The easiest way to manage your accounting:

- Quick start: you're ready to work in minutes

- Fast entries and instant checks

- For Professionals and beginners: everyone at their own level

- Accounting features: VAT management, customers/suppliers, cost centres, segments and more

- Create and print invoices, also with QR code for Switzerland

- Customised Professional reports in just a few clicks

- Increased productivity: Banana Plus also includes Timesheets, Estimates and Invoices, Fixed Assets Register, ...

- Safety combined with convenience: NoCloud, installation on different devices, targeted help

- Different subscription plans: choose the one that suits you!

Fast entries and instant check

Whether you enter them manually or get them automatically from the bank, your data is always clear and visible in the table;

you can modify it as needed and have everything under control. It's easy, fast and powerful!

Familiar and intuitive interface

Write and move around the table freely with all the editing possibilities typical of Office programmes.

Speed up entry and processing of records by selecting zones, rows or even an entire table. Copy/Paste also from and to Excel.

Highlight your data with the help of colours, for easier analysis and retrieval.

Import your bank transactions

Automate the entry of your transactions by quickly importing bank, credit card or PayPal statements. Save time and minimise the possibility of errors!

The Professional plan offers the standard ISO 20022 international import format, made available by most banks.

In the Advanced plan you will additionally find import extensions specific to various institutions and credit cards.

Automatic import with the Rules

With Banana Accounting Plus Rules, you can quickly turn your bank statement transactions into complete transactions.

- Import your bank statement digitally – the Advanced plan supports all major banks and standard formats

- Set up your Rules just once, and they will be automatically applied every time

Bank transactions are now transformed into complete entries with counterpart, cost center, VAT code, etc. The Rules feature is available exclusively with the Advanced plan.

"The Rules from bank import function work great! They make accounting much easier and faster!" - G. Goroesch

Always perfect accounting

Account balances update automatically after each movement. Your accounting is thus always perfectly in order and gives you constant control over your business.

With the Balance column in the Transactions table you instantly acknowledge if and where there are accounting differences, so you can amend them immediately.

"It's fantastic! Thanks to the new Balance column, I can quickly identify any errors. If I correct one, I immediately see the next error... Now it takes me only one-third of the time to perform the audit...... - Mr. Eberle

Control and editing speed

Efficiently review and edit entered data with the Filter and the temporary Sort rows features:

Use the Filter to instantly find the transactions you are looking for and edit them directly from the Transactions table. Remove the filter and the edited entries will go back to their original order.

With the Temporary Sort rows command, you can temporarily arrange the transactions as desired. Remove the sorting criteria to revert back to the original layout.

"The solution with the rows filter and the Ctrl + L shortcut is simply fantastic. I have always wished for it. Well done!" - B. Heller

Just-a-click-away digital documents

Attach the supporting document in digital format to each movement, take your accounting to the next level and keep everything at your fingertips!

Receipts, invoices and proofs of payment. View everything in PDF format with a simple click, without wasting time looking for the version on paper!

For Professionals and Beginners

With Banana Accounting Plus you can manage your accounts successfully, even if you are not an expert.

Different types of accounting offer everyone the right tool for their skills and guarantee professional results to everyone.

High flexibility

Unlimited number of accounts: with one subscription you can manage as many accounts as you want.

Easily change the language of both the individual file and the entire programme. Available languages: Italian, German, French, English, Spanish, Portuguese, Chinese, Dutch.

Double-entry accounting for those already familiar

The traditional method of accounting par excellence: the classic table with Debit and Credit columns in digital format.

Double-entry accounting templates are ideal for accountants, trustees or professionals.

Easy income & expenses accounting

Income/expense accounting is exclusive to Banana, recommended for those with little or no accounting experience. Although it has the same calculation method as double-entry accounting, it uses the more intuitive concept of 'Income and Expenses'.

In the Account and Category columns, it simply indicates which account the money comes from and which category of expense or income it relates to.

Multi-currency for those working with foreign countries

You can enter transactions in any currency: set the exchange rate and indicate the foreign currency account in the entry. The programme calculates the exchange rate automatically and enters the amount in base currency.

