Accounting Applications

Banana Accounting Plus offers various easy to use and professional applications, inspired by Excel, that allow for instant results.

The accounting Apps use an accounting calculation, planning and reporting engine, based on the Double-entry accounting method and offer several common features.

Income & Expense accounting

- Cash Manager (previously Cash Book)

For management of a single account, with the possibility of classifying income and expenses by category. - Income & Expense accounting.

To manage comprehensive accounting with various balance sheet accounts and categories, to which income and expenses are attributed.

This is a simplified mode of use, that doesn't require knowledge about Debit and Credit. There are also Balance Sheet and Income statement reports.

Double-entry accounting

- Double-entry accounting with or without VAT options

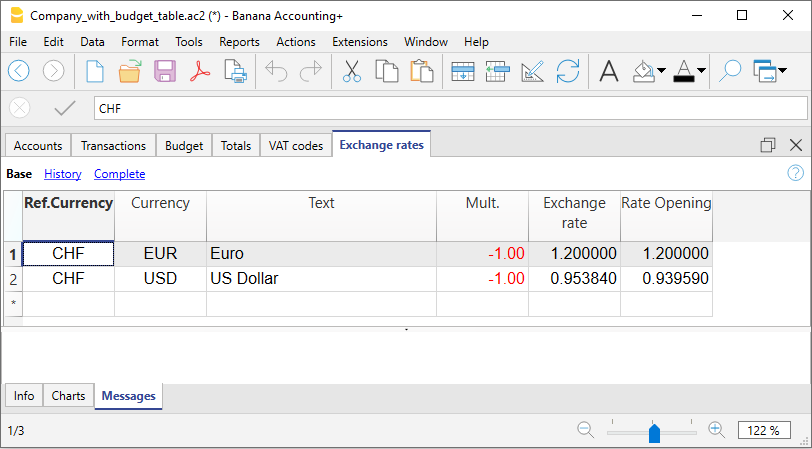

Comprehensive accounting solution, according to the Double-entry method. Transactions are classified by indicating the Debit and Credit account. The financial statements are complete with Balance Sheet, Income statement, Journal and Account cards. - Multi-currency accounting with or without VAT options

Double-entry accounting offering the possibility to manage accounts in different currencies:- Accounts for customers and suppliers, in various currencies.

- Transaction with current, historical or freely set exchange rate.

- Invoices in the currency of the customer's account.

- Balance sheet and account movement in base currency or that of the account in foreign currency.

- Calculation of unrealized exchange gains and losses (exchange rate differences).

Invoicing integrated in accounting

- Invoice entry as normal transaction rows.

- Columns for different contents, related to invoices.

- With or without VAT.

- Ability to edit and correct.

- Printing of a single invoice or bundling of several invoices via a simple command.

- Choice of different print print formats available. and customizable.

- Exports in digital format via Extensions.

- Customizable recalls and account statements.

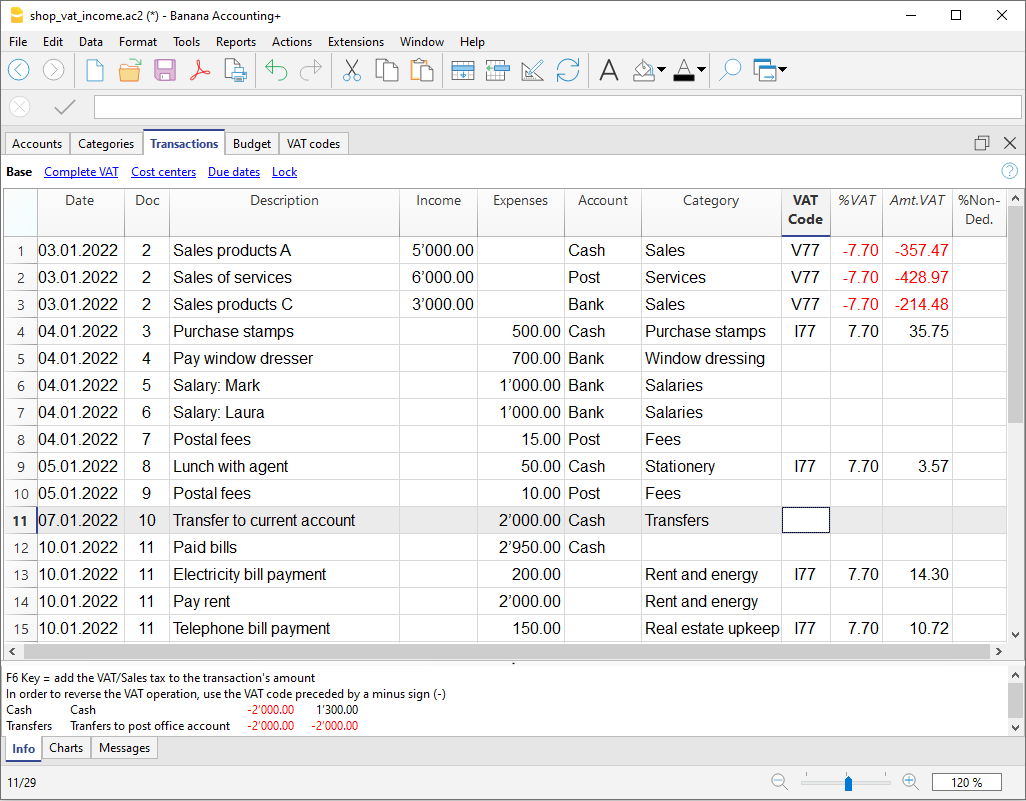

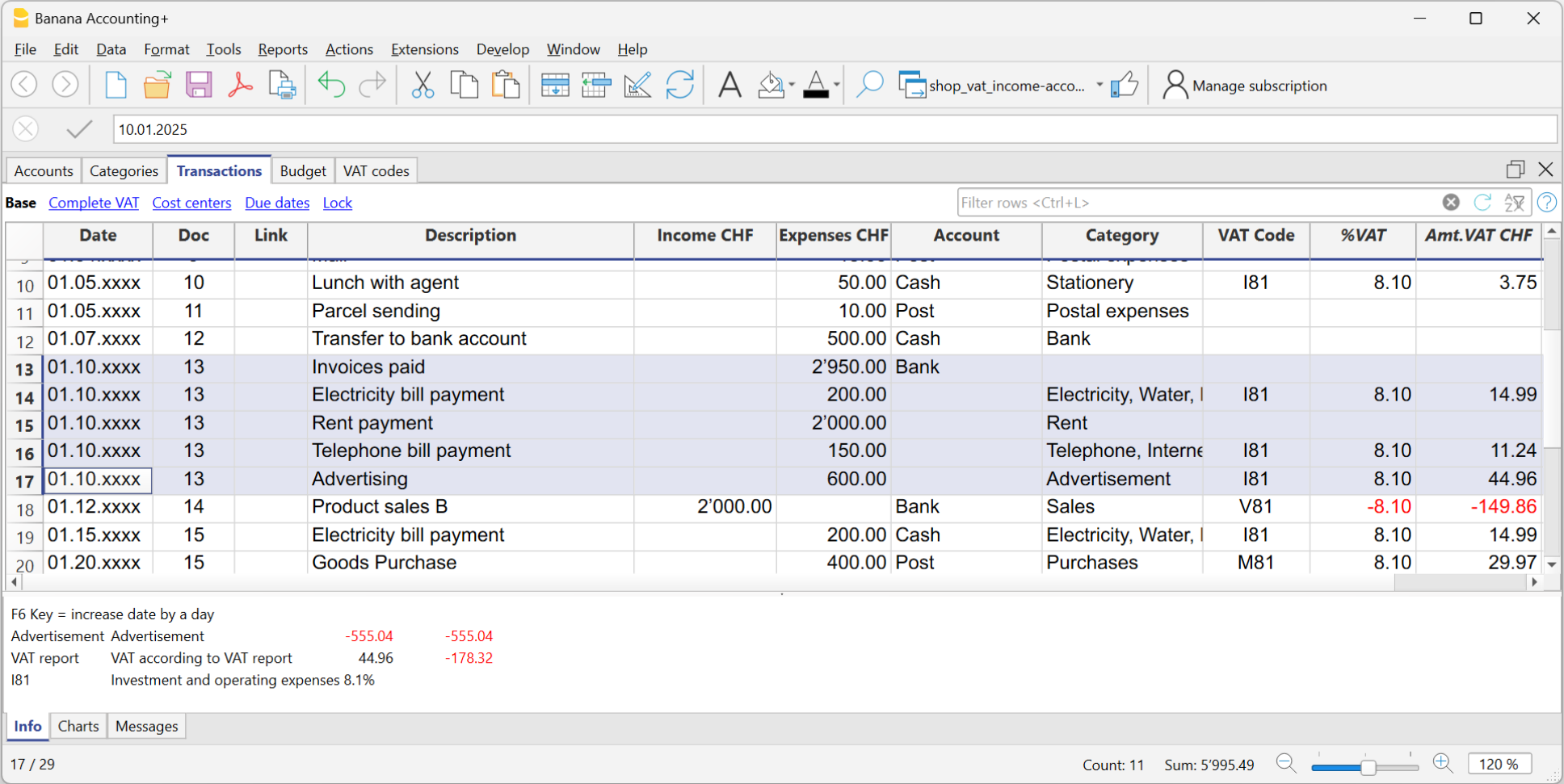

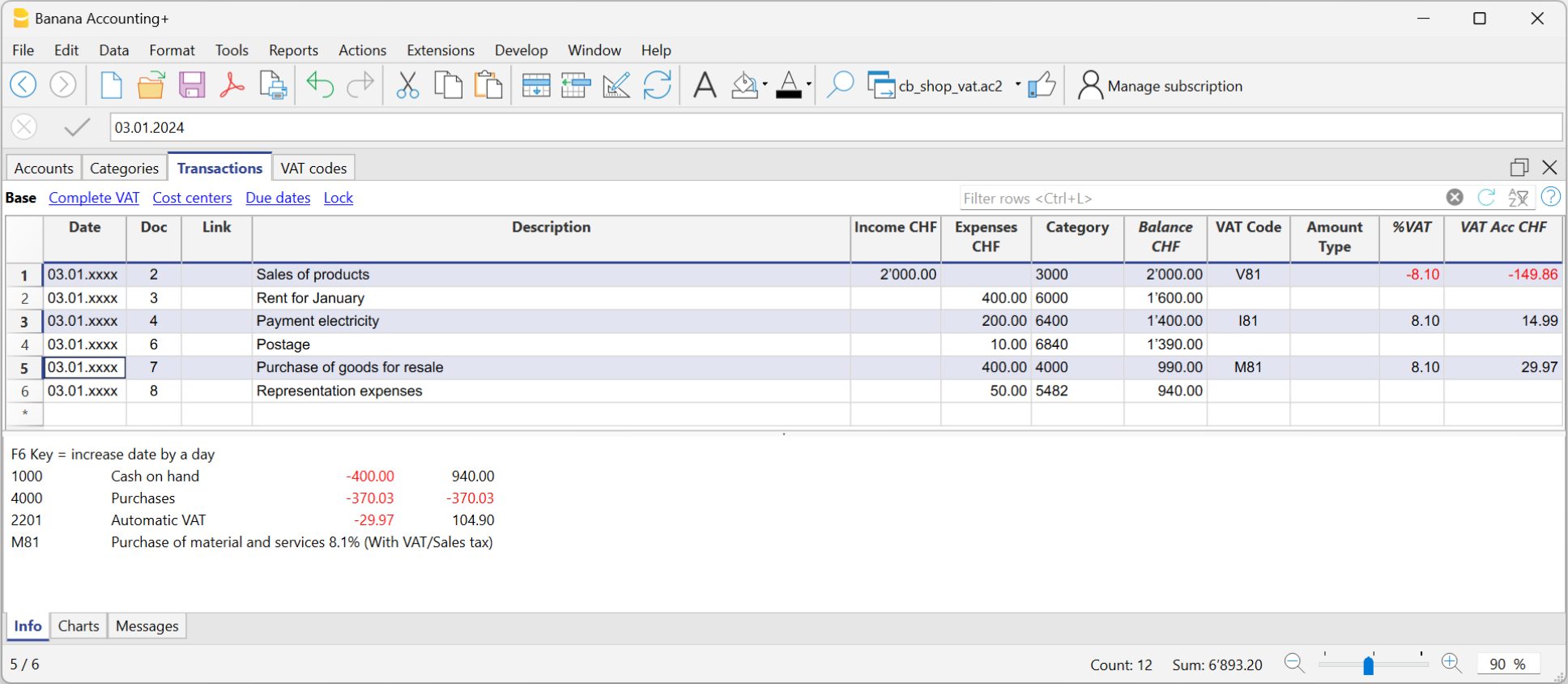

VAT management

Any national specifications supported:

- VAT code table to indicate the different VAT rates and case studies. Any VAT transaction supported.

- Automated VAT calculation, net or gross..

- VAT control reports.

- Electronic transmission of VAT data on the VAT platform of the Swiss Confederation.

- National extensions for VAT reporting based on the requirements of tax authorities.

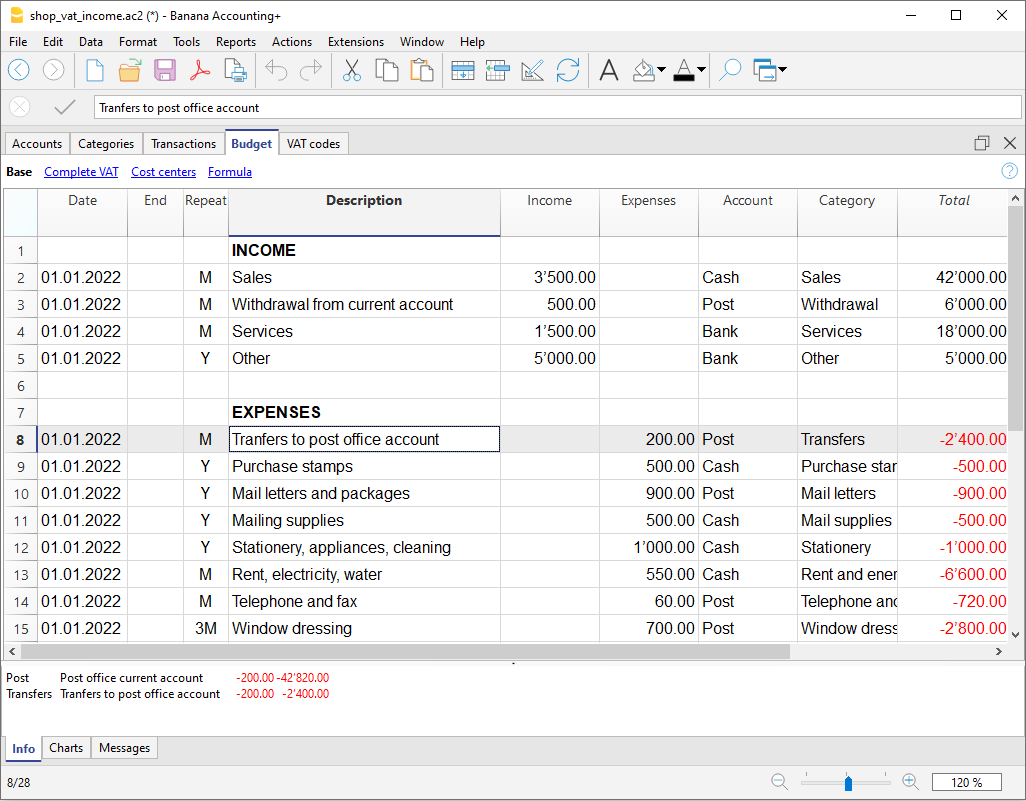

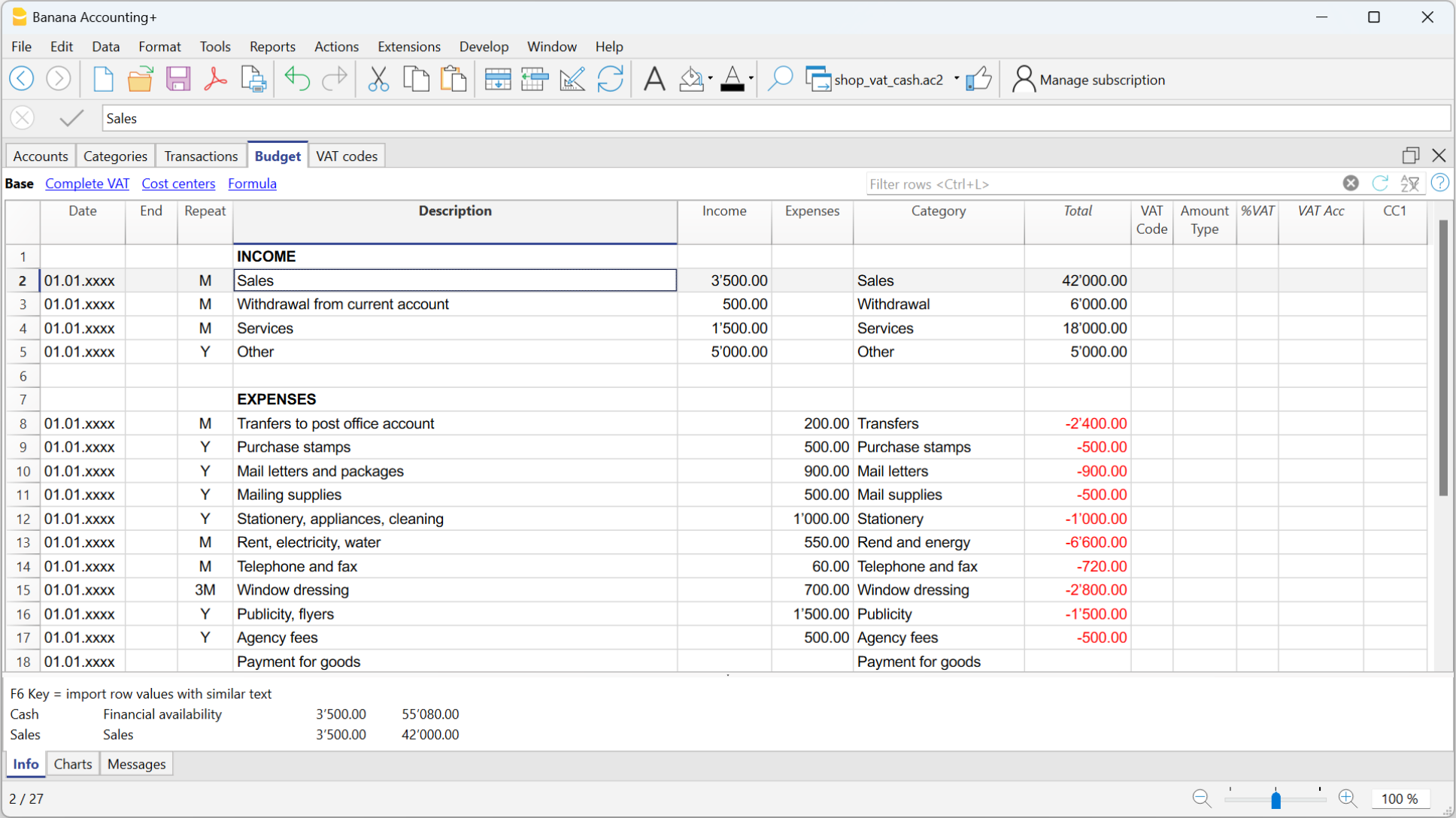

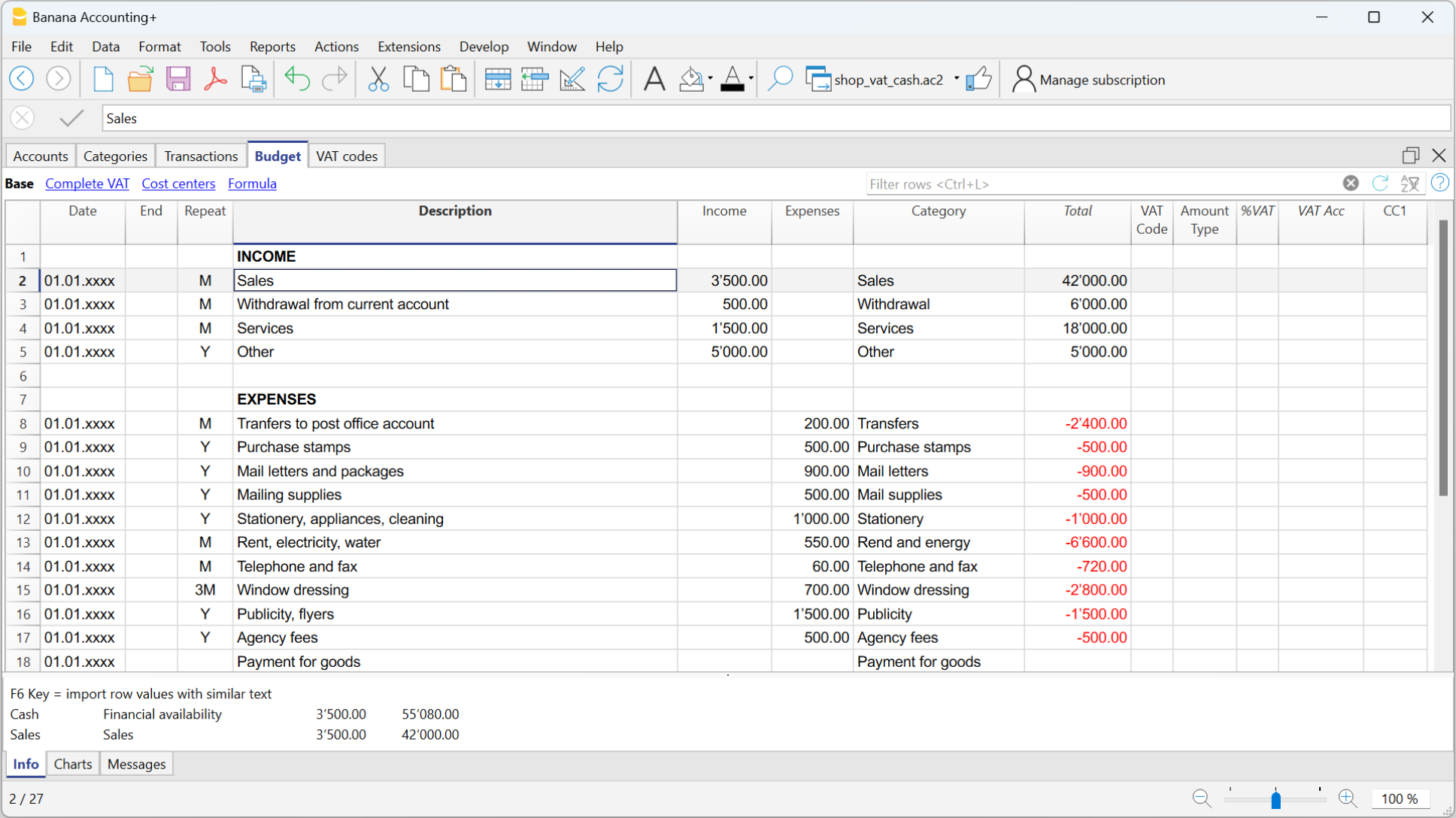

Financial Planning

- For existing companies or startups.

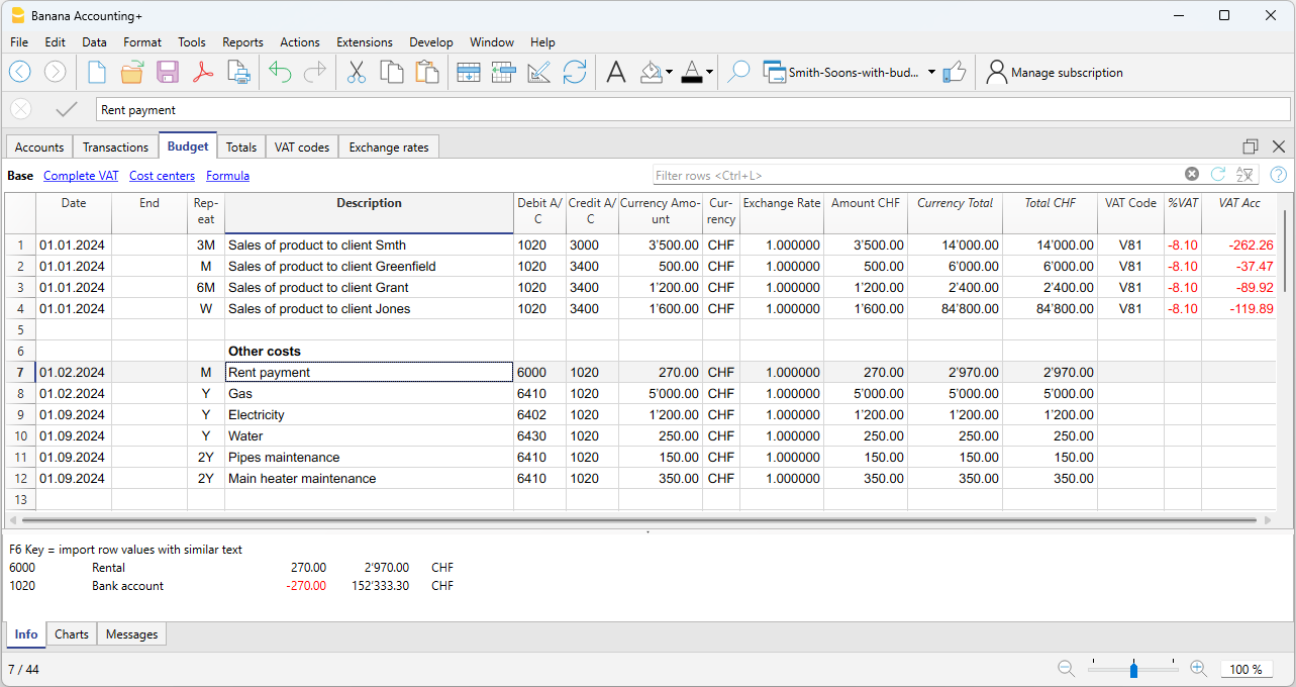

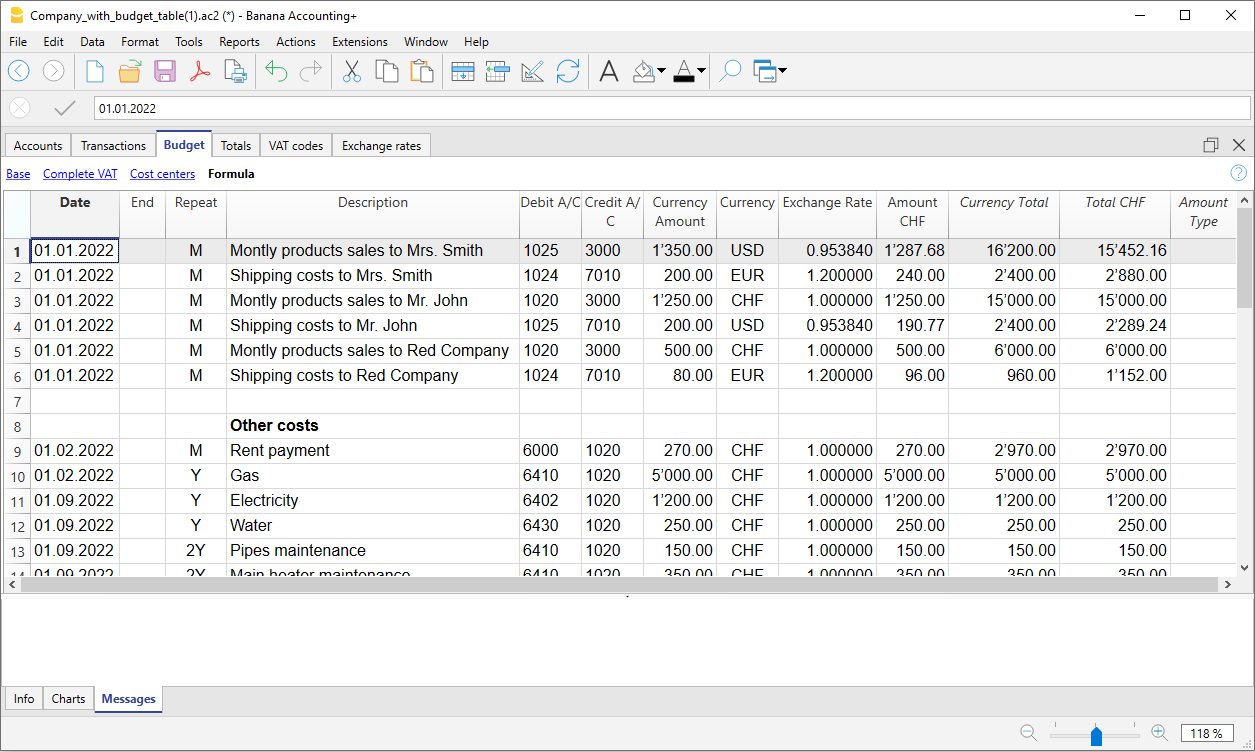

- Inclusion of budget by means of transactions in budget.

- Automatic assumption of repetitive expenses or income (rent, wages, bank charges, etc.).

- Possibility to indicate item code, quantity and price.

- Javascript calculation formulas to automate the dependent values (calculation of interest on the actual use of a loan).

- The program automatically sets up financial plans, complete with liquidity planning, balance forecasts, balance sheet and provisional income statement and movements on an account.

- Automatic financial projections for several years.

- Choice of display per period.

