Documentation Banana Accounting 9

Banana Accounting 9 was last updated in 2019; it has not been developed nor tested with the new operating systems since then. Banana 9 is to be considered unstable with the new Windows 11 and the latest versions of Windows 10, Mac OSX 11 Big Sur, macOS 12 Monterey, macOS 13 Ventura: there have been reports of problems with certain configurations and devices.

If you want an always up-to-date version, switch to Banana Accounting Plus.

Below you will find links to key topics and the various pages of Banana Accounting 9 documentation.

Banana Accounting 9:

Installation under Windows, Mac and Linux

- System requirements

- Install Banana 9 on Windows

- Install Banana 9 on Mac

- Install Banana 9 on Linux

- Install Banana on a server

- Enter the license key

- Uninstalling an older version

- Installing and App offline

Accounting types

Accounting templates and examples

- Svizzera: Nuove norme per i rendiconti

- Accounting templates for Switzerland

- Full list of accounting templates .ac2

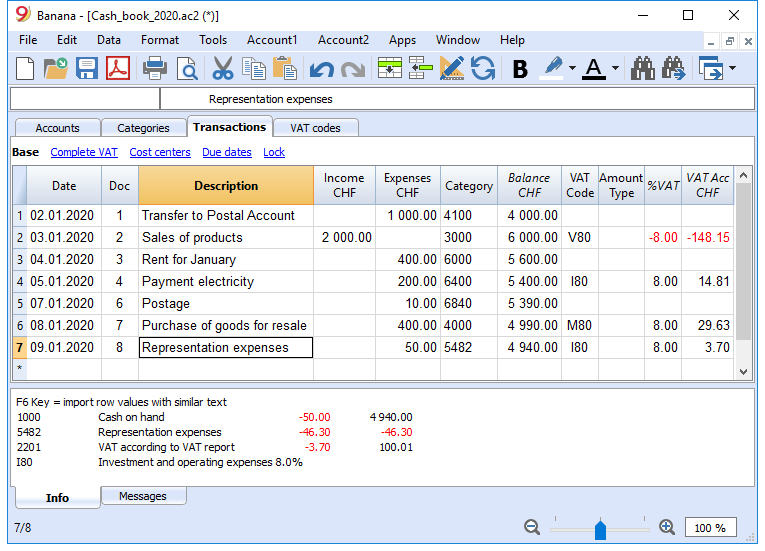

VAT management - basic knowledge

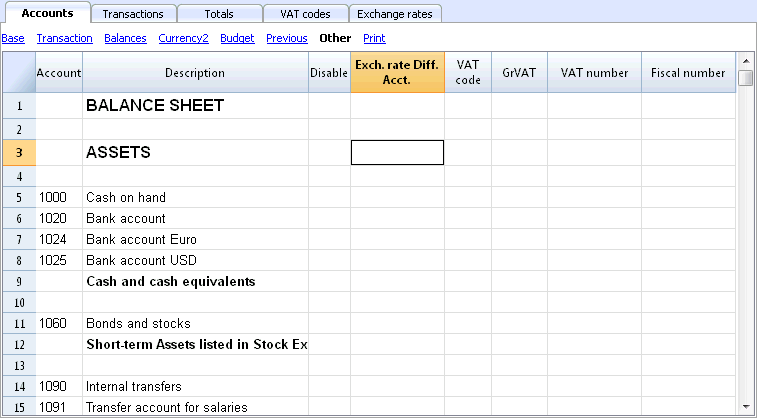

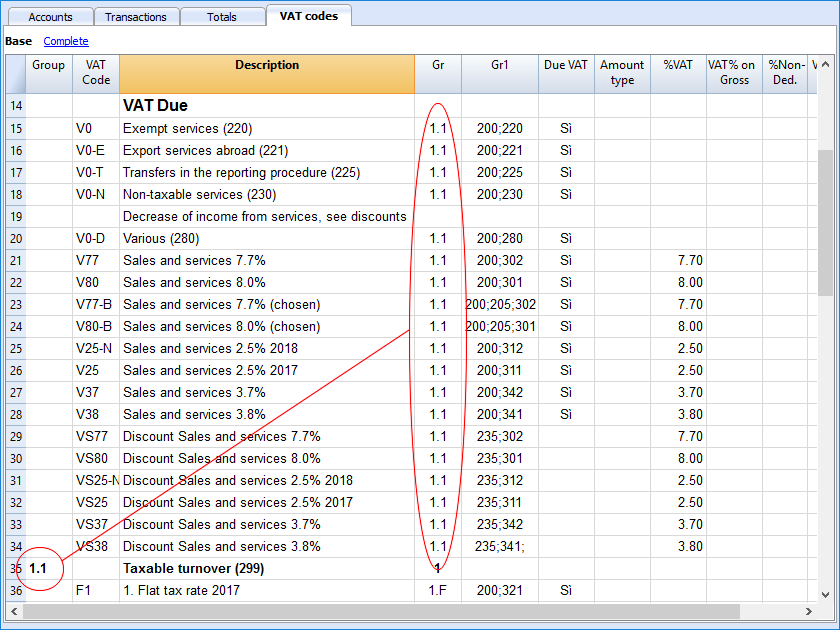

- VAT codes table

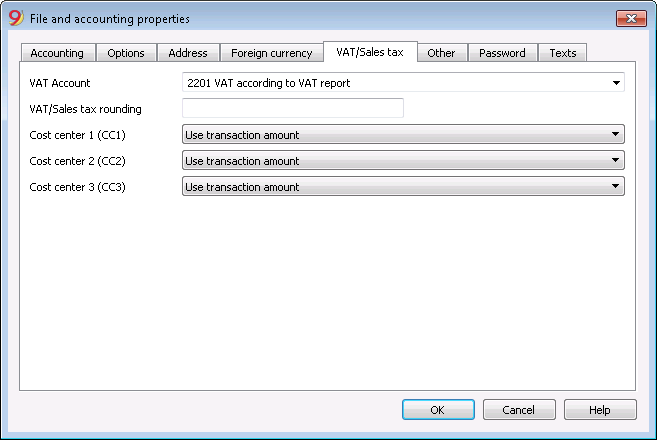

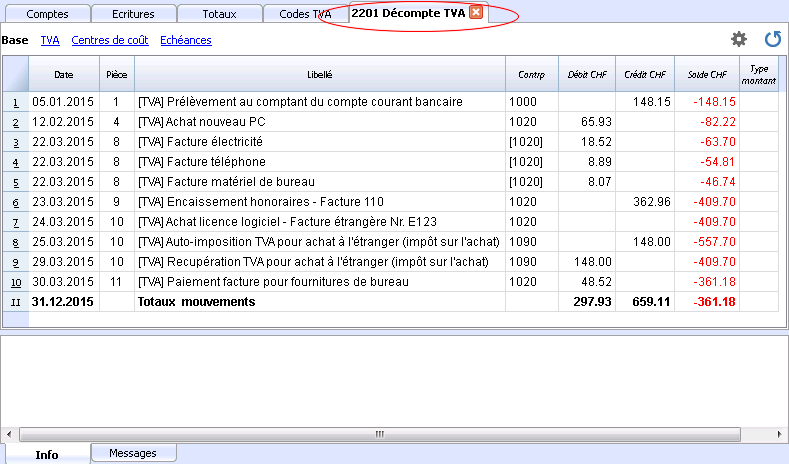

- Entering the VAT account in the File Properties

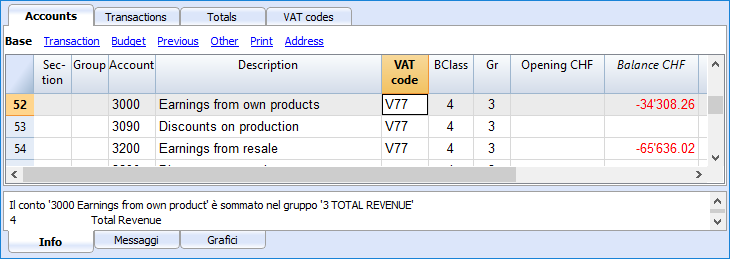

- Associate VAT code to the account

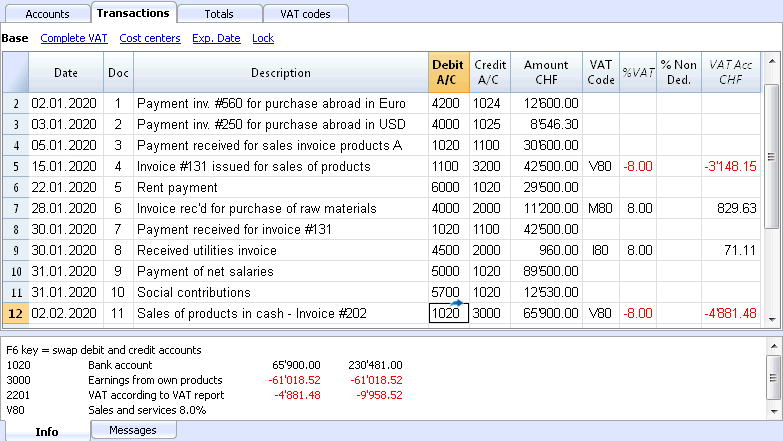

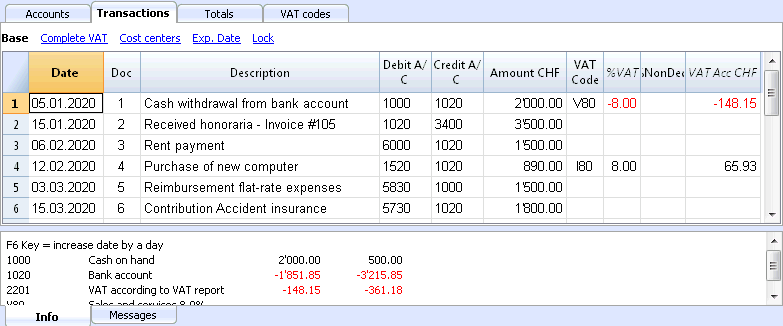

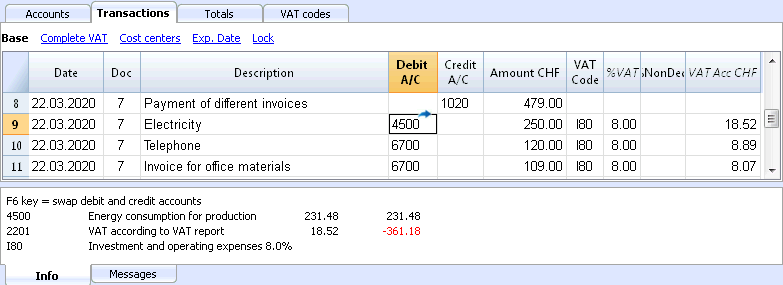

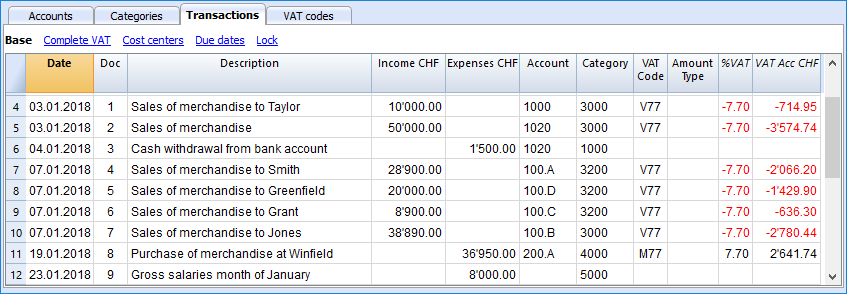

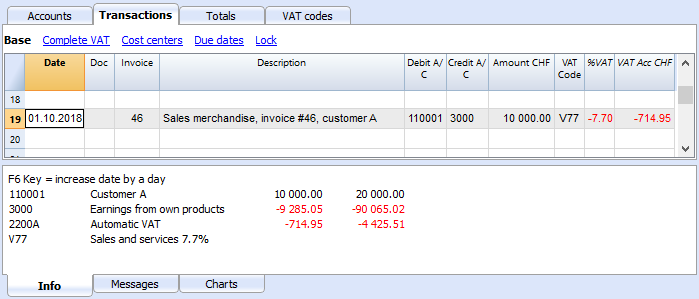

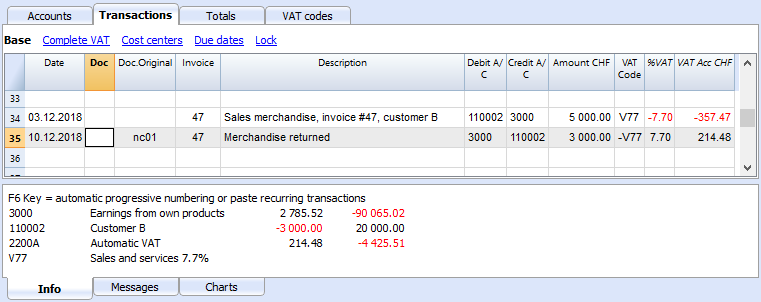

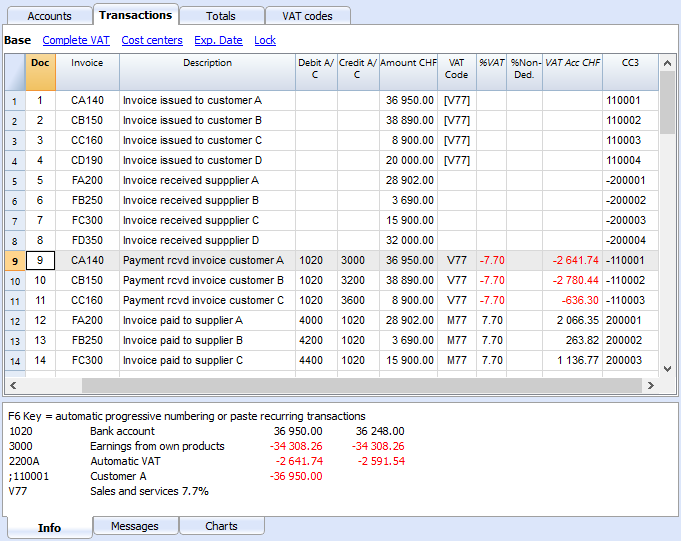

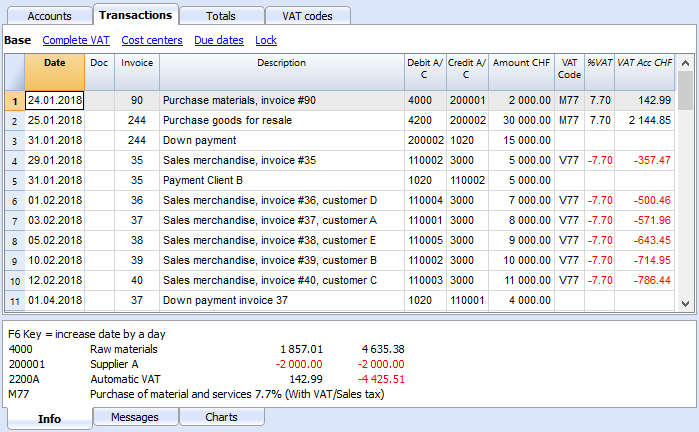

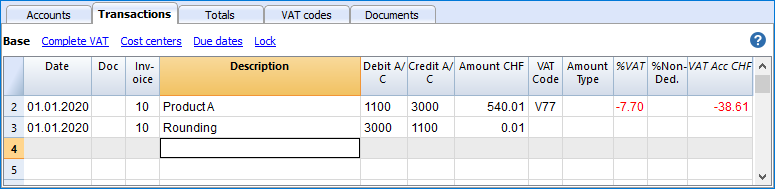

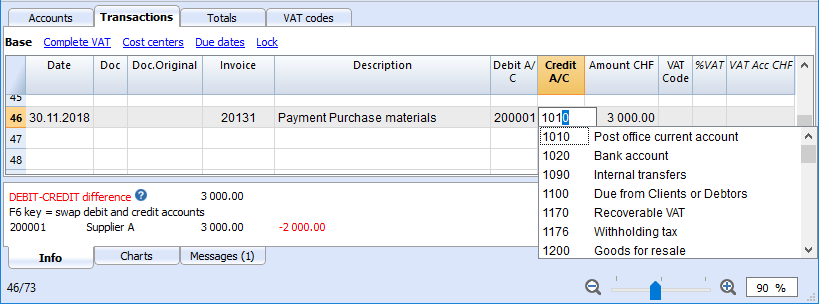

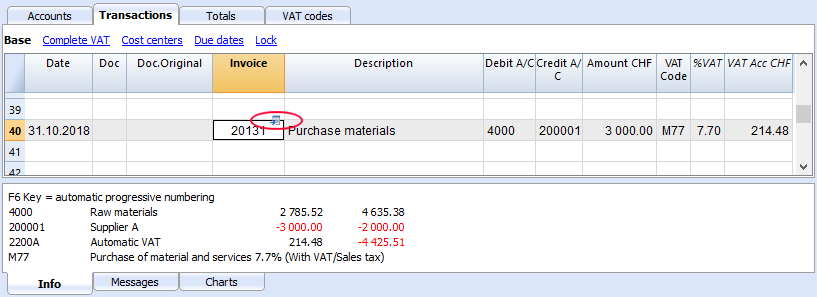

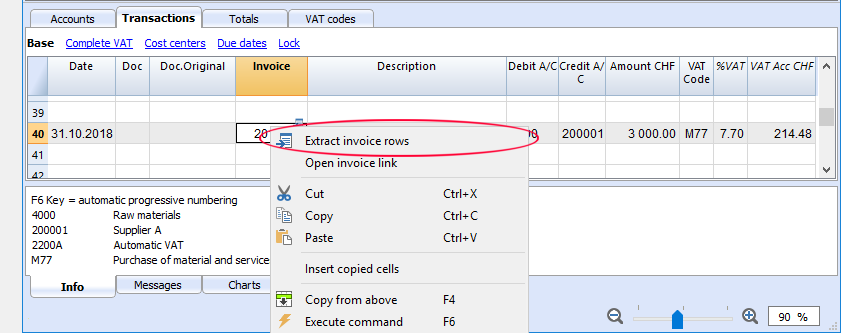

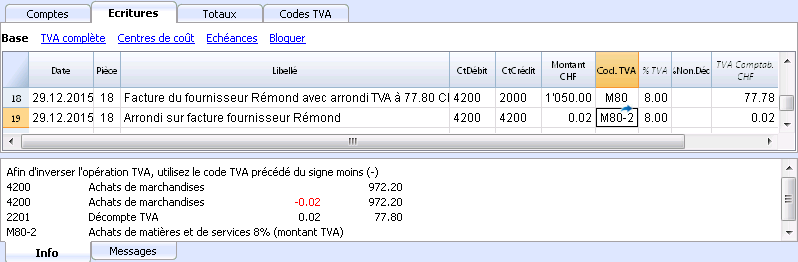

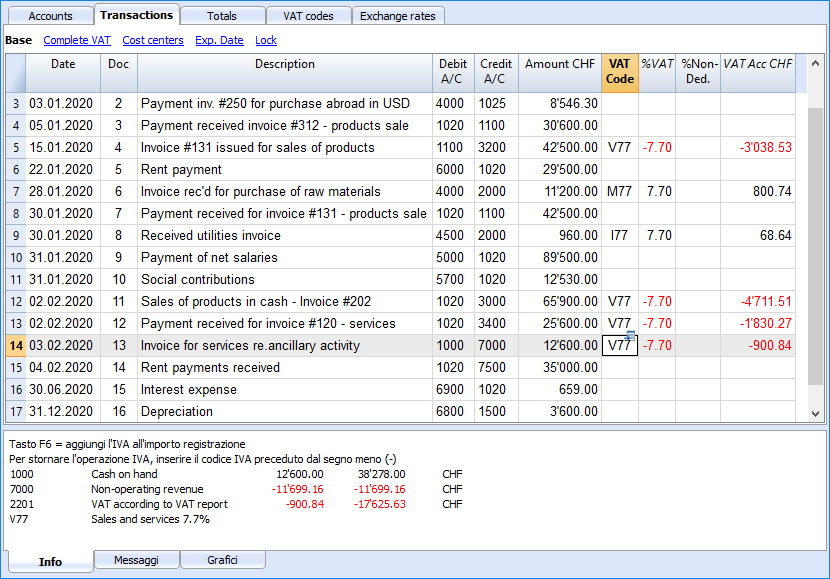

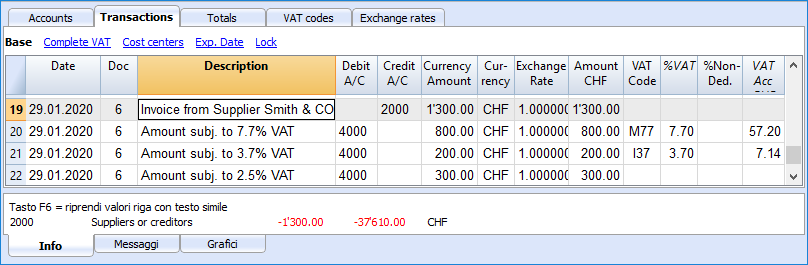

- Entering transactions with VAT

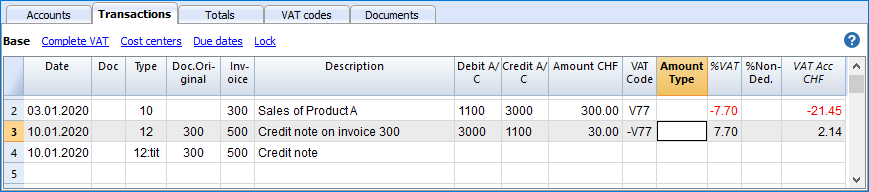

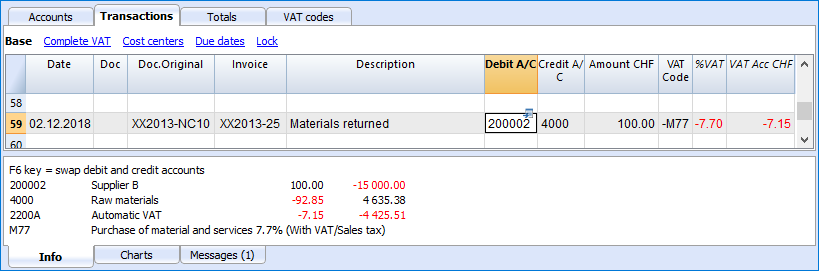

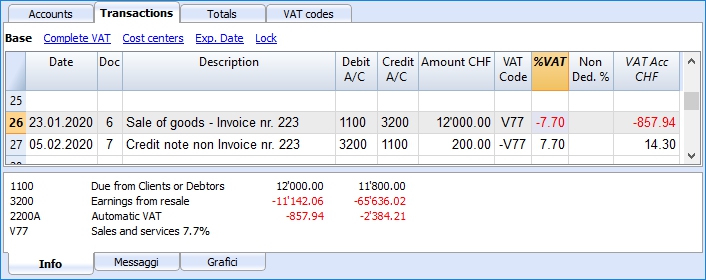

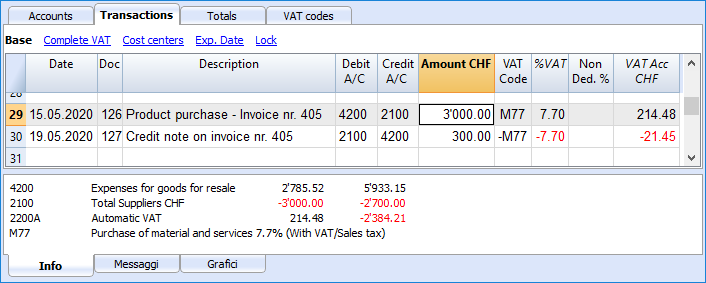

- Reversal transactions and credit notes with VAT

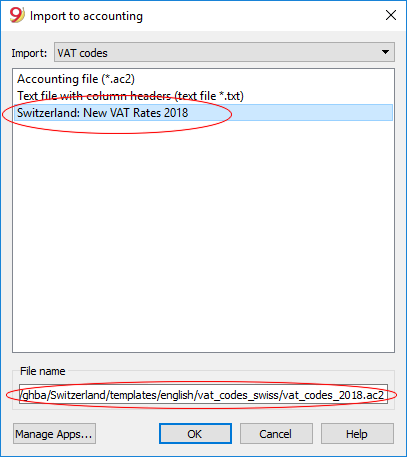

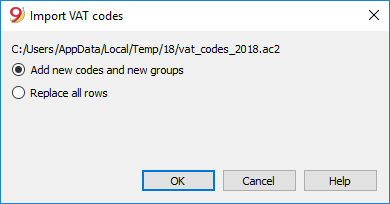

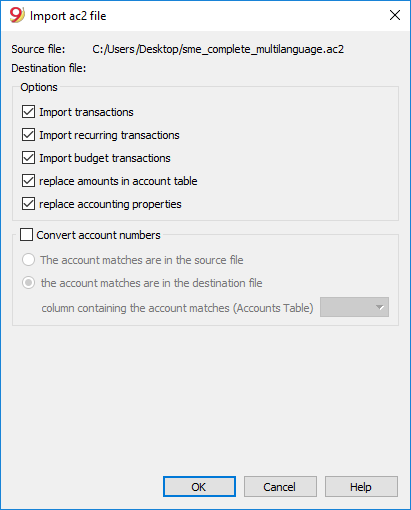

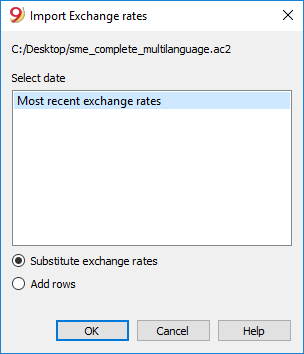

- Import the VAT codes table from another file

VAT management for Switzerland

- VAT codes for Switzerland (automatic English translation or available in Italian, German or French)

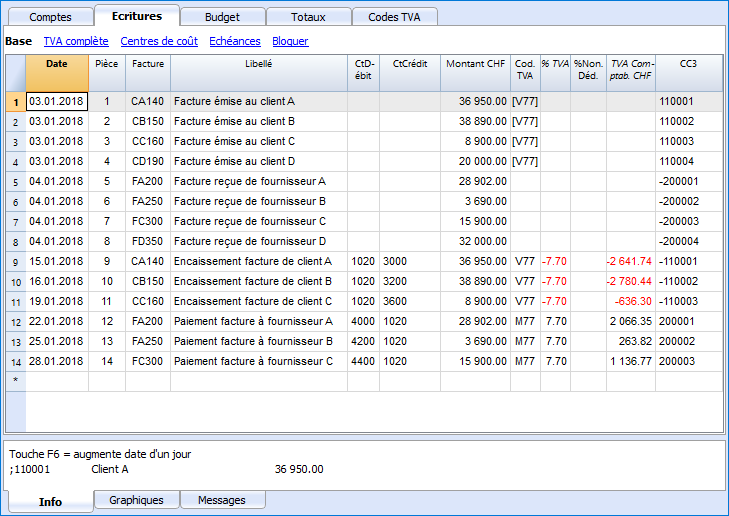

- Clients and suppliers with VAT on cash received

- VAT on cash received and transitory assets/liabilities at the end of year

- Entering VAT at customs for import

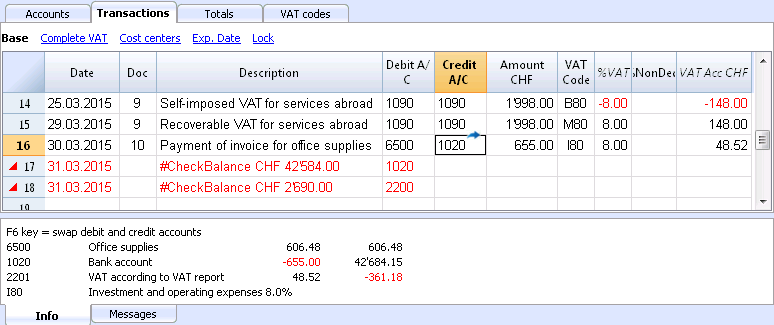

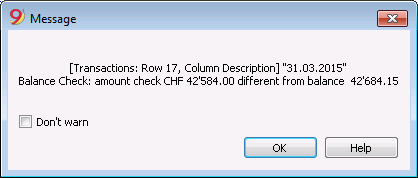

- VAT on services obtained abroad

- Swiss VAT Tax report - Effective method

(available in Italian, German or French) - Swiss VAT Tax report - Flat tax rate method

(available in Italian, German or French)

