In this article

▶ Video: How to start a Double-entry accounting file. Find out how to easily set up a Double-entry accounting, adapt the Plan of Accounts, import bank transactions easily or insert transactions manually, set up a Budget, enter the Transactions and Print reports.

Creating an accounting file, starting from a template

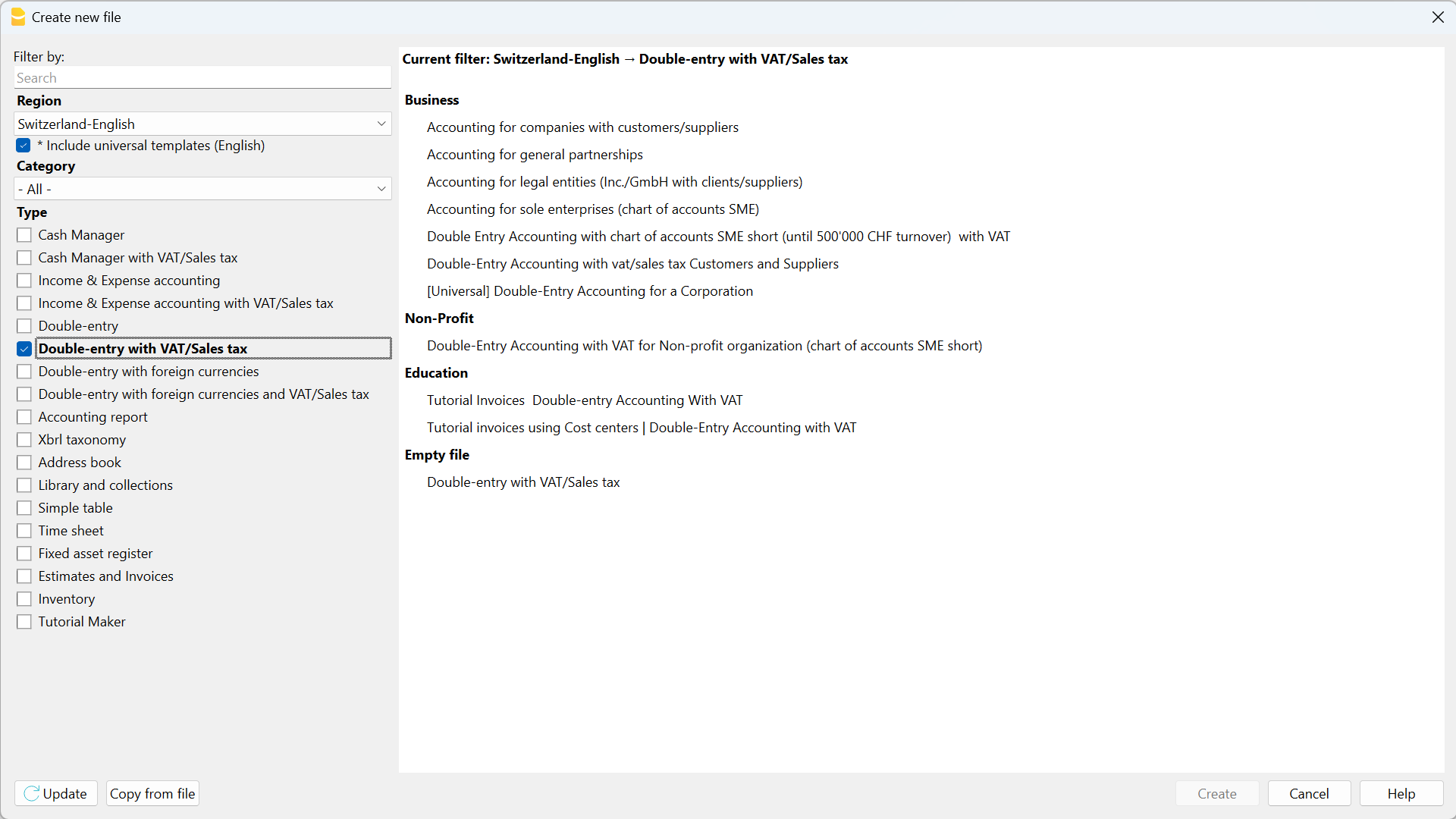

Banana Accounting Plus includes templates for all legal forms, divided by country and by category. They can be opened directly in the program, from the File menu, New... command, or they can be downloaded from our Templates page.

Here is how to start choosing a template directly from the program:

- File menu, > New...

- Select the region, the language, the category and the accounting type.

- From the list of the templates that appears, select the template that is closest to your own needs.

- Click on the Create Button.

In the Search area, when entering a key word, the program will display the templates that contain the entered key word.

It is equally possible to set out from a blank file, by activating the Create Empty file option. However, in order to facilitate the start and avoid grouping errors, we recommend that you always start with an existing template.

More information on the Create New File page.

