Extra accounting features

All the functions you need

The program includes a set of features to manage your business efficiently and professionally. Our users are thrilled to save time on handling accounting tasks that would otherwise take up much of their time. Additionally, you will save money by reducing the need for a financial consultant's intervention and associated costs.

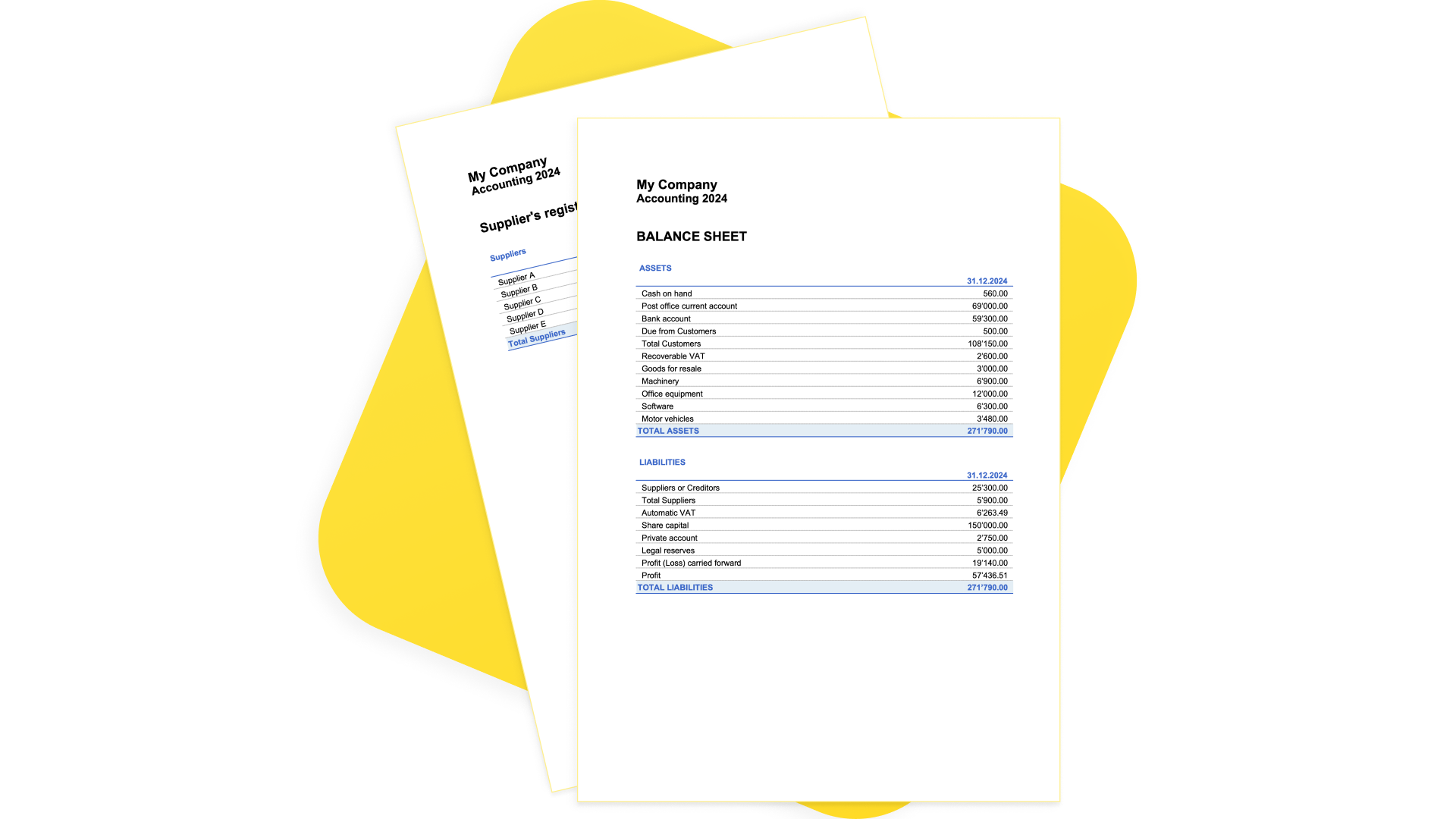

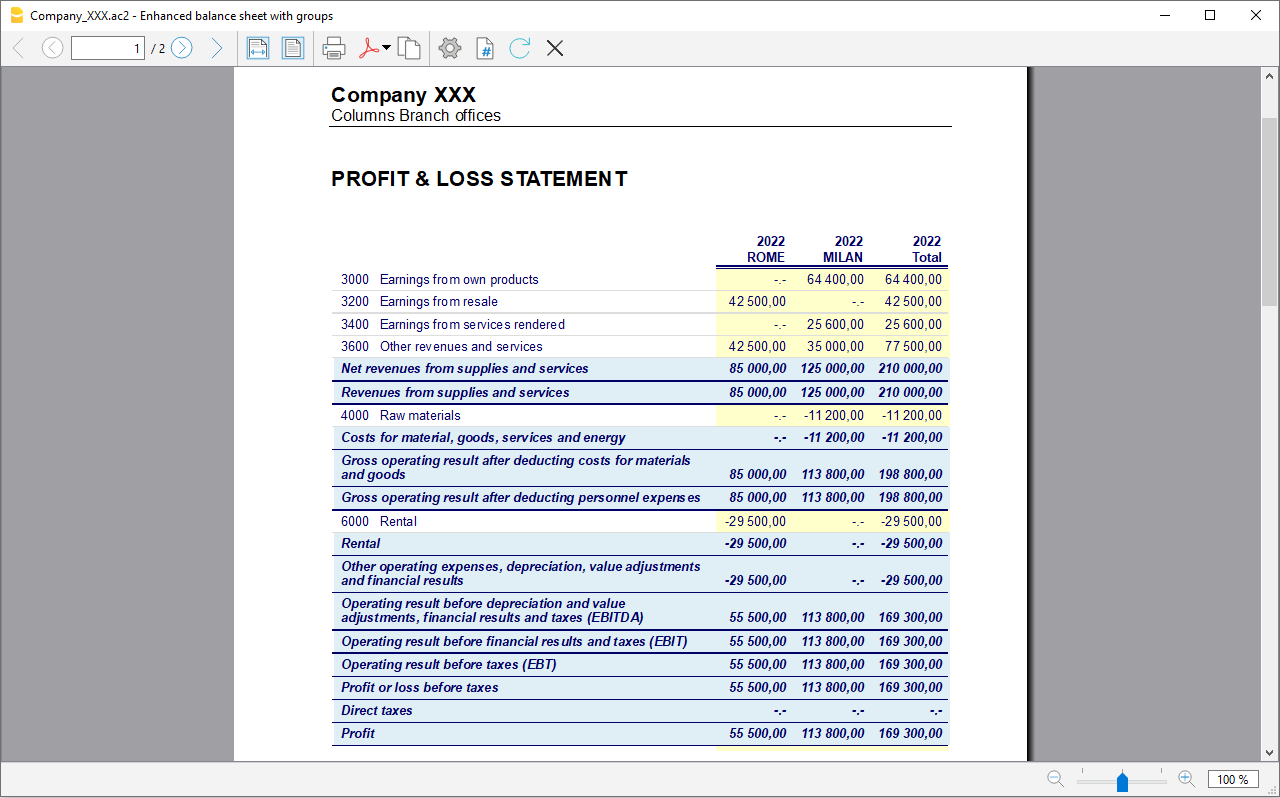

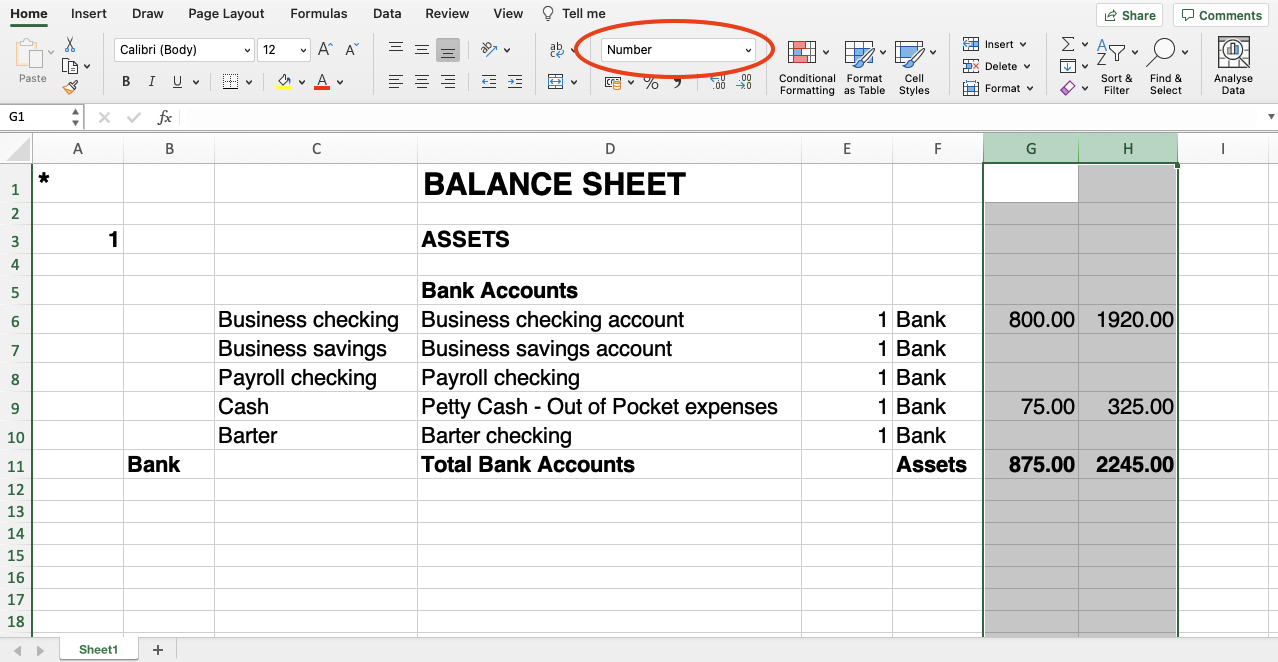

Financial reports at a glance

Quickly print all the reports you need and at any time:

- Chart of accounts

- Balance sheet and Income statement

- Transaction journal

- Budget and much more!

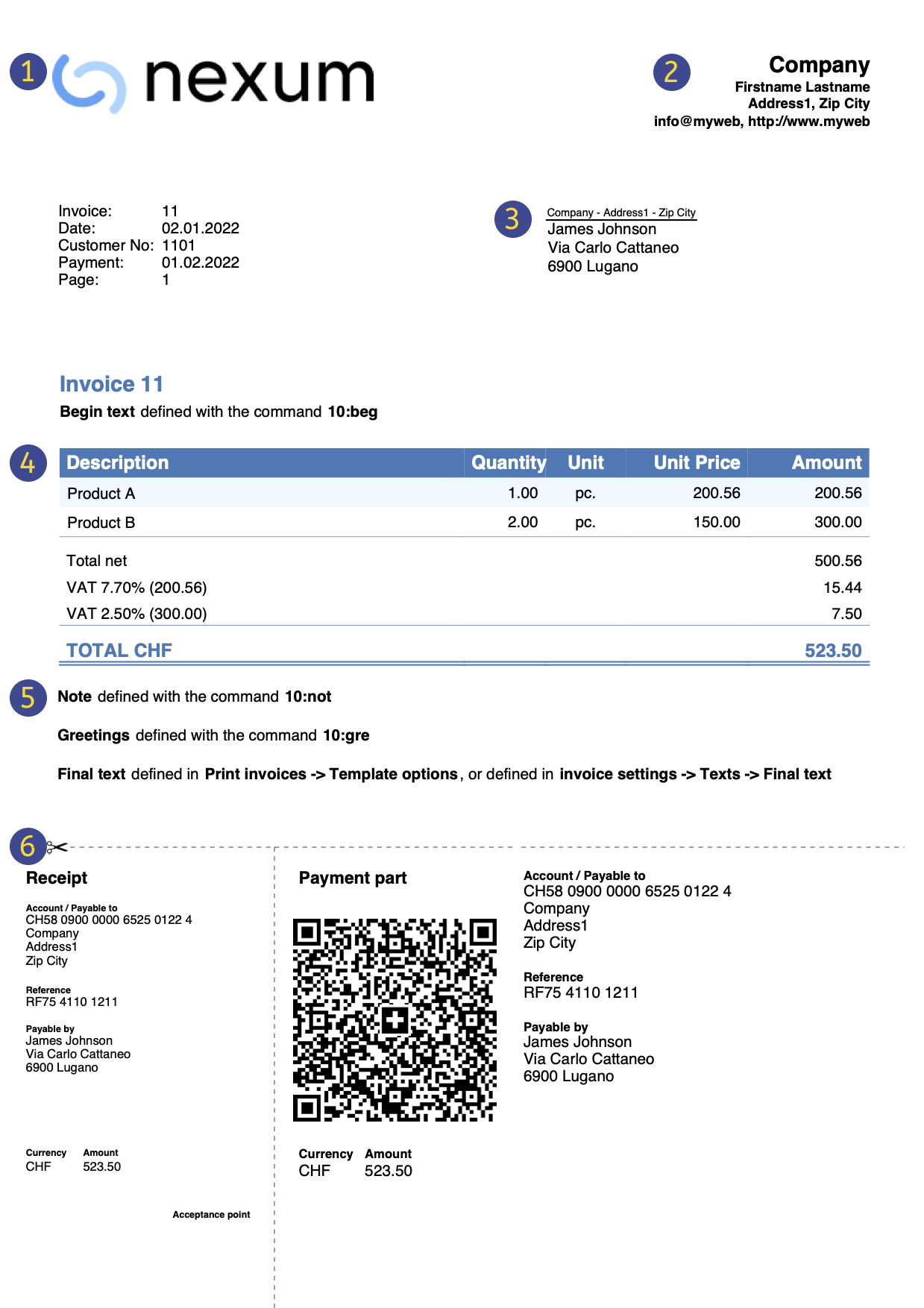

Invoices with QR codes

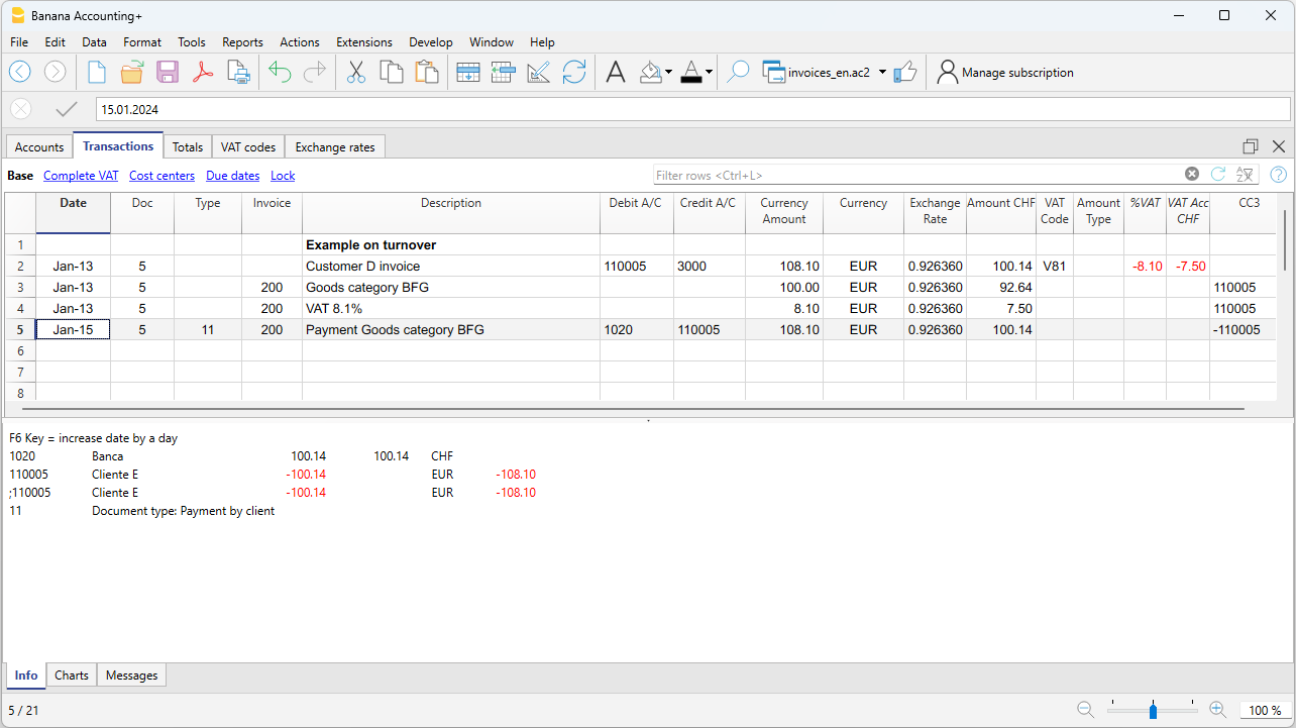

You can enter invoices as simple records by indicating the invoice number and the customer's account. If you have multiple products, you can also use columns for Quantity, Unit, and Unit Price.

With a single command, your records will transform into professional invoices, ready to be printed or sent via email to your customers.

Customer and supplier management

Thanks to the ready-made templates with the customer and supplier ledger, you can manage everything optimally: simply enter the customer or supplier account in the entry.

Get the full list of suppliers and customers and keep track of payments and receipts.