Year's End and New Year

- Recheck the accounting

- Dealing with transaction differences

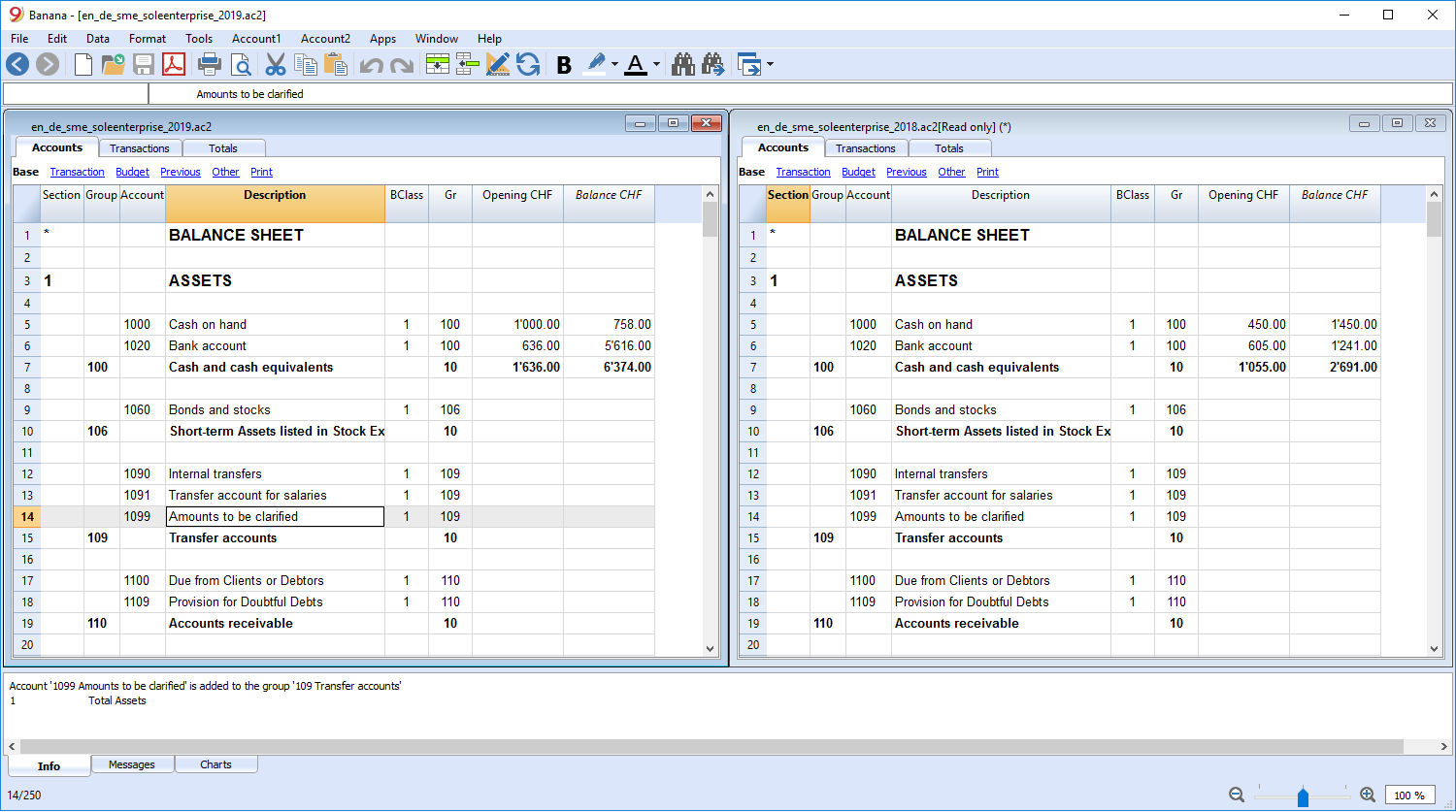

- Create a New Year

- Update opening balances

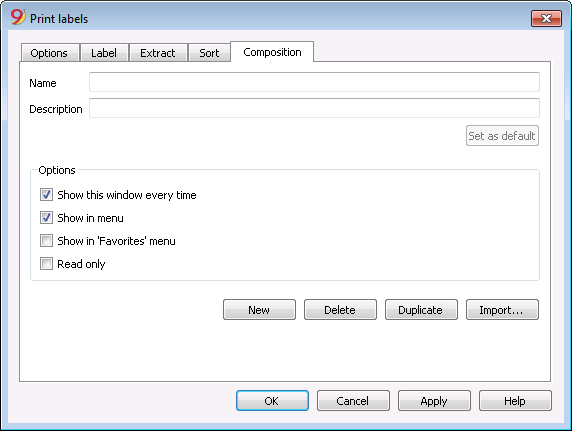

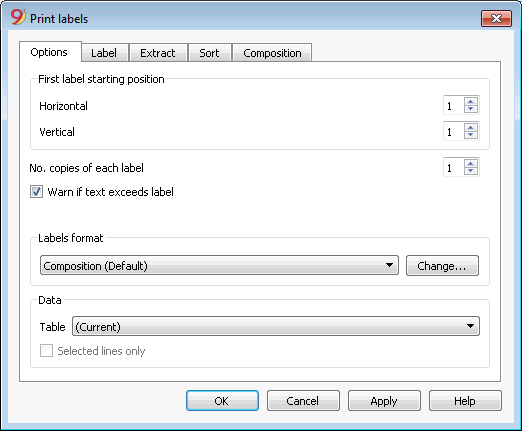

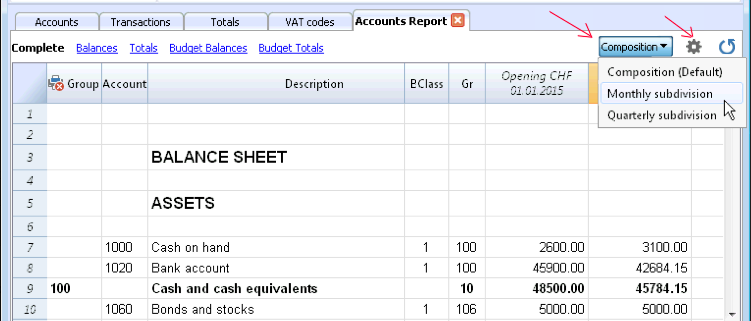

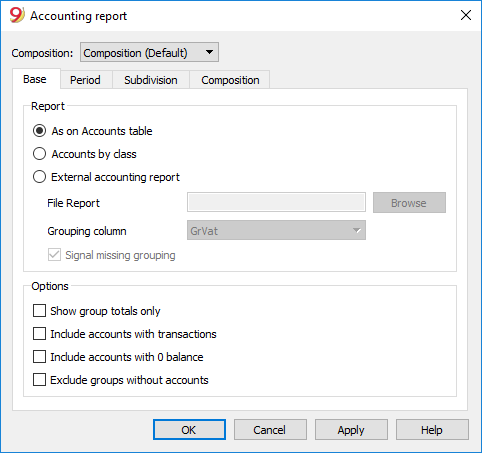

- Compositions

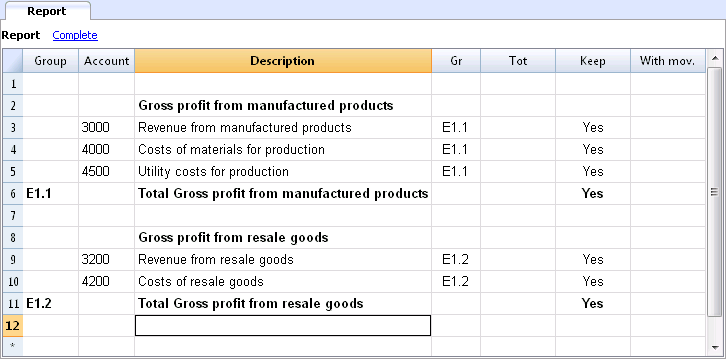

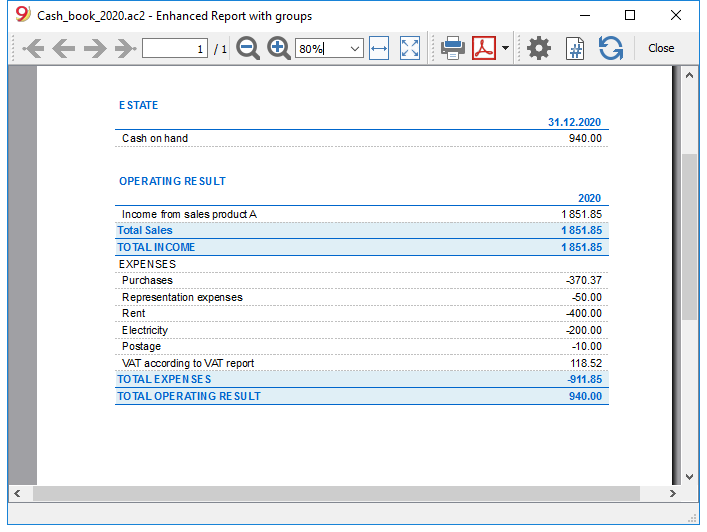

- Reports

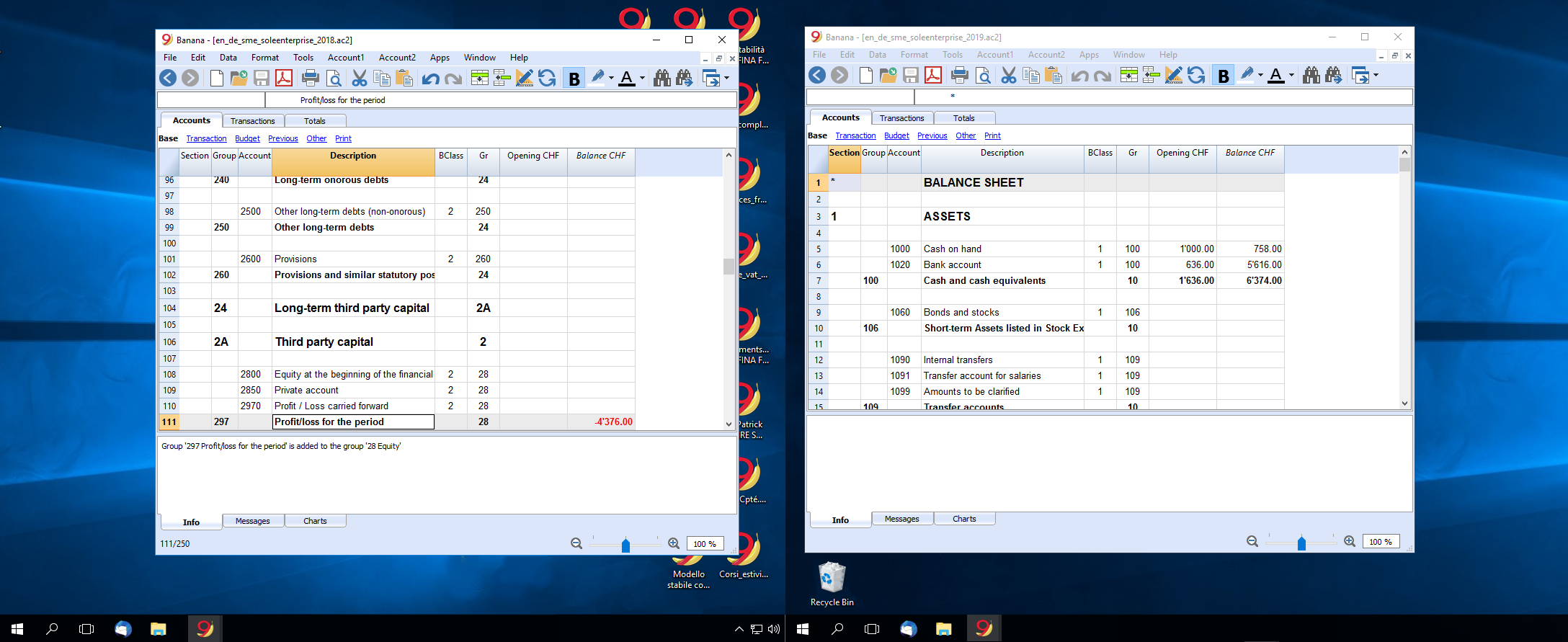

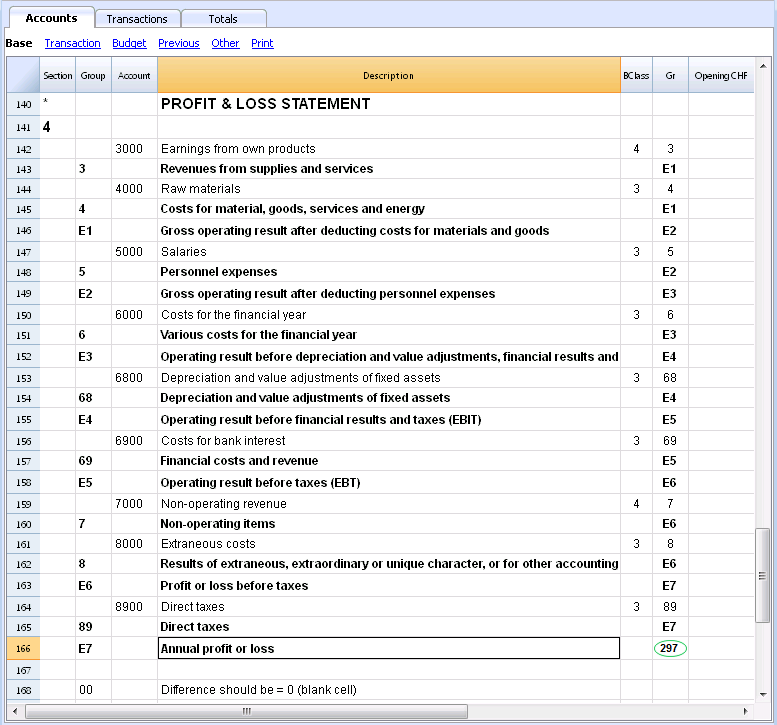

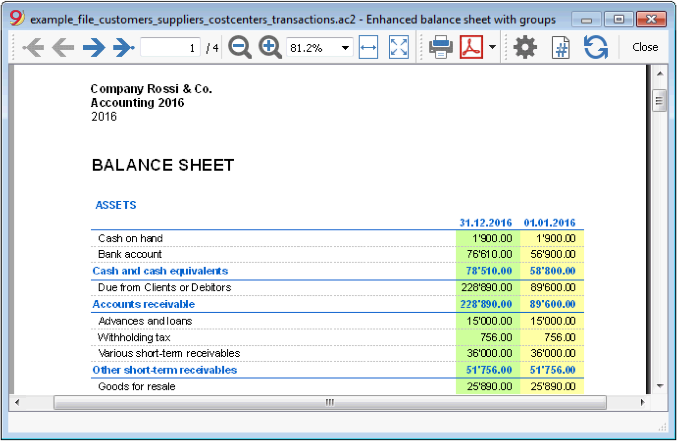

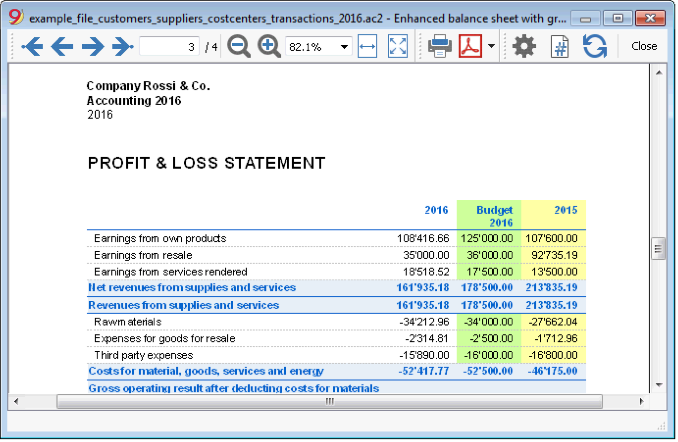

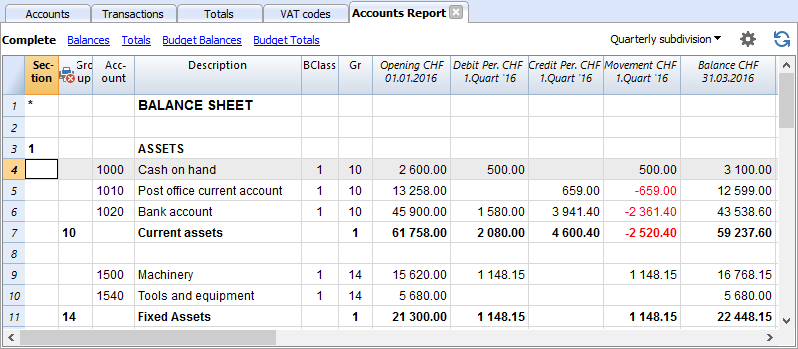

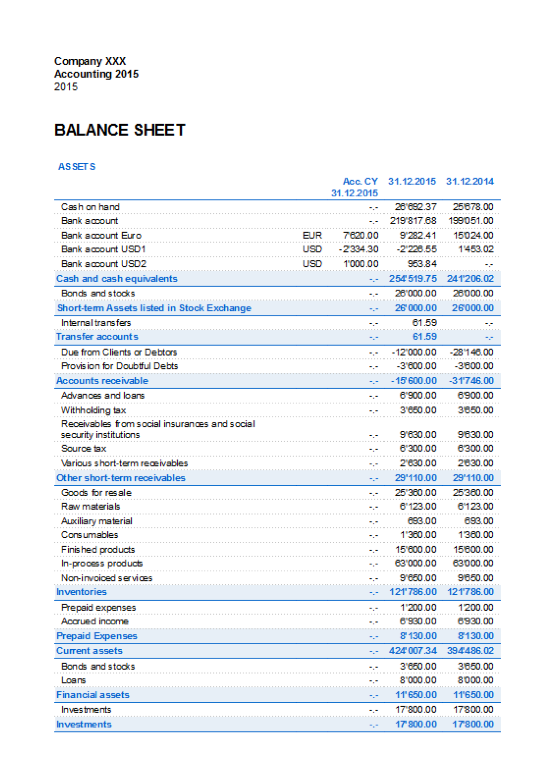

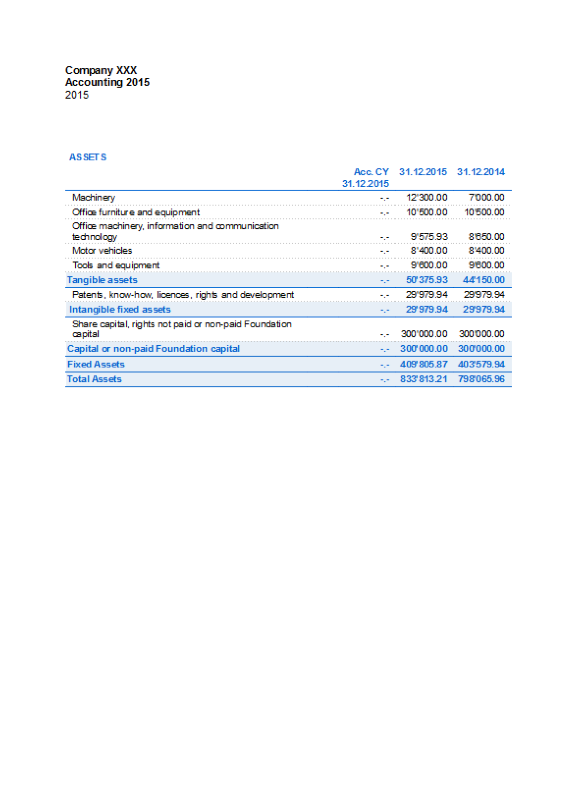

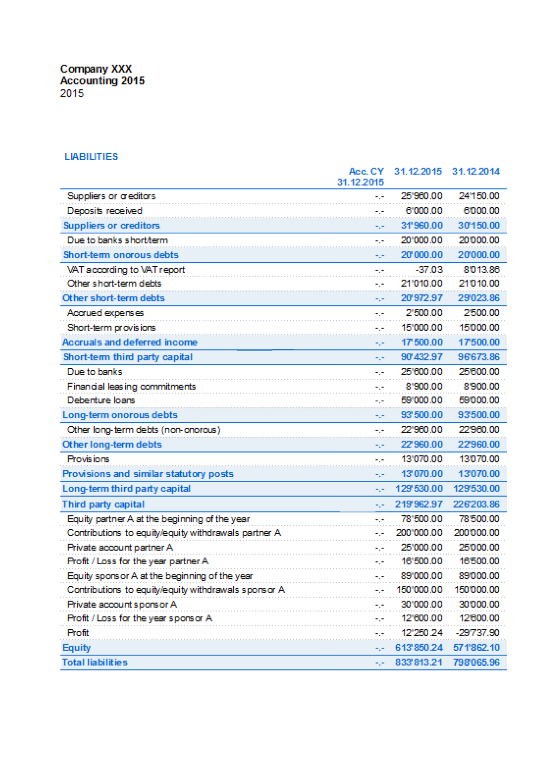

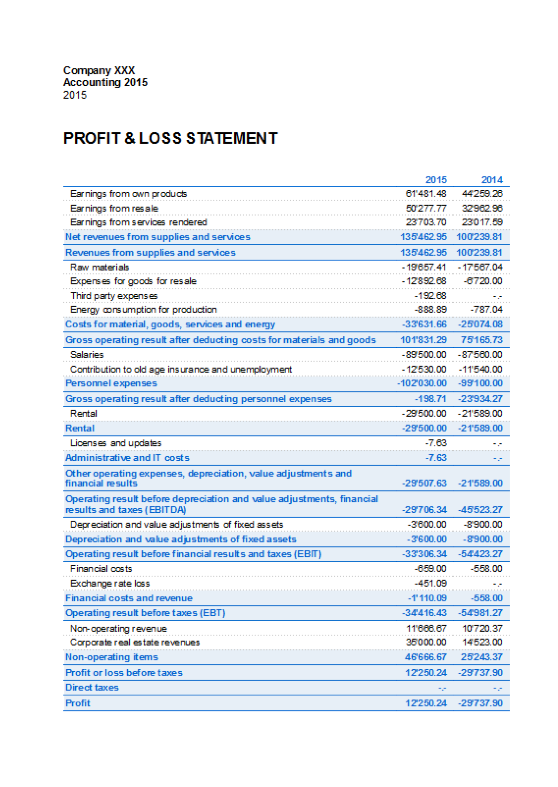

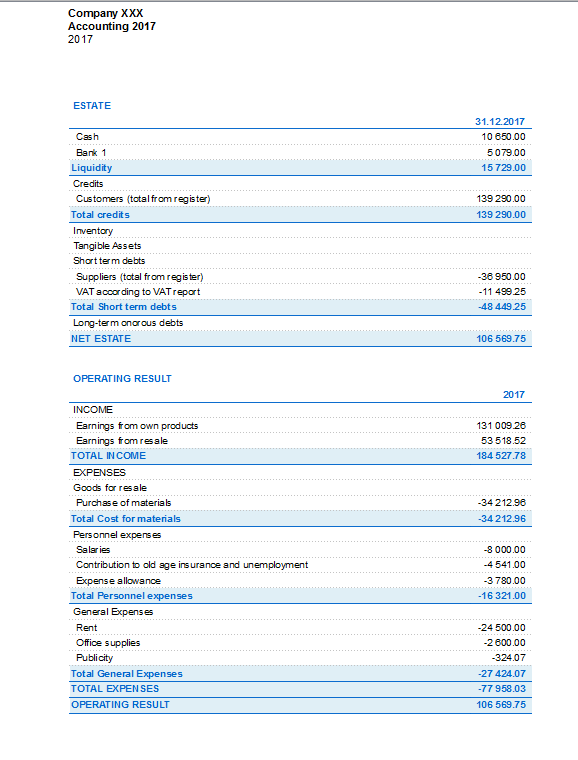

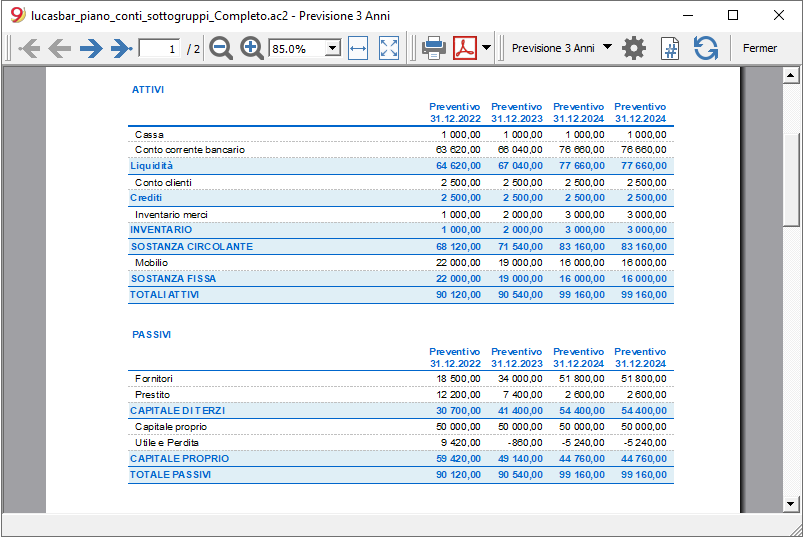

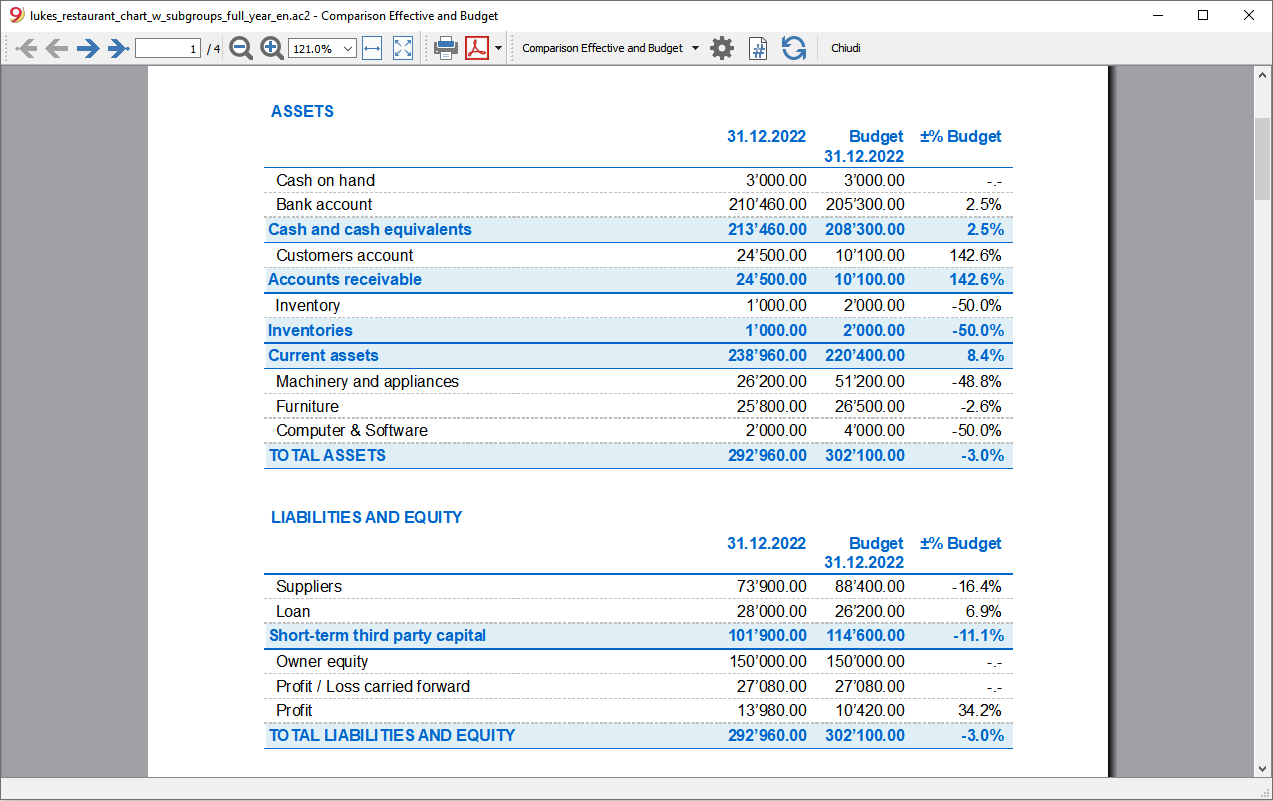

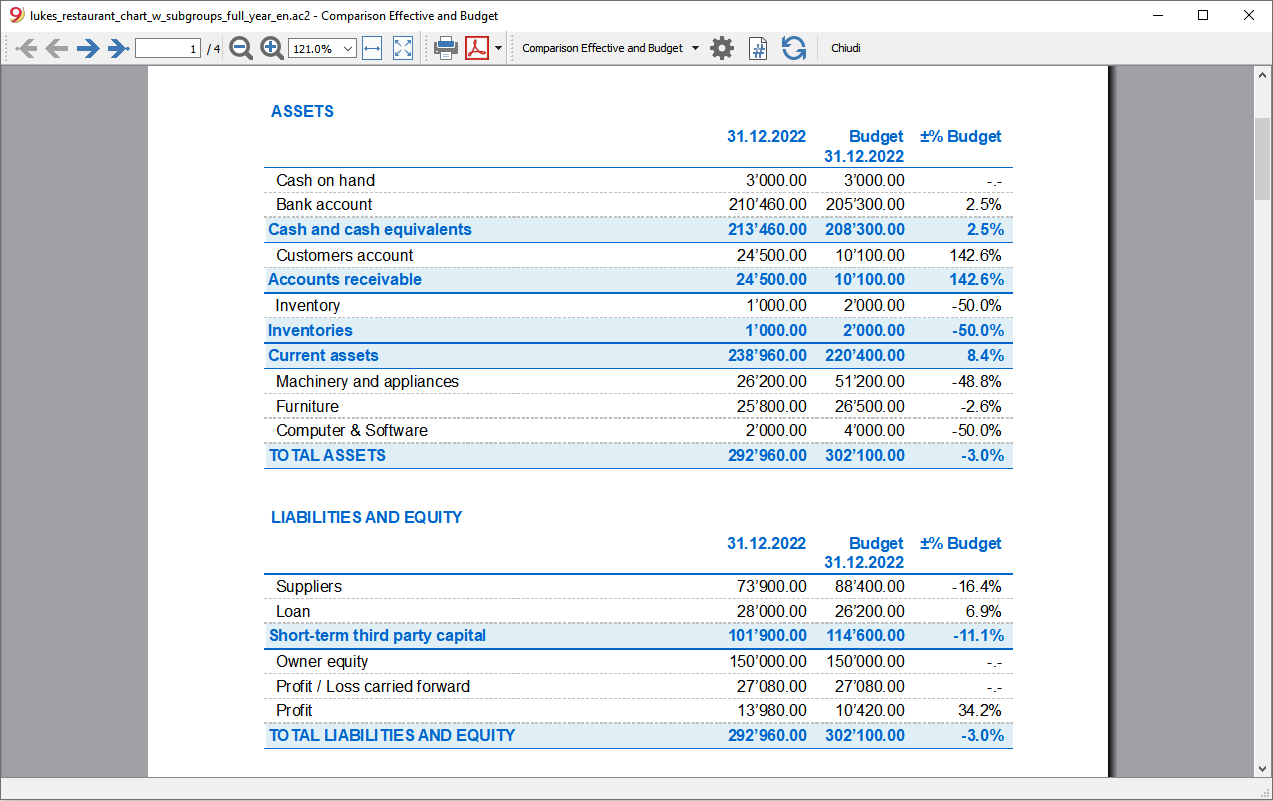

- Balance sheet and Profit and Loss Statement

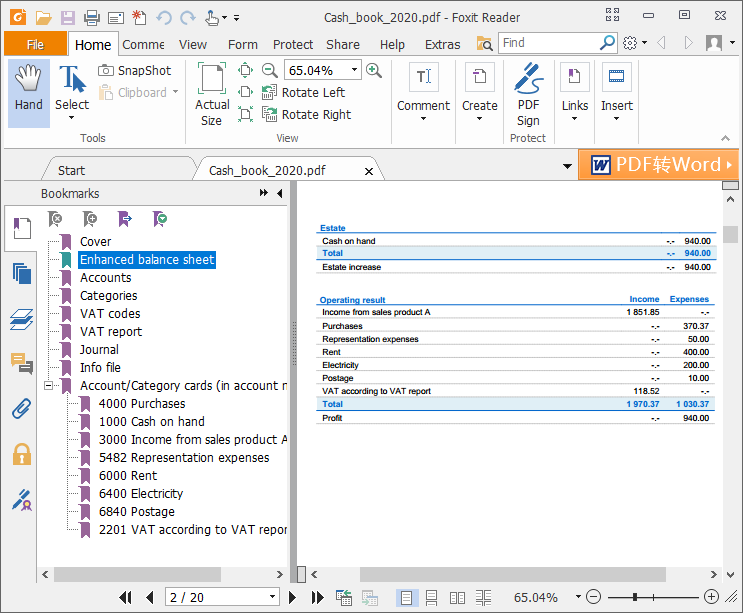

- End of Year PDF printouts

Various

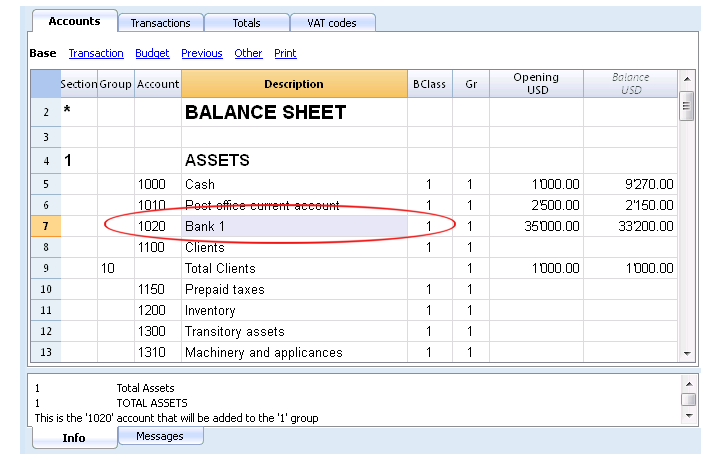

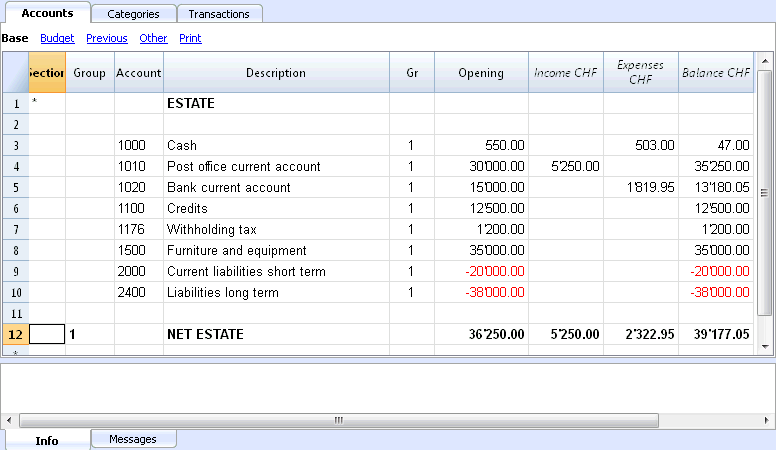

How to start

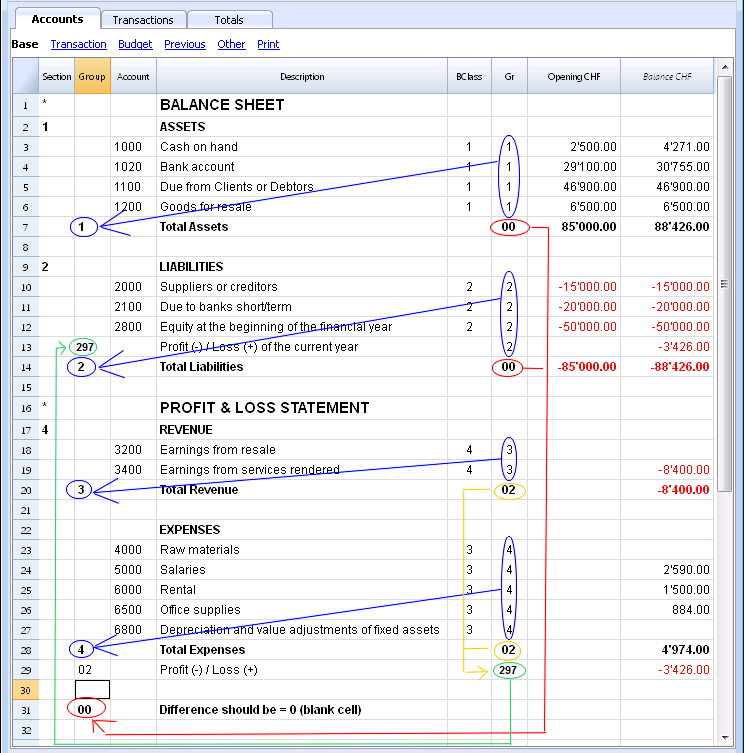

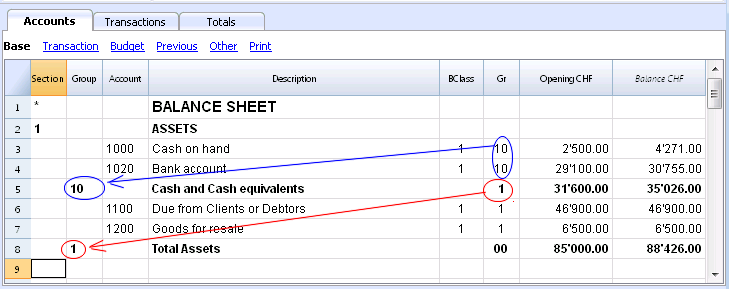

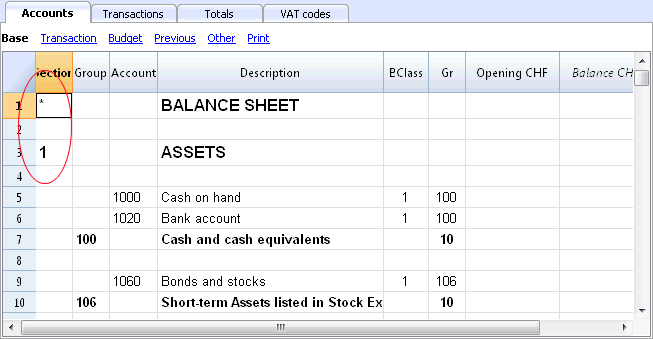

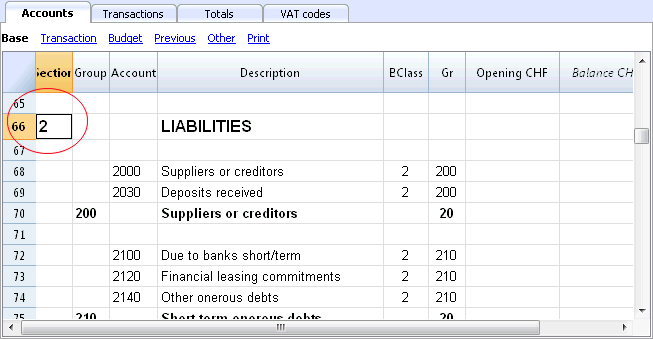

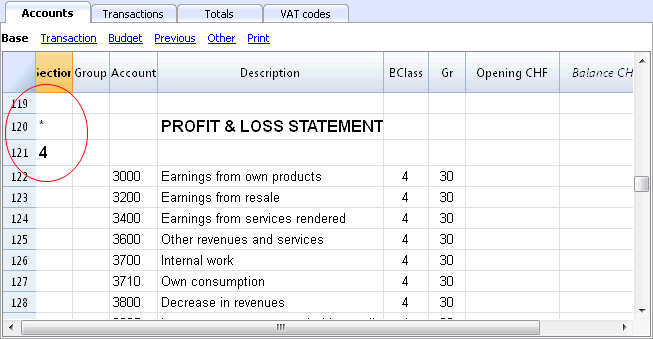

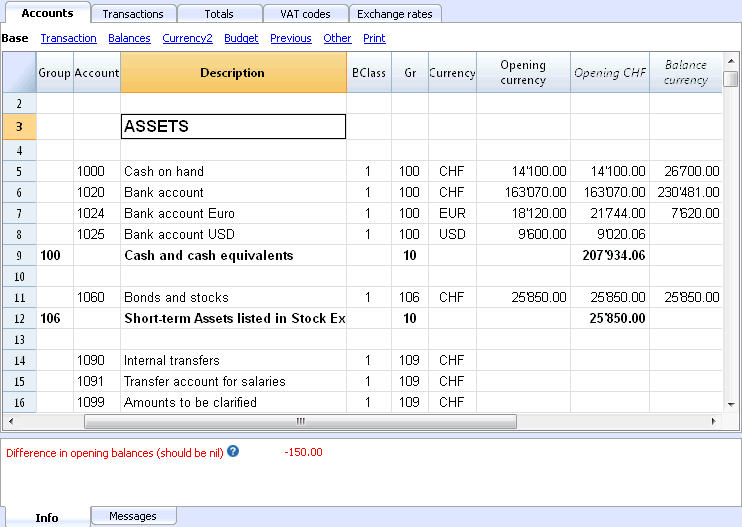

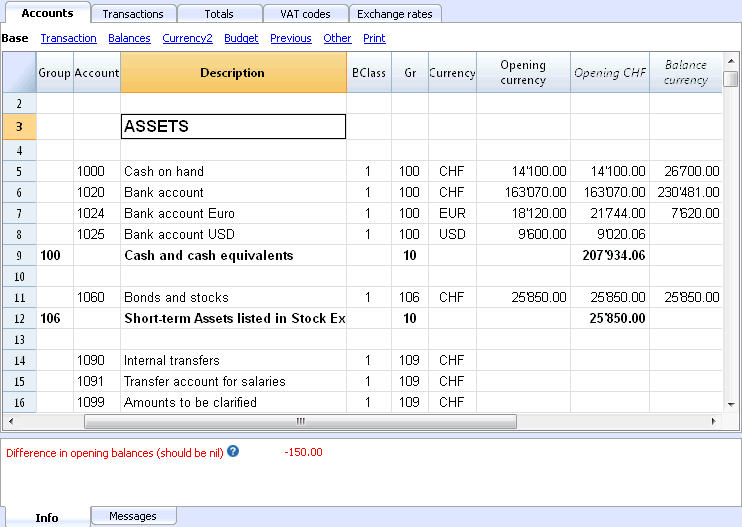

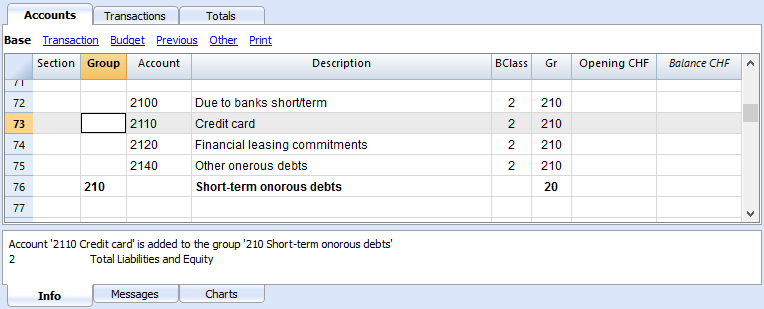

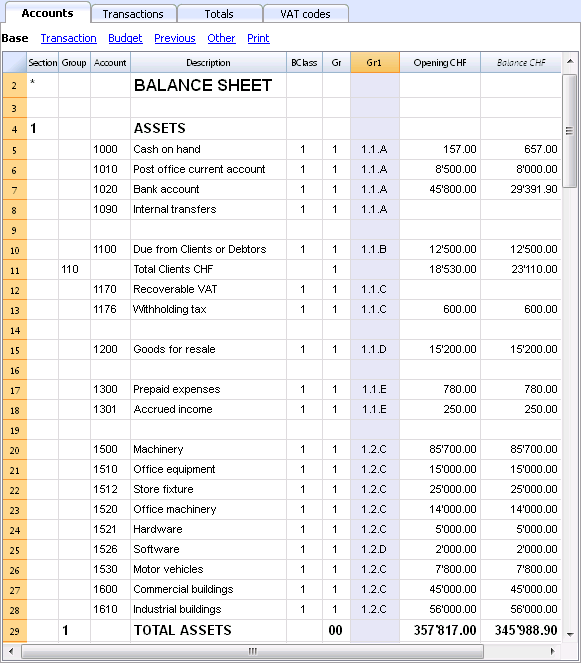

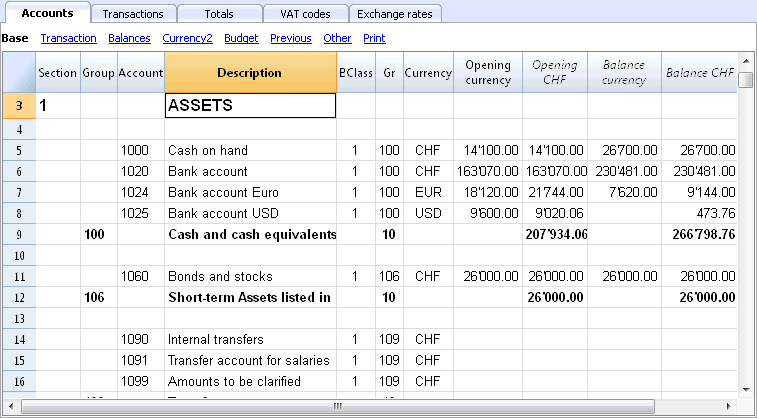

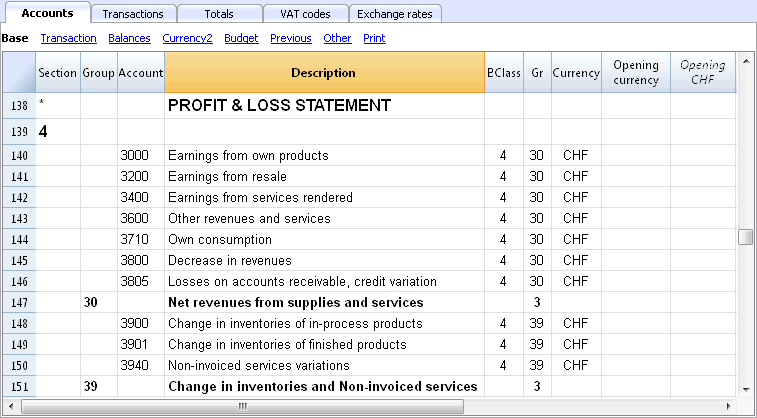

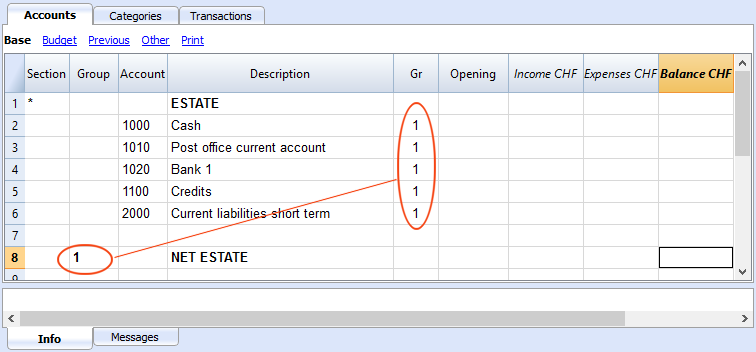

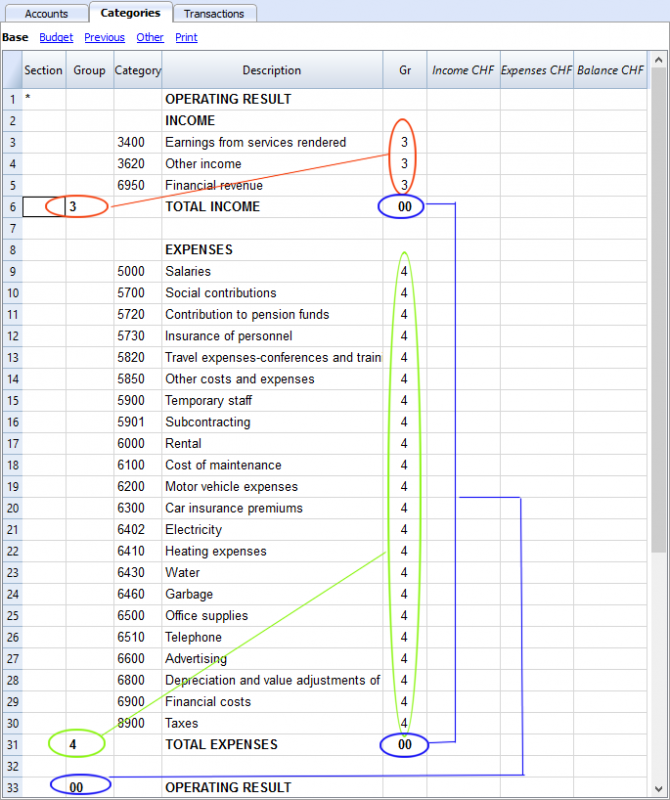

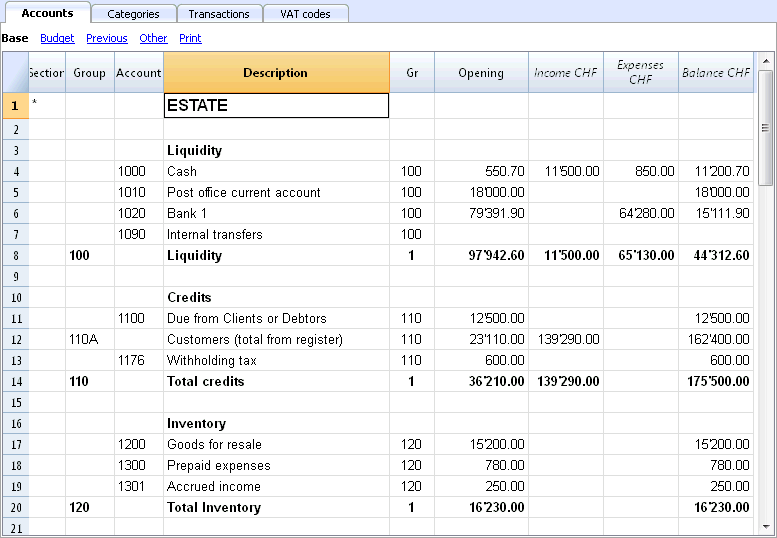

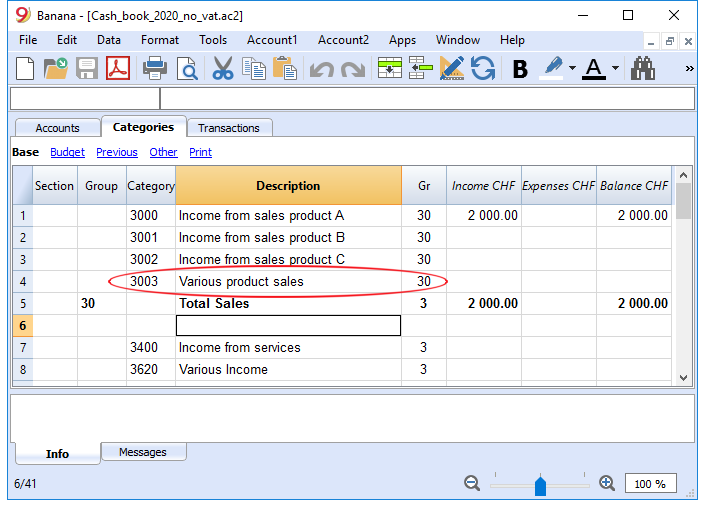

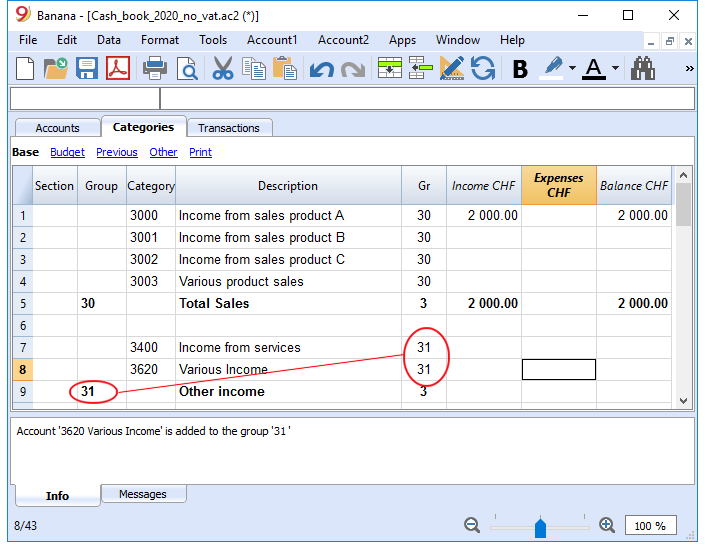

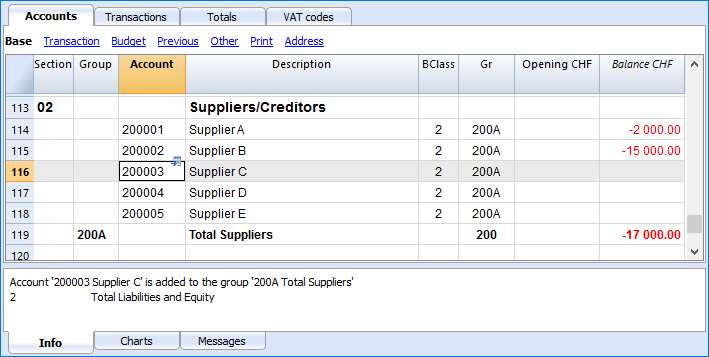

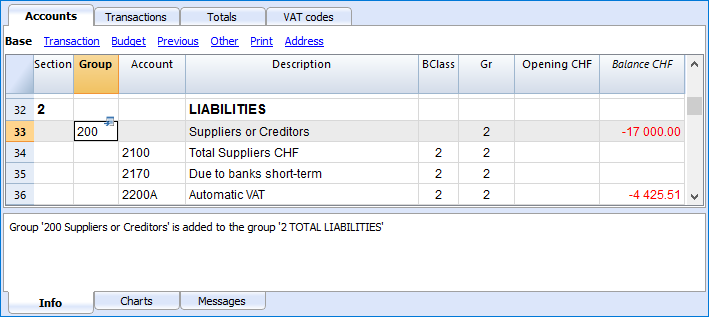

- The Chart of Accounts

- How to set up the Chart of Accounts from scratch

- Setting up a new accounting file based on a template

- Adding, deleting, renaming an account or a group

- Adding and deleting subgroups

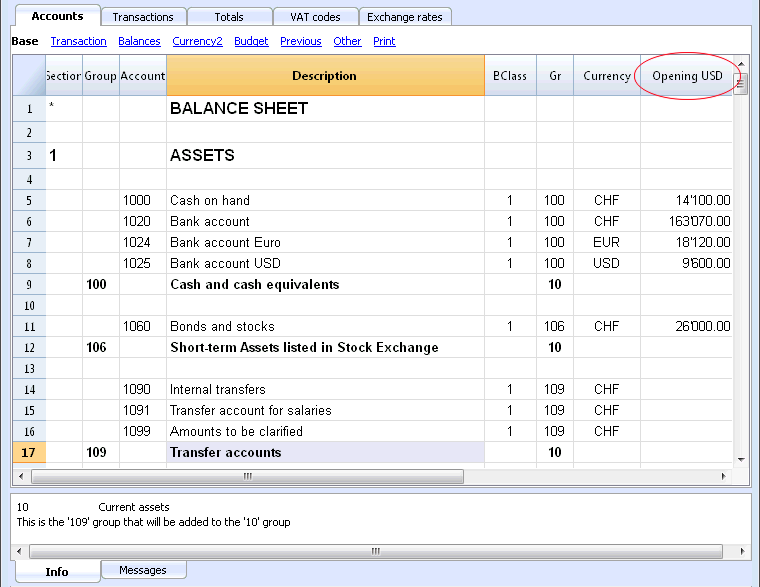

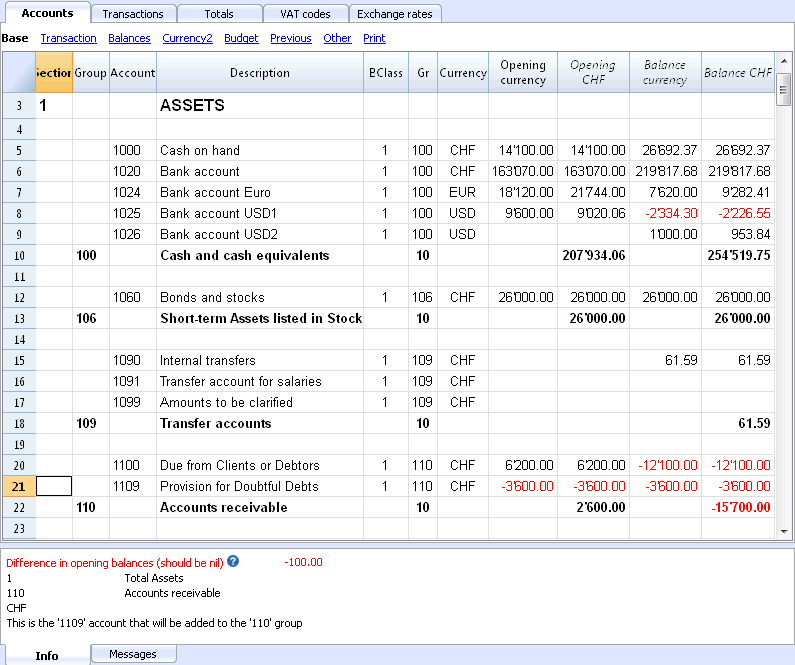

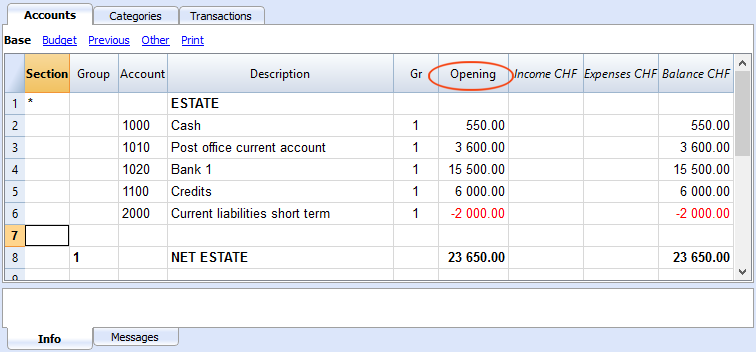

- Entering opening balances in a new accounting file

- Updating existing opening balances

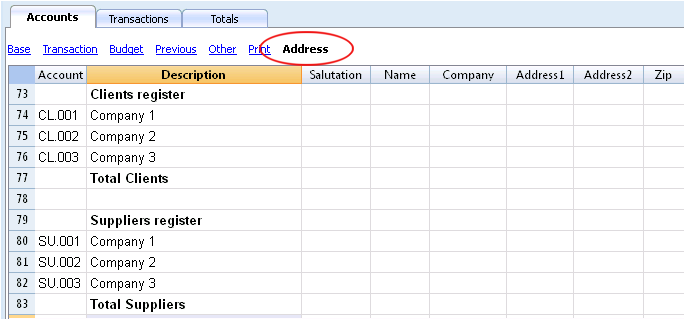

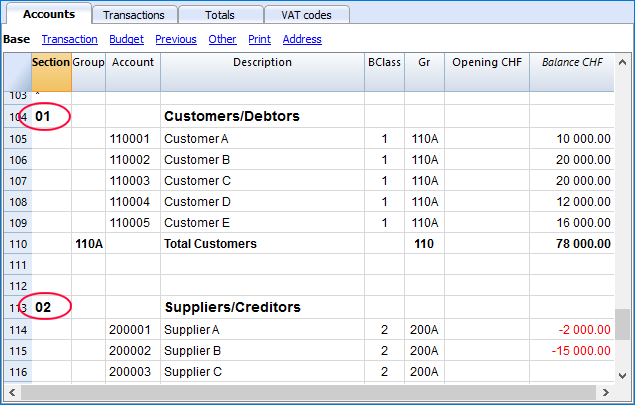

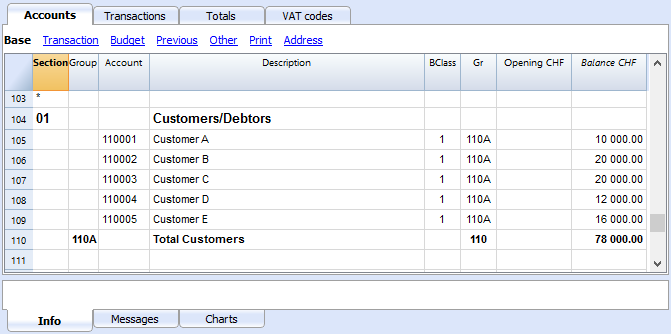

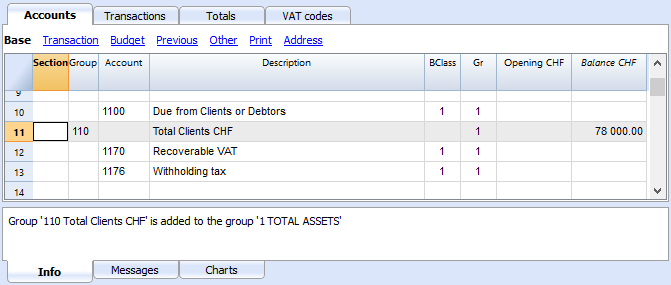

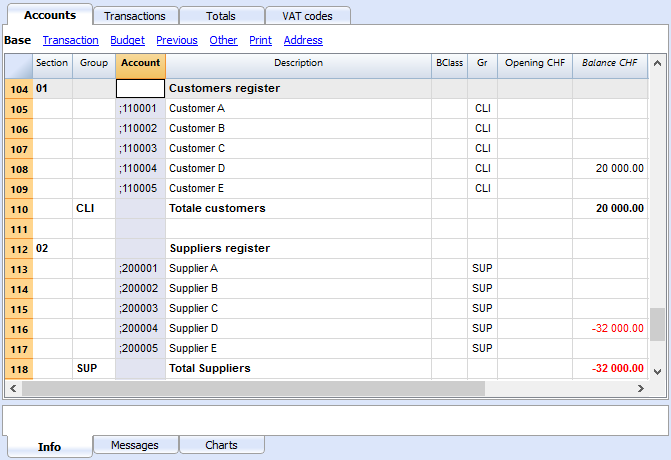

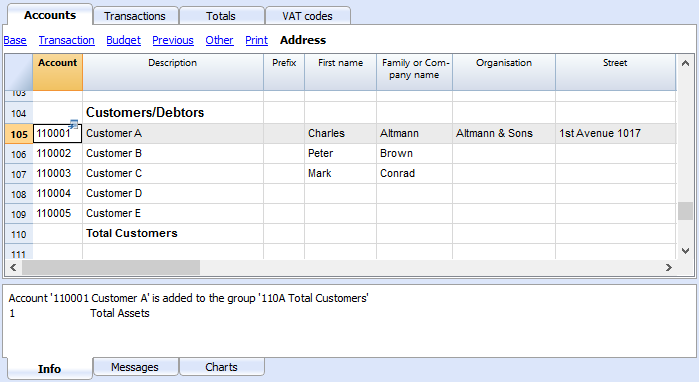

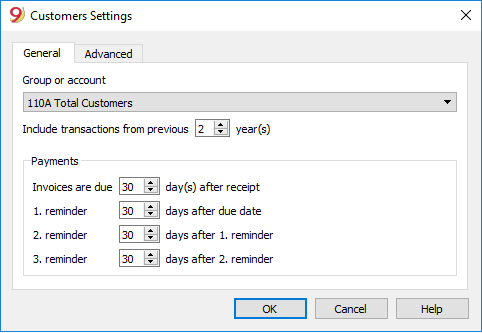

