In this article

The Actions > Create New Year command prepares a file for the new year based on the accounting file that is about to be closed. The command does not modify the current file, so it can be executed without any effect.

Transition logic to the new year

With Banana Accounting, you have a separate file for each year. When the new year begins, the operational logic is as follows:

- With the Actions > Create New Year command, the program creates a new file for the following year using the same chart of accounts, settings, and balances of the current year that is being closed.

- Once the file for the new year is created, you must save it with a new name.

- The operation of creating the new file can be repeated if you decide not to save the file.

- It is possible to work on both files simultaneously:

- In the new file, the entries for the new year will be recorded. You can also make changes to the chart of accounts, VAT, or other items without affecting the previous one.

- In the previous year's file, you will continue to enter transactions to complete the year and carry out the typical closing operations, such as verifying balances, printing financial statements, etc.

- In the file for the new year, using the Actions > Update Opening Balances command, the changes made in the previous year's file are imported. This operation should be performed at the latest when there are no more changes in the previous year.

Note: Users with a subscription to the Professional plan of Banana Accounting Plus will see the following message at the bottom after creating the new year file: Active subscription: Professional Plan. Advanced plan features are available up to 70 transactions.

Check and close the previous year's accounting

Before updating the opening balances, to avoid discrepancies between closing and opening balances for the next year, it is important to ensure that all checks, verifications, and closing accounting entries have been completed.

In Banana Accounting Plus, in the Advanced plan, there is a Filter feature that is especially useful during closing to quickly search for rows with the same texts or values, based on the key entered for the filter (word, account, amount, etc.). With this function, you can make corrections directly on the filtered rows without having to scroll through the Transactions table—very convenient especially at year-end when the number of entries is high.

For more details, refer to the following pages:

- Filter (paragraph Filter rows)

- Check and close double-entry accounting

- Closing and exchange rates for multi-currency accounting

Specific information for setting closing rates and recording unrealized exchange gains and losses.

Operations performed by the Create New Year command

The Create New Year command, based on the parameters set by the user, automatically performs the following operations:

- Creates a new file (unnamed) with the same chart of accounts and settings as the open file, without transactions.

- Copies the data from the Balance column of the current file and inserts them into the Opening column of the new file (only for the specified classes).

- Adds the previous year's profit or loss to the opening balance of the account(s) specified for allocation (usually the Retained Earnings account).

- Copies for all Balance Sheet accounts the data from the Balance column of the current file and inserts them into the Previous Year column of the new file.

- Updates file properties:

- Sets the start and end dates of the fiscal year, adding one year to the existing ones.

- In the Options section, sets the name of the previous year’s file and enables the option to use previous year’s transactions for autocomplete.

- In multi-currency accounting, it sets the opening exchange rates to match the closing exchange rates of the previous year.

- If there is data in the Budget table, it carries forward the transactions to the new year according to the settings.

- If the Segments option is enabled, it creates opening entries for the segments.

Carry forward new balances dialog

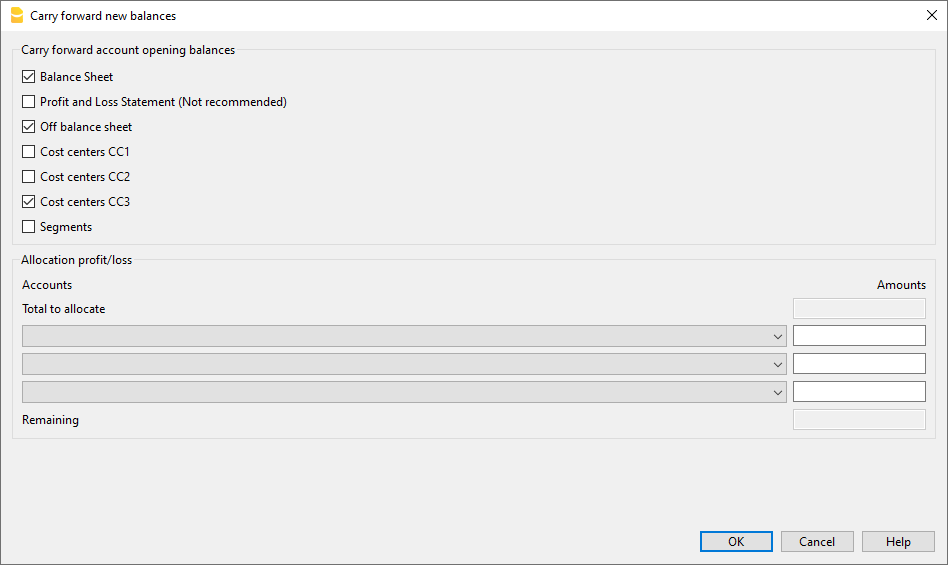

The Carry forward new balances dialog allows you to specify parameters for creating the new year's file:

Carry forward opening balances of accounts

The opening balances of the activated items are carried forward:

Balance Sheet

Transfers balances of asset, liability, and equity accounts. This option should generally be activated.