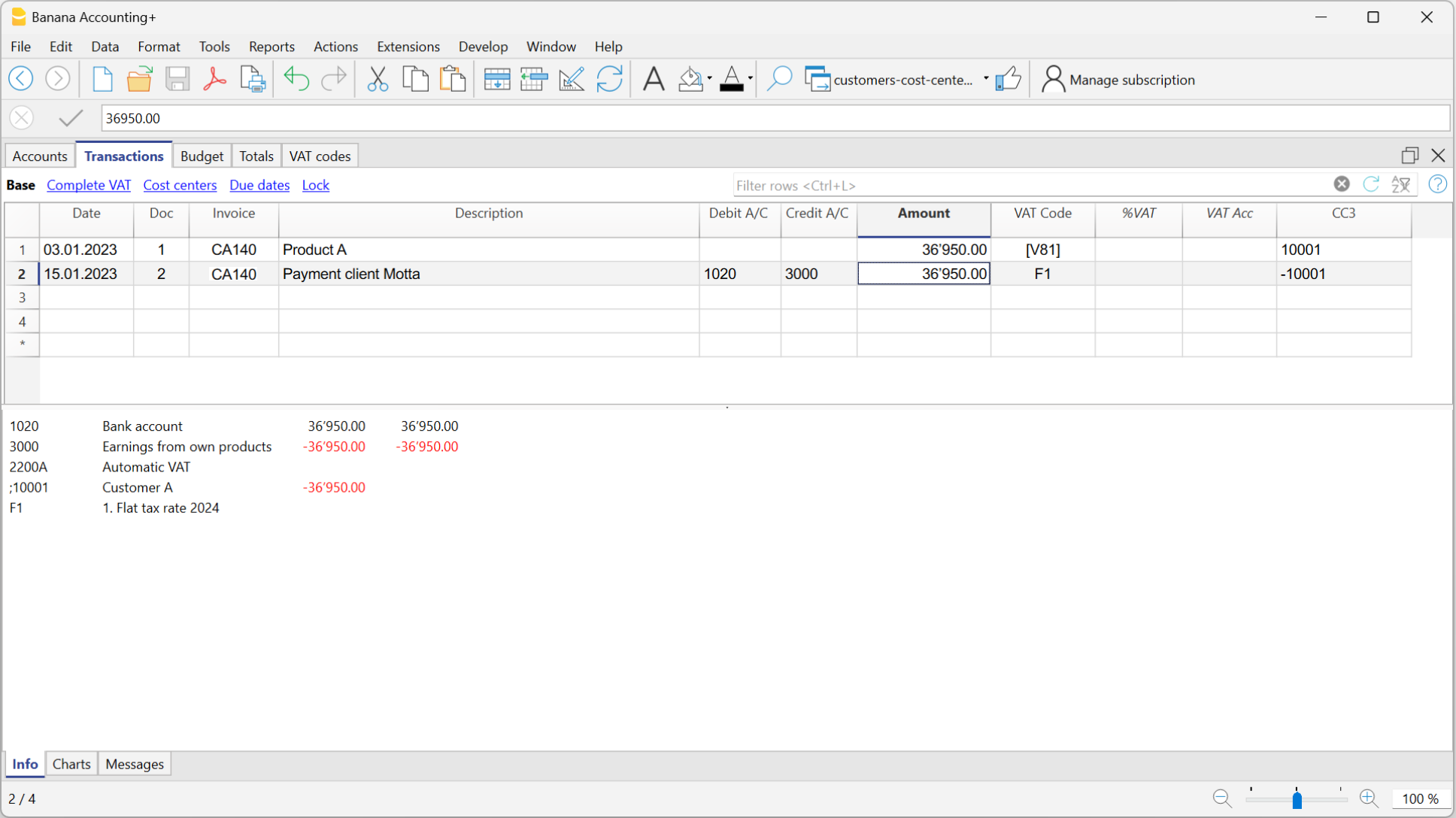

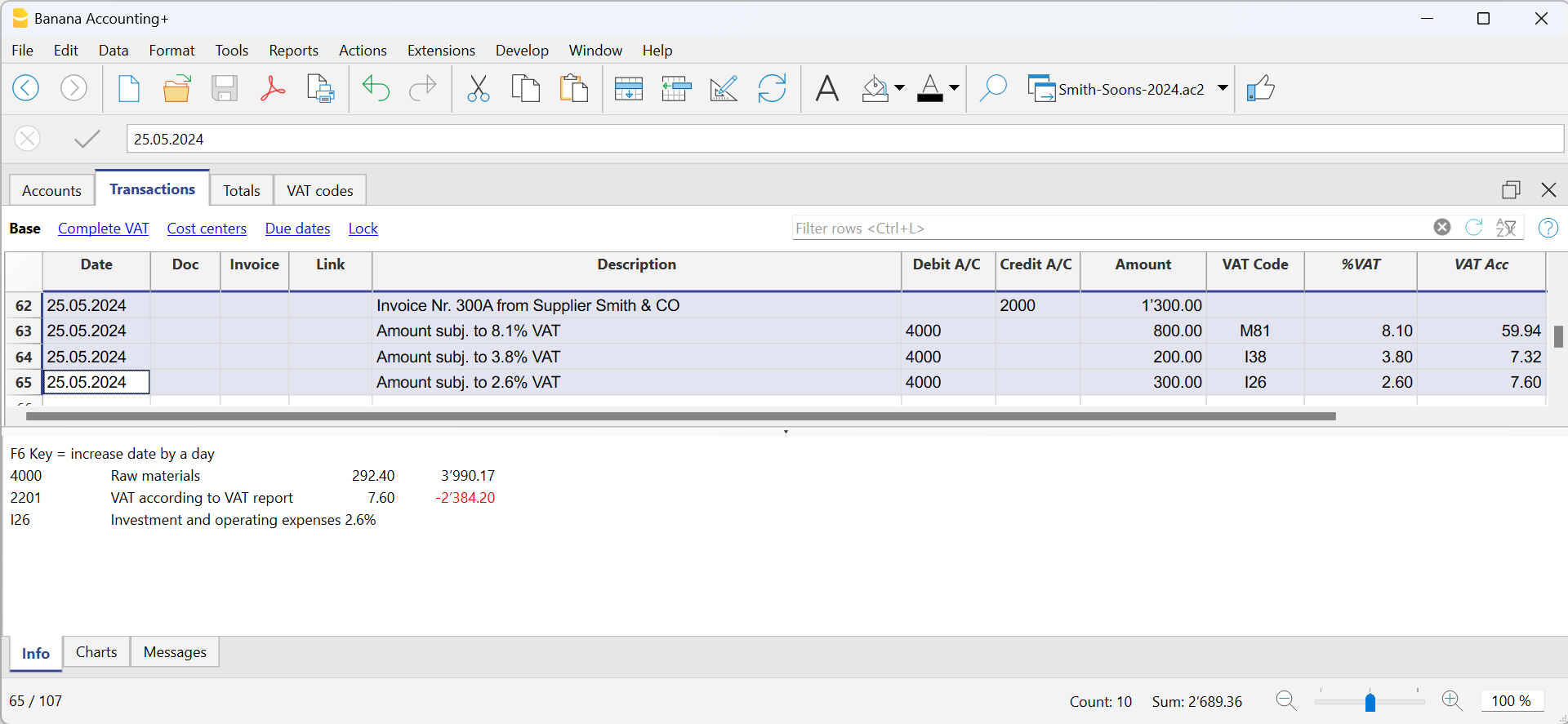

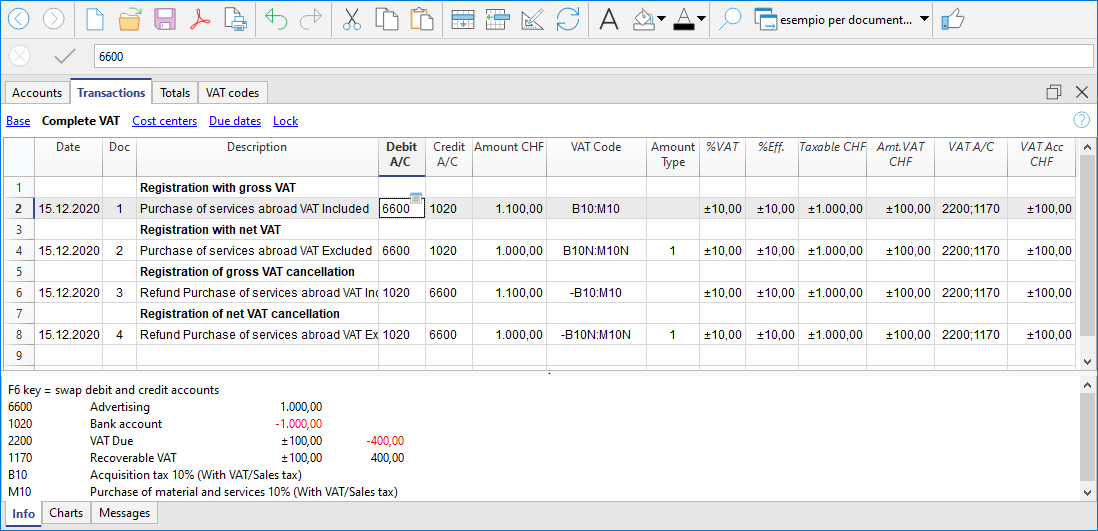

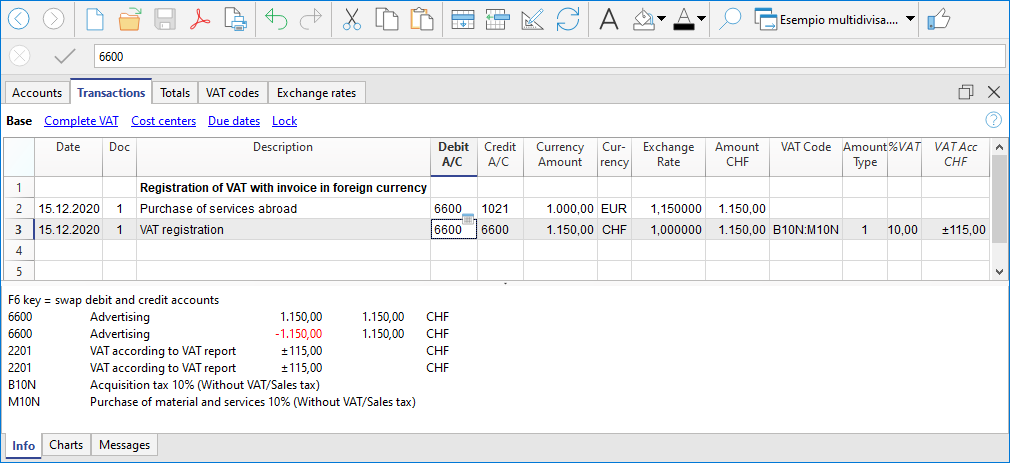

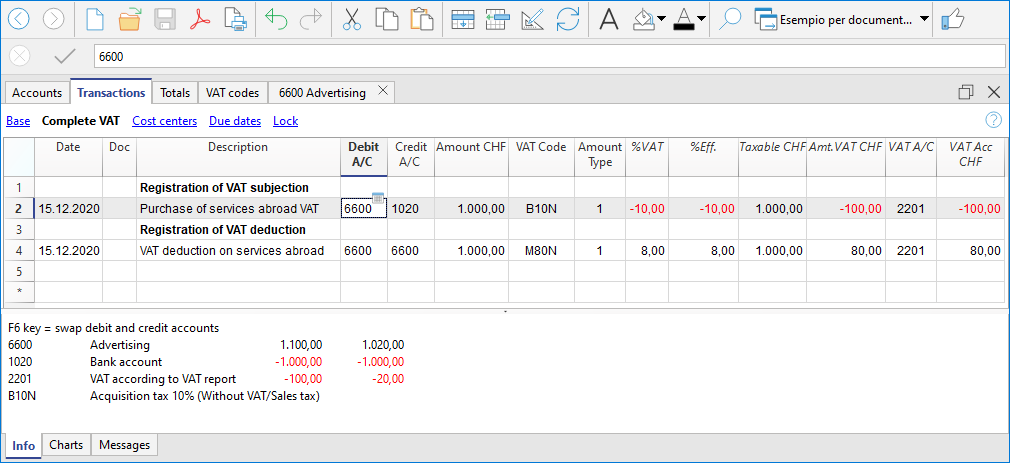

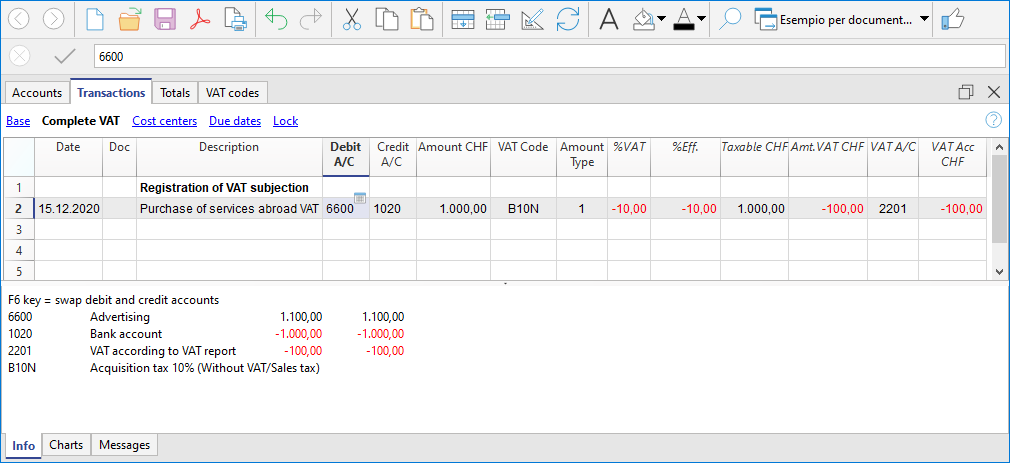

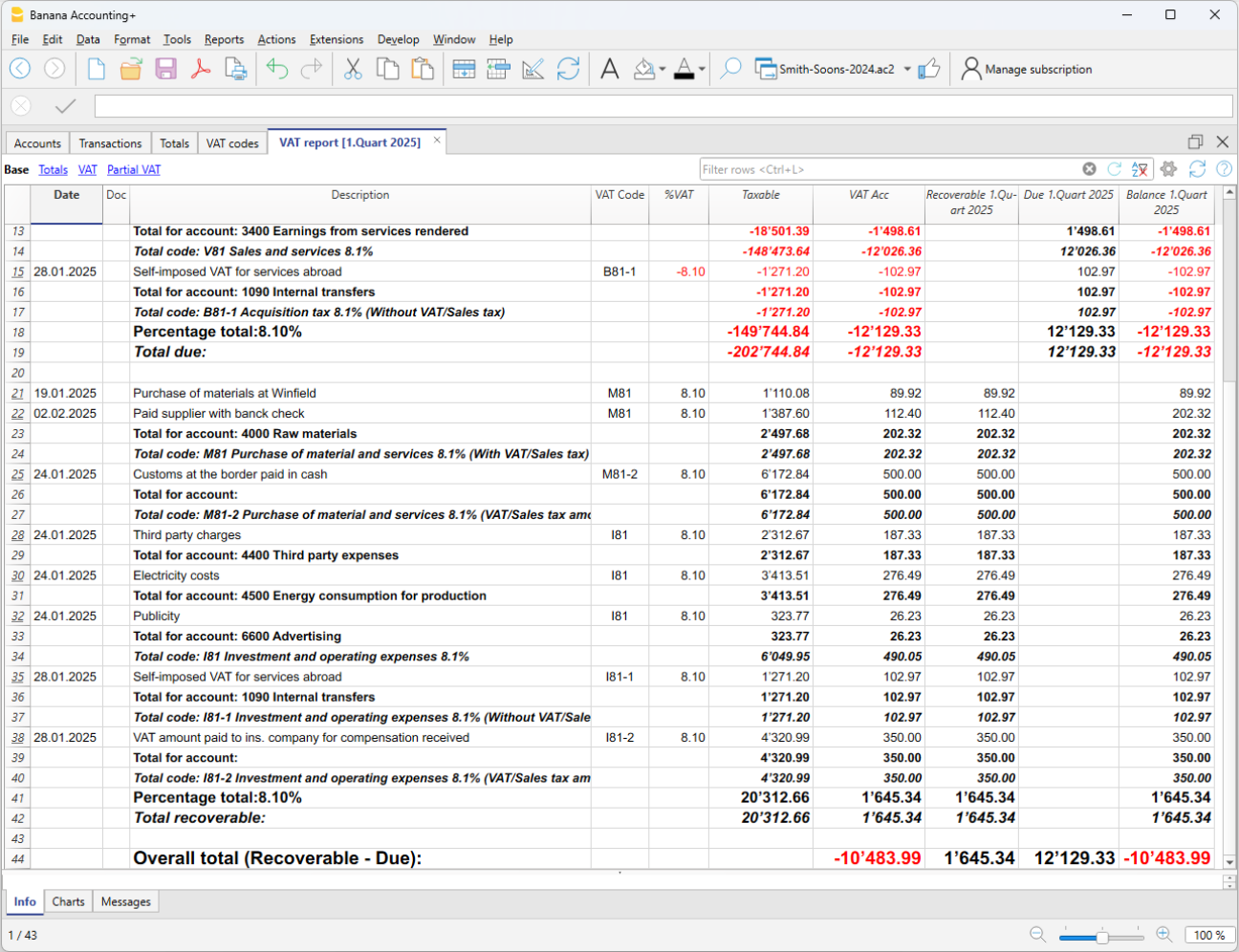

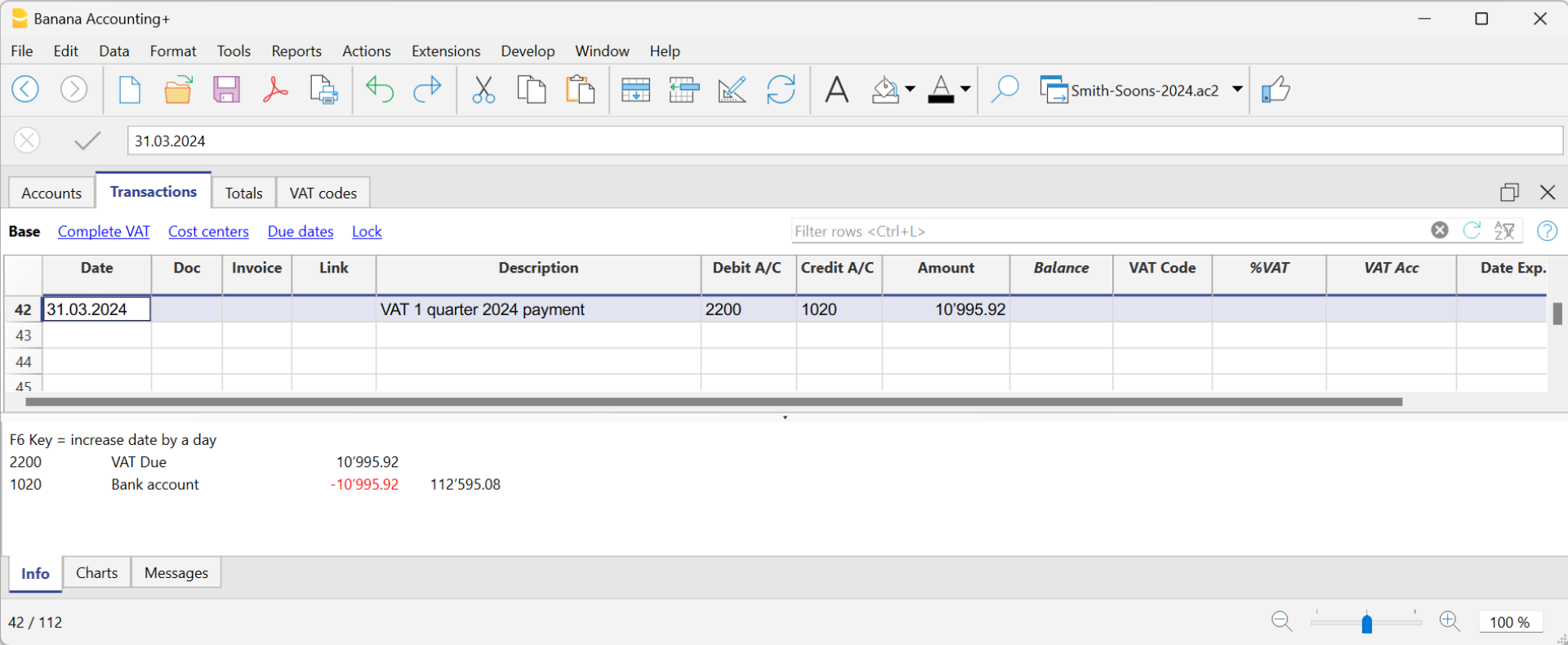

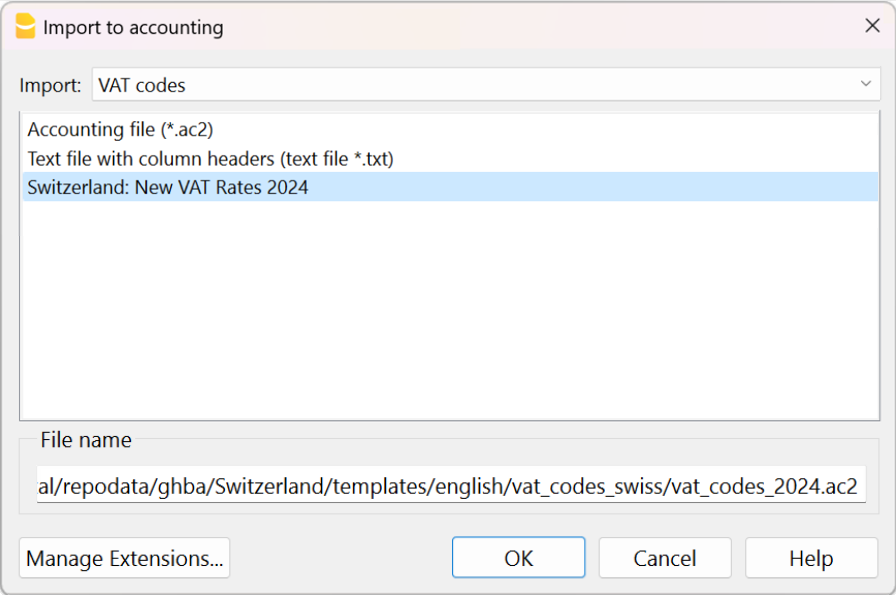

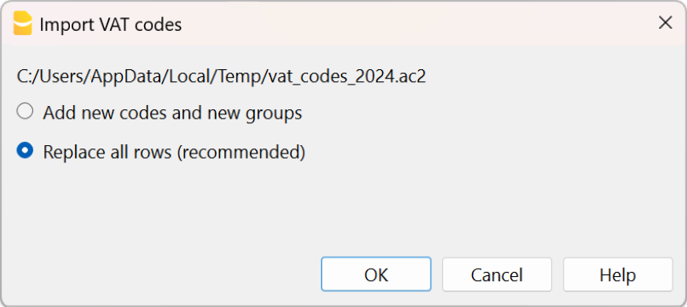

VAT management

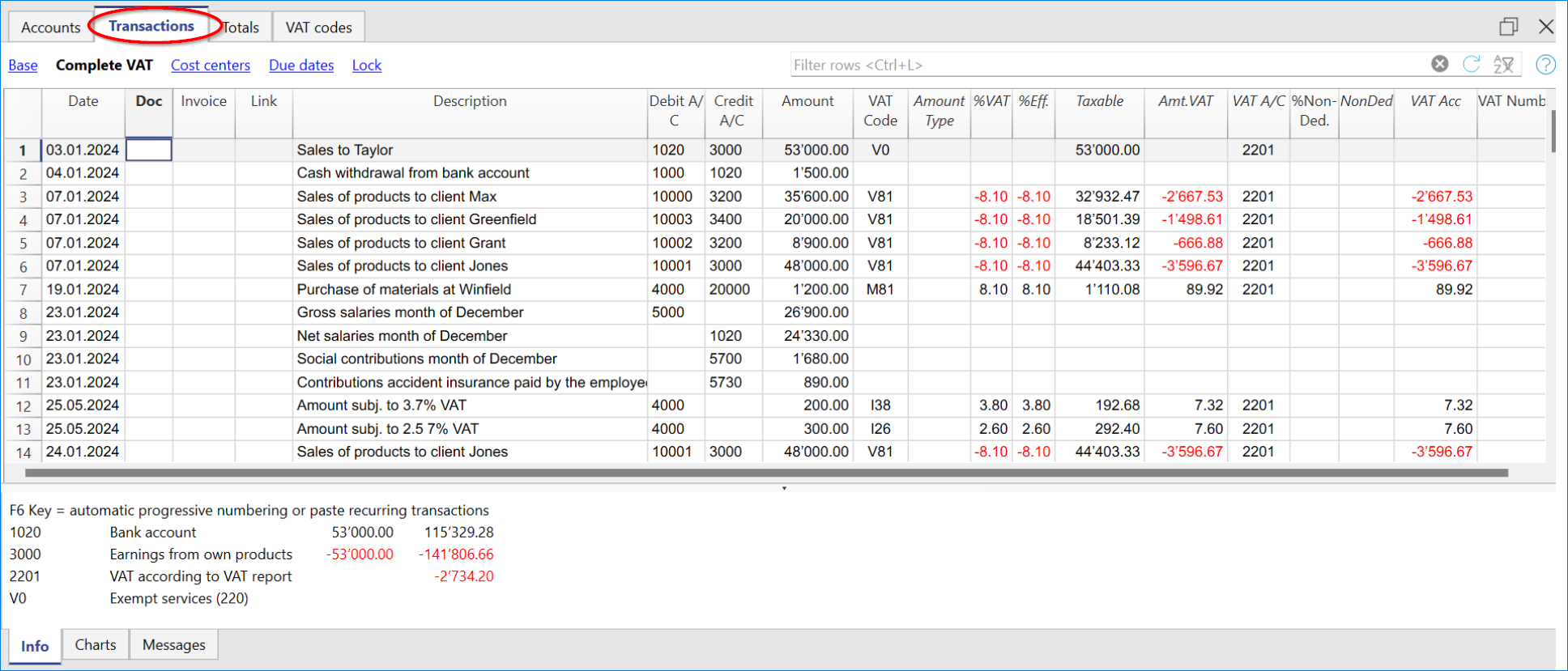

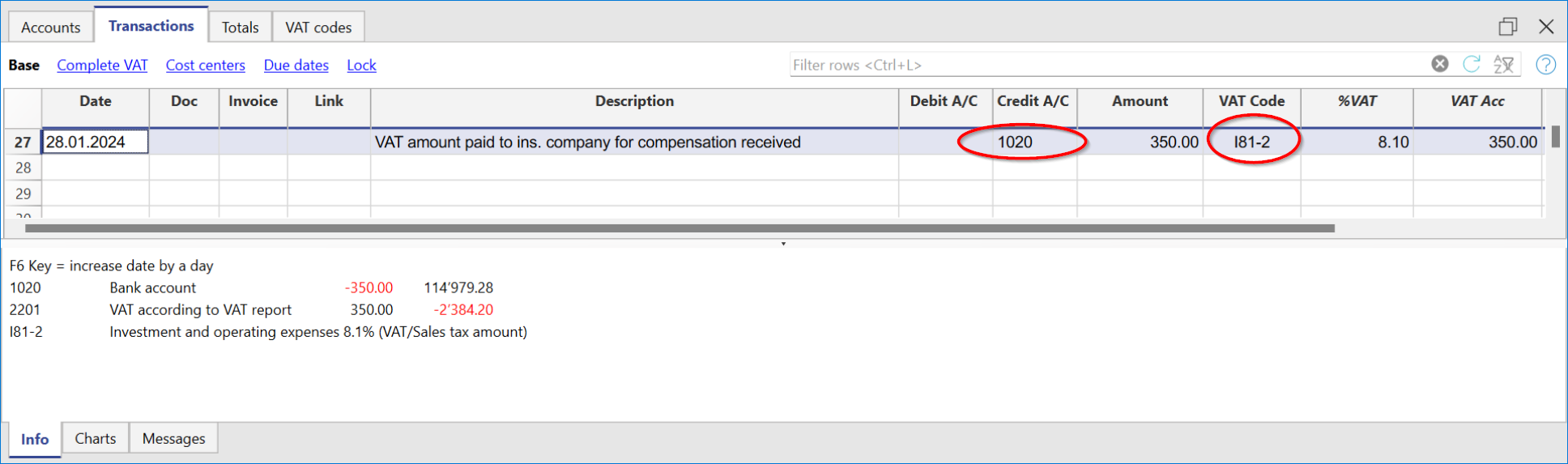

Great simplicity: indicate the VAT rate code in the transactions and the programme takes care of the rest!

Get the Swiss VAT form, detailed summaries by period, by VAT code, account and percentage in just a few clicks, either by totals or with all transactions.

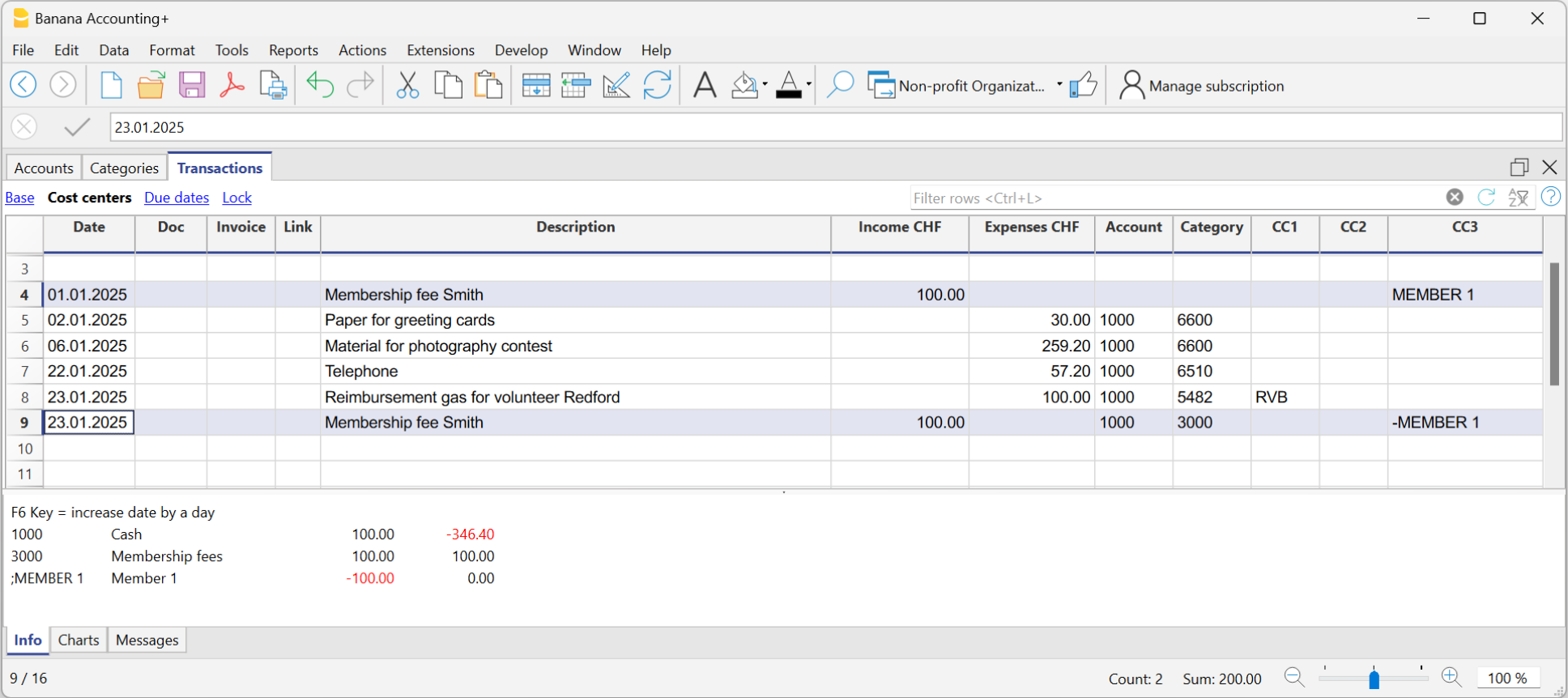

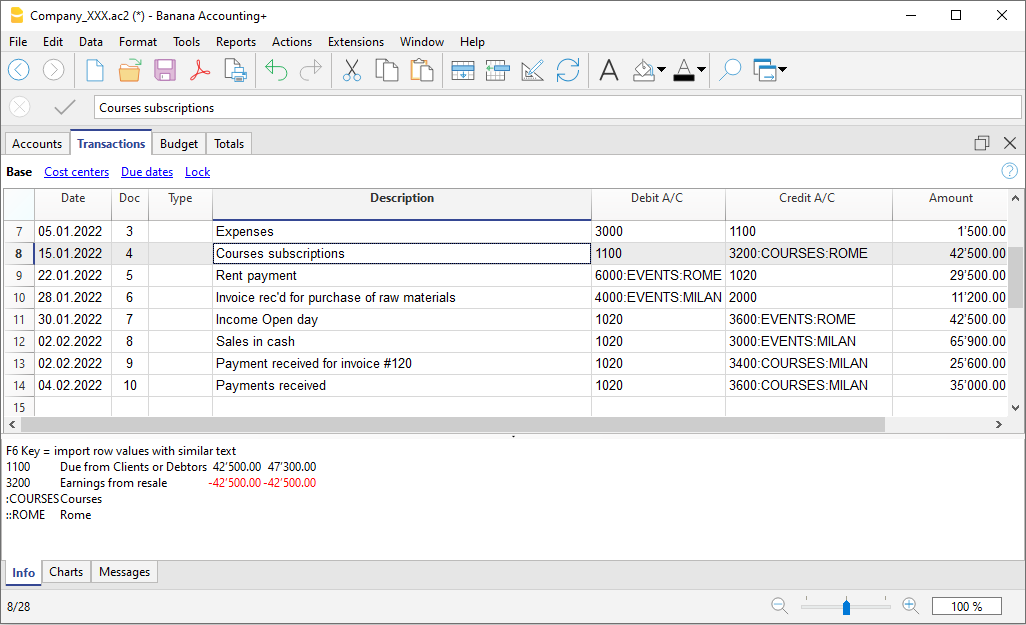

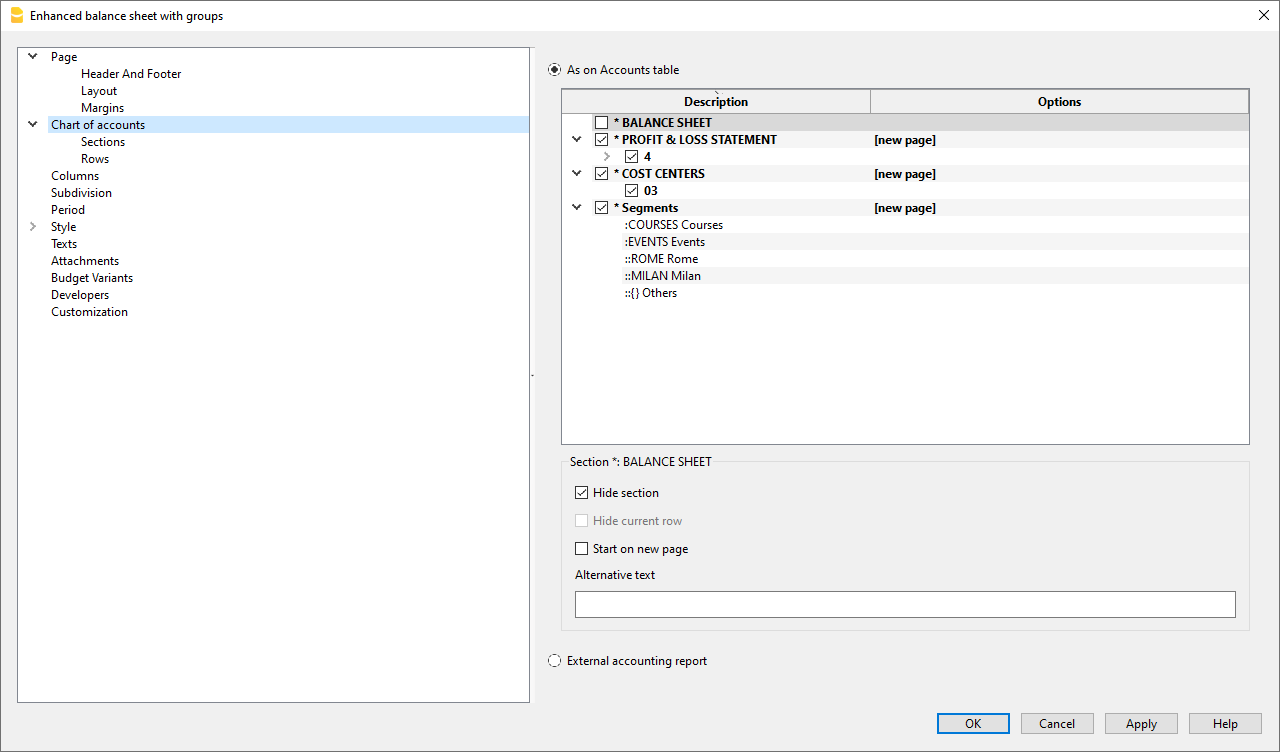

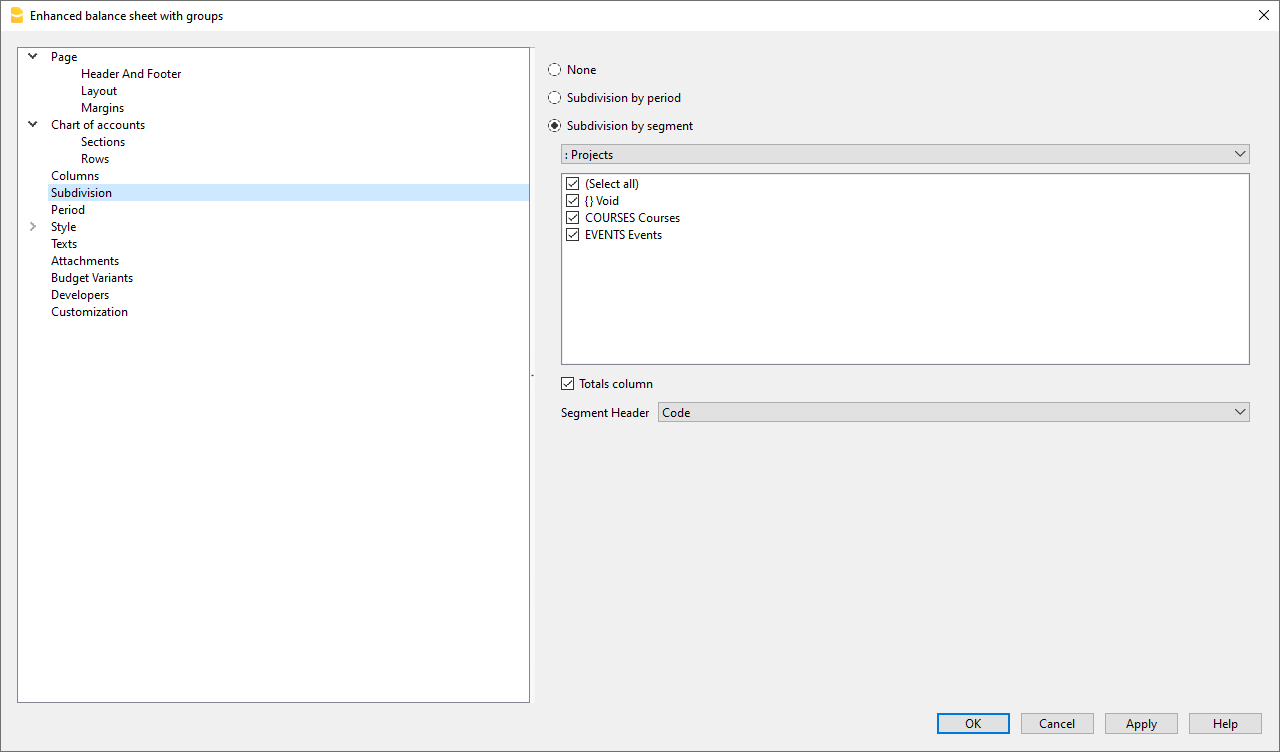

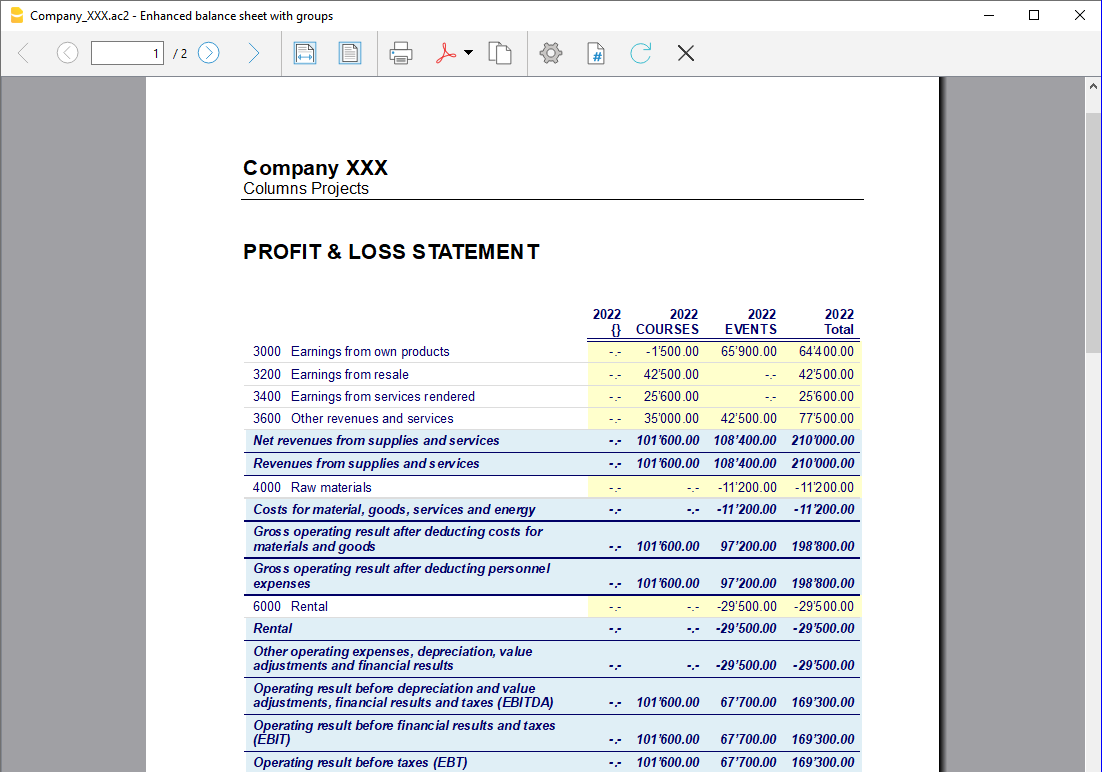

Cost centres and Segments

Highlight particular areas of your business easily and efficiently with a higher level of detail!

Cost centres and segments in Banana Accounting Plus offer the possibility to see details of projects, events, construction sites, members and other specific activities, or to highlight costs and revenues by unit, department or branch.