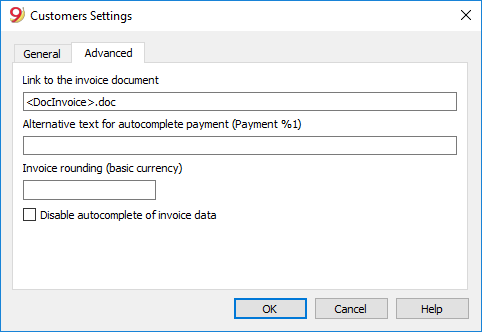

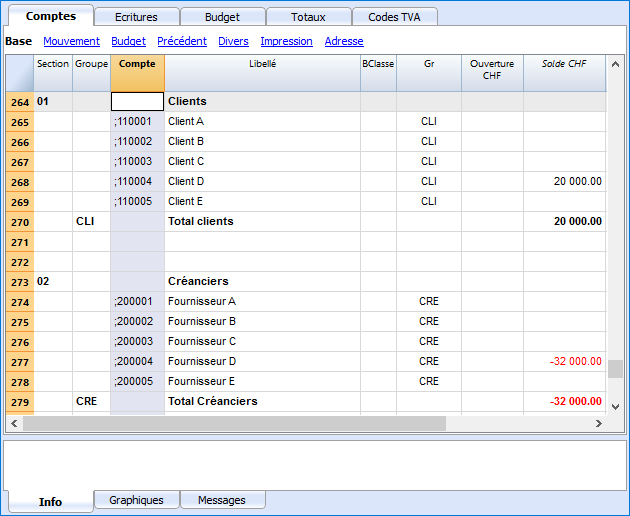

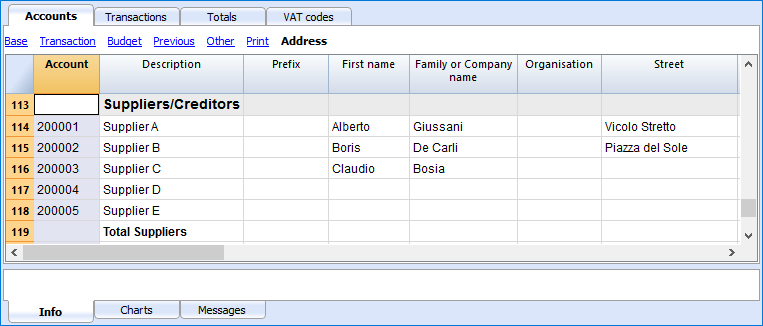

- Setting up a clients/suppliers register

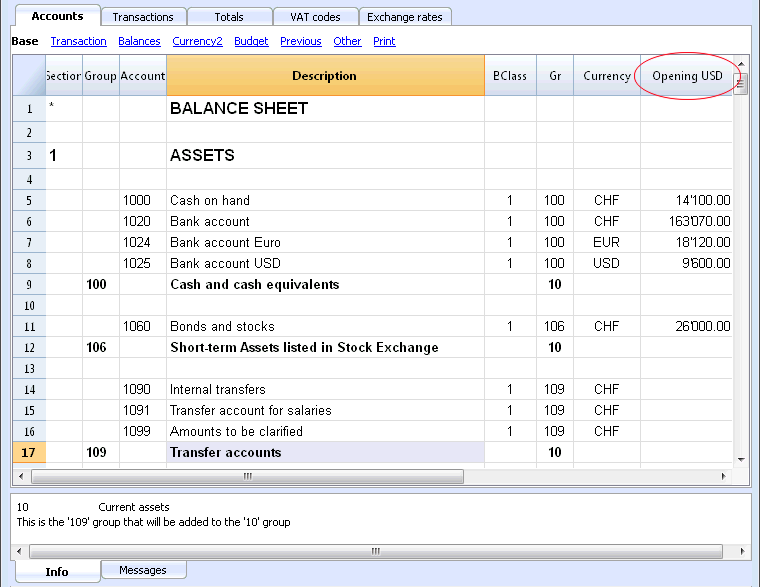

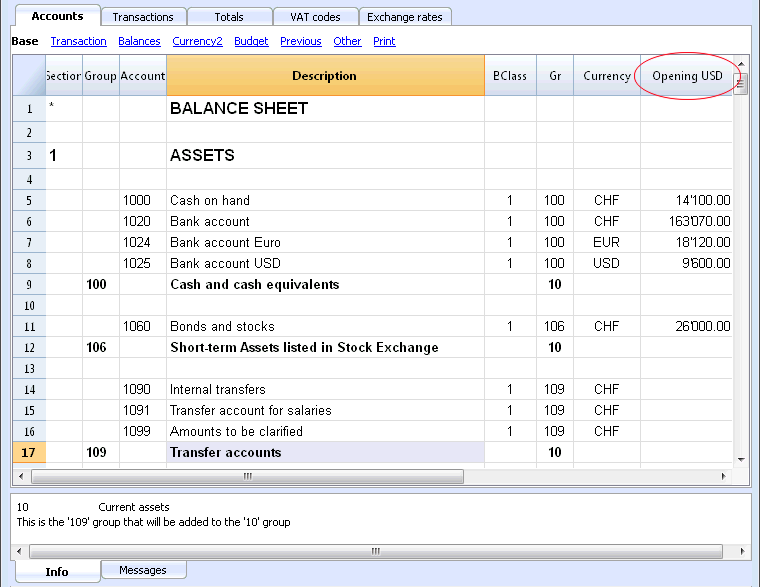

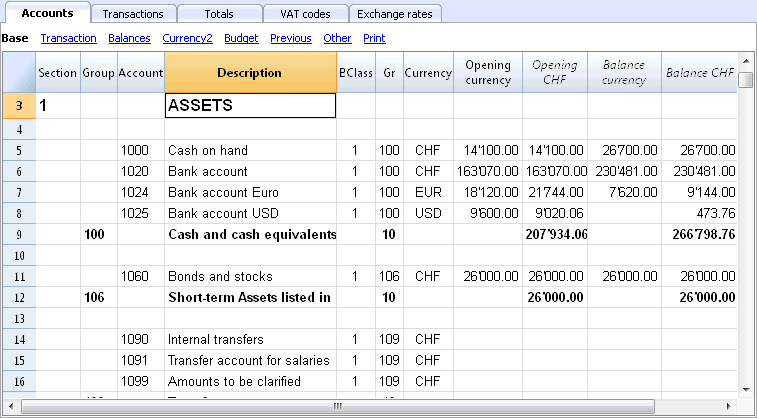

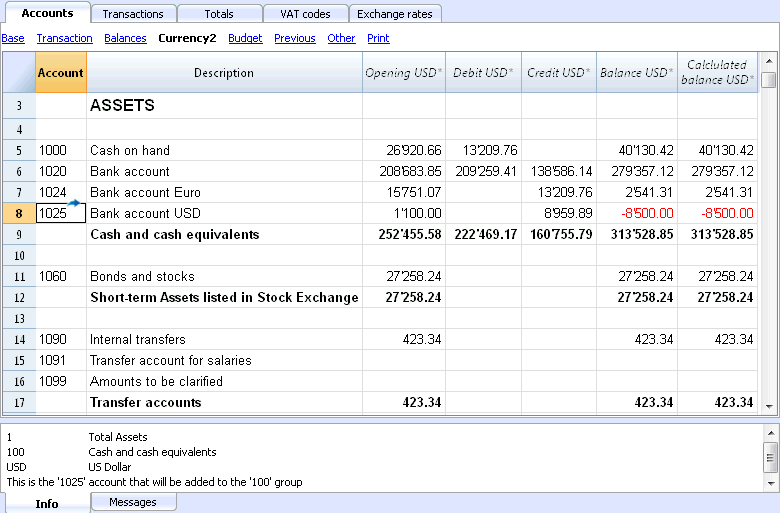

- Multi-currency chart of accounts

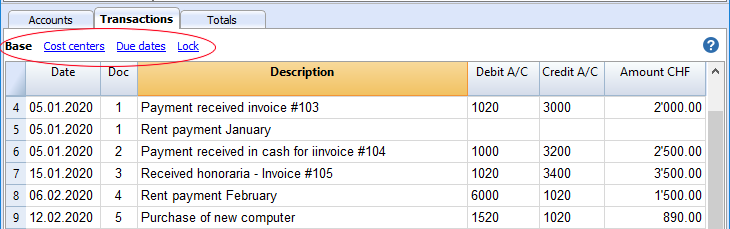

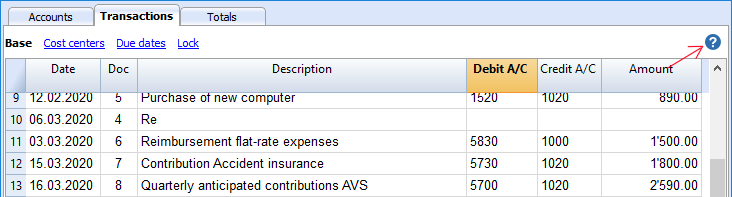

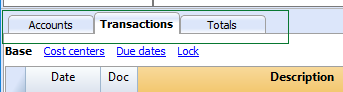

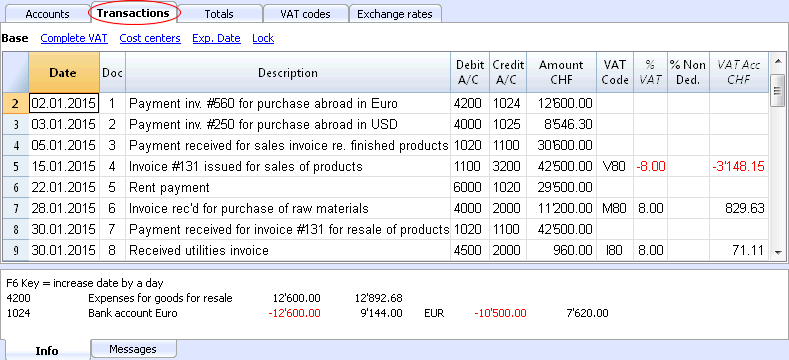

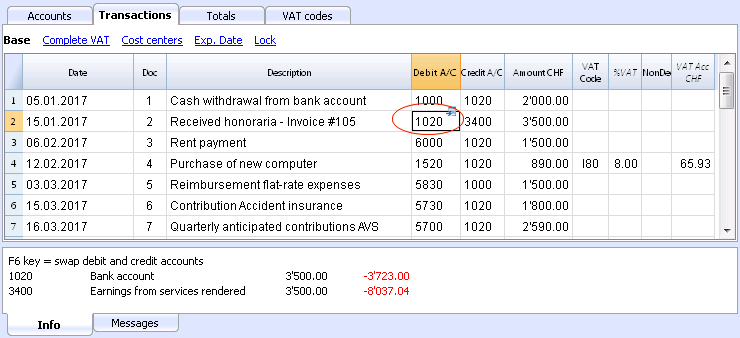

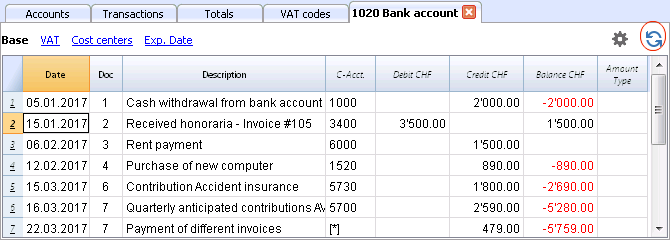

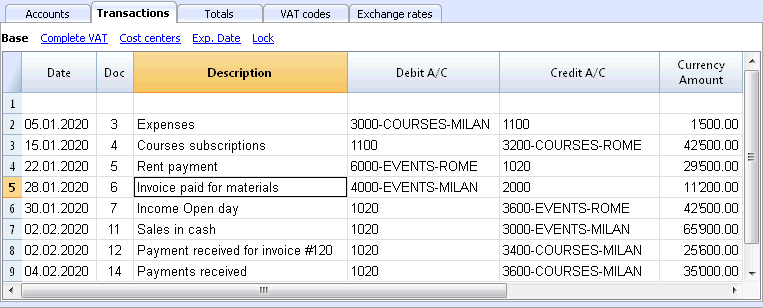

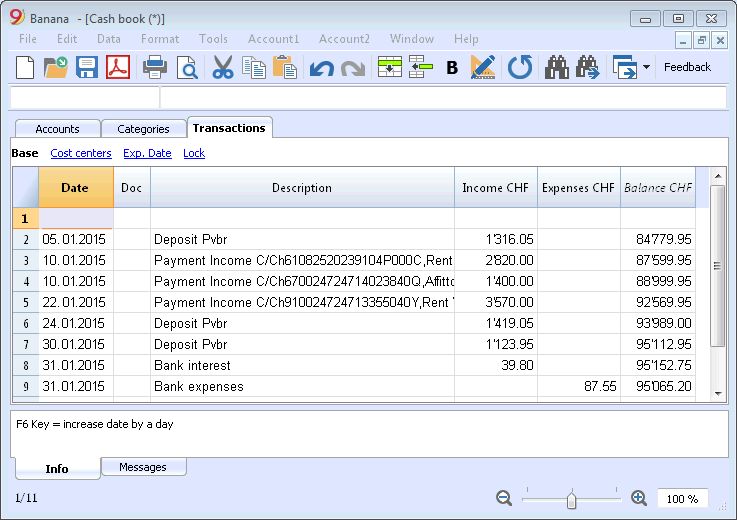

Transactions

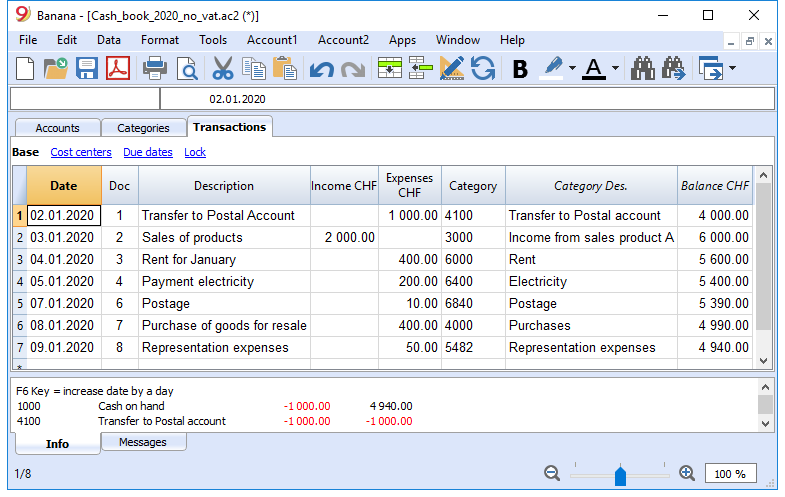

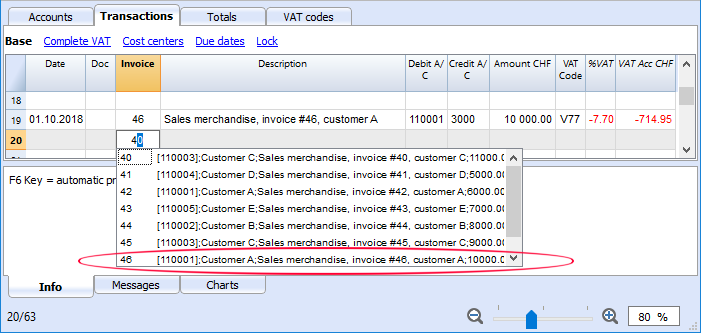

- Fast transactions input

- Automatic numbering of the Doc column

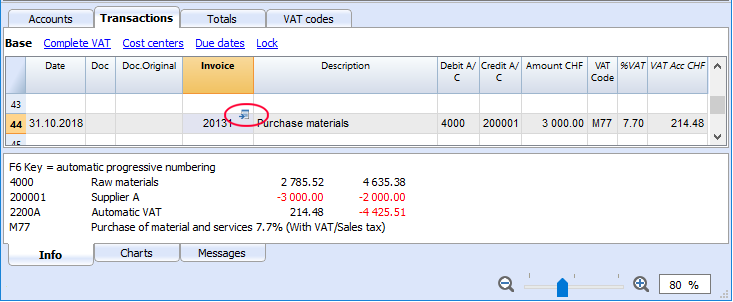

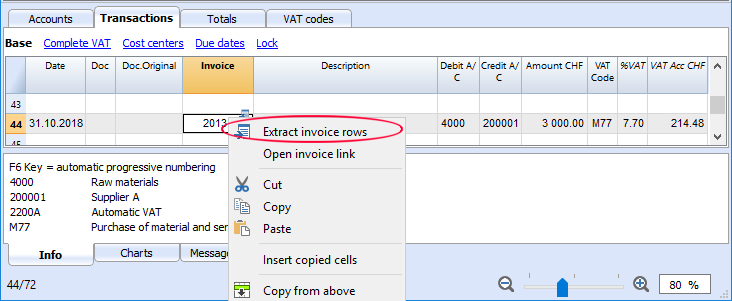

- Include a link to an electronic document

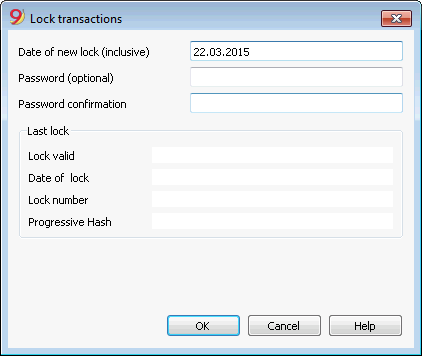

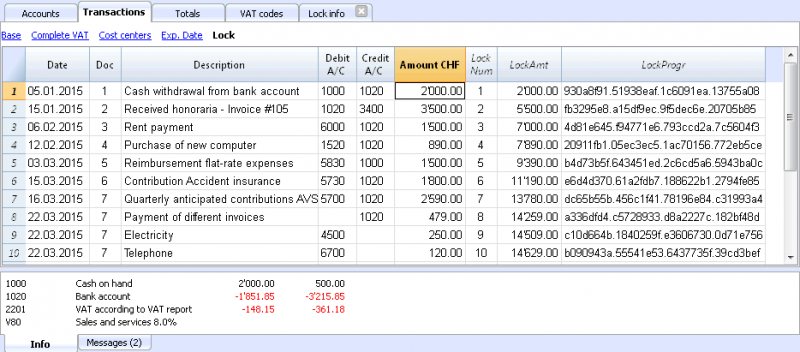

- Lock transactions

- Unlock transactions

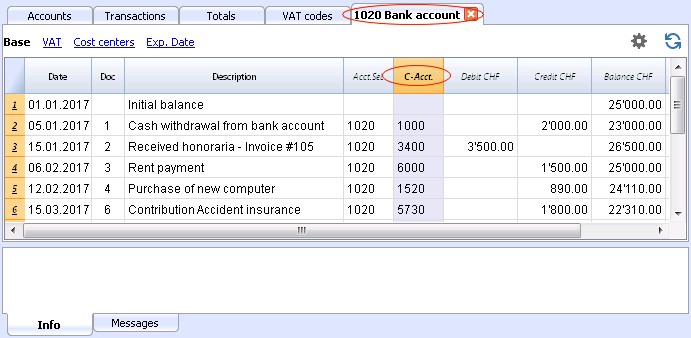

- Entering simple transactions (a Debit and a Credit account)

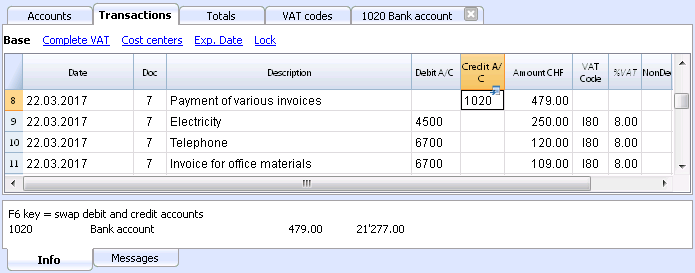

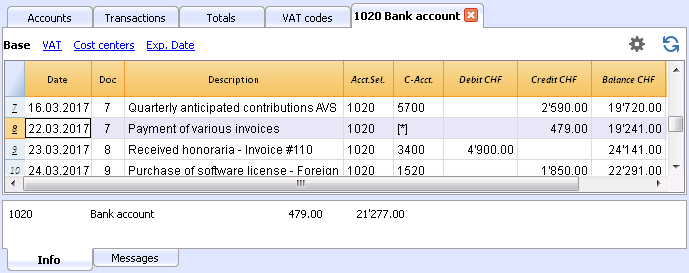

- Entering complex transactions (on multiple accounts)

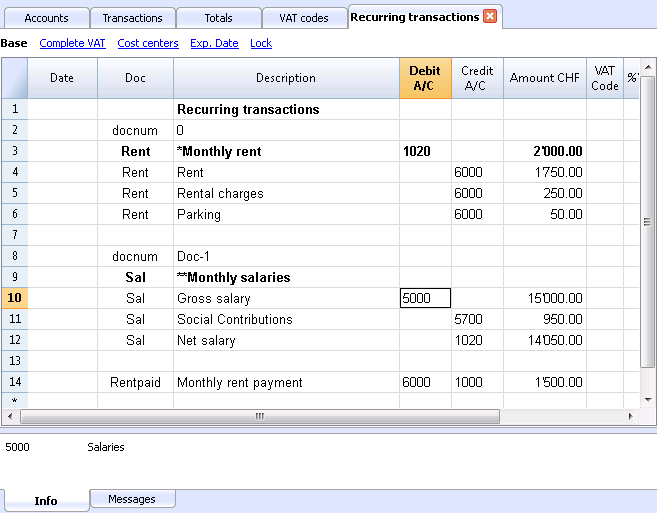

- Recurring transactions

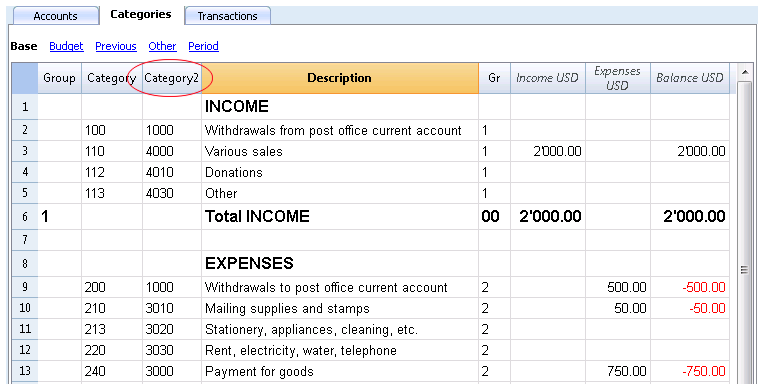

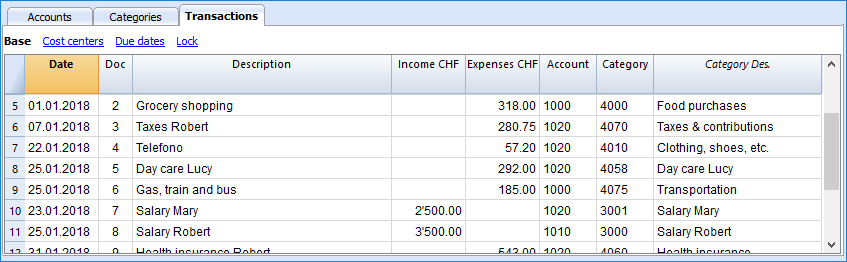

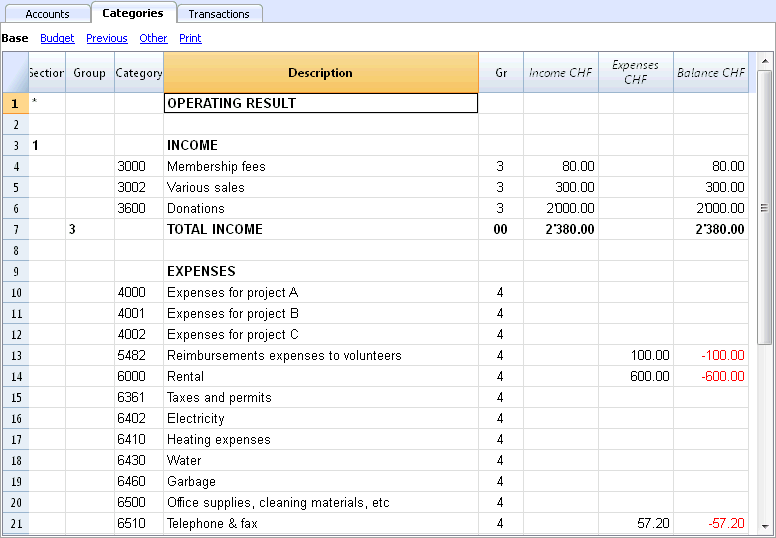

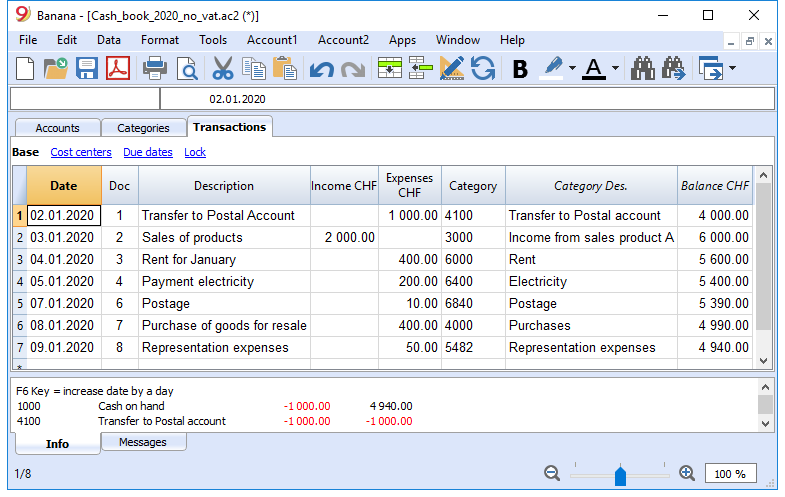

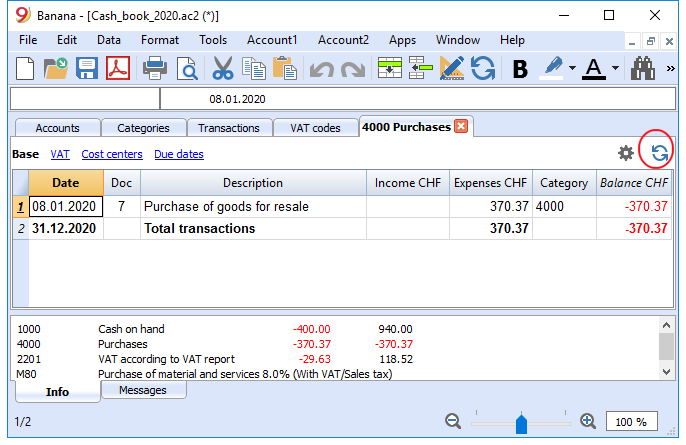

- Entering transactions in a Income & Expenses or Cashbook file

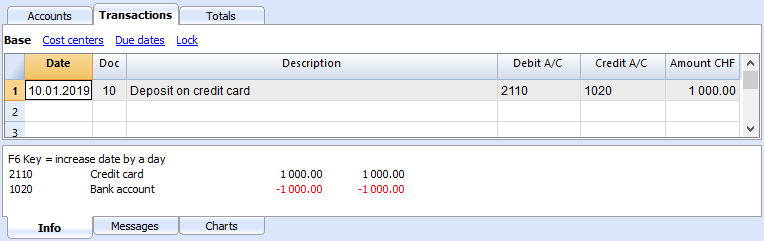

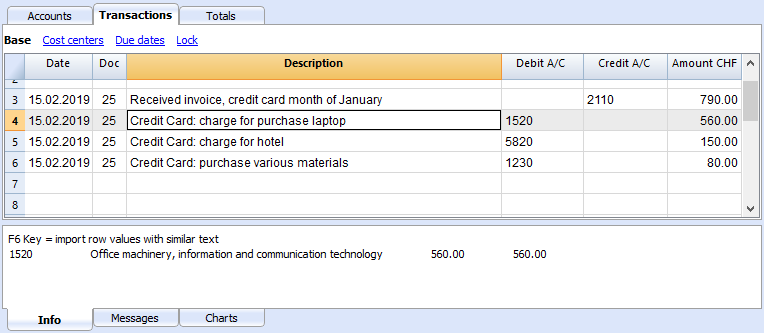

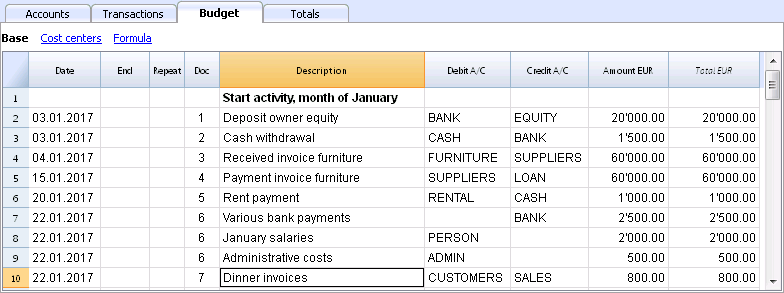

- Entering transactions in a double-entry accounting file

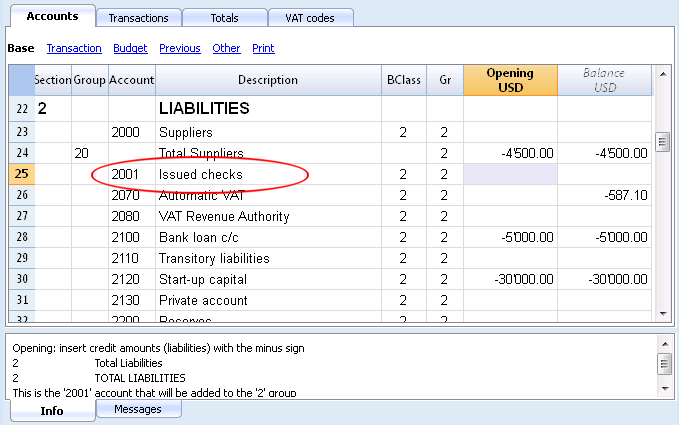

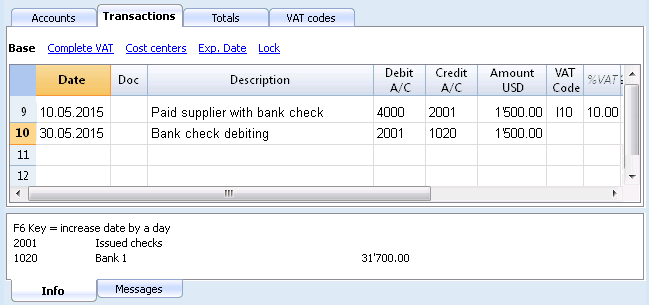

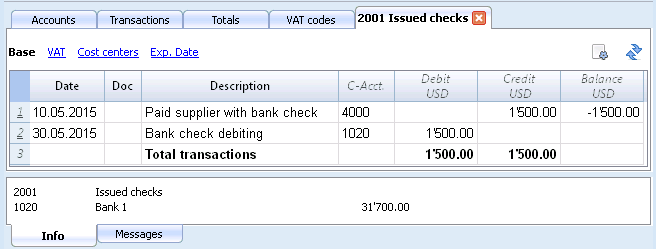

- Entering issued bank checks

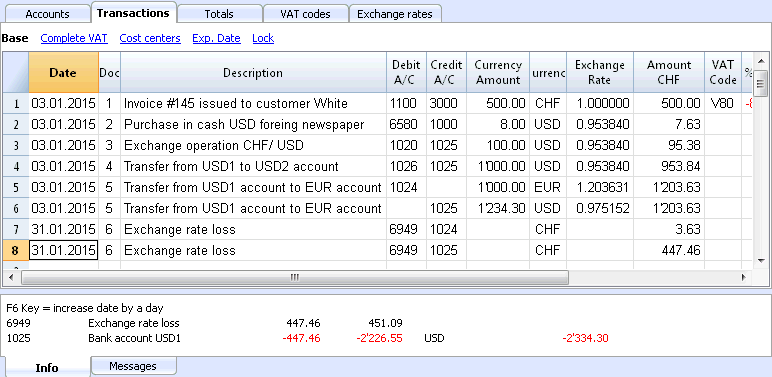

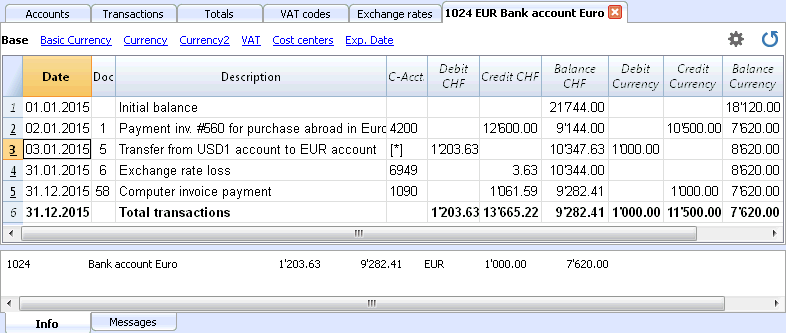

- Entering transactions in a multicurrency accounting file

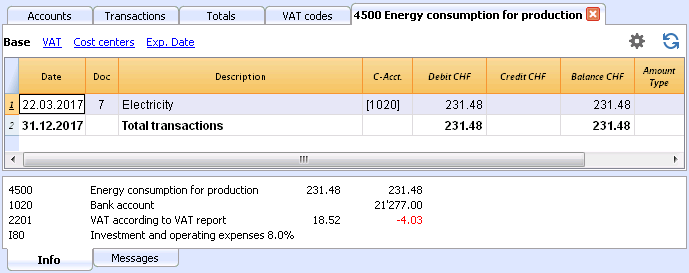

- Entering transactions with VAT

Advanced features

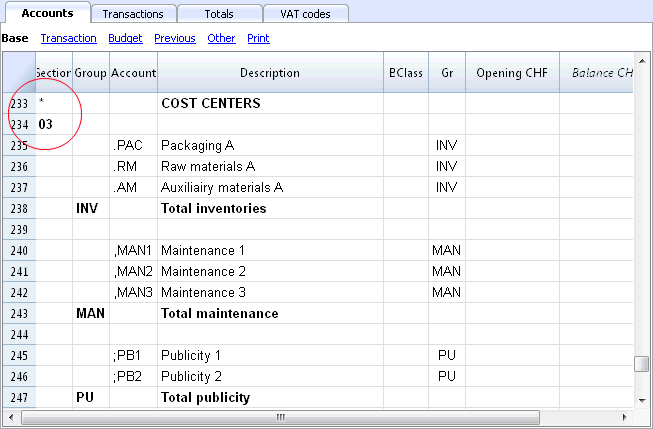

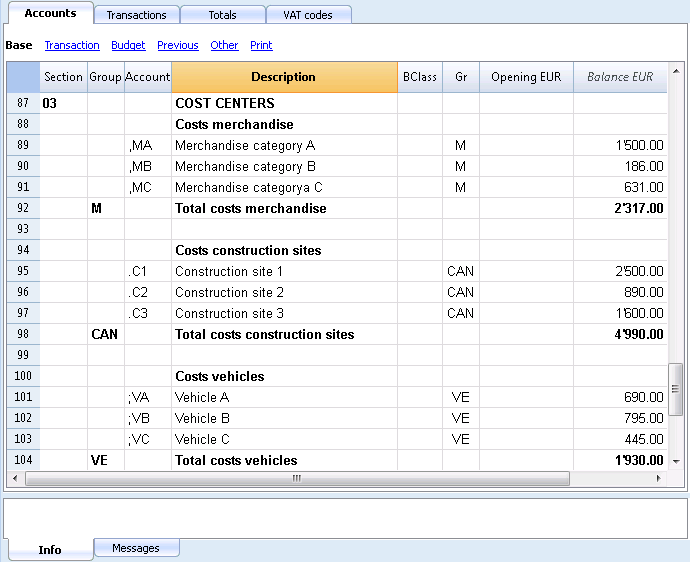

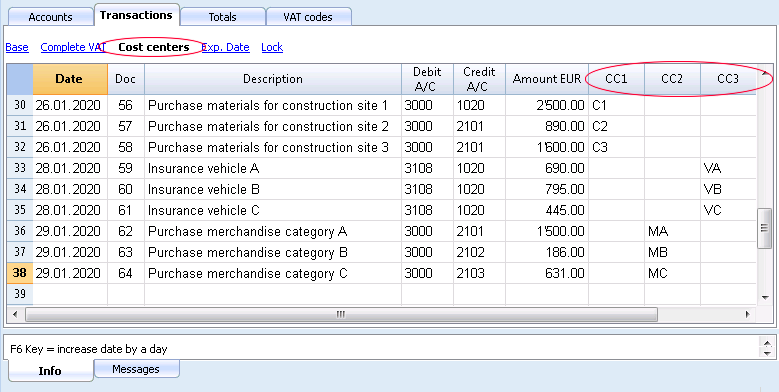

- Cost and profit centers

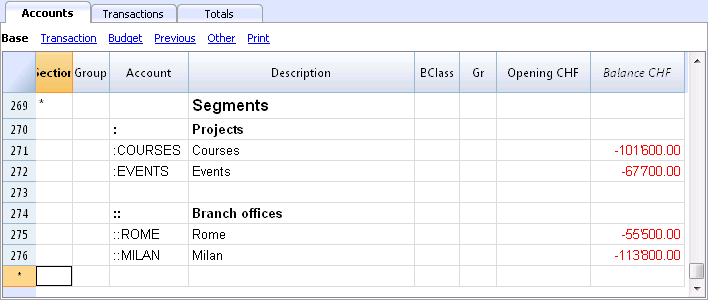

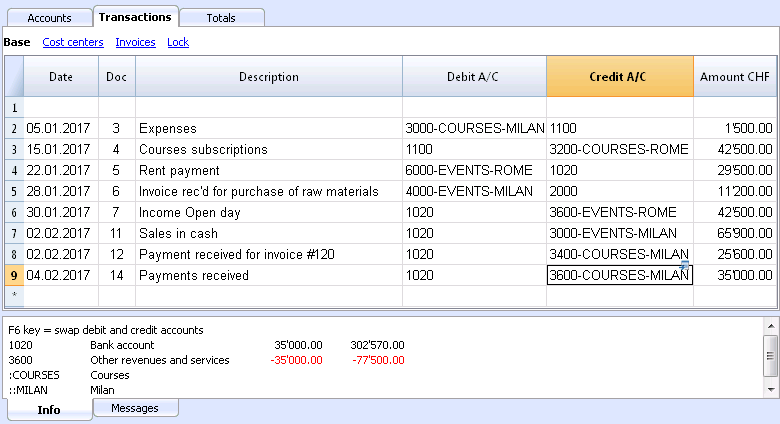

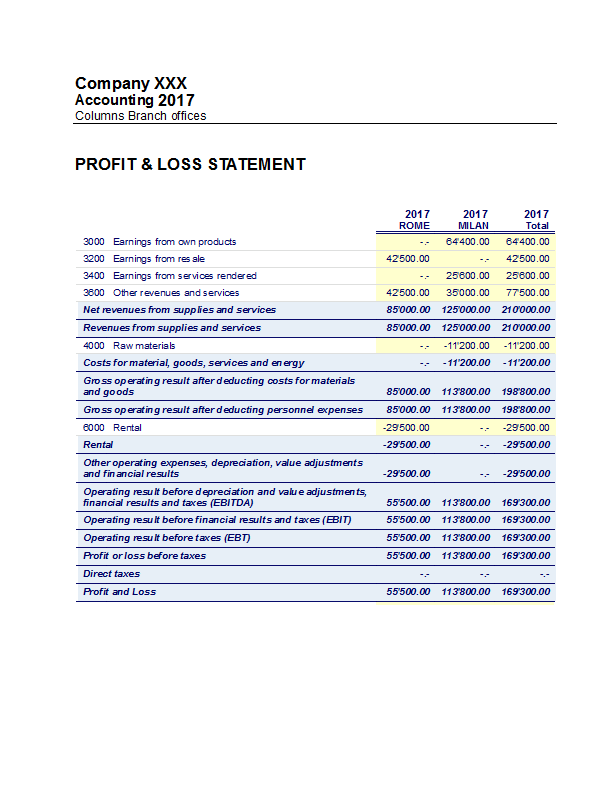

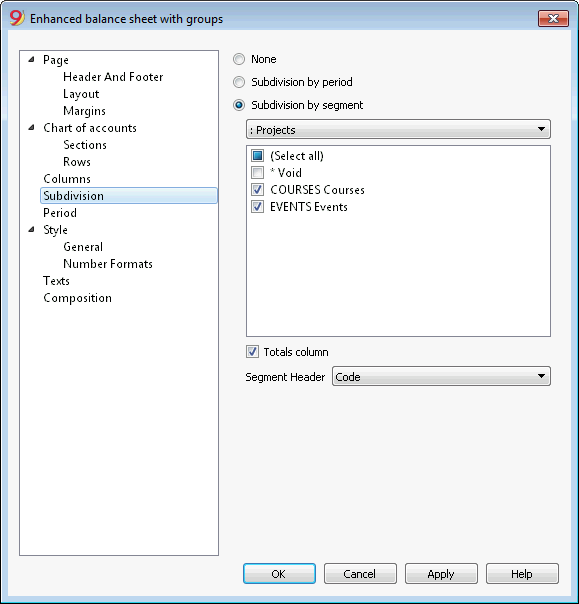

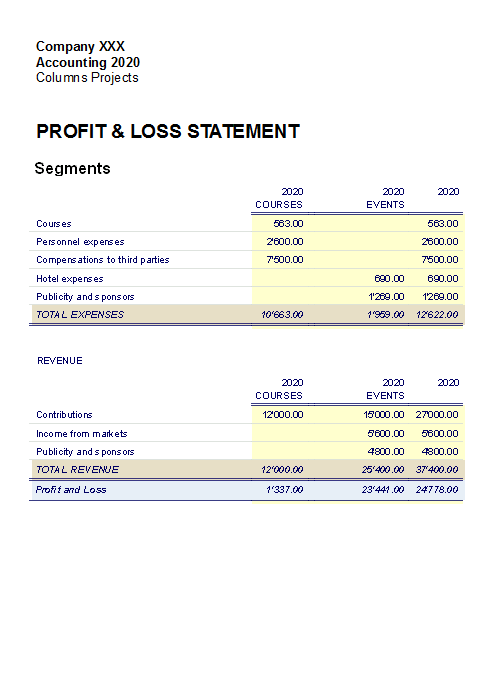

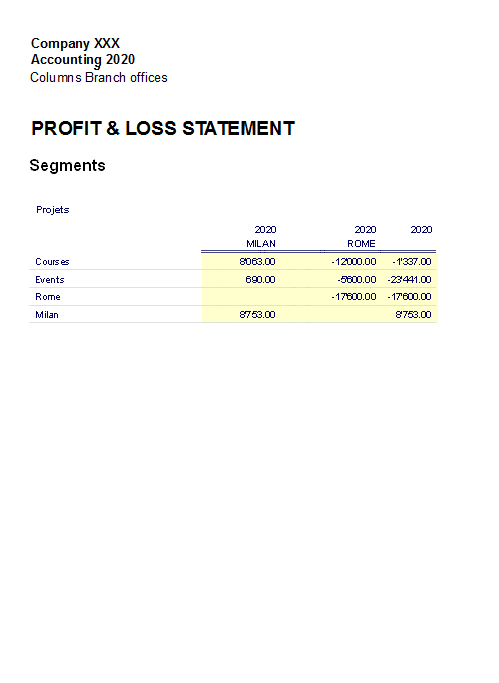

- Segments (in order to manage multiple projects)

