In this article

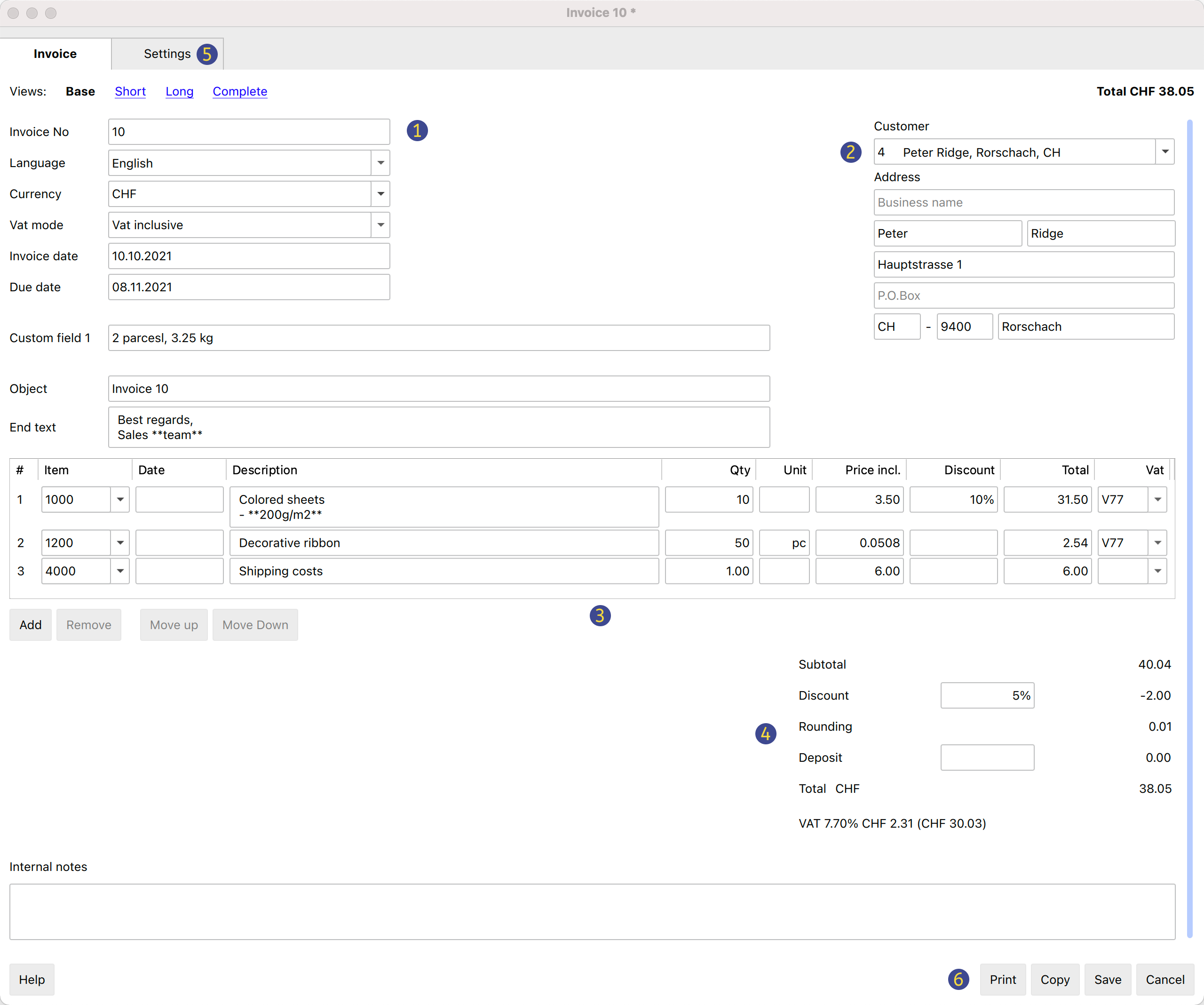

Here is how the invoice dialog window appears. Below, we explain its individual elements.

Views

These are shown at the top.

They define which data entry fields are visible and which are hidden.

By switching between the different views, you can switch between more general and more detailed views.

The following views are available:

- Base

- Shows the most frequently used fields.

- Can be adjusted to one's needs.

- Short

- Focuses on the Item table.

- Can be adjusted to one's needs.

- Long

- Complete view with all fields.

- Can be adjusted to one's needs.

- Complete

- Complete view with all fields.

- Cannot be adjusted.

Via the Settings section, for the Base, Short and Long views, it is possible to define which fields to make visible and which ones to hide.

Structure

(1) Information and Free Texts

This section allows you to enter information regarding the invoice and define free texts to be included in the printout.

- Invoice number

- The invoice number is entered.

- The number is taken and inserted automatically by the programme in the Id column of the Invoices table.

- It can be included in the invoice printout.

- Language

- The language in which the invoice is to be printed is entered.

- If defined, the customer language set in the Contacts table is taken over and inserted.

- Currency

- The currency in which to print the invoice is entered.

- You can indicate the abbreviation (CHF, EUR, USD, etc.) that will be printed on the invoice.

- The programme does not make exchanges and conversions to other currencies.

- VAT mode

- Select the VAT mode.

- If the VAT mode is changed, the programme modifies the amounts already entered, so that the same invoice can be printed with gross and net amounts.

- Without VAT

No VAT is applied. - VAT excluded

Amounts are net. - VAT included

Amounts are considered gross.

- Without VAT

- The total VAT amount may vary by a few cents compared to the calculation performed directly on the VAT taxable total. The reason for this is that the VAT total is calculated by adding up the (rounded) VAT amount of each individual item. This difference is not to be considered an error, but a feature of the calculation of invoice amounts.