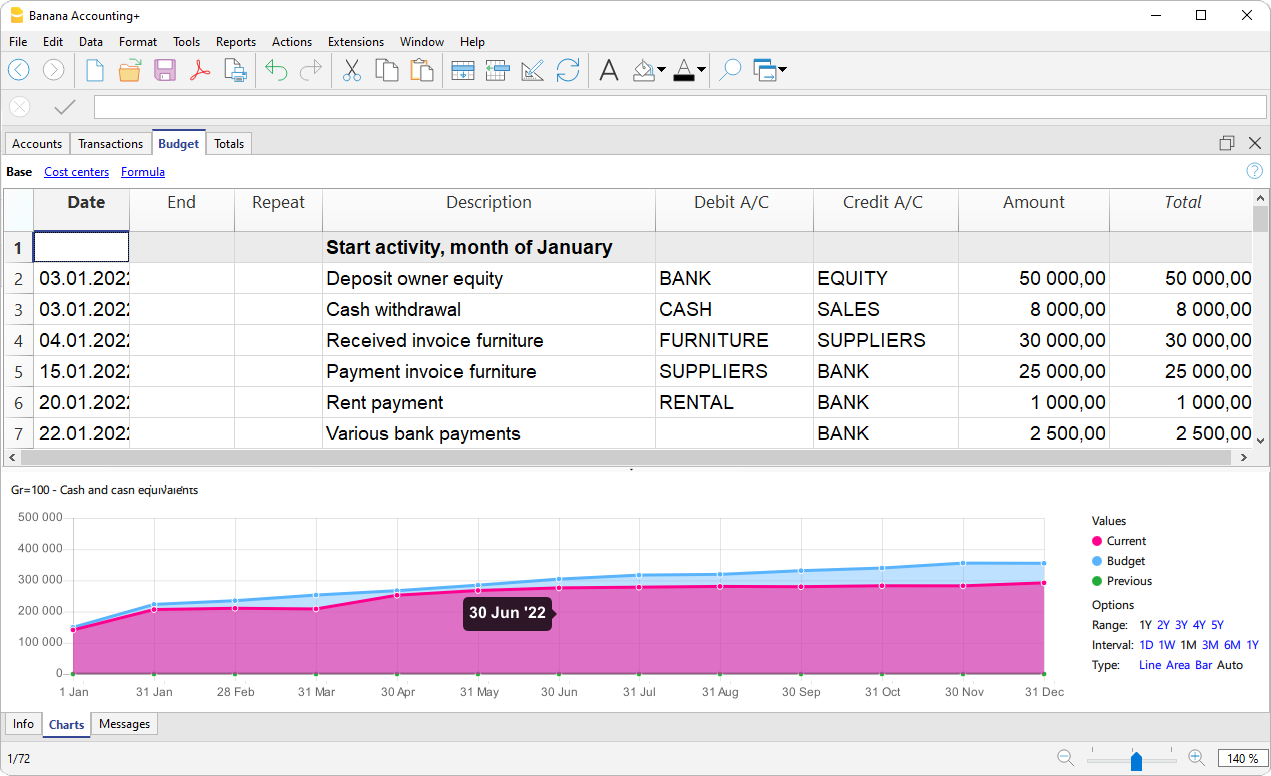

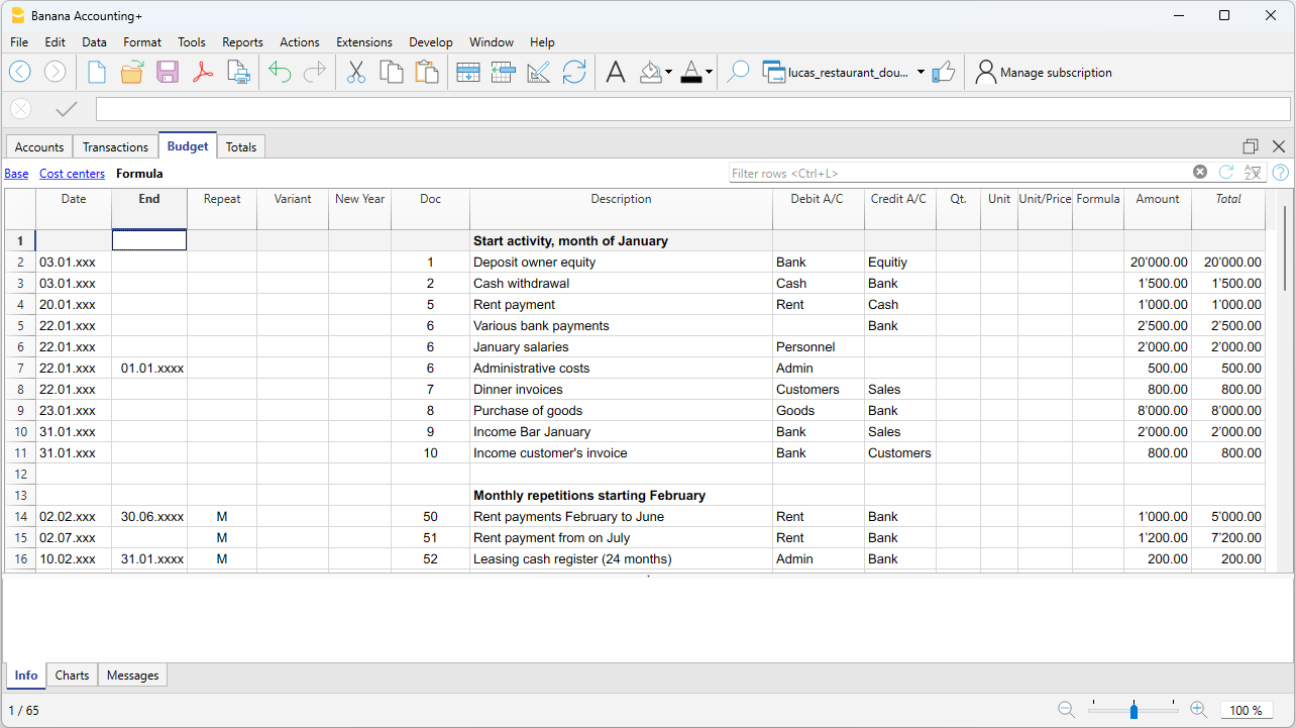

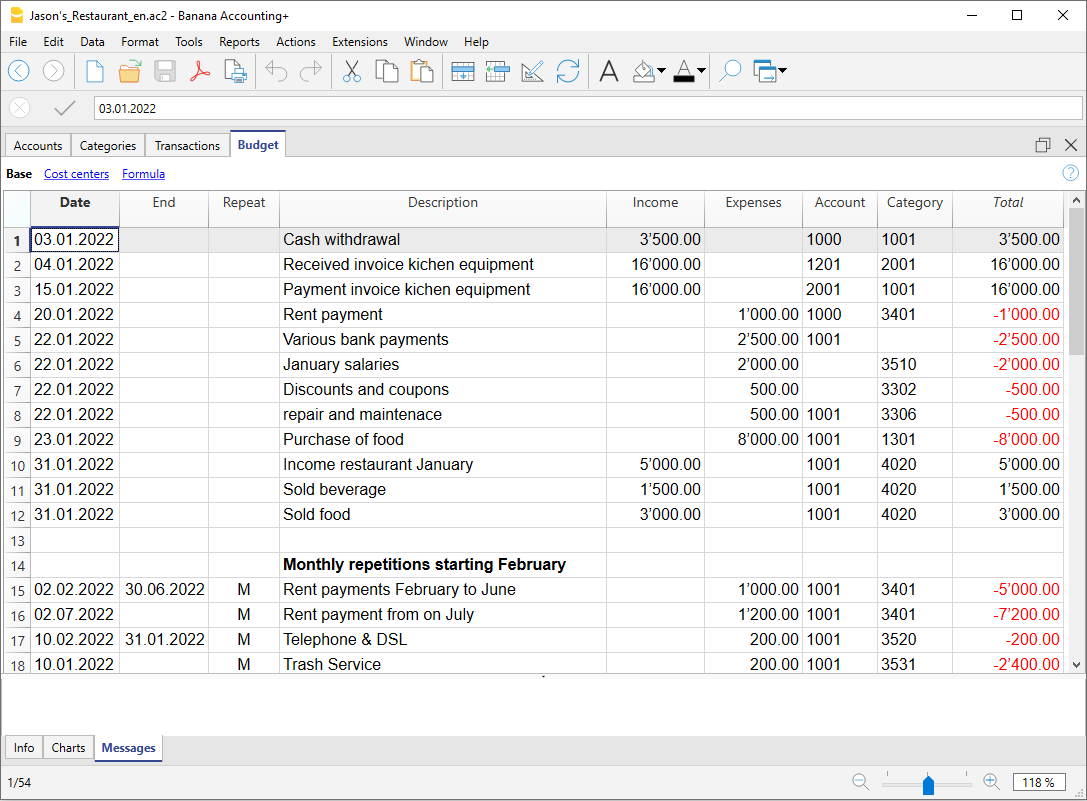

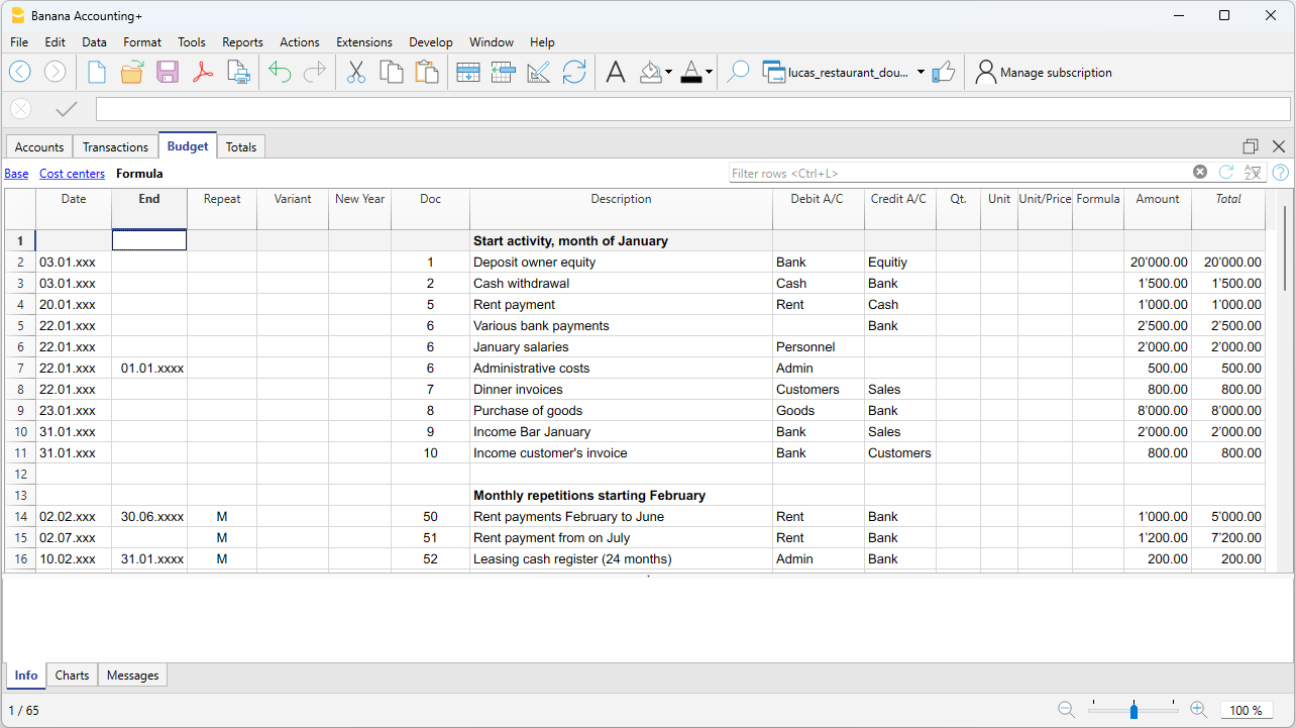

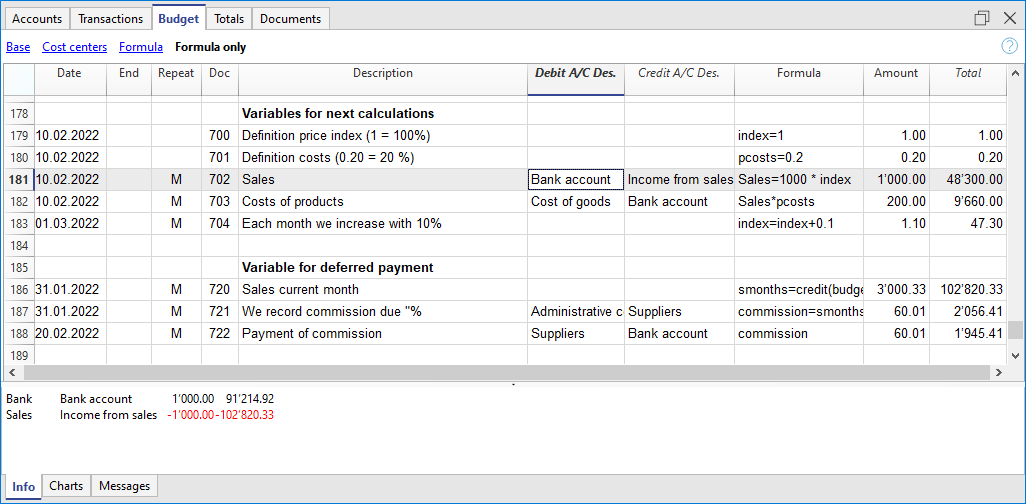

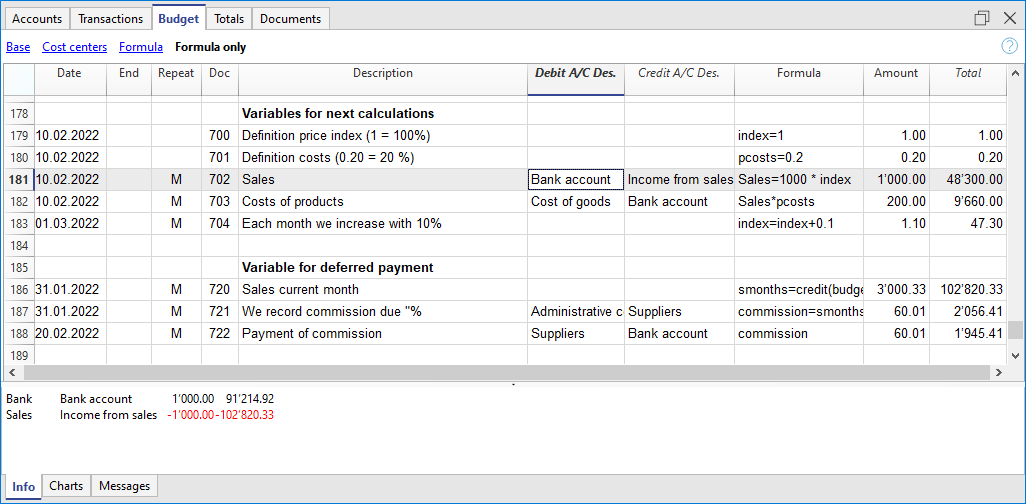

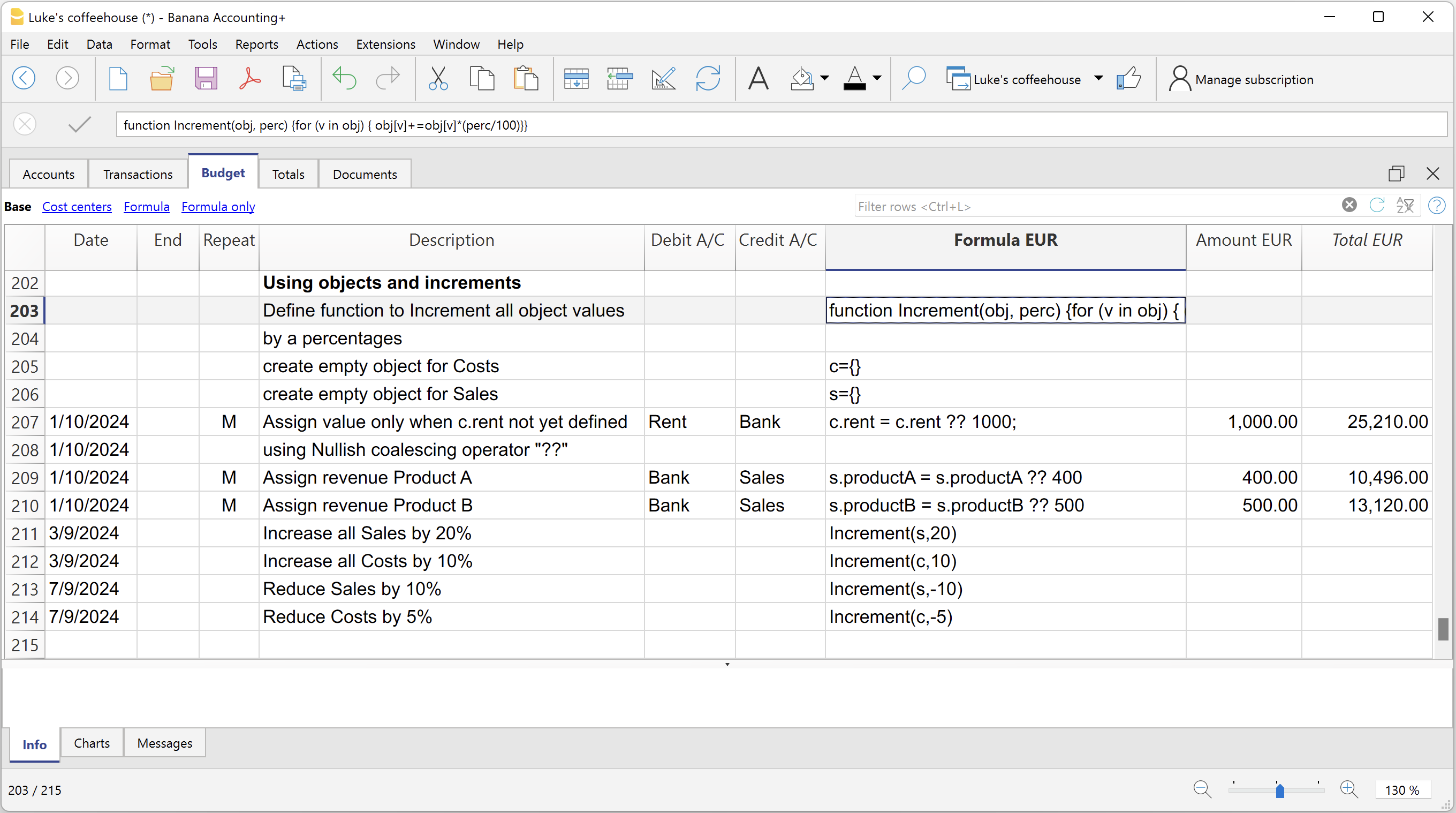

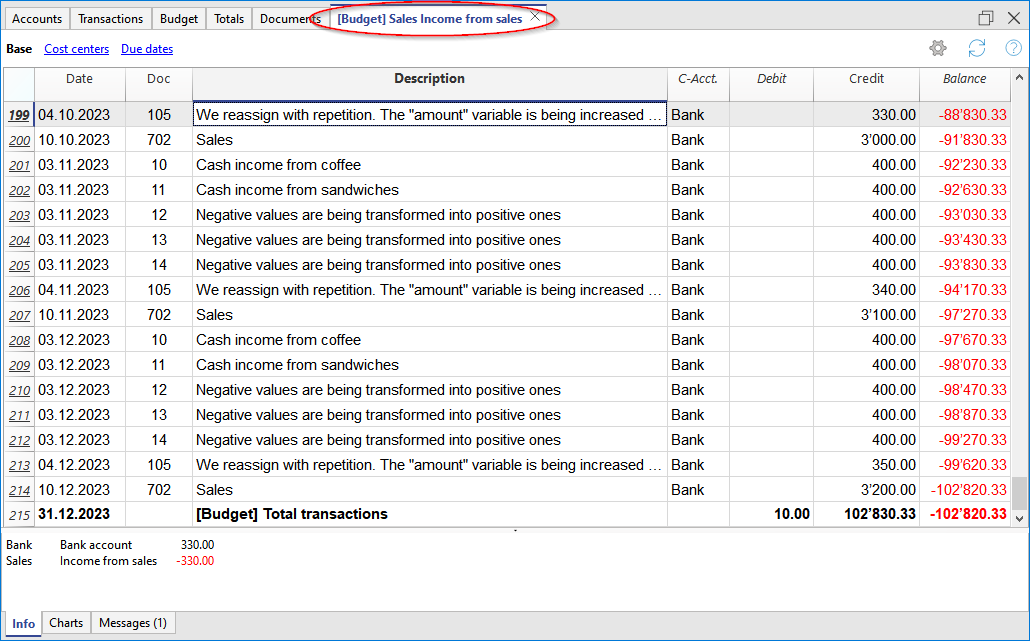

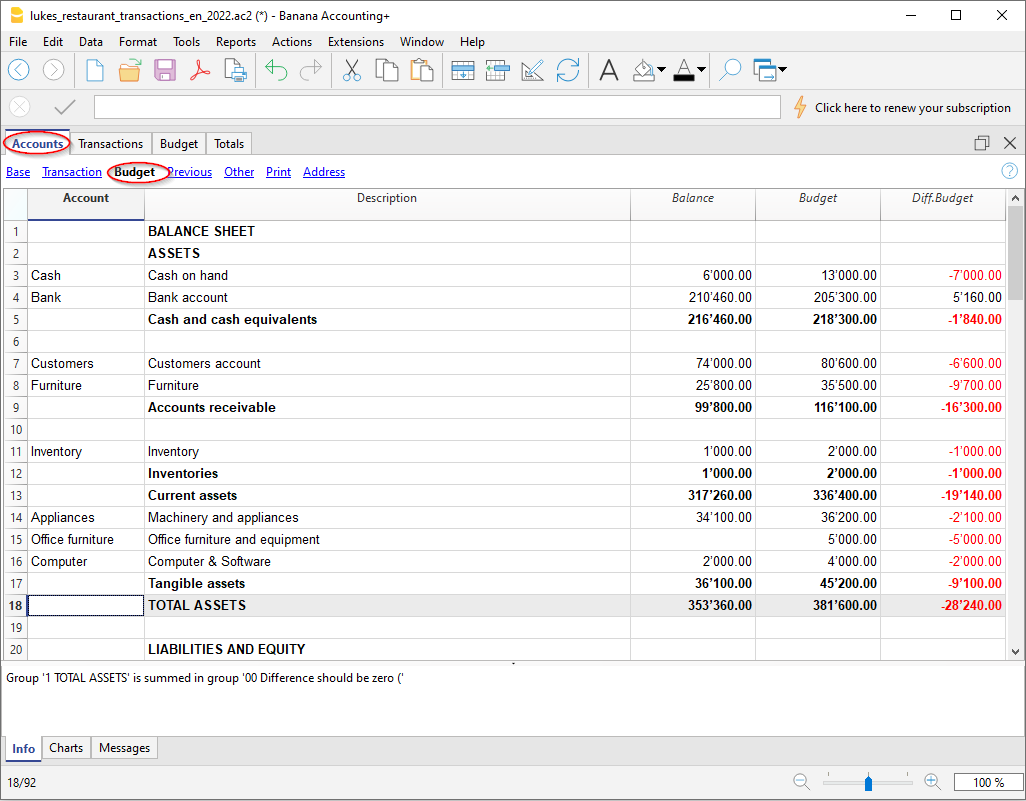

Budget and Cash plan

Easily create your budget for effective cost control and an eye on the future!

In the Budget table enter forecast entries with a future date and indicate their repetition. The programme projects your forecasts by month, quarter, half-year, year and over several years.

A great tool for anticipating times and taking timely action to achieve your goals.

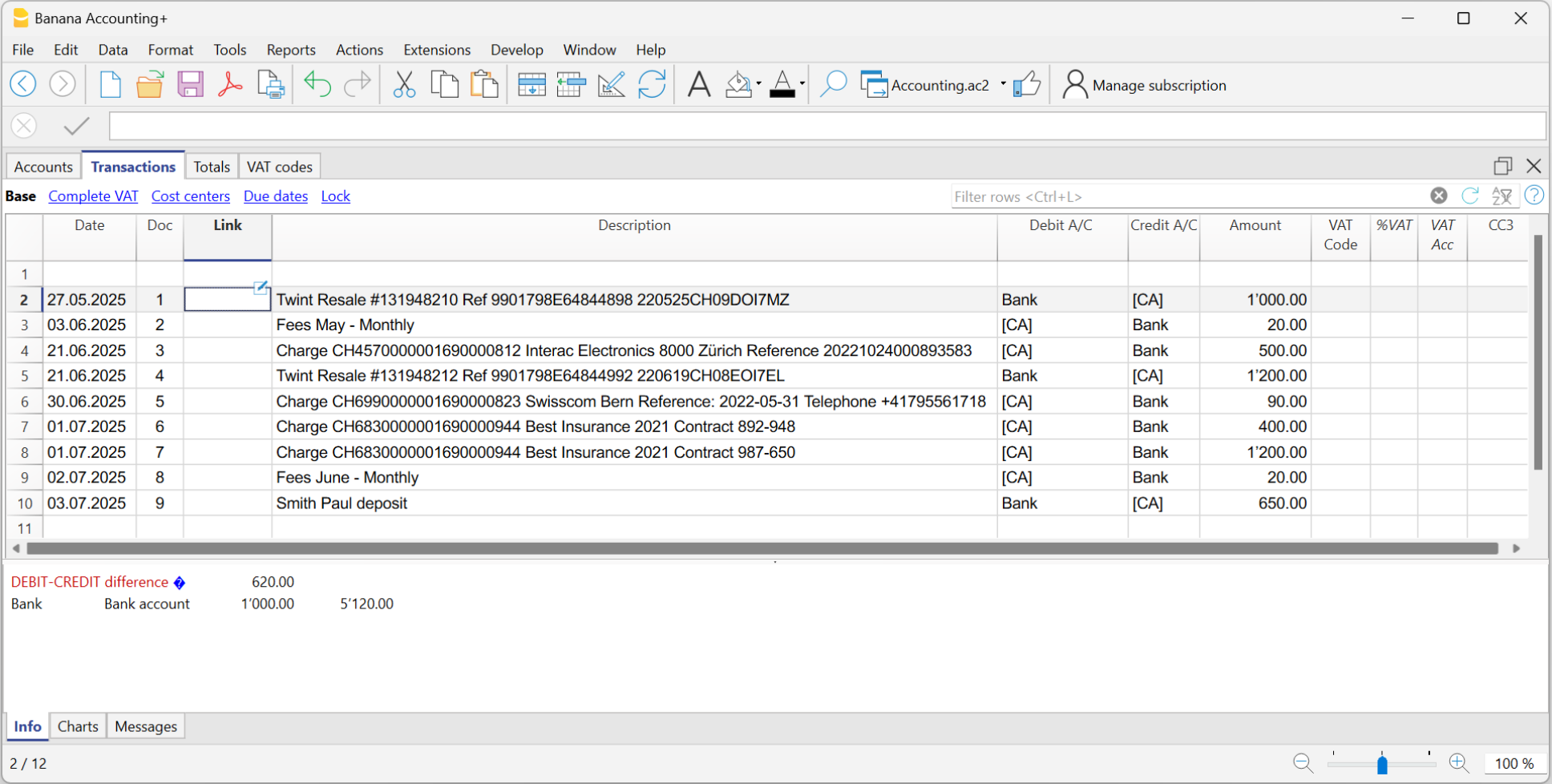

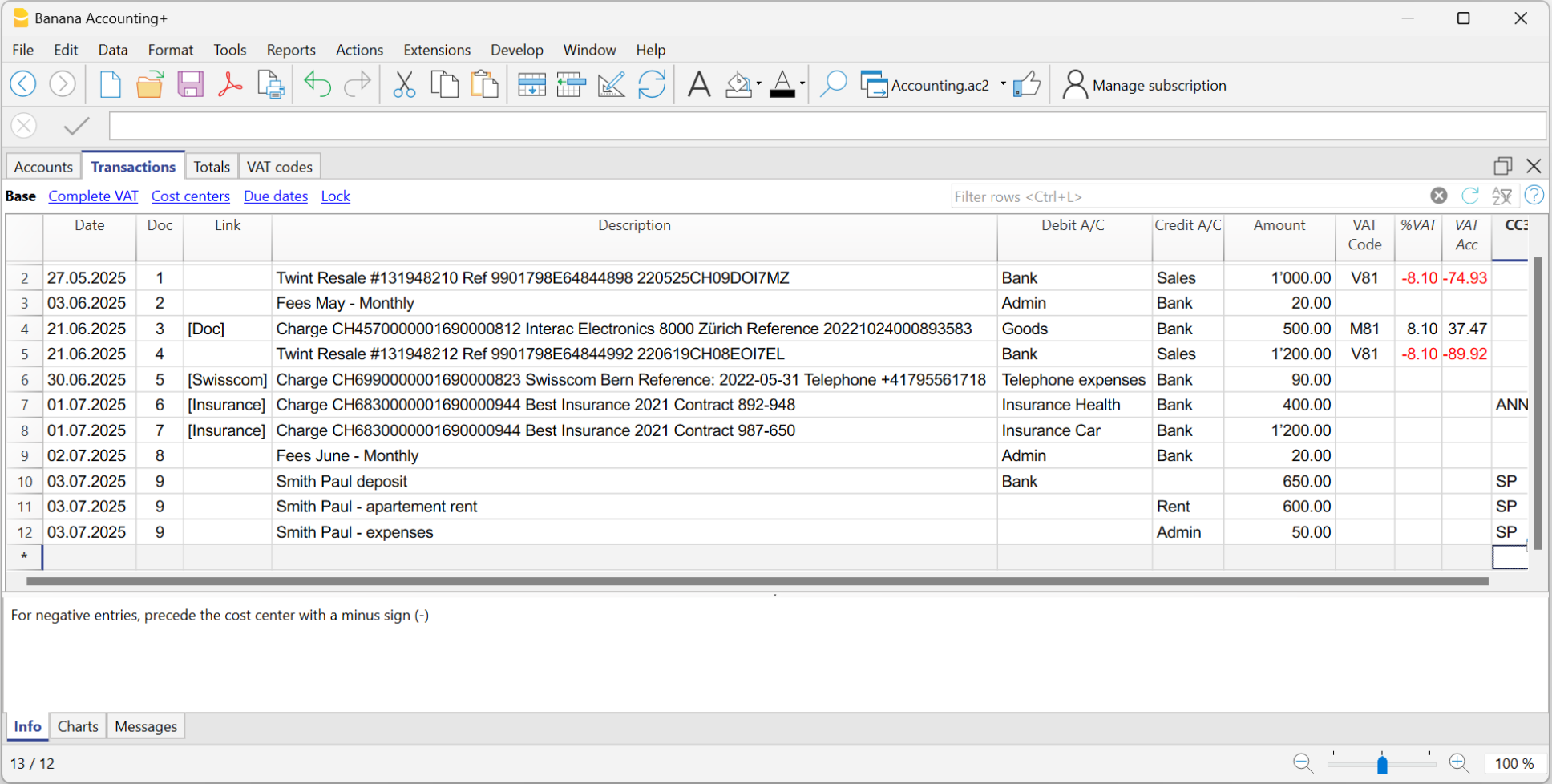

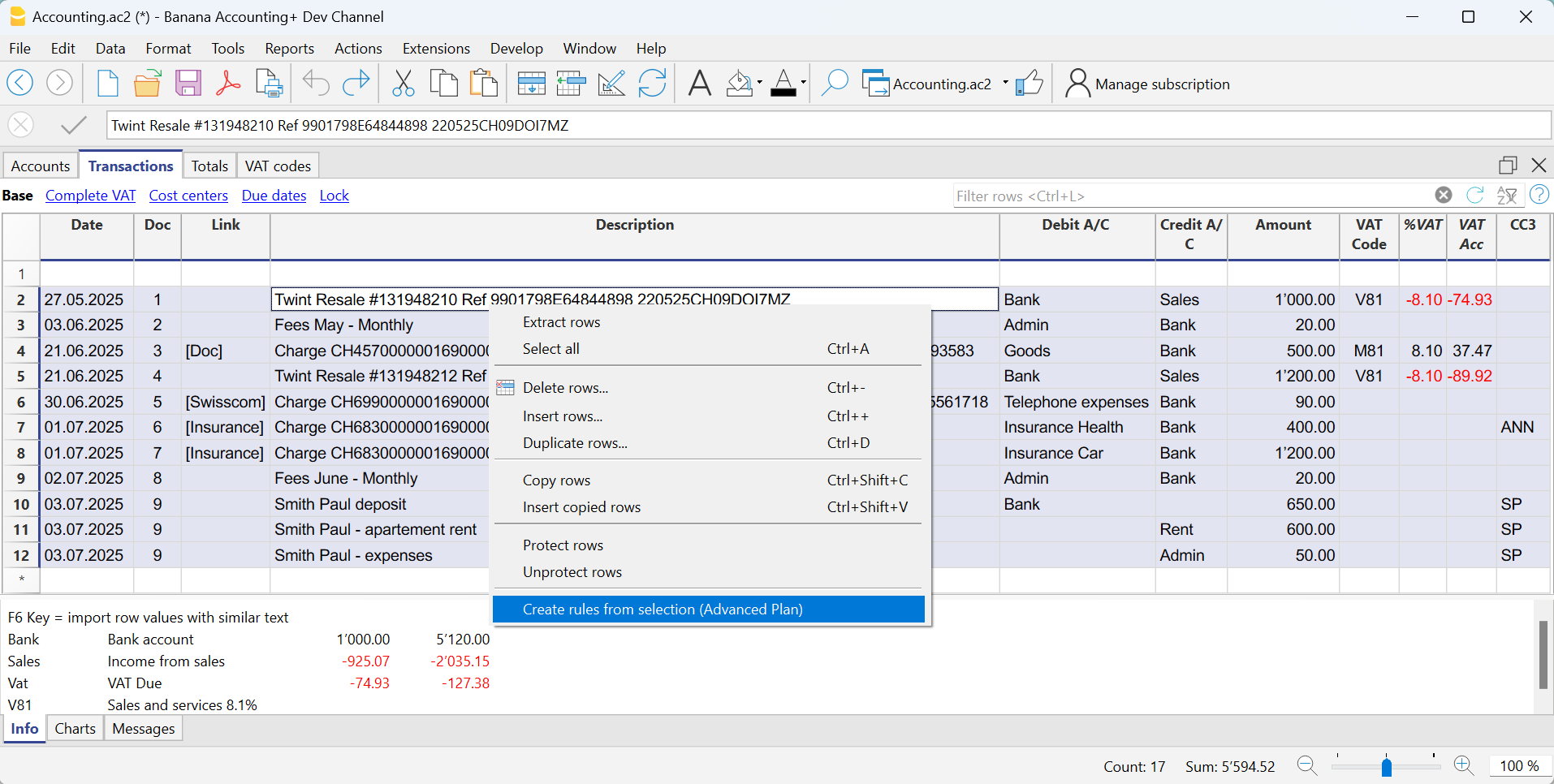

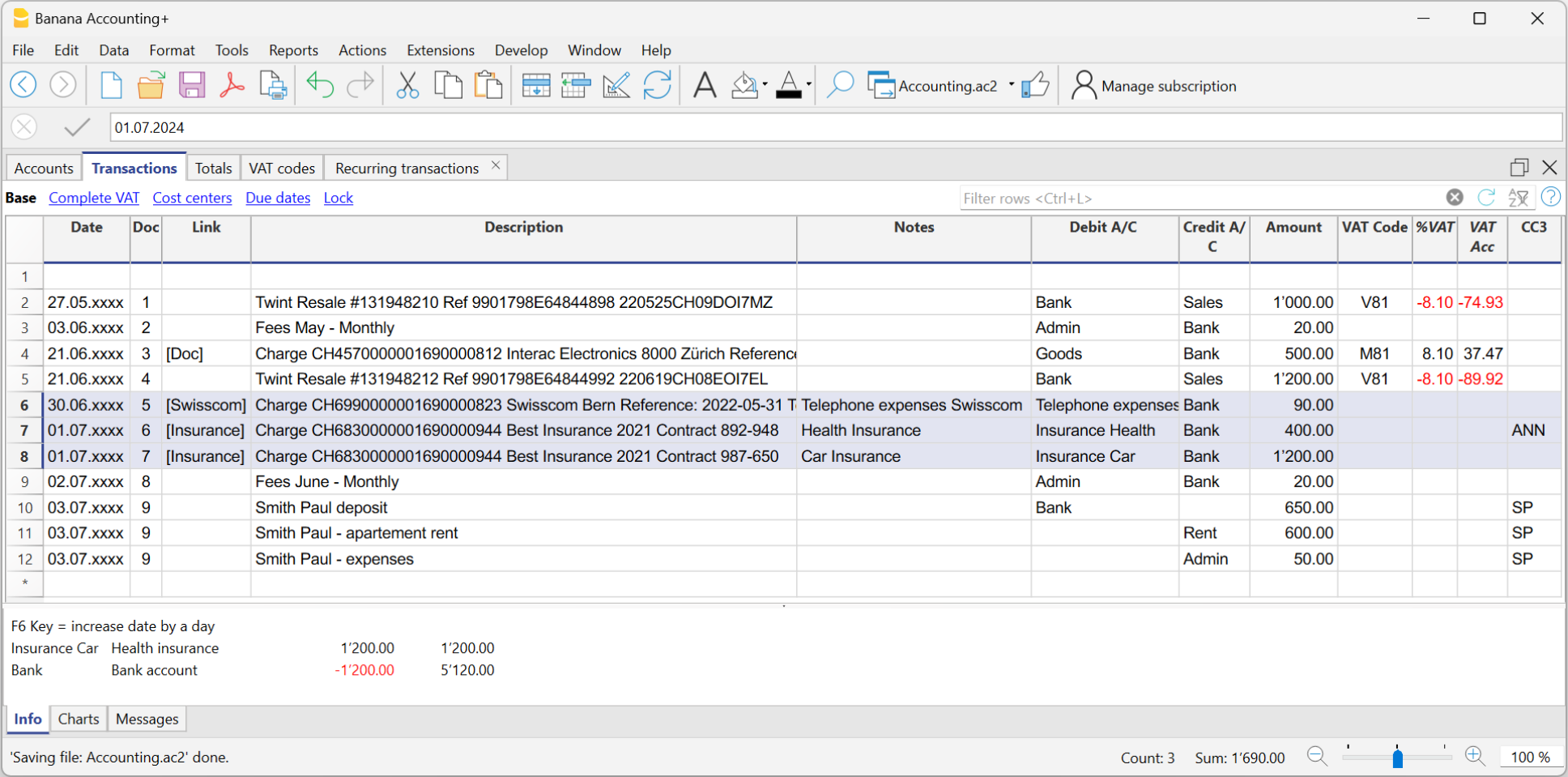

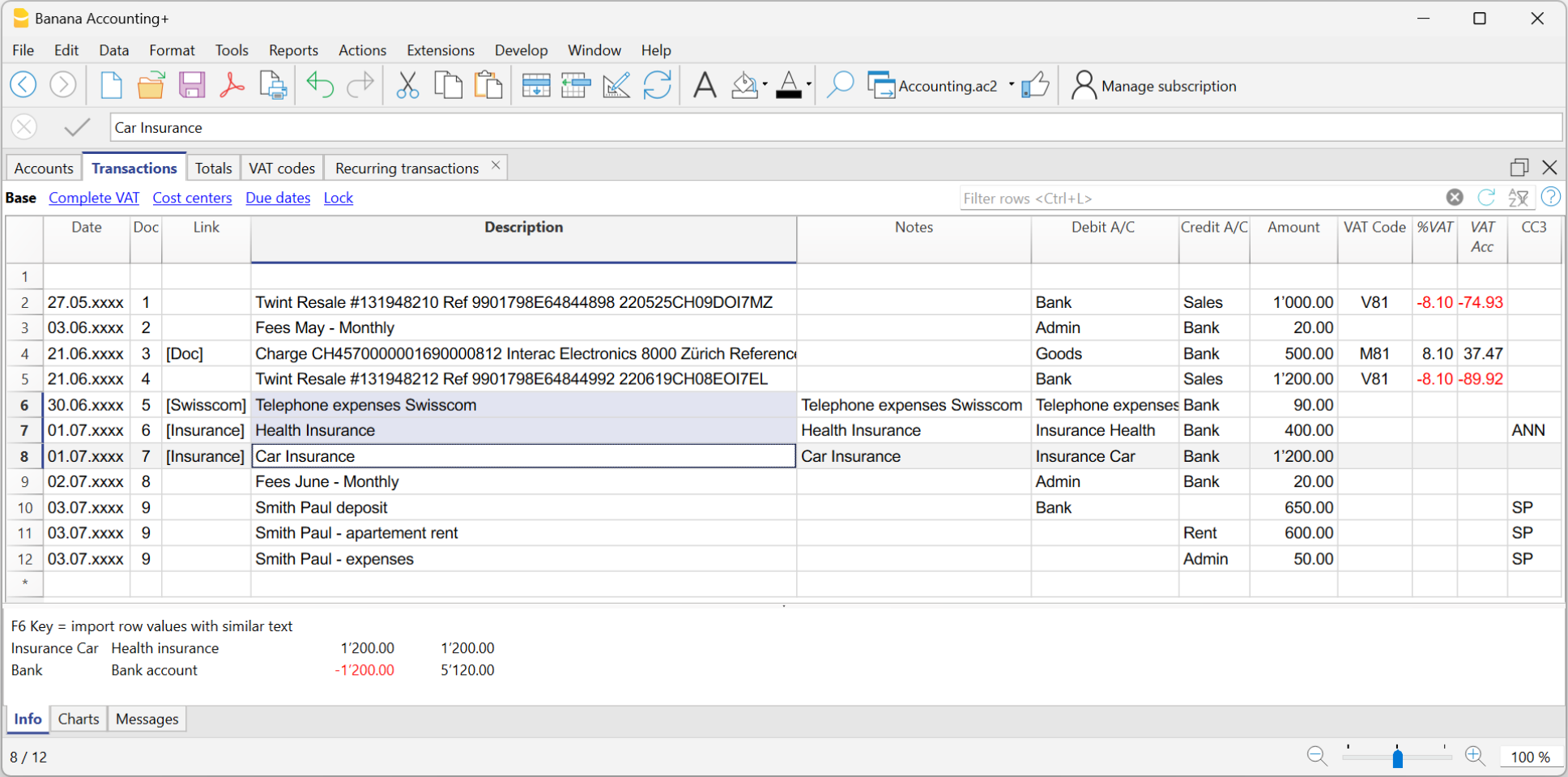

Import and Automation.

Thanks to the innovative data import features from bank statements and the automation of saved rows using Rules, accounting becomes simple, immediate, and error-free.

During the import process, for each transaction that is expected to repeat in the future, you can create a Rule by entering the corresponding account, VAT code, and optional cost or profit center. In subsequent imports, all transactions that match these Rules will be automatically entered and completed by the program, drastically reducing data entry times.

