Switzerland: Templates and Extensions

Our templates are included for free in the Banana Accounting Plus program.

Templates compliant with Swiss tax regulations

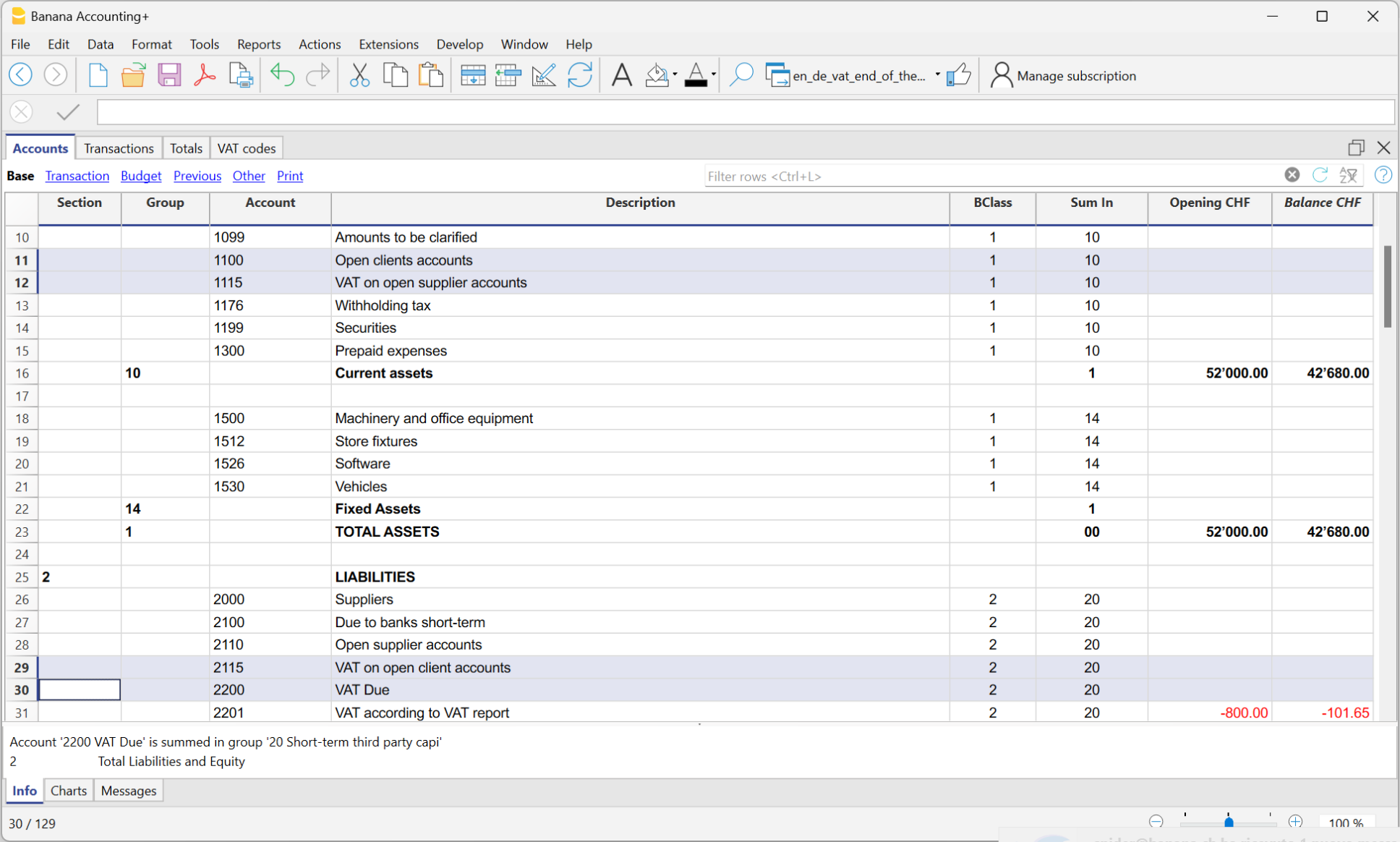

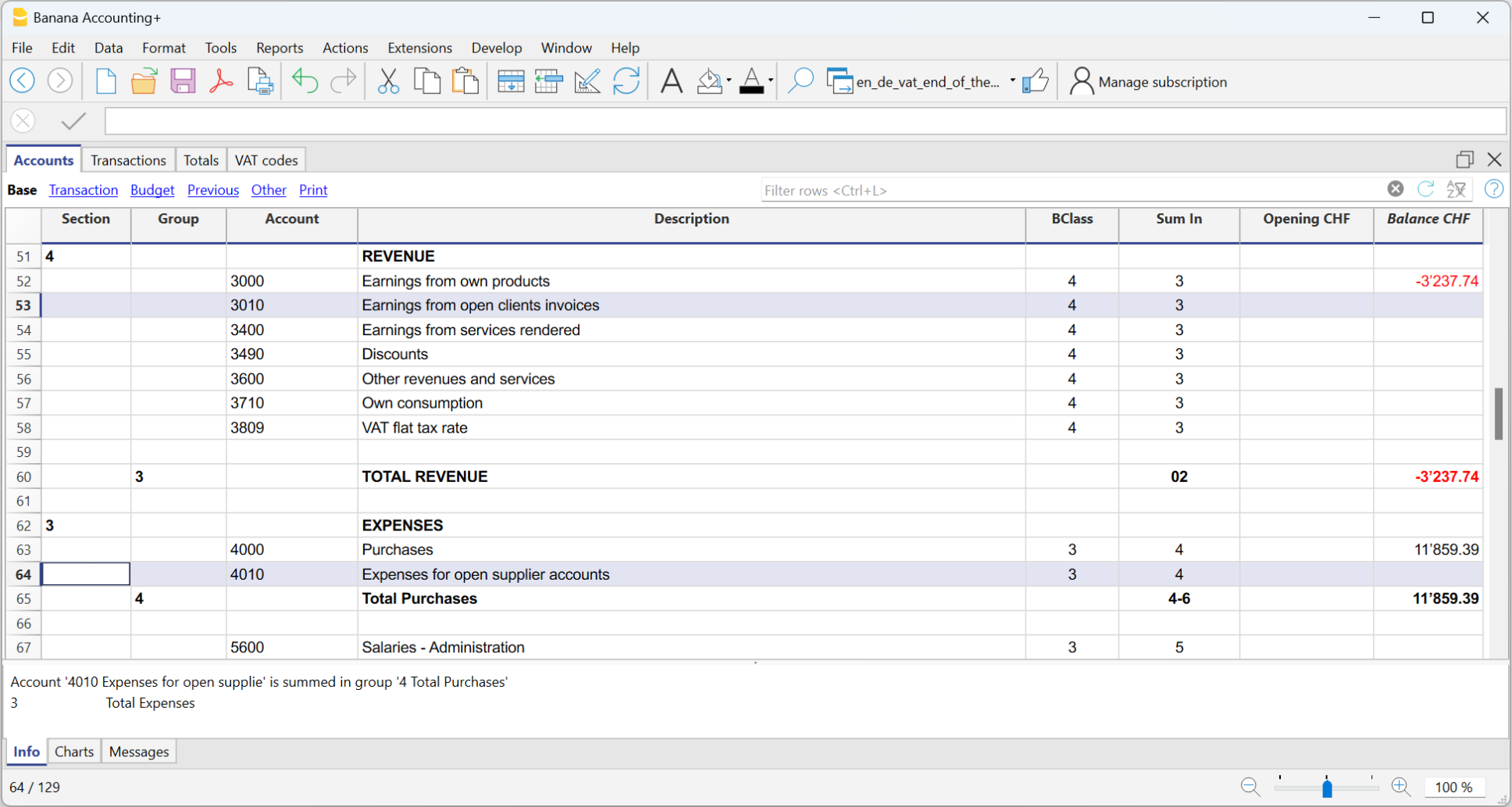

The chart of accounts in the Banana Accounting Plus templates, based on the Swiss SME system (Swiss SME accounting system - Sterchi, Mattle, Helbing), and compliant with the Code of Obligations (Articles 957-963b CO), strictly adhere to tax numbering and classification. They are constantly updated to ensure full compliance with any legislative changes.

If you need to customize the chart of accounts, you can easily add new accounts. Check our page dedicated to the complete SME Chart of Accounts, which includes all the accounts and groups provided by the Swiss SME accounting system, ensuring perfect integration.

Customizable chart of accounts

All charts of accounts are highly customizable and can always be adapted to the growth and changes of your company. If your needs change over the years, you can seamlessly switch from one type of accounting to another, with your existing data, by simply converting your file automatically.

Templates for every need

The program includes templates categorized by country, language, legal form, and type of business or company. With VAT or without VAT. With foreign currencies or just in the base currency. There are various types available to suit your accounting knowledge: from simple income and expense-based accounting to double-entry bookkeeping.

Quick and easy start

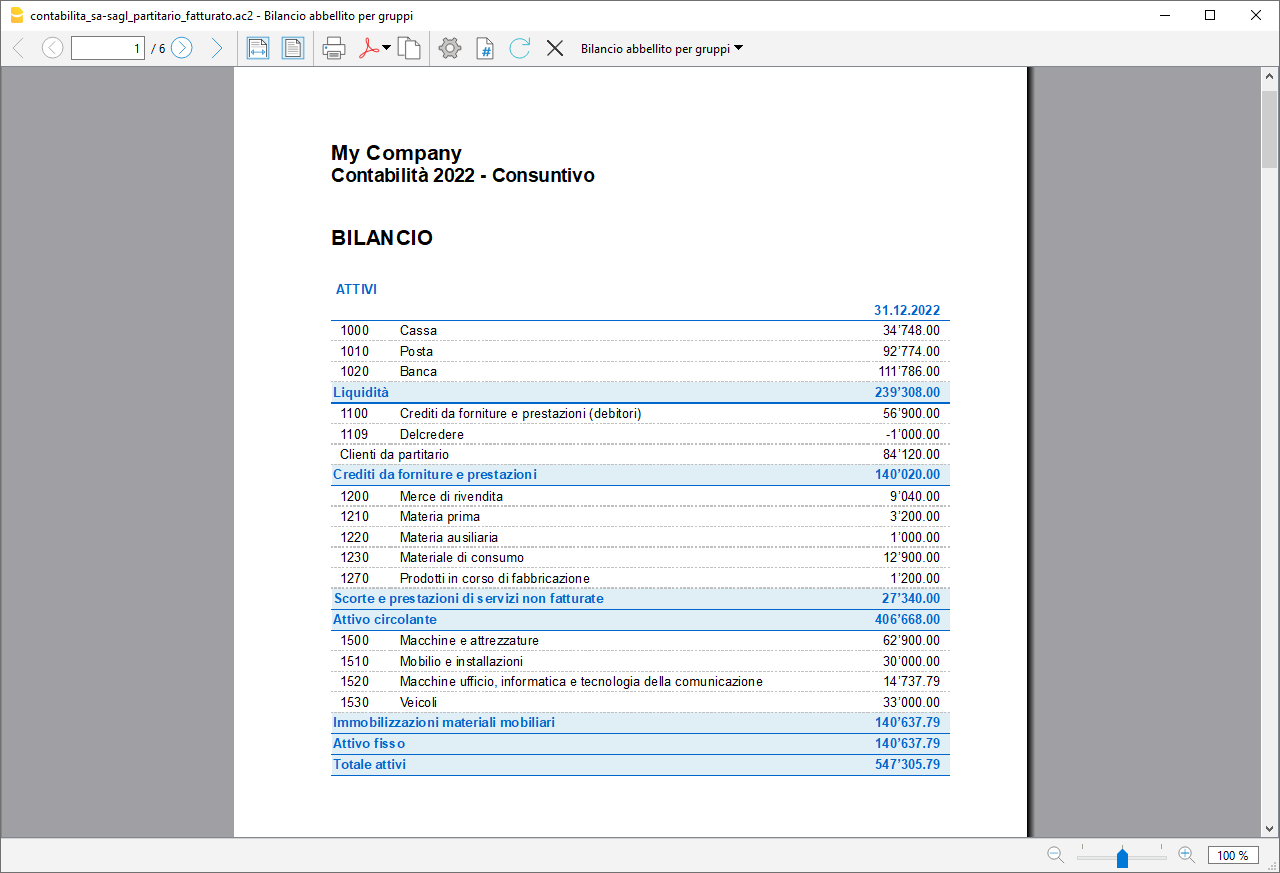

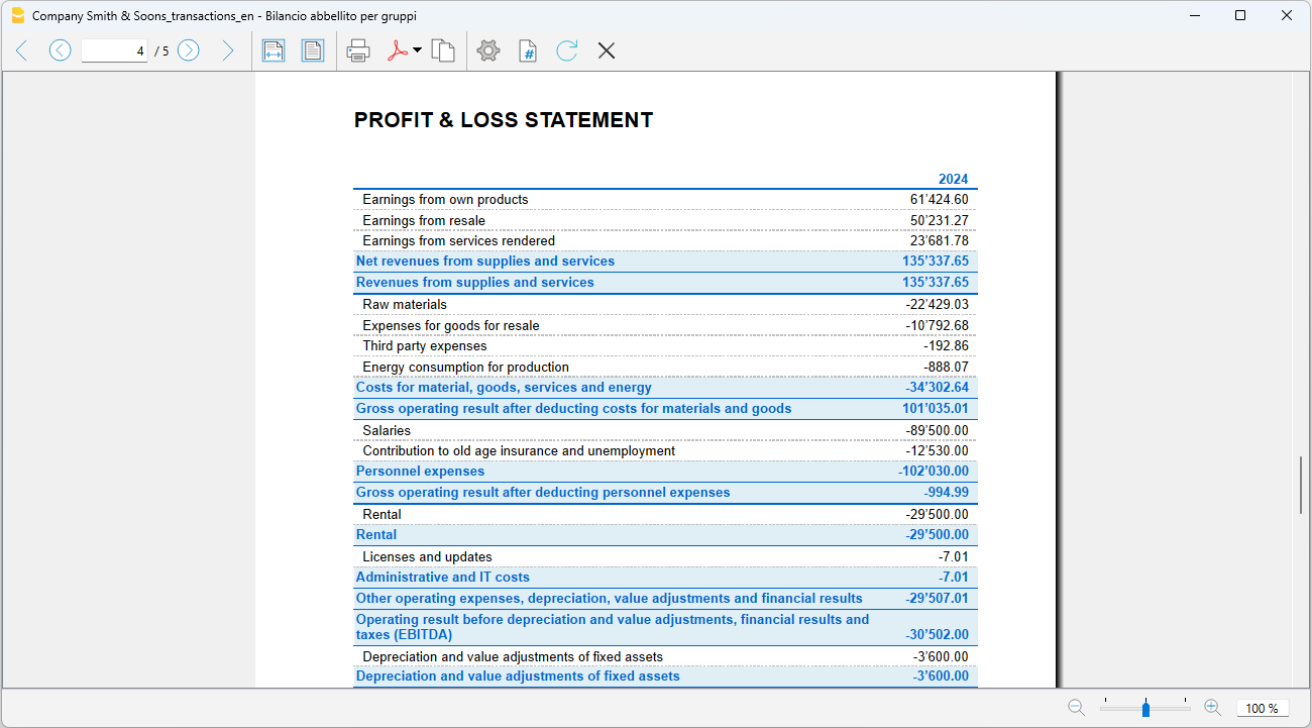

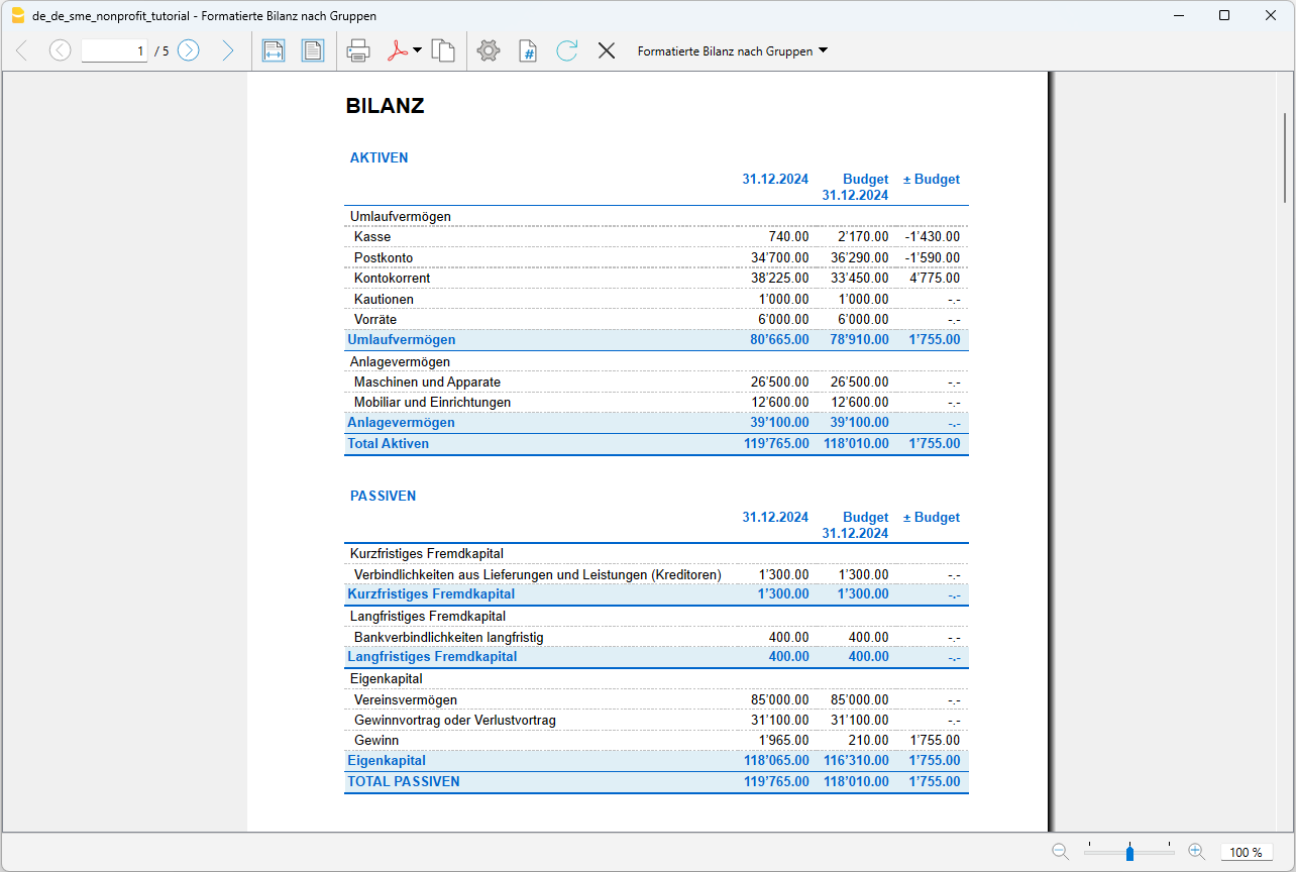

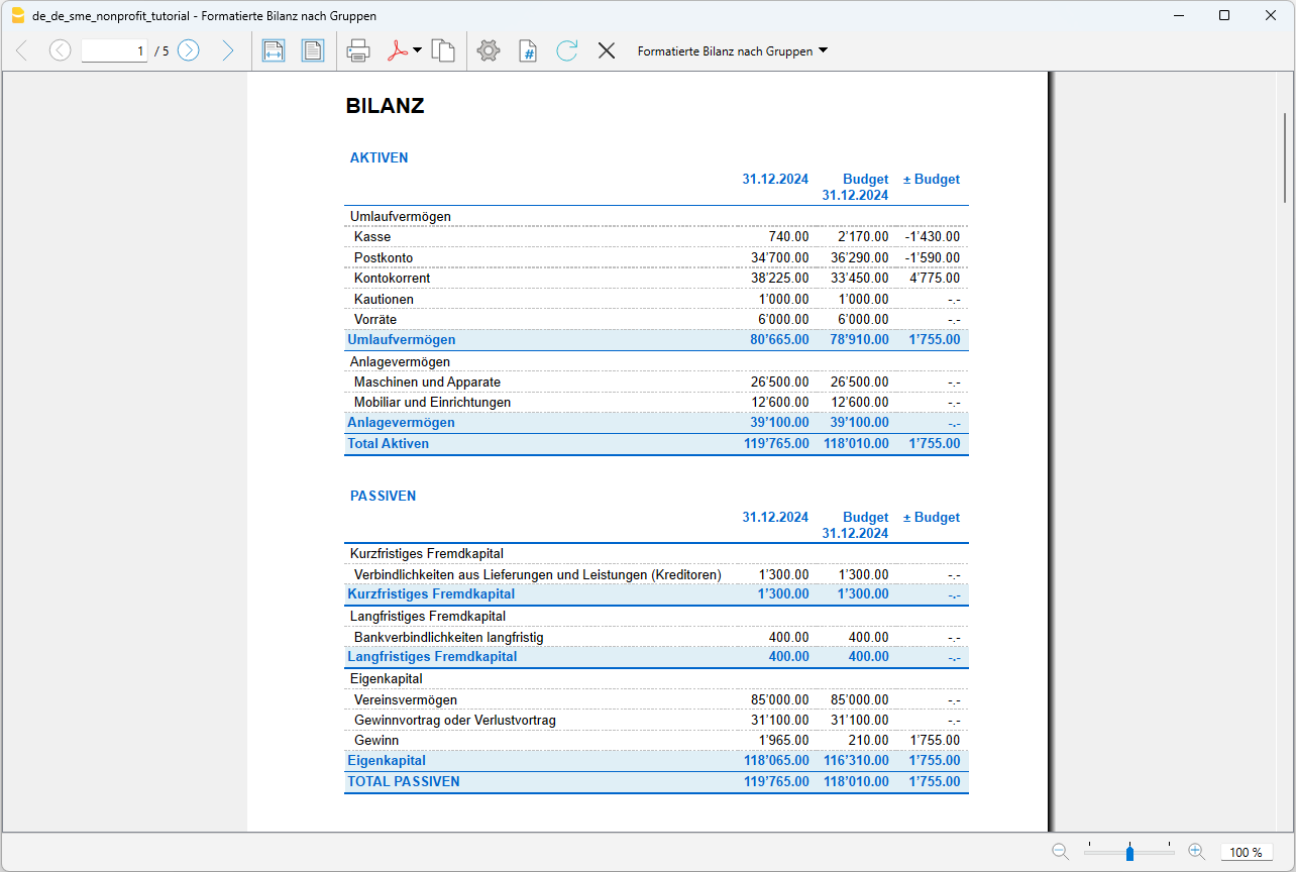

Our well-structured and comprehensive chart of accounts, with precise classifications, allows you to generate detailed reports such as the Balance Sheet and Income Statement. Thanks to their clarity and coding, you can start recording transactions immediately.

Automated functions

The program includes many automation features that allow you to work quickly and securely. From recalling saved entries to importing bank data, calculating VAT and currency exchanges in foreign currency accounting, to preparing balance sheets and other reports.

The Advanced plan of Banana Accounting Plus includes important additional automation features that allow you to work even more efficiently, such as the temporary Filter and Sort rows functions, Rules, the VAT Form facsimile and the XML file for electronically submitting data to the AFC, the creation of attachments in a single PDF file, and much more.

Security and precision

Many automatic verification and control functions alert you to errors and discrepancies. You can always make corrections and be confident of having perfect accounting.

There are models to manage cash inflows and outflows, as well as models for managing income and expenses across multiple accounts:

- Models with accrual method and cash method management

You can choose models with accrual method management, where the accounts receivable are set up with a list of customers and suppliers linked to the balance sheet. Alternatively, you can opt for a cash method management, where the accounts receivable are set up as cost centers (CC3).

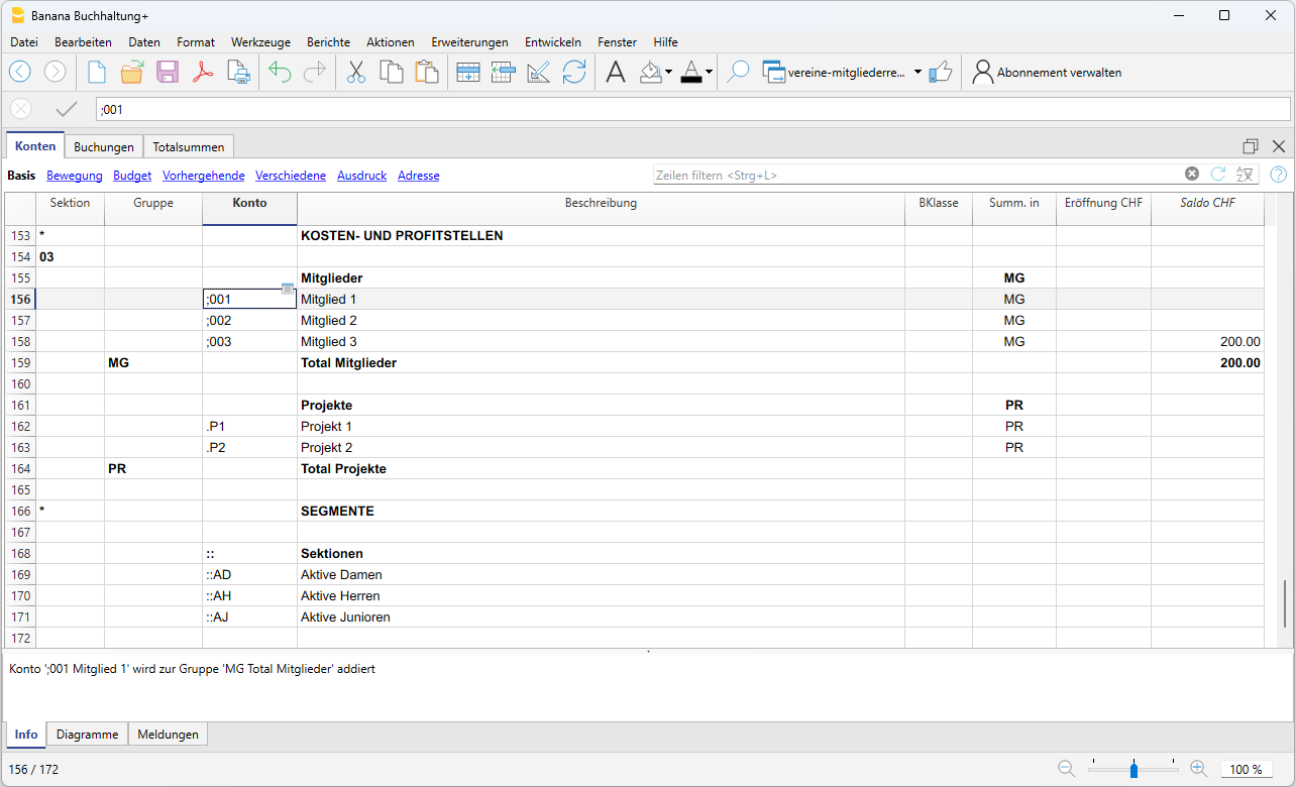

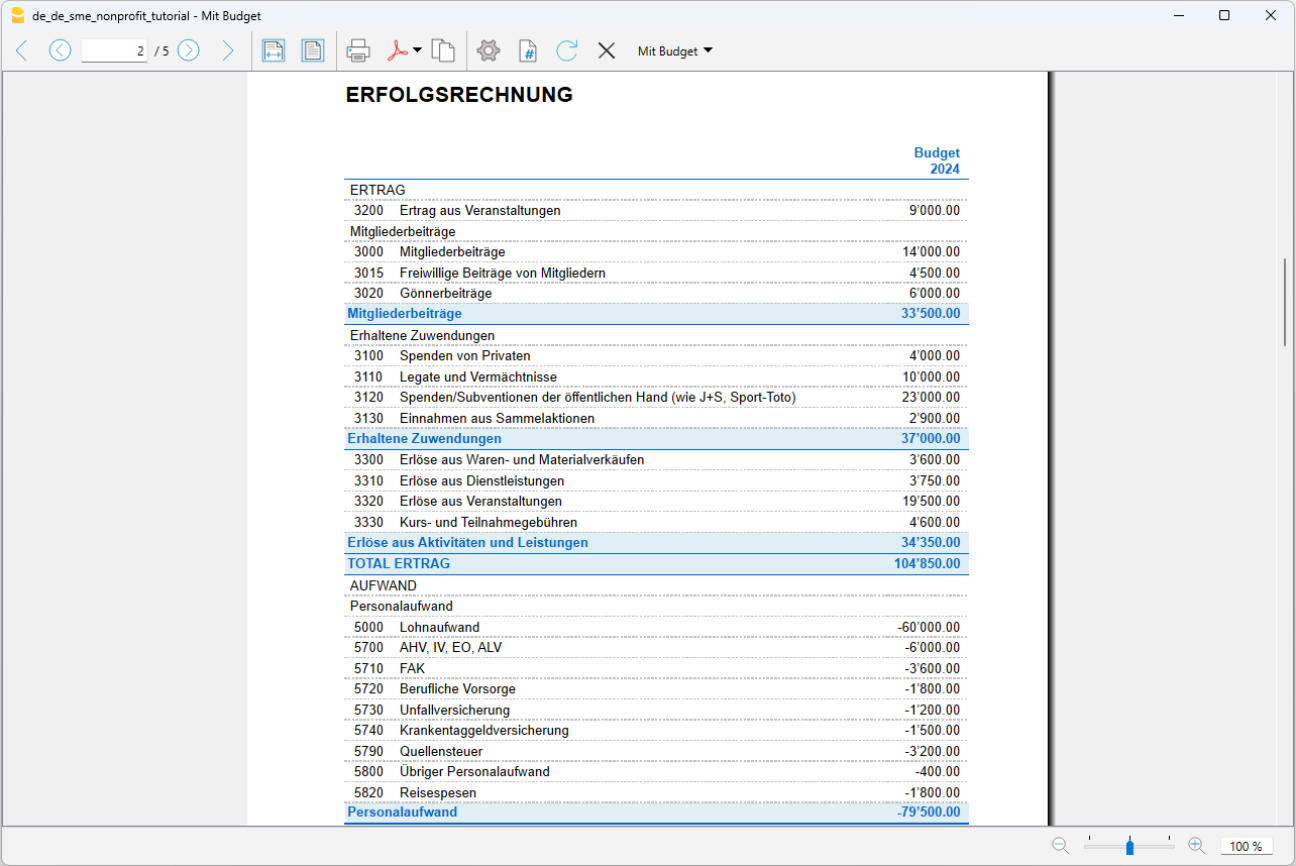

- Models for Non-Profit Organizations

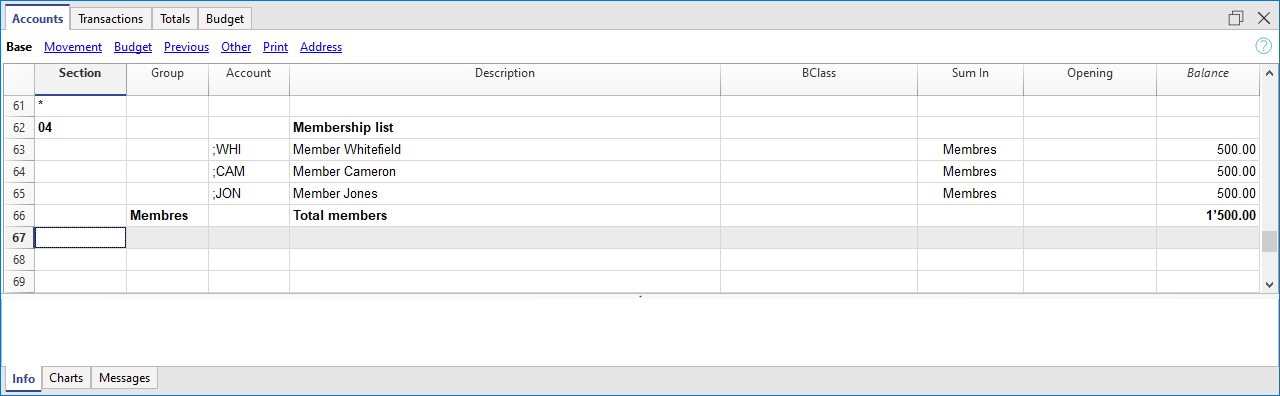

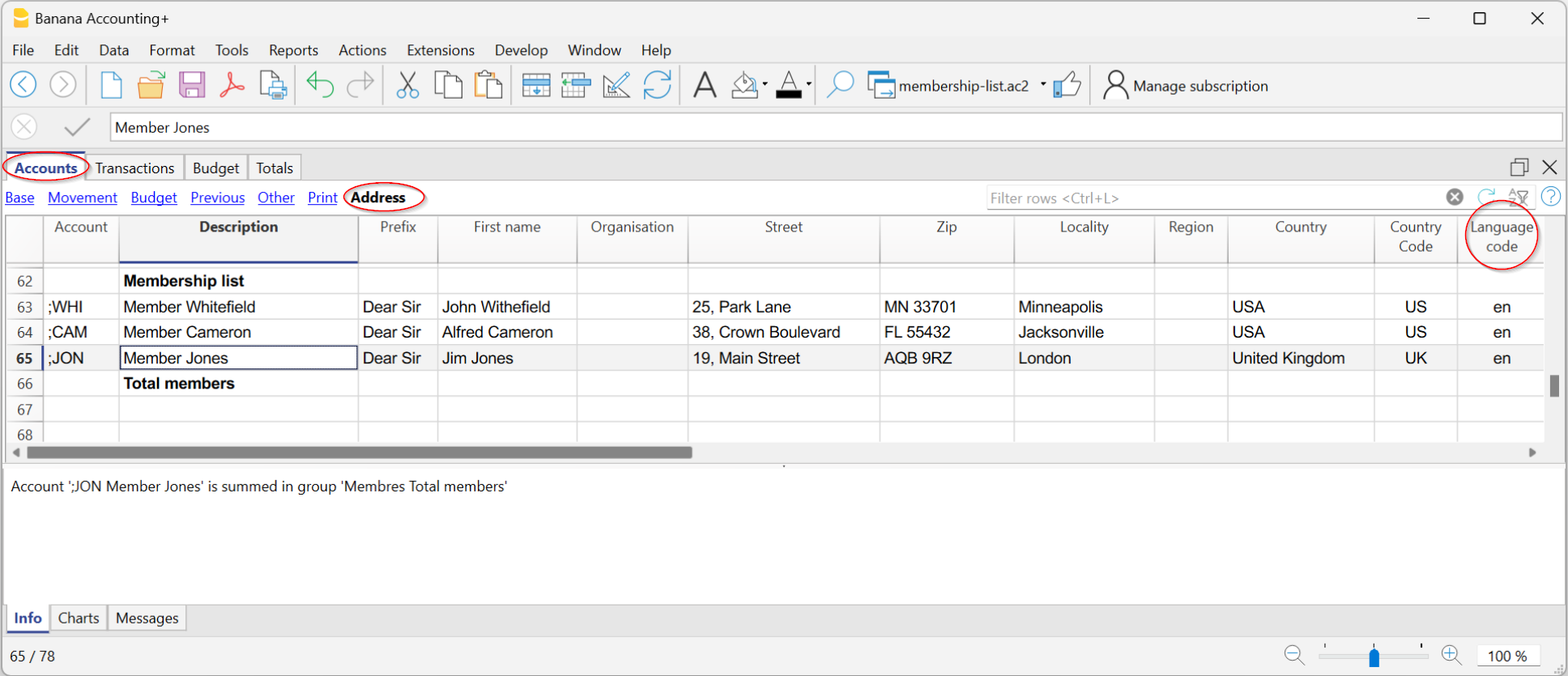

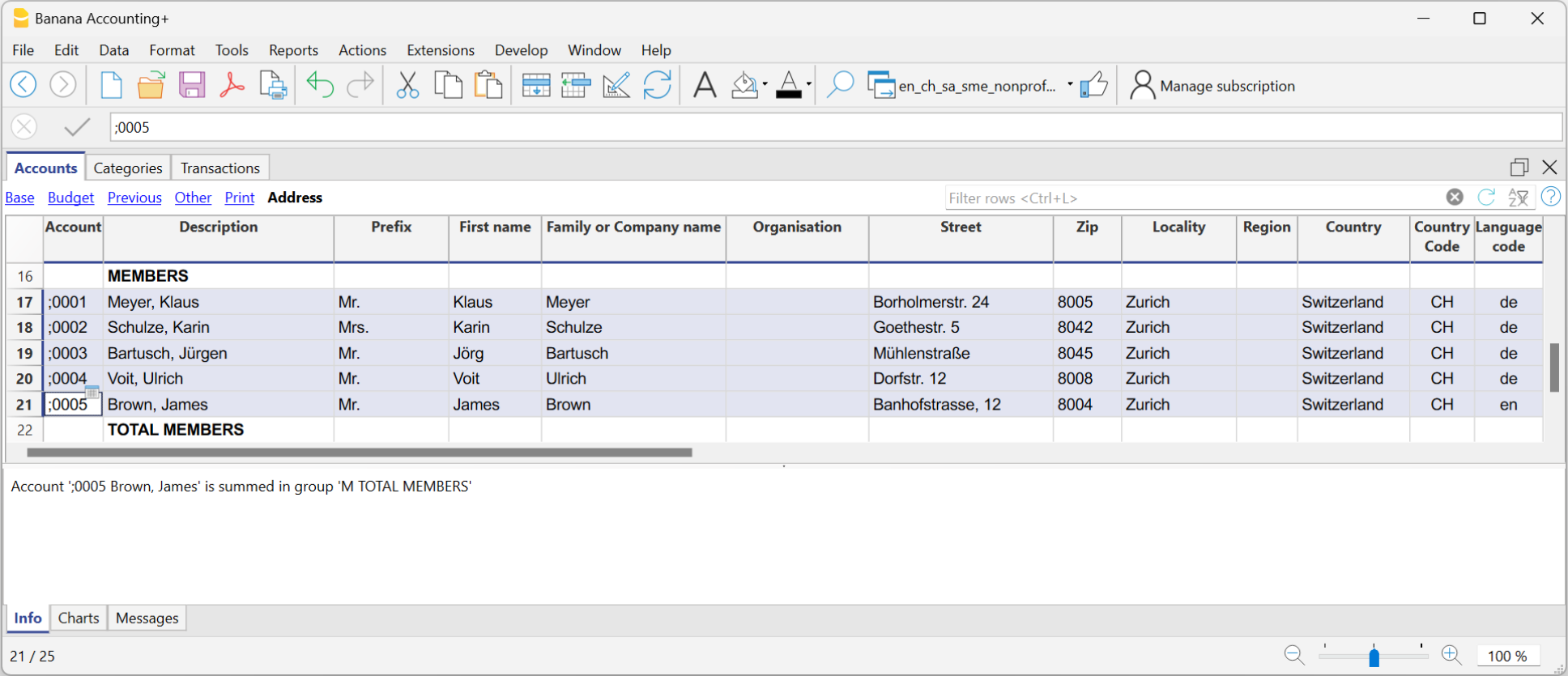

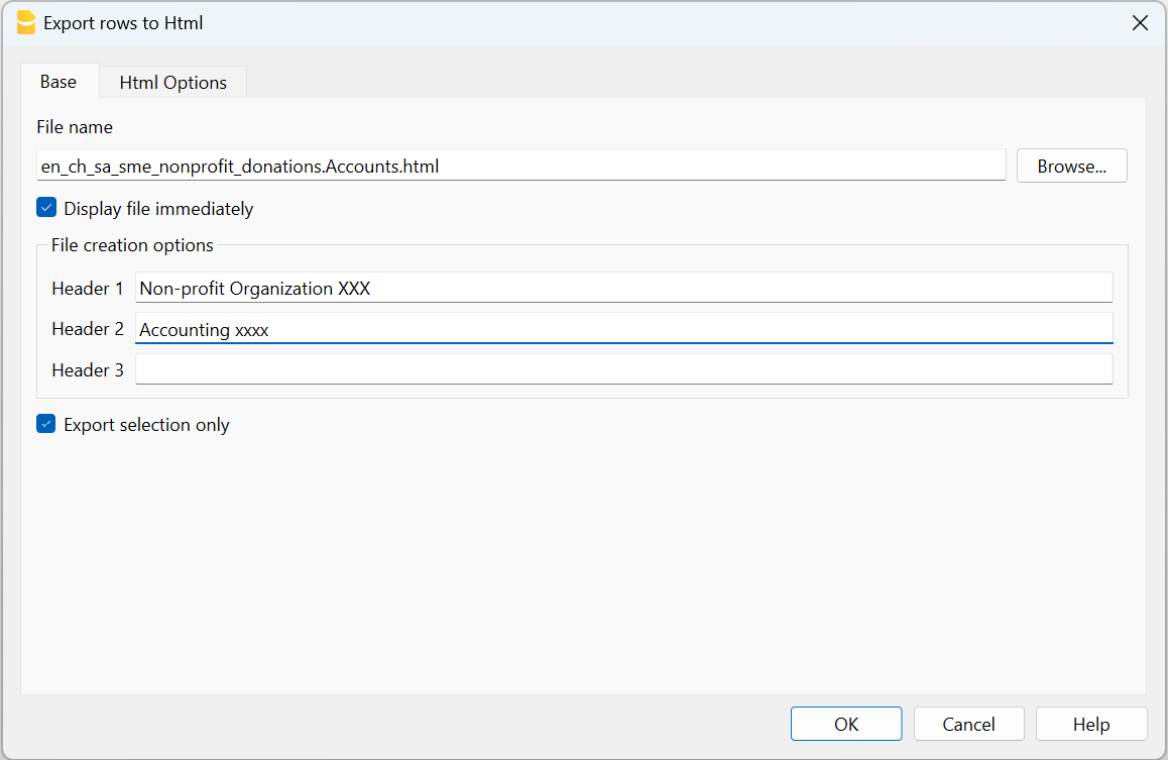

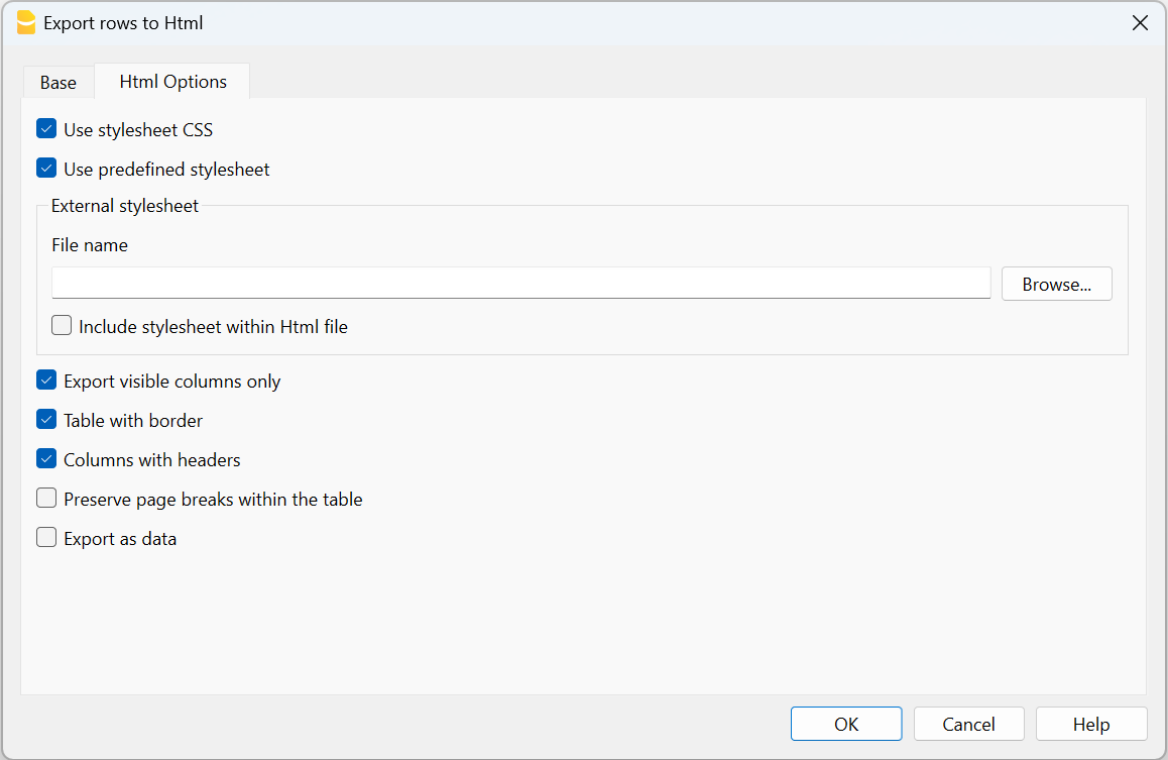

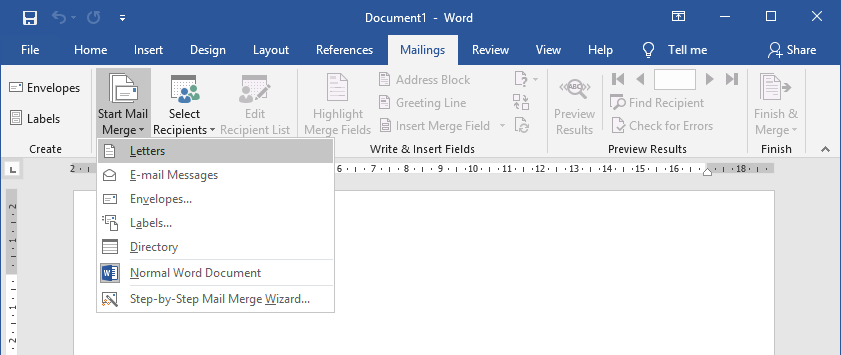

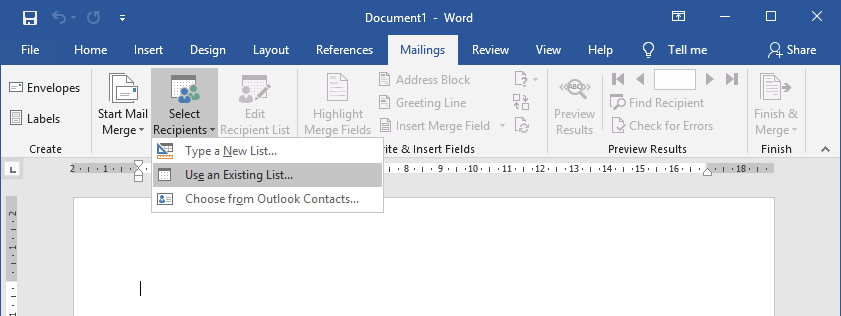

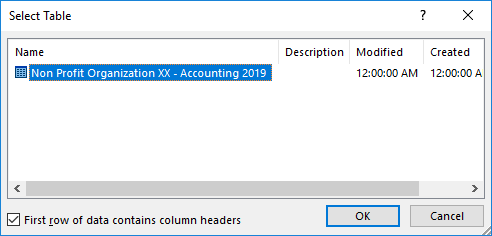

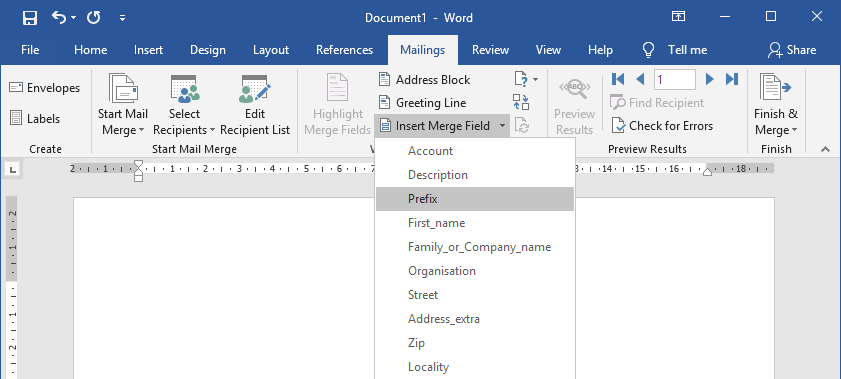

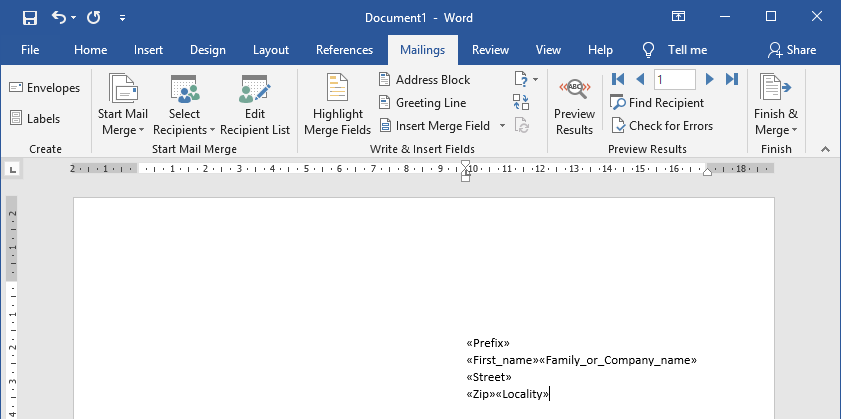

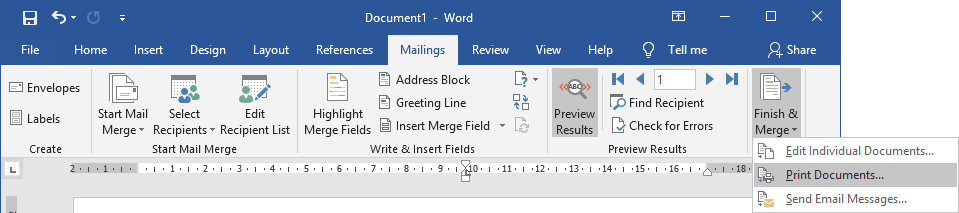

The models for associations are available in various types of accounting systems, from Cash Manager to handle cash inflows and outflows, to Income/Expense accounting for multiple accounts, and up to double-entry accounting. All models are set up to create invoices for members, manage projects and events, and send donation statements or other communications through mail merge of Word. Additionally, the program also includes specific models for Switzerland, such as GAAP FER 21 templates.

- Models for Individuals and Families

We offer pre-configured accounting plans to manage household finances, side activities, healthcare costs, and other purposes.

The extensions

Extensions are additional modules of the program that allow you to use supplementary features; most of these are available only with the Advanced plan of Banana Accounting Plus.

Complete multilingual Swiss SME chart of accounts (for reference only)

Complete multilingual Swiss SME chart of accounts (for reference only)Do not use this template to create a new accounting, but use a chart of accounts specific to your legal entity type.

Introduction

This chart of accounts template contains all the accounts and groups listed in the manual of the Swiss SME Accounting System by Sterchi, Mattle, Helbing.

We have also translated all the account descriptions into different languages, and in the liabilities section, there are all the accounts related to Share Capital/Equity, depending on the legal form of the company.

The columns and the headings of the file are in German; to change the language of the file go to the page Convert to new file.

The SME chart of accounts has been updated following the amendments to the Swiss Code of Obligations that came into force on the January 1, 2023.

List of accounts and groups

All accounts and groups are listed below for reference purposes. See also (KMU Deutsch, PME Francais, PMI Italiano).

