Documentation Banana Accounting 8

Banana Plus, new detailed and optimized documentation

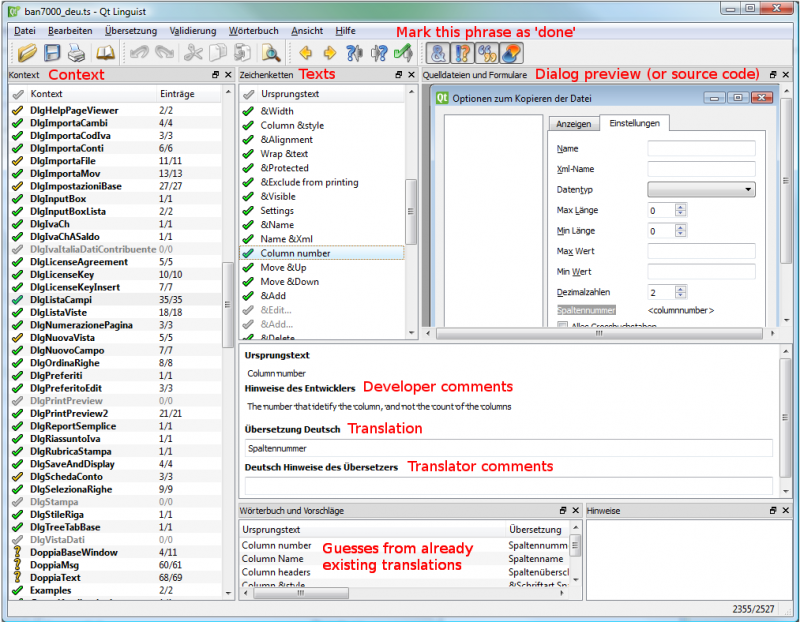

In the new version, Banana Accounting Plus, all the documentation has been revised, optimized, and expanded with information on new features and new applications, with example images and videos. A new function has also been added: by clicking on any error message, you are taken to the page that explains the causes and solutions.

We recommend switching to Banana Accounting Plus, our latest version, always up to date.

Switch now to Banana Accounting Plus

Available in two subscription plans. Very easy transition.

