In this article

To manage your members, you can start from one of the following templates (with example entries):

- Income/Expense Accounting for Associations in Switzerland

- Double-entry Accounting for Associations in Switzerland

With Banana Accounting Plus, you can set up a member list with address data and other configurations. You can then automatically generate:

- Member Invoicing (using integrated invoicing)

- Member account cards with all transactions and balances

- Donation certificate

- Letters to members / Mail merge

Below is how to set up the member list as cost centers (cash-based accounting).

In a later section, you’ll find how to set up the member list with active accounts if using accrual accounting.

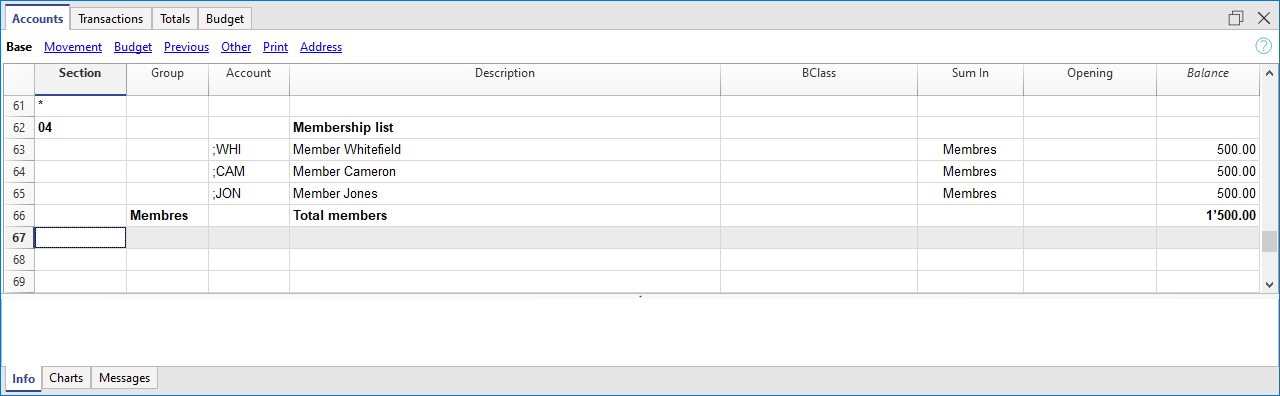

Set up member accounts – cash-based accounting

Associations that use cash-based accounting must configure member accounts with cost center CC3 (;). Membership fees are recorded as income upon receipt. The member code appears as supplementary information.

- In the Section column, insert an asterisk to change the section.

- In the next row’s Section column, insert 04 for income.

- Use cost center CC3 (;) for each member account.