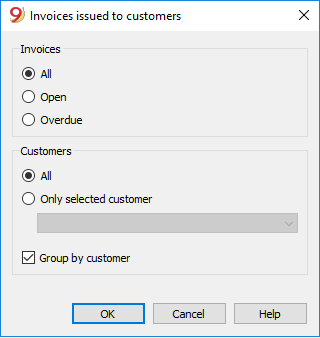

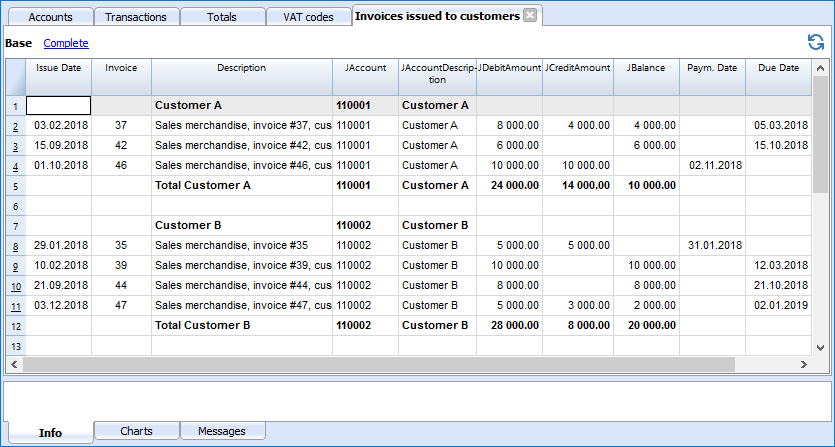

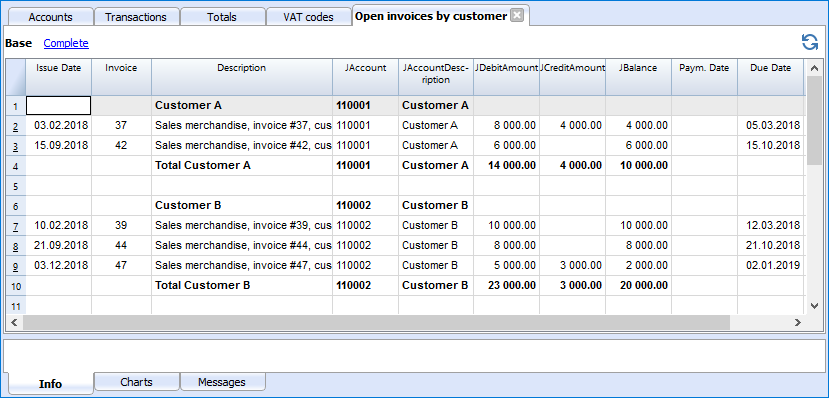

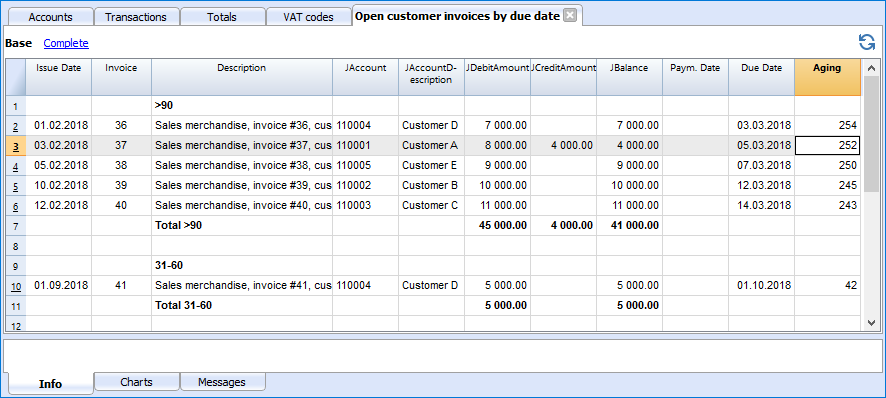

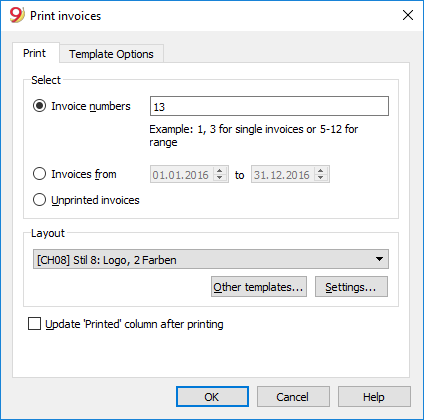

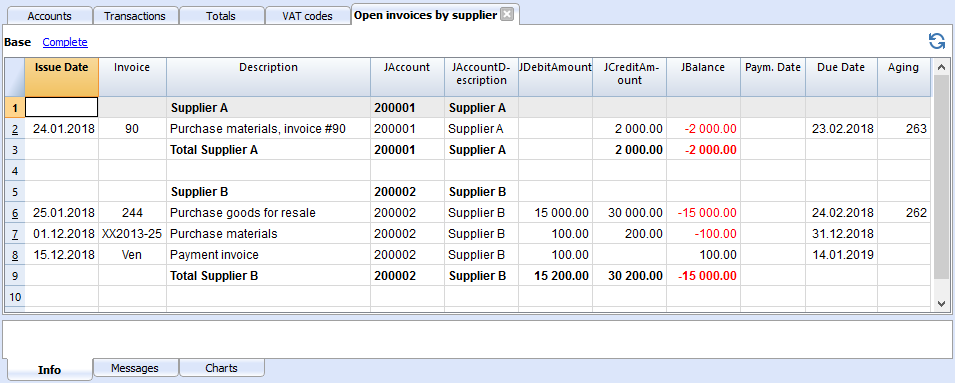

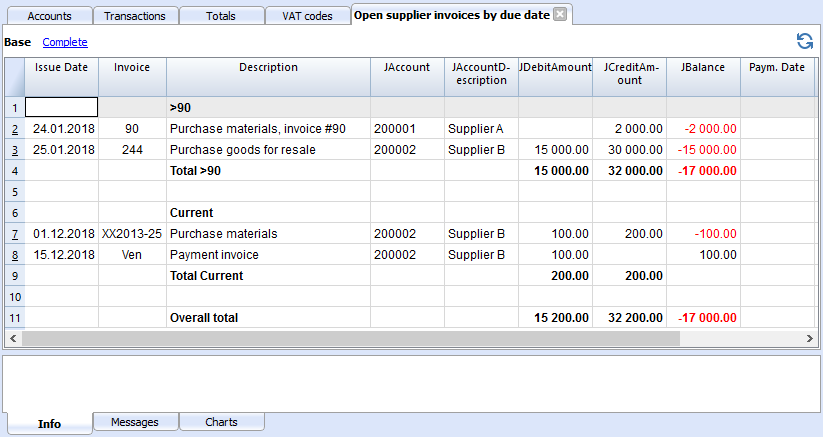

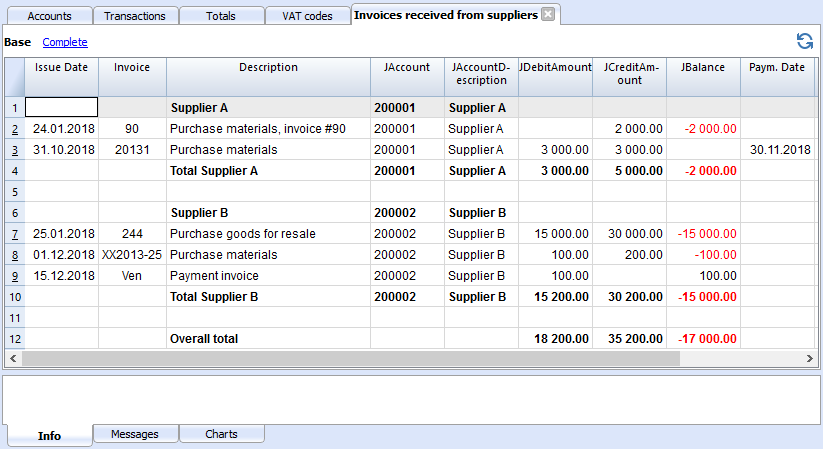

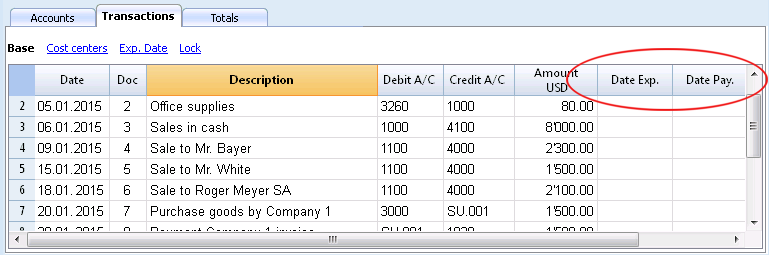

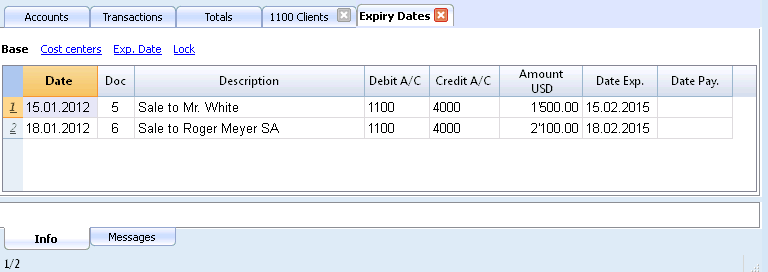

- Invoice management (open & overdue invoices, history)

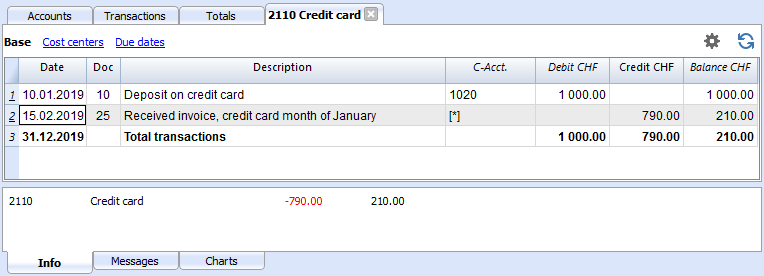

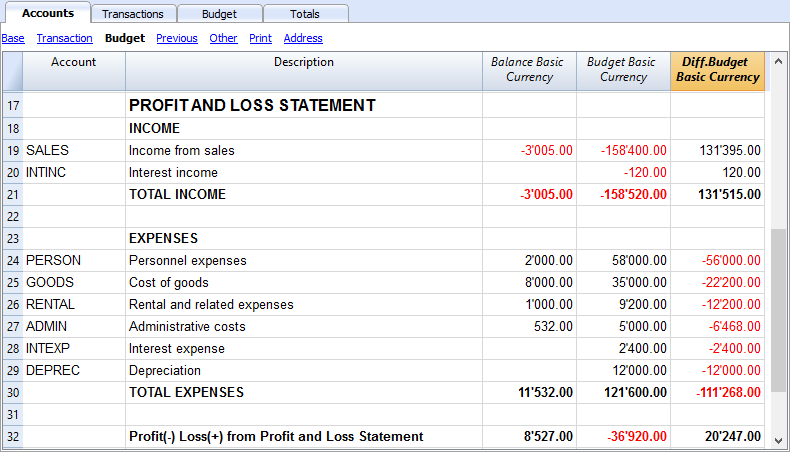

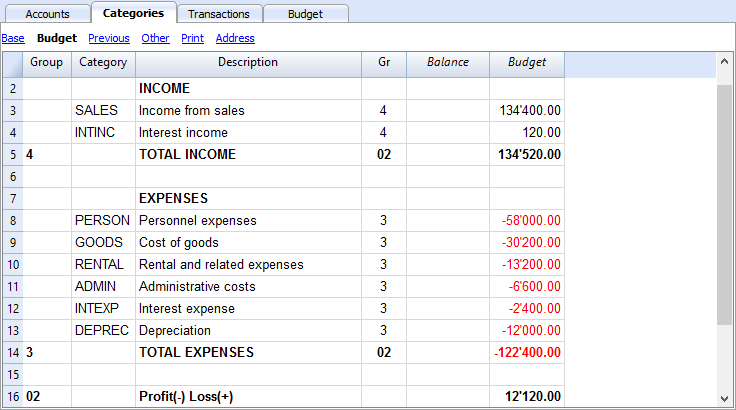

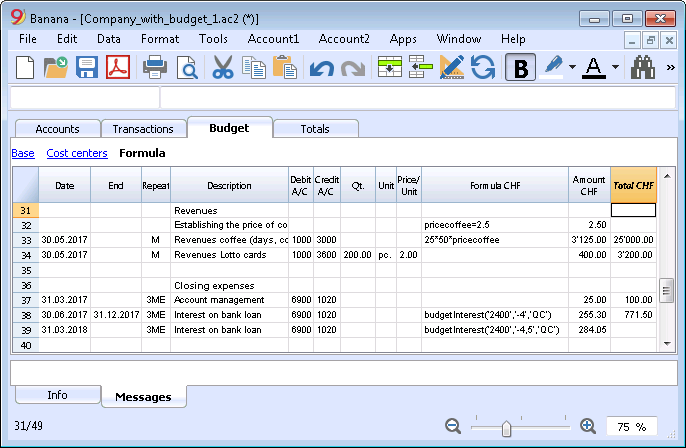

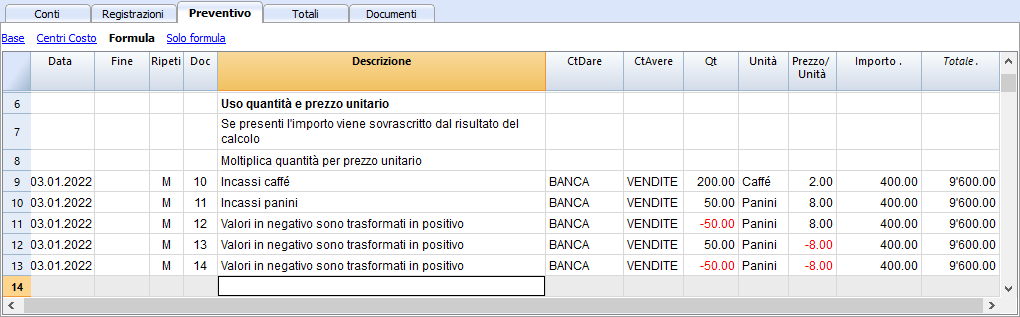

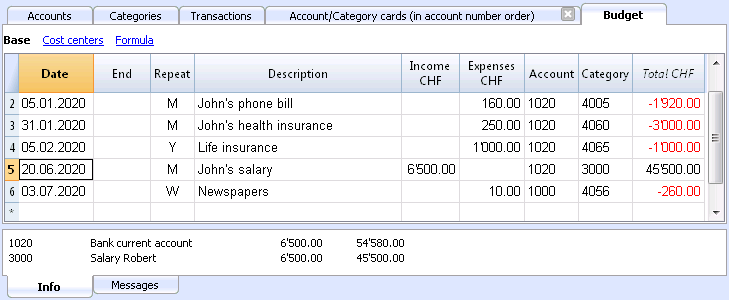

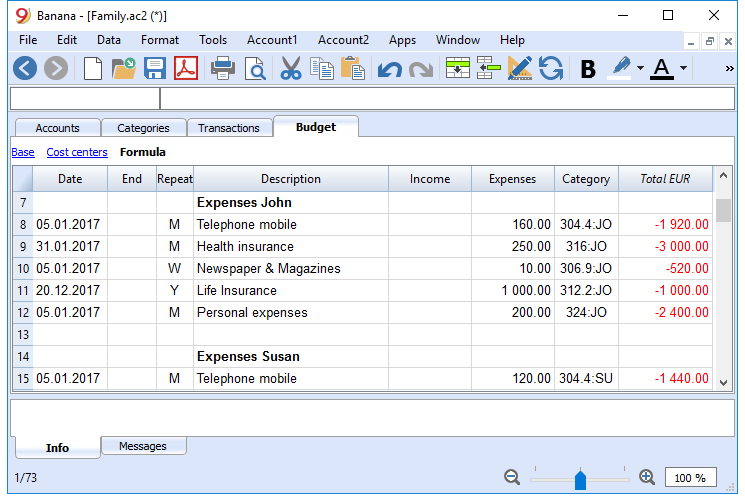

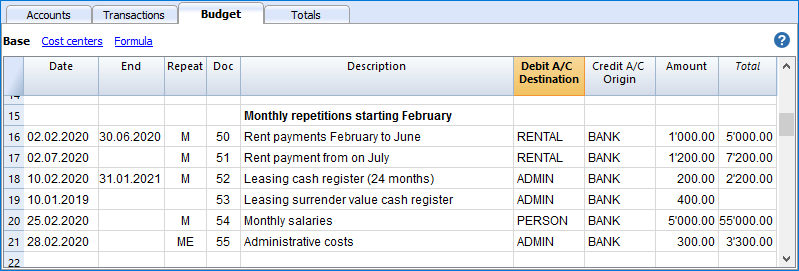

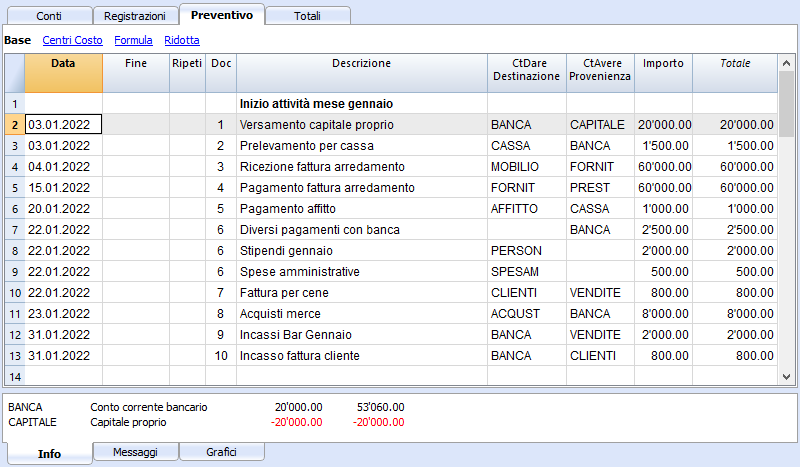

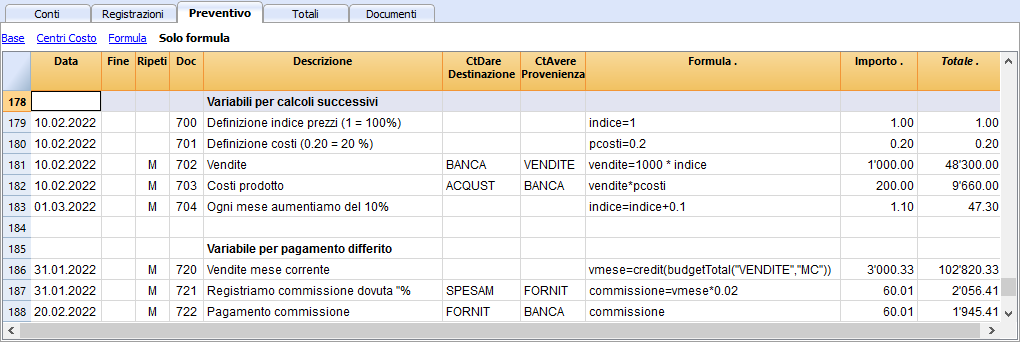

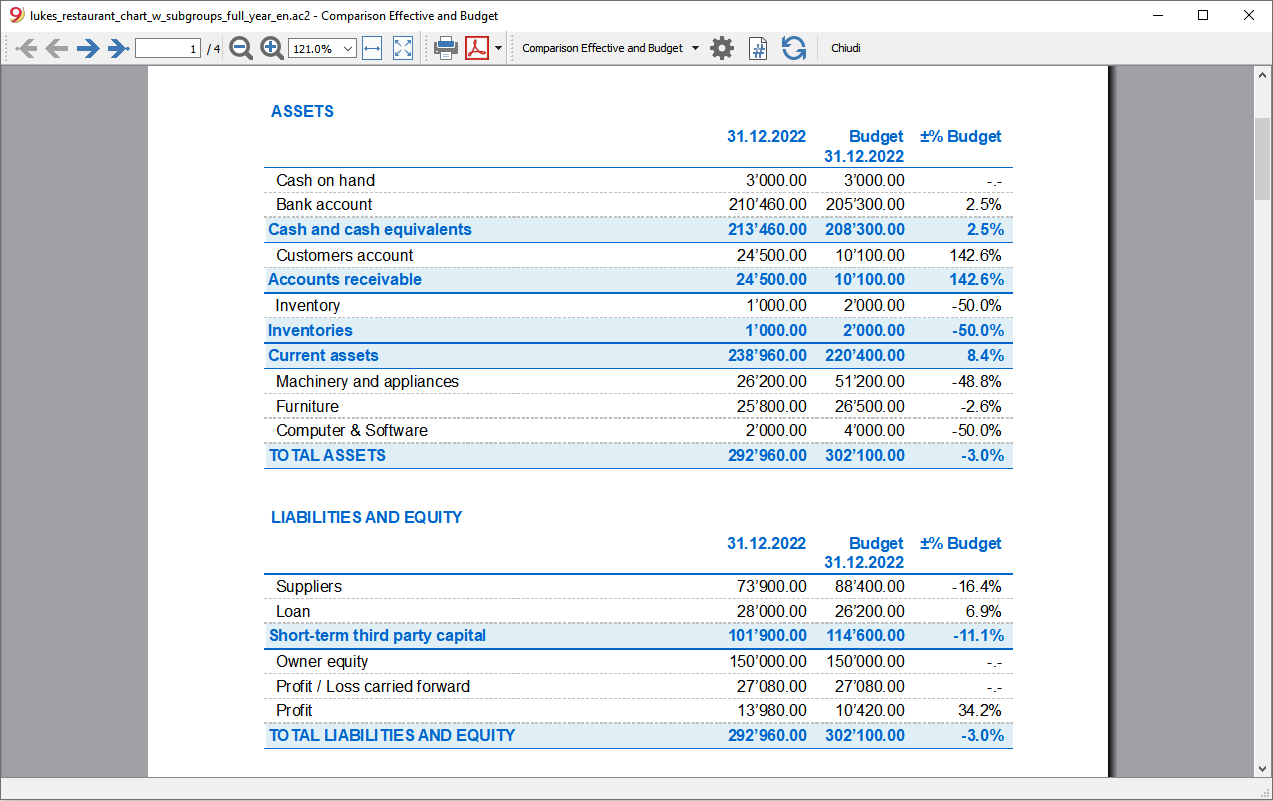

- Budget table with transactions

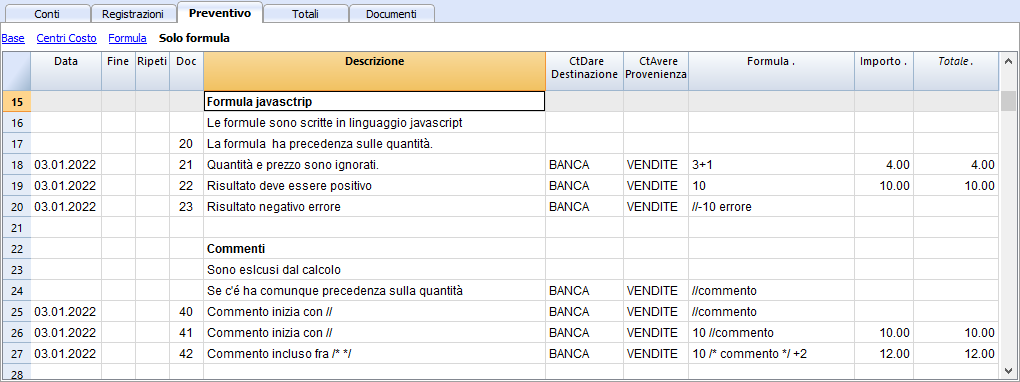

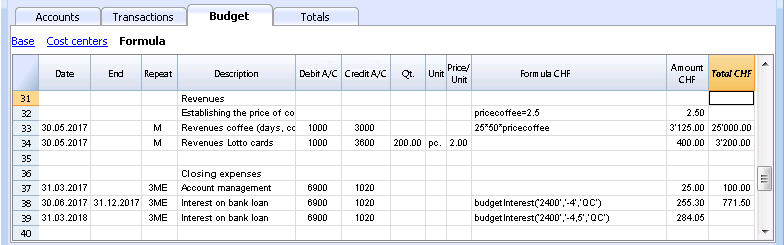

- Possibility to insert formulas

Data import and export

- Bank Statement SEPA/ISO 20022

- Data import

- Import transactions from a bank or post statement

- Data export

- Transferring data from other accounting software

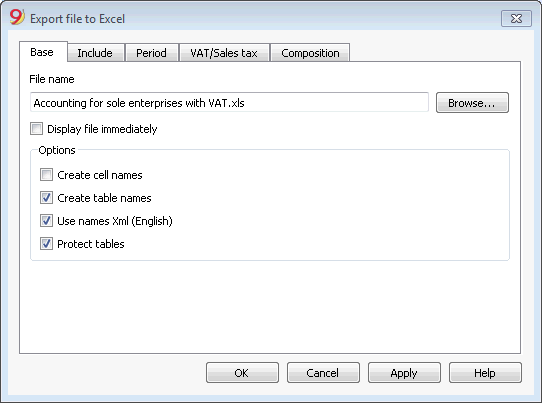

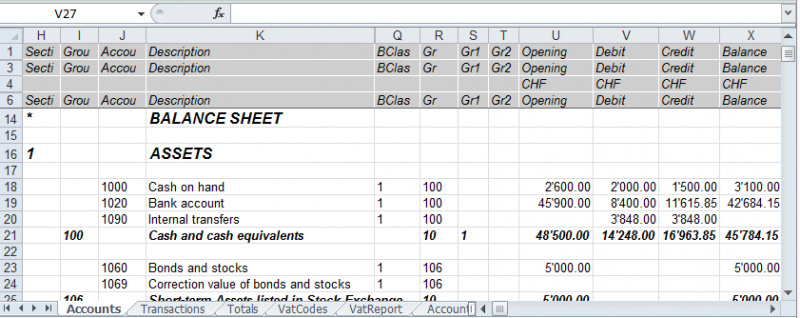

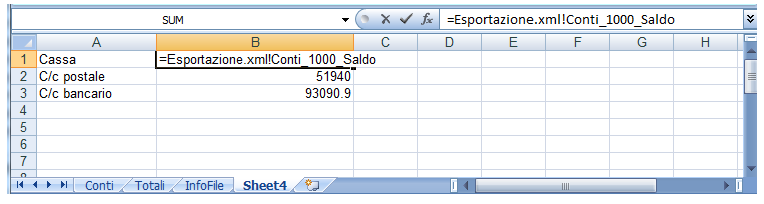

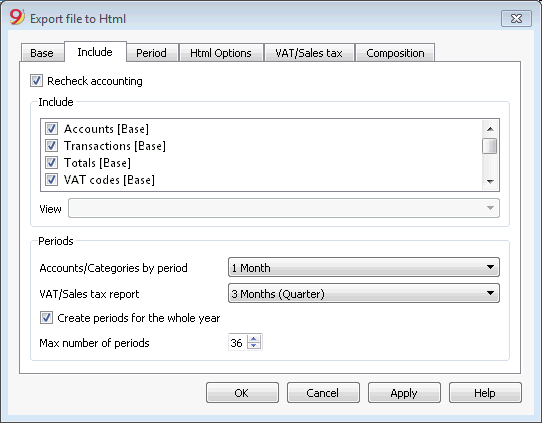

- Data export: Excel - Html - Xml - txt

- Option on which data to Include in the export

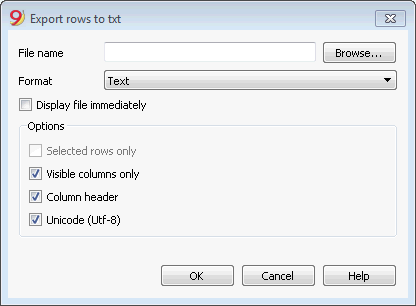

- Export rows or selected area in txt format

Security

Useful information

- Courses and consultancies

- Opening and closing days

- Lost license key

- Help menu

- If you get an error message

- Error messages

Documentation of previous versions

Index

hello world

Installing Banana Accounting

When downloading the program, it is automatically saved in your Download folder.

After you execute, if you don't indicate any other destination folder, the program will be installed by default into the Programs folder (Windows: C:\Programs; MAC OSX: /Applications; Linux: /bin).

The following pages explain how to install Banana Accounting in all operating systems.

For more information about the Banana files please visit the Save, copy and backup page.

System requirements

Banana Accounting 9 is available for Windows, Mac and Linux, as a stand alone version.

This version won't be updated anymore. Last update: Dec 2019.

For an always up to date version switch to Banana Accounting Plus, subscription based.

Banana 9 for Windows

- Windows 10, 8.1, 8. NOT Compatible with Windows 11 (please update to Banana Plus)

- 180 MB of disk space

- Internet connection to access the Templates and the Help function of the program

- Windows 7 is supported up to version 9.0.3

Banana 9 for Mac OS X

- Mac OSX 10.14, 10.13, 10.12

- 180 MB of disk space

- Internet connection to access the Templates and the Help function of the program

Banana 9 for Linux

- Ubuntu 16.04 LTS or more recent versions,

other supported distributions - 180 MB of disk space

- Internet connection to access the Templates and the Help function of the program

Banana Mobile for Android and Chrome OS

- Available on Google Play Store

- Version Android 4.2 or more recent

- Banana Mobile for Android and Chrome OS have some limitations compared to the Desktop version.

Banana Mobile for Apple iOS (iPhone and iPad)

- Available on the Apple Store

- Version iOS 8.4 or more recent

- Banana Mobile for iOS has ome limitations compared to the Desktop version.

Other information

- The indicated disk space requirement depends on the amount of transactions and accounts used in the accounting file. 3 MB is an average space for an accounting file with 200 accounts and 2000 transactions.

- There is no limitation to the number of files.

- Files created with different versions (Windows, Mac, Linux, iOS, Android and Chrome OS) are interchangeable.

- The software is a single user program, just like Excel. Only one person at a time can edit a file.

- The Windows version can be installed on a server, and then be run on client computers.

- The program can be used with Terminal Server or similar remote desktop technologies.

Also see the Installing on a server or on a USB key page.

License key

Banana Accounting 9 is an old product that is no longer sold. The information about the license key refers to products sold in the past. Banana Accounting Plus is our new version.

The license key is a code that was provided when purchasing the program and made the program fully operational.

The license key was provided in the following ways:

- in the box, printed on a special card

- sent by email on the day of the online purchase via credit card

- printed on the invoice (for those who purchased directly from us).

IMPORTANT: Keep the license key carefully. In case of loss, follow the instructions in the chapter Lost license key.

A single license key for Windows, Mac and Linux

With Banana Accounting 9 the license key can be used on all operating systems.

Free Version mode at no cost

If you install the program without entering the license key, the program runs in Free Version mode.

With the Free Version mode, you can:

- Use the Cash book and the Time sheet management in a free and unlimited mode

- For all other applications you can use the program in complete mode, entering up to 70 rows into the Transactions table.

If you have more than 70 rows in the Transaction table you won't be able to save or export the file, and in the print-outs the words "Starter Edition" will appear.

When the license key is being entered, Banana Accounting switches from the Free Version mode into the complete Professional mode.

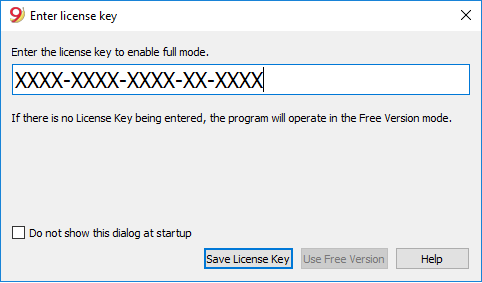

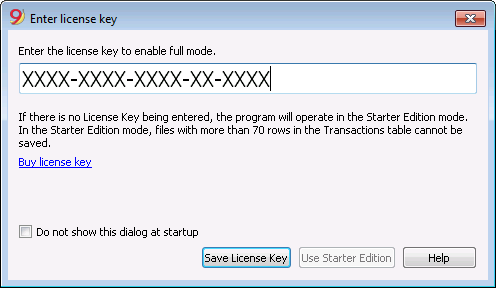

Entering the license key

- Open Banana Accounting

- Select the command Manage license keys from the Help menu

- Enter the license key number into the appropriate field

- Click on the Save license key button

- Confirm the operation if asked

Important: The license key is saved only for the current user of the computer.

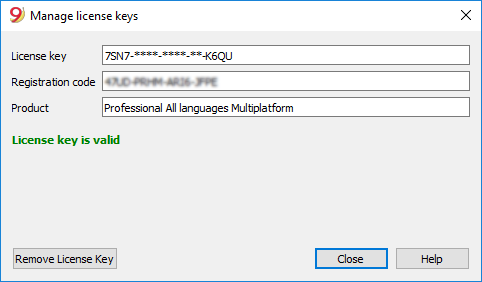

Registration code

Once the license key has been entered and saved, the program displays the registration code and the following dialog appears in the Manage license keys (Help menu) window:

For security reasons the license key is partially hidden.

In case the user loses his license key, the registration code can be used to find the license key that he has entered.

It is important to copy this registration code and keep it in a safe place.

Modifying the license key

Before modifying an already entered license key, please save your open accounting files and close them; only the program remains open.

In order to modify a license key, you have to first remove the existing license key and then enter the new (different) license key.

Remove License Key

Click on the Remove license key button to remove the key.

By removing the license key, the program switches back to the Starter Edition mode.

Enter a new (different) license key

- Enter the new license key number into the appropriate field

- Click on the Save license key button

- Confirm the operation if asked

At the end of this operation, close the program and restart.

Lost license Key

For Banana Accounting 9, if you have registered your product, you can recover your Banana Accounting 9 license key through the License key recovery form without fees. You can also ask us - by email - to resend you your own license key. The recovery of the license key is considered technical support, which is charged at CHF 70.

When contacting our technical service, send the registration code that can be found in the Manage License Keys window from the menu, or send us a screenshot of the same window as an attachment.

As an alternative to the recovery of the lost license key we recommend the switch to Banana Accounting Plus, available as an annual subscription for CHF 89.- or CHF 179.- (plan with advanced functions that also includes email and telephone support). It is possible to upgrade to Banana Accounting Plus even without the license key of the old version.

You also receive 1 free month with the upgrade:

- Banana Accounting Plus features

- What's new in Banana Accounting Plus

- Banana Accounting Plus plans: choose the one that's best for you.

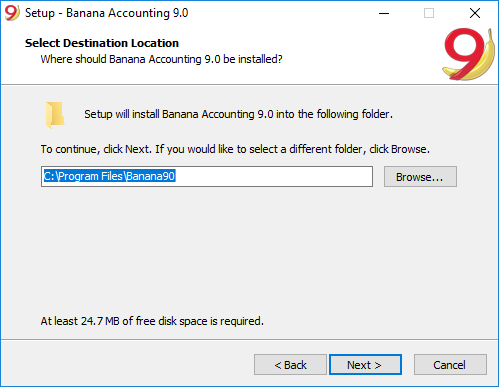

Installing under Windows

The program installation is a matter of minutes and it is all automatic.

By downloading the program, you accept the user license conditions.

Once the download is finished, just double-click on the file you downloaded.

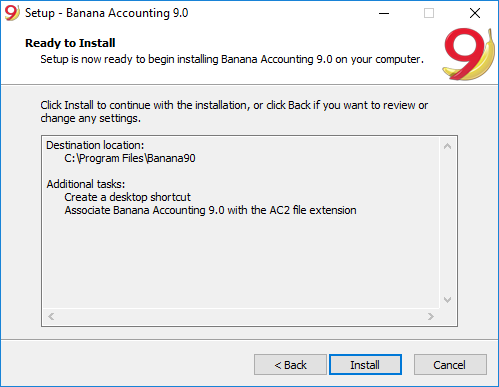

The software will be saved by default in the C:\Programmi Files\Banana90 folder. If you wish to save it in a different folder click on the Browse button and choose the desired path.

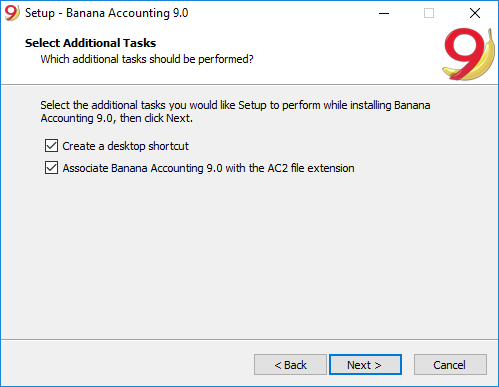

The installer has already activated the options:

- Create a desktop icon from where to launch the program.

- Associate the extension AC2 to Banana Accounting 9, so that when you click on an accounting file the program starts. See also associate Banana Accounting.

- In the Banana Experimental version this option is not activated. If you always want to use the Experimental to open files, you have to activate it.

The program activates by default the Create a desktop icon and Associate Banana Accounting 9.0 with the AC2 file extension options; if you do not wish to have these options, simply uncheck them.

Click on the Install button to start the installation process.

The program will be automatically installed in your operating system language; you will be able to change the program language anytime by choosing the Program options command from the Tools menu.

Entering the license key

After opening the program for the first time enter the license key and confirm with OK

By entering the license key into Banana Accounting, you go from the Starter Edition demo mode to the complete mode. If the license key is not entered, a message appears at the opening of the accounting file, warning the user that he is working in the Starter Edition mode.

Open the software

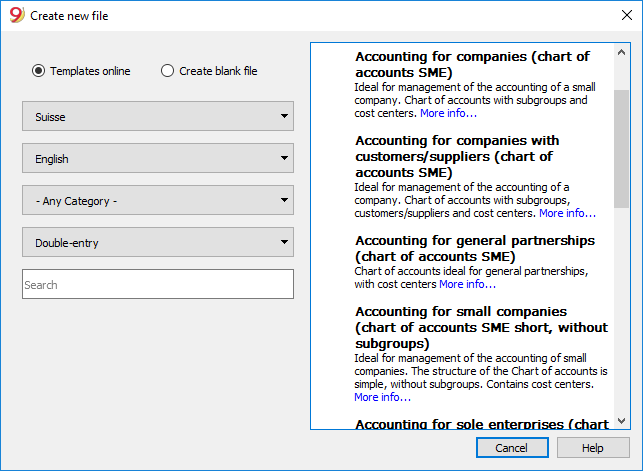

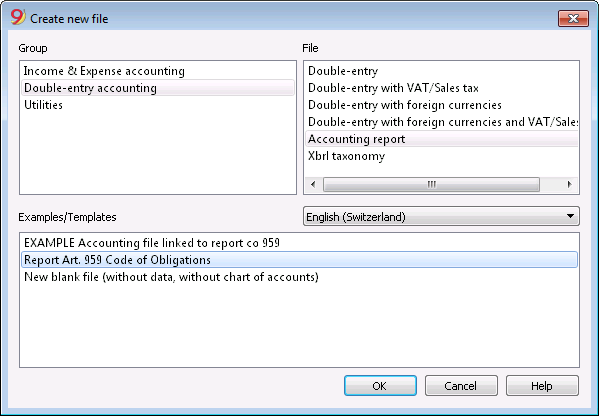

As soon as you open the software, choose the New command from the File menu. From the pop-up window you will be able to choose your accounting type, the option with or without VAT, the file language, and an example or template (or you can also open a blank file - not recommended)

Note: in order to uninstall the software, please select the Install/Uninstall applications from the Control Panel and then chose to remove Banana Accounting from the list.

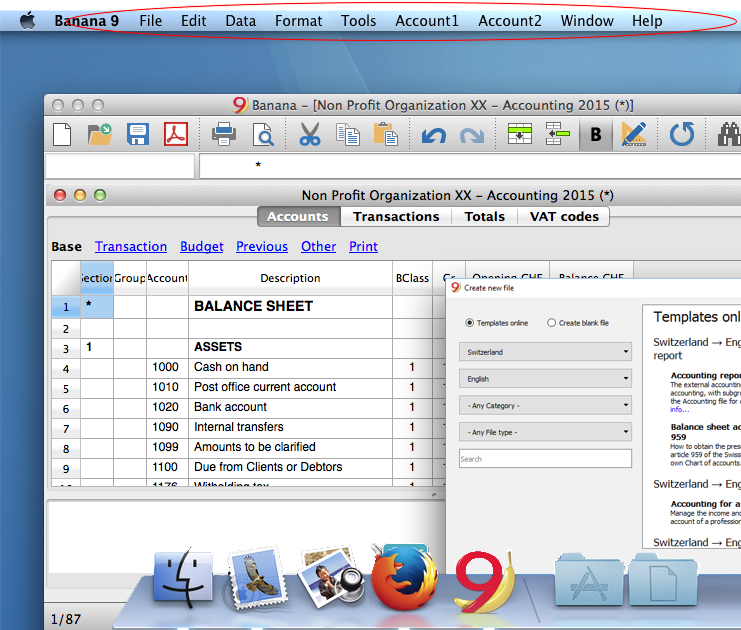

Installing under Mac

Installing the software is very easy, thanks to the autoinstall function.

By downloading the program, you accept the user license conditions.

Follow these steps:

Download the .dmg file by clicking on the Save file button.

After saving the file in your Download folder, double click on it.

Drag the Banana9 icon in the Applications folder

Banana Accounting 9 is now ready to be used. Double click on the Banana 9 icon from your Applications folder. The program is installed in your operating system language, but is always possible to change it from the Tools menu, using the Program options command.

Entering the license key

After opening the program for the first time, enter the license key and confirm by pressing the button Save license key.

Then launch the New command from the File menu. From the pop up window it is possible to choose the accounting type, the with or without VAT management option, the language and a template or example (or you can choose to open a blank file - not recommended).

In case of problems while installing the program: verify in Apple -> System Preferences, Security & Privacy, to have chosen the option "Anywhere" instead of "Mac App Store and identified developers". See also Apple's internet page.

NOTE: in order to uninstall the software, simply drag the Banana9 icon from the Applications folder to the Trash.

Installing under Linux

The best way to install Banana Accounting for Linux is via the App Store for Linux: Snapcraft.

On Ubuntu, just select Ubuntu Software, search for "banana", select Banana Accounting and click on the "Install" button.

The Snapcraft store can be used on various Linux distributions, including OpenSUSE and Mint.

Here you find how to use Snapcraft on your favorite distribution.

By downloading the program, you accept the user license conditions.

Install using the App Store for Linux

.AppImage Package

Download the application, make it executable, and run! No need to install. No system libraries or system preferences are altered.

- Download the package

- Make the package executable

- Right click the package and select Properties

- Under the tab Permission activate the option "Allow execution ..."

- Confirm the change with Ok

- Start the application with a double click on the package

Package .tgz

For those who need it...

- Download the .tgz package

- Extract the .tgz package

- Run the file start_Banana.sh

The .tgz package contains the script install-banana.sh. When you execute it, Banana Accounting 9 will be copied to the /opt/banana9 folder, registered in the system and associated with the .ac2 files.

Technical information for updates

Important information when updating to Banana Accounting 9

for those who have an accounting file created with a previous version (4.5.6.7.and 8) and want to update to version 9.

In order to see what's new, visit the page What's new in version 9.

File management and -exchange

Once Banana Accounting 9 has been installed (on Windows or Mac), you can launch the program and open the accounting files that have been created with Banana Accounting:

- Banana 9 opens the files of all previous versions: 2.02, 3, 4, 5, 6, 7 or 8.

- Files saved with Banana 9 can be opened and edited with the versions 5, 6, 7 and 8 of Banana Accounting.

- If you are using features only available in Banana 9, these do not work with earlier versions.

- Files saved with Banana 5, 6, 7, 8 and 9 cannot be opened anymore with Banana 2, 3 or 4.

- Files can be transfered easily from one operating system to another.

If the files are not listed in the recent files (Initial page), you can look for them following these instructions.

Free Version version / License key

If the program is installed without license key, Banana Accounting 9 operates in the Free Version mode. This allows the user to use the Cash book and the Timesheet in a full and unlimited way and to use all other application exploiting all features up to 70 transactions.

- In order to use version 9 in the complete mode, you need to purchase the update license key and enter it in the software (update) that you can download from our download page.

- An Update Version is the normal version sold at a preferential price. It can therefore as be installed on a computer that doesn't have a previous Banana version installed.

- The license keys are valid for Windows, Mac and Linux, for installing Banana Accounting 9 on a maximum of 2 computers (belonging to the same owner).

- In the Free Version mode, the Cash book (without VAT) and the Time sheet are full and unlimited.

Version for Mac

In order to avoid conflicts with the keys used by the Apple operating system, the function keys F4, F5, F6 of Windows have become CMd+4, Cmd+5, Cmd+6 under Mac.

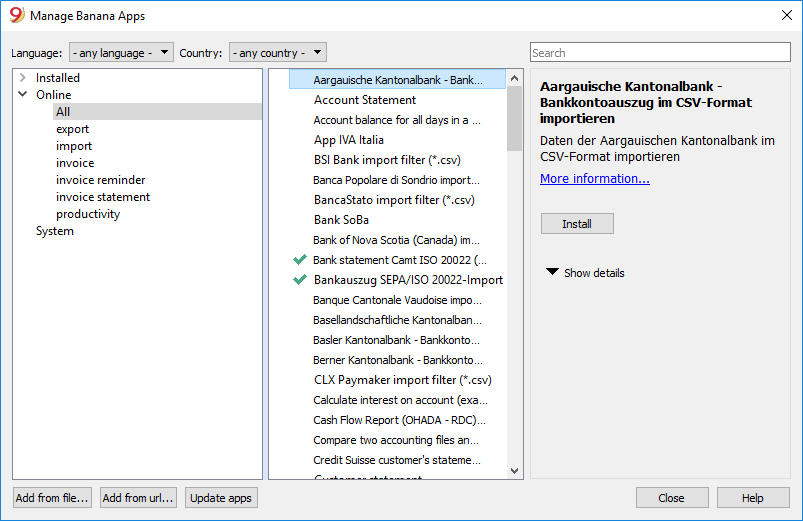

Importing bank statements

Banana 9 provides various import filters that can be downloaded from our website.