Banana Accounting 8 Documentation

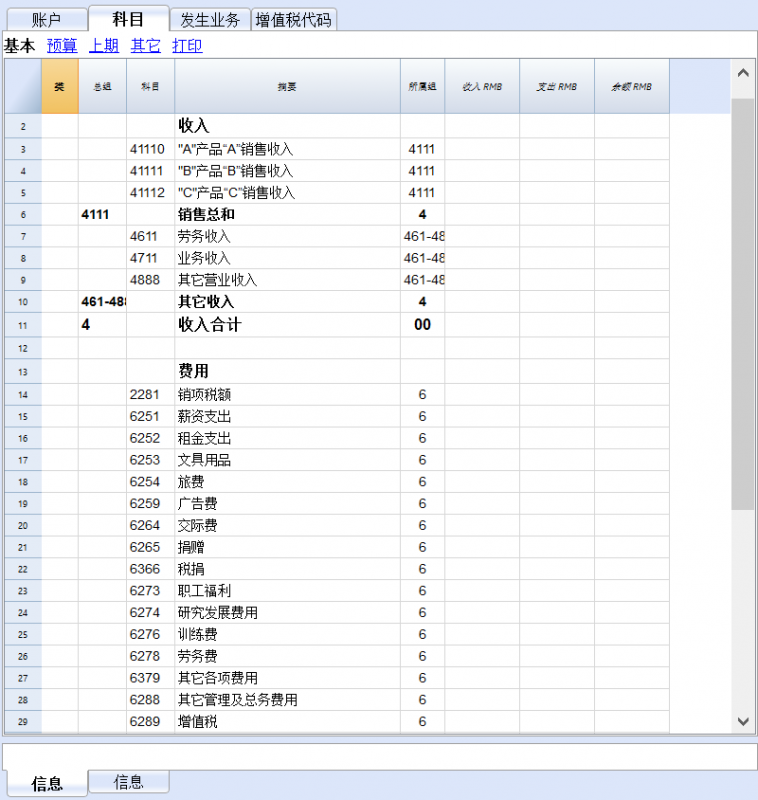

Chart of Accounts templates

Closings, New Year and Printing

- Check the accounting

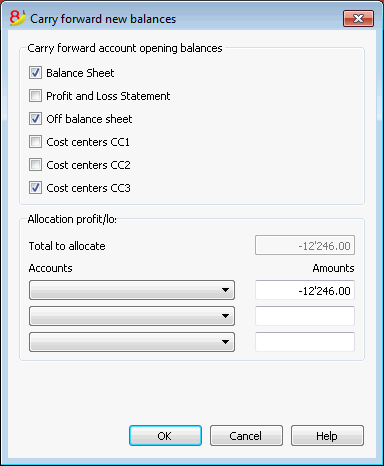

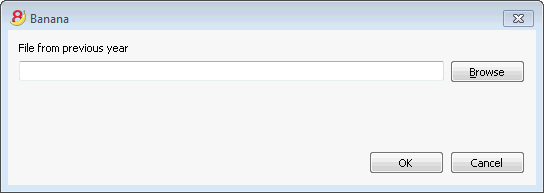

- Create a new year

- Update opening balances

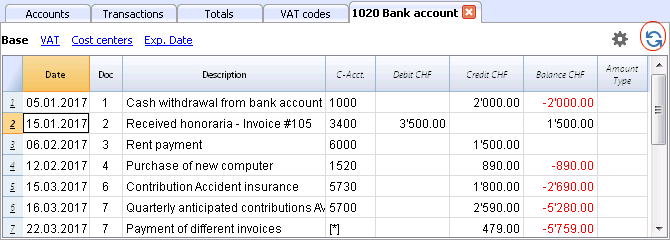

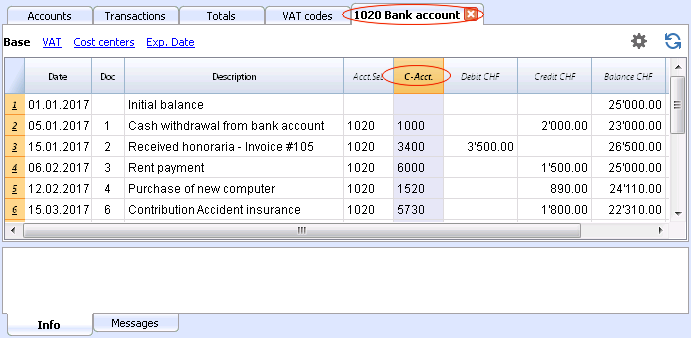

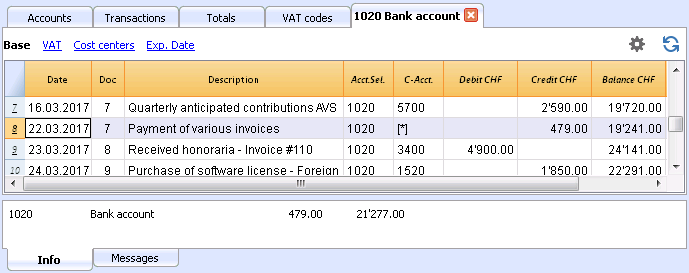

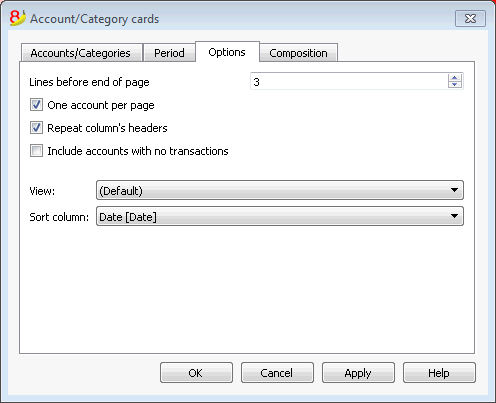

- Account cards

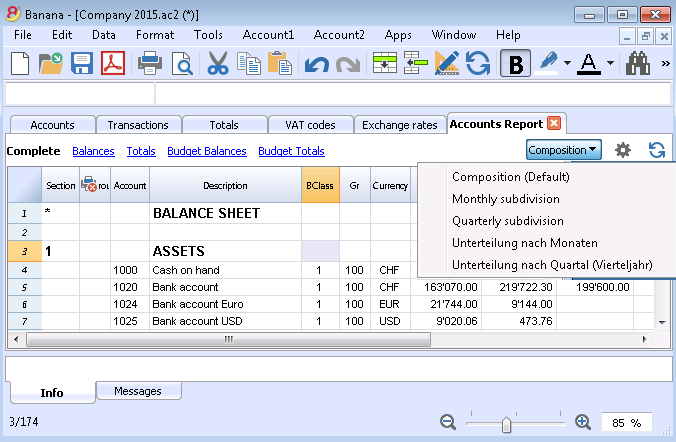

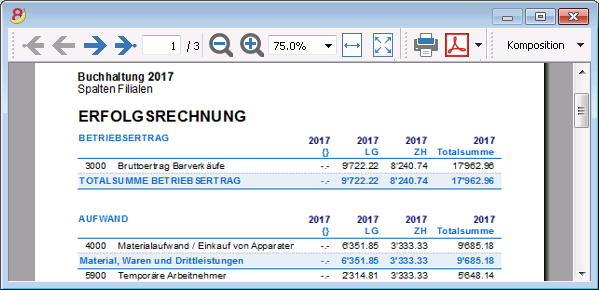

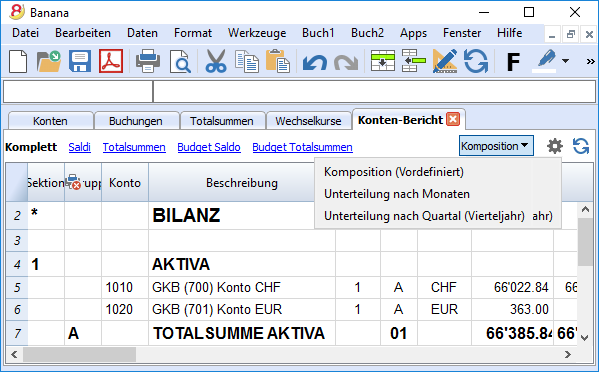

- Compositions

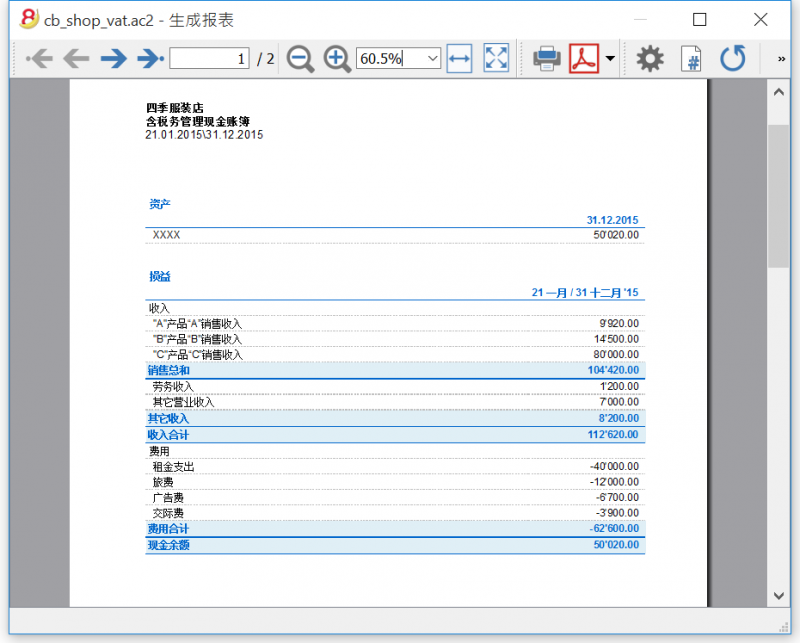

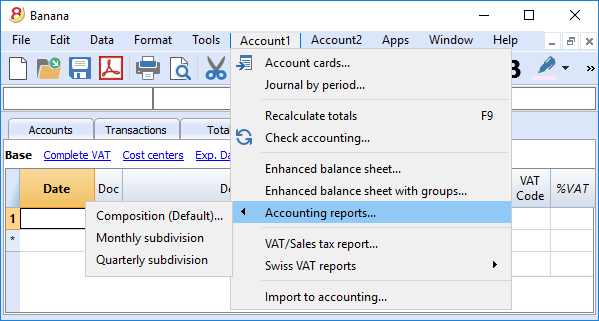

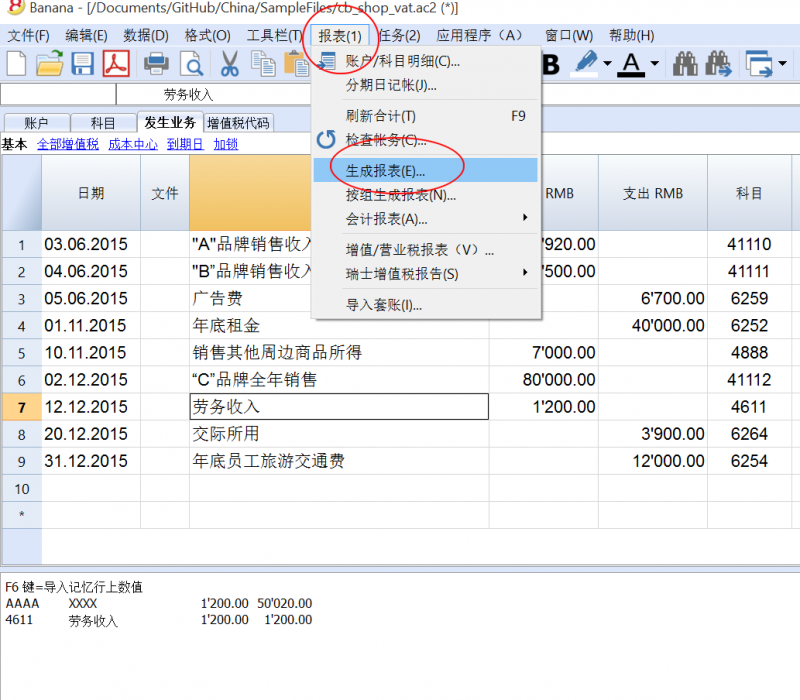

- Reports

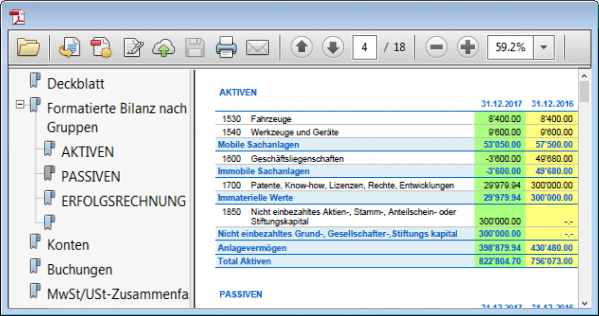

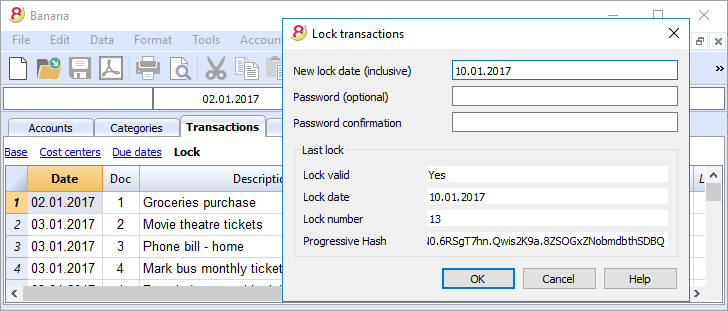

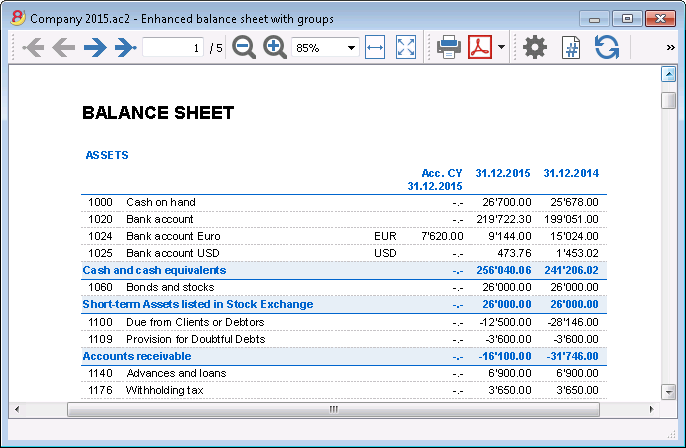

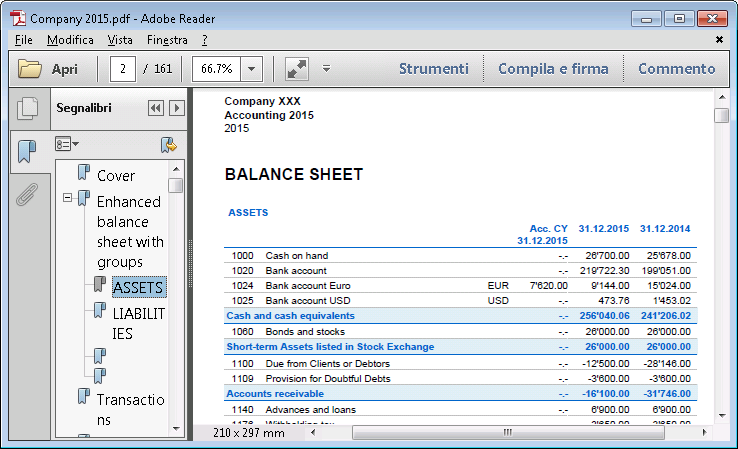

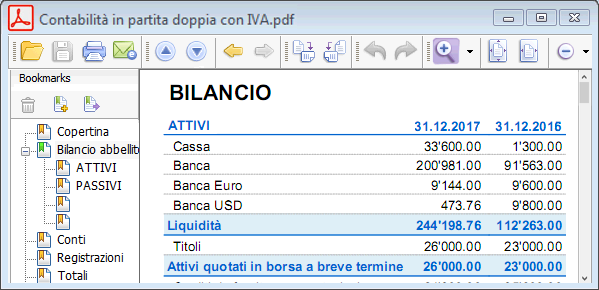

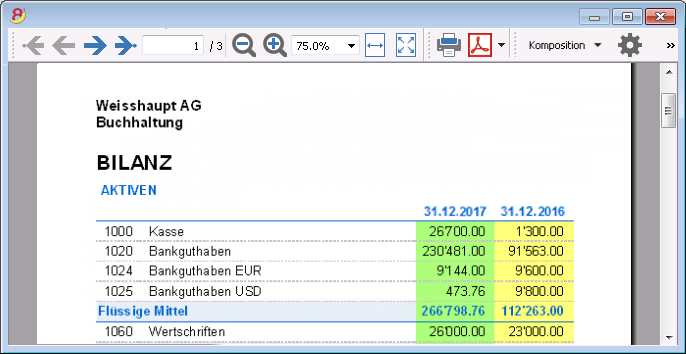

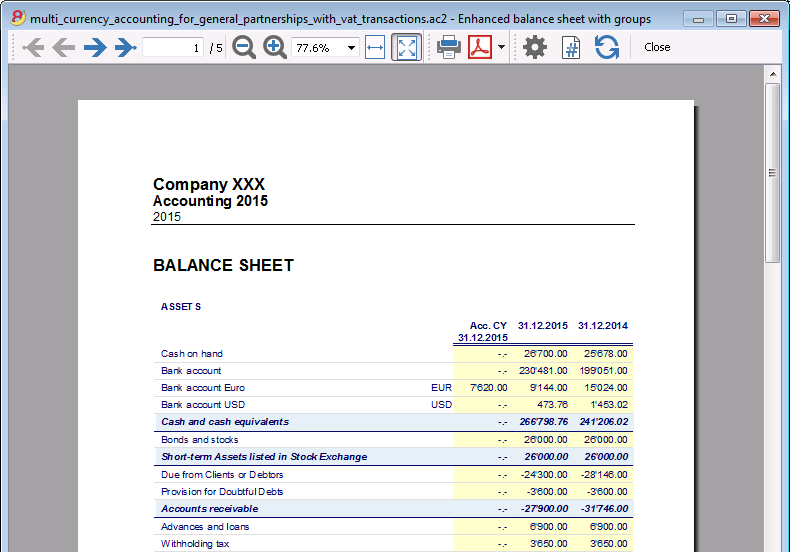

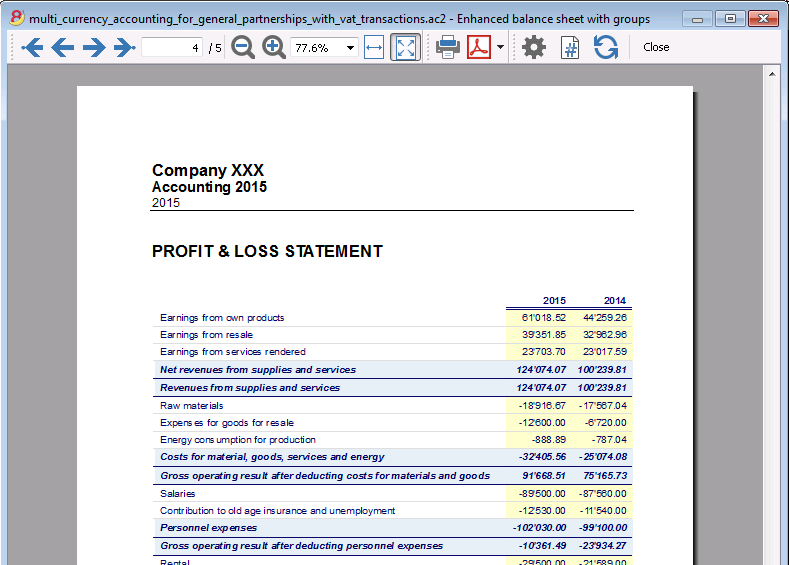

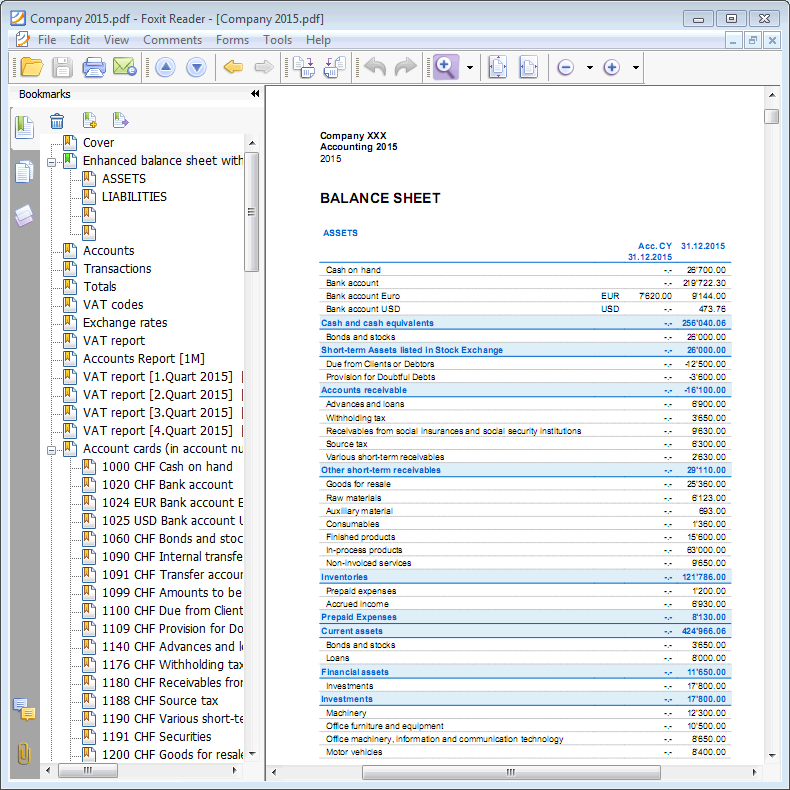

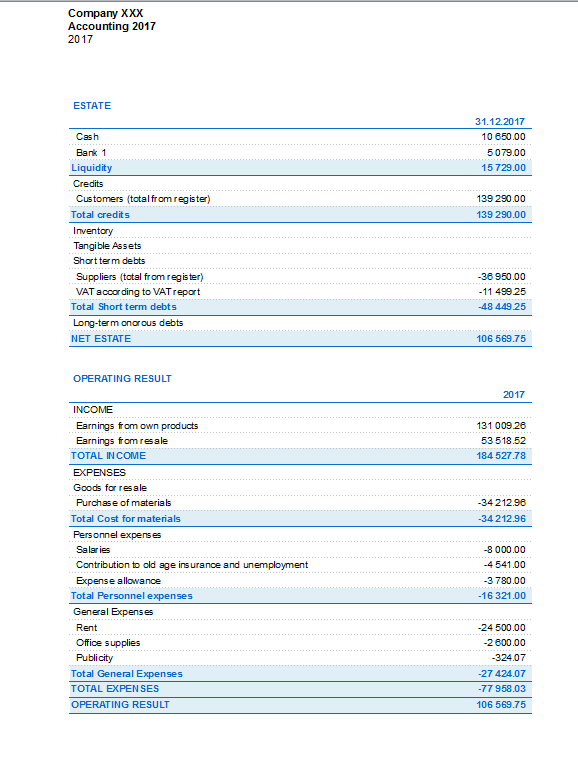

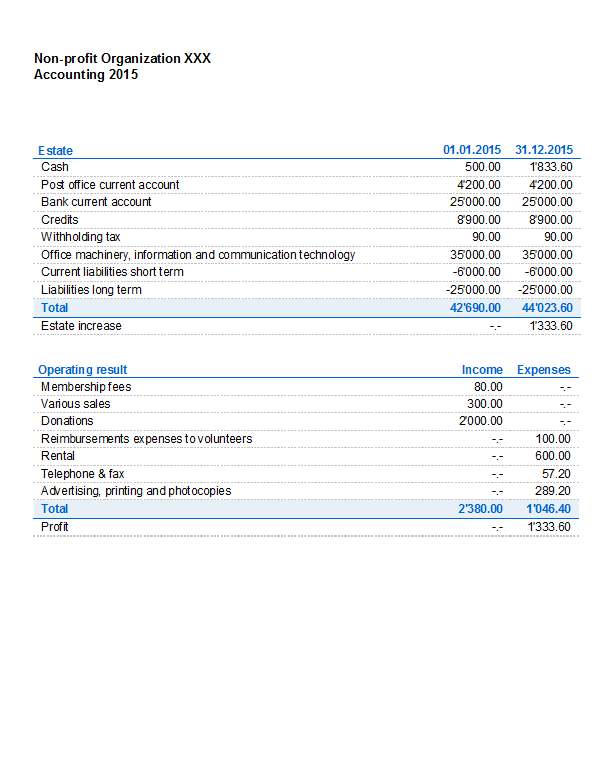

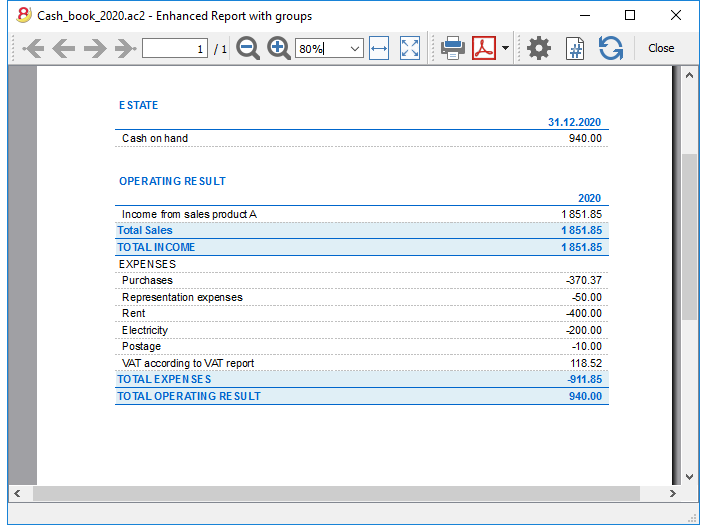

- Balance sheet and income statement

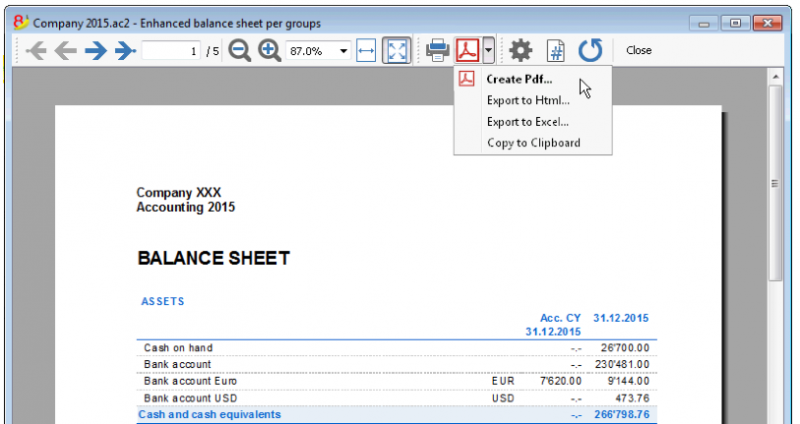

- Print in PDF format

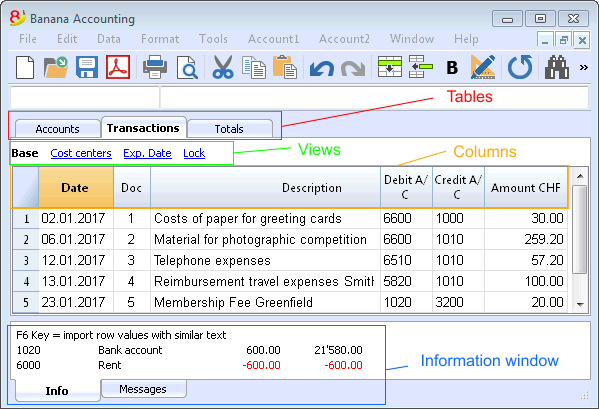

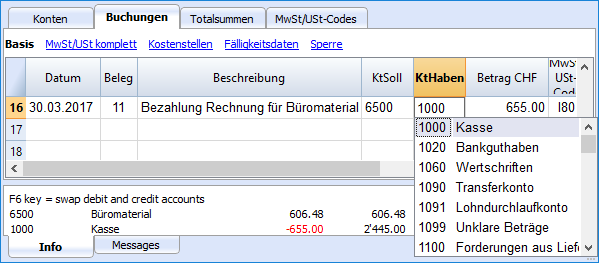

