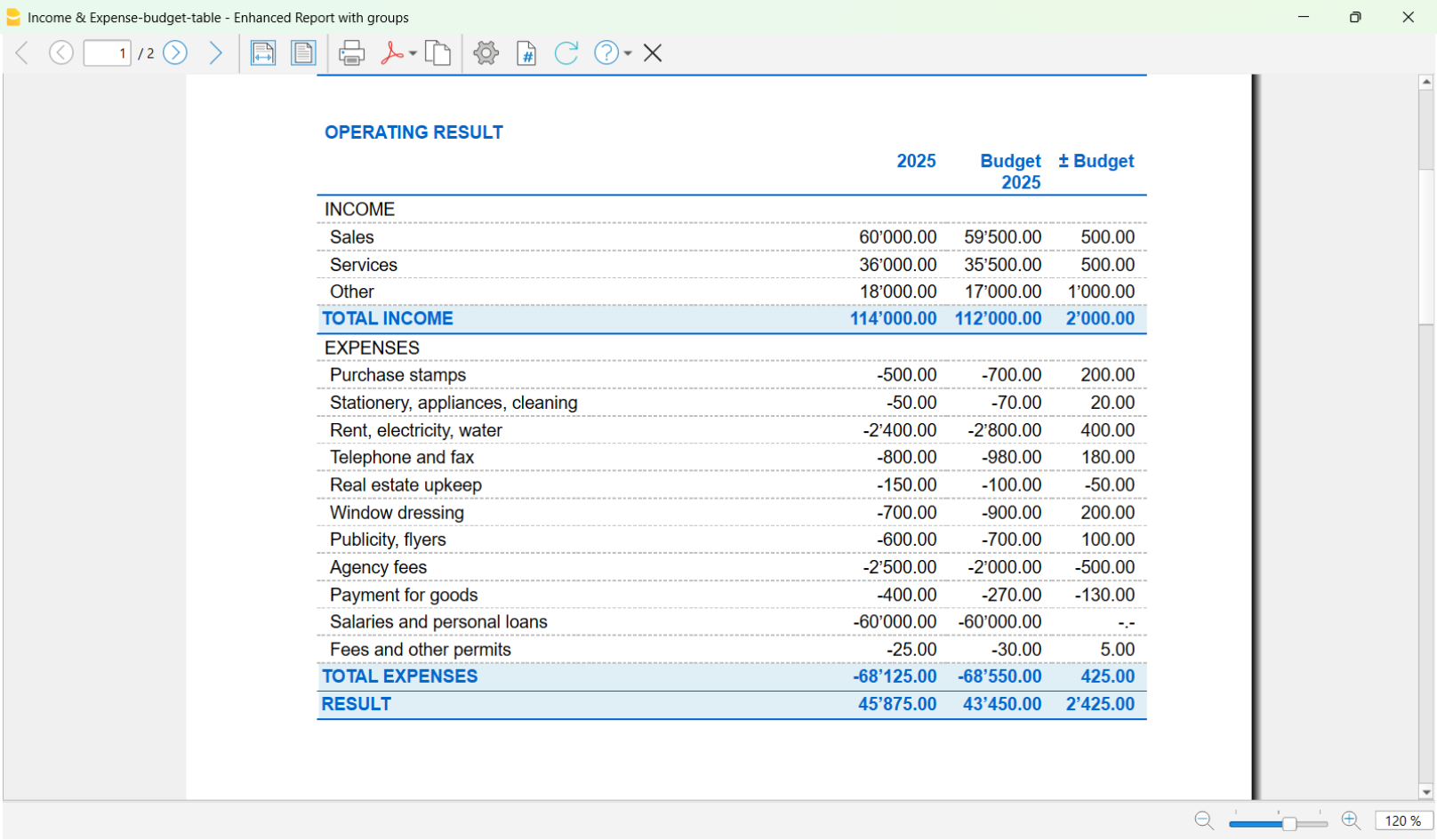

- From the menu Report > Enhanced Balance sheet with Groups.

In the Columns section, the Budget option must be enabled for the Categories and optionally for the Accounts.