To import the bank statements / update the filters, you need to:

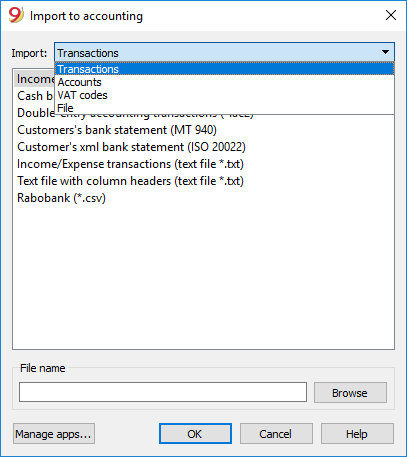

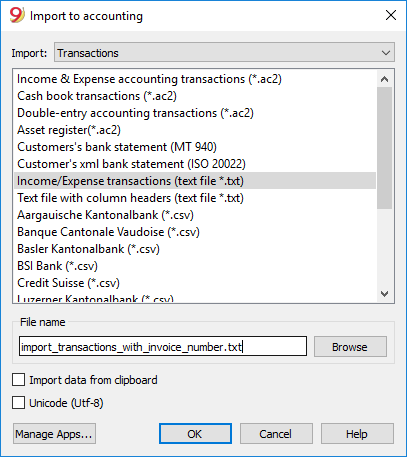

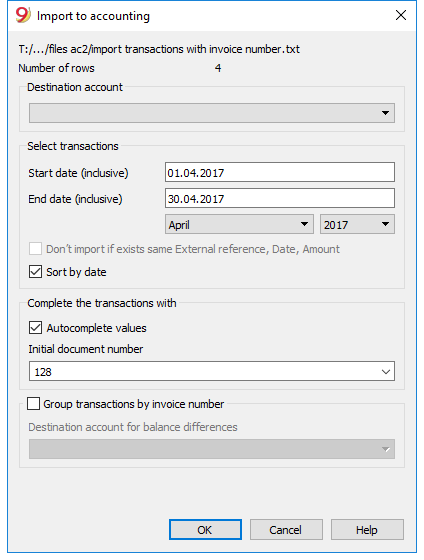

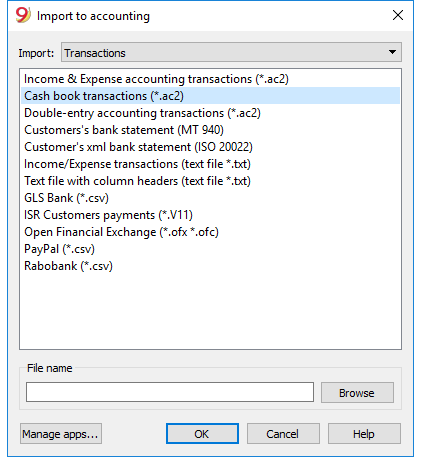

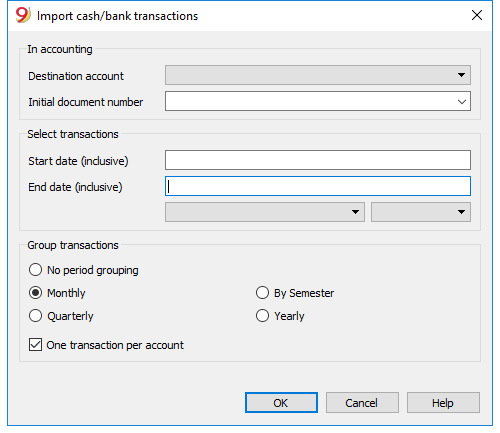

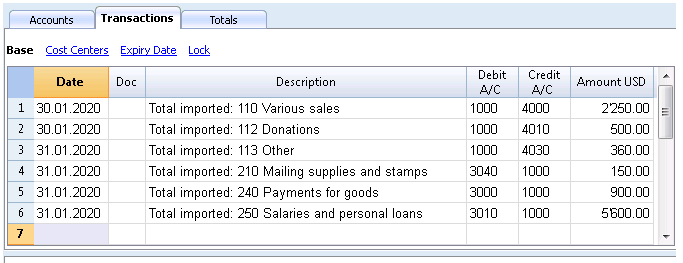

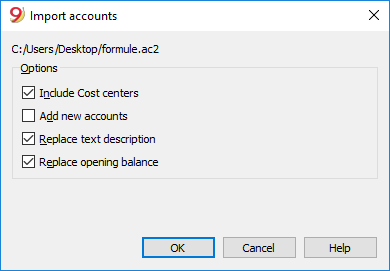

- select the Import to accounting command from the Account1 menu -> Import transactions

- click on the Manage filters button to see all the available filters

- click on the Update filters button

- enable the desired filters by selecting them and clicking on the Enable filters button

Importing Postfinance Xml file

Banana 9 imports bank statements using the new XML ISO 20022 standard. Postfinance supplies this format only when requested by the customer.

It is therefore necessary to ask your Postfinance consultant to change the format and switch to the ISO 20022.

Postfinance Business clients can ask to have the Pfd as well as the ISO 20022 format.

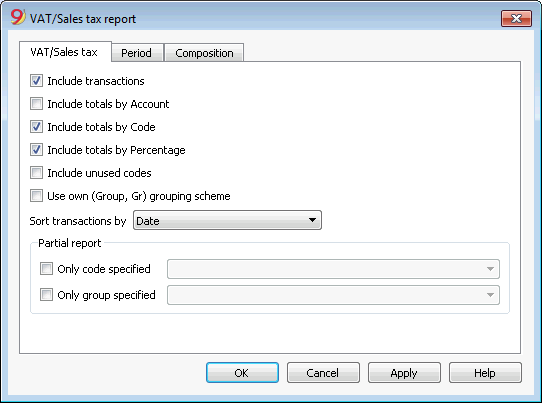

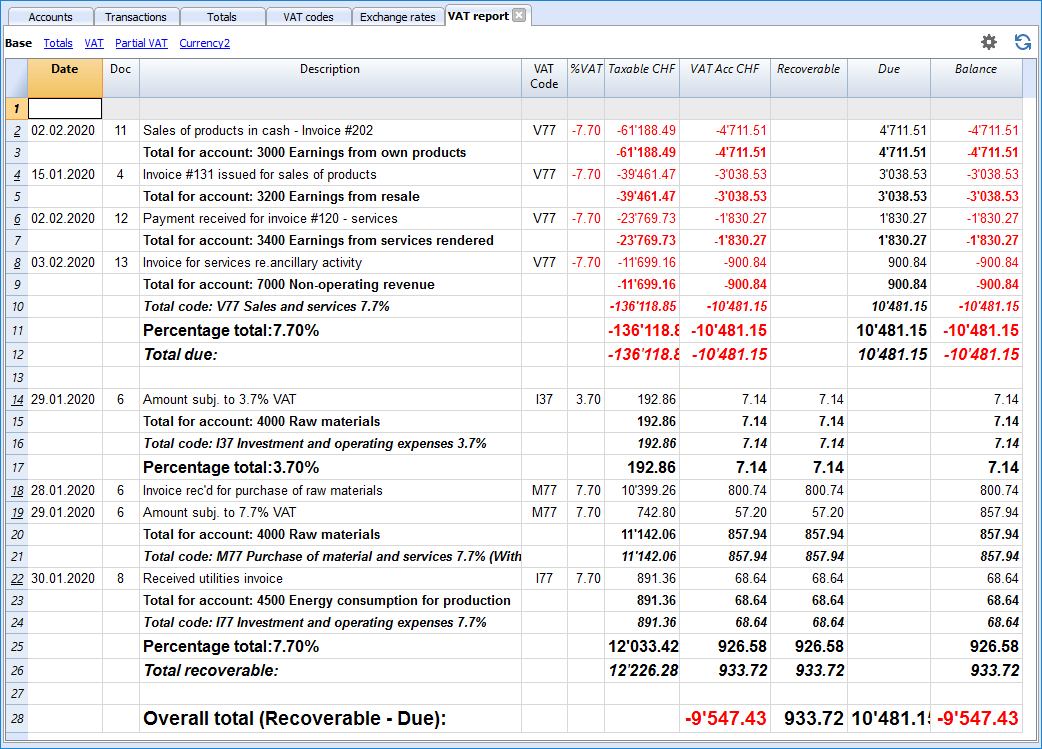

Swiss VAT Report

In order to obtain the quarterly Swiss VAT report, ready for the official form, proceed as follows:

- Apps Menu -> Manage Apps -> select Swiss VAT Report (effective method or flat rate method) -> press Install

- Once you have installed the Swiss VAT report App, when needed you just need to go to the Apps Menu and select it.

- In Banana Accounting 9, the VAT report will also be available for those who are submitted to the flat rate method.