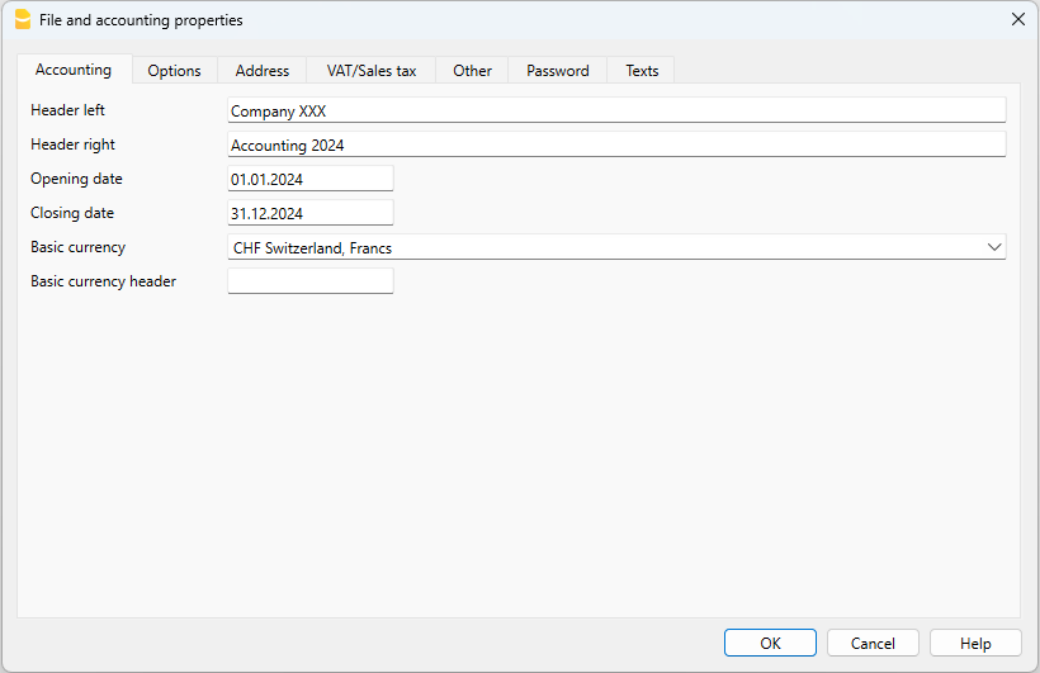

Setting up the file properties (basic data)

- Via the File > File and accounting properties command, indicate the company name that will appear in the headers of the printouts and on other data.

- Select the base currency, in which the accounting will be kept.

Save to disk

With the File > Save As command, save the data and also assign a name to the file. The typical save dialog of your operating system will be displayed.

- It is advisable to use the name of the company followed by the year "ie. Company-2020.ac2." to distinguish it from other accounting files.

- You can keep as many accounting files as you need, each will have its own name.

- You can select the path you want, (save to disk, USB key or cloud).

If you plan to have documents linked to the accounting of the current year as well, we recommend creating a separate folder for each accounting year in which to group all the files. Please also visit the Organizing your files page

General use of the program

Banana Accounting Plus is Excel-inspired. User commands are kept as similar as possible to the ones of Microsoft Office.

For more information on the general use of the program, please visit our Program interface page.