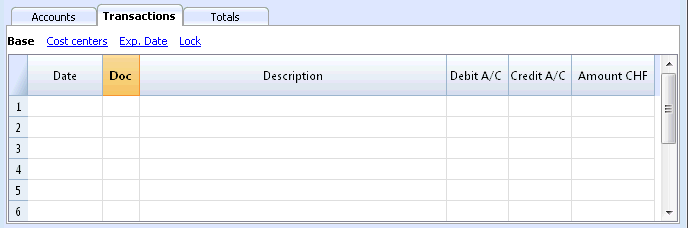

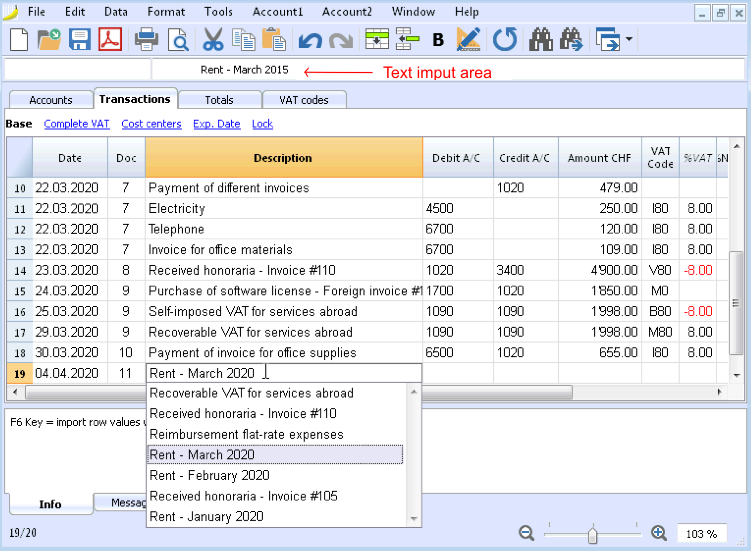

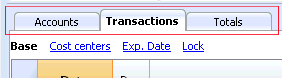

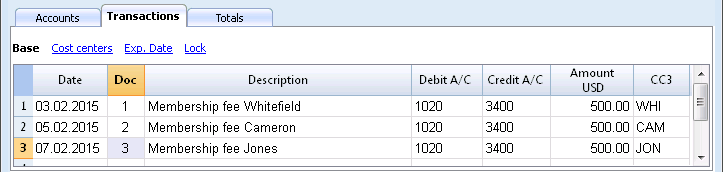

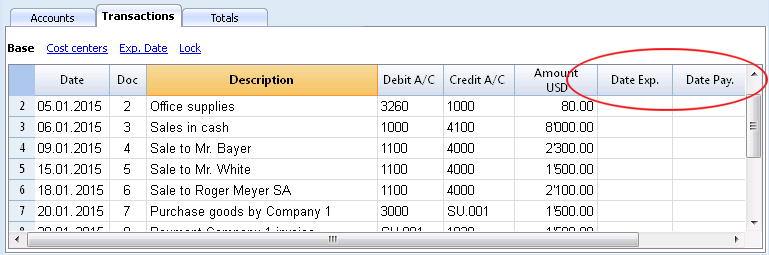

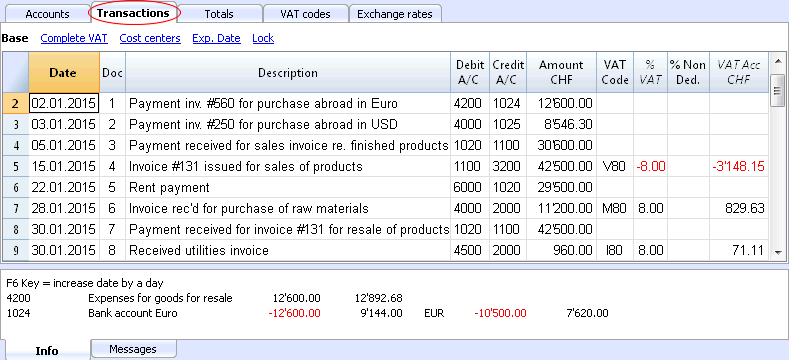

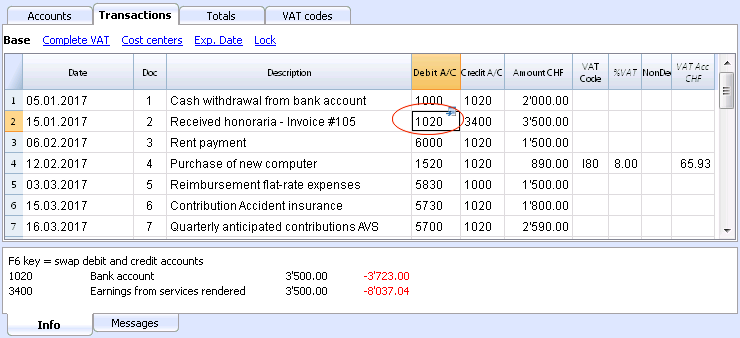

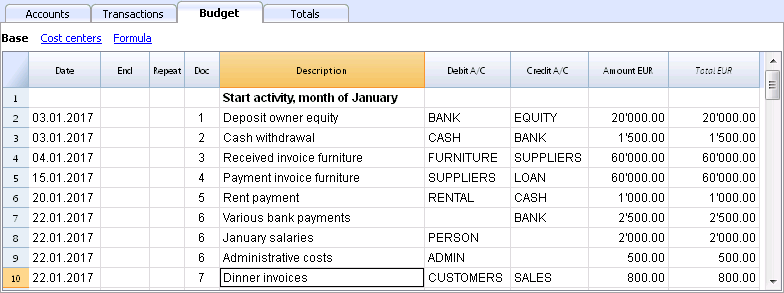

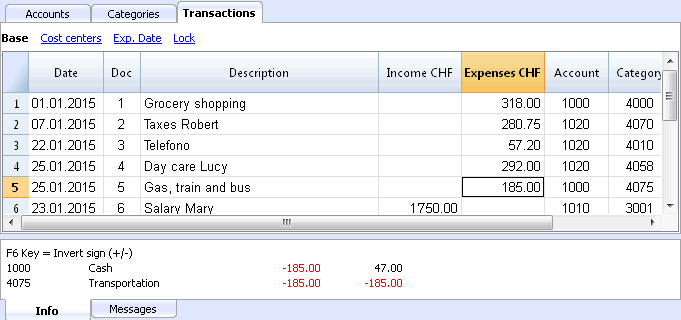

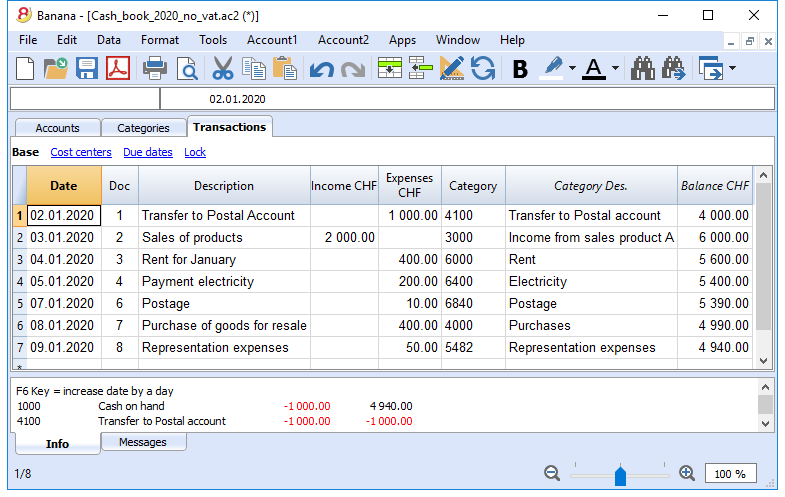

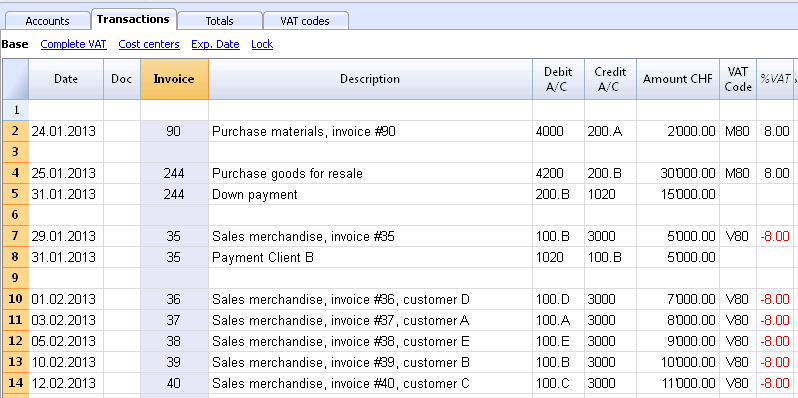

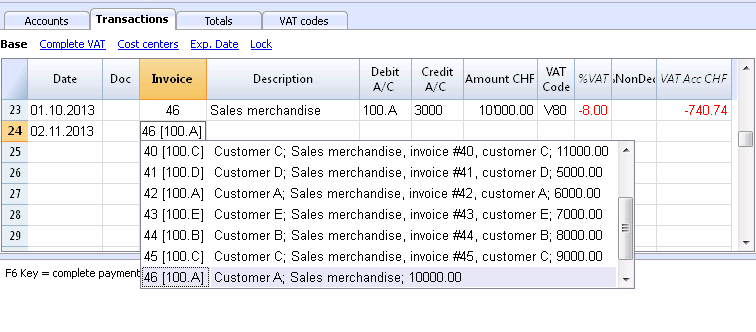

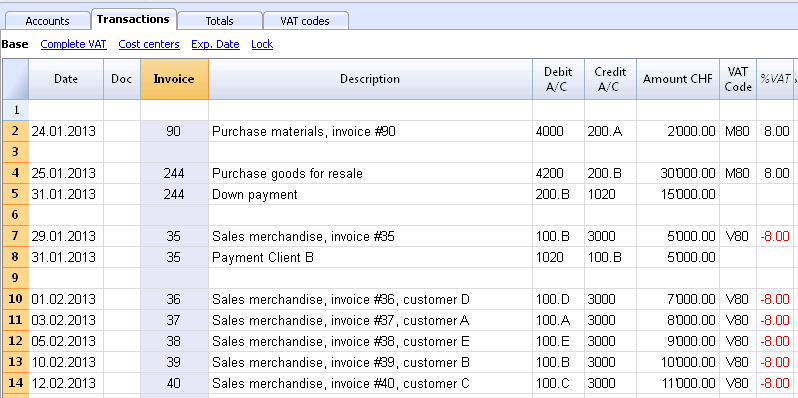

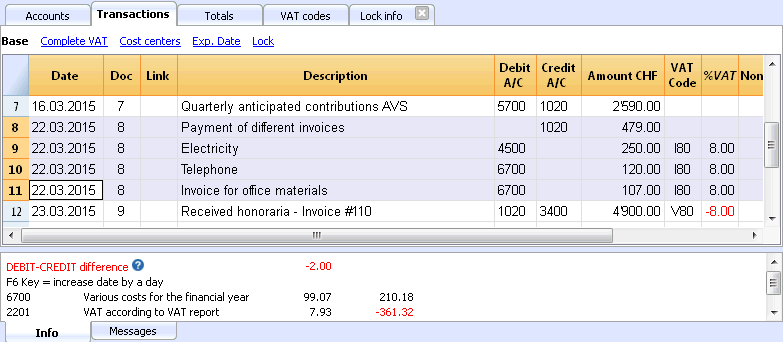

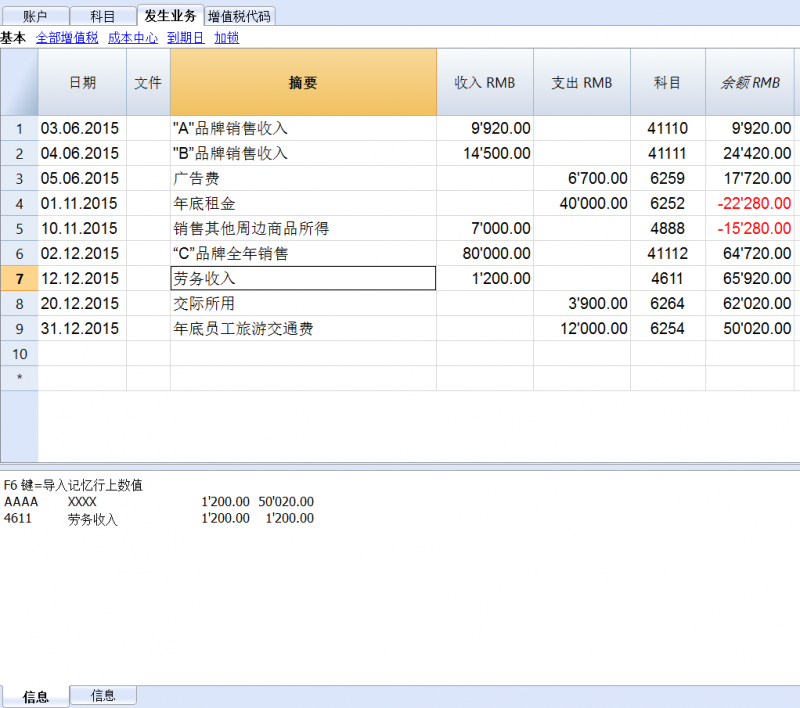

Transactions

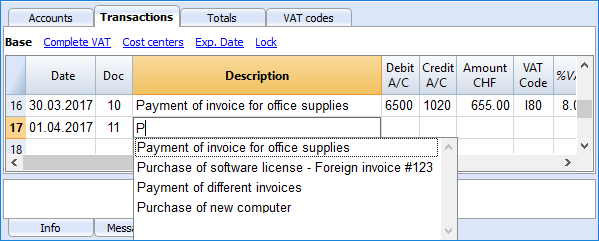

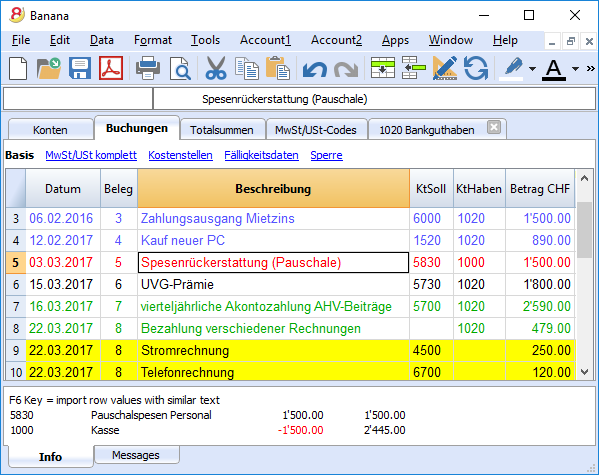

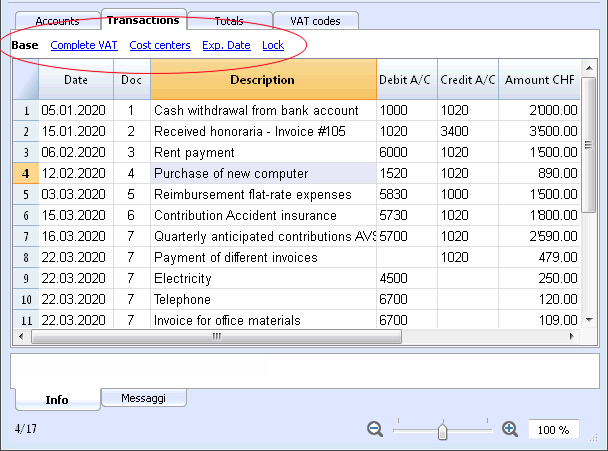

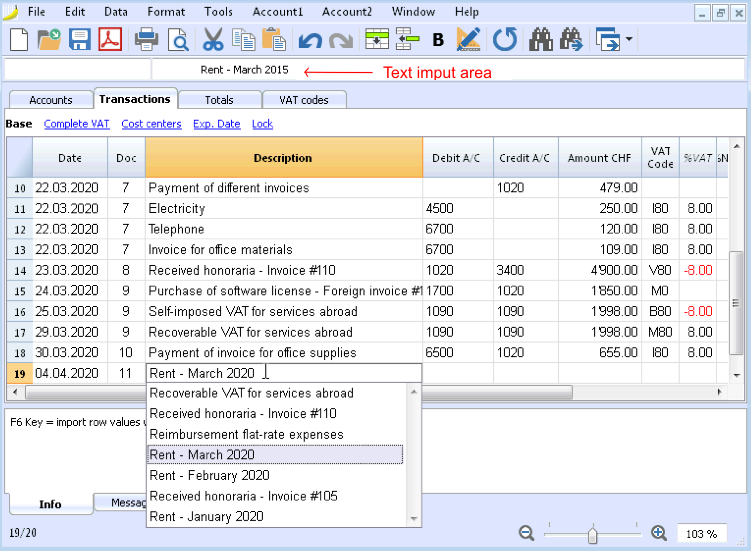

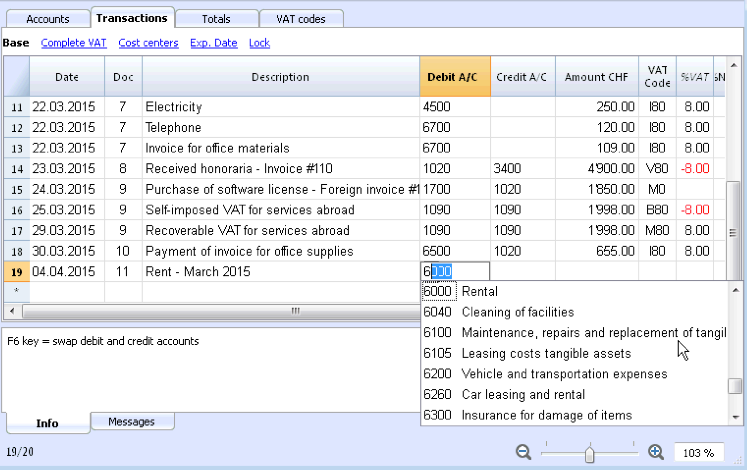

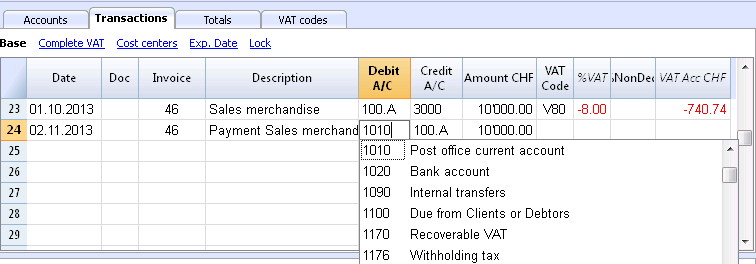

- Quick data entry

- Automatic numbering in the Doc column

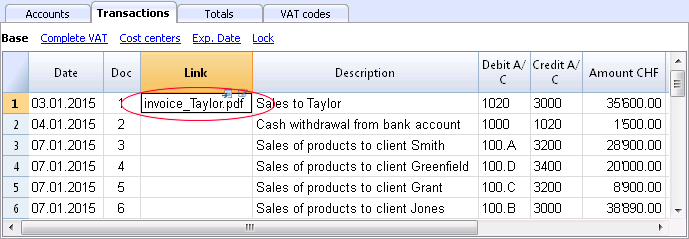

- Insert a link to a document

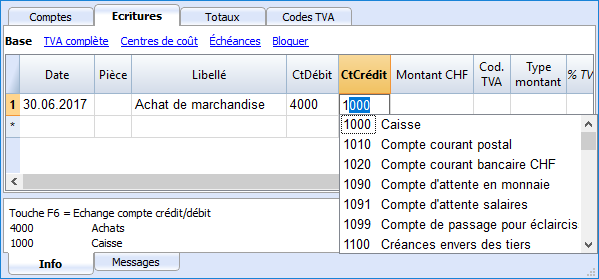

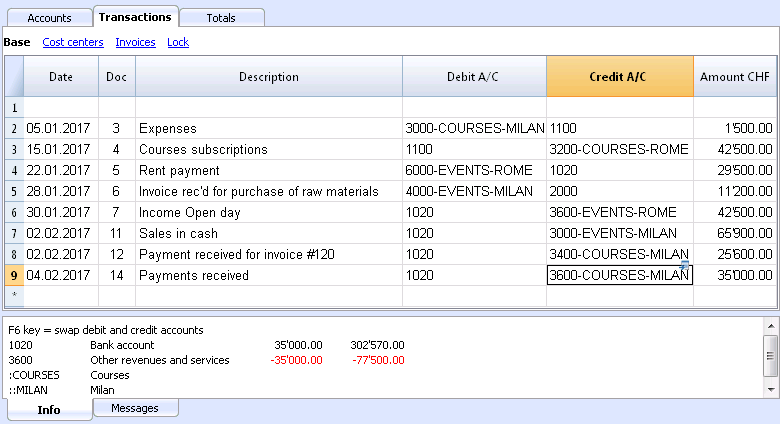

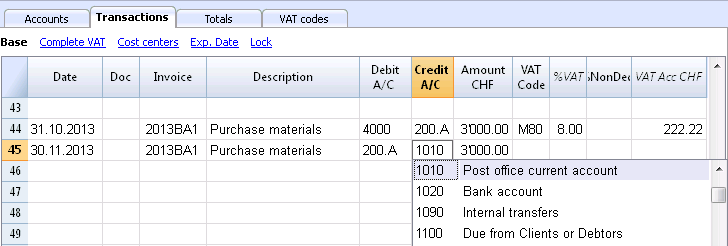

- Simple transactions (one debit and one credit)

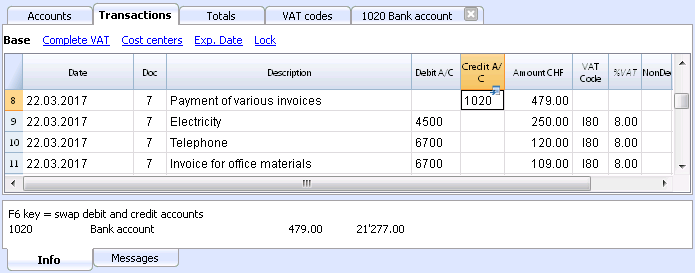

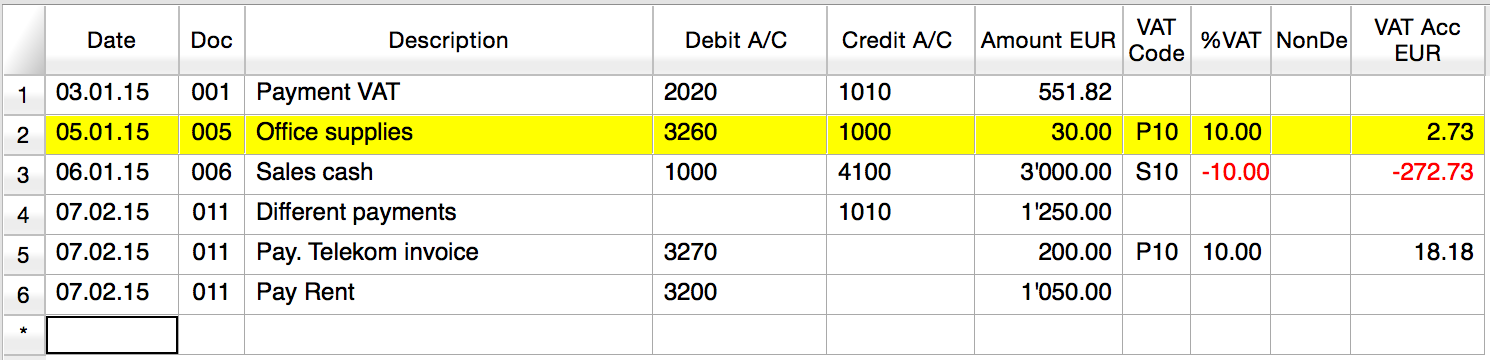

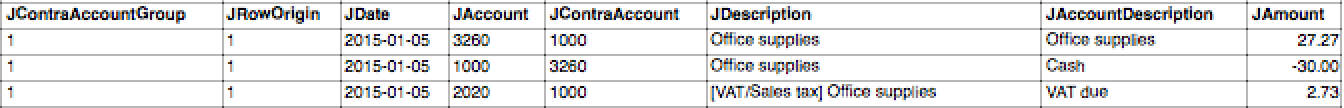

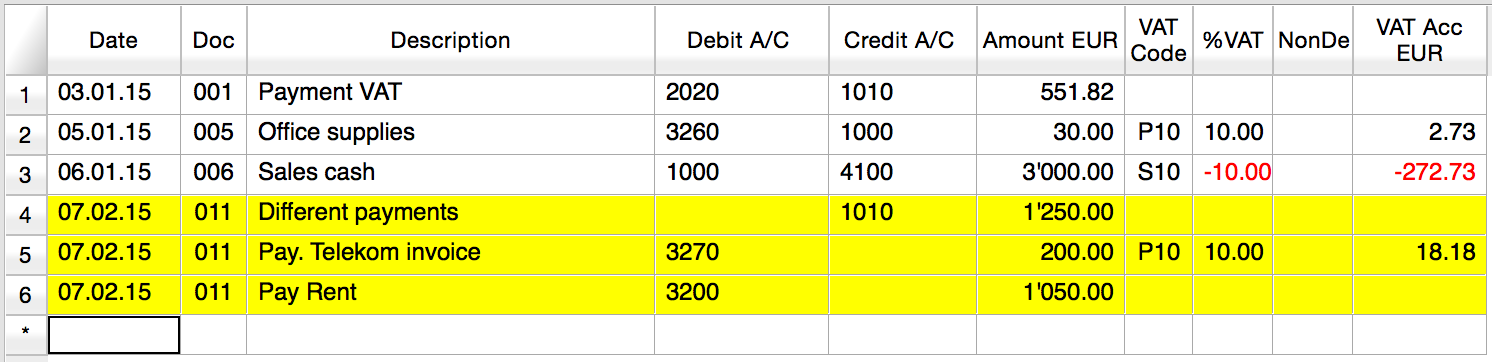

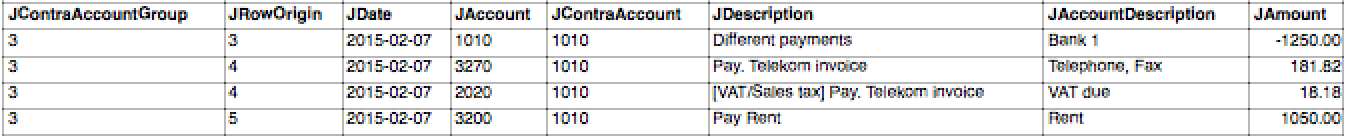

- Compound or multiple transactions (on several accounts)