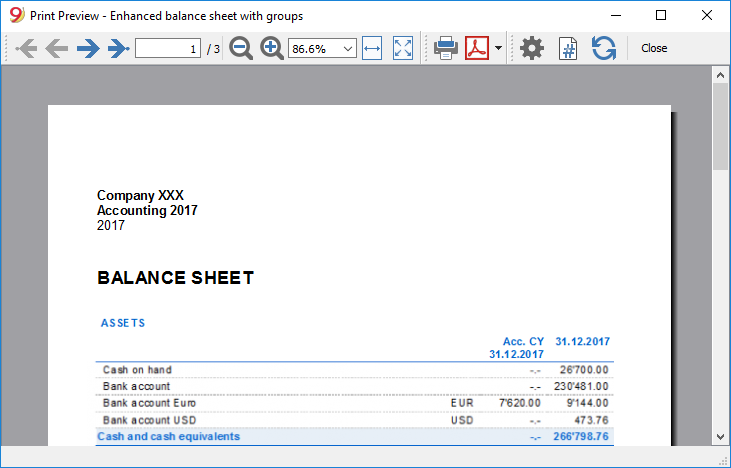

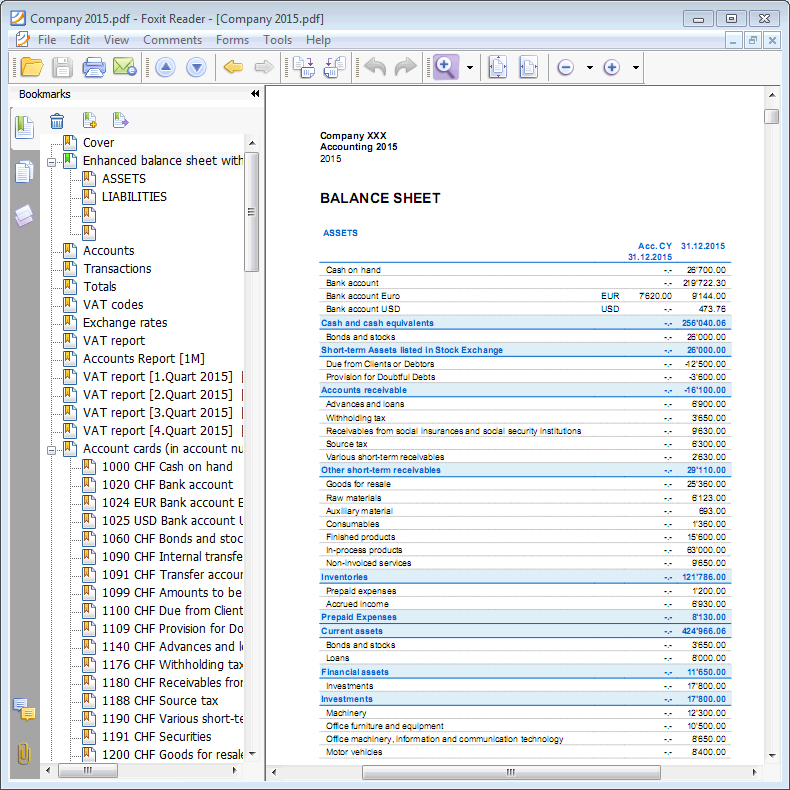

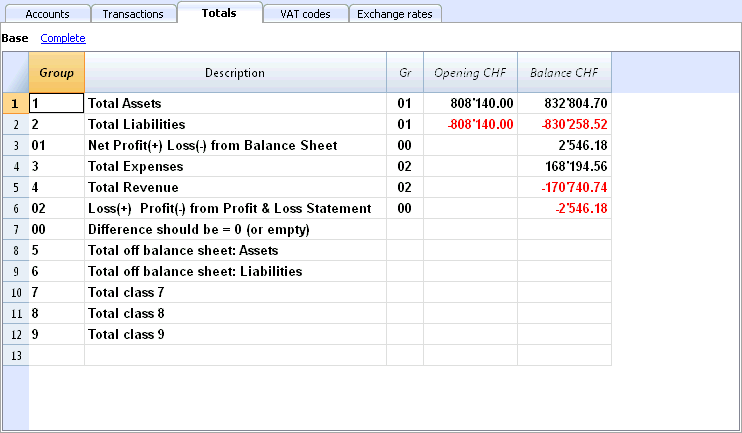

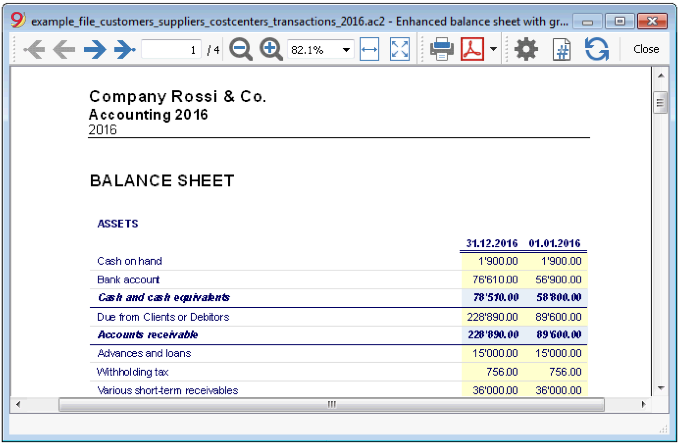

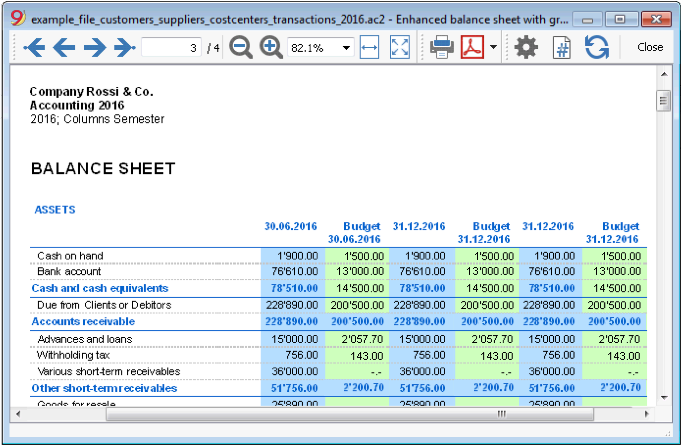

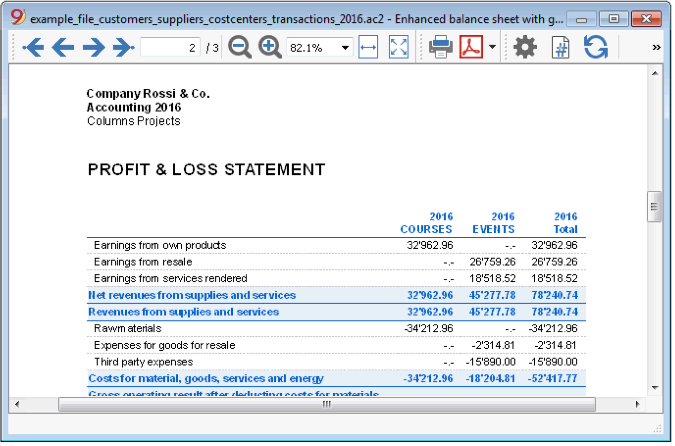

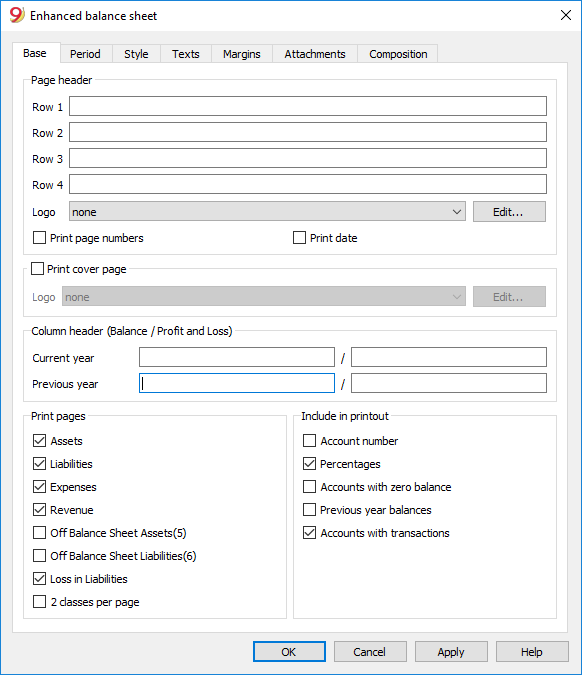

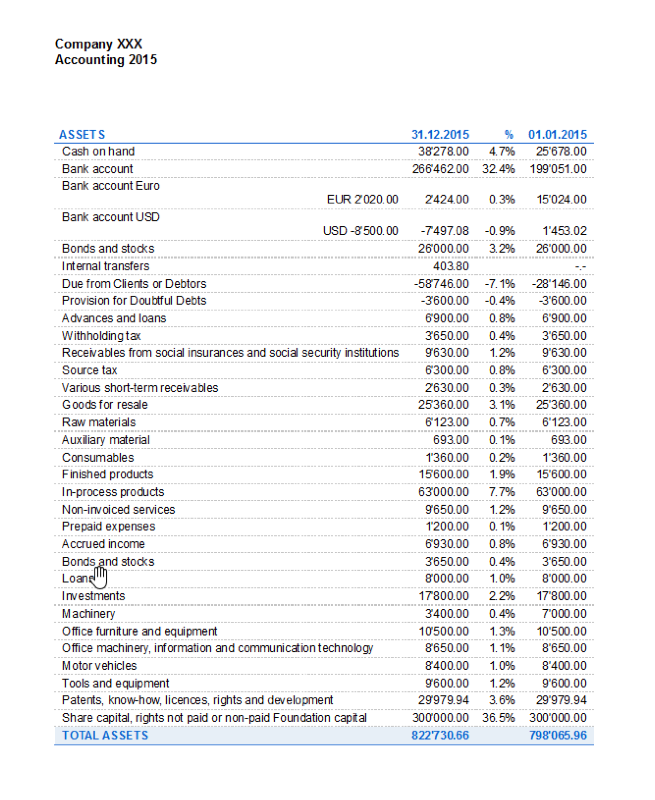

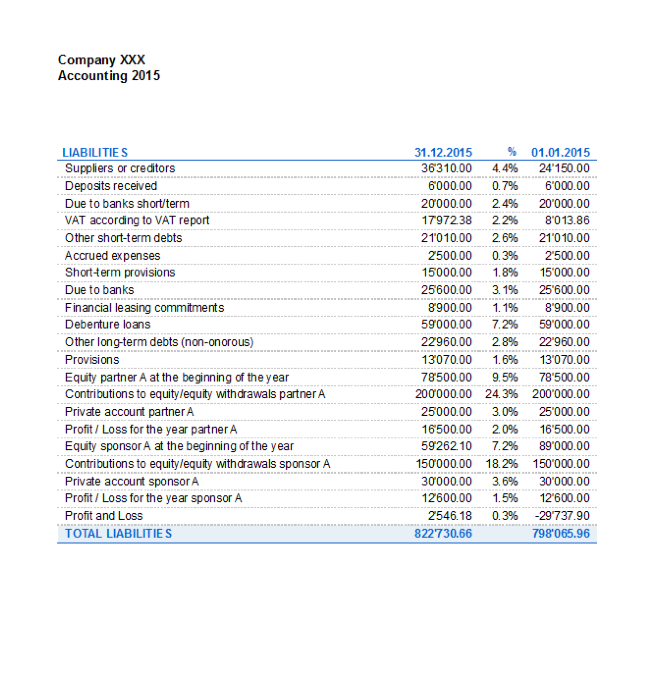

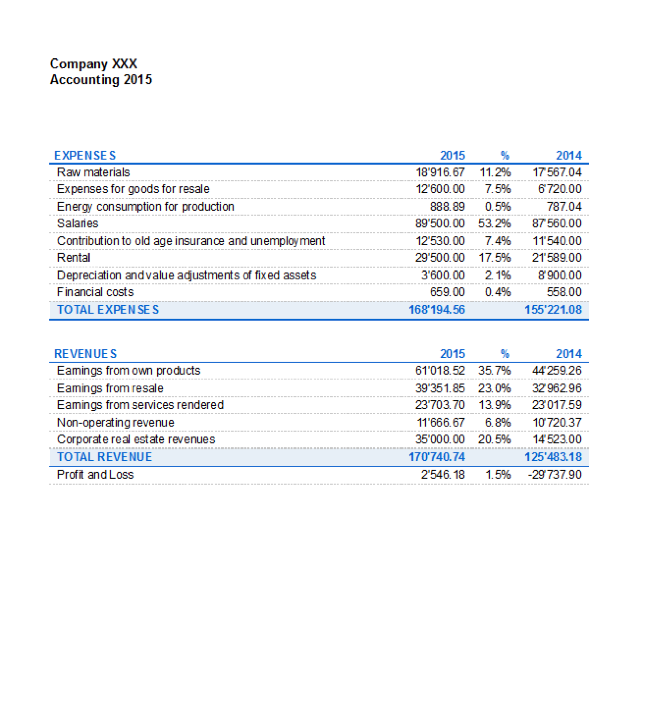

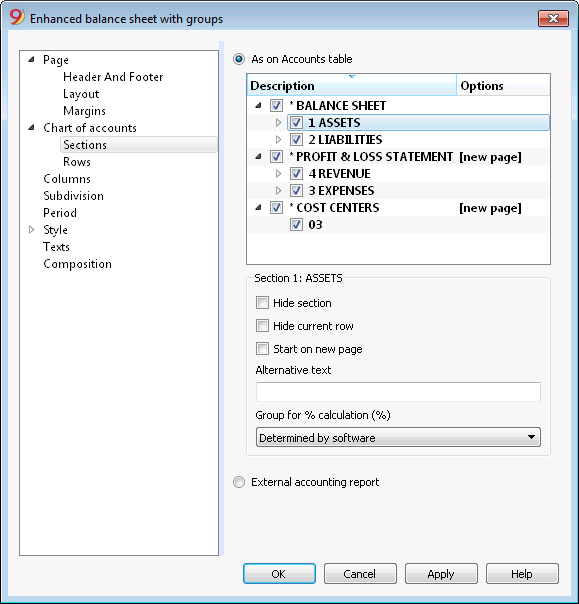

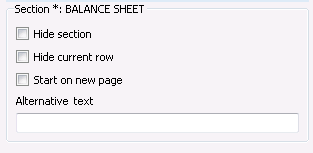

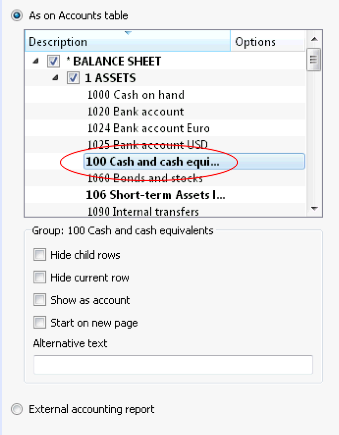

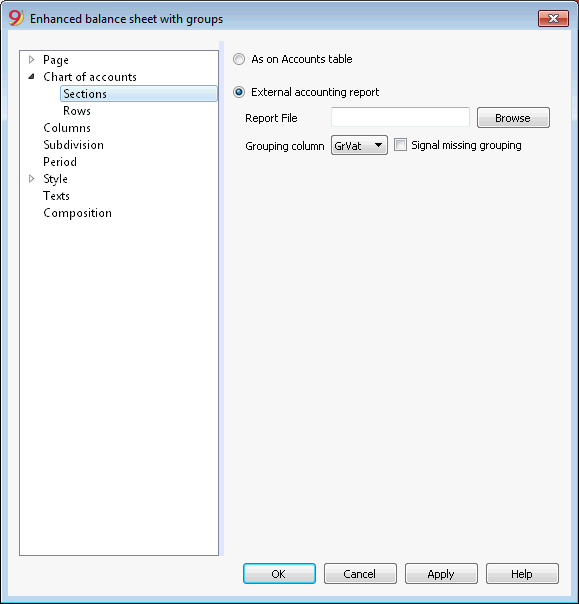

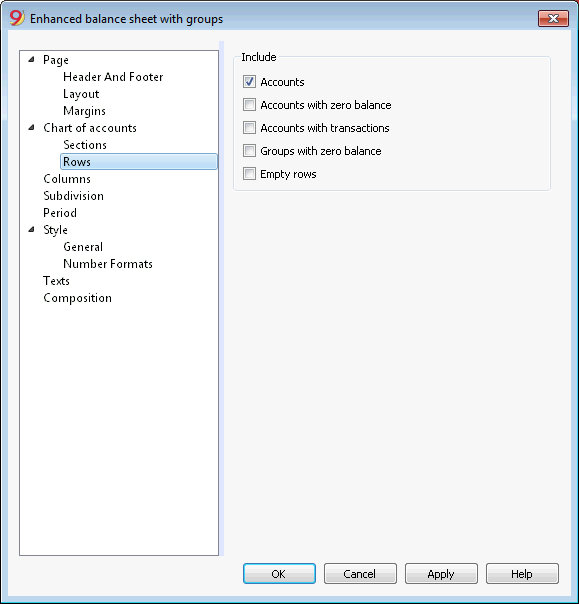

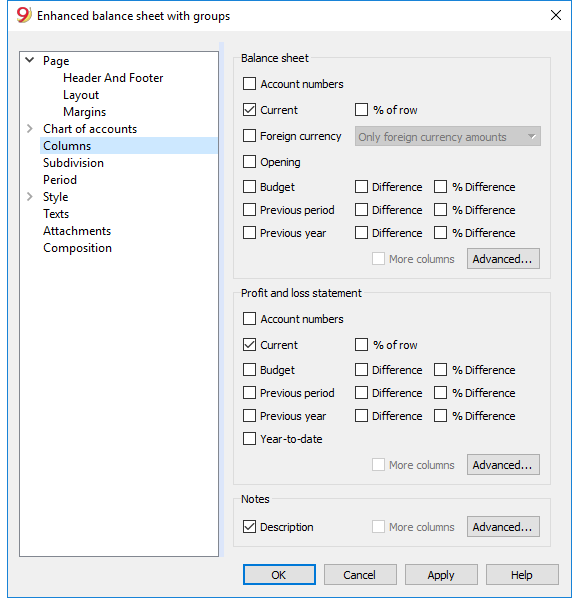

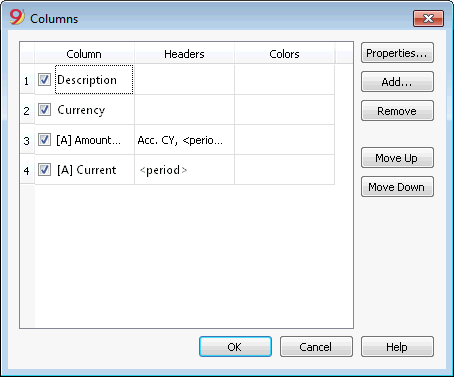

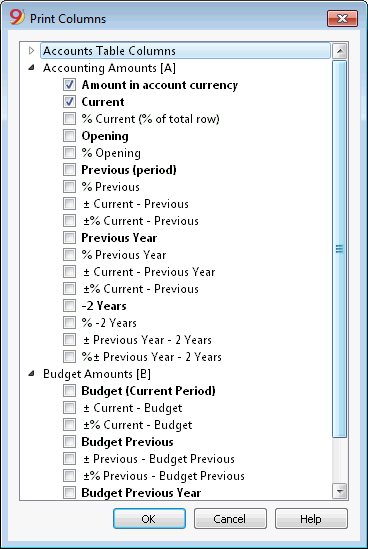

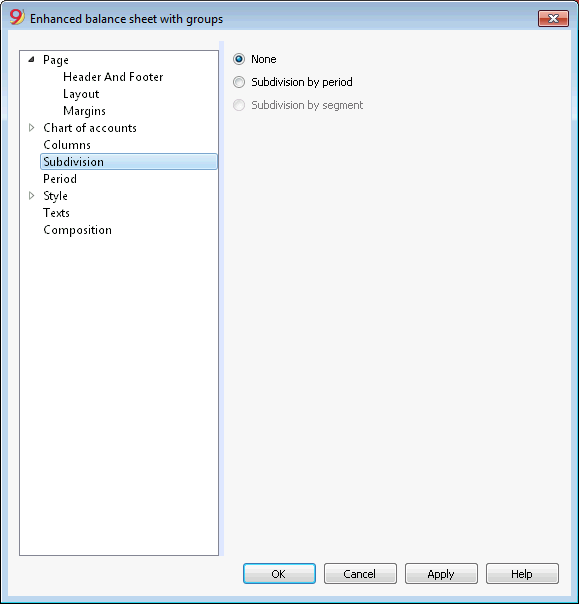

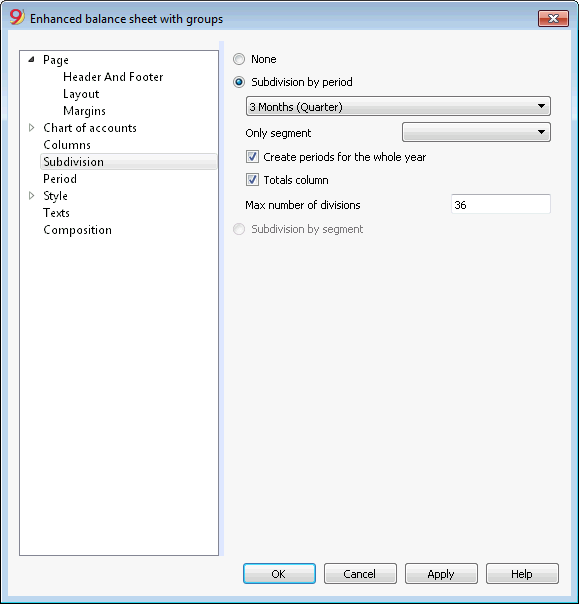

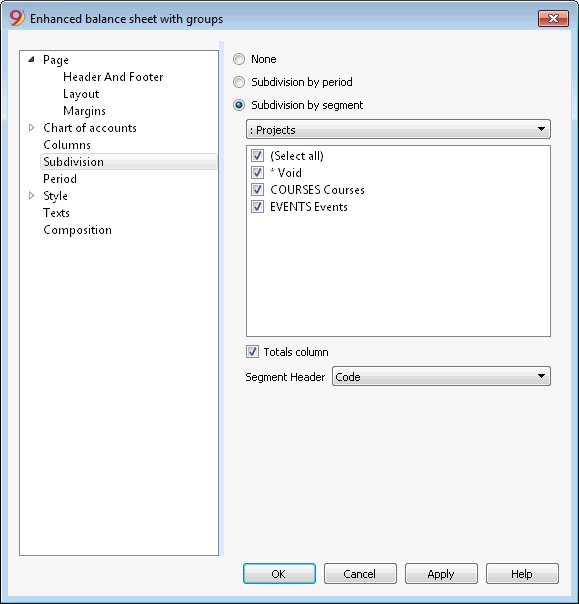

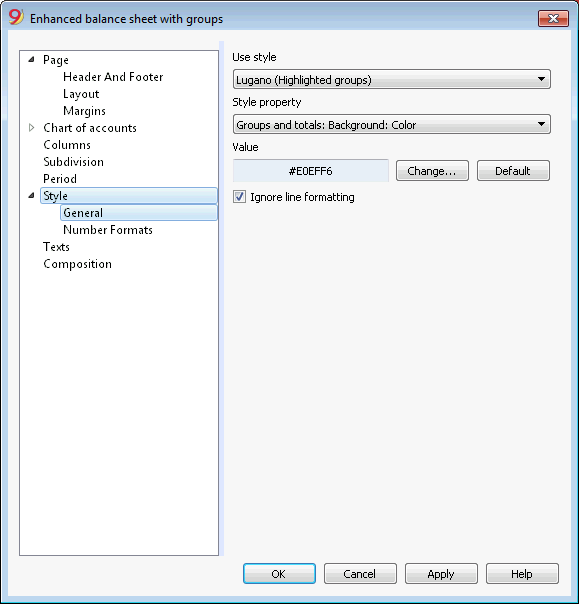

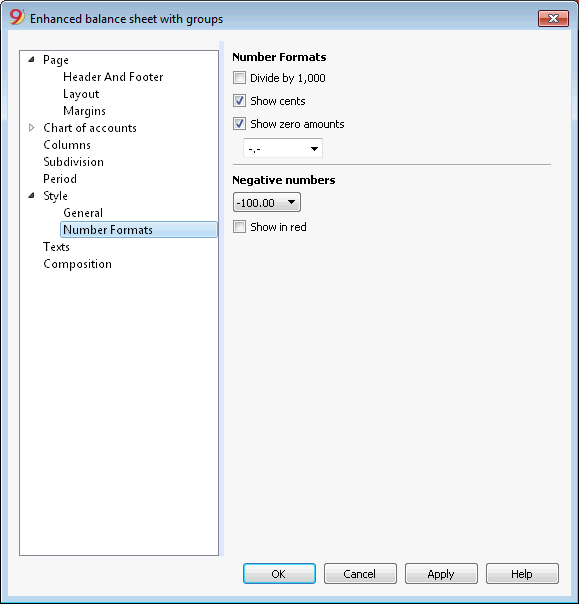

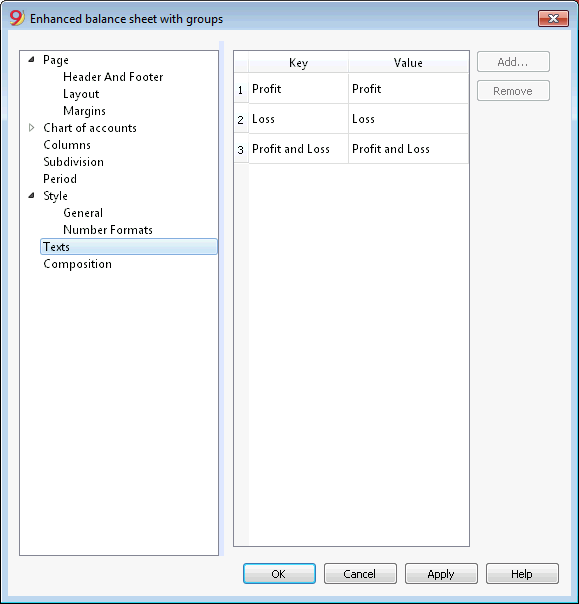

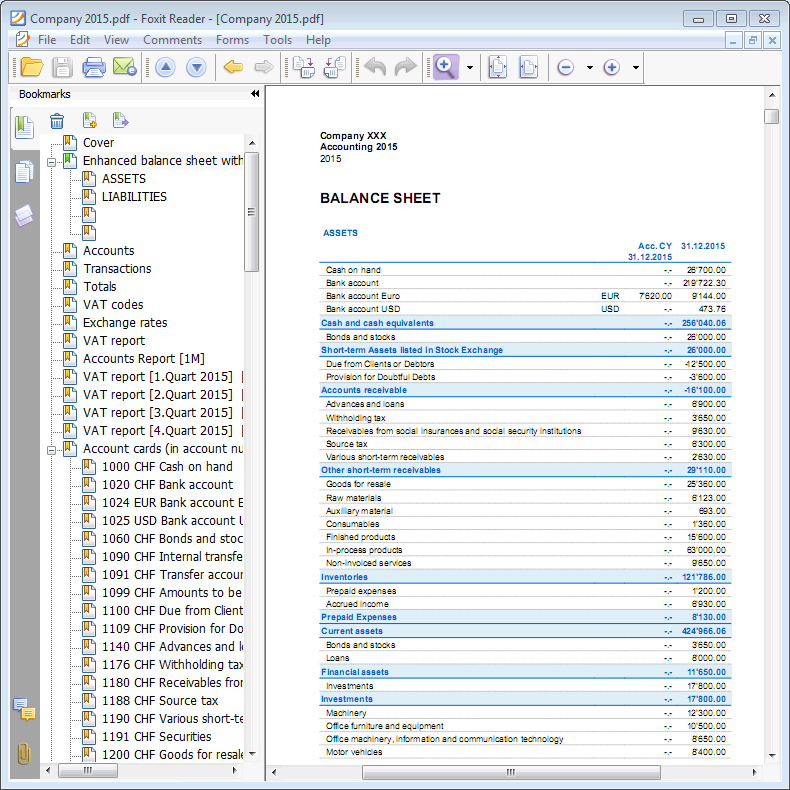

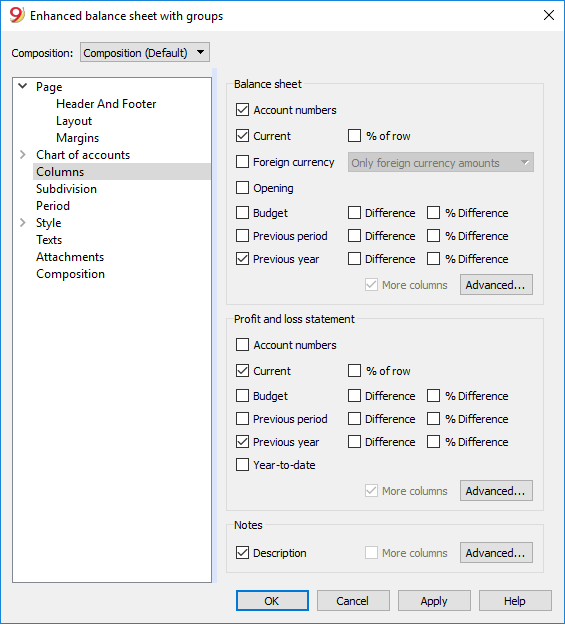

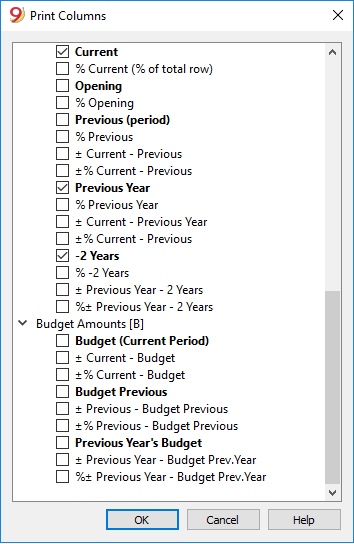

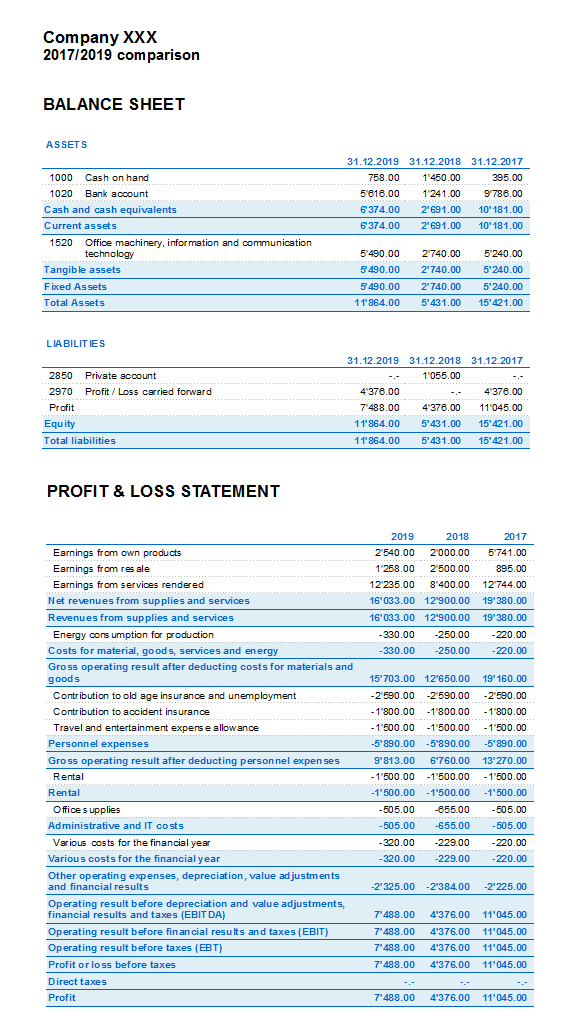

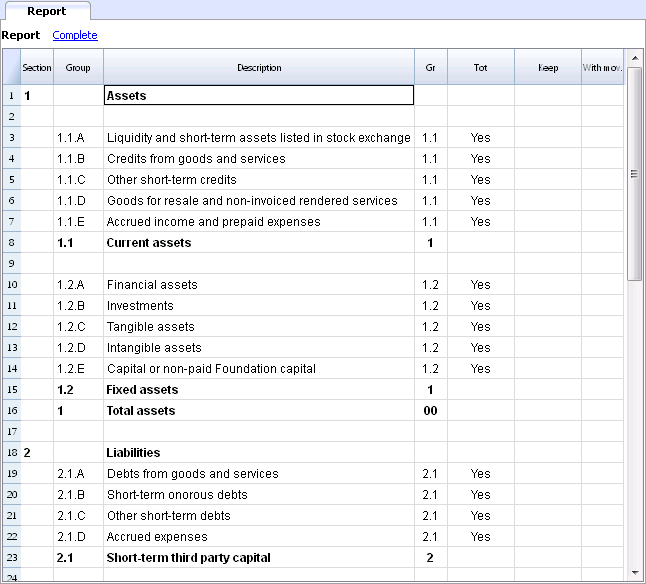

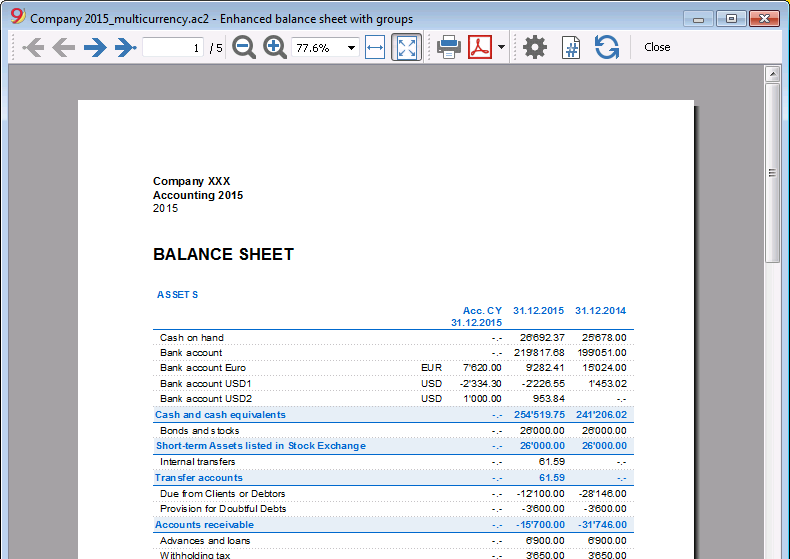

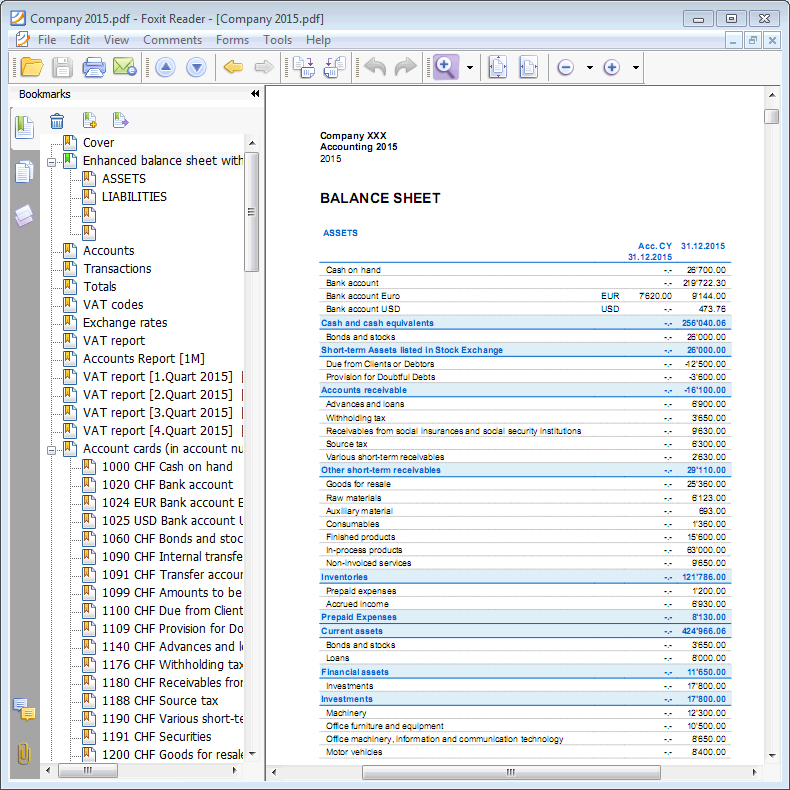

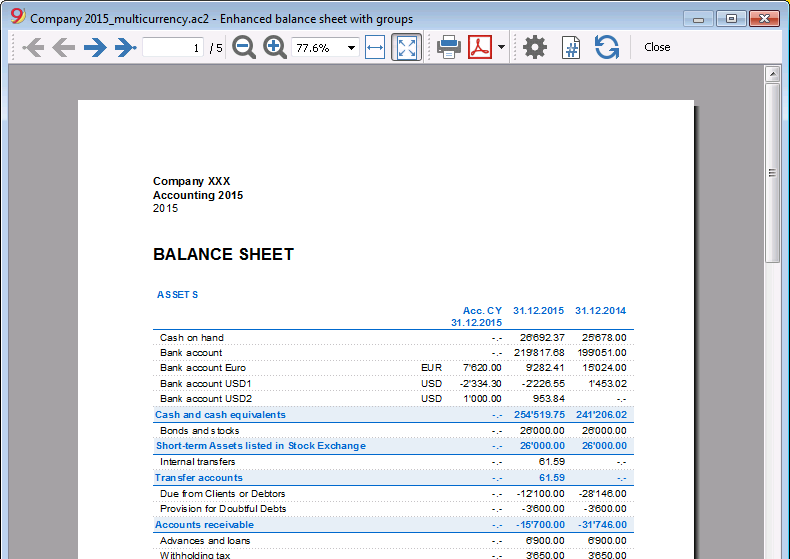

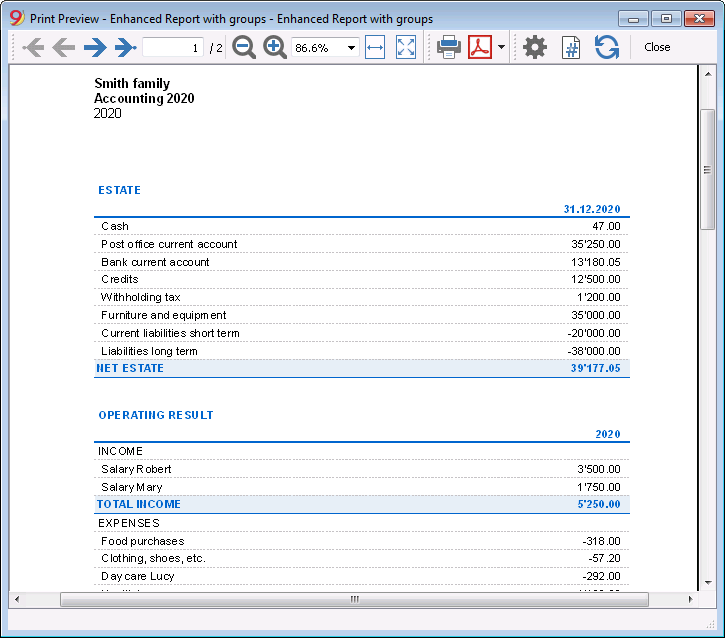

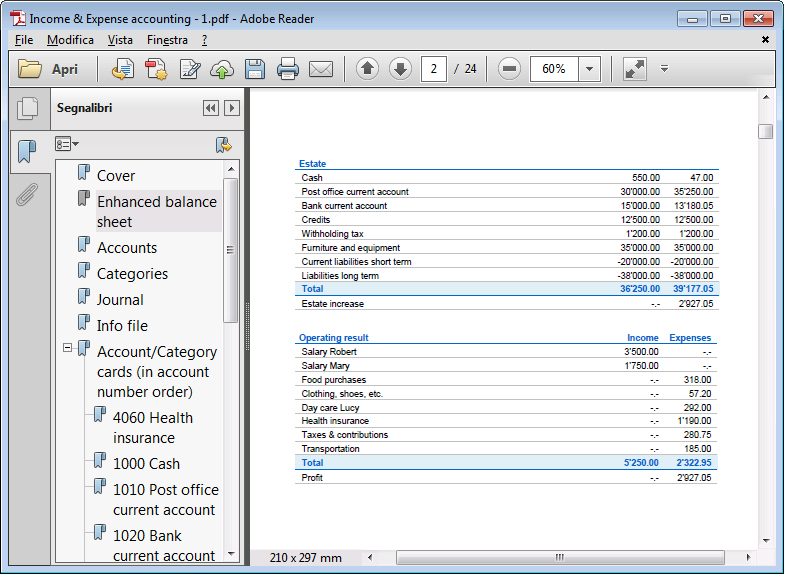

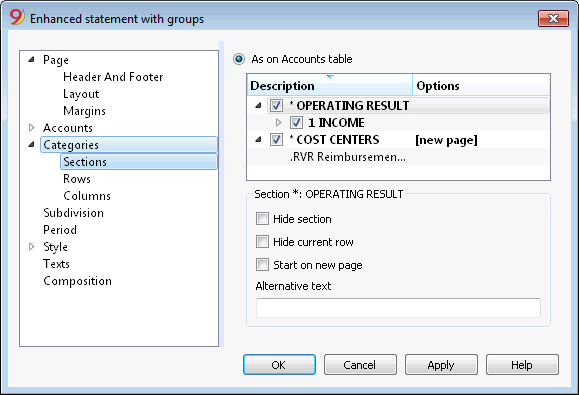

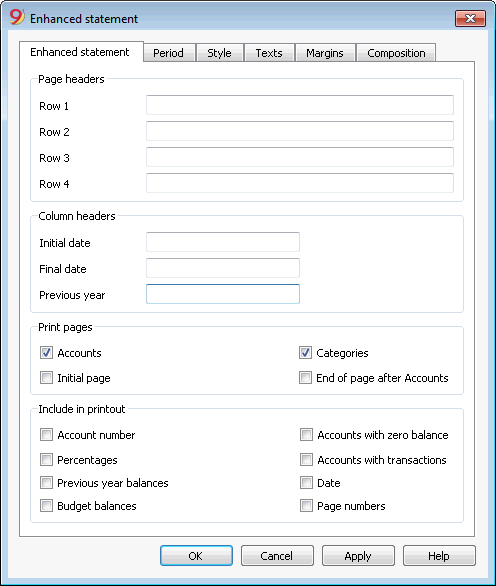

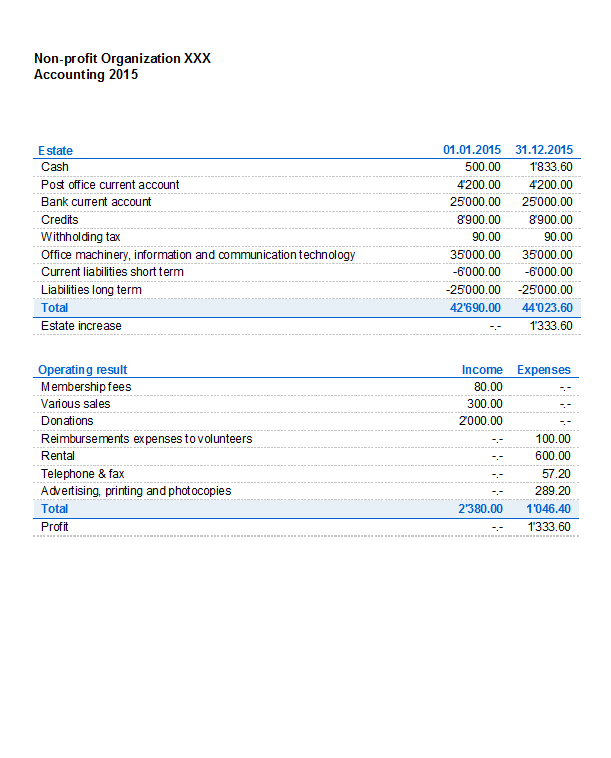

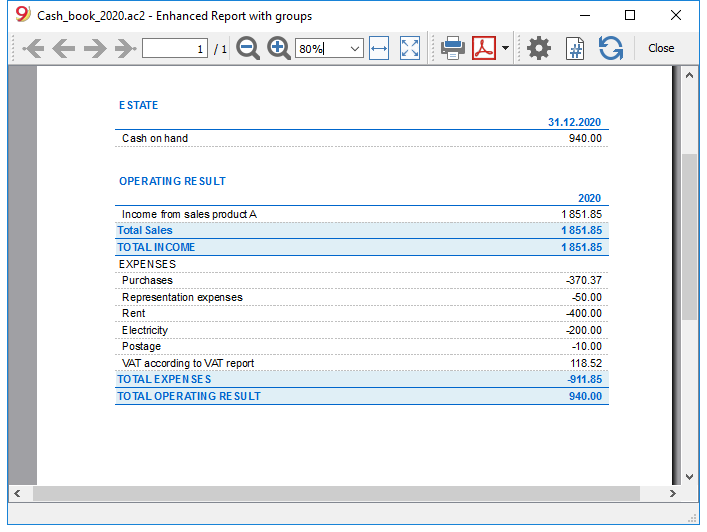

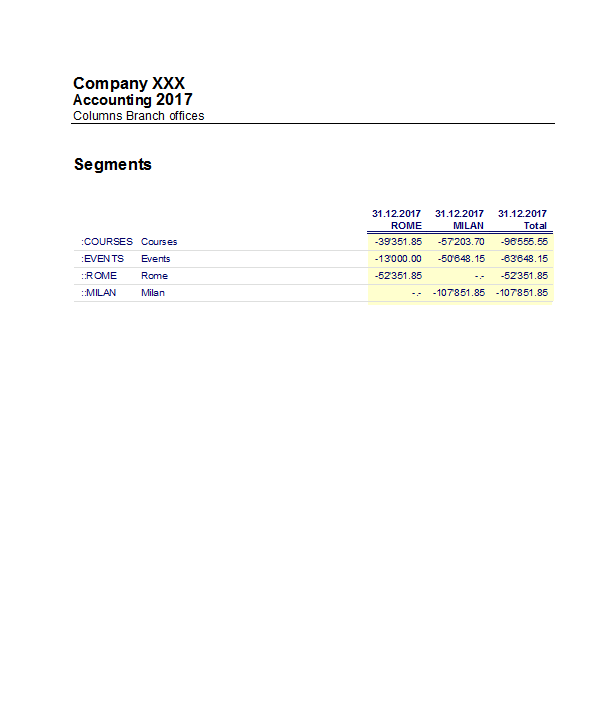

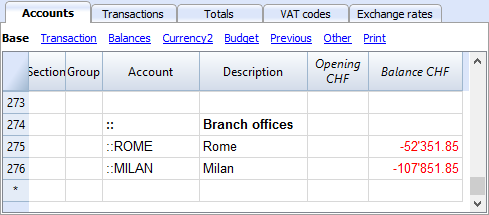

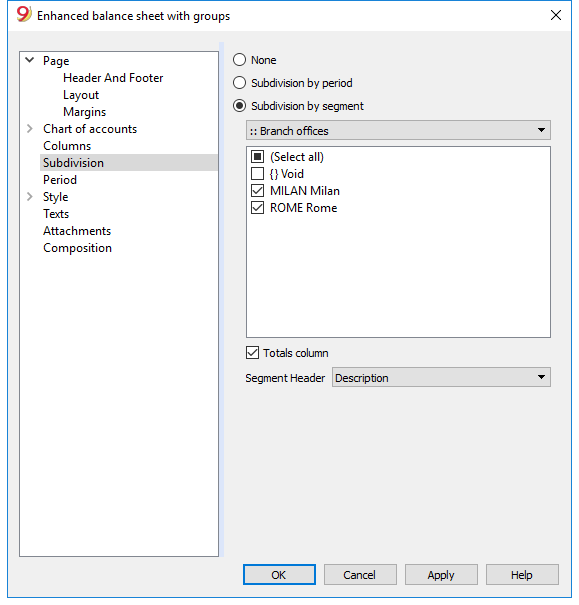

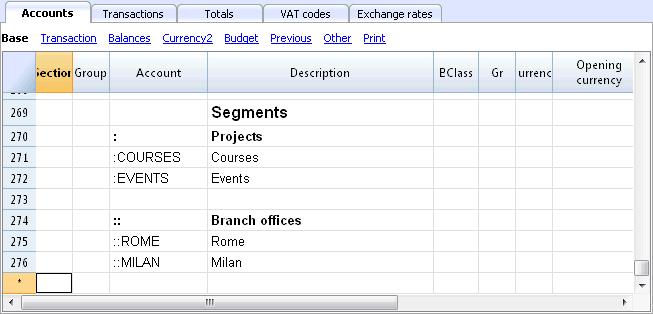

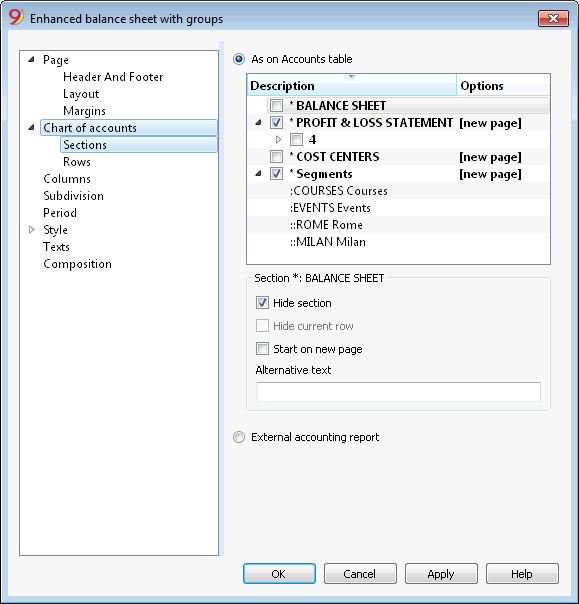

Enhanced Balance Sheet with Groups

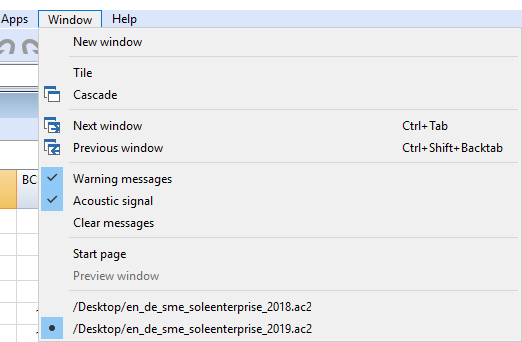

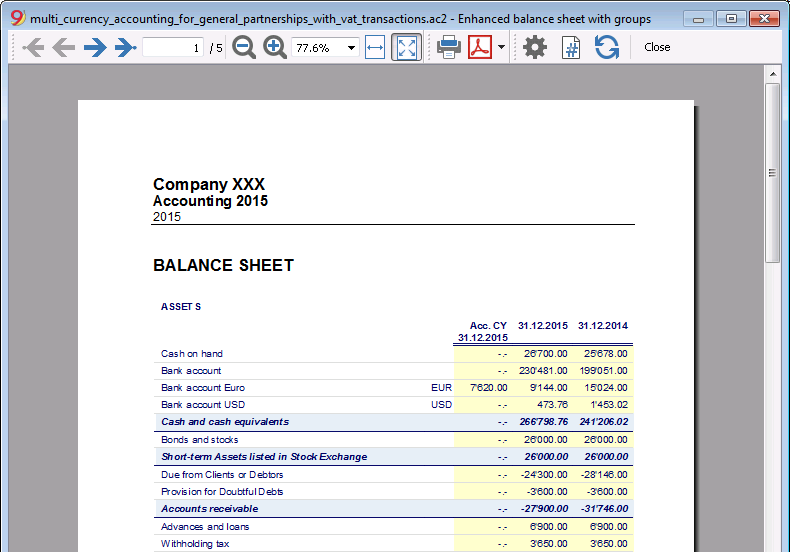

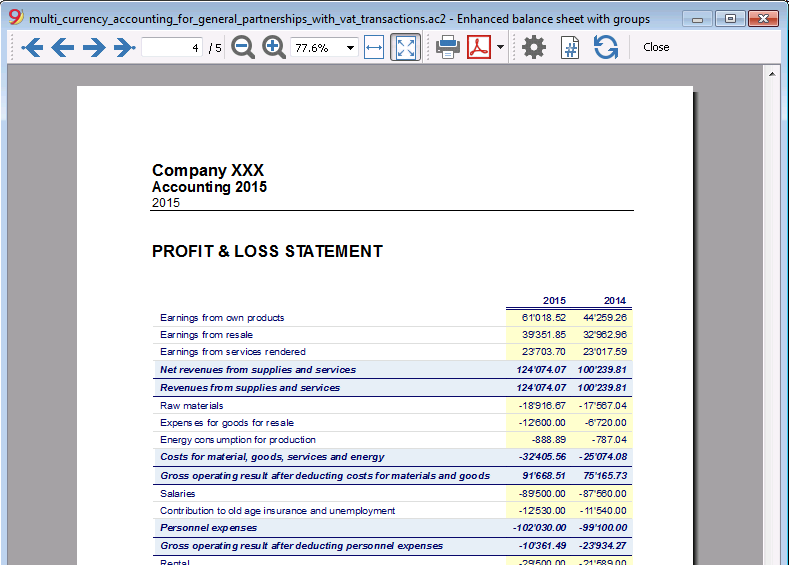

In the Enhanced Balance sheet with Groups (from the Account1 menu), in the Previous Year column, the balances that have been carried forward from the previous year's file are being displayed. If, in the Options tab of the File and Accounting Properties dialog window, no previous year's file has been indicated, then the balances will be carried forward from the Prior column of the Accounts table.

Changes from Banana 6 or previous versions

From Banana 6 to Banana 9 some functions changed their names:

- Data can be edited directly in the table cell (just like in Excel)

- With a double-click you go in the cell editing mode.

In order to open an account card or to access the Extract rows command, instead of the double-click you can use:- Alt + mouse click

- Right mouse click (opens the menu)

- A mouse click on the little blue arrow next to the account number (cell top left corner)

- The Messages window has been moved in the lower corner of the screen, next to the Info window.

The Messages window can be reached by clicking on the correspondent table. - The Views list has been moved to the top of the screen, just below the tables list.

- When scrolling the vertical bar, the table content now immediately scrolls too.

- In the transactions, the indication of the date and the document are not shown any more.

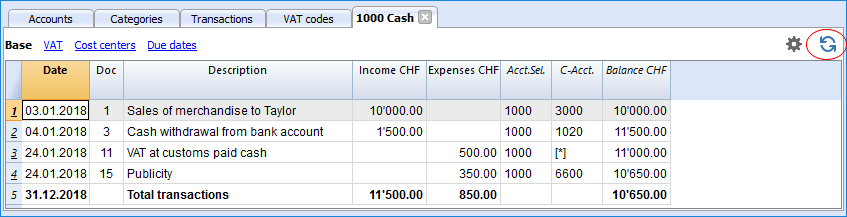

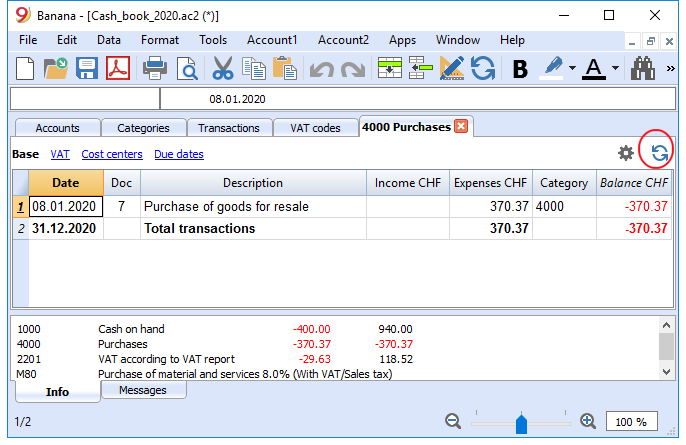

- From the Banana 7 version it is possible to update the account card (see refresh button on the top right corner); in Banana Accounting 6 it was necessary to give the command again.

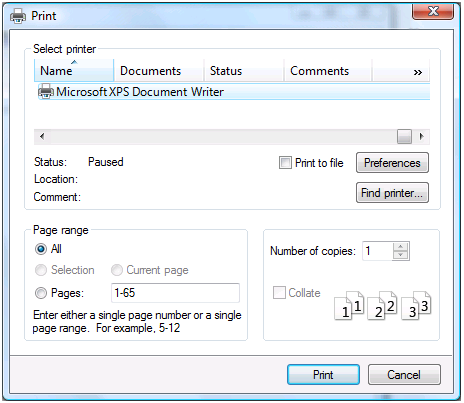

- When printing or when viewing the print preview, it is now possible to only print a selection of rows.

In the print dialog window, it is possible to choose if you want to print everything or just a selection (only in Banana for Windows). - In the Date column, by entering the “.” symbol, the program automatically enters the date of the day.

- Simple Accounting -> has been changed into -> Income & Expense accounting

- The Cash1, Simple1, Cash2 and Simple2 menus have been replaced by the Account1 and Account2 menus

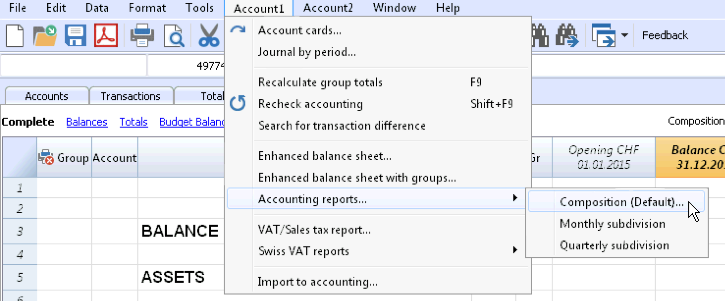

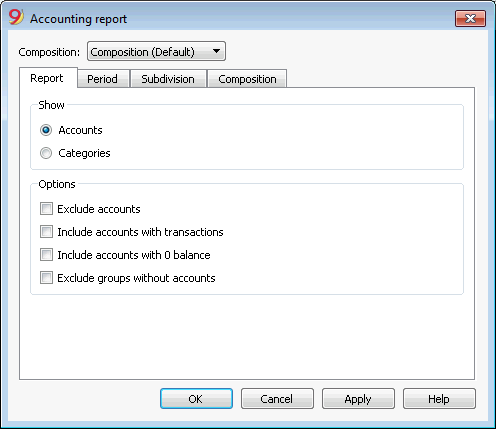

- Accounts by period -> has been changed into -> Accounting Report

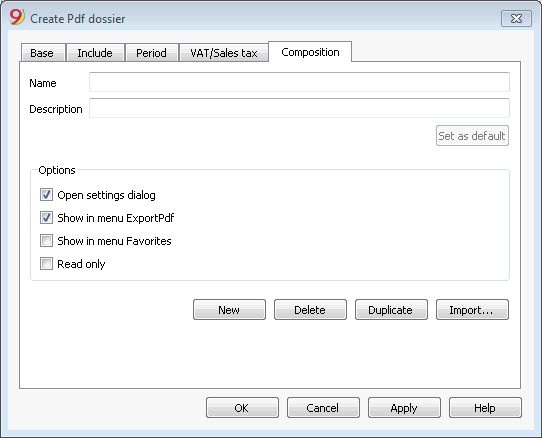

- Export file in pdf -> has been changed into -> Create Pdf dossier

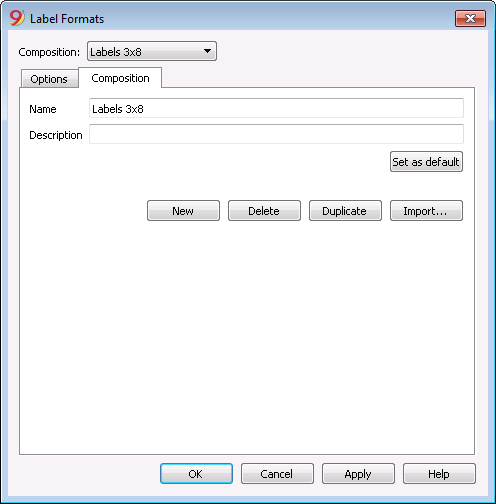

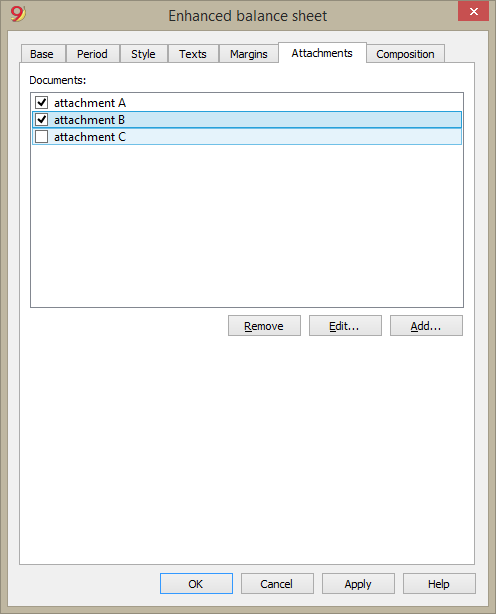

- In some functions, such as the Enhanced Balance sheet, ... a new submenu called "Compositions" has been created in order to recall saved personal settings (in Banana 6 they were called Favorites).

- In the Help menu "Keyboard Shortcuts", you find the list of key-combinations and the commands that are associated with them.

- In the Info and Messages windows, next to the error message, there is now the

symbol: if you click on it, you will be directly connected to the online page explaining the error message and suggesting possible causes and solutions.

symbol: if you click on it, you will be directly connected to the online page explaining the error message and suggesting possible causes and solutions. - DDE connections are no longer supported

Advanced installing

Installing on a computer that is not connected to the Internet

- Use a computer that has an Internet connection and download the installer that is suitable for the operating system of the computer on which Banana Accounting will be installed.

- Copy the file to a USB key or a CD.

- Enter the USB key into the computer where the program should be installed.

- Launch the installer.

- Start Banana Accounting and enter the license key.

Windows installation on a server or a USB key

Legal considerations

Remember that in order to execute Banana Accounting from multiple computers, you need to buy as many licenses as there are computers that use the program.

Banana with terminal server and package management systems

Banana accounting can, without any problem, be installed on a server, a terminal server, external disks or can be packaged for distribution, because:

-

Everything necessary to execute Banana Accounting is installed in the installation directory (exe, dll, examples).

-

Banana does not write in the system directories and the system registry.

- The user settings are stored in the registry of each user.

-

For each accounting, there is a single file that (as in Excel) can reside on a local disk, network, USB flash drive or a directory in DropBox, Google Drive, or other similar systems.

-

Banana is compatible with Remote Desktop systems or systems of software packaging for the installation.

For more information on the files, see also File - Save.

Installation on a shared folder, package management or USB key

- Follow the normal installation procedure, usually the program will be installed under C \ Program Files \ BananaXX \ (XX stands for the version number).

- Start the program BananaXX.exe "as Administrator".

- Enter and save the license key.

- Copy the entire installation directory on the USB key, shared folder or package management system.

- The USB key can then be used on compatible computers.

If there is any doubt that there might be compatibility problems with your systems, we recommend that you do an installation with the version of the program that you download from the internet, without a license key.

For more information on this subject, contact our technical support.

Apple/Mac server installation

It is not possible to install Banana Accounting on Mac servers.

The program must be installed and the license key must be entered on each computer.

Of course, you can save the accounting files on a network disk.

Associate .ac2 files with the most recent Banana version

When the Banana Accounting program is being installed, the "Associate Banana Accounting 9 with the AC2 file extension" option is activated by default; as a result all the accounting files will be opened with the new version.

If, when clicking directly on the file before opening the program, it should occur that the file gets opened with a previous version of Banana Accounting, this problem can be solved in the following way:

Windows:

- right-click on the file icon

- on the menu that appears select "Open with" and then "Choose Default Program..."

- choose the Banana program, the latest installed version.

Mac:

- right-click (or "ctrl "+ click) on the file icon

- on the menu that appears select "Get Info"

- under "Open with..." choose the latest installed version of Banana, click then on "Change All..." option.

Uninstalling Banana

Uninstalling Banana Accounting on Windows

- From the Start menu choose -> Control Panel

- Select -> Programs -> Uninstall a program

- Choose the program you wish to uninstall, for example a Banana Accounting old version

- Press the Uninstall button

By uninstalling Banana Accounting you will only deleting the program; your personal .ac2 files will not be modified.

Uninstalling Banana Accounting on Mac

- Go to the Finder

- Choose the Applications folder

- Choose the program you wish to uninstall, for example a Banana Accounting old version

- Drag the selected program into the Trash

By uninstalling Banana Accounting you will only deleting the program; your personal .ac2 files will not be modified.

Uninstalling Banana Accounting on Linux

For the details, we refer to our 'Installation under Linux' page: Packages .AppImage and Packages .tgz .

Interface

Improved interface

In the new version Banana Accounting Plus, you will find an updated interface, with very intuitive and functional menus, so you can access the commands much more quickly.

We advise you to switch now to Banana Accounting Plus and take advantage of the many new features.

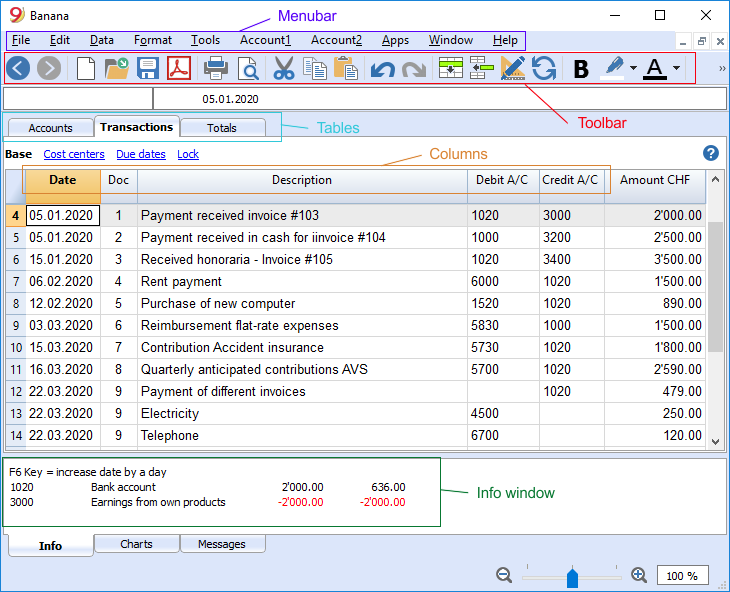

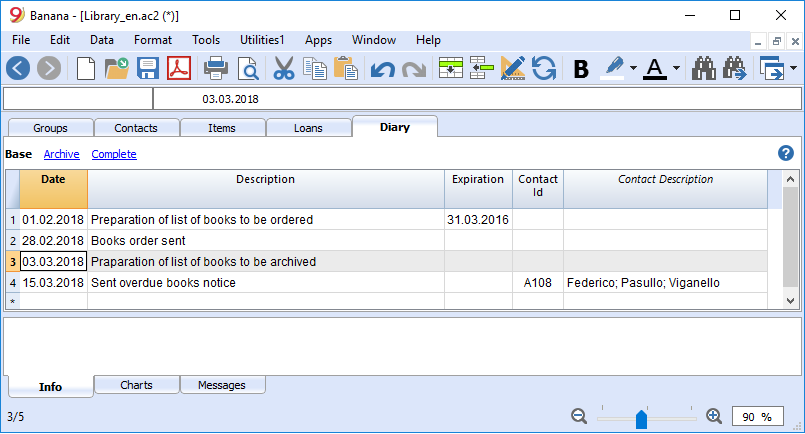

When a new file is being created or an existing one is opened, the software presents a structure that is characterized by the following elements

The menubar

The menu bar contains commands grouped by menu.

The menu bar consists of:

- General menus: File, Edit, Data, Format, Tools, Apps, Windows, Help

- Menu's specific to the type of file used. The commands are different depending on the application used.

- Accounting applications (Cash book, Income & Expenses, Double-Entry Accounting):

Account1 and Account2 menus

- Accounting applications (Cash book, Income & Expenses, Double-Entry Accounting):

- Utility Applications (Time Sheet, Address Book, Library, Fixed Assets register)

Menu Utilities1 and possibly Utilities2

Attention: in the Mac operating system, the Banana menu bar is located on the top of the screen, at the rightside of the apple logo:

The toolbar

The toolbar contains icons that allow you to access the most used commands and dialogs.

If you go over the icon with your mouse a command description will be displayed.

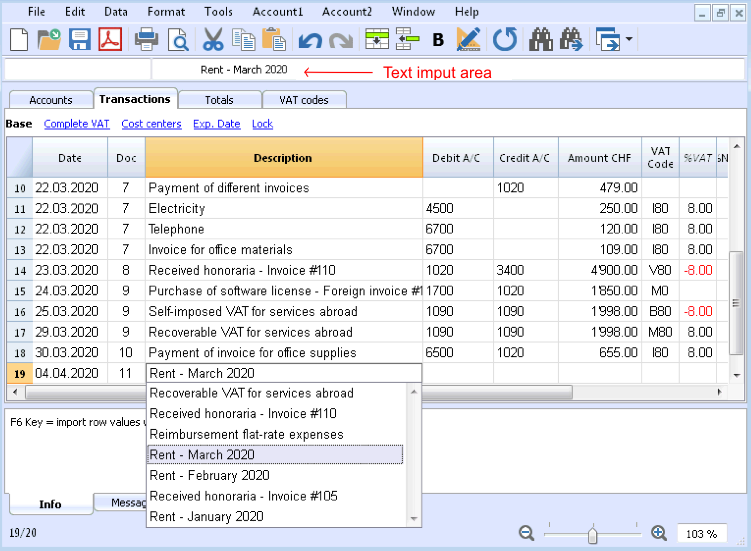

Text input area

Text are entered directly in the cell. The entered text is also shown in the text input area, right below the toolbar.

Editing a text

- double click on the cell

- press on the F2 key

- pres the spacebar key (you will be able to edit an empty cell)

Short-cut keys for editing

- If you press "." on a Date column, the software will enter today's date

- If you press "." on a Hour column, the software will enter the current time (for example in a Time sheet management file)

- when the Smart Fill option is activated, you select your choice with the combination Ctrl + arrow down keys - the software will accept your choice and move to the following cell.

Other very useful short-cut key are:

- F4 key (or Cmd+4 on Apple computers) - copies data from the cell above

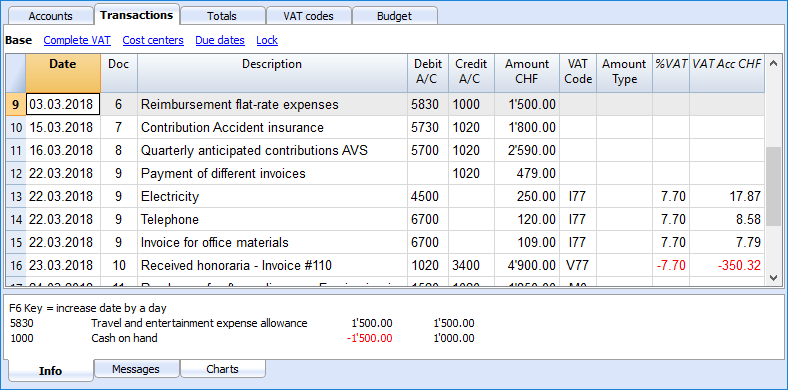

- F6 key (or Cmd+6 on Apple computers) - different features depending on the cell you are in. See below.

You can always view the short-cut keys list from the Help menu - Keyboard shortcuts command.

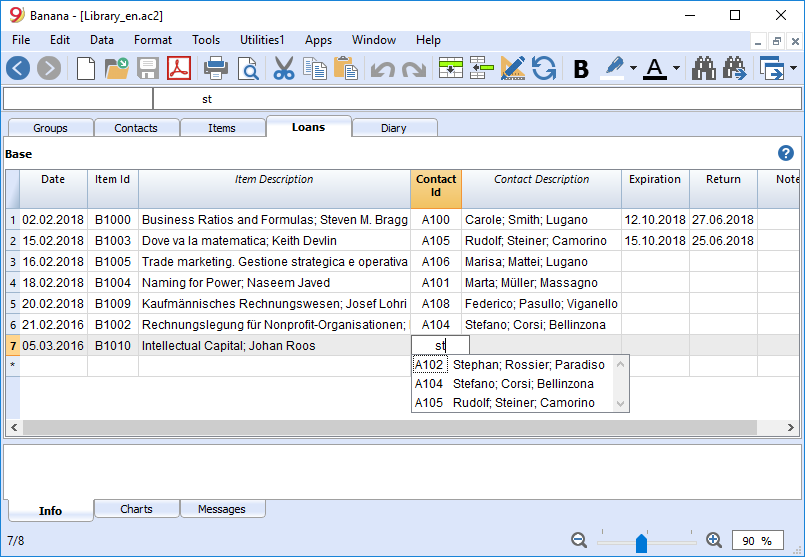

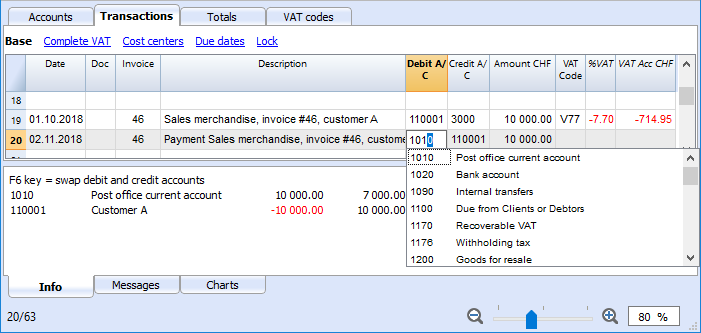

Suggestions and auto-complete function

If the Smart fill (Autocomplete) option is activated (Program Options command from the Tools menu), a drop-down menu will be shown with all the possible text choices: you can then select the chosen text in different ways:

- press the Enter key - the program will accept your choice and move to the following cell on the right or below (depending on your settings)

- press the Tab key - the program will accept your choice and move to the following cell on the right

- press the Shift + Tab keys - the program will accept your choice and move to the following cell on the left

- or the F6 key (or Cmd+6) - the program will accept your choice and execute the associate command (see below)

The program will suggest some choices (similar transactions, accounts or VAT codes) based on the entered text.

You must scroll with the arrow down key and select the appropriate choice.

The program will select for you:

- Transactions starting with the same text (if any)

- Elements containing the entered text anywhere. For example the account 1000 cash will be shown by the program as soon as you type 10 or just "cash".

Integrated calculator

If you need to execute a calculation, you can just position yourself in any non protected Amount cell and enter your calculation: as soon as you press the Enter key the program will execute the calculation showing the result. This is a practical and time saving tool if for example you need to enter in the program only some amounts of a paper document or if you need to enter a percentage.

This feature is available in all tables and in all Amount columns.

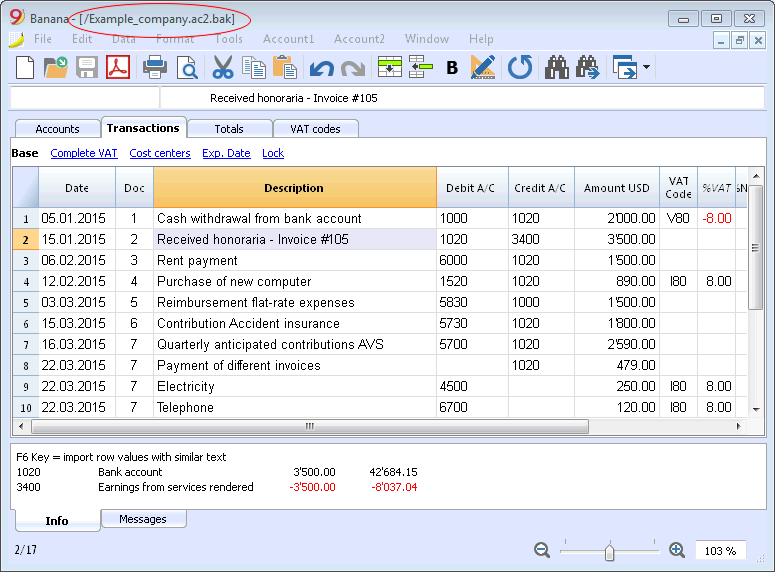

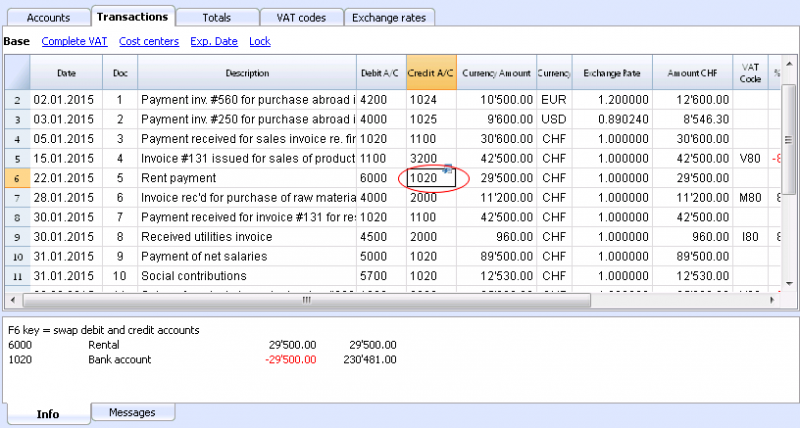

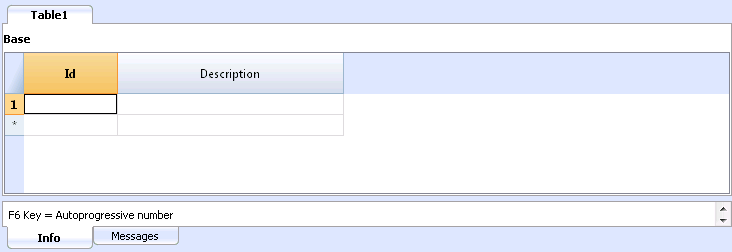

Execute command (F6 key)

Some columns are associated with certain actions that can be executed with the Execute command (from the Edit menu) or relative touch key (F6 or Cmd +F6 for Apple computers) as indicated in the information window.

Some examples:

- Doc column: recovery of recurring rows or progressive number

- Description column: recovery of similar row data

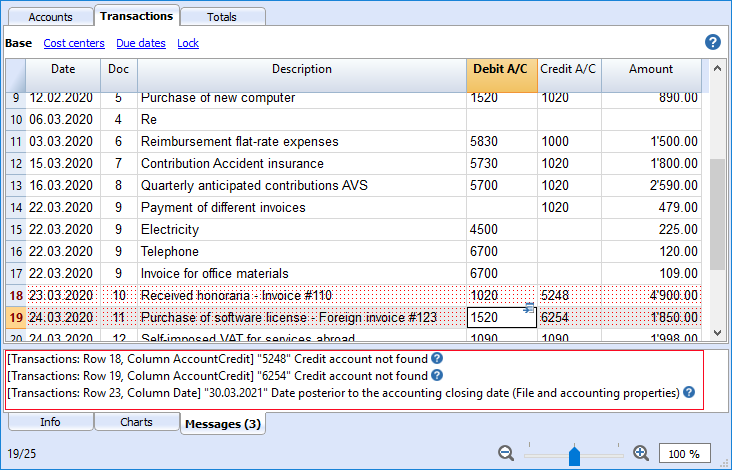

The tables

Each accounting file has various tables. Some of them are main tables and others are optional. Tables vary depending on the chosen accounting type.

In case of tables generated by the user, such as an Account card, in case of adding/modifying data, just click on the appropriate icon to update the table with the new data.

Print everything you see on the screen

In addition to the various reports available, Banana Accounting allows you to print everything you see on the screen, in any table.

For more information visit the Print/Preview page.

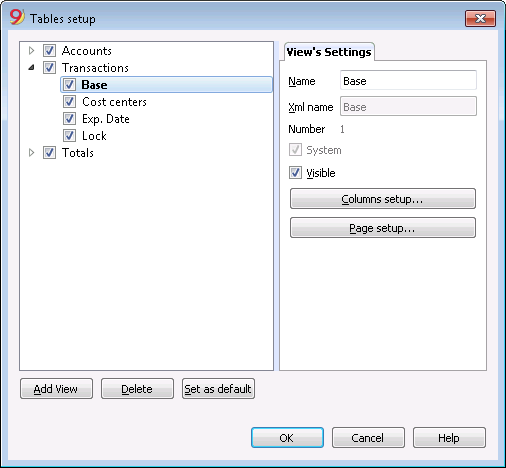

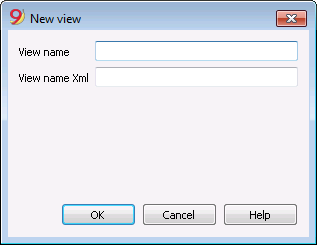

The views

The views are ways of showing the accounting data with specific columns. For each table there are different views and they are very useful when you want to show your data in different ways, without altering your basic settings.

Views are located right below the tables and can be personalized using the Tables setup command from the Data menu. You can also create new ones.

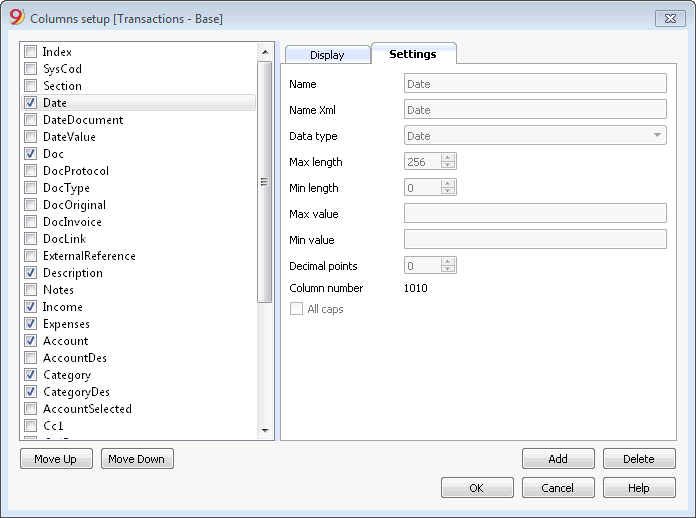

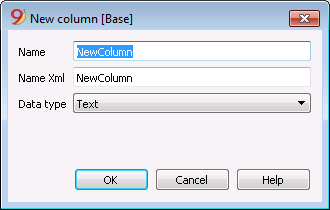

The columns

Columns are the table vertical elements. Each table has specific columns with specific headers. The display, size, description, format, width, style, alignment can be edited thorough the Columns setup command from the Data menu.

Some columns contain data entered by the user, and some others can only be used by the program and cannot be edited by the user (for example the account cards columns).

Users can add new columns in order to include additional information (always with the Columns setup command from the Data menu), but the data entered will not be processed by the program.

A group of specific columns composes a view that displays only specific data.

The information window

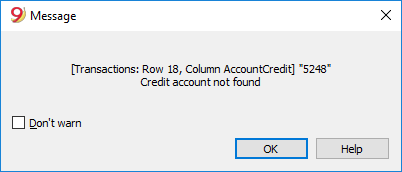

This is a window located in the lower part of the screen, where the program displays useful information related to the active table and cell. Error messages are shown in red.

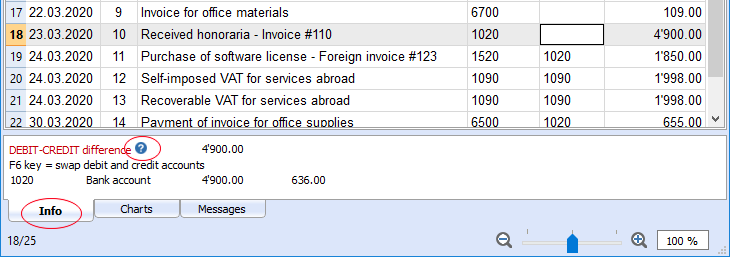

The Message dialog window

When an error occurs, the program displays the error in the Message window, indicating in which row of which table the error is located. It also shows a description of the error.

- By clicking on the Help button you will be addressed of the online page where the error is explained, along with possible solutions.

- All error messages reported by the program are saved in the Error Message window.

The Error Messages window

The Messages windows contains a list of the errors found by the program.

In order to read the messages click on the Messages tab.

