In this article

Cash movements can be managed separately from the main accounting file via the Cash Manager. On a regular basis, the movements are imported into the main accounting file, grouping them according to a chosen period.

In this case you have two separate files:

- One file contains all the general accounting data (including the cash account).

- A file contains only the cash register data.

In order to integrate the cash data into the main accounting, a link must be established between the main accounting and the Cash Manager file.

There are two different ways to create the link:

- In the Cash Manager file, give the categories the same numbers as the accounts of the main accounting (double-entry accounting or Income / Expense).

- Enter the corresponding accounts of the main accounting file in the Category2 column (Categories table).

If the Category2 column is not present, it must be displayed via Data → Columns setup.

Set up the internal transfer account

When importing the cash data into the accounting file, certain settings are required so that there are no overlaps of accounting entries for payment operations between the cash account of the main accounting and the transactions imported from the Cash Manager file.

In the Main accounting file:

- In the Accounts table, enter the Internal transfer account.

In the Cash Manager file:

- In the Categories table, Categories column in the Revenue group, enter the internal transfer account (the same number set in the main accounting) as a category for payments from the bank or postal current account.

- Alternatively, in the Categories table, Categories2 column in the Revenue group, enter the internal transfer account. In this case, a category is set in the Categories column to determine payments from the bank. The internal transfer account, located in the Categories2 column, creates the link when you import the transactions into the main ledger.

Payments from the bank account to cash account

Whenever a payment is made from the bank account to the cash desk, the movement is recorded both in the main accounting file and in the cash register file. To avoid overlapping of accounting entries when importing data from the cash desk, the internal transfer account account is used

- The receipt of funds is recorded in the cash register file, using the tour account as category or alternatively the category for payments from the bank account, if the tour account has been set in the Category2 column.

- The outflow of funds is recorded in the main accounting file, with the bank account in credit and the internal transfer account in debit.

When importing the cash register data into the main accounting file, the tour account is reset.

Import the cash register data

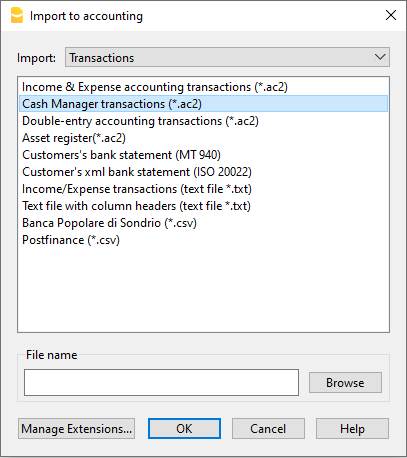

- Open the main accounting file

- Click Action→ Import to accounting

- In the window that appears, from the drop-down menu Import → select Transactions → Cash book movements (* .ac2) "

- Using the Browse button, select the Cash Manager file.

The explanations of this window are available at the page Import to accounting.

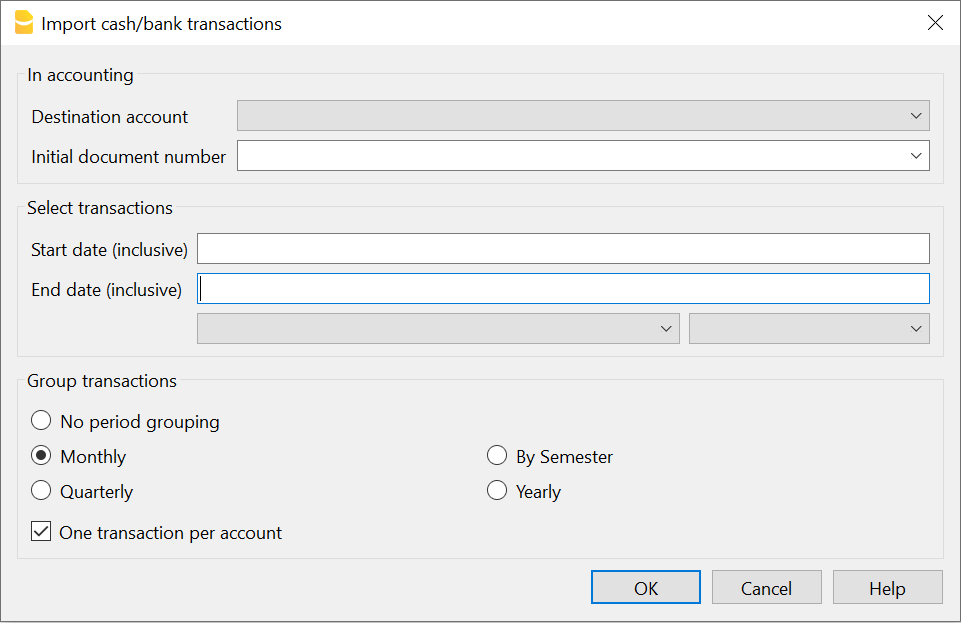

In accounting

Destination account

You must select the cash account number, present in Double-entry accounting or Income / Expense accounting, where the movements are to be imported.