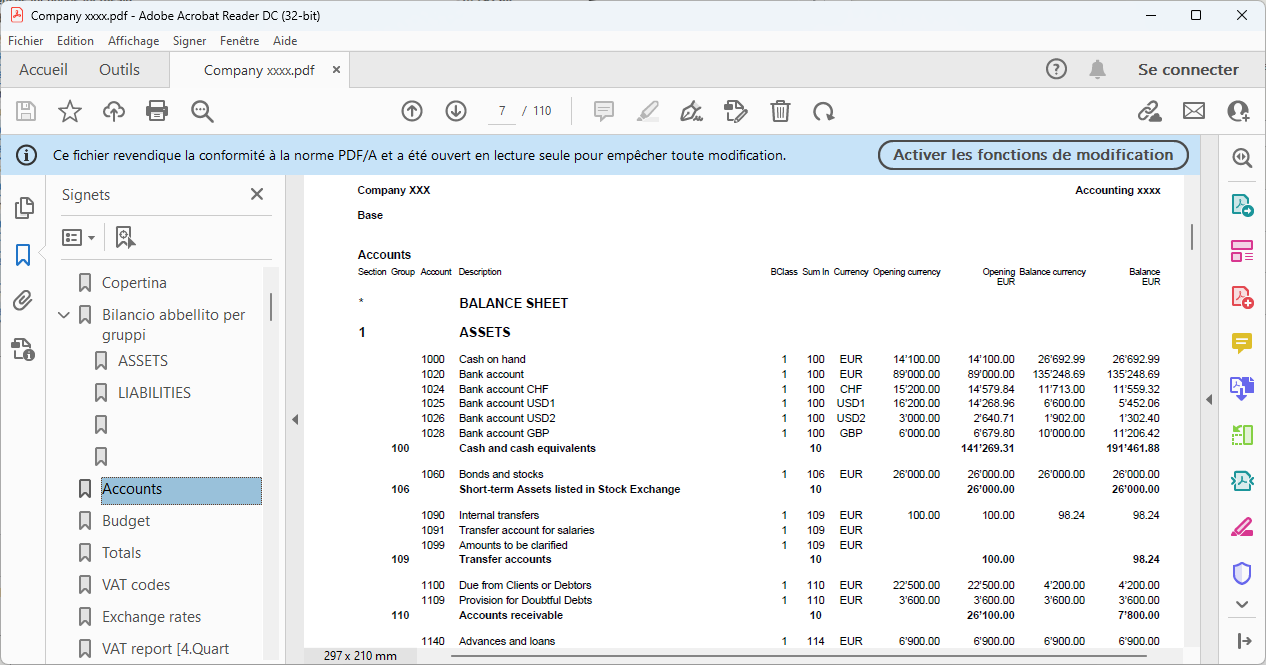

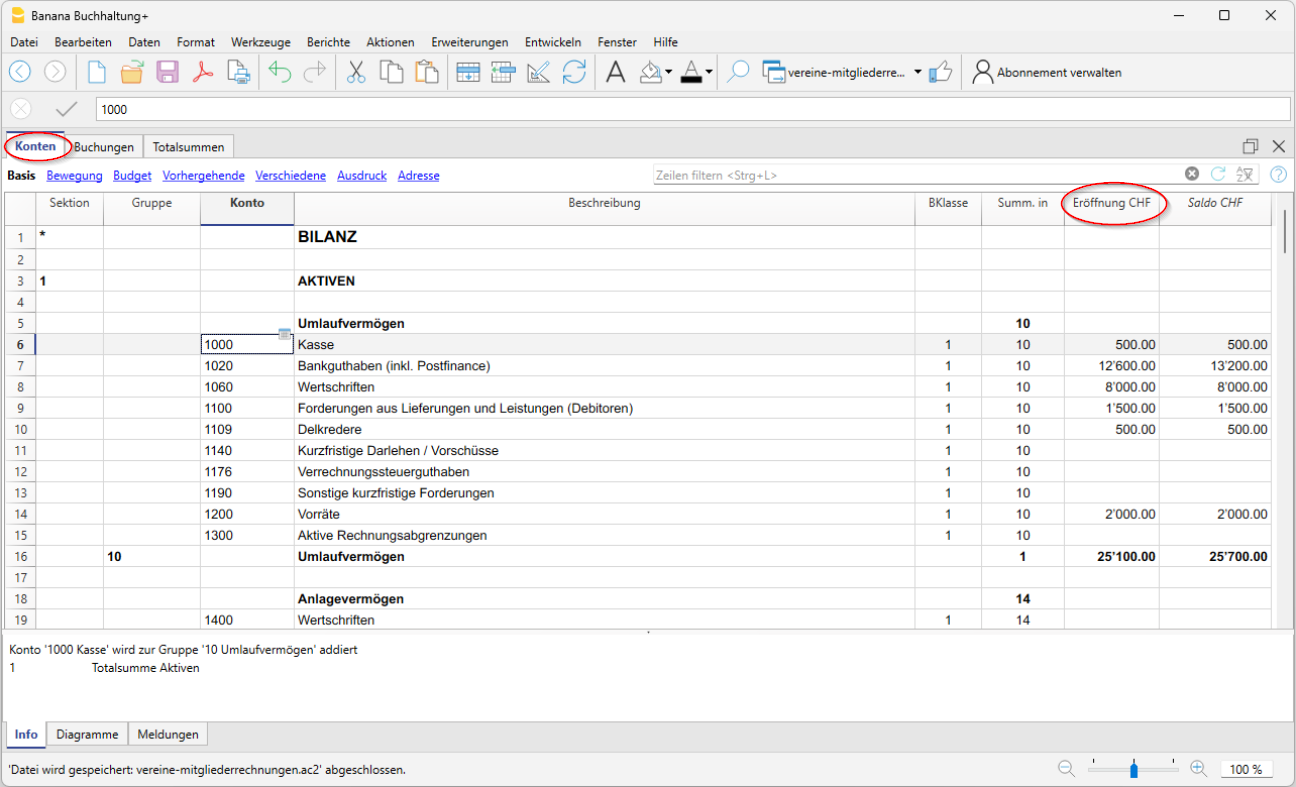

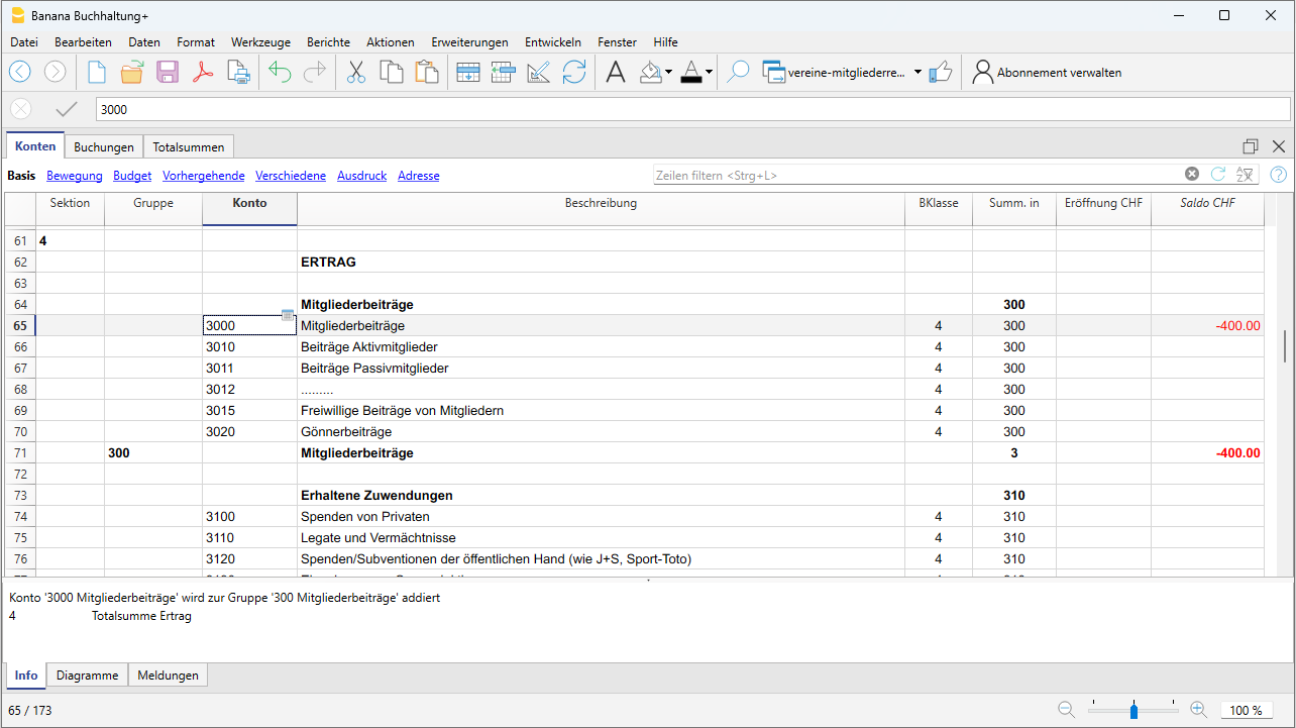

The account preview below is in English, but the other languages are also available in the file.

Template preview

| Group | Account | Description | BClass | Sum In |

|---|---|---|---|---|

| Swiss chart of accounts for SME | ||||

| BALANCE SHEET | ||||

| ASSETS | ||||

| 1000 | Cash on hand A | 1 | 100 | |

| 1005 | Cash on hand in foreign currency A | 1 | 100 | |

| 1020 | Bank account A | 1 | 100 | |

| 1025 | Bank account in foreign currency A | 1 | 100 | |

| 1040 | Cheques | 1 | 100 | |

| 1041 | Promissory notes to collect | 1 | 100 | |

| 1045 | Credit cards / Debit cards | 1 | 100 | |

| 1050 | Short-term deposit investments | 1 | 100 | |

| 1051 | Short-term fiduciary investments | 1 | 100 | |

| 100 | Cash and cash equivalents | 10 | ||

| 1060 | Stocks (listed) | 1 | 106 | |

| 1061 | Participation certificates (listed) | 1 | 106 | |

| 1062 | Investment funds (listed) | 1 | 106 | |

| 1063 | Bonds (listed) | 1 | 106 | |

| 1064 | Cryptocurrencies | 1 | 106 | |

| 1068 | Short-term securities fluctuation reserve | 1 | 106 | |

| 1069 | Short-term securities value adjustments | 1 | 106 | |

| 1070 | Financial derivatives | 1 | 106 | |

| 1078 | Other short-term assets fluctuation reserve | 1 | 106 | |

| 1079 | Other short-term assets value adjustments | 1 | 106 | |

| 106 | Short-term assets listed on the stock exchange | 10 | ||

| 1090 | Internal transfers | 1 | 109 | |

| 1091 | Transfer account for salaries | 1 | 109 | |

| 1099 | Clarification account | 1 | 109 | |

| 109 | Transfer accounts | 10 | ||

| 1100 | Receivables Switzerland | 1 | 110 | |

| 1101 | Receivables abroad | 1 | 110 | |

| 1102 | Receivables abroad in foreign currency | 1 | 110 | |

| 1109 | Receivables towards third parties value adjustments | 1 | 110 | |

| 1110 | Receivables towards subsidiary A | 1 | 110 | |

| 1119 | Receivables towards group companies value adjustments | 1 | 110 | |

| 1120 | Receivables towards person involved A | 1 | 110 | |

| 1121 | Receivables towards member of the Board of Directors A | 1 | 110 | |

| 1122 | Receivables towards member of Executive Board A | 1 | 110 | |

| 1123 | Receivables towards group company A | 1 | 110 | |

| 1124 | Receivables towards close person A | 1 | 110 | |

| 1125 | Receivables towards auditor | 1 | 110 | |

| 1129 | Receivables towards shareholders value adjustments | 1 | 110 | |

| 110 | Receivables from deliveries and services | 10 | ||

| 1140 | Advances and loans | 1 | 114 | |

| 1149 | Other short-term receivables towards third parties value adjustments | 1 | 114 | |

| 1150 | Loans to subsidiary A | 1 | 114 | |

| 1159 | Other short-term receivables towards group companies value adjustments | 1 | 114 | |

| 1160 | Loans to person involved A | 1 | 114 | |

| 1161 | Loans to member of the Board of Directors A | 1 | 114 | |

| 1162 | Loans to member of Executive Board A | 1 | 114 | |

| 1163 | Loans to group company A | 1 | 114 | |

| 1164 | Loans to close person A | 1 | 114 | |

| 1169 | Other loans to shareholders value adjustments | 1 | 114 | |

| 1170 | Input tax on materials, goods, services and energy, cl. 4 | 1 | 114 | |

| 1171 | Input tax on investments, remaining operating expenses, cl. 1/5-8 | 1 | 114 | |

| 1172 | Input tax compensation under the reporting method | 1 | 114 | |

| 1173 | Input tax reduction | 1 | 114 | |

| 1174 | Input tax correction | 1 | 114 | |

| 1175 | Settlement account VAT | 1 | 114 | |

| 1176 | Withholding tax | 1 | 114 | |

| 1177 | Receivables towards Directorate General of Customs | 1 | 114 | |

| 1178 | Direct taxes | 1 | 114 | |

| 1179 | Tax at source | 1 | 114 | |

| 1180 | AHV, IV, EO, ALV current account | 1 | 114 | |

| 1181 | Current account family allowance fund | 1 | 114 | |

| 1182 | Current account pension funds | 1 | 114 | |

| 1183 | Current account accident insurance | 1 | 114 | |

| 1184 | Daily sickness benefits insurance current account | 1 | 114 | |

| 1190 | WIR accounts | 1 | 114 | |

| 1191 | Deposits | 1 | 114 | |

| 1192 | Advance payments to suppliers | 1 | 114 | |

| 1193 | Rent deposits | 1 | 114 | |

| 1199 | Other short-term receivables value adjustments | 1 | 114 | |

| 114 | Other short-term receivables | 10 | ||

| 1200 | Inventories of commercial products A | 1 | 120 | |

| 1207 | Change in commercial product inventories | 1 | 120 | |

| 1208 | Advance payments for commercial products | 1 | 120 | |

| 1209 | Commercial products inventories value adjustments | 1 | 120 | |

| 1210 | Inventories of raw materials A | 1 | 120 | |

| 1217 | Change in raw materials | 1 | 120 | |

| 1218 | Advance payments for raw materials | 1 | 120 | |

| 1219 | Raw material inventories value adjustments | 1 | 120 | |

| 1220 | Inventories of finished products | 1 | 120 | |

| 1221 | Inventories of semi-finished products | 1 | 120 | |

| 1227 | Change in production material | 1 | 120 | |

| 1228 | Advance payments for production material | 1 | 120 | |

| 1229 | Production material inventories value adjustments | 1 | 120 | |

| 1230 | Auxiliary material inventories | 1 | 120 | |

| 1231 | Consumables inventories | 1 | 120 | |

| 1232 | Packaging inventories | 1 | 120 | |

| 1237 | Change in auxiliary material and consumables | 1 | 120 | |

| 1238 | Advance payments for auxiliary material and consumables | 1 | 120 | |

| 1239 | Auxiliary material and consumables value adjustments | 1 | 120 | |

| 1240 | Compulsory inventories | 1 | 120 | |

| 1247 | Changes in compulsory inventories | 1 | 120 | |

| 1249 | Compulsory inventories value adjustments | 1 | 120 | |

| 1250 | Goods on delivery | 1 | 120 | |

| 1257 | Changes in goods on delivery | 1 | 120 | |

| 1259 | Goods on delivery value adjustments | 1 | 120 | |

| 1260 | Finished products | 1 | 120 | |

| 1267 | Changes in finished products | 1 | 120 | |

| 1269 | Finished products value adjustments | 1 | 120 | |

| 1270 | Semi-finished products | 1 | 120 | |

| 1277 | Changes in semi-finished products | 1 | 120 | |

| 1279 | Semi-finished products value adjustments | 1 | 120 | |

| 1280 | Non-invoiced services | 1 | 120 | |

| 1287 | Changes in non-invoiced services | 1 | 120 | |

| 1289 | Non-invoiced services value adjustments | 1 | 120 | |

| 120 | Inventories and non-invoiced services | 10 | ||

| 1300 | Prepaid expenses | 1 | 130 | |

| 1301 | Accrued income | 1 | 130 | |

| 1303 | Discount on liabilities | 1 | 130 | |

| 130 | Accrued income and prepaid expenses | 10 | ||

| 10 | Current assets | 1 | ||

| 1400 | Stocks | 1 | 140 | |

| 1401 | Participation certificates | 1 | 140 | |

| 1402 | Investment funds | 1 | 140 | |

| 1403 | Bonds | 1 | 140 | |

| 1404 | Cryptocurrencies (Investments) | 1 | 140 | |

| 1408 | Fixed assets securities fluctuation reserve | 1 | 140 | |

| 1409 | Fixed assets securities value adjustments | 1 | 140 | |

| 1410 | Long-term financial investments | 1 | 140 | |

| 1411 | Rent deposits | 1 | 140 | |

| 1419 | Other financial investments value adjustments | 1 | 140 | |

| 1440 | Loans | 1 | 140 | |

| 1441 | Mortgages | 1 | 140 | |

| 1449 | Long-term receivables towards third parties value adjustments | 1 | 140 | |

| 1450 | Loans to participation A | 1 | 140 | |

| 1451 | Mortgages to participation A | 1 | 140 | |

| 1459 | Long-term receivables towards participations value adjustments | 1 | 140 | |

| 1460 | Loans/Mortgages to person involved A | 1 | 140 | |

| 1461 | Loans/Mortgages to member of the Board of Directors A | 1 | 140 | |

| 1462 | Loans/Mortgages to member of Executive Board A | 1 | 140 | |

| 1463 | Loans/Mortgages to group company A | 1 | 140 | |

| 1464 | Loans/Mortgages to close person A | 1 | 140 | |

| 1469 | Long-term receivables towards shareholders value adjustments | 1 | 140 | |

| 1470 | Employer contribution reserve | 1 | 140 | |

| 140 | Financial assets | 14 | ||

| 1480 | Participation A | 1 | 148 | |

| 1489 | Participations value adjustments | 1 | 148 | |

| 148 | Participations | 14 | ||

| 1500 | Machinery and equipment | 1 | 150 | |

| 1501 | Production plants | 1 | 150 | |

| 1507 | Leased machinery and equipment | 1 | 150 | |

| 1508 | Advance payments for machinery and equipment | 1 | 150 | |

| 1509 | Depreciation and value adjustments to machinery and equipment | 1 | 150 | |

| 1510 | Furniture and installations | 1 | 150 | |

| 1511 | Workshop installations | 1 | 150 | |

| 1512 | Shop installations | 1 | 150 | |

| 1513 | Office furniture | 1 | 150 | |

| 1517 | Leased furniture and installations | 1 | 150 | |

| 1518 | Advance payments for furniture and installations | 1 | 150 | |

| 1519 | Depreciation and value adjustments to furniture and installations | 1 | 150 | |

| 1520 | Office machines | 1 | 150 | |

| 1521 | Information technology | 1 | 150 | |

| 1522 | Communication technology | 1 | 150 | |

| 1527 | Leased office machines, information and communication technology | 1 | 150 | |

| 1528 | Advance payments for office machines, information and communication technology | 1 | 150 | |

| 1529 | Depreciation and value adjustments to office machines, information and communication technology | 1 | 150 | |

| 1530 | Vehicle A | 1 | 150 | |

| 1537 | Leased vehicles | 1 | 150 | |

| 1538 | Advance payments for vehicles | 1 | 150 | |

| 1539 | Depreciation and value adjustments to vehicles | 1 | 150 | |

| 1540 | Tools and equipment | 1 | 150 | |

| 1547 | Leased tools and equipment | 1 | 150 | |

| 1548 | Advance payments for tools and equipment | 1 | 150 | |

| 1549 | Depreciation and value adjustments to tools and equipment | 1 | 150 | |

| 1550 | Storage facilities | 1 | 150 | |

| 1557 | Leased storage facilities | 1 | 150 | |

| 1558 | Advance payments for storage facilities | 1 | 150 | |

| 1559 | Depreciation and value adjustments to storage facilities | 1 | 150 | |

| 1570 | Fixed facilities | 1 | 150 | |

| 1571 | Installations | 1 | 150 | |

| 1572 | Movable structures | 1 | 150 | |

| 1577 | Leased fixed facilities and installations | 1 | 150 | |

| 1578 | Advance payments for fixed facilities and installations | 1 | 150 | |

| 1579 | Depreciation and value adjustments to fixed facilities and installations | 1 | 150 | |

| 1590 | Linen and work clothing | 1 | 150 | |

| 1591 | Moulds and models | 1 | 150 | |

| 1597 | Other leased movable tangible assets | 1 | 150 | |

| 1598 | Advance payments for other movable tangible assets | 1 | 150 | |

| 1599 | Depreciation and value adjustments to other movable tangible assets | 1 | 150 | |

| 150 | Movable tangible assets | 14 | ||

| 1600 | Commercial properties | 1 | 160 | |

| 1601 | Commercial properties land | 1 | 160 | |

| 1606 | Commercial properties renovation | 1 | 160 | |

| 1607 | Leased commercial properties | 1 | 160 | |

| 1608 | Advance payments for commercial properties | 1 | 160 | |

| 1609 | Depreciation and value adjustments to commercial properties | 1 | 160 | |

| 1610 | Factories | 1 | 160 | |

| 1611 | Factories land | 1 | 160 | |

| 1617 | Leased factories | 1 | 160 | |

| 1618 | Advance payments for factories | 1 | 160 | |

| 1619 | Depreciation and value adjustments to factories | 1 | 160 | |

| 1620 | Workshops and ateliers | 1 | 160 | |

| 1621 | Workshops and ateliers land | 1 | 160 | |

| 1627 | Leased workshops and ateliers | 1 | 160 | |

| 1628 | Advance payments for workshops and ateliers | 1 | 160 | |

| 1629 | Depreciation and value adjustments to workshops and ateliers | 1 | 160 | |

| 1630 | Warehouses | 1 | 160 | |

| 1631 | Warehouses land | 1 | 160 | |

| 1637 | Leased warehouses | 1 | 160 | |

| 1638 | Advance payments for warehouses | 1 | 160 | |

| 1639 | Depreciation and value adjustments to warehouses | 1 | 160 | |

| 1640 | Exhibition buildings | 1 | 160 | |

| 1641 | Sales buildings | 1 | 160 | |

| 1642 | Sales buildings land | 1 | 160 | |

| 1647 | Leased exhibition and sales buildings | 1 | 160 | |

| 1648 | Advance payments for exhibition and sales buildings | 1 | 160 | |

| 1649 | Depreciation and value adjustments to exhibition and sales buildings | 1 | 160 | |

| 1650 | Office and administration buildings | 1 | 160 | |

| 1652 | Office and administration buildings land | 1 | 160 | |

| 1657 | Leased office and administration buildings | 1 | 160 | |

| 1658 | Advance payments for office and administration buildings | 1 | 160 | |

| 1659 | Depreciation and value adjustments to office and administration buildings | 1 | 160 | |

| 1660 | Staff housing | 1 | 160 | |

| 1661 | Other residential buildings | 1 | 160 | |

| 1662 | Other residential buildings land | 1 | 160 | |

| 1667 | Leased residential buildings | 1 | 160 | |

| 1668 | Advance payments for residential buildings | 1 | 160 | |

| 1669 | Depreciation and value adjustments to residential buildings | 1 | 160 | |

| 1680 | Undeveloped land | 1 | 160 | |

| 1687 | Leased undeveloped land | 1 | 160 | |

| 1688 | Advance payments for undeveloped land | 1 | 160 | |

| 1689 | Depreciation and value adjustments to undeveloped land | 1 | 160 | |

| 160 | Fixed tangible assets | 14 | ||

| 1700 | Patents | 1 | 170 | |

| 1701 | Know-how | 1 | 170 | |

| 1702 | Recipes | 1 | 170 | |

| 1709 | Depreciation and value adjustments to patents, know-how and recipes | 1 | 170 | |

| 1710 | Brands | 1 | 170 | |

| 1711 | Samples | 1 | 170 | |

| 1712 | Models | 1 | 170 | |

| 1713 | Plans | 1 | 170 | |

| 1719 | Depreciation and value adjustments to brands, samples, models and plans | 1 | 170 | |

| 1720 | Licences | 1 | 170 | |

| 1721 | Concessions | 1 | 170 | |

| 1722 | Rights of use | 1 | 170 | |

| 1723 | Company rights | 1 | 170 | |

| 1729 | Depreciation and value adjustments to licences, concessions, rights of use and company rights | 1 | 170 | |

| 1730 | Copyrights | 1 | 170 | |

| 1731 | Publishing rights | 1 | 170 | |

| 1732 | Contractual rights | 1 | 170 | |

| 1739 | Depreciation and value adjustments to copyrights, publishing rights and contractual rights | 1 | 170 | |

| 1740 | In-house developed software | 1 | 170 | |

| 1741 | Purchased software and licences | 1 | 170 | |

| 1749 | Depreciation and value adjustments to software | 1 | 170 | |

| 1750 | Own development | 1 | 170 | |

| 1751 | Purchased development | 1 | 170 | |

| 1759 | Depreciation and value adjustments to development | 1 | 170 | |

| 1770 | Goodwill | 1 | 170 | |

| 1779 | Depreciation and value adjustments to goodwill | 1 | 170 | |

| 1790 | Other intangible assets | 1 | 170 | |

| 1799 | Depreciation and value adjustments to other intangible assets | 1 | 170 | |

| 170 | Intangible assets | 14 | ||

| 1850 | Unpaid share capital | 1 | 180 | |

| 1850(2) | Unpaid nominal capital | 1 | 180 | |

| 1850(3) | Unpaid participation certificate capital | 1 | 180 | |

| 1850(4) | Unpaid foundation capital | 1 | 180 | |

| 1851 | Unpaid participation capital | 1 | 180 | |

| 180 | Unpaid share capital or foundation capital | 14 | ||

| 14 | Fixed assets | 1 | ||

| 1 | Total assets | 00 | ||

| LIABILITIES | ||||

| 2000 | Costs of materials and goods payables | 2 | 200 | |

| 2001 | Third-party/subcontracted services payables | 2 | 200 | |

| 2002 | Personnel expenses payables | 2 | 200 | |

| 2004 | Other operating expenses payables | 2 | 200 | |

| 2030 | Advance payments from third parties | 2 | 200 | |

| 2050 | Payables due to participation A | 2 | 200 | |

| 2060 | Payables due to person involved A | 2 | 200 | |

| 2061 | Payables due to member of the Board of Directors A | 2 | 200 | |

| 2062 | Payables due to member of Executive Board A | 2 | 200 | |

| 2063 | Payables due to group company A | 2 | 200 | |

| 2064 | Payables due to close person A | 2 | 200 | |

| 2065 | Payables due to auditor | 2 | 200 | |

| 200 | Accounts payable | 20 | ||

| 2100 | Current account A | 2 | 210 | |

| 2107 | Loan A | 2 | 210 | |

| 2109 | Mortgage A | 2 | 210 | |

| 2111 | WIR commitments | 2 | 210 | |

| 2120 | Financial leasing commitments | 2 | 210 | |

| 2130 | Bond loans | 2 | 210 | |

| 2140 | Other onerous debts due to third parties | 2 | 210 | |

| 2150 | Debts due to participation A | 2 | 210 | |

| 2160 | Debts due to person involved A | 2 | 210 | |

| 2161 | Debts due to member of the Board of Directors A | 2 | 210 | |

| 2162 | Debts due to member of Executive Board A | 2 | 210 | |

| 2163 | Debts due to group company A | 2 | 210 | |

| 2164 | Debts due to close person A | 2 | 210 | |

| 2170 | Debts due to pension funds | 2 | 210 | |

| 210 | Short-term interest-bearing debts | 20 | ||

| 2200 | VAT due | 2 | 220 | |

| 2200A | Automatic VAT | 2 | 220 | |

| 2201 | VAT settlement account | 2 | 220 | |

| 2202 | VAT due compensation according to the reporting method | 2 | 220 | |

| 2203 | Acquisition tax | 2 | 220 | |

| 2206 | Withholding tax | 2 | 220 | |

| 2207 | Stamp duty | 2 | 220 | |

| 2208 | Direct taxes | 2 | 220 | |

| 2209 | Tax at source | 2 | 220 | |

| 2210 | Debts due to third parties | 2 | 220 | |

| 2250 | Debts due to participation A | 2 | 220 | |

| 2260 | Debts due to person involved A | 2 | 220 | |

| 2261 | Debts due to member of the Board of Directors A | 2 | 220 | |

| 2262 | Debts due to member of Executive Board A | 2 | 220 | |

| 2263 | Debts due to group company A | 2 | 220 | |

| 2264 | Debts due to close person A | 2 | 220 | |

| 2265 | Debts due to auditor | 2 | 220 | |

| 2269 | Adopted distributions (dividends) | 2 | 220 | |

| 2270 | AHV, IV, EO, ALV current account | 2 | 220 | |

| 2271 | Family allowance fund current account | 2 | 220 | |

| 2272 | Pension funds current account | 2 | 220 | |

| 2273 | Accident insurance current account | 2 | 220 | |

| 2274 | Daily sickness benefits insurance current account | 2 | 220 | |

| 220 | Other short-term debts | 20 | ||

| 2300 | Accrued expenses | 2 | 230 | |

| 2301 | Revenues received in advance | 2 | 230 | |

| 2303 | Receivables discount | 2 | 230 | |

| 2330 | Provisions for warranty commitments | 2 | 230 | |

| 2331 | Provisions for purchase commitments | 2 | 230 | |

| 2340 | Provisions for direct taxes | 2 | 230 | |

| 2341 | Provisions for indirect taxes | 2 | 230 | |

| 2350 | Provisions for repairs and maintenance | 2 | 230 | |

| 2351 | Provisions for renovation of tangible assets | 2 | 230 | |

| 2352 | Provisions for research | 2 | 230 | |

| 2353 | Provisions for development | 2 | 230 | |

| 2354 | Provisions for restructuring | 2 | 230 | |

| 2355 | Provisions for environmental protection measures | 2 | 230 | |

| 2360 | Provisions for threatening losses from ongoing business | 2 | 230 | |

| 2370 | Provisions for pension funds commitments | 2 | 230 | |

| 2371 | Provisions for salary commitments | 2 | 230 | |

| 2380 | Provisions for participations commitments | 2 | 230 | |

| 2381 | Provisions for commitments to shareholders | 2 | 230 | |

| 2390 | Provisions to ensure the lastingly prosperity of the company | 2 | 230 | |

| 2391 | Other short-term provisions | 2 | 230 | |

| 230 | Accruals and deferred income, short-term provisions | 20 | ||

| 20 | Short-term third party capital | 2 | ||

| 2400 | Loan A | 2 | 240 | |

| 2401 | Mortgage A | 2 | 240 | |

| 2420 | Financial leasing commitments | 2 | 240 | |

| 2430 | Debenture loans | 2 | 240 | |

| 2450 | Loans | 2 | 240 | |

| 2451 | Mortgages | 2 | 240 | |

| 2470 | Loans to participation A | 2 | 240 | |

| 2471 | Mortgage to participation A | 2 | 240 | |

| 2480 | Loans/Mortgages to person involved A | 2 | 240 | |

| 2481 | Loans/Mortgages to the Board of Directors A | 2 | 240 | |

| 2482 | Loans/Mortgages to member of Executive Board A | 2 | 240 | |

| 2483 | Loans/Mortgages to group company A | 2 | 240 | |

| 2484 | Loans/Mortgages to close person A | 2 | 240 | |

| 2490 | Pension funds loans | 2 | 240 | |

| 2491 | Mortgages to pension funds | 2 | 240 | |

| 240 | Long-term interest-bearing debts | 24 | ||

| 2500 | Debts due to third parties | 2 | 250 | |

| 2550 | Debts due to participation A | 2 | 250 | |

| 2560 | Debts due to person involved A | 2 | 250 | |

| 2561 | Debts due to member of the Board of Directors A | 2 | 250 | |

| 2562 | Debts due to member of Executive Board A | 2 | 250 | |

| 2563 | Debts due to group company A | 2 | 250 | |

| 2564 | Debts due to close person A | 2 | 250 | |

| 2570 | Debts due to pension funds | 2 | 250 | |

| 250 | Other long-term debts | 24 | ||

| 2630 | Provisions for warranty commitments | 2 | 260 | |

| 2631 | Provisions for purchase commitments | 2 | 260 | |

| 2640 | Provisions for direct taxes | 2 | 260 | |

| 2641 | Provisions for indirect taxes | 2 | 260 | |

| 2650 | Provisions for repairs and maintenance | 2 | 260 | |

| 2651 | Provisions for renovation of tangible assets | 2 | 260 | |

| 2652 | Provisions for research | 2 | 260 | |

| 2653 | Provisions for development | 2 | 260 | |

| 2654 | Provisions for restructuring | 2 | 260 | |

| 2655 | Provisions for environmental protection measures | 2 | 260 | |

| 2660 | Provisions for threatening losses from ongoing business | 2 | 260 | |

| 2670 | Provisions for pension funds commitments | 2 | 260 | |

| 2671 | Provisions for salary commitments | 2 | 260 | |

| 2680 | Provisions for participations commitments | 2 | 260 | |

| 2681 | Provisions for commitments to shareholders | 2 | 260 | |

| 2690 | Provisions to ensure the lastingly prosperity of the company | 2 | 260 | |

| 2691 | Other long-term provisions | 2 | 260 | |

| 260 | Long-term provisions and similar statutory positions | 24 | ||

| 24 | Long-term third party capital | 2 | ||

| Equity (legal entities) | ||||

| 2800 | Share capital category A | 2 | 280 | |

| 2800(2) | Nominal capital category A | 2 | 280 | |

| 2800(3) | Participation certificate capital category A | 2 | 280 | |

| 2800(4) | Foundation capital | 2 | 280 | |

| 2810 | Participation capital | 2 | 280 | |

| 280 | Nominal capital or capital of the foundation | 28 | ||

| 2900 | Premium at foundation or in the event of a capital increase | 2 | 290 | |

| 2901 | Other contributions or allocations | 2 | 290 | |

| 2902 | Premium from merger, demerger or asset transfer | 2 | 290 | |

| 2903 | Reserves from capital contributions (fiscally recognised) | 2 | 290 | |

| 2904 | Profit from capital reduction | 2 | 290 | |

| 2905 | Profit/loss from own capital share acquisition | 2 | 290 | |

| 2950 | Legal retained earnings | 2 | 290 | |

| 2955 | Revaluation reserve | 2 | 290 | |

| 2959 | Reserves for own shares (indirect acquisition) | 2 | 290 | |

| 2960 | Statutory retained earnings | 2 | 290 | |

| 2961 | Decided retained earnings | 2 | 290 | |

| 2962 | Profit/loss from own capital share acquisition | 2 | 290 | |

| 2965 | Own shares | 2 | 290 | |

| 2965(2) | Own nominal shares | 2 | 290 | |

| 2965(3) | Own share certificates | 2 | 290 | |

| 2966 | Own participation certificates | 2 | 290 | |

| 2970 | Profit or loss carried forward | 2 | 290 | |

| 2971 | Interim dividend distribution | 2 | 290 | |

| 2972 | Contribution of interim profit to the legal retained earnings | 2 | 290 | |

| 2973 | Contribution of interim profit to the voluntary retained earnings | 2 | 290 | |

| 2979 | Annual profit or loss | 2 | 290 | |

| 290 | Reserves, own capital share and profit or loss | 28 | ||

| Equity (sole proprietorships) | ||||

| 2800.E | Own capital | 2 | 28 | |

| 2801.E | Spouse individual property | 2 | 28 | |

| 2820.E | Capital contributions and capital withdrawals | 2 | 28 | |

| 2821.E | Individual property contributions and individual property withdrawals of the spouse | 2 | 28 | |

| 2850.E | Private cash withdrawals | 2 | 28 | |

| 2851.E | In kind withdrawals | 2 | 28 | |

| 2852.E | Private share of operating expenses | 2 | 28 | |

| 2853.E | Private flat rental value | 2 | 28 | |

| 2854.E | Private insurance premiums | 2 | 28 | |

| 2855.E | Private pension contributions | 2 | 28 | |

| 2856.E | Private taxes | 2 | 28 | |

| 2891.E | Annual profit or loss | 2 | 28 | |

| Equity (partnership) | ||||

| 2800.P | Partner A equity at the beginning of the financial year | 2 | 28 | |

| 2810.P | Partner A capital contributions and capital withdrawals | 2 | 28 | |

| 2820.P | Partner A cash withdrawals | 2 | 28 | |

| 2821.P | Partner A in kind withdrawals | 2 | 28 | |

| 2822.P | Partner A private share of operating expenses | 2 | 28 | |

| 2823.P | Partner A private flat rental value | 2 | 28 | |

| 2824.P | Partner A private insurance premiums | 2 | 28 | |

| 2825.P | Partner A private pension contributions | 2 | 28 | |

| 2826.P | Partner A private taxes | 2 | 28 | |

| 2830.P | Partner A annual profit or loss | 2 | 28 | |

| 2850.P | Limited partner A equity at the beginning of the financial year | 2 | 28 | |

| 2860.P | Limited partner A capital contributions and capital withdrawals | 2 | 28 | |

| 2870.P | Limited partner A cash withdrawals | 2 | 28 | |

| 2871.P | Limited partner A in kind withdrawals | 2 | 28 | |

| 2872.P | Limited partner A private share of operating expenses | 2 | 28 | |

| 2873.P | Limited partner A private flat rental value | 2 | 28 | |

| 2874.P | Limited partner A private insurance premiums | 2 | 28 | |

| 2875.P | Limited partner A private pension contributions | 2 | 28 | |

| 2876.P | Limited partner A private taxes | 2 | 28 | |

| 2880.P | Limited partner A annual profit or loss | 2 | 28 | |

| 297 | Profit/Loss from Balance Sheet | 28 | ||

| 28 | Equity | 2 | ||

| 2 | Total liabilities | 00 | ||

| PROFIT & LOSS STATEMENT | ||||

| REVENUES | ||||

| 3000 | Gross revenues from product A | 4 | 30 | |

| 3000(2) | Gross revenues from cash sales | 4 | 30 | |

| 3001 | Gross revenues from retail credit sales | 4 | 30 | |

| 3002 | Gross revenues from wholesale credit sales | 4 | 30 | |

| 3007 | Gross revenues from ancillary services (postage and packing) | 4 | 30 | |

| 3008 | Changes in receivables | 4 | 30 | |

| 3090 | Discounts | 4 | 30 | |

| 3091 | Rebates and price reductions | 4 | 30 | |

| 3092 | Refunds | 4 | 30 | |

| 3093 | Commissions to third parties | 4 | 30 | |

| 3094 | Collection charges | 4 | 30 | |

| 3095 | Losses on receivables, changes in value adjustments | 4 | 30 | |

| 3096 | Exchange rate differences | 4 | 30 | |

| 3097 | Freights, postages | 4 | 30 | |

| 30 | Manufactured products revenues | 3 | ||

| 3200 | Gross revenues from item A | 4 | 32 | |

| 3200(2) | Gross revenues from cash sales | 4 | 32 | |

| 3201 | Gross revenues from retail credit sales | 4 | 32 | |

| 3202 | Gross revenues from wholesale credit sales | 4 | 32 | |

| 3203 | Gross revenues from purchase prices | 4 | 32 | |

| 3207 | Gross revenues from ancillary services (postage and packing) | 4 | 32 | |

| 3208 | Changes in receivables | 4 | 32 | |

| 3290 | Discounts | 4 | 32 | |

| 3291 | Rebates and price reductions | 4 | 32 | |

| 3292 | Refunds | 4 | 32 | |

| 3293 | Commissions to third parties | 4 | 32 | |

| 3294 | Collection charges | 4 | 32 | |

| 3295 | Losses on receivables, changes in value adjustments | 4 | 32 | |

| 3296 | Exchange rate differences | 4 | 32 | |

| 3297 | Freights, postages | 4 | 32 | |

| 32 | Revenues from resale of goods | 3 | ||

| 3400 | Gross revenues from provided service A | 4 | 34 | |

| 3400(2) | Gross revenues in cash | 4 | 34 | |

| 3401 | Gross revenues on credit | 4 | 34 | |

| 3407 | Gross revenues from ancillary services | 4 | 34 | |

| 3408 | Changes in receivables | 4 | 34 | |

| 3490 | Discounts | 4 | 34 | |

| 3491 | Rebates and price reductions | 4 | 34 | |

| 3492 | Refunds | 4 | 34 | |

| 3493 | Commissions to third parties | 4 | 34 | |

| 3494 | Collection charges | 4 | 34 | |

| 3495 | Losses on receivables, changes in value adjustments | 4 | 34 | |

| 3496 | Exchange rate differences | 4 | 34 | |

| 3497 | Postages | 4 | 34 | |

| 34 | Revenues from provided services | 3 | ||

| 3600 | Revenues from raw materials | 4 | 36 | |

| 3601 | Revenues from auxiliary materials | 4 | 36 | |

| 3602 | Revenues from garbages | 4 | 36 | |

| 3607 | Revenues from ancillary services | 4 | 36 | |

| 3608 | Changes in receivables | 4 | 36 | |

| 3609 | Decrease in ancillary revenues | 4 | 36 | |

| 3610 | Revenues from product A licence | 4 | 36 | |

| 3619 | Decrease in revenues from licences, patents, etc. | 4 | 36 | |

| 3670 | Revenues from staff provision | 4 | 36 | |

| 3680 | Other revenues | 4 | 36 | |

| 3690 | Discounts | 4 | 36 | |

| 3691 | Rebates and price reductions | 4 | 36 | |

| 36 | Other revenues from deliveries and services | 3 | ||

| 3700 | Own production of movable tangible assets | 4 | 37 | |

| 3701 | Own production of fixed tangible assets | 4 | 37 | |

| 3702 | Own repair of movable tangible assets | 4 | 37 | |

| 3703 | Own repair of fixed tangible assets | 4 | 37 | |

| 3710 | Own consumption of product A | 4 | 37 | |

| 3720 | Own consumption of product A | 4 | 37 | |

| 3740 | Own consumption of provided service A | 4 | 37 | |

| 3790 | In kind withdrawals | 4 | 37 | |

| 37 | Own contributions and own consumption | 3 | ||

| 3800 | Discounts | 4 | 38 | |

| 3801 | Rebates and price reductions | 4 | 38 | |

| 3802 | Refunds | 4 | 38 | |

| 3803 | Commissions to third parties | 4 | 38 | |

| 3804 | Collection charges | 4 | 38 | |

| 3805 | Losses on receivables, changes in value adjustments | 4 | 38 | |

| 3806 | Exchange rate differences | 4 | 38 | |

| 3807 | Shipping costs | 4 | 38 | |

| 3809 | VAT net tax rate | 4 | 38 | |

| 3810 | Credit/debit card fees | 4 | 38 | |

| 3860 | Changes in warranty provisions | 4 | 38 | |

| 3861 | Changes in deductible provisions | 4 | 38 | |

| 38 | Decrease in revenues | 3 | ||

| 3900 | Changes in finished products inventories | 4 | 39 | |

| 3901 | Changes in semi-finished products inventories | 4 | 39 | |

| 3940 | Changes in non-invoiced services value | 4 | 39 | |

| 39 | Changes in inventories of semi-finished products, finished products and value of non-invoiced services | 3 | ||

| 3 | Net revenues from supplies and services | 02 | ||

| EXPENSES | ||||

| 4000 | Purchases of product A material | 3 | 40 | |

| 4000(2) | Purchases of equipment | 3 | 40 | |

| 4001 | Purchases of components | 3 | 40 | |

| 4002 | Purchases of accessories | 3 | 40 | |

| 4003 | Purchases of other materials | 3 | 40 | |

| 4004 | Purchases of auxiliary and consumable materials | 3 | 40 | |

| 4005 | Purchases of packing material | 3 | 40 | |

| 4006 | Third-party services | 3 | 40 | |

| 4007 | Direct purchasing expenses | 3 | 40 | |

| 4008 | Changes in inventories | 3 | 40 | |

| 4009 | Purchase price reductions | 3 | 40 | |

| 4060 | Sector A third-party services | 3 | 40 | |

| 4070 | Incoming freight | 3 | 40 | |

| 4071 | Import duties | 3 | 40 | |

| 4072 | Incoming shipments | 3 | 40 | |

| 4080 | Changes in sector A inventories | 3 | 40 | |

| 4086 | Sector A material losses | 3 | 40 | |

| 4090 | Discounts | 3 | 40 | |

| 4091 | Rebates and price reductions | 3 | 40 | |

| 4092 | Refunds | 3 | 40 | |

| 4093 | Commissions to third parties | 3 | 40 | |

| 4096 | Exchange rate differences | 3 | 40 | |

| 40 | Material costs | 4 | ||

| 4200 | Purchases of resale product A | 3 | 42 | |

| 4205 | Purchases of packing material | 3 | 42 | |

| 4207 | Direct purchasing expenses | 3 | 42 | |

| 4208 | Changes in inventories | 3 | 42 | |

| 4209 | Purchase price reductions | 3 | 42 | |

| 4270 | Incoming freight | 3 | 42 | |

| 4271 | Import duties | 3 | 42 | |

| 4272 | Incoming shipments | 3 | 42 | |

| 4280 | Changes in sector A inventories | 3 | 42 | |

| 4286 | Sector A loss of goods | 3 | 42 | |

| 4290 | Discounts | 3 | 42 | |

| 4291 | Rebates and price reductions | 3 | 42 | |

| 4292 | Refunds | 3 | 42 | |

| 4293 | Purchasing commissions | 3 | 42 | |

| 4296 | Exchange rate differences | 3 | 42 | |

| 42 | Costs of goods for resale | 4 | ||

| 4400 | Expenses for service A | 3 | 44 | |

| 4407 | Direct purchasing expenses | 3 | 44 | |

| 4409 | Deductions obtained on purchases | 3 | 44 | |

| 4470 | Direct purchase expenses for purchased services | 3 | 44 | |

| 4490 | Discounts | 3 | 44 | |

| 4491 | Rebates and price reductions | 3 | 44 | |

| 4492 | Refunds | 3 | 44 | |

| 4493 | Purchasing commissions | 3 | 44 | |

| 4496 | Exchange rate differences | 3 | 44 | |

| 44 | Expenses for purchased services | 4 | ||

| 4500 | Heat electricity | 3 | 45 | |

| 4501 | Industrial electricity | 3 | 45 | |

| 4510 | Natural gas | 3 | 45 | |

| 4511 | Liquid gas in cylinders | 3 | 45 | |

| 4520 | Heating oil | 3 | 45 | |

| 4521 | Coal, briquettes, wood | 3 | 45 | |

| 4530 | Petrol | 3 | 45 | |

| 4531 | Diesel | 3 | 45 | |

| 4532 | Oil | 3 | 45 | |

| 4540 | Water | 3 | 45 | |

| 45 | Energy consumption for production | 4 | ||

| 4600 | Other material costs of production | 3 | 46 | |

| 4620 | Other costs of goods for resale | 3 | 46 | |

| 4640 | Other costs of services | 3 | 46 | |

| 4650 | Packaging costs | 3 | 46 | |

| 4660 | Changes in warranty provisions | 3 | 46 | |

| 4661 | Changes in deductible provisions | 3 | 46 | |

| 46 | Other costs of materials, goods for resale and services | 4 | ||

| 4700 | Incoming freight | 3 | 47 | |

| 4701 | Import duties | 3 | 47 | |

| 4702 | Incoming shipments | 3 | 47 | |

| 47 | Direct purchasing expenses | 4 | ||

| 4800 | Discounts | 3 | 48 | |

| 4801 | Rebates and price reductions | 3 | 48 | |

| 4802 | Refunds | 3 | 48 | |

| 4803 | Purchasing commissions | 3 | 48 | |

| 4804 | Exchange rate differences | 3 | 48 | |

| 48 | Purchase price reductions | 4 | ||

| 4900 | Changes in goods for resale inventories | 3 | 49 | |

| 4901 | Changes in raw material inventories | 3 | 49 | |

| 4902 | Changes in production material inventories | 3 | 49 | |

| 4903 | Changes in auxiliary material and consumables inventories | 3 | 49 | |

| 4904 | Changes in compulsory inventories | 3 | 49 | |

| 4905 | Changes in goods on delivery inventories | 3 | 49 | |

| 4980 | Material losses | 3 | 49 | |

| 4986 | Losses of goods for resale | 3 | 49 | |

| 49 | Changes in inventories, material and goods losses | 4 | ||

| 4 | Costs for material, goods, services and energy | 02 | ||

| 5000 | Salaries | 3 | 50 | |

| 5001 | Allowances | 3 | 50 | |

| 5002 | Profit-sharing | 3 | 50 | |

| 5003 | Commissions | 3 | 50 | |

| 5005 | Social insurance benefits | 3 | 50 | |

| 5006 | Provision of personnel | 3 | 50 | |

| 5007 | Social insurance expenses | 3 | 50 | |

| 5008 | Other personnel expenses | 3 | 50 | |

| 5009 | Benefits from third parties | 3 | 50 | |

| 5070 | AHV, IV, EO, ALV | 3 | 50 | |

| 5071 | Family allowance | 3 | 50 | |

| 5072 | Pension funds | 3 | 50 | |

| 5073 | Accident insurance | 3 | 50 | |

| 5074 | Daily sickness benefits insurance | 3 | 50 | |

| 5079 | Tax at source | 3 | 50 | |

| 5080 | Staff recruitment | 3 | 50 | |

| 5081 | Education and training | 3 | 50 | |

| 5082 | Reimbursements of actual expenses | 3 | 50 | |

| 5083 | Reimbursements of flat-rate expenses | 3 | 50 | |

| 5089 | Other personnel expenses | 3 | 50 | |

| 5090 | Temporary staff | 3 | 50 | |

| 50 | Personnel expenses - production | 5 | ||

| 5200 | Salaries | 3 | 52 | |

| 5201 | Allowances | 3 | 52 | |

| 5202 | Profit-sharing | 3 | 52 | |

| 5203 | Commissions | 3 | 52 | |

| 5205 | Social insurance benefits | 3 | 52 | |

| 5206 | Provision of personnel | 3 | 52 | |

| 5207 | Social insurance expenses | 3 | 52 | |

| 5208 | Other personnel expenses | 3 | 52 | |

| 5209 | Benefits from third parties | 3 | 52 | |

| 5270 | AHV, IV, EO, ALV | 3 | 52 | |

| 5271 | Family allowance | 3 | 52 | |

| 5272 | Pension funds | 3 | 52 | |

| 5273 | Accident insurance | 3 | 52 | |

| 5274 | Daily sickness benefits insurance | 3 | 52 | |

| 5279 | Tax at source | 3 | 52 | |

| 5280 | Staff recruitment | 3 | 52 | |

| 5281 | Education and training | 3 | 52 | |

| 5282 | Reimbursements of actual expenses | 3 | 52 | |

| 5283 | Reimbursements of flat-rate expenses | 3 | 52 | |

| 5289 | Other personnel expenses | 3 | 52 | |

| 5290 | Temporary staff | 3 | 52 | |

| 52 | Personnel expenses - commerce | 5 | ||

| 5400 | Salaries | 3 | 54 | |

| 5401 | Allowances | 3 | 54 | |

| 5402 | Profit-sharing | 3 | 54 | |

| 5403 | Commissions | 3 | 54 | |

| 5405 | Social insurance benefits | 3 | 54 | |

| 5406 | Provision of personnel | 3 | 54 | |

| 5407 | Social insurance expenses | 3 | 54 | |

| 5408 | Other personnel expenses | 3 | 54 | |

| 5409 | Benefits from third parties | 3 | 54 | |

| 5470 | AHV, IV, EO, ALV | 3 | 54 | |

| 5471 | Family allowance | 3 | 54 | |

| 5472 | Pension funds | 3 | 54 | |

| 5473 | Accident insurance | 3 | 54 | |

| 5474 | Daily sickness benefits insurance | 3 | 54 | |

| 5479 | Tax at source | 3 | 54 | |

| 5480 | Staff recruitment | 3 | 54 | |

| 5481 | Education and training | 3 | 54 | |

| 5482 | Reimbursements of actual expenses | 3 | 54 | |

| 5483 | Reimbursements of flat-rate expenses | 3 | 54 | |

| 5489 | Other personnel expenses | 3 | 54 | |

| 5490 | Temporary staff | 3 | 54 | |

| 54 | Personnel expenses - supply of services | 5 | ||

| 5600 | Salaries | 3 | 56 | |

| 5601 | Allowances | 3 | 56 | |

| 5602 | Profit-sharing | 3 | 56 | |

| 5603 | Salaries to participants and members of the Executive Board | 3 | 56 | |