Choose a multi-currency accounting template to start immediately and find the Exchange rates table already preset.

All the features you need

The programme includes VAT Management, Customers & Suppliers, Cost Centres and Segments, Budget, and many other functions.

Choose and use only the ones you need with the peace of mind that you can add as needed.

VAT management

Simply specify the VAT rate code in the transactions and the programme takes care of the rest!

You will obtain detailed summaries by period, VAT code, account, and percentage, including totals and transactions. Methods based on effective VAT and flat tax rate.

- New VAT Codes table with the rates for 2024, available for download and automatic import.

- Automatic VAT report with XML file to be sent to the AFC (Advanced plan) .

- VAT summary and manual entry of totals for the VAT report (Professional plan).

Customer and supplier management

Thanks to the ready-made templates with the customer and supplier ledger, you can manage everything optimally: simply enter the customer or supplier account in the entry.

Get the full list of suppliers and customers and keep track of payments and receipts.

Cost centres and segments

Highlight particular areas of your business easily and efficiently with a higher level of detail!

Cost centres and segments in Banana Accounting Plus offer the possibility to see details of projects, events, construction sites, members and other specific activities, or to highlight costs and revenues by unit, department or branch.

Professional invoices

Enter invoices as simple entries, indicating the invoice number and customer account. If you have several products you can also use the columns Quantity, Unit and Unit Price.

With one command your entries become professional invoices, ready to be printed or emailed to your customers.