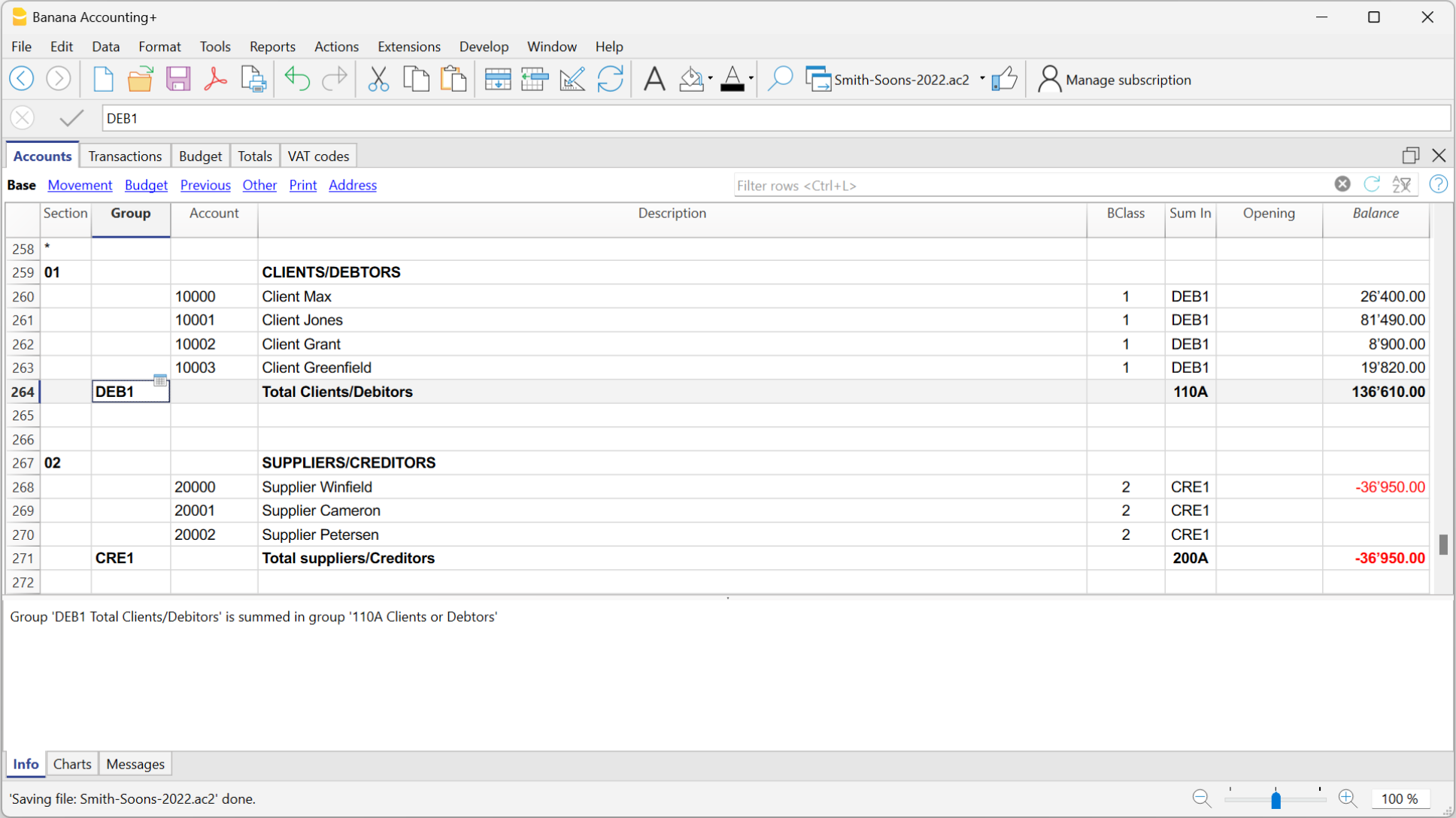

Customizing the Chart of accounts

In the Accounts table, customize the Chart of Accounts and adapt it to your own requirements.

It is possible to:

- Add new accounts and /or delete existing ones (see Adding new rows)

- Modify the account numbers, the description (for example enter the name of your own Bank account), enter other groups, etc.

- Create subgroups, please consult our Groups page.

- Define Cost centers or Segments that are used to catalogue the amounts in a more detailed and specific way.

