In this article

If you happen to be interested in practicing theoretical accounting on computer, you can learn with Banana Accounting, and find out, in a hands on way, how to manage personal or small and medium-sized businesses accounting.

This approach is valid for Double-Entry accounting, but also for Income & Expense accounting.

Before starting, please refer to the:

- Free plan page to download the free version for your students (up to 70 rows of transactions).

Templates and customization

- You can download and get started with the following example template (template in Italian) which has been designed specifically for beginner level students. You also have the possibility to customize it according to your needs.

- Alternatively you can select a standard template in Banana Accounting, that is ready for use but can also be modified if you wish to adapt it.

- Last but not least, you can create a new file starting from scratch, perhaps for the company that interests you the most: hairdresser, restaurant, shop, doctor, lawyer, etc.

- Unlike other accounting software, Banana Accounting files can be created, copied, exchanged and then distributed without any restrictions. No login procedure is required and compatibility is guaranteed for major operating systems (Windows, Mac, Linux, Android, iOS).

- This didactic approach therefore consists in applying the various accounting concepts directly. Understanding those will be more intuitive than teaching of a traditional theoretical course, because you will see them as they are put into practice in concrete terms. Thus, you will be ready to apply accounting in a professional context.

- Finally, through Banana Accounting, you may also gain valuable knowledge for any accounting software. In fact, thanks to the interface that fully displays the various elements of accounting management (as shown in the screen captures below), you acquire full awareness of the process and also apply what you have learned to other programs.

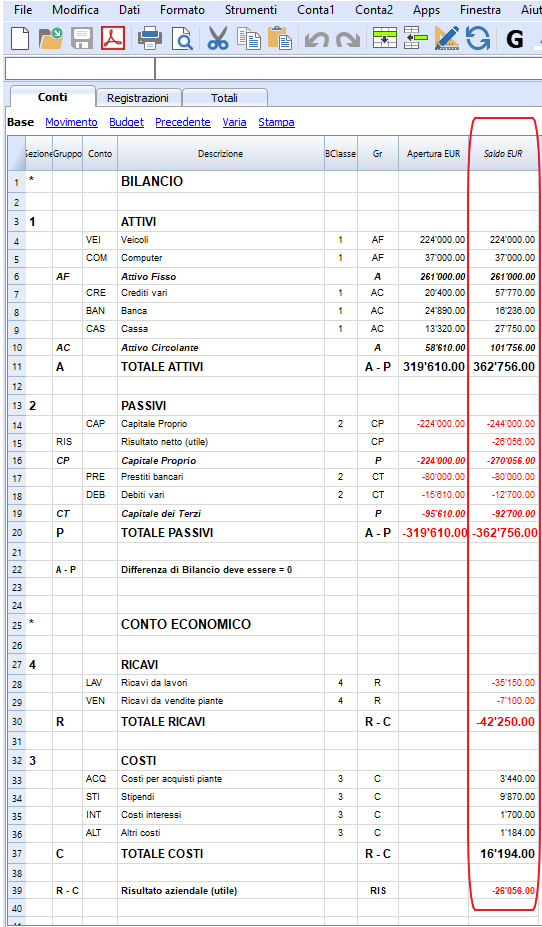

Chart of Accounts

- As far as the Chart of Accounts is concerned (see screen captures below), it is displayed in it's entirety, with Balance Sheet and profit & Loss statement visible at a glance and under control. To adapt it to your needs you can immediately and easily modify items and amounts, as if it were a simple Excel document.

- You can enter the names of the accounts you want, label them with a code or an account number, and create categories and sub-categories, with their totals and sub-totals, through the simple setting up of groups (see Group and Gr columns that work jointly with this purpose).

- The BClass column is used to inform the system if the related account is an Asset (1), a Liability (2), a Cost (3) or a Revenue (4). You can therefore rely on it to learn how to distinguish these basic four categories of accounting.

- One important aspect, from an IT point of view, is that accounting software is generally based on the equation "Debit = Credit", which should translate into "Debit - Credit = 0". It has been chosen by programmers to maintain this form, so Debit amounts are associated by the system with the plus sign "+", while the Credit amounts carry the minus "-" sign. Since it is the sign that establishes the distinction between amount types, one single column rather than two is sufficient. This clearly improves the visibility of the display. For the formal presentation of the accounts, Balance Sheet and Profit & Loss Statement are however "enhanced" by the software and exhibited in a traditional way (see following points).