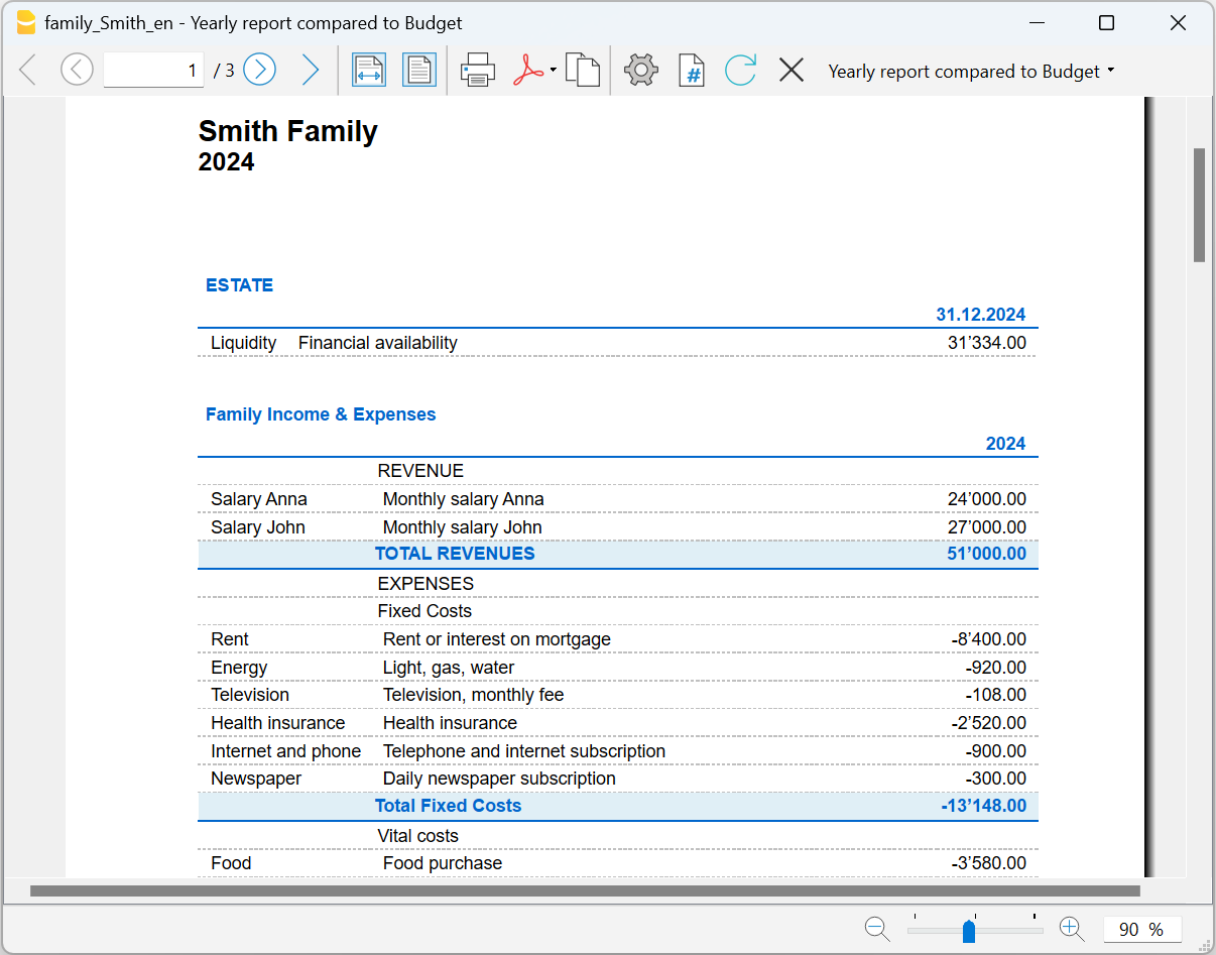

- Comparison between Budget and Finalized Balance Sheet.

Features for accounting applications

The various accounting applications provide different functionalities.

These features can be activated or added as per your requirements.

The program is easily applied because, if a feature is not used, it is not activated.

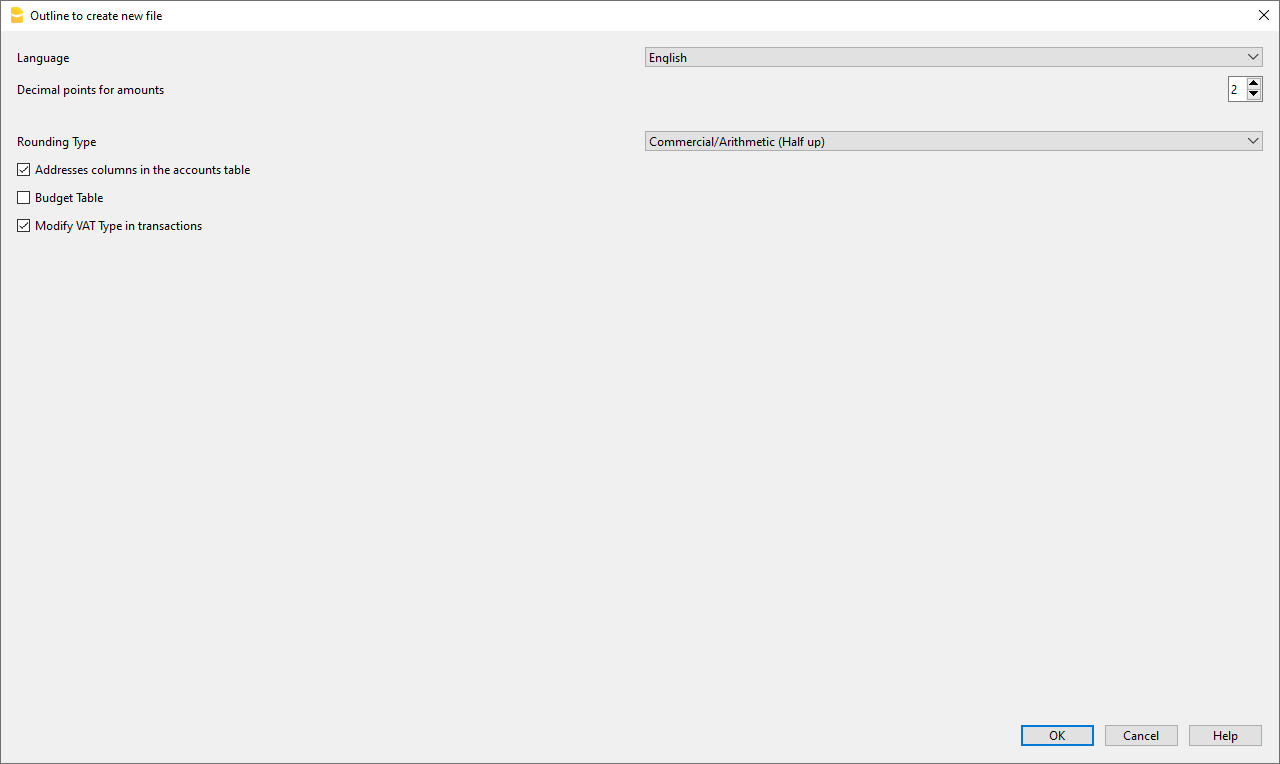

Accounting setup

- Works in any currency. The currency symbol is chosen from the list or freely set.

- Possibility to alter the number of decimals (generally 2), from 0 to 12 decimals to manage crypto-currencies.

- Accounting period is set freely, either as a calendar year or with a start and end date different from the calendar year.

- Choice of accounting language.

Files and data saving (similar to Excel)

Applicable to all Banana applications:

- Create new file starting from preset templates or from own files.

- The data for an accounting year are saved in one single file.

- The file can be located on any media, computer, network, cloud or sent by email.

- Possibility to manage unlimited number of accounting files, of any kind.

- Data is accessible to multiple users simultaneously, but to one person only when in edit mode.

Chart of Accounts

- Plan and structure of accounts are fully customizable.

- Numeric or alpha-numeric account and group number.

- Possibility to add notes or further columns.

- Grouping and totals are adaptable and according to any nationally required grouping scheme.

- Balance, account movement and totals are displayed and updated in real time.

- Cost and profit centres, for detailed control of costs and revenues of specific activities or projects.

- Segments for reporting by sector (branch), thanks to Segments.

- Customer details with monitoring of pending invoices, reminders and account statements.

- Supplier statements with monitoring of paid and pending invoices.

- Management of customers and suppliers, also as non-Balance Sheet accounts (with cost centre) for accounting managed with the cash method.

- Off-Balance sheet accounts.

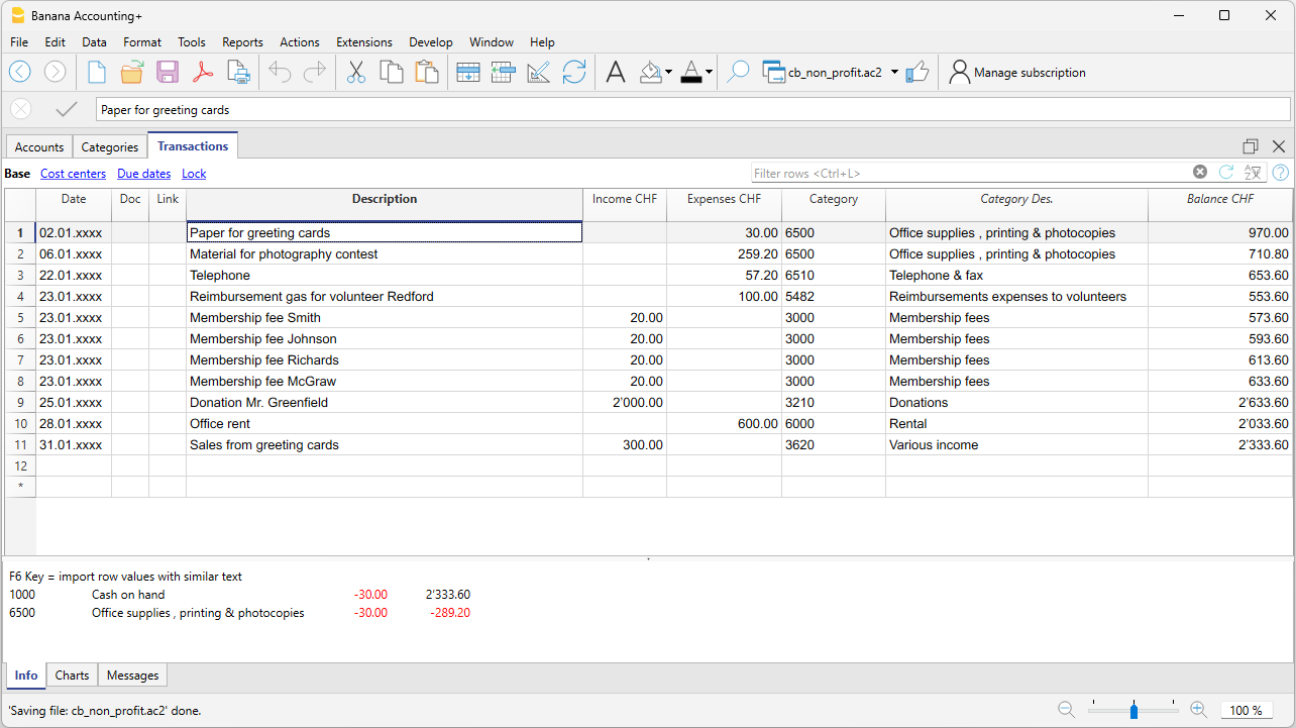

Transactions

- Single or collective transactions (on multiple rows).

- Accrual or cash method.

- Use of Excel type interface, select, copy and paste, add lines, search and replace.

- Suggestions, auto-complete and memorization of repetitive operations for faster input.

- Automatic or customized numbering of documents.

- Ability to edit data entered, organize or add columns and any other information.

- Link to files of receipts in digital format (pdf, images) and opening of documents by a click.

- Import of data from bank statements:

- Several formats are supported.

- Possibility to complete or remove imported operations.

- Row colouring.

- Possibility to have different displays of columns.

- Contextual information concerning account balance, differences or errors.

Blockchain for data protection

- Protection of movements entered with digital data certification technology (similar to Bitcoin).

- Compliance with legal requirements.

- Transfer of data to auditor with the certainty of impossibility of tampering.

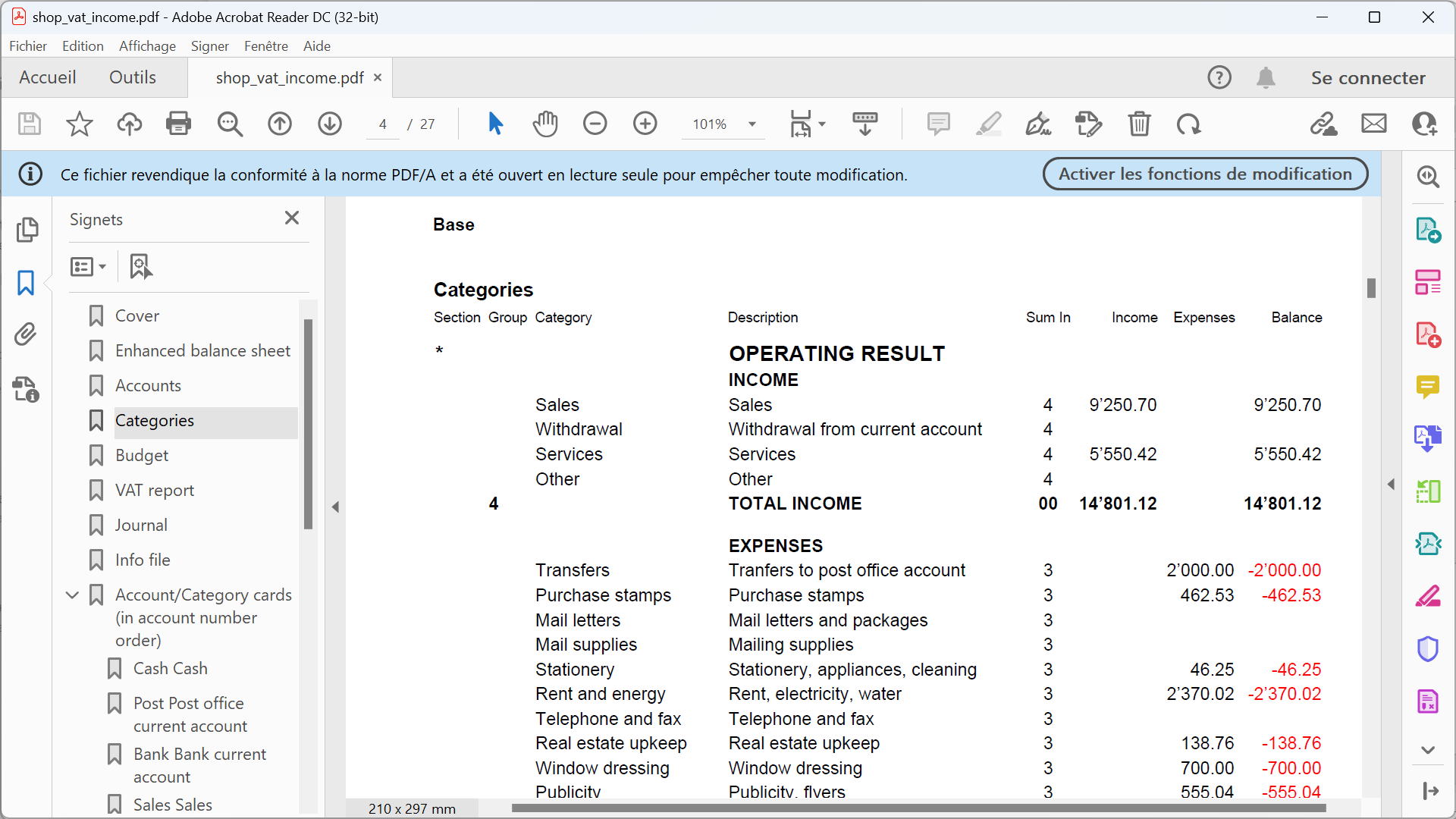

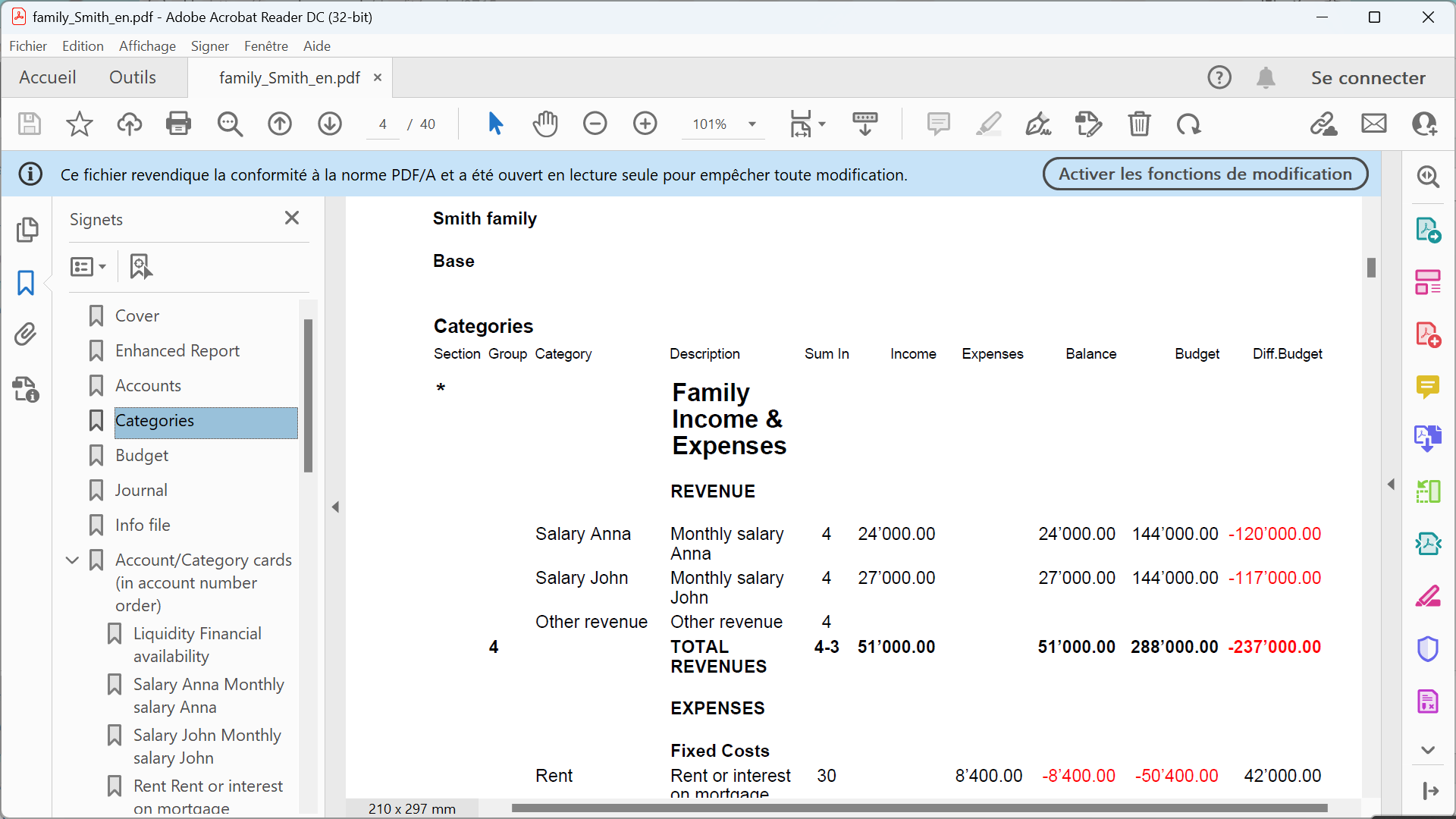

Standard and customized reports:

- Balance Sheet, Income Statement, Journal, Account cards.

- Customization and saving of print settings.

- Export and link data to Excel.

Charts

- Overview of account evolution.

- Comparison of Budget and Final Accounts.

- Real time display while entering.

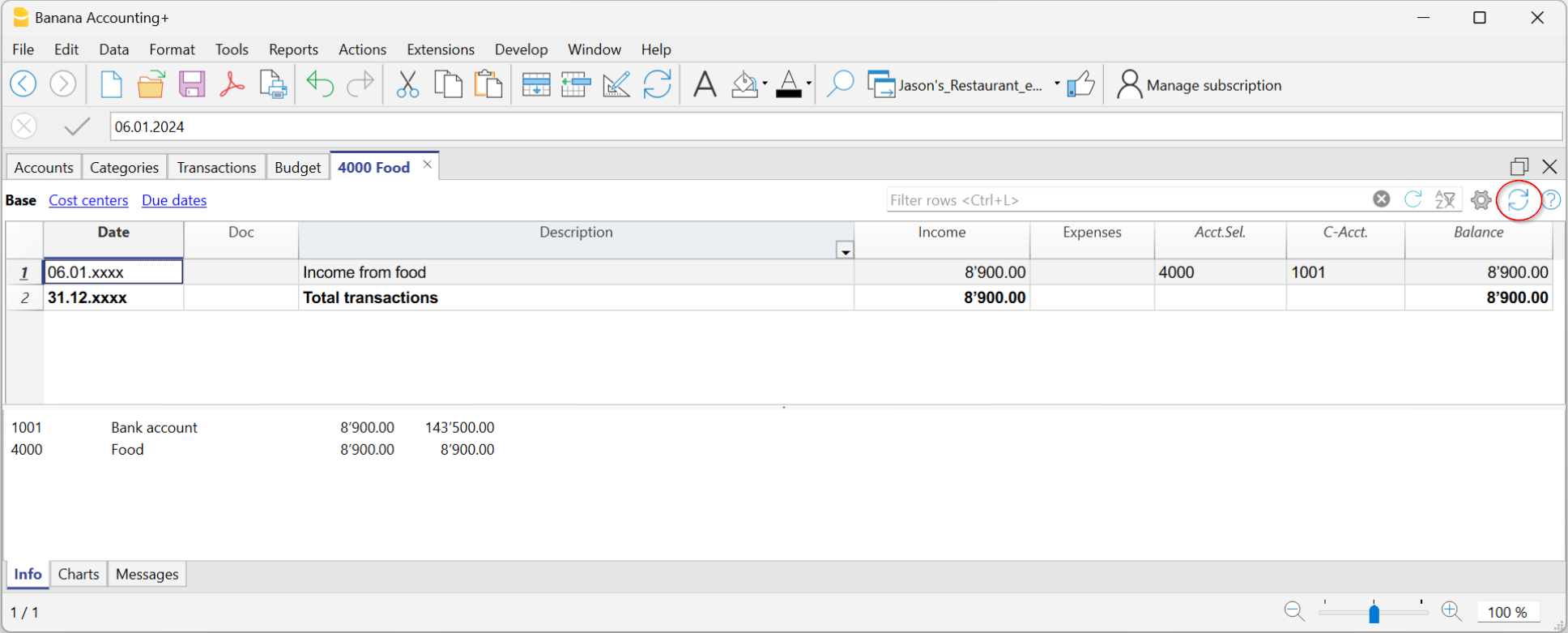

Check Accounting

- Check accounting command. In one click, the accounting is recalculated as if all transactions were inserted again.

- Any erroneous settings, differences or errors will be reported.

- Each report is linked to a help page that explains the causes and provides the solutions.

- Possibility to correct anytime.

Year-end closing and Creation of New Year

- Automatic process for creating new year files, with report of balances and profit or loss.

- You may start working on the new year, even if you have not closed the previous one.

- Command to report the final balances when the previous year has been closed.

- Possibility to add and print year-end notes.

- Command for archiving all data and printouts in pdf format.

Various

- Creating new files starting from an existing file.

- Converting from one accounting type to another, in order to grow and add functionalities.

- Adding other tables:

- Items Table

- Serves to indicate items to be included in invoicing.

May serve as a small inventory or securities management.

- Serves to indicate items to be included in invoicing.

- Documents Table:

- To store images (company logo) or text documents (for example Javascript programs).

- Other tables:

You can add tables where you may enter notes or other information. Tables can be customized by adding columns to them.

- Items Table

XBRL Report

Ability to create instances of XBRL files suitable for different countries.

Double-entry accounting

Double-entry accounting is an application of Banana Accounting Plus, to manage your accounts with great professionalism. It is free up to 70 transactions, in the Free plan of Banana Accounting Plus. In the Professional and Advanced plans it is instead unlimited.

Ideal for SMEs, experienced accountants and frequent bookkeepers. Work fast and get the Balance Sheet, Profit and Loss statement, Financial Planning, Budget and many other reports in no time.

Many complex operations, such as VAT management, multi-currency, budgeting and profit and loss accounts have been made very simple because they are all automated.

- ▶ Video: How to start double-entry Accounting

- Discover all the double-entry Accounting characteristics

Many functions, more automation

- Start Immediately: Choose one of many templates for diversified needs.

- Quick entries: Import from ebanking, store repetitive transactions with Auto-completion rules.

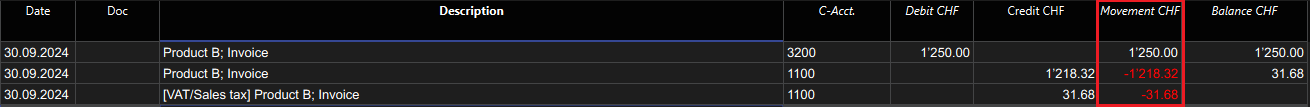

- Immediate checks: With the Balance column you can quickly see if there are any imbalances between the Debit and Credit columns and from which line the differences start.

- Balances updated after each entry, with an indication of the result for the year.

- Attach documents quickly: link each transaction to its digital document.

- Data import and export

- Balance sheet and Profit and Loss statement, Account cards (ledger), Journal in one click

- Analytical accounting for projects, sectors or particular activities thanks to Cost/Profit Centres and Segments

- Automated account cards (ledger). The carry forward of amounts is automatic after posting in the journal (Transactions table).

- The Balance Sheet and the Income statement can be displayed instantly with a click and you can choose either a simple structure with the grand totals or a more detailed structure, with intermediate totals for the subgroups .

- To register VAT, you do not need to enter an additional transaction, but simply enter a code that allows to calculate the VAT amount and to record it simultaneously in the VAT account.

- Automated VAT statements with data in Xml for online submission to tax authorities.

- Create budgets for financial and income planning and ensure an uncertainty-free future.

Learn more

- Organizing your accounting documents

- Accounting with accrual or cash method

- VAT management

- Multi-currency accounting

Starting a Double-entry accounting

▶ Video: How to start a Double-entry accounting file. Find out how to easily set up a Double-entry accounting, adapt the Plan of Accounts, import bank transactions easily or insert transactions manually, set up a Budget, enter the Transactions and Print reports.