| 5604 | Board of Directors fees | 3 | 56 | |

| 5605 | Social insurance benefits | 3 | 56 | |

| 5606 | Provision of personnel | 3 | 56 | |

| 5607 | Social insurance expenses | 3 | 56 | |

| 5608 | Other personnel expenses | 3 | 56 | |

| 5609 | Benefits from third parties | 3 | 56 | |

| 5670 | AHV, IV, EO, ALV | 3 | 56 | |

| 5671 | Family allowance | 3 | 56 | |

| 5672 | Pension funds | 3 | 56 | |

| 5673 | Accident insurance | 3 | 56 | |

| 5674 | Daily sickness benefits insurance | 3 | 56 | |

| 5679 | Tax at source | 3 | 56 | |

| 5680 | Staff recruitment | 3 | 56 | |

| 5681 | Education and training | 3 | 56 | |

| 5682 | Reimbursements of actual expenses | 3 | 56 | |

| 5683 | Reimbursements of flat-rate expenses | 3 | 56 | |

| 5689 | Other personnel expenses | 3 | 56 | |

| 5690 | Temporary staff | 3 | 56 | |

| 56 | Personnel expenses - administration | 5 | ||

| 5700 | AHV, IV, EO, ALV | 3 | 57 | |

| 5701 | AHV, IV, EO holder | 3 | 57 | |

| 5710 | Family allowance | 3 | 57 | |

| 5720 | Pension funds | 3 | 57 | |

| 5730 | Accident insurance | 3 | 57 | |

| 5740 | Daily sickness benefits insurance | 3 | 57 | |

| 5790 | Tax at source | 3 | 57 | |

| 57 | Social insurance expenses | 5 | ||

| 5800 | Advertisements of job openings | 3 | 58 | |

| 5801 | Recruitment commissions | 3 | 58 | |

| 5810 | Training necessary for business needs | 3 | 58 | |

| 5811 | Professional training | 3 | 58 | |

| 5820 | Travel expenses | 3 | 58 | |

| 5821 | Food expenses | 3 | 58 | |

| 5822 | Accommodation expenses | 3 | 58 | |

| 5830 | Management flat-rate expenses | 3 | 58 | |

| 5831 | Executive Board flat-rate expenses | 3 | 58 | |

| 5832 | Board of Directors flat-rate expenses | 3 | 58 | |

| 5840 | Staff canteen meals | 3 | 58 | |

| 5841 | Staff canteen beverages | 3 | 58 | |

| 5845 | Revenues for meals (as expense reduction) | 3 | 58 | |

| 5846 | Revenues for beverages (as expense reduction) | 3 | 58 | |

| 5880 | Staff events | 3 | 58 | |

| 5881 | Company sports group | 3 | 58 | |

| 5890 | Private share of personnel expenses | 3 | 58 | |

| 58 | Other personnel expenses | 5 | ||

| 5900 | Benefits from third parties | 3 | 59 | |

| 5901 | Temporary staff | 3 | 59 | |

| 59 | Benefits from third parties | 5 | ||

| 5 | Personnel expenses | 02 | ||

| 6000 | Factory rent | 3 | 60 | |

| 6001 | Workshop and atelier rent | 3 | 60 | |

| 6002 | Warehouse rent | 3 | 60 | |

| 6003 | Showrooms and shop floors rent | 3 | 60 | |

| 6004 | Office and administration rooms rent | 3 | 60 | |

| 6005 | Staff rooms rent | 3 | 60 | |

| 6006 | Garage, parking rent | 3 | 60 | |

| 6030 | Factory additional costs | 3 | 60 | |

| 6031 | Workshop and atelier additional costs | 3 | 60 | |

| 6032 | Warehouse additional costs | 3 | 60 | |

| 6033 | Showrooms and shop floors additional costs | 3 | 60 | |

| 6034 | Office and administration rooms additional costs | 3 | 60 | |

| 6035 | Staff rooms additional costs | 3 | 60 | |

| 6036 | Garage additional costs | 3 | 60 | |

| 6030(2) | Heating additional costs | 3 | 60 | |

| 6031(2) | Electricity, gas, water additional costs | 3 | 60 | |

| 6032(2) | Caretaker additional costs | 3 | 60 | |

| 6040 | Factory cleaning | 3 | 60 | |

| 6041 | Workshop and atelier cleaning | 3 | 60 | |

| 6042 | Warehouse cleaning | 3 | 60 | |

| 6043 | Showrooms and shop floors cleaning | 3 | 60 | |

| 6044 | Office and administration rooms cleaning | 3 | 60 | |

| 6045 | Staff rooms cleaning | 3 | 60 | |

| 6040(2) | Cleaning staff | 3 | 60 | |

| 6041(2) | Third-party cleaning services | 3 | 60 | |

| 6042(2) | Cleaning materials | 3 | 60 | |

| 6050 | Factory maintenance | 3 | 60 | |

| 6051 | Workshop and atelier maintenance | 3 | 60 | |

| 6052 | Warehouse maintenance | 3 | 60 | |

| 6053 | Showrooms and shop floors maintenance | 3 | 60 | |

| 6054 | Office and administration rooms maintenance | 3 | 60 | |

| 6055 | Staff rooms maintenance | 3 | 60 | |

| 6056 | Garage maintenance | 3 | 60 | |

| 6050(2) | Repairs | 3 | 60 | |

| 6051(2) | Small investments | 3 | 60 | |

| 6052(2) | Subscription services | 3 | 60 | |

| 6059 | Insurance services | 3 | 60 | |

| 6060 | Factory leasing | 3 | 60 | |

| 6061 | Workshop and atelier leasing | 3 | 60 | |

| 6062 | Warehouse leasing | 3 | 60 | |

| 6063 | Showrooms and shop floors leasing | 3 | 60 | |

| 6064 | Office and administration rooms leasing | 3 | 60 | |

| 6065 | Staff rooms leasing | 3 | 60 | |

| 6066 | Garage leasing | 3 | 60 | |

| 6070 | Ground rents | 3 | 60 | |

| 6090 | Private share of facility expenses | 3 | 60 | |

| 60 | Facility expenses | 6 | ||

| 6100 | MRR machines and apparatuses | 3 | 61 | |

| 6101 | MRR furniture and equipment | 3 | 61 | |

| 6102 | MRR tools and devices | 3 | 61 | |

| 6105 | Leasing of manufacturing plants | 3 | 61 | |

| 6110 | MRR shop equipment | 3 | 61 | |

| 6111 | MRR showroom equipment | 3 | 61 | |

| 6115 | Leasing of sales equipment | 3 | 61 | |

| 6120 | MRR central warehouse | 3 | 61 | |

| 6121 | MRR warehouse A | 3 | 61 | |

| 6125 | Leasing of warehouse equipment | 3 | 61 | |

| 6130 | MRR office furniture | 3 | 61 | |

| 6131 | MRR office machines | 3 | 61 | |

| 6132 | MRR information technology | 3 | 61 | |

| 6133 | MRR communication technology | 3 | 61 | |

| 6135 | Leasing of office equipment | 3 | 61 | |

| 6140 | MRR staff canteen furniture | 3 | 61 | |

| 6141 | MRR staff rooms furniture | 3 | 61 | |

| 6145 | Leasing of staff equipment | 3 | 61 | |

| 6190 | Insurance services | 3 | 61 | |

| 61 | Maintenance, repairs, replacements (MRR): leasing of movable tangible assets | 6 | ||

| 6200 | Repairs | 3 | 62 | |

| 6201 | Services | 3 | 62 | |

| 6202 | Cleaning | 3 | 62 | |

| 6210 | Petrol | 3 | 62 | |

| 6211 | Diesel | 3 | 62 | |

| 6212 | Oil | 3 | 62 | |

| 6213 | Electricity | 3 | 62 | |

| 6220 | Liability insurance | 3 | 62 | |

| 6221 | Comprehensive insurance | 3 | 62 | |

| 6222 | Legal protection insurance | 3 | 62 | |

| 6230 | Road taxes | 3 | 62 | |

| 6231 | Contributions | 3 | 62 | |

| 6232 | Vehicle taxes | 3 | 62 | |

| 6260 | Vehicle leasing | 3 | 62 | |

| 6264 | Vehicle rentals | 3 | 62 | |

| 6270 | Private share of vehicle expenses | 3 | 62 | |

| 6280 | Freights | 3 | 62 | |

| 6281 | Freight forwarder | 3 | 62 | |

| 6282 | Cargo domicile | 3 | 62 | |

| 62 | Vehicle and transport expenses | 6 | ||

| 6300 | Natural hazard insurance | 3 | 63 | |

| 6301 | Glass breakage insurance | 3 | 63 | |

| 6302 | Theft insurance | 3 | 63 | |

| 6310 | Business liability insurance | 3 | 63 | |

| 6311 | Warranty insurance | 3 | 63 | |

| 6312 | Legal protection insurance | 3 | 63 | |

| 6320 | Business interruption insurance | 3 | 63 | |

| 6330 | Death risk insurance | 3 | 63 | |

| 6331 | Guarantee premiums | 3 | 63 | |

| 6360 | Charges | 3 | 63 | |

| 6361 | Fees | 3 | 63 | |

| 6370 | Permits | 3 | 63 | |

| 6371 | Operating licences | 3 | 63 | |

| 63 | Property insurance, charges, fees, permits | 6 | ||

| 6400 | Industrial electricity | 3 | 64 | |

| 6401 | Heat electricity | 3 | 64 | |

| 6402 | Electricity for lighting | 3 | 64 | |

| 6410 | Natural gas | 3 | 64 | |

| 6411 | Liquid gas in cylinders | 3 | 64 | |

| 6420 | Heating oil | 3 | 64 | |

| 6421 | Coal, briquettes, wood | 3 | 64 | |

| 6430 | Water | 3 | 64 | |

| 6460 | Garbage collection | 3 | 64 | |

| 6461 | Hazardous waste collection | 3 | 64 | |

| 6462 | Waste water | 3 | 64 | |

| 64 | Energy and disposal costs | 6 | ||

| 6500 | Office equipment | 3 | 65 | |

| 6501 | Printers | 3 | 65 | |

| 6502 | Photocopies | 3 | 65 | |

| 6503 | Specialist publications, newspapers, periodicals | 3 | 65 | |

| 6510 | Telephone | 3 | 65 | |

| 6512 | Internet | 3 | 65 | |

| 6513 | Postages | 3 | 65 | |

| 6520 | Contributions | 3 | 65 | |

| 6521 | Donations, grants | 3 | 65 | |

| 6522 | Tips | 3 | 65 | |

| 6530 | Bookkeeping | 3 | 65 | |

| 6531 | Business consultancy | 3 | 65 | |

| 6532 | Legal advice | 3 | 65 | |

| 6540 | Board of Directors expenses | 3 | 65 | |

| 6541 | General meeting expenses | 3 | 65 | |

| 6542 | Auditing expenses | 3 | 65 | |

| 6550 | Formation, capital increase and organisational expenses | 3 | 65 | |

| 6551 | Collection and execution costs | 3 | 65 | |

| 6555 | Management fees | 3 | 65 | |

| 6559 | Other administration costs | 3 | 65 | |

| 6560 | Private share of administration costs | 3 | 65 | |

| 6570 | Hardware leasing | 3 | 65 | |

| 6571 | Software leasing | 3 | 65 | |

| 6572 | Hardware rent | 3 | 65 | |

| 6573 | Software rent | 3 | 65 | |

| 6580 | Licenses and updates expenses | 3 | 65 | |

| 6581 | Hardware maintenance/hotline | 3 | 65 | |

| 6582 | Software maintenance/hotline | 3 | 65 | |

| 6583 | Consumables | 3 | 65 | |

| 6585 | Dedicated phone line expenses | 3 | 65 | |

| 6590 | Basic advice | 3 | 65 | |

| 6591 | Individual development, individual adjustments | 3 | 65 | |

| 6592 | Implementation costs | 3 | 65 | |

| 6590(2) | IT development - project A | 3 | 65 | |

| 65 | Administrative and IT expenses | 6 | ||

| 6600 | Advertisements | 3 | 66 | |

| 6601 | Radio advertising | 3 | 66 | |

| 6602 | TV advertising | 3 | 66 | |

| 6604 | Internet and social media | 3 | 66 | |

| 6610 | Printed advertisements, advertising material | 3 | 66 | |

| 6611 | Advertising items, samples, billboards and electronic adverts | 3 | 66 | |

| 6620 | Shop windows, decorations | 3 | 66 | |

| 6621 | Trade fairs, exhibitions | 3 | 66 | |

| 6640 | Expenses | 3 | 66 | |

| 6641 | Customer care | 3 | 66 | |

| 6642 | Gifts to customers | 3 | 66 | |

| 6660 | Advertising contributions | 3 | 66 | |

| 6661 | Sponsoring | 3 | 66 | |

| 6670 | Customer events | 3 | 66 | |

| 6671 | Media contacts | 3 | 66 | |

| 6672 | Corporate anniversaries | 3 | 66 | |

| 6680 | Advertising consultancy | 3 | 66 | |

| 6681 | Market analysis | 3 | 66 | |

| 6690 | Private share of advertising expenses | 3 | 66 | |

| 66 | Advertising expenses | 6 | ||

| 6700 | Business information | 3 | 67 | |

| 6701 | Debt collection | 3 | 67 | |

| 6710 | Operational safety | 3 | 67 | |

| 6711 | Surveillance | 3 | 67 | |

| 6720 | Project A research | 3 | 67 | |

| 6721 | Project A development | 3 | 67 | |

| 6740 | Input tax correction (in the case of mixed use) | 3 | 67 | |

| 6790 | Other operating expenses | 3 | 67 | |

| 6791 | Private shares | 3 | 67 | |

| 67 | Other operating expenses | 6 | ||

| 6800 | Fixed assets securities value adjustments | 3 | 68 | |

| 6801 | Other financial assets value adjustments | 3 | 68 | |

| 6804 | Long-term receivables towards third parties value adjustments | 3 | 68 | |

| 6805 | Long-term receivables towards participations value adjustments | 3 | 68 | |

| 6806 | Long-term receivables towards shareholders value adjustments | 3 | 68 | |

| 6810 | Participation A value adjustments | 3 | 68 | |

| 6820 | Depreciation and value adjustments to machinery and equipment | 3 | 68 | |

| 6821 | Depreciation and value adjustments to furniture and installations | 3 | 68 | |

| 6822 | Depreciation and value adjustments to office machines, information and communication technology | 3 | 68 | |

| 6823 | Depreciation and value adjustments to vehicles | 3 | 68 | |

| 6824 | Depreciation and value adjustments to tools and equipment | 3 | 68 | |

| 6825 | Depreciation and value adjustments to storage facilities | 3 | 68 | |

| 6827 | Depreciation and value adjustments to fixed facilities and installations | 3 | 68 | |

| 6829 | Depreciation and value adjustments to other movable tangible assets | 3 | 68 | |

| 6830 | Depreciation and value adjustments to commercial properties | 3 | 68 | |

| 6831 | Depreciation and value adjustments to factories | 3 | 68 | |

| 6832 | Depreciation and value adjustments to workshops and ateliers | 3 | 68 | |

| 6833 | Depreciation and value adjustments to warehouses | 3 | 68 | |

| 6834 | Depreciation and value adjustments to exhibition and sales buildings | 3 | 68 | |

| 6835 | Depreciation and value adjustments to office and administration buildings | 3 | 68 | |

| 6836 | Depreciation and value adjustments to residential buildings | 3 | 68 | |

| 6837 | Depreciation and value adjustments to undeveloped land | 3 | 68 | |

| 6840 | Depreciation and value adjustments to patents, know-how and recipes | 3 | 68 | |

| 6841 | Depreciation and value adjustments to brands, samples, models and plans | 3 | 68 | |

| 6842 | Depreciation and value adjustments to licences, concessions, rights of use and company rights | 3 | 68 | |

| 6843 | Depreciation and value adjustments to copyrights, publishing rights and contractual rights | 3 | 68 | |

| 6845 | Depreciation and value adjustments to development | 3 | 68 | |

| 6847 | Depreciation and value adjustments to goodwill | 3 | 68 | |

| 6849 | Depreciation and value adjustments to other intangible assets | 3 | 68 | |

| 68 | Depreciation and value adjustments to fixed assets positions | 6 | ||

| 6900 | Bank interest fees | 3 | 69 | |

| 6901 | Loan interest fees | 3 | 69 | |

| 6902 | Mortgage interest fees | 3 | 69 | |

| 6903 | Default interest fees | 3 | 69 | |

| 6904 | Interest fees from advance payments received | 3 | 69 | |

| 6905 | Interest fees from financial leasing | 3 | 69 | |

| 6920 | Person involved A interest fees | 3 | 69 | |

| 6921 | Member of the Board of Directors A interest fees | 3 | 69 | |

| 6922 | Member of Executive Board A interest fees | 3 | 69 | |

| 6923 | Group company A interest fees | 3 | 69 | |

| 6924 | Close person A interest fees | 3 | 69 | |

| 6930 | Pension funds loans interest fees | 3 | 69 | |

| 6940 | Bank charges | 3 | 69 | |

| 6941 | Custody fees | 3 | 69 | |

| 6942 | Exchange losses on short-term assets listed on the stock exchange | 3 | 69 | |

| 6943 | Exchange losses on financial assets | 3 | 69 | |

| 6944 | Exchange losses on interest-bearing debts | 3 | 69 | |

| 6945 | Granted customer accounts | 3 | 69 | |

| 6946 | Exchange loss on cryptocurrencies | 3 | 69 | |

| 6947 | Factoring fee | 3 | 69 | |

| 6949 | Currency losses | 3 | 69 | |

| 6950 | Revenues from bank deposits | 3 | 69 | |

| 6951 | Revenues from short-term financial investments | 3 | 69 | |

| 6952 | Revenues from short-term securities | 3 | 69 | |

| 6953 | Revenues from other short-term assets | 3 | 69 | |

| 6960 | Revenues from fixed assets securities | 3 | 69 | |

| 6961 | Revenues from other financial assets | 3 | 69 | |

| 6962 | Revenues from participations | 3 | 69 | |

| 6963 | Revenues from long-term receivables | 3 | 69 | |

| 6980 | Revenues from person involved A | 3 | 69 | |

| 6981 | Revenues from member of the Board of Directors A | 3 | 69 | |

| 6982 | Revenues from member of Executive Board A | 3 | 69 | |

| 6983 | Revenues from group company A | 3 | 69 | |

| 6984 | Revenues from close person A | 3 | 69 | |

| 6990 | Default interest income, remuneration interest | 3 | 69 | |

| 6991 | Revenue from advance payments to suppliers | 3 | 69 | |

| 6992 | Exchange gains on short-term assets listed on the stock exchange | 3 | 69 | |

| 6993 | Exchange gains on financial assets | 3 | 69 | |

| 6995 | Discounts received from suppliers | 3 | 69 | |

| 6996 | Exchange gain on cryptocurrencies | 3 | 69 | |

| 6999 | Currency gains | 3 | 69 | |

| 69 | Financial expenses and revenues | 6 | ||

| 6 | Other operating expenses, depreciation, value adjustments and financial results | 02 | ||

| 7000 | Gross profits | 3 | 70 | |

| 7009 | Decrease in revenues | 3 | 70 | |

| 7010 | Material costs | 3 | 70 | |

| 7011 | Personnel expenses | 3 | 70 | |

| 7012 | Facility expenses | 3 | 70 | |

| 7013 | Maintenance, repairs, replacements, leasing expenses | 3 | 70 | |

| 7014 | Vehicle and transport expenses | 3 | 70 | |

| 7015 | Property insurance, charges, fees, permits | 3 | 70 | |

| 7016 | Energy and disposal costs | 3 | 70 | |

| 7017 | Administrative and IT expenses | 3 | 70 | |

| 7018 | Advertising expenses | 3 | 70 | |

| 7019 | Other expenses | 3 | 70 | |

| 70 | Result from ancillary activities | 7 | ||

| 7502 | Rental income from commercial premises | 3 | 75 | |

| 7503 | Rental income from flats | 3 | 75 | |

| 7504 | Rental income from garages | 3 | 75 | |

| 7505 | Opted rental income | 3 | 75 | |

| 7508 | Share of heating, lighting | 3 | 75 | |

| 7509 | Other real estate income | 3 | 75 | |

| 7510 | Mortgage interest fees | 3 | 75 | |

| 7511 | Real estate maintenance | 3 | 75 | |

| 7512 | Charges, fees, property taxes | 3 | 75 | |

| 7513 | Insurance premiums | 3 | 75 | |

| 7514 | Water, waste water | 3 | 75 | |

| 7515 | Waste, disposal | 3 | 75 | |

| 7516 | Administrative expenses | 3 | 75 | |

| 7517 | Heating, lighting, water | 3 | 75 | |

| 7518 | Depreciation and value adjustment | 3 | 75 | |

| 7519 | Other real estate expenses | 3 | 75 | |

| 75 | Result from operational real estate | 7 | ||

| 7 | Ancillary operating result | 02 | ||

| 8000 | Non-operating costs | 3 | 80 | |

| 8100 | Non-operating revenues | 3 | 80 | |

| 80 | Non-operating costs and revenues | 8 | ||

| 8500 | Extraordinary provisions | 3 | 85 | |

| 8501 | Extraordinary depreciation and value adjustment | 3 | 85 | |

| 8503 | Extraordinary currency losses | 3 | 85 | |

| 8504 | Extraordinary losses on disposal of fixed assets | 3 | 85 | |

| 8505 | Extraordinary losses on receivables | 3 | 85 | |

| 8506 | Inconvenience compensation payments | 3 | 85 | |

| 8510 | Dissolution of reserves | 3 | 85 | |

| 8511 | Dissolution of provisions no longer required | 3 | 85 | |

| 8513 | Extraordinary currency gains | 3 | 85 | |

| 8514 | Extraordinary gains on disposal of fixed assets | 3 | 85 | |

| 8515 | Subsidies and other non-payments received with input tax reduction | 3 | 85 | |

| 8516 | Donations and other non-payments received without input tax reduction | 3 | 85 | |

| 8517 | Inconvenience compensation received | 3 | 85 | |

| 8600 | Non-recurring expenses | 3 | 85 | |

| 8610 | Non-recurring revenues | 3 | 85 | |

| 8704 | Creation of employer contribution reserve | 3 | 85 | |

| 8705 | Deductibles | 3 | 85 | |

| 8709 | Other expenses unrelated to the period | 3 | 85 | |

| 8710 | Revenues from insurance services or indemnity payments | 3 | 85 | |

| 8711 | Revenues from refunds | 3 | 85 | |

| 8712 | Revenues from reimbursements | 3 | 85 | |

| 8714 | Dissolution of employer contribution reserve | 3 | 85 | |

| 8719 | Other revenues unrelated to the period | 3 | 85 | |

| 85 | Extraordinary, non-recurring or unrelated to the period expenses and revenues | 8 | ||

| 8900 | Taxes on profits | 3 | 89 | |

| 8901 | Capital taxes | 3 | 89 | |

| 8902 | Direct taxes unrelated to the period | 3 | 89 | |

| 8900(2) | Cantonal and municipal taxes | 3 | 89 | |

| 8901(2) | Direct federal taxes | 3 | 89 | |

| 89 | Direct taxes | 8 | ||

| 8 | Non-operating, extraordinary, non-recurring or unrelated to the period result | 02 | ||

| 9200 | Profit or loss for the year | 3 | 9 | |

| 9 | Closure | 02 | ||

| 02 | Loss(+)/Profit(-) from income statement | 297 | ||

| 00 | Difference should be = 0 (empty cell) |

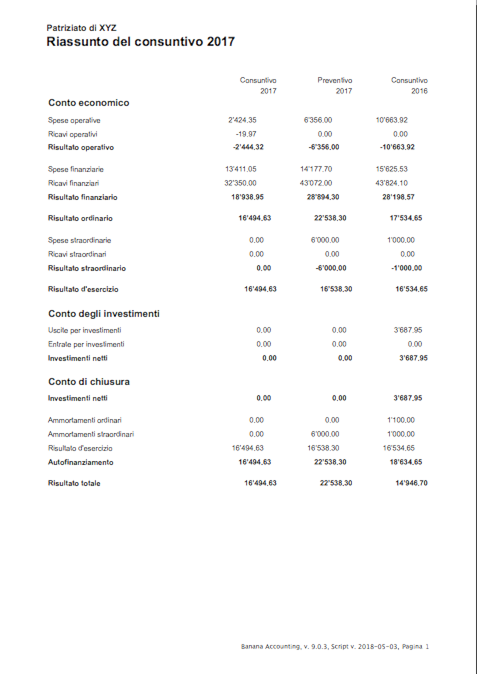

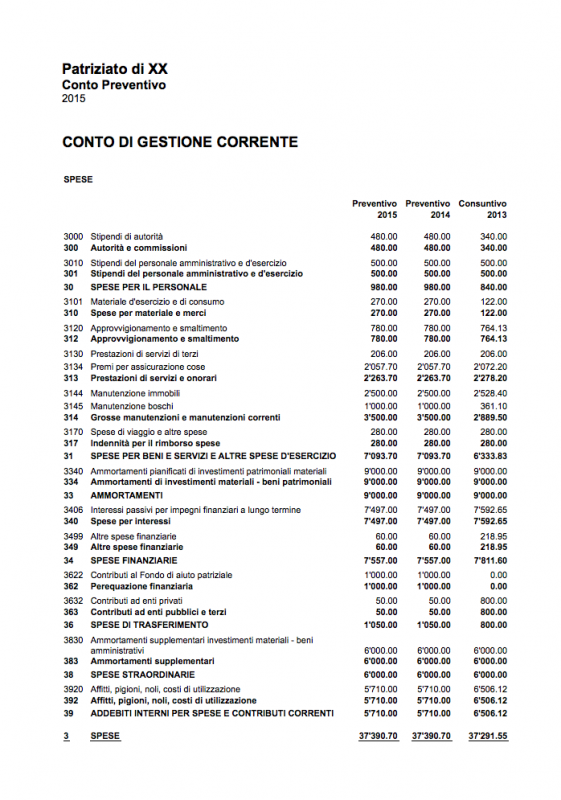

Business Accounting Templates Switzerland

The Business accounting templates have chart of accounts based on the SME system (Swiss SME chart of accounts - Sterchi, Mattle, Helbing), in compliance with the Swiss Code of Obligations (articles 957-963b CO).

They are mainly divided into:

- Cash method -based accounting – Costs and revenues are recorded at the time of payment and receipt.

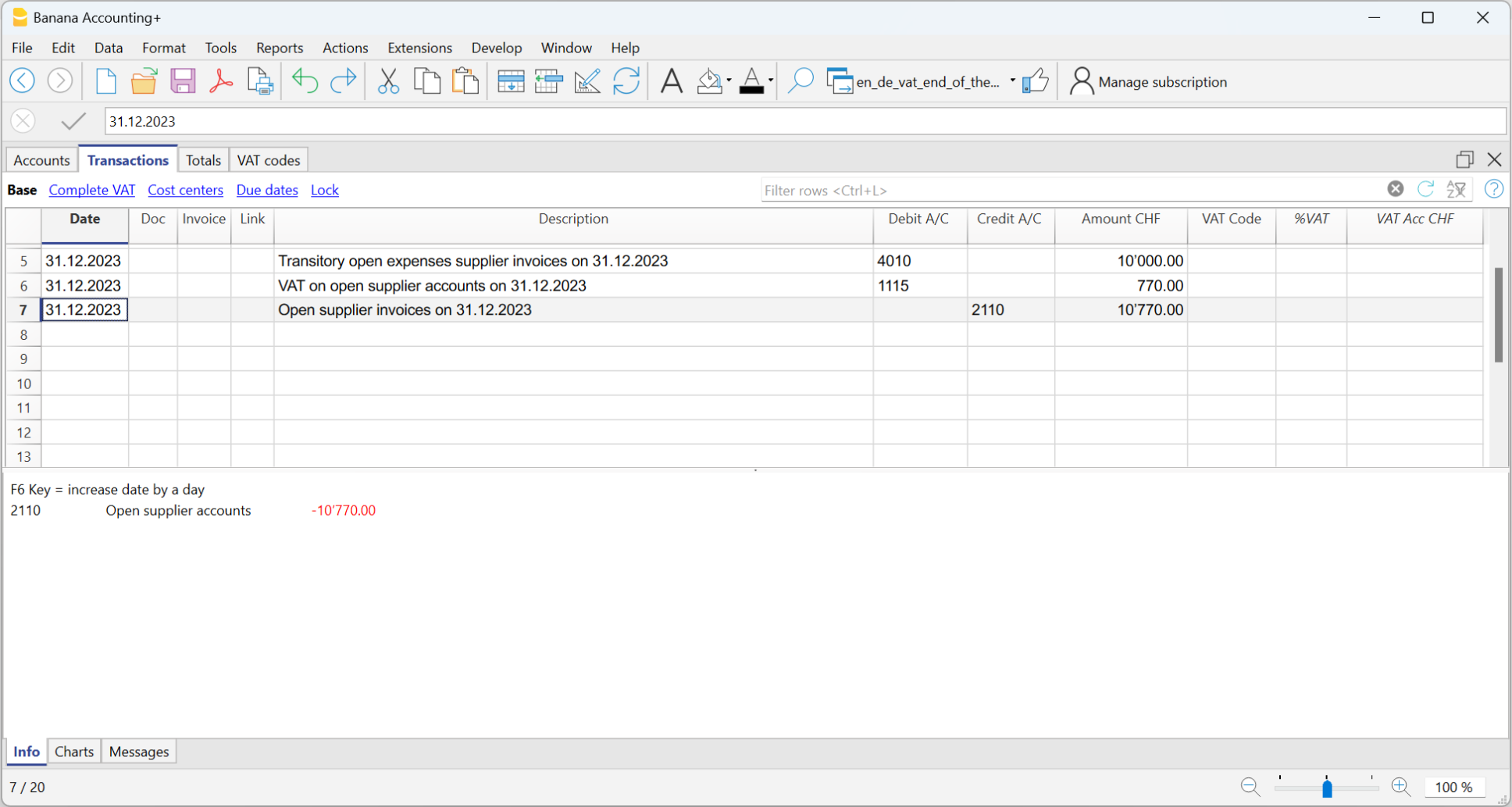

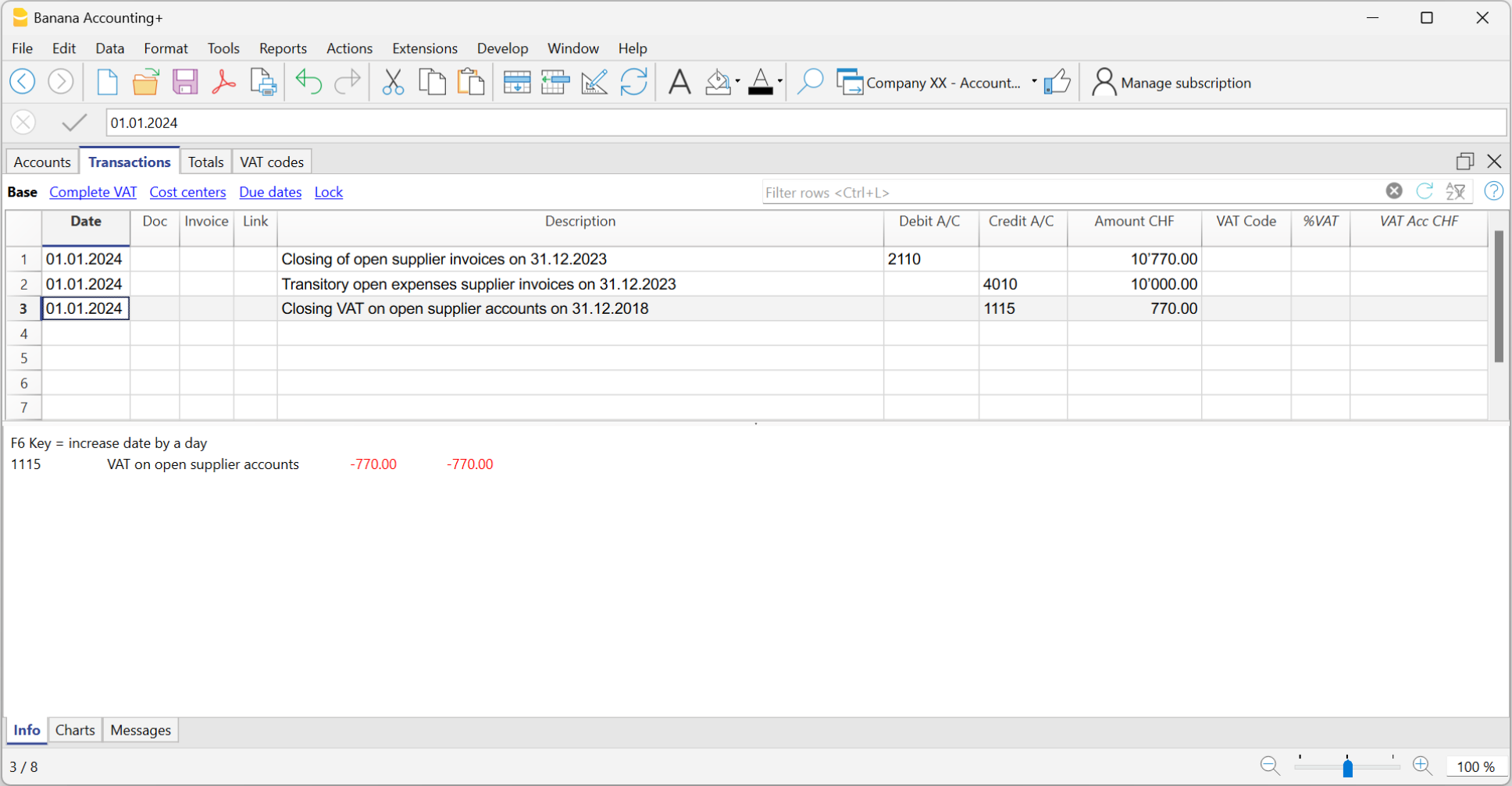

- Accrual method-based accounting – Costs and revenues are recorded at the time of issuing invoices to customers and receiving invoices from suppliers.

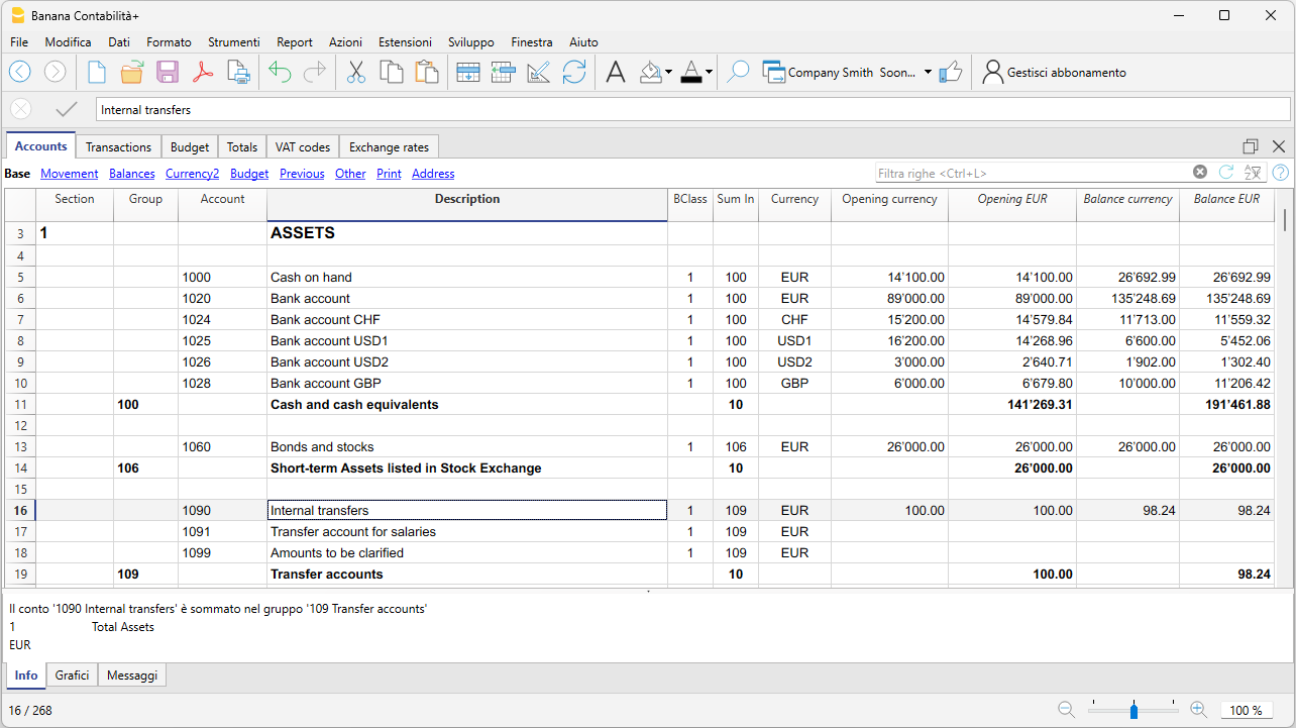

Additionally, templates are included to manage accounts in both the base currency and foreign currencies.

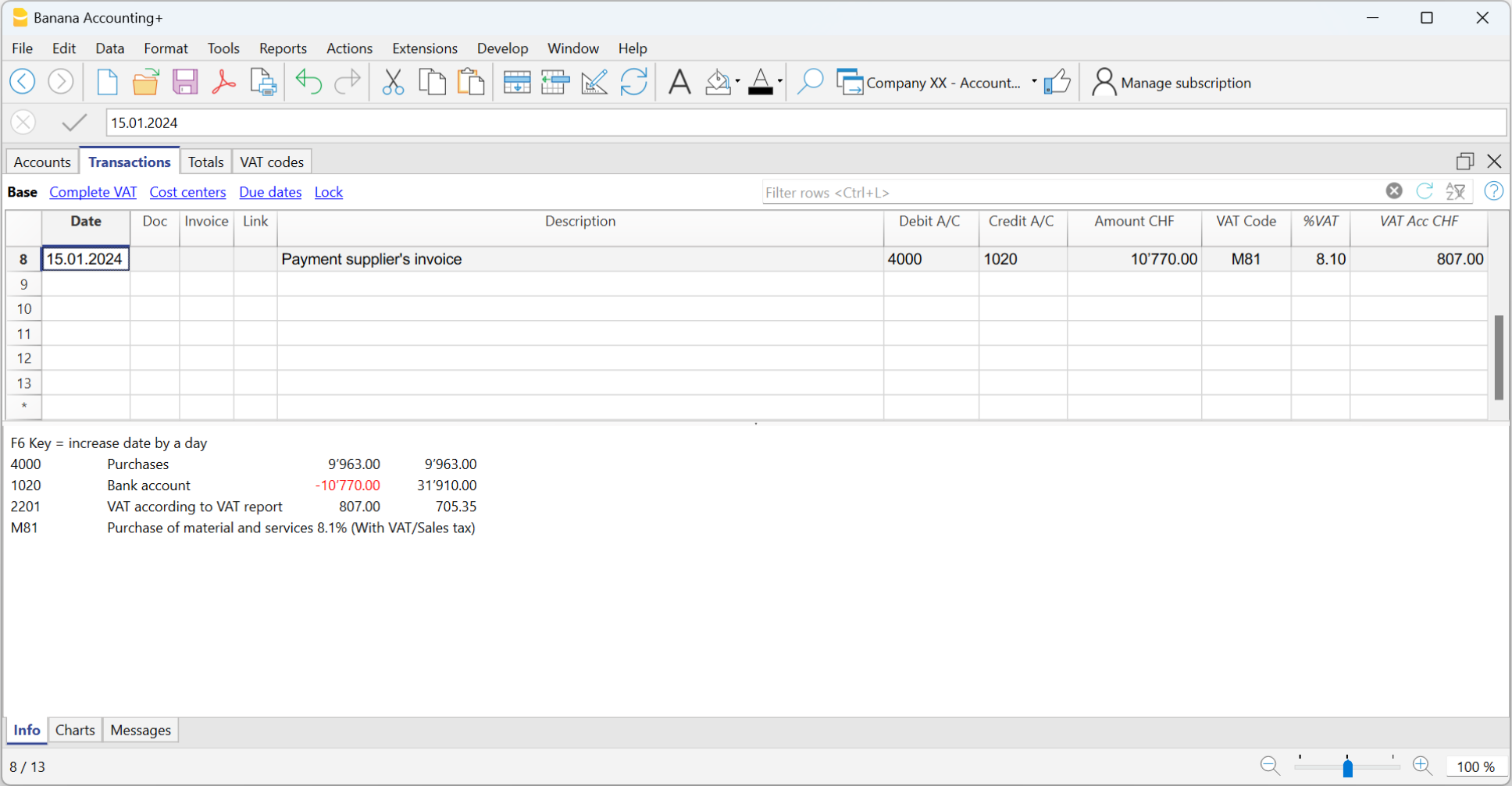

Work quickly with automation features

The program includes many automation features that allow you to work quickly and securely.

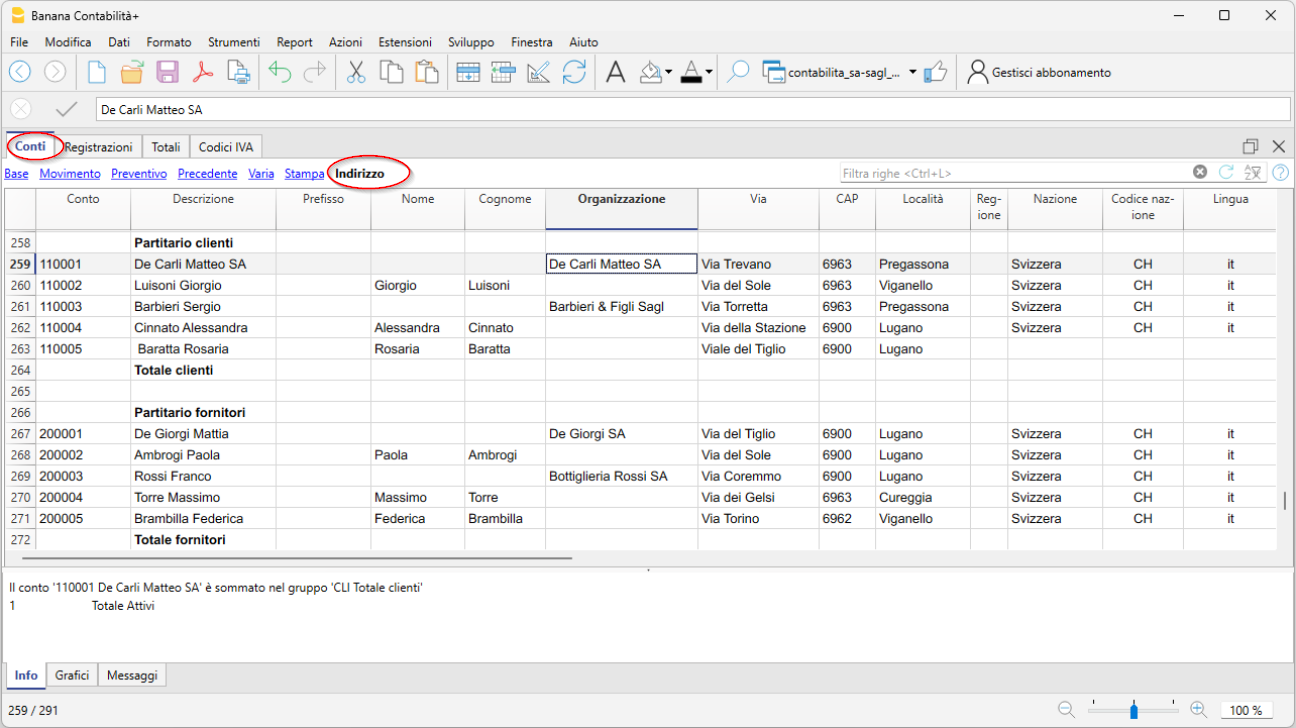

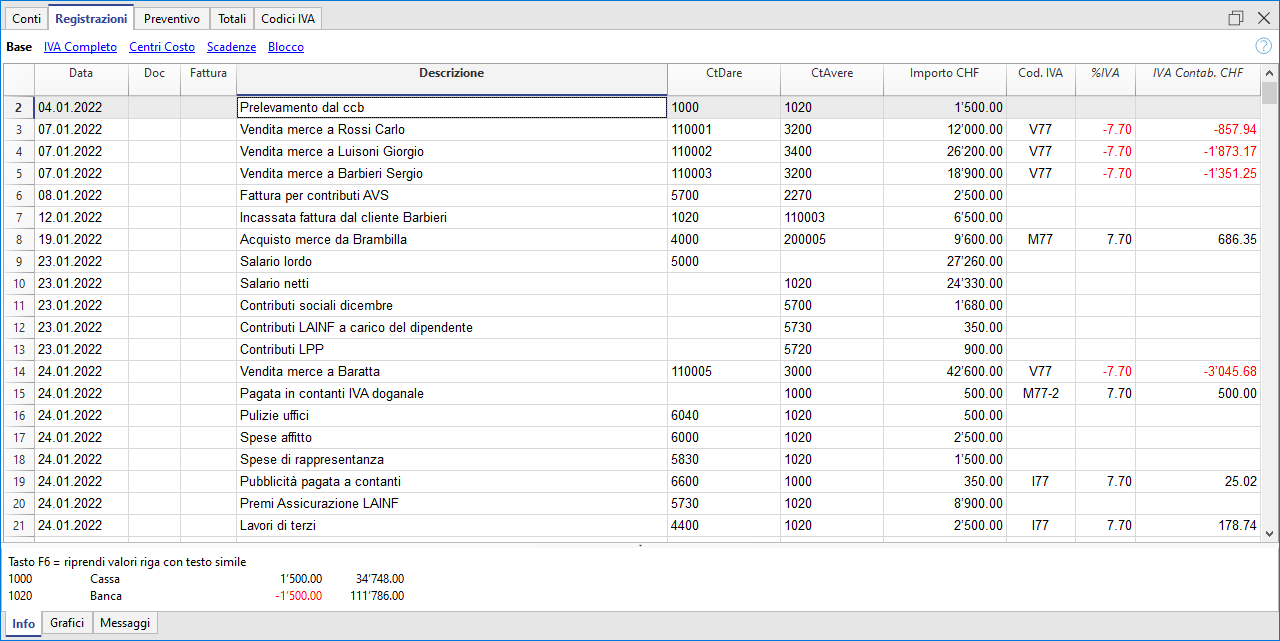

- Reuse previously entered texts

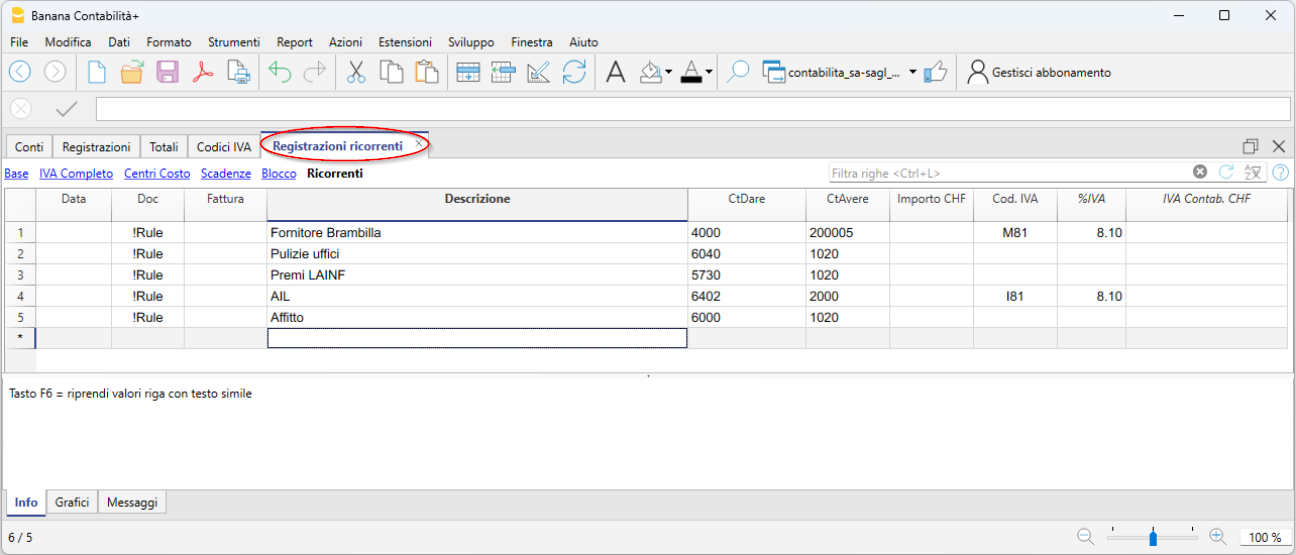

Easily reuse previously entered content without having to retype it manually. - Retrieve data from stored transactions

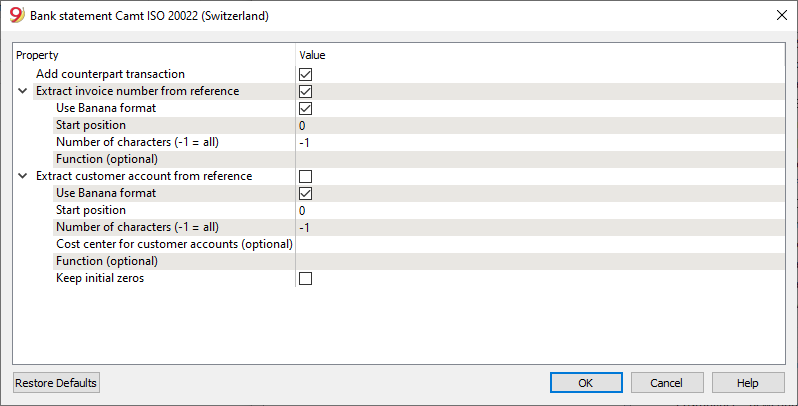

You can store recurring transactions in a table and retrieve them with a click, without having to re-enter the text - Import bank, postal, and credit card data

