In this article

Banana Accounting Plus simplifies VAT management by automating the calculation, recording, and submission of VAT returns to tax authorities. Cutting-edge features reduce manual errors, ensuring tax compliance. Banana Accounting Plus simplifies VAT management by automating the calculation, recording, and submission of declarations to tax authorities. Cutting-edge features reduce manual errors, ensuring tax compliance. Pre-set templates with VAT options and pre-configured codes are available for all accounting applications,

For Switzerland, the new 2024 VAT rates are already available. The new VAT extension for submitting returns digitally is available.

- Swiss VAT management

- ▶ Video: Swiss VAT return (in French, German, Italian)

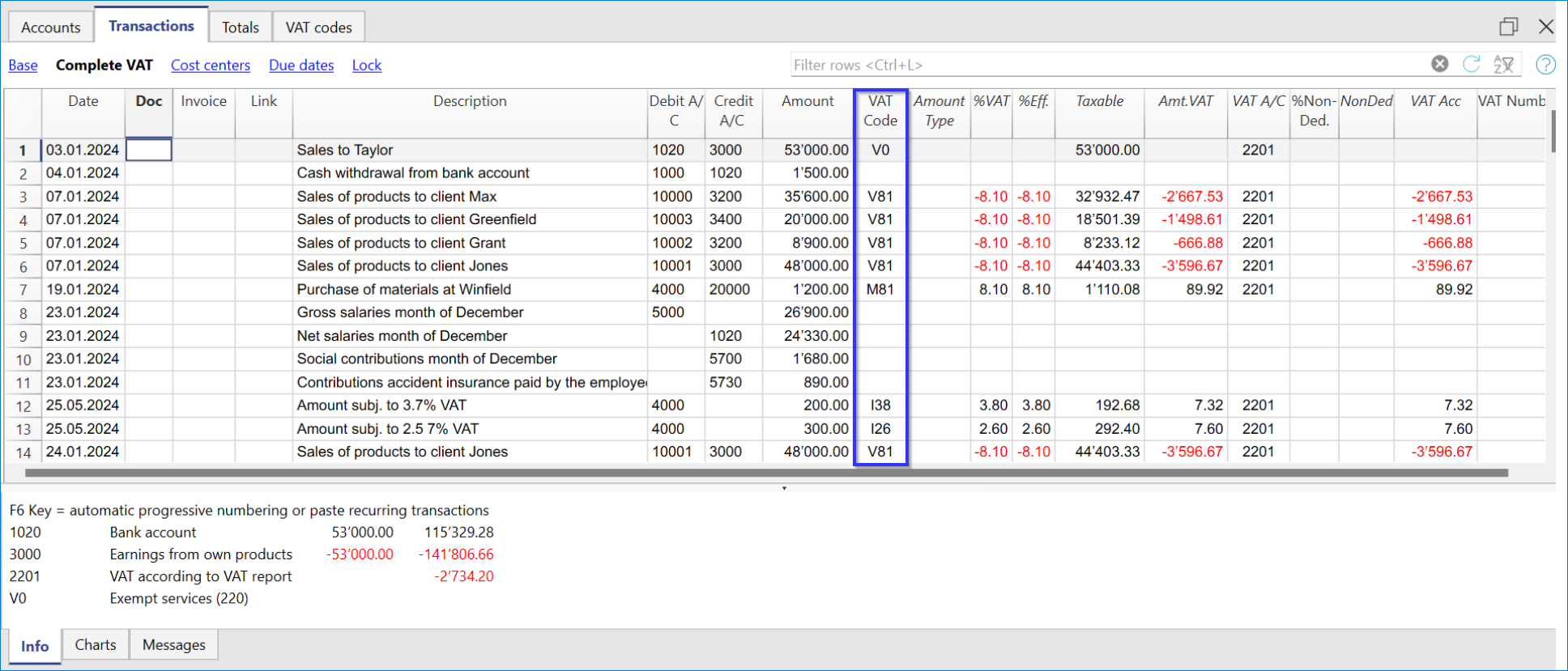

Recording transactions with VAT

With Banana Accounting, VAT management is very simple because it is completely automated. Transactions with VAT are recorded in the Transactions table, the main hub of all accounting, by entering for each VAT transaction the corresponding VAT code, referring to the sale or purchase, according to the rates in force.