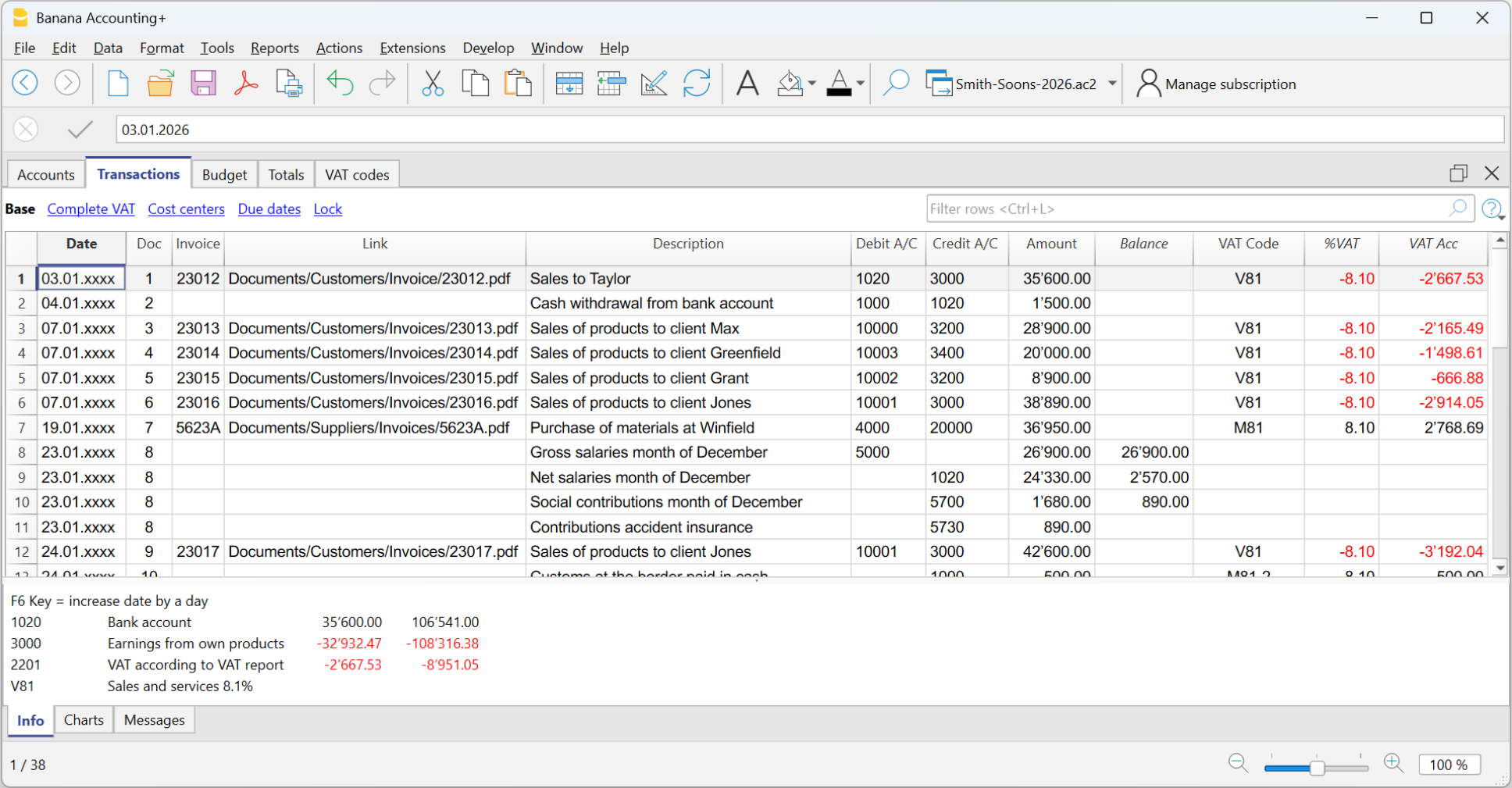

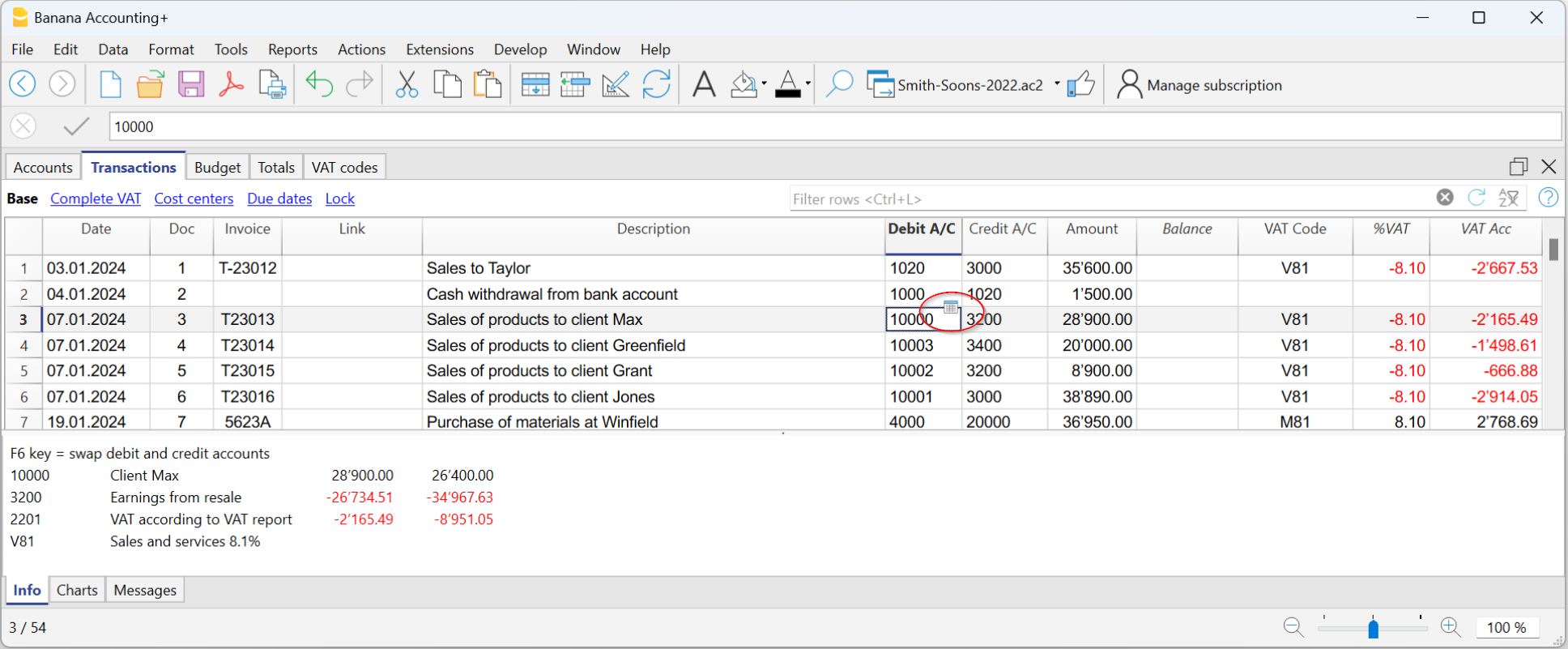

The Transactions

Transactions must be entered into the Transactions table and they compose the Journal.

In the specific columns:

- Enter the Date

- Enter the Document number, manually assigned to the paper document. This allows for easy location of the documents once the accounting transaction has been entered.

- Enter the Description

- Into the Debit account column, enter the destination account.

- Into the Credit account column, enter the account of origin.

- Enter the Amount.

- In the accounting with VAT, enter the gross amount and VAT code. The program will separate the VAT, splitting the net cost or net income.

Make visible the Balance column in the Transactions table

The new Balance column is a very useful feature: it allows you to immediately spot possible differences.

The Balance column is not visible by default: you can make it visible via the Data → Columns setup menu.

Speeding up the recording of the transactions

In order to accelerate the recording of the transactions, you can use:

- Smart fill - allows for auto-complete of data that has already been entered previously.

- Recurring transactions - memorizes repetitive movements in a table and can be called up when necessary.