- From the Messages window, by double clicking on the error message, you will be taken to the row that generated the error.

- If you click on the help symbol next to the error message

you will be taken to our online documentation page where the error is explained, along with possible solutions

you will be taken to our online documentation page where the error is explained, along with possible solutions

Table help

From version 9.0.4 of Banana Accounting 9, a help button has also been introduced in each table, on the top-right corner.

By clicking on the help button you will be automatically addressed to our online documentation page where that specific table is described.

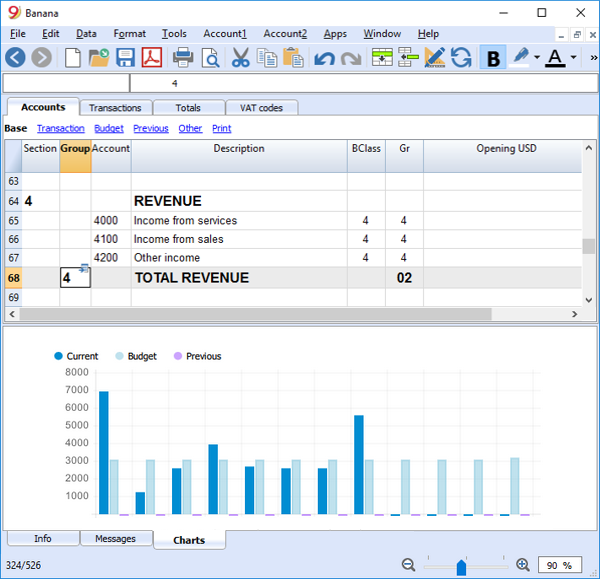

Charts window

Graphs are integrated in the program: you can now generate graphs directly in Banana accounting. By selecting an account or group, it is possible to display a chart in the charts window at the bottom. The graph will allow you to instantly visualise the evolution of your situation, and even allow a comparison between your forecast and your actual figures.

Status bar

Status bar is located at the very bottom of the Banana Accounting window and contains the following information:

- row number of the selected cell

- rows in the table

- if you select more than one cell (amounts or time)

- Calculator: the software counts the amount of selected cells (if they contain numbers)

- Value sum

- Zoom - you can change the window zoom from here

Date and numbers format by per default

Once the program is installed, it automatically uses as default your operating system settings.

If you wish to change your operating system settings, you should go in your Control Panel (Windows) or your System Preferences (Mac).

Here is the step by step process on Windows 8 and Windows 10:

- from the Start menu, go to the Control Panel

- click on International options and then on Change date, time or numbers format

- a dialog window will appear where you can change your data format (in the Format tab)

- in order to change your numbers or currency format, from the same window you can click on the Additional settings button and then on the Numbers or currency tab.

Here is the step by step process on Mac OS X 10.9.5:

- from the Apple logo (on the top left of your screen) click on System Preferences

- from the dialog window that appears choose the Date and time icon

- a new window will appear where you can choose Open language and zone...

- a new window will appear where you can click on the Advanced button

- finally a new window will appear where you can change the numbers format (General tab), date or time format (Date and Time tabs)

Format and numbers in Banana Accounting

Cells

Copy, Cut and Paste

It is possible to copy/paste cells, rows or selected text just as it is possible to do with any normal Windows program:

- Select the line or the area of data to be copied

- In the Edit menu, select the Copy or Cut command

- Move to the row or the area where the information should be copied

- From the Edit menu, select Paste

The user can also copy/paste by using the following icons  or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

There are also commands such as Copy rows, Delete rows and Paste rows: in this case they refer to a full row or rows and not to a cell selection. For this purpose the commands Copy, Cut and Paste should not be used.

Entering a text

In order to enter a text position yourself in the cell you wish to write in. With a double click on the cell a drop down menu will appear with all the text previously entered; as you start writing the program automatically suggest similar text previously entered; select the appropriate text and:

- press Enter - in order to automatically enter the selected text

- press the F6 key - in order to automatically enter the selected text + all other row data (debit account, credit account, amount, ...)

Editing a text - Smart Fill

From the version 7 of Banana Accounting it is possible to edit the text directly in the cell; just double-click in the appropriate cell (or press the F2 key) and enter the new text. Also when editing the texts, the Smart fill and autocomplete texts feature suggests earlier entered texts.

It is also possible to edit a text selecting the cell and entering the new text in the text input area, under the toolbar. On the left side of this area, two icons will appear to undo or accept the entered text.

Wrap text

When the text for a row is very long, the Calculate row height command from the Format menu allows the user to view it completely, adapting the height of the row.

To adapt the height of the row to the text, the user should:

-

choose the Columns setup command from the Data menu;

-

select the appropriate field name;

-

activate the option Wrap text in the Display tab;

-

recall the Calculate row height command from the Format menu each time it is necessary.

The Calculate all row heights command is equal to the one described above, with the difference that it operates on all rows of the table.

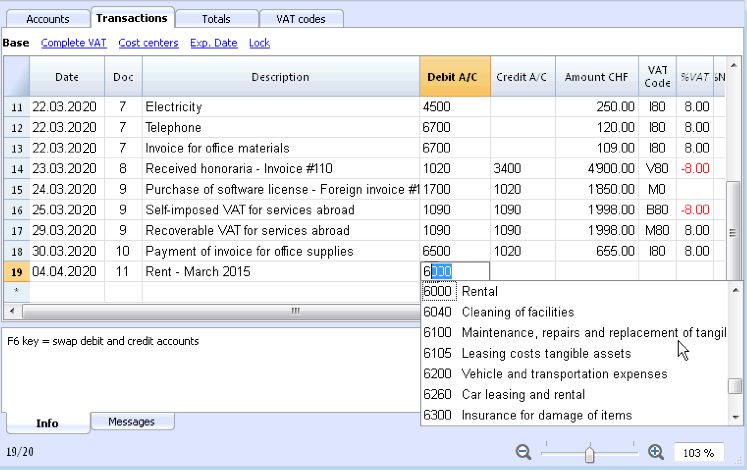

Entering an account number

Position yourself in the Debit or Credit account column and start entering the account number or account description; the program will suggest you all the accounts with a similar number or description. Choose the appropriate one with the Down arrow key or Up arrow and press Enter.

Attention: to deactivate last year's smart fill, you must deactivate the Smart fill with transactions from previous year option from the File and accounting properties command (Options tab - File menu).

File Menu

When using Banana Accounting, each accounting management is on a different file.

Banana Accounting files are compatible with versions from all operating systems and with synchronization systems (Dropbox, ICloud, ...)

New...

This command opens the window to create a new file. All the available templates are accessed from the same window. We recommend starting from an existing template and personalizing it with your data. For more information, see the Create a new file page

Open...

This command allows you to open a previously created Banana Accounting file. For more information, visit the Open, save, copy and backup page.

Close / Close all

These commands allow you to close the active file or all open files of Banana Accounting.

File and accounting properties

This command accesses the basic data of the accounting file. For more information visit the File properties page.

Save / Save As / Save All

To save your accounting files. For more information see the Save page.

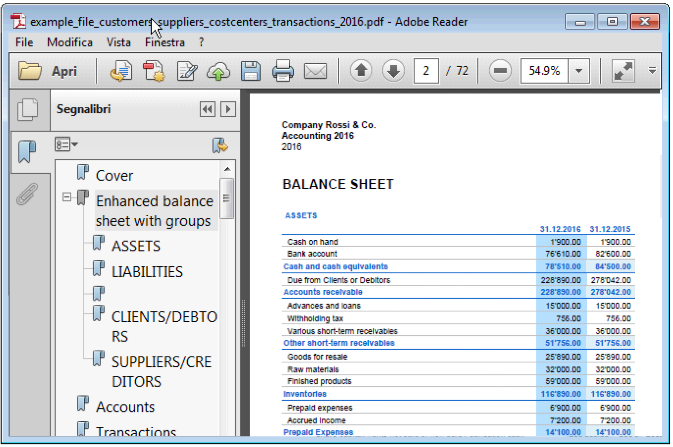

Create PDF dossier...

Create a single PDF file where you can customize what you want to include. All accounting data can be included.

For more information, visit the Create PDF dossier page.

Export file

It is possible to export the entire accounting file or only certain parts in Html, Excel, Xml, JCsv, Json

For more information, see the Export page.

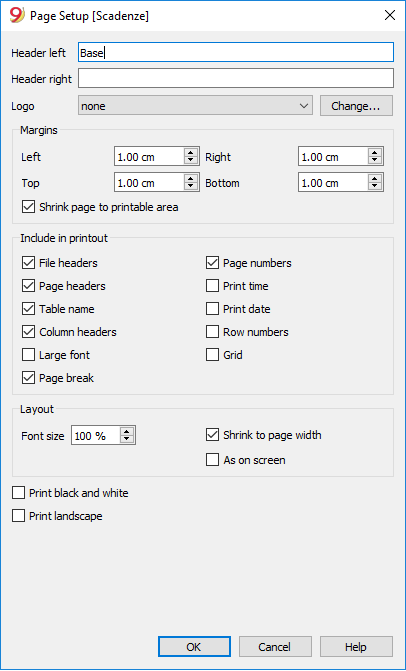

Page setup...

Allows you to define printing properties. For more information see the Page setup page.

Setup a Logo ...

To insert a logo into your prints. For more information, visit the Setup a Logo page.

Print ...

To start printing. For more information, visit the Printouts/preview page.

Create PDF ...

To print in PDF format what you see on the screen.

Print Preview

To check how your printout will look like.

Recent files / Favorite files

Banana Accounting automatically shows, when the program is opened, a list of recently used files.

It is also possible to draw up a list of favorite files.

For more information visit the Recent / Favorite files page.

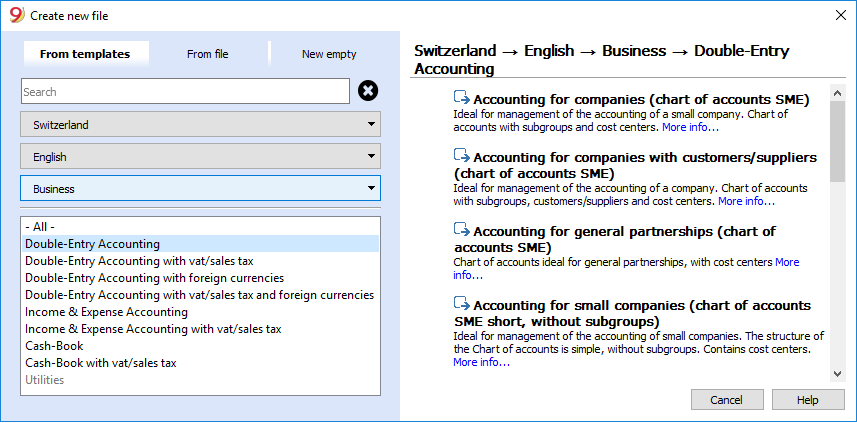

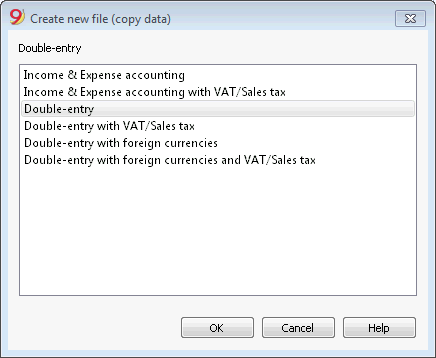

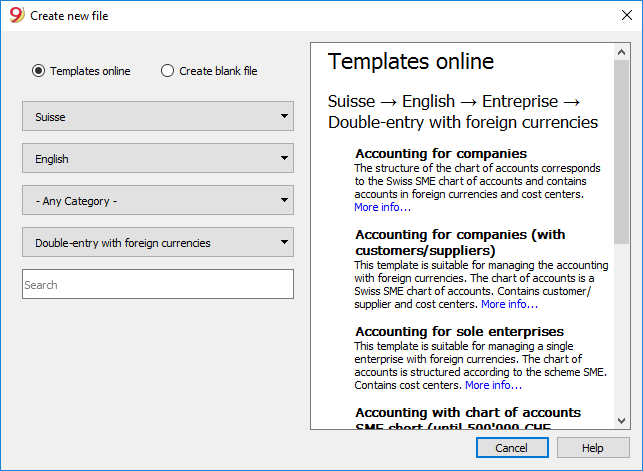

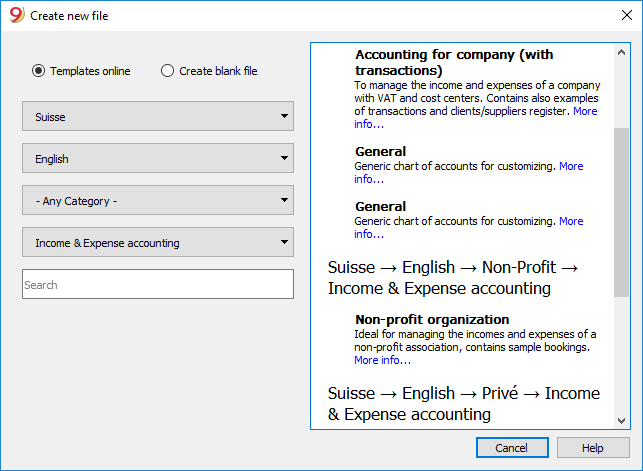

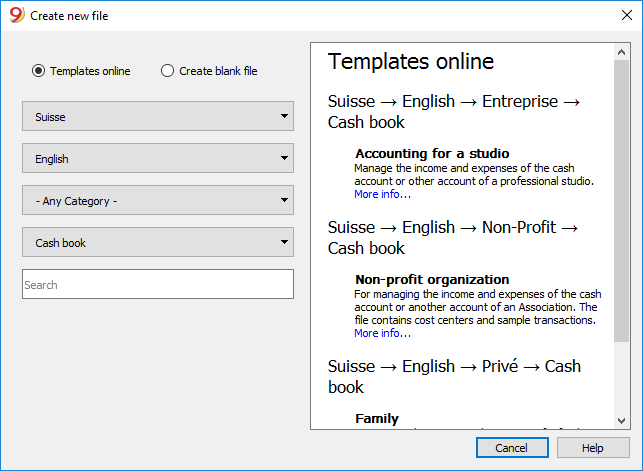

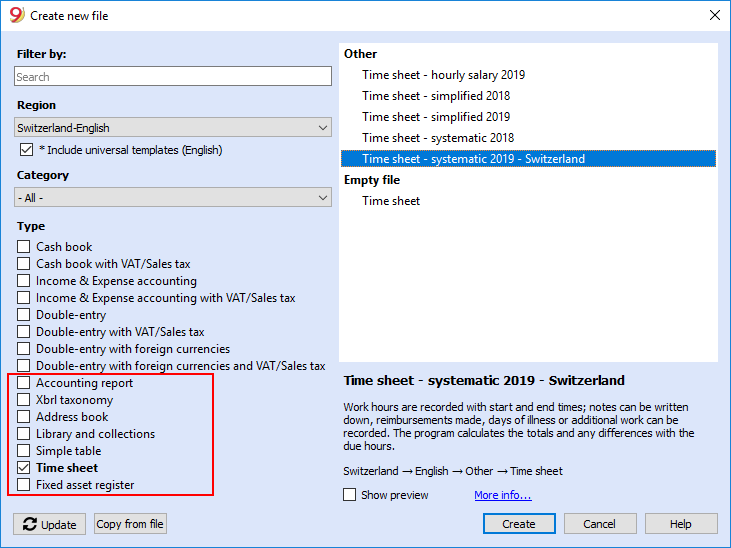

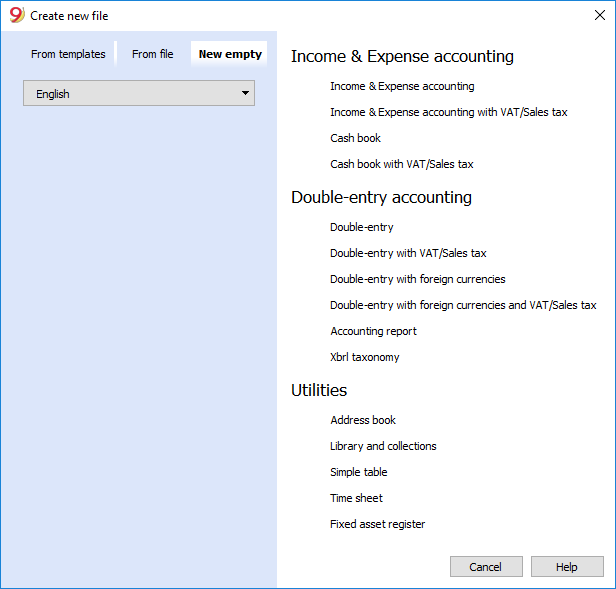

Create a new file

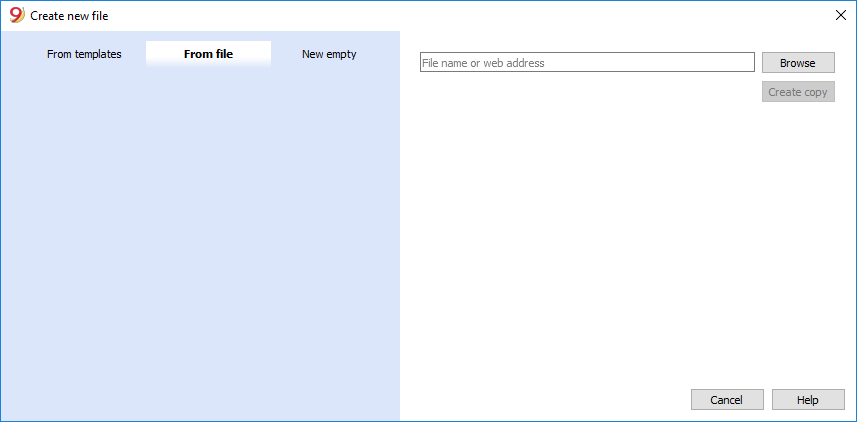

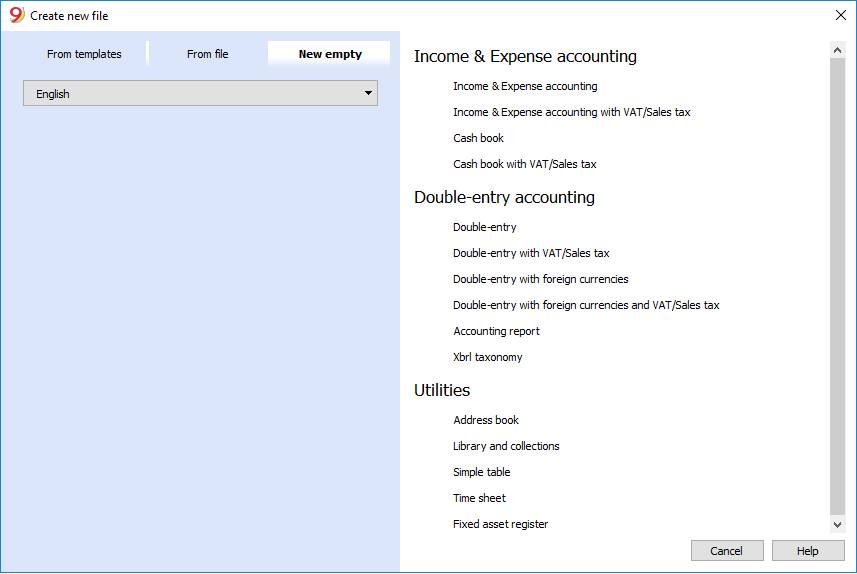

To create a new File, go to the File menu and click the New command

The appearing window will allow you the possibility to create a new file in three different ways:

Start with one of our templates adapted to your business

This will generate a new File based on one of the existing templates.

- File Menu, New command

- Select your country

- Select your language

- Select your category

- Select your Accounting template

- From the dropdown list of templates that will display in the dialog box, select the template that most closely matches your needs.

Clicking on the file will automatically open it and can then be saved with the name you wish.

All the files with the VAT option have the VAT codes table adjusted to the new rates.

The Chart of Accounts can be adapted to your requirements (change of account description, insert or delete groups, sub-groups, etc.)

You can search for a template by entering a keyword in the search box.

Save the file with a name

Once you have opened the template with Banana you need to use the Save as command from the File menu

- Chose the destination folder

It might be useful to create a separate folder for each year, so you are able to store documents, other than the accounting file that are related to that year. - Chose a file name containing the company name and the accounting year, for example smith_company_2018.

- The software will add the .ac2 extension, typical for the Banana files

- Chose a file name containing the company name and the accounting year, for example smith_company_2018.

The software will add the .ac2 extension that distinguishes the Banana files.

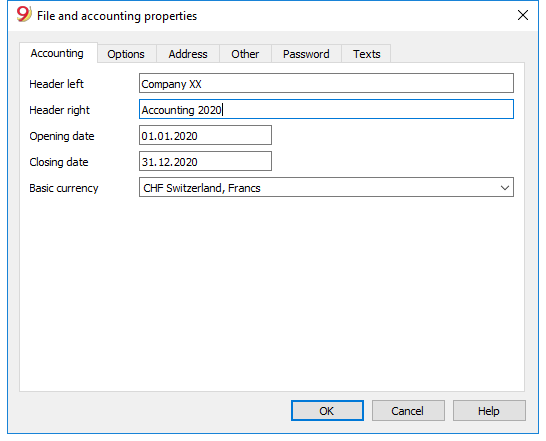

Adapt the template

- Edit the File properties

- Enter the headings and the accounting period

- Enter the address

- You can now adapt your Chart of accounts

- Enter your bank accounts.

- Enter or edit the chart of account to fit it to your requirements.

While going along with your work, you will still be able to add or edit, if new needs arise.

Start with an existing File

Starting from an existing file or template, without modifying the existing file.

There are several possibilities to copy data:

- Open the File that is to be your template via the Browse button and indicate the path to locate your file.

- Create a copy of the open file, using the Save As command from the File menu

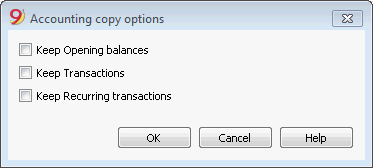

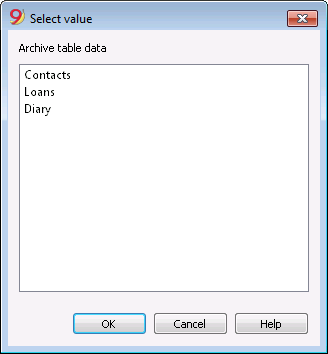

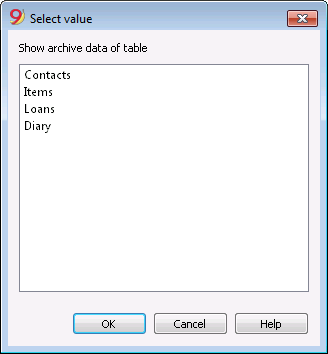

- Else, you may create a copy of the open file via the Tools menu, click on the Create File Copy command, the window that will appear allows you to choose which data to keep. If none of the three options are activated, a file is created with the Plan of Accounts only.

Save the file in the folder where you wish to keep the data (normally in the documents folder)

- Enter the company name and the accounting year as file name, for example smith_company_2018.

- If you are taking over an existing accounting file, you will also need to enter the opening balances in the Opening column.

- If you are working in a multi-currency file, you need to update the opening exchange rates.

Starting from a New empty File

You will be starting from scratch, so you will need to set up the basic accounting data and the entire Plan of Accounts (not recommended).

- File Menu, New command

- Click New empty

- Select your language

- Select your category

- Select your Accounting template

- From the dropdown list of templates that will display in the dialog box, select the template that most closely matches your needs.

Clicking on the file will automatically open it and can then be saved with the name you wish. - Setup the Outline to create new file

- Setup the File and accounting properties

- Save with File Name.

- Create the Plan of Accounts structure

Related documents

- Start a new Income and expenses accounting and Cashbook file

- Start a new Double-entry accounting file

- Start a new Double-entry accounting with multicurrency file

- Utilities documents

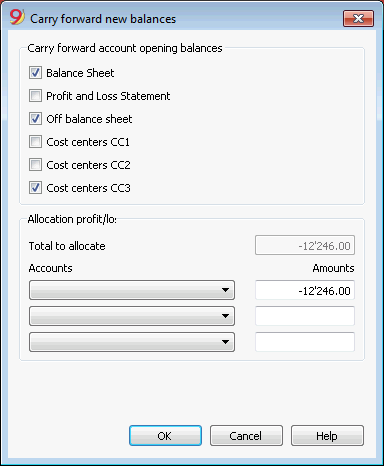

Transferring to a new year

When transferring to a new year, there is a specific procedure to follow, in order to create a new year's file and automatically carry forward the opening balances.

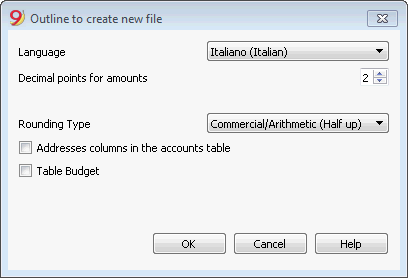

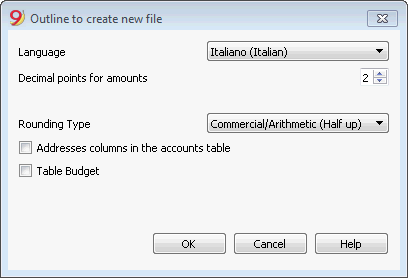

New file settings

When the program creates a file with new characteristics, you need to setup the outline of the new file.

Outline to create new file

Language

The language used for the columns headers of the various tables.

Decimal points for amounts

In order to avoid accounting differences, the number of decimal points for the amounts is fixed for each file. Two decimal points are normally used, but there are currencies where decimal points are not required so 0 needs to be inserted.

Decimal points for amounts in foreign currency

If using multi-currency accounting, then it is necessary to define the number of decimal points for the amounts in the foreign currency as well.

Rounding type

The amounts are rounded up or down to the closest whole number. In the case of exactly half (for example: 100.5 / 101.5 / 102.5 / 103.5) the following systems are being used:

- Banking (Half at even) is being rounded up or down towards the nearest even number (100 / 102 / 102 / 104).

- Commercial/Arithmetic (Half up) is being rounded up to the next whole number (101 / 102 / 103 / 104). In accounting, this is the system most used.

- Compatible version 4. A minor precision is being used, which in very special cases, can bring forth a different rounding.

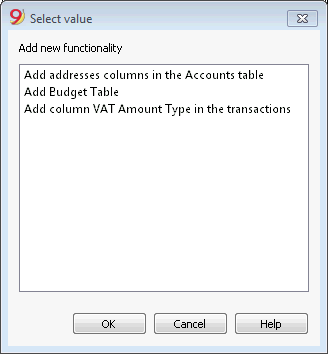

Address fields in accounts table

When this option is activated, the Address view is created in the Accounts table. In this view, the user can enter the addresses of clients, suppliers and members.

Budget Table

When this option is activated a Budget Table is created, where the user can enter his budget transactions.

The user can thus create different accounting files, in different languages, and with different decimal points. In order to change the language or the decimal points once the accounting file has been created, the accounting type must be converted by selecting Convert to new file from the Tools menu.

Open, save, copy and backup

Opening a file

- Accounting files can be opened in Banana Accounting if they are on the local computer or if they are accessible through a network.

If they have been sent by email, before opening them you need to move them in a computer folder - Only one user at a time can edit a file

If you edit a protected file or a file already in use by other users, you need to save the file with another name in order to save your changes. - The Banana Accounting program, notifies that you have opened a read-only file in the following cases:

- the file is located on a non-writable disk (CD-ROM)

- the file is located on a temporary non-writable folder

- the file is protected or the user doesn't not have rights to edit it

- the file has already been opened by another user

- the file has already been opened from the same user but in another session

How to look for *.ac2 files

If you don't remember in which directory your accounting files are located, you can use the search Windows Explorer box or the Mac finder search tool.

Find your accounting file on a Windows computer

Banana Accounting files have an .ac2 or .sba extention. The Windows search tool will vary depending on your Windows version.

- Windows 10: click on the search icon on the Applications bar and enter "ac2" or "sba" or your file name and click on the Documents arrow.

- From the Explorer File Manager enter the "*.ac2" extension, the "*.sba" extension or your file name and let Windows look for it.

- When in Banana you get to the Open file dialog window (File menu -> Open), enter the "*.ac2" or "*.sba" extension in the top right search box and then click on the look in the whole PC icon, or select the directory where you want Windows to look for your file.

Find your accounting file on a Mac computer

- When in Banana you get to the Open file dialog window (File menu -> Open), enter "ac2" or "sba" or a word that is part of the file name in the top right search box. With the icons, select where you want to look for your file (in the entire computer or in selected folders).

- Open the Finder and enter "ac2" or "sba"or a word belonging to the file name in the search box.

- Right click on the Finder icon, then click on Search, and then enter "ac2" or "sba" or a word belonging to the file name.

Saving a file

With the Save or Save as... command, the data are saved onto the hard disk. Pre-existing disk data are replaced with the new ones.

- A single file can be saved by one user at a time

The file can be saved by the user only if it is not also being used by other users - Files can be saved anywhere.

You can enter the file name and destination when saving it for the first time or when using the Save as command from the File menu

As a first option, Banana Accounting suggest the Documents folder as destination folder for the .ac2 files, but it can be changed with the Browse button. - If you are managing different accounting files, we suggest you to create a separate folder for each company and for each accounting year.

- Each file can be password protected.

Accounting files (*.ac2, *.sba)

- Files created with Banana Accounting have an ".ac2" or ".sba" extension, regardless the operating system used.

- The file with the extension "sba" is completely similar to ac2. The sba extension is used for the Dutch and Chinese version of the program. When referring to the file type "ac2" it also applies to the file type "sba".

- The .ac2 file format is specific for Banana. When saving, all data are compacted and saved in bulk.

- Ac2 files are compatible between different operating systems (Windows, Mac and Linux)

You can save a file with Windows, then open it and edit it on a Mac, and then reopen in on a Linux or Windows computer. - Each file can be sent as an email attachment, edited on different operating system and resent to the sender.

- Accounting files are completely separated from the software Banana itself, that has an .exe extension for Windows,

- The installation files for Mac have a .dmg extension and a .deb, .rmp .run or .tgz extension for Linux.

Automatic saving

Banana Accounting automatically creates and saves your work in a temporary file that ends with ".autosave" . When you press the Save button or you exit the program, this temporary file is deleted. In case your computer should crash or turn off in the middle of your work, it would be possible to recover your data by opening this file.

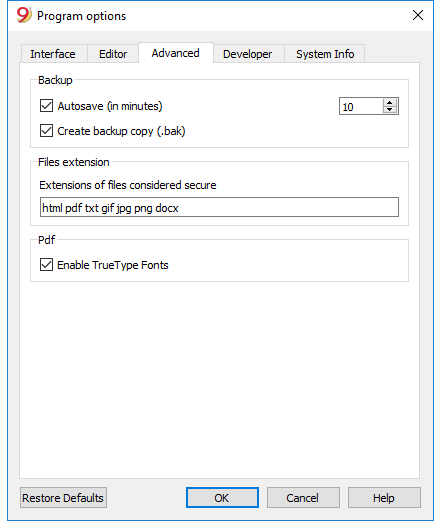

In order to have the program automatically create this temporary autosave file, the corresponding option should be active (it usually is by default) in the Program Options (you can access them from the Tools menu).

How to copy or move your accounting files

Banana can save your files on any unit seen by the operating system or on a rewritable disc.

From non-rewritable discs (CDs or DVDs) Banana can open the files on a "read only" mode.

All .ac2 files can be moved in different ways:

from one directory to another:

- using Windows Explorer or Mac Finder to locate the directory where your files have been saved

- copying and pasting them in the new destination directory (once you pasted them you can delete from the original directory)

from one computer to another:

- saving the files on a memory stick and then saving them on the new computer:

- open the file to be moved

- from the File menu choose the Save as command, choosing the memory stick as destination unit

- this copy can also be made from Explorer by dragging the accounting file into the memory stick unit

- by sending them as email attachments and then saving them on the new computer

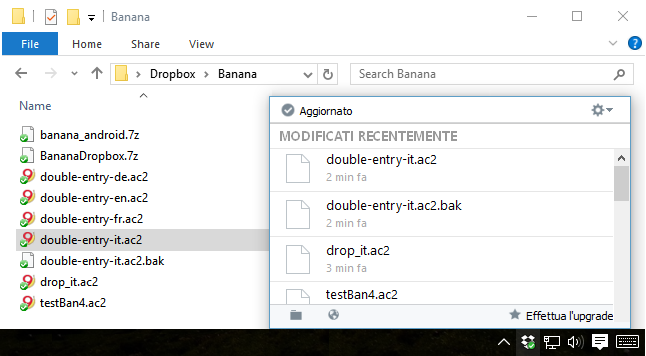

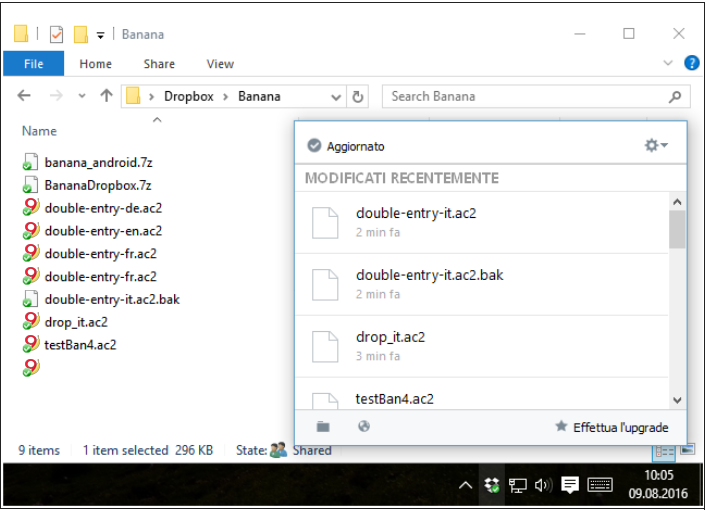

DropBox, Google Drive and other synchronization systems

Banana is compatible with systems such as DropBox and Google that keep files synchronized with cloud storage services.

Banana overwrites *.ac2 files and deletes the *.ac2.bak files. In the deleted files list you will find all *.ac2.bak files previous versions.

Viewing changes

Banana Android works directly with Dropbox servers. If you make changes on your PC, usually you have to wait a few seconds before you see the changes on the server, so also on Banana.

To ensure that the file is properly synchronized with the server, the file on your PC must be marked with the green check mark.

If you do not see the sync symbols (green, red, blue), you have to update the Dropbox application installed on your PC.

Another way to check the synchronization status from your PC, is to click on the Dropbox icon in the bottom bar:

In addition, Android synchronization does not occur while you are working with the app. You must close and reopen it.

Attention: Banana cannot realize if some files are opened simultaneously on more than one computer. It could thus happen that someone erases some data or that someone else adds some new data. Only the more recent copy of the saved file is kept. For this reason we strongly advise to avoid working at the same time on the same file.

Security copies (backup)

We strongly advise you to create external backup copies of your accounting files, in order to prevent a possible data loss, due for example to a computer crash or other causes.

- if you have a Mac computer you can use "Time Machine"

- if you have a Windows computer you can use the "File history" function

You can find other programs on the market that allow you to automatically create a backup of your data.

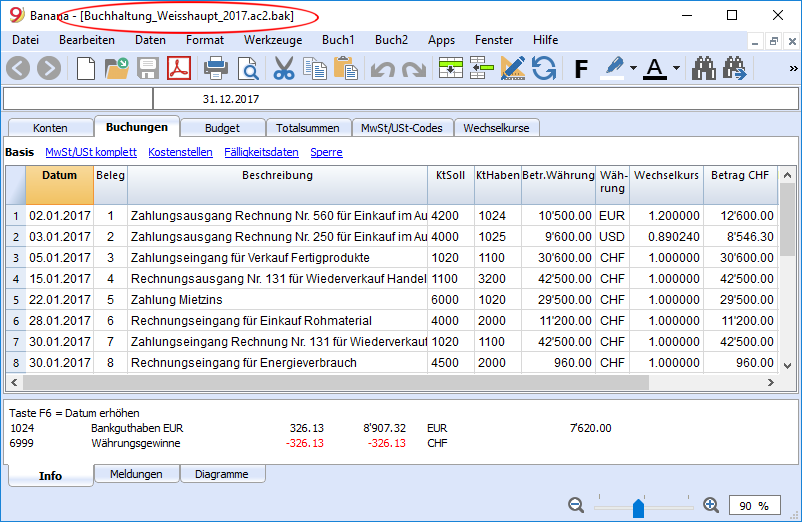

Saving and .bak files

When saving, Banana Accounting replaces the contents of the existing file, with the more recent data, only if the saving process is successfull:

- Data are saved on a temporary file

Only if the saving process is successfull the data on your disk are replaced to the existing ones. - If the Create backup copy (.bak) option is activated (Tools menu -> Program options command -> Avanced tab) the program renames the pre-existing file with the same name, adding the .bak extension.

A new file named "filename.ac2.bak" is created, containing the data before the saving process.

If an error occurs during the saving process, if for example the network disk is no longer available, choose another file name for saving your data.

Recover your data from a .bak file

When for a number of reasons you cannot find your accounting file, you can recover your data from the backup copy automatically created by the program. Here is how to proceed:

- open the directory where your accounting file was located

- open the file with a .bak extension. If it is not shown in the dialog window, you need to select the "show all files (*.*)" option at the bottom right of the window

- once the file is opened, save it with a name. Usually the same name as the lost file is chosen.

Damaged .ac2 files

Sometimes a computer crashes due to technical problems or viruses. Sometimes data received by email are compromised or damaged. For these reasons we strongly suggest you to make copies of your files.

If, for technical reasons you have a damaged file, our support team can verify, for a fee, if there are data that can be recovered.

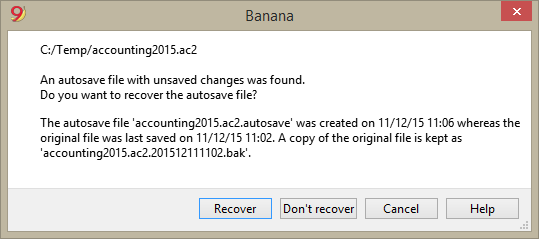

Recover autosave file

This dialog appears when the program closes unexpectedly, and it was not possible to save changes made to the file.

When the program is reopened, it detects that the autosave file (temporary file) has not been canceled, and then asks if you want to retrieve the file.

You can choose from the following options:

- Recover

- The autosave file is copied replacing the original file

- The original file is renamed as indicated in the dialog window

- Don't recover

- Both the original file and the autosave file are kept

- The program will not warn you anymore that the autosave file was kept

- Cancel

- Both the original file and the autosave file are kept

- Next time you open this file, the program will warn you that an autosave file with unsaved changes was found

The autosave files that were not recovered will be kept, and will have to be deleted manually.

If the program stops working

If the program is closed normally, it asks whether to save the modified data, and the autosave file is deleted.

However that program may be unexpectedly closed for a number of reasons:

- A power outage or another event that caused an immediate arrest of the operating system

- A problem that led to the crash of the program

- Due to another program or to a situation of the operating system or driver that caused the program to stop.

Try to restart your computer and use the program without other programs.- A flaw in the operating system or a faulty program can cause an interruption of Banana.

- Problem with some Dell computers.

- A computer fault (memory error)

- A virus or some other problem

- A flaw in the operating system or a faulty program can cause an interruption of Banana.

- A problem in the Banana Accounting software

Usually when, repeating the same command always causes the program to crash.

If the program stops in completely different situations, is more likely that the problem is due to a computer or operating system problema (see above)- First of all make sure that you have the latest version of the program

Install the updates if necessary. The problem could have been solved in the meantime

- First of all make sure that you have the latest version of the program

- Due to another program or to a situation of the operating system or driver that caused the program to stop.

Contact technical support

Verify the situation in which the program stops.

- It is important to understand in what situations the program stops, so that technicians can replicate the problem.

- When you contact the technical service:

- Describe the problem and how it can be reproduced - describe the error.

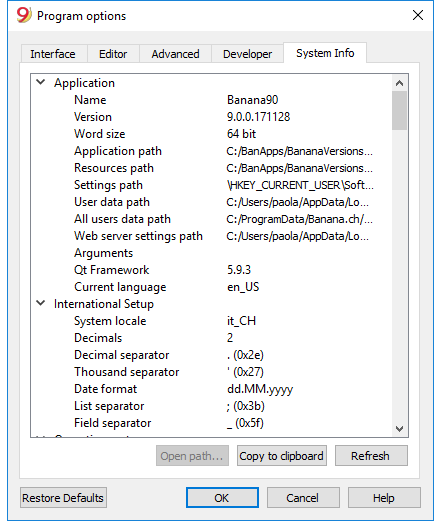

- Enter your system details (you can copy them under Tools -> Program Options -> Info System.

- If the problem occurs in relation to a file, send a copy of the file (removing confidential data).

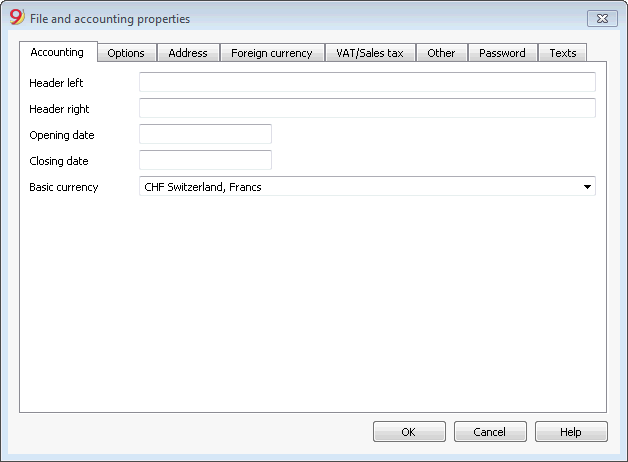

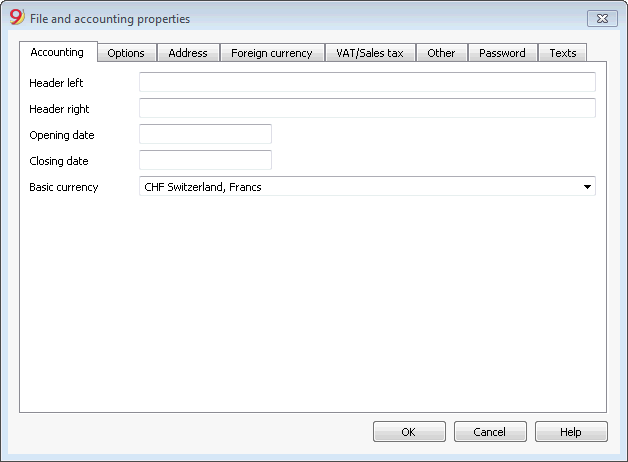

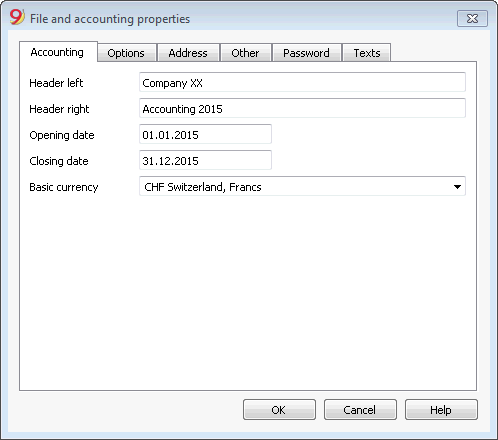

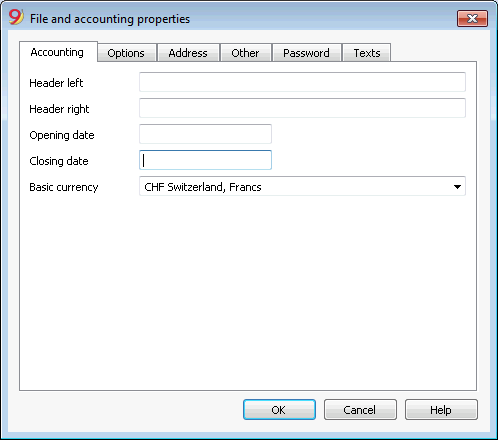

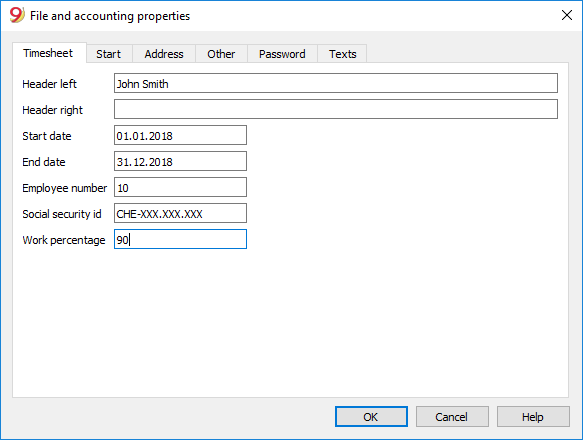

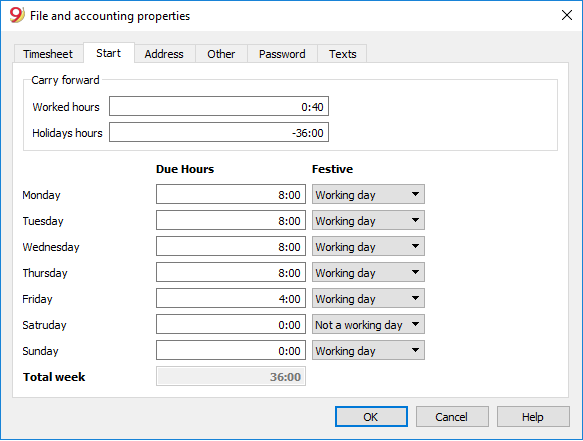

File properties

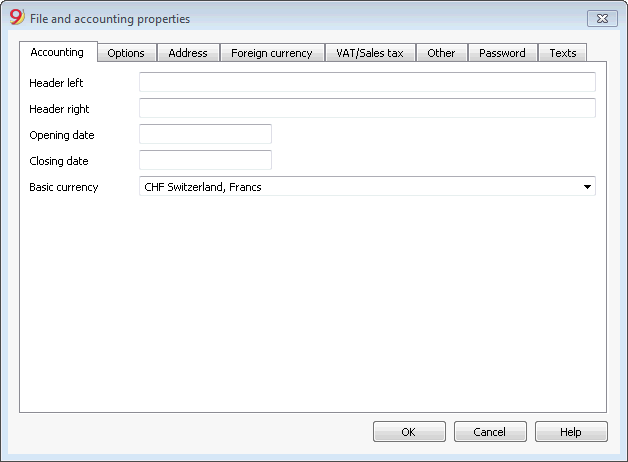

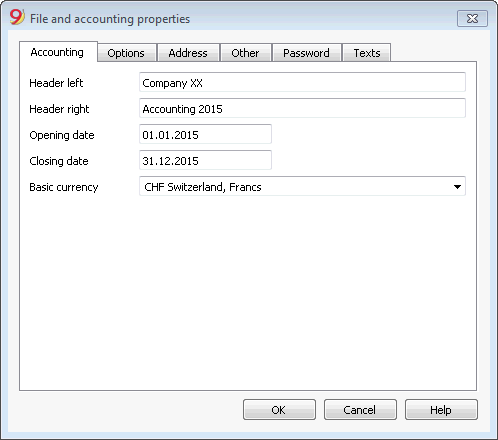

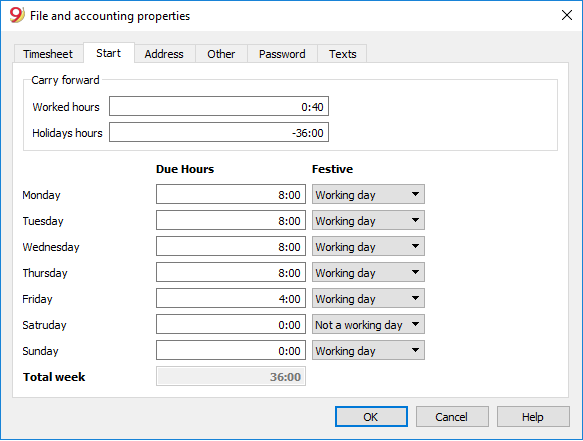

When a new file is created, the basic data need to be entered in the File menu, using the File and accounting properties command.