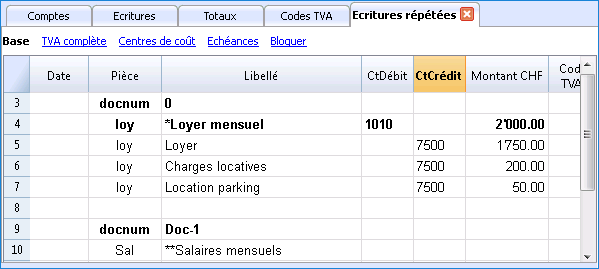

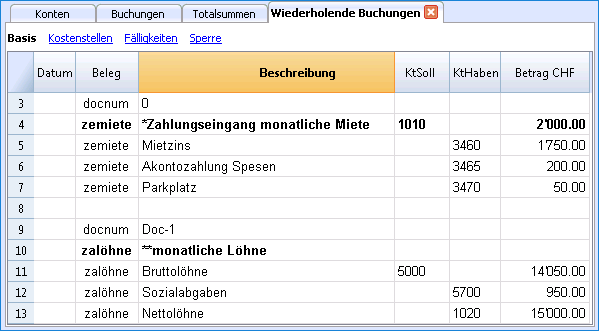

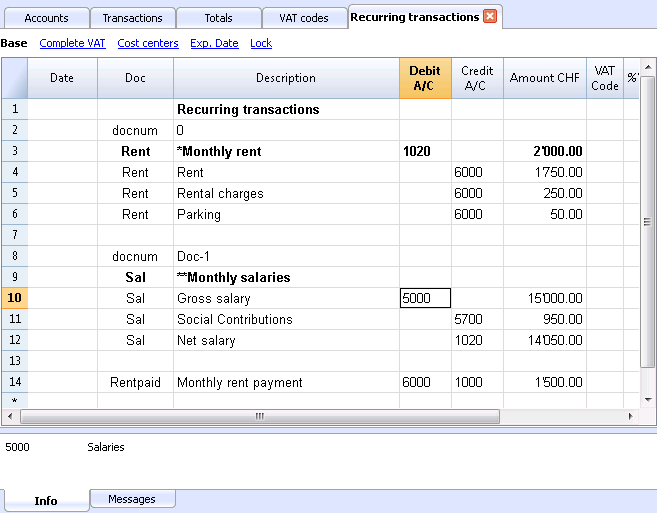

- Recurring transactions

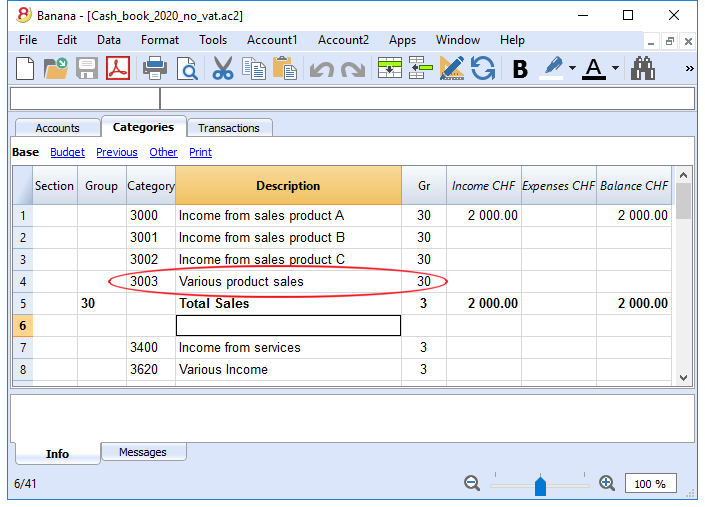

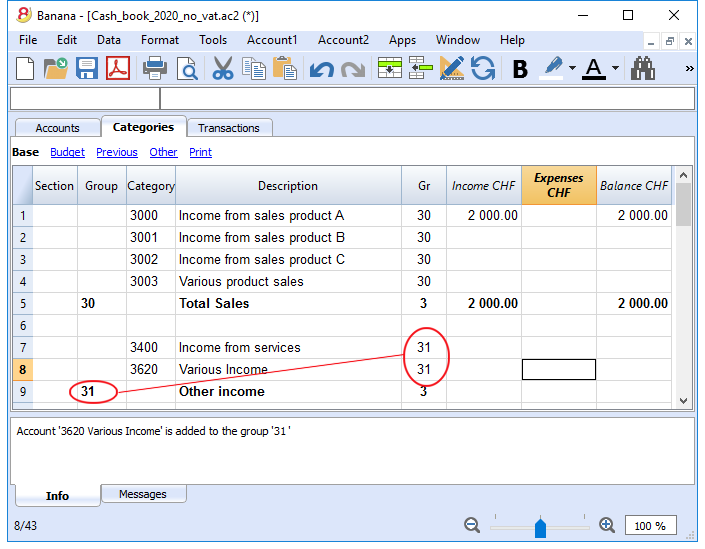

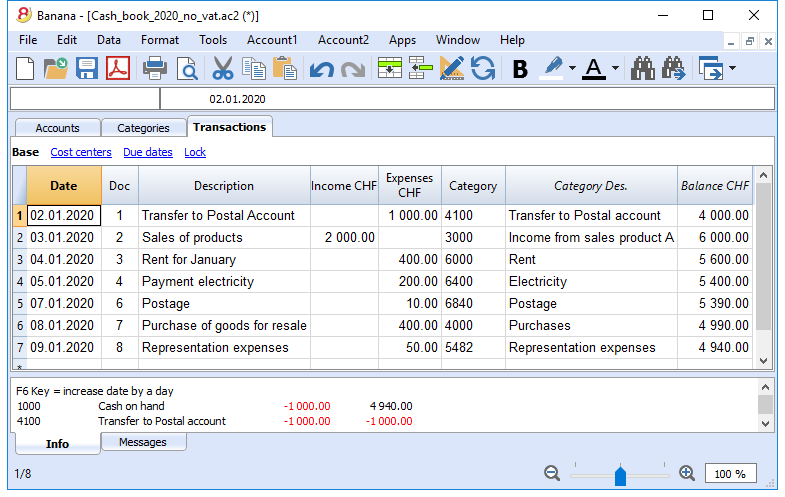

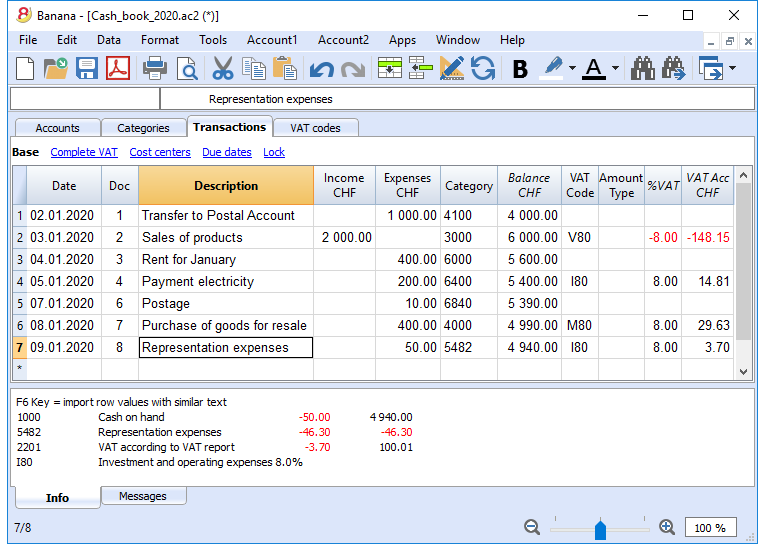

- Cash book and Income/Expense transactions

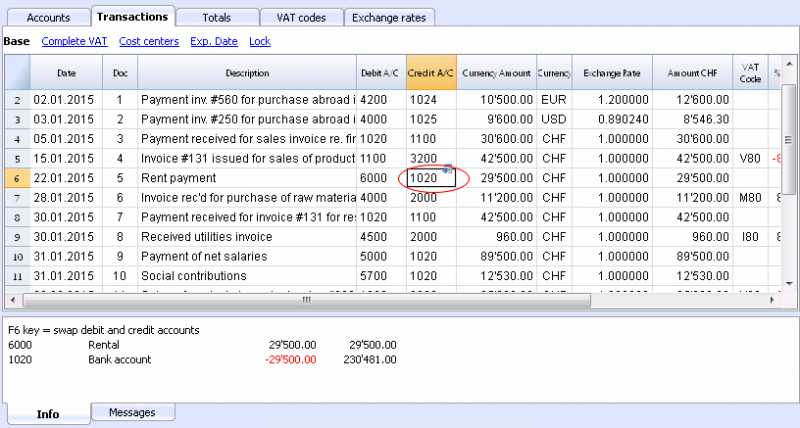

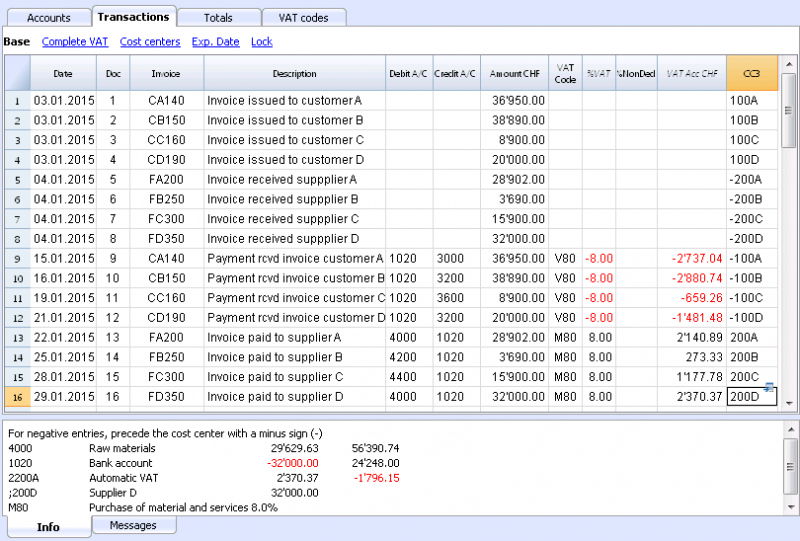

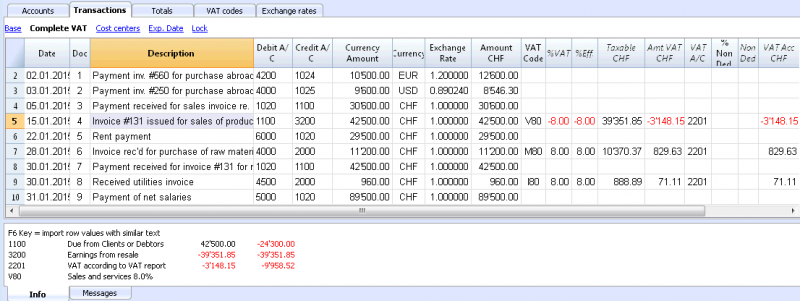

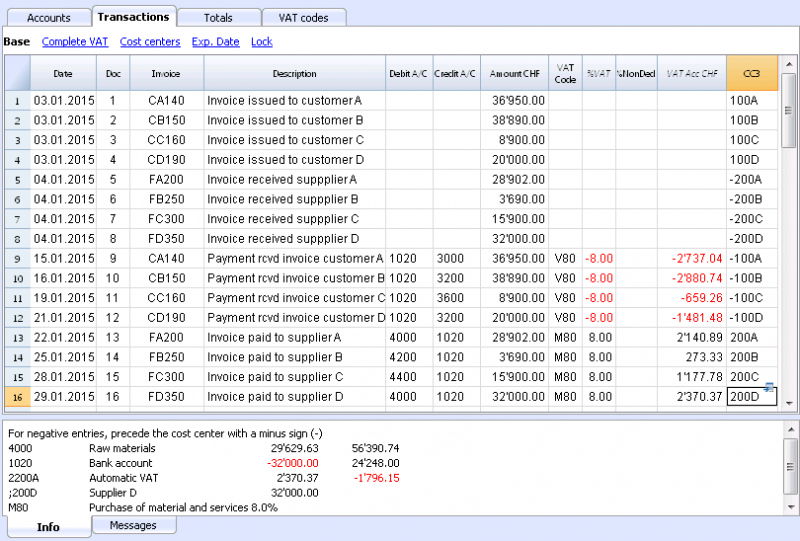

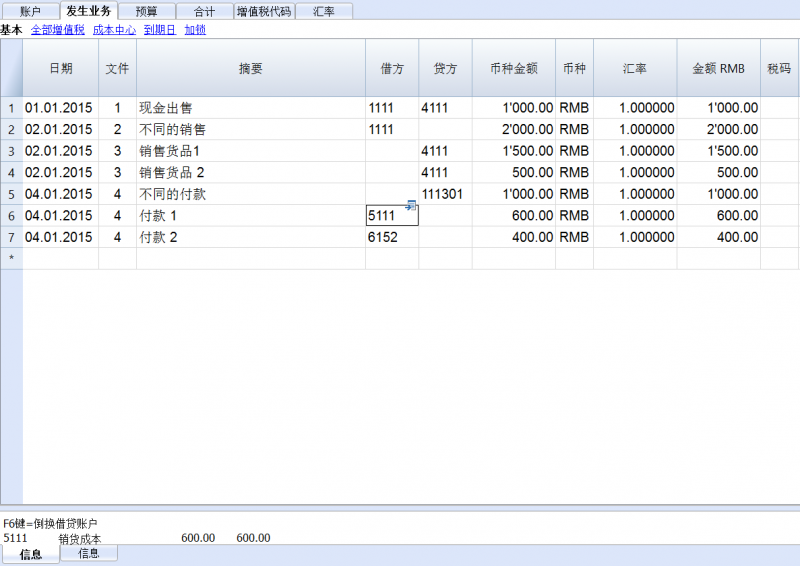

- Transactions in double-entry accounting

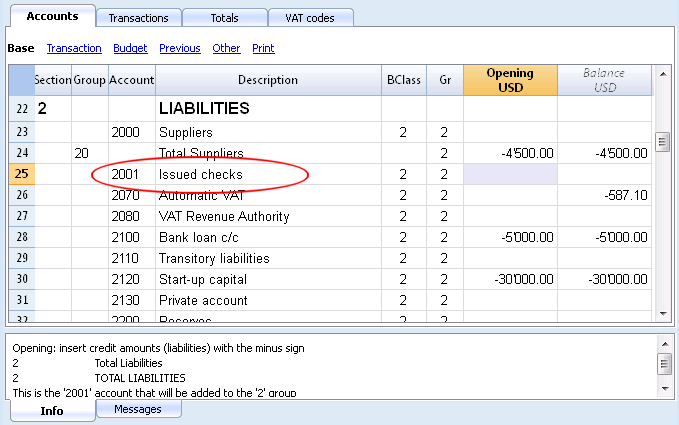

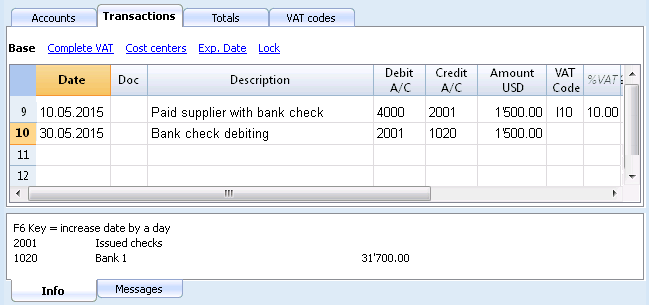

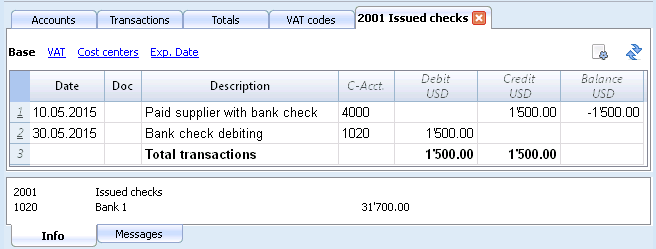

- Issuing checks

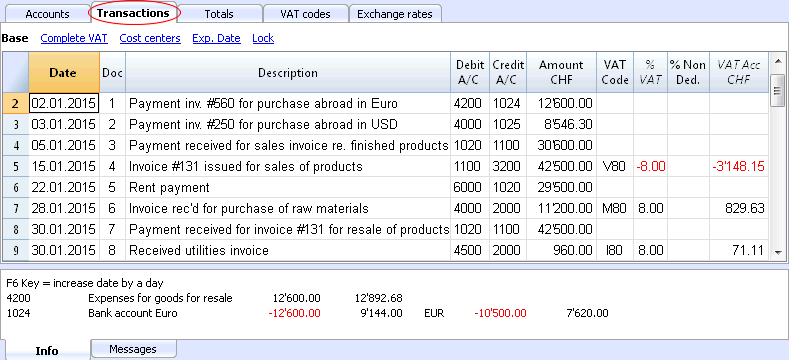

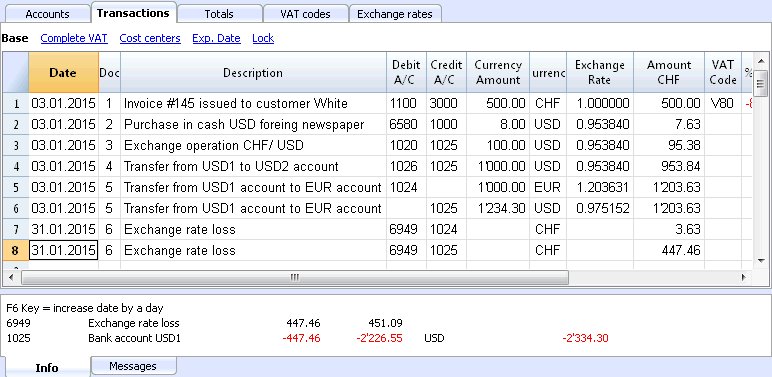

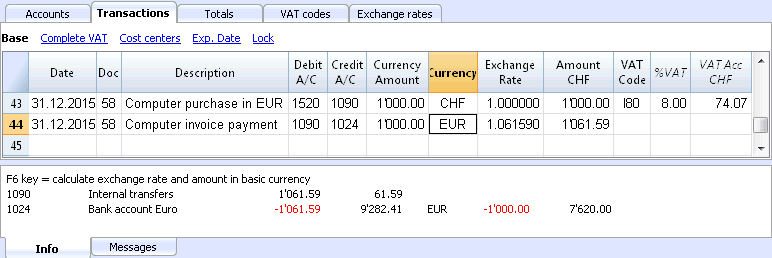

- Multi-currency transactions

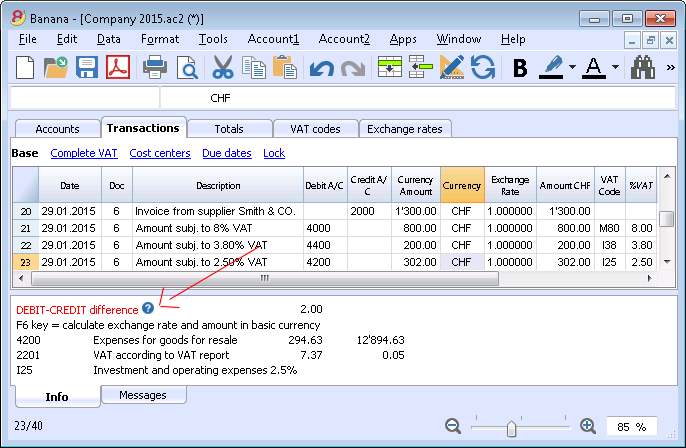

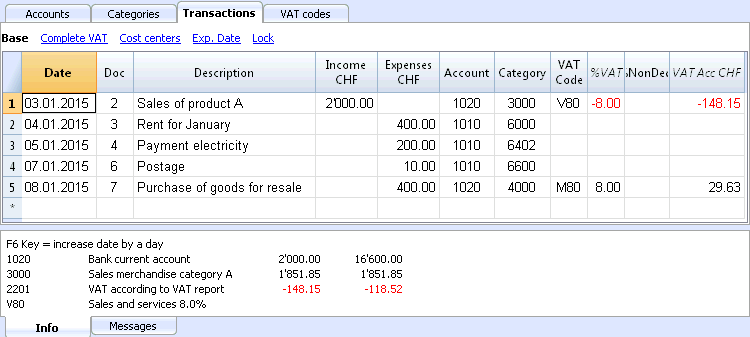

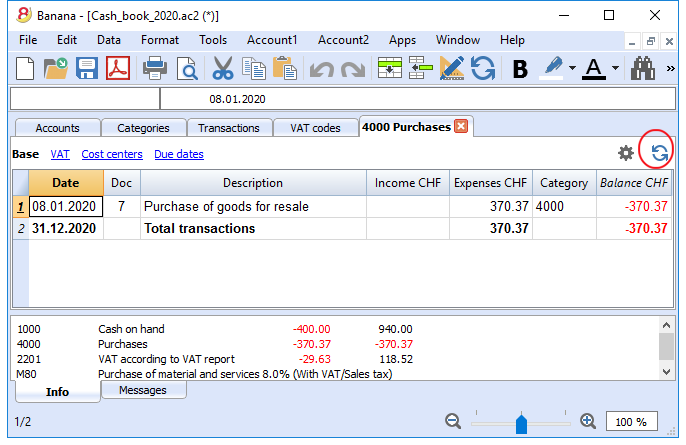

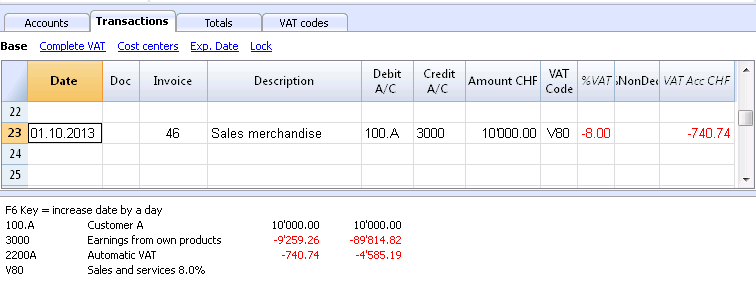

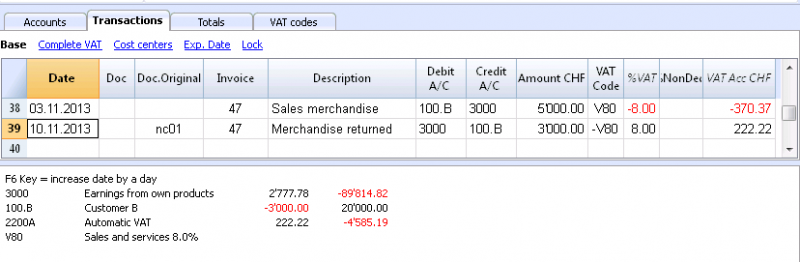

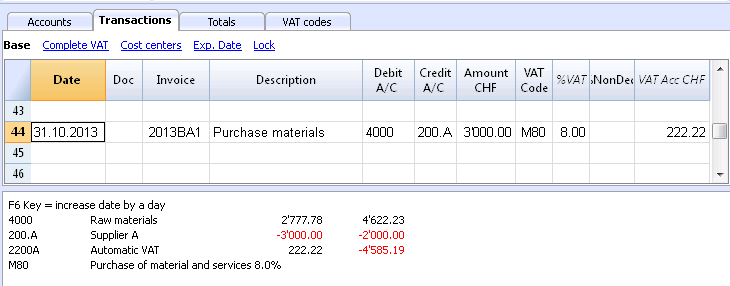

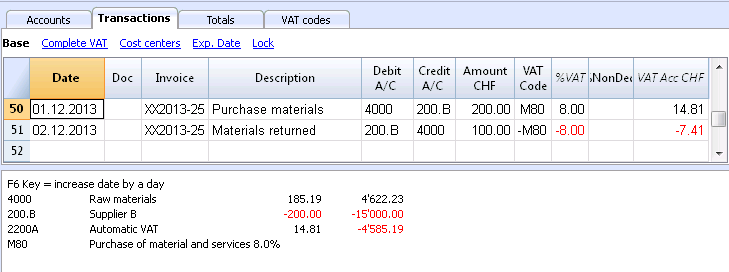

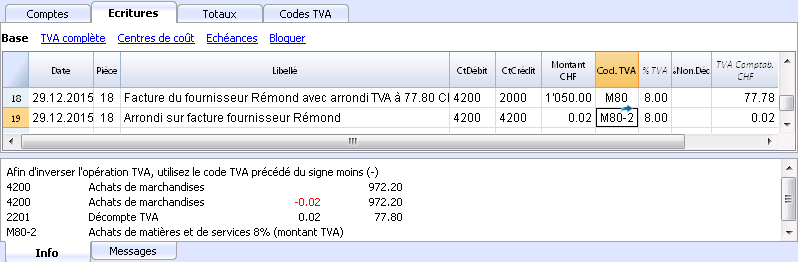

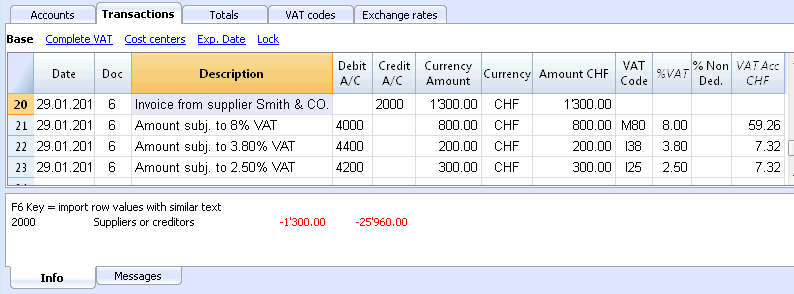

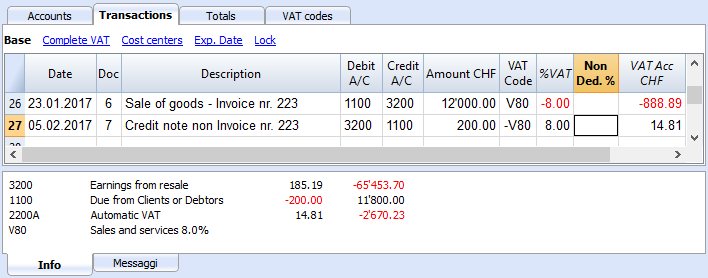

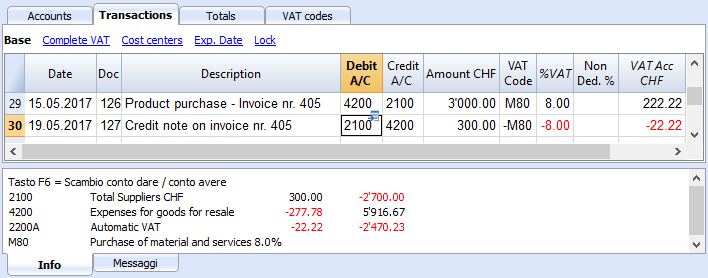