- Invoice date

- The invoice date is entered.

- The date is taken and inserted automatically by the programme in the Date column of the Invoices table.

- It can be included in the invoice printout.

- Due date

- The payment due date is entered automatically by the programme for all invoices.

- It can be entered manually for each invoice.

- It can be included in the invoice printout.

- Order number

- It's optional.

- The order date is entered.

- It can be included in the invoice printout.

- Order date

- It's optional.

- The order date is entered.

- It can be included in the invoice printout.

- Invoice custom fields

- It requires the Advanced Plan.

- They are optional.

- Additional information fields can be defined and added to the invoice (maximum 8 fields) where customised texts can be entered.

- The value/content is entered. In the Settings section, you define the names/texts of the fields.

- They can be included in the invoice printout using the CH10 and UNI11 layouts. In the print settings of the layouts, under Print → Information . Custom fields must be activated.

- Invoice title

- It's optional.

- The text of the invoice subject is entered.

- The text is taken over and inserted automatically by the programme in the Description column of the Invoices table.

- The text is included in the invoice printout as title/object. It takes priority over any title entered in the settings of the invoice layout.

- Begin text

- It's optional.

- You enter the initial text to be included in the invoice printout, immediately after the title/object.

- The text may be entered on several lines.

- You can put the text in bold, including the part of the text between double asterisks **.

Example: **text1 text2** text3 = text1 text2 text3.

- End text

- It's optional.

- You enter the final notes to be included in the invoice printout, immediately below the details table.

- The text is taken over and inserted automatically by the programme in the Notes column of the Invoices table.

- The text may be entered on several lines.

- You can put the text in bold, including the part of the text between double asterisks **.

Example: **text1 text2** text3 = text1 text2 text3.

(2) Customer address

This section allows you to enter the invoice address. You have two possibilities:

- Retrieve the data from the Contacts table.

- Select a customer from the list.

- You can also search directly for an address by entering the first name, surname, company, email or tax number.

- When you select a contact, the various address fields are automatically completed by the programme.

- Enter the data manually.

- Complete each element of the address field by field.

The address fields are as follows:

- Business name

- Enter business name.

- Prefix

- Enter customer's prefix.

- First Name

- Enter the first name.

- Last name

- Enter the last name.

- Address street

- Enter the street.

- Address extra

- If necessary, enter extra address.

- Post Box

- Enter Post Box

- Country code

- Enter country code.

- ZIP

- Enter ZIP.

- Locality

- Enter locality.

- Email

- Enter email.

- Phone

- Enter phone number

(3) Items / Items' Columns

This section allows line by line entry of all invoice details.

It is a table with the following columns:

- Item

- Optional.

- Using the Items table, an item can be selected from the list. In this way, the fields in the subsequent columns (Description, Quantity, Unit, Unit Price) are automatically completed by the programme.

- You can also search for an article by typing part of the descriptive text.

- Item date

- Requires the Advanced Plan.

- Optional.

- A date is entered for each item, useful for example to indicate the date of execution of the invoiced work.

- Description

- The description of the item or object of the invoice is entered.

- The text of the description may be on several lines.

- You can put the text in bold, including the part of the text between double asterisks **.

Example: **text1 text2** text3 = text1 text2 text3.

- Quantity

- It is mandatory.

- The quantity is entered.

- To create, for example, a credit note or a discount, enter the quantity with a negative sign (the total amount for the row will be negative). See also Create a Credit Note.

- Unit

- Optional.

- The text related to the unit (pcs, hours, etc.) is entered.

- Unit price

- It is mandatory.

- The price of the individual unit is entered.

- Discount

- Requires the Advanced Plan.

- Optional.

- A discount is indicated for each item.

The discount is calculated on the unit price (Unit Price column), and can be indicated:- As an amount. The amount of the discount is entered directly.

Example: Quantity 2; Unit price 10.00; Discount 1.00; Total = 18.00

If the Discount is same or greater than the Unit price the Total will be set to 0. - As a percentage. A percentage is entered (e.g. 10%).

Example: Quantity 2; Unit price 10.00; Discount 10%; Total = 18.00

If the Discount is same or greater than 100% the Total will be set to 0.

- As an amount. The amount of the discount is entered directly.

- Totals

- The totals are calculated and entered automatically by the program.

- VAT

- Optional.

- The VAT code to be used defined in the VAT Codes table is entered.

(4) Discounts and totals

This section allows any discounts to be entered and shows the invoice totals.

The programme automatically calculates the following

- Subtotal

- The sum of all amounts in the Total details column is shown.

- Discount

- It's optional

- You enter the discount to be applied to the invoice total by entering a description and the percentage or amount.

- If a percentage is entered, the programme automatically calculates and displays the discount based on the percentage value entered.

- Rounding

- Rounding is indicated.

- Deposit

- It's optional

- The deposit already paid by the customer is entered, indicating the description and amount.

- Total

- The final total of the invoice is shown.

- The total is also shown in the top right-hand corner of the dialogue to speed up invoice verification.

- VAT

- The totals of the VAT amounts are shown.

(5) Settings

The settings of the Invoice Dialogue.

For more information, please refer to the Invoice settings dialogue page.

(6) Commands

- Print

- Command to print an invoice.

- Copy

- Command to copy an invoice.

- Save

- Command to save changes.

- Close

- Command to end the dialogue.

- Cancel

- Command to delete changes and close the dialogue without saving.

- Help

- Command linking to online documentation where information on invoice dialogue can be found.

Customisation

The invoice dialog is programmed through a BananaPlus extension, and is updated independently of the application. The version provided is generic and covers most of the needs.

For contexts where invoices are complex, or many invoices are created, you can adapt the dialog to make creating invoices easier, more functional, and faster.