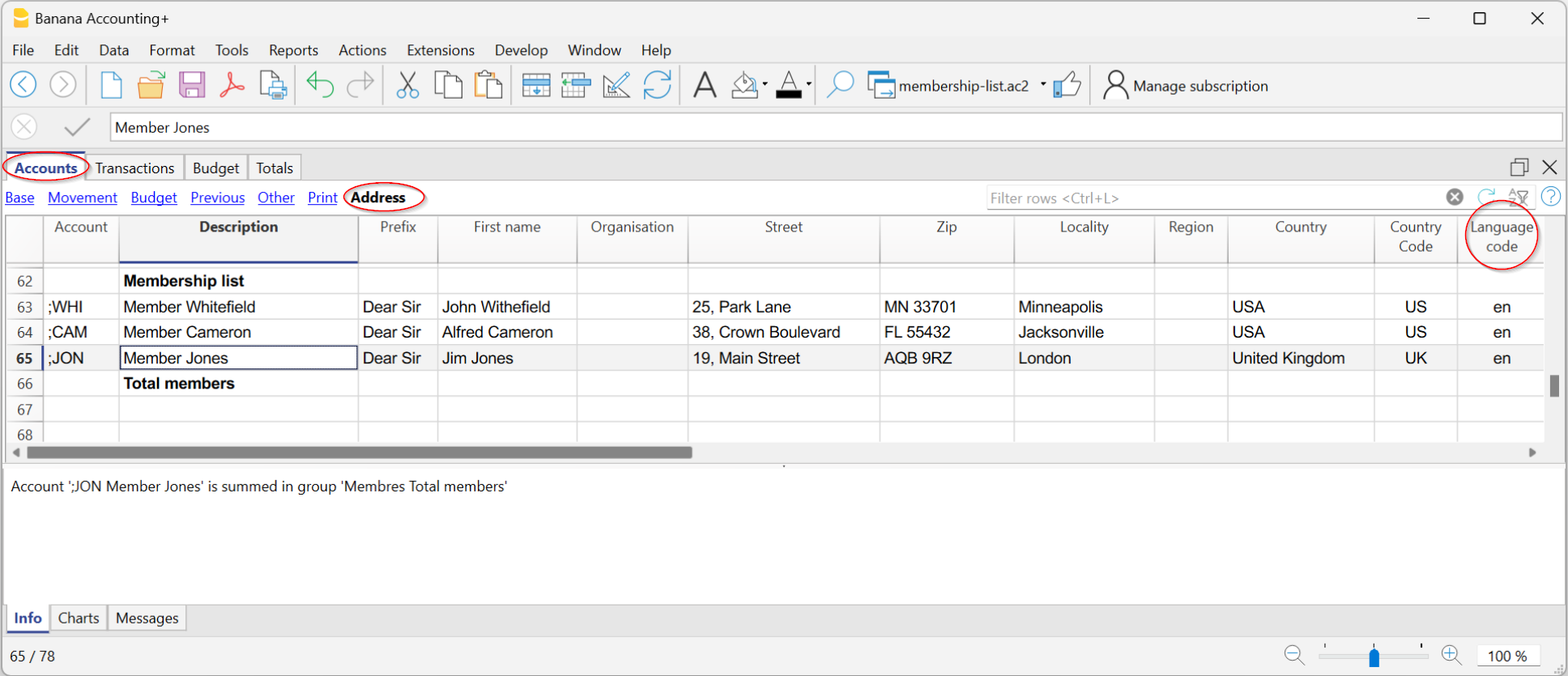

Enter address data

Member data such as address, phone, and email are entered in dedicated columns visible in the Addresses view. If the view is not visible, add it from the menu Tools > Add/Remove Features > Add Address columns in Accounts table.

Enter membership fee payments in CC3

Payments and other entries related to members are recorded in the Transactions table. If members were set up with CC3, record as follows:

- Enter date and document number

- Enter description

- In the Debit column, enter the bank account; in Credit, the donation income account

- In the CC3 column, enter the member account (without punctuation)

If the CC3 column is not visible, go to Data > Organize Columns > CC3 and enable visible.

You can view each member’s transactions and balance in the account card by clicking the blue icon in the cell, or via Reports > Account cards.

Invoices for membership fees

With entries set (either with CC3 or ledger), you can generate membership fee invoices:

- From the menu Reports > Customers > Print invoices, access the dialog to customize and print invoices.

For more details, see the tutorial Invoices for membership fees.

Donation certificate for members

If income is recorded with member information, you can use the extension to print donation certificates. This automatically prepares a letter with member payment info.

Print member list

- Select the member rows in the Accounts table

- Go to File > Print and choose Print selection

You can also use the Extract Rows command to filter accounts, then print the displayed table.

Export member data

- Use the Extract Rows command

- Copy/paste data from Banana Accounting Plus into Excel

- Export data to CSV or Excel

Set up member accounts – accrual-based accounting

Associations using accrual accounting can set up members as standard asset accounts or subledger accounts at the end of the chart of accounts.

The fee is recorded as income when the invoice is issued (or at the start of the period) by debiting the member account. Upon payment, the member account is credited.

Detailed instructions on setting up member accounts in this case are the same as for Customer subledger.

Registering and invoicing membership fees with member subledger

- Enter the date and document number

- Enter the description and invoice number

- In the Debit column, enter the member account; in Credit, the donation income account