In this article

All the accounting applications in the Banana software include powerful and innovative Financial Planning tools based on the double entry method. You can easily display Balance Sheets, forecast Income statements, financial, liquidity and investment plans.

A vision of the future

When using the double entry accounting method, financial forecasts allow you to have a comprehensive vision of the future of the company. You can imagine what the situation will be before things happen, and you are offered the opportunity to take action in time. If you notice that the costs will be too high, you can examine measures to lower them. If you're made aware of a shortage of liquidity, you will have time to take steps to avoid it.

By using financial forecasts, you will add value to your business management.

- ▶ Video: How to start an Income & Expense accounting

- ▶ Video: How to start a Double-entry accounting

- ▶ Video: How to start a Multi-currency accounting

Financial forecasts within reach of everyone

The planning system based on the double-entry method is incredibly powerful and within everyone's reach.

- Planning is fully integrated into accounting.

- The identical Chart of Accounts as the one in your accounting is being used.

No need to set up a new file, just add the budget movements. - Forecasts are carried out with budget registrations.

The proven accounting method of double-entry accounting is used. Costs and revenues can be specified in detail. - Income statement and Balance Sheet forecasts are available.

You can see how sales, costs, profits, liquidity and the evolution of capital will evolve. - You can check the evolution of an account or a group with all the individual budget movements.

- The program prepares forecasts by month, quarter or year.

- Forecasts can be set up with quantities and calculation formulas.

When the forecast is changed, for example when an investment is increased, the year-end depreciation is automatically recalculated. - The financial plan prepared for one year can also be projected over several years.

- All accounting reports are available with the values of the past, present and future.

Below we focus on the method that uses the Budget table.

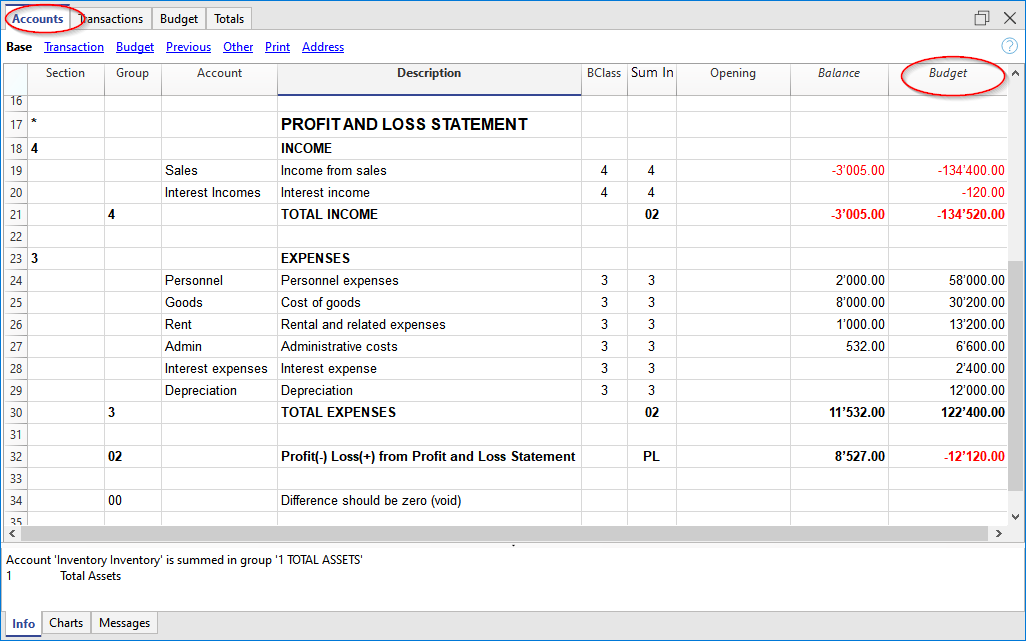

Instant display of the budget values

Financial planning, based on the double-entry method, uses the same Chart of Accounts as the accounting.

In the Accounts and Categories table (Income & Expense accounting) not only the current balances are displayed but also the budget balances.

You can freely set up the structure of the Balance Sheet and Income statement by adding accounts and groups.

You can also use cost and profit centers, segments, as well as accounts for customers and suppliers.