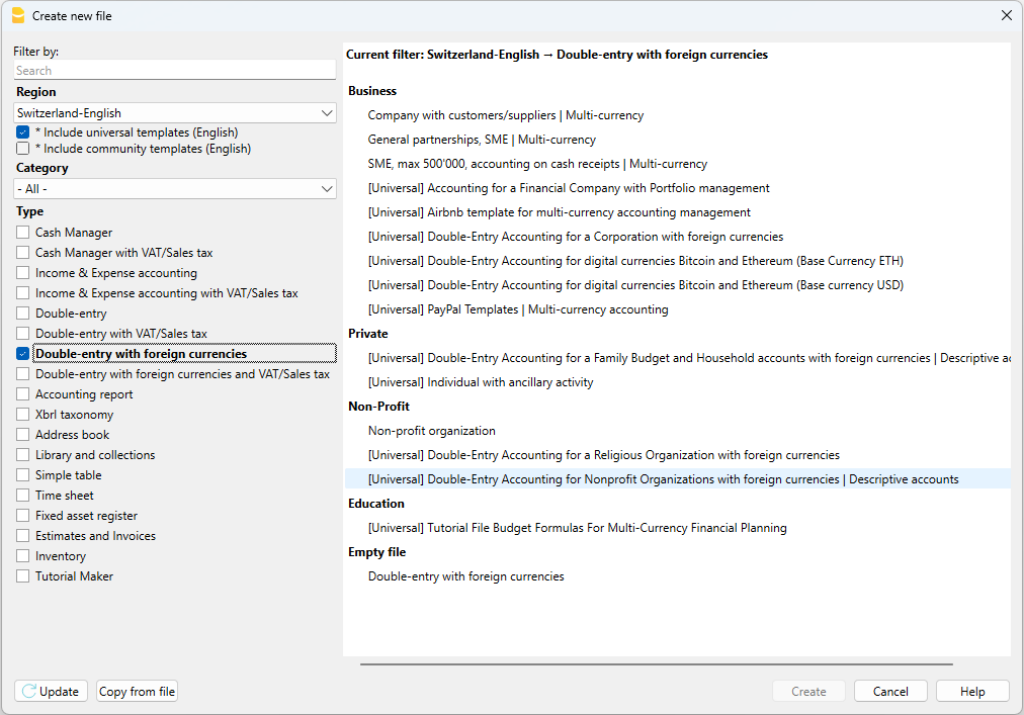

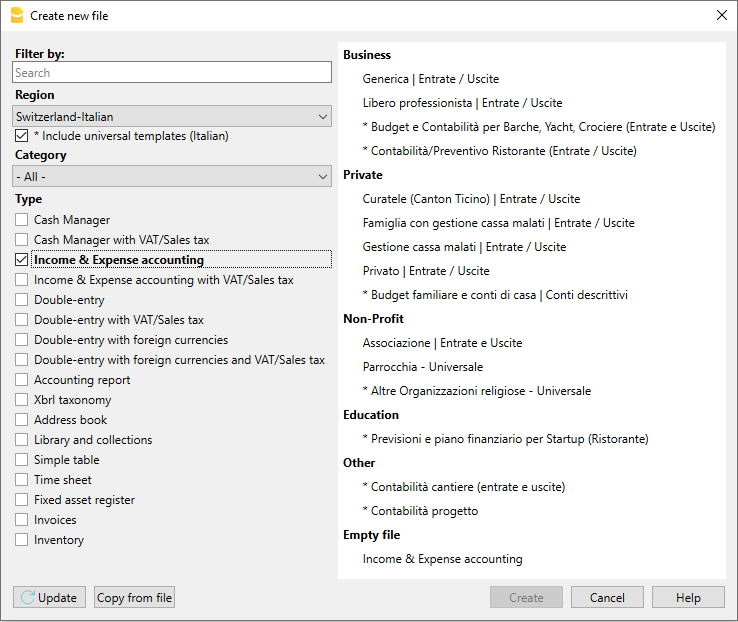

Creating an accounting file, starting from a template

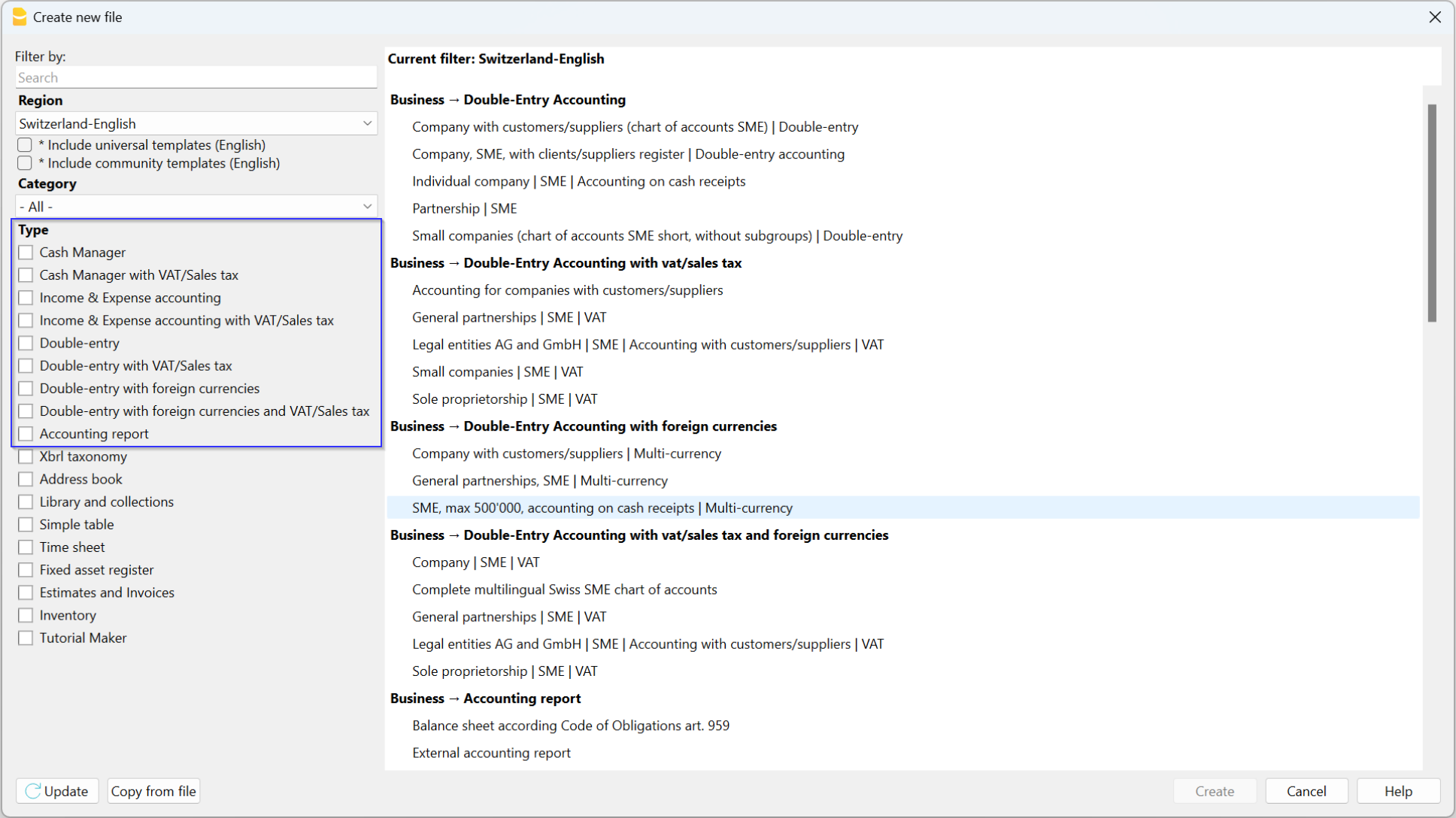

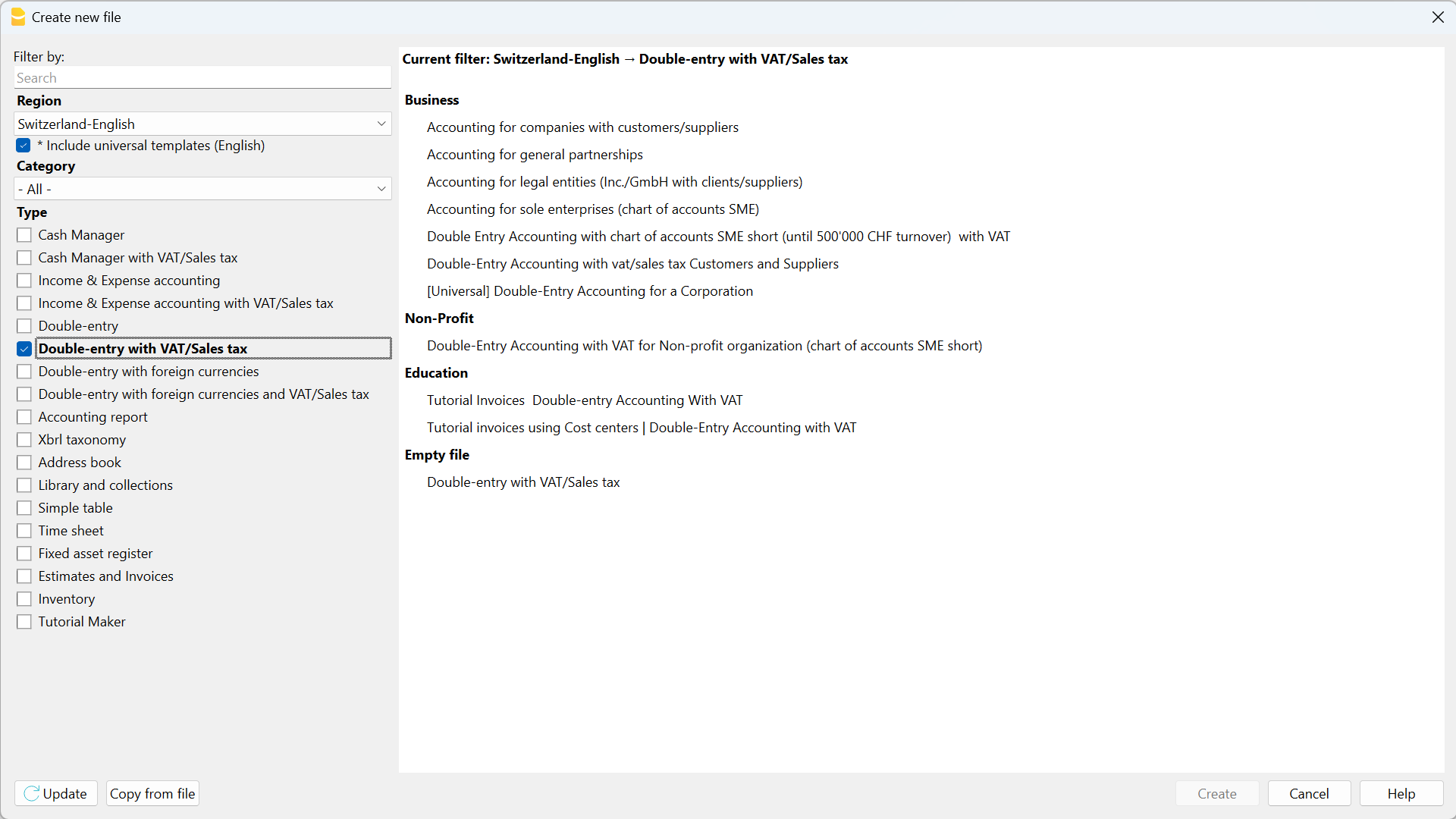

Banana Accounting Plus includes templates for all legal forms, divided by country and by category. They can be opened directly in the program, from the File menu, New... command, or they can be downloaded from our Templates page.

Here is how to start choosing a template directly from the program:

- File menu, → New...

- Select the region, the language, the category and the accounting type.

- From the list of the templates that appears, select the template that is closest to your own needs.

- Click on the Create Button.

In the Search area, when entering a key word, the program will display the templates that contain the entered key word.

It is equally possible to set out from a blank file, by activating the Create Empty file option. However, in order to facilitate the start and avoid grouping errors, we recommend that you always start with an existing template.

More information on the Create New File page.

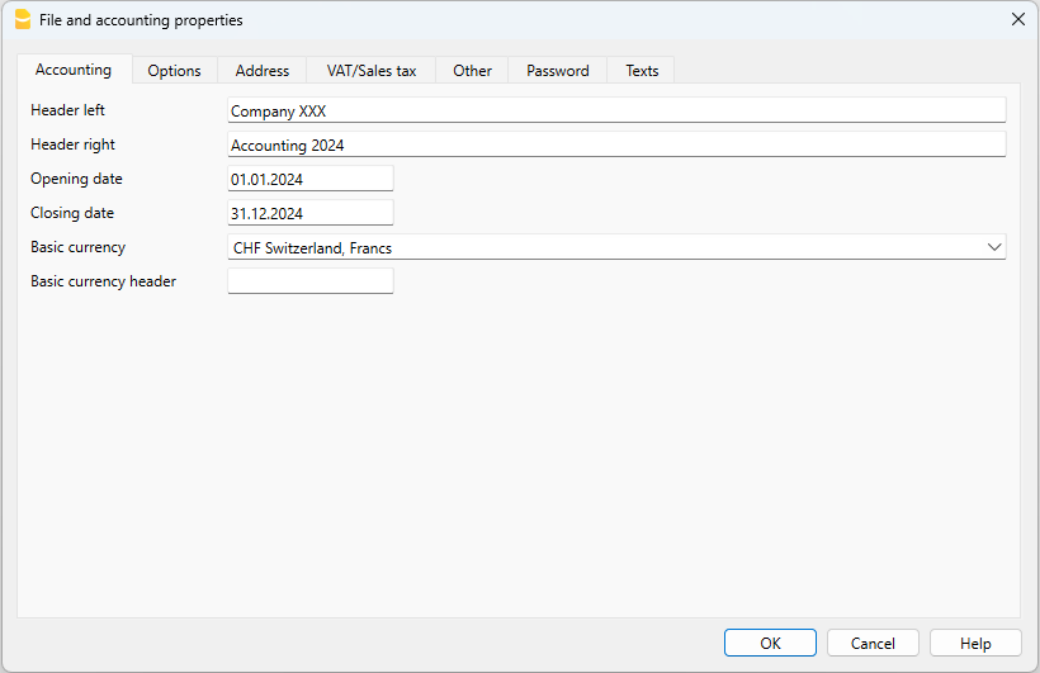

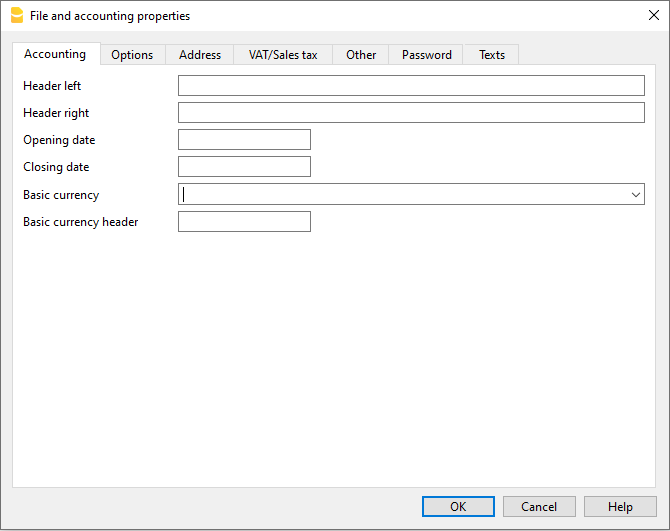

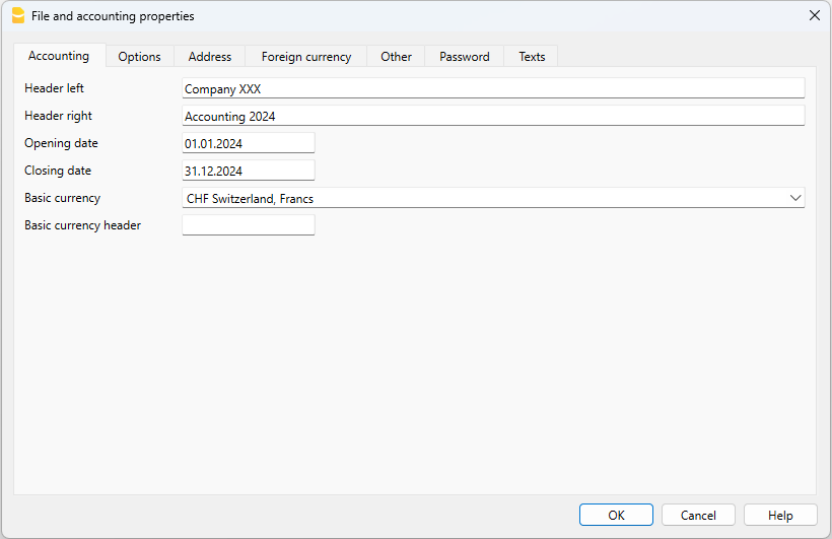

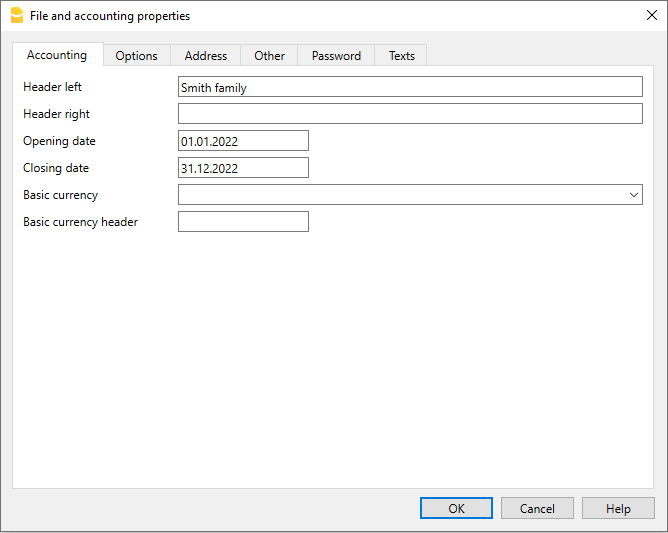

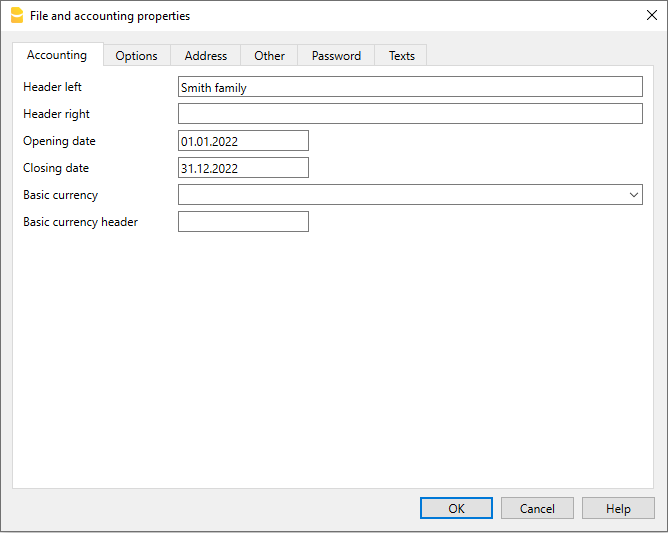

Setting up the file properties (basic data)

- Via the File → File and accounting properties command, indicate the company name that will appear in the headers of the printouts and on other data.

- Select the base currency, in which the accounting will be kept.

Save to disk

With the File → Save As command, save the data and also assign a name to the file. The typical save dialog of your operating system will be displayed.

- It is advisable to use the name of the company followed by the year "ie. Company-2020.ac2." to distinguish it from other accounting files.

- You can keep as many accounting files as you need, each will have its own name.

- You can select the path you want, (save to disk, usb key or cloud).

If you plan to have documents linked to the accounting of the current year as well, we recommend creating a separate folder for each accounting year in which to group all the files. Please also visit the Organizing your files page

General use of the program

Banana Accounting Plus is Excel-inspired. User commands are kept as similar as possible to the ones of Microsoft Office.

For more information on the general use of the program, please visit our Program interface page.

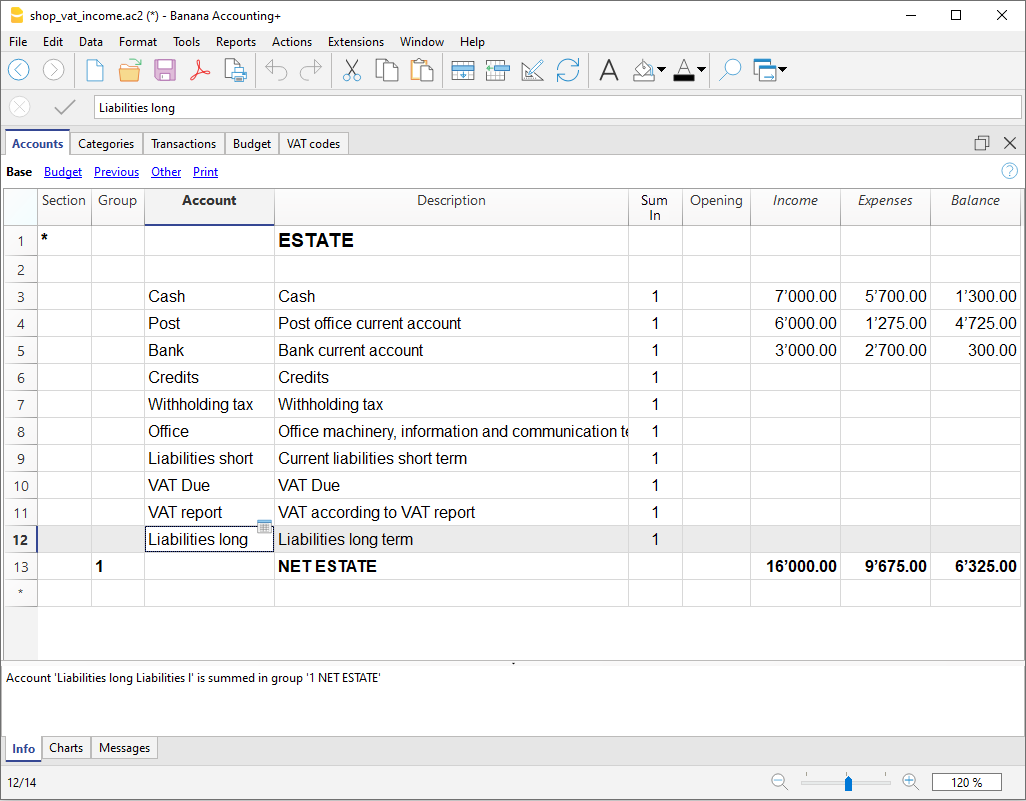

Customizing the Chart of accounts

In the Accounts table, customize the Chart of Accounts and adapt it to your own requirements.

It is possible to:

- Add new accounts and /or delete existing ones (see Adding new rows)

- Modify the account numbers, the description (fe. enter the name of your own Bank account), enter other groups, etc.

- Create subgroups, please consult our Groups page.

- Define Cost centers or Segments that are used to catalogue the amounts in a more detailed and specific way.