The file properties can vary depending on the chosen accounting type.

For the explanations of the different tabs please visit the pages hereunder.

Accounting Tab

Left and right headers

These are the two empty cells at the top where any desired text can be inserted which will be used as a header for print-outs (left and right).

Opening date

The opening date is the date when the accounting begins. It can also be left blank. If a date prior to the opening date is inserted when entries are made, the program will give an error message.

Closing date

This is the closing date of the accounting. It can also be left blank. If a date greater than the closing date is inserted when entries are made, the program will give an error message.

Basic currency

The code of the currency in which the accounting is being handled. You can enter any currency code, even the one that are not in the list. When the code of the basic currency is being changed, the program changes the column headers for the amounts in basic currency using the new code.

In the multicurrency accounting files it is mandatory to select the basic currency, which will work as the funcional currency, the one used for the calculation of the Balance sheet and Profit & Loss statement.

Changing the basic currency symbol

If you change the basic currency symbol the program will not change the existing amounts. We advise you to change your basic currency symbol only if you don't have yet entered any opening balances and any transactions.

Accounting file WITHOUT foreign currencies

You can replace the basic currency symbol with the new symbol.

Accounting file WITH foreign currencies

- Replace the currency symbol in the File properties dialog (from the File menu)

- in the Accounts table

- Select the whole Currency column (click on the column's header)

- Use the Find and replace command from the Data menu and enter the old and the new currency symbol - make sure to check the Selected area only option. Replace all the symbols found.

- in the Exchange rates table

Enter the new exchange rates for all the currencies. - Give the Check accounting command from the Account1 menu.

- If there are opening balances or transactions, the amounts and the exchange rates will have to be manually updated.

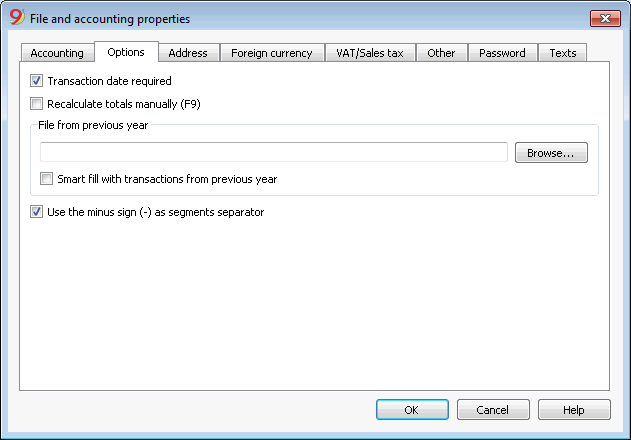

Options Tab

Transaction date required

If this option is activated and then a transaction is entered without a date, there will be an error message.

Recalculate totals manually (F9)

If this option is activated, the program will not automatically recalculate the principal groups of the accounting file, but the user needs to use the F9 key.

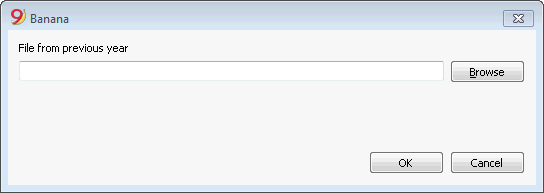

File from previous year

By using the Browse button, the user can select a file from the previous year.

Smart fill with transactions from previous year

If this cell is checked, the program keeps the transactions from the previous year in memory, and offers them as Smart Fill while the user inputs new entries.

Use the minus sign (-) as segments separator

When this option is activated, the segments have to be entered in the Transactions table with the minus (-) sign preceding the segment code. When this option is deactivated, the segments need to be entered with the colon sign (:), as in the chart of accounts. The colon needs to always precede the segment code.

Records (+/-) cost centers according to the category

This function is active only for Income & Expenses accounting and Cash book. By activating this box, the amount is entered in the cost center (positive or negative) according to the category.

If, instead, this option is not active, in order to enter a negative value, it is necessary to enter a minus sign before the cost center (-CC).

Related document: Text imput, edit and Smart fill

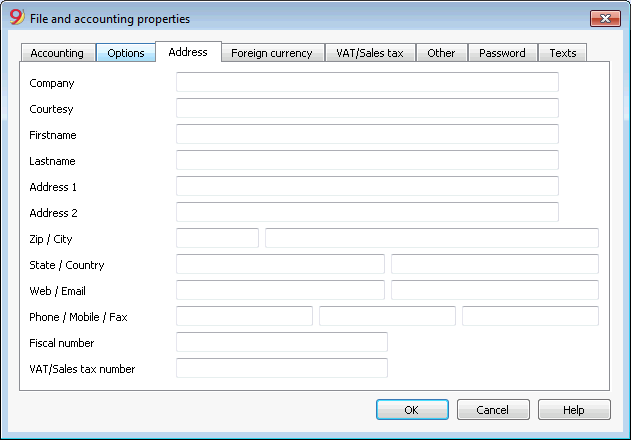

Address Tab

In this tab data about the company or the individual whose accounting is being handled can be entered.

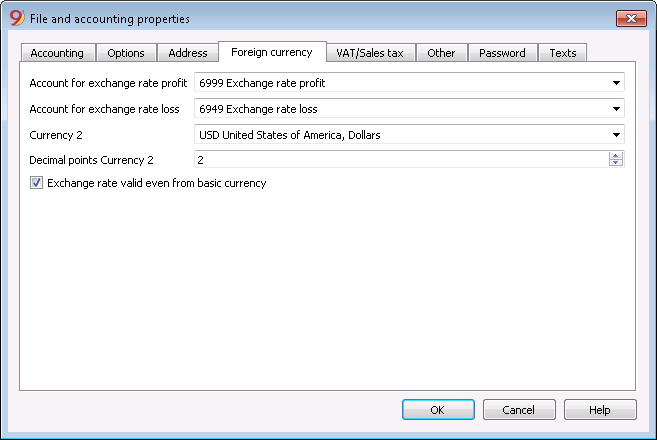

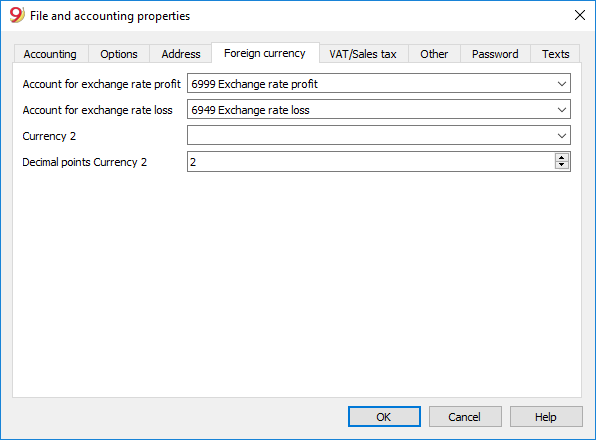

Foreign currency

For the explanations of the different tabs please visit the corresponding page Starting a multi-currency accounting.

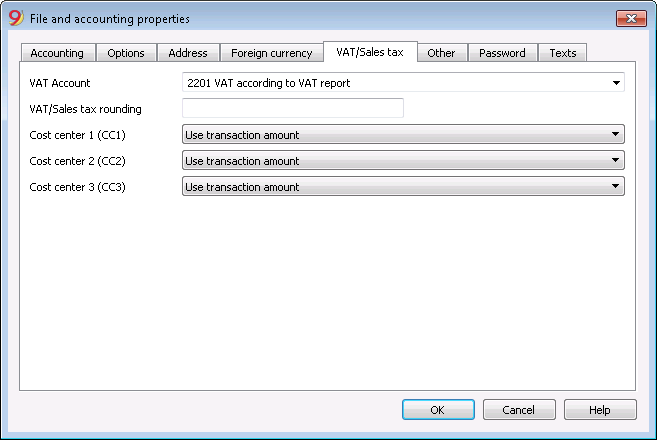

VAT/Sales tax

For the explanations of the different tabs please visit the corresponding page File properties (VAT/Sales tax tab).

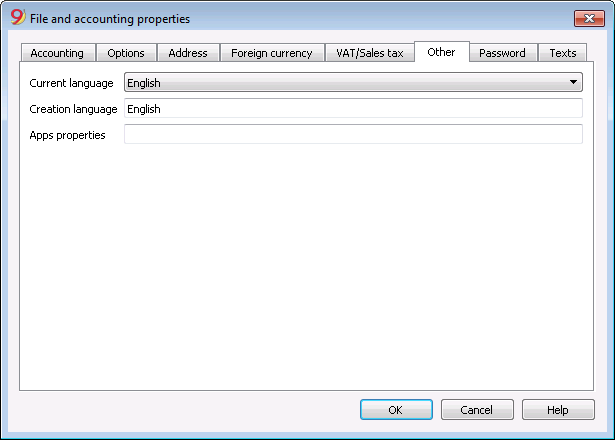

Other Tab

Current language

There are some file texts that the program generates automatically, (e.g. the lines of the Totals table, the transactions on the account card, and the printout of the Enhanced balance sheet); in this tab, the user can indicate the language for these texts (usually the same as the creation language).

Creation language

This is the language chosen and selected when the user creates an accounting file; this language is used for the column headers. If the user wants to change the creation language, then it is necessary to convert the file to a new one using the Convert to new file command in the Tools menu.

Apps properties

You can enter one or more keywords to view the Banana scripts (BananaApp) that require so.

If a script has the @docproperties attribute, it will only work in Banana files that have set the same keyword in the Apps properties field. To set multiple keywords, you need to separate them with the ; (example: datev; donations)

Usually these keywords are specified in the scripts installation instructions; most of the scripts do not use keywords to limit the display to certain files.

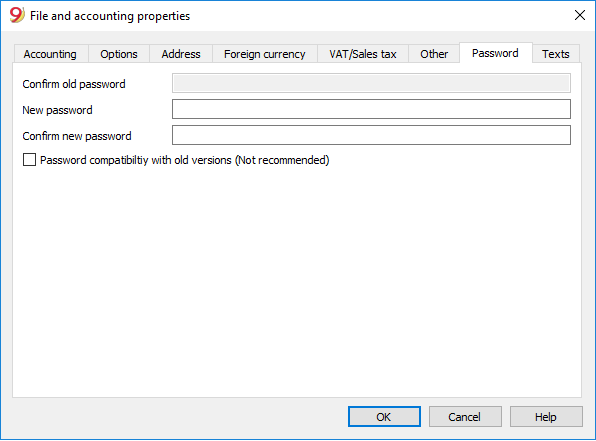

Password Tab

The files can be protected by using a password.

Password compatibility with old versions

Activate this option if you want your password to be compatible with the Banana Accounting 8 versions and earlier.

This option not recommended because the password is saved in a less secure mode.

Entering a password in a file that doesn't have a password

- The box Confirm old password is shown in gray.

- Indicate your new password twice (New password and Confirm new password).

- Confirm with OK.

Changing an existing password

- Enter the existing password.

- Indicate your new password twice.

- Confirm with OK.

How to cancel a password

- Enter the existing password.

- Leave the boxes for the new password empty.

- Confirm with OK.

Forgotten password

For information about a forgotten password, please refer to the Questions and Answers page, Password unlock paragraph.

Note

Using a password does not give a high level of protection. In order to render the data truly inaccessible to third parties, it is necessary to have the appropriate cryptographic software.

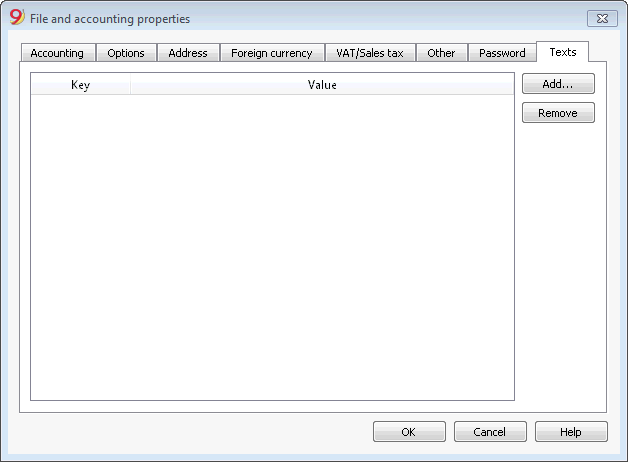

Text Tab

In this tab it is possible to enter different keys in order to save extra information, such as the accountant name, for example.

Key

In this field, input the reference text (e.g.: Address).

Value

In this field, it is necessary to input the value related to the key (e.g.: Ocean Avenue, ...).

Add

This button saves the new entered data.

Remove

This button removes the selected Key.

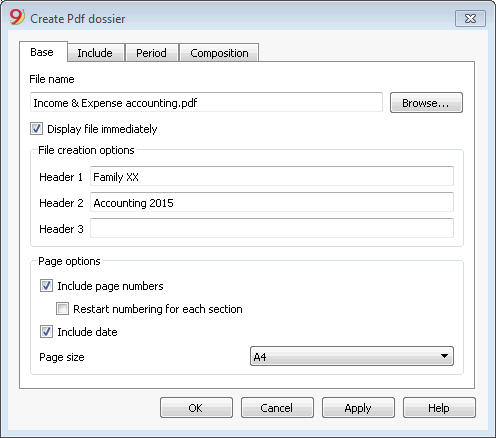

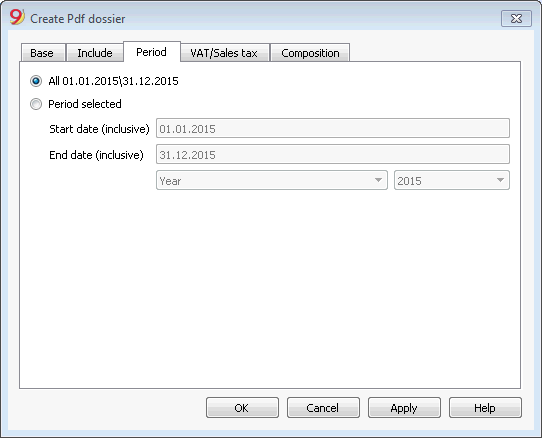

Create Pdf dossier

In order to create a Pdf file choose the Create Pdf dossier from the File menu (or click on the corresponding icon on the Toolbar).

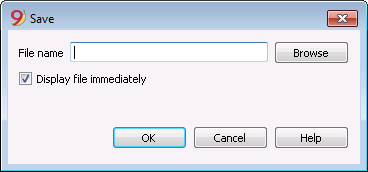

File Name

In this area you need to enter the name of the new file that the program will create to export the data. If, however, an existing file is selected by using the Browse button, the program will overwrite it with the new data.

Display file immediately

As soon as the Pdf file has been created, the software to view it will be launched. In this way, the result of the export can be seen immediately. It is best to remember that browsers like Mozilla and MS Explorer use a cache mechanism for files. When the export is made for a second time, it is possible that the user will see the previous version until the browser Reload button is pressed.

Table creation options

Headers 1, 2 and 3

These are the table headers.

Page options

By activating the page options it is possible to include:

- page numbers

- page progressive numbering

- date

Page size

You can select the page format

Other Tabs

For the explanations of the other tabs, please visit the following pages:

Setup a Logo

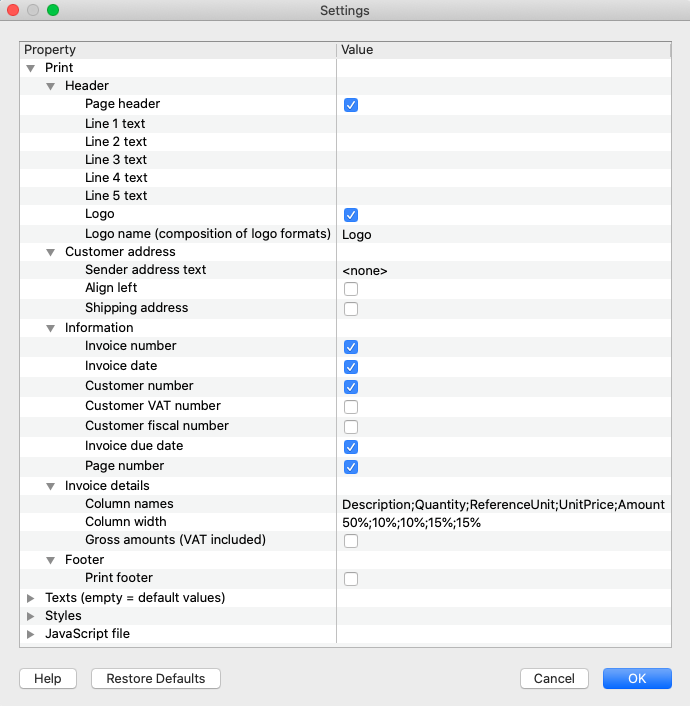

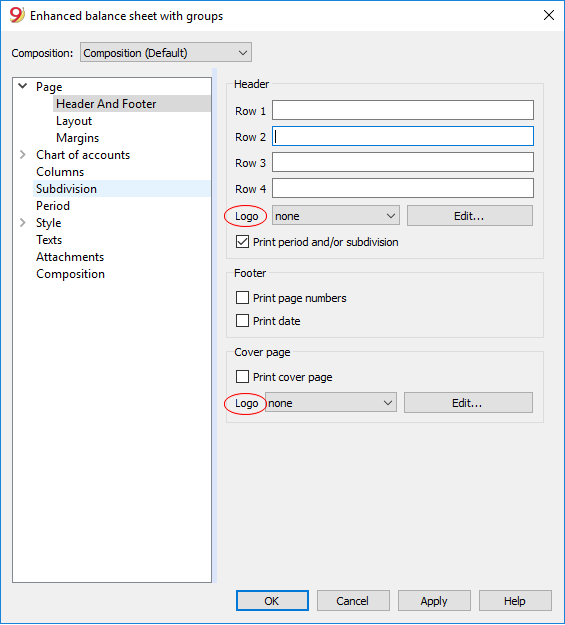

Setup a LogoFrom the Banana version 9.0.3 it is possible to include a logo and to define its settings (width, height, position) from the File menu > Logo setup command. It is also possible to create and save Compositions with different logo settings.

This feature is a simplified alternative to the logo setting with the Documents Table.

In the Logo Formats dialog window -> Options tab, it is possible to include an image with the Add button; you can also define the width, height and alignment of the logo image. If the logo has already been inserted, it my be modified or deleted via the Modify/Delete button.

Note:

Thanks to this feature, the logo can now be recalled and applied for all printouts, as follows:

- from the File -> Page setup command

- or directly from the Print preview, by clicking on the Settings icon.

If, however, you only wish to use the logo in a specific printout, you need to directly enter it in the setup of that printout, for example the Account cards, the Enhanced Balance sheet, the Enhanced Balance sheet with groups and the Accounting report.

Text

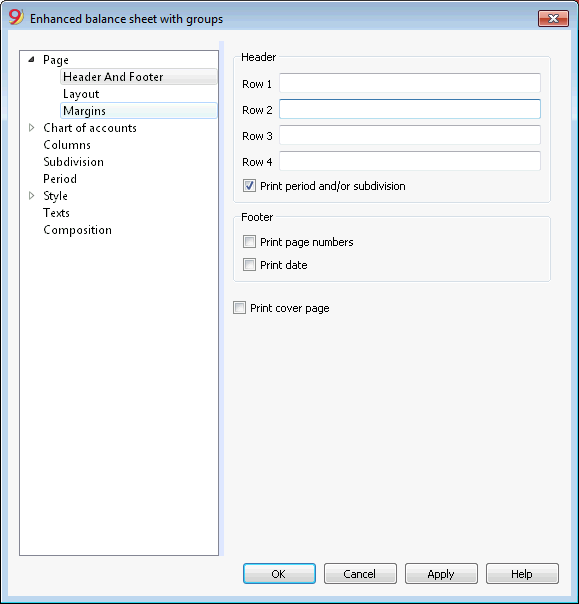

If this box is ticked, headings of the dialog windows for "Account Cards", "Enhanced Balance Sheet", "Enhanced Balance Sheet with Groups" and "Accounting Report" will be added, relative to the logo (i.e. Below, Center, Top).

Dateispeicherort öffnen

Dieser Befehl im Menü Datei öffnet das Dateiverwaltungsprogramm Ihres Betriebssystems (Windows Explorer, Finder Mac) und zeigt den Ordner an, in dem sich die Datei befindet, an der Sie gerade arbeiten. Hieraus kann die gewünschte Datei kopiert, verschoben, umbenannt oder gelöscht werden (rechte Maustaste).

- Menü Datei

- Befehl Speicherort öffnen - Öffnet das Dateiverwaltungsprogramm um die Dateien zu verwalten.

- Zum umbenennen, verschieben oder löschen, muss die Datei zuvor in Banana Buchhaltung geschlossen werden.

Manchmal bleibt die Datei gesperrt, auch wenn Sie sie geschlossen haben. In diesem Fall muss auch das Programm beendet werden, um die Datei vollständig freizuschalten. - Kehren Sie zum Dateiverwaltungsprogramm zurück.

Recent / Favorite files

These commands display the list of recently used files and the favorite files.

In order to eliminate the list of recently used files, click on the File menu, Recent files, and on Clear list recent files.

In order to remove just one single file from the Recent Files list of the Favorites (Start page), position the cursor on the file name, proceed with a right mouse click and select Remove (Mac users should use the key combination Ctrl + right mouse button).

To make a file Favorite:

- Open the desired file

- Click on Favorite files

- Click on Add to list

To edit the list of favorites, click on:

- Favorite files

- Edit list..

- In the window that appears, edit the favorites, by using the buttons: Add, Remove, Open folder.

Edit Menu

The Edit menu contains a series of practical data editing commands.

See also Keyboard shortcut.

Undo / Redo operation

These simple commands allow you to cancel or restore the last operation made.

Copy, Cut and Paste

It is possible to copy/paste cells, rows or selected text (unless protected), just as you can do it in Excel.

- Select the line or the area of data to be copied

- In the Edit menu, select the Copy or Cut command

- Move to the row or the area where the information should be copied

- From the Edit menu, select Paste

The user can also copy/paste by using the icons  or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

or press Ctrl+C to copy, Ctrl+X to cut and Ctrl+V to paste.

There are also commands such as Copy rows, Delete rows and Paste rows: in this case they refer to a full row or rows and not to a cell selection. For this purpose the commands Copy, Cut and Paste should not be used.

Copy with column headers

Use the Preview command and the Copy o Clipboard.

Select all

This command selects all the active table.

Copy row from above (F4 or Cmd + 4)

This command is very practical and allows you to copy the contents of the cell above to the one you are in. Applicable to a single cell, several cells or an entire row.

Execute command (F6 or Cmd + 6)

This command performs various practical functions depending on the cell in which you are located. More information on the Interface page.

Insert rows... (Ctrl+ +)

This command inserts blank rows above the selected row:

- Position the cursor below the line where the empty rows are to be inserted

- From the Edit menu, select the Insert rows ... command

- In the window that appears, type the number of rows to be inserted

- Confirm with OK.

Add rows...

To insert blank rows below the selected row, follow these steps:

- Move the cursor above the row where additional rows need to be inserted

- From the Edit menu, select the Add rows command

- In the window that appears, key in the number of rows to insert

- Confirm by clicking on OK

There is still another procedure to add blank rows:

- Move the cursor above the row where additional rows need to be inserted

- Click on the following icon

on the Tool bar, one time for each row that you want to add. This procedure is advised when the amount of rows to be added is rather limited. The sequence for the shortcut key is: Ctrl+Enter.

on the Tool bar, one time for each row that you want to add. This procedure is advised when the amount of rows to be added is rather limited. The sequence for the shortcut key is: Ctrl+Enter.

Duplicate rows...

This command duplicates the selected row (s).

Copy rows ... (Ctrl + Shift + C)

This command copies the selected rows. If rows are copied, the command Insert copied rows is automatically activated, which can be exploited by positioning the mouse at the point where you want to insert the previously copied rows.

Delete rows... (Ctrl+ -)

In order to delete one or more rows, select the row or rows that need to be deleted and from the Edit menu, click on the Delete rows command.

Protect/Unprotect rows

Using the Protect rows command, from the Edit menu, the user activates rows protection to avoid making any changes by mistake.

The protected rows cannot be edited until, by using the Unprotect rows command, the protection is being removed.

To put protection into effect:

- Select the desired row(s) to protect

- From the Edit menu, select the Protect rows command

- Confirm the number of rows to be protected by clicking on OK.

Protected rows have light grey row numbers. In order to edit them again, first remove the protection by the Unprotect rows command in the Edit menu.

Data Menu

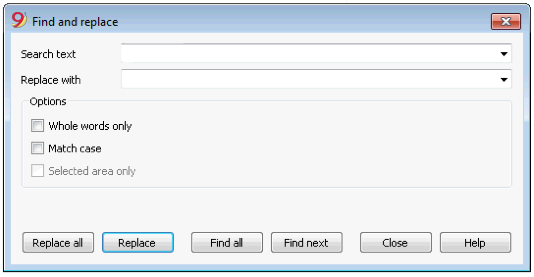

Find and Replace

The text to be searched and the text to be used as a replacement should be inserted in the same format as the one displayed in the input field. For example, the amounts should be inserted without the separator for the thousands.

Search text

Enter the text to be searched.

Replace with

Enter the replacement text.

Options

Whole words only

If this box is activated, the program will find whole words only. For example, if the word being searched is Tot, it will not find Totals.

Match case

If this box is activated, the program will make a distinction between capital letters and small letters.

Selected area only

If this box is activated, the program will only search the information in the selected area.

Replace all

This key will replace the desired data throughout the whole document at once. When you need to change data that are being repeated in the Accounts, Categories, Transactions and VAT codes tables (for example, an account number or a VAT code), you can also use the Rename function.

Replace

This key will replace one data at a time.

Find all

Looks for all the information, according to the entered keyword, and displays it in the Information window in the lower part of the screen.

Find next

Looks for the following information item.

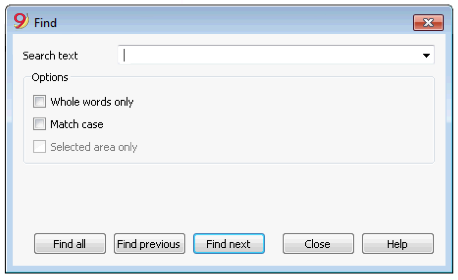

Find

Search text

Enter the text to be searched. Amounts must be entered without separators.

Options

Whole words only

If this box is activated, the program will find whole words only. For example, if the word being searched is Tot, it will not find Totals.

Match case

If this box is activated, the program will make a distinction between capital letters and small letters.

Selected area only

If this box is activated, the program will only search the information in the selected area.

In order to begin the search, click on the Find button. The first piece of information corresponding to the request will be selected. To continue the search and find the next piece of information, select the Search next command from the Data menu, or else use the F3 key.

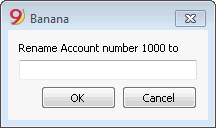

Rename

This command allows the user to change the account or category number (accounts or categories table) and the VAT code (VAT Codes table), without having to enter the necessary modifications in the transactions.

In order to rename, you need to:

- position yourself with the mouse on the cell that has to be changed (account/category number, VAT code);

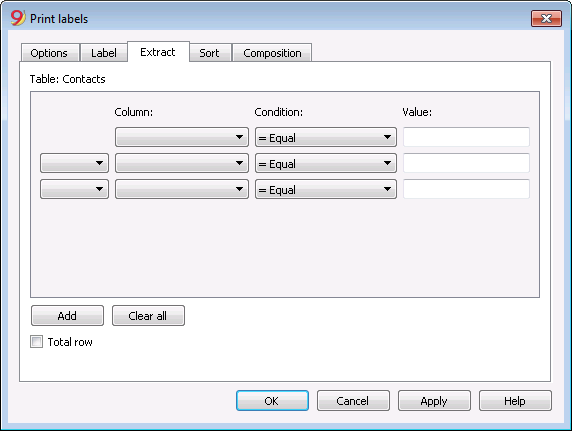

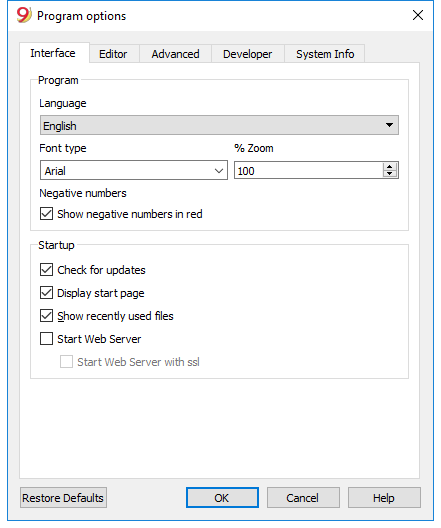

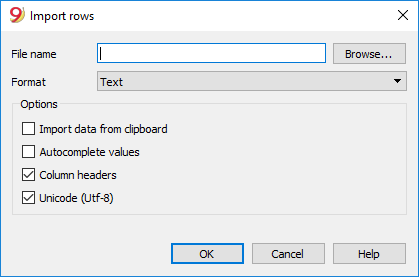

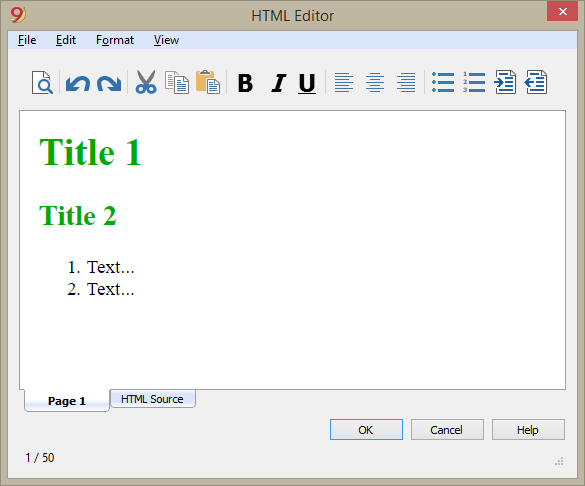

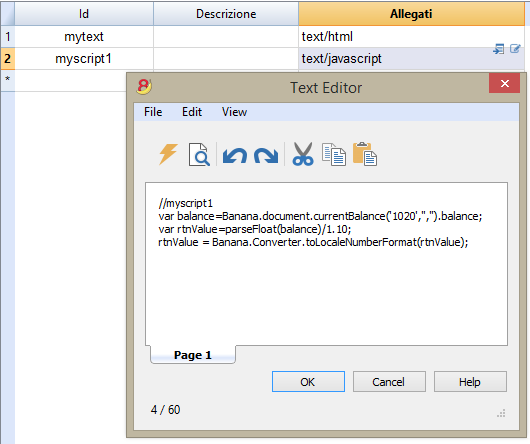

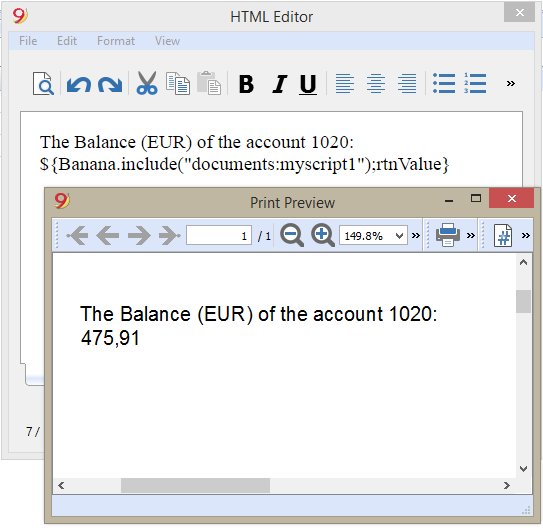

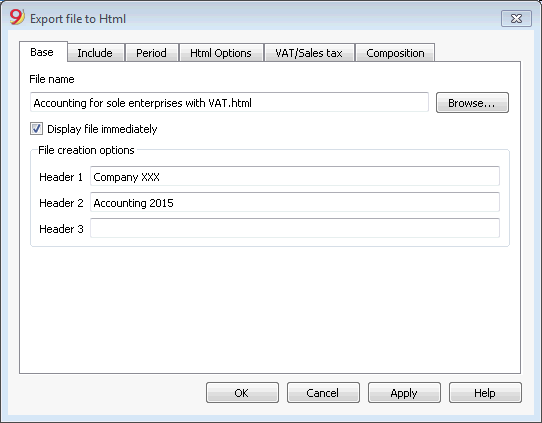

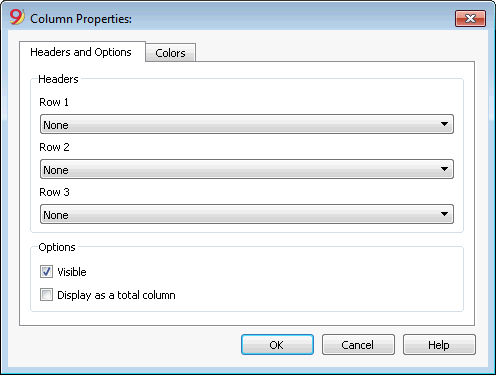

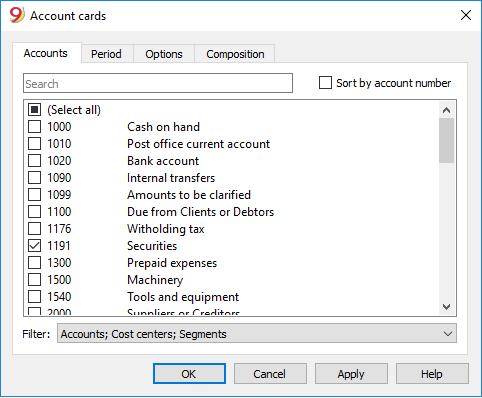

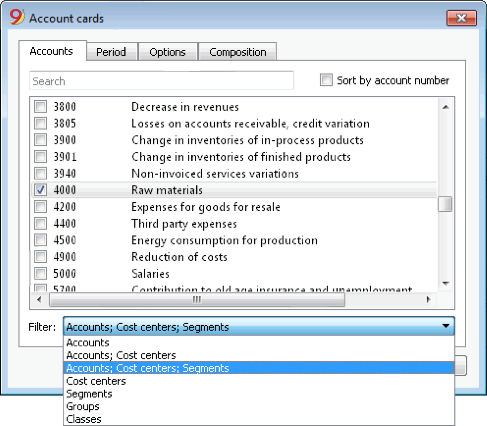

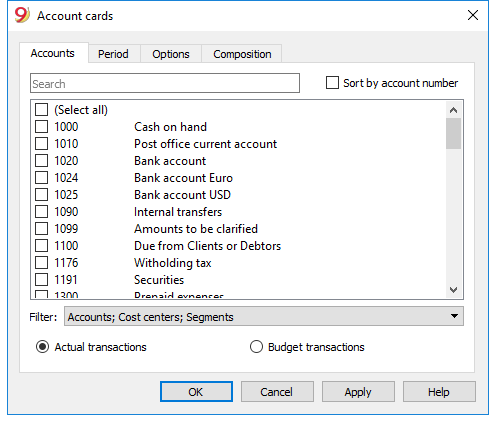

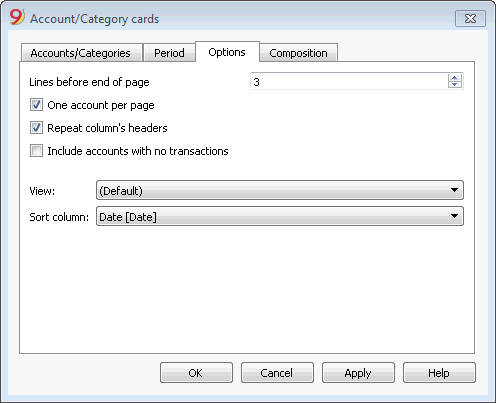

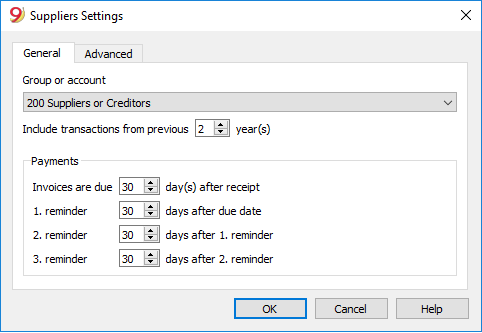

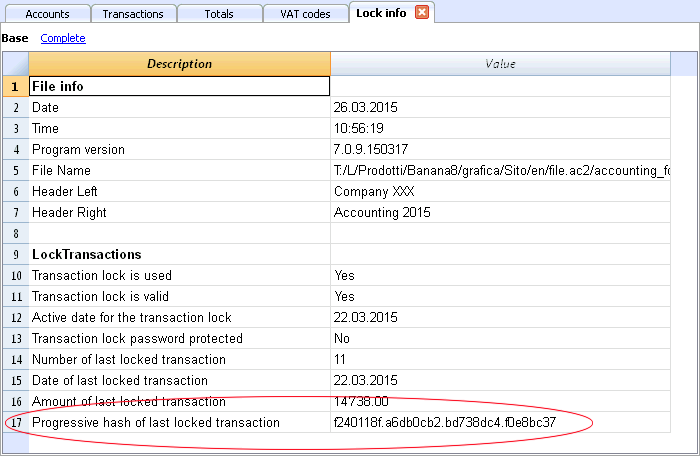

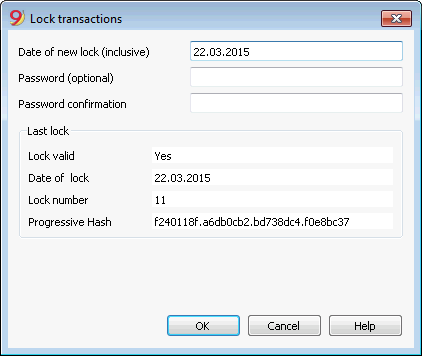

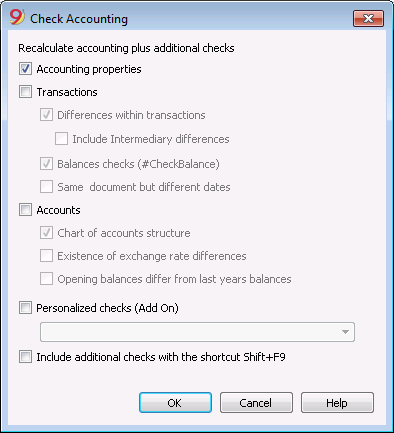

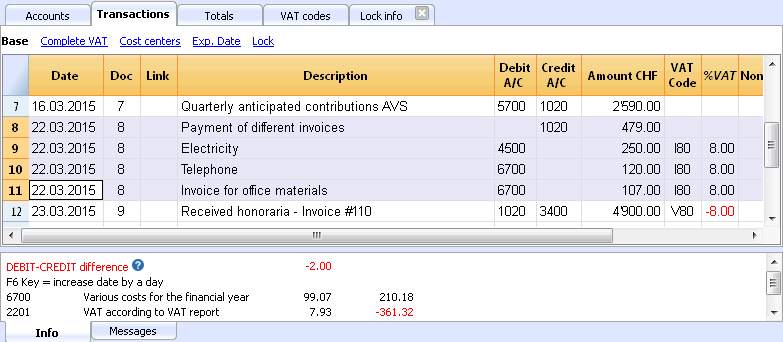

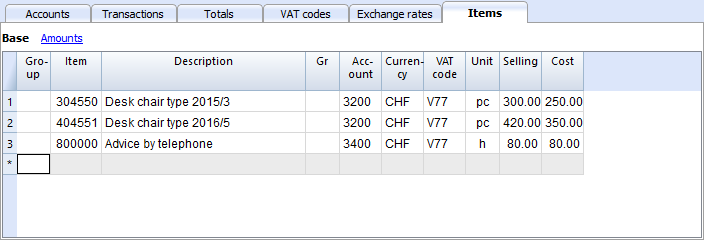

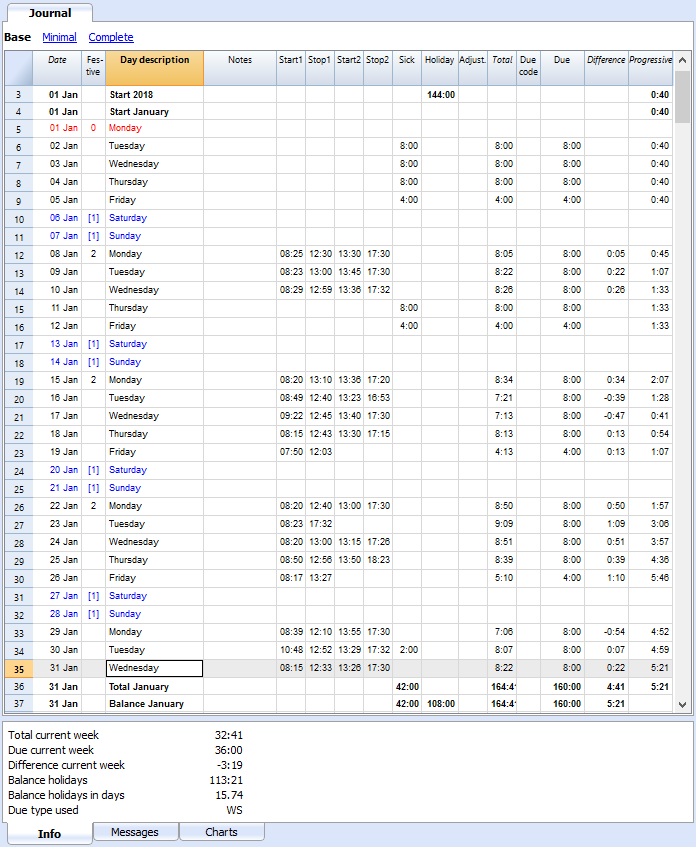

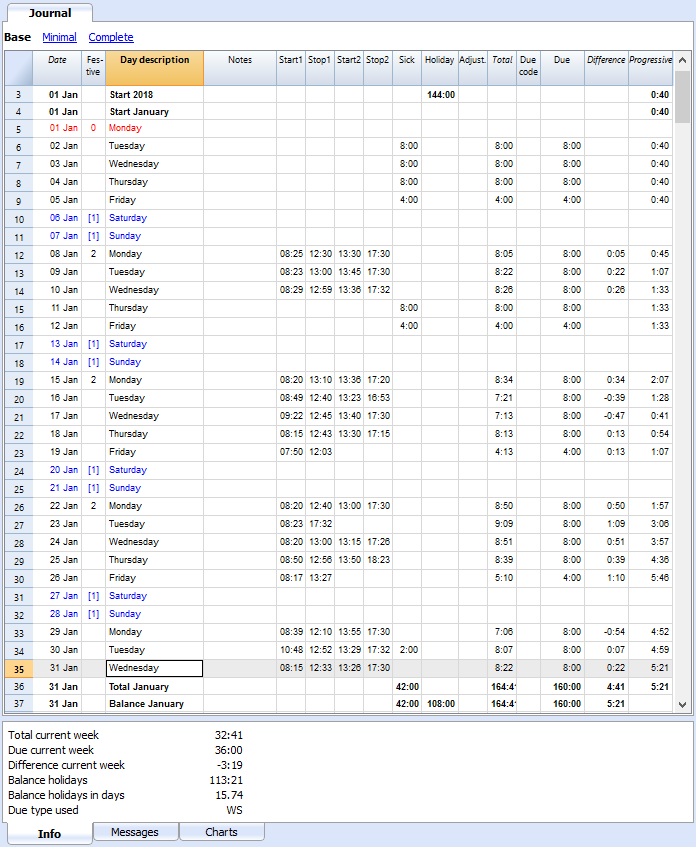

- click on the Rename command from the Data menu;