- Import transactions from bank or postal statement - imports all transactions from the bank, postal or credit card statement into the accounting file.

Transactions with VAT

In order to enter transactions with VAT please proceed as follows:

- Select Double-entry accounting with VAT/Sales tax in the File > New... menu.

- Choose one of the existing accounting templates with existing VAT Codes table, containing all prevailing VAT codes.

In order to enter transactions with VAT, please visit the Transactions page.

Transactions on multiple rows

Compound transactions, those that concern debits and / or credits to multiple accounts (e.g. when paying different invoices from the bank account) must be recorded on several rows:

- One row for each debit and / or credit account.

- When all the debits and credits have been entered there must be no differences.

For more details, consult the page Composed transactions.

Checking customer and supplier invoices

Banana Accounting allows you to keep track of invoices to be collected from customers and paid to suppliers. Further details are available on the following web pages:

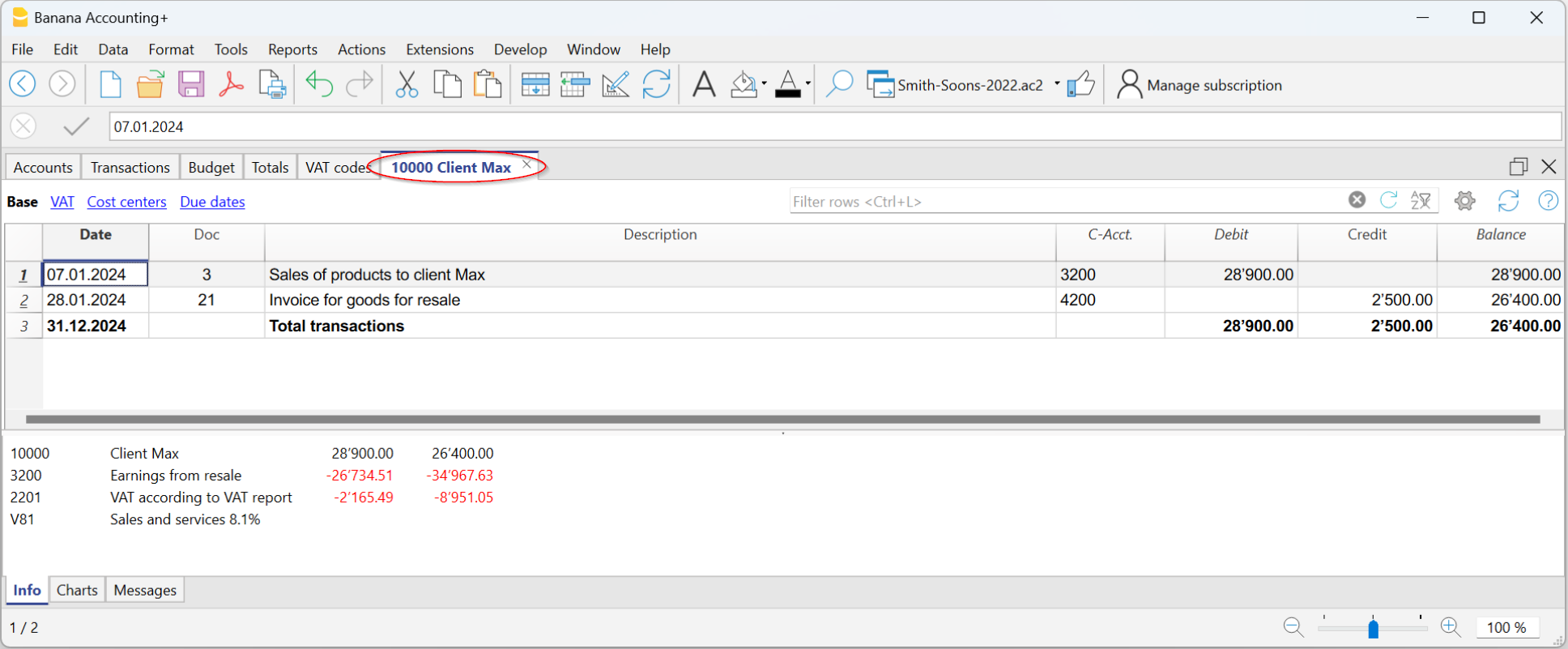

The Account cards

The account cards automatically display all the transactions that have been recorded on the same account (e.g., cash, bank, clients, etc).

To display a single account card, just position yourself with the mouse on the account number and click on the small blue icon that appears in the cell.

Account card by period

To display the account card with the balances referring to a specific period, proceed as follows:

- Menu Reports > Account Cards.

- In the Period section, activate Period selected, by entering the start and end date of the period.

For more details, consult the Period page.

Printing one Account card

In order to print a single account card, just display the card from any table (Accounts or Transactions) and launch the print from on the File menu.

Print all or some account cards

To print all or some account cards, proceed as follows:

- Menu Reports > Account Cards,

- Select the account cards to print:

Using the filter in the window, you can automatically select all accounts, cost centers, segments, groups or you can simply select the desired accounts only.

For more details, consult the Account Cards page.