Income Statement (not recommended)

Cost and revenue account balances should NOT be carried forward to the new year.

Activate this option only in special cases and only if you are sure of the implications.

Off-Balance Sheet

Transfers accounts with BClass (5 and 6 for off-balance asset and liability accounts and 7 - 10 for other off-balance accounts). If the closing balances should not be carried forward, deactivate the relevant option.

Cost Centers

Activate only if cost centers are used to manage positions that must continue over time, such as customers, suppliers, and members.

Cost Center CC1

Those starting with a dot ".".

Cost Center CC2

Those starting with a comma ",".

Cost Center CC3

Those starting with a semicolon ";".

For more information see the page Cost/Profit Centers.

Segments

The opening balances of segments are created with opening entries in the Transactions table.

- For more information see the page Segments.

- The program creates one entry for each combination of account and segment, reproducing exactly the final situation of the previous year.

- It is preferable not to enter segment opening balances using the Opening column. If this was done in the previous year, the program will again transfer the balance into the Opening column of the new year.

Note: adjusting operations such as recording and closing transitional accounts must be entered manually.

Allocation of profit/loss

When carrying forward the opening balances into the new year, the amounts indicated are added to the profit carryforward accounts.

Total to be allocated

The program automatically shows the amount of profit or loss to be allocated.

Accounts

Select the account or accounts (up to three) in which the result of the financial year should be allocated. If there are more than three destination accounts, you must manually enter the amount in the appropriate fields.

If only one account is indicated, the amount will be automatically entered in the selected account from the list.

The program automatically updates the opening balances. The total assets exactly match the total liabilities.

Allocation of the financial result to more than three accounts

In this case, automatically allocate the result only to the Retained Earnings account and continue with the creation of the new year.

In the new year (new file), in the Transactions table, perform a multiple entry to transfer the result from the Retained Earnings account to the desired accounts.

Postpone the allocation of the financial result

If you do not want to allocate the financial result yet, you can still proceed with the creation of the new year by clicking the OK button. You can later allocate the result from the Actions > Update Opening Balances menu. The program will display the same window as the Create New Year command.

Save the new file

The program creates a new accounting file for the new year:

- Confirm the Basic data of the new year. The program takes the headers from the previous year and automatically enters the start and end date of the new year.

- Click on the File menu > Save As, indicating the folder where you want to store the new accounting file. It is recommended to use the company name and year as the filename.

See also Organize your accounting files.

If there are differences or other error messages, you may choose not to save the created file and repeat the new year file creation later.

Professional Plan message with Advanced features up to 70 rows

The message that appears in the active Professional Plan, Active Plan: Professional Plan. Advanced features are available up to 70 rows, simply confirms that the Advanced plan features are also active and can be used free of charge for up to 70 transactions, without affecting the use of the Professional plan, where entries can continue without any limit. This message disappears automatically once 70 rows are exceeded.

Update opening balances

After saving the file for the new year and making modifications in the previous year, click on the Actions > Update Opening Balances menu to carry forward and reallocate the profit.

This operation can be repeated multiple times and can be performed safely, as data integrity during the transition to the new year is guaranteed and no data is lost.

If you want to switch to another type of accounting in the new year (with multi-currency or VAT), proceed with the creation of the new file and then use the Tools > Convert to New File command.

If instead you want to create a copy of the file without carrying forward the balances, use the Tools > Create File Copy command.

Modify carried forward balances

Once the balances have been carried forward into the new year (new file), if you need to modify the opening balances, you can manually change the amounts in the following columns:

- Opening column in the Accounts table.

- Previous column ( Accounts table > Previous view) , for balances related to the previous year.

- In the Transactions table for Segments.

If you have made changes in the previous year's file, click on the Actions > Update Opening Balances menu to carry forward and update the opening balances again.

Check the Rules in the Recurring Transactions table

When the Create New Year command is executed, the program carries over into the new year's file all the transactions that have Rules.

Before proceeding to post the transactions for the new year, it is advisable to check and update all the Transactions with Rules in the Recurring Transactions table.

If the conditions are no longer valid, you may:

- Modify the account, counterpart, VAT code, CC3, or segments.

- Delete outdated transactions.

- Add new transactions with Rules.

If, in the Recurring Transactions table, in addition to the transactions with rules, you have also saved:

you must also check and update these.

Performing this check immediately helps prevent errors and later corrections both in the Transactions table and in the Recurring Transactions table.

Resuming texts in the new year / Smart Fill

When a new year is created, the descriptive texts from the previous year are also transferred. This feature simplifies and speeds up the entry of transactions in the new year.

If you do not want the descriptive texts to be carried over automatically, simply disable the Smart Fill function:

- from the menu File > File and accounting properties > Options.