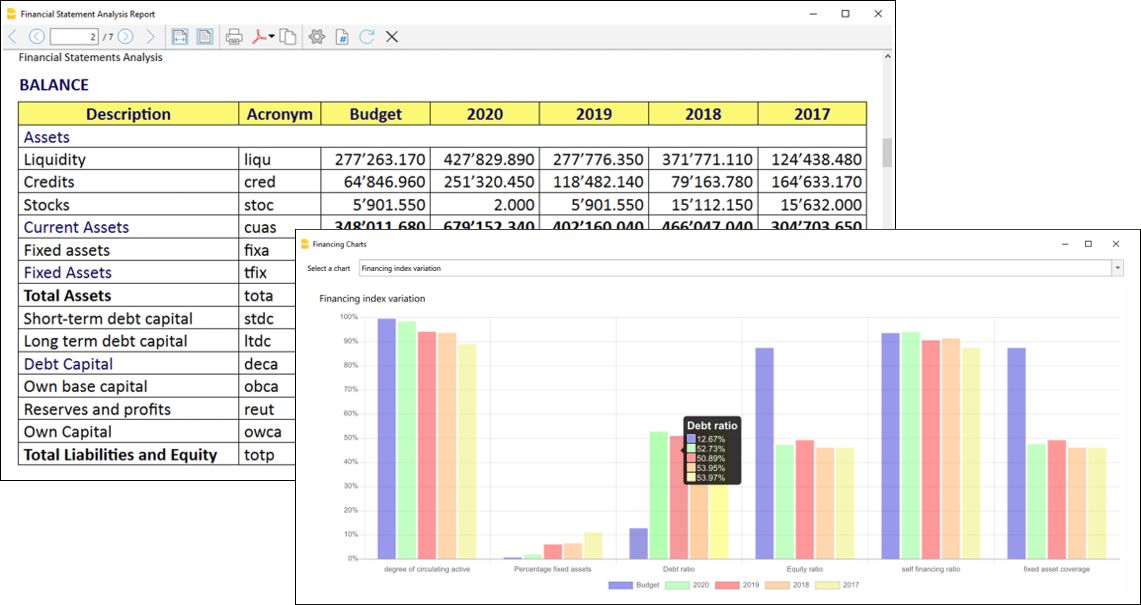

Unique prints thanks to the Extensions

The Extensions are additional programs that extend the functionalities of Banana Accounting Plus. Thanks to them, you can also obtain:

- Donation certificate for associations

- List of books for libraries

- Financial analysis and cash flows

- Portfolio management for securities

- Construction and renovation management

Many of these extensions require the Advanced plan

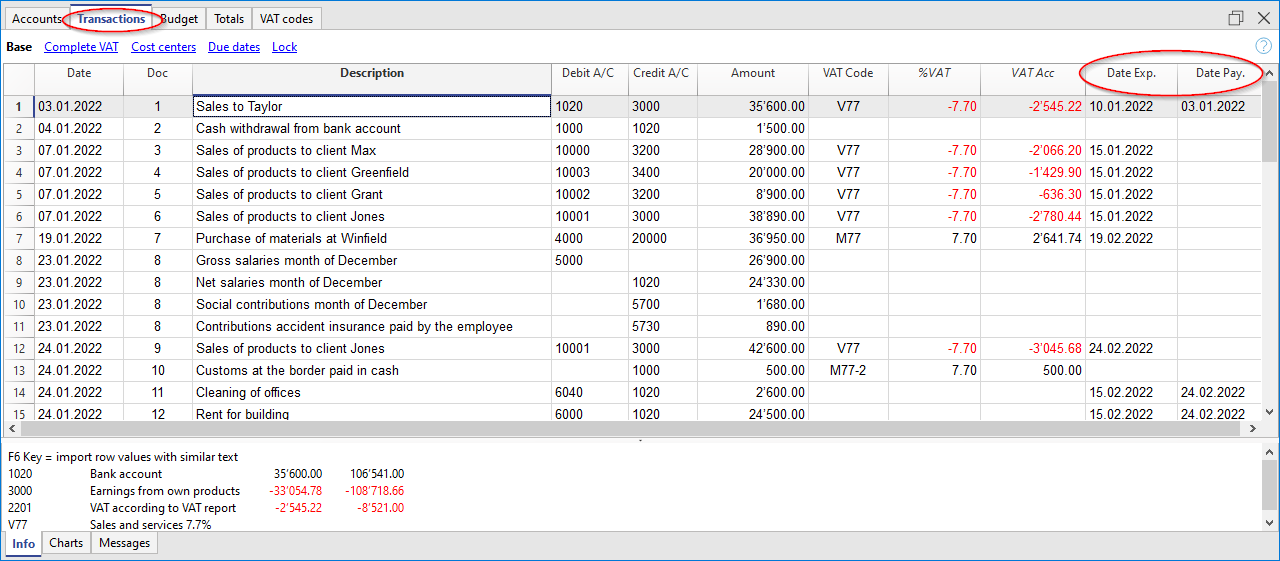

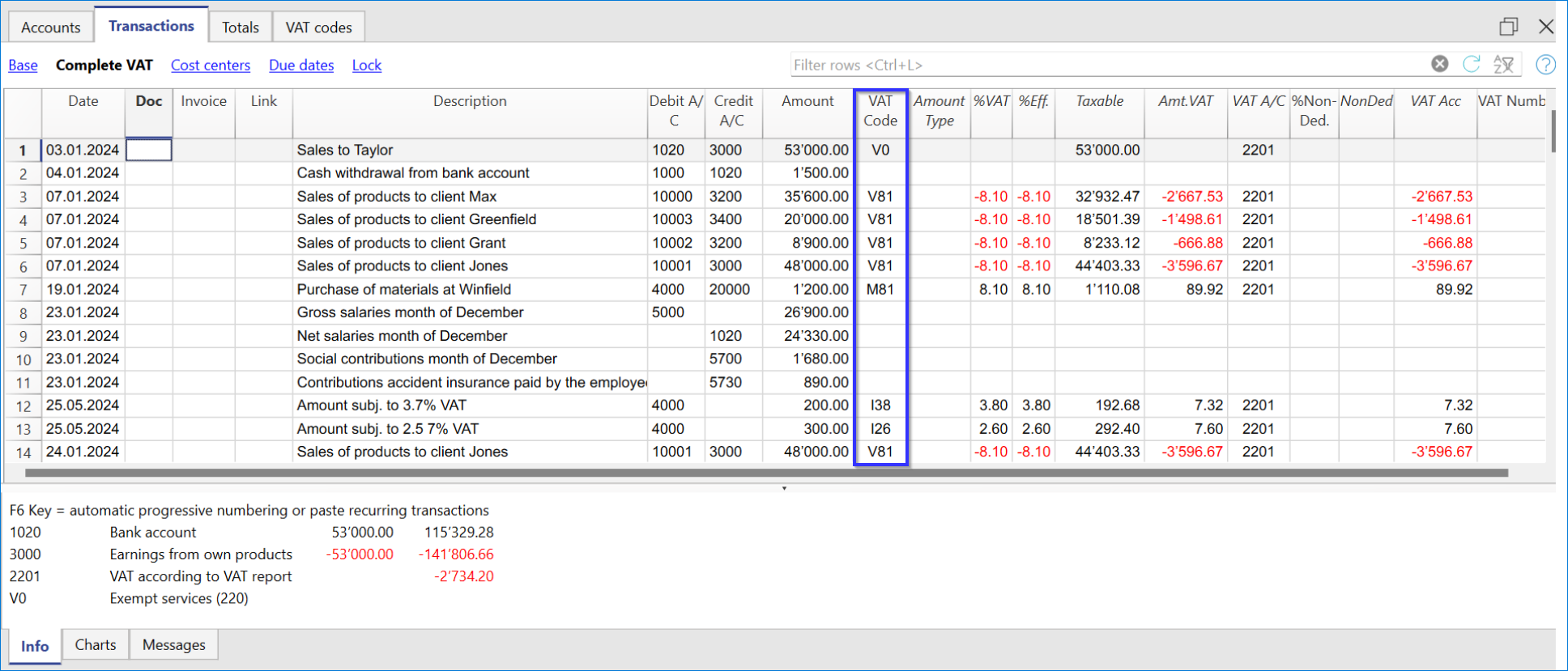

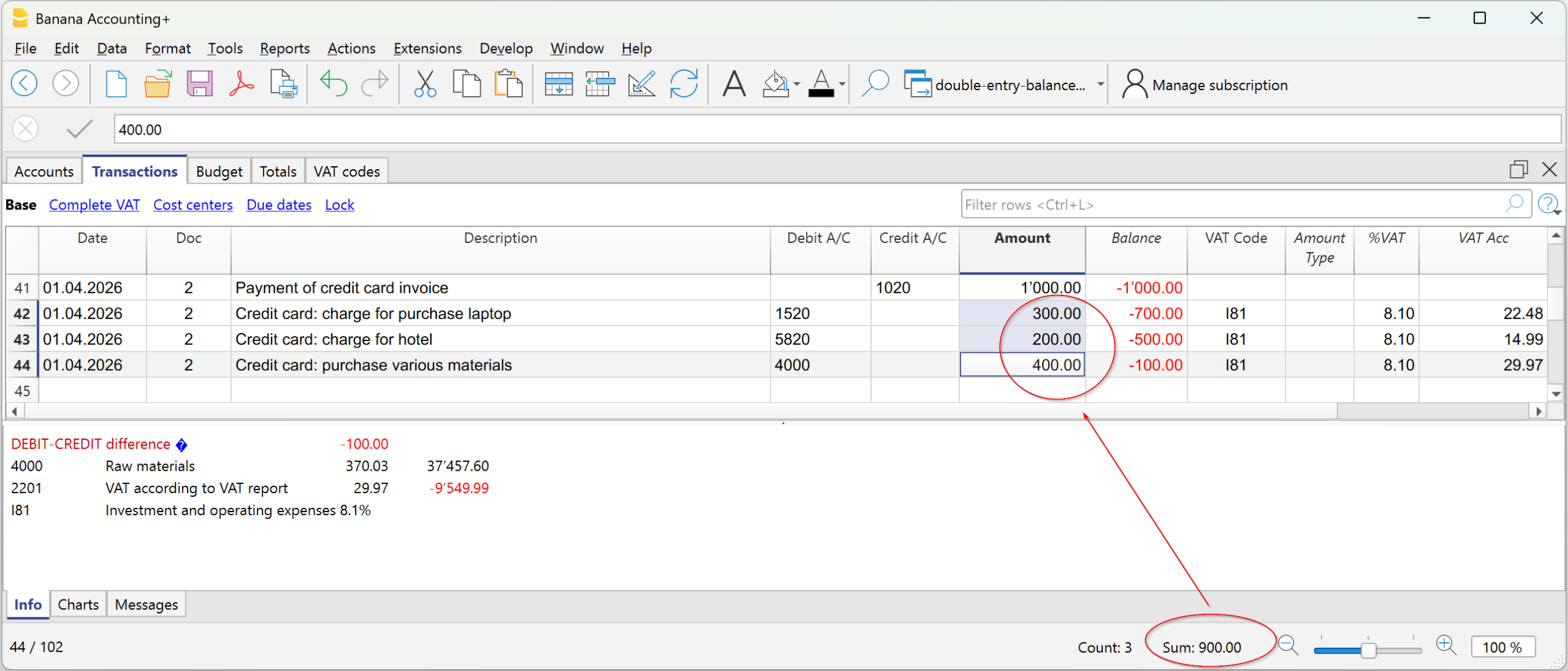

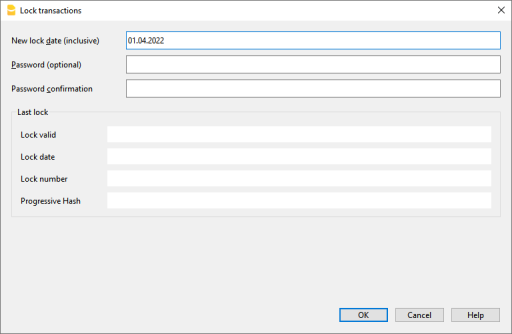

Customising the Transactions Table

The Transactions table is the hub of accounting and can be customised to support a multitude of functions, such as entering quantities and prices, VAT, cost and profit centres and much more.

The table can be customised by displaying or adding columns, so that certain functions are only activated when needed.

Default settings

The Transactions table is set up with standard columns, such as Date, Description, etc., which are already visible when the file is opened. The user can decide which columns to make visible and customise with the command from the menu Data > Columns setup.

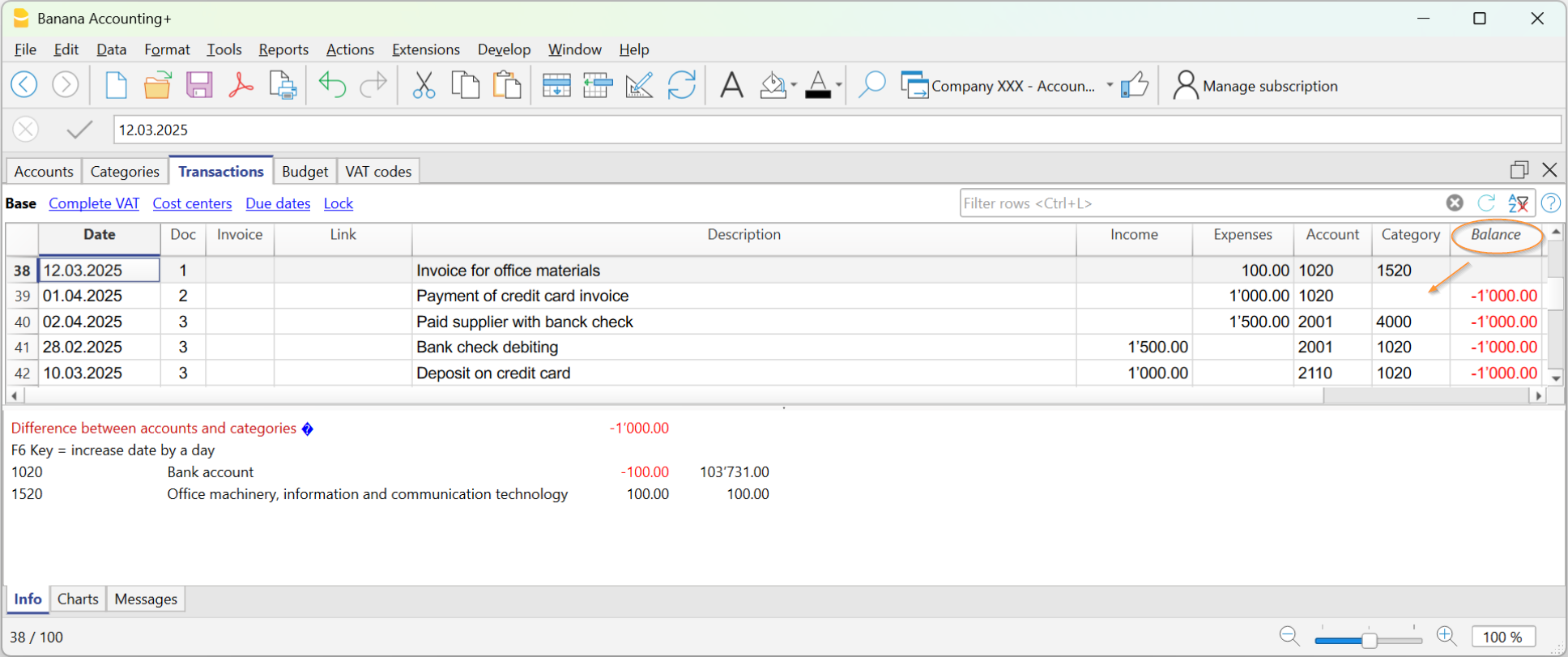

There are specific columns for the type of file opened. For example, in double-entry accounting, there are Debit and Credit columns, whereas in Income and Expense accounting, there are Account and Category columns.

The columns common to all accounts are fully explained on the page Columns of the transactions table - Double-entry, as listed:

- Columns for entering different dates

Currency date, document date, due date or estimated date - Documents

Columns to insert references to documents or protocol. - Remarks and observations

To add additional information of all kinds. - Links to digital documents

To immediately display the movement receipts. - Document type.

To indicate the type of entry (e.g. 01 means opening balance.) - Invoice number

- Cost and Profit centers

To subdivide costs and revenues into specific accounts for projects or other - Segments

To obtain branch or business sector reports.

Here listed the columns only present in certain types of accounts:

- VAT management

Columns only present in accounts with VAT. - Multi-currency accounting

Columns only present in double-entry accounting with multi-currency.

Customising the display

You can adapt the table display to your specific needs, as follows:

- With the command Data > Column setup

- By changing the width and formatting of columns.

- By changing the order in which columns are displayed.

- By making visible or hiding columns already present.

- By creating or modifying new views with display settings (Tables setup)

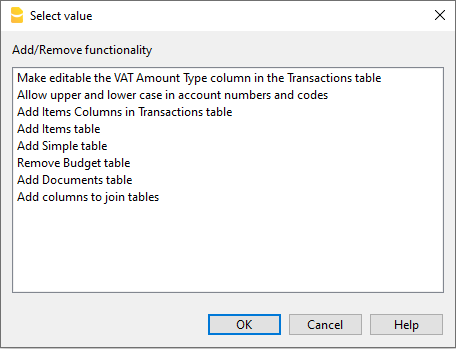

Adding additional columns

You can add additional columns according to your needs. The options are:

- Add preset columns with specific functionalities

For example, columns for quantities, unit price (as explained in the next section). - Add free columns (Data > Columns setup)

To insert any other information required. - Add columns and link them to tables added by the user

You can add additional tables, e.g. the Projects table, and then create a column where you can enter the name of the project.

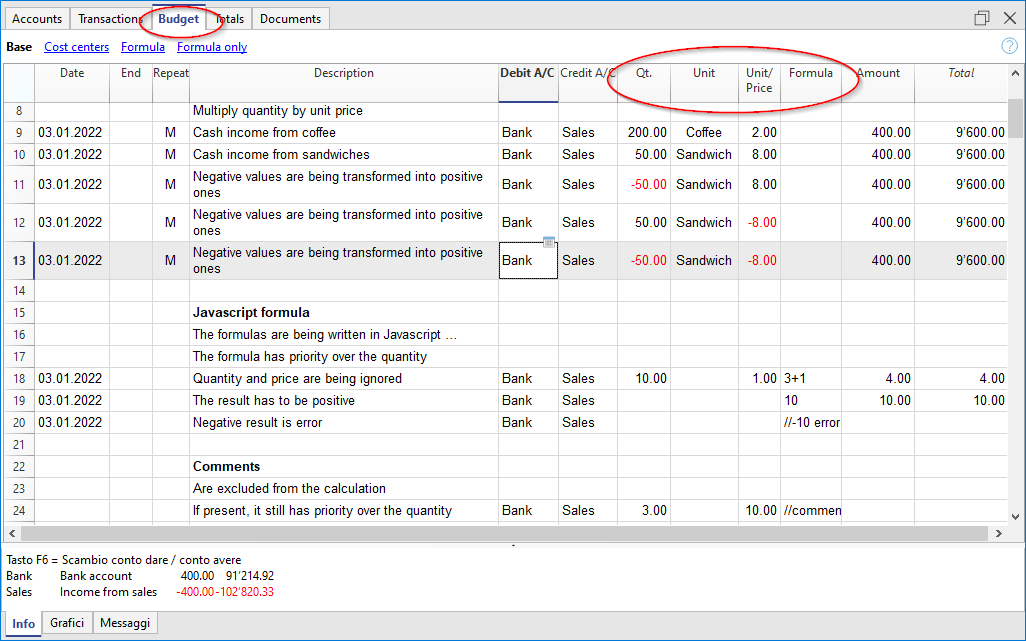

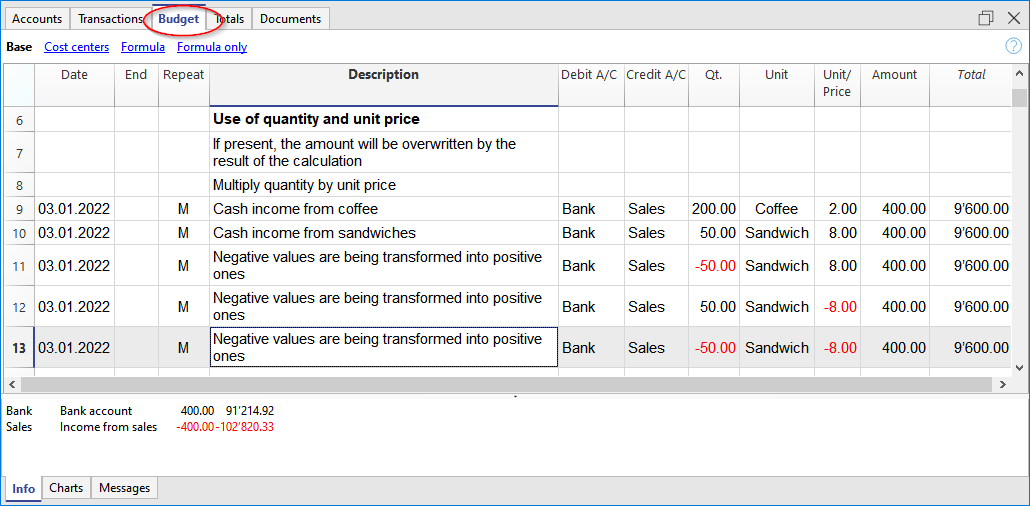

Additional columns quantities and prices

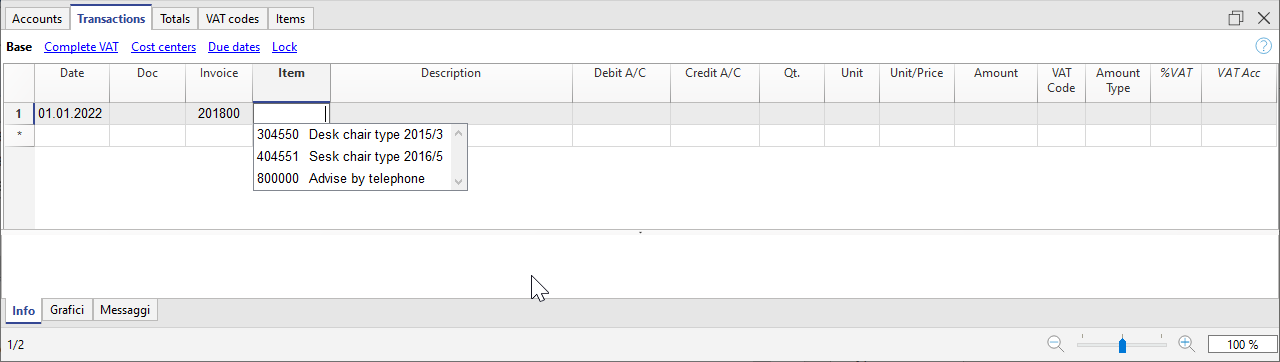

You can enter quantities and prices directly in the accounting file.

Specific columns are displayed from the menu Tools > Add / Remove Functionality. The following columns are added in bulk:

- Article identifier

Which is linked to the Items table - Quantity. A numerical value

- Unit price

- Descriptive quantity.

If you enter a value in the quantity or price column, the programme automatically calculates the amount by multiplying the two values.

These columns can be used for various purposes:

- Manage quantities and prices for cost accounting.

- Specify the elements of an invoice.

- Enter the movements of items indicated in the Items table or to manage the purchase and sale of securities (see Portfolio extension).

Link to the Items table

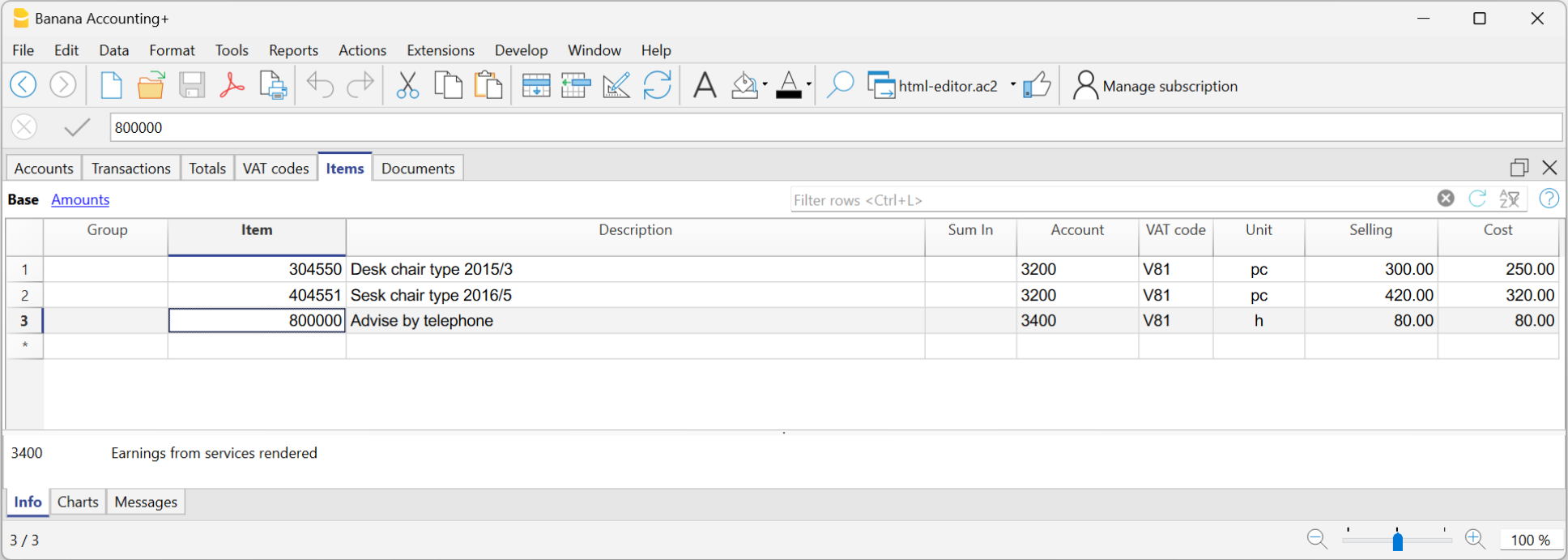

The Items table is a kind of mini-warehouse integrated into the accounting , where:

- You can enter the list of products, quantities and prices.

- When you enter an item in a line in the transactions table, the programme automatically takes over the description and sales price.

- If you enter transactions in the Transactions table by entering quantities, the programme updates the current quantity in the Items table.

Additional Payment Management Columns

They are added from the menu Tools > Add / Remove Functionality

Please refer to the explanation in the Payment Management page.

Additional columns end date, repeat

You can also add specific columns to insert automatic movements in the Recurring Transactions table.

They are added from the menu Tools > Add / Remove Functionalities

Please refer to the explanation Automatic Transactions.

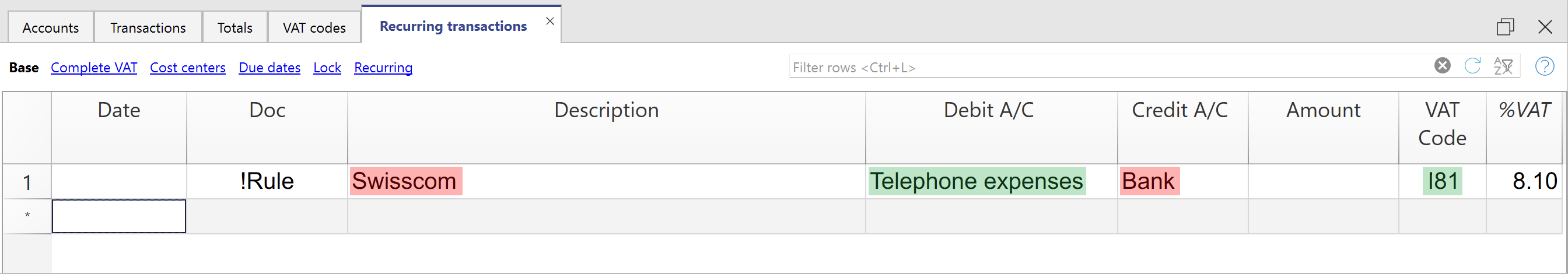

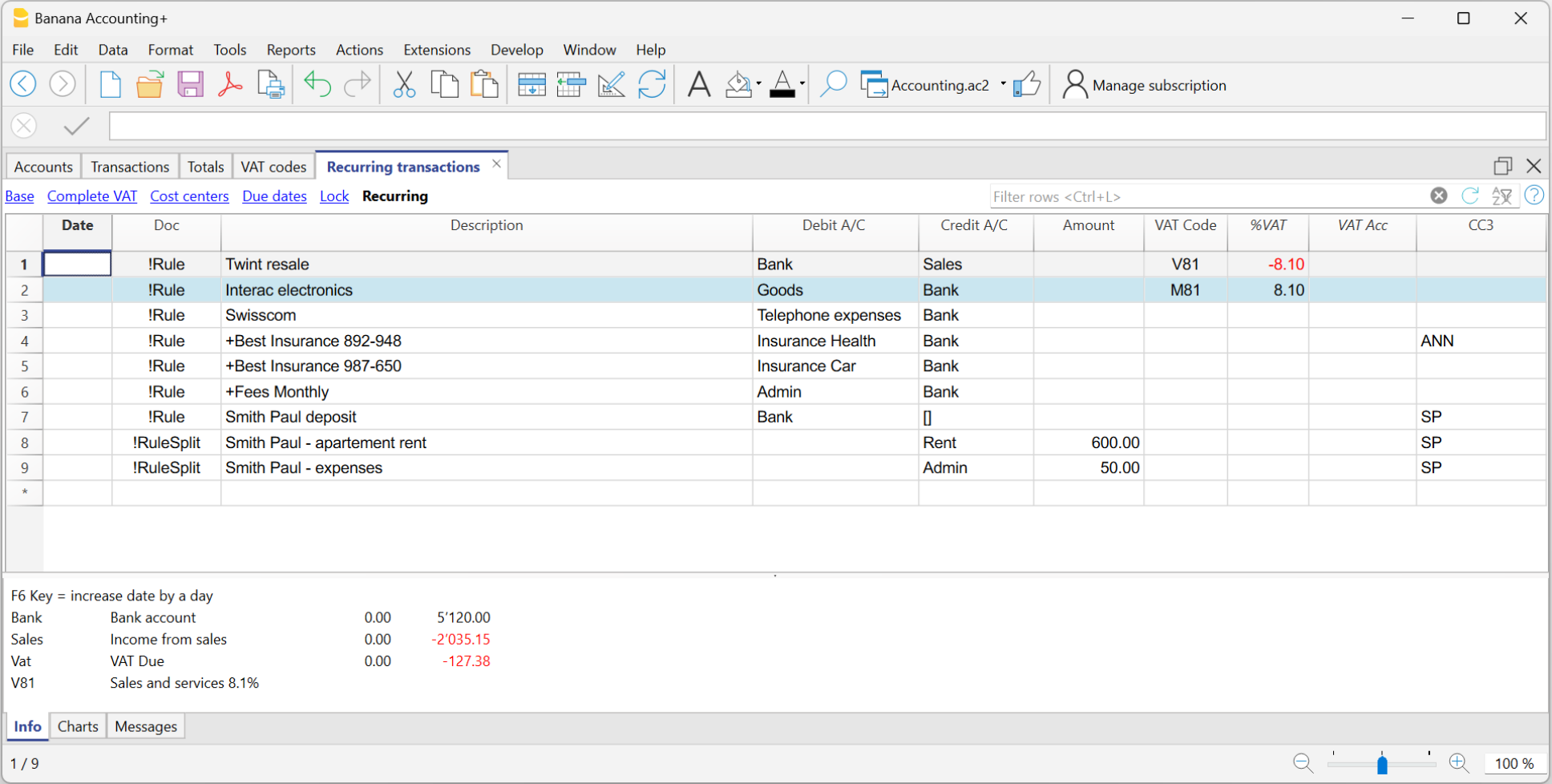

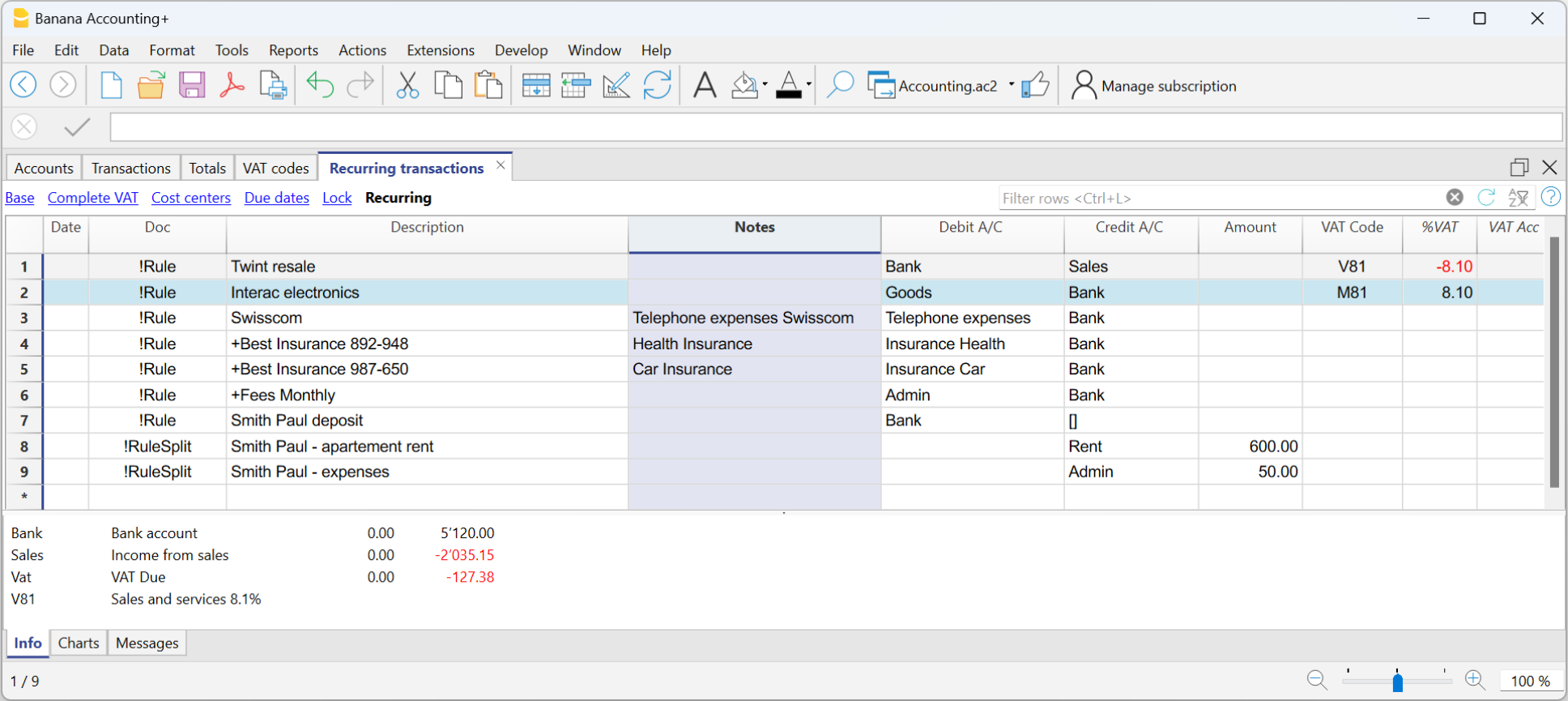

Recurring Transactions table

The Recurring Transactions table has the same columns and arrangements as the Transactions table. If you change the display of columns in the Recurring Transactions table, this will also be changed in the Recurring Transactions table.