Several pre-set columns are available, the display of which can be customised.

In addition, the programme offers:

- Accounting with different VAT rates in the same transaction

- Add the invoice in PDF in the link column.

In the Transactions table there are specific VAT Columns for various VAT-related information.

To record a transaction with VAT, enter the following data:

- The date of the transaction.

- The invoice number.

- In the Link column, you can enter the digital link to the Pdf accounting document.

- The Debit and Credit Account where you can indicate the account and the contra-account

- The amount.

- The VAT code relating to the purchase or sale (codes found in the VAT Codes table).

For each transaction, the programme performs the following automatisms:

- Accurately records the VAT paid on purchases and the VAT received on sales.

- Automatically calculates the VAT amount.

- Breaks down the VAT amount from the cost or revenue.

- Retreives the VAT amount, taxable amount and VAT amount on the VAT accounts.

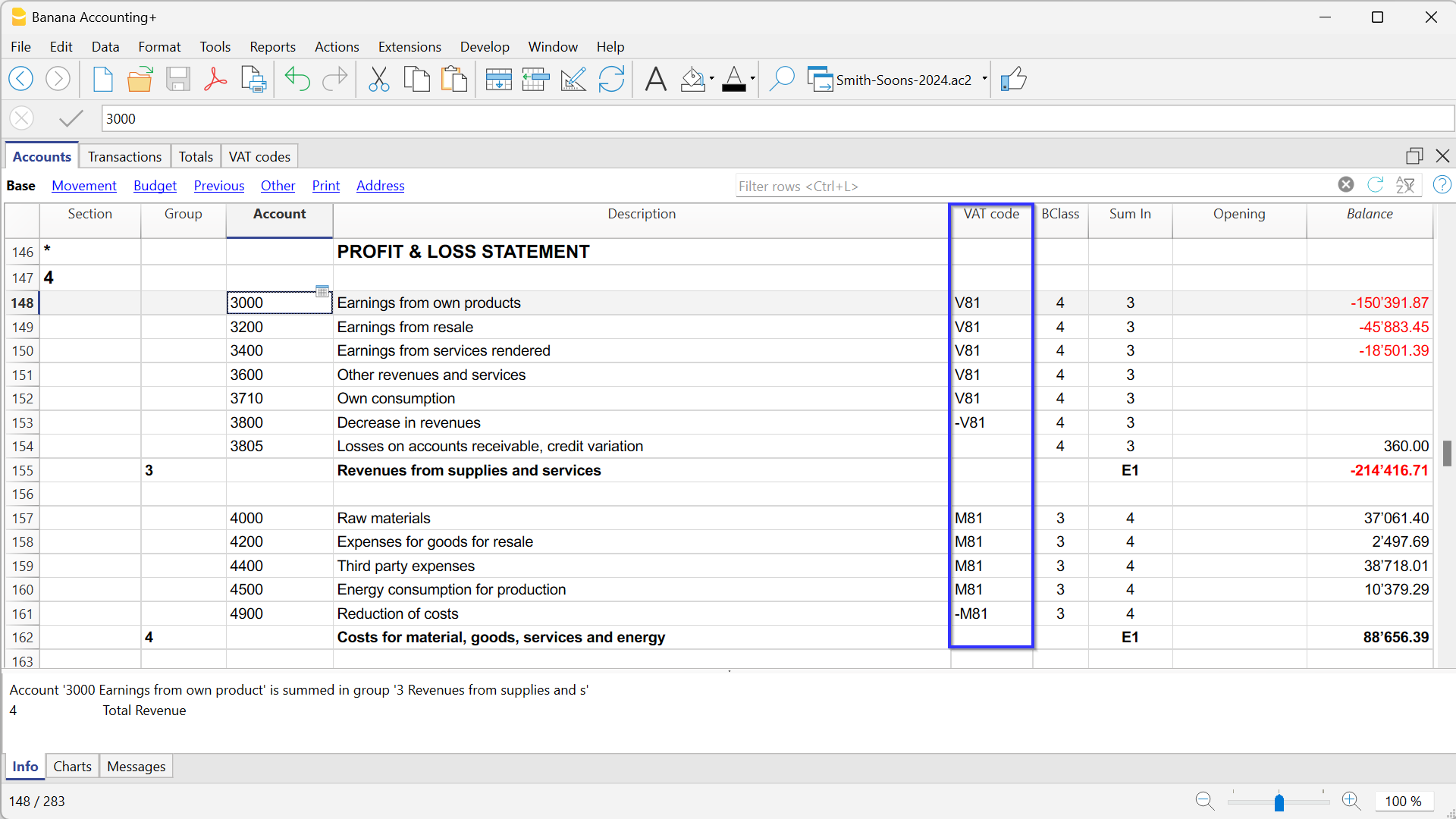

Predefined VAT accounts and settings

In the Banana Accounting Plus VAT models, the VAT accounts are already set up in the Accounts table. In the passive accounts, there are the automatic VAT split account and the VAT due account (or VAT receivable account).

To speed up VAT transactions, it is possible to set the VAT code to each account that has VAT transactions in the Accounts table. This setting allows you to automate the entry of the VAT code when you enter the account in the Accounts table.

More details can be found on the page Match the VAT code to account.

VAT Codes Table

The VAT Codes table defines the VAT codes for the rates in force and other parameters for calculating VAT.

- There are columns in which to set VAT codes for calculating VAT gross, net or by VAT amount only.

- There are both VAT codes for the effective method and for the flat rate method

- Swiss templates have the VAT Codes table already set up:

- with the VAT codes relating to the rates in force

- for each VAT code, in the GR1 column, the reference figure is set, which will allow the VAT data to be reported in the VAT reporting template and also in the Xml file to be transmitted to the Federal Tax Administration (FTA).

- For each country, there are files with the VAT codes already set according to the national reporting requirements.