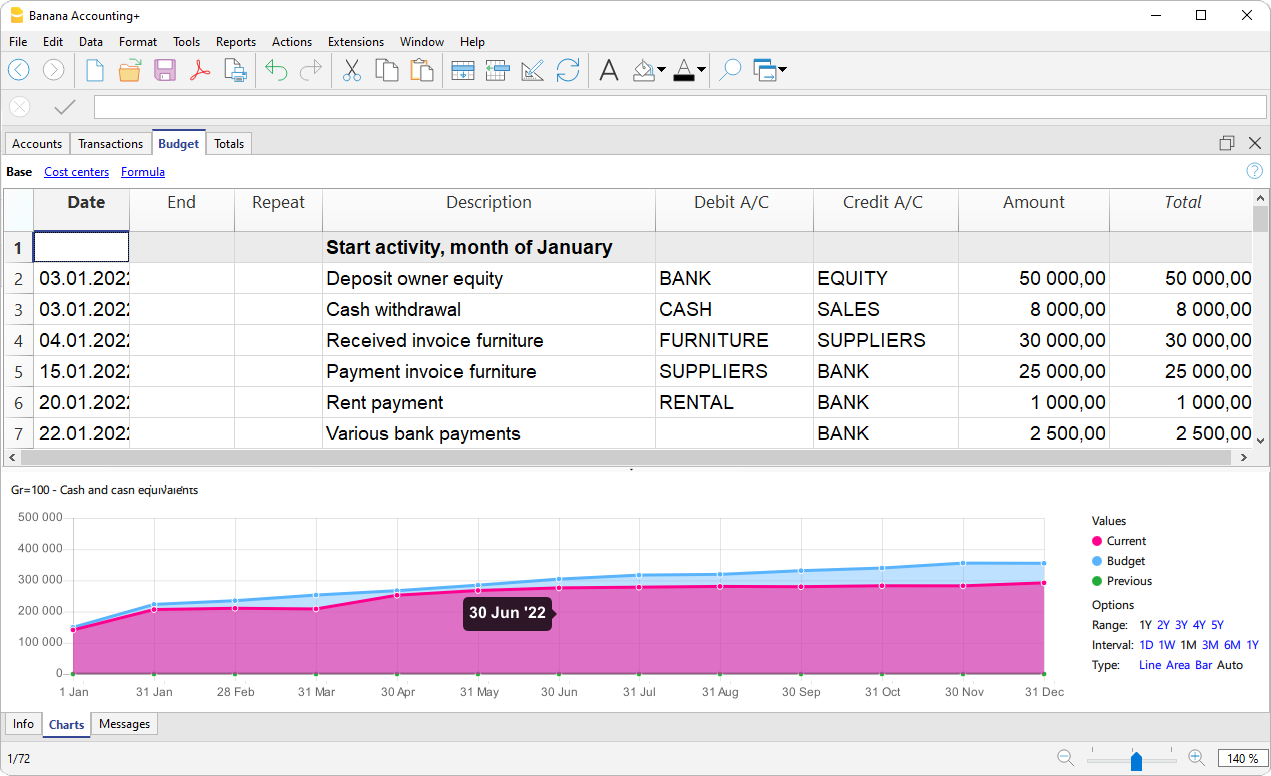

Budget and Cash plan

Easily create your budget for effective cost control and an eye on the future!

In the Budget table enter forecast entries with a future date and indicate their repetition. The programme projects your forecasts by month, quarter, half-year, year and over several years.

A great tool for anticipating times and taking timely action to achieve your goals.

Maximum security with Blockchain

The security of your data is a must. With the innovative Blockchain system, you can create security seals that guarantee the integrity of your data from unauthorised or involuntary changes.

Banana Accounting was the first accounting software in the world to introduce this technology in 2002, later also adopted by the Bitcoin system.

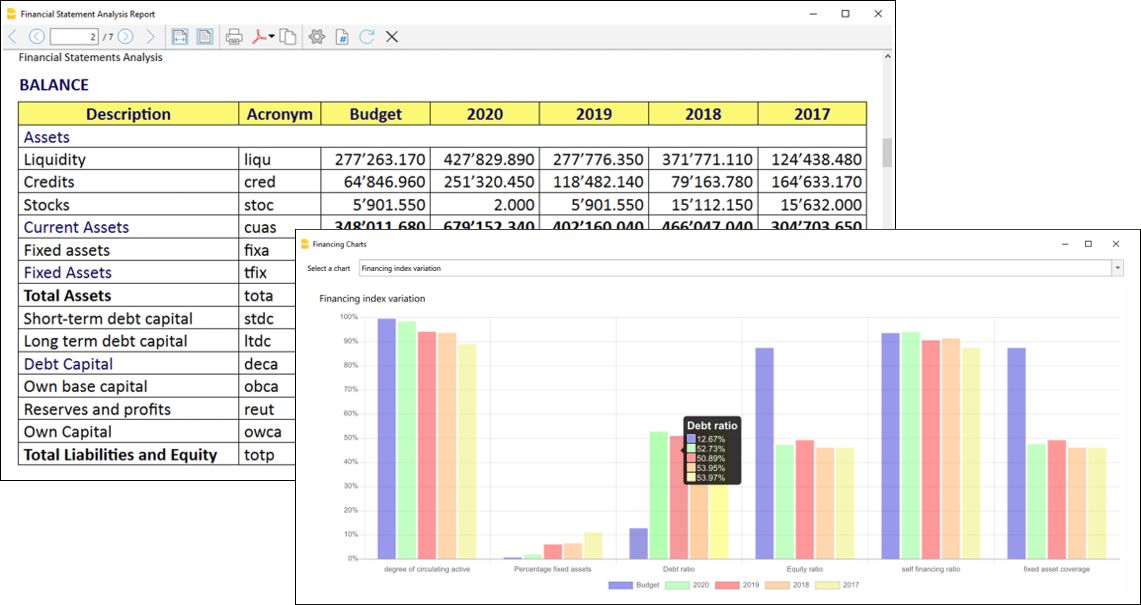

Professional reports

Get the reports you need in one click, customise them and save your settings.

Print customisation

Easily print everything you see on the screen. get the PDF by using the appropriate icon.

Insert your logo, define colours and choose which data to print, also per period and over several years. For each report store your personal settings, which you can retrieve each time you need to reprint it.

Financial reports at a glance

Quickly print all the reports you need and at any time:

- Chart of accounts

- Balance sheet and Income statement

- Transaction journal

- Budget and much more!

Account details

View and print detailed sheets for each account or category, customer or supplier, paid or unpaid invoices. Choose whether you want to print only one, selected ones or all of them together. For the entire accounting period or for defined periods.