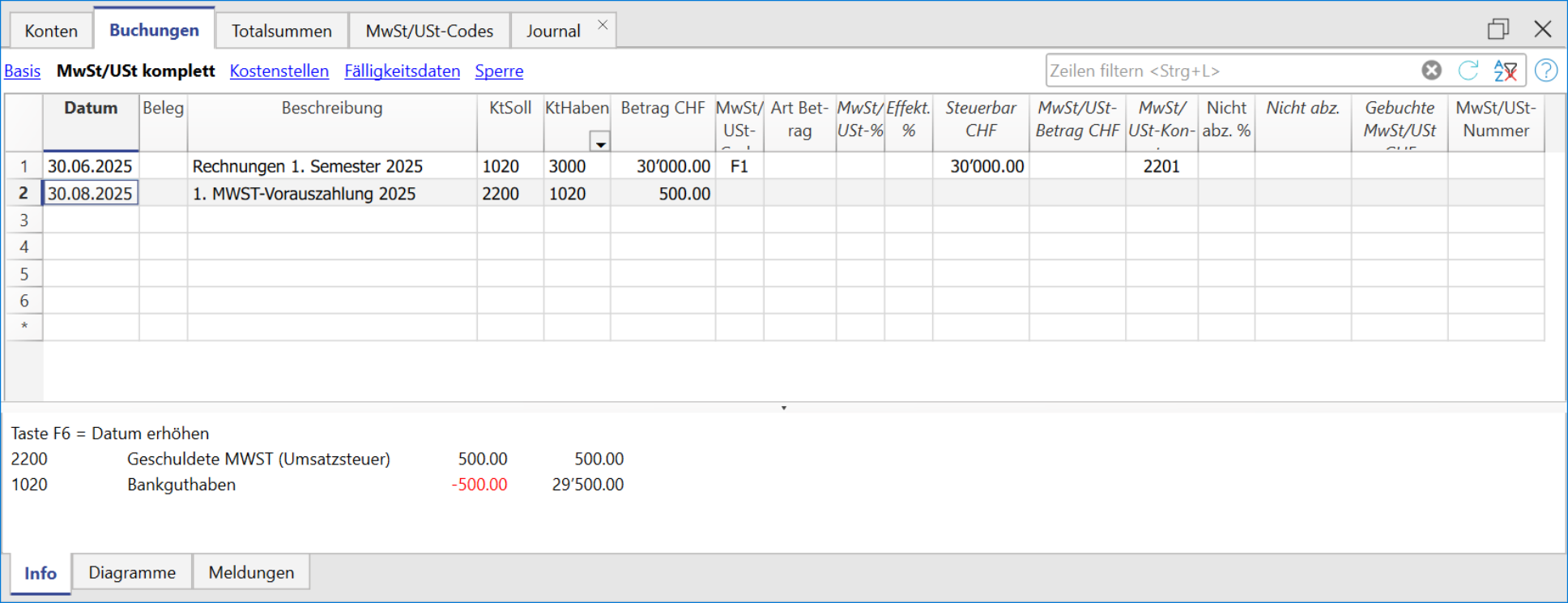

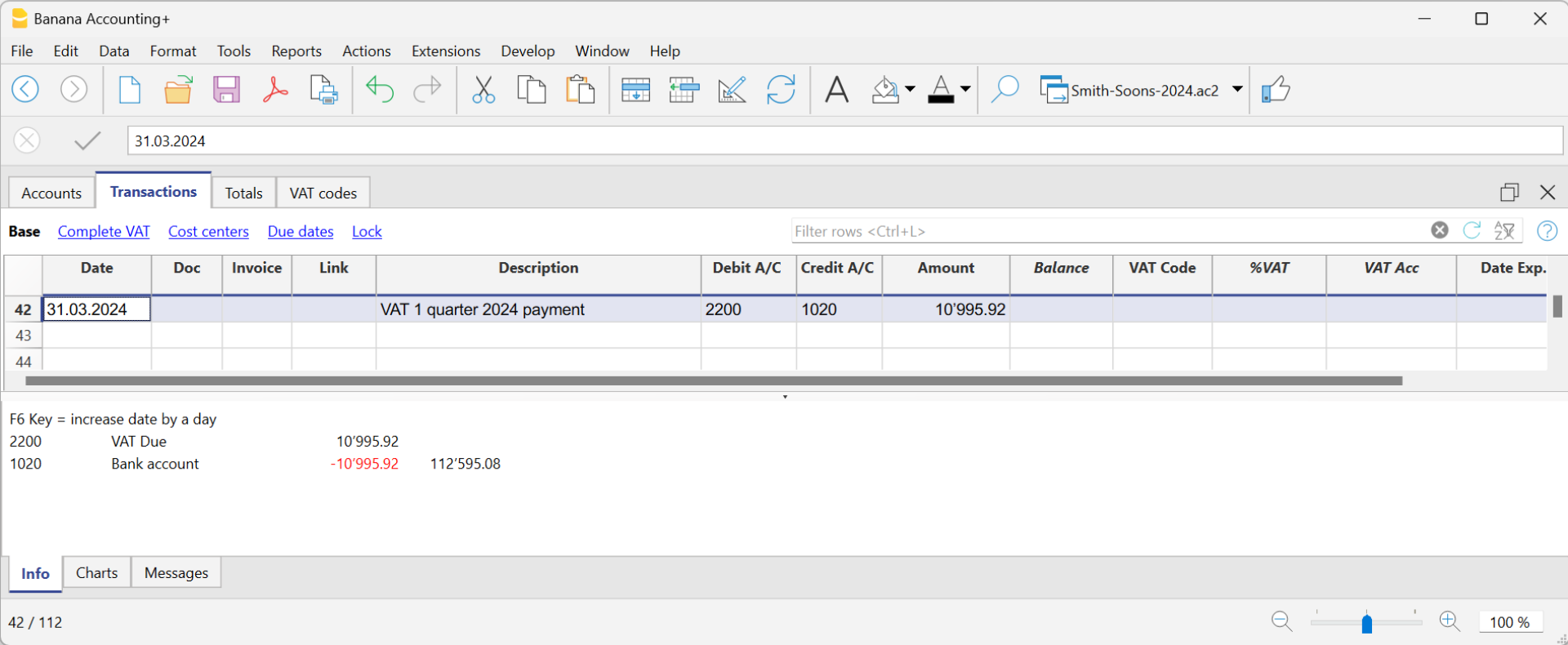

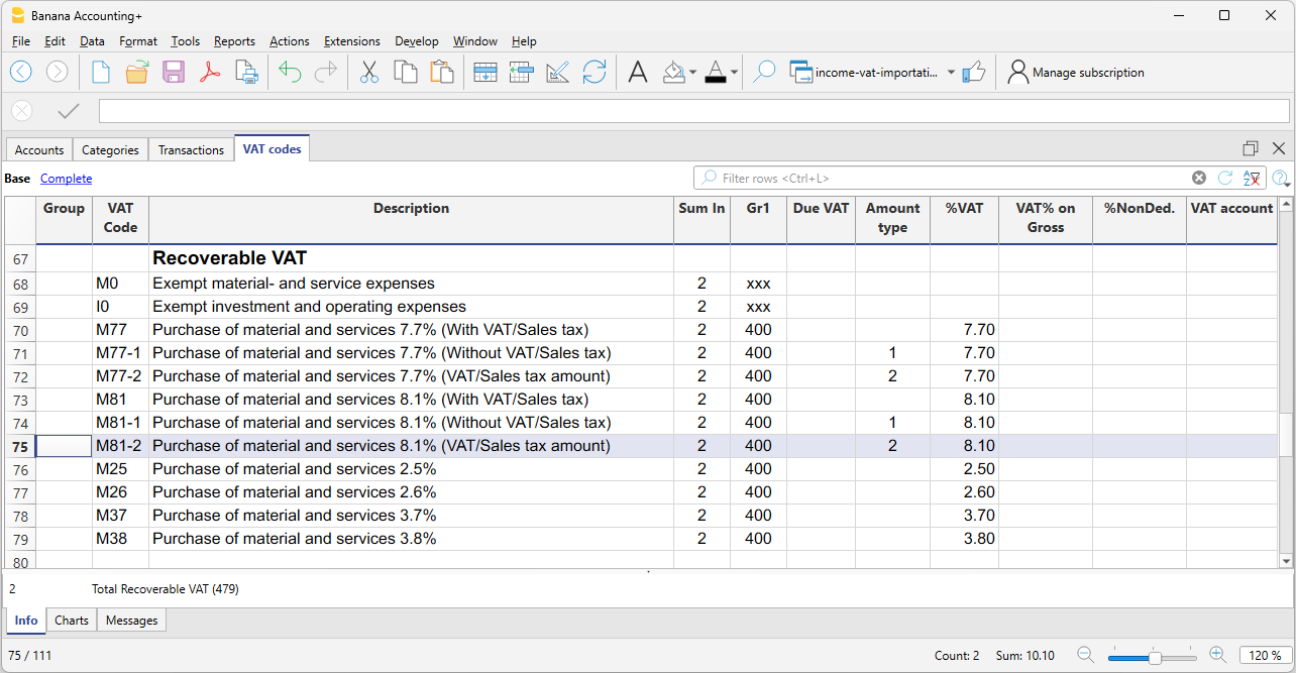

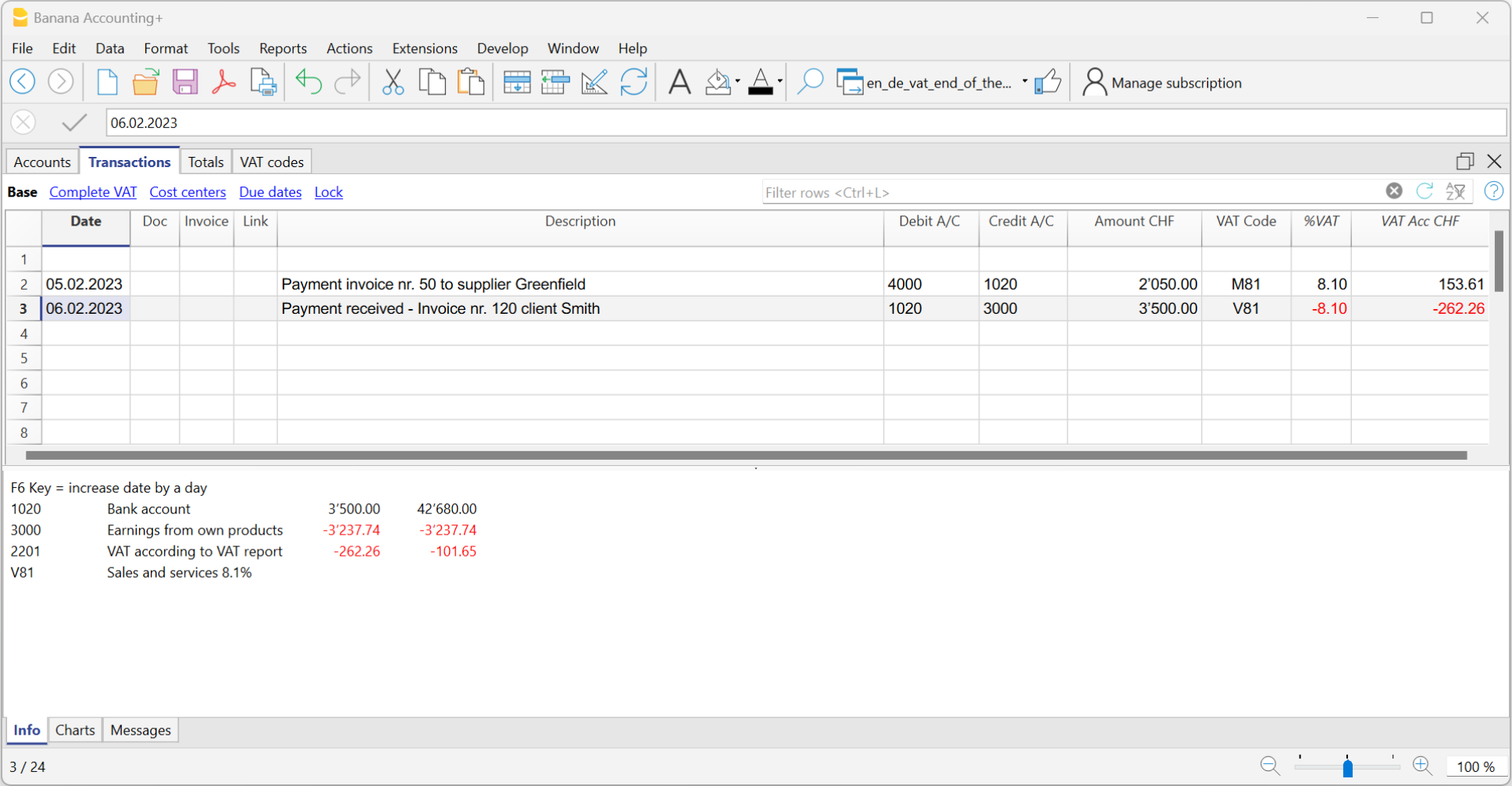

Effortlessly integrate bank, postal, and credit card data into your accounting. Numerous import formats are available to automatically retrieve the data. - VAT calculations and summaries

Automate VAT calculations and summaries for error-free tax management. - Foreign currencies

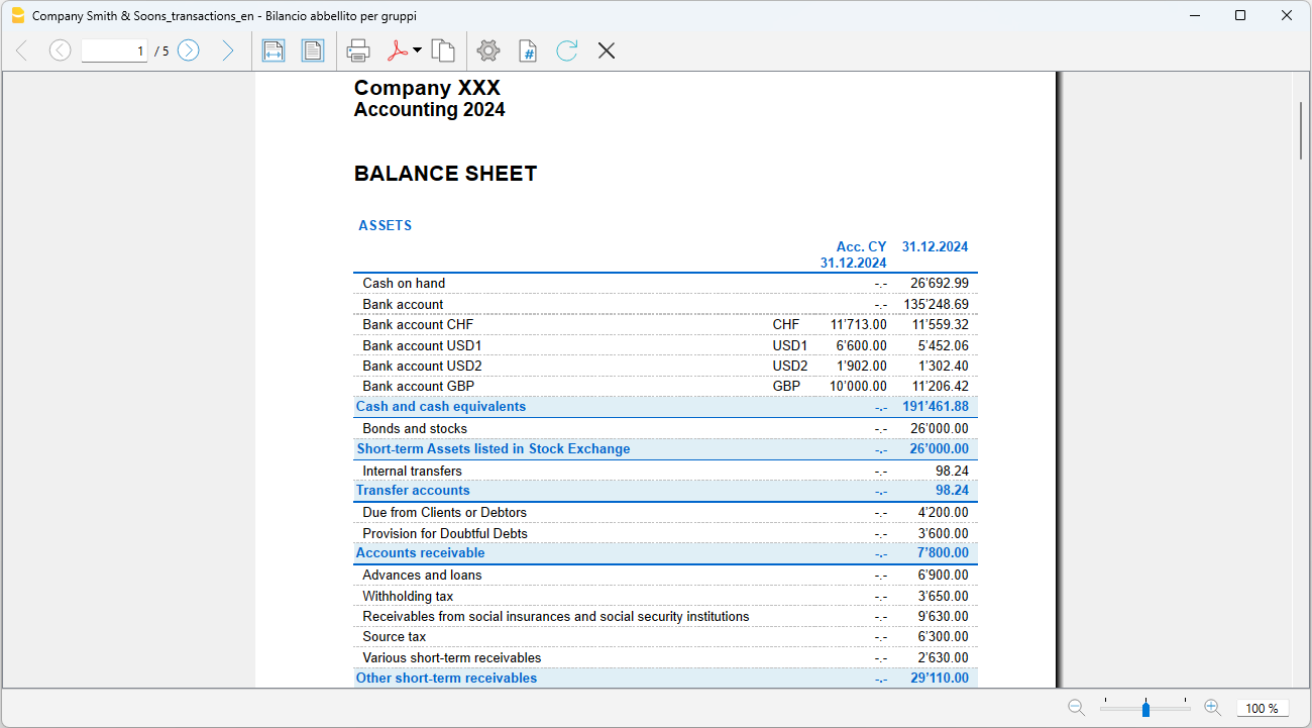

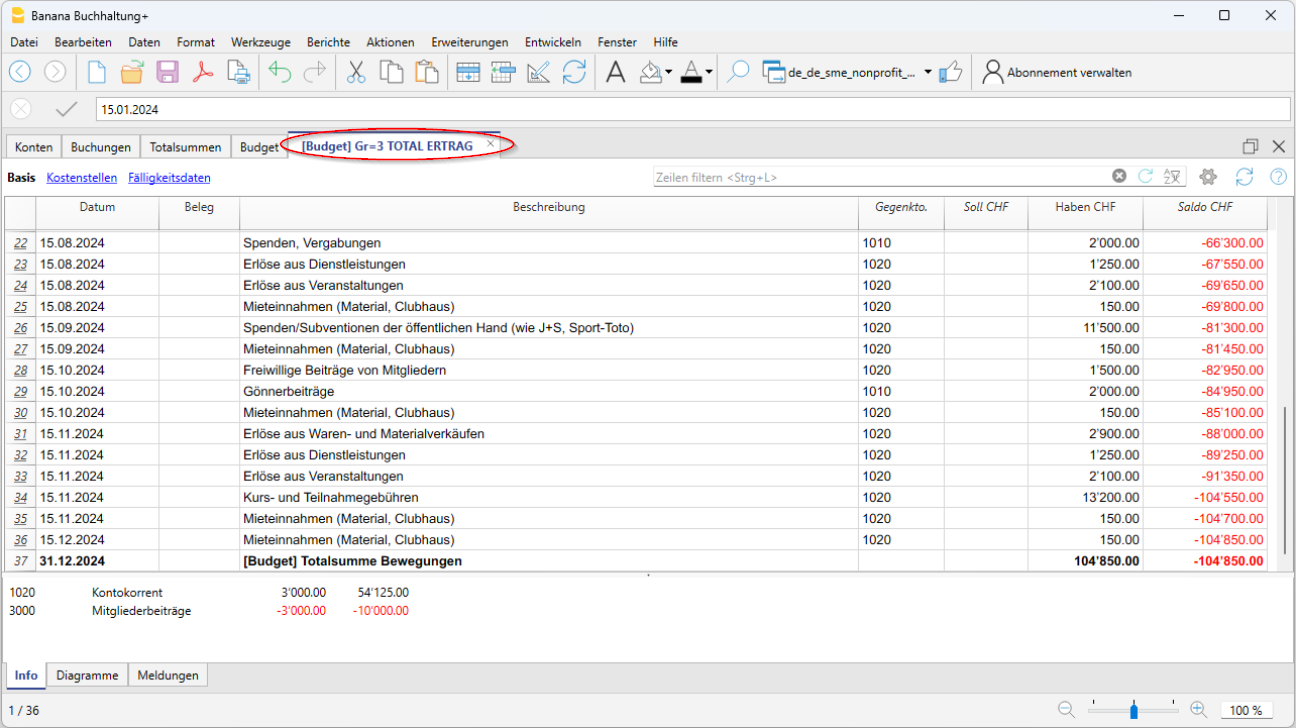

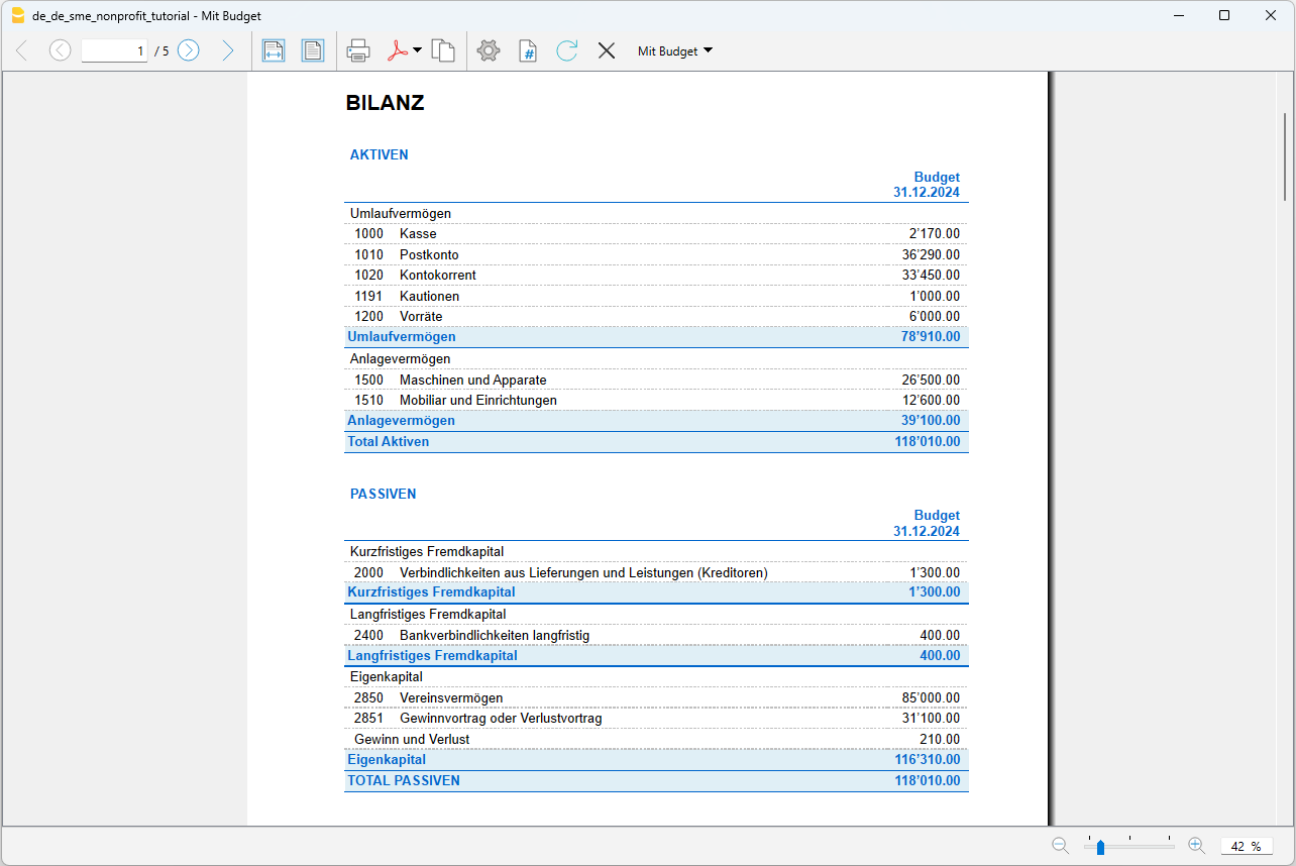

Easily account for transactions in different currencies, including cryptocurrencies. Fixed and variable exchange rates. Automated exchange rate differences. - Balance sheets, account ledgers, journals, and other reports

Generate detailed balance sheets, account ledgers, journals, and other reports with just one click. - Cost/Profit Centers and Segments