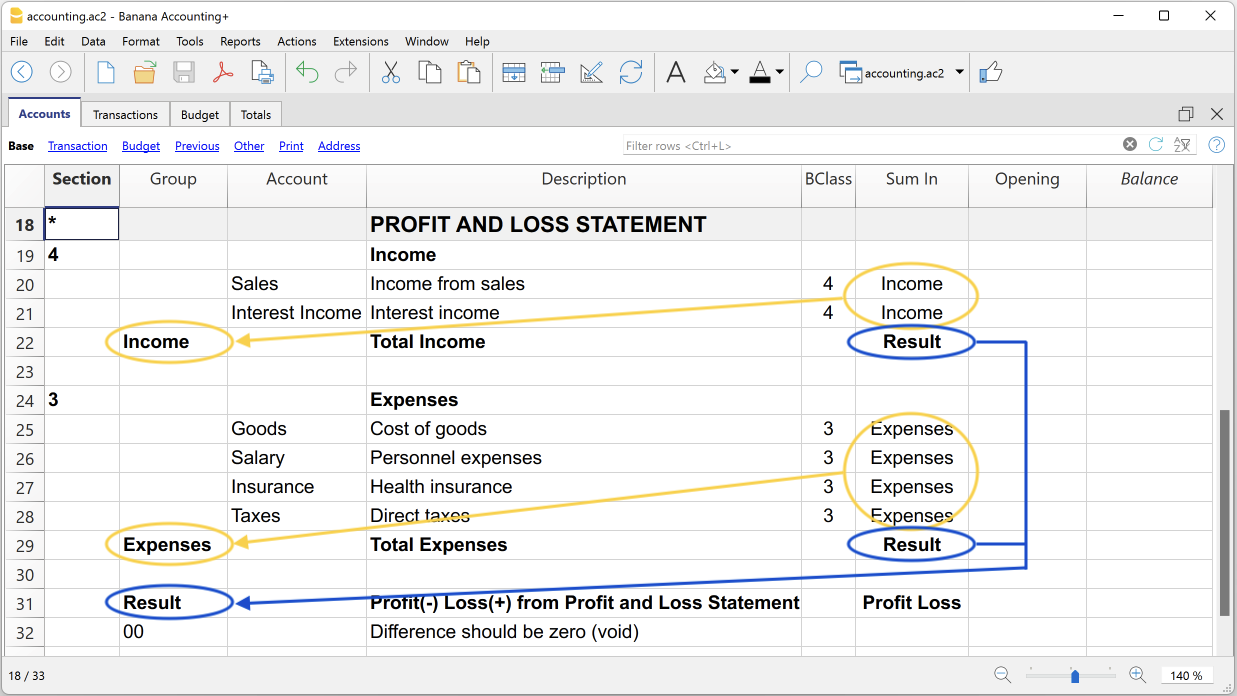

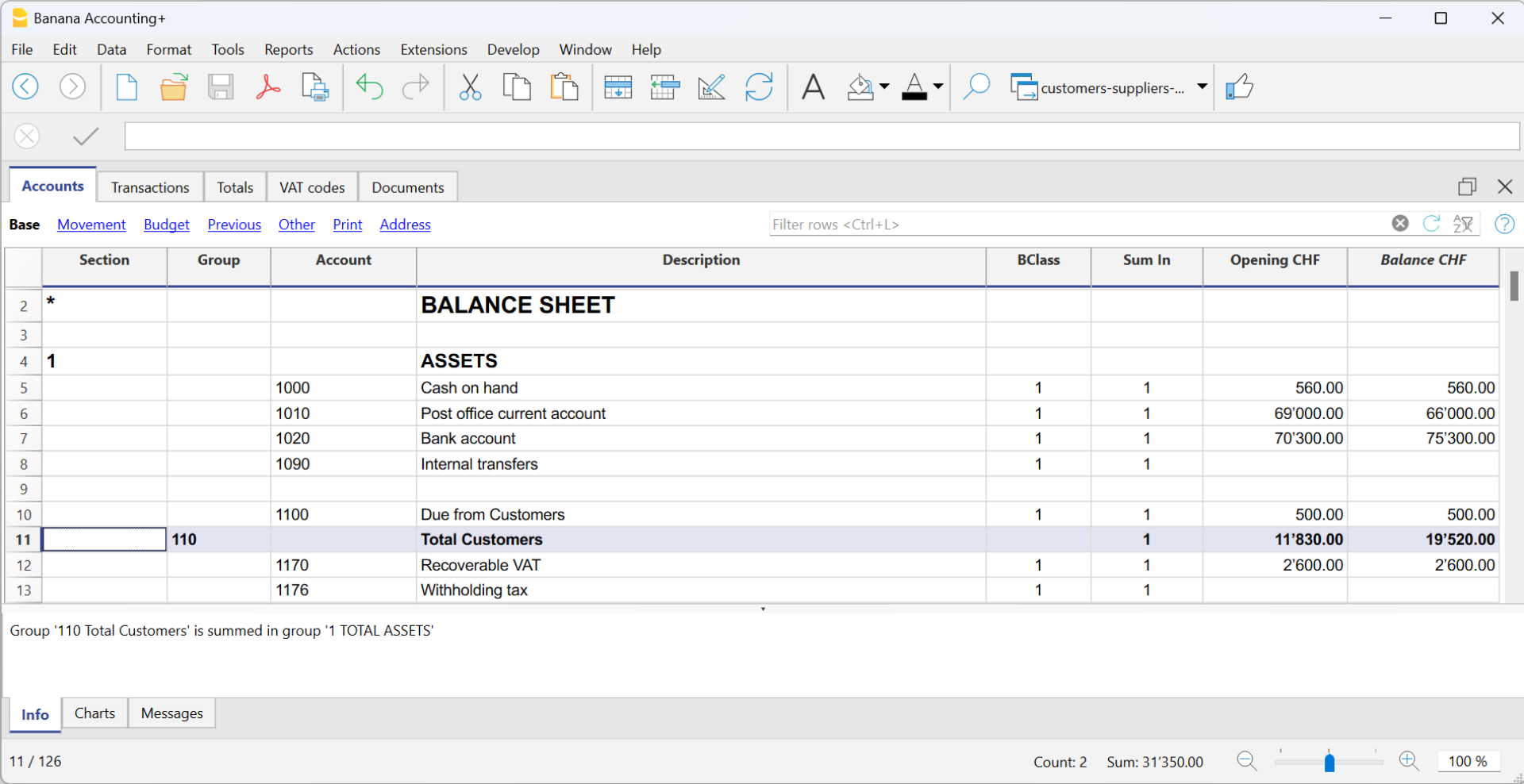

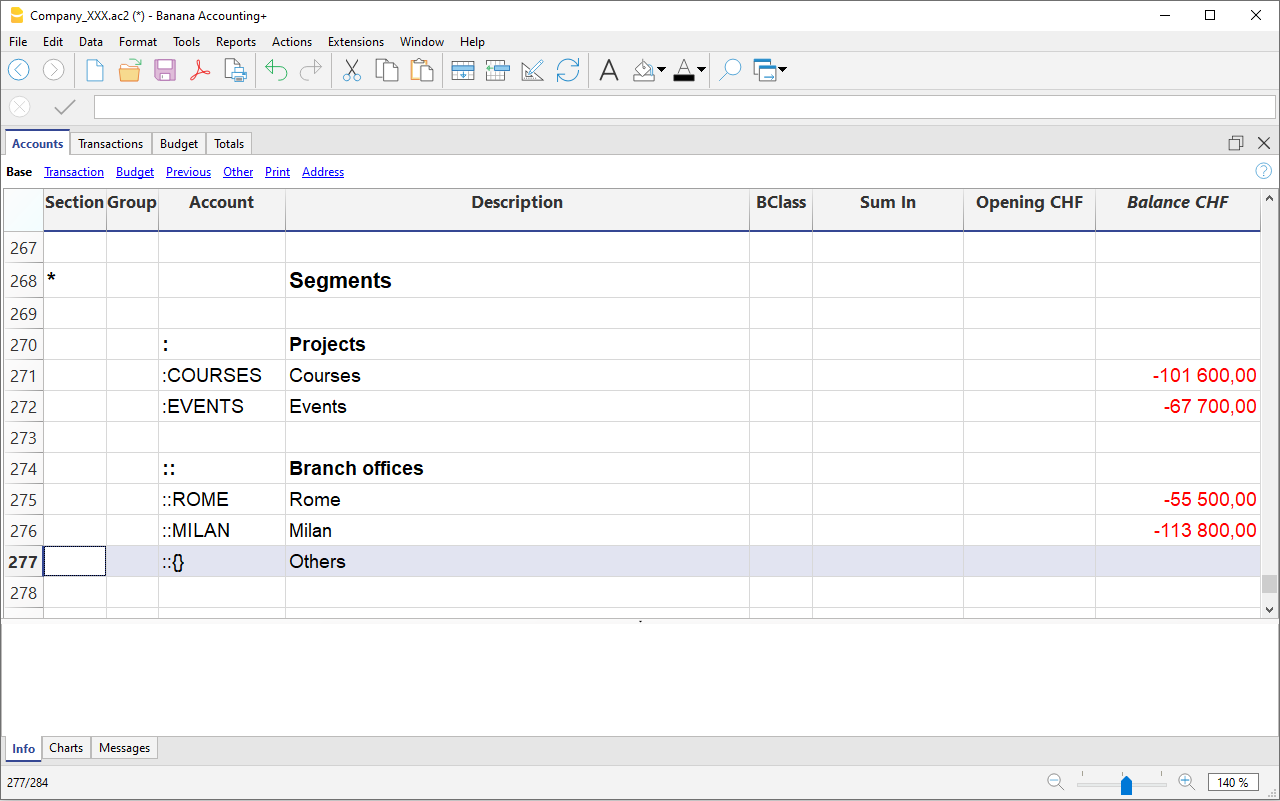

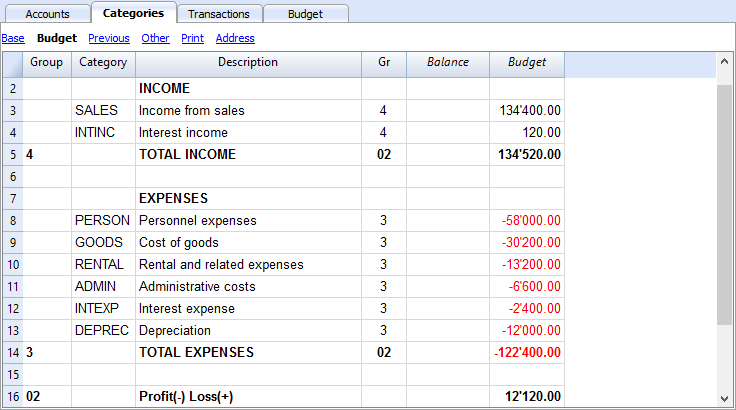

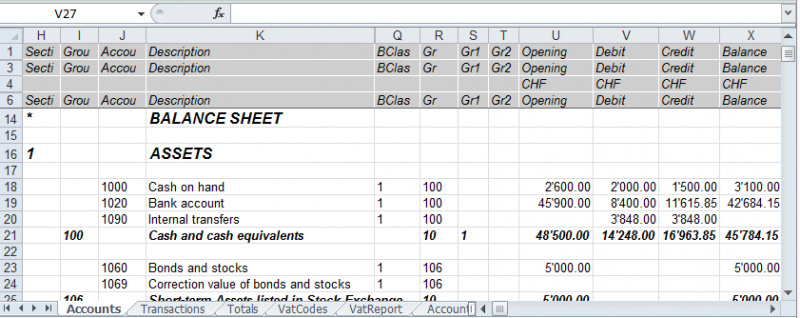

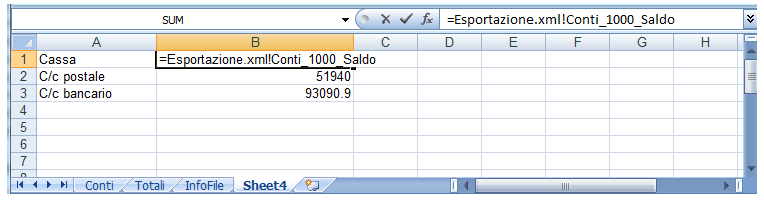

The grouping system in Banana Accounting+

Banana Accounting's grouping system is used to totalise the amounts of accounts and groups quickly and easily. The programme gives you maximum flexibility to create as many levels of totalling as you want.

Grouping is a very powerful tool for calculating totals automatically.

Where it is used

- In the Accounts and Categories tables to define the structure of the Balance sheet and the Profit & Loss Statement.

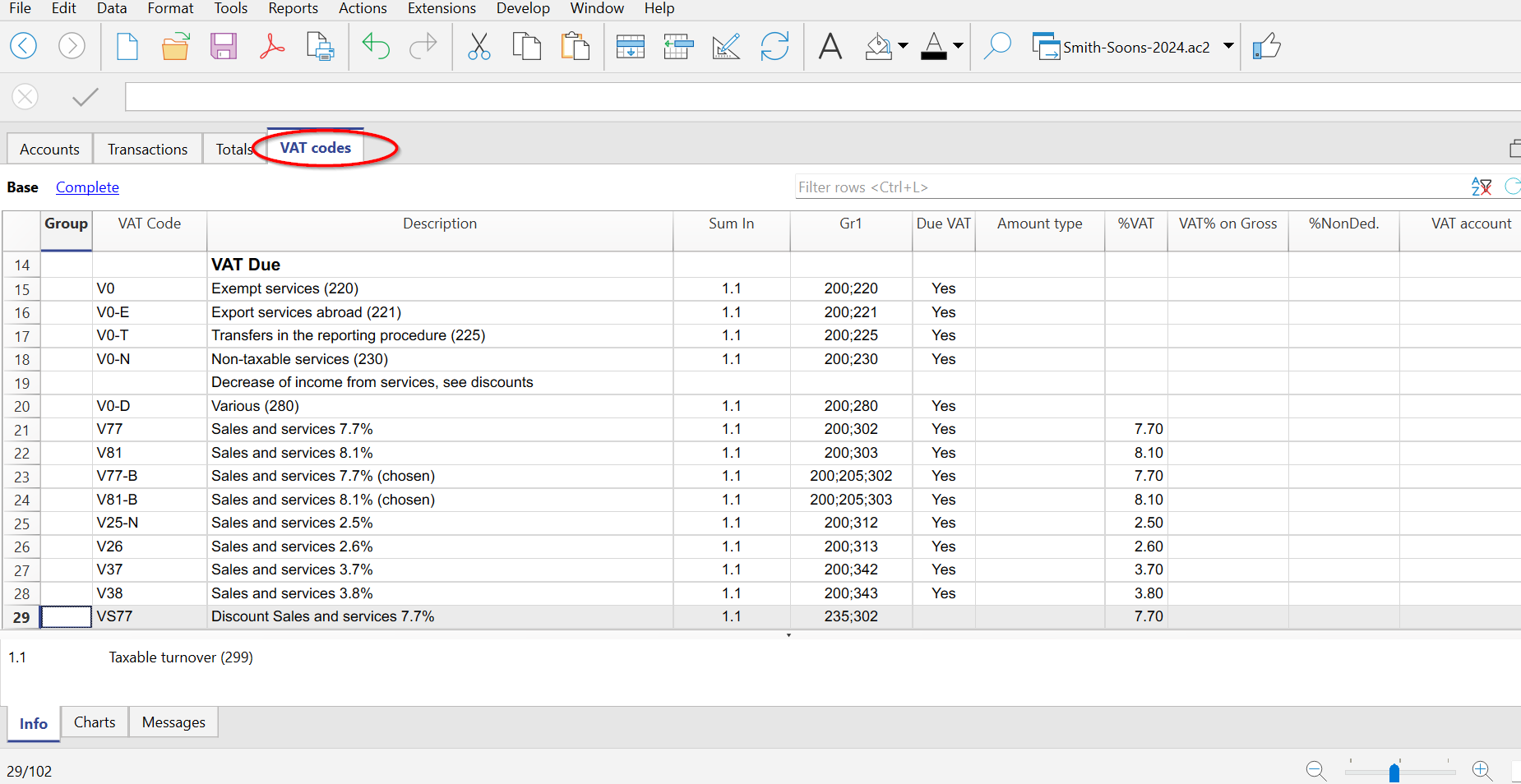

- In the VAT Codes table to group VAT codes

- In the Items table in the Stock Application.

- In the Items table in the Fixed asset register Application.

▶ Video: Grouping and totalling system

How it works

Grouping is always based on two columns:

- The Group column, where group identifiers are indicated, which may be textual or numeric.

- The column Sum In, where for each account or group row the Totalisation Group is indicated.

Each group row is a total row, where:

- Group balances are the sum of the rows that contain the group name in the Sum In column.

- The programme calculates the totals of all columns containing amounts (type Amount), both the predefined ones (Opening, Balance, etc.) and those added manually.

Grouping allows the creation of many levels of totalisation.

The logic of the programme

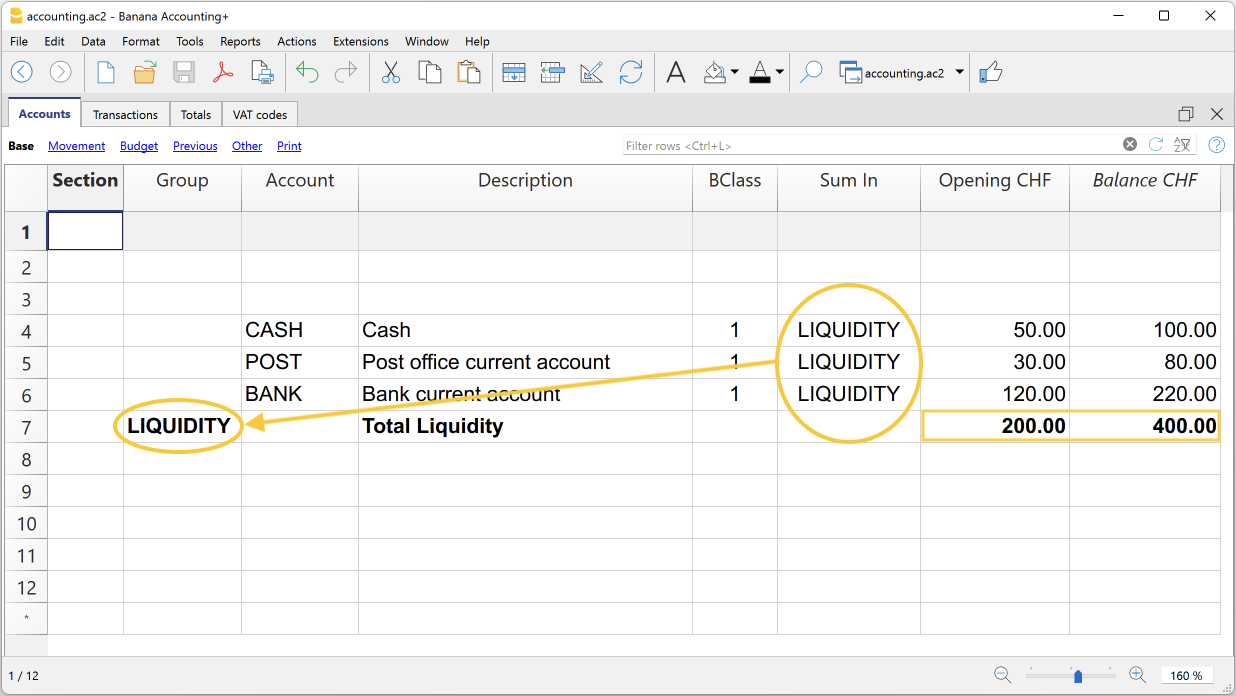

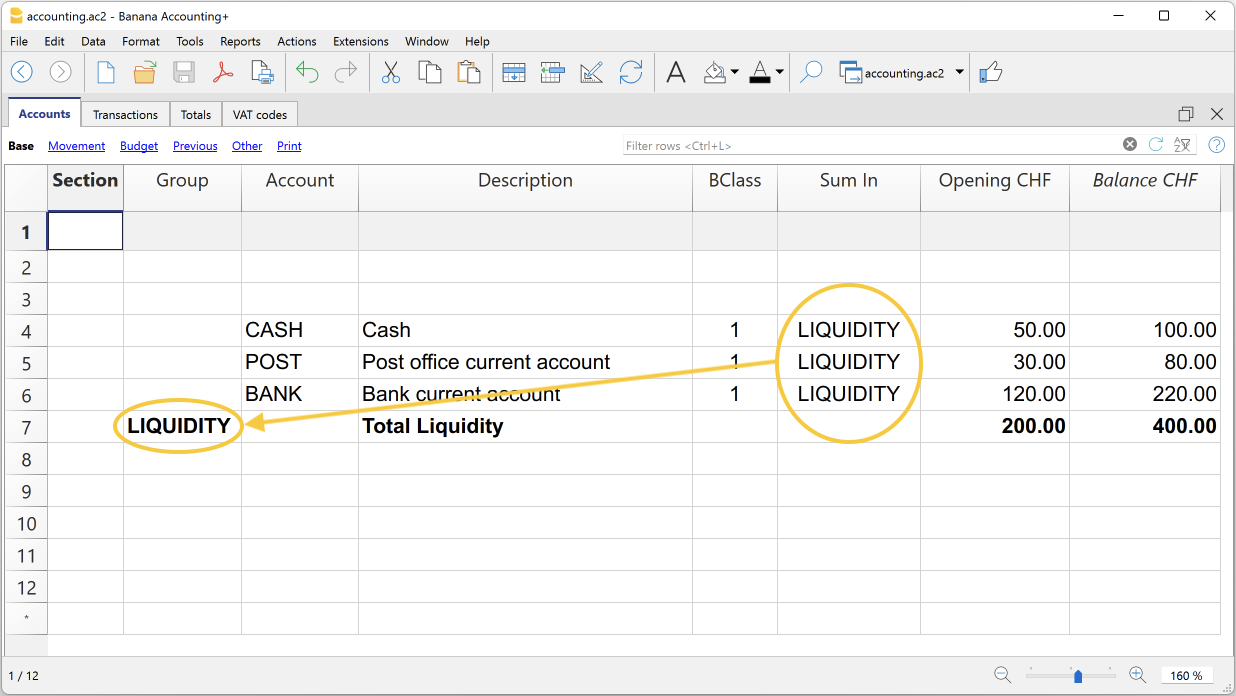

To understand the logic, let us present an example of a small part of the chart of accounts. For the accounts Cash, Post and Bank we create the Liquidity group:

- In the line below the liquidity accounts, in the Group column, enter the name of the Liquidity group.

- In the Description column, you enter the description of the group.

- In order for the programme to be able to update the balances in the liquidity group, it must be indicated which accounts are to be totalled.

In the Sum In column of the Cash, Post and Bank account, the name of the cash group is entered. The balances of the group are updated immediately.

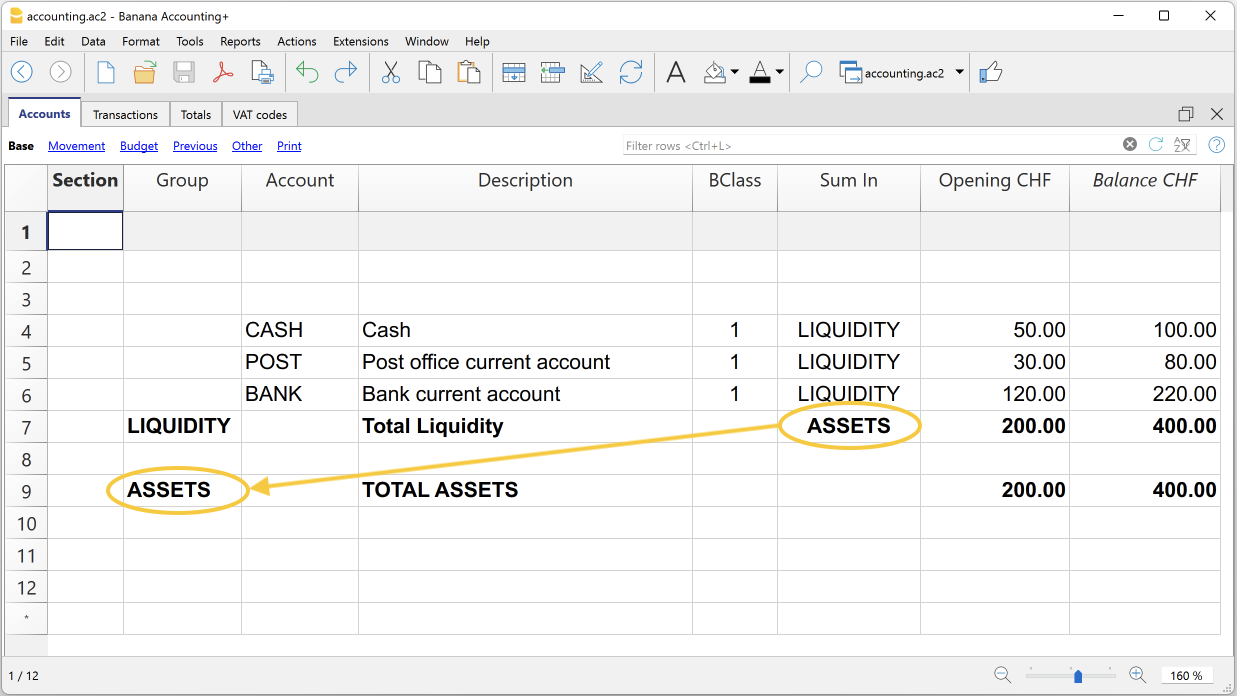

Using the same logic, we can also group groups. In fact, groups can also be totalled into other groups at a higher level.

Suppose we add a group into which to group and then total the Liquidity group.

- In the line below the Liquidity group, in the Group column, the name of the Assets group is entered.

- In the Description column, you enter the description of the group.

- In order for the programme to be able to update the balances in the Assets group, it must be indicated which groups are to be totalled.

In the Sum In column of the Liquidity group, the name of the Assets group is entered. The group's balances are updated immediately.

Following this logic, it is possible to create a structure with groups and subgroups for the entire chart of accounts, in order to create charts of accounts suitable for any specific country and requirement.

The exact same logic can also be applied for grouping VAT codes in the VAT Codes table, and also for grouping items in the Items table of the Warehouse and Fixed asset register.

Extensive use of the totalisation system

The totalisation system is very flexible:

- Accounts and groups can be added together in a group.

- Title texts can be assigned the group to which they belong.

- Any kind of numbering (numerical and/or letter) can be used.

- Up to 100 totalisation levels can be created.

- Group totalisation is independent of the sequence of rows:

- The total row can be defined before and after the account or group rows.

- The total row can also be defined in a completely detached position from the account and group rows, as in the case of the Accounts Payable / Suppliers ledger.

- The same account cannot be totalled in two Groups at the same time.

- The system is also used to total the Cost Centres and Segments.

The totalisation of amount columns

The calculation procedure totals the columns of type amount.

- The amount columns defined by the system are totalled.

- The amount columns added by the user are totalled.

The calculation sequence

The programme calculates totals as follows:

- Clears the column amounts of the Group rows.

- Adds up the amounts of the Accounts rows in the Group rows (first level of calculation).

- Adds up the balance of the Group rows in the higher level Groups.

Repeats the operation until all levels are calculated.

When a Group is totalled in a lower level Group, an infinite error loop is created.

Error checking and reporting

When creating groupings, the programme checks and reports any errors so that they can be corrected immediately.

When a non-existent group has been indicated in the Sum In column, the programme reports the error 'Group not found'. In this case it is sufficient to:

- Create the group in the Group column.

- Recalculate accounting with the command Check and recalculate accounting

- Recalculate all totals with the command Recalculate totals.

Rename groups

With the Rename command, existing group names can be renamed automatically, without having to manually change the matches in the Group and Sum In columns.

Printouts

When printing the Balance Sheet, Profit and Loss Statement or other reports that contain groupings, the printout shows the order of the groupings as they have been set in the various tables.

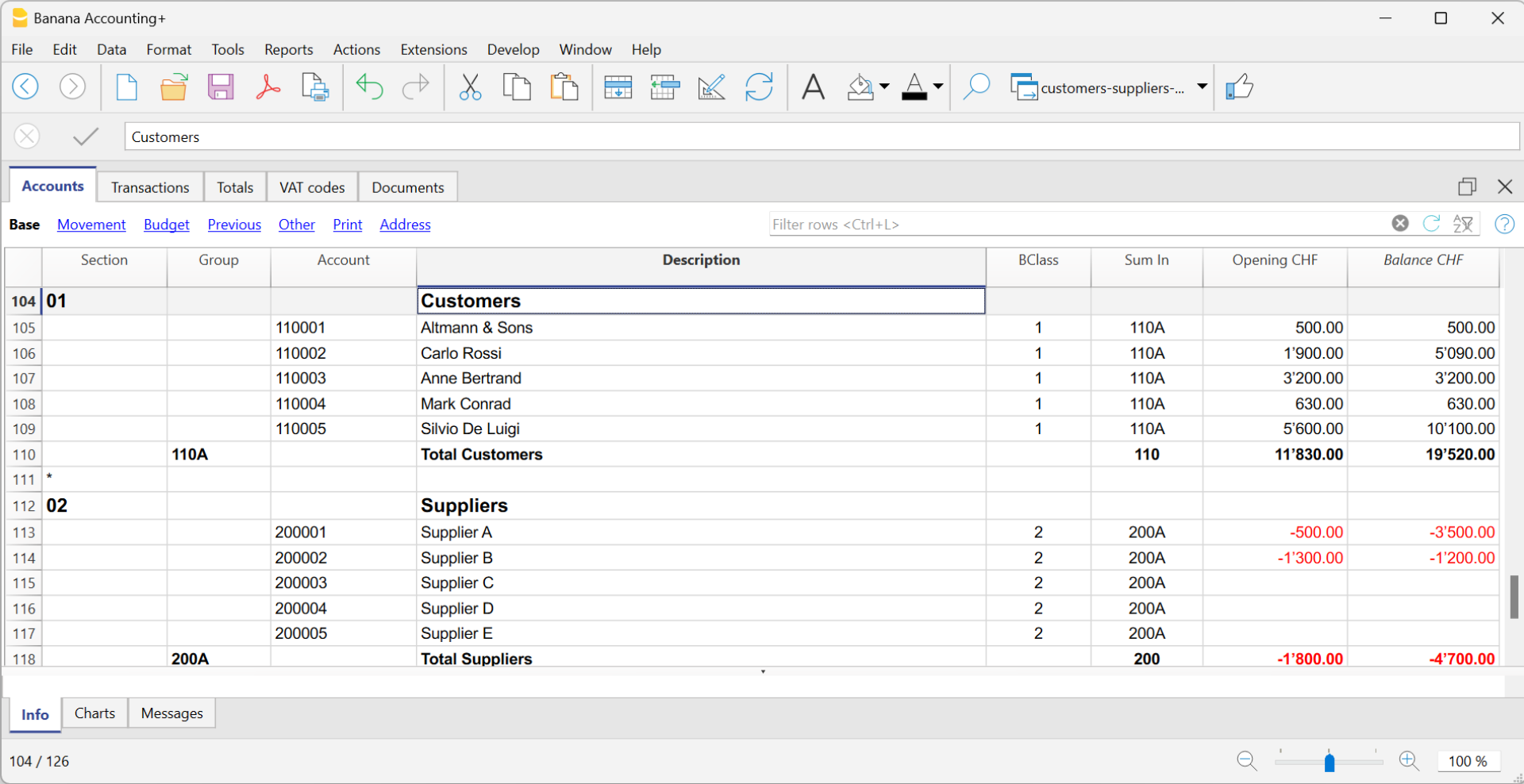

Customer Management

Customer management in Banana Accounting Plus allows you to record, organise, and manage customer information and allows you to keep track of customer transactions and payments, payment due dates, and contact information. You can track customer payments, update the payment status of issued invoices as well as enter and print invoices.

Customer management is a feature available in all accounting applications of Banana Accounting Plus, but it is especially used in double-entry accounting.

