In this article

New Swiss VAT rates 2024

New VAT rates go into effect on 01.01.2024. Choose Banana Accounting Plus Advanced plan for a smooth transition.

Key benefits

- Automatically import the new rates into the VAT Codes table.

- Receive the VAT Statement in paper facsimile format or as an XML file ready for upload to AFC.

- Dramatically reduce your work time with advanced built-in features.

With Banana Accounting 9

- You CANNOT automatically import new 2024 VAT Codes; you can enter them manually.

- You CANNOT create the VAT Statement , but you can get the VAT Report from the Account1 menu command.

Choose Banana Accounting Plus - Advanced plan - get 1 month free!

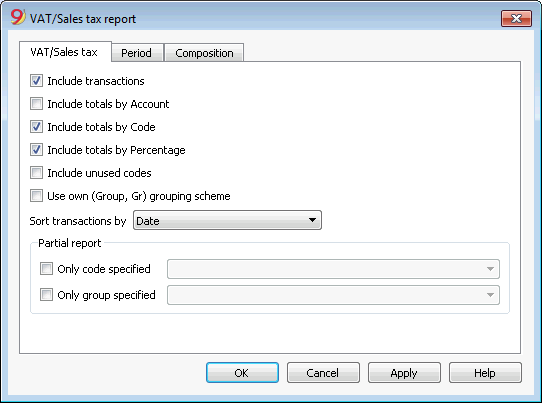

The VAT Report elaborates and displays the VAT calculation according to the selected period and parameters.

Procedure:

- Select, from the Account1 menu, the VAT report command

When activated, the following options allow the user to include the following data in the VAT report:

All the transactions with VAT/Sales tax are included.

Include totals by Account

All totals of operations with VAT/Sales tax, grouped per individual account, are included.

All totals of operations with VAT/Sales tax, grouped per individual VAT code, are included.

Include totals by Percentage

All totals of operations with VAT/Sales tax, grouped per individual percentage, are included.

Include unused codes

Also the unused codes of the VAT Codes table will be listed.

Use own (Group, Gr) grouping scheme

The operations with VAT/Sales tax are grouped according to the groupings of VAT Codes table.

Sort transactions by

By activating this cell, the transactions are sorted on the basis of a preselected option (Date, Doc., Description, etc….).

- only code specified (by selecting from the list)

- only group specified (by selecting from the list).

Other sections

The information relating to the other sections are available on the following internet pages:

VAT Report / transactions with totals by code

The overall total in the last row of the VAT report has to correspond with the amount for the end of period of the Automatic VAT account, Balance column, on the condition that both of them refer to the same period.

The data of the VAT report can also be transferred to and elaborated by other programs (f.i. Excel, XSLT) and be presented in formats that are similar to the forms of the tax authority

For Switzerland, one can automatically obtain a document similar to the form that has to be sent to the VAT office. This form shows the amount to enter for each number. Please consult (in German, French, or Italian) Swiss VAT Report.