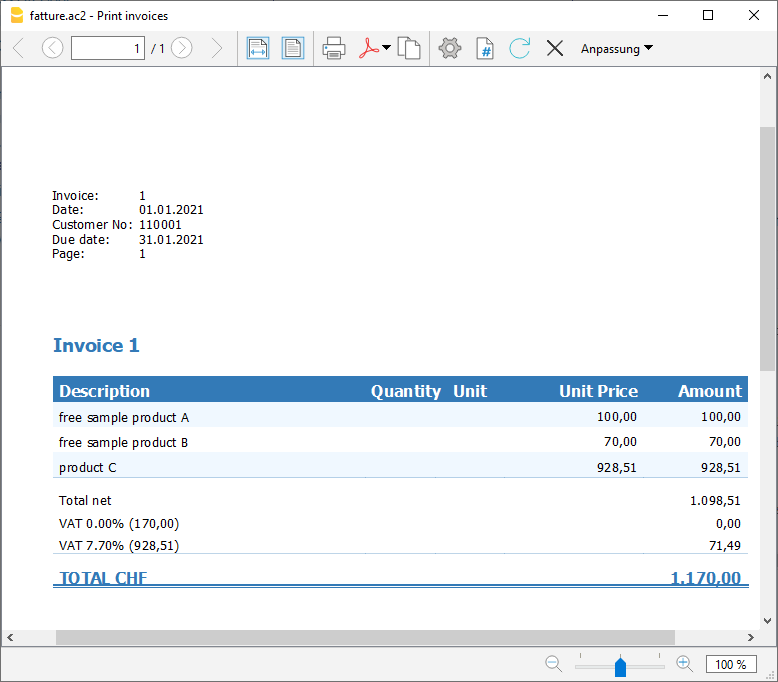

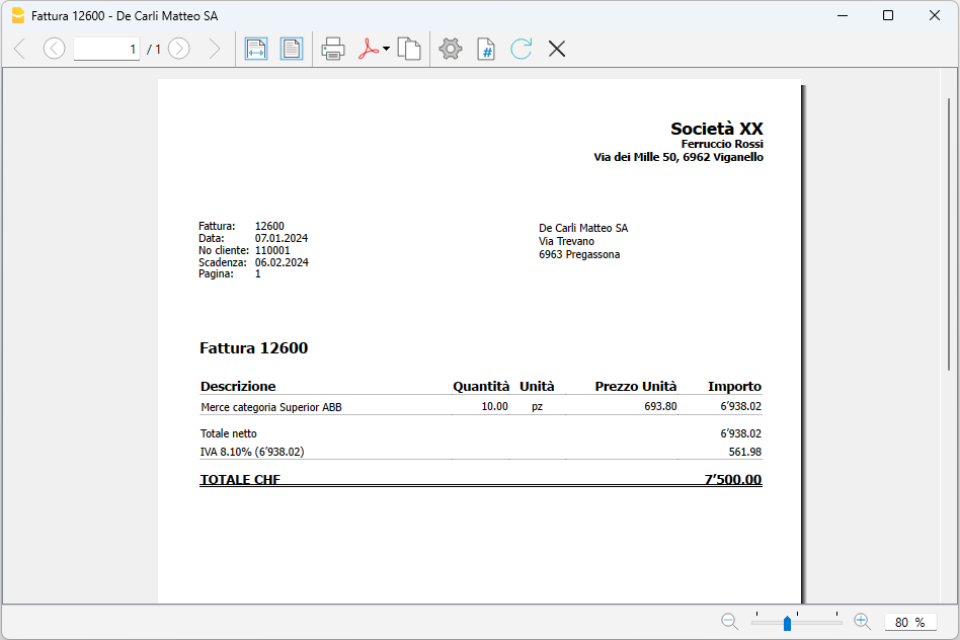

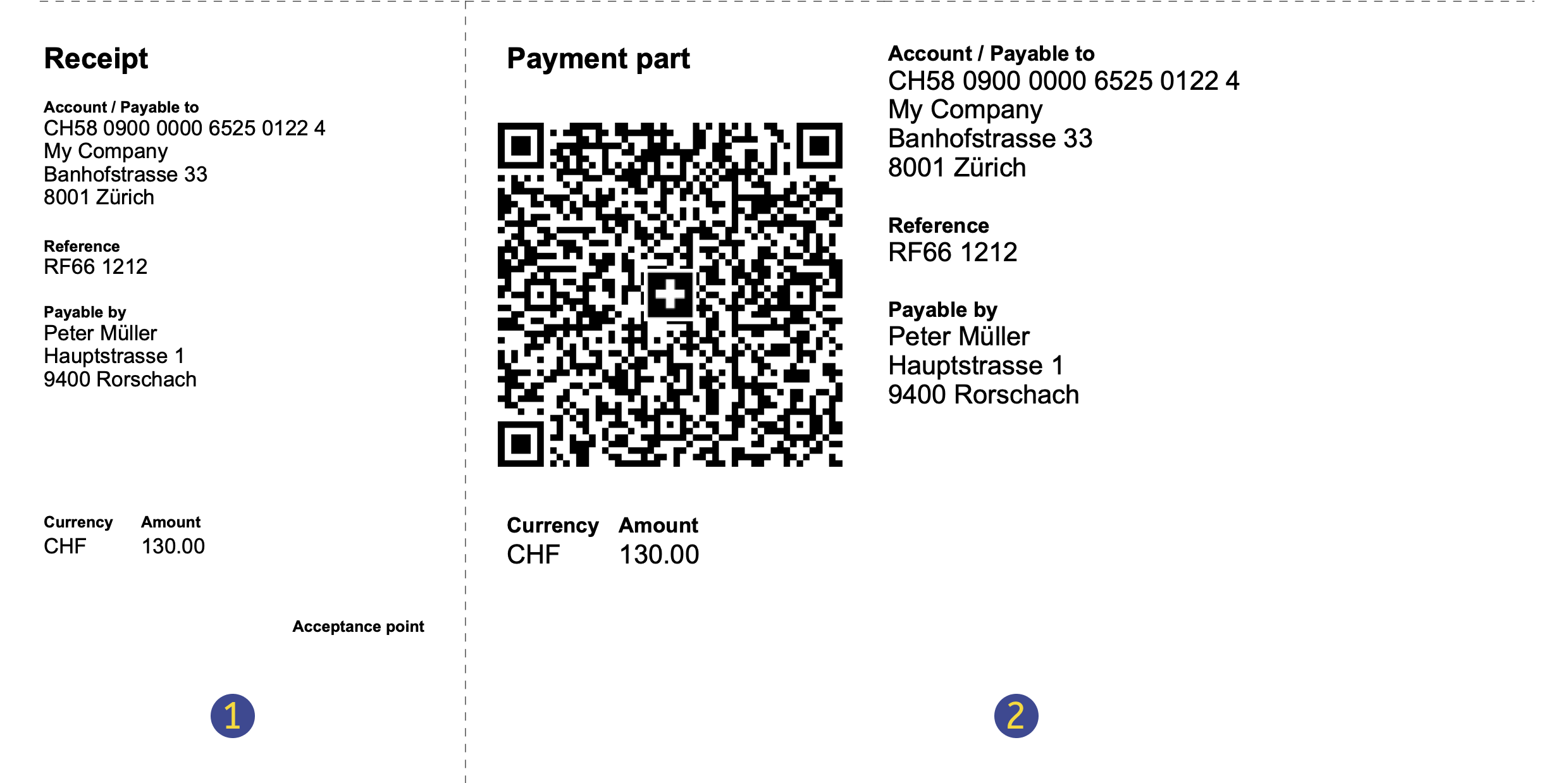

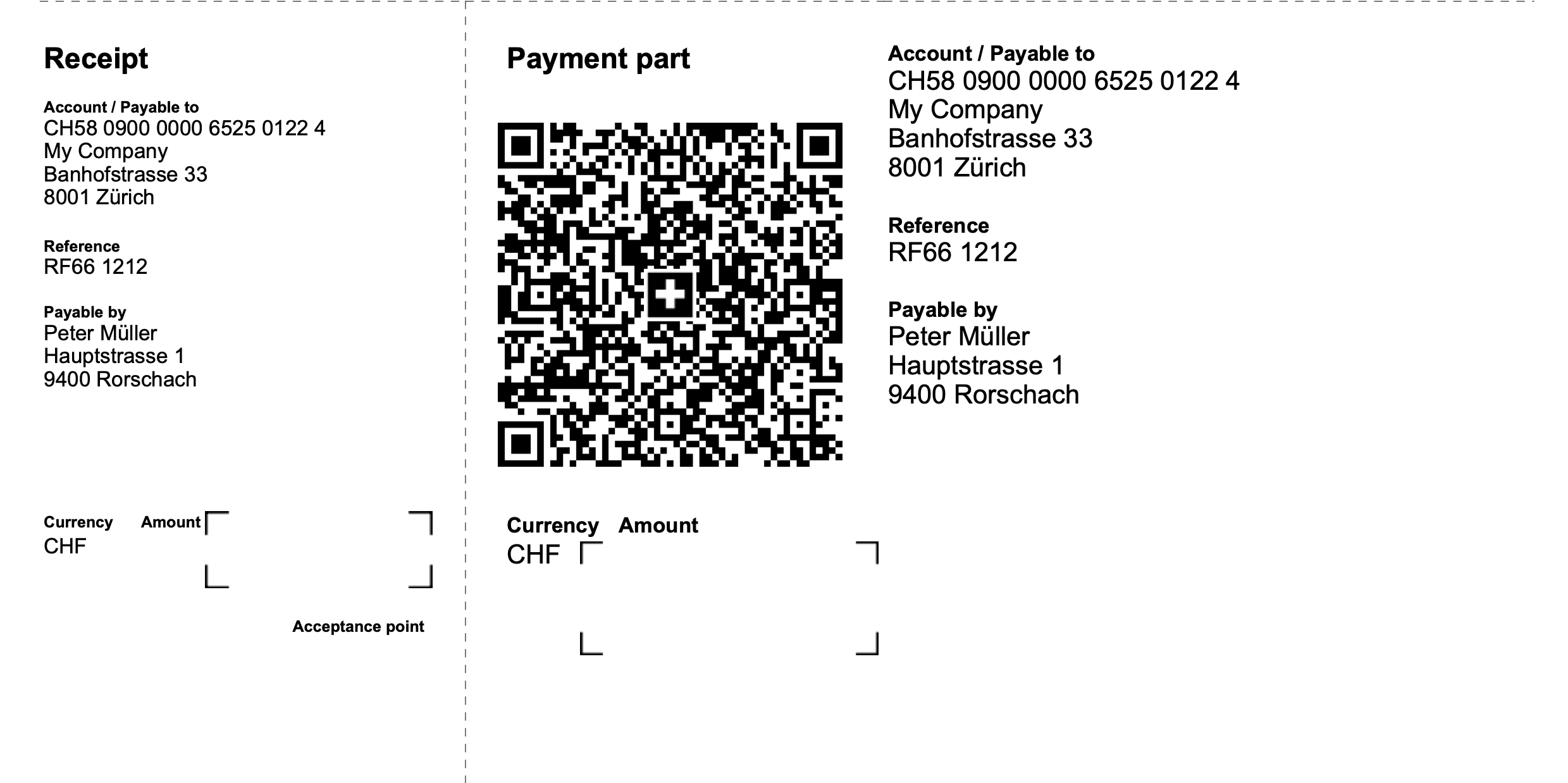

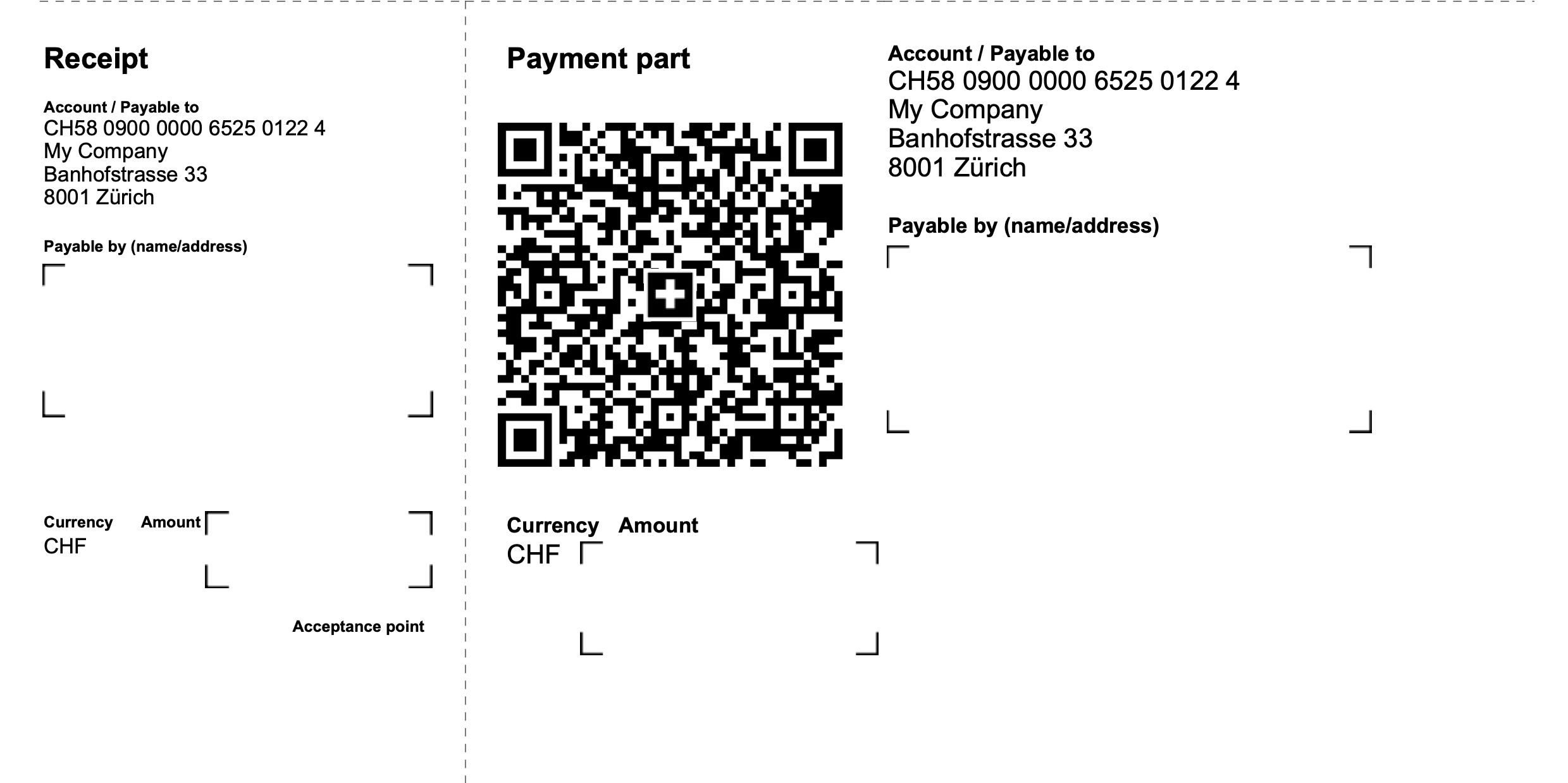

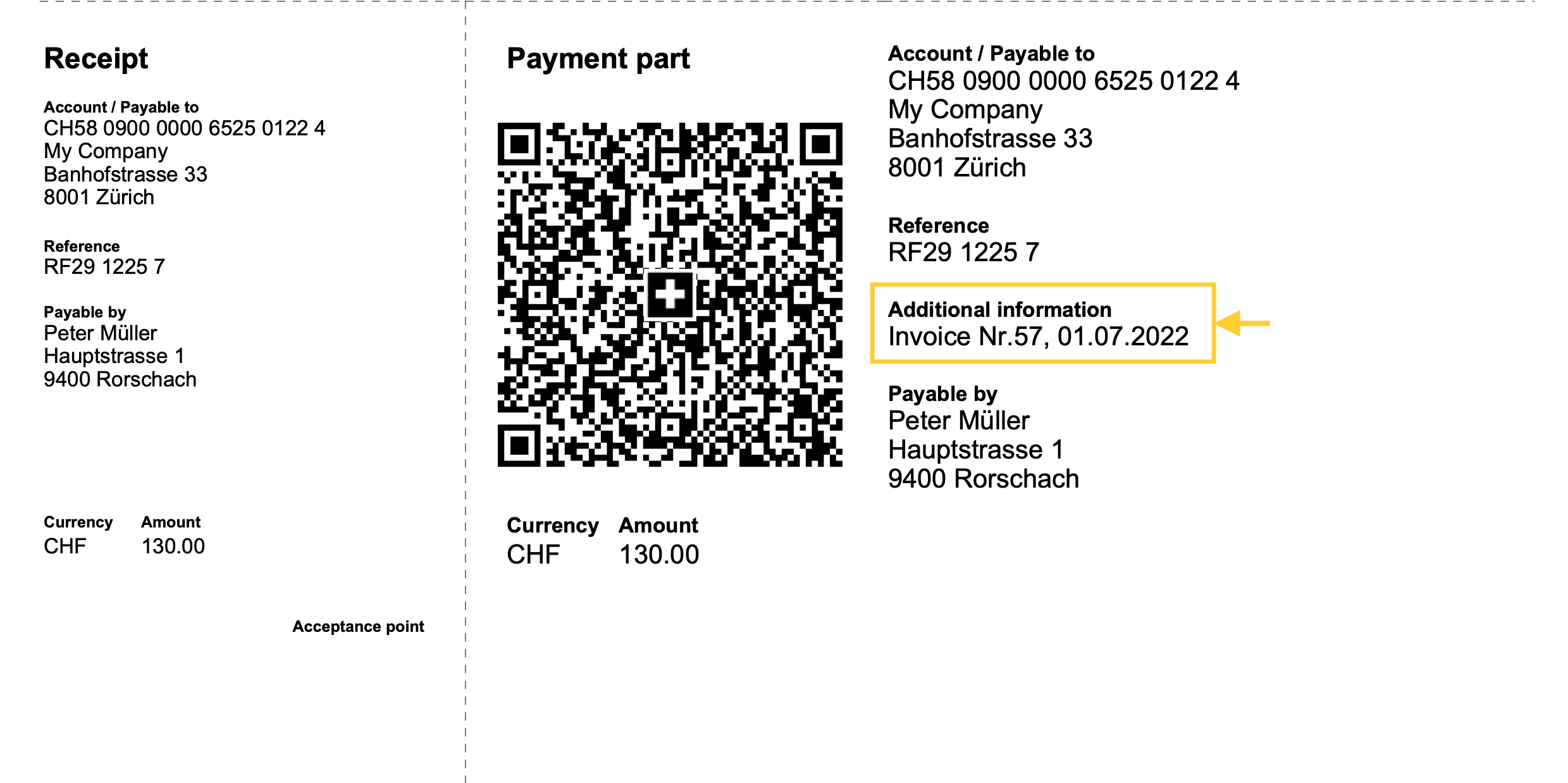

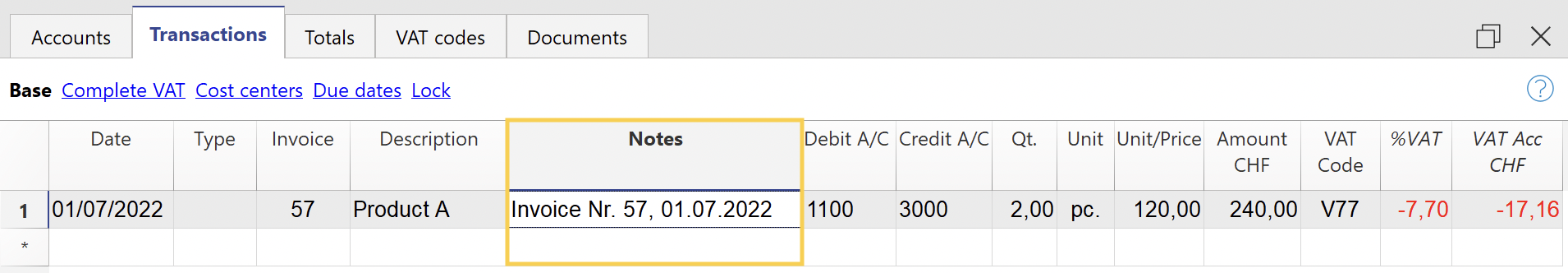

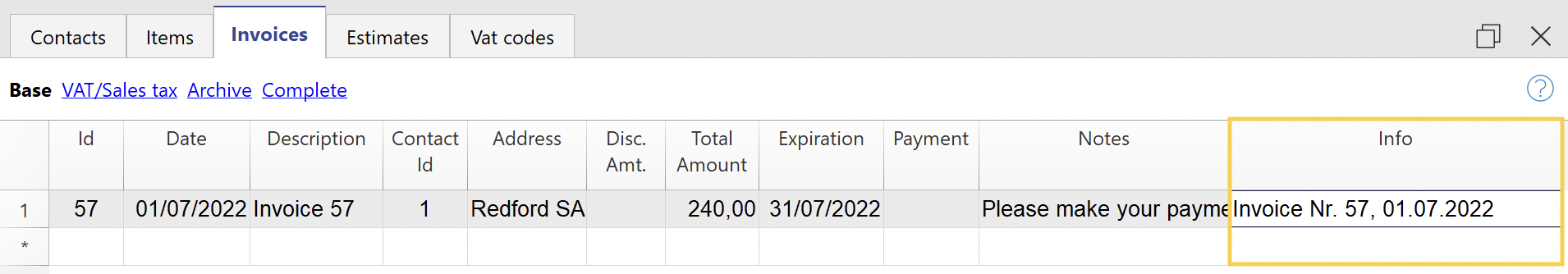

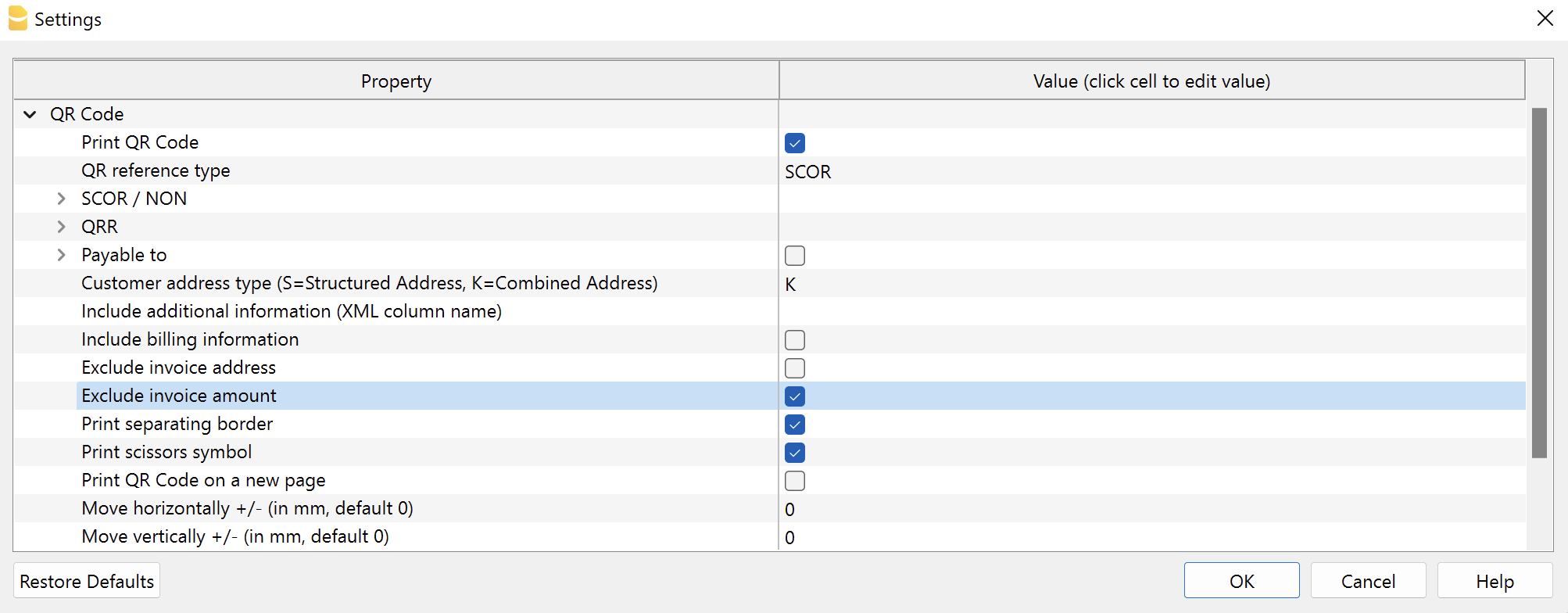

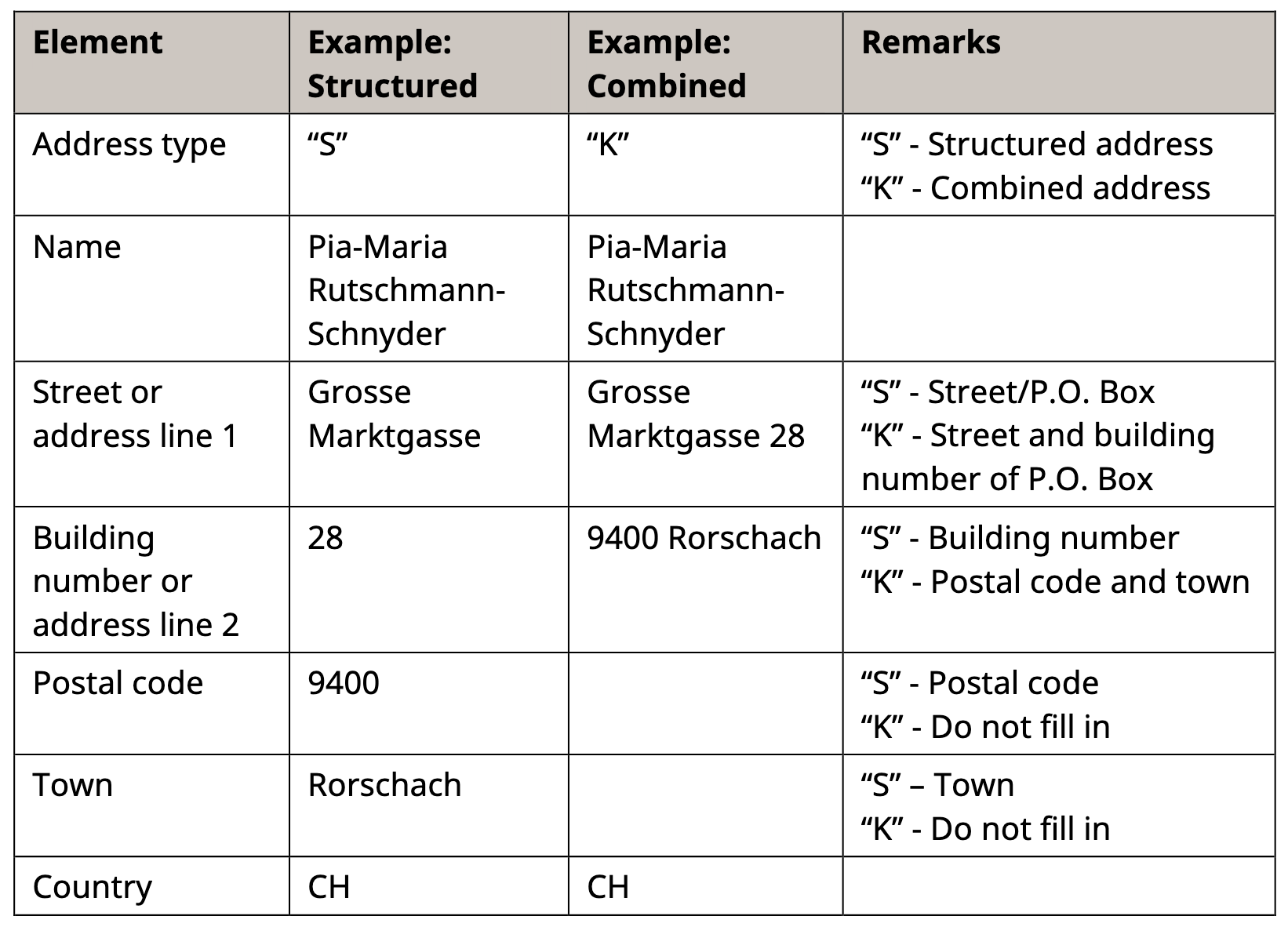

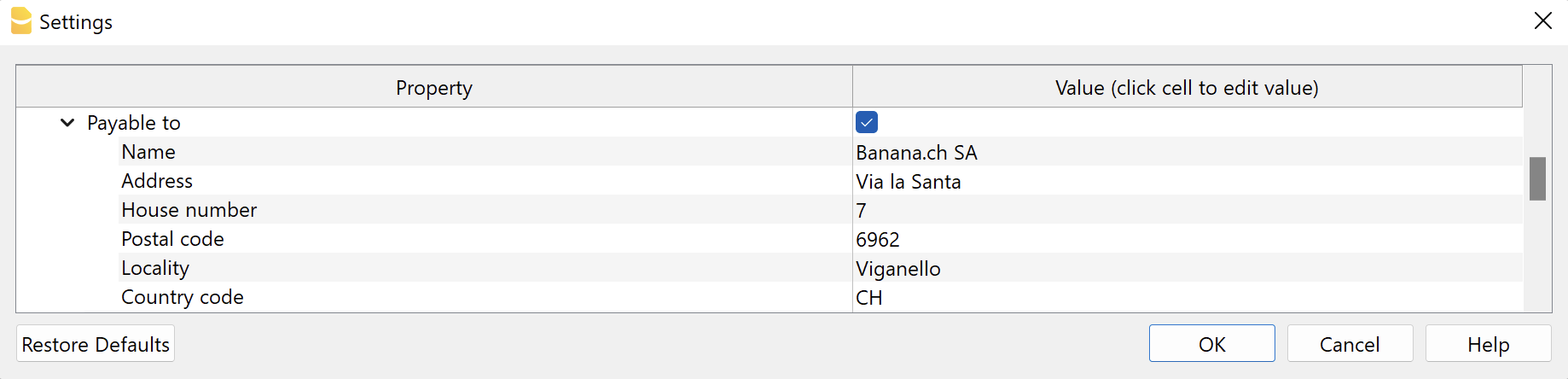

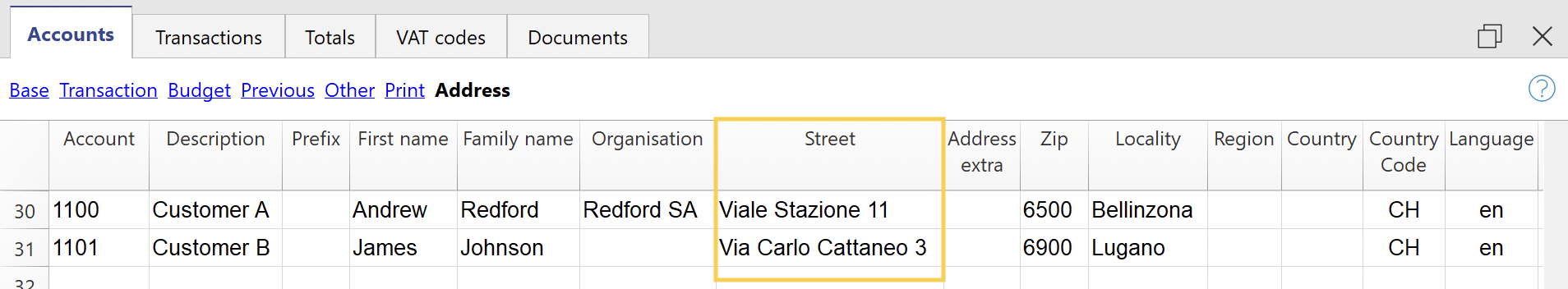

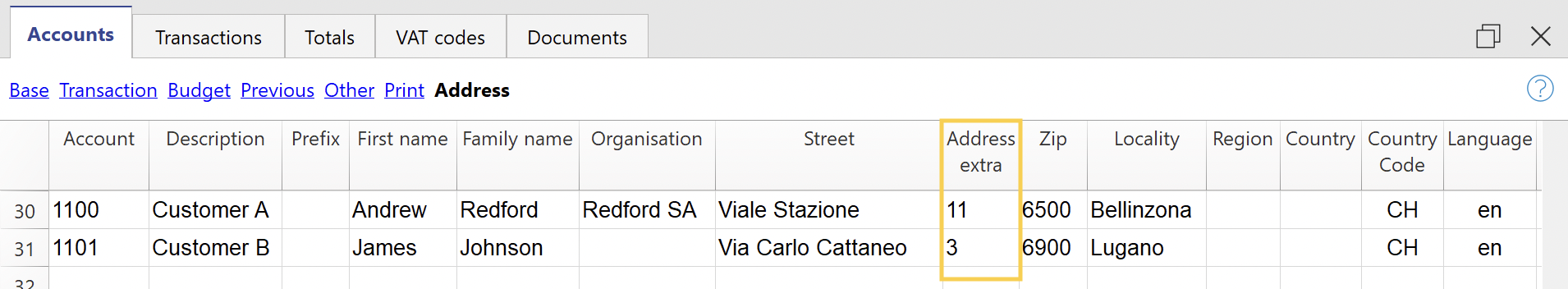

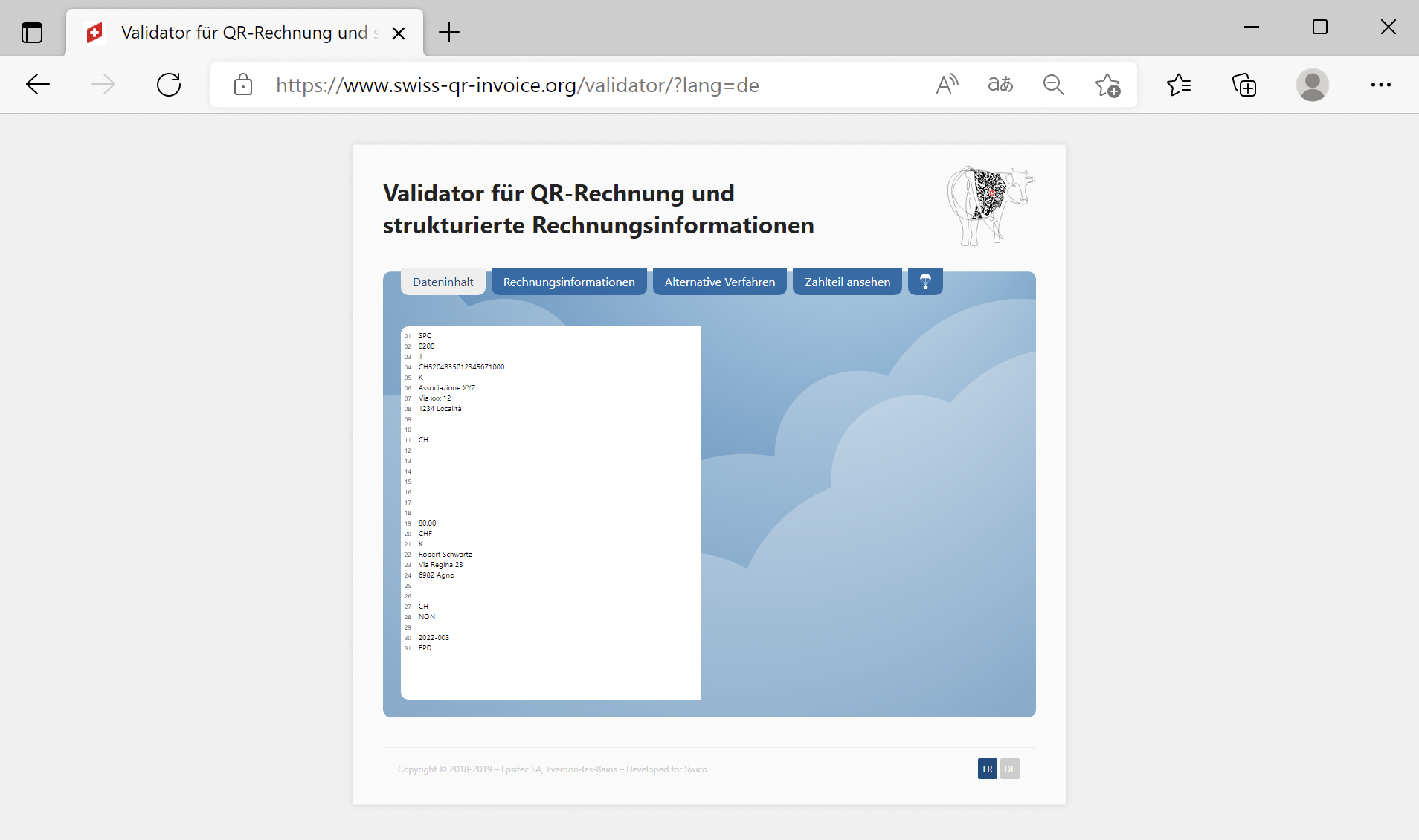

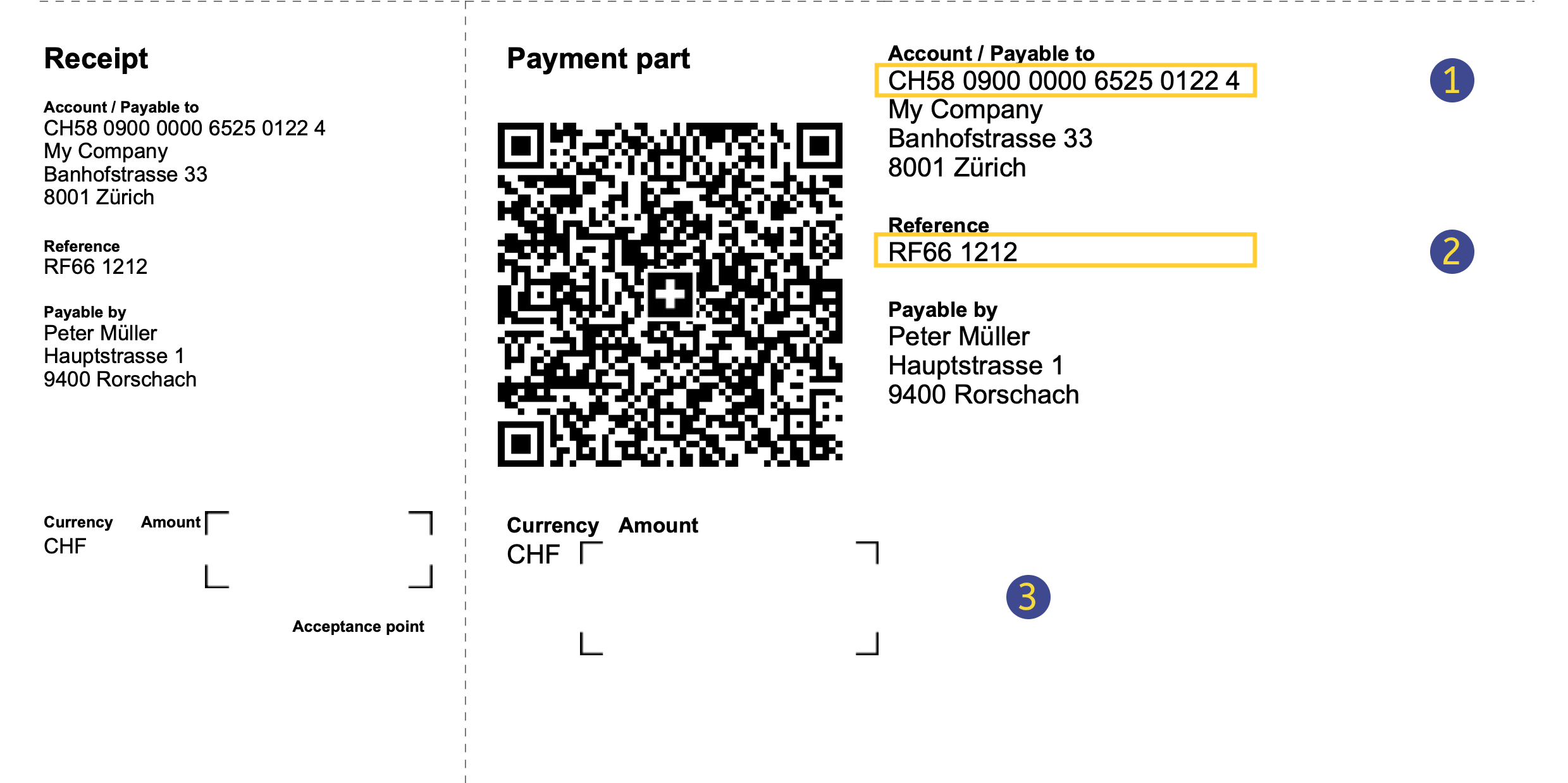

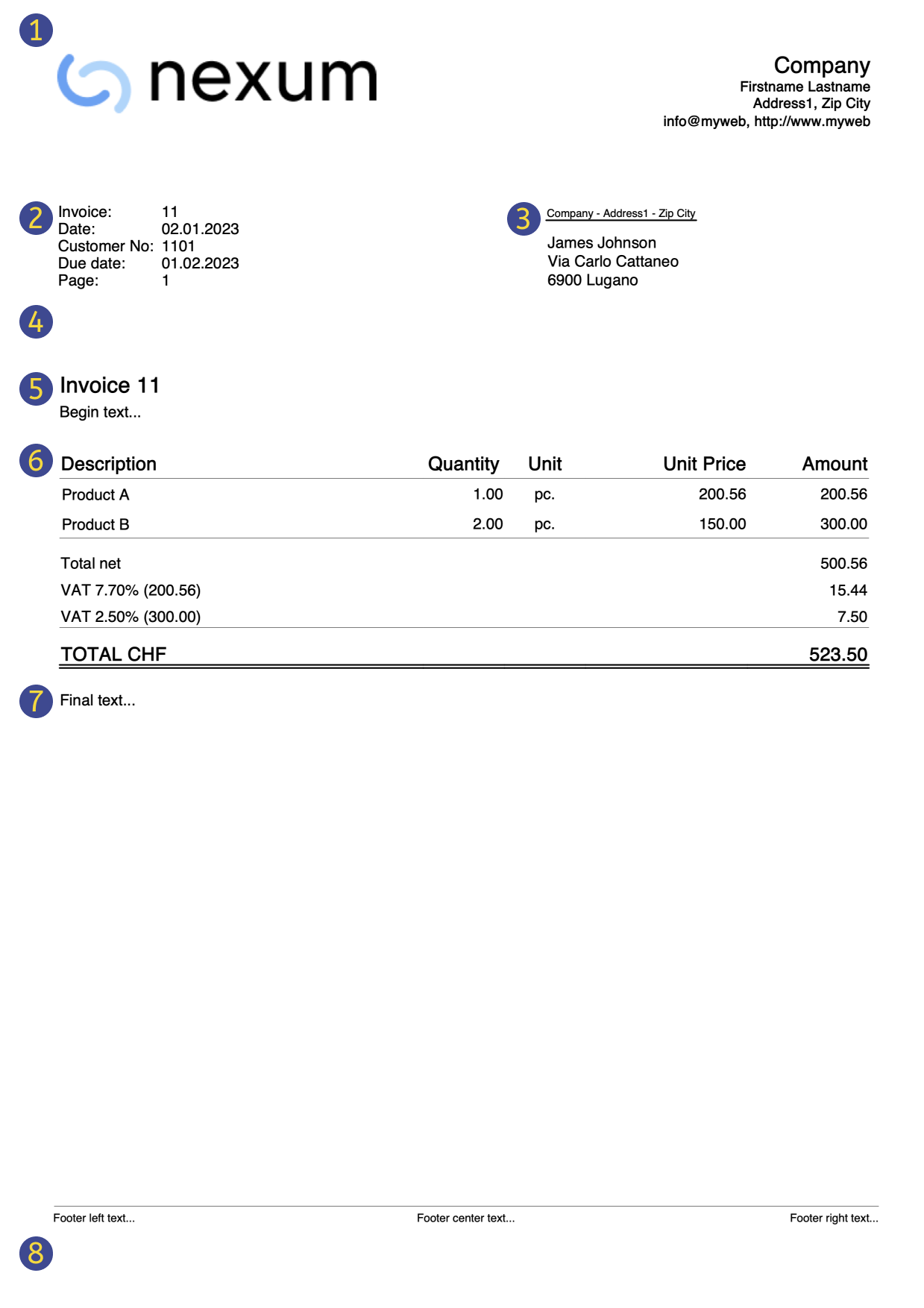

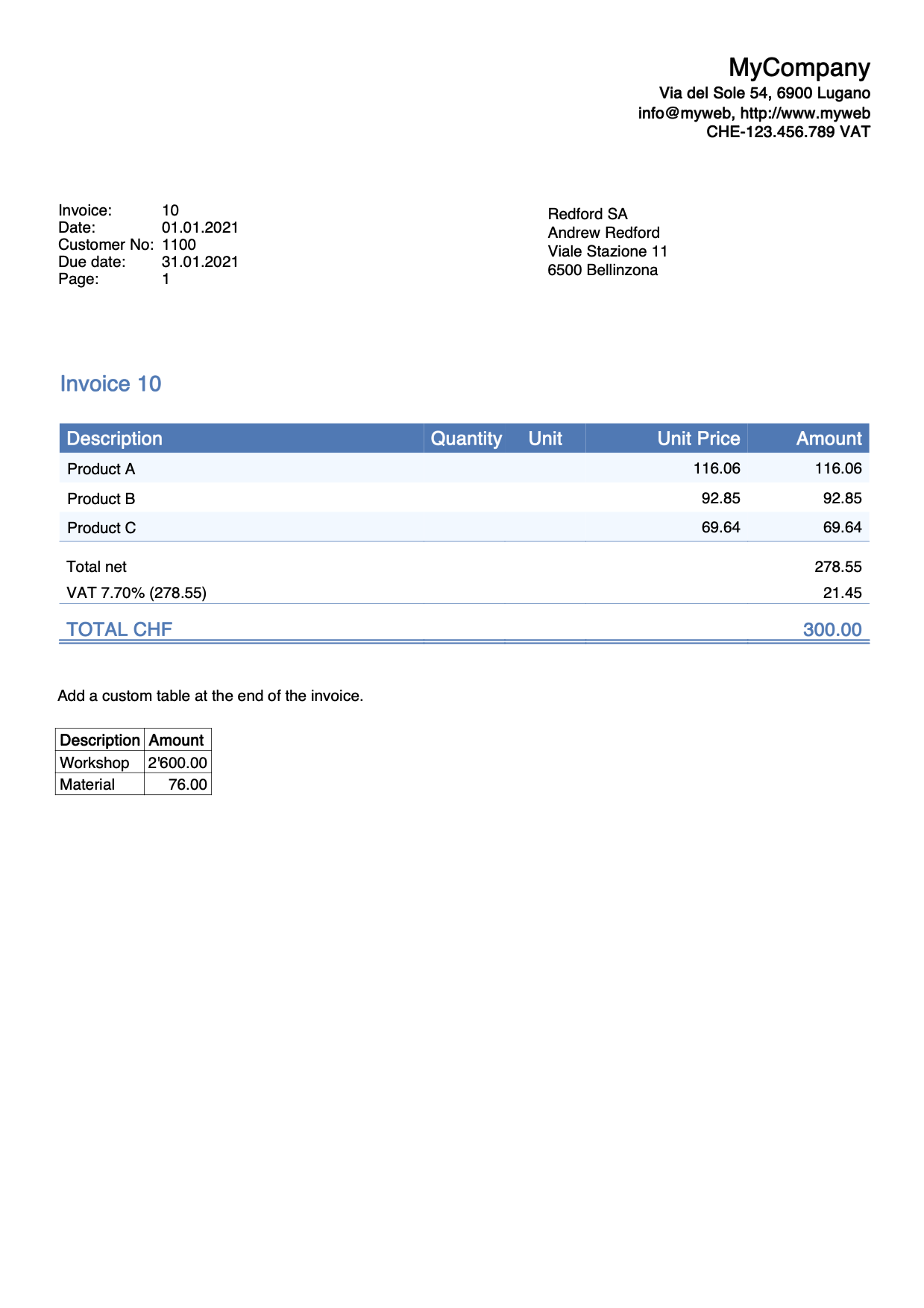

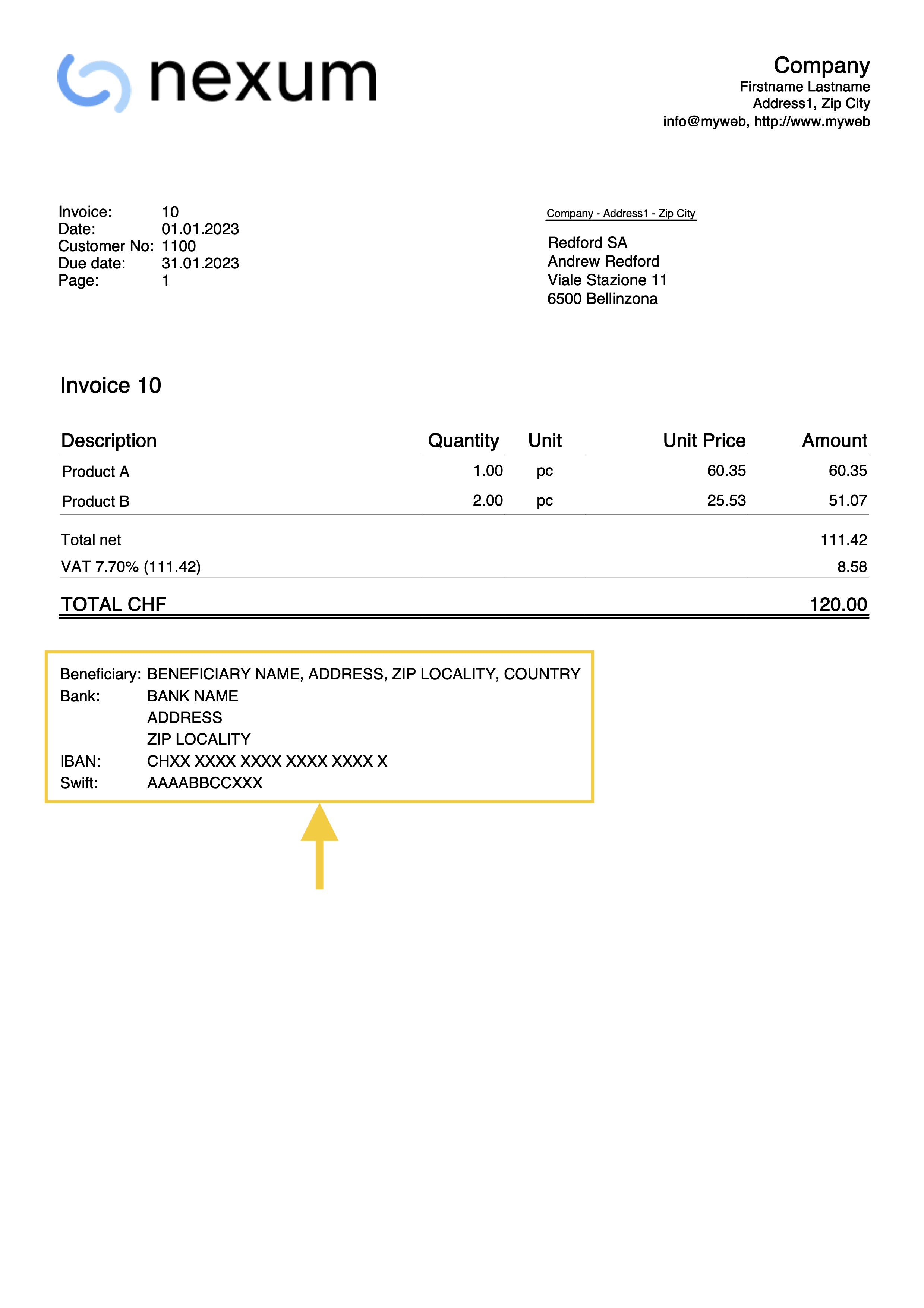

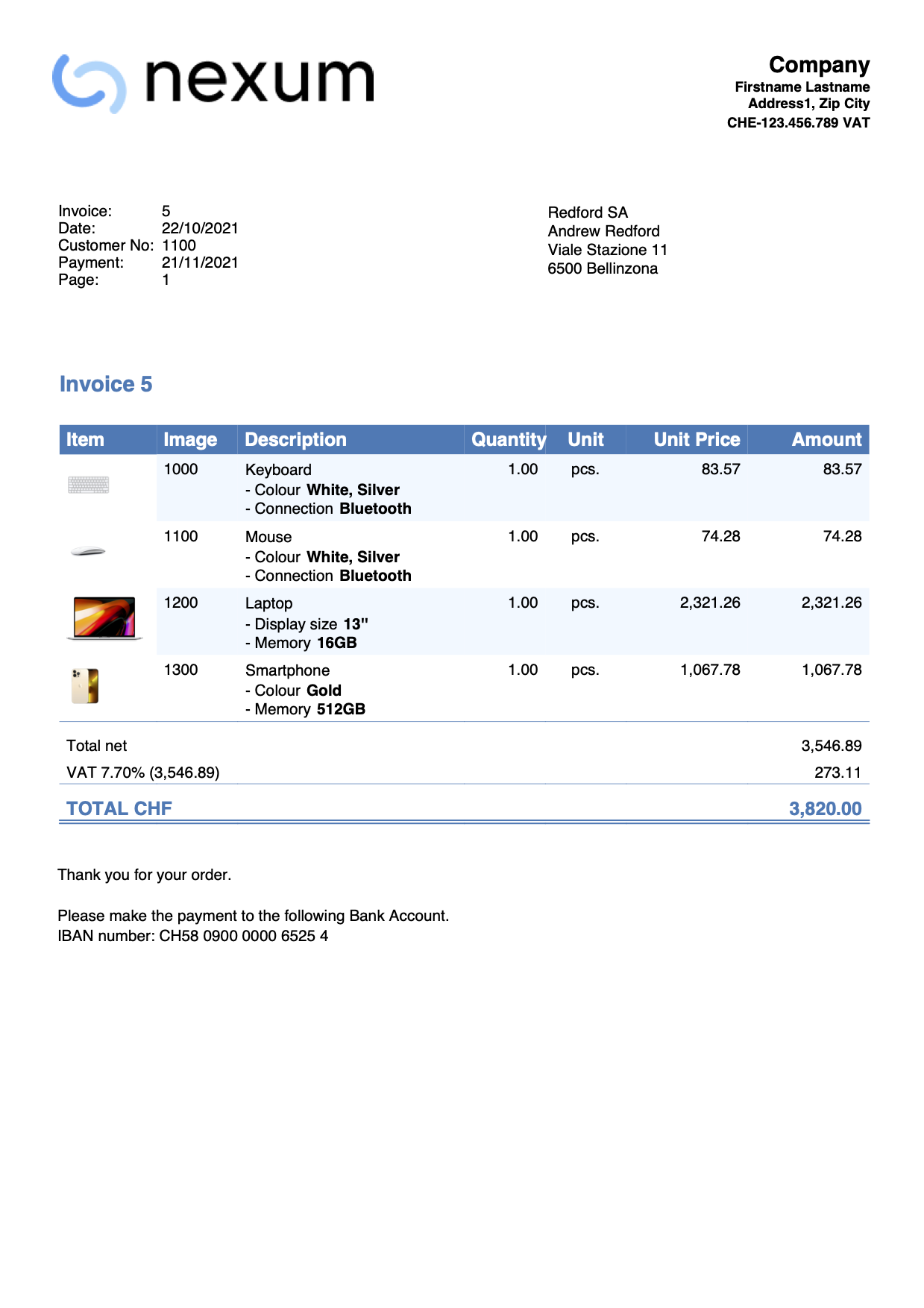

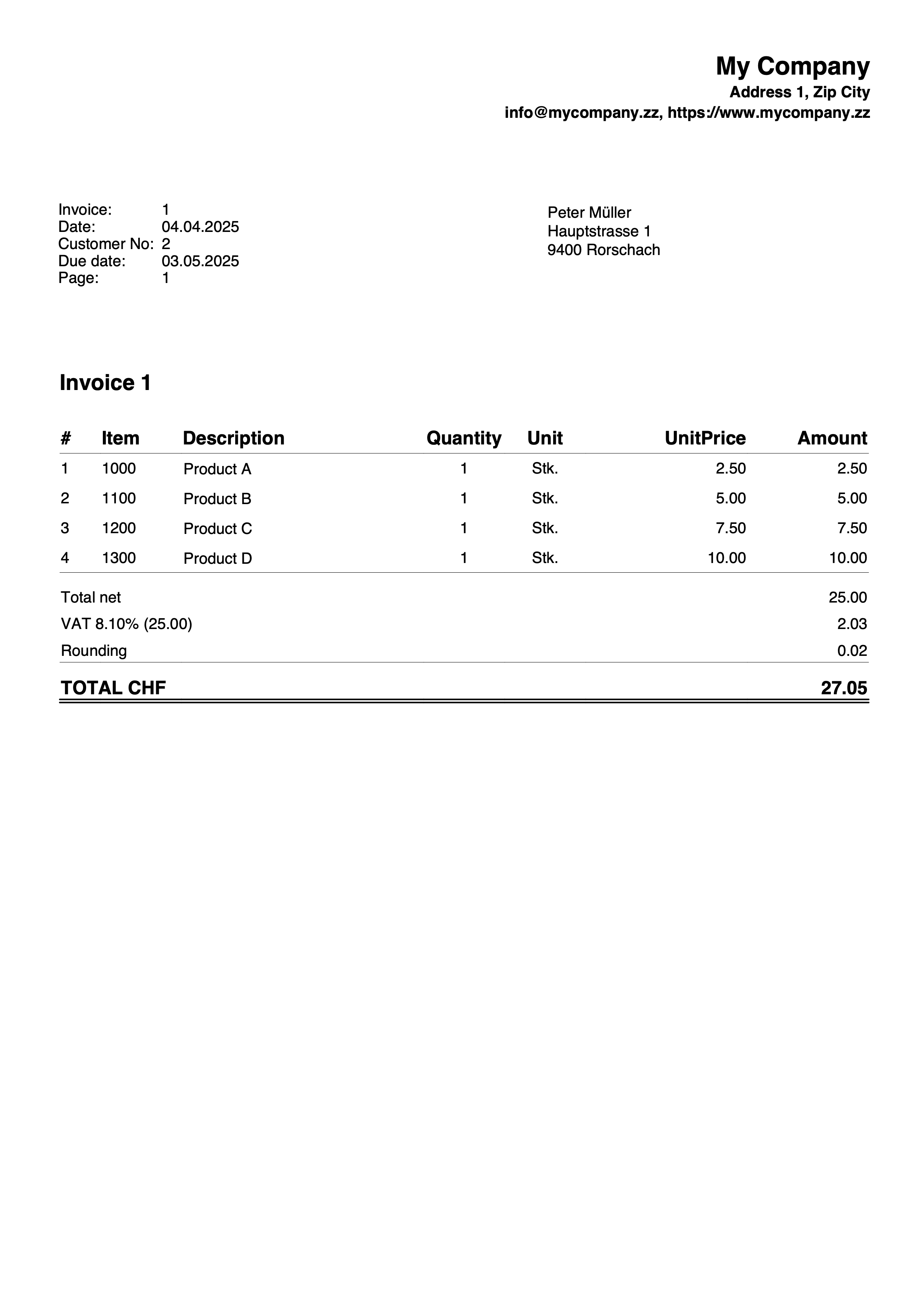

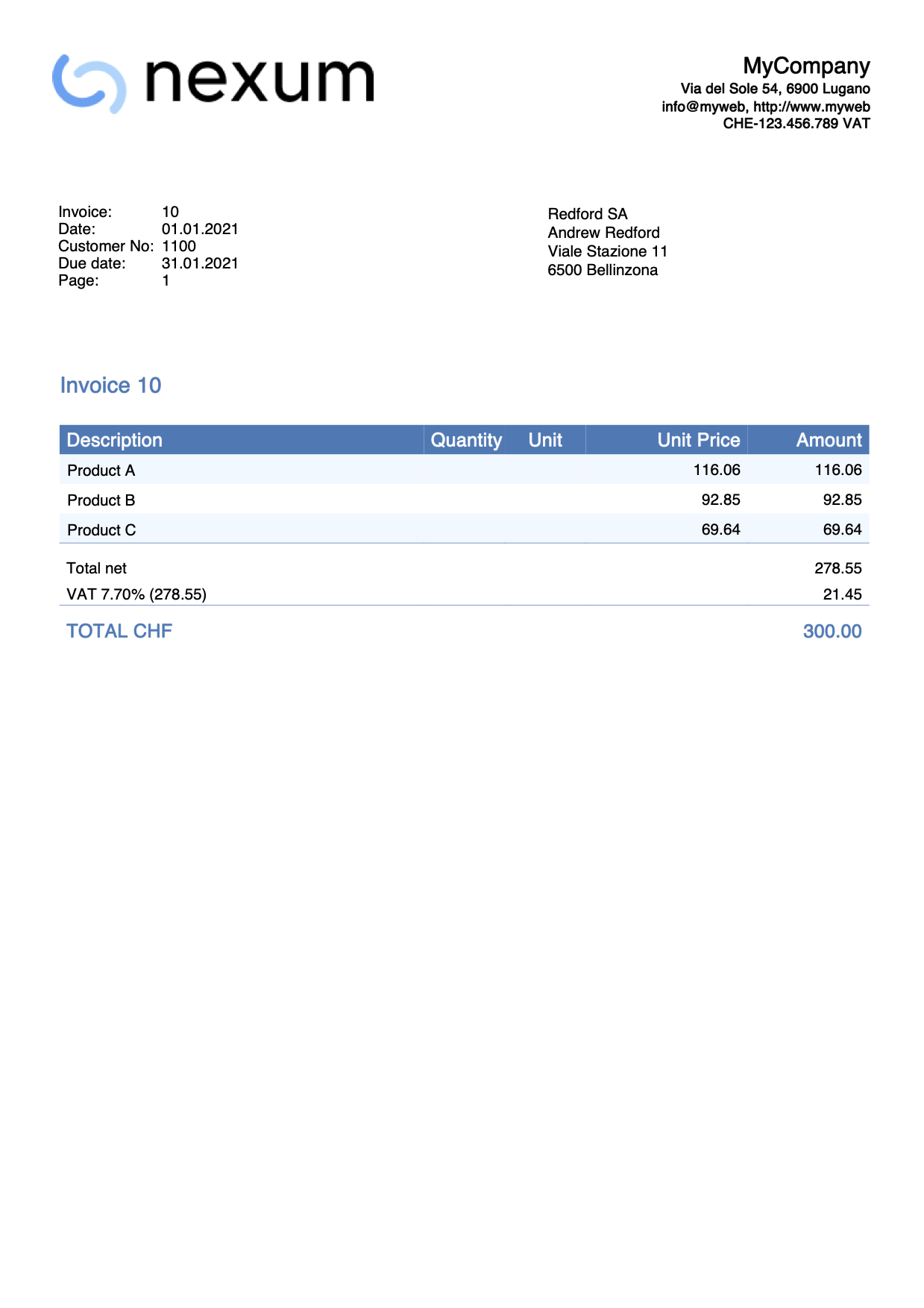

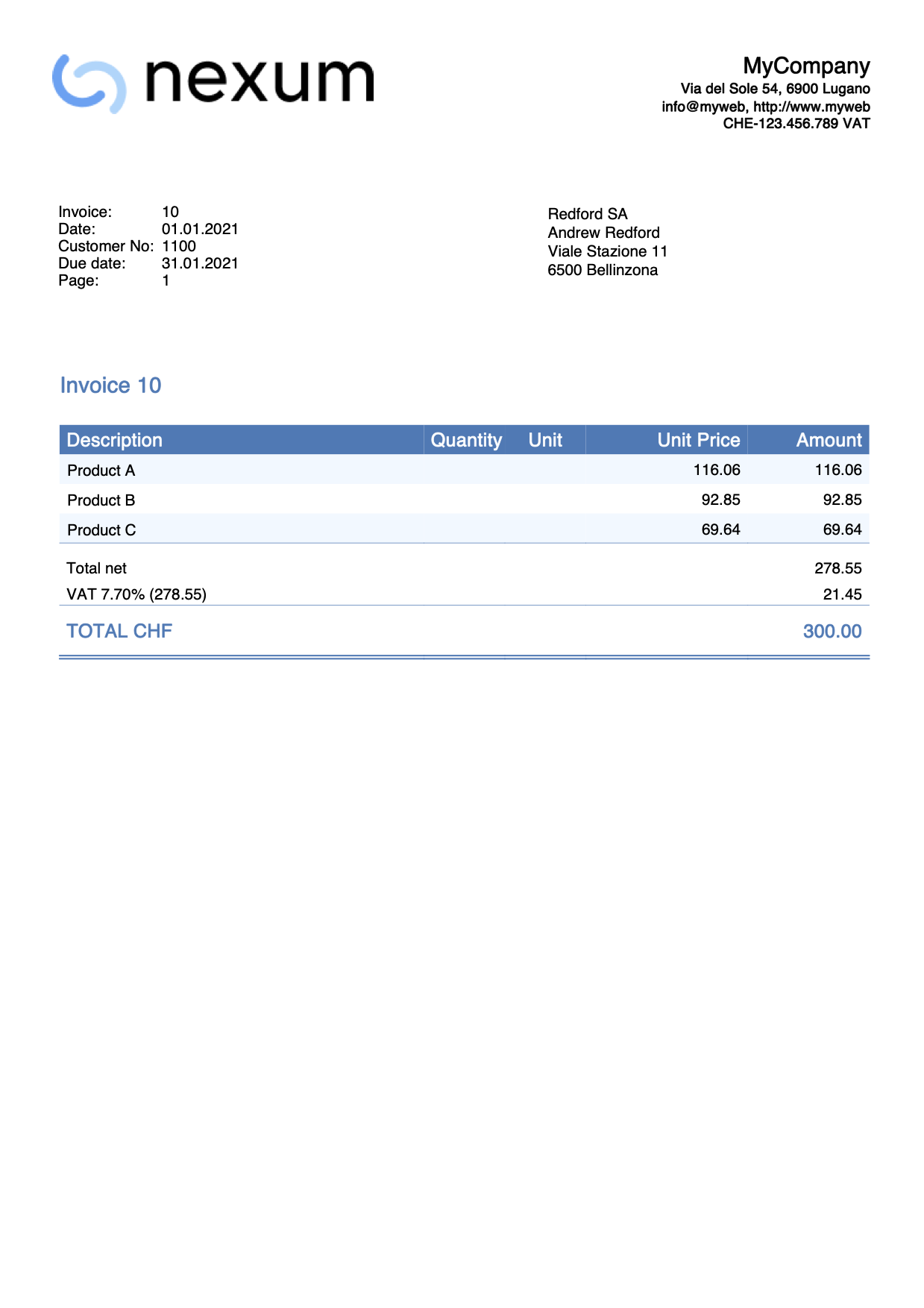

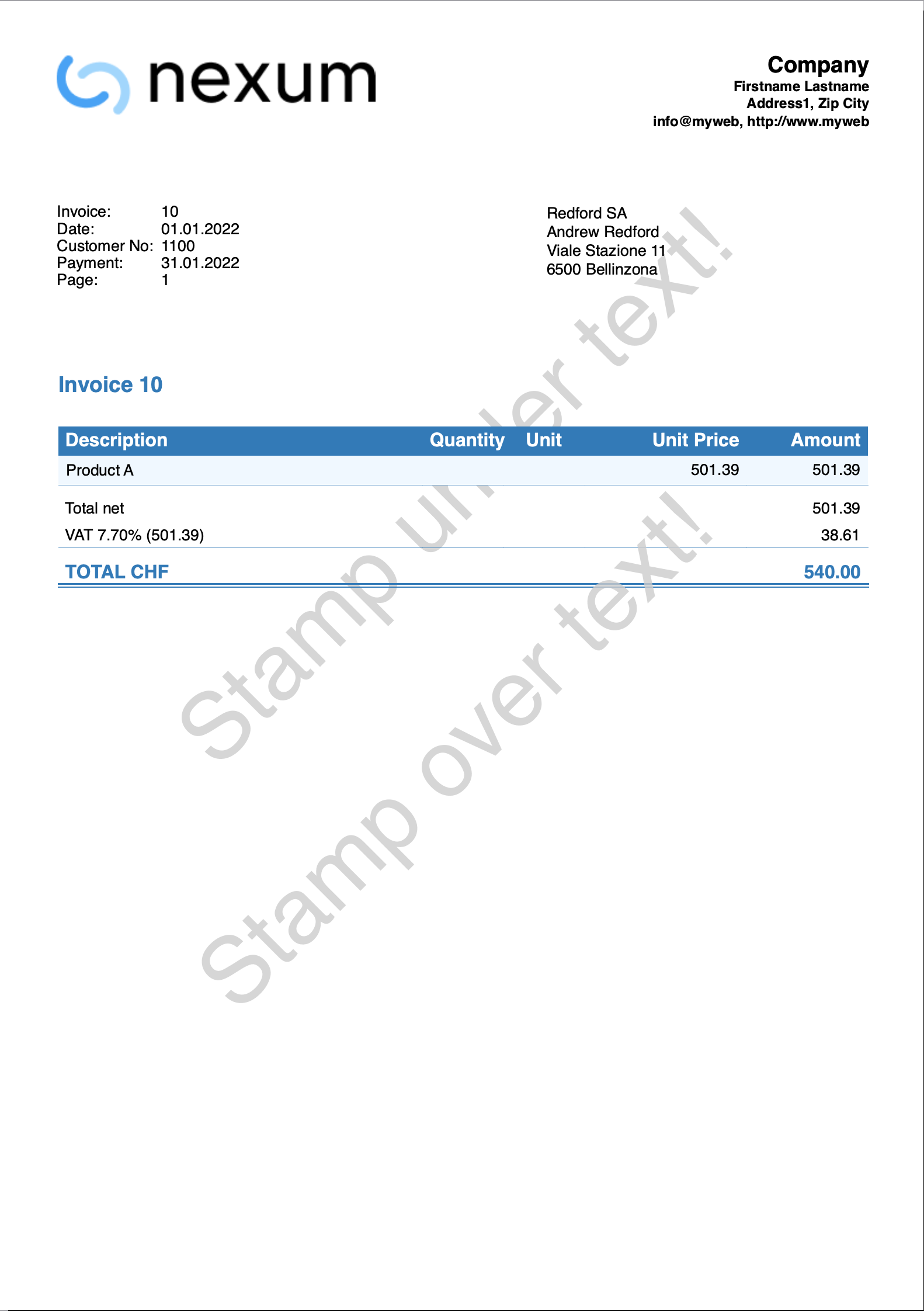

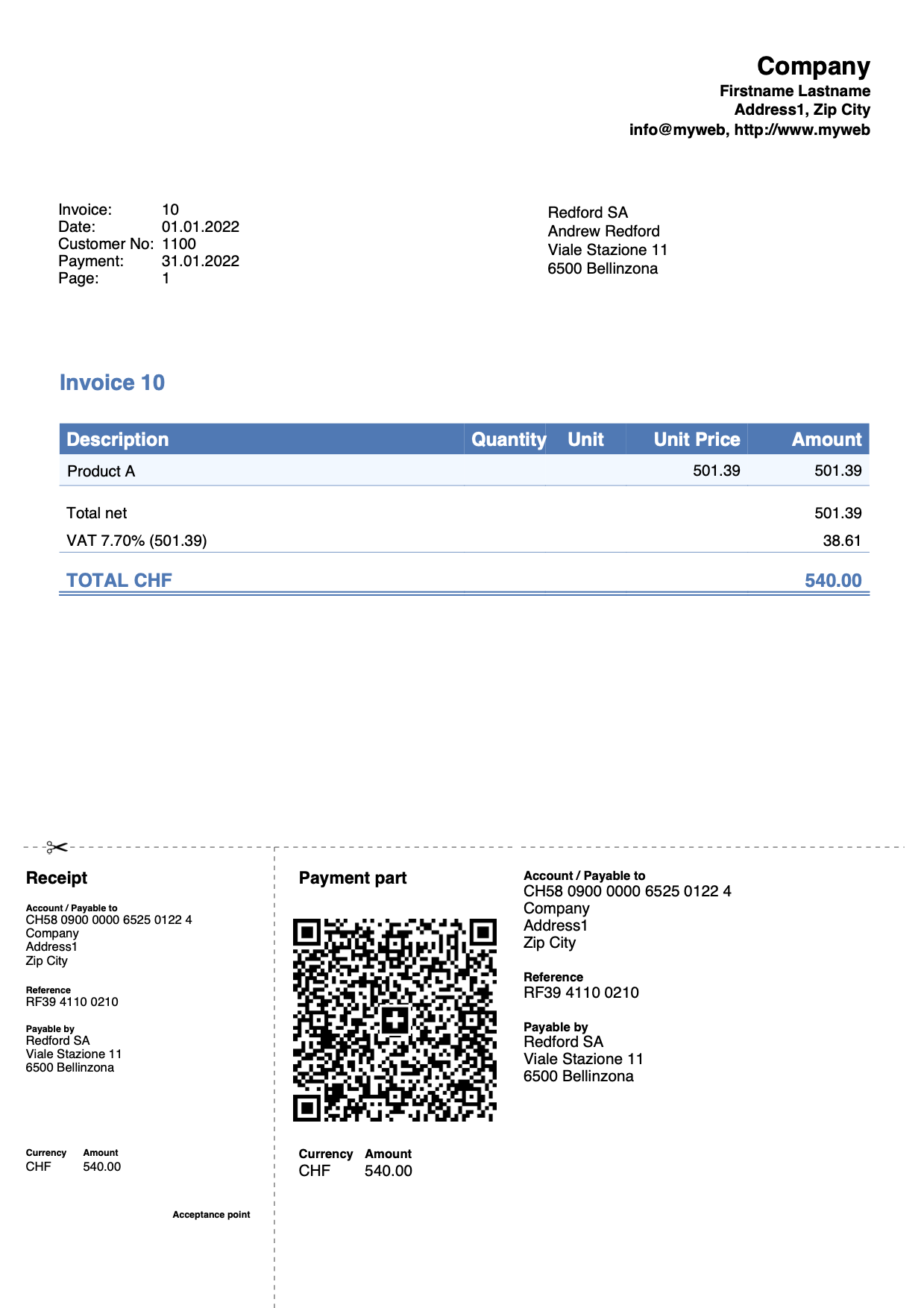

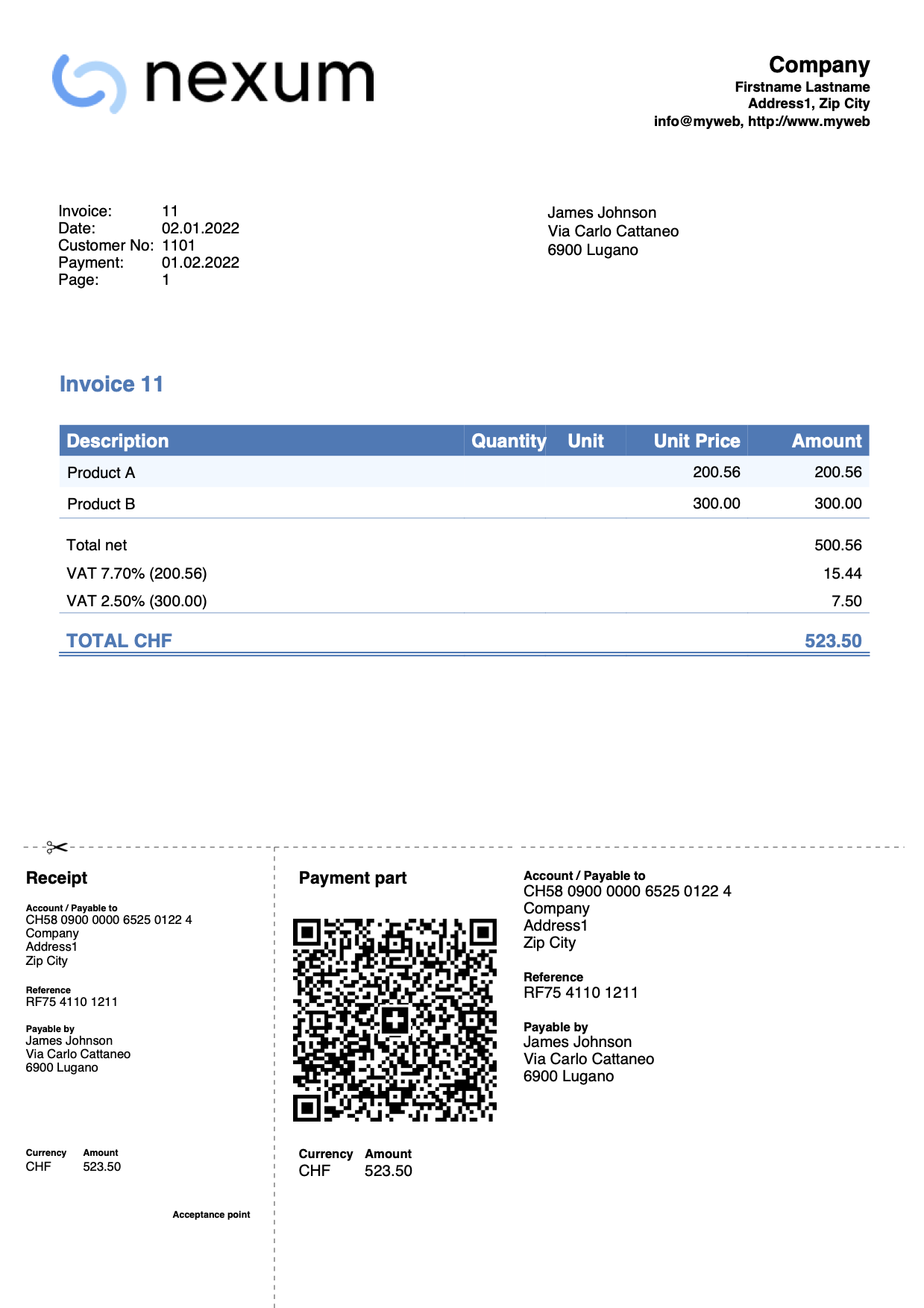

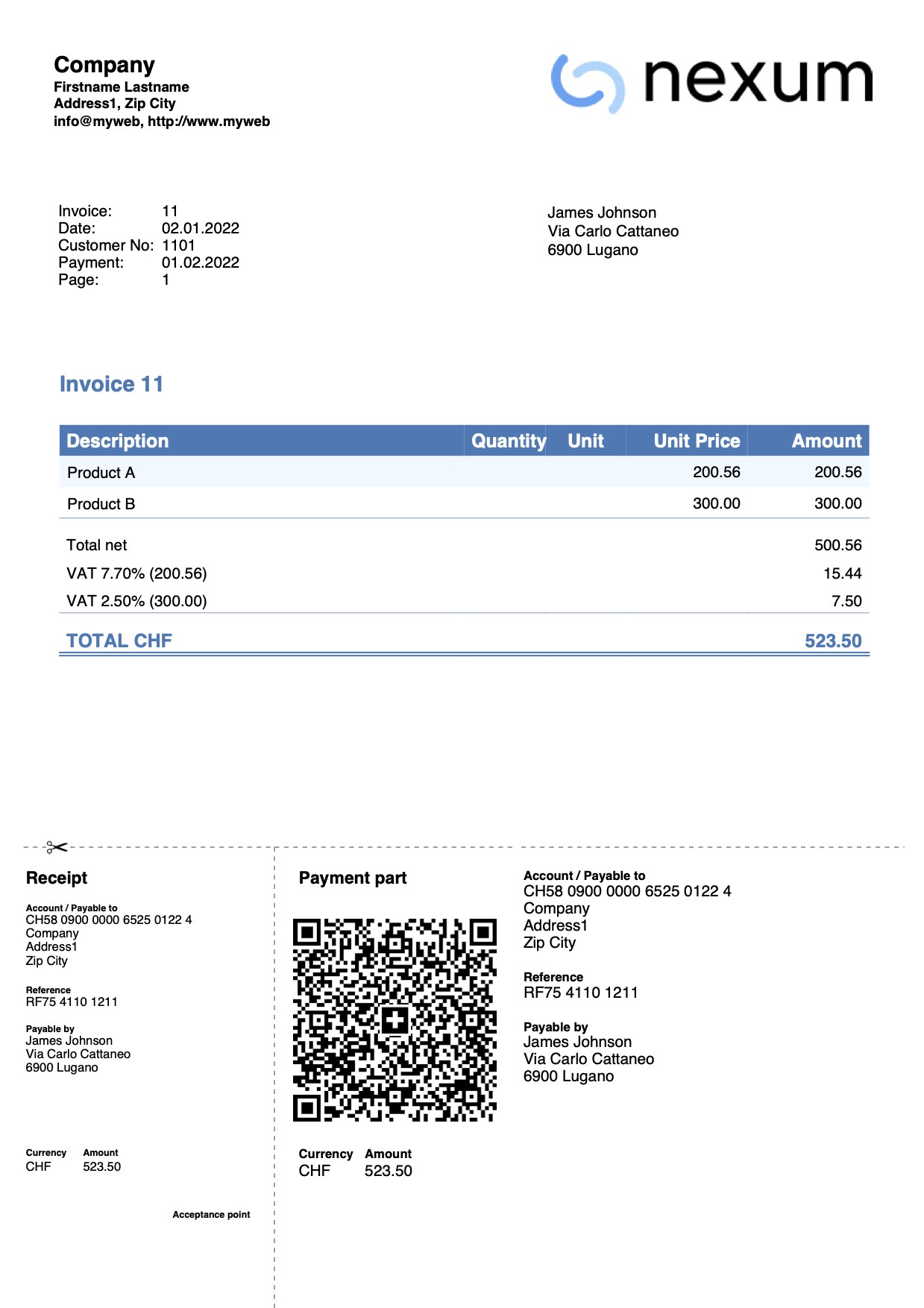

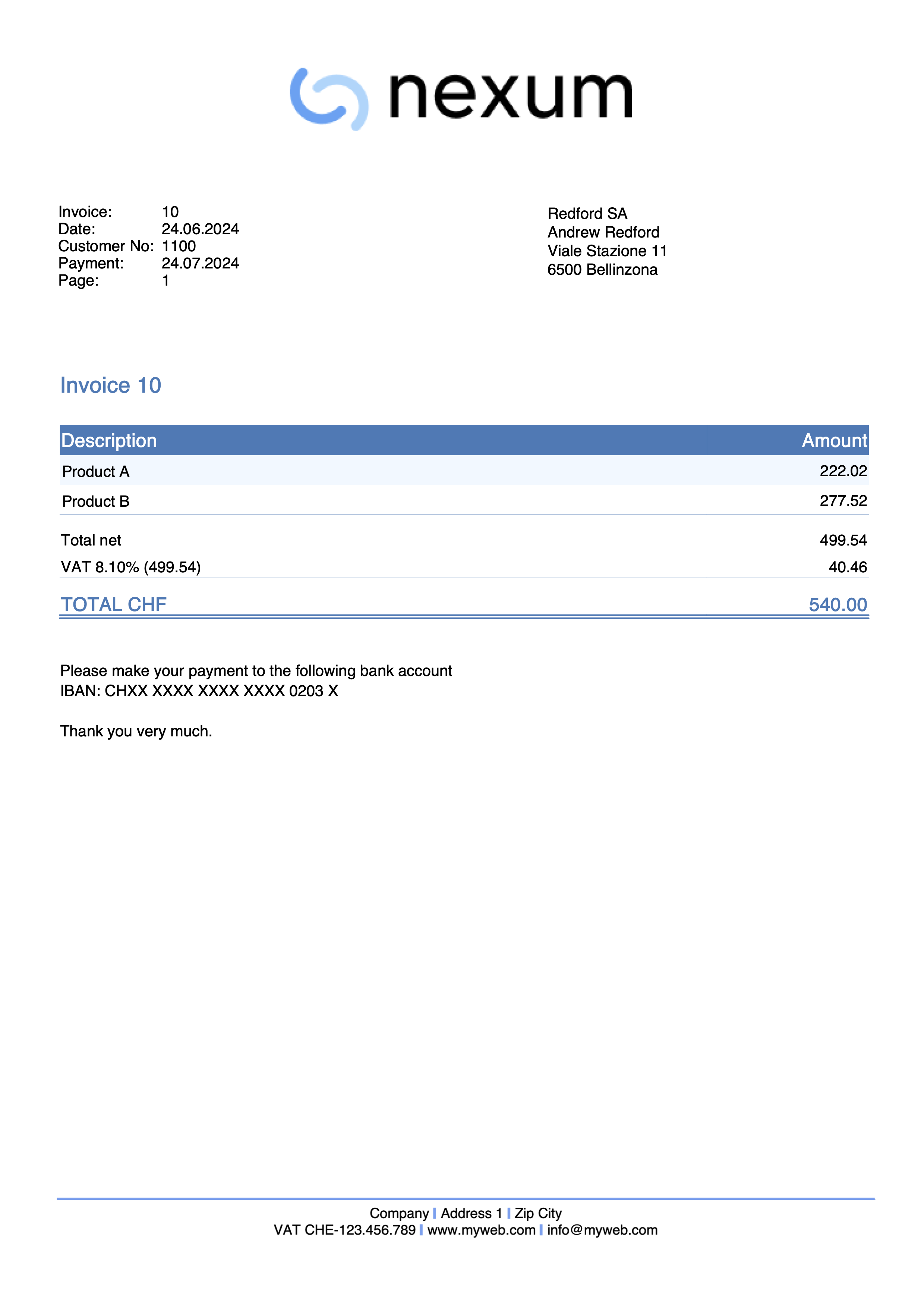

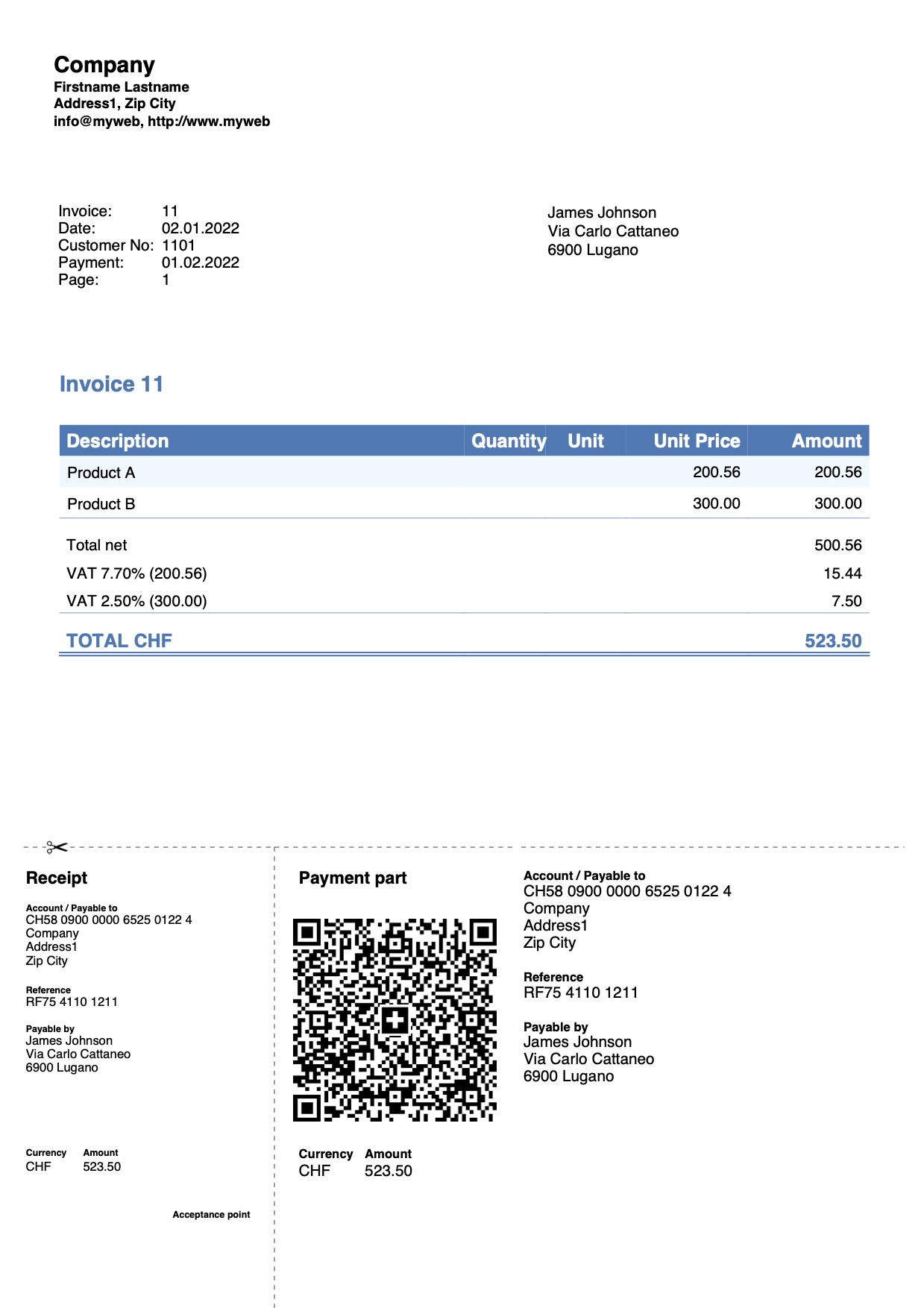

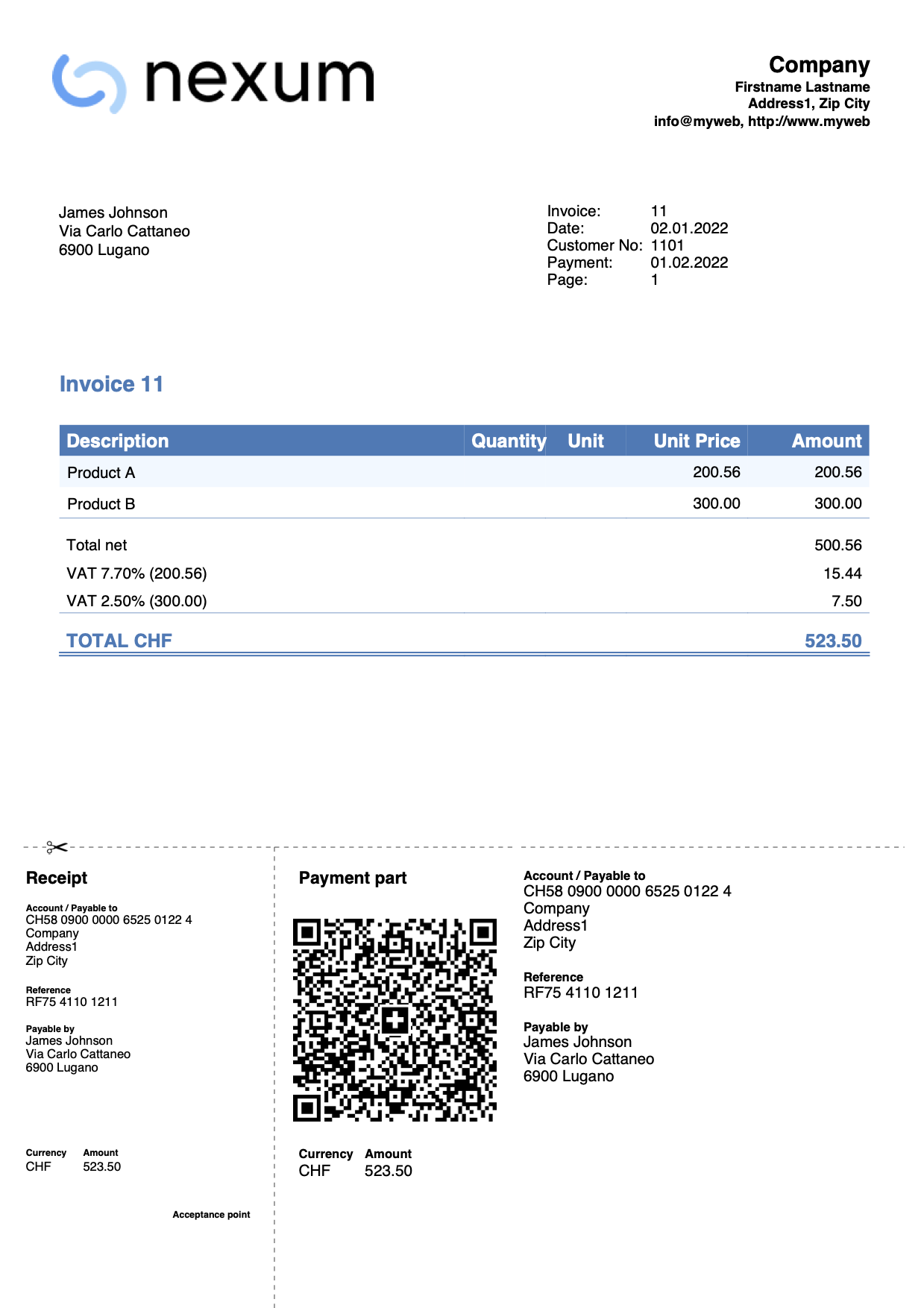

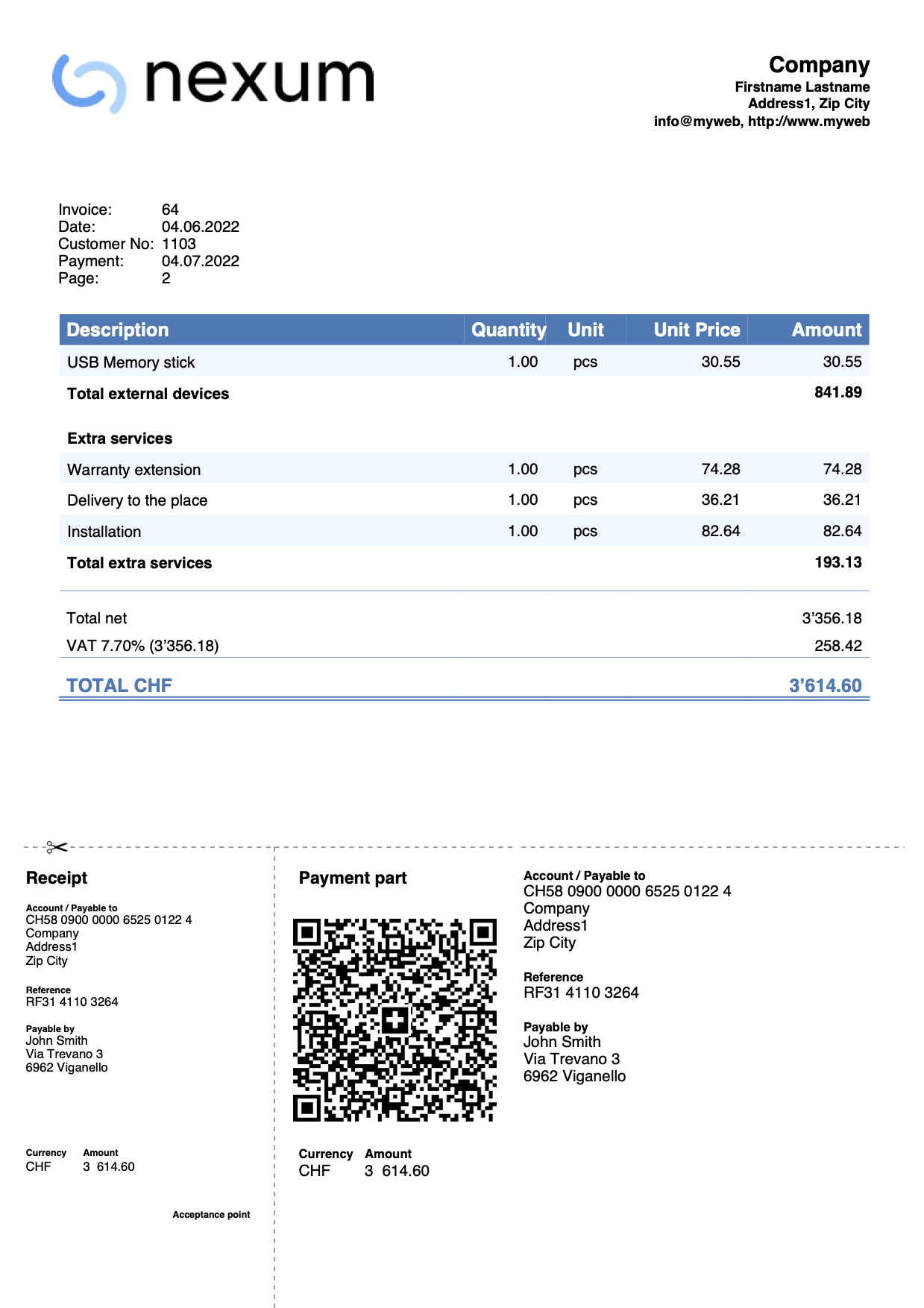

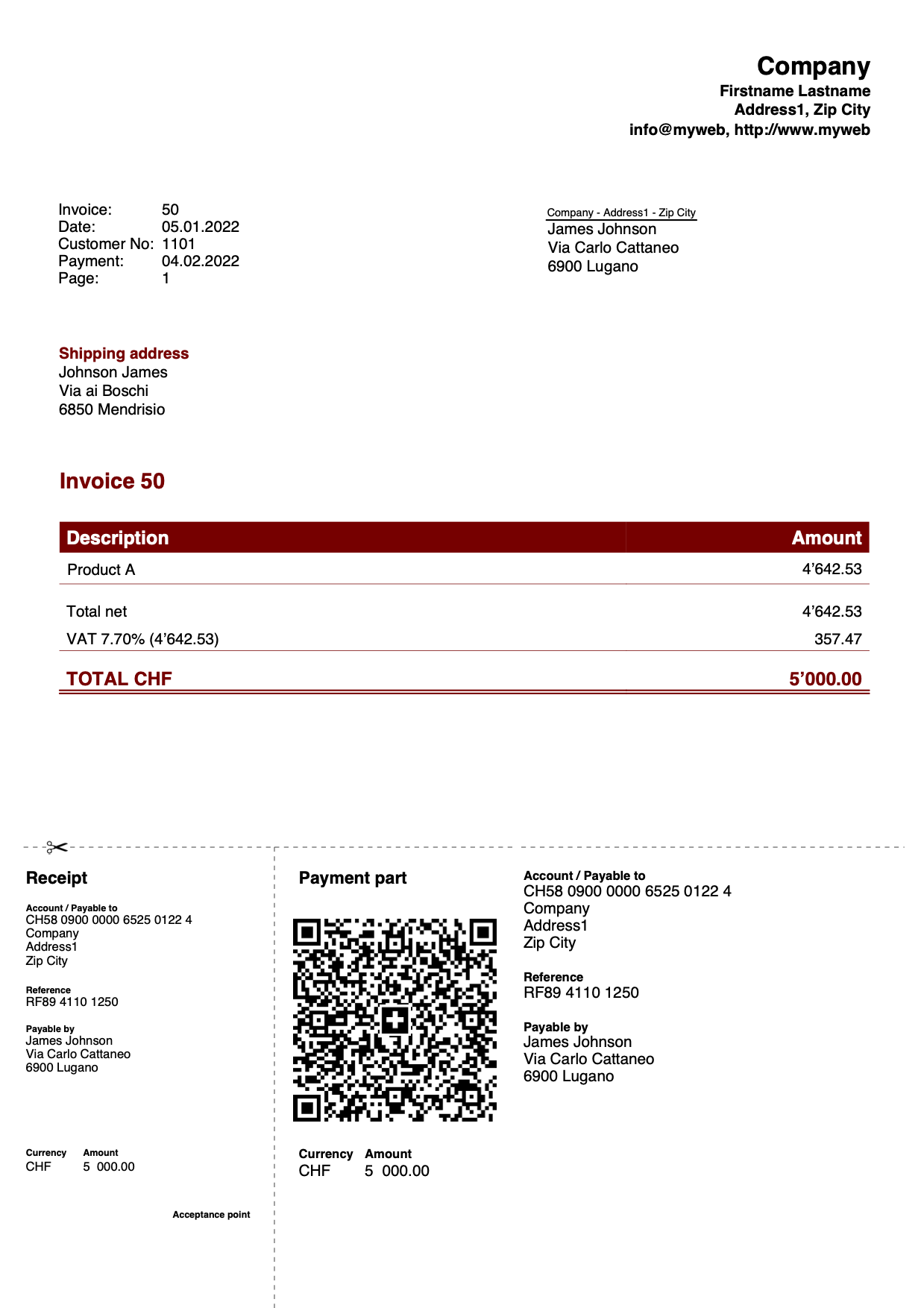

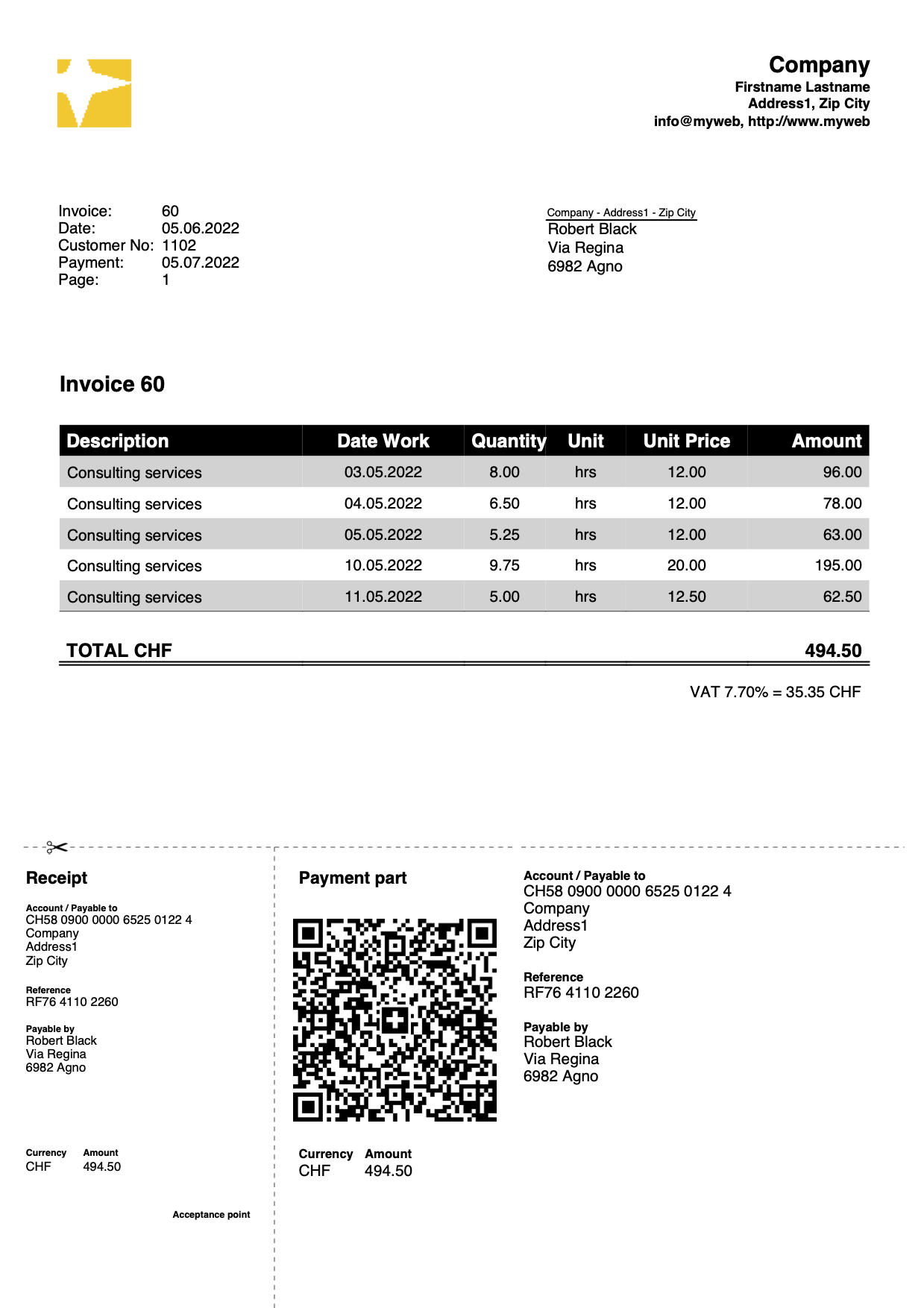