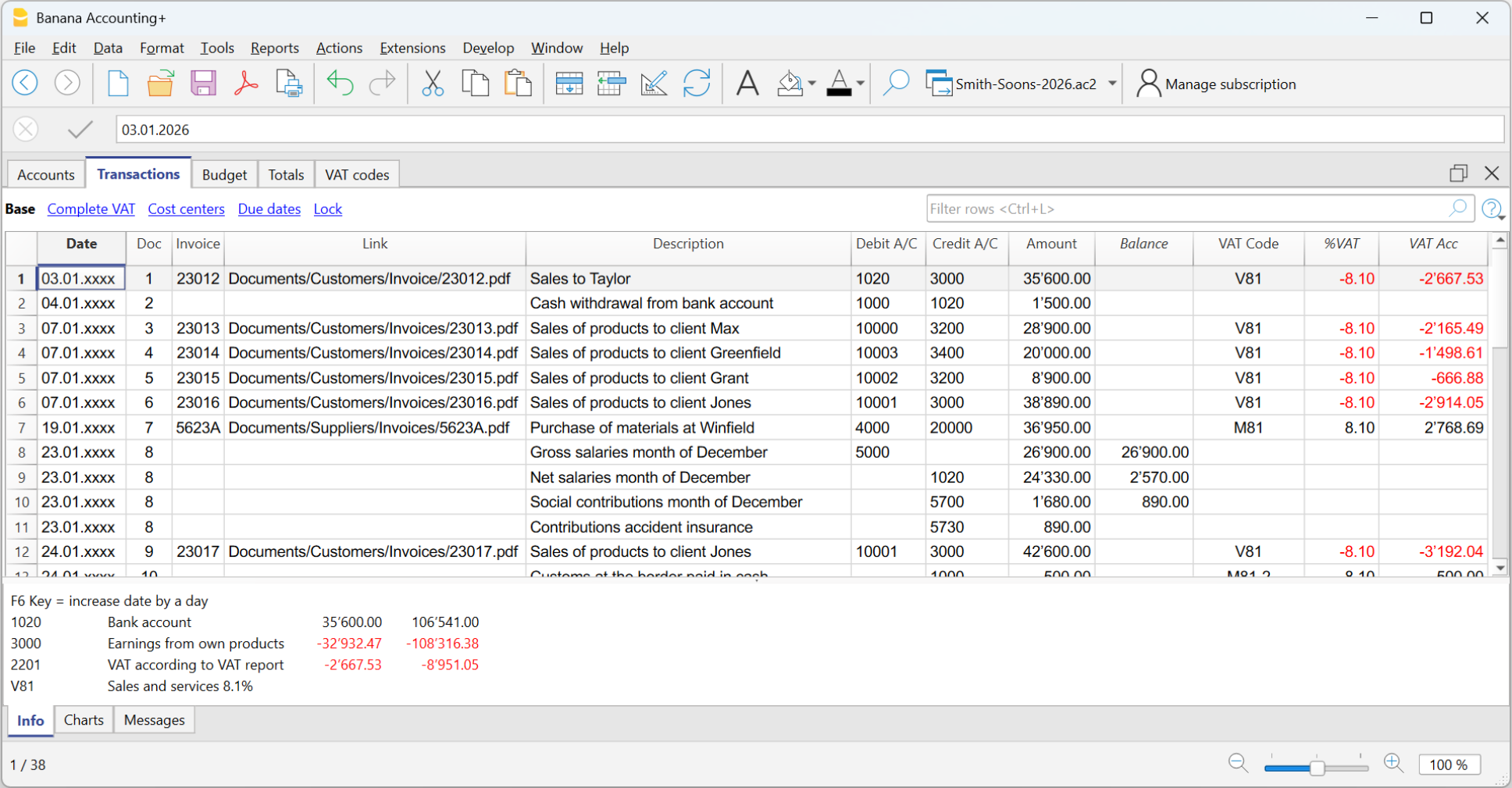

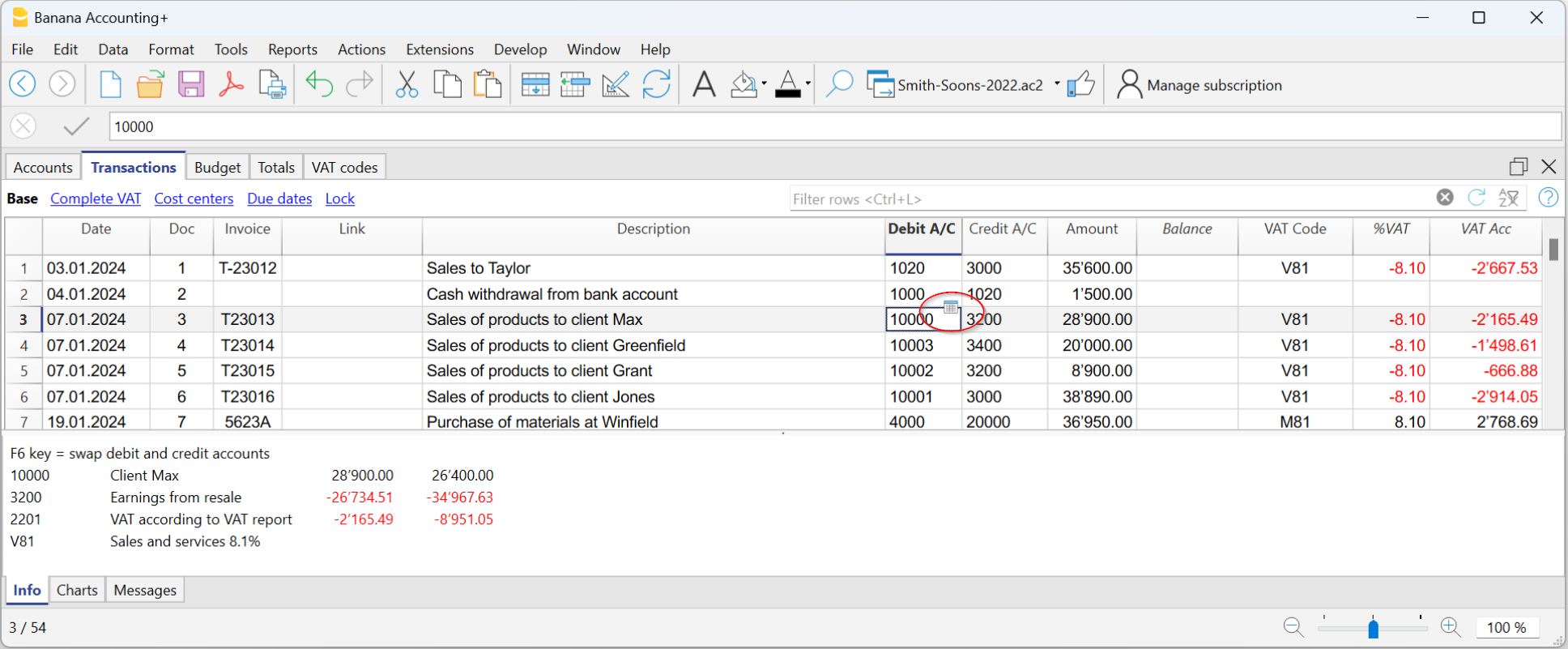

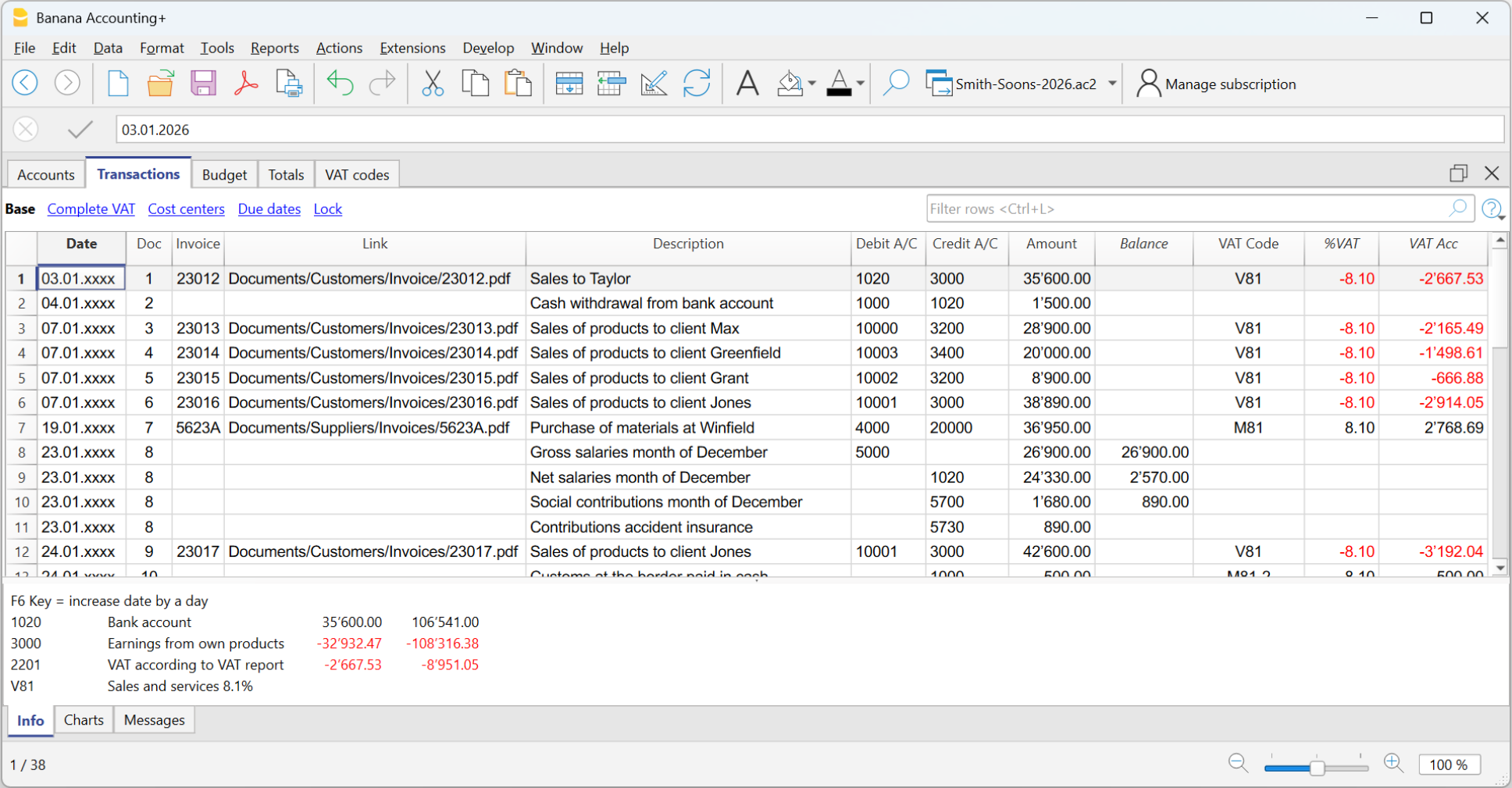

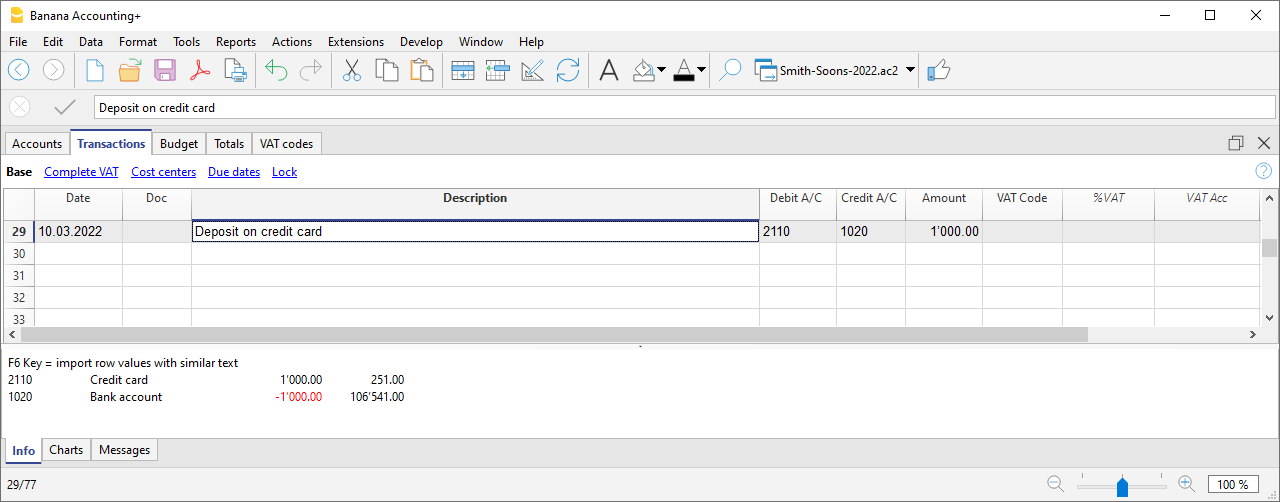

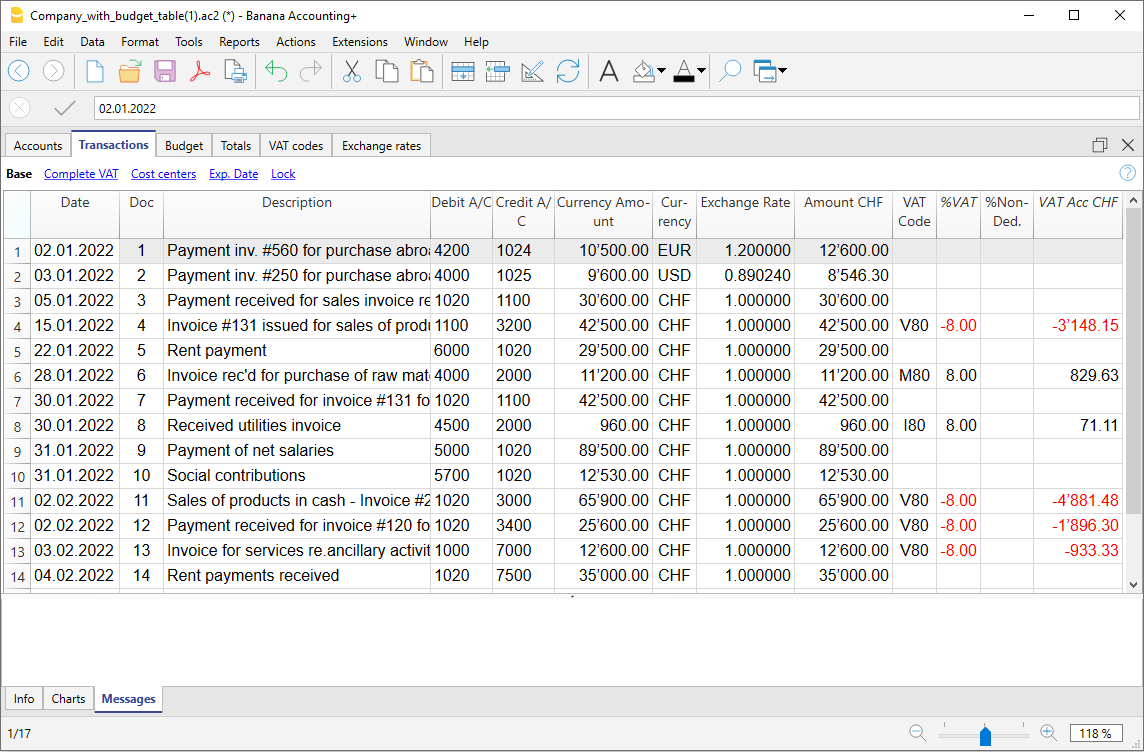

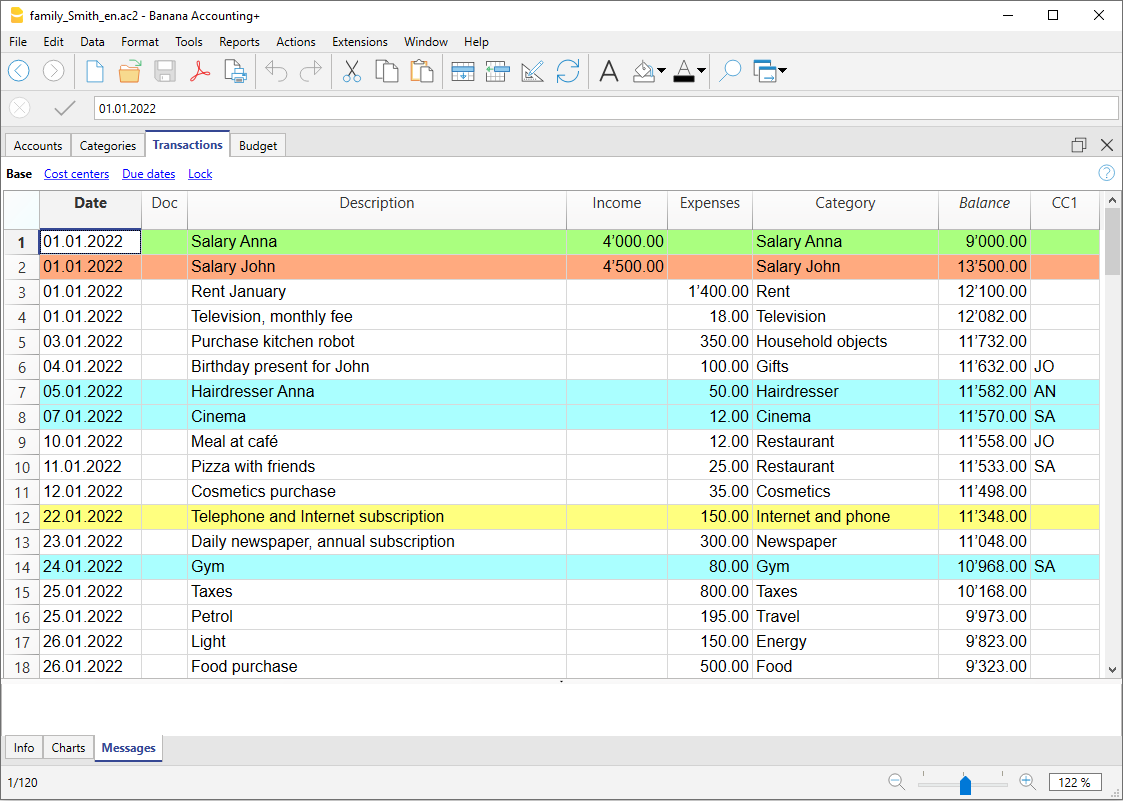

The Transactions

Transactions must be entered into the Transactions table and they compose the Journal.

In the specific columns :

- Enter the Date

- Enter the Document number, manually assigned to the paper document. This allows for easy location of the documents once the accounting transaction has been entered.

- Enter the Description

- Into the Debit account column, enter the destination account.

- Into the Credit account column, enter the account of origin.

- Enter the Amount.

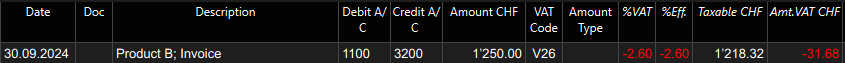

- In the accounting with VAT, enter the gross amount and VAT code. The program will separate the VAT, splitting the net cost or net income.

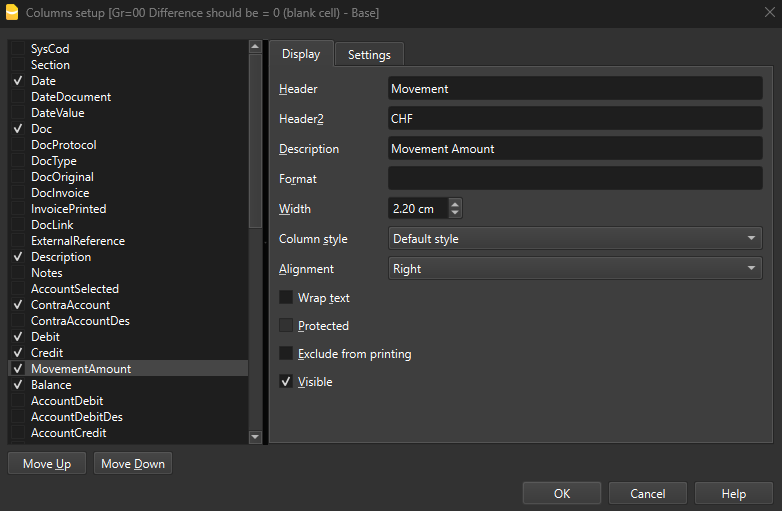

Make visible the Balance column in the Transactions table

The new Balance column is a very useful feature: it allows you to immediately spot possible differences.

The Balance column is not visible by default: you can make it visible via the Data → Columns setup menu.

Speeding up the recording of the transactions

In order to accelerate the recording of the transactions, you can use:

- Smart fill - allows for auto-complete of data that has already been entered previously.

- Recurring transactions - memorizes repetitive movements in a table and can be called up when necessary.

- Import transactions from bank or postal statement - imports all transactions from the bank, postal or credit card statement into the accounting file.

Transactions with VAT

In order to enter transactions with VAT please proceed as follows:

- Select Double-entry accounting with VAT/Sales tax in the File → New... menu.

- Choose one of the existing accounting templates with existing VAT Codes table, containing all prevailing VAT codes.

In order to enter transactions with VAT, please visit the Transactions page.

Transactions on multiple rows

Compound transactions, those that concern debits and / or credits to multiple accounts (e.g. when paying different invoices from the bank account) must be recorded on several rows:

- One row for each debit and / or credit account.

- When all the debits and credits have been entered there must be no differences.

For more details, consult the page Composed transactions.

Checking customer and supplier invoices

Banana Accounting allows you to keep track of invoices to be collected from customers and paid to suppliers. Further details are available on the following web pages:

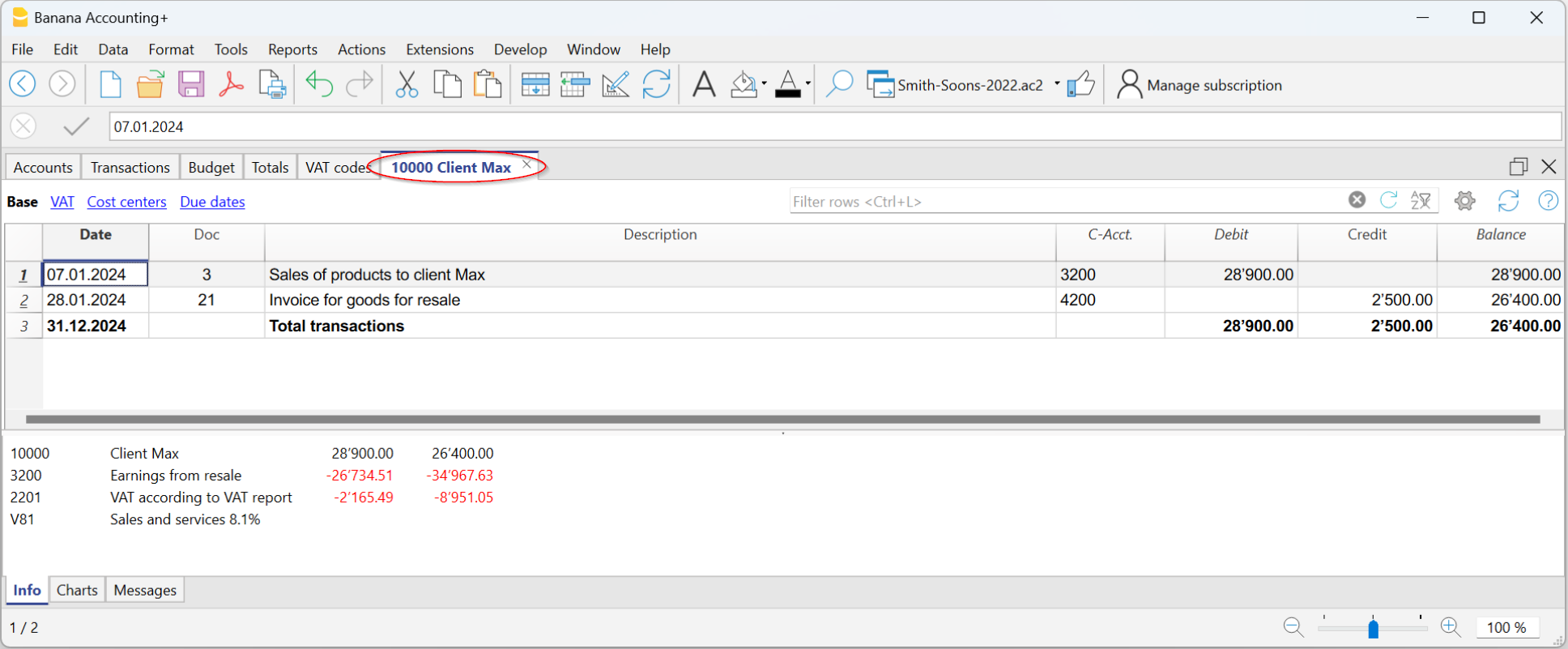

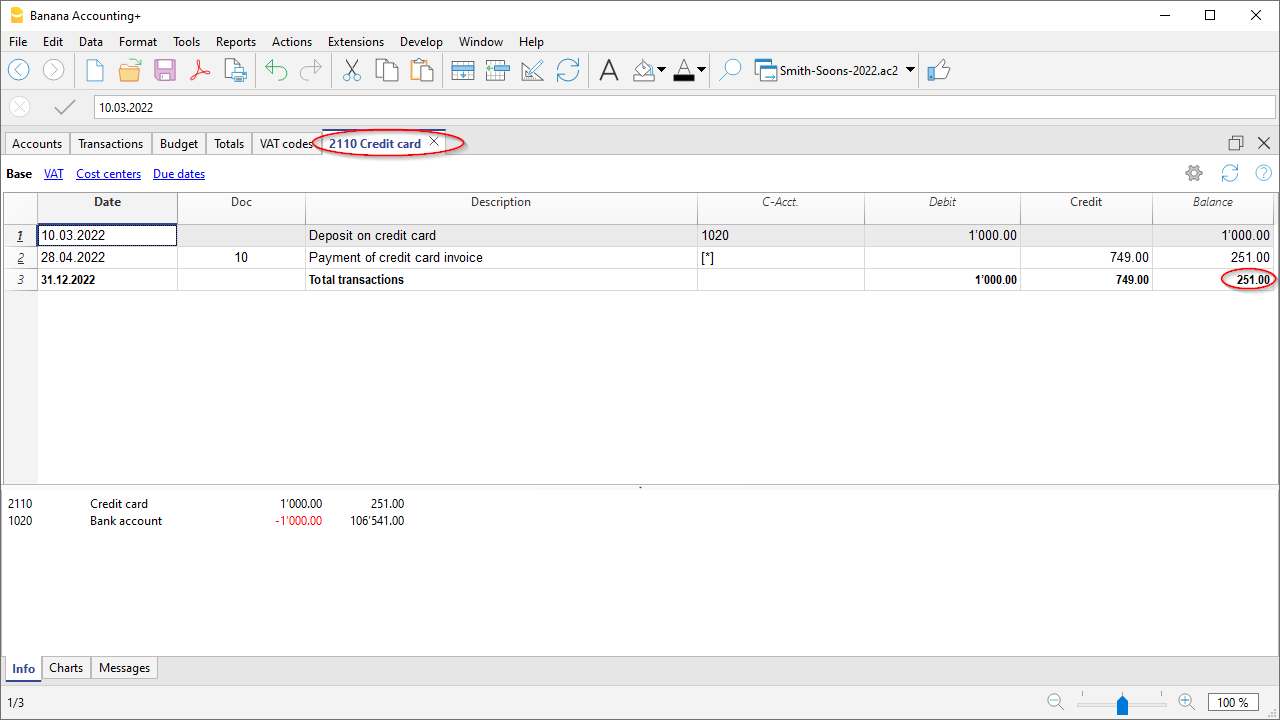

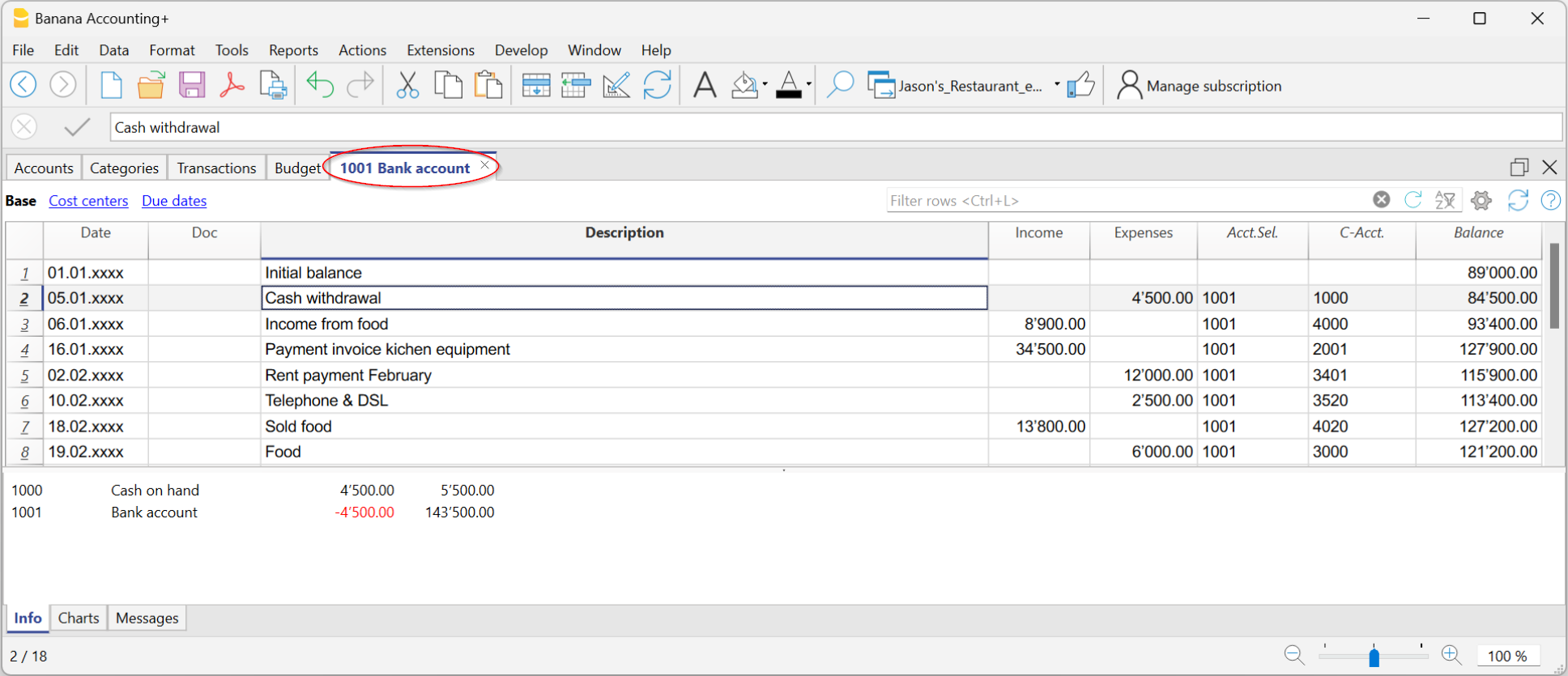

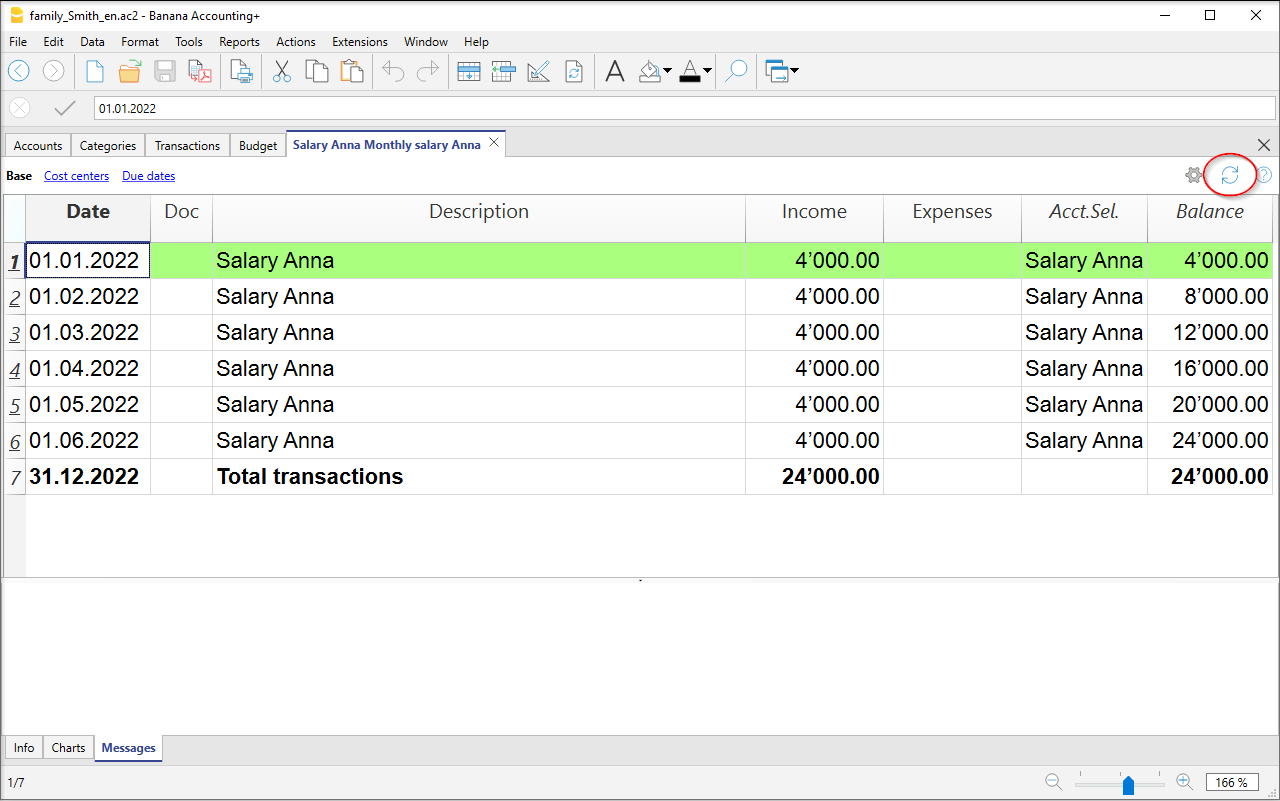

The Account cards

The account cards automatically display all the transactions that have been recorded on the same account (e.g., cash, bank, clients, etc).

To display a single account card, just position yourself with the mouse on the account number and click on the small blue icon that appears in the cell.

Account card by period

To display the account card with the balances referring to a specific period, proceed as follows:

- Menu Reports → Account Cards.

- In the Period section, activate Period selected, by entering the start and end date of the period.

For more details, consult the Period page.

Printing one Account card

In order to print a single account card, just display the card from any table (Accounts or Transactions) and launch the print from on the File menu.

Print all or some account cards

To print all or some account cards, proceed as follows:

- Menu Reports → Account Cards,

- Select the account cards to print:

Using the filter in the window, you can automatically select all accounts, cost centers, segments, groups or you can simply select the desired accounts only.

For more details, consult the Account Cards page.