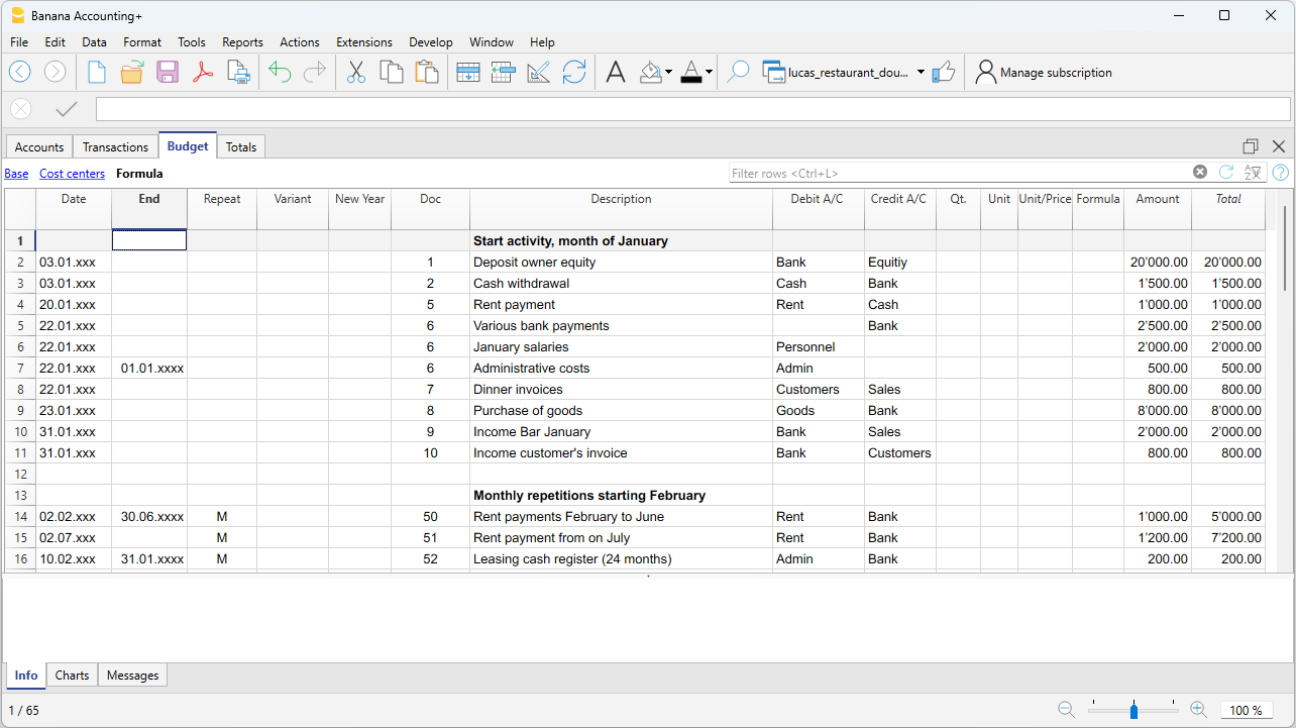

The Budget table

The planning is prepared by inserting transactions in the Budget table. This is like entering accounting records, but they concern the future.

The rent and other recurring transactions are indicated only once, setting the repeat option and any end date.

The sum for the year is indicated in the Total column.

You may add as many lines as you need, for the current year or for the following ones, carry out changes and modifications at any time.

A clear and comprehensive vision of the future

Banana Accounting provides you with all the necessary reports to have a comprehensive view of your financial future, the same that are used for your accounting, all integrated and balanced, without differences, just like for accounting. All is automatic, you don't need to waste time setting up tables in Excel, inserting and checking formulas, setting up rows and columns.

- Liquidity plan.

You can see how liquidity will evolve in the chosen planning period, know in advance if you will have the means to cope with the different commitments. - Forecast Income statement.

You can see what the revenues and costs and the expected result will be, select a summary view with the totals per group or even detailed with the values of the individual elements. The layout of the Income statement can be freely set and changed according to requirements. The program will do the totals automatically, without you having to enter formulas. - Forecast budget.

For each account and group of Assets and Liabilities you will see the evolution over time. - Investment plan.

For each account or group of Assets you can see the evolution over time in detail. - Detailed account cards.

You can analyze each item in detail, thanks to the account card, examine how the evolution of the bank account or liquidity is. - Graphs with evolution over time.

You can instantly see the future evolution of each item. With a single glance, you can check how sales will evolve or understand if there will be a liquidity crisis. - Cost and profit centers and segments.

You can also use cost centers, profit centers and segments when forecasting.

You can get detailed forecasts for individual projects, customers or geographical areas. - Projections over several years.

You can have the Balance Sheet and Income statement for one, two, five or even ten years.

The program automatically projects the data of the year for subsequent periods. - View data by month, quarter, year or multiple years.

You can have the Balance Sheet and the Income Statement for a month, quarter, semester, year or more years.

You can thus analyze in detail the period that interests you. - Compare the budget with the actual figures.

Using the same Chart of Accounts, the comparison between the forecast and the actual is immediate. You can easily identify deviations from the estimate. - Save the report settings (customizations).

Create reports and save the customizations to be recalled when you wish.

For each report you can select the layout that interests you. The program automatically adapts the prints without you having to set up rows, columns and formulas. You can analyze the data from different points of view, moving from one visualization type to another.