Initial document number

An initial document number can be entered which will be attributed to the first imported transaction. In subsequent recordings, the program automatically assigns a progressive number, starting from the initial one entered.

If you do not wish to assign progressive numbering automatically, leave the box empty.

Select movements

Start date / End date (inclusive)

Enter the start and end date of the period to which the imported transactions refer.

Group transactions

By activating one of the options it is possible to choose how the movements of the period should be grouped:

- No period groupingAll rows are imported with their column contents. The Doc number present in the corresponding column of the cash register file is also imported.

- If you want to use a different numbering in the accounting and simultaneously keep the original document of the file, in the Cash Manager insert the document in the DocProtocol column.

- Monthly - groups the transactions by month.

- Quarterly - groups movements by quarter.

- Semi-annual - groups the movements by semester.

- Annual - groups the transactions by year.

One registration per account

If several categories are grouped into a single account in the accounting, but separate transactions are desired for each category, this box must be activated; the program creates recordings for each category. When using VAT codes, postings are created not only by category, but also by different VAT codes for the same category.

Note

When you have an accounting with VAT, the VAT calculations may be slightly different. If the transaction amounts are entered net, the cash account balance may also differ due to rounding differences.

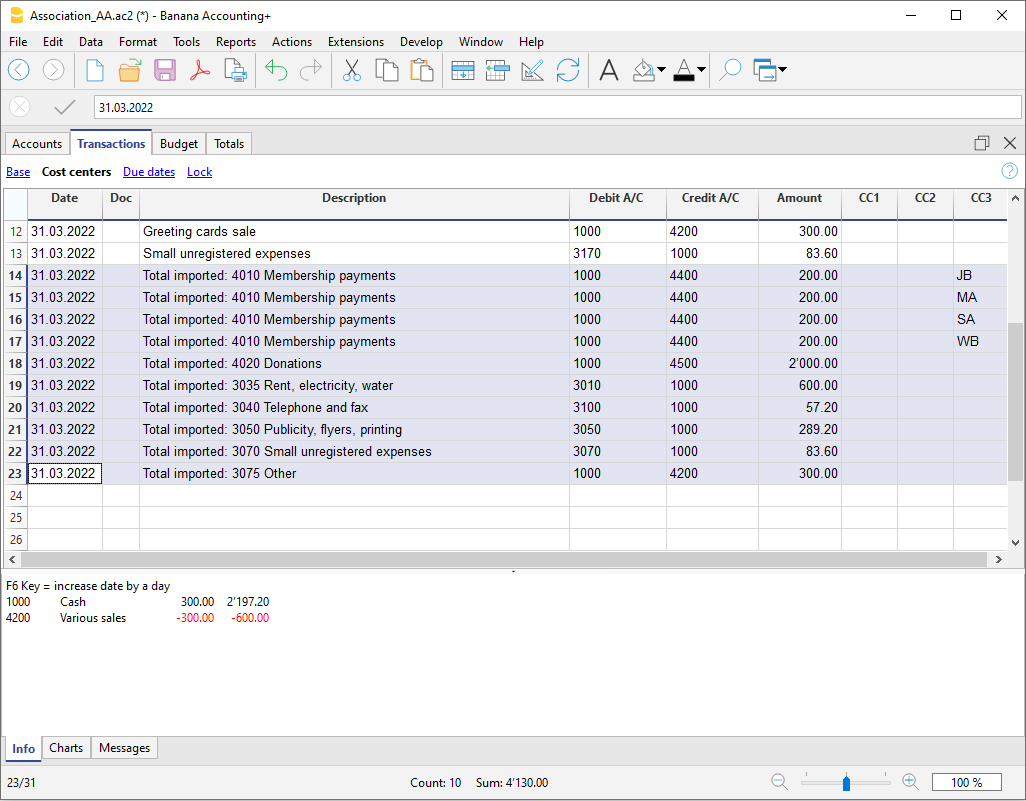

The accounting file is updated with the cash register data.