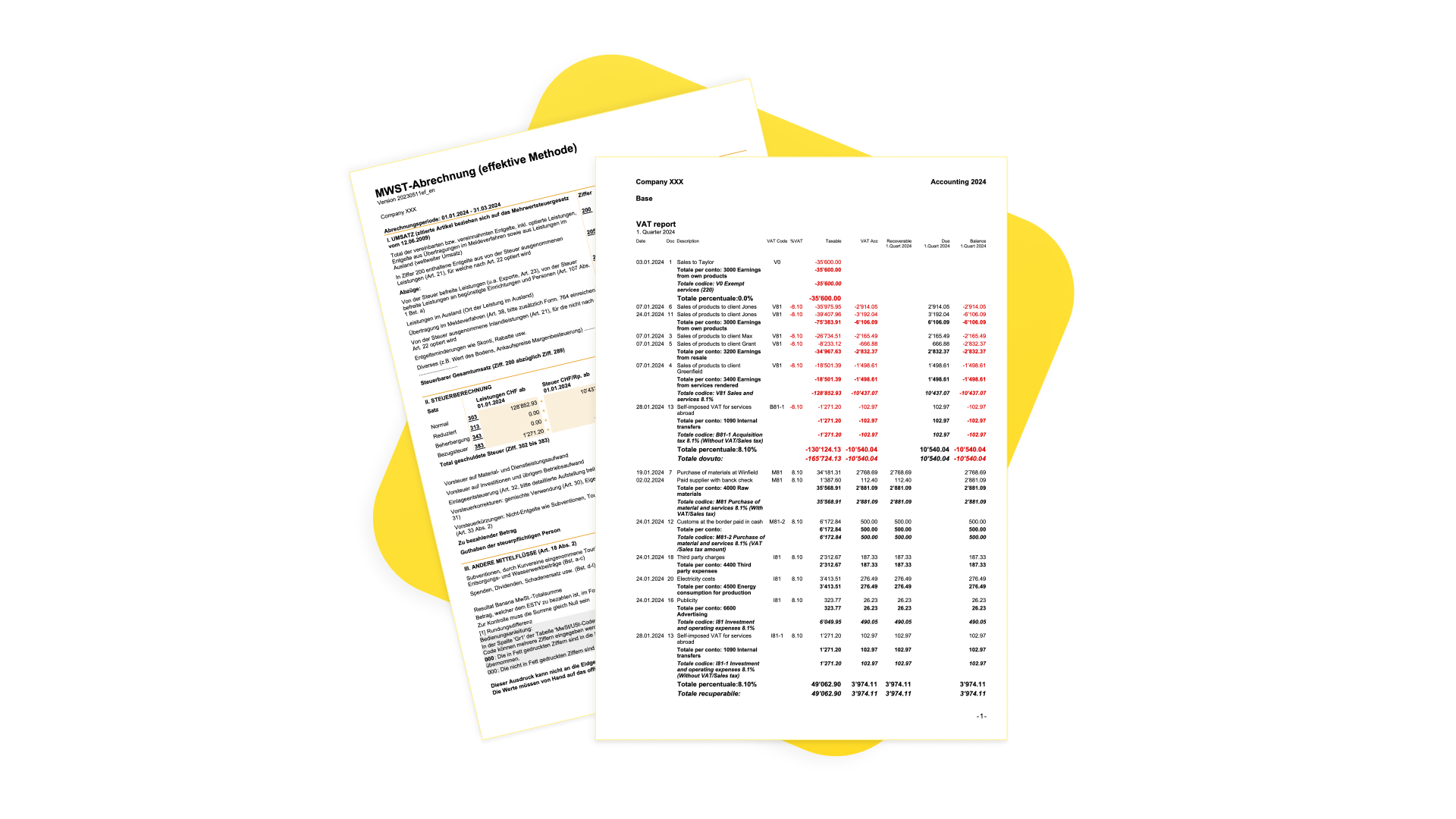

Automated VAT reports and returns

The programme automatically generates various reports with very detailed summaries by VAT code, account, percentages, records and period. VAT summaries can be customised by displaying columns specific to the data you wish to obtain. VAT summaries are useful for understanding the movement of VAT (VAT due, recoverable and payable) and allow effective control and in the event of audits by tax authorities, targeted details are available to facilitate audit work.

More information is available on the VAT Report page.

The VAT functionalities of Banana Accounting Plus offer several advantages:

- Efficiency

You avoid preparing calculations and statements manually, saving time and effort - Accurate calculations and statements

Errors are avoided because calculations are performed automatically and accurately by the programme on the basis of the data recorded by the system. - Compliance with current regulations

The programme is updated according to current rates. Simply update the VAT Codes table and the calculations and statements are performed correctly and in a manner consistent with the regulations. - National VAT Reports Extensions

These are additional modules, different per country, that print or export VAT data in the format required by the tax authorities. Please refer to the national VAT documentation - Archiving of VAT printouts

All printouts with VAT data can be saved in pdf or other formats and archived. Archiving allows the data to be available at all times in case of tax audits.

Calculation methods

Banana Accounting is a powerful calculation tool and in VAT management, too, you can take advantage of its potential to always have accurate and correct VAT calculations and reports.

