In this article

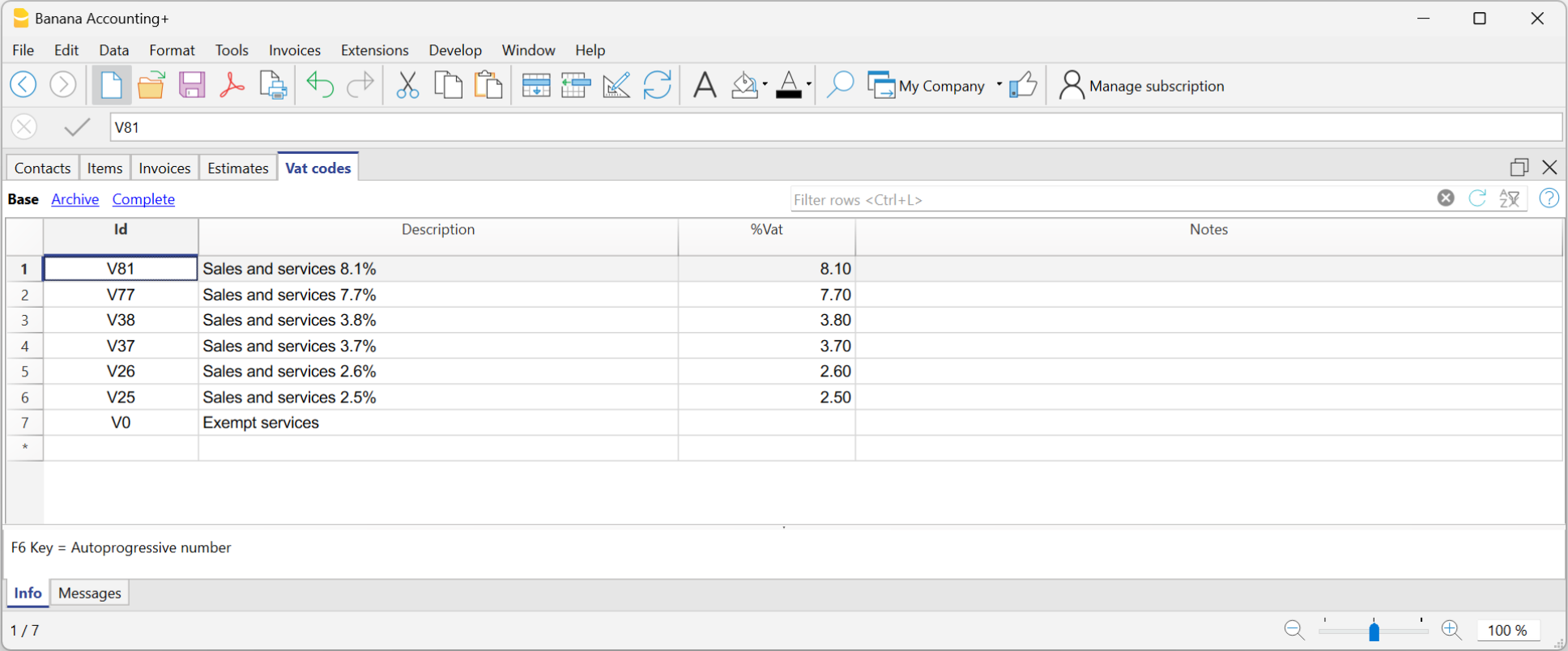

The VAT codes table displays the columns where you can enter the VAT codes with the respective rates.

The data must be entered manually. When VAT rates change, the table must be updated by changing or adding the ID codes and percentages of the new tax rates.

VAT Codes will be automatically taken over in the invoice dialogue when creating or editing the invoice, simplifying data entry.

The columns

The VAT Codes table contains many columns; those displayed in the image are those in the Base view. The full list is available in the Complete view. To customise the columns, please consult the Columns setup page.

Id

The VAT code is entered.

The ID should be used only once and must not be repeated, even if multiple years are managed in a file.

Description

Enter the description of the VAT code.

%VAT

The VAT rate is entered.

Notes

Any notes may be inserted.

VAT on the gross or net amount

The setting for calculation on the net or the gross amount is done at the individual invoice level, in the Invoice settings dialogue.