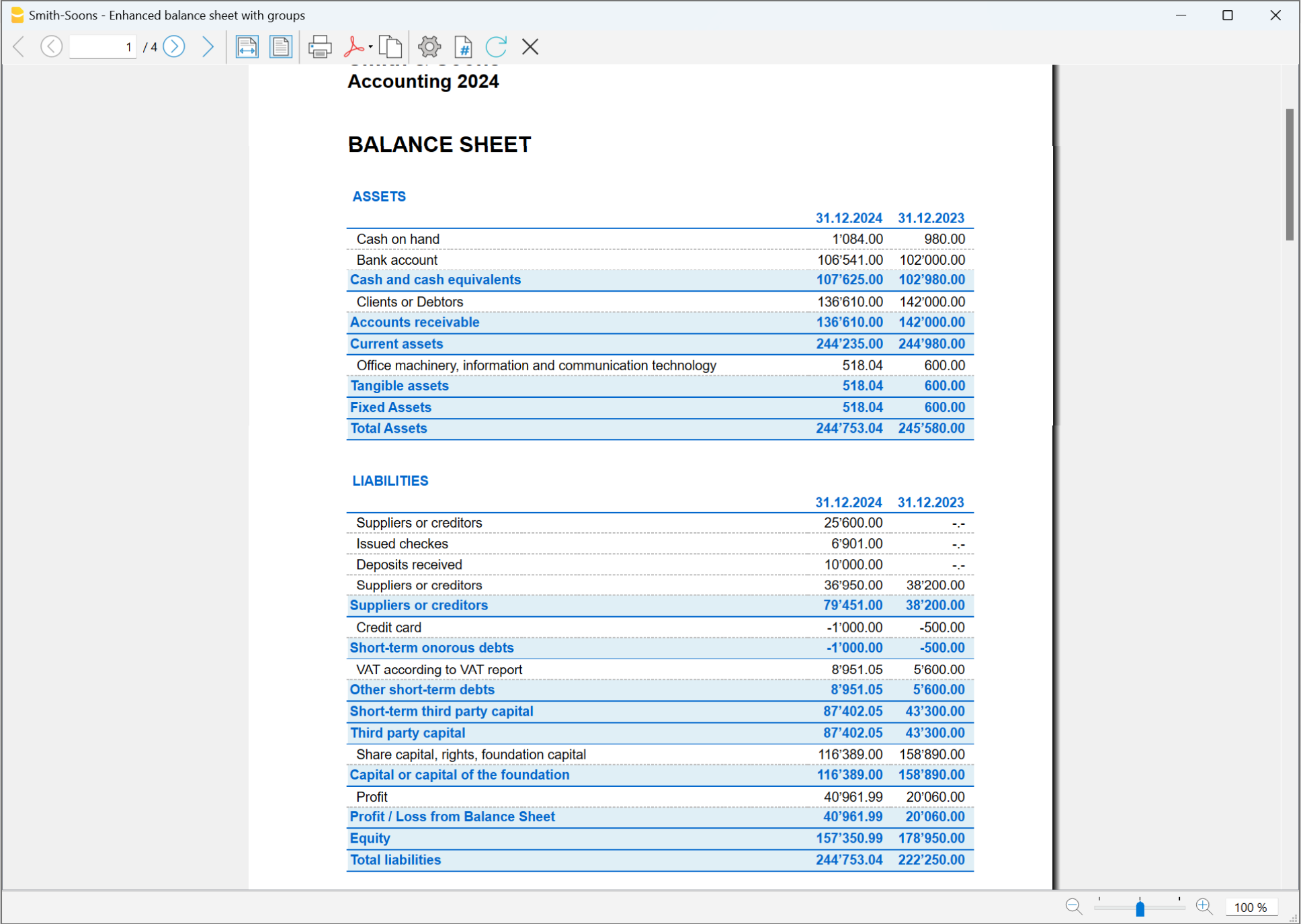

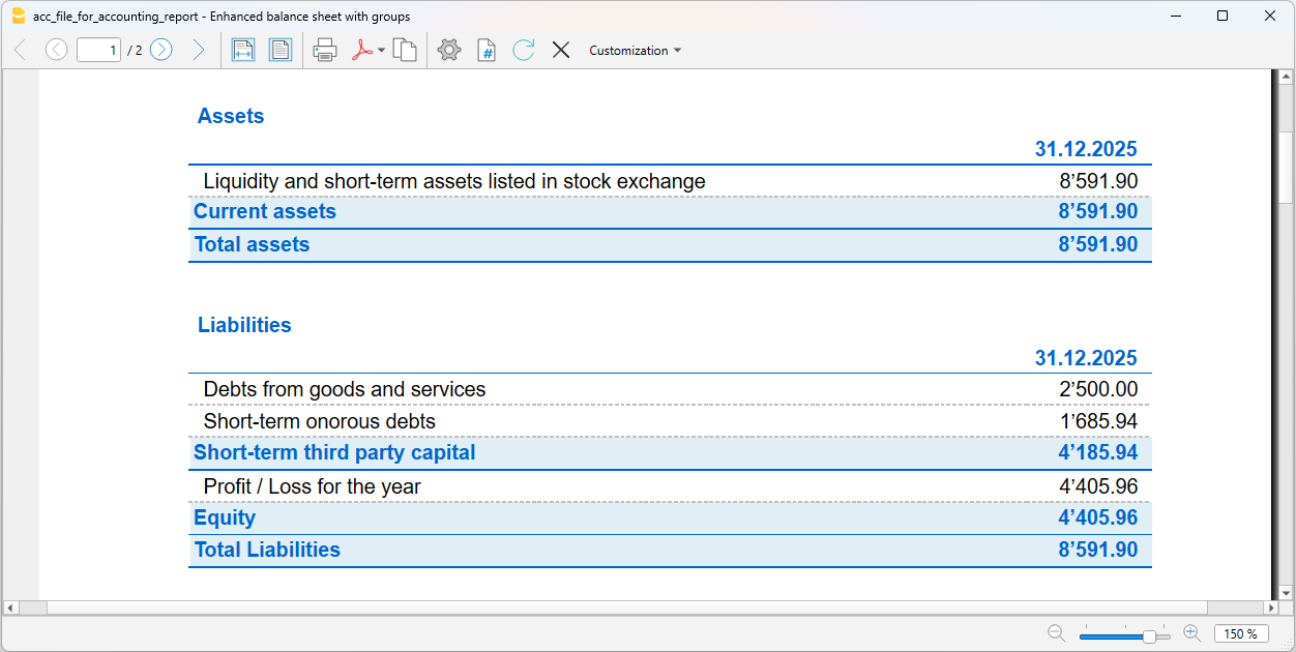

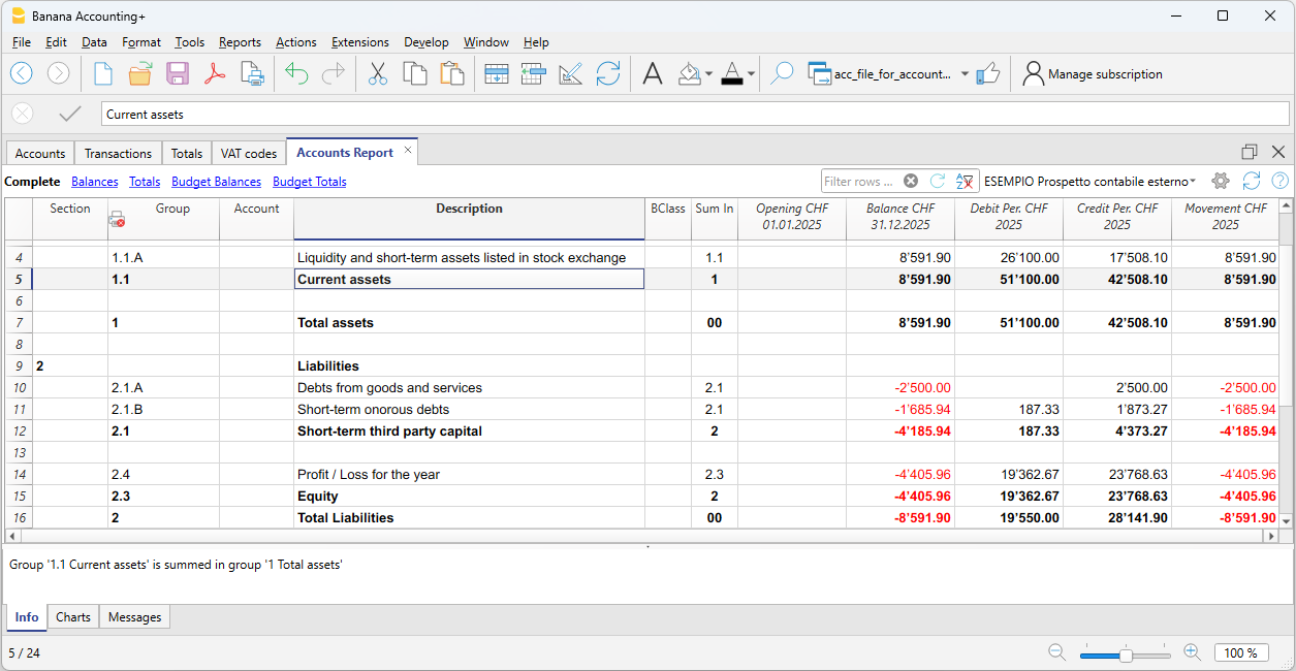

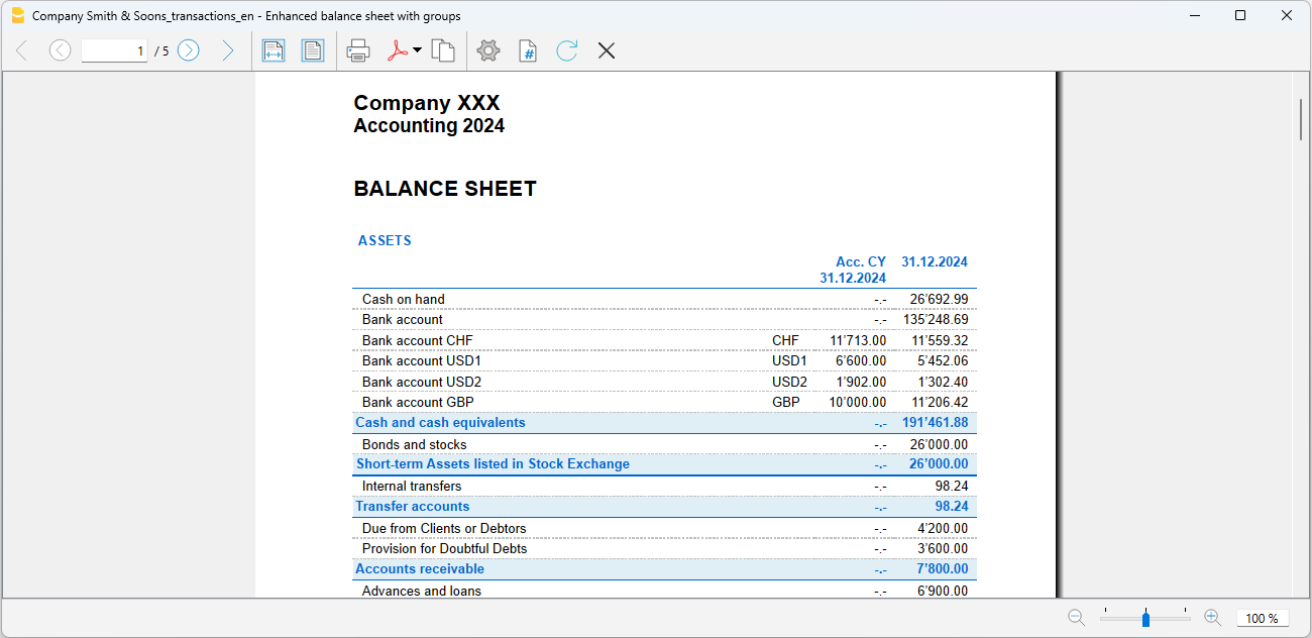

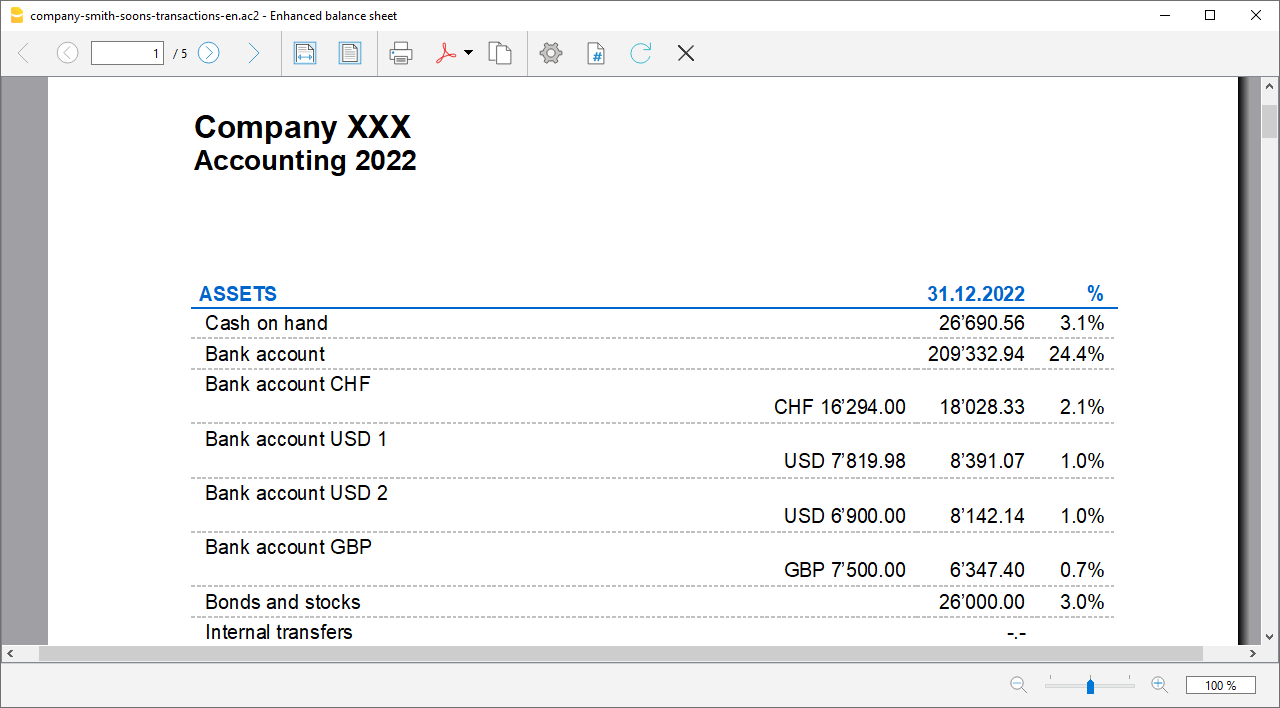

The Balance Sheet

The Balance sheet displays the balances of all the Assets & Liabilities accounts and determines the Equity capital.

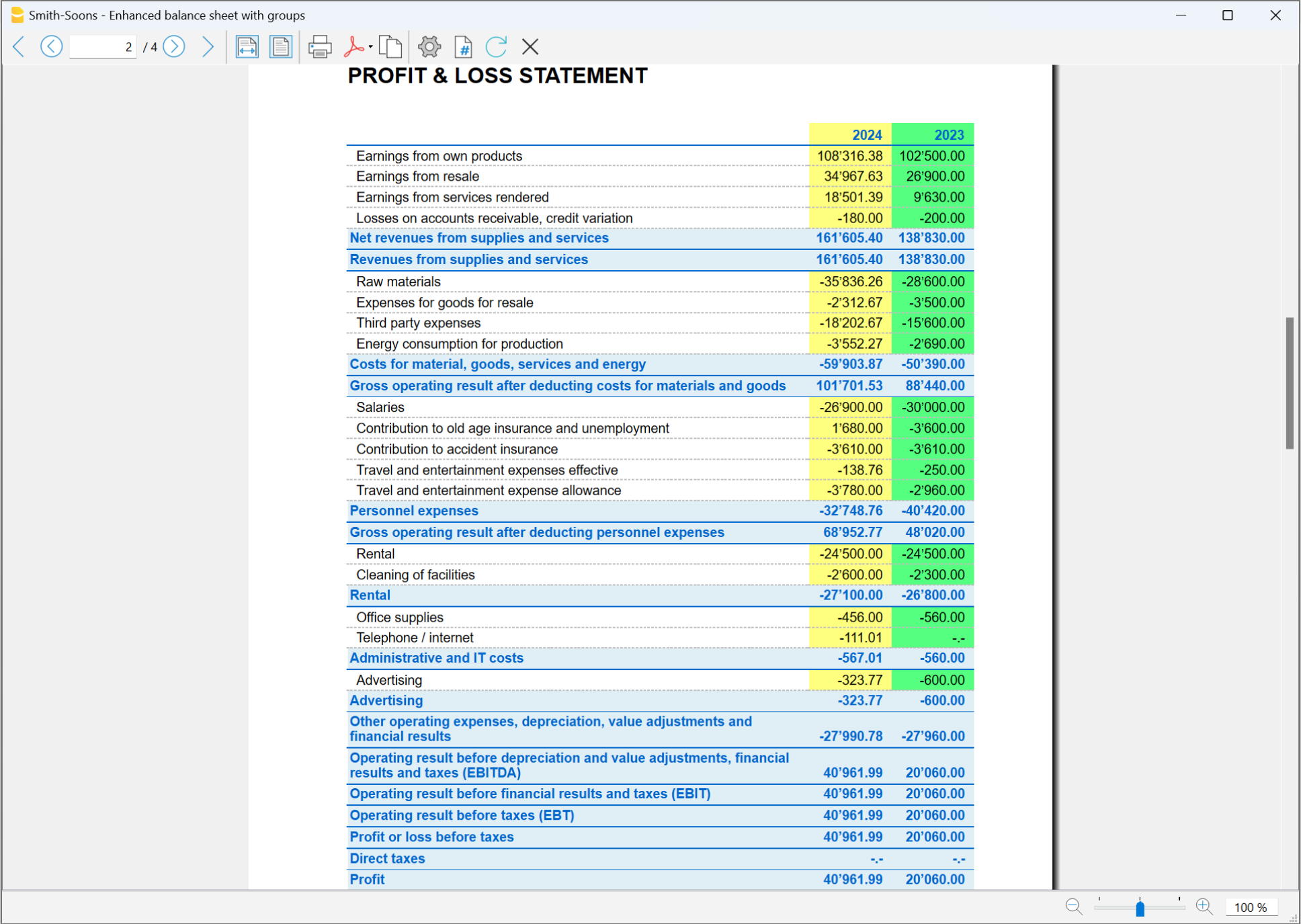

The Profit and Loss Statement

The Profit & Loss statement displays all the Expenses and Income accounts indicating the Profit or Loss of the Accounting year.

Printing of the Balance Sheet and the Income Statement

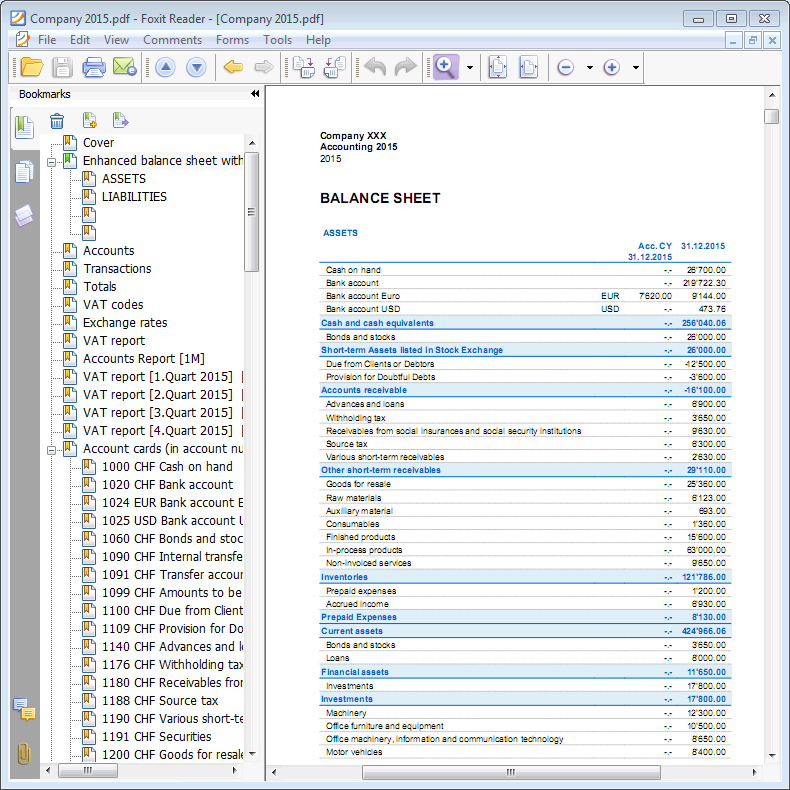

In Banana Accounting, the Balance Sheet and the Income Statement can be printed and viewed in two different ways:

- In Enhanced Balance Sheet mode, a balance sheet with a simple listing of all accounts is displayed, without distinction of Groups and Subgroups.

- In Enhanced Balance Sheet mode with groups, the balance is displayed with the accounts divided into groups and subgroups; in addition there are many features to customize the presentation that are not included in the Enhanced Balance sheet.

To print the Financial Statements and the Income Statement in the two modes:

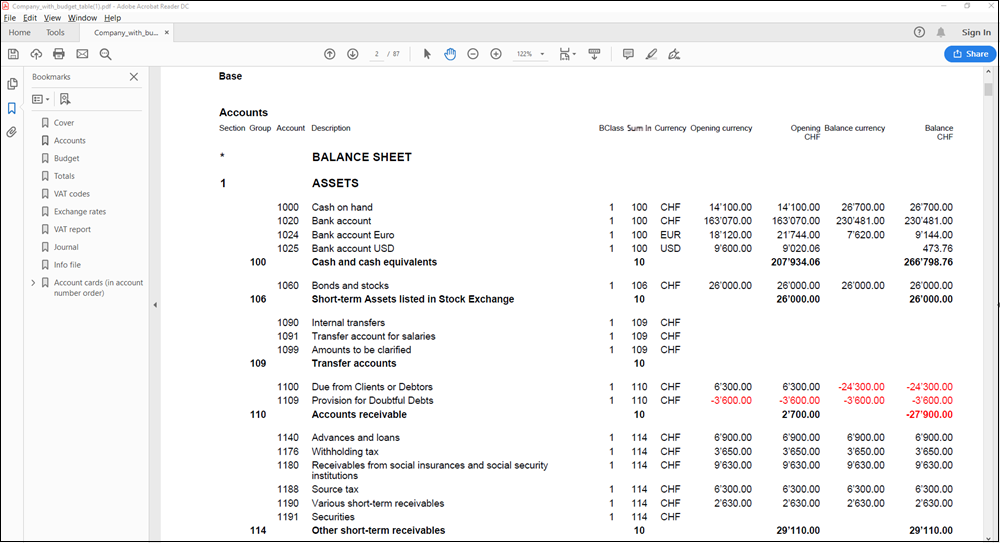

Data archiving in PDF format

All the accounting data can be archived at the end of the year, when the entire accounting has been completed, corrected and audited, :

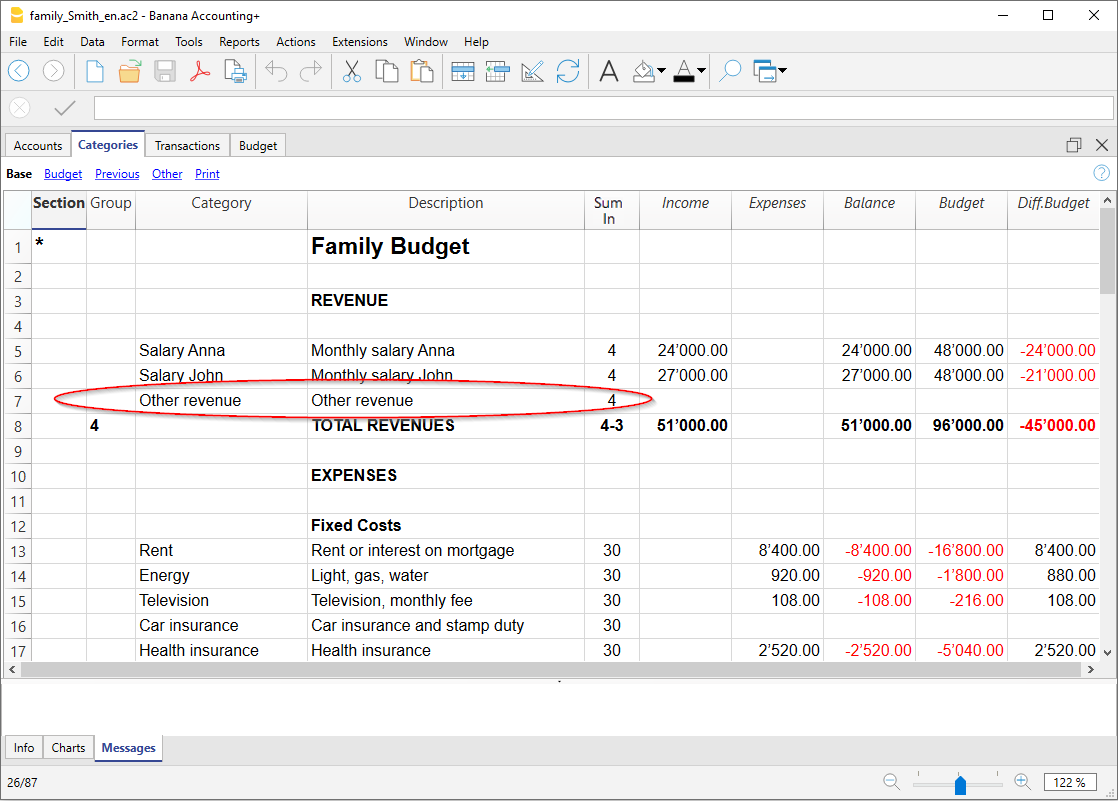

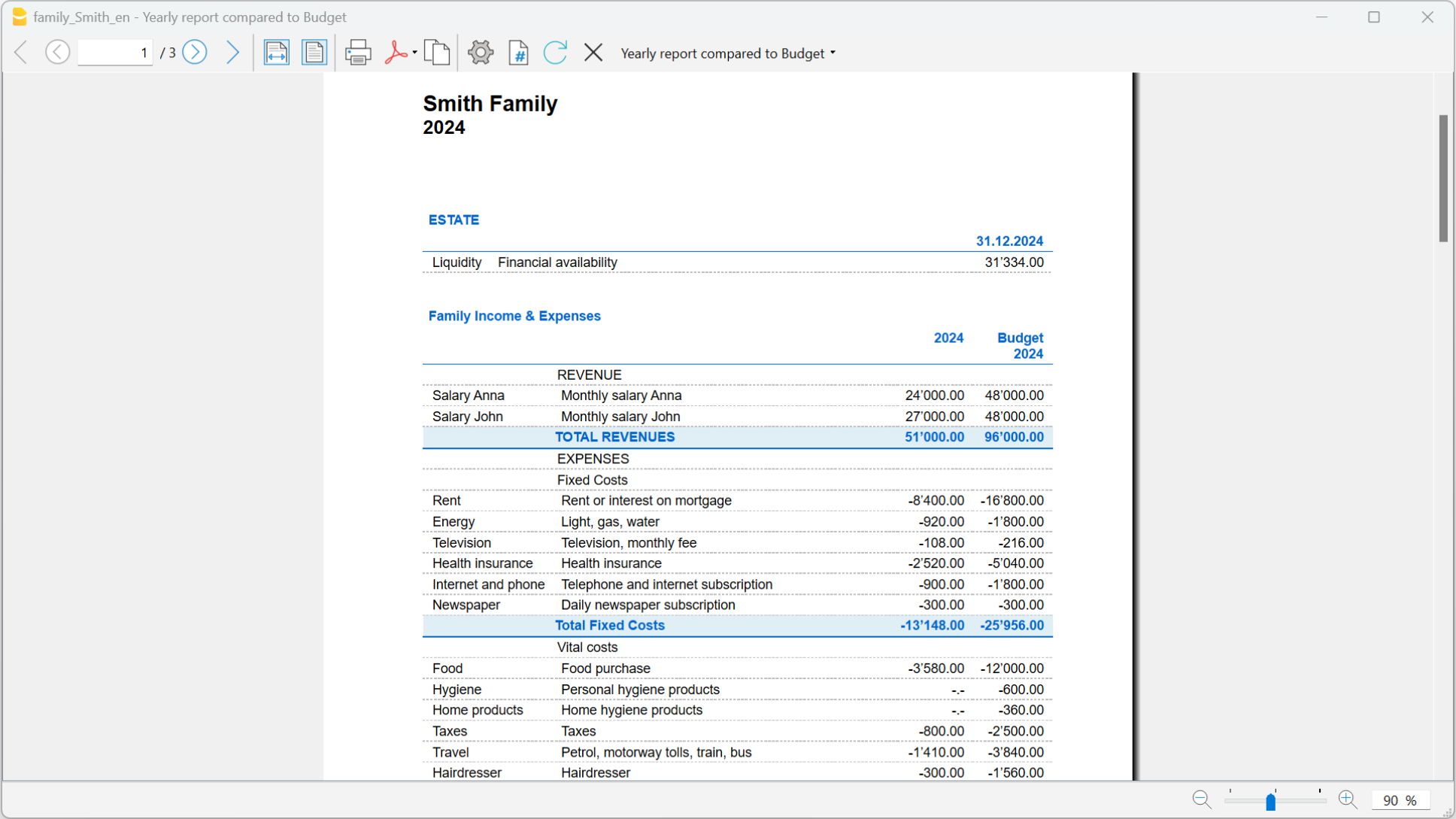

The Budget

- Annual budget is set in the Accounts table, Budget column. The annual budget amount is indicated for each account. In this case, when the Budget is elaborated via the menu Report → Enhanced statement with groups, the budget column displays the amounts that refer to the entire year.

- Budget is set in the Budget Table. The Budget table is activated via the Tools → Add/Remove functionalities menu.

This table records all the movements referring to expenses and income, as if the movements were to be recorded in the Transactions table. When this table is switched on, the Budget column of the Accounts table is automatically deactivated.

For more details, consult the Budget page.

Characteristics of the Double-entry accounting method

The double-entry bookkeeping application meets the professional criteria for companies and entities of any kind, where accounting is required by law.

- It is a very powerful tool, but is very flexible and easy to use at the same time, as the different features can be activated or deactivated. This allows you to manage both the main accounting as well as structured Chart of Accounts on several levels: with VAT, customer and supplier management, invoicing, cost centers and segments.

- It can be edited at any time, offering everyone perfect results. It is ideal for the experienced accountant who wants to work quickly as well as for beginners. For this reason it is used for teaching accounting in many schools.

▶ Video: How to start a Double-entry accounting

Similar to Excel

Excel-like features and commands

- All the data you enter in the tables are always on display and close at hand.

- You work quickly because you can select, copy and paste recurring transactions on multiple cells and multiple rows.

- If you make a mistake, you can correct it by canceling or restoring operations.

- Add as many rows as you want without limits, or delete the lines you don't need.

- If you have made a mistake on a a value, an account, a VAT code, a description, you are able to correct it in an instant with the Find and Replace function.

- You don't need to enter formulas because the calculations are updated instantly and you have a contextual view (like in spreadsheets).

- Everything you see can be printed or exported to pdf or other formats.

- You can set your company logo to customize the printout headers.

- The columns are customizable, you can move them to position, add new ones and change their width.

- Work with the format that suits you best.

- Colour the lines to immediately identify the transactions that you need to review or show to the accountant or that need to be completed.

Spreadsheet-based

Accounting management is concentrated in three tables, which are used in a similar way to the Excel spreadsheets, but that are already completely set up and programmed with everything needed to keep your accounting quickly and safely.

- Accounts table.

Set up all liquidity accounts, customers, suppliers, etc. and enter the opening balances without having to enter them manually in the Transactions table. You can aggregate multiple accounts, such as the cash accounts, bank or post in the liquidity group, so as to have the updated balances and they can be checked immediately. - Transactions table.

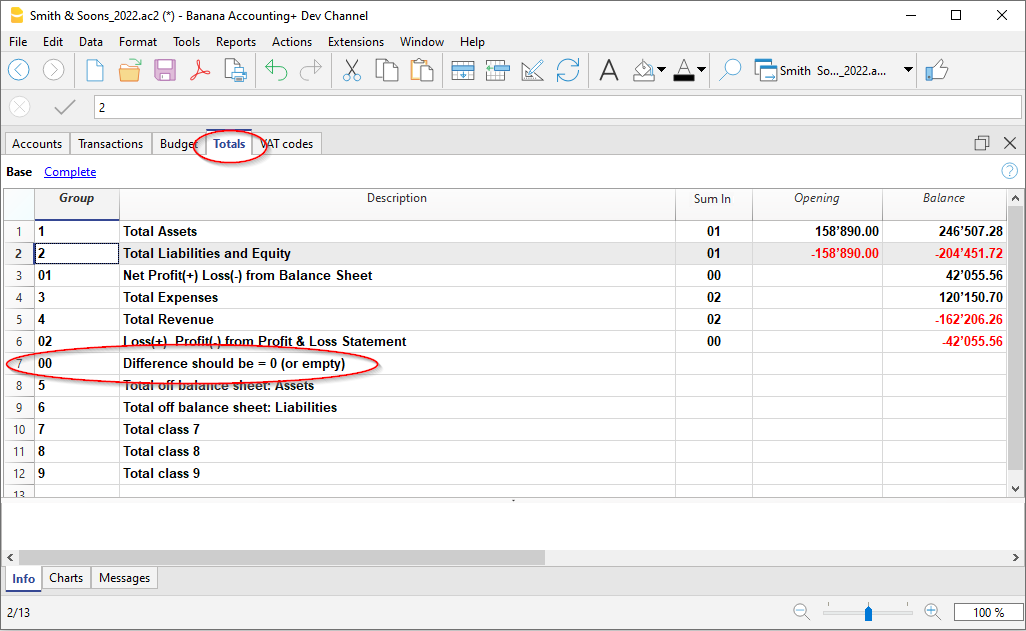

The centre of keeping accounts, where the transactions are entered or imported. The debit and credit transactions can be completed with additional information to manage customers and suppliers, issue invoices, manage cost / profit centers, segments, quantities and prices and anything else you need. Scrolling through the table you will have a comprehensive view of all the events. It can be modified in order to always keep accounting in perfect order. - Totals table.

This displays the totals by Group and is used to check the accounting balances.

Further tables can be added to support additional functionalities.

- Budget table.

Prepare financial forecasts, with the double-entry method. Complete with liquidity planning, budget and forecast income statement, customer, supplier, investment, project, segments for one or several years. - VAT codes table.

Set the required rates and parameters to be used in the Transactions table for the automatic calculation of VAT and the reports to be presented to the tax authorities. - Items table.

To set up a list of items to be used for billing. The program keeps track of your income and expenses. - Free tables.

To meet further needs.

Quick start

Templates

Accounting management focuses mainly on three tables, which are used in a similar way to Excel spreadsheets, but which are already fully set up and programmed with everything needed to keep accounting quickly and safely:

- Easy and immediate start, creating your accounting file starting with a template.

- If you already have your own template in Banana Accounting you can upload it with all the settings and use it for a different accounting.

- Over 1000 templates subdivided by country and type of user, customizable and with user documentation.

- Easy search and use of templates directly in the program.

Accounting setup

- Freely set the currency for your accounting, you can choose it from a list of world currencies or set it freely (cryptocurrencies).

- Freely set an accounting period, even over several years if required and not linked to the classic 1st January to 31st December period.

- Headings and accounting data set in a single dialog box, easy to display.

- Enter as many decimals as you want, from 0 to 27 (selected when the accounting) is created.

- You can change the number of accounting decimals during the year without problems.

Multi-lingual

- You are free to choose the language for your accounting when you create your file.

- Customize the column headers as you wish.

- You can run accounting in multiple languages simultaneously.

- Prints are also customizable in multiple languages.

File and data saving

- All the data is saved in a single file, where you can easily retrieve everything without wasting time.

- A separate file is created for each year. All data refer to the year so there is no confusion.

- Assign the file the name you want.

- With a single license you can manage an unlimited number of accounts.

- Data remains in your full possession.

- Data saved to any media, computer, network, cloud or can be emailed. You can access it wherever you are.

- Simultaneous access by multiple users, but only one person can open the file when in Edit mode.

- Make your accounting more secure by using password protection.

Plan-Execute-Control

In the same file and always with the double-entry method, you can keep the accounting, or your budget or both. The powerful Plan-Execute-Control approach is very intuitively used.

Double-entry accounting method

- Banana Accounting allows you to keep accounting with the international double-entry method and is compliant with international standards.

- Meets the criteria for keeping any accounting.

- Usable in any country.

- Transactions with debit and credit columns.

- Should there be imbalances in the transactions, a related notification will be generated.

Amounts are displayed in the columns in the format used by your computer, without you having to get used to other formats that you are not familiar with.- Debit amounts are indicated in positive and in credit in negative.

- Calculation is done according to the Debit - Credit = 0 equation.

- Balance sheet, Income Statement and all typical accounting printouts.

- All printouts are customizable.

- Choice of display format.

- Transactions according to the cash or accrual principle.

- Protect your data with cutting-edge blockchain technology (patented method).

- The double-entry method is used by many schools around the world to teach accounting.

Chart of Accounts

- Fully customizable Chart of Accounts to better meet your needs.

- The same Chart of Accounts is used for accounting and for financial, asset and income forecasts.

- Balance Sheet and Income statement are adaptable according to the structure and content of your requirements.

- Any national, international or free grouping scheme us supported.

- Off-balance sheet accounts for the management of items that should not be included in the budget, but that you need to mark down.

- Choose your account ID freely (numeric or alpha-numeric account, up to 256 characters).

- You can freely enter the description of the text for up to 256 characters.

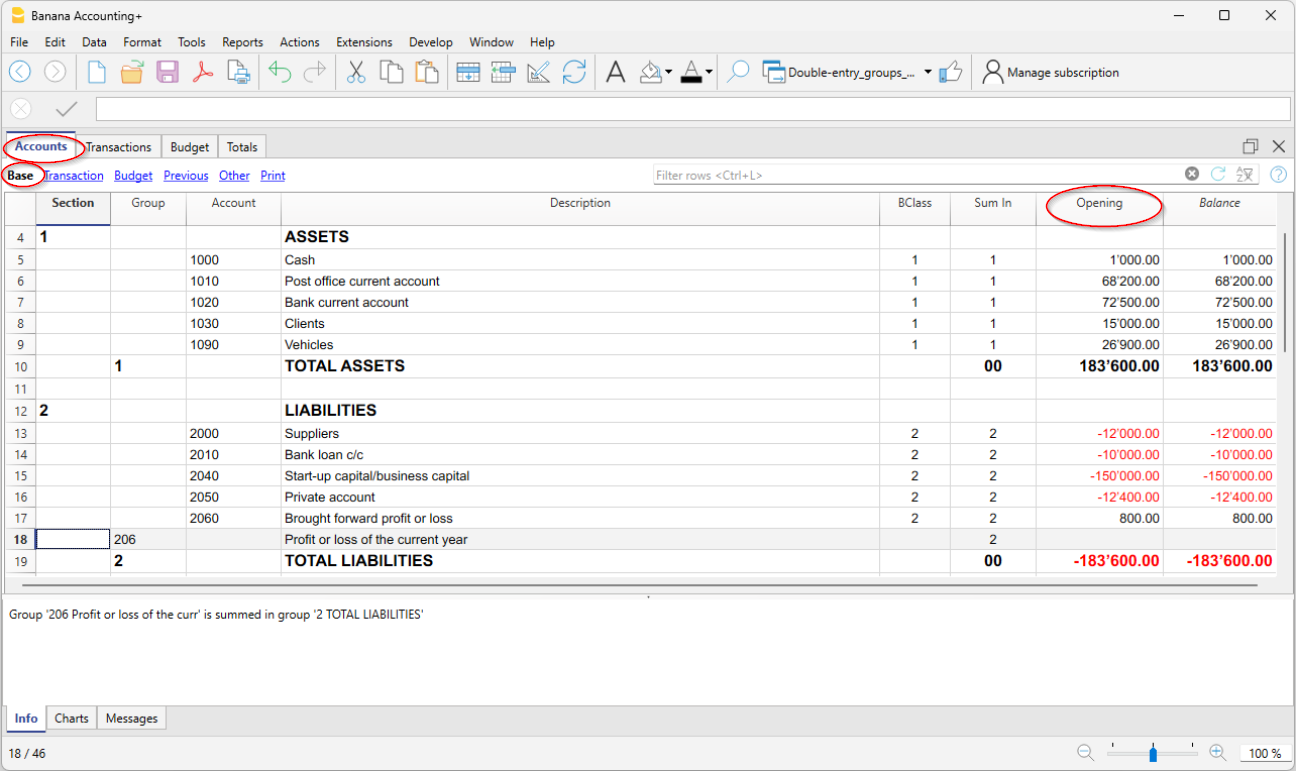

- It is no longer necessary to insert the initial and final balances via accounting transactions

Enter the balances directly in the Opening column of the Accounts table and only when you use Banana Accounting the first time. In the following years the carryover will be automatic. - Balance, account movement and totals displayed contextually and always updated.

