In this article

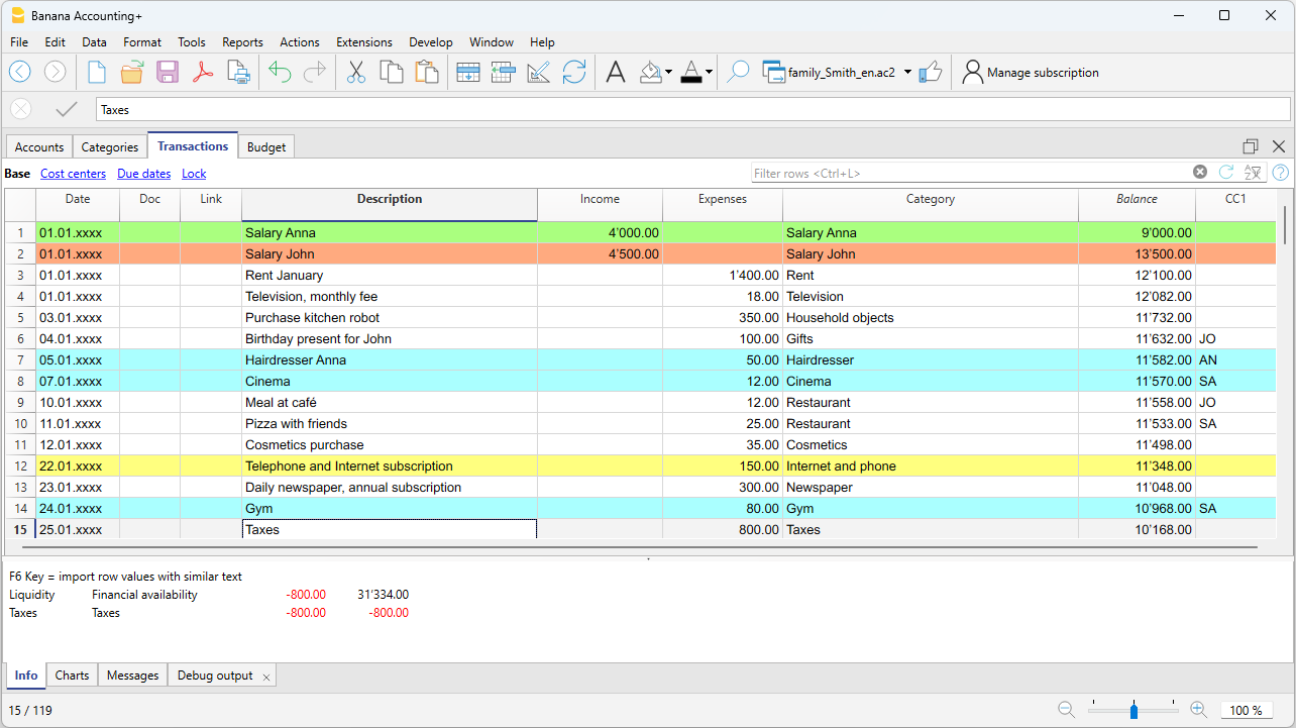

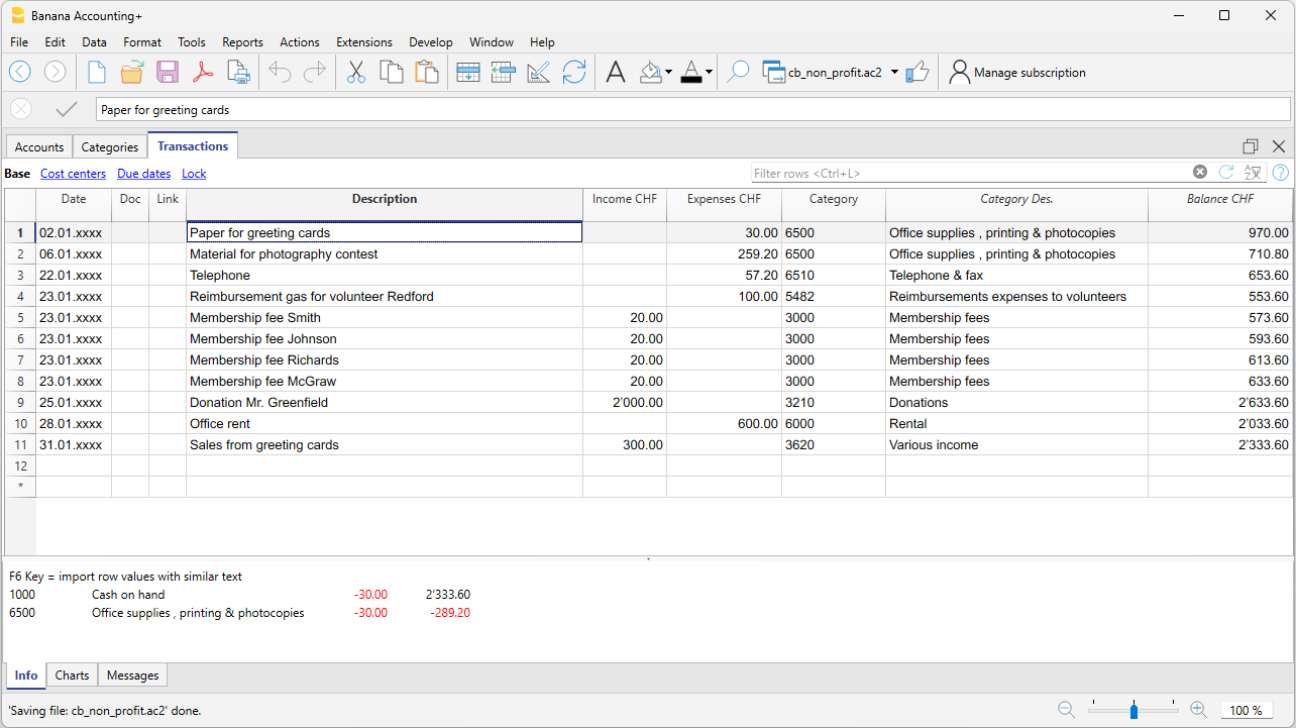

The transactions of the Cash Manager are entered in the Transactions table.

There are specific columns to enter:

- the date

- the document number

- the description

- the income or expense amount

- the category relevant to the income or expense in the Category table

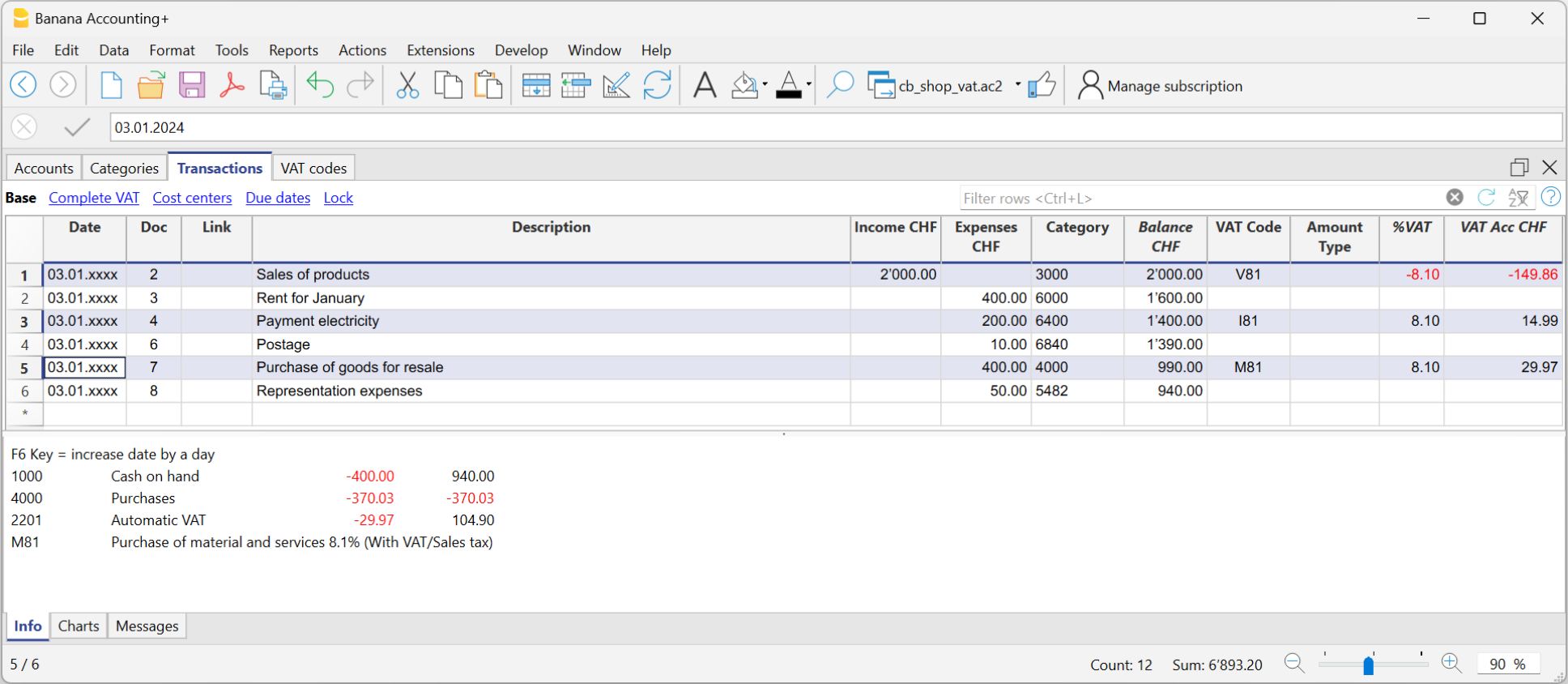

- should the transaction be subject to VAT tax, enter the VAT code in the VAT code column.

The VAT codes are listed in the VAT codes table.

Speeding up the recording of the Transactions

In order to accelerate the recording of the transactions, you can use:

- the Smart fill function that allows the automatic auto complete of data that have already been entered at an earlier date.

- the Recurring transactions function (Actions menu), used to memorize recurring transactions into an appropriate table.

