In this article

New Swiss VAT rates 2024

New VAT rates go into effect on 01.01.2024. Choose Banana Accounting Plus Advanced plan for a smooth transition.

Key benefits

- Automatically import the new rates into the VAT Codes table.

- Receive the VAT Statement in paper facsimile format or as an XML file ready for upload to AFC.

- Dramatically reduce your work time with advanced built-in features.

With Banana Accounting 9

- You CANNOT automatically import new 2024 VAT Codes; you can enter them manually.

- You CANNOT create the VAT Statement , but you can get the VAT Report from the Account1 menu command.

Choose Banana Accounting Plus - Advanced plan - get 1 month free!

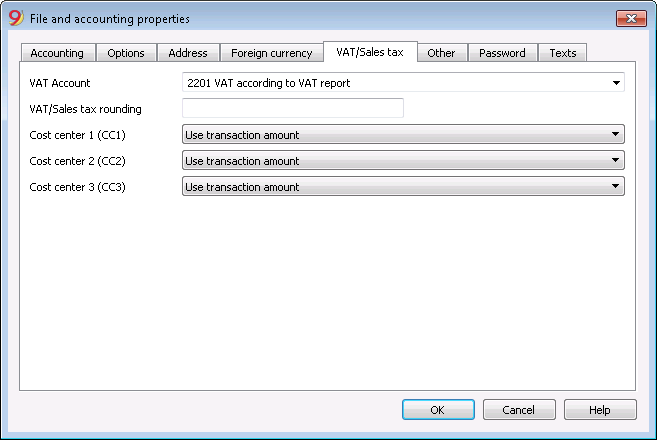

This tab only appears if an accounting with VAT/Sales tax management is chosen.

VAT Account

The Automatic VAT account, that is present in the chart of accounts, is defined here as default. In this case, the VAT account does not need to be inserted in the VAT Codes Table.

VAT/Sales tax rounding

This is where the user inserts how the VAT/Sales tax amounts should be rounded; if, for example, the user inputs 0.05, the VAT/Sales tax amounts will round to multiples of 0.05.

Cost Centers 1 (CC1), 2 (CC2), 3 (CC3)

For each type of Cost Center, the user can select which amount to use for the transaction in the cost center.

- Use transaction amount

- Use amount inclusive VAT/Sales tax

(When cost centers are being used for Client/Suppliers accounts) - Use amount without VAT/Sales tax

(When cost centers are being used for Revenue and Expenses)

Note: If one of these parameters is modified, the accounting must be recalculated.

Related documents: VAT Management, Cost and Profit Centers