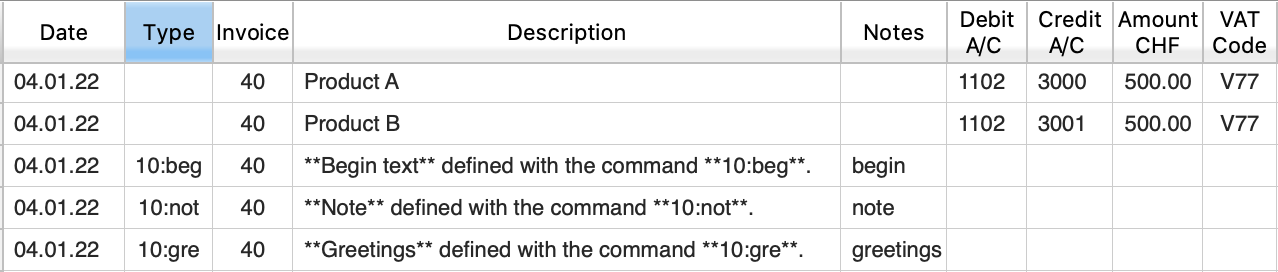

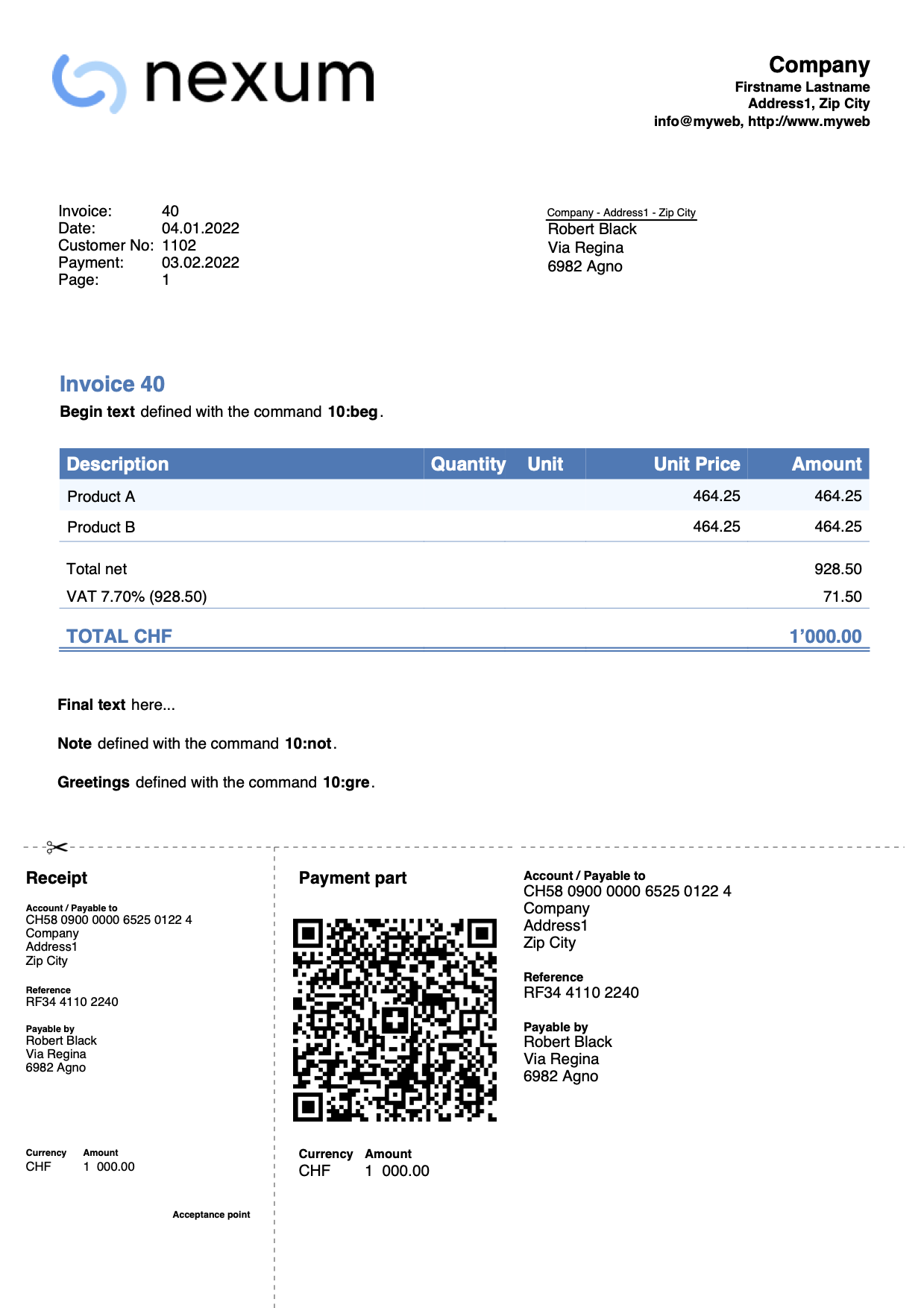

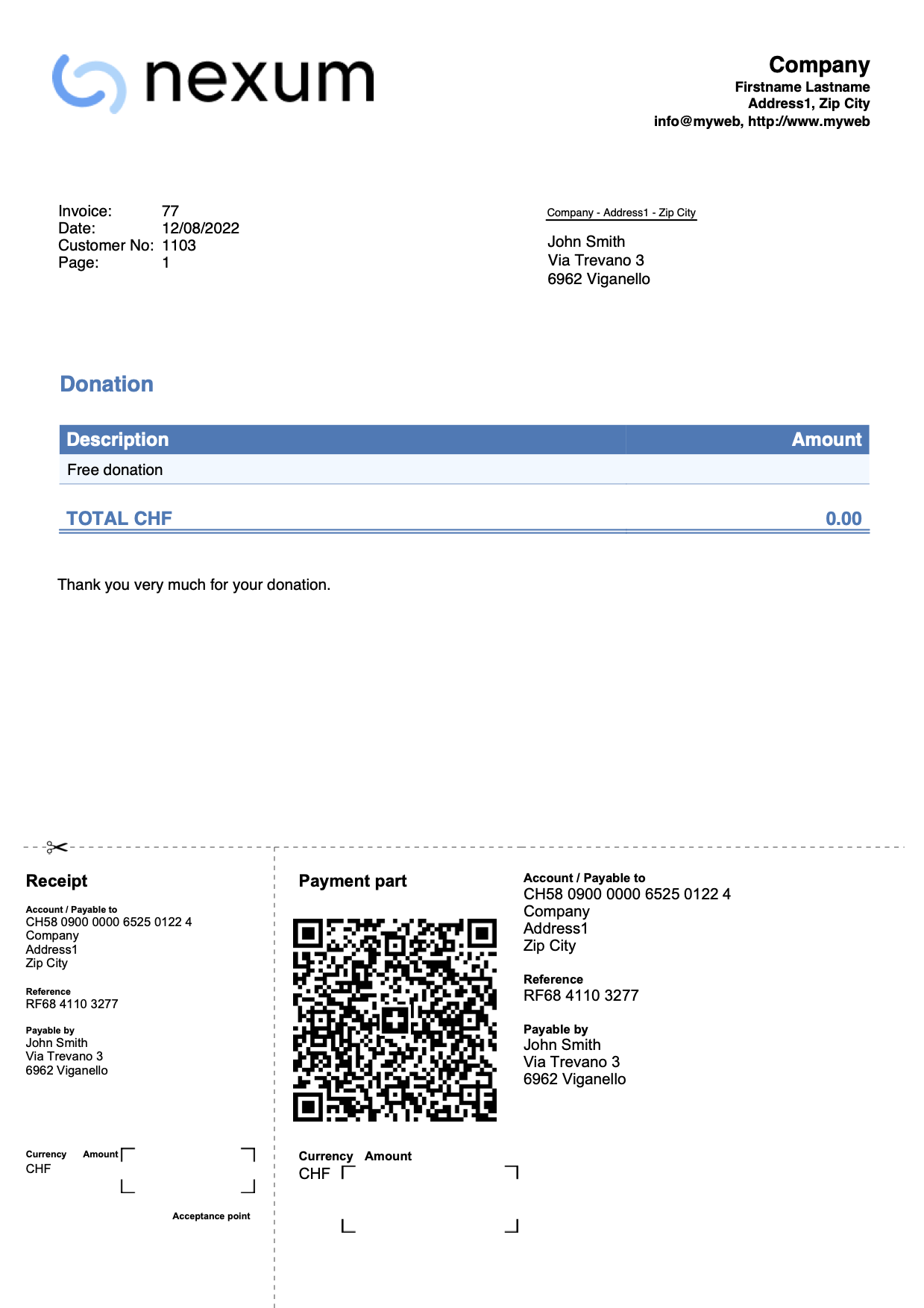

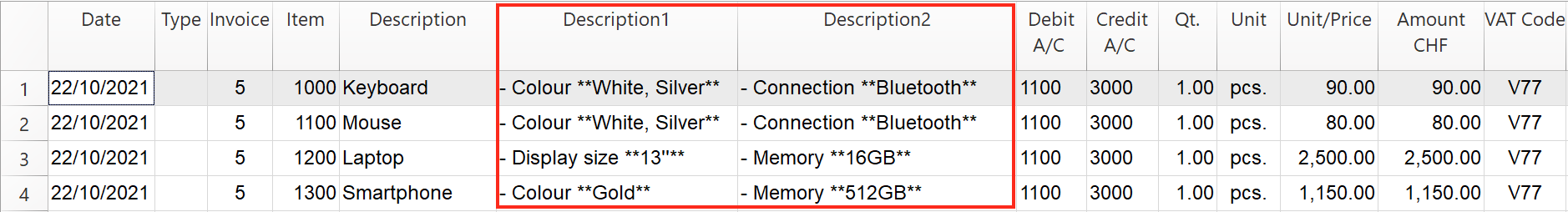

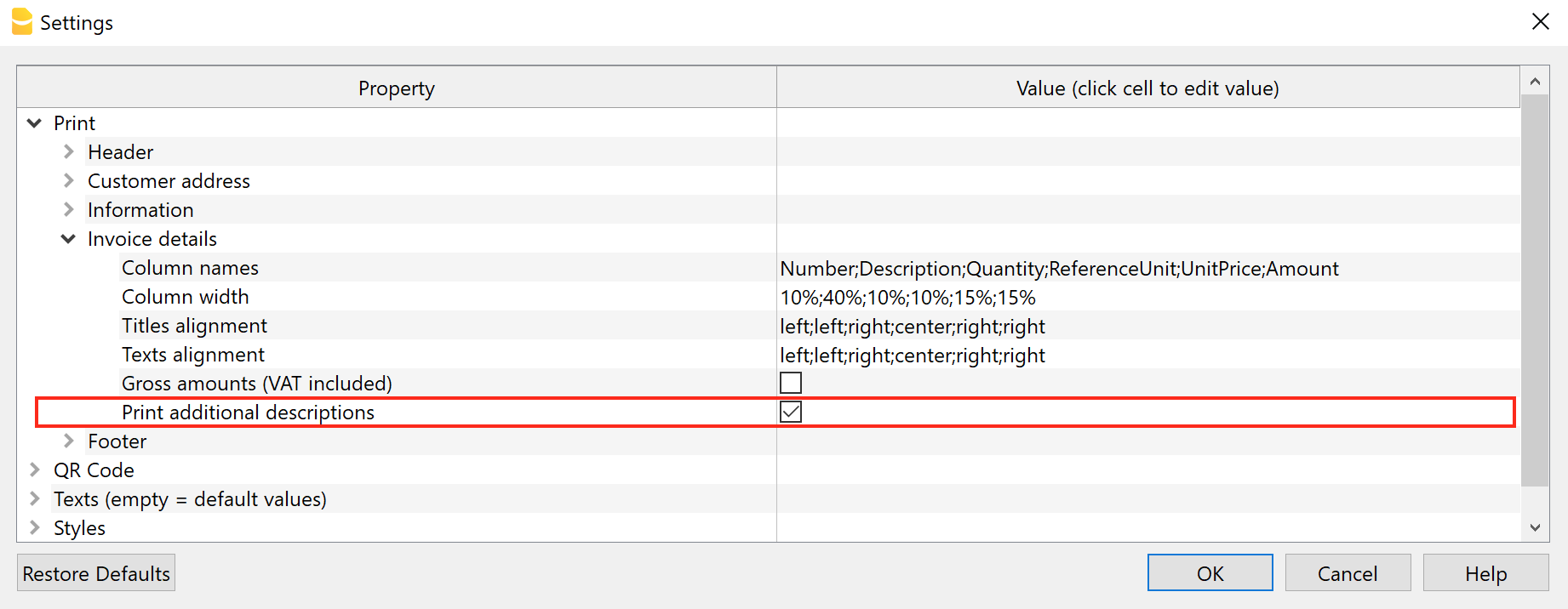

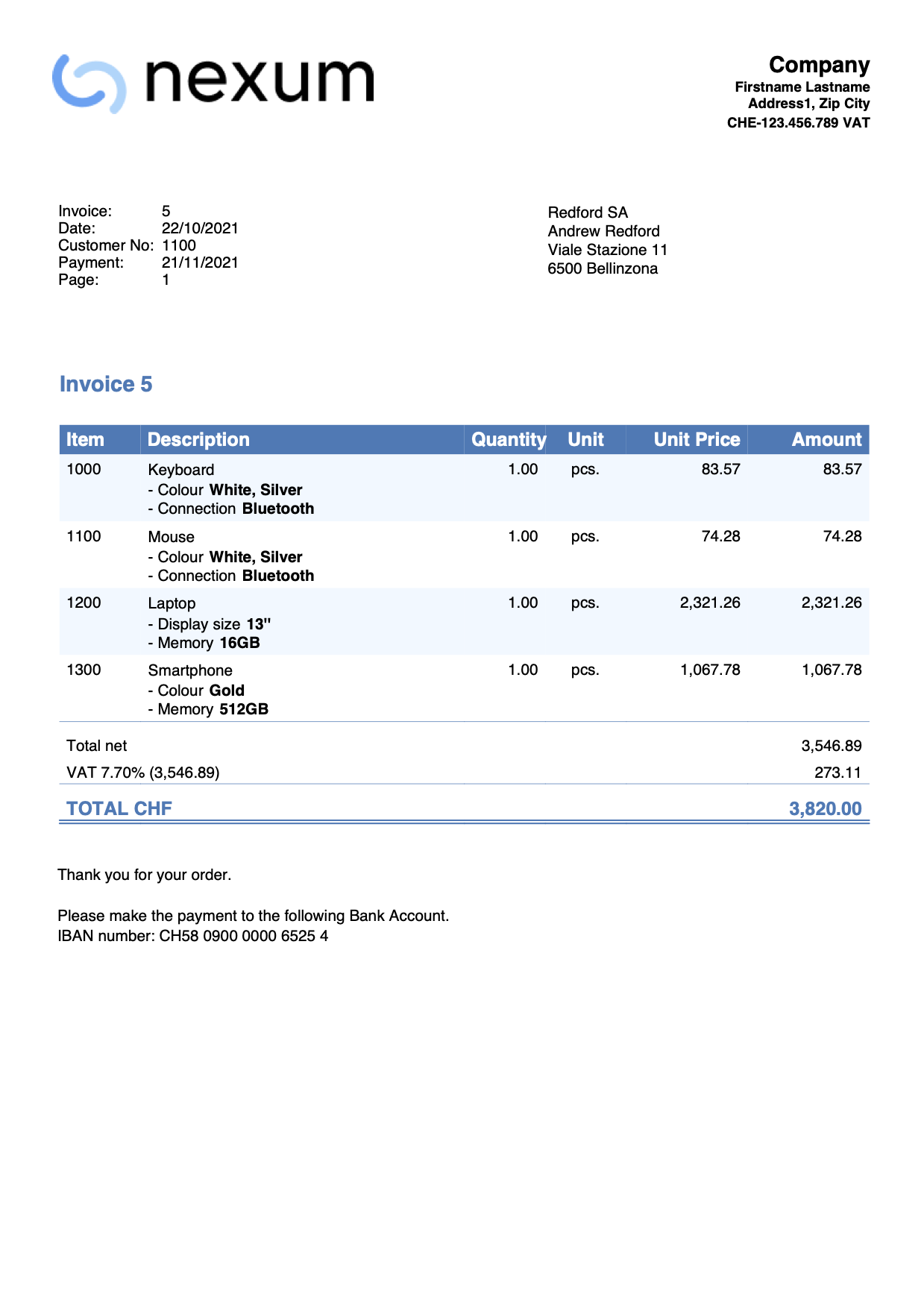

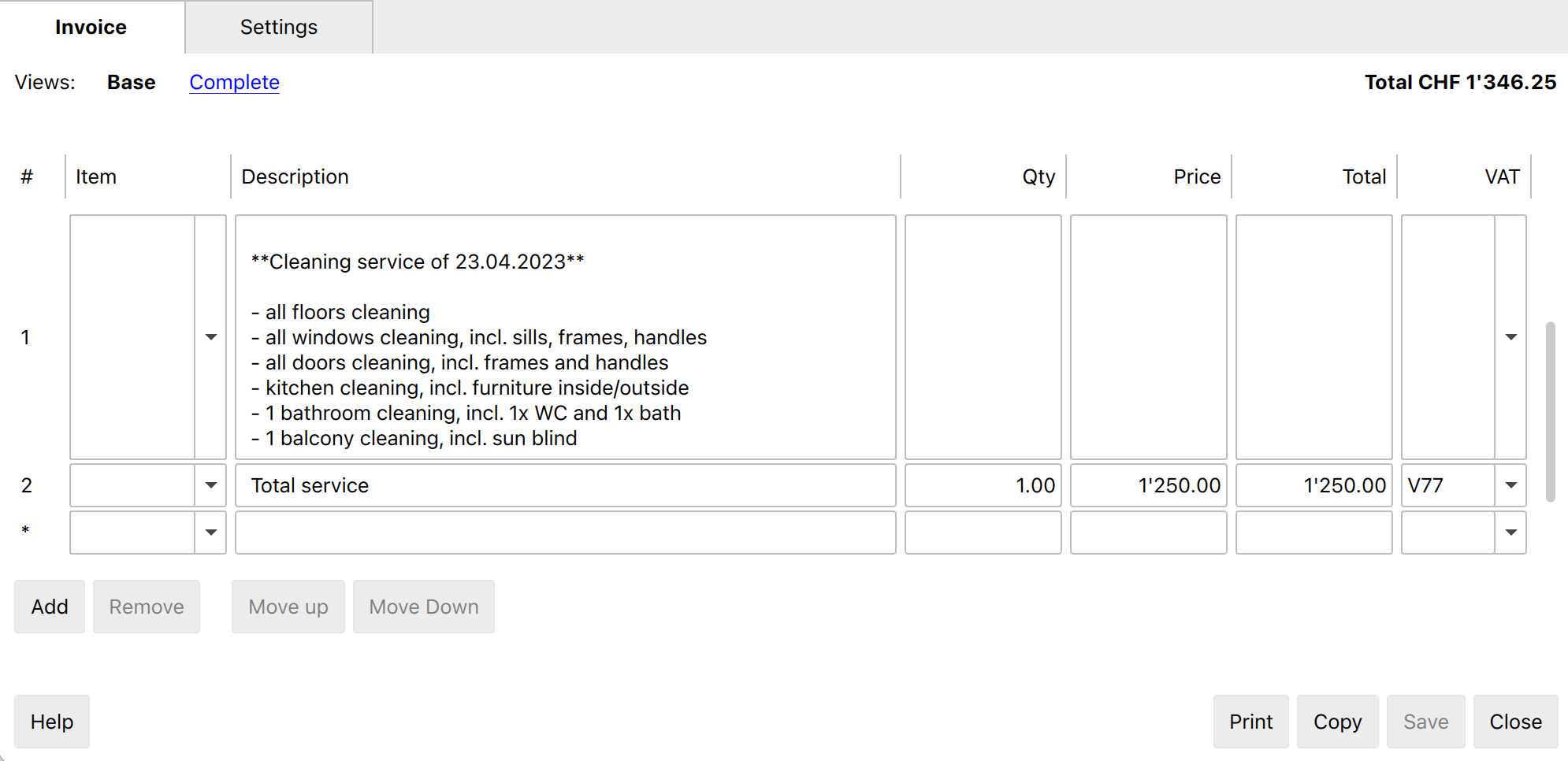

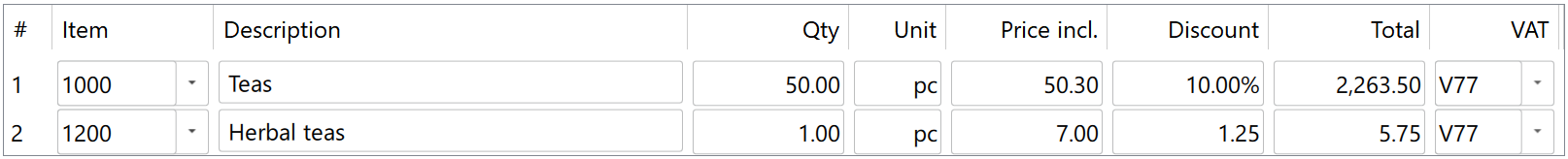

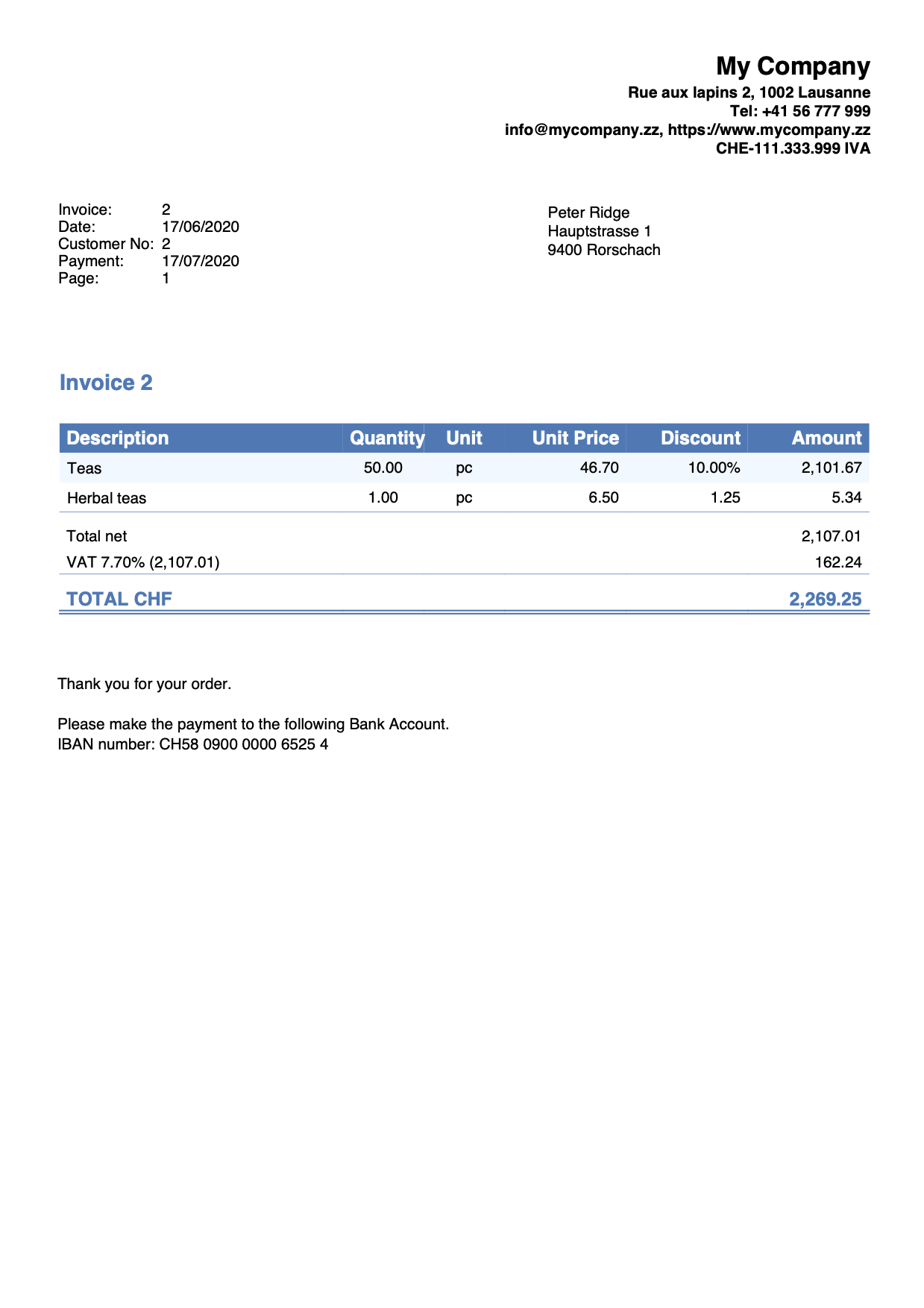

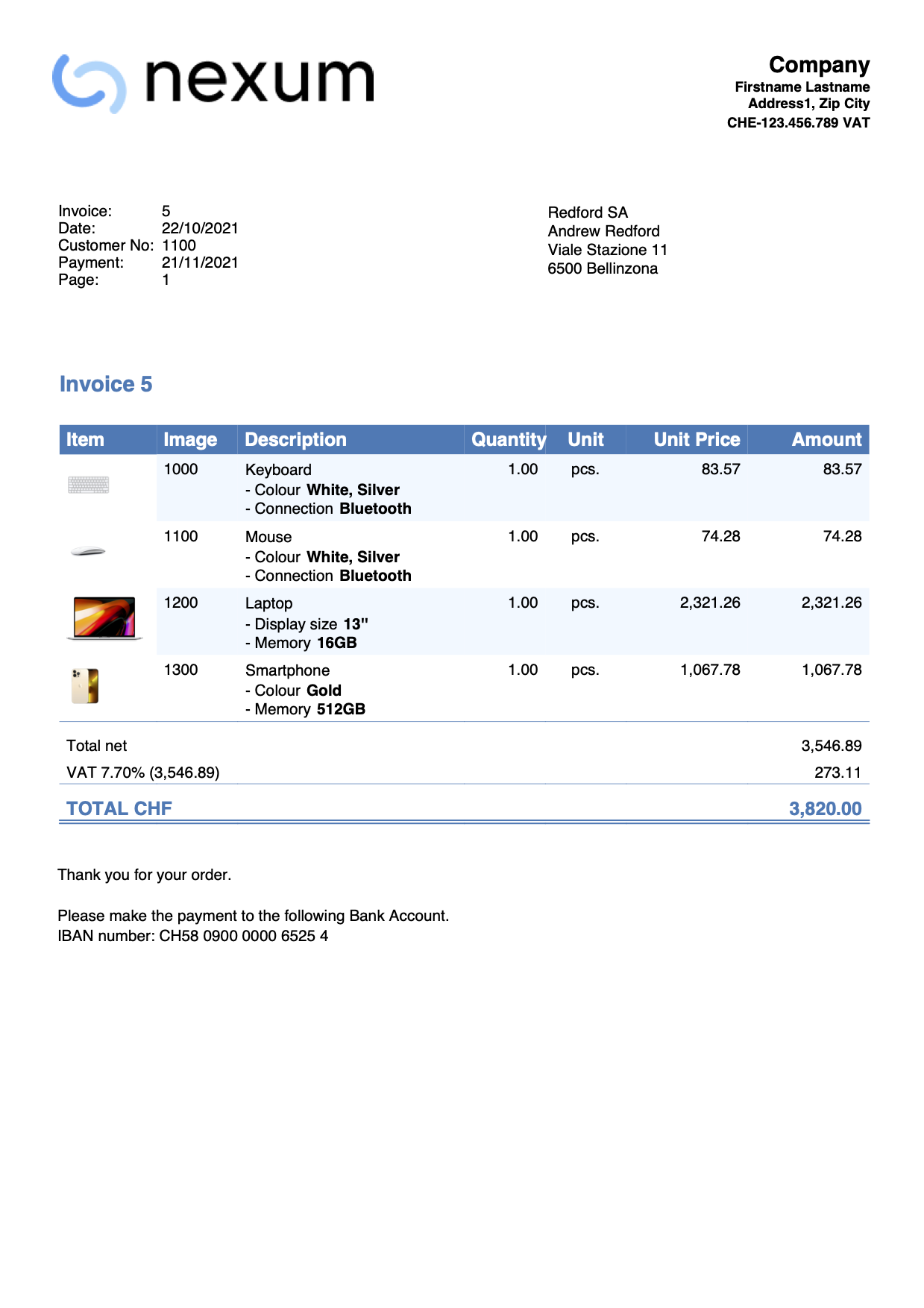

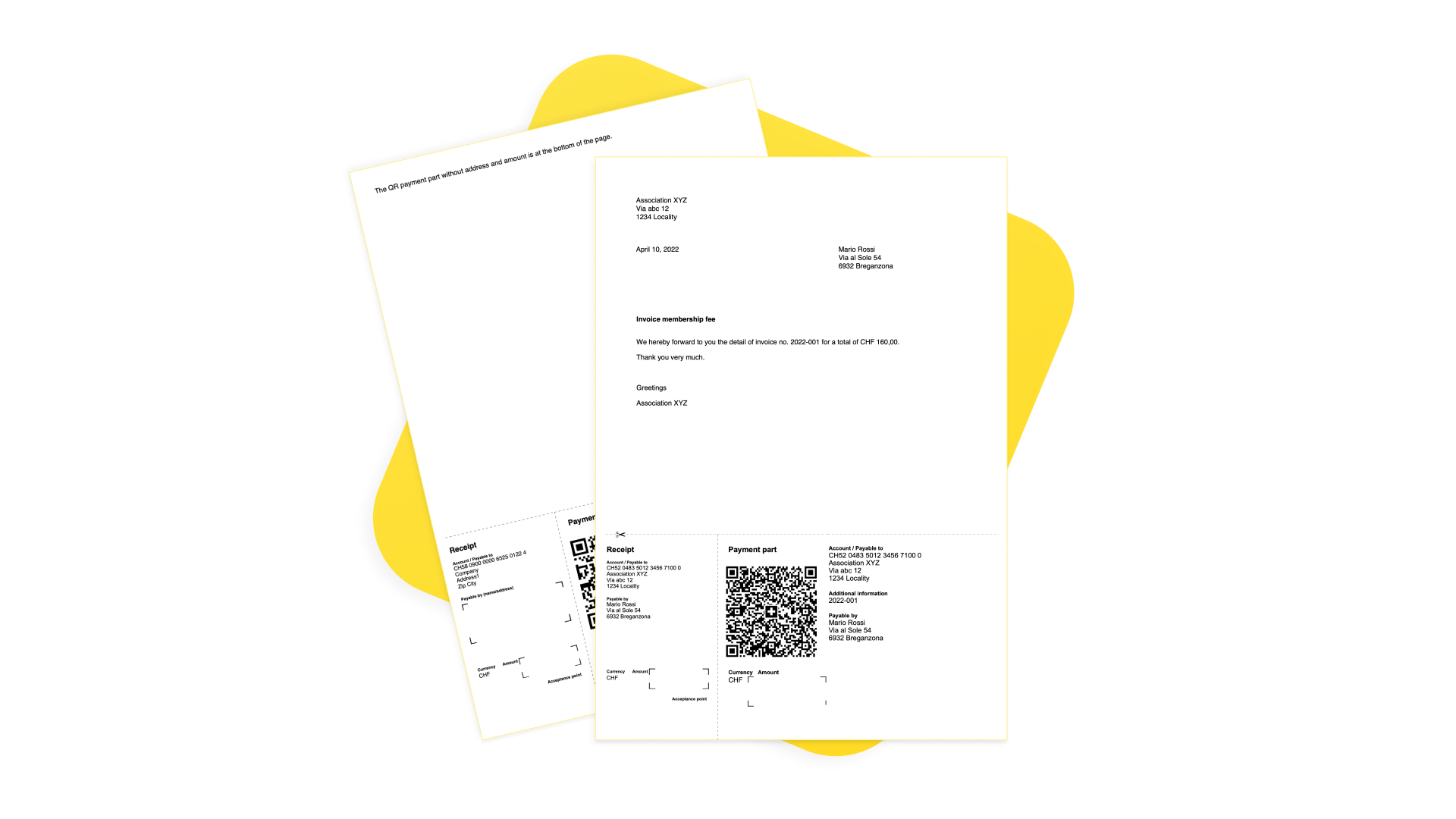

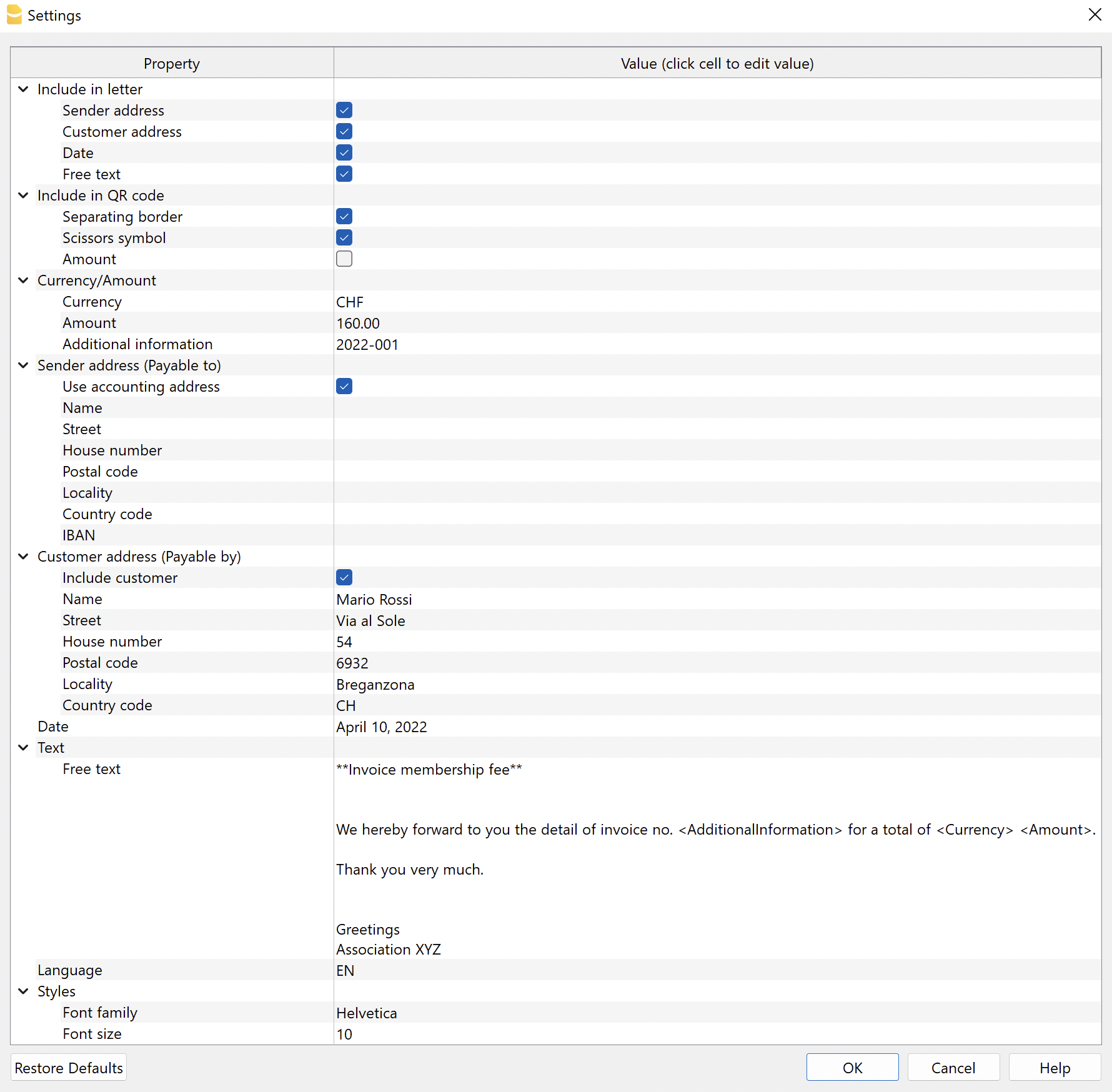

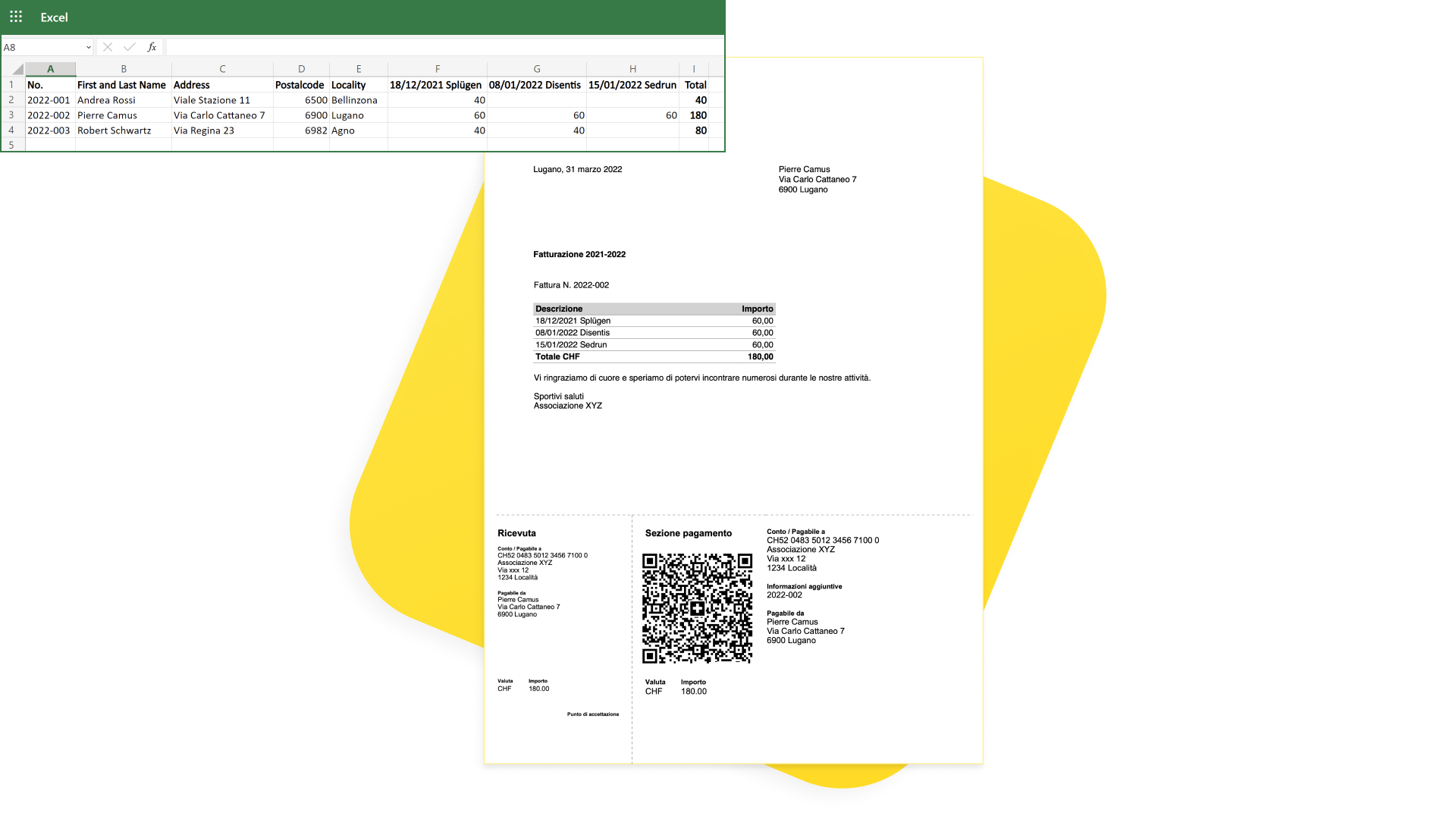

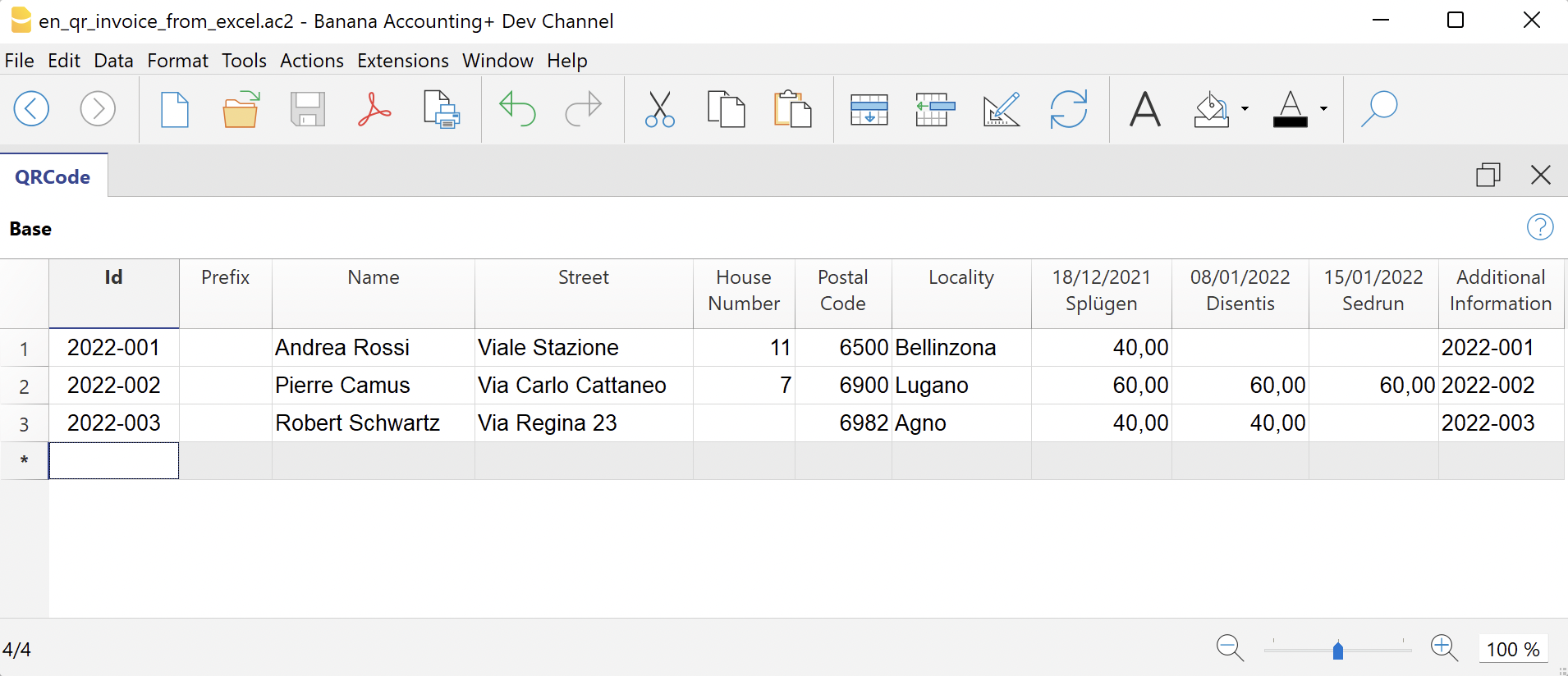

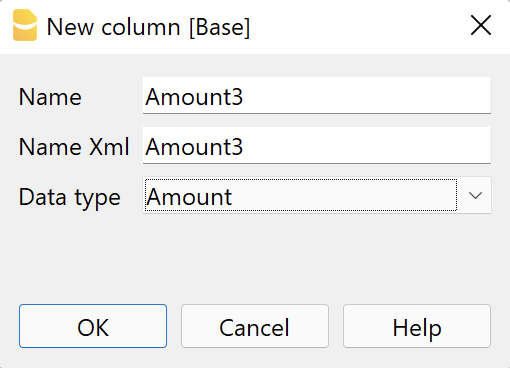

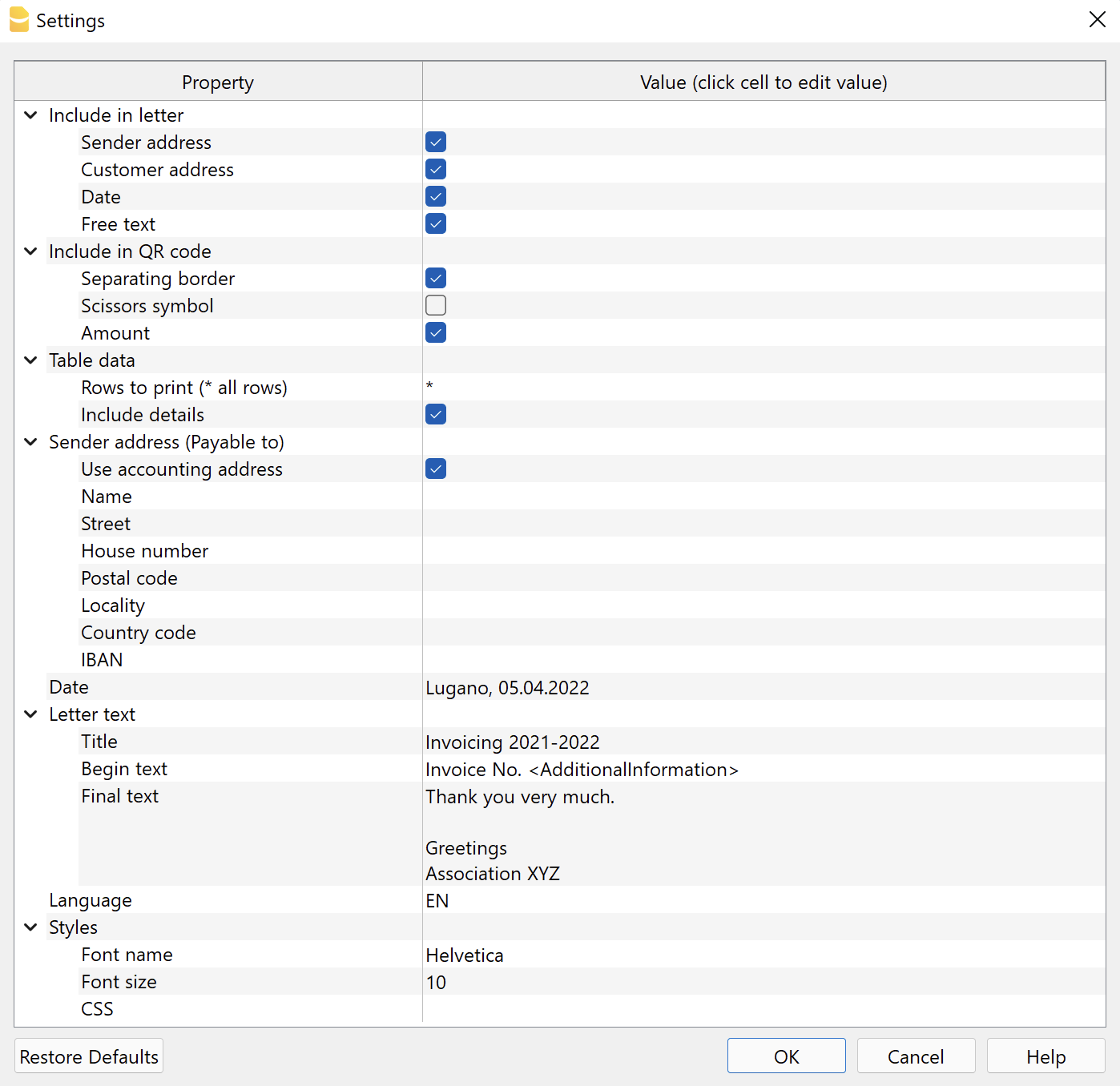

Used to analyze and monitor the performance of different areas or divisions of a company. - Invoice creation with QR codes, reminders, quotes, and delivery notes

Create invoices in a few steps, which you can integrate into your accounting file for automatic entry. If you need to create highly detailed and extensive invoices, use the features of the Estimates and Invoices application. - File checks and security

Various control functions immediately alert you to discrepancies in opening balances, transactions, bank accounts, errors in the chart of accounts, and much more. - File conversion from one type of accounting to another