- The Profit & Loss statement can be set up by either separating Cost and Revenue, as in the present template, or at stages and levels that mingle them. Click on example template structured for this second option (template in Italian).

- To facilitate classification and readability, you may insert space between the accounts by adding blank lines, as well as zooming. For illustrative purposes, it has been chosen to compress the lines and the accounts in the screen captures shown.

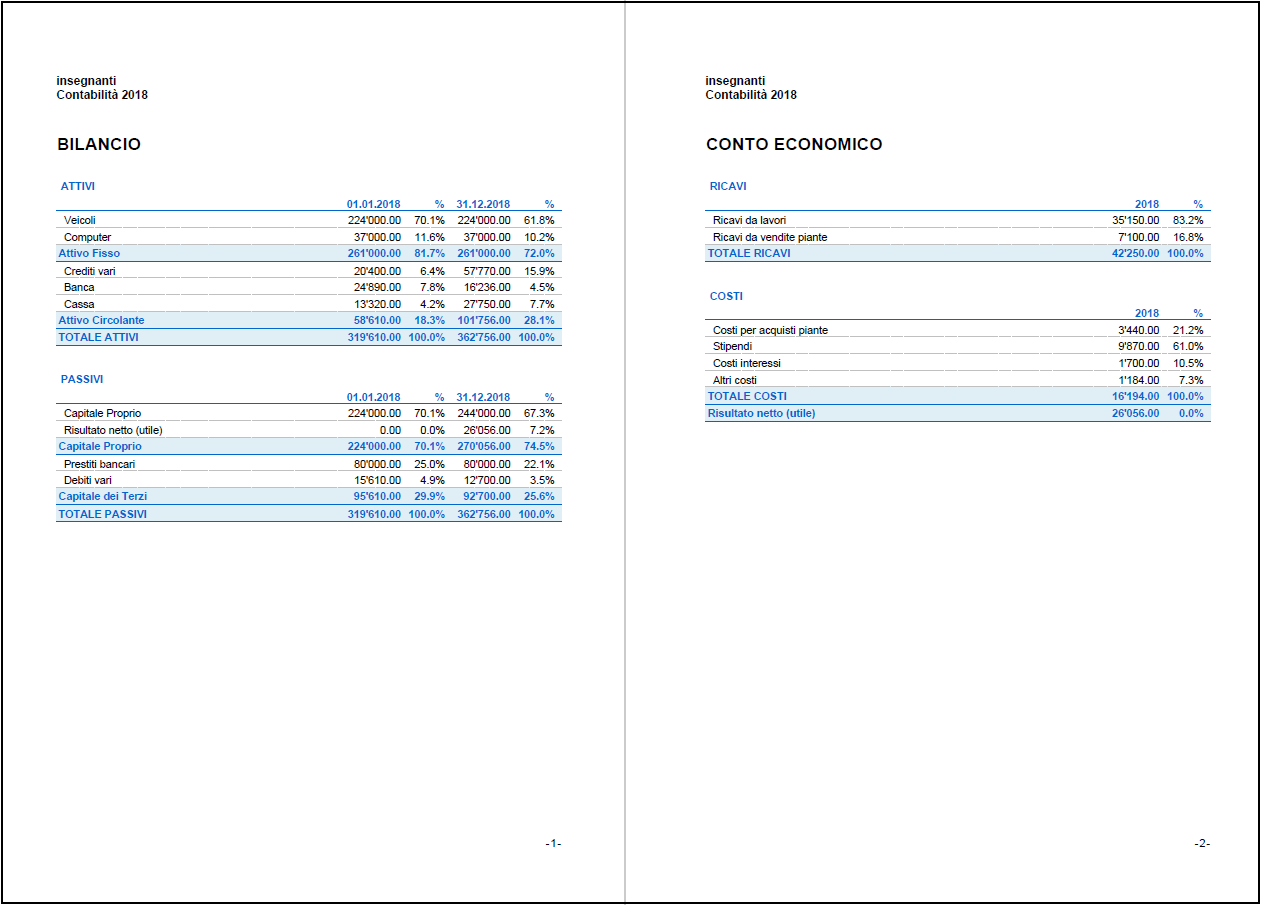

- As a final illustration, the following screen captures will give you the idea of the goal you aim to achieve at the end of the accounting course: to know how to construct and interpret the financial and the income statements of a company, as well as the Account Cards, mastering the Transactions Journal technique that allows and determines amounts and evolution of balances.

