In this article

In contrast to Double-entry bookkeeping, Multi-currency Accounting has the Exchange rate table and columns for calculating foreign currency amounts and balances.

Grouping of the Accounts table

For the Accounts and Groups grouping system, please refer to the Grouping System page.

Setting the basic currency

The base currency is set from the menu File > Accounting properties

Account Currency

Each account has a currency abbreviation, which may be that of the base currency or a foreign currency abbreviation, indicated in the exchange rate table.

Assets and liabilities accounts can be set up in different foreign currencies in addition to the base currency (in the example EUR).

- Foreign Currency Accounts

Accounts in foreign currencies are set up in the Accounts table. In the Currency column , for each foreign currency account the currency code must be entered.

In the Exchange rate table, for each foreign currency, the abbreviations of the foreign currencies, set in the Accounts table, and the opening exchange rate must be entered.

In the example below, the base currency is EUR. The abbreviation of the base currency EUR appears in the column headings with the amounts in base currency.

- Accounts in base currency (accounting currency)

Accounts in base currency are set up in the Accounts table. In the Currency column, the abbreviation of the base currency must be entered.

Income and Expense accounts, other than in basic currency (EUR in the example), can also be set in different currencies.

Explanation of multi-currency accounting columns

Currency

Enter the symbol of the account currency. For foreign currency accounts, the symbol must also be present in the exchange rate table.

Opening currency

The initial balance is entered for each account, whether it is a basic or foreign currency account

Opening balance (basic currency)

- A protected column calculated by the program.

- The initial balance in basic currency is calculated by the program.

- For basic currency accounts, the opening balance in the Opening currency column is reported.

- For foreign currency accounts, the balance is converted according to the exchange rate in the exchange rate table.

Balance currency

- Protected column used by the program.

- The balance is calculated by the programme and corresponds to the sum of the opening balance (for accounts in foreign currency, this is the balance converted into the base currency) and the amounts of the transactions in base currency and in foreign currency (amounts converted according to an exchange rate, which can be found in the exchange rate table).

Balance

- Protected column used by the program.

- The balance is calculated by the program and corresponds to the sum of the opening balance (for accounts in foreign currency it is the balance converted into basic currency) and the amounts of the transactions in basic currency and in foreign currency (amounts converted according to an exchange rate present in the exchange rate table).

Calculated balance

- Protected column used by the program.

- This is the currency balance of the account converted at the current exchange rate (exchange rate from the exchange table of the undated row).

- In this column, the currency account balances converted to basic currency may differ from those in the Balance column, as exchange rate differences are present.