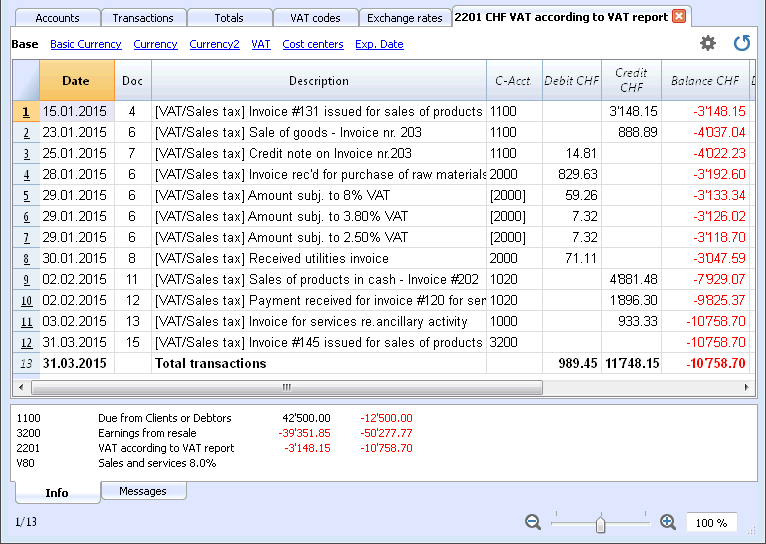

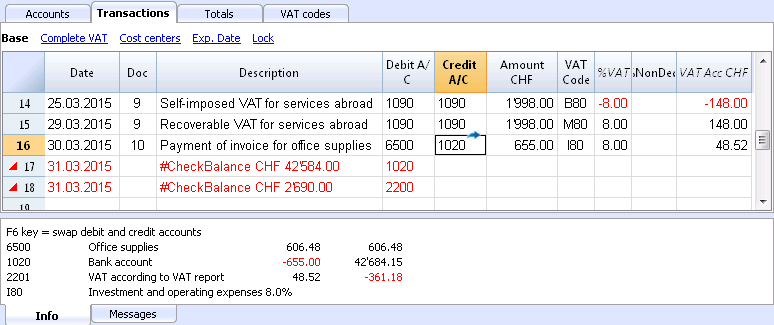

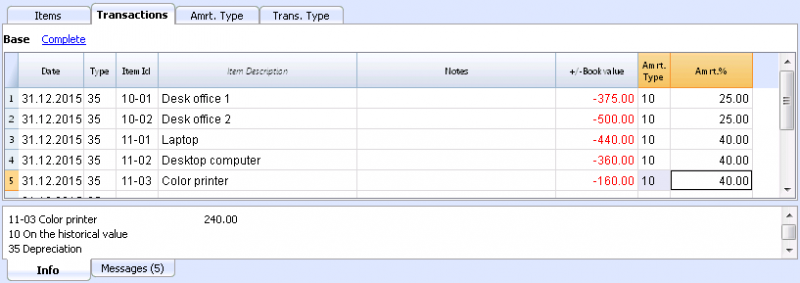

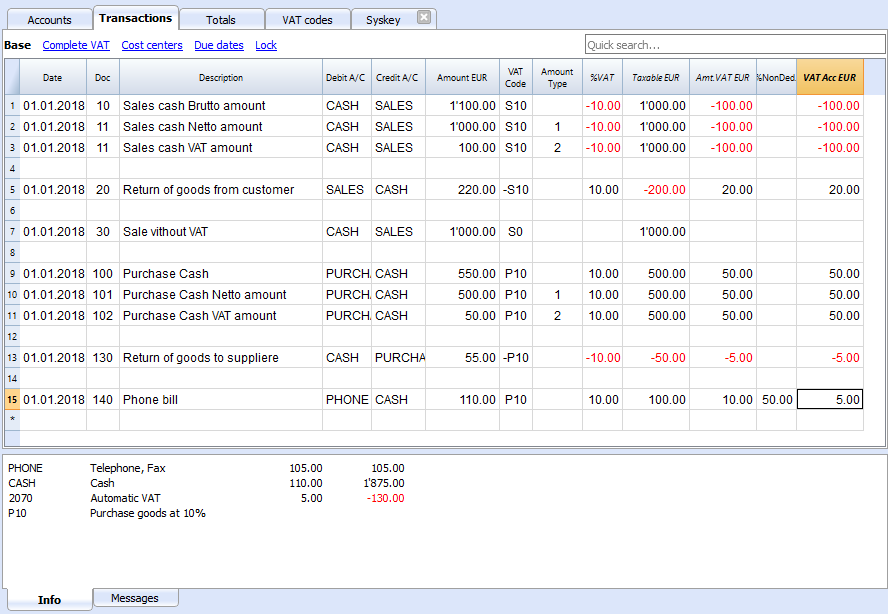

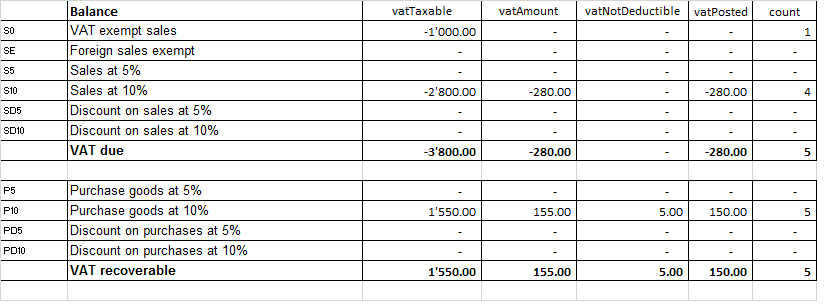

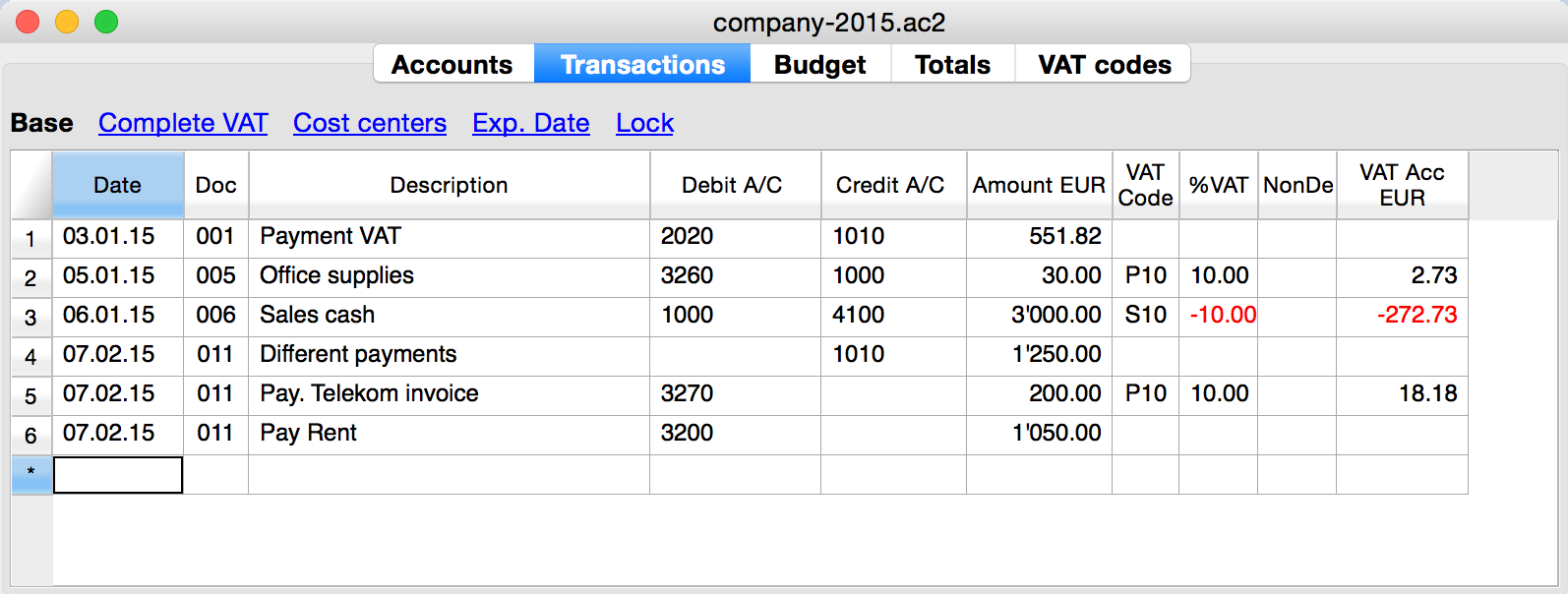

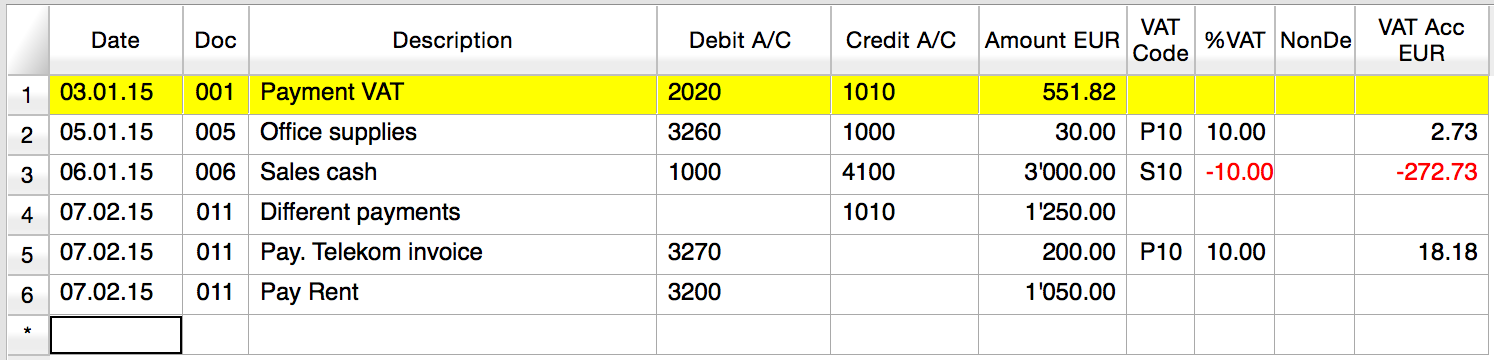

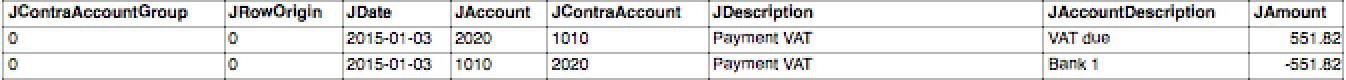

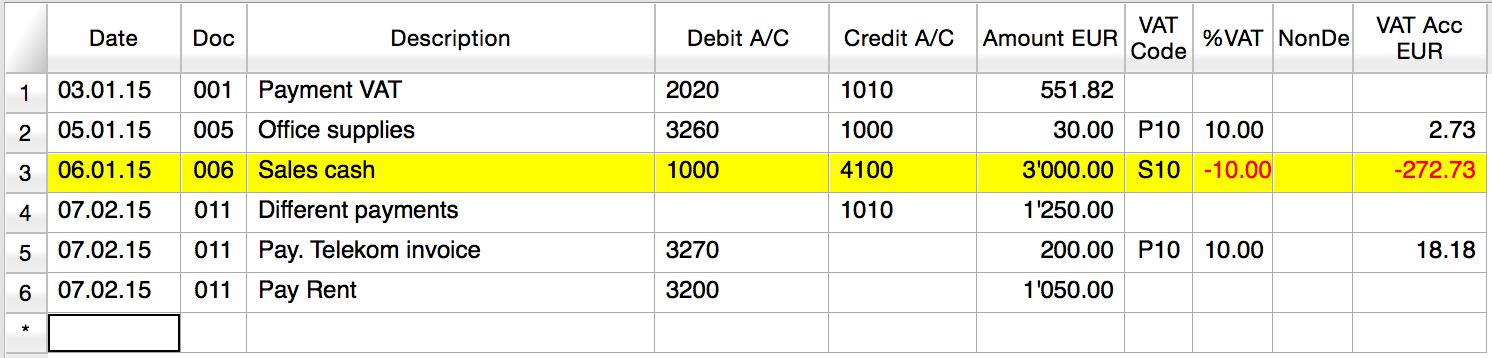

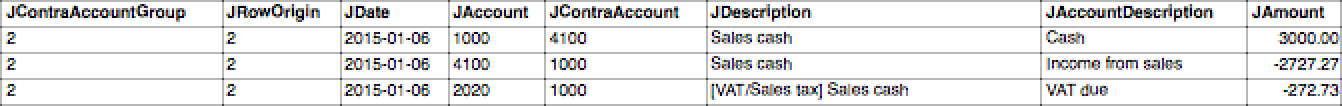

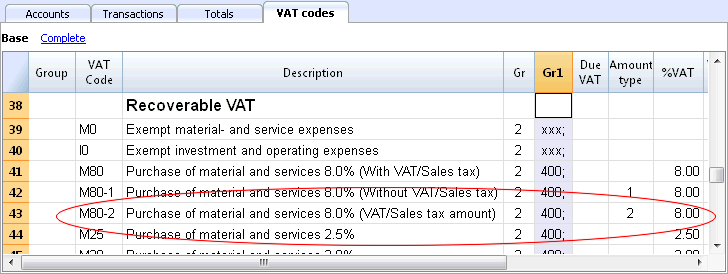

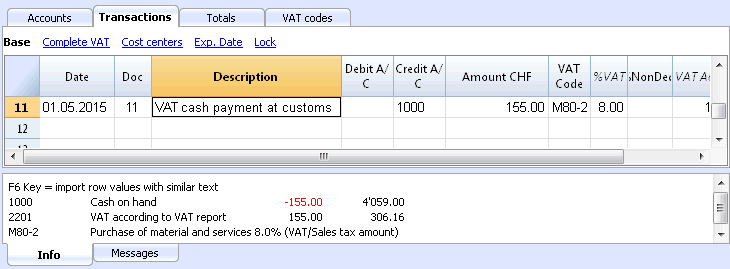

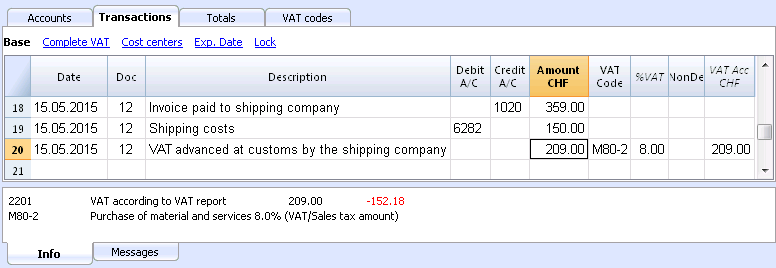

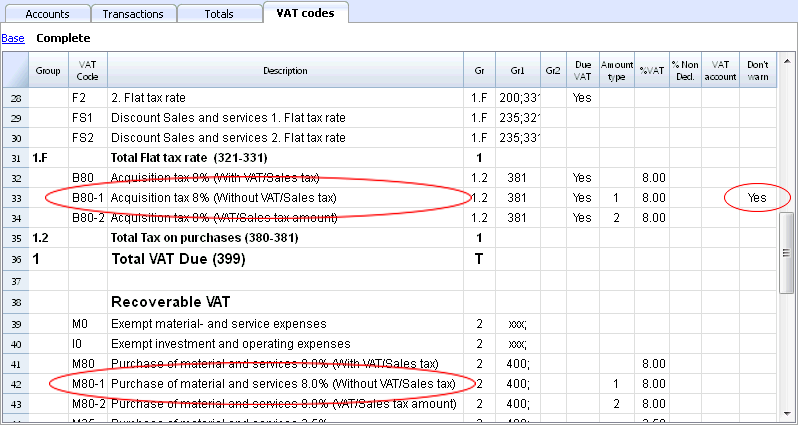

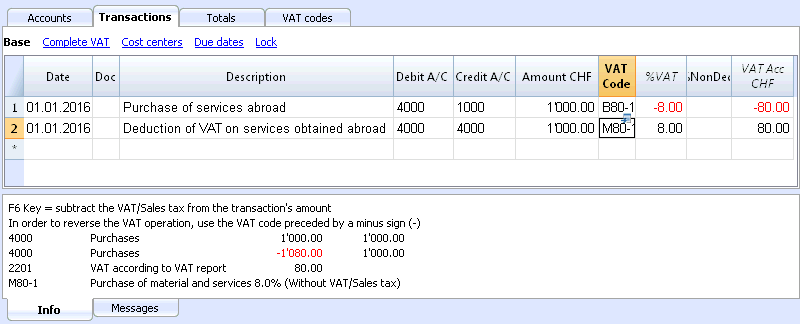

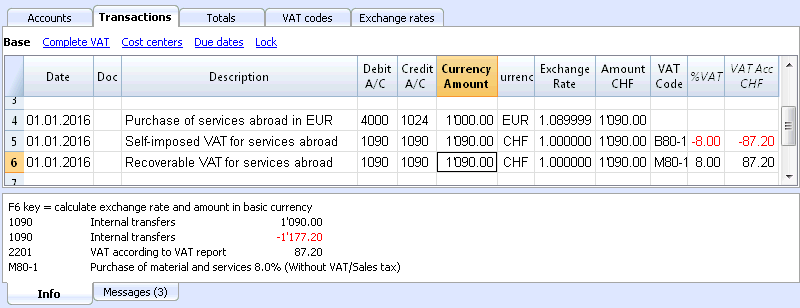

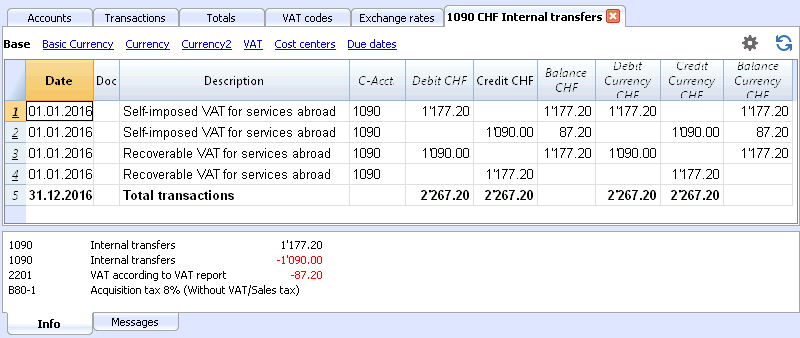

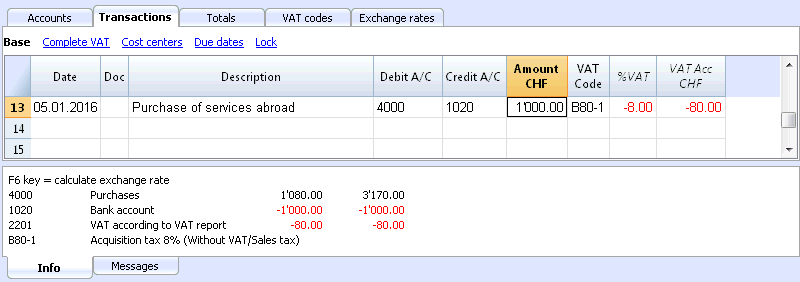

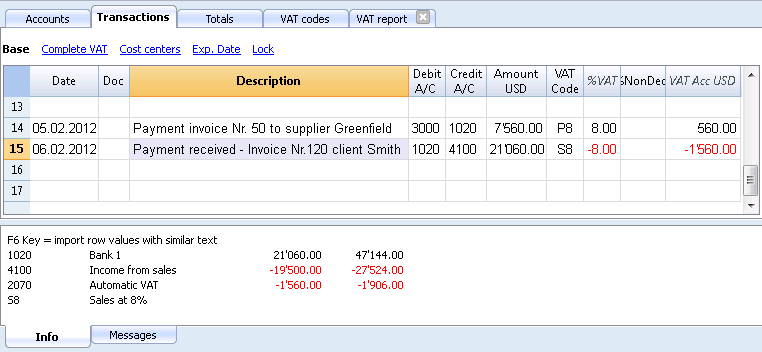

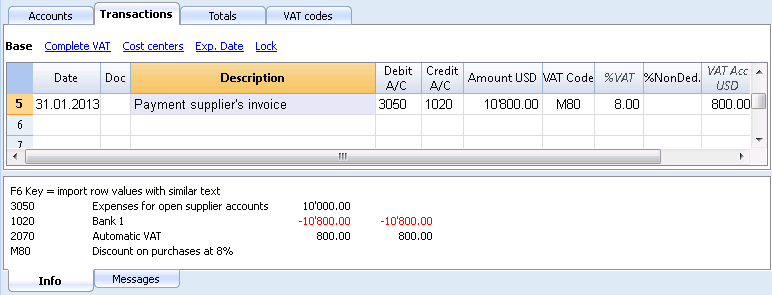

- Transactions with VAT

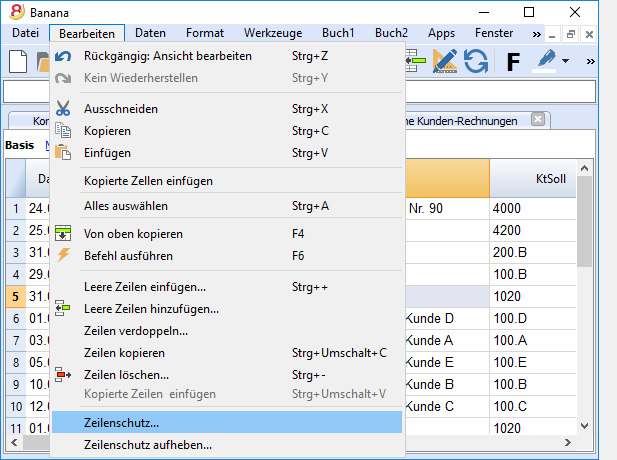

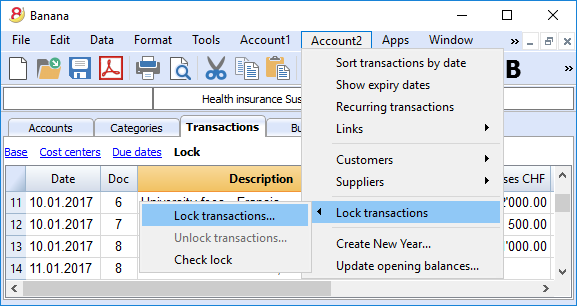

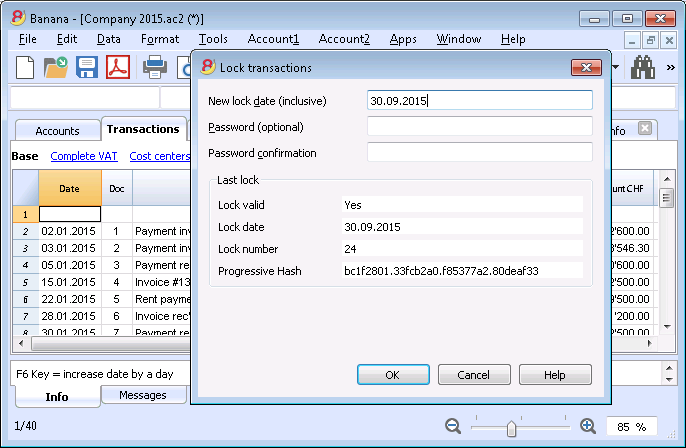

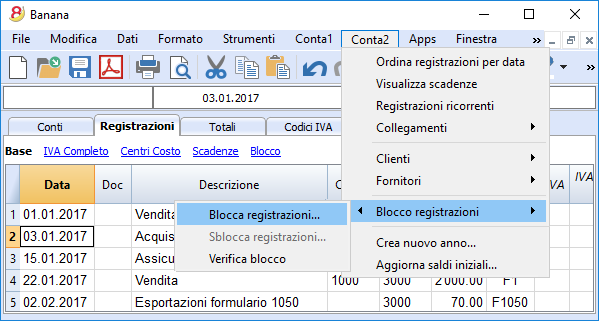

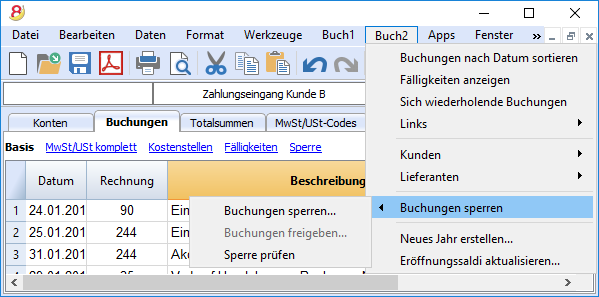

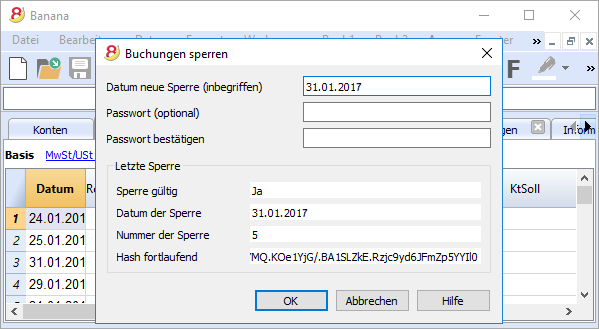

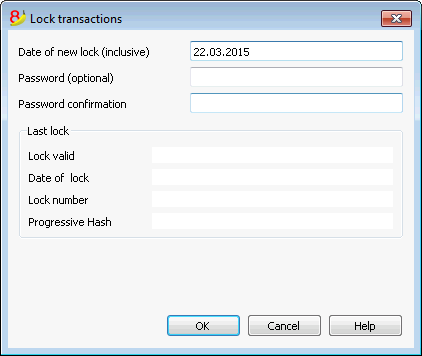

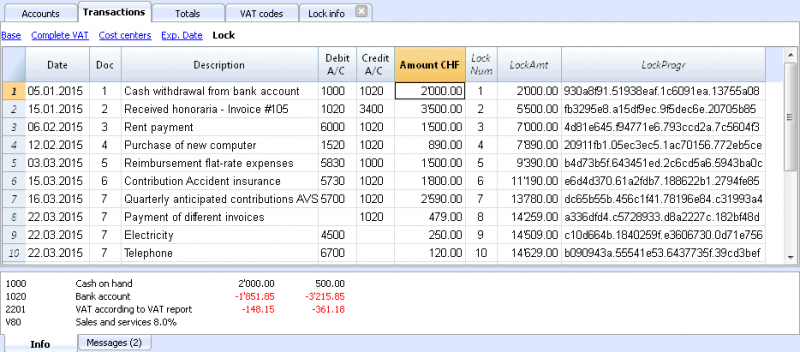

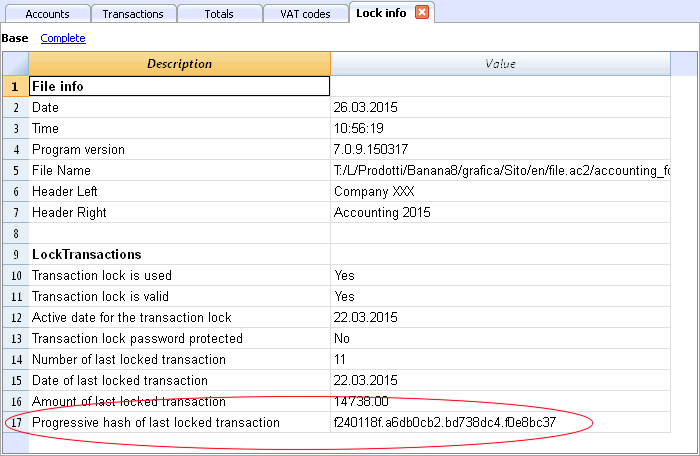

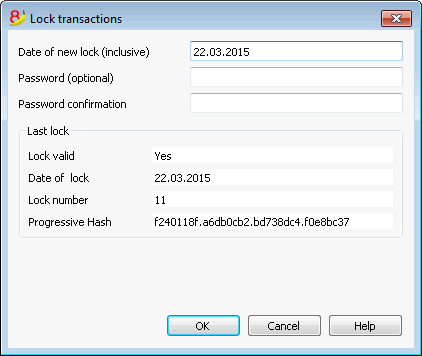

- Lock transactions

- Unlock transactions

Advanced features

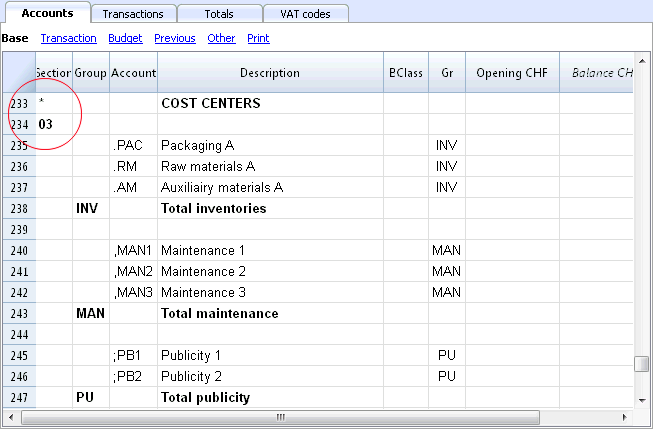

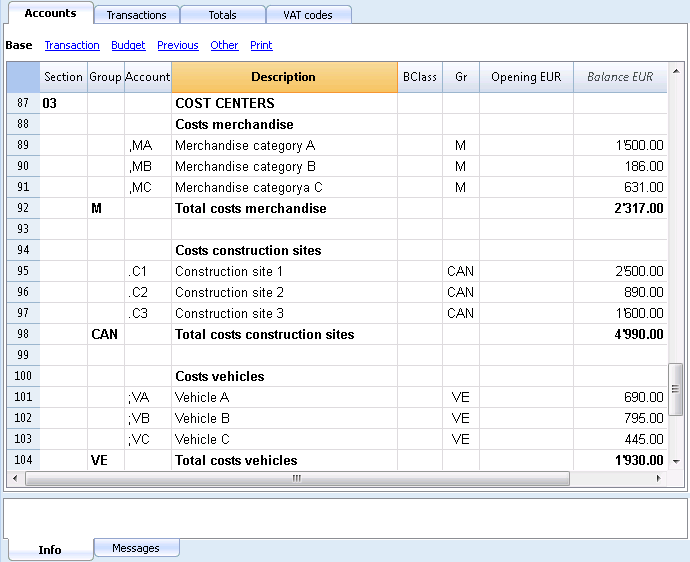

