In this article

With Banana Accounting Plus, you can easily manage business, association, or personal accounting with the simplicity of a spreadsheet and the accuracy of professional software.

You can choose the application that best suits your needs and grow your management over time without ever losing your data. You can get started right away with one of our templates and always achieve professional results.

Watch the video: ▶ Accounting in 3 easy steps

Choose between two accounting methods

Banana Accounting Plus applications are based on two different recording methods, designed for users with different levels of experience.

This modular structure allows you to start simply and expand features as your needs grow.

- Income and Expense Accounting – ideal for beginners and non-accounting specialists.

Manages income and expenses from multiple accounts in a simple and intuitive way.

Also includes the Cash Manager, which manages income and expenses from a single account (such as cash, bank, or project).

- Double-entry Accounting – ideal for users with accounting knowledge and professionals. Based on the international standard Debit and Credit system, the professional method par excellence.

Also includes Multi-currency accounting for managing foreign currency accounts and exchange rate differences.

- All applications are also available with VAT options. They include tables, columns, accounts, and features for VAT calculation and reporting.

- Extensions for Swiss VAT reports are included in the Advanced plan of Banana Accounting Plus, but can also be tested in the Free and Professional plans up to 70 transactions.

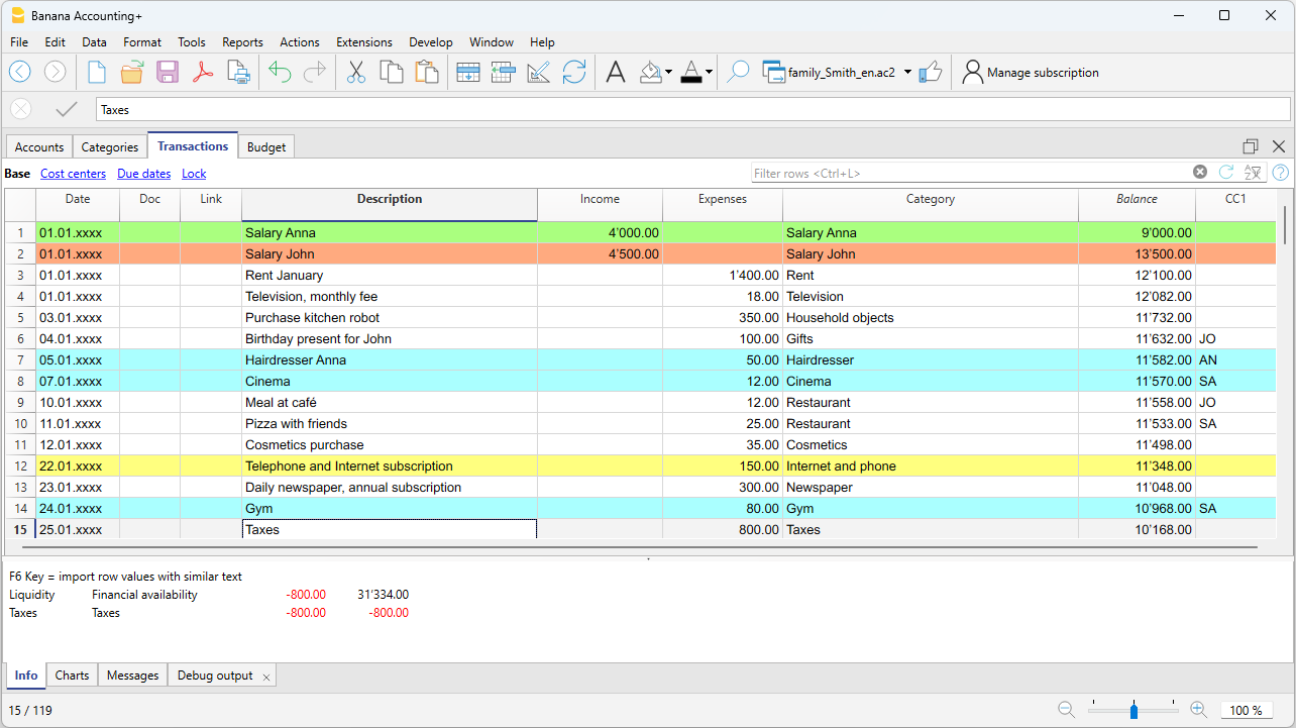

Income / Expense Accounting

The Income and Expense application allows you to record income and payments easily. It's perfect for small businesses, associations, or freelancers who want to keep track of income, expenses, and account balances even without specific accounting training.