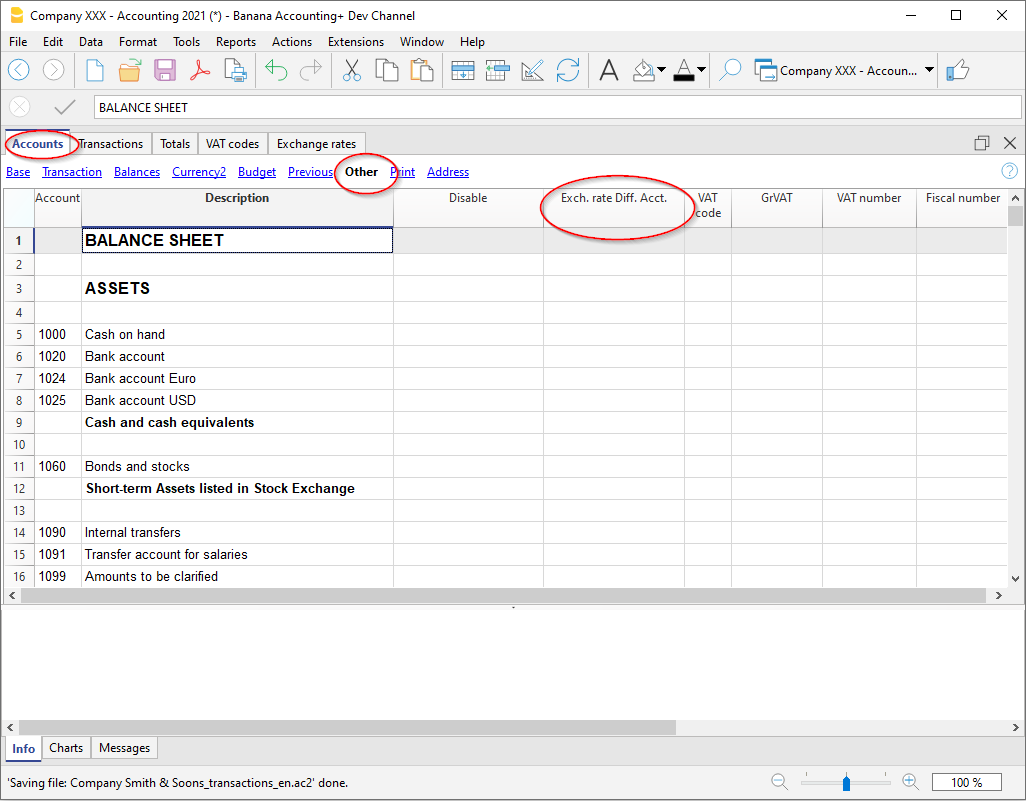

Exchange rate difference account

- Visible in the Other view.

- In this column, you can enter an exchange rate profit or loss account for a given account.

The account you enter will be used by the Create Exchange Rate Difference procedure instead of the exchange rate profit and loss accounts defined in the multi-currency file properties. - In the Exchange Rate Difference Account column you can specify:

- "0;0" This means that no exchange rate difference is to be calculated for this account.

It is used for historical exchange rates, which must not change. - Two accounts separated by semicolons, "Currency Exchange loss account; Currency Exchange rate profit", e.g. "6949;6999".

If there is a loss the first account will be used, if there is a profit the second. - "One account only" for example "6949".

This account will always be used whether there is an exchange rate profit or loss.

- "0;0" This means that no exchange rate difference is to be calculated for this account.

Opening balances

Information on how to enter opening balances in multi-currency accounting is available on the Opening balances page in multi-currency accounting.

Exchange Profit and Loss Accounts

In the chart of accounts, it is necessary to insert the predefined accounts for the exchange gain and loss to be reported in the File menu File properties → Foreign currency.

Accounts for exchange rate differences must have BClass 3 (Costs - Exchange Loss) or 4 (Revenue - Exchange Profit).

Revaluation accounts and historical exchange rates

Exchange rates are fluctuating. The actual value of the balance in the account currency varies therefore depending on the foreign exchange fluctuation.

The basic currency amount of an account is being calculated using the opening exchange rate and the exchange rates that are indicated in the transactions. Because this value corresponds to equivalent of today's exchange rate, it is necessary to revaluate the account.

The revaluation takes place by calculating the exchange rate differences. With the automatic calculation of exchange differences, the software enters an amount in basic currency (exchange difference) so that the balance in basic currency is equal to the counter value (calculated balance column).

There are accounts (related to investments, for example) for which a so-called historic exchange rate is being used. By an historical exchange rate, we mean an exchange rate that doesn't vary over time.

There are two ways to have currencies that do not vary:

- Create an additional currency code in the exchange rate table (e.g. USD2) to which the same exchange rate will always be attributed.

- In the currency description, indicate that this is a historical exchange rate.

- This currency must then be used for the account with the historical exchange rate and of course also in the entries for the account.

- For each new account with a different historical exchange rate, create a new currency symbol.

You can create as many currency symbols as you need for different accounts with historical exchange rates. - Change the exchange rate of the historical account if there are additional purchases or sales that require an adjustment of the value, while creating a transaction for the exchange rate profit or loss.

- Entering opening balances as Opening transactions.

- Instead of using the opening balances column, the opening balances are entered as transactions. You can assign the opening exchange rate you want.

- In the Account exchange difference column enter the value "0;0" indicating that the account should not be revalued.

Group totals in foreign currency

Normally, the columns with amounts in foreign currency don't have totals, as it makes little sense to calculate totals for values in a different currency.

If you have a group that includes only accounts in a specific currency, the currency symbol can be indicated at a group level and, in the Accounts table, the program totals these amounts. If there were to be accounts with various currency symbols, there would be no amount indicated (the program would not report an error either).