- For each customer, supplier, partner account you have the columns to enter the addresses and other useful data you need.

- Adding other columns for notes, grouping or amounts.

- If you add amount columns, they are automatically totaled.

You thus have the possibility to create columns with your own data and have very selected details.

Transactions

- You can insert single or compound transactions.

Single ones are registered in a single row, while the compound ones allow you to easily record transactions that will affect multiple accounts. - You can enter with either the cash or the competence method.

- When you enter data, already existing texts are suggested. With one click the transaction will be filled (auto-completion).

- Immediate reporting of errors and differences, with the possibility of completing them later.

- Store recurring transactions to resume them when they reappear without having to rewrite them.

- Predefined columns columns are available in all the tables and can be displayed at your choice.

- Quantity and price columns, for billing or cost control.

- Auto-numbering of documents with different numbers simultaneously.

- Documents are always at hand, by connecting the digital accounting vouchers (pdf, images) to the files, and open them with a click.

- Enter free texts of up to 256 characters as well as on multiple rows.

- Colour the lines to instantly search for the transactions you need to check or correct later, or to report them to the auditor.

- Adding columns to insert any further information.

- Recordings on Cost and Profit Centers.

- Recordings on segments.

- Save the arrangement of the columns (views) to display the content that is most important to you.

- Contextual information about account balance, differences or errors.

- Before the periodic or year-end closings you can use the Check Accounting functions.You will be able to identify errors between the actual balances (e.g. bank balances provided by the statement, and those of the accounting). You will immediately notice the errors and you can correct so as to have everything matched.

- Movements import:

- Speeds up entry of transactions by importing data from digital bank statements.

- You can import transactions in different formats provided by banks.

- Imported rows can be edited, completed or removed.

- It also imports invoice data or from other software.

Financial forecasting

- If you need to create a Budget, you can activate the function by adding the Budget table.

- Work without difficulty with the same methodology you are already used to, based on the double-entry method.

- Financial forecasts complete with liquidity plan.

- Balance Sheet forecasts.

- Income Statement forecasts.

- Automatic projections over several years.

- Entering the transactions through budget postings.

- Recurring income and expenses set with one transaction.

- All the features of accounting available:

- Calculation formulas in Javascript with access to the values of the current forecast:

- Forecast values available in accounting printouts:

- Account card with forecast movements by account or group.

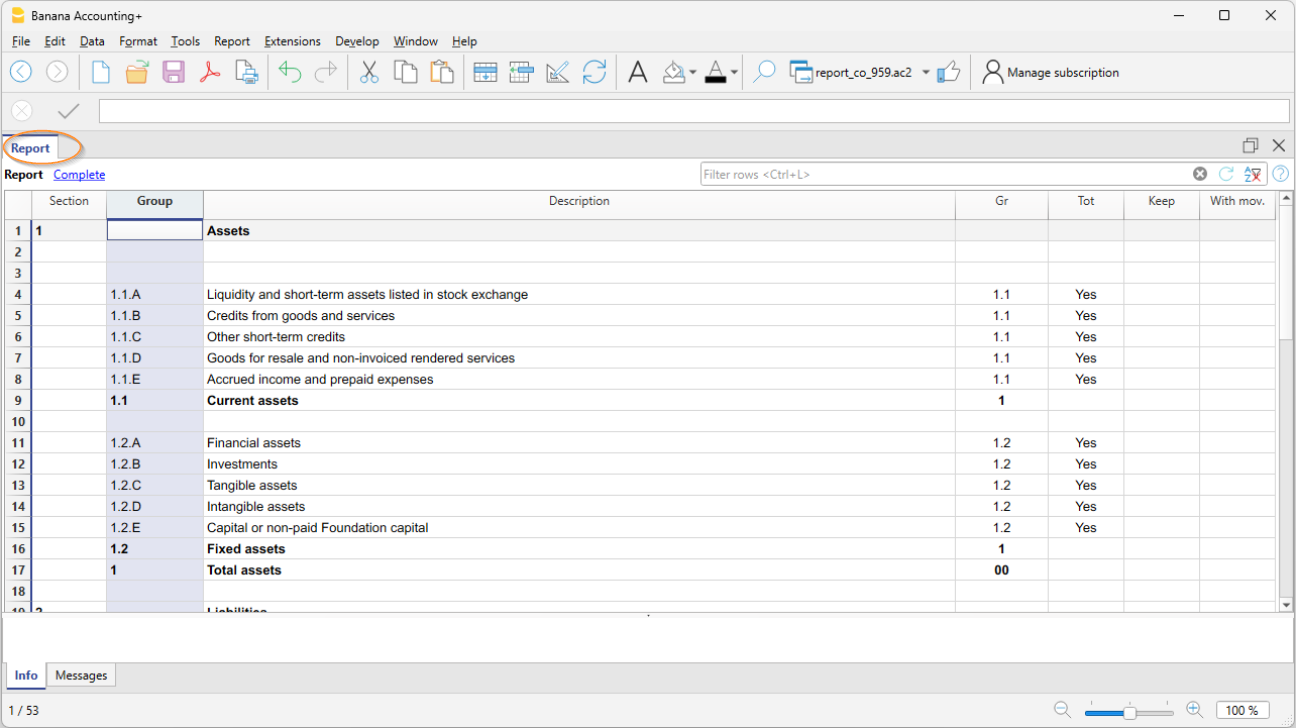

Balance Sheet and Income statement

- Reports with final or Budget data or both, with indication of variations.

- Free arrangement with groups and subgroups.

- Updated results visible directly in the Accounts table.

- Customizable prints:

Watch the video tutorial that shows how to create and print the Enhanced Balance Sheet with groups.- Adding your own logo.

- Choice of columns to include.

- Choice of sections to include.

- Detailed or printout per groups

- Printouts per single period.

- Columns divided by period (month, quarter, semester, year).

- Values from previous year.

- Comparison prediction value.

- Columns with subdivision by segment.

- Added attached notes.

- Grouping as in the Chart of Accounts or according to your own scheme.

- Saving composition.

- Tabular report (similar to customizable printouts, but with the data in the table).

- Export to pdf for data conservation and export to other formats for data processing.

Other accounting prints

- Fully printable content tables or by for selection only.

- Adding your own logo to personalizing documents and prints.

- Journal.

- Account cards with account movements and groups:

- With accounting or forecast movements.

- By period.

- By Account, Group, Cost Center or Segment.

- Accounting or forecasting data.

- Customizable column arrangements.

- Export to pdf or other formats.

Charts

- Contextual, at the foot of the table.

- Different layouts.

- Evolution per accounts and groups.

- Accounting values.

- Forecasting.

- Preceding year.

- Choice of chart type.

Further management

The program also allows you to add additional information to the transaction, allowing you to use the same data needed for VAT management, for tracking customers and suppliers, issuing invoices, generating reports for projects or business sectors and to face the various corporate and tax obligations.

VAT management

- The function can be activated at choice (when creating an accounting).

- VAT code table to indicate the different VAT rates and cases.

- All national specifications supported.

- It can also be used to manage other types of sales taxes (eg American sales tax).

- Entering the VAT code.

- VAT reversal functionality (using the VAT code preceded by the minus sign).

- VAT calculation as per net or gross.

- Automatic breakdown and registration on the indicated VAT accounts.

- VAT control reports:

- By period or complete.

- With or without movements.

- Optionally, with totals per rate, VAT code, account.

- National extensions for VAT reporting based on the requirements of the relative tax authorities.

Customer management and control

- Function activated at choice (adding accounts in the Chart of Accounts).

- Checking invoices and customer payments.

- Customer master data set in the Chart of Accounts.

- Create groups and totals for customers in different groups.

- Open invoices per customer or global overview.

- Customer movement account statement and open invoices.

- Automatic reconciliation, open invoices.

- Customer management also available as cost centers (on a cash basis).

Invoices to customers

- Function can be activated at choice (using the invoice number column in the Transaction table)

- Entering invoices directly into the Transactions table.

- Requires setting up the customer database.

- Entering invoice data as normal row of transactions.

- See issue and print invoices to customers.

- Column to indicate quantities and prices.

- With or without VAT.

- Possibility of modification, correction.

- Print a single invoice with a click or several invoices combined.

- Choice of different print layouts.

- Customize the invoice according to your preferences.

- Exports in digital format via extensions.

- Customizable reminders via extensions.

- Customizable customer account statements via extensions.

Supplier management

- Function activated at choice (adding accounts in the Chart of Accounts.

- Supplier database set in the Chart of Accounts.

Possibility to group suppliers into different groups. - Invoice and payment to suppliers control .

- Open invoices per supplier or full report.

Supplier movement account statement and invoices still open. - Automatic reconciliation, open invoices.

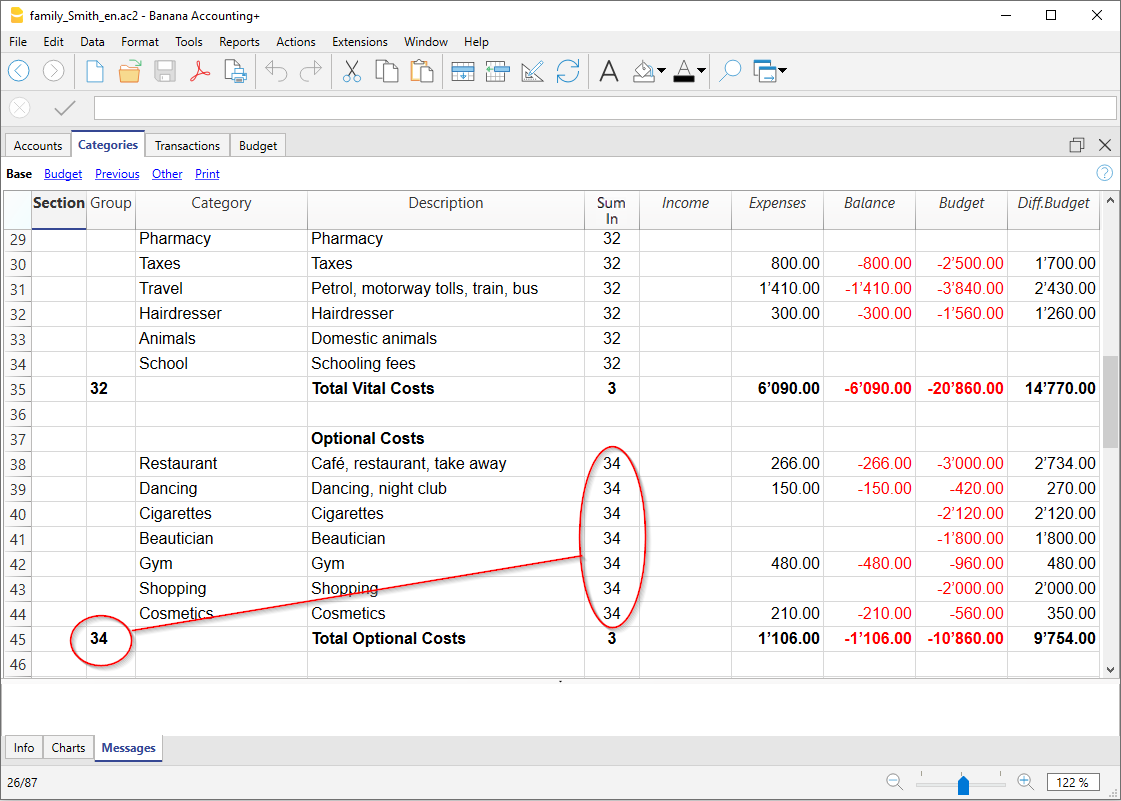

Cost and profit centers

- Function can be activated at choice (adding the cost and profit centers accounts).

- For projects, cost accounting or profitability.

- Setting up cost centers directly in the Chart of Accounts.

- Multi-level grouping.

- Three levels of cost and profit centers.

- Unlimited number of cost centers per level.

- Negative registration (with minus sign).

- Reports such as Balance Sheet and Profit and Loss accounts:

- Balance constantly updated.

- Customizable reports.

- Card of all movements with progressive balance.

- Contextual chart.

Segments

- Function activated at choice (by adding segment accounts).

- Segment column

- The Balance Sheet and Income statement of one or more business sectors.

- Setting up segments directly in the Chart of Accounts.

- Multi-level grouping.

- Up to 10 segment levels.

- Unlimited number of segments per level.

- Balance constantly updated.

- Reports such as Balance Sheet and Profit and Loss accounts:

- Balance Sheet and Income statement for each segment.

Items table

- For invoices and with integrated warehouse or securities management.

- Linking of the articles to the movements of the Transactions table.

- Automatic update of incoming and outgoing movements.

- Initial and final value.

- Adding additional columns.

Control and closure

Error reports and accounting control

- Command to check the accounts.

The accounting is recalculated instantly, as if all operations were entered again. - Reports any wrong settings, differences or errors.

- Each report is linked to a help page that explains the causes and suggests the solution.

- Checks if the account balance matches the real one (cash, bank, VAT).

- Ability to correct.

Transaction protection

- Rows protection.

- Locking of movements entered with digital data certification technology (Bitcoin type).

- Password protection.

- Compliant with legal requirements.

- Sending data to the auditor with the certainty of the impossibility of tampering.

- Unlock movements with date.

Closing and new year

- Automatic procedure to create the new year file.

- Carryover of balances and allocation of profit.

- Work can begin on the new year, even if the previous one has not been closed.

- Command to carry over the closing balances of the previous year.

Exporting and storing data

- Copy and paste directly to and from Excel.

- Export tables to pdf and various other formats.

- Archiving of printouts and accounting data in pdf or other formats.

- Saving the accounting file on any backup device.

Extensions and other features

Added functionalities

- Adding new features.

- Removing features that are no longer needed.

- Conversion from one accounting type to another:

- Accounting with or without VAT.

- Multi-currency accounting or vice versa.

- From Income/Expense accounting to double-entry or vice versa.

Documents Table

Other additional tables

- Addition of other tables where notes or other information can be entered.

- Tables can be customized by adding columns to them.

Extensions

- Default extensions for various prints and other features.

- Quick search and installation.

- Customizable extensions.

- Automatic update.

- Ability to create and install your own local extensions.

Comprehensive documentation

- Each dialogue and error has its own documentation page accessible in a click.

- Constantly updated documentation.

- FAQ.

- Documentation also available in Pdf format.

File and accounting properties

This is where the main data of the accounting file are entered, such as the printout heading, the opening and closing dates, the base currency, the company address, the VAT account, the password, etc

The File and accounting properties window has the following tabs:

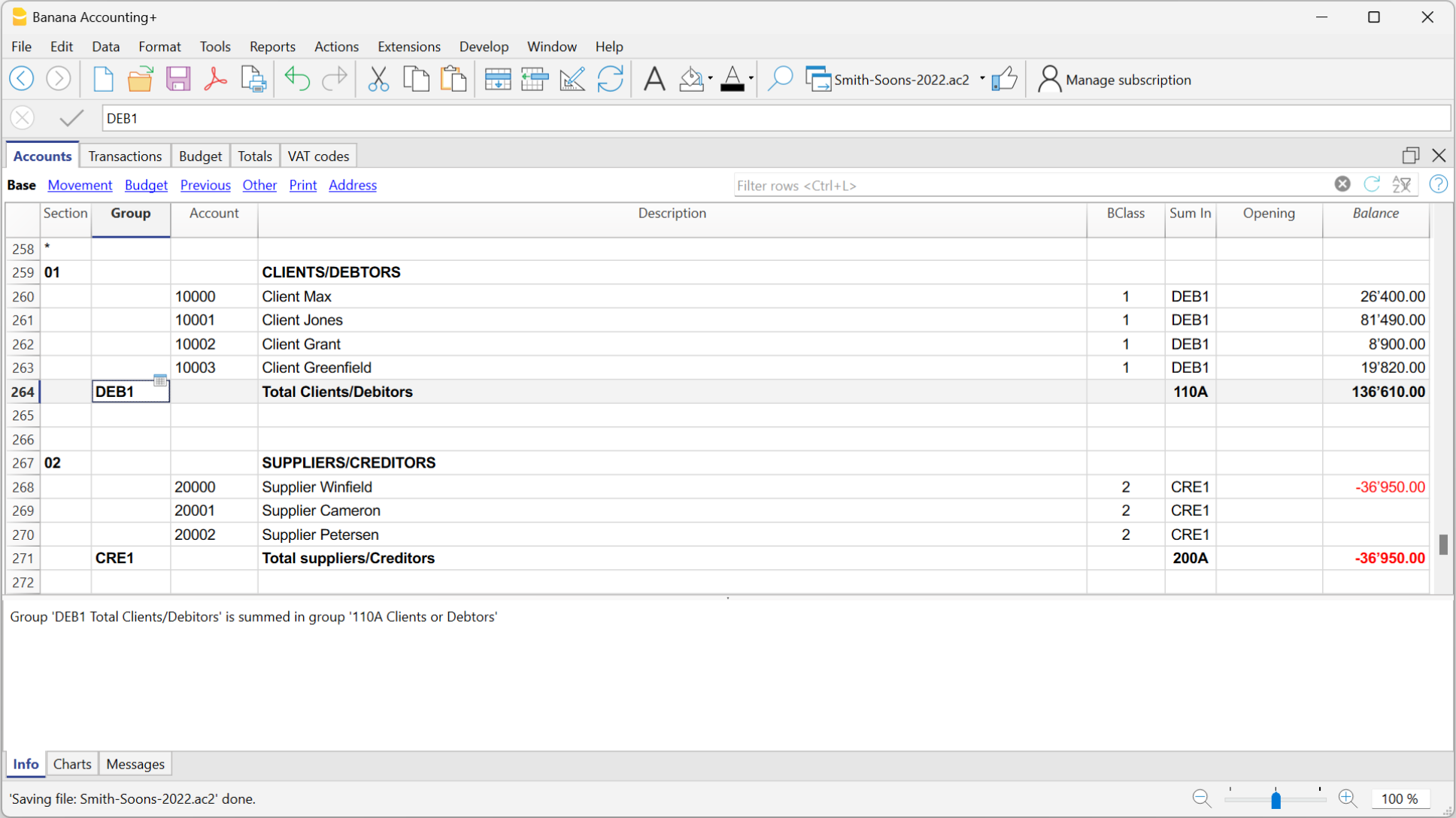

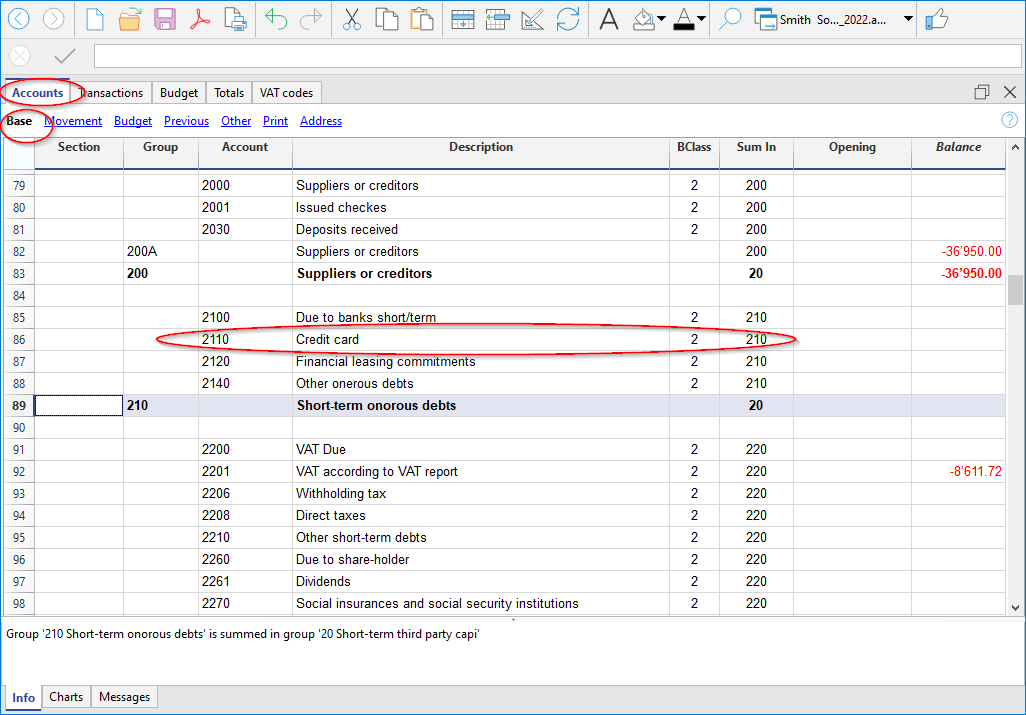

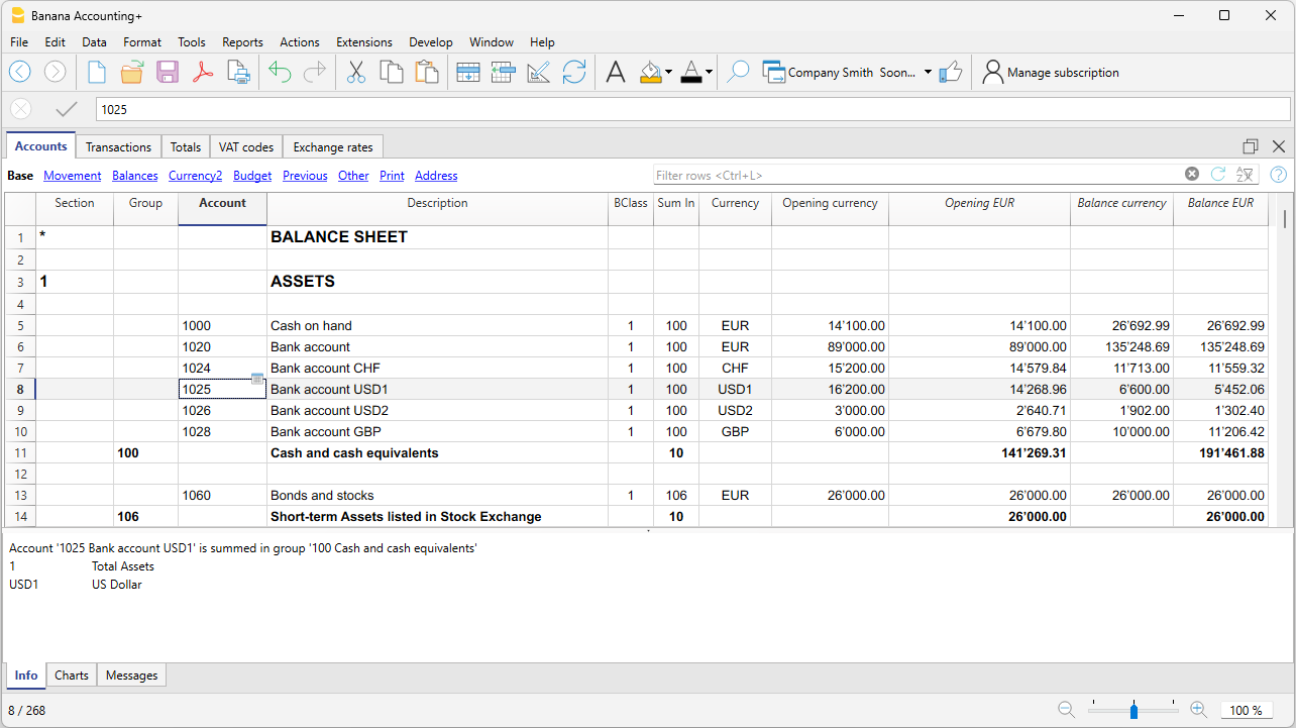

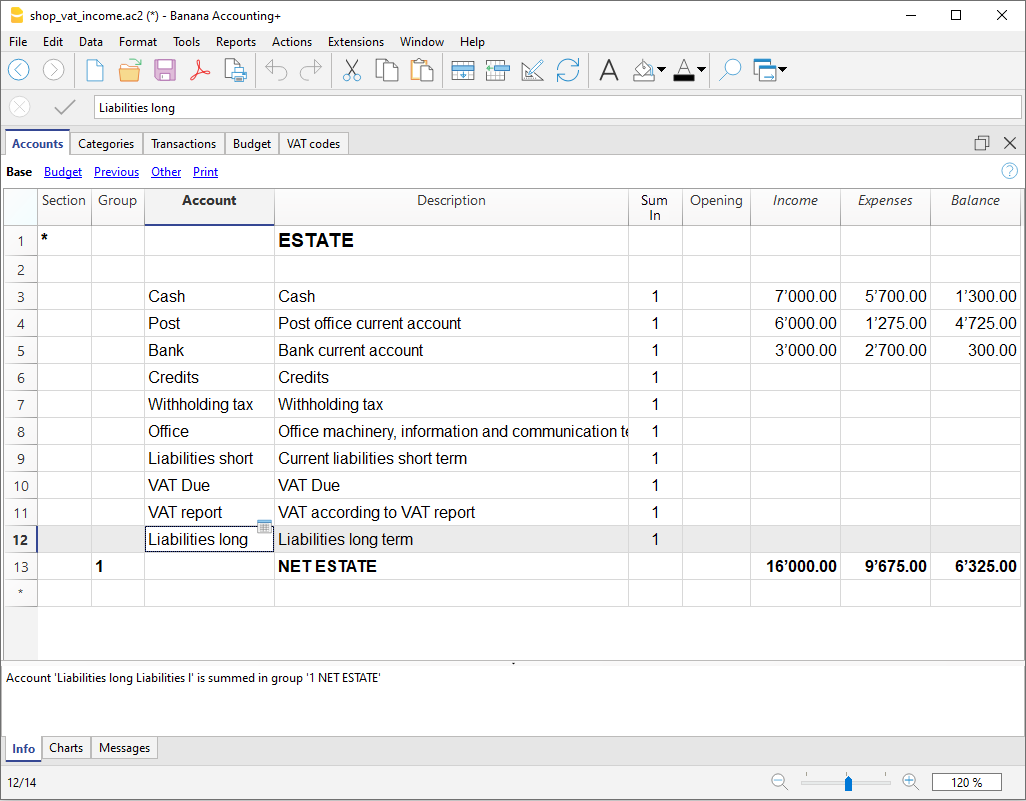

Chart of accounts | Double-entry accounting

The Accounts table is the control room of your accounting. It's use is similar to that of an Excel spreadsheet.

In the Accounts table you set up everything you need to manage the accounting and have a quick updated overview of the financial and economic situation of your company.

Ready-to-Use Chart of Accounts

Each accounting application by Banana offers a wide variety of chart of accounts templates, already prepared for immediate use. Simply select the file whose template meets your needs, and you'll have the chart of accounts already set up. File templates can be chosen based on the type of business activity and legal regulations.

They have the following characteristics:

- Fully customizable chart and account structure.

- Account and group numbers can be numerical or alphanumeric.

- Ability to add notes or additional columns.

- Grouping and totals adaptable to any national grouping scheme.

- Balances, account movements, and totals displayed and always up to date.

- Cost and profit centers for detailed control of costs and revenues for specific activities or projects.

- Segments for sector reporting (branch).

- Customer database, with control over outstanding invoices, reminders, and statements.

- Supplier database, control over paid and outstanding invoices.

- Management of off-budget customers and suppliers (with cost center) for cash-based accounting.

- Off-balance sheet accounts.

Entering and editing data is simple

- Add and edit accounts quickly and easily by simply inserting or deleting the row.

- There is no limit on the number of accounts to be added in the Chart of Accounts.

- Each account can be set up using numbers or texts.

- The description can also be very long.

- The Groups and Subgroups can be freely arranged to compose the Balance Sheet and the Income Statement.

- The opening balances are immediately entered in the opening column.

- Columns can be added to enter additional information.

- Accounts can be renamed and replaced automatically in the Transactions table as well.

- The columns of the amounts are updated instantly, at glance you know the status of liquidity, capital, sales, profit.

- Then, set the budget and have the comparison with the final balance.

Flexible grouping system

The grouping system is highly flexible and powerful:

- It allows to set up the Chart of Accounts according to any national scheme and to adapt exactly to the needs of the company.

- If you are not satisfied with the arrangement or numbering of accounts and groups, these can easily be changed.

The structure present in the Accounts table is also maintained in the presentation of the Balance Sheet and Income Statement.

Main elements

- Sections

They are used to indicate the subdivisions of the chart of accounts for printing the balance sheet, income statement, etc. - Groups

They allow you to create items that total the accounts and subgroups at multiple levels. - Accounts

These are the elements of accounting where the movements are recorded. They can be indicated in Debit or Credit depending on the nature of the movement, destination or origin.

Each account has a number or abbreviation (account number), a description, the B class and group to which it belongs, the opening balance, current balance, estimate, etc.

Customer and supplier data

You can have specific accounts for issuing invoices and checking payments. They are usually set at the end of the chart of accounts. They can be set up as register with the totals linked to the balance sheet, or as cost and profit centers, with all the details but without links to the balance sheet.

Cost and profit centers

Great to manage projects or have precise details of a specific event, or to manage customers and suppliers on the Cash principle (collected).

- Costs and Profits centers

They are special accounts whose number is preceded by a full stop ".", a comma "," or by a semi-colon ";". Their purpose is to be able to assign some amounts to special accounts other than the general accounting accounts.

Segments

Used to generate financial statements also for different sectors or activities in which the company operates.

- Segments

They are a sort of sub-accounts who's number is preceded by a ":". Their purpose is to be able to assign some transactions to subcategories of the chart of accounts.

