In this article

In Banana Accounting, in the Charts of Accounts prepared for Switzerland, the VAT accounts and the VAT rates currently in force are already set. In particular, the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) is set both in the Chart of accounts and in the File properties (basic data) → VAT section. In this case no VAT account needs to be inserted in the VAT Codes Table.

In case you are not using the Charts of accounts already available in Banana, make sure that the necessary VAT accounts are present in your own Chart of accounts. Our advice is to use the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) and to enter it into the File properties (basic data) → VAT section.

In the VAT codes table, there are codes for the sales, the purchases and for services rendered. When entering the transactions, use the appropriate VAT code.

The software automatically splits the VAT amounts and records them in the "VAT according to VAT report" account or in the VAT account that has been indicated by the user in the File and Accounting properties.

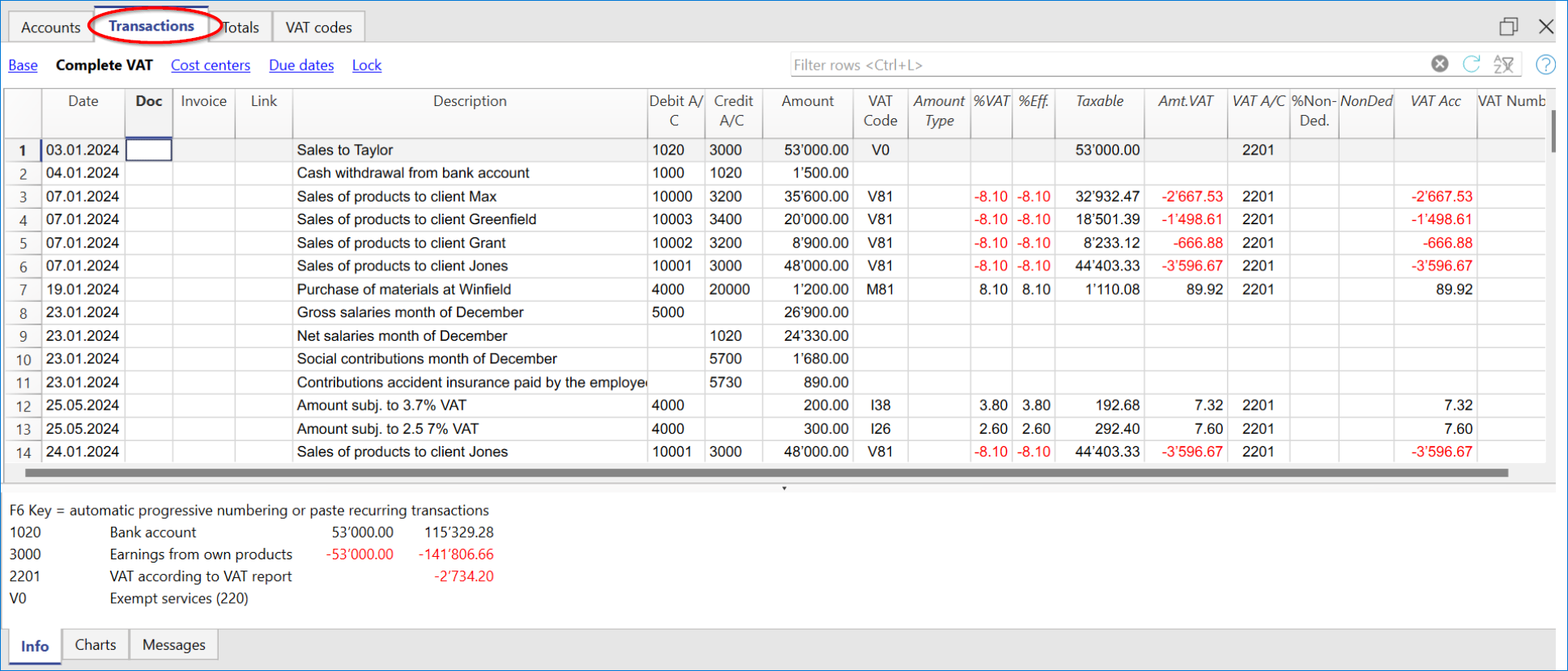

VAT columns in the Transactions table (Complete VAT view)

You can find the full explanation of the main Transactions table columns in the Columns and Views page.

In the Double-entry accounting with VAT or in the Income & Expense accounting with VAT, you will find the following VAT columns:

- VAT Code: for each transaction with VAT you need to enter one of the VAT codes from the VAT codes table. In Reverse Charge operations, two VAT codes can be used, separated by the symbol ":".

- VAT %: the program automatically enters the VAT percentage associated with the VAT code you entered. If the amount is preceded by a "+/-" sign, it is a Reverse Charge operation.

- VATExtraInfo: A code related to extra info about the VAT, to be used only in very exceptional cases.

It is possible to enter a symbol to identify specific VAT cases. The program suggests options, corresponding to the VAT Codes that start with a colon ":". - %Eff.: the program automatically enters the VAT percentage referred to the net amount (taxable amount). It is different from the percentage applied when the latter is calculated on the gross amount (balance rate).

- Taxable: once you enter the VAT code, the software automatically indicates the taxable amount (without VAT).

- VAT amount: the program automatically indicates the VAT amount.

- VAT A/C: the account where the VAT is registered is automatically indicated (for Switzerland, this is normally the 2201 "VAT according to VAT report" account) previously entered in the File Properties (basic data), VAT tab (from the File menu).

- Amount type: this is a code that indicates how the software considers the transaction amount:

- 0 (or empty cell) with VAT/sales tax, the transaction amount is VAT included.

- 1 = without VAT/Sales tax, the transaction amount is VAT excluded.

- 2 = VAT amount, the transaction amount is considered the VAT amount at 100%.

- Amount type not editable: Default mode.

- The column is protected.

- The program uses the associated value of the VAT Codes table.

- When you edit the value in the VAT Codes table and you recalculate the accounting, the program uses the new value associated with this VAT Code.

- Amount type editable: this option can be activated with the Add new functionalities command. The activation of the option cannot be undone.

- When you edit the VAT Code, the program uses the Amount type associated with this code.

- The value can be edited manually.

- When the accounting is being recalculated, the value indicated in the Transactions table is being maintained.

- Non. Ded. %: this indicates the non deductible %.

- The program uses the Non. Ded. % associated to a VAT Code that is present in the VAT Codes table.

- You can manually edit the value.

- VAT Acc.: this is the VAT amount registered in the VAT account.

It is calculated by the program according to the transaction amount, the Amount type and the non deductible percentage. - VAT number: this is the code or VAT number of your client/supplier.

When you enter a transaction with VAT, it is possible to enter the VAT number of your counterparty. If in the Accounts table, Address view, in your clients/suppliers register accounts, you enter their VAT number, this is automatically loaded in the Transactions table, in the VAT number column.