If your accounting needs change, you can always convert your data into a different type of accounting file (for example, from double-entry accounting without VAT to one with VAT).

These features are included in the Professional plan. If you're looking for even more efficiency and speed in accounting work, the Advanced plan offers innovative automations to further optimize your workflow.

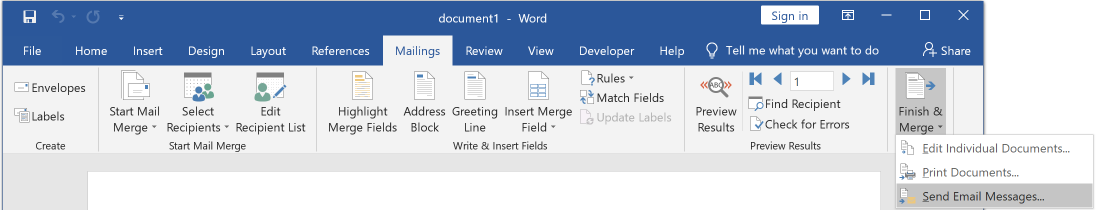

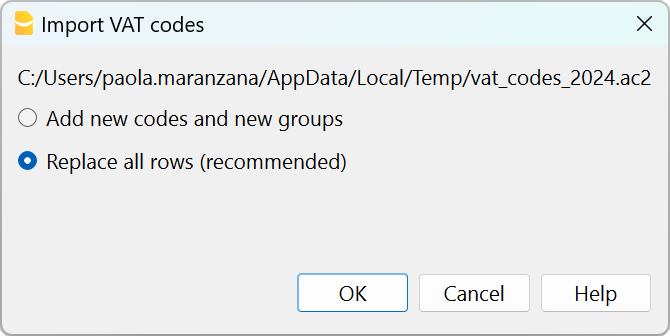

- Bank data import using Rules

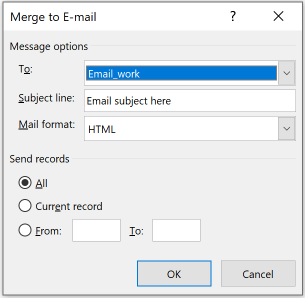

For a complete import without the need to manually enter counterpart accounts, VAT codes, cost centers, and more. - Creation of VAT Statement facsimile, both in paper and XML format, for electronic submission to the AFC

No more manual calculations to sum the amounts for different VAT codes, as everything is automated. - Temporary filtering and sorting of rows

Quickly search for data without navigating from one row to another. You can directly correct or modify the filtered rows. Once done, by removing the filter, the data will return to its previous order. - All your accounting PDF attachments in a single file

This allows you to save and archive all documents in one file. It is highly useful and convenient, especially for audits and tax reviews. - E-banking payments