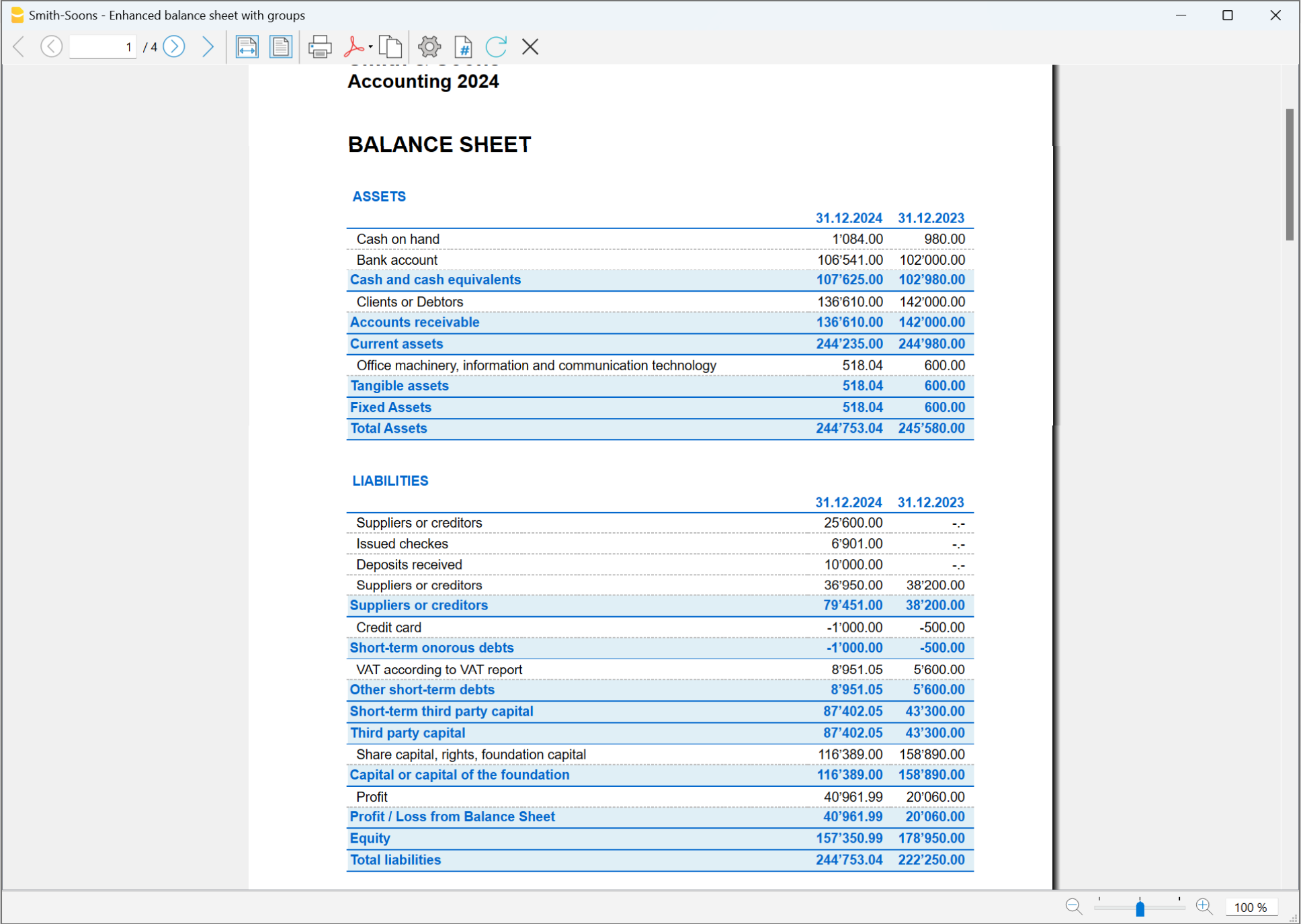

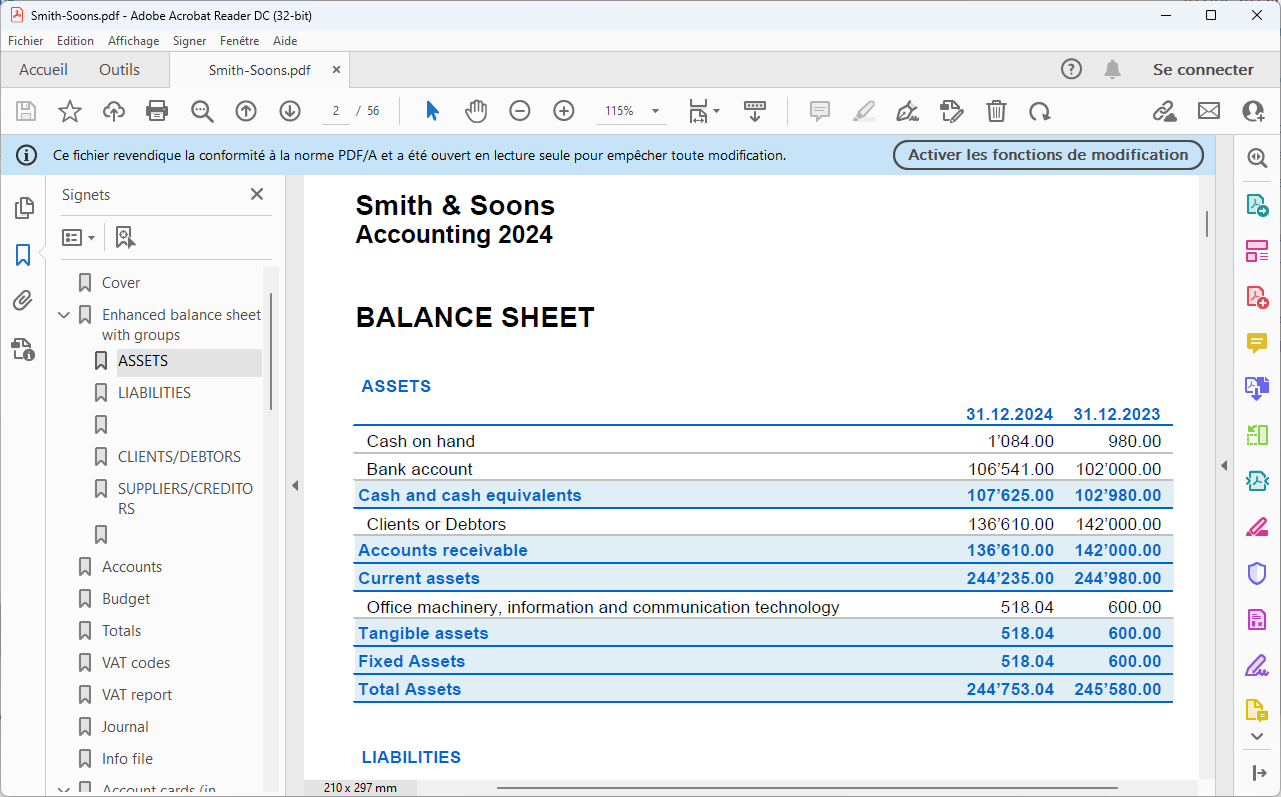

The Balance Sheet

The Balance sheet displays the balances of all the Assets & Liabilities accounts and determines the Equity capital.

