In this article

In integrated invoicing, invoices are created and recorded in the same file. As for cash-based accounting, invoices must be recorded at the time of payment.

In managing cash-based invoicing, it is necessary to set up the customer subaccount in the Accounts table using the Profit Center CC3.

- All customer accounts must have complete information (first name, last name or company name, address), because when creating the invoice, the program uses this data for the invoice header.

It is possible to create and record invoices with or without VAT.

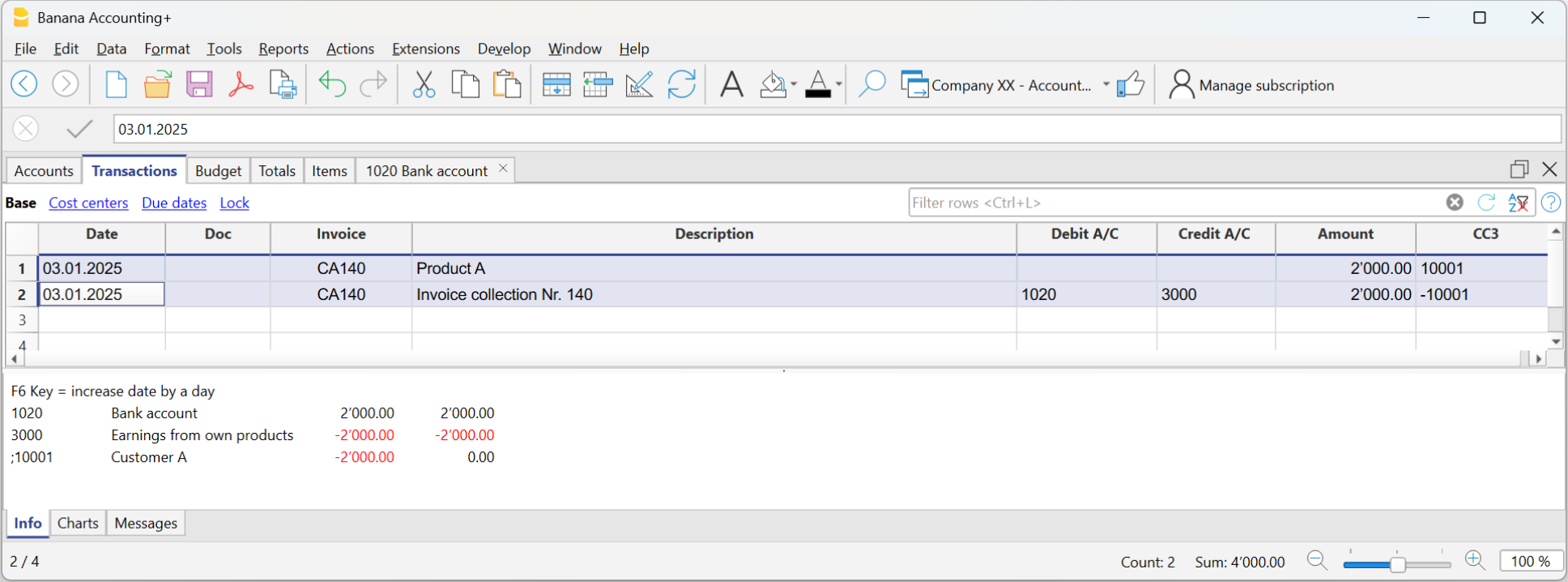

Cash-based Invoice

In the cash-based system, the invoice is created to be sent to the customer, but the accounting entry is made later when payment is received.

Therefore, to create the invoice, the items to be invoiced are recorded using the customer’s CC3 profit center:

- In the Date and Doc. columns, enter the date and any document number.

- In the Invoice column, enter the invoice number.

It is important that the invoice number complies with certain requirements: see how to correctly create the invoice number. - In the Description column, enter the items to be invoiced that should appear on the customer’s invoice.

- The Debit and Credit columns must remain empty because the accounting entry is made when the customer's payment is received.

- In the Amount column, enter the gross amount.

- In the CC3 column, enter the customer's CC3 profit center account.

It is important that the customer number complies with certain requirements: see how to correctly create the customer number.