Please also visit Supplier management

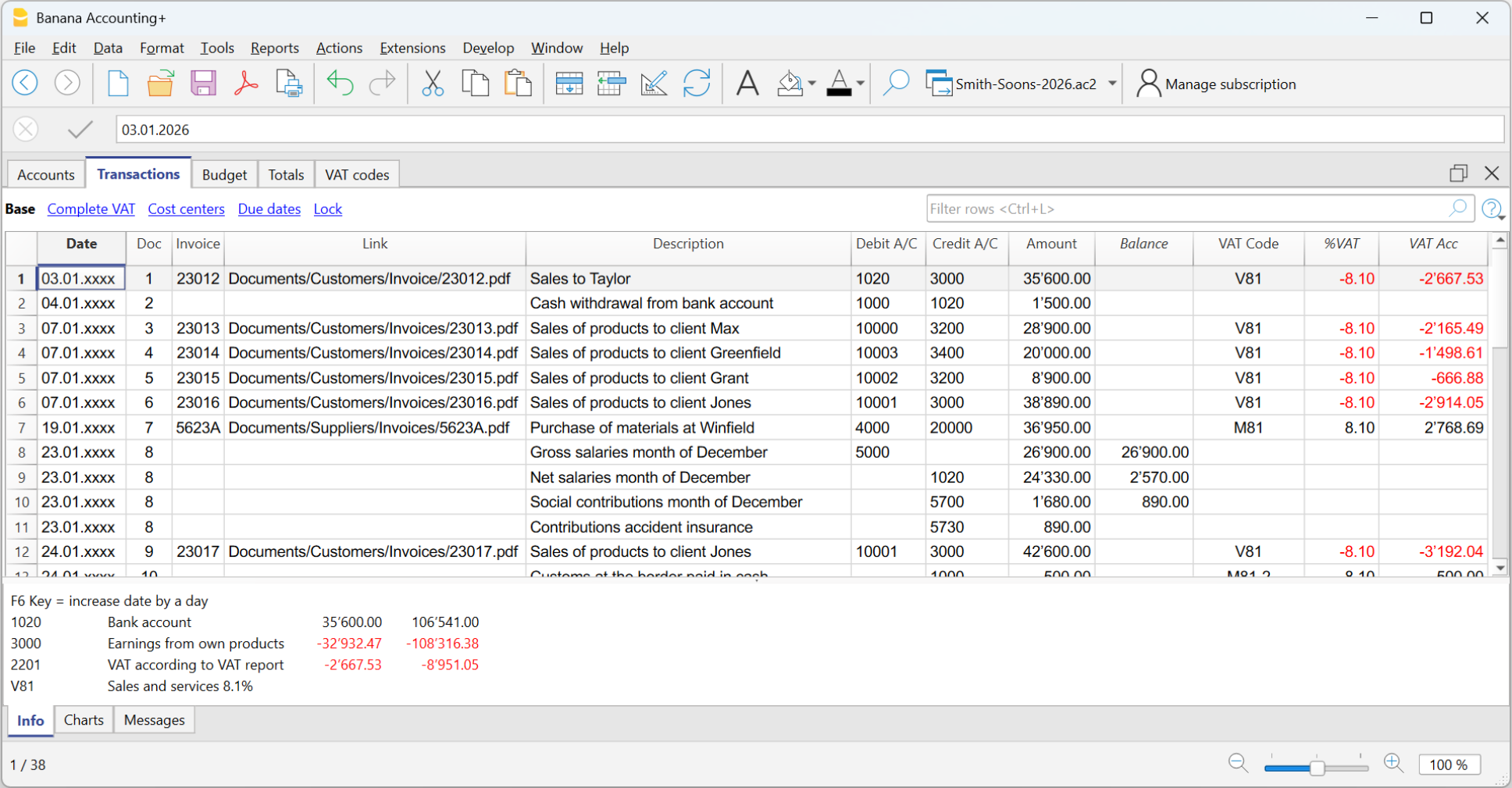

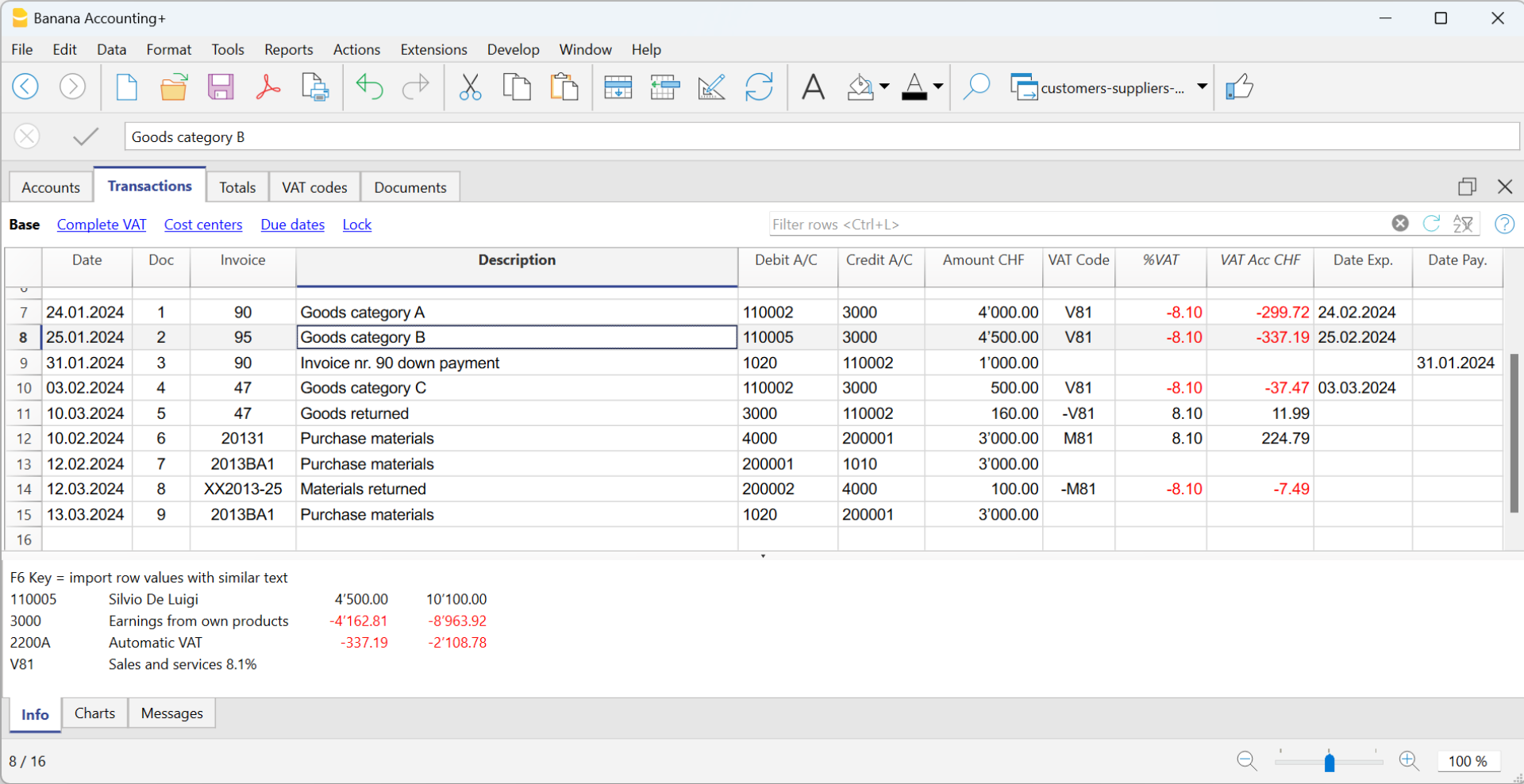

Recording customer transactions

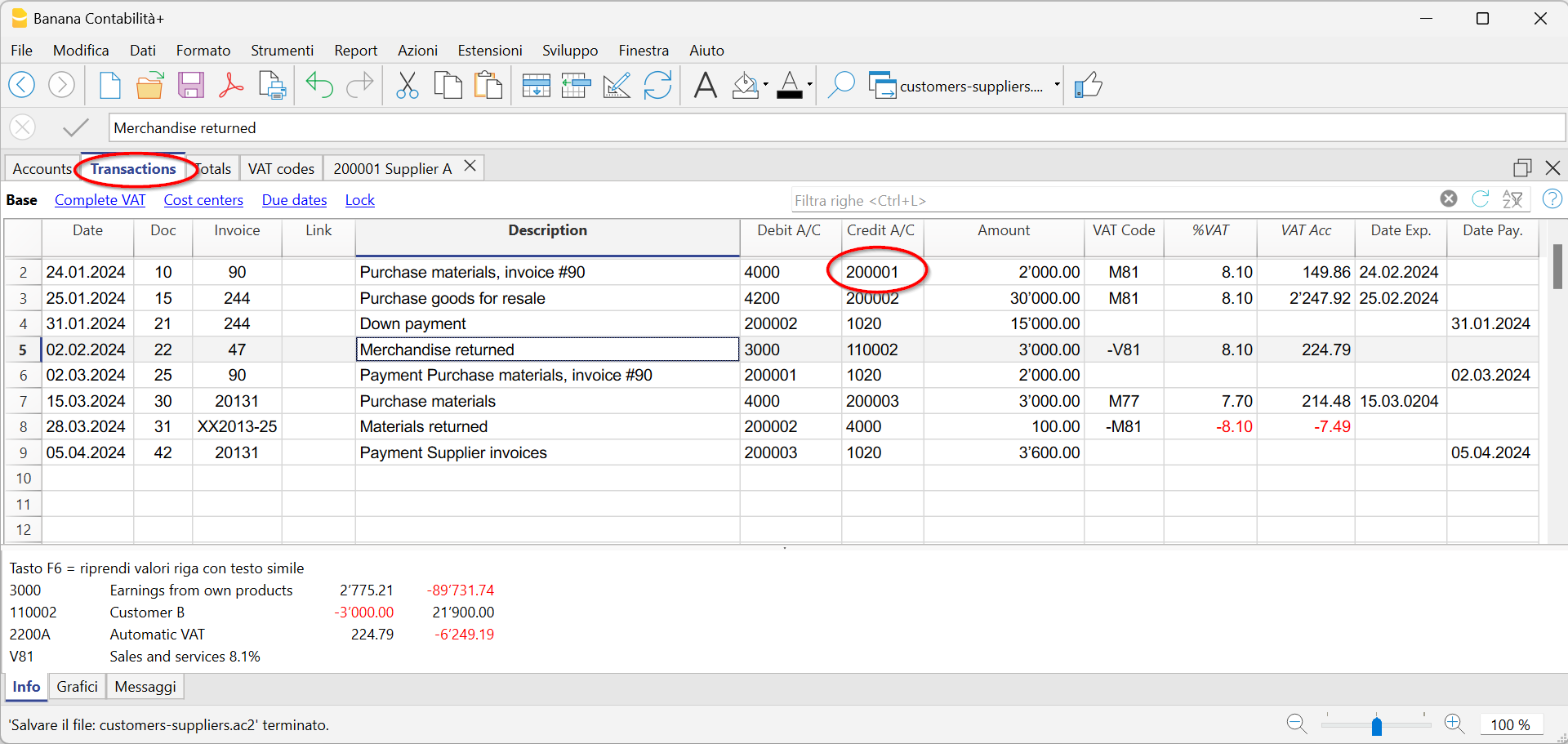

The Transactions table is the heart of Banana Accounting and is used to record all transactions, including customer transactions, simply by entering the customer's account. You work quickly because you can select, copy and paste customer transactions that have already been entered previously. If you make mistakes you can correct them so it is easy to record:

There are columns for entering various information, as:

- The date of the transaction, due date, expectation date and payment date.

- The Invoice Number.

- The Debit and Credit Account where to indicate the customer account and the counterpart.

- The amount.

- The VAT codes for the automatic calculation of VAT.

- Links to digital documents (e.g. the invoice issued to the customer, or notes in pdf).

Customer accounts

Customer accounts are used to record all transactions relating to the customers of a company.

The main functions of customer accounts are as follows:

- Create an account for each customer and keep track of all transactions made.

- Record the invoices issued for each customer.

- Record customer payments and associate them with the invoices issued.

In Banana Accounting:

- Customer accounts and addresses (first name, surname, company name, address, customer language, VAT number, etc.) are set up in the Accounts table.

- Account movements on the accounts are entered in the Transactions table.

- After each entry, all customer account balances (Accounts table) are automatically updated and you immediately have an overview of the outstanding balances.

Recording issued invoices

The invoice is used for accounting and tax purposes, as it allows you to accurately record the company's revenues and expenses, and to calculate sales or purchase tax.

If you issue invoices in Word, Excel or other programs, you can record the issuance in accounting so that you know what the customer owes and, if necessary, send reminders.

In Banana Accounting, the invoices are recorded in the Transactions table:

- By entering the date and description

- By entering an invoice number

- By recording in the Debit account the customer's account and in the Credit account the revenue

- By entering the VAT code for sales or services. The calculations and VAT amounts are entered automatically.

When the invoice is posted, the programme automatically creates the invoice and prints it out.

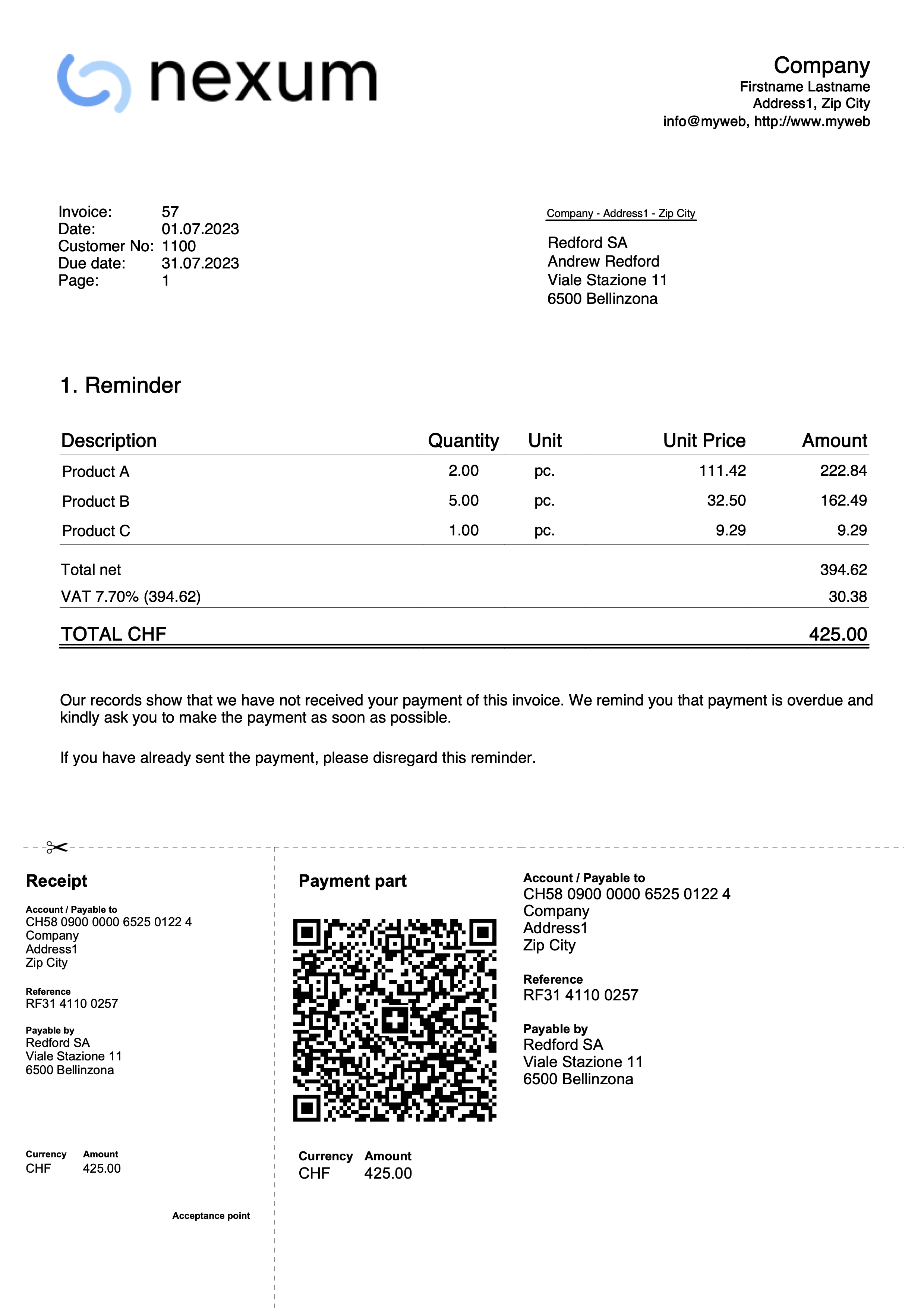

Creating and printing invoices

Directly in the Transactions table, you can also enter transactions to create invoices as simple entries in the Transactions table.

By entering the Debit and Credit account, in addition to printing the invoice, you have the accounting of the invoice in the accounting file at the same time.

From the menu, Reports > Customers > Print Invoices, you can:

- Preview and print the invoice.

- Choose the Print Layout and set other information to customise the printout, such as the QR Code.

More customisation is possible with the Advanced plan.

Recording collections

In Banana Accounting, collections are recorded in the Transactions Table in one of the following ways:

- Manually:

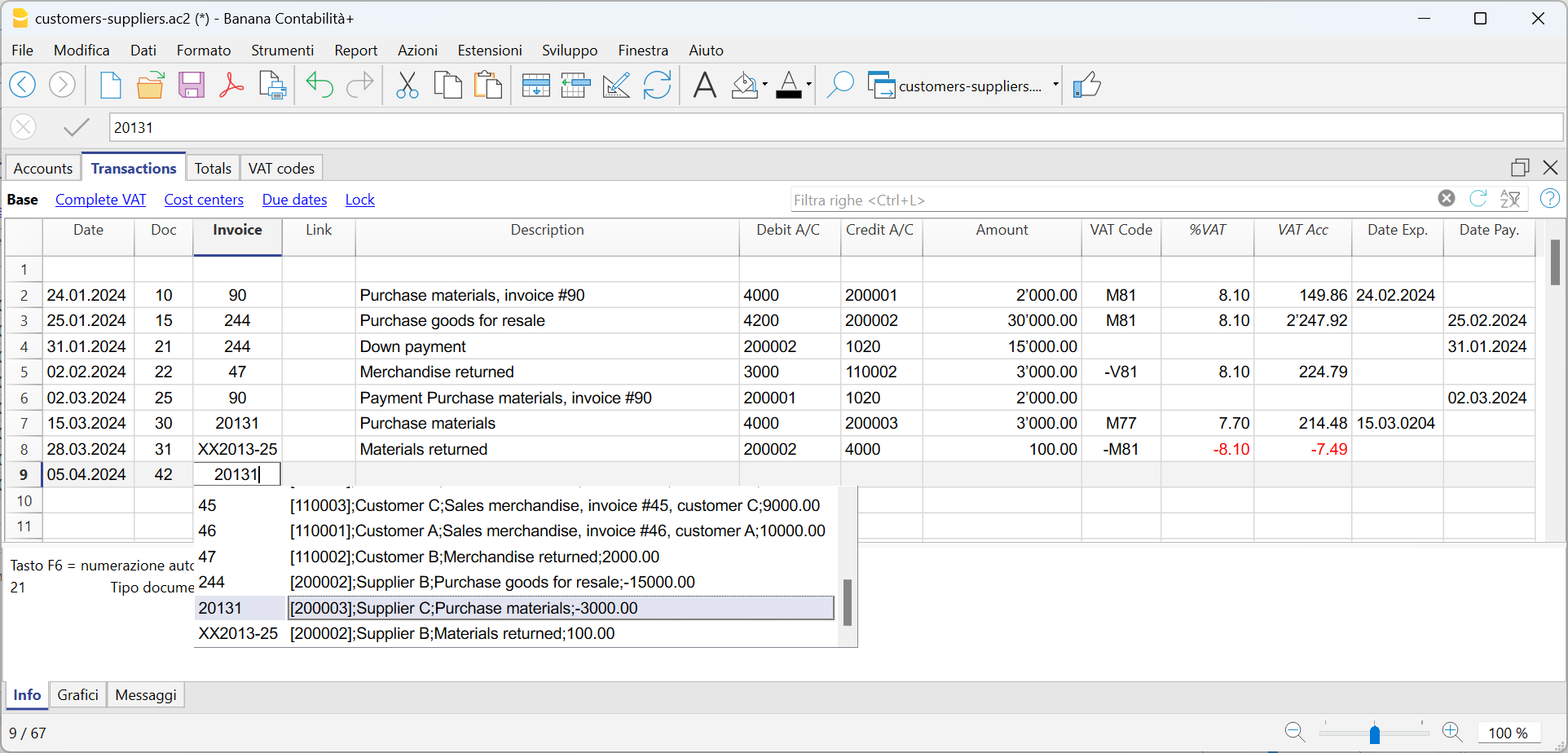

- The date and description are recorded

- In the Invoice column, by entering the customer's account, a drop-down menu displays the invoices still open, simply select the invoice collected and press the Enter key, the program automatically enters the customer's account in Credit, and the amount of the invoice. Then simply enter the cash account in Debit to complete the transaction.

- Importing Data from Account Statements with Rules

- The programme imports data from ISO 20022 account statements and with the use of Rules the programme enters the complete entry, entering all data, without manual intervention.

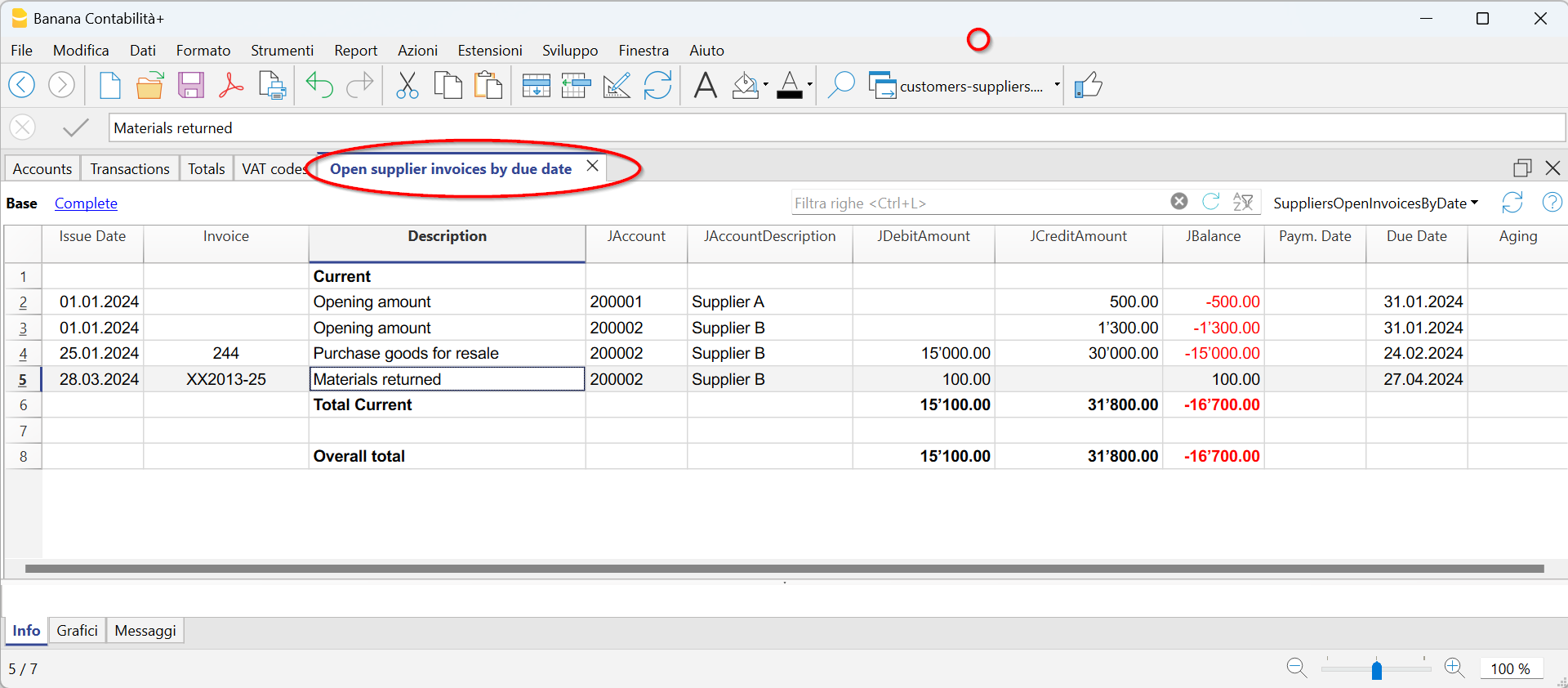

Open invoices

Open invoices per customer are issued invoices that remain open or outstanding because the customer has yet to make full payment.

Open invoices per customer can be managed via an accounting ledger that keeps track of invoices issued, payment due dates and payments received. In this way, the seller can monitor the financial situation of each customer and send payment reminders if invoices remain open for too long.

It is important to note that open invoices per customer can affect the liquidity of the seller's company, as the money tied up in these invoices has not yet been collected.

Banana Accounting automatically generates an open invoice report where you can immediately see which invoices are still outstanding and from which customer, as well as the total amount of outstanding invoices.

There are two types of reports:

- Open invoices by customer, where all open invoices for each customer are listed.

- Open invoices by due date, where open invoices are listed in order of due date.

The due date of an invoice can be set in different ways. More information can be found on the following page Due dates and payment terms

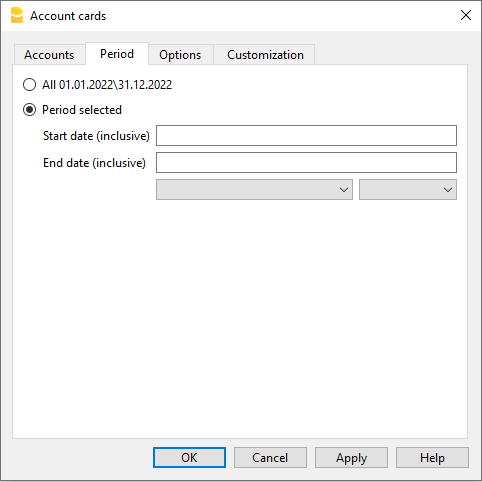

Account card

Account cards are documents used in accounting that record the financial transactions of a company. Each card represents a specific account in the company's general ledger and contains detailed information on the transactions involving that account, such as the date of the financial transaction, the type of transaction, the amount and the description of the transaction.

In Banana accounting, on the basis of the data entered in the Transactions table, the programme automatically prepares the Account card for each customer, where the opening balance, all transactions and relative closing balance are shown. You can also have the account card by period.

Reminders

Payment reminders are used to request customers to pay overdue or outstanding invoices.

Through the function of payment reminders you speed up the payment process from customers, reducing delays, and at the same time effectively manage cash flow.

Banana Accounting provides functions to:

- Identify overdue or outstanding invoices.

- Generate payment reminders.

- Customise payment reminders.

In Banana Accounting Plus you can print recalls in two different ways:

- With Reminder layouts

- Print reminder summary (list of overdue invoices).

- Print without QR payment slip.

- Limited customisations.

- Function available in Banana Accounting Plus - any plan (excluding Free plan limitations).

- With Invoice layout

- Print with QR payment slip.

- Layout customisations.

- Requires Banana Accounting Plus Dev-Channel version and Advanced plan.

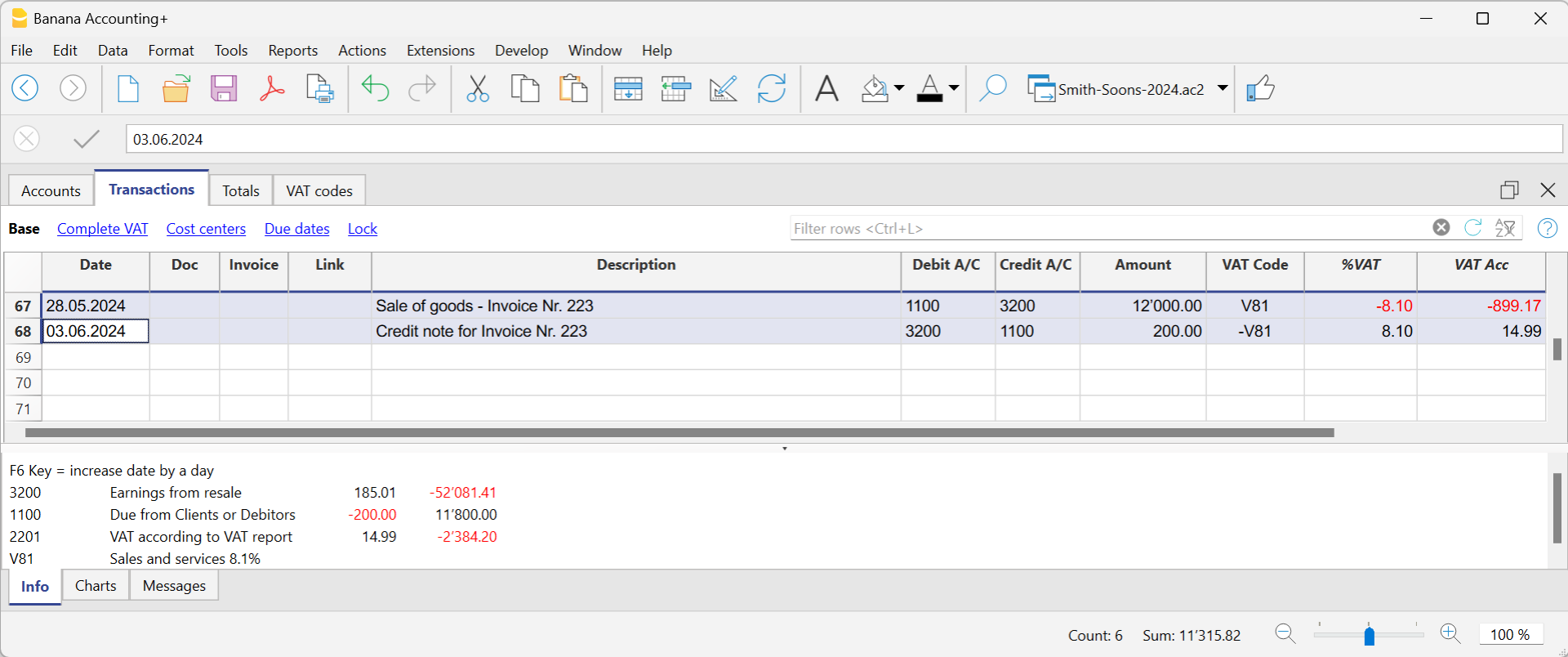

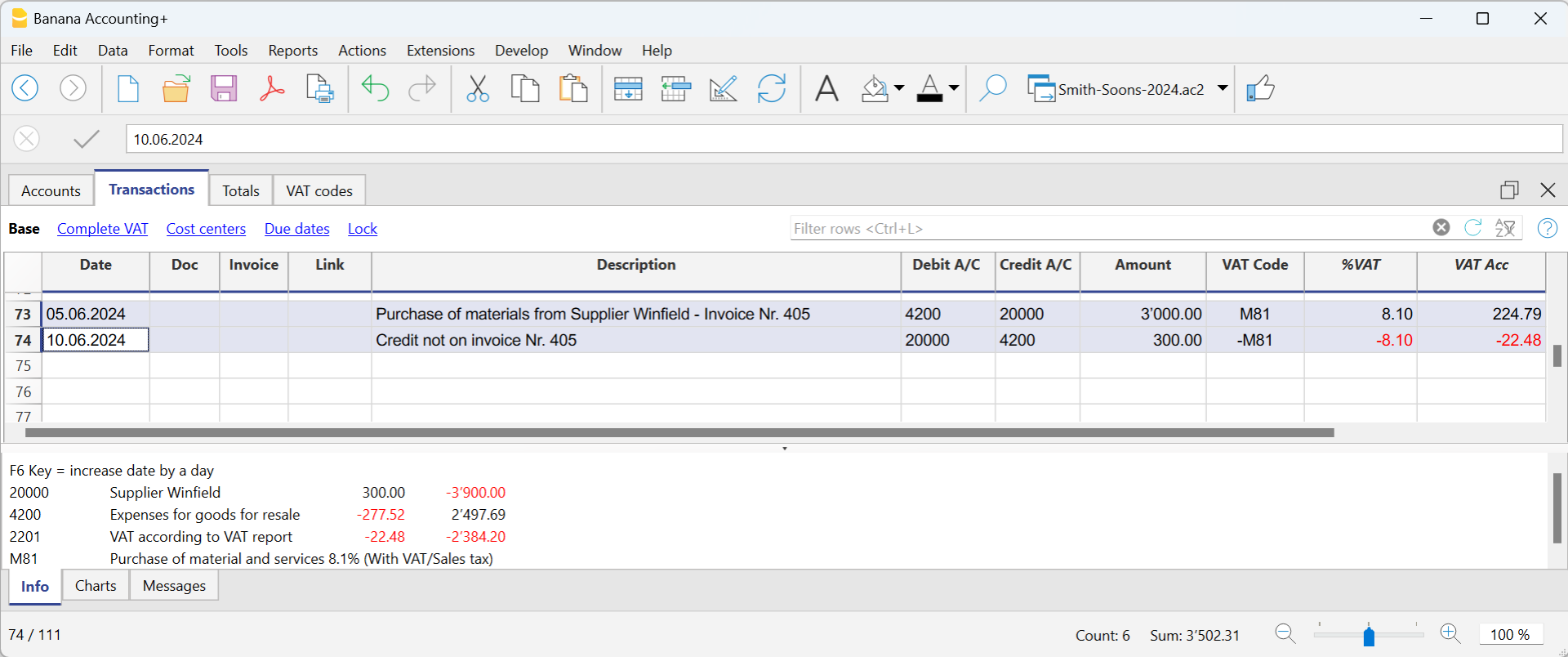

Credit notes

A credit note is an accounting document used to correct or cancel an invoice already issued. It may be issued for a number of reasons:

- Reimbursement of an overpayment

- Reduction in the price of a product or service

- Product return

- Correction of an invoicing error

In Banana Accounting you account for credit notes in the Transactions table, entering the revenue account in the Debit account and the customer account in the Credit account; the VAT code must be entered with a minus sign in front, so that the VAT amount is reversed at the same time.

The programme uses the accounting entry of the credit note to automatically create a printout of the credit note.

Setting up and using the customers and invoices features

- Setting up accounting on actual bills issued (accrual principal) or

- Setting up accounting on a collected cash basis.

- Setting up Customers settings.

- Setting up the Transactions table and entering the invoices.

- Reports for open, overdue and issued invoices.

- Generating invoices.

Notes

- Multi-currency accounts: reports are based on the customer's account currency balances; possible exchange rate differences will not be taken into account.

In the Issued invoices table, the recordings of exchange rate differences are also listed, whereas only the customer's currency amount is used in other printouts.

Example file

Customers' register and checking of open invoices

Directly in the accounting you can:

- Prepare customers' accounts, with the related addresses and other customers' data.

- Add to the transactions:

- the data related to the issued invoices (invoice number, customer, amount, due date).

- the data related to the payment for the invoices and the issuing of credit notes, if any.

- Retrieve the list of your Payments schedule

Other features available:

Addresses | Customers / Suppliers register | Members

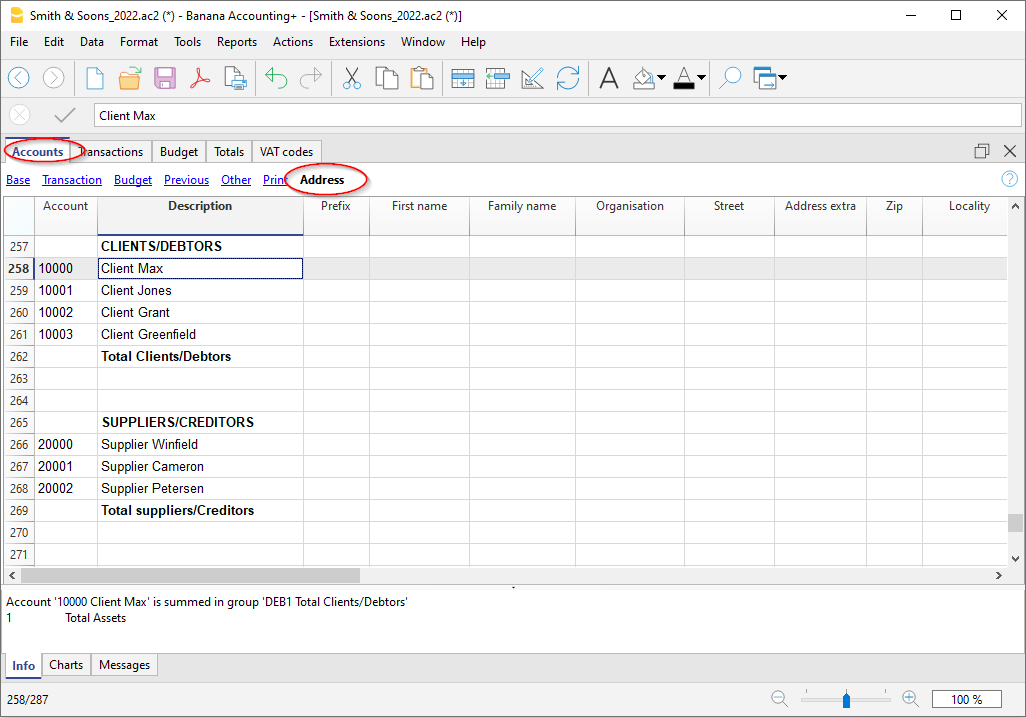

In the Addresses view of the Accounts table, there are columns to manage the addresses of customers, suppliers or members.

Address data are essential in order to manage billing, reminders and to control receipts and payments.

If columns for managing address data are missing in the Accounts table, you can add them:

If IBAN column is missing, your accounting file has an old configuration and you need to convert it with the command Tools > Convert to new file...

In the Accounts table the command will add:

- The Address view which displays columns for entering address data.

To change the display or arrangement of the columns use the Setup columns command.

The columns of the Address view

Prefix

Insert courtesy code (Mr., Mrs., Doctor or other).

First name

The name of the customer, supplier or member.

Family name

The name of the customer, supplier or member.

Organization

Enter the name of the company, of the association.