There are two calculation methods:

- Effective Method - calculations and accounting of VAT using the cash principle and on turnover

- Flat tax rate Method - Calculations and accounting of VAT upon the VAT rates granted by fiscal authorities

Accounting methods

- Turnover

Demands the for the keeping of a customer and supplier ledger.

Costs and revenues, with the corresponding VAT code, are recorded when the invoice is issued and received.

More information can be found on the page How to manage VAT on turnover.

- Cash principle/ Collection

It is not compulsory to keep a customer and supplier ledger, but if you still wish to have one, it is important to set it up with cost centres.

Costs and revenues, with the corresponding VAT code, are recorded when collected or paid.

More information can be found on the page Clients and Suppliers with VAT using the Cash principle

Features currently unavailable

These features are not available at the moment:

- In multi-currency accounting, the account to which VAT is recorded net (usually Revenue and Expense accounts) must be in base currency.

It is not possible to deduct VAT from accounts that are not in base currency. - The VAT amount is calculated by the programme and recalculated when the Recalculate accounting is done. This gives the auditor or others who check the accounts the certainty that the calculations are always made with the same logic.

For VAT rounding, it is not possible to enter a different VAT amount than the one calculated by the programme. Generally, these are VAT amounts that have been rounded on the invoice, even by a few cents.

Insights