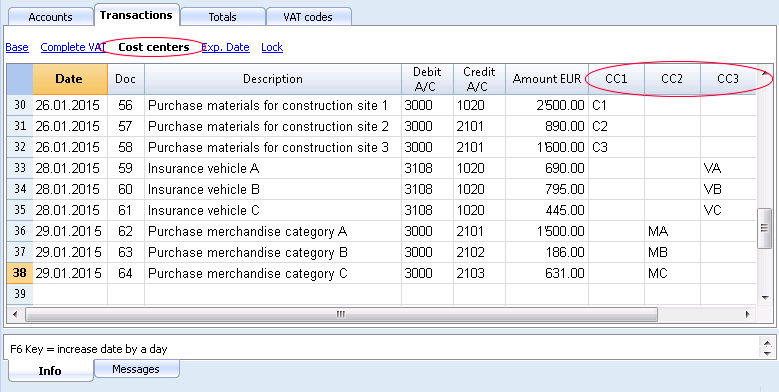

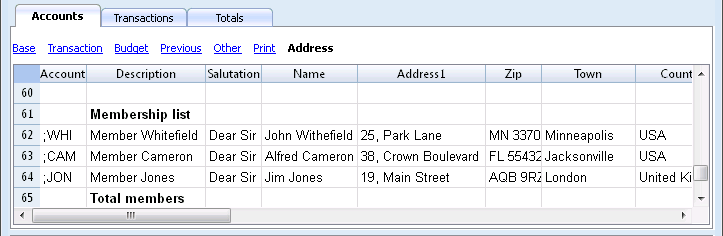

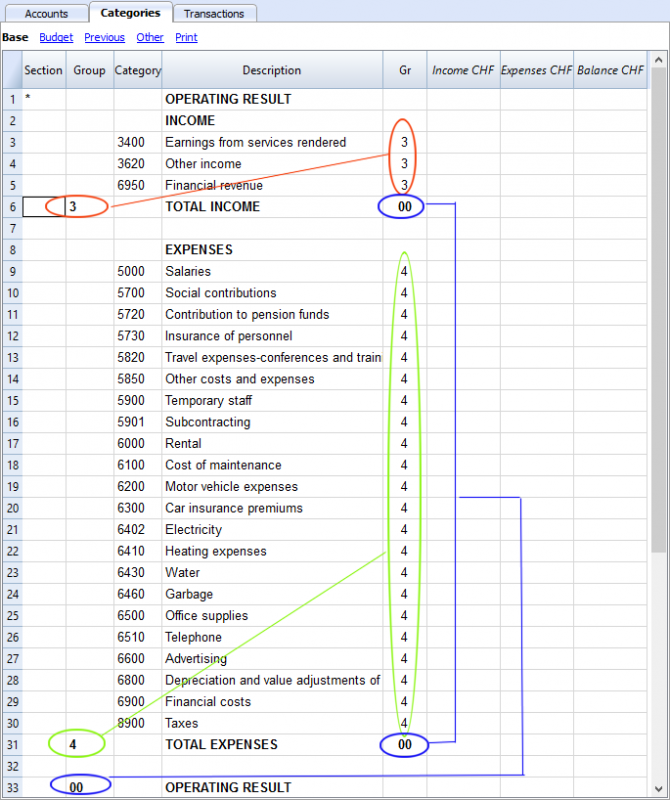

- Cost centers

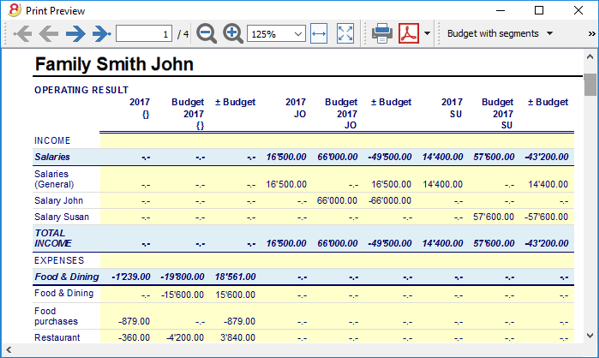

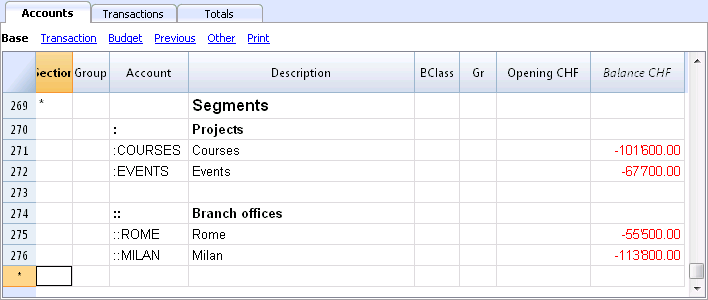

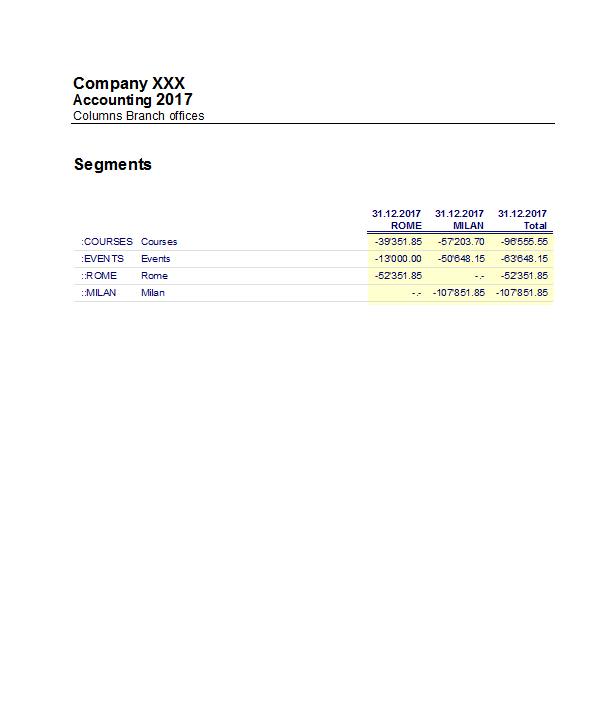

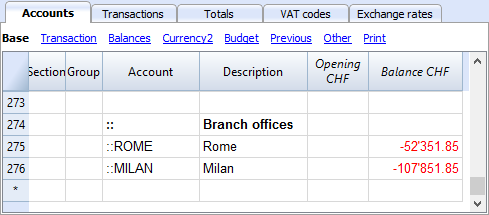

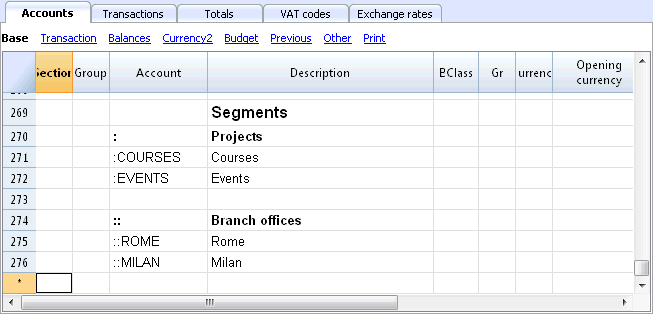

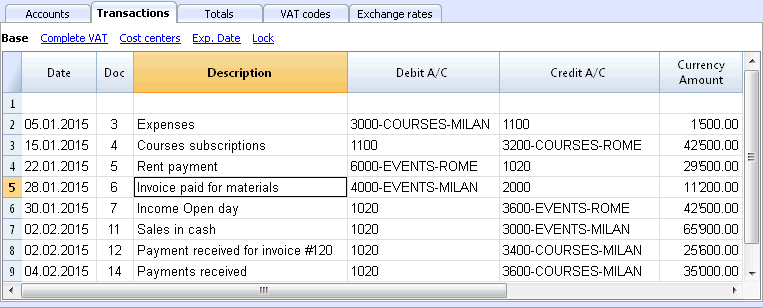

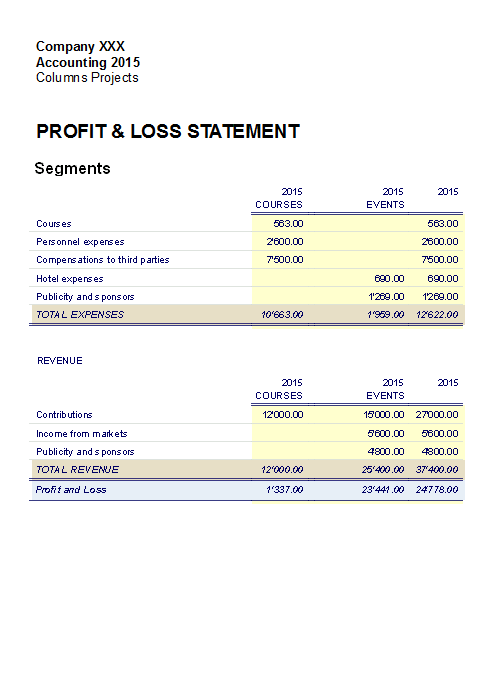

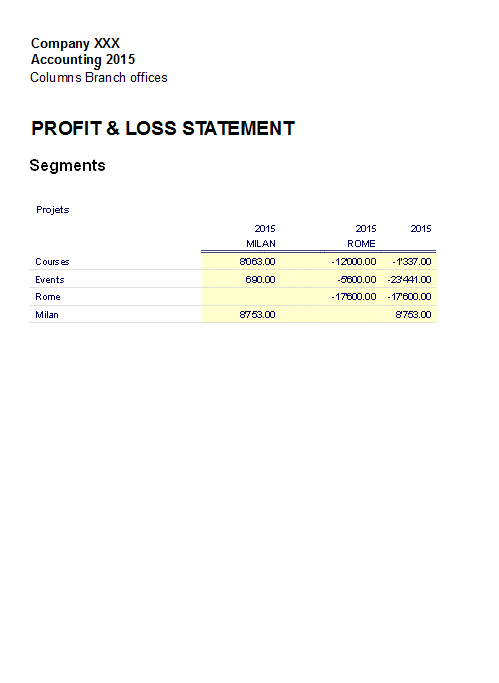

- Segments (to manage different projects)

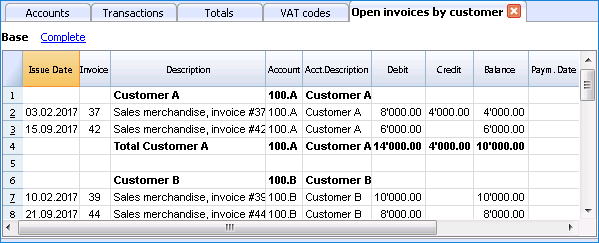

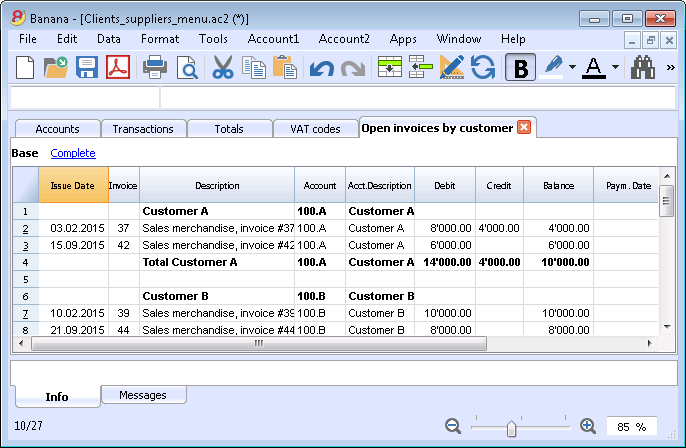

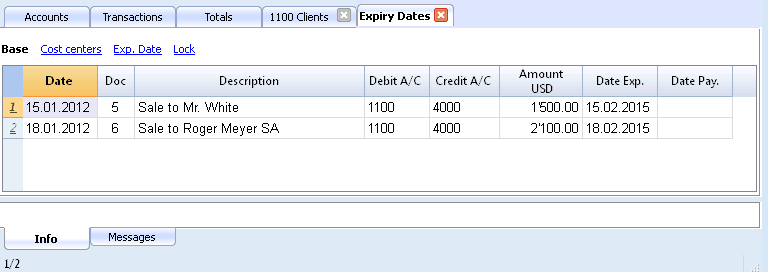

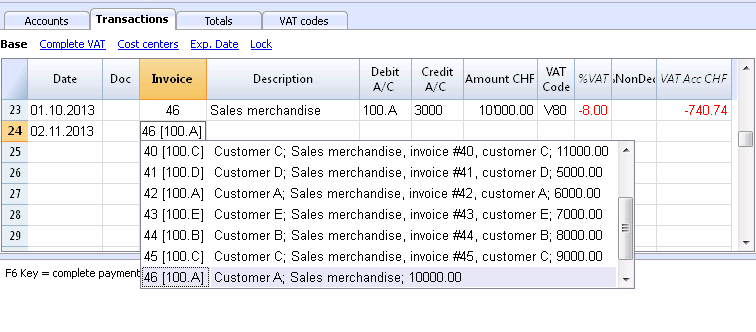

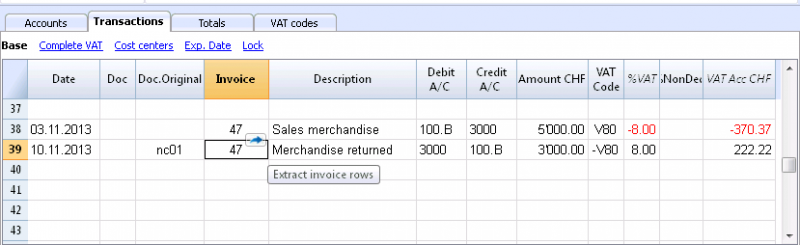

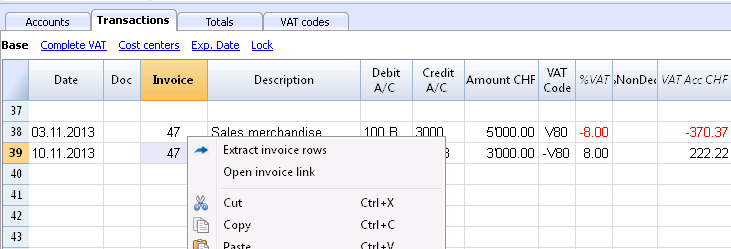

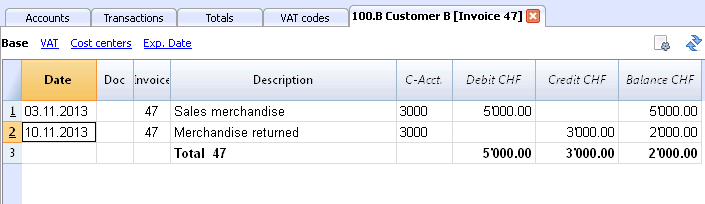

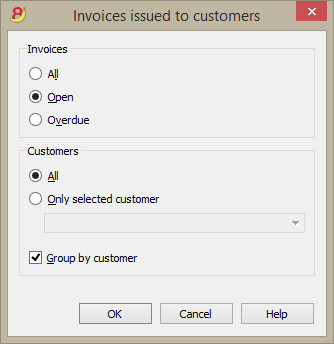

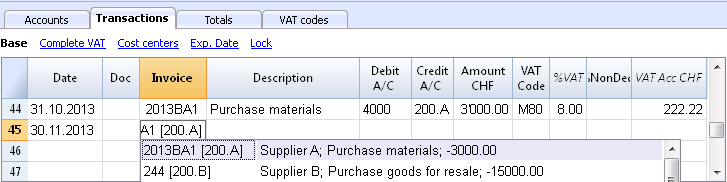

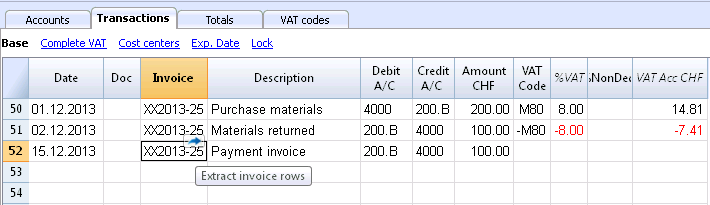

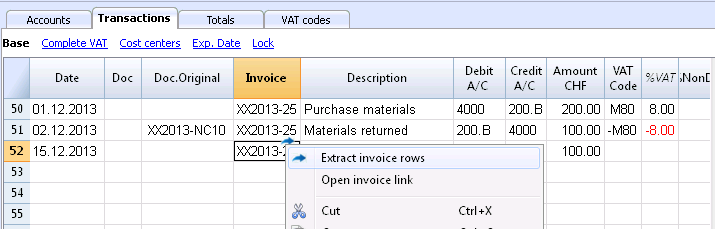

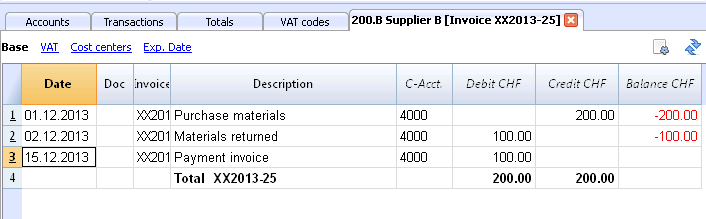

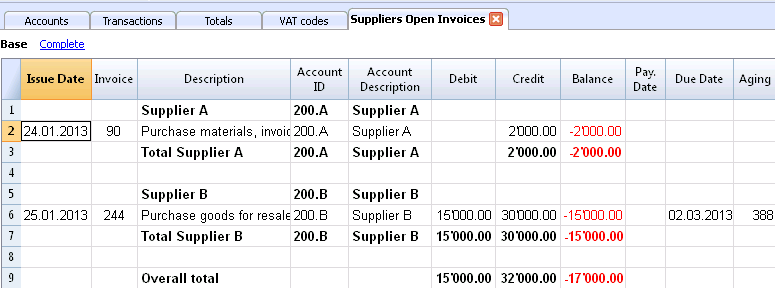

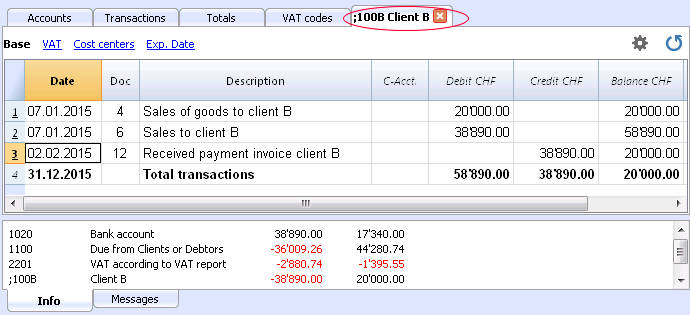

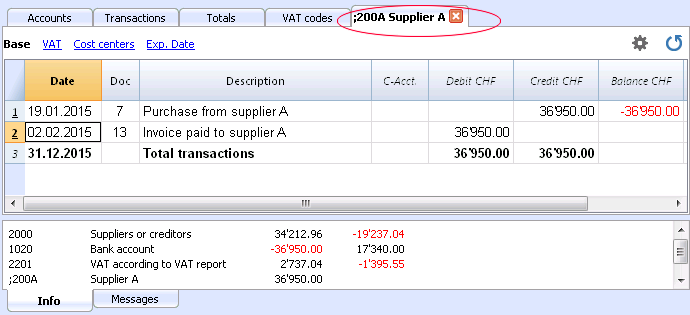

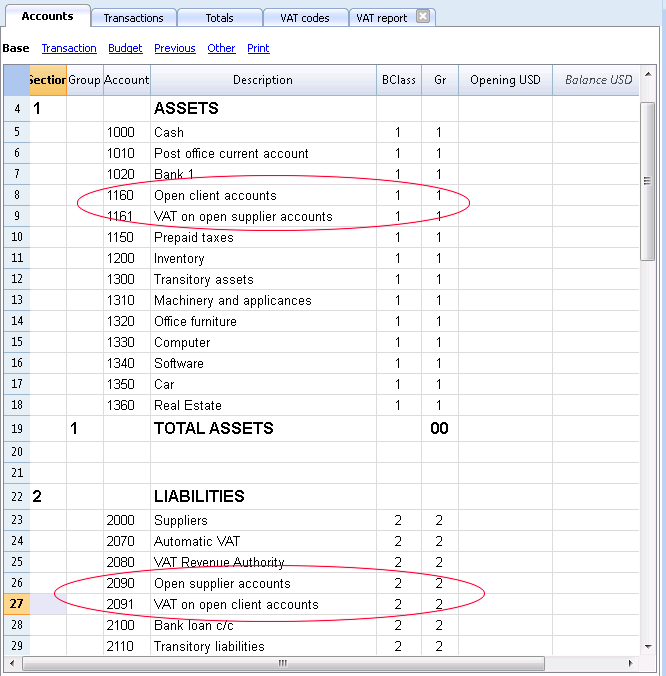

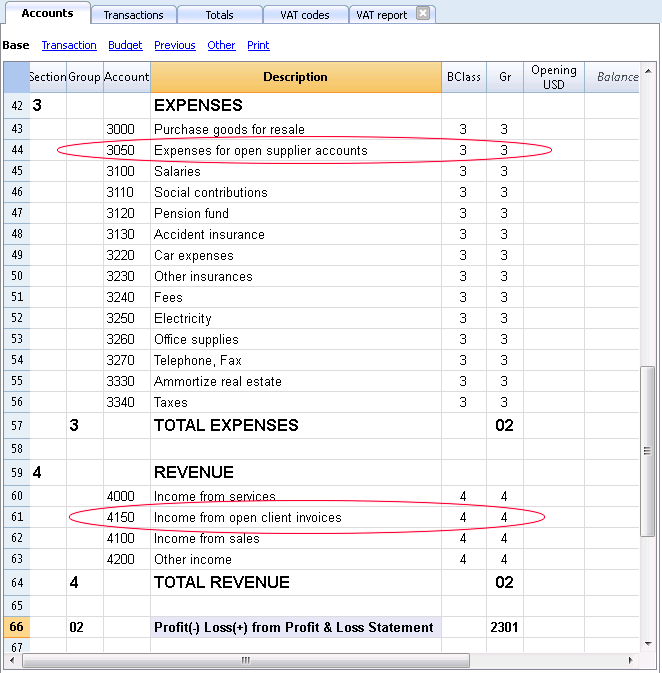

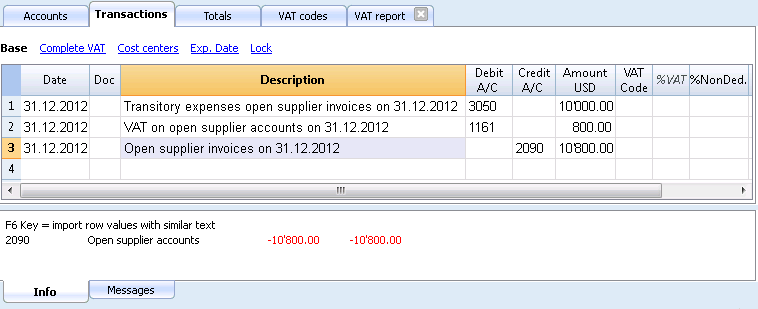

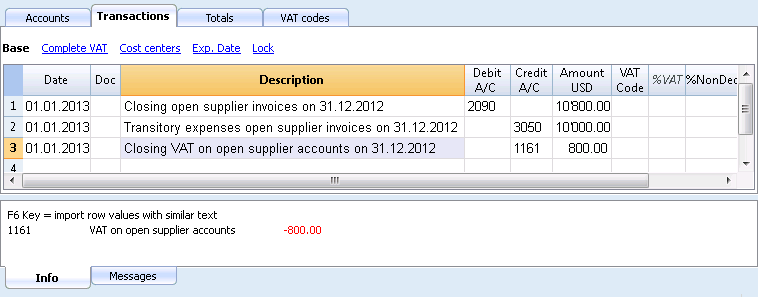

- Invoice control (management of open, overdue, historical invoices)