Opening Balances

- For a better understanding of how accounts and categories make up the Balance Sheet and the Income Statement, their structure, and how these two documents share the company result, it may initially be useful to present the various accounting elements gradually including the opening balances. Numerical relationship created between amounts, totals and subtotals, will factually facilitate learners to get familiar with the categories and sub-categories of accounts.

- Costs and Revenues do not carry initial balances, but the system offers you the possibility to enter them. For educational purposes only, you can initially make use of this possibility. Particularly, when you deal with the theme of the Income Statement for the first time, it may be suggested to also assign initial balances to Costs and Revenues. Thus you will obtain a profit or loss in the Income Statement, which can be reported easily in the Balance sheet in order to even it up. Once you have acquired this principle, you will be able to omit the initial balances from Costs and Revenues, and the balances in the Income Statement will be determined by your journal entries.

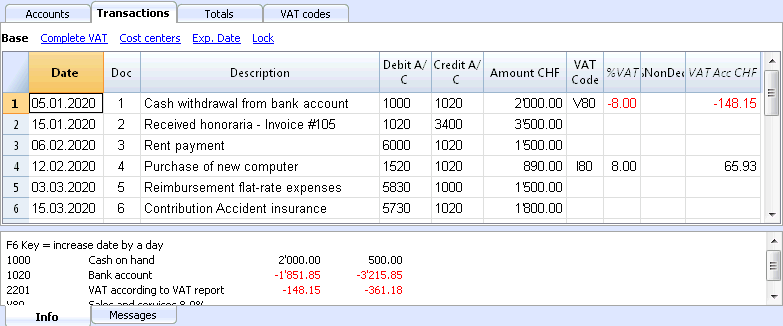

Journal and Transactions

- When entering Transactions in the journal, the values in the Chart of Accounts, ie in the Balance Sheet and in the Income Statement, adjust immediately and you will see the impact of each transaction in real time. As for the accounting mechanisms for Assets, Liabilities, Costs, Revenues, ie Debit and Credit are concerned, you're offered two possibilities to understand their functioning:

- Method 1:

- Assets: Their value increases on the Debit side and decreases on the Credit side.

- Costs: Their value increases on the Debit side and decreases on the Credit side.

- Liabilities: Their value decreases on the Debit side and increases on the Credit side.

- Revenues: heir value decreases on the Debit side and increases on the Credit side.

- Method 2:

- On the Credit side, enter the provenance account of the loans, typical for Liabilities and Revenues, which will answer your question: "which is the source (which account) of my financing?"

- On the Debit side instead, enter the destination account of the loans, typical for Assets and Costs, which will answer your question: "which is it I am financing?" I

- Should you need to reverse an accounting transaction, for any the reason, you only have to cancel the flow of loans, either totally or partially.

- Method 1:

- Individual transactions may take the form of a simple, that is a one row entry, or a composite , ie occupying multiple rows (if more than two accounts were involved). This is exactly similar to traditional practice on paper, but faster thanks to the use of the computer.

- When initial balances and journal transactions are entered, you will immediately notice the repercussions on the final balance of the individual accounts, as well as on the Chart of the Accounts as a whole, help you recognize any errors or anomalies and correct the data entered. This allows for a faster familiarization with accounting mechanisms and a clear understanding of them.