Street

The street where the customer, supplier or member resides.

Address extra

Column to enter other address data, such as the post office box, or to enter a very large address.

Postal Code /ZIP

The postal/ZIP code.

Locality

The name of the city of the customer, supplier or member.

Country

The nation inherent in the city.

Country Code

The country code.

Language

You can define the language for each customer, supplier or member account. This allows you to view and print the documents (eg invoice) in their language.

Indicate:

- de - for German

- fr - for French

- it - for Italian

- en - for English

- es - for Spanish

- nl - for Dutch

- zh - for Chinese

- pt - for Portuguese

- ru - for Russian

Main phone

Landline phone number

Mobile

Mobile phone number

Fax

Fax number

Email work

email address.

www

website address of the customer, supplier, association.

Birth

The date of birth of the customer, supplier, association.

Days

Enter a number of days within which the collection and payment must take place

Limit

If a credit is made, the credit limit is indicated, or the debit limit if it is a supplier.

Bank name

The name of the customer's, supplier's or member's bank.

IBAN

IBAN number of the customer's, supplier's or member's bank.

Bank clearing

The identification code of the customer bank, supplier or member.

The accrual method management

Introduction

Banana Accounting allows you to manage the customers both on an accrual or cash method. A detailed explanation is available at the page Accounting with accrual or cash method.

The following explains how to set up separate accounts for each customer and a group for customers, so that you can have a list of separate invoices per customer available.

In case you only have few invoices and don't want to keep a detail per customer, you may also keep one single account only to record all customer invoices. The list of invoices will thus apply for all customers and not for any single customer.

Setting up the Customers' register

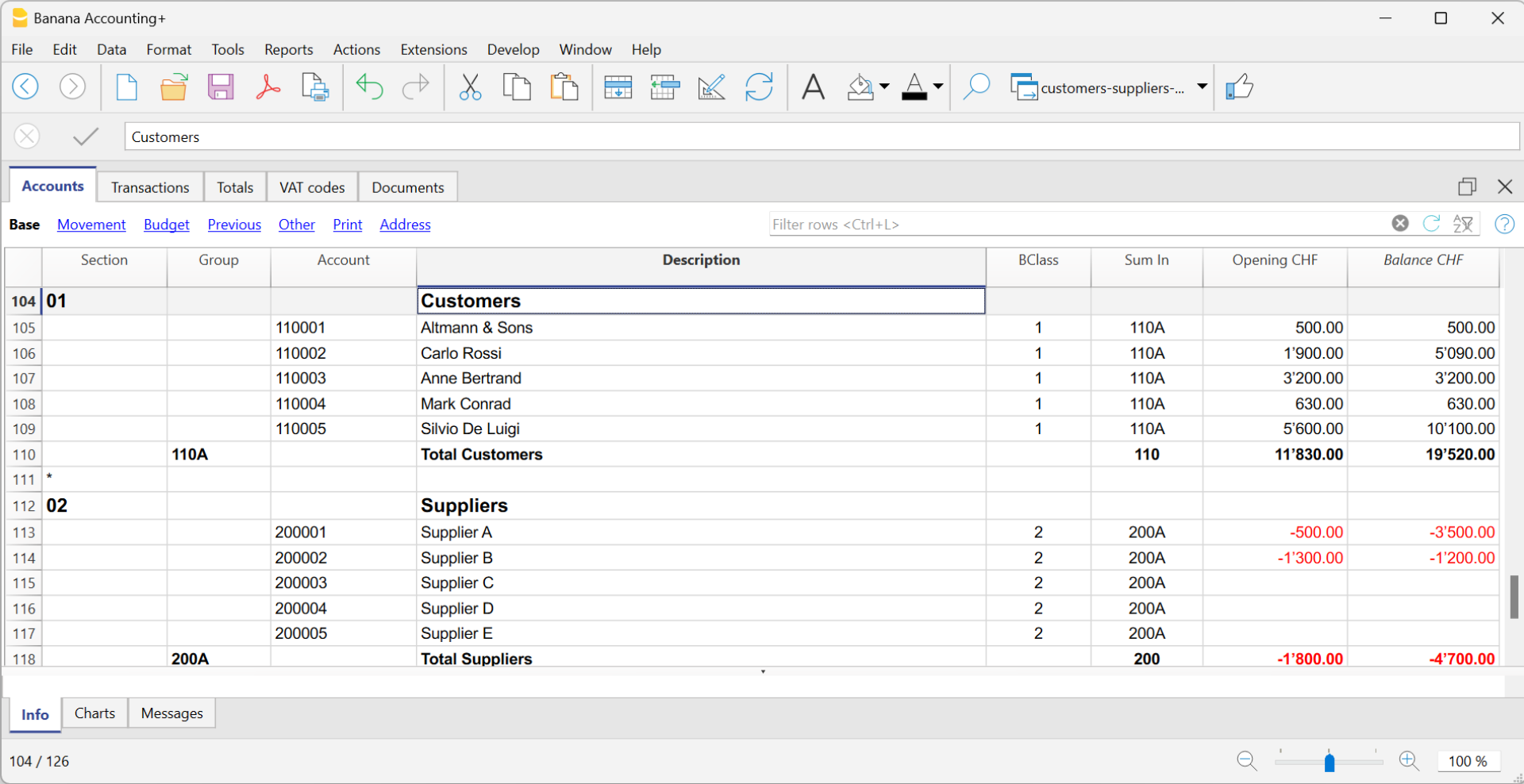

The customer ledger with its accounts and/or groups is inserted at the end of the chart of accounts with a separate section.

The following settings must be added to create the ledger:

- A * section (header) (see Sections)

- A 01 section for the Customers (see Sections)

- The Customers accounts that are required (see Adding a new account). Each customer will be allocated one row in the Chart of Accounts and a his/her single account number. Account numbers is at your discretion (see Accounts) it is however advisable to use numbers only, especially for the management of payments.

- A group where all customer accounts are totaled.

- This group, in turn, is totaled into a group present in the Assets.

Alternatively, customer accounts and/or groups can be entered directly in the assets section.

- The total for Customers will be totaled in the summary group 110A of the Sum in column.

- The same code or number used in the Sum in column (110A), must be used in the Assets Group column, in the row corresponding to the Total Customers of the Balance Sheet.

- The groups' numbering can be freely chosen (see Groups).

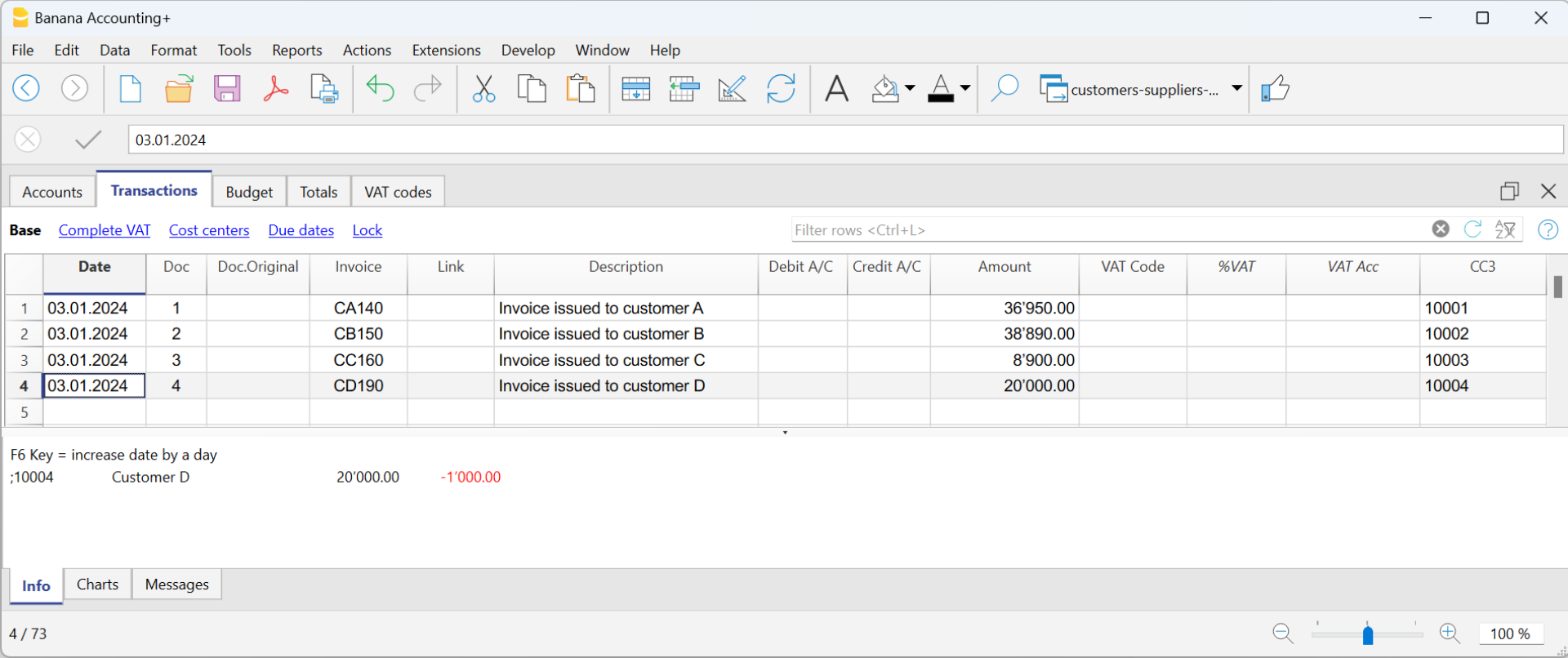

Recording an issued invoice

The issued invoice is registered by entering the following data in the respective columns:

- Date of the invoice and any document number

- Invoice number - It is very important to enter the invoice number in the Invoice column, because it is used to automate the various customer reports and to automatically close the customer's open invoice when recording the payment.

- Customer account in Debit and Revenue account in Credit

- The VAT code corresponding to the sale.

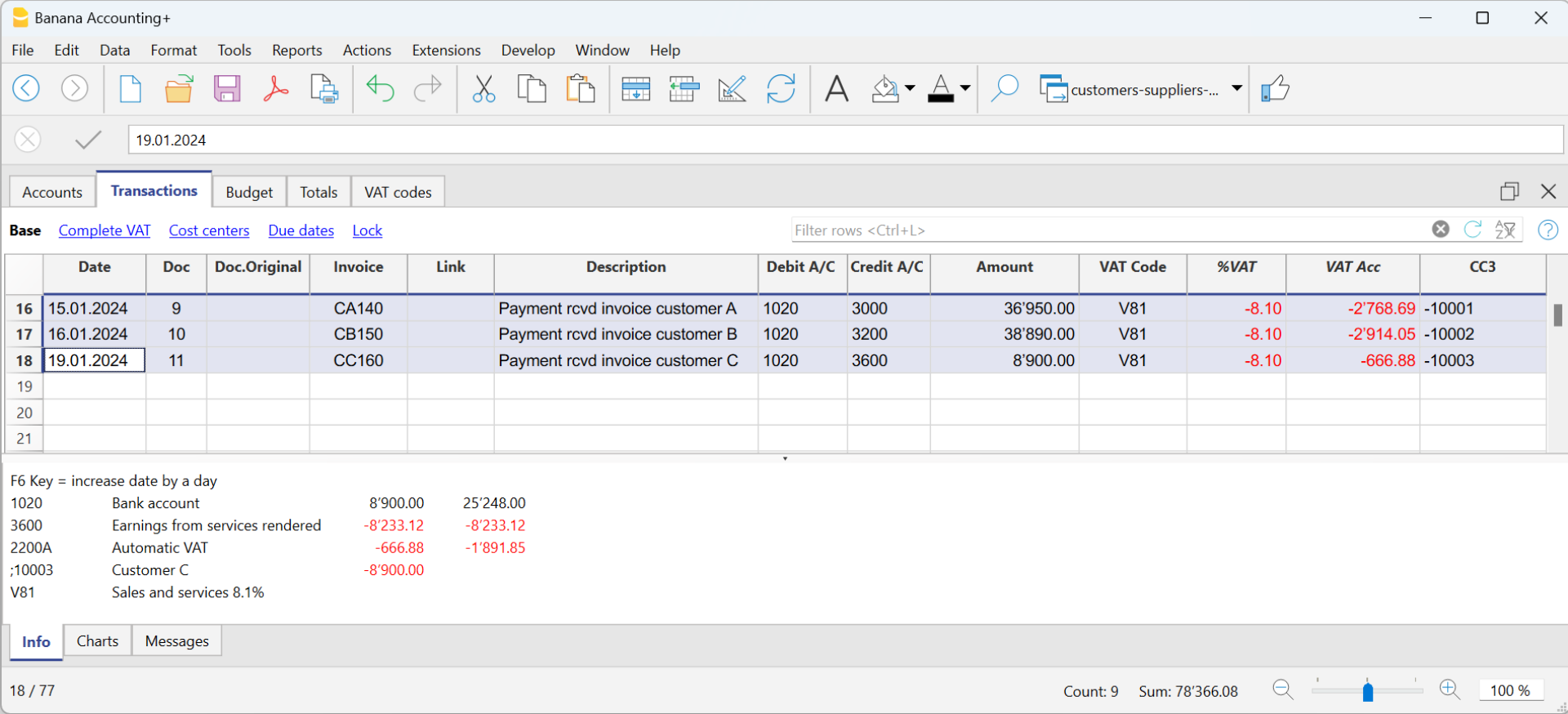

Recording a payment

There are two ways to record the collection of a customer invoice:

- Manual recording of customer invoice collection.

- Automatic recording with data import from account statement in ISO 20022 format.

The collection of a customer invoice is recorded by entering the following data in the respective columns:

- In the Date column enter the transaction date

- In the Type column enter 11 (customer payment)

Note: If an advance payment is to be recorded by the customer and is to appear on the invoice, the cell in the Type column must remain empty. - In the Invoice column enter the paid invoice number.

- With a double-click on the cell, the program will show a list of all open invoices.

Alternatively, you may also press the F2 button. If the F2 button doesn't work, you need to activate your customers/suppliers settings, by entering your customers register group, via the Reports menu → Customers → Settings. - Select the number of the paid invoice. The program will automatically enter:

- In the Description column, the payment description

- In the the Credit account column, the customer account number

- In the Amount column, the invoice amount.

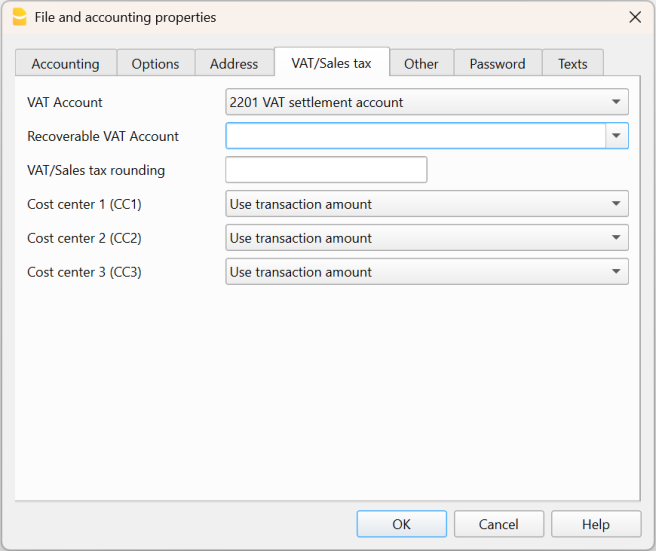

If the entered amount does not include VAT and the customers are set up as cost centers, you must configure the cost centers correctly to use the amount with VAT in File and accounting properties (basic data), VAT/Sales tax tab. See also VAT amount with cost and profit centers.

- With a double-click on the cell, the program will show a list of all open invoices.

- In the Debit column, you must manually enter the conra account (the bank account where the amount has been credited).

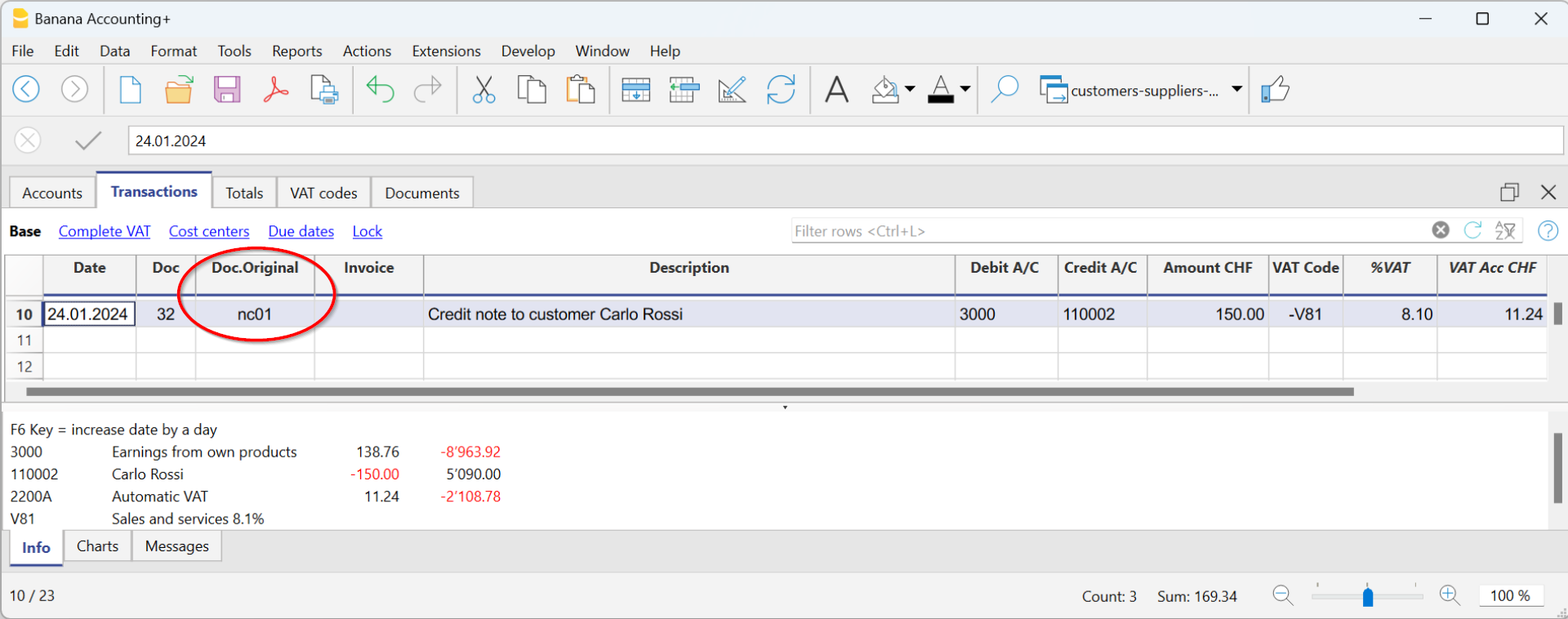

Recording a credit note

In order for the amount to be deducted from the initial invoice, the same invoice number must be used.

- If the adjustment document (for example a credit note) has a different numbering that you still need to keep available, write this reference in another column, for example Doc Original.

- Enter data for the columns Date, Doc., Original Doc, Description

- The VAT Code must be preceded by the minus sign "-" so that the VAT operation is reversed, or use a specific VAT Code for debit notes (set in the VAT Codes table).

Note: to print the credit note to be sent to the customer, it is necessary to indicate in the DocType: 12 column, see Entering a credit note.

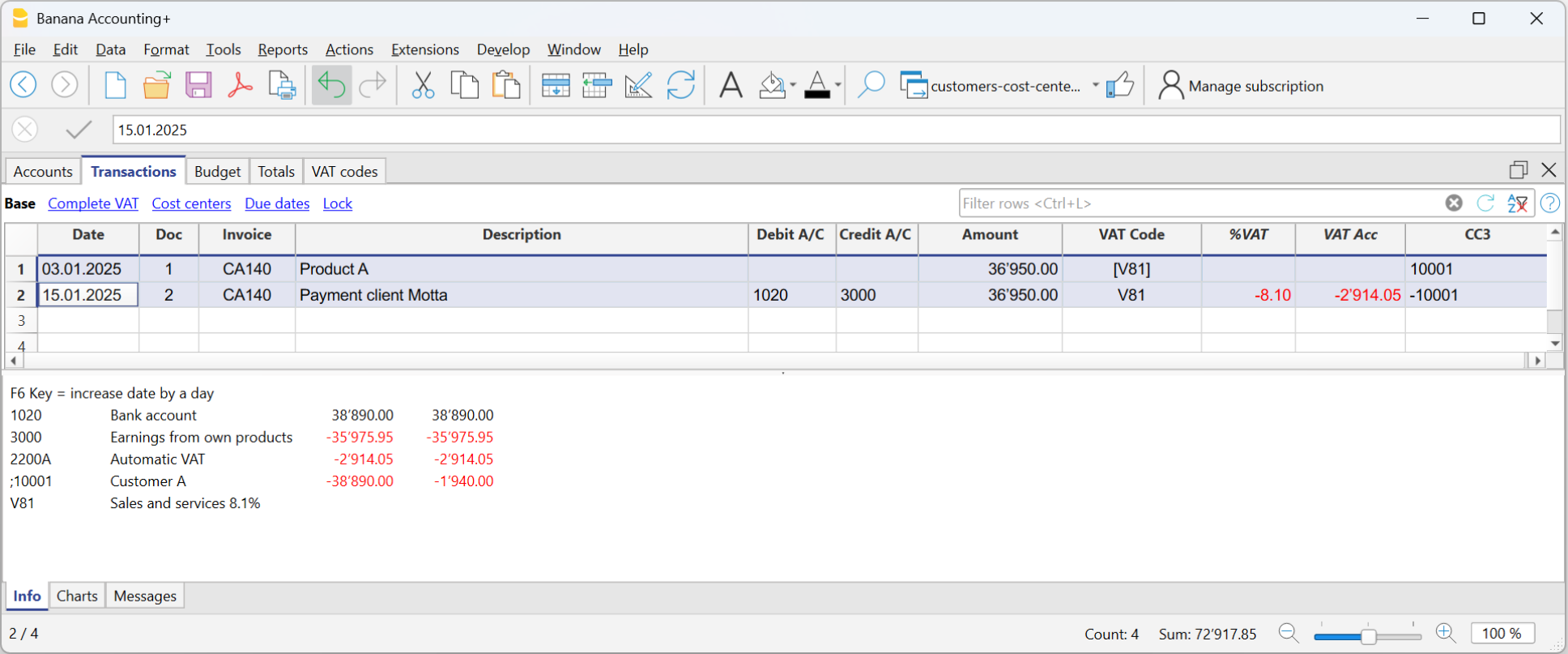

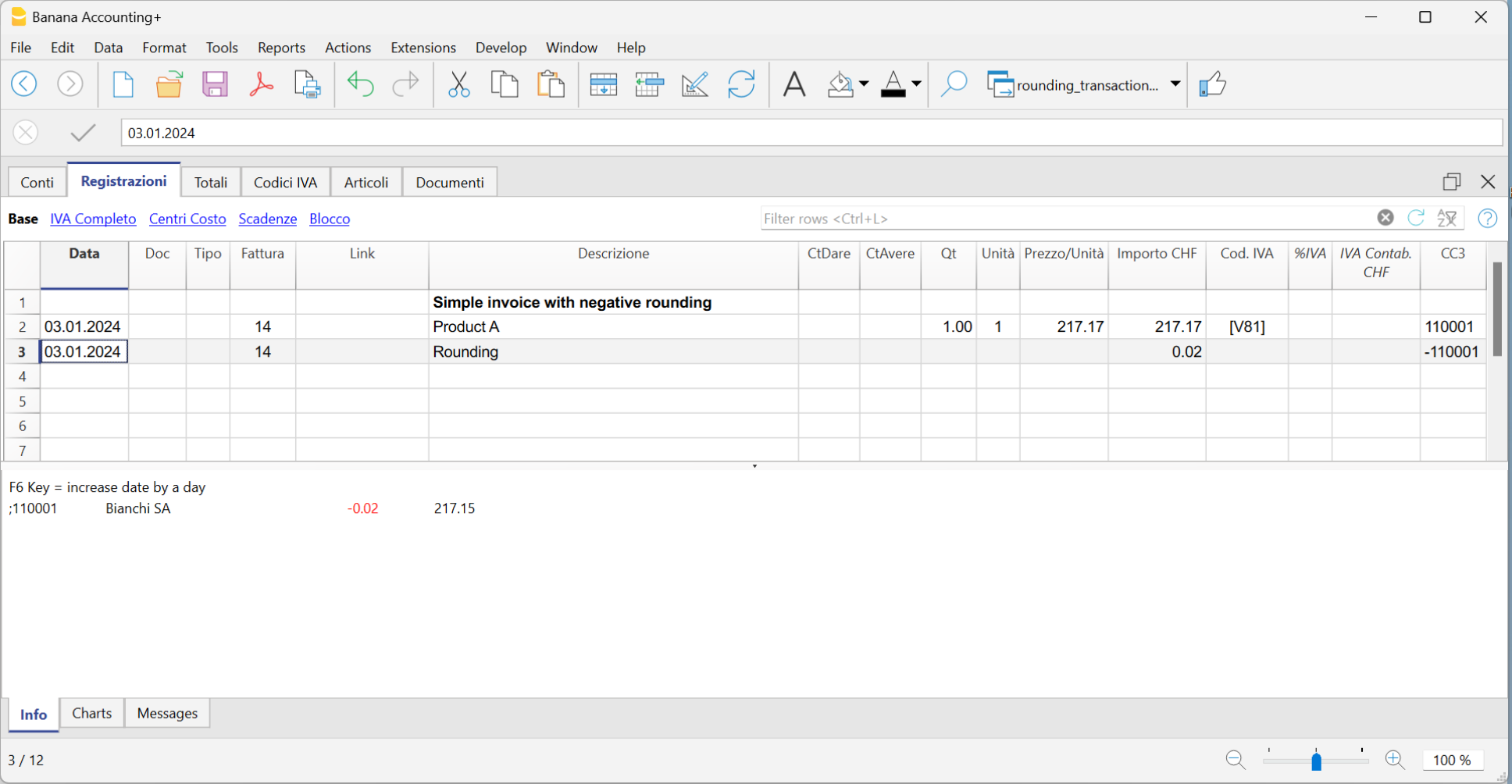

The cash method management

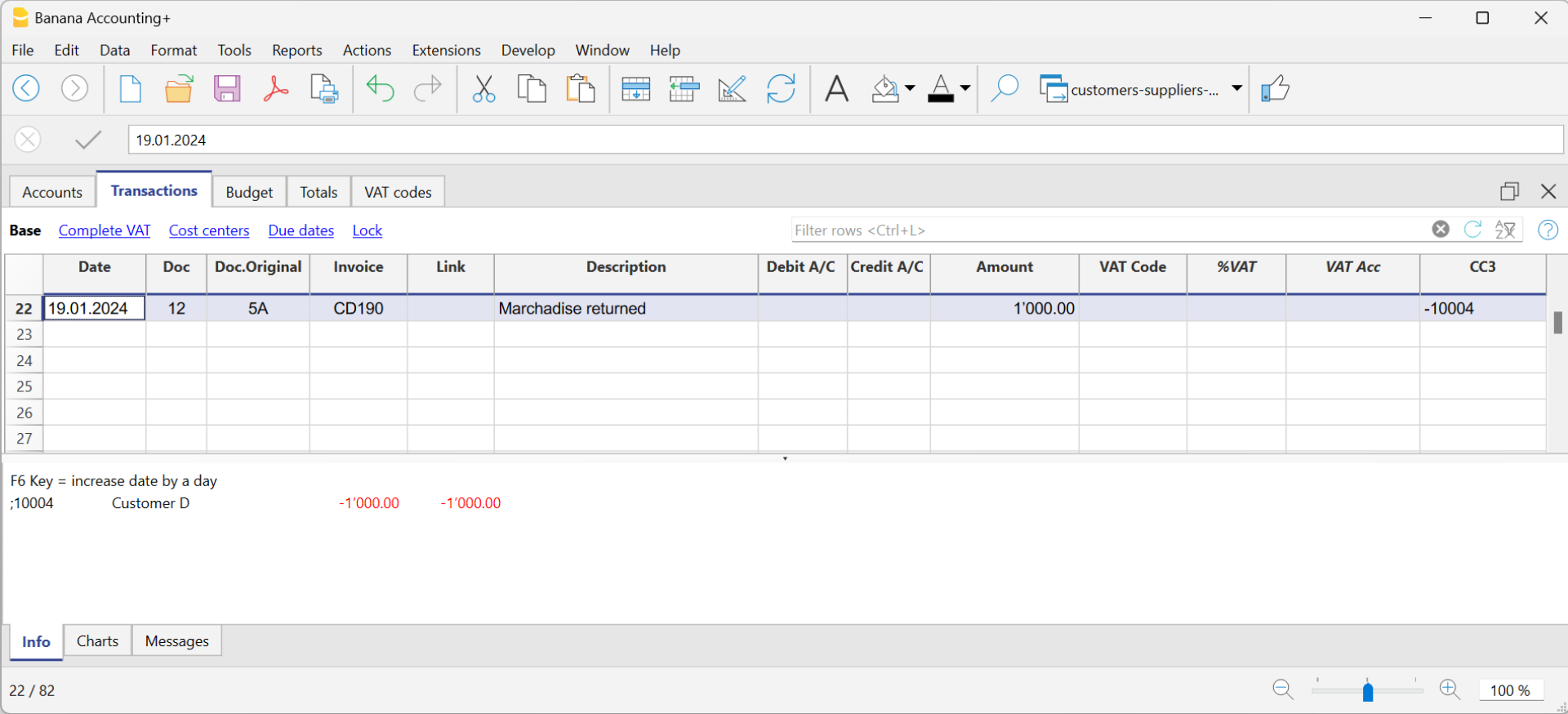

It is possible to manage the customers/suppliers register, even when using the cash method, as with the Cost and Profit Centers.

- We advise you to use the CC3 cost center (where the accounts are preceded by a semi-colon ";") to set up the customer and supplier register

- Set up the customers group via Reports → Customers → Settings.

For all Swiss users who manage the VAT on cash received, this setup is the best to manage the VAT. This setting allows to manage VAT optimally and to know the details for customers and suppliers.

By using this setup, the cost center balances for customers and suppliers will not appear in the Balance Sheet, but you will have all data and reports for internal purposes.

How to record when issuing an invoice

When you issue an invoice, record it as follows:

- In the Date column, enter the date of the invoice.

- In the Doc column, enter the document number if available.

- In the Invoice column, enter the invoice number.

- In the Description column, enter a description.

- In the Debit, Credit and VAT Code columns, do not enter any data.

- In the Amount column, insert the gross amount without any VAT code.

The VAT code in the case of cash management is recorded when the invoice is collected. - In the CC3 column, insert the CC3 account of the client without the ";" (ex. 10004).

How to record when an invoice is paid

When you collect an invoice, record it as follows:

- In the Date column, enter the date the invoice was collected.

- In the Doc column, enter the document number if available.

- In the Invoice column, enter the invoice number collected.

- In the Description column, enter a description.

- In the Debit column, enter the bank account (or other cash account).

- In the Credit column, enter the revenue account corresponding to the invoice.

- In the Amount column, enter the gross amount.

- In the VAT Code column, enter the VAT code of the invoiced sales or service.

- In the CC3 column, enter the customer's CC3 account without the ";", with the minus sign "-" in front of the account (e.g. -10004).

In Integrated invoicing with Income/Expense accounting, with a customer ledger configured with profit centres, the option Record (+/-) cost centres as category should not be activated, as the account and category are not indicated when the invoice is issued.

More information can be found on page Clients and suppliers with VAT, using the Cash method.

How to record a credit note with cash method

For the amount to be deducted from the initial invoice, the same invoice number must be used.

- If the adjusting document (e.g. a credit note) has a different number, which you must still keep, write this reference in another column, e.g. Doc. Original

- Enter the data for the Date, Original Document, Description columns

- Leave the Debit and Credit columns blank

- Enter the amount and in column CC3, enter the customer's cost centre with a - sign.

N.B: In order to print the credit note to be sent to the customer, you must indicate in the column TypeDoc: 12, see Credit notes.

Customers' settings

To activate the options in the Customers menu, you need to set the customer group via the menu Reports → Customers → Settings menu.

The functions related to customers are explained below, but also apply to those of suppliers (Reports → Suppliers → Settings). the dialogues that follow are identical for both customer and supplier functionalities.

Without the indication of the group in the settings of the Customers menu, all functions are disabled.

General

Group or account

Select the generic group or account that contains the Customers or Suppliers list. The group or the account needs to be already present in the Accounts table.

For further details on customers or suppliers settings see:

- Setting up the Customers' register and Setting up the Suppliers' register (accrual method).

- Setting up the Customers' register and Setting up the Suppliers' register (cash method).

Due date invoices (in days)

The program uses the following order of priority to calculate the invoice deadline:

- The due date if you entered it in the transaction row.

If there are several dates for the same invoice number, the program takes into consideration the most recent one. - If the number of days is indicated in the PaymentTermInDays column of the Accounts table, the transaction date is incremented by the number of days set.

- The date of the transaction is incremented by the days indicated in the settings dialog box.

Include transactions from previous (years)

- If 0, the program will not display invoices from the previous year, but only the opening balances of the customer account.

- If 1, the program will also include the invoices of the previous year in the customer card.

- If 2 or more, the program will also include invoices from years before in the customer card.

Advanced

Link to the invoice document

You can save invoices (pdf, doc or other) and insert the link in the Link to invoice document cell. In the Transactions table, Invoice column, the program will open the document if the invoice number is indicated, allowing access to the content.

The link may contain:

- The XML name <DocInvoice> or the name of another column contained between <>.

If you use the "<DocInvoice>.pdf" command and you are on the row with invoice number 100, the program will try to open the "100.pdf" file. You can also prefix the filename with the name of a directory. - Any file name extension can be used. This extension must, however, be included in the list of file extensions considered safe (Tools- Program options-Advanced).

- It is also possible to indicate a path preceding the field name, that contains the name of the document to be opened.

- With the "c:\temp\<DocInvoice>.pdf" link and the invoice number 100, the program proceeds to open the file c:\temp\100.pdf.

- The name of the directory is relative to the directory where the file is located.

Alternative text for payment auto-completion (Payment %1)

The entry of a payment for an invoice can be facilitated by the auto-completion of the payment, which can be activated via the F2 key in the Invoice field of the Entries table.

The auto-completion completes the entry columns such as invoice number, description, amount, accounts. In the Description column, it is possible to edit the text 'Payment' followed by the description of the first line of the invoice (%1), indicating the desired text.