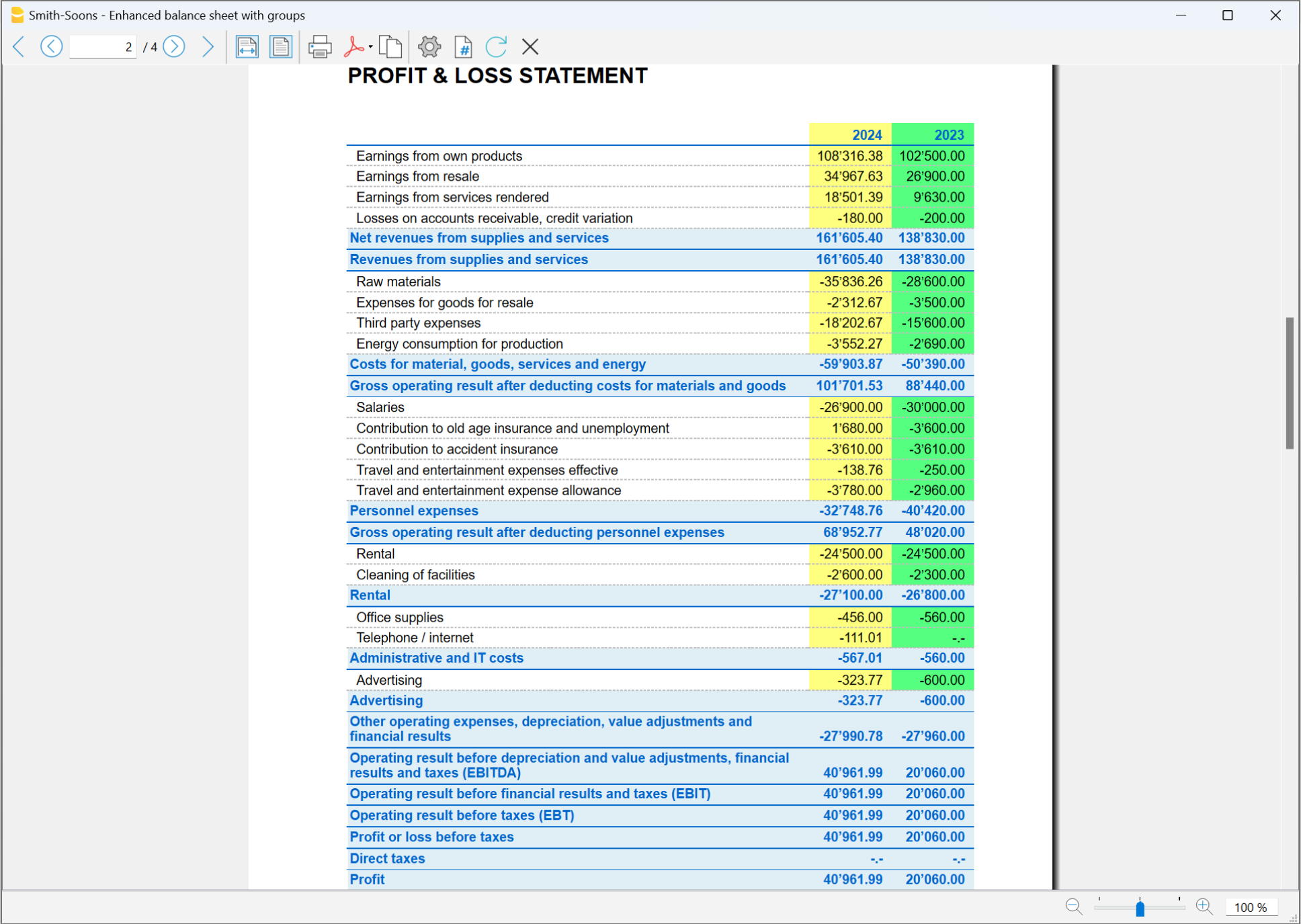

The Profit and Loss Statement

The Profit & Loss statement displays all the Expenses and Income accounts indicating the Profit or Loss of the Accounting year.

Printing of the Balance Sheet and the Income Statement

In Banana Accounting, the Balance Sheet and the Income Statement can be printed and viewed in two different ways:

- In Enhanced Balance Sheet mode, a balance sheet with a simple listing of all accounts is displayed, without distinction of Groups and Subgroups.

- In Enhanced Balance Sheet mode with groups, the balance is displayed with the accounts divided into groups and subgroups; in addition there are many features to customize the presentation that are not included in the Enhanced Balance sheet.

To print the Financial Statements and the Income Statement in the two modes:

Data archiving in PDF format

All the accounting data can be archived at the end of the year, when the entire accounting has been completed, corrected and audited:

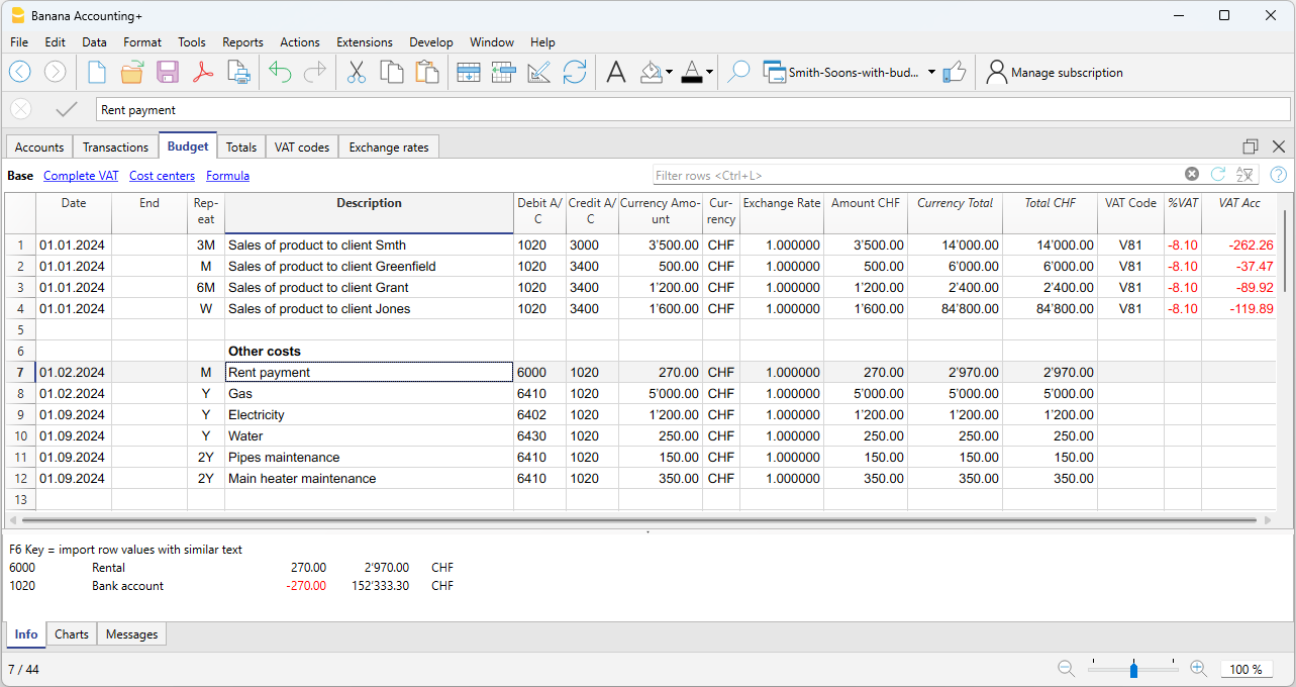

The Budget

- Annual budget is set in the Accounts table, Budget column. The annual budget amount is indicated for each account. In this case, when the Budget is elaborated via the menu Report > Enhanced statement with groups, the budget column displays the amounts that refer to the entire year.

- Budget is set in the Budget table. The Budget table is activated via the Tools → Add/Remove functionalities menu.

This table records all the movements referring to expenses and income, as if the movements were to be recorded in the Transactions table. When this table is switched on, the Budget column of the Accounts table is automatically deactivated.

For more details, consult the Budget page.