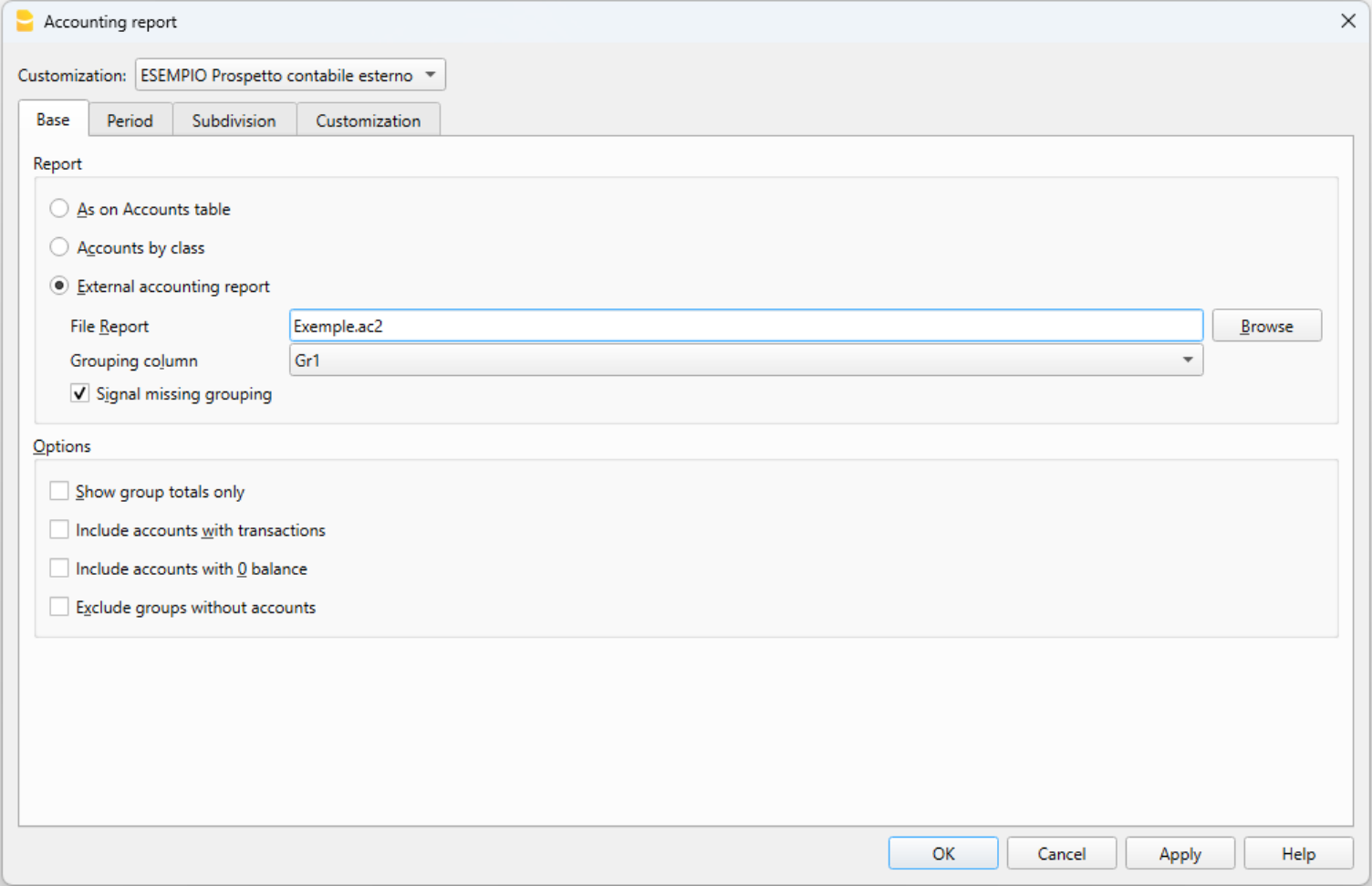

Advanced printouts

- Accounting report

It is possible to select just the accounts with transactions, to obtain temporary groupings or accounts grouped according to the BClass or an external grouping scheme. - Enhanced Balance sheet

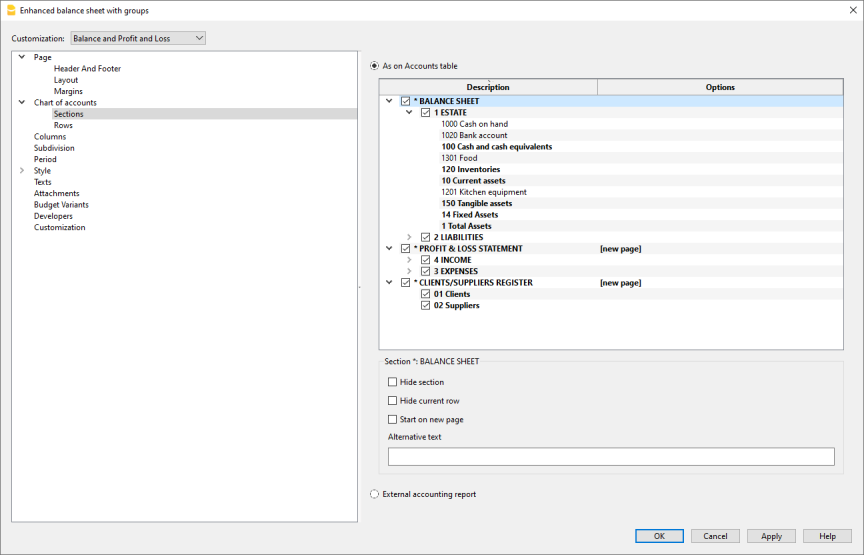

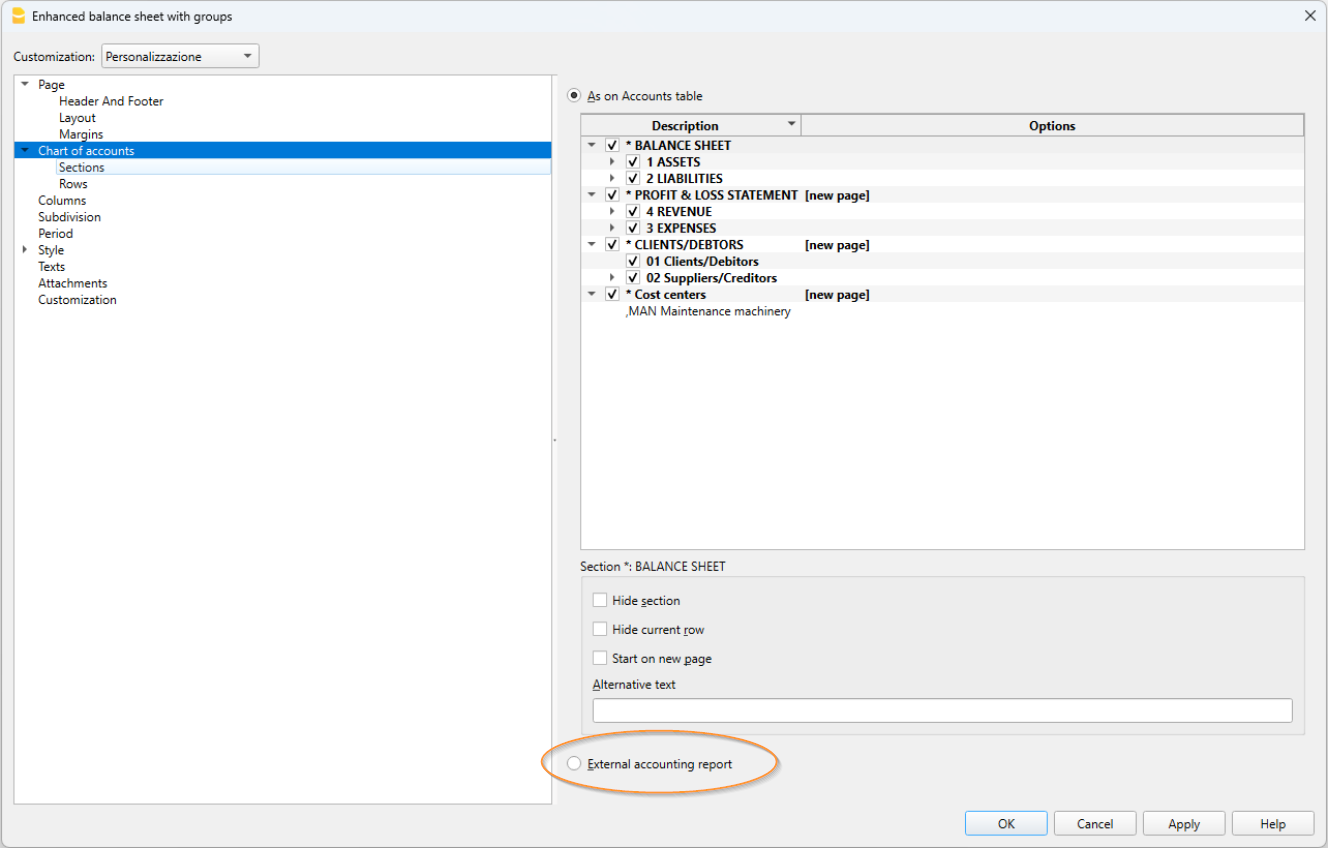

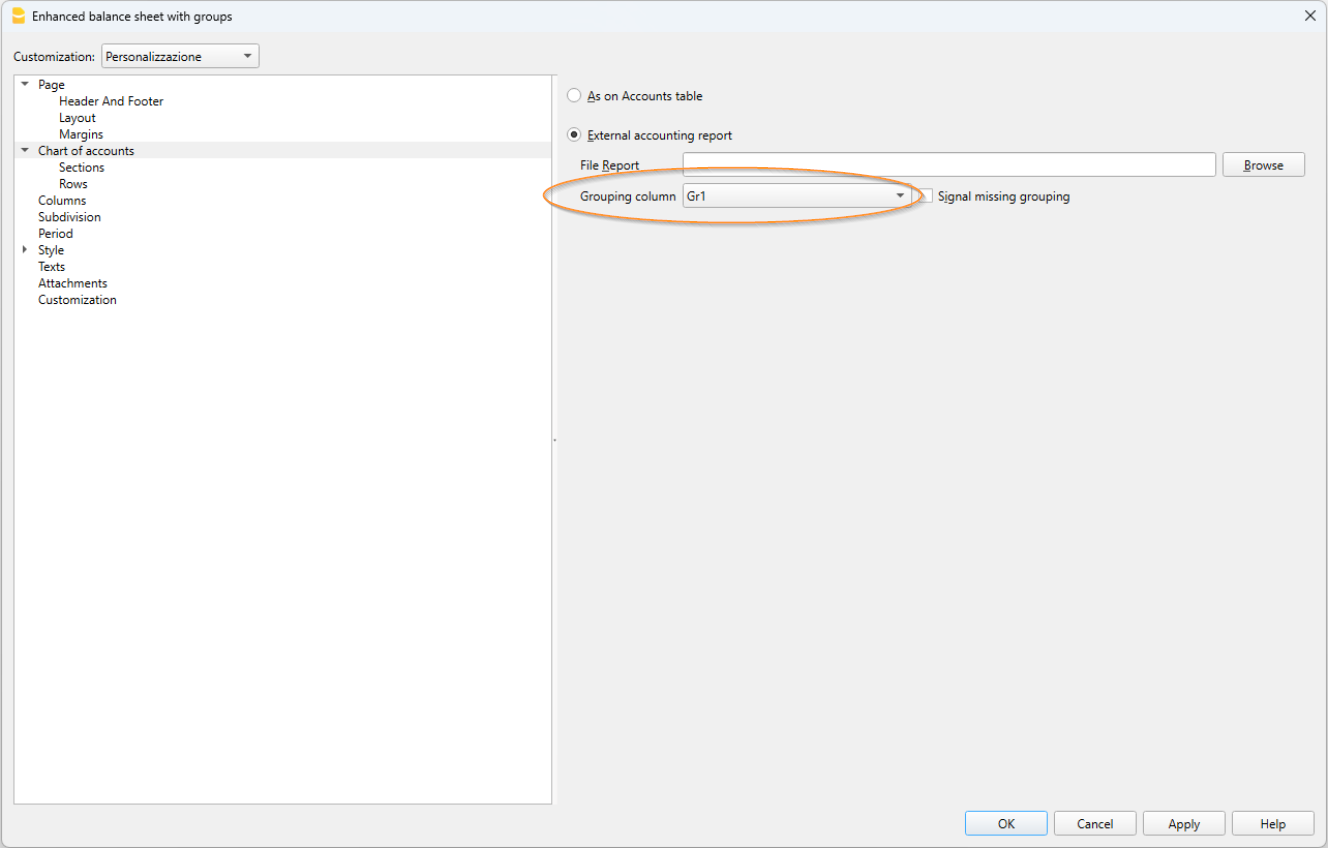

Prints all the accounts of the accounting divided by Assets, Liabilities, Expenses and Revenue - Enhanced Balance sheet with groups

Allows the user to obtain customized printouts with groups - Specific advanced printouts are available using the Banana Extensions

The columns of the double-entry Accounts Table

The Accounts table is made up of several columns. Depending on the Views, columns are displayed simultaneously. Each column has its own purpose.

The data to be entered in the following columns are explained below:

- Section

Codes are being entered that allow the user to print determined parts of the Chart of accounts only, when printing the Enhanced Balance sheet by groups.

- Group

Contains the code that defines that this is a group row. The group code is then used in the GR column to indicate the total of an account or group.

- Account

The account number, cost center or segment is being entered.

- Description

A text to indicate the name of the account, group, or section.

- Disable (only visible in the Other view)

By entering 1, the account does not appear in the auto-complete list, but can be used in the Transactions table;

By entering 2, the account is disabled and can not be used.

- BClass

It indicates whether the account is 1 = Assets, 2 = Liabilities, 3 = Expenses, 4 = Revenue, see Accounts page

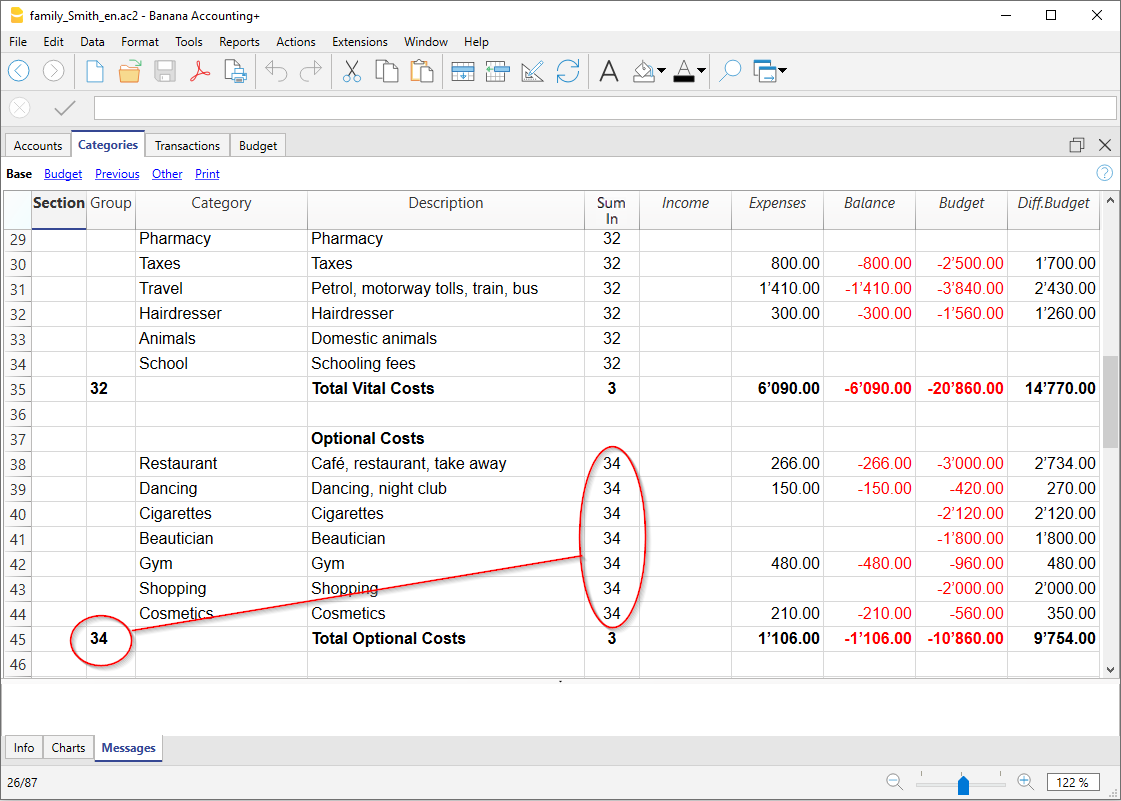

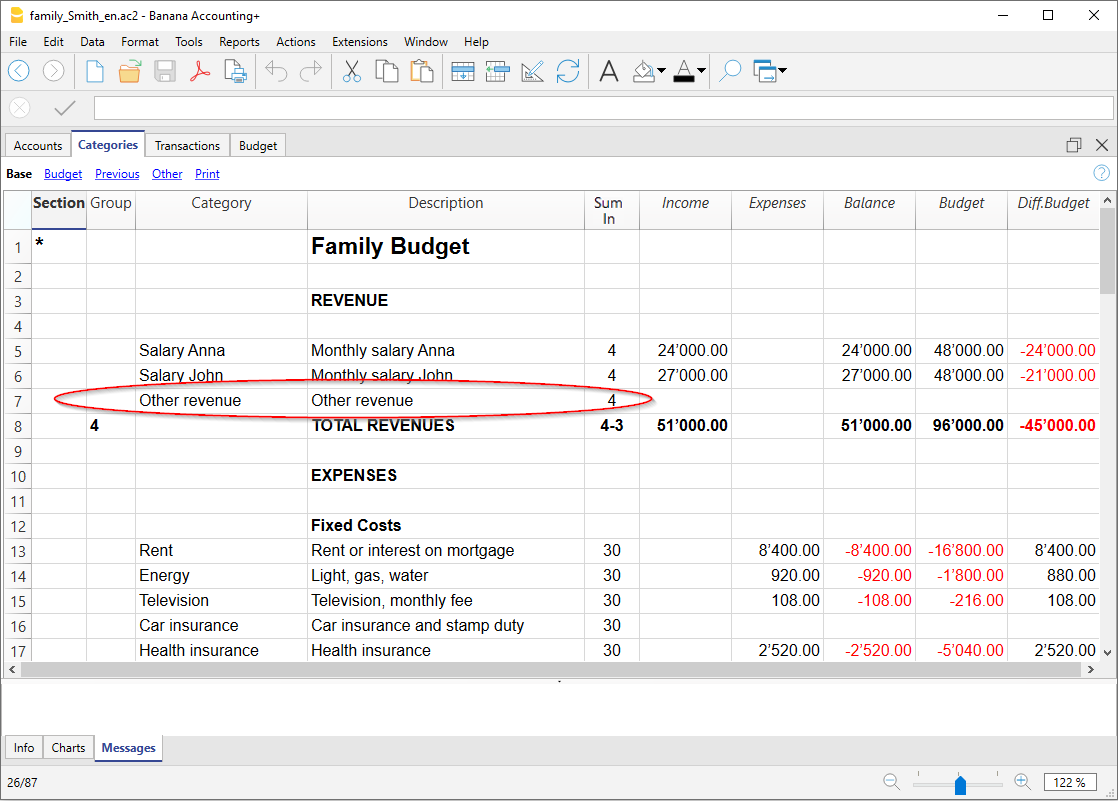

- Sum in (Gr)

The code of a group is indicated so that the programme totals the amount of the line in the group.

The heading 'Sum in' has been adopted with the Banana Plus version.

The column name has remained Gr, to maintain compatibility with earlier versions of the programme.

- Gr1 and Gr2

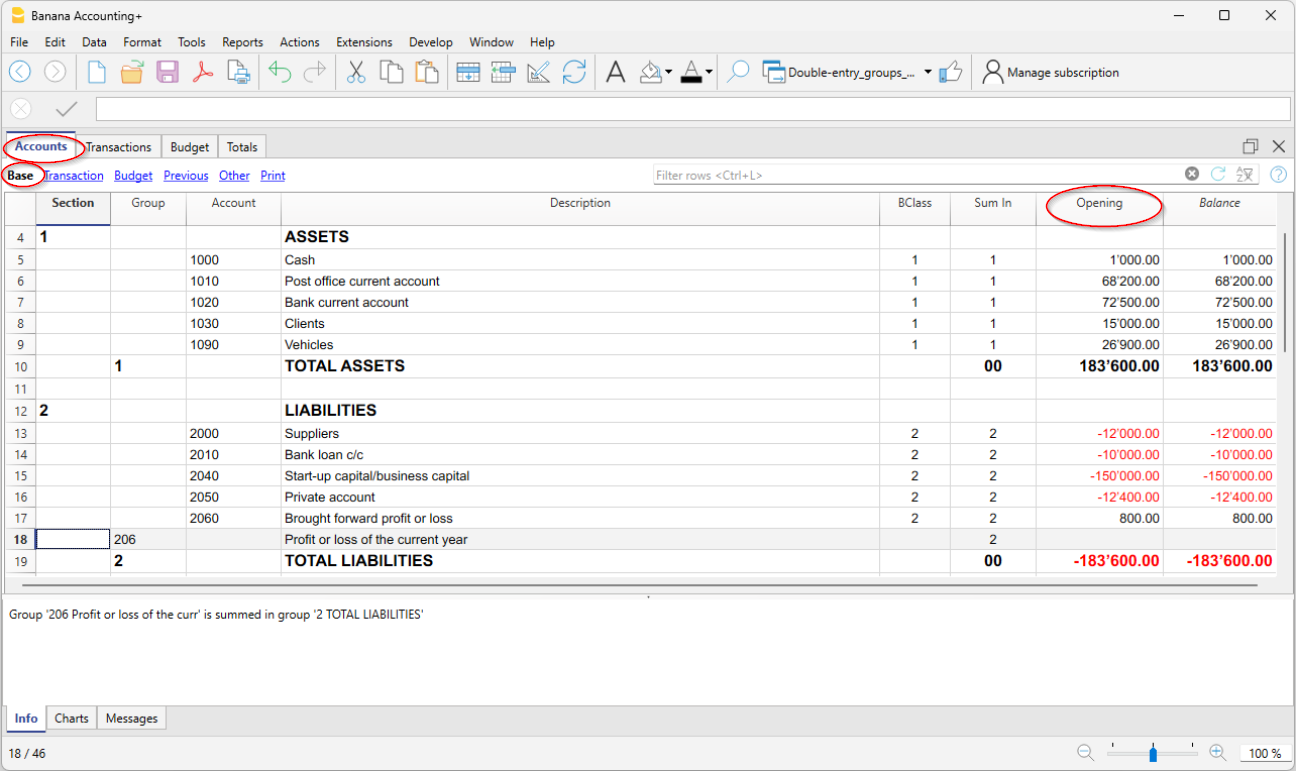

- Opening balance

- The account balance is entered at the beginning of the year.

- Credit amounts must be entered with a minus sign in front

- The sum of all the amounts, those in debit (positive) and credit (negative) of the accounts belonging to classes 1,2,3 and 4 must result as zero. If the opening balances do not balance, a difference is indicated in the information window.

If accounts have been added and the difference is not exact, Recalculate the accounting. - The opening balance, in the balance sheet accounts, is used to calculate the current balance.

- If values have been entered in the Budget table, the opening balance is used by the program for opening financial planning.

- For further information, see the Double Entry Opening Balances page.

- Debit and Credit movements (Protected columns)

The total of the debit and credit movements included in the Transactions table.

- If there are no errors, the totals of the two columns are balanced, otherwise a difference is displayed in the Balance column which must be checked and corrected.

- In line called Difference must be zero, regarding these two columns, it is correct that there are amounts. The important thing is that their values are equal. See also Mathematical Basis of Accounting.

- Balance (Protected column)

The balance of the account includes the opening balance and the movements in debit and credit.The balance in debit is positive, while a credit balance is negative (minus sign).

- Budget

You enter the budget amount for the current period.- The budgeted amount for costs (debit) must be entered in positive, for revenue in negative (credit).

- If the Budget table has been activated, the Budget column in the Accounts table is protected and the amounts are those calculated on the basis of the budget postings.

-

Difference Budget (Protected column)

The difference between Balance and Budget amount.

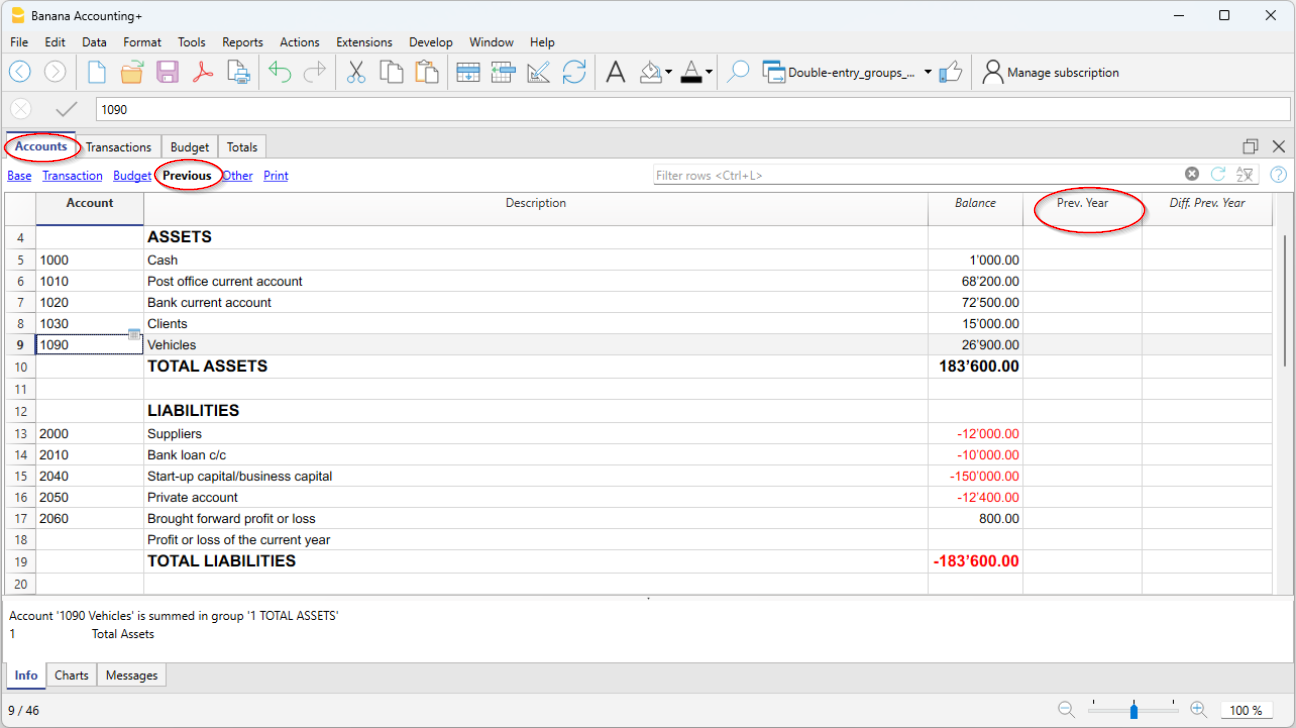

- Previous

The balance of the account at the end of the preceding year.

With the command Create new year or Update opening balances the values in the Balance column of the file of the preceding year are being carried forward.

When a new accounting is being created and the user wants to obtain printouts with the amounts of the preceding year, the values of that year have to be entered manually.

- Difference Prev. year (Protected column)

The difference between the Balance and the amount of last year.

- VATNumber

The VAT number in case this account is linked to a client or a supplier.

- VATCode

The VAT code that needs to be applied automatically, when this account is being entered in the debit A/c or credit A/c column of the Transactions.

- Address columns

These columns are used to enter the addresses of the customer and supplier accounts. If the columns are not present, they can be added by activating them via the Tools → Add new features → Add address columns menu in the Accounts table.

Adding or moving columns

- When an Amount column is being added in the Chart of accounts, the program will calculate the total of the amounts according to the selected grouping scheme

-

Columns added of the number type, on the contrary, are not being totaled.

- With the Columns setup command, the columns can be displayed, the sequences can be altered and it is equally possible to add other columns.

- With the Page setup command one can also define the layout of the print (portrait or landscape) and the zoom.

Accounts list sorted by description or other criteria

To obtain lists of accounts sorted in different ways, use the Extract and sort rows command from the Data menu. We recommend you to be very careful when sorting the rows with different criteria in order not to create confusion in the groupings and totals.

Views

- Base The principal columns, the grouping columns and the balances are displayed.

- Transaction The columns with the Debit and Credit transactions are displayed.

- Budget The Budget column and the Difference Budget column are displayed.

- Previous The Previous column and the Difference Prior columns regarding the previous year are displayed.

- Other The Disable column, the VAT number and the Fiscal number column are being displayed.

- Print Only the Account column, the Description and the Balance are being displayed.

The views can be customized and others can be added with the Views setup command.

Accounts | Double-entry book-keeping

Accounts constitute the main structure on which all accounting is created. If you open one of the templates included in Banana Accounting, the accounts are already present in the Accounts table and contain all the settings needed to instantly record the transactions in the Transactions table.

The accounts in the Accounts table are divided as follows:

- Balance Sheet Accounts - Assets and Liabilities.

- Profit and Loss Accounts - Expenses and Income.

- Customer and Supplier master Data

- Account Cost and Profit centers - for managing projects or keeping the Customers / Suppliers register

- Segment Accounts - for managing business segments or branches.

The BClass

The BClass is essential for the correct total of amounts and balances. In the BClass column, each account must be assigned one of the following values, regardless of the account number or group to which it belongs:

- 1 - for Assets

- 2 - for Liabilities

- 3 - for Expenses

- 4 - for Income

Groups and subgroups do not have BClass, so the cell of the relevant column remains empty.

BClass of off-balance sheet accounts

Off-balance sheet accounts are those whose amounts and balances do not fall within the totals of the balance sheet and income statement accounts. They are accounts that are entered in the chart of accounts to view guarantees and conditional commitments.

Off-balance sheet accounts must have the following BClass:

- 5 for Off Balance Sheet Assets

- 6 for Off Balance Sheet Liabilities

- 7 - 10 - for other Off Balance Sheet accounts

Add a new account or category

In the Accounts table, Base view, you can add new accounts (or new categories in the Income / Expense accounting).

Before adding an account or a category it is important to know:

- The account or category number can consist of numbers, letters and separator characters.

- There cannot be multiple accounts or categories with the same number.

- Each account must have a grouping (Gr) and a class (BClass).

To add an account or a category proceed as follows:

- Go to the row preceding the one where the new account or category will be inserted.

- Add a row with the Edit → Insert row command

- Fill in the respective columns the account or category number, the description, the BClass (1 for assets, 2 for liabilities, 3 for costs and 4 for revenues - only for double-entry accounting), the number of Gr which must be the same as the one entered for the accounts belonging to the same Group.

Warning: if you enter a transaction with an account that does not exist in the chart of accounts and only after creating the new account, you will initially receive an error message; to eliminate it, it is necessary to recalculate the accounting with the command Shift + F9 or through the menu Actions → Recalculate totals.

Rename an account

This is a very useful function because it allows you to change an account and simultaneously have it replaced in the Transactions table. It avoids having to change the account for each transaction that contained the previous account. In addition, it also allows you to rename a group or a VAT code.