In just a few steps, you can find out:

- how much you have earned or spent,

- view the balance of all income and expense categories,

- automatically generate clear and professional reports.

Banana Accounting Plus includes templates with pre-configured accounts and categories, so you can start recording right away. Data entry is very intuitive thanks to the clearly structured columns.

Cash Manager or Cash Book

The Cash Manager, also based on the Income and Expense accounting, offers management of cash account income and expenses or any other account.

It is simple, fast, intuitive, and usable by everyone:

- families who want to monitor expenses;

- teenagers and students learning to manage their savings and first expenses;

- businesses, freelancers, associations to manage liquidity.

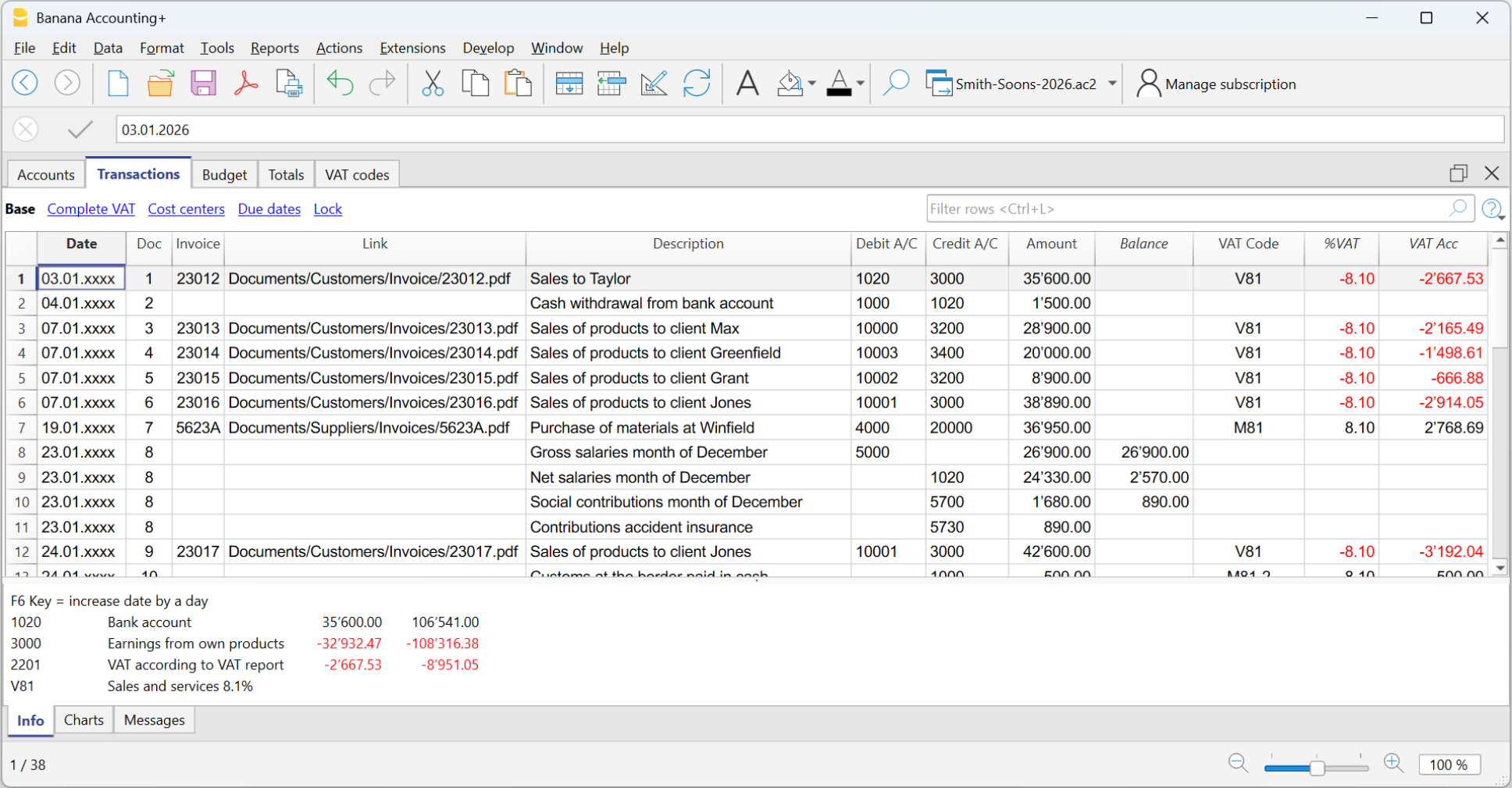

Double-entry Accounting

With the double-entry accounting application, Banana Accounting Plus lets you work with precision but with great simplicity, thanks to its familiar spreadsheet-style environment.

It is a complete and professional solution based on the international Debit and Credit accounting system.

Each transaction is recorded in two accounts — one in Debit and one in Credit — to ensure accounting balance.

It is ideal for businesses, accountants, fiduciaries, and expert users who want maximum accuracy and management control.

It provides a complete view of assets, costs, revenues, and business results, with accurate reports ready for tax filing.

Thanks to its powerful calculation engine, Banana Accounting Plus manages double-entry accounting in a very simple and complete way:

- updates all balances in real time after each transaction;

- automatically detects any imbalance between Debit and Credit;

- allows you to filter rows and modify them directly in the filtered table;

- allows importing bank transactions, saving recurring operations, and attaching digital documents;

- generates balance sheets, profit & loss statements, account ledgers, and journals with one click.

It ensures an up-to-date and consistent view of your business’s financial and economic situation.