- View for a period.

The program presents you with reports for the year, but you can also request to have the forecast only for a quarter. You can easily switch between annual and multi-year planning. - Evolution over time.

The program is able to present all the reports with a breakdown by period. You can thus see the evolution over time of liquidity, Balance Sheet, sales, costs and operating result. You can easily switch between views without having to reset formulas or tables. - Fully customized reports.

You can select and change the view as you require. You can present your plans professionally and make a good impression on those who support you. - Save report setup.

You can create and save print settings and recall them when needed.

Simple use

Everything is already set up, you have to enter the forecast movements with simple transactions. This approach is particularly suitable for accountants, who are instantly are able to prepare precise and complete forecasts. Thanks to the Income and Expense accounting, even people without particular accounting skills can do it.

- Entry as for accounting records.

For each future financial event, a transaction with date, description and the accounts that are concerned is inserted.

It is the program that totals the amounts by item and period, just like in accounting. - Indication of income and expenses in detail.

The different items of expenditure can be indicated in detail and at the exact moment in which they will occur. For personnel expenses, the salaries of individual employees can be indicated. - Easier changes and updates.

Adapting, adding or removing revenues or expenses is simple, because you just change the specific detail. If in the following year the rent increases, just change this item. If there is a new expense, a new line is added. The program will automatically update the budget.

Fast thanks to repetitions

Repeating operations are entered only once. The forecast movement indicates the frequency with which the operation will repeat itself and the program takes it into account for the future.

In a planning, there are many operations that repeat themselves. Comprehensive planning can be set up in no time. The repetition function is particularly effective when you have to adapt the budget, change a single amount and in an instant everything is updated.

Automation of calculations

The program automatically performs simple or complex calculations.

- Calculation based on quantities and prices.

Sales quantities can be memorized to have a more concrete vision of the budget. The program automatically calculates the amount of the movement and updates the accounting. - Calculation formula (Javascript).

The possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

Banana Accounting Plus provides an extremely powerful formula system, specially designed for financial planning. You have access to the budget data, so you can create movements that depend on previous events. You can calculate the depreciation based on the value of the investments made or calculate the interest on the loan based on actual use. The program after each modification will recalculate the exact values.

Formulas are expressions of the Javascript language, simple or complex schedules can be created, fully automated.- You can assign values to variables and recall them on subsequent lines.

- Javascript expressions have access to the Banana API.

- You can also program your own Javascript functions and call them up.

Automatic projections over several years

You can set the budget for one year and let the program create projections for the following years.

All reports such as liquidity plan, income statement and forecast balance sheet will also be available for subsequent years.

This way, a medium and long-term view of the financial situation are made available. The projection can be completely controlled for the following years as well. The operating logic is simple, for the operations of the year that will repeat themselves in the consecutive years, an annual repetition code is inserted. This way the program is able to project the planning data for the period in question. Schedules for two, five or even more years can easily be made.

Customer portfolio analysis and supplier control

When entering forecast movements, customer codes can be indicated. In this way, you can build realistic planning starting from your customer portfolio and understand if the costs will be covered and which customers will be more profitable.

Obviously, the same analyzes can be done for suppliers.

Planning of projects or sectors

You can also create financial plans with reports by projects, activities or by business sectors. It is sufficient to indicate in the movements that an expense or income is relevant to a project or department and the program is able to automatically prepare specific reports.

Easy adaptation

You can adapt the structure of the Chart of accounts and the layout of the Balance Sheet and Income statement; add accounts, categories and and groups, and reports change automatically, without having to set up formulas to calculate row or column totals.

Comparison between the estimate and actual data

Accounting and budget use the same calculation and report preparation engine. In the transactions table, enter the values referring to the past and in the estimate, those of the future. The Chart of Accounts and the arrangement of the balance are always the same and comparisons and indications about any changes compared to the budget are automatically displayed.

Automatic data transfer to a new year

The budgets set up with Banana Accounting are easy to update and modify. Just change the relative movements and the program automatically recalculates the formulas and updates the budget.

When you create a new year, the program reports the budget data, changing the dates. It is then a question of modifying the elements that will change compared to the previous year. This provides detailed and perfect planning for the following year.

Corporate financial simulation

Integrated planning in accounting is very powerful and opens a new era in business planning, as it offers the possibility to simulate the series of future events with great precision and in detail. Forecasts can be analyzed in detail with the same tools used for accounting analyzes; check what is the break-even point and analyze the situation of customers or projects.

Learning accounting with planning

By preparing the budget with transactions similar to accounting, one practices and learns the accounting technique. Accounting training courses can be made much more interesting and effective, because students can be offered the task of creating their own company and ensure to make it become solid and profitable. Students will not only have to practice entering transactions, but they will have to keep an eye on the activity and get used to reading the Balance Sheet and the Income statement.