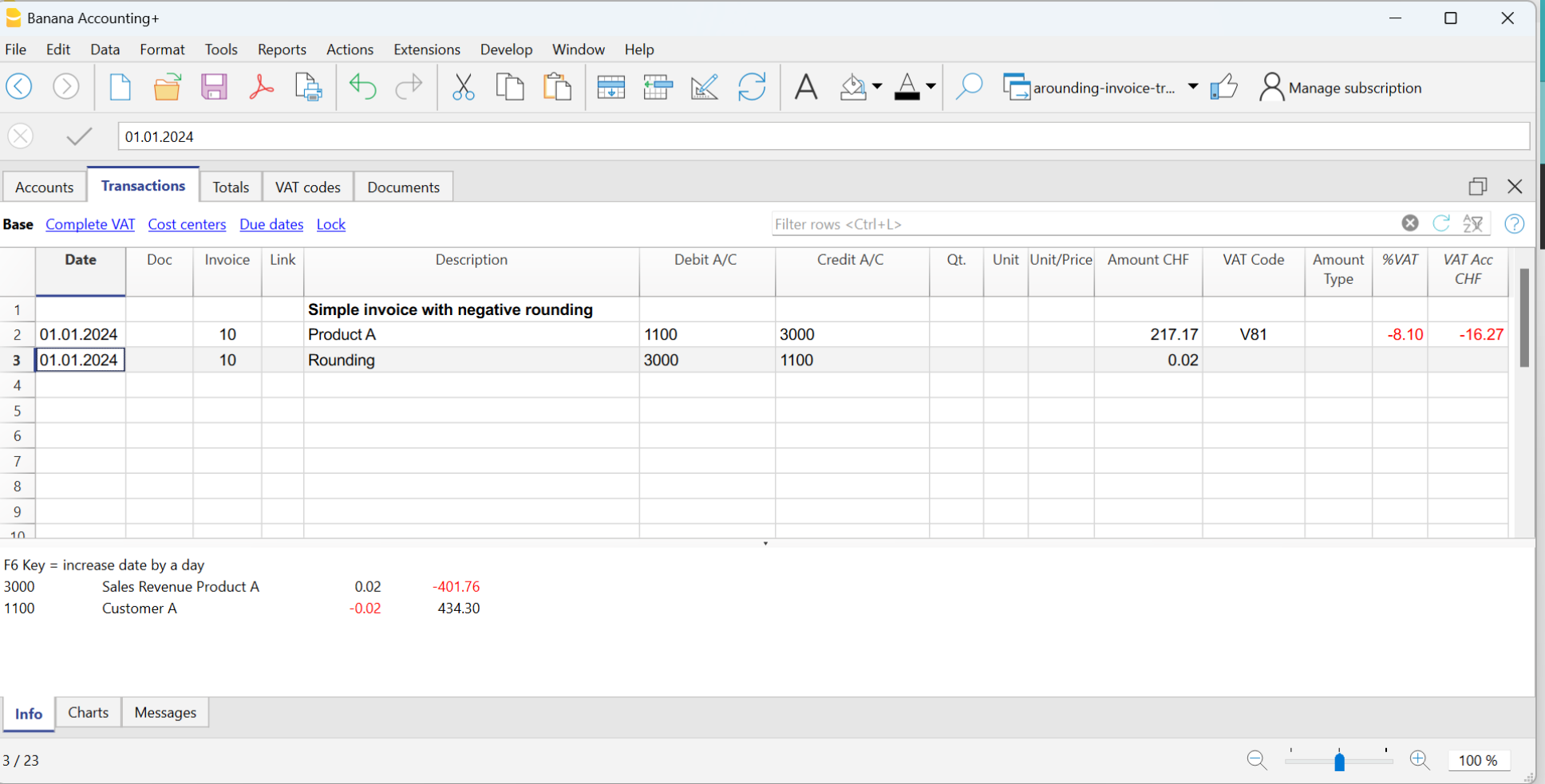

Invoice rounding (base currency)

Indicate the minimum amount for rounding the invoice total. For example:

0.01 rounds the invoice total to the nearest cent, 0.10 rounds to the nearest 10 cents.

If the field is empty, the invoice total in CHF is rounded to the nearest 5 cents, for other currencies rounding is to the nearest cent.

Disable auto-completion of invoice data

This option is usually deactivated when there are many entries in the accounts and the data entry is slowed down by the display of the list of open invoices in the Invoice field of the Entries table.

Disable automatic compensation of open invoices with opening balances

Automatic compensation (or settlement) refers to the process where the opening balance of the account is used to offset open invoices. When the opening balance can fully cover the amounts in the transaction table, the invoices are considered paid, and their status will be marked as "paidOpening." If the opening balance is insufficient to cover the invoices, they will remain open.

Disabling this function means that the system will no longer use the opening balance to offset open invoices. As a result, the opening balance will be displayed separately from the invoices in the invoice list.

If you wish to offset an invoice with the opening balance, regardless of the 'Disable automatic compensation' option, simply enter 'openBalance' in the invoice number field.

Opening an invoice document

- Position yourself in the Invoice column of the transaction row related to the invoice you wish to open

- Open the context menu with the right mouse button

- Select the Open Invoice Link command.

Miscellaneous operations

Below we will explain some very important features and settings to best manage your customers, to speed up the work and get the reports correctly.

- Displaying the Invoice column in the Transactions table

- Auto-complete of invoice data

- Extract invoice rows and Open invoice link commands

- Activating the Address columns (optional)

- Setting up the expiration date for invoices

- Setting up the Customers' parameters

Displaying the Invoice column in the Transactions table

If the Invoice column is not displayed in the Transactions table, it can be activated via the Data Menu → Columns setup → Invoice Doc column.

It is very important to enter the invoice number for various program automatism that concern the processing of the various reports and the closing of the amount in the customer card when the invoice is collected.

Access the invoice saved in pdf format by clicking on the cell in the Invoice column.

Auto-complete of invoice data

When a payment is being recorded or an issued invoice is being corrected, the program offers suggestions to complete the transaction automatically. Proceed as follows:

- Create a new transaction row and add the date and the eventual document number.

- Press the F2 key in the Invoice column :

- The list of still open invoices will appear. If you type an invoice number or a customer number, the list will be filtered according to the entered text.

- Select the invoice you want from the list and press Enter. The program will automatically complete the registration with the description, the debit or credit account and the amount. The data can of course also be changed manually.

- In addition to the date, it is also possible to indicate the customer account before pressing F2 to display the list of open invoices, in this case the list will be filtered with the customer account present in the transaction row.

Note

The list displayed in the Invoice column includes both the Customers' and Suppliers' invoices. A supplier's invoice may have the same number as the invoice of another supplier, because the criterion for display takes into consideration the invoice number besides the Supplier's account number.

Extract invoice rows and Open invoice link commands

The Extract invoice rows command displays the transactions for the selected invoice.

The command is available by clicking on the small blue icon at the upper right corner of the cell or with the right mouse button.

The Open Invoice link command provides the text, as defined in the Customers' settings (Reports - Customers - Settings - Advanced - Link to the Invoice document).

On the command line, you can also indicate other columns in the table using their XML name.

If the message 'File with extension considered unsafe' appears, add the extension (for example .doc) using the Tools - Program options, Advanced, File extension command.

Activating the Address columns (optional)

It is possible to add some specific columns in the Chart of Accounts, to insert the address and other customers data:

- Choose the Tools → Add new functionalities command from the menu

- Choose the Add addresses columns in the Accounts table command

(If you don't see this option in the list, it means that this function has already been activated).

In the Accounts table, the program will add :

- An Address view, where the added columns are made visible.

- The columns that allow the insertion of the address data and other information.

- To display one or more of these columns, use the Columns setup command from the Data menu.

- To create other views with only selected columns, use the Tables setup command (Data menu).

Select Accounts table, Address view and add the required information to the customers' accounts.

Setting up the expiry date for invoices

To set / modify invoice expiration dates, you may act on three levels, where higher priority is given to the first one. Expiration data will be displayed in the payments schedule and printed out on the invoice document.

1. level - setting the expiry date on an individual invoice

In the row of the Transactions table, where your invoice is entered, you will find an Date Exp. column when using the Due Date view. If a date is set up, it will have priority over dates set up on the 2nd or 3rd level.

2. level - setting the expiry date on an individual customer/supplier account

In order to set up an expiration date on a customer level, for example +20 days after issuance of the invoice, select the account in the Accounts table, using the Address view, go to the Days Column (PaymentTermInDays) to set up the number of days to be used.

3. level - general setup

Expiration dates applying to all Customers/Suppliers can be set up via menu Reports → Customers → Settings.

Setting up the Customers' parameters

- Select the Reports → Customers → Settings command

- Please indicate the group of the Chart of Accounts in which the different customers' accounts are grouped in "Group or account".

- For an explanation of the different options, go to Customers and Suppliers settings.

List of customer invoices

Displaying invoices issued to customers

Reports menu → Customers → Invoices issued to customers...

This dialog box is identical for both Customers and Suppliers functionalities.

The following explains the functions related to customers, but they also apply to suppliers.

All customers

Displays the account statement of all customers belonging to the group, as defined in the Customers and Suppliers settings.

Select a single customer

Displays the account statement for the customer selected belonging to the group defined in the Customers and Suppliers settings.

Displaying open invoices

Command: Reports → Customers → Open invoices by customer

Invoices showing an open balance are being listed in this table.

For multi-currency accounting, if there are unposted exchange rate differences for a particular customer, an 'Adjustment exchange rate differences' line will be displayed that balances the balance in the open invoice list with the balance on the account card.

Displaying overdue invoices

Command: Reports → Customers → Open invoices by due date

In this table, invoices showing an open balance are being listed, filtered by due date.

The due date of an invoice can be set in different ways. More information can be found on the following page: Due dates and payment terms.

Print statements

To view this window, it is necessary to configure customer settings.

Access the printing of the statements via the menu Reports > Customers > Print statements.

It is essential to install the Customer Statement layout for printing the statement. There are two ways:

- From the Extensions menu > Manage extensions select the Customer Statement layout from the list of the extensions and click onto button Install.

- From the menu Reports > Customers > Print statements > More layouts select the Customer statement layout.

Statement date

This is the date printed on the statement. It is not possible to set up a date prior to the date of the last existing transaction.

Layout

The styles allow you to change the print layout.

Export PDF

The programme displays a preview of the extracts, with the Export PDF command you can then create the file containing all extracts or PDFs for each extract.

Print payment reminders

Feature available with Banana Accounting Plus - any plan (excluding Free plan limitations)

The printing of Payment reminders is accessed from the Reports menu > Customers > Print reminders.

The program automatically creates payment reminders from past due invoices.

- In addition to the printouts, the program directly creates the transactions in the Transactions table, which are used to recreate the issued reminders history.

- These transactions show the document date and the document Type: 16-1 first reminder, 16-2 second reminder and 16-3 third reminder.

Use last payment reminders

If in the Transactions table there are reminder transactions with the indicated date, the program will suggest to print these reminders.

Create new payment reminders

For all invoices that have expired, automatic reminder transactions are created in the Transactions table, which allow the printing of reminders.

Payment reminders

The program will show the expired invoices, which you can deactivate if you do not wish to send the reminder.

Template

Two reminder templates are available, one with a logo and one without (see Logo setup) . It is not possible to include the payment slip, insert notes and free texts.If you need the payment slip, use the Print Reminders Invoices dialogue.

Manage extensions

To update the templates with the latest ones or to add your own custom templates go to the Extensions menu.

It allows you to set the parameters of the selected style.

Show expiry dates

Customers & Suppliers Management

In order to automatically manage the invoices issued or received, we advise you to use the Customers Menu and the Suppliers Menu.

Associate an expiry date to a transaction

As an alternative to the customers and suppliers management, or for simpler checking purposes, you can also enter the payment date manually in the transaction row, in the Date Payment column.

This is an operating mode that consents simplified checkup.

With the Data menu → Columns Setup command, you should display the Date Exp. and Date Pay columns.

You should then enter the invoice expiration date in the Date Exp. column, and the invoice payment date in the Date Pay. column, when the payment is being recorded.

The due date of an invoice can be set in different ways. More information can be found on the following page: Due dates and payment terms.

Show expiry dates

With the Show expiry dates command of the Actions menu, the program displays in the Expiry dates table the transaction rows that have a due date and no payment date.

To obtain an automatic expiration schedule (Customer and Supplier open positions), see the List of customer invoices page.

Invoicing with Banana Accounting

In Banana Accounting Plus, you can create your invoices directly within the accounting file or manage them completely separately using the Estimates and Invoices application.

- Integrated invoicing in accounting

Additional functionality included in all accounting applications (double-entry, income/expense, multi-currency, cash manager). - Estimates and Invoices application

A separate application from all other accounting applications, used only to create offers and invoices without any connection to the accounting file. There is no link to the accounting file.

Below is a summary table for the two methods, detailing what they allow you to do and the customisations available.

Legend: ✅ with Professional or Advanced plan, 🔒 only with Advanced plan, ❌ not available

Features | Integrated Invoicing | Offers and Invoices Application |

| Common Features | ||

| Invoice Creation | ✅Yes, directly in the Transactions table. | ✅Yes, in the dedicated dialog. |

| Proforma Invoice Creation | 🔒 Yes, create the invoice in the Transactions table and print it as a Proforma Invoice (Advanced plan only). | 🔒 Yes, create the invoice in the dialog and print it as a Proforma Invoice (Advanced plan only). |

| Estimates Management | 🔒 No, but an invoice can be created with the "Estimate" label and print it as Estimate (Advanced plan only). | ✅Yes, in the dedicated dialog. |

| Payment Reminders Management | ✅Yes, automated management with the Print Reminders command. | 🔒 No, create the invoice with the "Reminder" label. and print it as a Reminder. (Advanced plan only). |

| Delivery Notes Creation | 🔒 No, only invoice with "Delivery Note" label. From the Invoice Printing dialog > Print as > Delivery Note. (Advanced plan only). | 🔒 No, only invoice with "Delivery Note" label. From the Invoice Printing dialog > Print as > Delivery Note. (Advanced plan only). |

| Order Confirmation Creation | 🔒 No, only invoice with "Order Confirmation" label. From the Invoice Printing dialog > Print as > Order Confirmation. (Advanced plan only). | 🔒 No, only invoice with "Order Confirmation" label and print as Order Confirmation. (Advanced plan only). |

| Header Logo | ✅Yes, with the Logo setup command | ✅Yes, with the Logo setup command |

| Sender Address in Header | ✅Yes, with File and Accounting Properties command. | ✅Yes, with File and Accounting Properties command. |

| Invoice Information | ✅Data of the invoice (invoice number and date, customer number, due date, etc.). | ✅Data of the invoice (invoice number and date, customer number, due date, etc.). Customizable with additional fields. |

| Invoice Address (Customer) | ✅Customer ledger management in the Accounts table, Address view. | ✅Customer address management in the Contacts table. |

| Title / Subject | ✅Yes, customizable via the DocType column in the Transactions table, or in Invoice Settings. | ✅Yes, customizable in the Dialog, or in Invoice Settings. |

| Free Initial Text | ✅Yes, through the DocType column in the Transactions table, or in Invoice Settings. | ✅Yes, in the Dialog, or in Invoice Settings. |

| Default Columns and Column Layout | ✅Columns in the Transactions table and Items ( Items, Description, Quantity, Unit, Unit Price, Amount, VAT Code). Display columns in the printout from Invoice Settings. | ✅Columns in the Dialog (Date, Item, Description, Quantity, Unit, Unit Price, Discount, Amount, VAT Code). Display columns in the printout from Invoice Settings. |

| Custom Columns (Transactions / Items Table) | 🔒 Uses custom columns in the Transactions and Items tables (Advanced plan only). | 🔒 Uses custom columns in the Items table (Advanced plan only). |

| Discounts and Reductions | ✅Yes, add a line to the invoice via accounting transaction | ✅Yes, item discount column and overall discount via Invoice Dialog. |

| Advance Payments | ✅Yes, add a line to the invoice via accounting transaction. | ✅Yes, via Dialog. |

| Notes and Final Text | ✅Yes, from the Dialog Options or Invoice Settings or DocType column | ✅Yes, via Invoice Dialog > Final Text or from Dialog options or from Invoice Settings |

| QR Bill with IBAN Account | ✅Yes, invoices with Swiss QR bill with IBAN account. | ✅Yes, invoices with Swiss QR bill with IBAN account. |

| QR Bill with Special QR-IBAN Account | ✅Yes, invoices with Swiss QR bill with special QR-IBAN account. | ✅Yes, invoices with Swiss QR bill with special QR-IBAN account. |

| Style and Color Customization | ✅Yes, from dialog Invoice Settings > Font type and Colors. | ✅Yes, from dialog Invoice Settings > Font and Colors. |

| CSS Customization | 🔒 Yes, customize invoice styles and appearance via CSS customization (Advanced plan only). | 🔒 Yes, customize invoice styles and appearance via CSS customization (Advanced plan only). |

| JavaScript Customization | 🔒 Yes, set invoice printing via JavaScript customization (Advanced plan only). | 🔒 Yes, set invoice printing via JavaScript customization (Advanced plan only). |

| Product Images | 🔒 Yes, add product or service images to invoices. See Invoice with Product Images (Advanced plan only) | 🔒 Yes, add product or service images to both offers and invoices See Invoice with Product Images. (Advanced plan only). |

| VAT management | ✅ Yes, print invoices with VAT and manage in accounting. | ✅ Yes, only print invoices with VAT |

| Multi currency invoices | ✅ Yes | ✅ Yes |

| Exclusive Features of Integrated Invoicing | ||

| Integrated Data in the Accounting File | ✅Yes, in the Transactions table. | ❌No |

| Revenue Management | ✅Yes, create invoices on revenue with customer subledger in the Balance sheet. | ❌No |

| Cash Basis Accounting Management | ✅Yes, create invoices upon cash method with Customer subledger via profit centers (CC3). | ❌No |

| Reporting | ✅Yes, account card per customer, history, and open invoice reports per customer and due date. | ❌No |

| Payment Reminders Management | ✅Yes, overdue invoice management and reminder printing with the Print Reminders command. | 🔒No, manual management of overdue invoices and reminder printing. (Advanced plan only). |

| Invoice Payment Management | ✅Yes, registration of invoice collection. | ✅No, it is possible to manually track paid invoices using the Payment column in the Invoices table. |

| Exclusive Features of the Estimates and Invoices Application | ||

| Offers Management | 🔒No, create the invoice with the label "Estimate" and print it as an Estimate (Advanced plan only) | ✅Yes, manage Estimates separately from invoices. |

| Offer Conversion | 🔒No, create the invoice with the label "Estimate" and print it as an Estimate (Advanced plan only). | ✅Yes, convert estimates into invoices with a simple command. |

Invoicing integrated in the accounting file

The integrated invoicing feature of Banana Accounting Plus uses the customer invoice recording system directly in the Transactions table. It allows you to create prints, including customizable ones, based on customer transaction records.

You can print both invoices for Switzerland with a QR payment slip and international invoices for other countries, even in foreign currency without a QR payment slip.

Creating invoices

The Transactions table is the heart of Banana Accounting and is also used to issue invoices. Nothing could be simpler: To create an invoice, enter a normal transaction that charges the customer.

Banana Accounting also allows you to create invoices in foreign currency.

The main columns for invoicing:

- Date - Invoice date

- Invoice - The invoice number.

- Description - Description of the item to be invoiced.

If there is more than one item to be invoiced, use another row that has the same customer number. - Debit - Customer account.

- Credit - Profit account.

- Amount - Invoice amount

You can also indicate the quantity, the unit price and the programme calculates the amount. - VAT code- VAT code of the profit

Advantages

With Banana Accounting's integrated invoicing you simplify your administrative work, reducing the time needed to manage invoices, customers and accounting transactions:

- Invoice transactions are always the same for both invoicing and accounting, reducing the possibility of errors and omissions.

- Banana Accounting automatically generates the related accounting documents, such as VAT registers, customer accounts, receipts registers.

- You have a more accurate and real-time view of your customers with constantly updated balances.

- Lots of automation to make your work easy and with immediate professional results:

- Automatic retrieval of addresses from contacts so that the data do not have to be re-entered on the invoice.

- No manual calculations. All calculations are automatic, always accurate and up-to-date.

- Setting of the language, currency, number of decimals and rounding for each individual invoice.

- Deadline display.

- Invoice archiving for a tidy history that is always available for tax audits.

Differences with the Estimates and Invoices application

Integrated invoicing is an additional feature included in all accounting applications: double-entry, Income / Expense, Multicurrency, Cash Manager.

Integrated invoicing is ideal for billing services or sales without the need for many structured details on the invoice.

- The elements and details for invoices (such as quantities, prices, units, etc.) are recorded solely in the Transactions table. In the Estimates and Invoices application, there is a Invoices table with an Invoice Dialog where various columns and options are available to detail the various items and data to be inserted. In this aspect, the Estimates and Invoices application is much more flexible and comprehensive because it allows for greater customization.

- In the Transactions table, in addition to the data for invoicing, by entering the Debit and Credit account, the registration remains accounted for in the accounting file without the need to register the invoice subsequently. This is ideal for managing revenue accounting.

In Estimates and Invoices, the data is not accounted for, so it is necessary to register the invoice in the accounting file. - In integrated invoicing, it's not possible to create offers. However, it is possible to create and print an invoice with the title "Estimate" (instead of "Invoice.")

The Estimates and Invoices application is specific for creating also Estimates.

Items Table

The Items Table allows you to manage the article catalogue, keep track of available quantities, sales and purchase prices.

Data for managing articles or services to be invoiced are entered in this table. Each article is assigned an ID, and groupings of articles and services in the same category can be created.

Various columns are available for complete and detailed information:

- Article (IdArticle): the code of the article.

- Description: the description of the article.

- Group membership

- Account (for accounting)

- VAT code of the sale

- Unit: an abbreviation to define the type to which the quantity refers (pieces, hours...)

- Sale: the unit sales price.

- Purchase cost.

The Items table is linked to the Items columns of the Transactions table.

The use of the Articles table speeds up the entry of invoice data into the Transactions table. By entering the ID (article code), the programme automatically takes over the description, unit and unit price. By entering the Quantity, the total price to be invoiced is calculated and entered.

Print invoice with Swiss QR Bulletin

After entering the invoice data in the Transactions table, you can create and print invoices with the Print Layouts.

From the Menu, Reports > Customers > Print Invoices:

- Choose CH10 Invoice layout with Swiss QR Code for Switzerland

- Customise your printing. More customisation is possible with the Advanced plan.

- Preview the invoice. You can save it as a PDF and send it electronically or print it.

If you use this layout, the bulletin with Swiss QR will be printed on the invoice and the reference data will appear on the statements. You can import customer payment data from the bank with the Bank statement extension Camt ISO 20022 Switzerland (Banana+). You have invoice receipts under control.

It is possible to print the invoice with a QR bulletin even without an amount and without an address, leaving an empty box to manually insert the data. More information is available on the QR-Code Customization page, section Include/Exclude from printing.

With the same registration, from the Print Invoices dialogue box, under Preferences Layout > Print as you can also choose to print Delivery Notes, Offers and Reminders.

Print International Invoices

After entering the invoice data in the Transactions table, you can create and print invoices with the Print Layouts.

From the Menu, Reports > Customers > Print Invoices:

- Choose the Layout 11 programmable Invoice

- Customise your printing. More customisation is possible with the Advanced plan.

- Preview the invoice. You can save it as a PDF and send it electronically or print it.

With the same registration, from the Print Invoices dialogue box, under Preferences Layout > Print as you can also choose to print Delivery Notes, Offers and Reminders.

Invoice Structure

In this image you can see how the invoice is structured:

| LogoInsert a personalized logo from menu file → Logo setup | |||

HeadingThe heading of the invoice will be identical to the one entered | ||||

Customer AddressThe customer's address will be retrieved from Accounts table, see Setting up customer accounts. | ||||

Invoice dataThe contents of the invoice must be entered in the Transactions table, learn how to enter invoices. | ||||

Free textsInsert begin text, notes and greetings using the Column Type, and ending texts from menu Reports→ Clients → Print Invoices → Option layout. | ||||

Settings Swiss QR-CodeSettings can only be defined for Switzerland and with the [CH10] Swiss QR Code layout . |

Customer Management

Customer Management allows you to record, organise and manage customer information, keeping track of customer transactions and payments, payment due dates and contact information. You can track customer payments, update the payment status of issued invoices as well as enter and print invoices.

In Banana Accounting the customer data is set up in the Accounts table.

In order to create invoices, it is necessary to:

- Define the Customer Register

- Create invoices, entering the transactions in the Transactions table, debiting the customer's account.

With a range of functions you can manage the:

- Invoice collections by entering them in the Transactions table:

Creating an invoice from a profit centre

When the customer ledger is set up with profit centres (cash method management), the profit centre column CC3 is used in the invoice transactions.

In the appropriate columns of the Transactions table indicate:

- The date.

- The invoice number.

- The description of the invoice item, which you want to appear on the invoice.

If there is more than one item to be invoiced, use another row with the same customer number. - In the Debit account do not record any account

- In the Credit account do not record any account

- The amount. You can also enter the quantity and the unit price and the programme will calculate the amount.

- In column CC3 enter the customer's profit centre account (Accounts table).

Features currently not available

These features, although requested by some users, are not available at the moment:

- Automated invoice sending by email.

- Creation of estimates.

The programme allows you to print an invoice with the indication 'Estimate'. - Creation of delivery notes.

The programme allows an invoice to be printed with the indication 'Delivery Note'. - Link with Inventory application.

- Link with Timesheet.

- Creation of invoices in foreign currency with VAT in base currency (e.g. invoices in EUR with VAT in CHF).

If you want to issue invoices separately from accounting (useful for cash accounting) and also prepare estimates, you may use:

This also allows you to add additional information more easily.

Full list of features currently not available in Banana+

Insights

- Invoice printing and VAT (based on turnover and cash received)

- Set customer language in invoices

- Due dates and payment terms

- All extensions with QR invoicing

Related topics:

- Example file in Income/Expense accounting

- Example file invoices in Double-entry accounting

- Example file invoices using Cost centers

Useful for registering invoice with VAT on the cash-in basis (with customer and supplier accounts as cost centres CC3) or if you want to exclude invoice details from the balance sheet accounts.

Setting up the file

There are two ways to set up your accounting file for your invoicing

- Create a new accounting file, using an existing template.

- Adapt your existing accounting file.

New Accounting File

Several templates are available, containing a preset ledger of clients. Creating Invoicing is possible in the following accounting types:

- Double-entry accounting with or without vat.

- Multi-currency accounting with or without vat.

- Income & Expense accounting with or without vat.

A new accounting file is created as follows:

- File Menu > New.

- Select the Region and the language.

- Type Invoice in the Filter by field.

- Select a template in the right hand section.

- Save your file with a name.

Please follow the instructions contained in the Invoicing documentation.

In the accounting types with VAT, in order to correctly set up the file, we advise you to consult the explanations on the page Invoice printing and VAT.

Adapt your existing Accounting File

If you wish to adapt your existing accounting file for creating your invoices, you will have to add certain functions and settings in order to be able to print them:

Insert the data for your company

- In the File menu > File and accounting properties... > Address, you can setup your company's address and data, which will be used as the header of the invoice.

- To use your personal logo, check instructions here.

Set the list of customers in the Accounts table

- In the Accounts table, you can setup your customers register

- Add and display customer address columns.

- In the Accounts table, you can select the Address view and enter your customer's data.

- If the Address view is not visible, you can add it using the Tools menu > Add new functionalities... command > Add Address columns in the Accounts table.

- Manage your customer settings via the Reports menu > Customers > Settings.

Add the columns you wish to use in the Transactions table

- Display the columns for Invoicing in the Transactions table:

- Data menu > Columns setup and check the DocType and DocInvoice boxes.

- Add the columns for Quantity and Unit Price (optional).

Tools Menu > Add new functionalities > Add Items Columns in Transactions table. - Add Items table (optional).

This will assist you keep track of your Items and micro-manage your inventory.

Tools Menu > Add new functionalities > Add Items table.

In the accounting types with VAT, in order to correctly set up the file, we advise you to consult the explanations on the page Invoice printing and VAT.

Invoicing managed in a file dedicated to Invoicing only,

If you wish to manage your invoicing separately from your main accounting, you will have to create a new file. You will insert the accounts for the clients you need for the Invoicing only, in your Plan of Accounts. Invoices are entered via the Transactions table.

This approach is suitable for when:

- Accounting on a cash-in basis. Only the the payed amount is entered in the accounting file.

- Wishing to keep the management of your invoices completely separate from your main accounting ledger, for example for an Association that needs to send membership fees to their members.

How to create a separate accounting file for invoices:

- Download the template, open it and adjust it to your requirements.

Alternatively, you may start out with any template and adapt it - as previously indicated - for use with invoicing. - Make sure al setups and and columns are present, as explained above.

Entering invoices in the transaction rows.

Before proceeding with the creation of invoices, it is necessary to establish the accounting method. The methods are as follows:

- Accounting and invoice issuance based on turnover.

- Issued invoices are immediately recorded and accounted for.

- Revenue is recognized at the time of invoice issuance.

- Customer sub-ledger through balance sheet accounts.

- Accounting and invoice issuance based on cash received.

- Issued invoices are recorded only at the time of payment.

- Revenue is recognized only when the invoice is actually paid, recording transactions at the time of collection.

- Customer sub-ledger through CC3 profit centers.

- Accounting and invoice issuance with net tax rate method.

- Invoices are issued with a different rate than the one accounted for.

- Revenue is recognized only when the invoice is actually paid, recording transactions at the time of collection.

- Customer sub-ledger through CC3 profit centers.

Issuing invoices with VAT with the Cash method

The Banana Accounting procedure for VAT management requires entering the VAT code on the same line where the revenue is recorded.

Revenue is recognized only when the invoice is actually paid, recording transactions at the time of collection.

It is necessary to set up the customer sub-ledger in the accounts table via the CC3 Profit Center.

Therefore, in cash-based VAT management, the VAT code is entered only when the invoice is collected.

Invoice data is entered in the Transactions table. For each new invoice, enter a new transaction line.

- Indicate the date of the transaction.

- The invoice number

- For invoicing with Swiss QR with IBAN account, use only numbers or letters, without spaces, separators, or other characters. The maximum allowed length is 7 characters.

- For invoicing with Swiss QR with QR-IBAN, use only numbers without spaces, separators, or other characters. The maximum allowed length is 7 digits.

- If Swiss QR is not used, the invoice number can be freely chosen.

- Each invoice must have a unique invoice number, even across multiple accounting years. This is important because using the same invoice number over multiple years is still considered a single document. If you wish to repeat the same invoice number, you must add the year to the invoice number or another identifier to distinguish it from previous years' invoices (e.g., 1234524, 1234525).

- The description text (products, services, consulting...) that will appear on the customer's invoice.

- The Debit account must remain empty.

- The Credit account must remain empty.

- Enter the amount.

- In cases subject to VAT, enter the VAT sales code in square brackets (e.g., "[V81]").

The VAT code entered in square brackets allows the VAT amount to be displayed on the invoice, without being recorded until the payment is registered.

Invoice with multiple lines

When there are multiple items to be invoiced (different products or services, or both), they must be recorded on multiple lines (one item per line):

- Enter a new transaction line for each item you want to print on the invoice.

- On each additional line, repeat the date and invoice number, identical to the previous lines.

Basic columns

Date

The invoice will show the date indicated in this column. All lines belonging to the document must have the same date.

Invoice

For invoice management, an invoice number must be entered in the Invoice column.

Description

A description of the products or services being invoiced. These texts appear on the invoice.

Debit

Use the column only to record the invoice payment, entering the liquidity account (bank, post,...).

Credit

Use the column only to record the invoice payment, entering the revenue account.

Amount

An amount. If VAT is managed, enter the gross amount (including VAT).

VAT Code

The VAT code corresponding to the revenue account (sales or services):

- For invoice issuance, the VAT code must be entered in square brackets (e.g., "[V81]").

- For recording the invoice payment, the VAT revenue code must be entered without square brackets.

CC3

A customer account present in the Accounts table, in the CC3 Profit Center group.

Optional columns

Type

In the Type column, detail rows can be defined, such as totalization rows or a specific payment term for an invoice.

This column is not visible by default, but it must be displayed via the menu Data > command Columns setup and checking the DocType column.

Quantity

The quantity of goods or services to be invoiced.

To add the quantity column, use the menu Tools > Add/remove functionalities > Add Item column in the Transactions table.

Unit

A type of unit (e.g., 'pz', 'h', 'm', 'kg').

Unit Price

The unit price related to the goods or services.

The program automatically calculates the total amount based on the quantities entered in the Quantity column.

Invoicing and VAT on turnover

The standard procedure of Banana Accounting in VAT management requires entering the VAT code always on the line where the revenue is recorded.

Issued invoices are immediately recorded and accounted for. Revenues are recognized at the time of invoice issuance.

It is necessary to set up the customer ledger in the Accounts table. At the end of the year, customer accounts must appear in the balance sheet.

Therefore, in VAT management on turnover, the VAT code is entered when creating the invoice.

Invoice data is entered in the Transactions table. For each new invoice, enter a new transaction row.

- Enter the date of the transaction

- The invoice number

- For invoicing with Swiss QR with IBAN account, use only numbers or letters, without spaces, separators, or other characters. The maximum allowed length is 7 characters.

- For invoicing with Swiss QR with QR-IBAN, use only numbers without spaces, separators, or other characters. The maximum allowed length is 7 digits.

- If Swiss QR is not used, the invoice number can be freely chosen.

- Each invoice must have a unique invoice number, even across multiple accounting years. It is important because using the same invoice number across years is considered as a single document. If you wish to repeat the same invoice number, add the year to the invoice number or another identifier to distinguish it from previous years' invoices (e.g., 1234524, 1234525).

- The description text (products, services, consulting...) that will appear on the customer’s invoice

- In the Debit account, enter the customer account number

- In the Credit account, enter the contraccount (Sales account, Consulting, or others)

- Enter the amount

- If subject to VAT, enter the VAT Code with the applicable VAT percentage. See Invoice printing and VAT management.

Multi-row Invoice

When there are multiple items to be invoiced (various products or services or both), they must be recorded on multiple lines (one item per line):

- Enter a new transaction row for each item to be printed on the invoice.

- On each additional line, repeat the date and invoice number, the same as the previous lines.

Basic Columns

Date

The invoice will display the date indicated in this column. All rows belonging to the document must have the same date.

Invoice

For invoice management, an invoice number must be entered in the Invoice column.

Description

A description of the products or services to be invoiced. These texts appear on the invoice.

Debit

A customer account that belongs to the ledger in the Accounts table.

Credit

A revenue account in the Accounts table.

Amount

An amount. If VAT is managed, enter the gross amount (including VAT).

VAT Code

The VAT code corresponding to the revenue account (sales or services).

Optional Columns

Type

In the Type column, you can define detail rows, such as subtotal rows or a specific payment term for an invoice.

This column is not visible by default but must be enabled through the menu Data > command Arrange columns and checking the column DocType.

Quantity

The quantity of goods or services to be invoiced.

To add the quantity column, use the menu Tools > Add new features > Add Items columns in the Transactions table.

Unit

A type of unit (e.g., 'pcs', 'h', 'm', 'kg').

Unit Price

The unit price for the goods or service.

The program automatically calculates the total amount based on the quantities entered in the Quantity column.