Multi-currency Accounting

Multi-currency accounting is based on double-entry accounting and allows you to also manage accounts in different currencies. Easily handle multiple currencies and benefit from automatic calculations for exchange rate fluctuations.

Ideal for those who work abroad, or with foreign countries, and anyone who has financial operations involving multiple currencies; small and medium-sized businesses with international suppliers or customers, import and export companies, financial service firms, investors, travelers, and tourists to keep track of expenses while traveling.

Structure of the Accounting applications

The strength of Banana Accounting lies in its clear and organized structure. Each application is based on tables, with clearly defined columns, similar to a spreadsheet, but with built-in accounting features. This approach combines the simplicity of Excel with the accuracy of professional software.

The main tables are:

- Accounts – available in all accounting applications. Lists cash, bank, customer, supplier, and other accounts, with balances updated in real time.

- In the Cash Manager, the Accounts table handles only one account.

- Categories – available in Income and Expense accounting, including the Cash Manager. Divides income and expenses by type (sales, donations, salaries, expenses, etc.).

- Transactions table – available in all accounting applications. Daily operations are recorded or imported with date, description, and amount by account/category.

- VAT Codes - available in all accounting applications with VAT. Manages the VAT codes to apply in transactions for automatic calculations and reports.

- Exchange Rates – available only in double-entry multi-currency accounting templates. Manages exchange rates of foreign currencies in relation to the base currency (national currency).

After each transaction, Banana Accounting automatically updates all totals and generates professional reports: balance sheets, financial statements, journals, and account ledgers, always ready for printing or export.