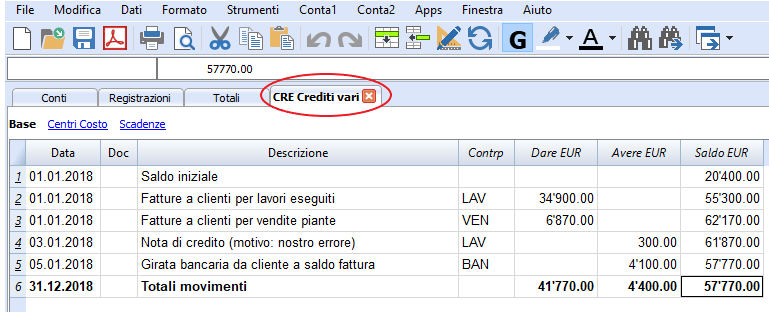

Account Cards

- You can also consult the details of each individual account. The Account Card shows the initial Balance, the variations resulting from transactions in the Journal and the resulting Final Balance.

- Calculations are generated automatically (sums, differences, carryovers), which is an advantage in terms of time in general, and especially if modifications are required. Thanks to this automation, you can therefore concentrate on analyzing single accounts (dates, descriptions, amounts in Debit and in Credit, initial and final balances) and therefore, on accounting mechanisms. This further increases your focus on noticing any anomalies and errors, and correcting them, instead of having to devote time and energy to perform traditional and tedious controlling routine, using the paper method.

- It is important to remember that all amounts entered as Debit in the Journal will be accounted for as a positive and Credit as a negative, in accordance with the "Debit-Credit should be 0" equation.

Final Balance

- Please note that the final balance of each individual account, which is visible in detail in the relevant account form, is finally automatically copied to the Chart of Accounts. This determines the composition of the financial statements and the final income statement, as well as the company's result (profit or loss).

- The Company's result carries the same sign in both the Income Statement and in the Financial Statements, because Banana Accounting considers the Income Statement to be a Balance sheet account (more precisely, as an equity account) and the Company's result as its final Balance. The latter is therefore reported in the financial statements, such as that of any account.

- The Chart of Accounts, adjusted automatically and instantaneously with it's final balances, offers you the opportunity to crosscheck the values present in the financial statements and the final Income Statement, as well as the changes in individual accounts, comparing them with those at the beginning of the period. Thanks to automatic reporting, which is not possible on paper, you are immediately made aware on the economic and financial impact of certain operations, especially if you are managing your company.

- Once working at more advanced levels, you will be able to allocate more time to accounting analysis, thanks to the possibility of exporting Banana Accounting data to Excel to calculate indexes and set up charts.

Orderly and edited Presentation

- Thanks to a dedicated function, Budget and Income Statement can be "enhanced" and reproduced and presented in traditional style. Working on computer, do you won't waste any more time and energy in a demanding manual work of transcription and preparation on paper, as your accounting will be presented in an orderly edited way.

- For this purpose, you'll find the Enhanced Balance Sheet ... function in the Reports menu, either with or without Groups. Contrary to Enhanced Balance Sheet, Balance Sheet with Groups will generate a report with Categories and Sub-Categories that you will have implemented in the Chart of Accounts, specifically in the Section column.

- Refer to the Documentation 9 page for comprehensive related detail.

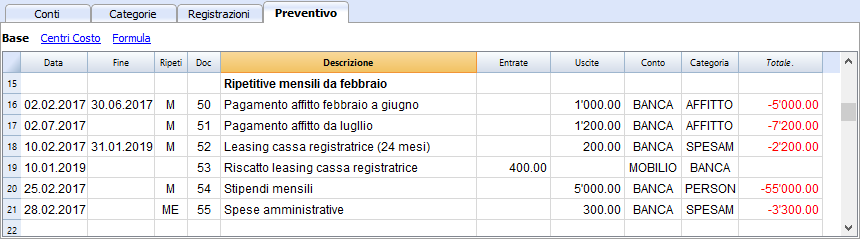

Plan and Budget

- Once you are at ease with accounting mechanisms and fell you understand it's background, you can proceed to projecting the future financial evolution of your company, namely plan and budget for items and movements (on a singular or recurrent basis). You will be able to focus on managing Income and Costs, Liquidity and Debt management for year's to come.

- Refer to the Documentation 9 page for comprehensive related detail.

The future of learning accounting

- The approach focusing on the union of accounting theory and practice is the future of learning. Although there may currently be limits dictated by official training plans, for reasons of effectiveness, competitiveness and progress, institutions will eventually adapt to new methods.

- This new approach has been successfully tested in various training situations, from middle schools to vocational training institutions, as well as universities. Refer to List of Schools / Resources.