VAT report

Get VAT reports by period, VAT code, account and percentage, both with totals only and with all entries. Country-specific VAT extensions process data as required by the tax authorities.

For Switzerland, easily manage both the effective VAT method and the VAT Flat tax rate method, and print the specimen of the official statement or export it directly in Xml for uploading to the AFC website. The 2024 Swiss VAT Report is available for all plans until June 30th 2024 (after that with the Advanced plan only).

Easy invoices with QR code as well

Your invoices are immediately ready to print. Banana Plus offers several ways to get them to meet all requirements:

- Invoices and reminders

- Estimates and delivery notes

- Empty QR code slip , without addressee or amount

- Letter with QR slip

- Bulk invoices to several recipients from Excel data (Advanced plan)

Special prints thanks to the extensions

Extensions are additional programmes that extend the functionality of Banana Accounting Plus. Thanks to them you can also obtain:

- Certificate of donation for associations

- Book lists for libraries

- Budget and cash flow analysis

- Securities portfolio management

- Construction and renovation management

Many of these extensions require the Advanced Plan.

Applications to increase your productivity

In addition to the various accounting types, Banana Plus includes several additional applications for all-round management of your business.

Estimates and invoices with also QR code

Simple table system to manage estimates and invoices separately from your accounting file. Set your customer data, articles or services to be invoiced, unit prices and VAT rates; the programme takes care of the rest.

- Create and print estimates and invoices (also QR)

- Convert estimates into invoices

- Edit and duplicate estimates and invoices

- View open invoices

- Archive invoices

Time sheet

It doesn't matter if you are a freelancer or entrepreneur, if you work full-time or part-time: you can manage your working hours as you wish.

Define your weekly work schedule (fixed or flexible), then enter your working hours, holidays, overtime, travel expenses or sick leave into the table. The programme immediately calculates the totals and with one click you get a complete monthly report.

Inventory or Stock

Manage your inventory or warehouse easily, with the freedom to search and replace items, update them according to what you sell, buy or transfer from one warehouse to another. Get your reports in no time:

- Journal for each item

- Full journal for all items

- Journal for each location or for several locations combined

Fixed asset register

Manage your fixed assets quickly and easily and immediately know their initial value, history and year-end depreciation.

Enter data in tables and take advantage of functions that automate calculations, obtaining constantly updated values and balances.

Safety combined with convenience

We guarantee the privacy of your data while offering great flexibility.

And if you need help, you benefit from excellent support tools.

For all operating systems

Banana Accounting Plus is available for Win, Mac, Linux, Android, iOs, but also runs in the browser thanks to the brand new WebAssembly.

Install it on all your desktop, laptop and mobile devices. Up to 5 installations with the same registered user email. Multi-user conditions apply for companies.

Full control of your data

Banana Accounting Plus is a NoCloud software: it is installed on your computer and works locally.

Your data and accounting files belong exclusively to you, and you can choose where to save them: locally, on external devices, on cloud systems such as Dropbox, ICloud, OneDrive, etc. Our company has no access to your data.

The programme also works completely offline.

Extended documentation

Functional contextual help - As you register, the programme alerts you of any errors and helps you solve them thanks to integrated contextual help. You will find immediate help buttons relating exactly to the context you are working on.

Extensive online resources - constantly updated and expanded online documentation, including video tutorials.

Technical support - direct telephone and email help with the Advanced plan.

Subscription mode

Operating systems, applications, payment methods have constant updates.

With the equivalent of two coffees a month, you have the peace of mind of keeping up with the world.

All plans offer highly professional functions with immediate results:

Free - For trying out the programme, for beginners or students, or for personal use

Professional - For those who like to keep it simple. Standard features granting professional results.

Advanced - For those who need ultimate speed and for those subject to Swiss VAT. Maximum automation and customisation.

Information on new features

In an effort to inform our Professional plan users of any available features of the higher plan, while not putting any pressure to upgrade, the possibilities of the Advanced plan will be visible in light gray.

Many activities in fact, grow and expand over time, or the users themselves become more familiar with the program and want to take full advantage of its functions. In this way we are able to inform everyone discreetly.