- In the Accounts table go to the Account / Category or Group column, or to the VAT Code column of the VAT Codes table.

- Use the Data → Rename command.

- Indicate the new account number, group, category or VAT code.

The program automatically updates the Transactions table with the new VAT number or code.

Delete an account

If an accounting is already started, before deleting an account, make sure that it has not been used in the Transactions table or that it does not have an opening balance.

- Locate the row of the account that is to be deleted.

- Use the command Edit → Delete rows command.

After deleting an account or a category it is advisable to use the Actions → Recalculate totals command. If the deleted account or category is in use in transactions, the program reports an error message.

Opening balances of the accounts

The opening balance of an account is shown in the Opening column.

- Debit (Asset) balances are shown normally.

- Credit (Liabilities) balances are indicated with a minus sign (in negative) in front of the amount

- Typically, only the opening balances of the Asset and Liabilities accounts are indicated.

To carry over the opening balances automatically to the following year, see the Create New Year lesson.

Further details on opening balances are available on the Opening balances page.

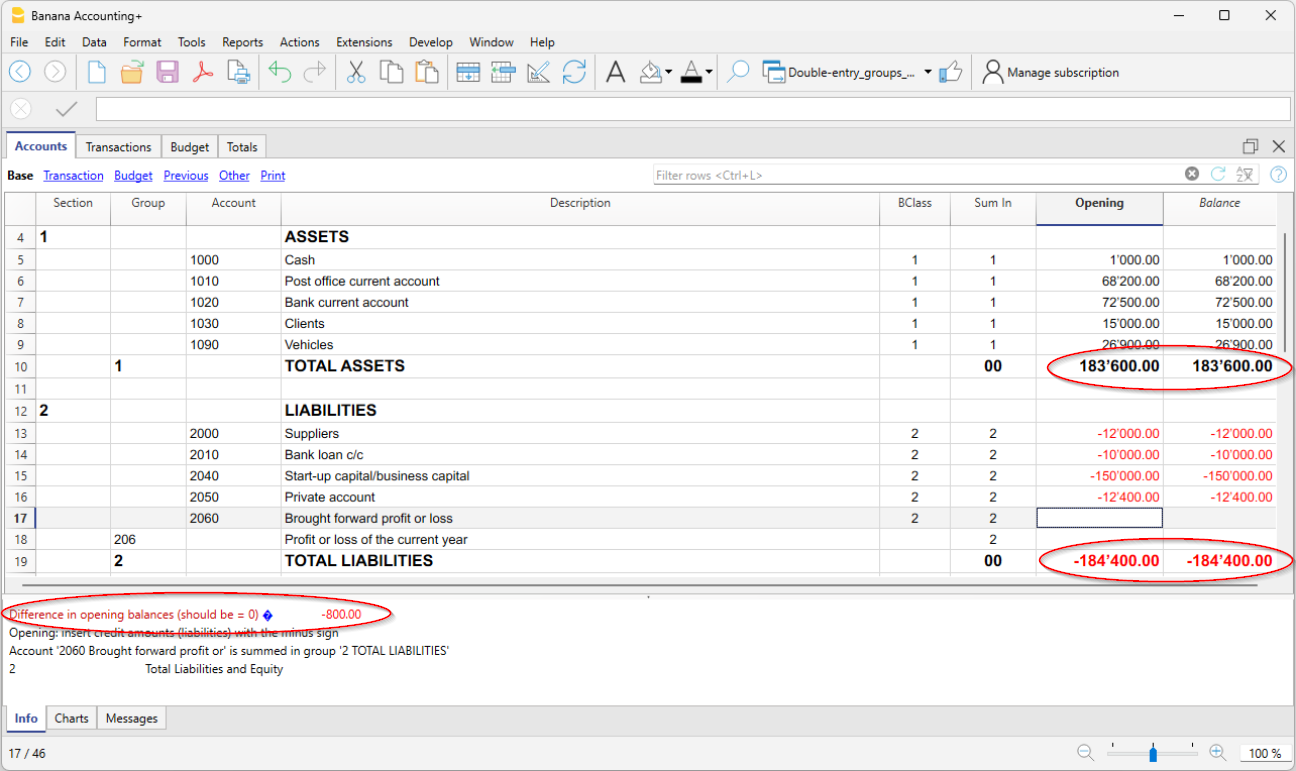

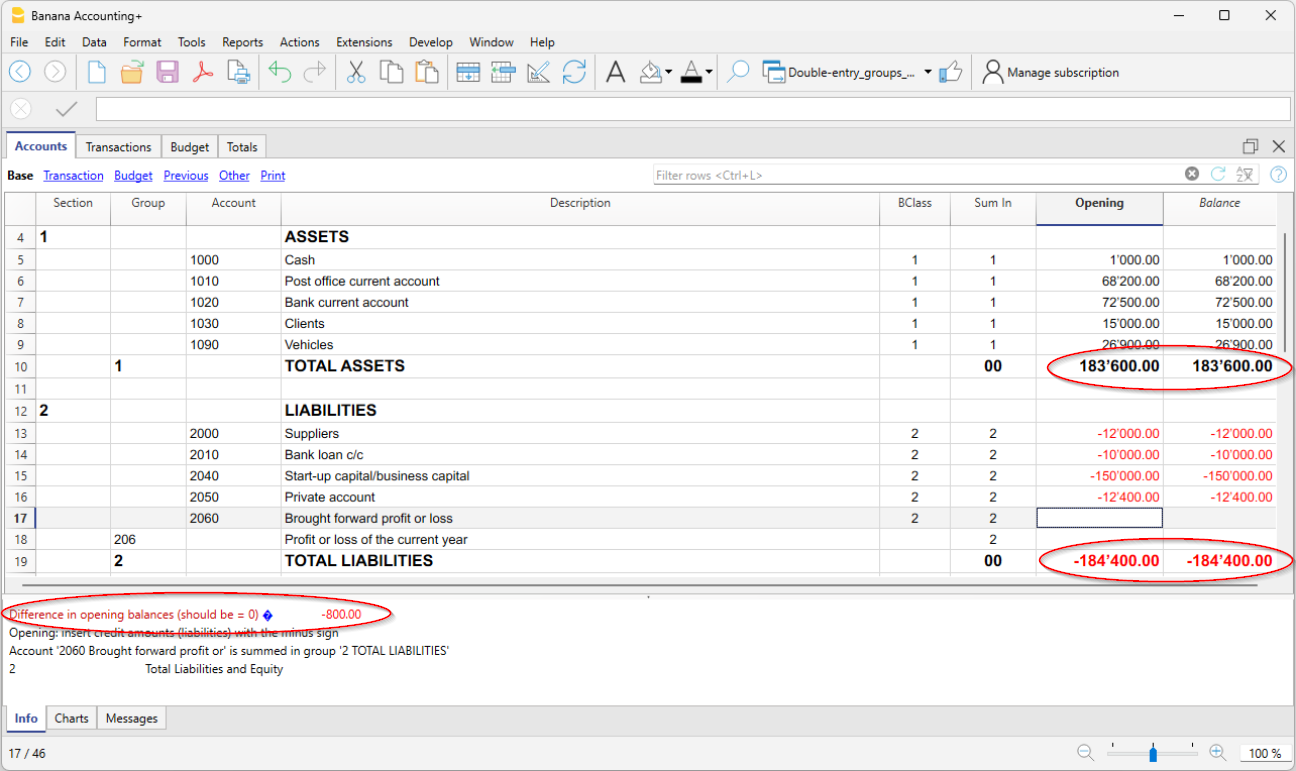

Differences in opening balances

To have correct accounting, the total of the opening debit balances must match the total of the opening credit balances, so that there are no differences.

If the total does not correspond there will be a notification of the difference between the initial balances in the Info window.

If any account numbers have been changed and there are differences, perform the Full Accounting Recalculation.

When using Banana Accounting for the first time, to create the opening balance, it is necessary to manually enter the opening balances (Opening column), making sure to enter the balances of the Liabilities with the minus sign (-) in front of the amount.

Further details on opening balances are available on the:

- Differences in opening balances (Double-entry accounting).

- Differences in opening balances (Multi-currency accounting).

Customer and Supplier accounts

Customer and supplier accounts can be entered directly in the Balance Sheet sections, listing the accounts for each customer and supplier and creating two distinct totaling groups, one in the Assets for customers, the other in the Liabilities for suppliers. If the list of customers and suppliers is very extensive, it is possible to create a customers / suppliers ledger at the end of the chart of accounts.

There are several setting options:

- Setting up directly in the Financial Statements, listing customers and suppliers, respectively in the Assets and Liabilities.

- Setting up with the customers / suppliers register, at the end of the accounting plan, with the totalization reported in the financial statements. This setting is ideal for those who manage VAT with the accrual method.

- Setting up with cost and profit centers, at the end of the chart of accounts, without totaling in the balance sheet.

This setting is ideal for those who manage VAT with the cash method.

Accounts with addresses

In the Accounts table, Address view, there are columns to enter the addresses of customers, suppliers or members. If the columns of the address view are missing, you can add them:

The address columns are essential to be able to manage billing, reminders and the control of payments and collections.

More details are available on the Address page.

The Cost and Profit Centers accounts

They are ideal for project management, have precise details on a specific event or for any other need.

- Cost and profit centers

They are accounts that have the number preceded by a period ".", by a comma "," or by a semicolon ";" and are used to attribute the transaction amounts to additional accounts as well, with respect to the basic accounting ones.

All the amounts attributed to the cost and profit centers are separate from the Balance Sheet and the Income Statement and are entirely for information purposes.

The Segment Accounts

To have financial statements also of different sectors or activities in which the company operates.

- Segments

They are similar to sub-accounts that have the number preceded by a colon ":" and are used to attribute the accounting operations to sub-categories of accounts.

Customize accounts and categories

Adding a new account or category

With Banana Accounting it is possible to customize the chart of accounts by adding or deleting accounts and categories.

To add a new account or category, proceed as follows:

- Position yourself in the row above the one where you want to add the new account or category.

- Add a new empty row with the command Edit → Add rows.

- Enter in the respective columns:

- The Account number

- The Description,

- The BClass (1 for the Assets, 2 for the Liabilities, 3 for the Expenses and 4 for the Revenue)

- Grouping number (Sum in column) which must be the same as that entered for accounts or categories belonging to the same Totalization Group.

If in the Transactions table you enter a transaction with a non-existing account, the program gives you an error message; to take it away you have to create the new account in the chart of accounts and recheck the accounting with the Shift + F9 key, or with the menu Actions → Recheck accounting command.

Adding a new group

If you want new totalization groups, proceed as follows:

- Position yourself in the row above the one where you want to add the new group

- Add a new empty row with the command command Edit → Add rows.

- Enter in the respective columns:

- The Group number

- The Group Description,

- Grouping number (Sum in column) in which you wish this group to be totalized.

Renaming an account, a group, a category or a VAT Code

This is a very practical function that allows you to rename an account, a category, a group or a VAT code and to have the replacement automatically in the Transactions and Budget table without having to enter them manually.

To rename one of the elements proceed as follows:

- Position yourself in cell where the account or group (Accounts table) or the category (Categories table), that needs to be renamed, is present.

- If it is necessary to rename a VAT code, it is necessary to position yourself in the VAT Codes table, on the cell of the code to be substituted.

- Choose the Data menu → Rename command

- Indicate the new account, group, category or VAT code number.

Removing an account, a group, a category or a VAT Code

- Position yourself on the row number that contains the element that is to be deleted

- Click on the Edit menu → Delete rows.

- Enter the number of rows that you wish to delete

After deleting an account, a group, a category or a VAT code, it is necessary to use the Recheck accounting command. The program will give you a warning message if the deleted element was used in the transactions.

When deleting a group and not all accounts belonging to the deleted group are deleted, you must change the grouping number in the Sum in column for the remaining accounts, otherwise errors will be reported.

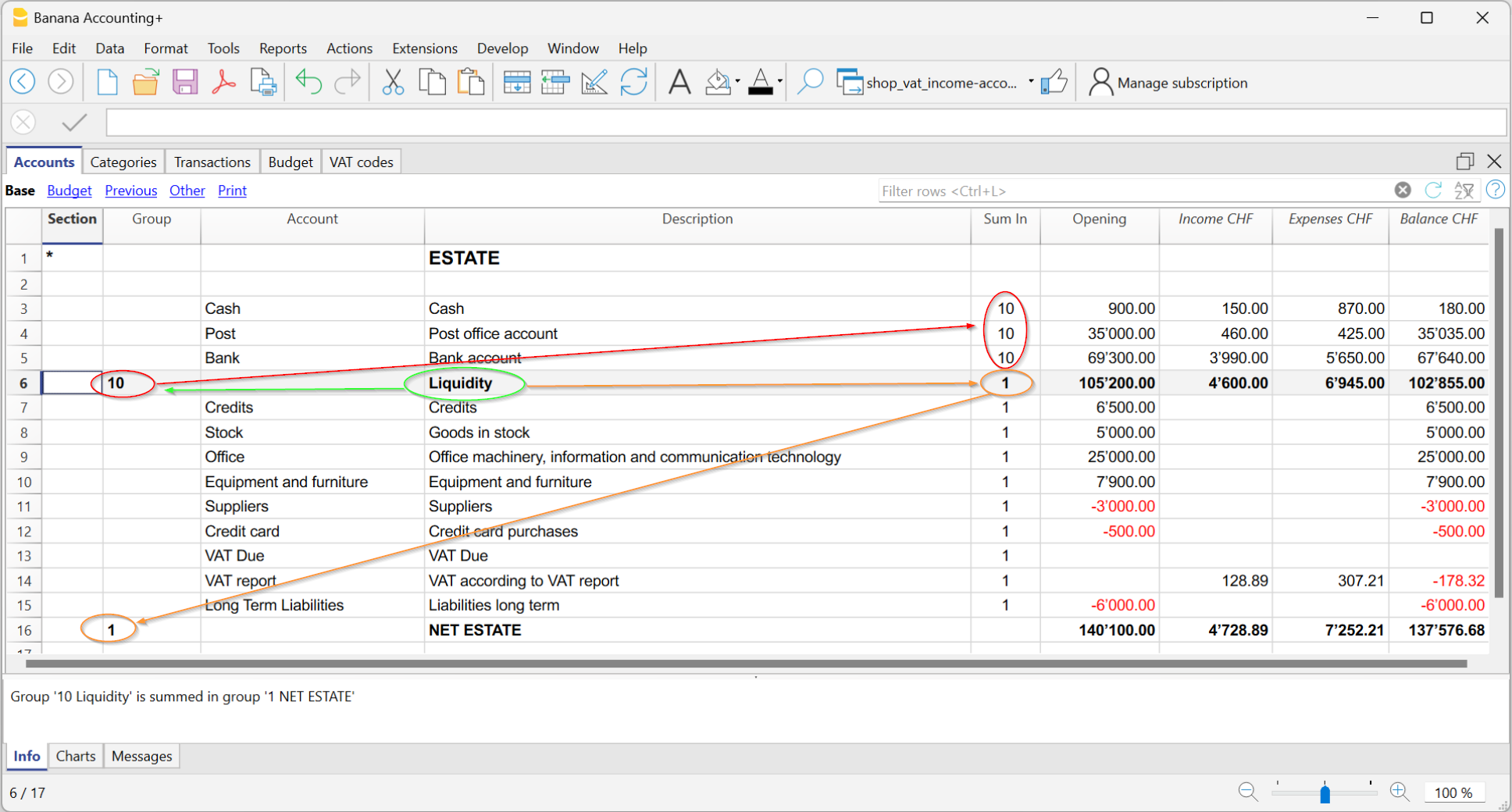

Groups

Banana has developed a very practical and immediate grouping system, which allows you to set in the Accounts table all the information necessary to define the structure of the Balance sheet, Profit & loss statement and of other sections of the accounting.

The grouping system is flexible; it allows you to implement any national chart of accounts and at the same time to adapt it to the specific needs of your business. Both very simple and very complex plans and presentations can be created, with multiple levels of totalling, for any type of accounting.

With grouping, the totals of balances, movements and the group budget are displayed immediately.

How it works

To understand how the Banana grouping system works, please refer to our documentation page:

Grouping and totalling system

The Banana grouping and totaling system is based on two columns of the Accounts and Categories table:

- Group (Total row)

- When, in a row, a group identifier is being entered, the row becomes a total row.

- In this row the amounts of the Sum in column, that contain the same identifier, are being totaled.

- In a row, when a group is present, there cannot be an account.

- Sum in

- Sums the row amounts in the indicated group.

- For each account or group row, you indicate the group in which the line is to be totaled.

- The number here must be one of the numbers defined in the Group column.

Main groups in double-entry accounting

Every accounting file template uses its own totaling system. Hereunder explanation of the main groups of double-entry accounting .

In double-entry accounting, the total of the Debit balances (positive) together with the Credit balances (negative) have to result in 0 (zero). In the case of differences, the group line 00 has a non-zero amount.

The calculation sequence to achieve 00 is therefore as follows:

- The 1000 accounts > group 1 (Total Assets) > Group 00

- The 2000 accounts > group 2 (Total Liabilities) > Group 00

- The 4000 accounts > group 4 (Total Expenses) > Group 02 (result Profit & Loss Statement) > Group 206 (Profit/Loss of the current year in the Balance Sheet) > Group 2 (Total Liabilities) > Group 00.

- The 3000 accounts > group 3 (Total Revenue) > Group 02 (result Profit & Loss Statement) > Group 206 (Profit/Loss of the current year in the Balance Sheet) > Group 2 (Total Liabilities) > Group 00.

- The 00 group is the control row where all the amounts are being added together.

- It is the "Grand total" of all the Debit & Credit balances as a result of the transactions entered in the Transactions table.

- If the line in the 00 group shows a difference (non-zero amount), this means that there are mistakes:

- If the difference is shown in the Accounts table, Opening column (all views) there are differences in the opening balances

- If the difference is shown in the Accounts table, Balance column (all views) there are differences in the Transactions table. In the Debit and Credit columns of the movement view, the totals are not balanced.

In cases where the difference is indicated issue the command Check and recalculate accounting. This command suggests any errors that need to be checked and corrected.

- In the Debit and Credit columns of the Movement view (Accounts table), the totals of the balances are always reported. If the totals in the two columns are equal, there are no errors.

The result of Profit & loss statement is added in equity capital

As you can see in the example, the Group 02 (Profit /Loss from Profit & Loss statement) is totalized in the 206 liabilities group (current year result).

With this group organization, we have several advantages:

- The current year operating result is displayed in the balance sheet

- The Total Liabilities will match the Total Assets (provided that there is no accounting error).

Set up of the Chart of Accounts structure

The chart of accounts in Banana Accounting can be set mainly in two different ways:

1. Structure without subgroups (or subtotals).

In this case, the structure is very simple. You list all accounts without subgroups, and total all accounts or categories in the main groups:

For Double-entry Accounting:

- Assets

- Liabilities

- Expenses

- Revenue

For Income/Expense Accounting or Cash Manager (Categories table):

- Income

- Expenses

2. Structure with subgroups

The structure is more complex. The accounts or categories of the main groups are divided into several subgroups, which in turn are totaled into the corresponding main groups.

Here we present a structure of the chart of accounts with an example of Subdivision with subgroups in Double-entry Accounting. Each subgroup can be in turn :

Assets

- Current Assets

- Cash and Cash equivalents

- Customers

- Inventory

- Fixed Assets

- Furniture

- Machinery and equipment

- Computers, software.

- Current Assets

Liabilities

- Third-party capital

- Suppliers

- Bank loans

- Other short-term debts

- Long-term debts

- Equity

- Equity

- Reserve funds

- Profit and loss carried forward

- Profit for the year

- Third-party capital

From the Accounts table, at any time, through the menu File > Print or Print Preview you can print the chart of accounts or part of it.

Always starting from the Accounts table, by selecting the Movement view, you have the printing of the verification balance.

Adding a new group

- Position yourself in the row preceding the one where the new group will be entered

- Add a row with the command Edit > Add Row

- Type in the group column the group number, description, and the number of the column Sum in where you want this group to be totaled.

Adding a totaling level

With this system it is easy to add totaling levels.

When we want to create a subgroup for the Cash & Cash equivalents accounts:

- Enter an empty row after the bank account

- Enter the value 10 into the Group column

- Enter the value 1 into the Sum in column

- Indicate the grouping 10 in columns Sum in the accounts 1000 and 1020

- The sequence for the calculation becomes:

The 1000 account > Group 10 (Cash & Cash equivalents) > Group 1 (Total Assets) > Group 00.

The programme totals the following:

- It totals the accounts in a group row.

For example, the Cash account is totalled in the Liquidity group. - Totallises a group or subgroup in another group, which in turn is totalled in another group, thus building the calculation structure of the Balance Sheet and Income Statement.

For example, the Liquidity group is totalled in Total Assets, which in turn will be totalled in group 00, in the control total row.

In case you want to insert another subgroup, "Current Assets", proceed in the same way.

- Add an empty row above the row of the Total Assets.

- In the new row:

- Indicate the number 11 in the Group column

- Indicate the number 1 in the Sum in column

- In the Clients and Goods for resale (inventory) rows, indicate the grouping 11 in column Sum in.

Title rows (with Sum in)

Also in the title rows it is useful to indicate the grouping Sum in (the group of the total row) to which it belongs.

In this way, in the printouts of the Enhanced Balance Sheet by groups, if the accounts are zero, the title will not be printed.

Deleting subgroups

In case the Chart of accounts shows subgroups that are no longer needed or not wanted, these can be deleted. Just delete the row of the subgroup and modify the grouping Sum in of every account that was part of that subgroup.

Checking of the structure

Once the Chart of accounts has been set up, execute the Actions menu > Check accounting command. In case there are errors, the program issues a warning.

Infinite loop error

This warning appears when a Group is being totaled in a Group of a lower level, reason for which an infinite error loop is being created.

There would be an infinite loop when, in the preceding example, the Assets Group (1) would be totaled in Group 10.

The program, after having calculated the Group 1, would total the amount in Group 10, which in turn would total the amount in Group 1, and then again in 10 without ending.

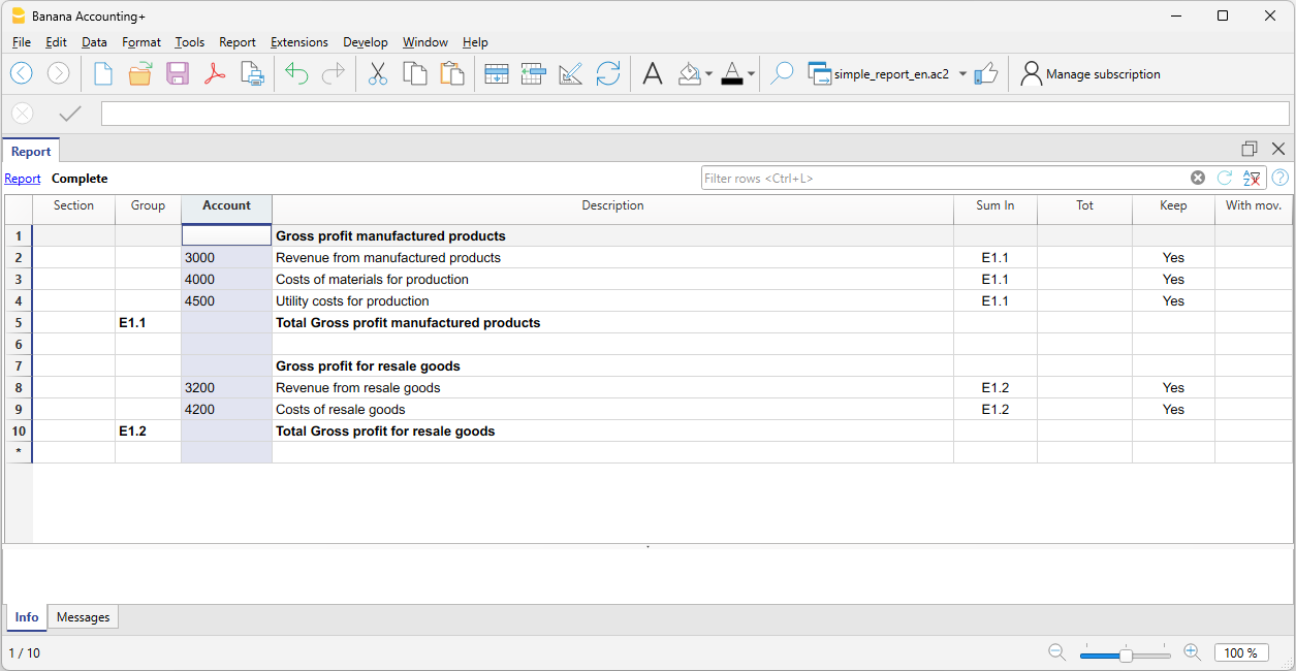

Profit & Loss Statement with Gross Profit

It is also possible to use a Profit & Loss Statement that starts with the total Business result and that subtracts the costs.

Hereunder the example of the Swiss PME Chart of Accounts is shown.

Related Documents

Sections

In the Section column, there must be an encoding that is used to determine the various settings of the printouts. The various items that make up the financial statements are divided into several sections; each section is as if it were in its own right.

This subdivision into sections allows you to choose whether to print the entire balance sheet and income statement, or choose which sections to print (eg only the balance sheet, or just a group, excluding the other components from printing).

Below we present a table with the coding to be used in the Accounts table, Section column.

| * | Title 1 | the asterisk separates the sections and indicates the main headers |

| ** | Title 2 | to be entered for the secondary headers |

| 1 | Assets | to be entered in the row of the Assets title |

| 2 | Liabilities | to be entered in the row of the Liabilities title |

| 3 | Expenses | to be entered in the row of the Expenses title |

| 4 | Revenue | to be entered in the row of the Revenue title |

| 01 | Client's Register | to be entered in the row of the Client's Register title |

| 02 | Supplier's Register | to be entered in the row of the Supplier's Register title |

| 03 | Cost Centers | to be entered in the row of the Cost Centers title |

| 04 | Profit Centers | to be entered in the row of the Profit Centers title |

| # | Notes | to be entered in the row of the Notes title |

| #X | Hidden data | to be entered in the row from whereon the data have to be hidden |

The type of encoding set in the Section column is used to determine the print settings for Enhanced Balance Sheet with Groups.

Each section is printed as if it were a separate table.

Title section

- *

The asterisk indicates a new section.- * Title 1 generates a level 1 folder.

- This section resets the level type to 1.

- It can contain level 2 sections or folders.

- It will be useful for grouping sections that need to be printed together such as the Balance Sheet, which contains both assets and liabilities.

- **

The double asterisk indicates a level 2 section.- ** Title 2 generates a level 2 folder

When you create a new title section, the numeric section is set to 1.

After a title section, the desired number section must therefore always be reset as well.

Numerical sections

The section number determines:

- How the amounts are printed; the amounts can be displayed as in the chart of accounts or reversed.

The credit amounts (in negative,) if they are inverted, are displayed in positive, while those in positive are displayed in negative. - Which columns are used to display the amounts; either the Balance column or the Period Movement column is used.

- The Balance column indicates the account balance at a certain point in time (balance as of June 30th).

- The Total Period Movement column indicates the amount of the movement in the indicated period; it is used for the income statement and indicates expenses or income for a certain period.

The explanations of the different sections are as follows:

- 1 Assets (amounts as in the chart of accounts, balance column).

- 2 Liabilities (inverted amounts, balance column).

- 3 Costs (amounts as in the chart of accounts, total movement column).

- 4 Revenues (inverted amounts, total movement column).

This section can also be used alone and include both costs and revenues (Income statement). In this case, revenues are shown in positive and costs in negative.

These sections must be unique. There can be only one section, 1 Assets or 2 Liabilities. Similar sections can be used for other sections, ledgers or cost centers.

Derived numerical sections

These are sections that behave like the main sections:

- 01 As Assets (amounts as in the chart of accounts, balance column)

Is used for the customer register. - 02 As Liabilities (inverted amounts, balance column)

Is used for the suppliers register. - 03 As Expenses (amounts as in the chart of accounts, total movement column)

Is used for cost centers. - 04 As Revenue (inverted amounts, total movement column)

Is used for profit centers.

Other Sections

There are other sections types:

- # Used to indicate the notes section (print description only)

To be used for budget annexes. - #X Hidden section. This section is not taken up in the selection of the sections nor in the printout. It is used to indicate a part that you do not want to print.

Disposition and width of columns in print

The disposition and the width of the columns are determined automatically by the program:

- Sections 1, 2, 01, 02 are printed with the balances on the specified date.

- Sections 3, 4, 03, 04 are printed with the movements for the period.

Sections of the Balance sheet report

In order to divide the Financial Statements into the various sections, the code indicated in the Section column must be entered:

- Insert a * on the same row as the Balance sheet title.

- Enter 1 on the same line as the Assets title.

- Enter 2 on the same line as the Liabilities title.

Sections of the Profit & Loss statement

- Enter a * on the same line as the Profit & Loss title.

- Enter 4 on the same line as the Revenue title.

- Enter 3 on the same line as the Expenses title.

Sections of the Profit & Loss statement in a graduated format

In the case of a graduated income statement, the groups of expenses and revenues alternate and consequently there is no clear distinction between the section of costs and revenues, therefore enter only:

- A * on the same row as the Profit & Loss Statement title

- 4 on the blank line below the income statement.

Sections in the customers / suppliers register

The display of the amounts is the same as for assets and liabilities. This coding also applies if customers and suppliers are set up as cost centers.

- Insert a * on the same row as the Customer / Debtors Register title or on a blank row (as in the example).

- Enter 01 on the same row as the Customers Register title

- Enter 02 on the same row as the Suppliers Register title

If there are cost and profit centers, you must enter:

- a * in the same row as the Cost and Profit Centers title or on a blank line

- 03 on the same row as the Cost Centers title or on a blank line (preceding the cost centers).

- 04 on the same row as the Profit Centers title or on a blank line (preceding the Profit Centers).

The cost center amounts will be shown in positive as the costs; profit centers will be displayed in negative as revenue.

Related document:

Enhanced Balance Sheet with groups

Transfer to a new Chart of Accounts

Hereunder we explain how to proceed when:

- passing to a chart of accounts with a different numbering,

- retrieve and convert the data of an existing accounting, including the transactions into the new Chart of Accounts.

Converting to the new year

There are two possibilities if you wish to start a new year with a new chart of accounts,

- Convert the previous year (2022) and then create the new year (2023).

There will be two files for 2022 (the one containing the Accounts column with the old account numbers and the Accounts_1 column with the new account numbers) and the file for 2023 with only the new chart of accounts.

This approach is ideal for having the two-year charts of accounts aligned.

This way you can also continue to make changes in the year 2022 and then resume the initial balances in the year 2023. - Create the new year (2023) and then convert the year 2023 file with the balances carried forward.

The 2022 year file will remain the same. For 2023 there will be an intermediate file, with the old chart of accounts, but the opening balances carried forward.

The conversion of the year 2023 file can be performed immediately or even after transactions have been entered.