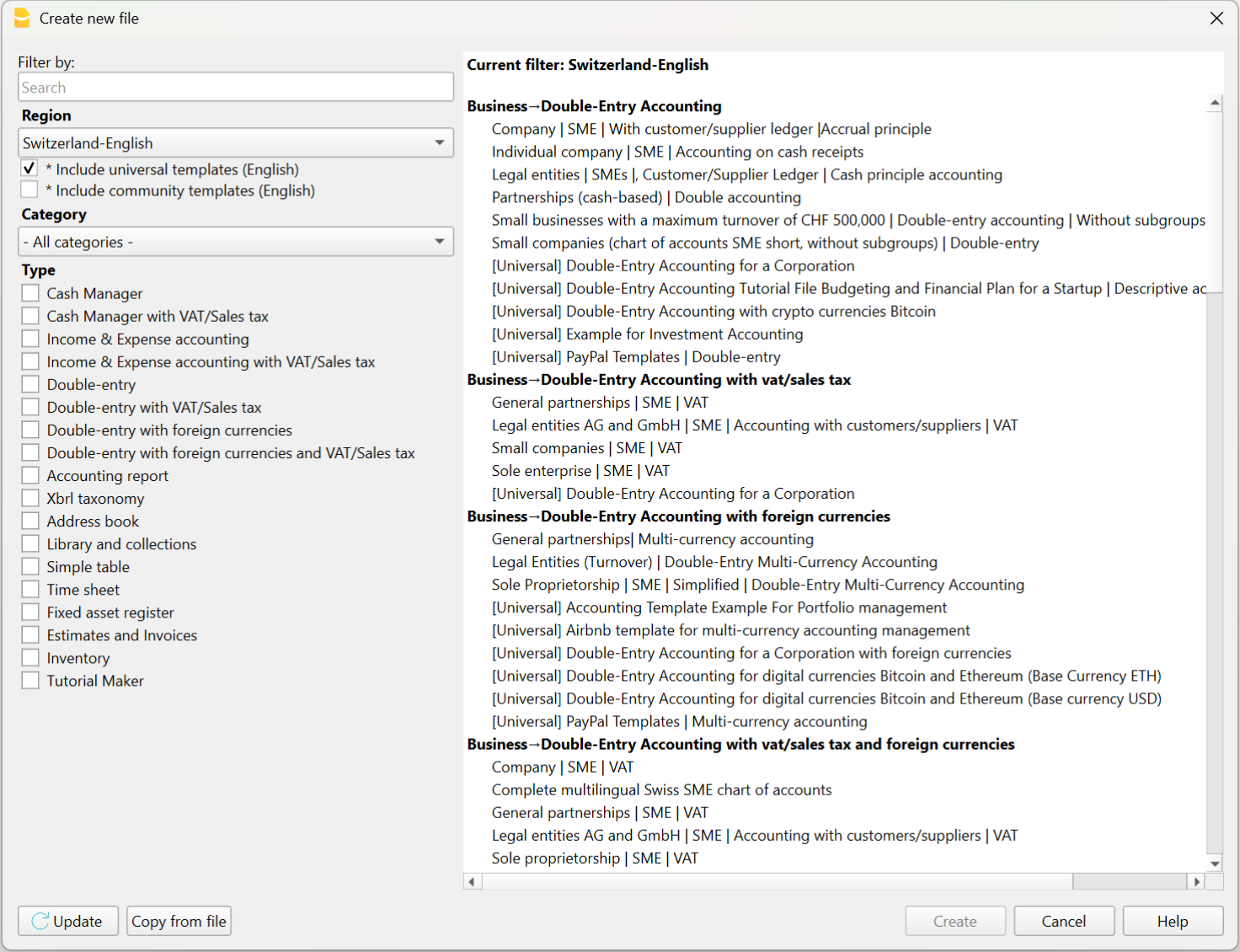

Predefined templates for each application

For each application, you will find ready-to-use templates with accounts, categories, and integrated features based on the selected accounting type.

Simply select the most suitable template to get professional reports and start working right away.

You can open them directly:

- from the program, via the File > New menu

- from our Template Store, by downloading them to your computer or opening them via the WebApp (directly in your browser – still in testing).

In just a few minutes, you can record your first transactions and get real-time updated reports.