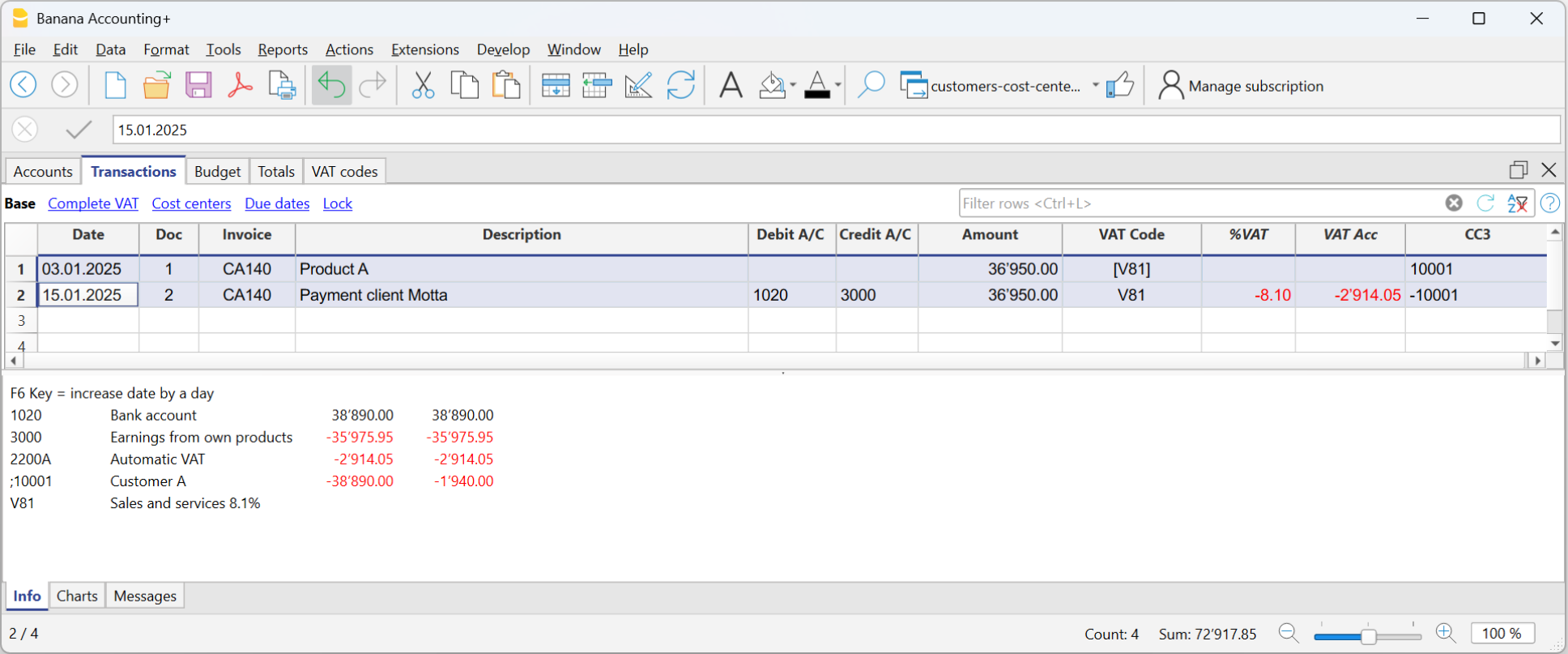

Cash-based Invoice and Effective VAT Method

The Banana Accounting VAT management procedure requires that the VAT code is always entered on the line where the income is recorded.

Income is recorded only when the invoice is actually paid. Therefore, in cash-based VAT management, the VAT code is entered only when the invoice is paid.

Invoice data is entered in the Transactions table. Enter a new transaction row for each new invoice.

- Enter the transaction date

- The invoice number

It is important that the invoice number complies with certain requirements: see how to correctly create the invoice number. - The description text (products, services, consulting...) that will appear on the customer’s invoice

- The Debit account must remain empty

- The Credit account must remain empty

- Enter the gross amount

- In cases subject to VAT, enter the sales VAT code in square brackets (e.g. "[V81]").

The VAT code entered in square brackets allows the VAT amount to be displayed on the invoice, without its accounting entry, which will occur when the payment is recorded. - In the CC3 column, enter the customer’s profit center account (CC3). It is important that the customer number complies with certain requirements: see how to correctly create the customer number.