Examples of transactions without VAT

Examples of transactions with VAT

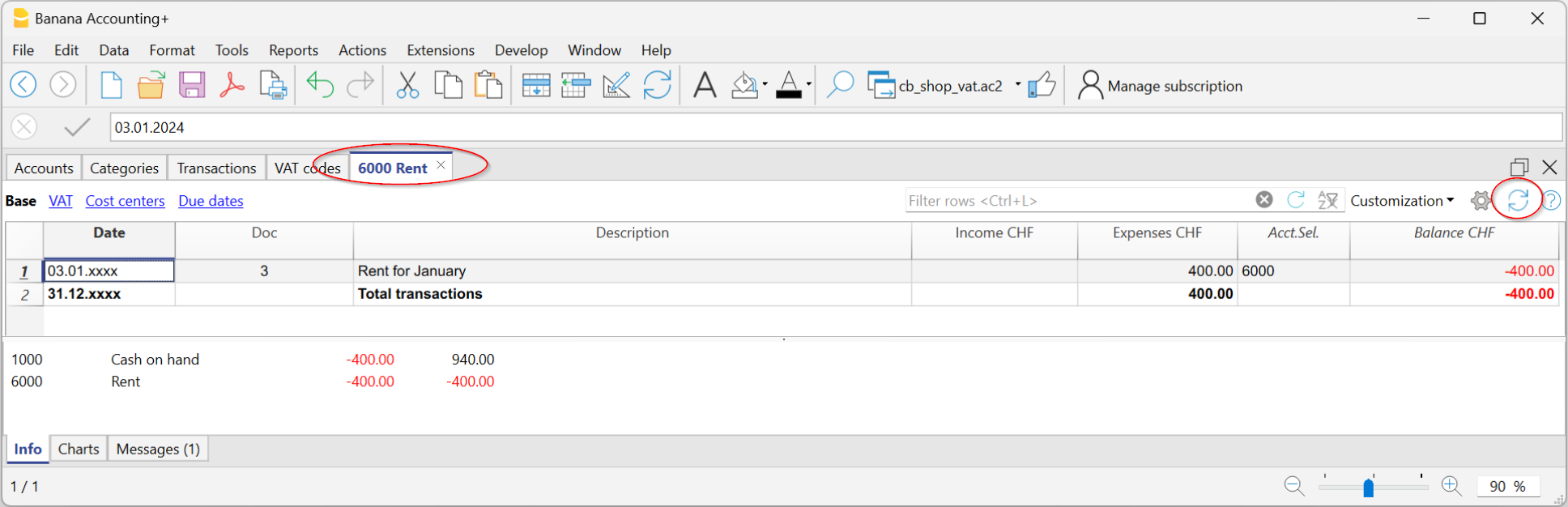

Category card

To display the transactions of a category, click once on the small blue arrow appearing in the upper right corner of the cell.

The display of entries in the Categories table is similar to the one in the Transactions table.

When new transactions are added or changes are made (i.e. in the Transactions table), it is possible to update the tab of a category by clicking on the Update symbol (blue symbol, of two circular arrows, located in the right part of the window).