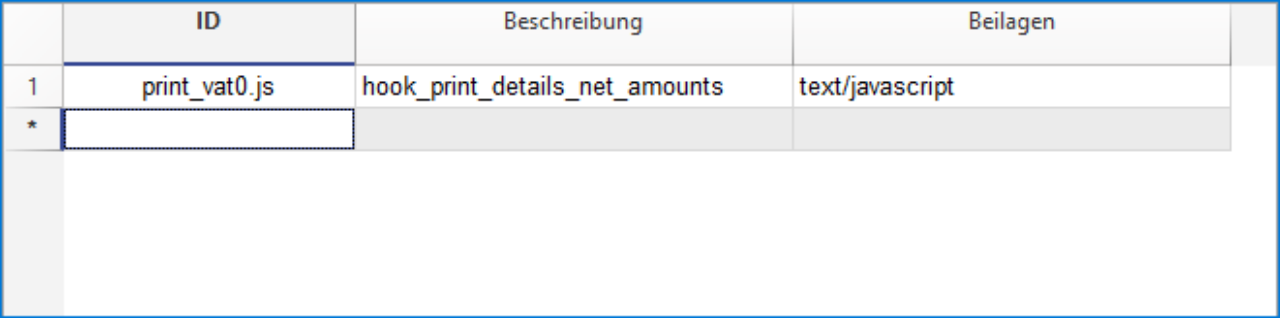

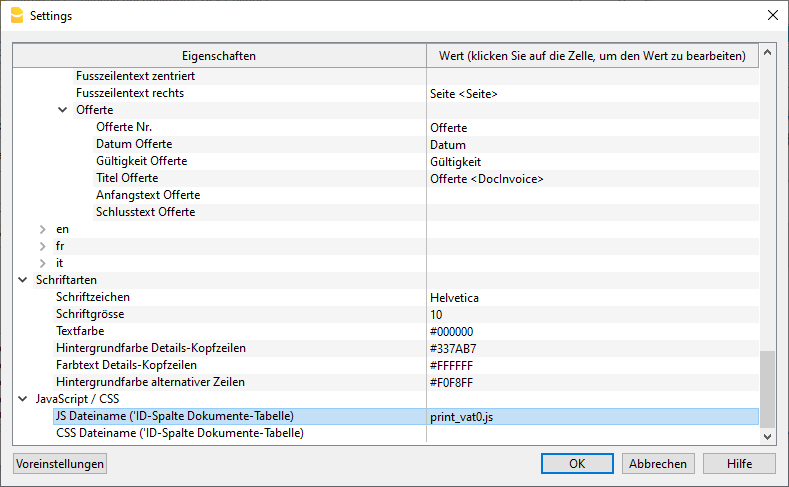

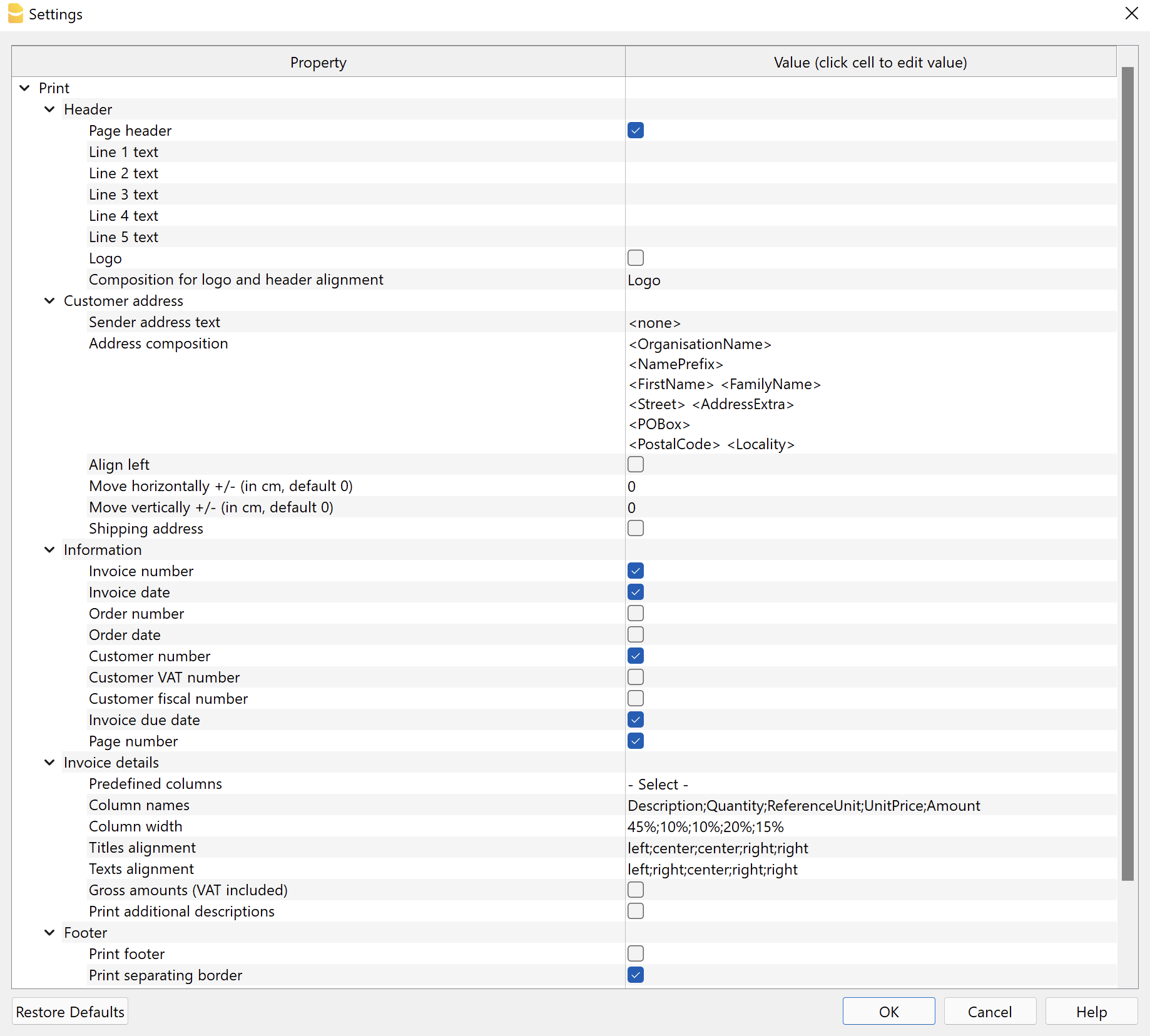

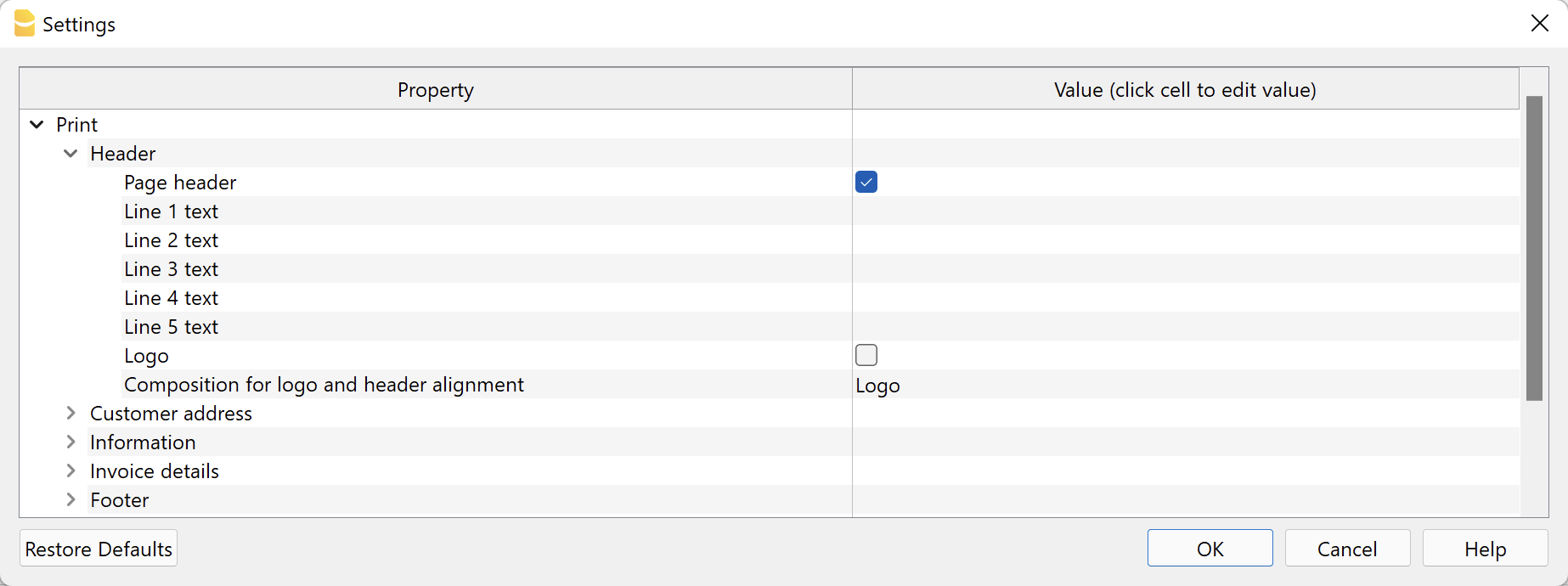

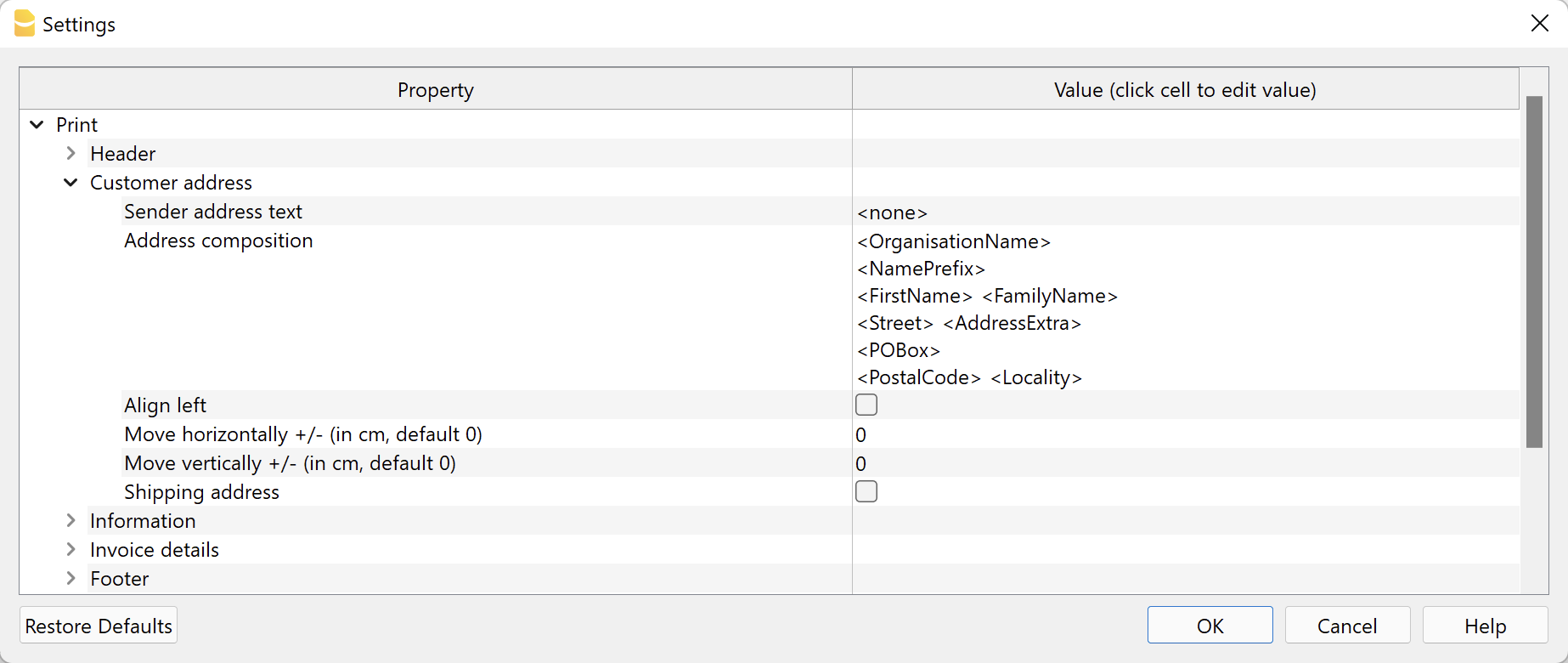

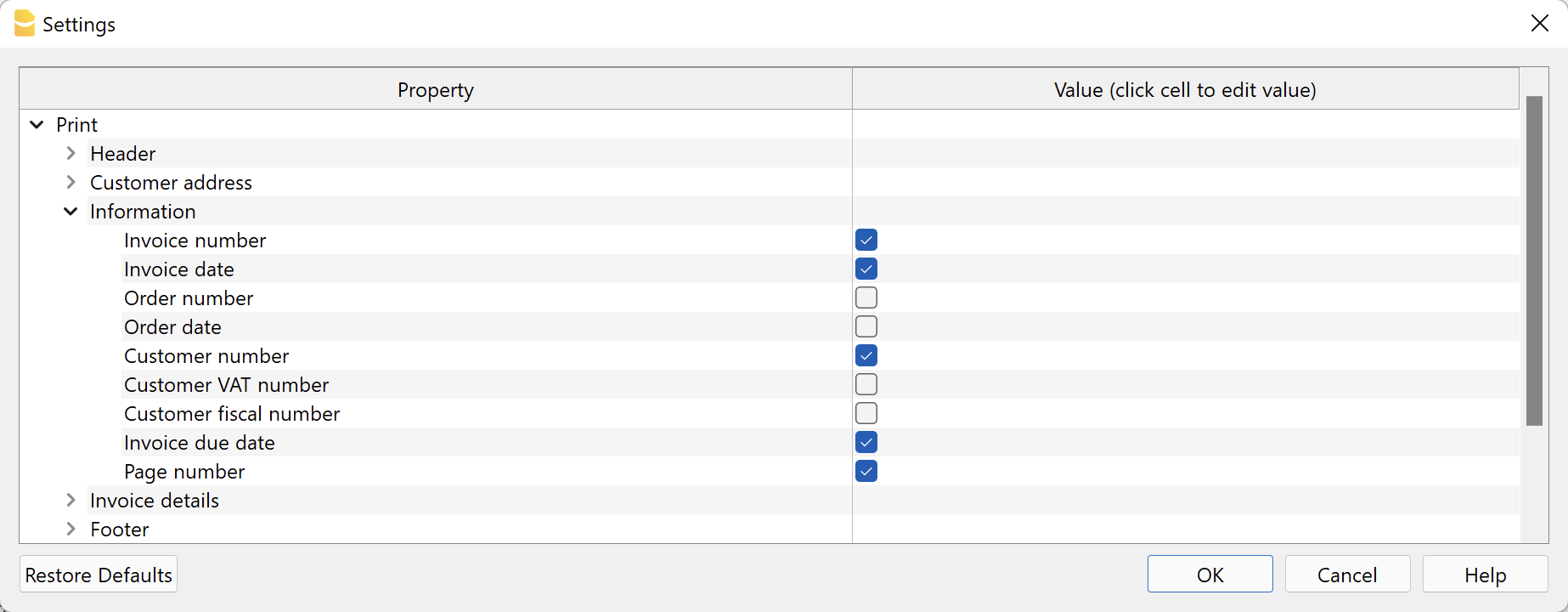

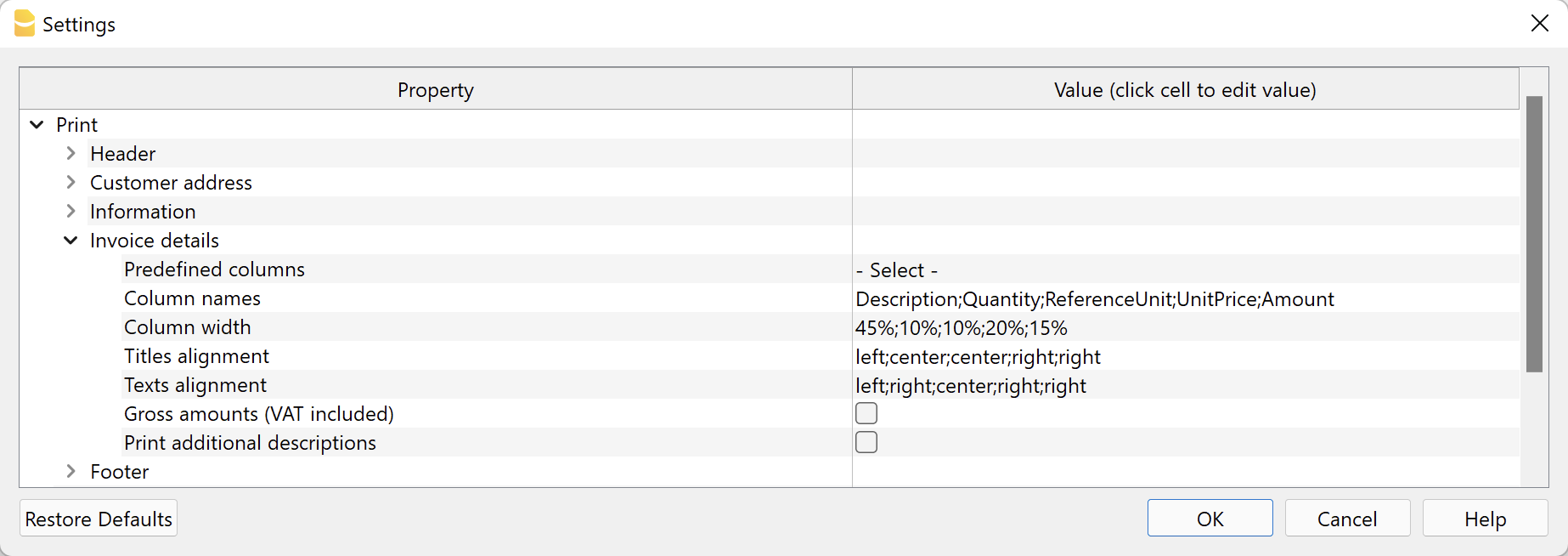

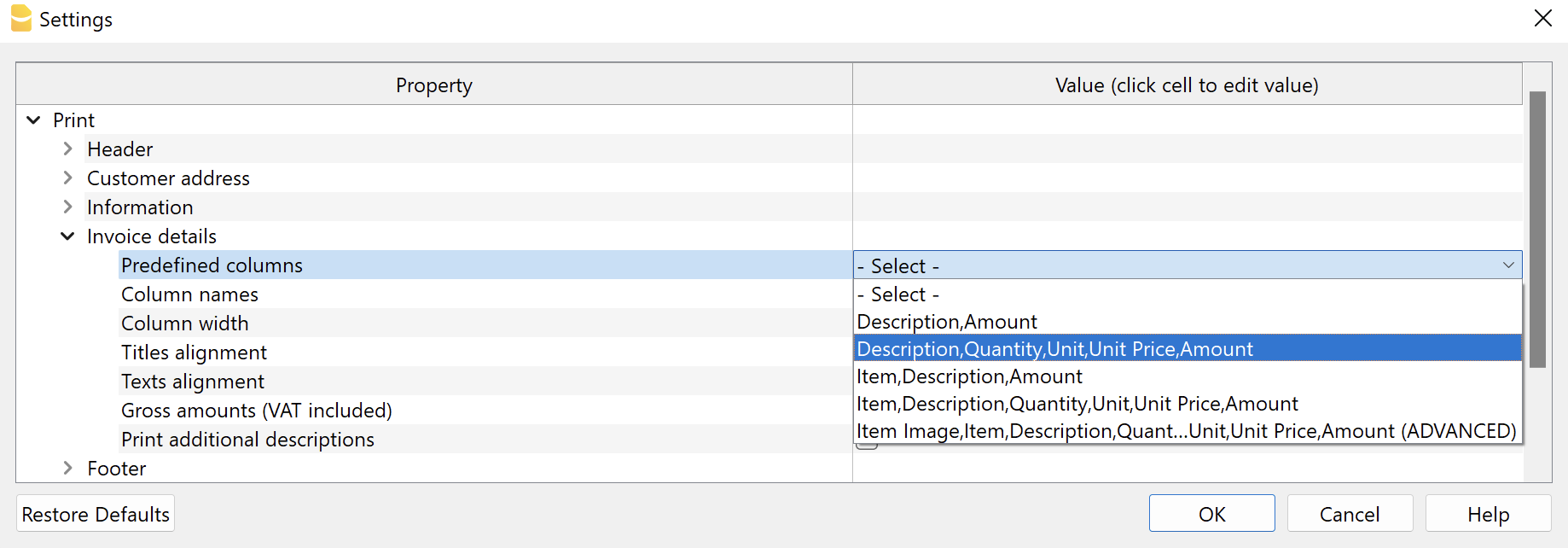

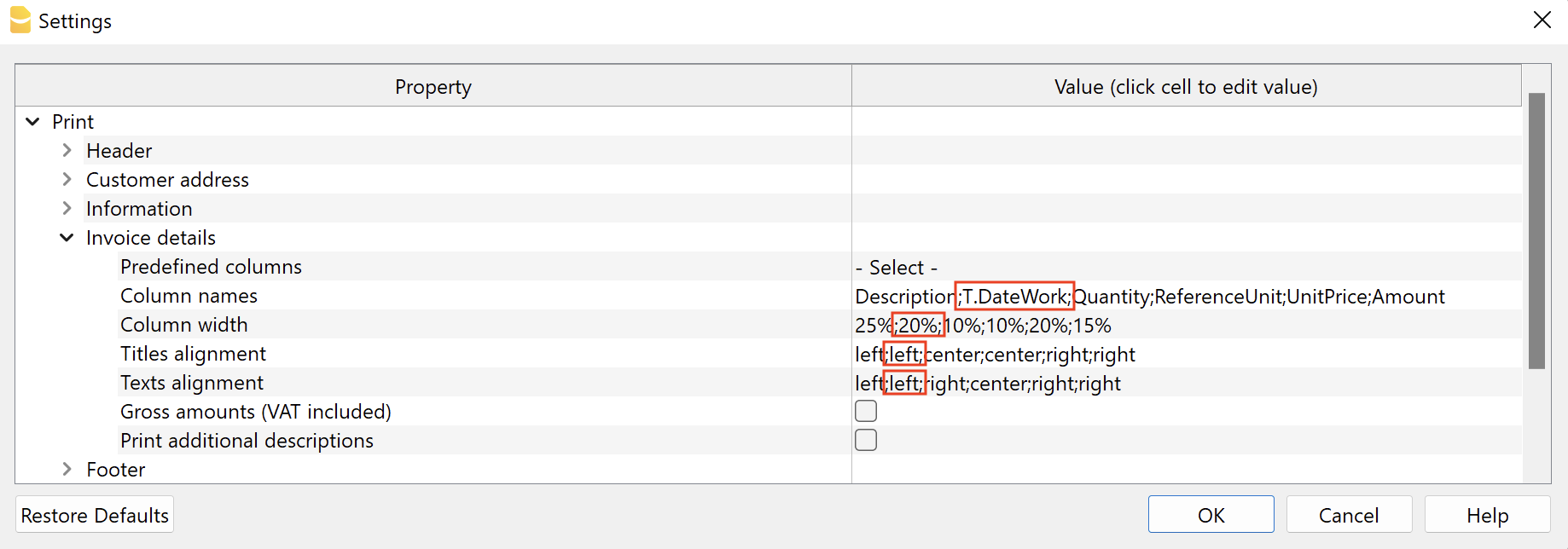

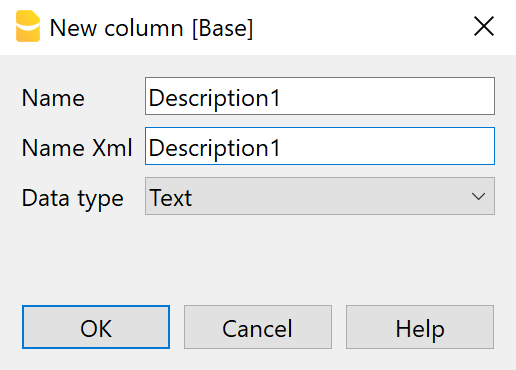

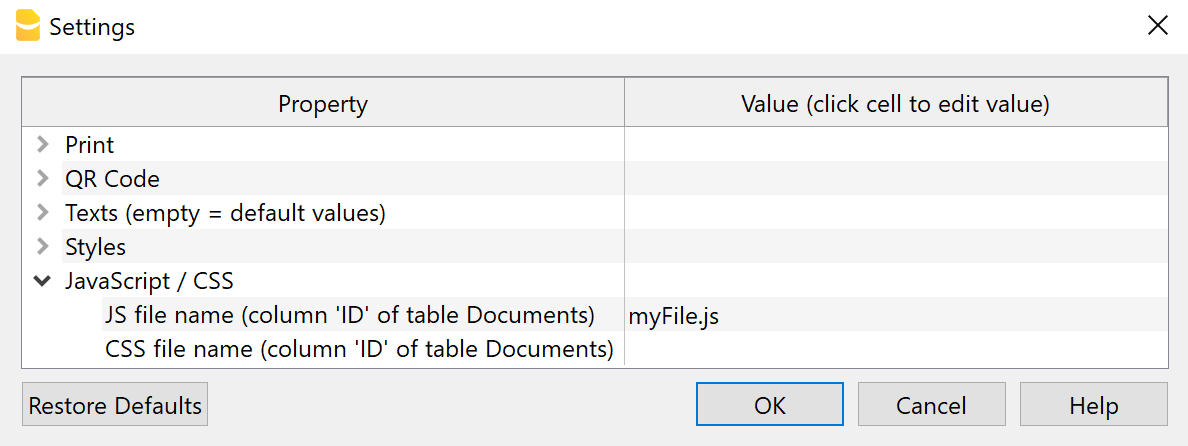

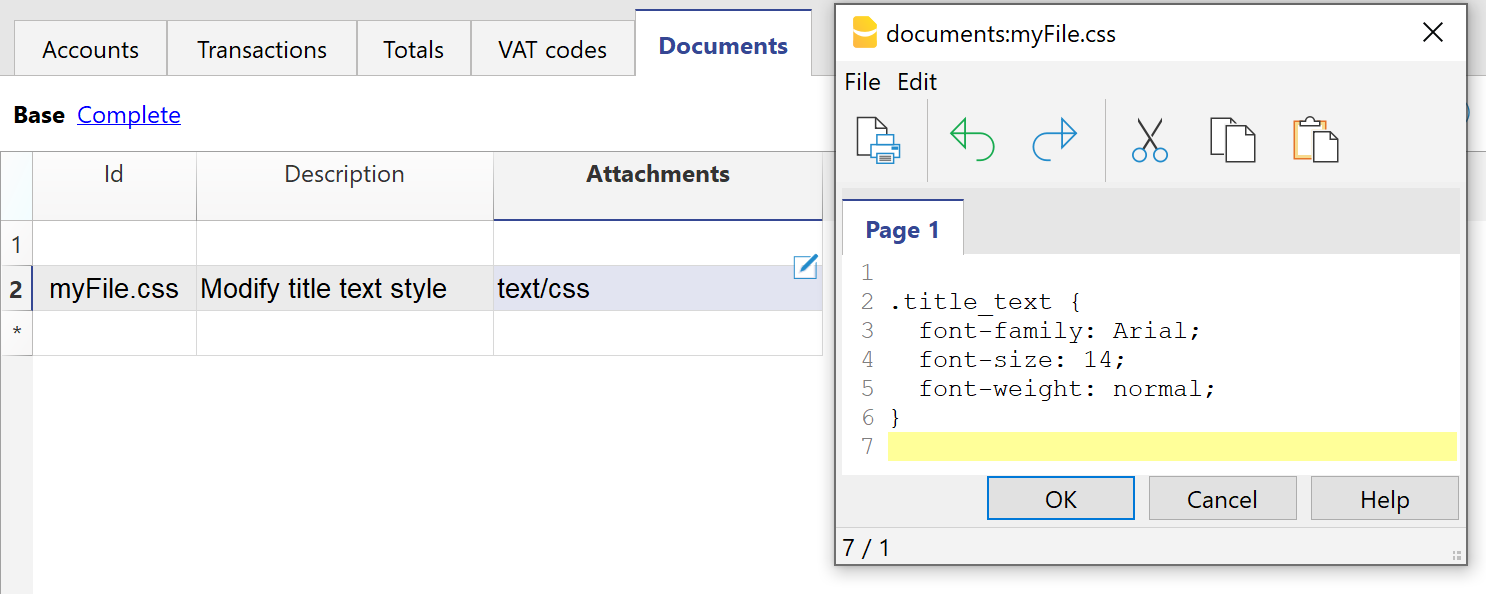

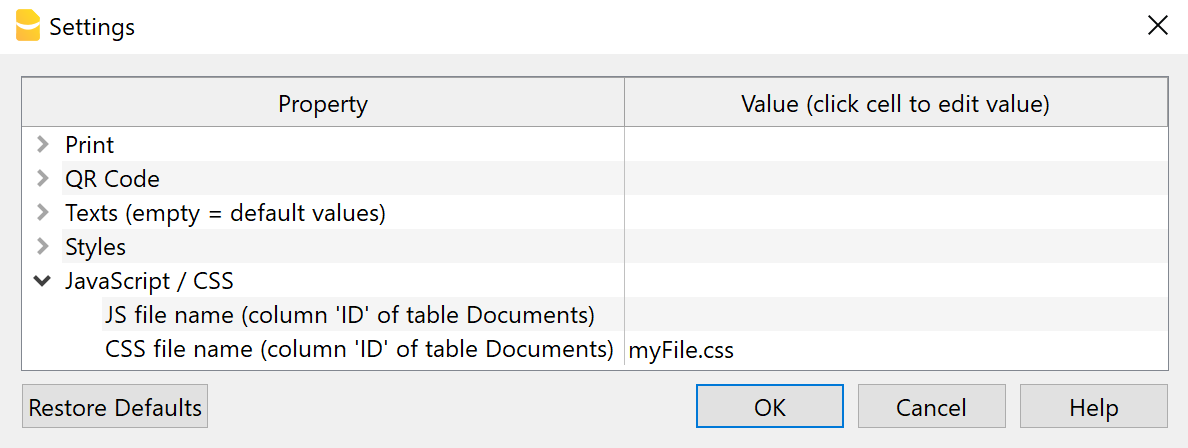

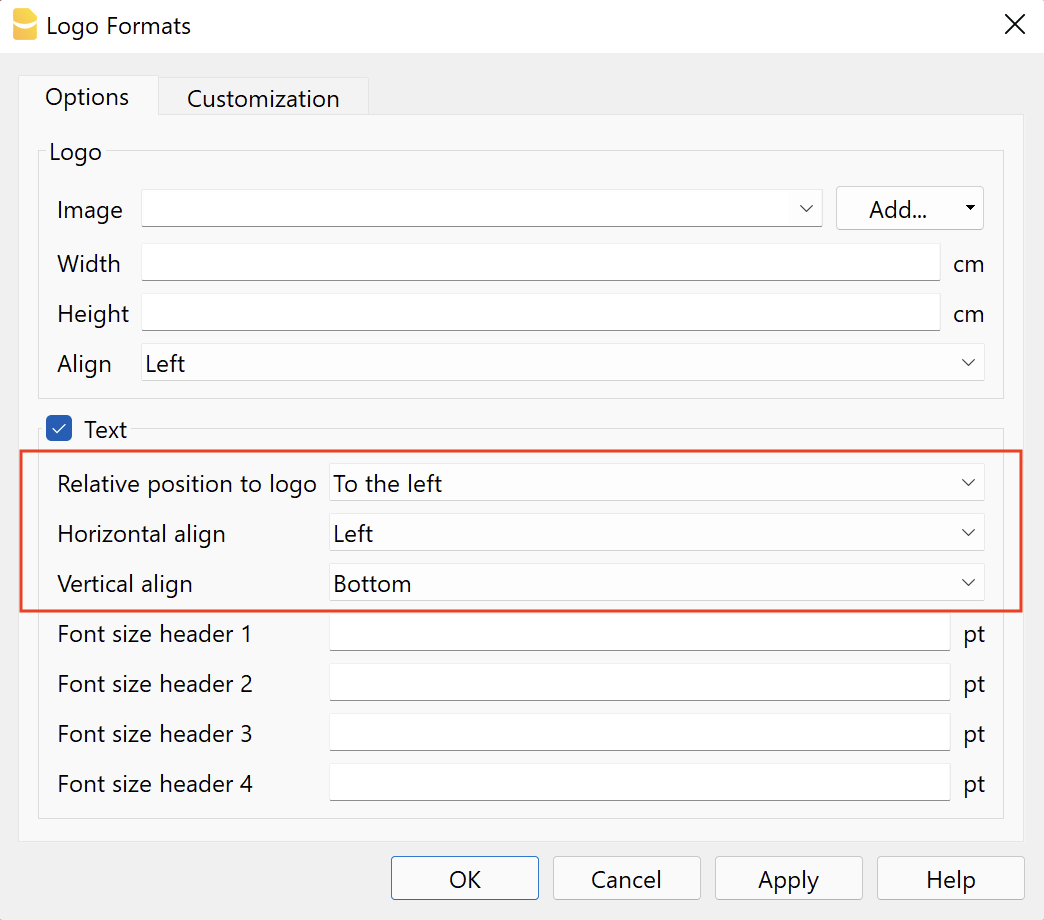

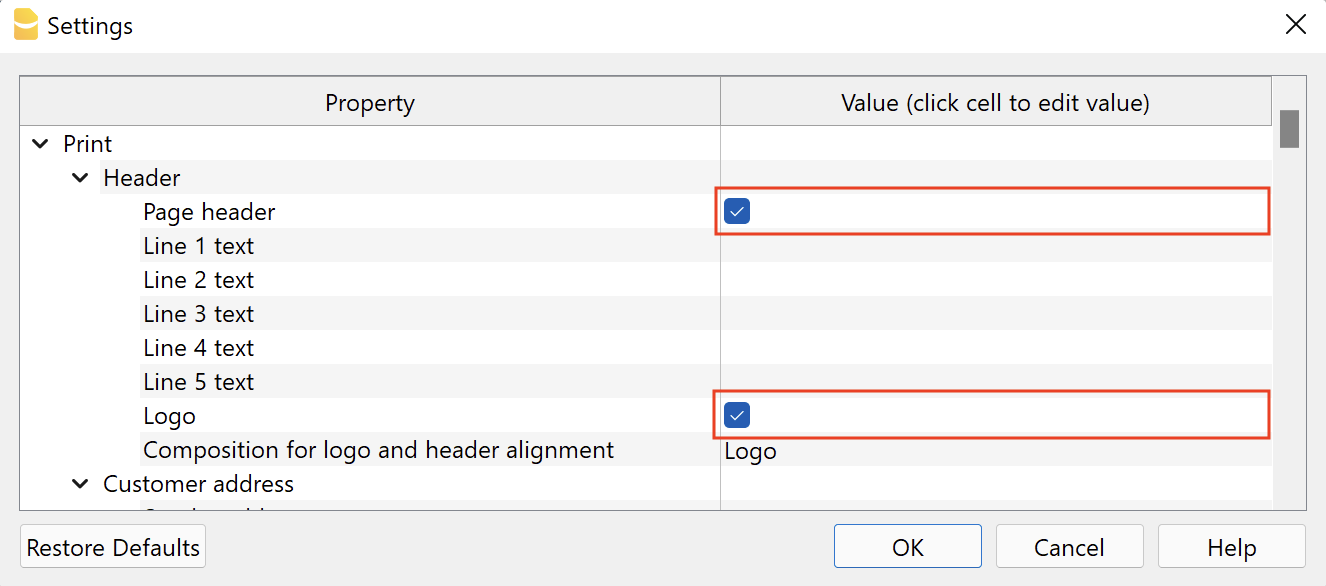

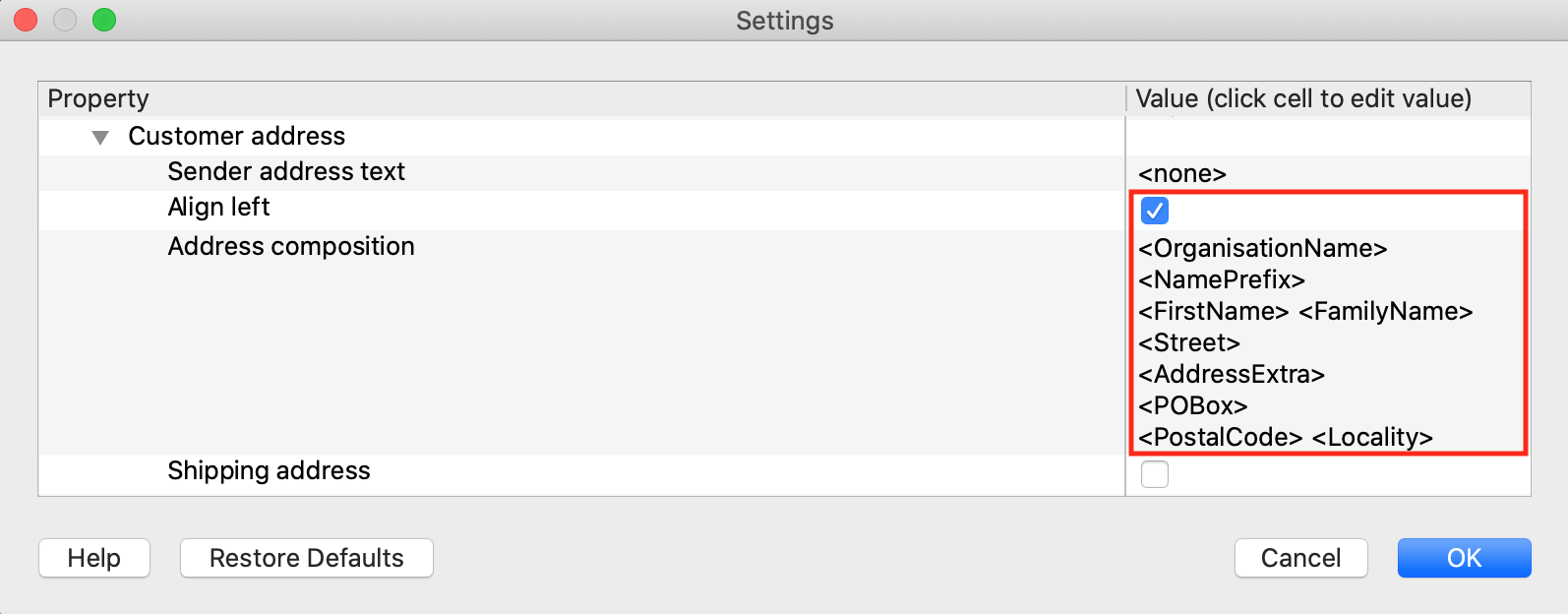

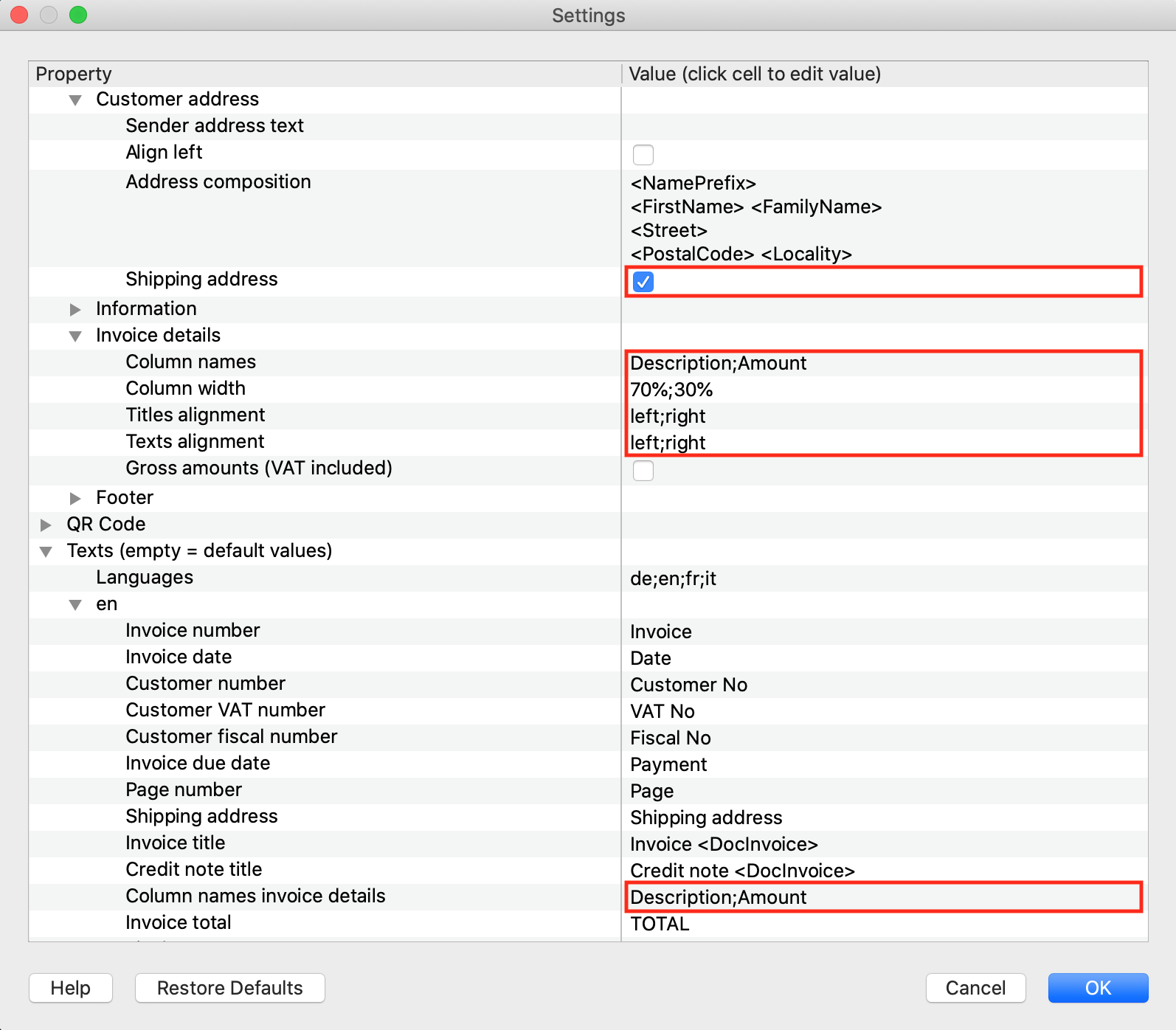

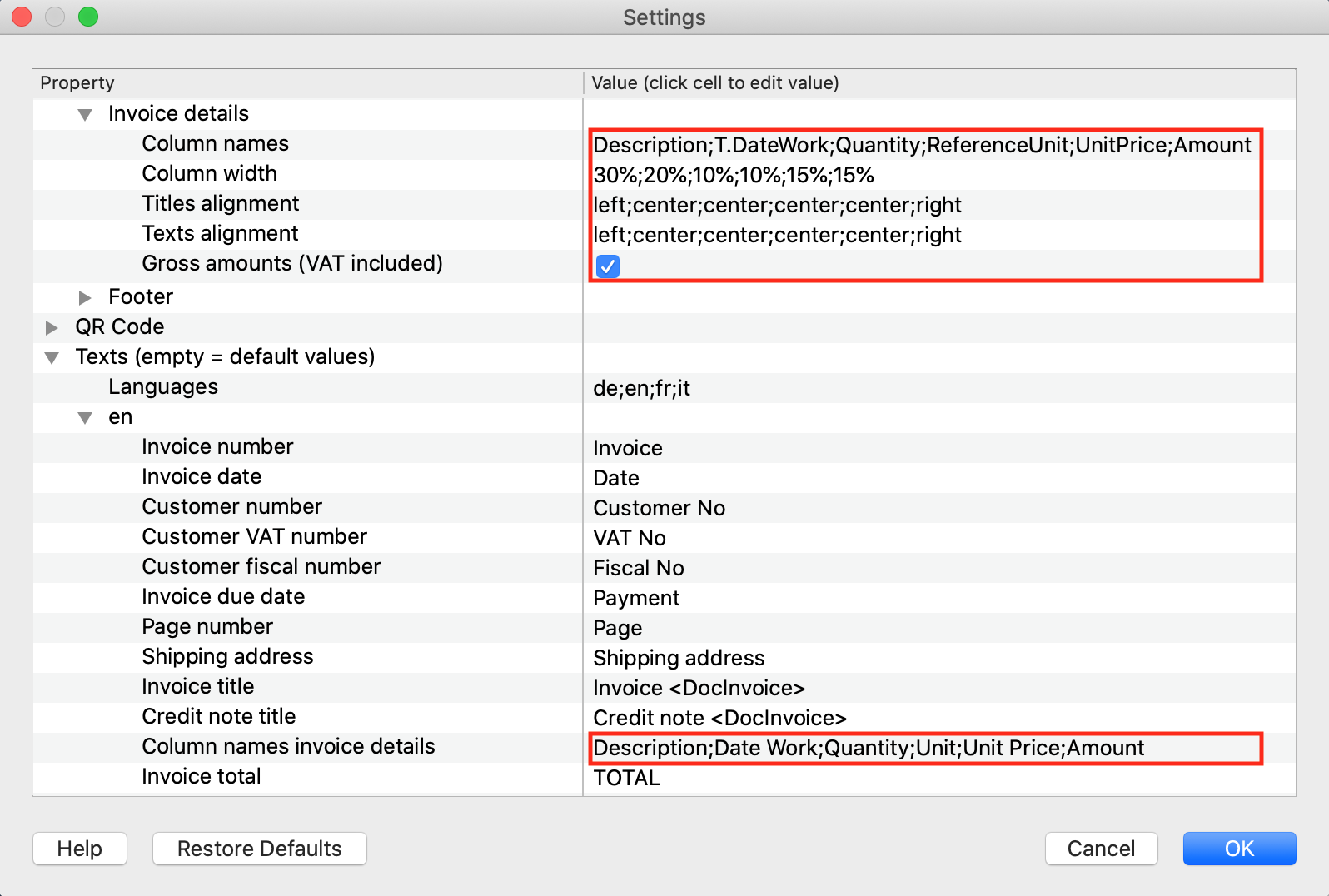

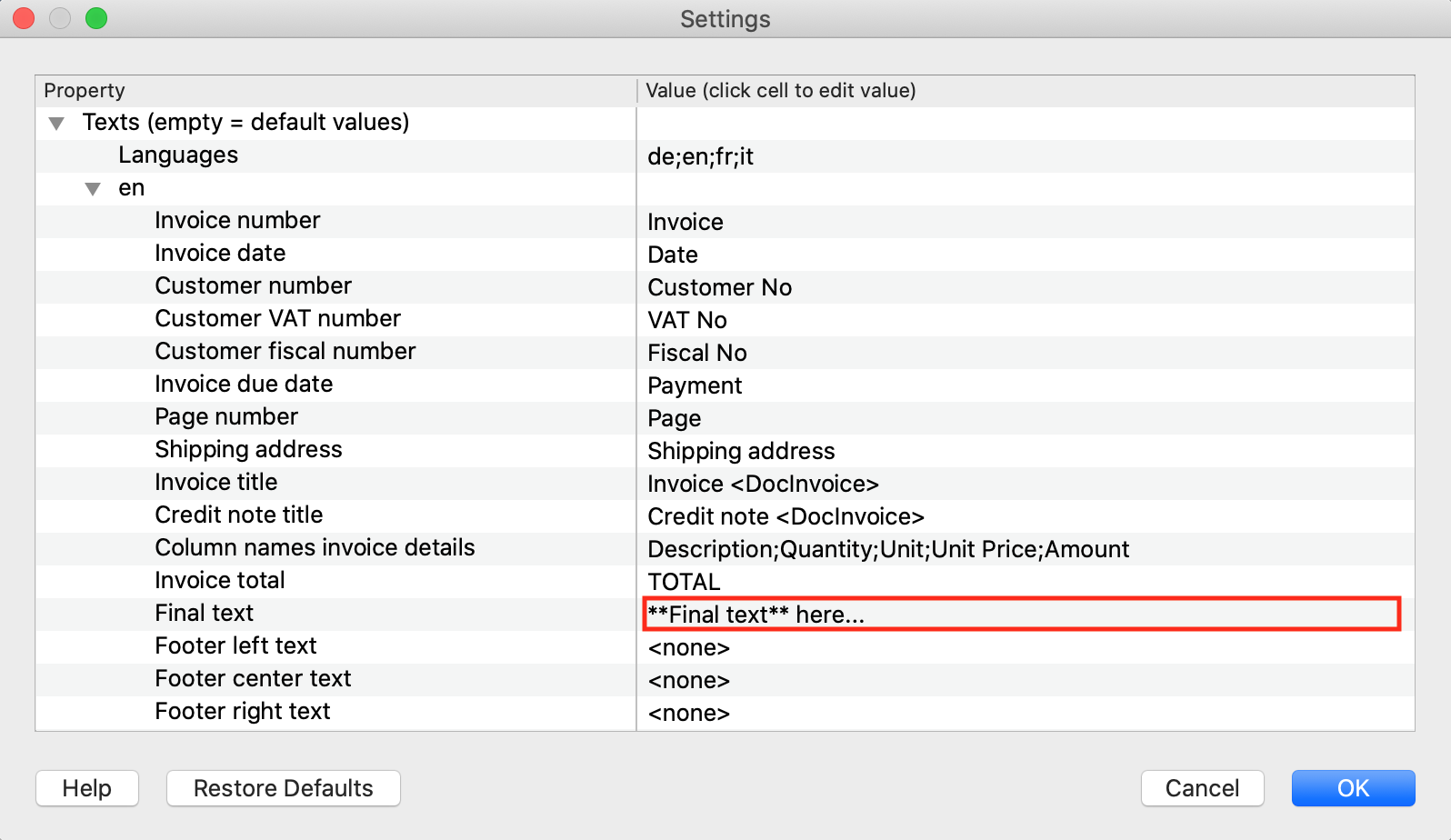

You can create payments for your suppliers within your accounting file or separately, without the need to manually prepare payment transfers. - Extensions for maximum invoice customization

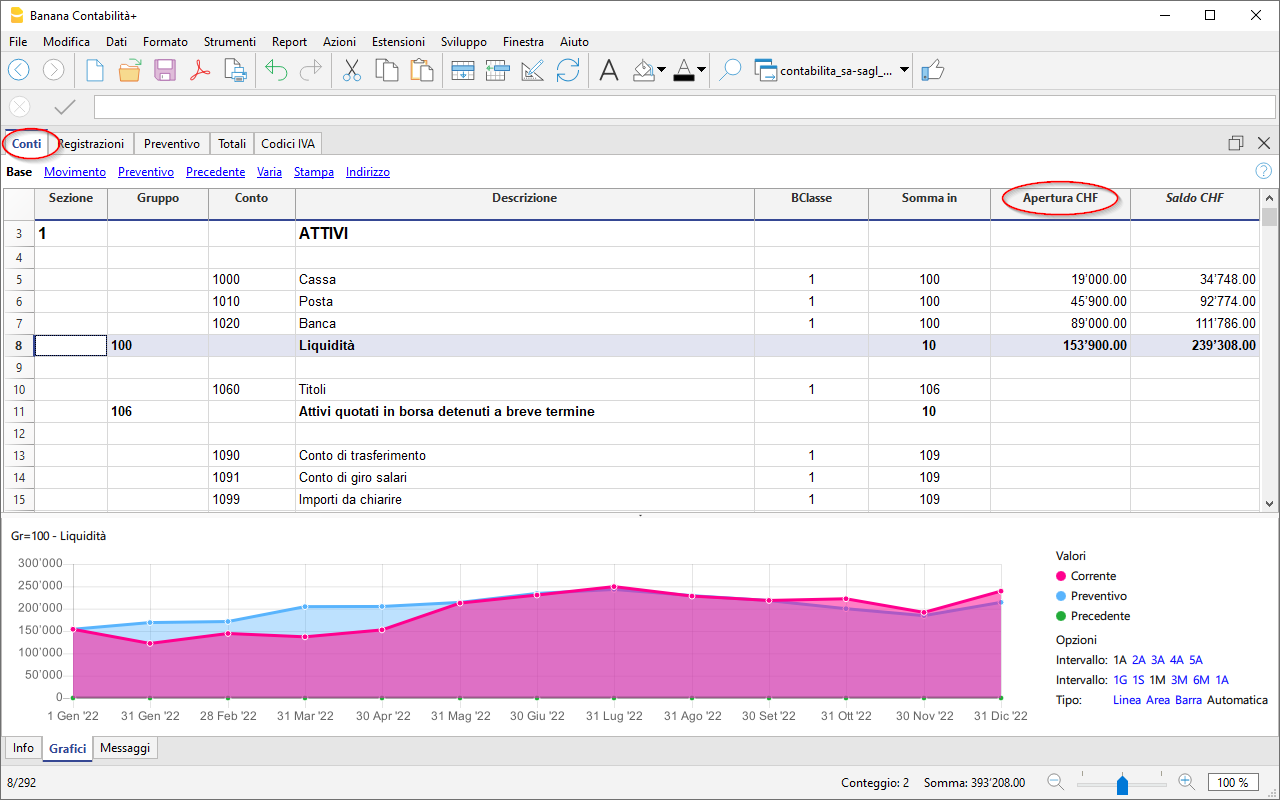

Offers greater flexibility to customize the position of logos, addresses, and texts. - Balance sheet and cash flow analysis

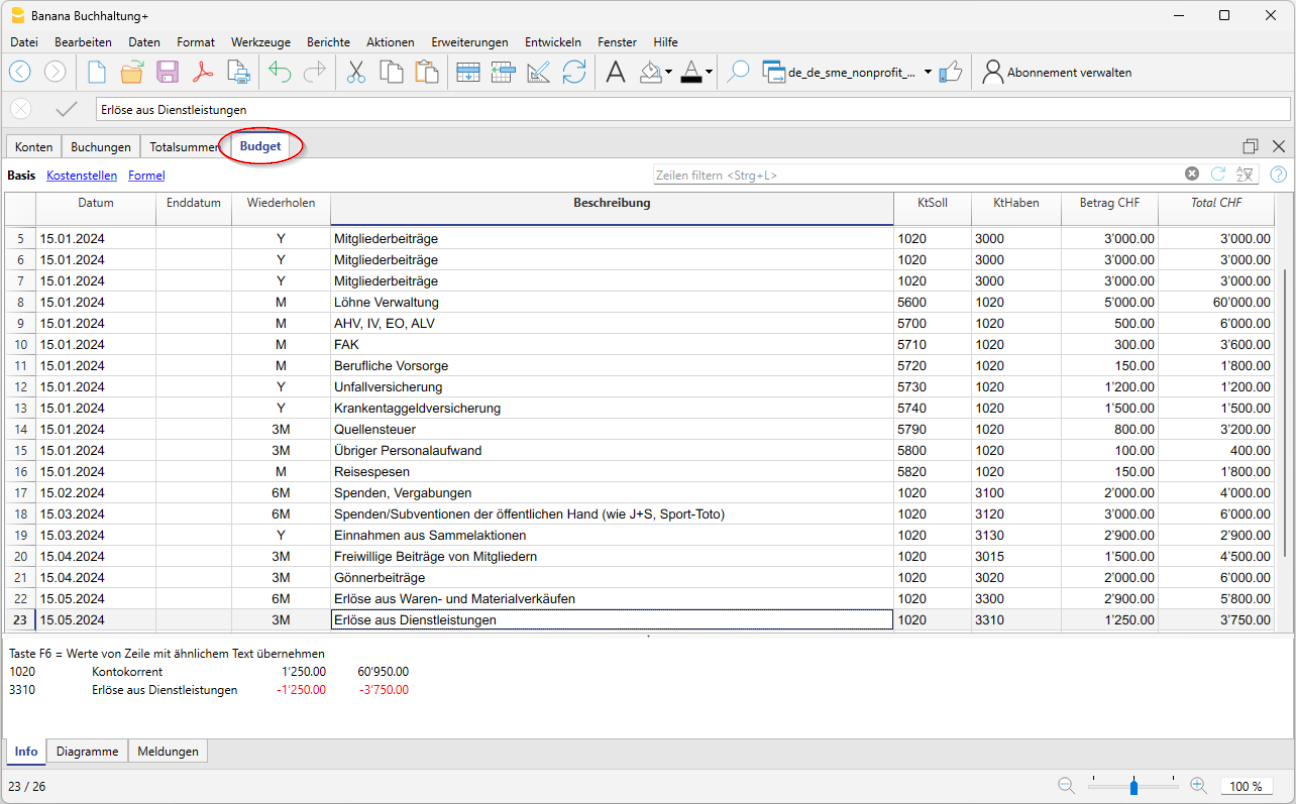

Evaluate the financial health of your company, monitor liquidity, and identify critical areas to intervene promptly. Use these analyses to plan effective strategies that improve business performance and ensure sustainable growth. - Financial forecasts and budgeting

Anticipate the financial performance to ensure the availability of necessary liquidity, plan targeted investments, and reduce waste. Optimize revenues and ensure efficient resource management, allowing you to make informed decisions and maintain financial control over your company.

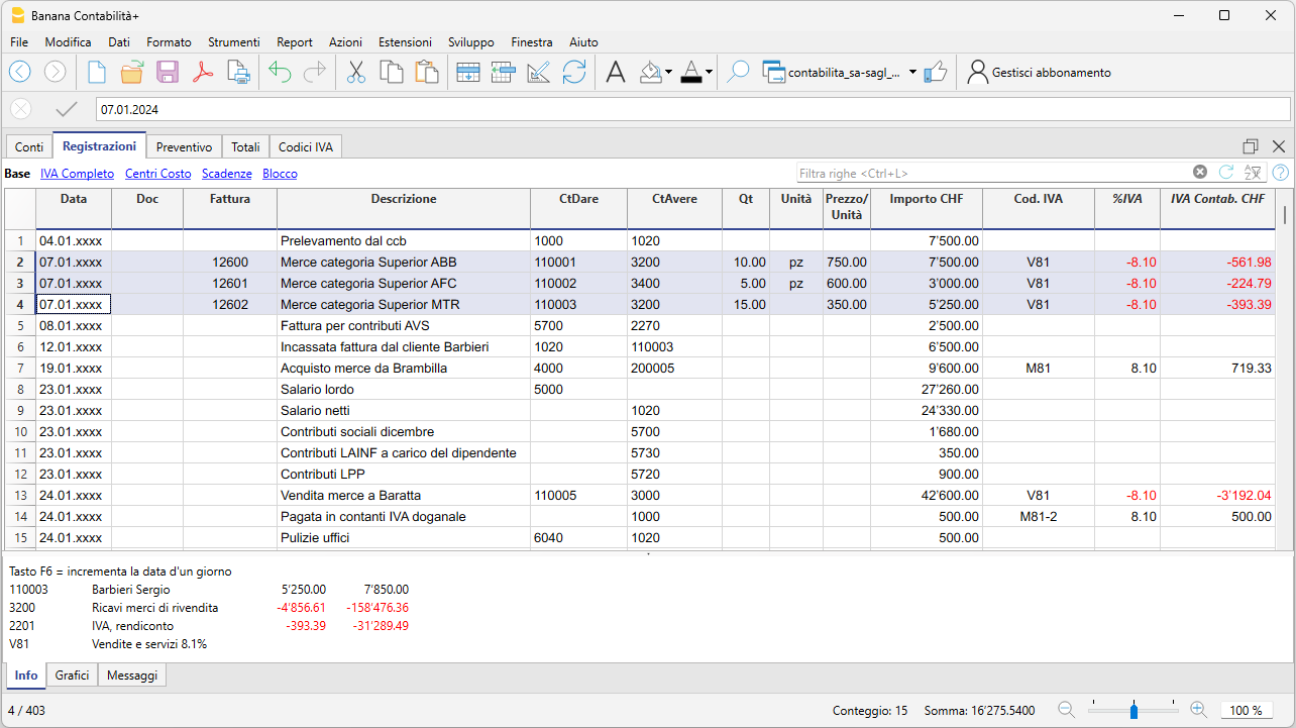

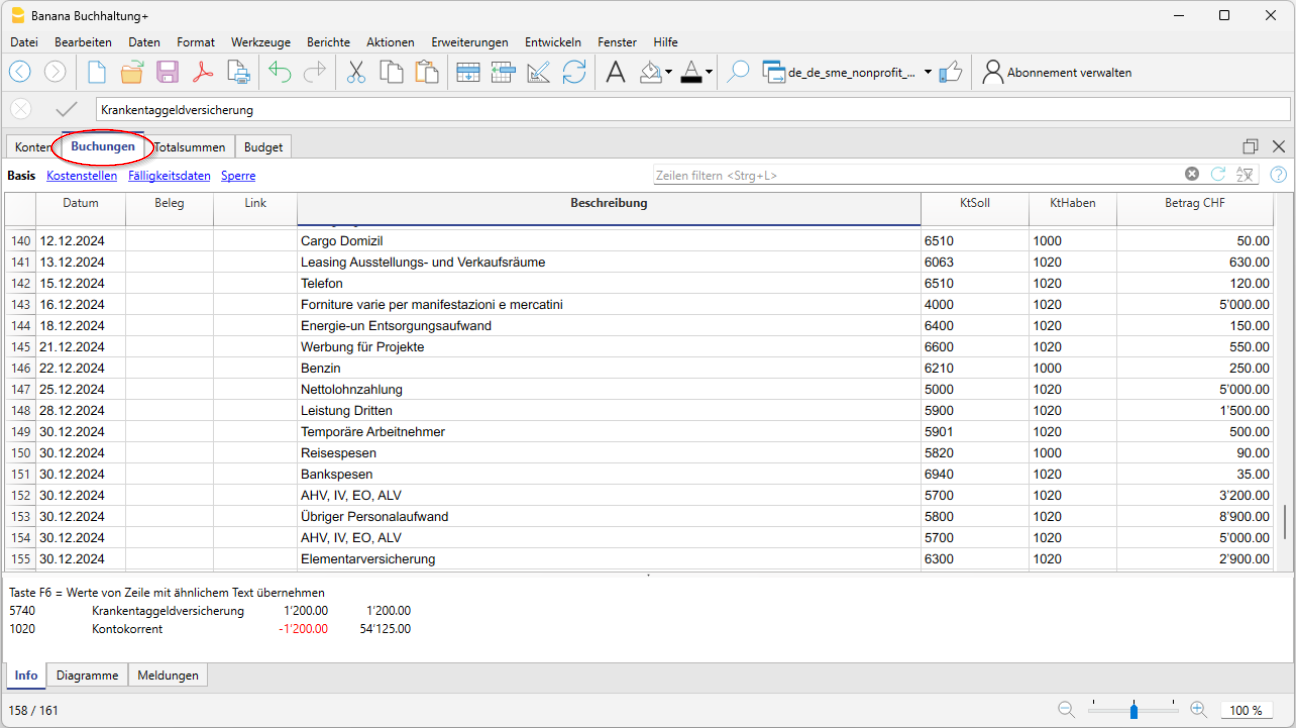

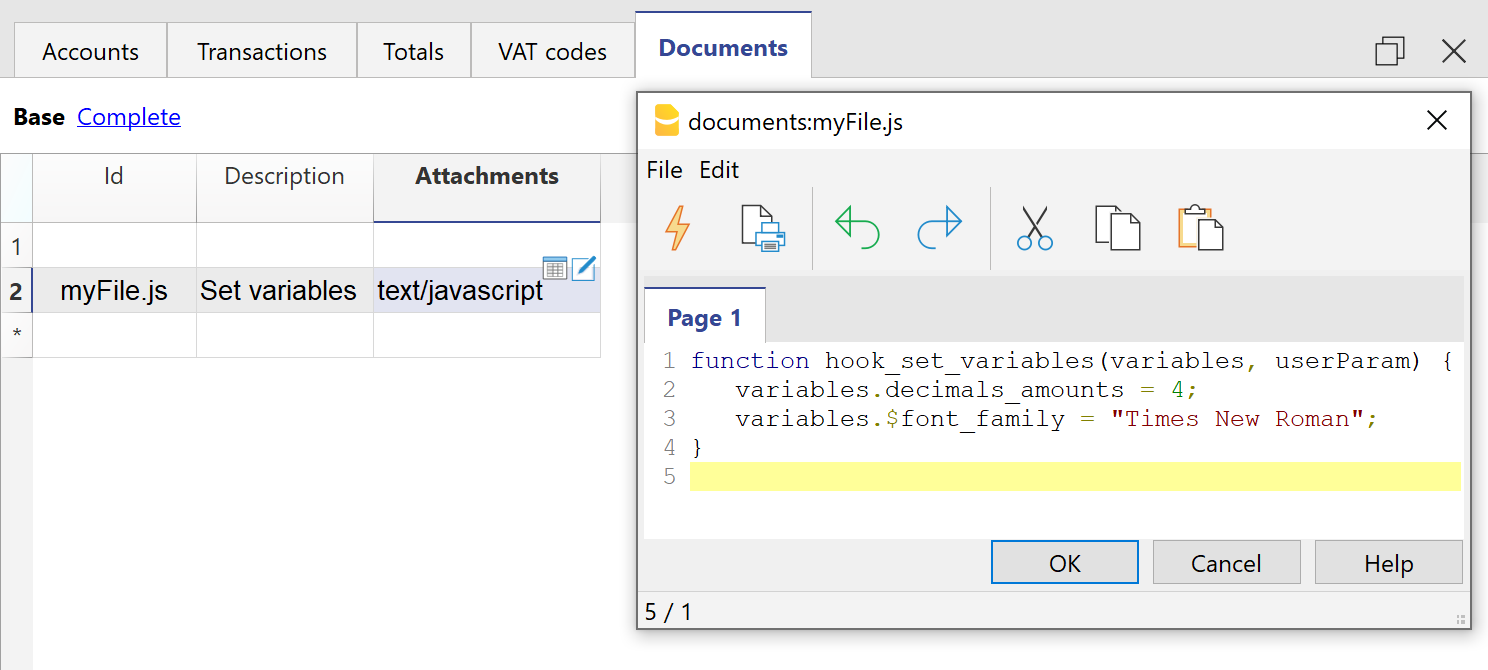

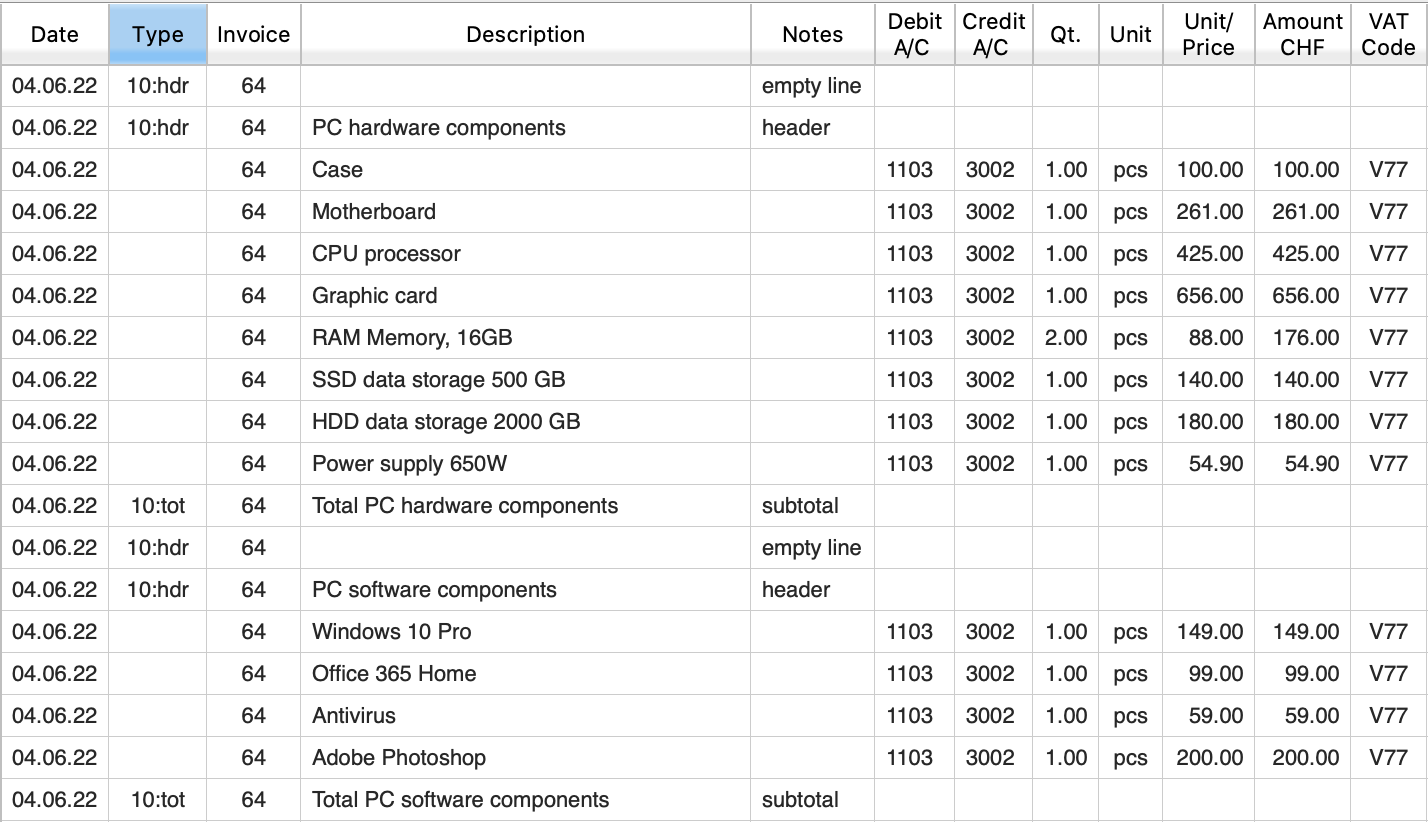

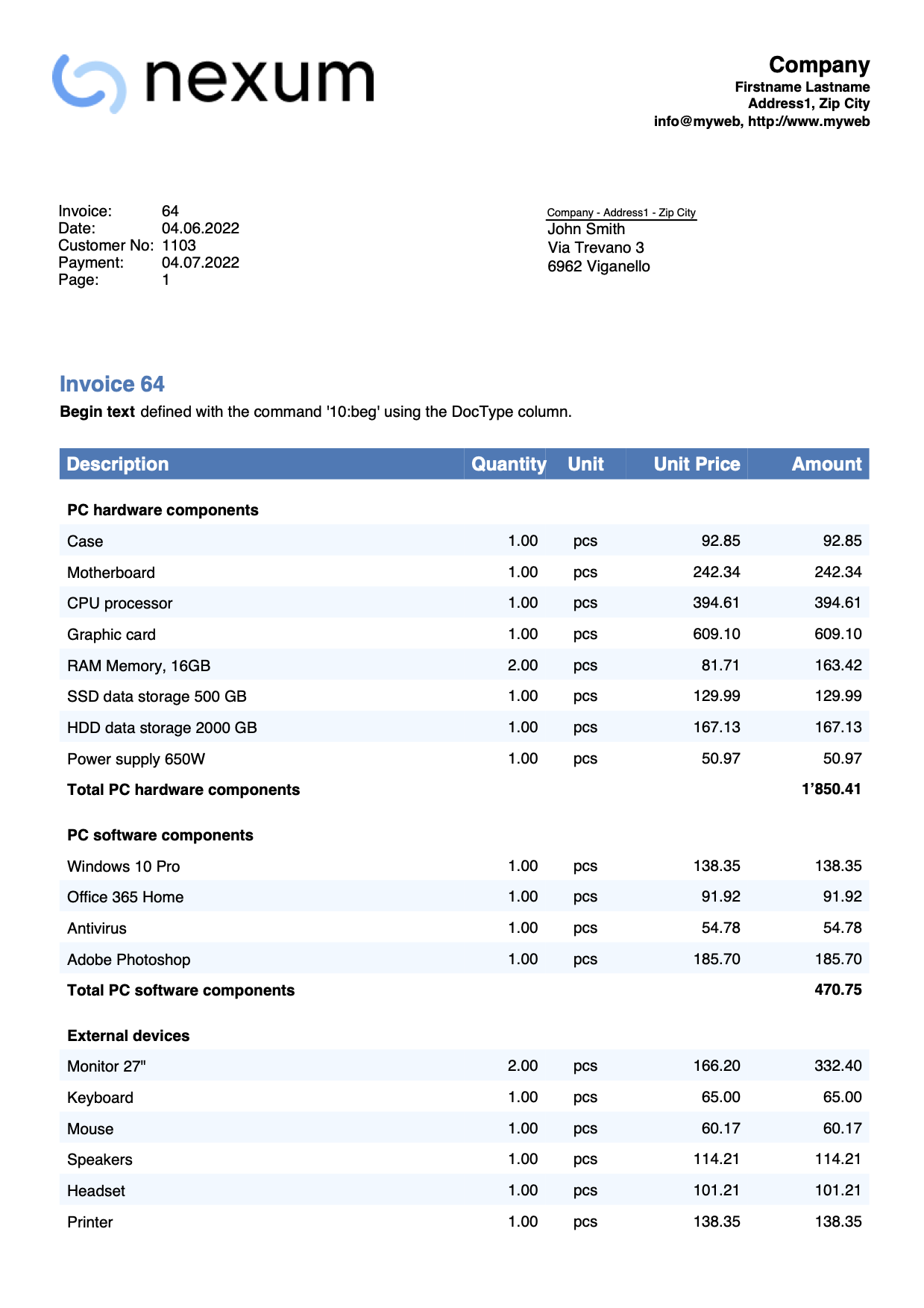

Tutorial

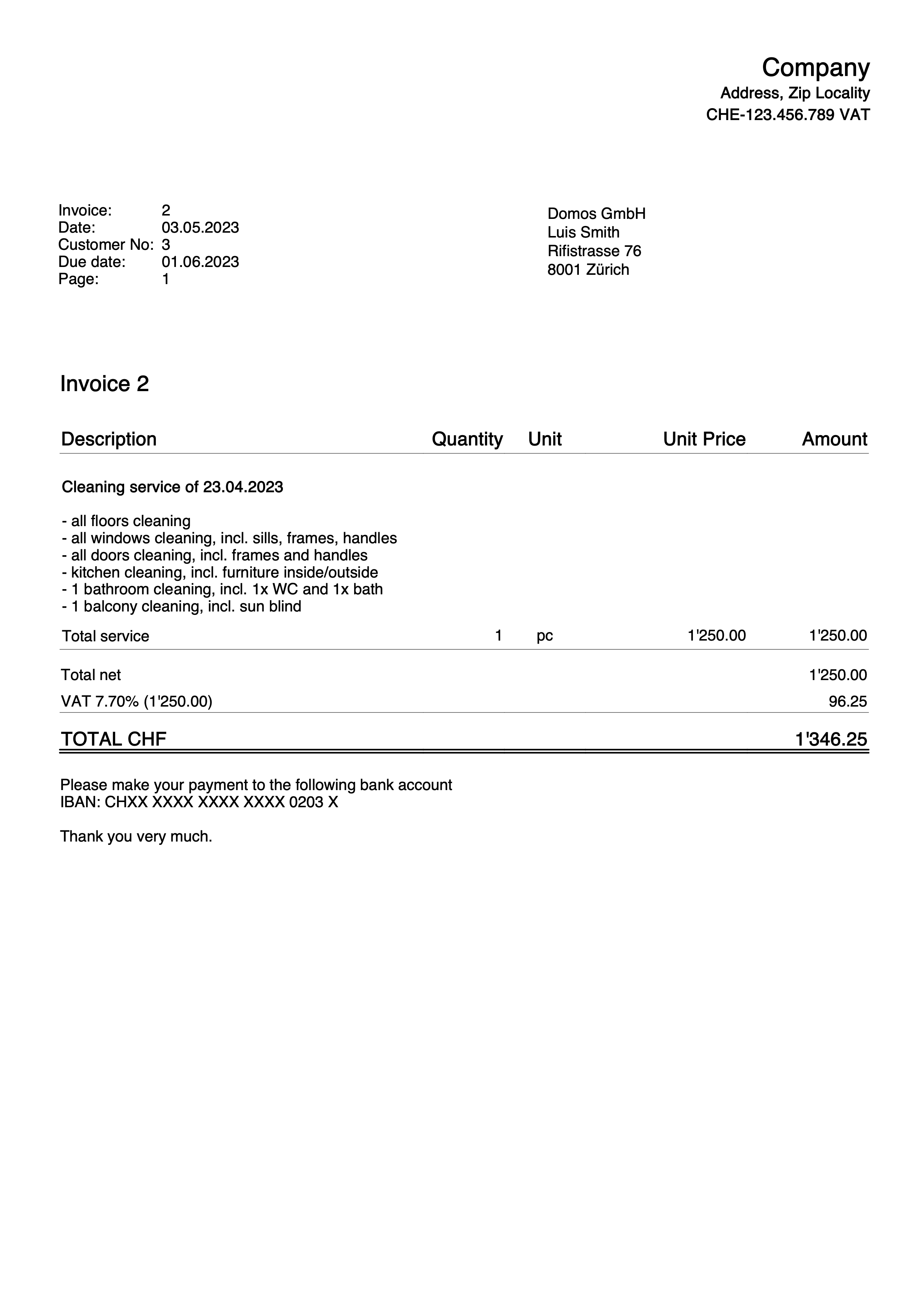

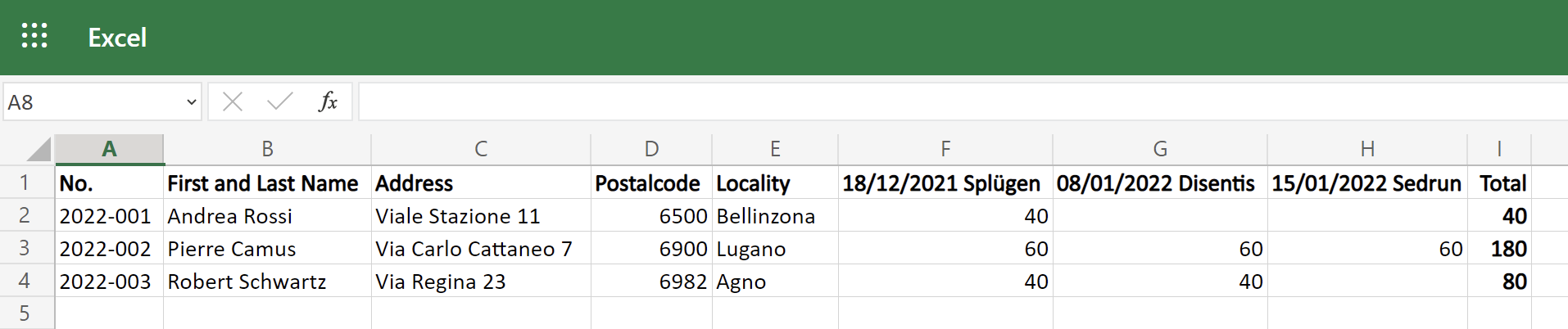

On the Tutorial pages, you will find step-by-step instructions on how to set up the file, record transactions, create invoices, import transactions using rules, and generate the balance sheet. The explanations are accompanied by images taken from sample files in the Banana program.

You can download the tutorial file, which contains not only the chart of accounts but also opening balances and sample entries. You can, of course, customize the file by changing the opening balances and replacing the sample transactions with your own.

Business Templates Switzerland without VAT

Templates without VAT are ideal for managing the accounting of small businesses and professionals not subject to VAT. You work easily in tables, similar to Excel, where you can correct and edit entries. The models are based on the Swiss SME system of accounts (Sterchi, Mattle, Helbing), in compliance with the Swiss Code of Obligations (articles 957-963b CO).

VAT-free templates ready for your accounting needs

Banana Accounting Plus offers various pre-set accounting models suitable for different types of businesses and accounting skills.

If you have no accounting knowledge, you can choose the Cash Manager (Cashbook) model to manage cash inflows and outflows, or an Income/Expense template, which allows you to manage income and expenses across multiple accounts.

On the other hand, if you have accounting knowledge or work in the field, choose a double-entry accounting model tailored to your legal structure or business activity.

Easy and Quick Start

You can open the templates immediately with our WebApp by saving the file to your computer, or by downloading the program from our Download page.

Create your file:

- Using the File > File Properties command, set the period, the name of your company, and the base currency (you can create the budget and accounting in any currency)

- With the File > Save As command, save the file. It's helpful to include the company name and year in the file name. For example, "Rossi-SA-20xx.ac2."

WARNING: If you close the browser without saving, you will lose the entered data. Always save the file to your computer.

To reopen the saved file, click on File > Open. You can also double-click the file name on your computer.

Since the charts of accounts are already set up, you can immediately start recording transactions.

Once the transactions are recorded, you can generate professional reports and prints. Banana Accounting Plus offers multiple functions, from invoicing with the Swiss QR code to the automatic import of bank or postal transactions, including the counterpart.

Here are the most important features for businesses in detail:

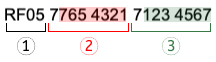

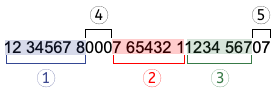

- Create and print invoices with the Swiss QR code

- Import transactions from bank statements

- Set up Rules to store and automate the completion of entries imported from bank statements

- Manage cost centers, customisable according to your needs, to get specific details on certain accounts

- Create budgets and financial forecasts

- Print all the reports you need: Balance Sheets, Journals, Account Ledgers, VAT Reports, Open Invoices, and much more

Some features require a subscription to the Advanced plan of Banana Accounting Plus, such as using the new Rules features, temporary Row Filter, and Sort. Check out all the features of the Advanced plan.

Cash Manager (free) | Freelancer

Cash Manager (free) | FreelancerThe Banana Accounting Plus Cash Manager is a completely free application. It only takes a few simple steps to create your file.

Create your file

- Open the template with Banana Accounting Plus WebApp.

- Using the command File > File Properties, set the period, the name of your office, and the base currency (you can create the budget and accounting in any currency).

- With the command File > Save As, save the file. It's useful to include the name of your office and the year in the file name. For example, "Rossi-20xx.ac2."

ATTENTION: If you close the browser without saving, you will lose the entered data. Always save the file to your computer.

You can then consult all the information in our Documentation, particularly on the following web pages:

Cash Manager (free) | Business

Cash Manager (free) | BusinessThe Banana Accounting Plus Cash Manager is a completely free application.

It is designed to manage the cash inflows and outflows of a small business. The file can also complement the main accounting file:

- Record all cash transactions in the file.

- At the end of each quarter (or a period of your choice), import the totals of categories and accounts into the main accounting file.

You will have the advantage of keeping all the details of cash transactions in a single file, while the main accounting file will only display the grouped totals by quarter or chosen period, streamlining the main accounting process.

Create your file

- Open the template with the Banana Accounting Plus WebApp.

- Using the command File > File Properties, set the period, the name of your business, and the base currency (you can create the budget and accounting in any currency).

- With the command File > Save As, save the file. It’s helpful to include the business name and the year in the file name. For example, "Cassa-Rossi-20xx.ac2".

WARNING: If you close the browser without saving, you will lose the entered data. Always save the file to your computer.

More information is available on the following pages:

Business | Income & Expense accounting

Business | Income & Expense accountingThe model, while having a simple and essential setup, still allows you to manage accounting professionally.

- You can customize the accounts and categories at any time, adapting it to your specific needs.

- The Accounts and Categories tables provide an immediate overview of the balances for each account and category, allowing you to maintain full control over your financial situation.

- By setting up the customer ledger, you can issue invoices to your clients with the added benefit of having them automatically recorded in your accounting.

- You can speed up the entry of transactions by importing bank data and using Rules: for each imported transaction, you enter a keyword (Rule) that completes all other elements of the transaction (counterparty, cost center...). On subsequent imports, whenever the program finds the keyword in the imported transaction, it completes it automatically, significantly reducing work time and minimizing the risk of errors.

Some features require a subscription to the Advanced plan of Banana Accounting Plus, such as using the new features of Rules, Filter, and Temporary Row Sorting. See all the features of the Advanced plan.

Create your file

- Open the template with the Banana Accounting Plus WebApp.

- Using the command File > File Properties, set the period, your company's name, and the base currency.

- Using the command File > Save As, save the file. It’s helpful to include your company's name and the year in the file name. For example, "Rossi-SA-20xx.ac2".

ATTENTION: If you close the browser without saving, you will lose the entered data. Always save the file to your computer.

In our documentation, you’ll find all the explanations on various topics to help you manage your accounting efficiently:

Freelance | Income & Expense accounting

Freelance | Income & Expense accountingThe Income and Expense Accounting module of Banana Accounting Plus allows you to manage your income and expenses across multiple accounts in a simple, fast, and professional way. While intuitive to use, it delivers professional-level results, as it is based on the same calculation engine as double-entry bookkeeping. This means you can easily generate balance sheets, income and expense reports, and manage cost and profit centers, segments, financial forecasts, and much more.

In the Accounts table, you will find the accounts to manage your resources (cash, equipment, clients, etc.), while in the Categories table, all income and expenses are categorized by item.