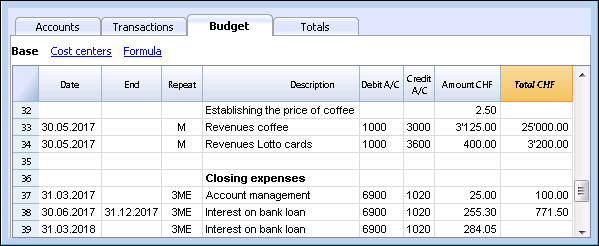

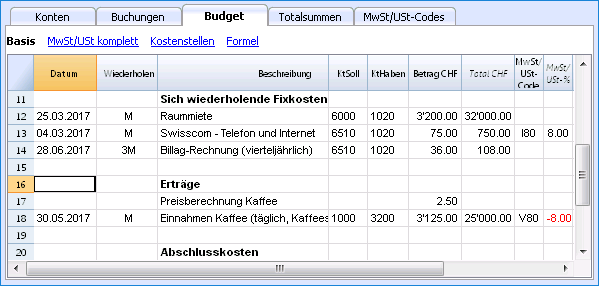

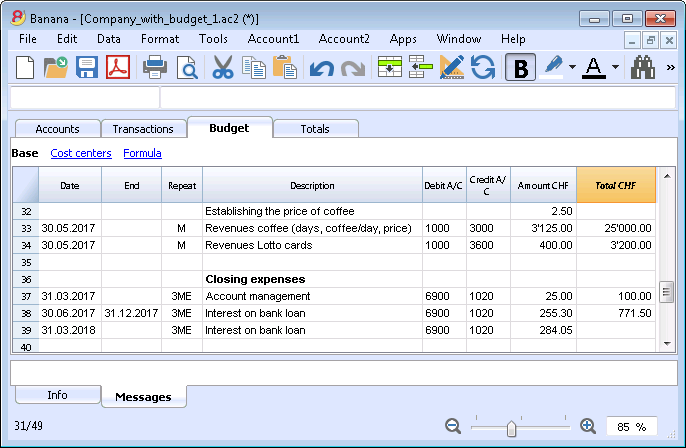

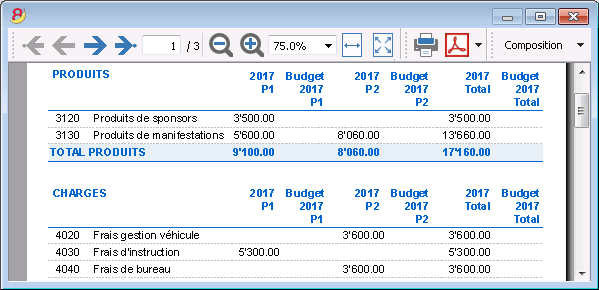

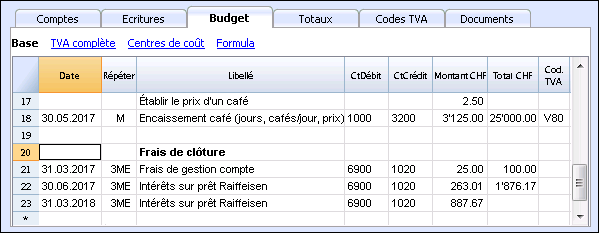

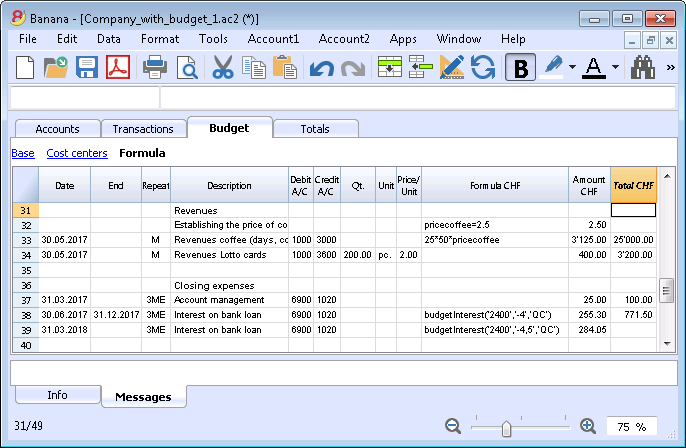

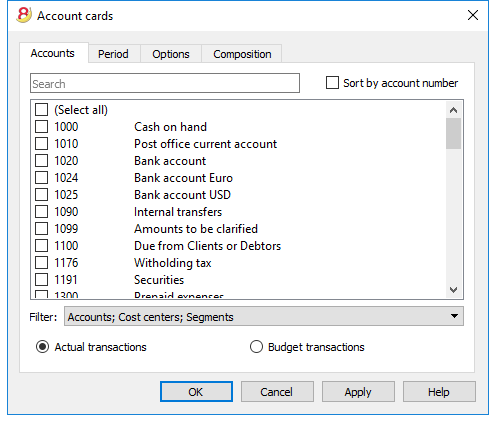

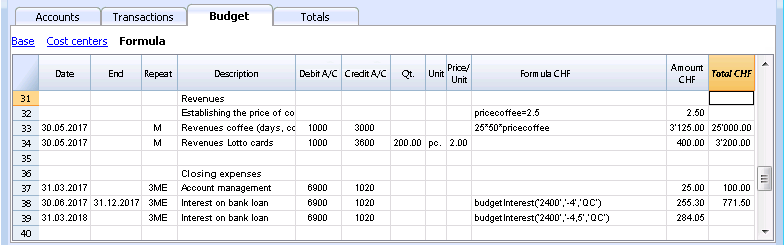

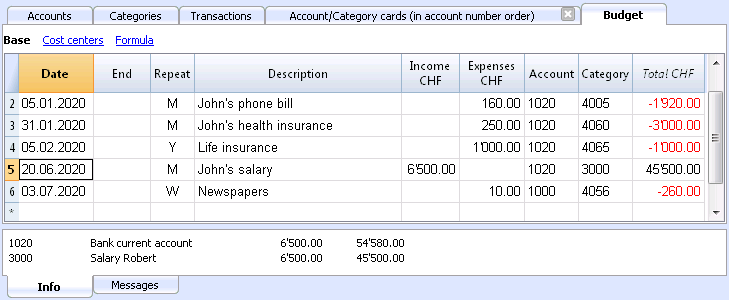

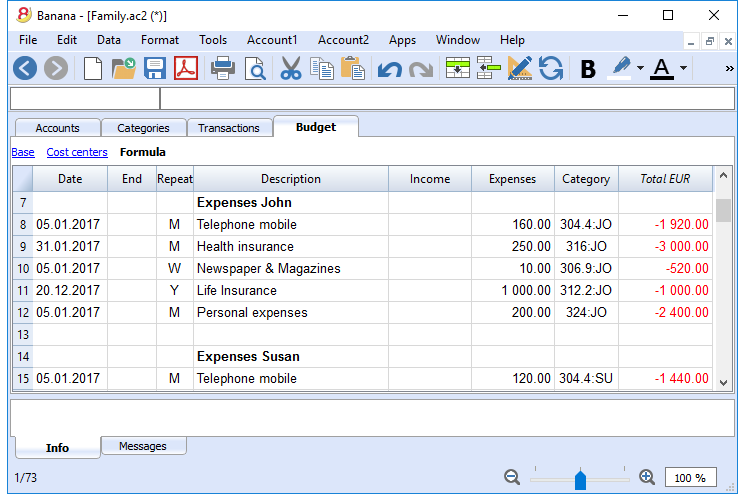

- Budget with Transactions table

- Possibility to insert formulas

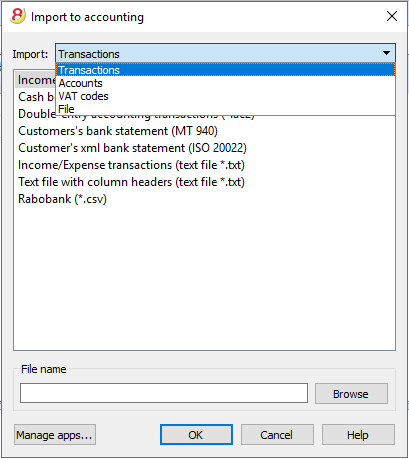

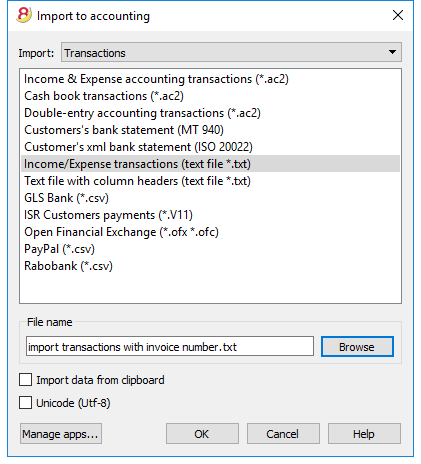

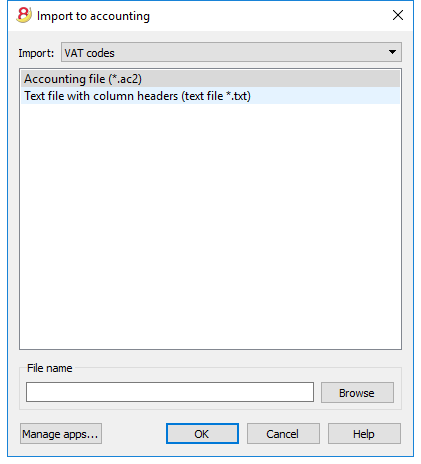

Import and export data

- SEPA/ISO 20022 account statement

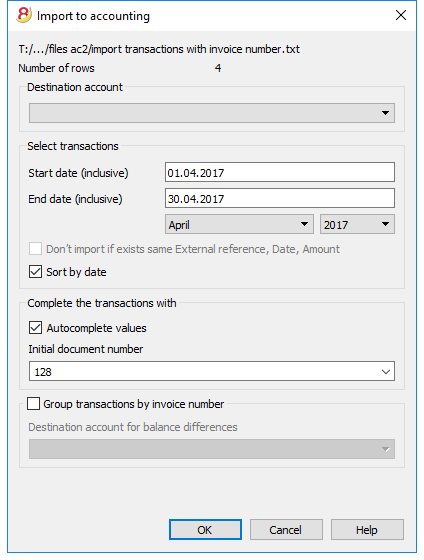

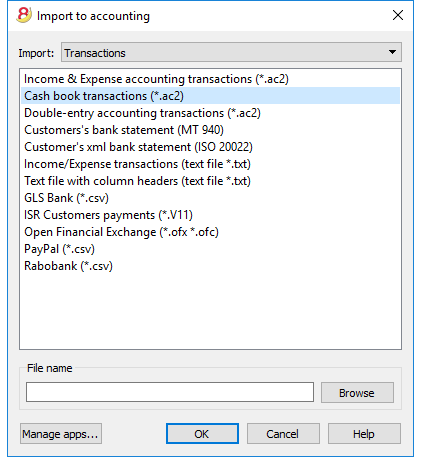

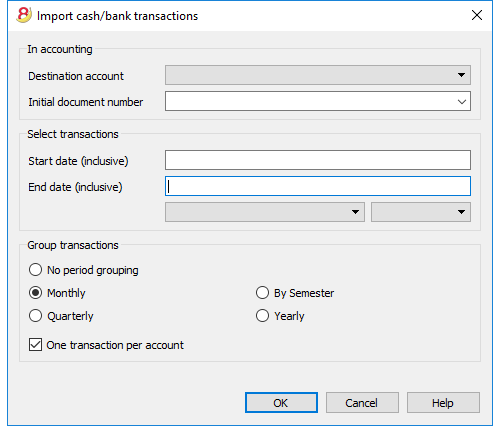

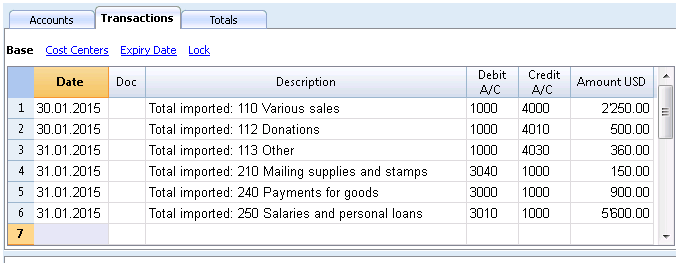

- Import data

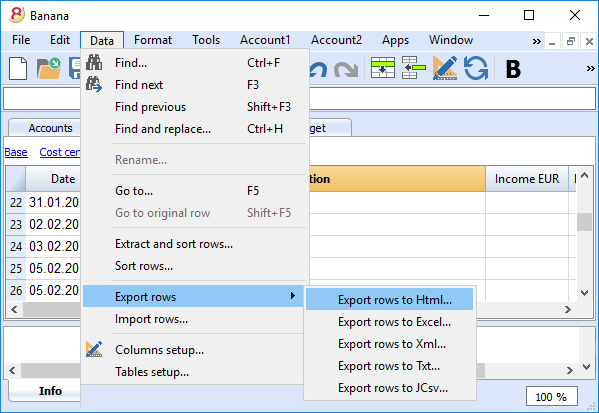

- Export data

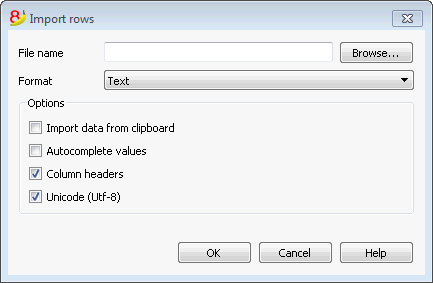

- Import data from other programs

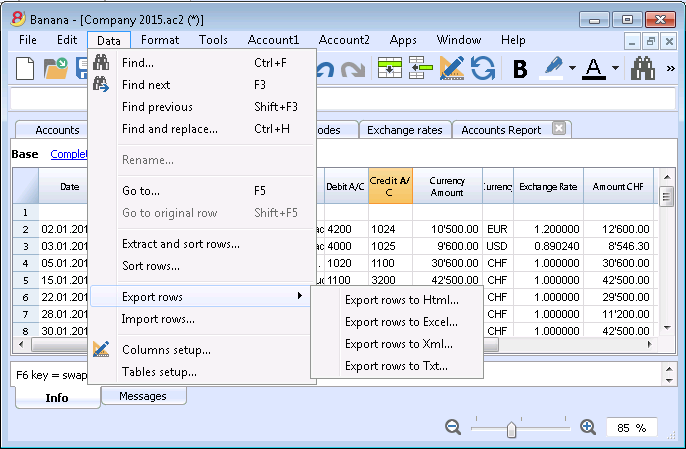

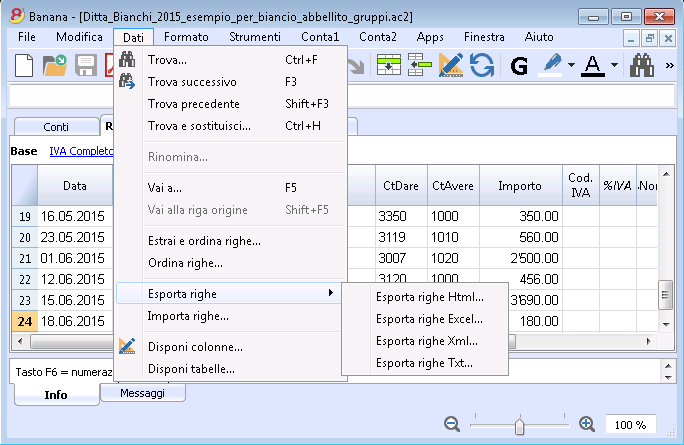

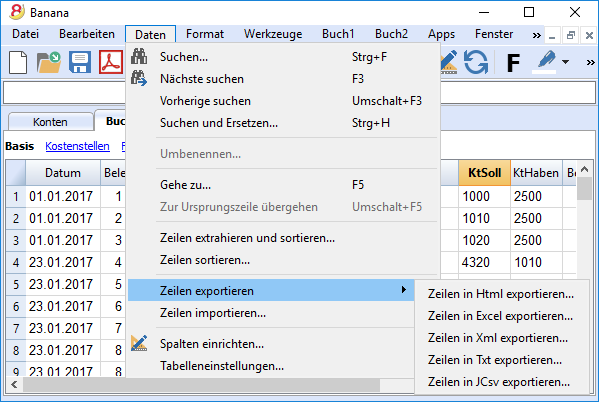

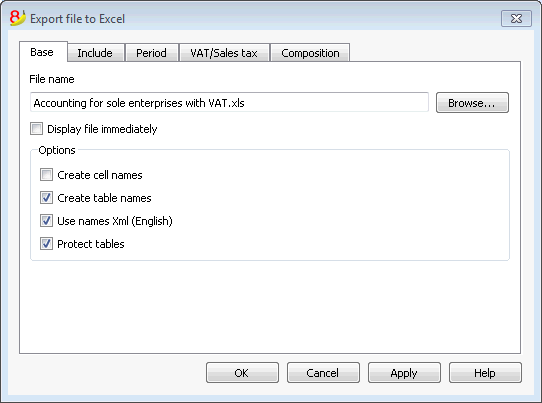

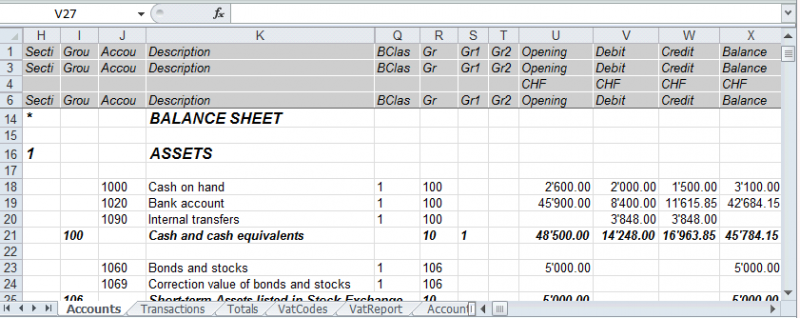

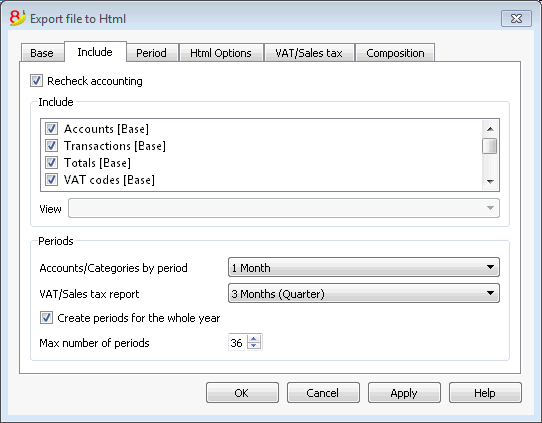

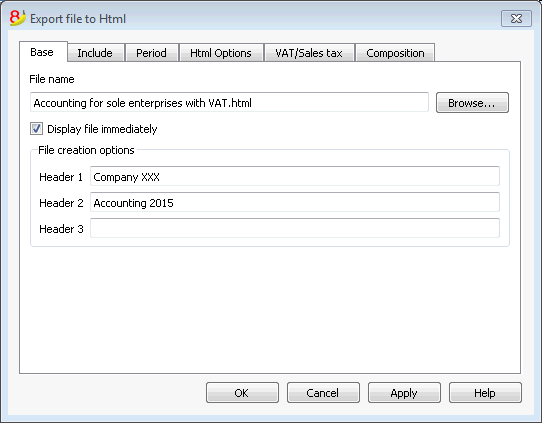

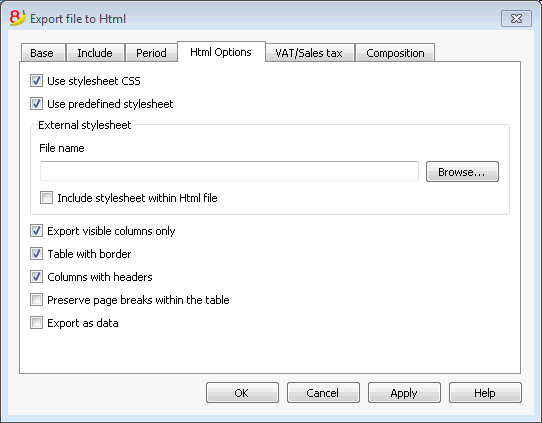

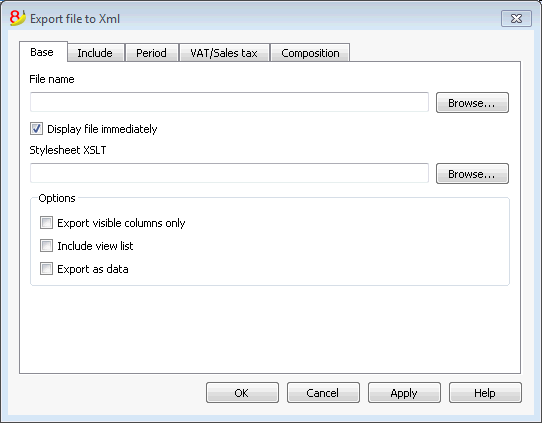

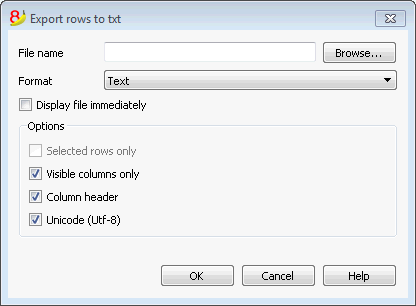

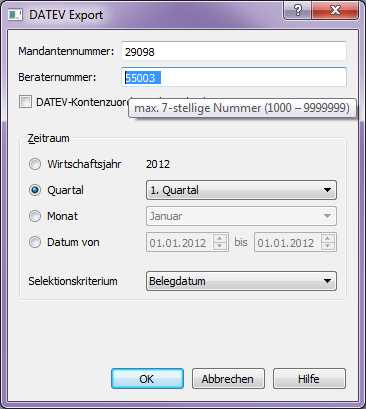

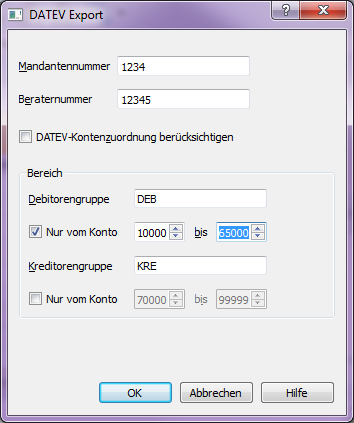

- Export data: Excel - Html - Xml - txt

- Data options to include in the export

- Export rows or only selected area to txt

Security

Index

Banana 8 characteristics

Banana Accounting for Windows, Mac and Linux main features

Banana Accounting 8 is an international software extremely versatile, perfect to keep accounting in any nation. Ideal for small economic entities.

VersatileIt adapts to your needs and accounting knowledge level.

|

Fast and easyStart now and save time every day.

|

UniversalUsed in more than 127 nations worldwide.

|

ProfessionalAn impeccable presentation of your business.

|

Security & CertificationMaximum level of security for your data.

|

Compatibility and sharing

|

Comprehensive support

|

||

Versatile

Choose from various accounting methods |

|

|

You can start with the accounting method you prefer, and you can change, if necessary. All your data will be retained:

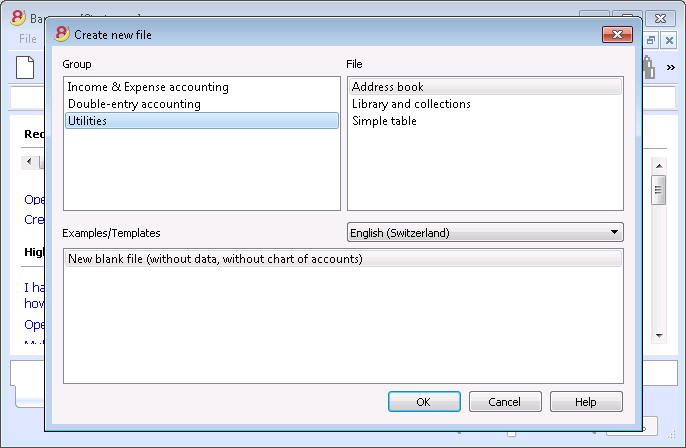

There are also several utility tools:

|

|

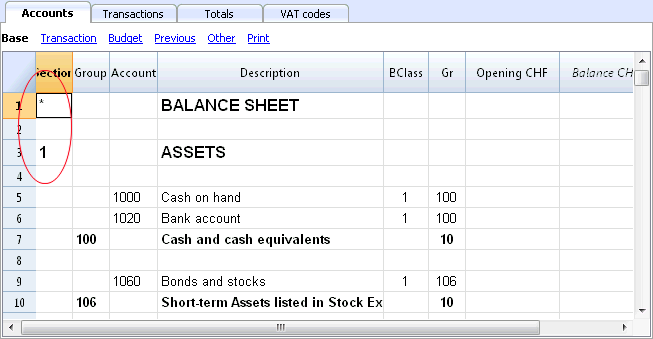

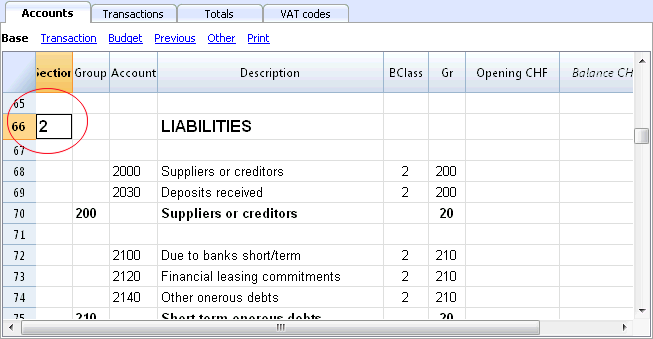

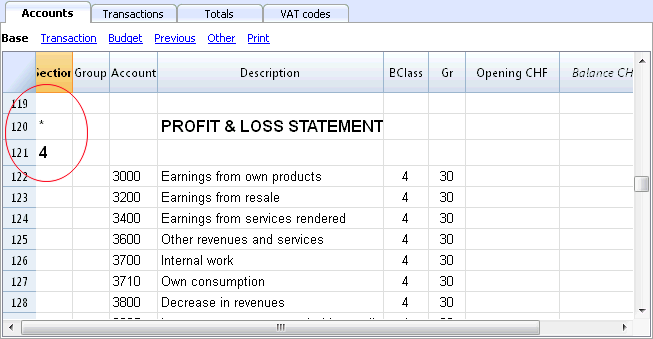

Freely organize your accounts |

|

|

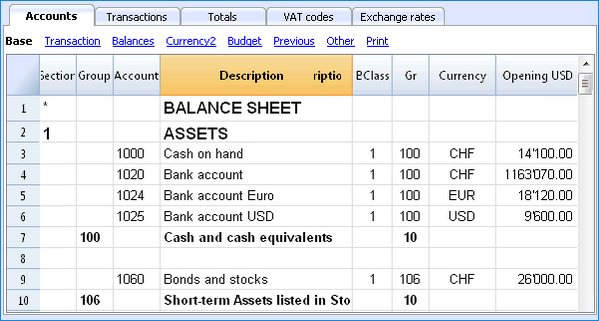

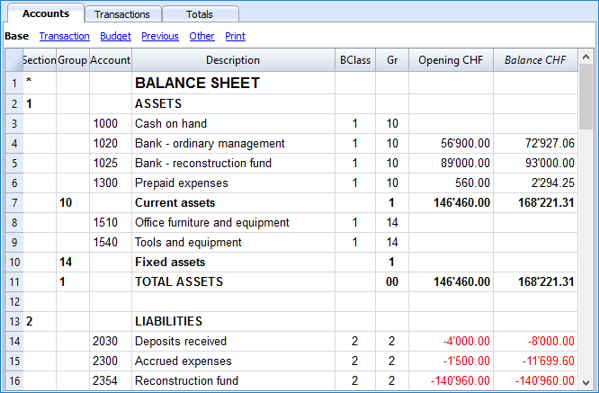

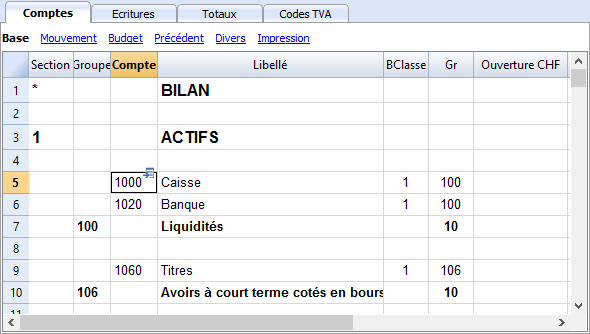

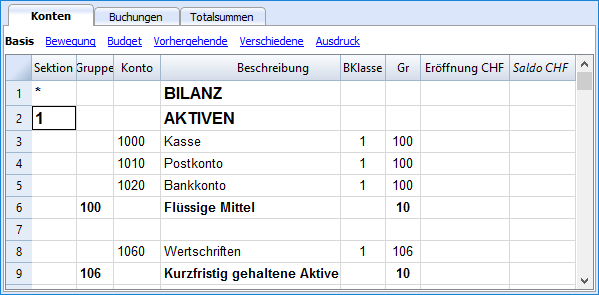

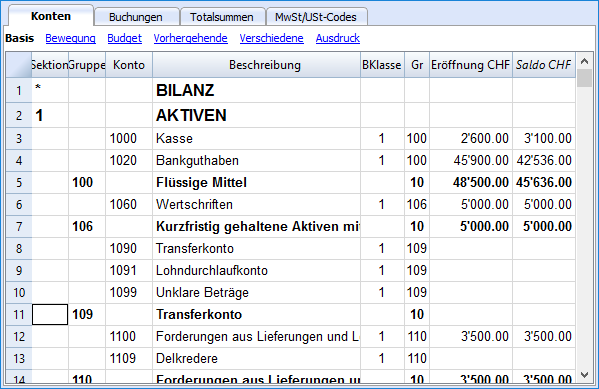

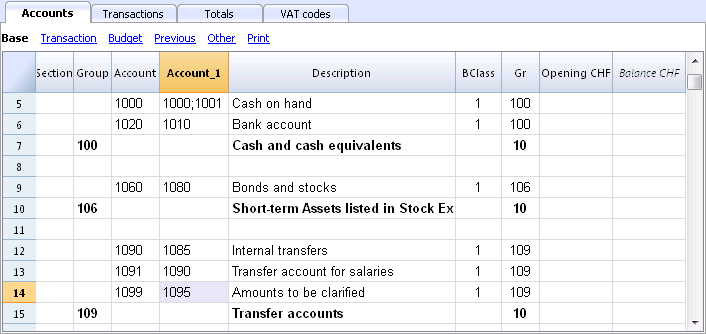

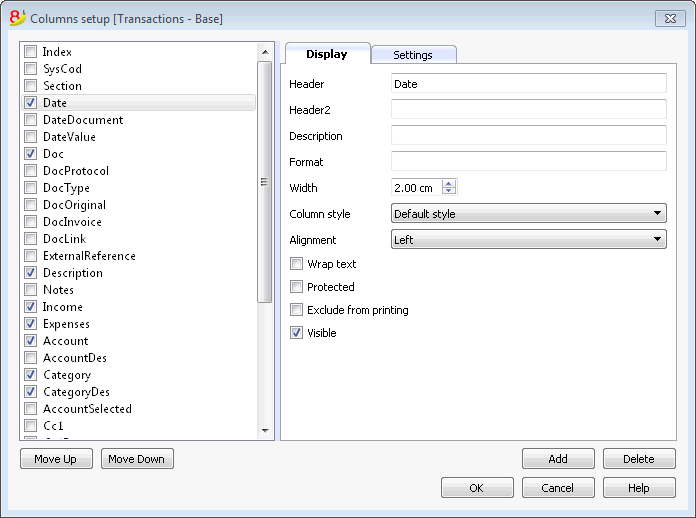

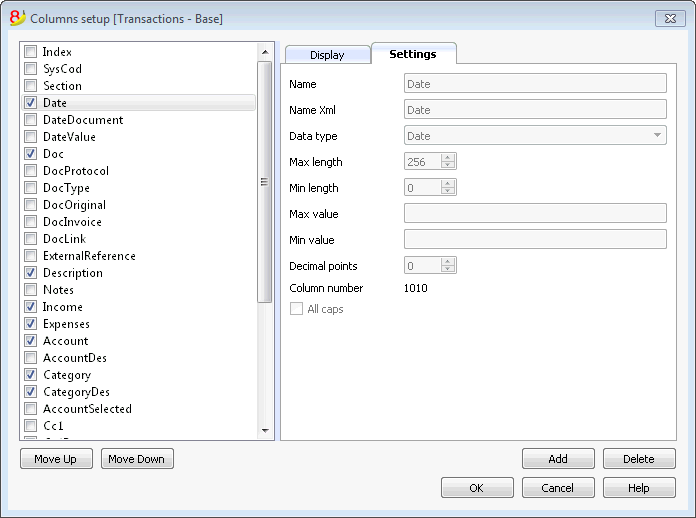

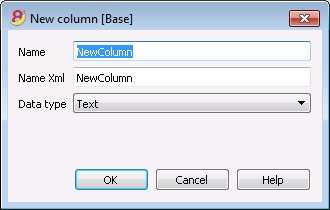

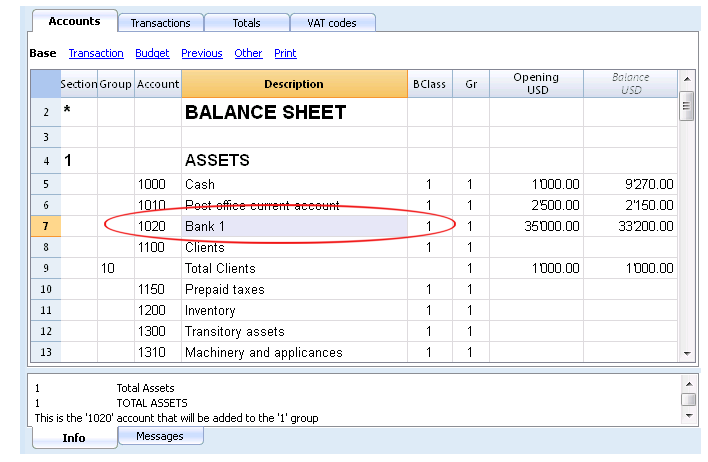

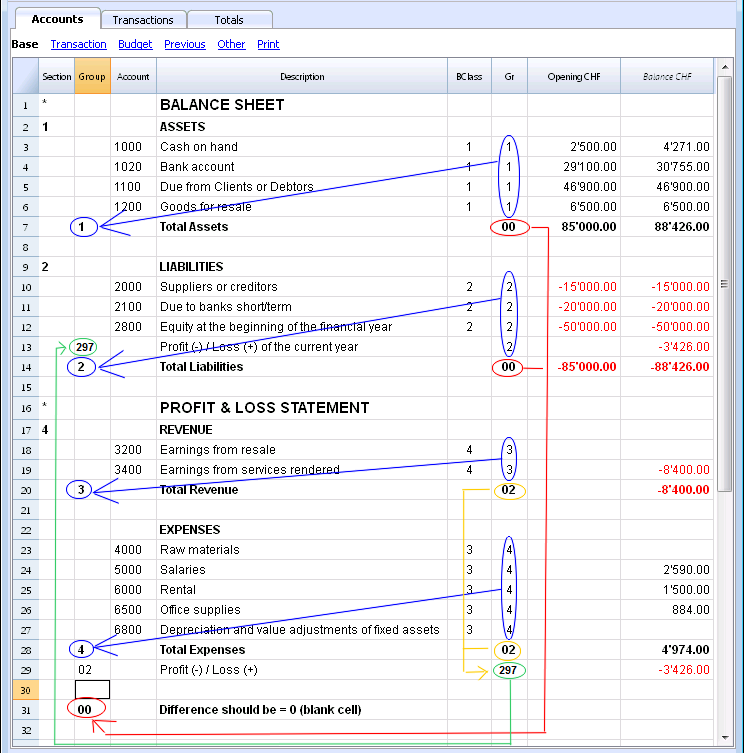

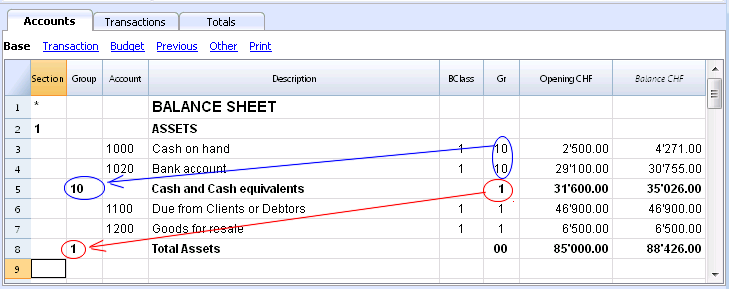

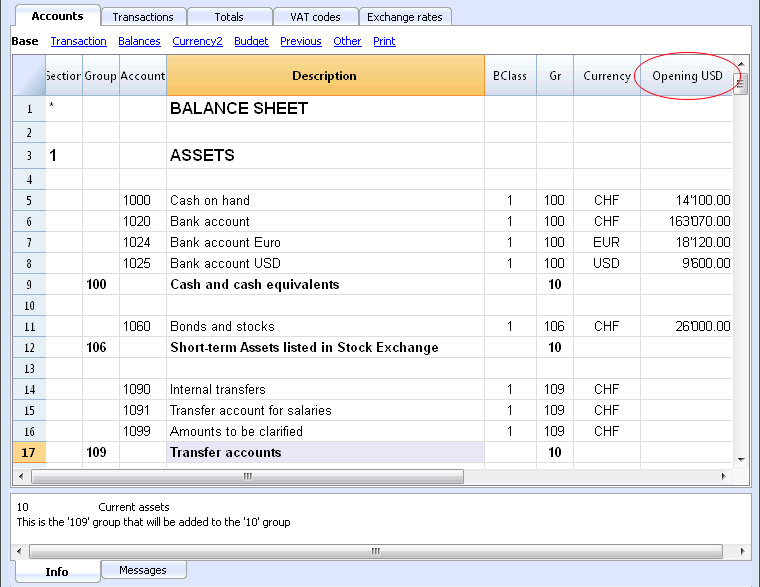

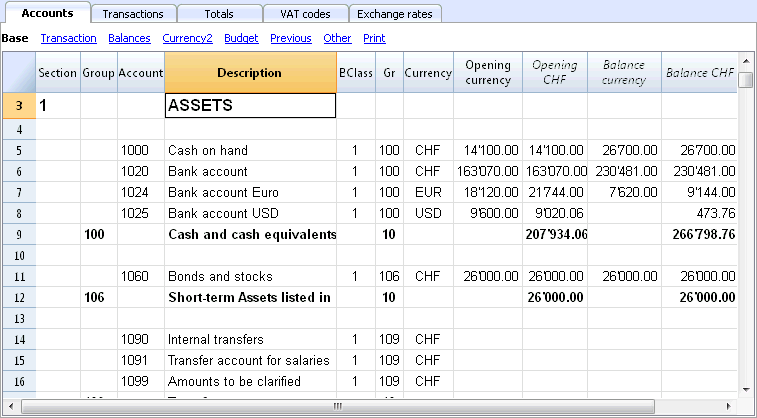

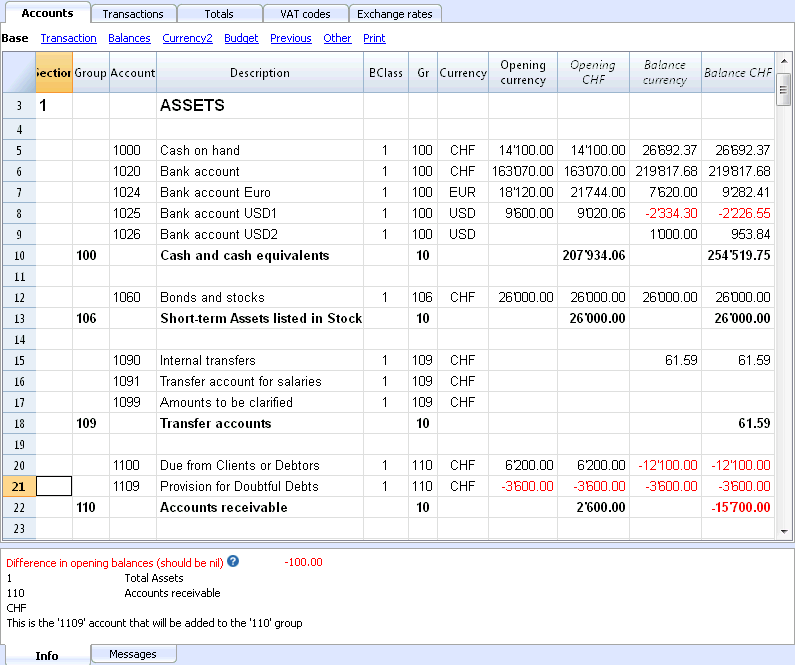

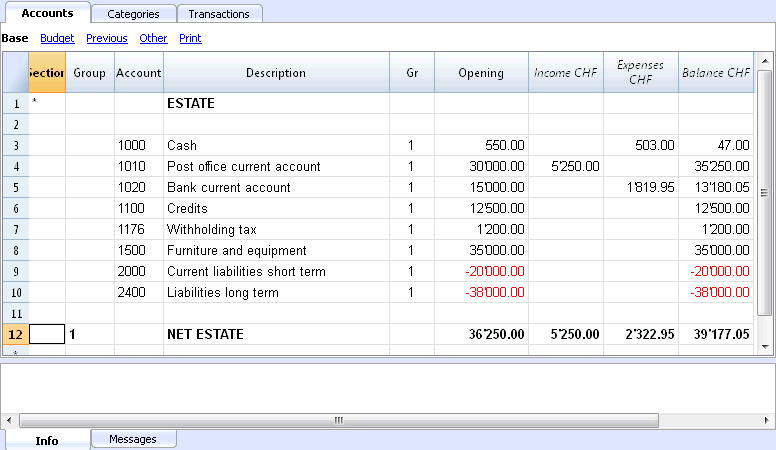

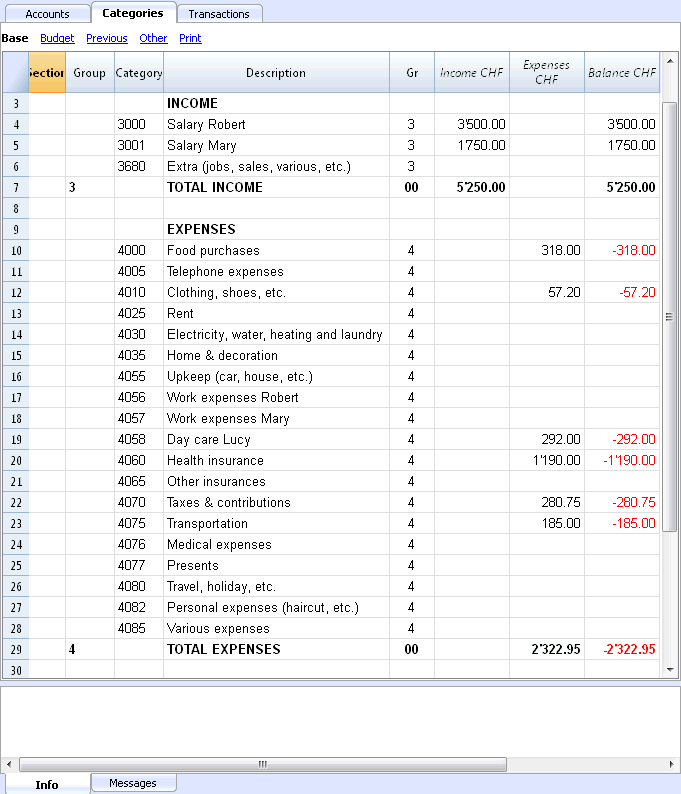

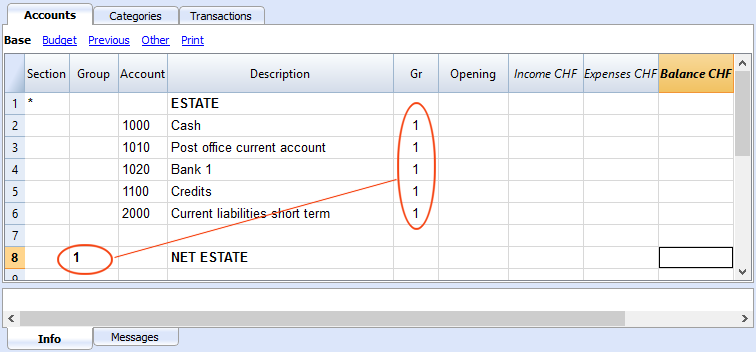

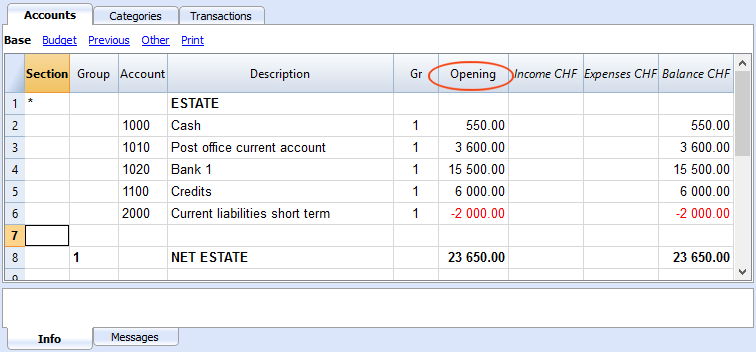

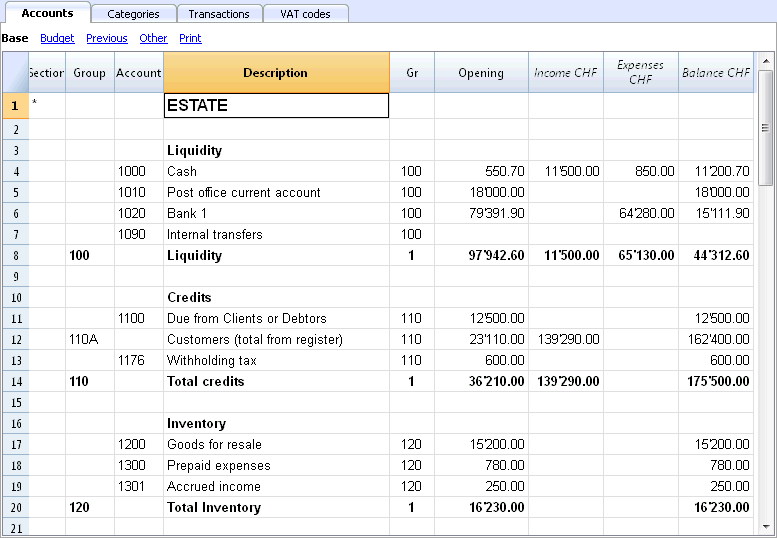

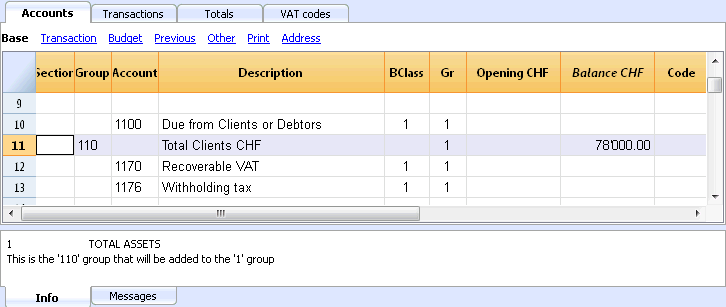

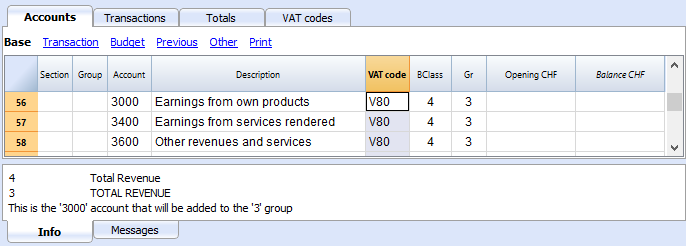

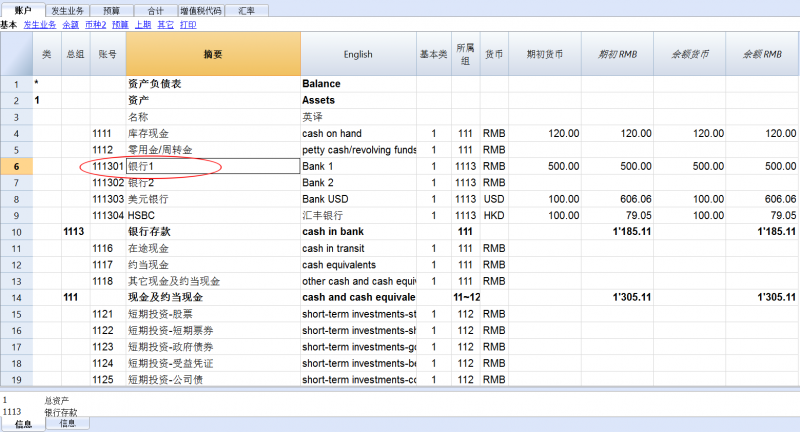

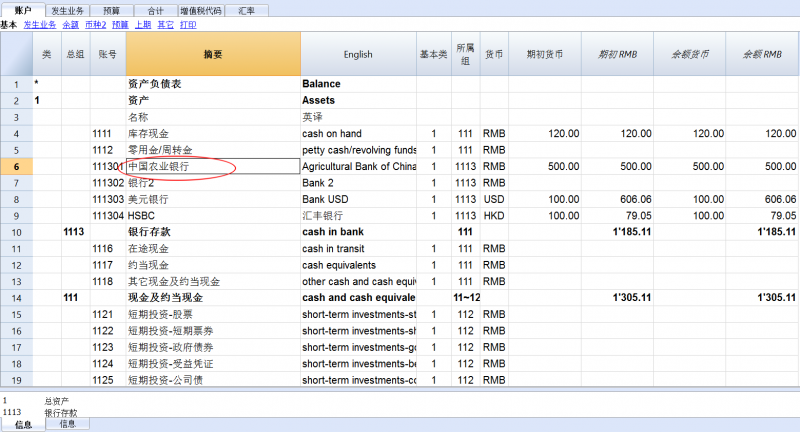

You can adapt the chart of accounts of your template to fit your needs, by adding or deleting accounts, creating groups or subgroups and different totalization levels. The results are immediately visible. You can edit and make changes to your accounting plan also during the year. You can also add extra columns or change the order of the existing ones both in the chart of accounts or in the table where you enter the transactions. |

|

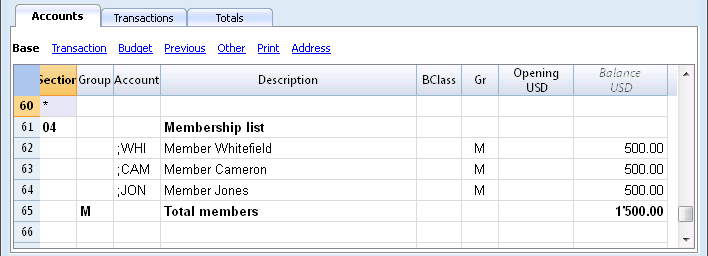

Your situation is always under control |

|

|

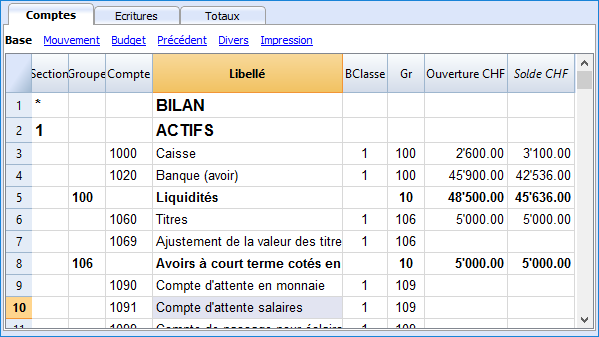

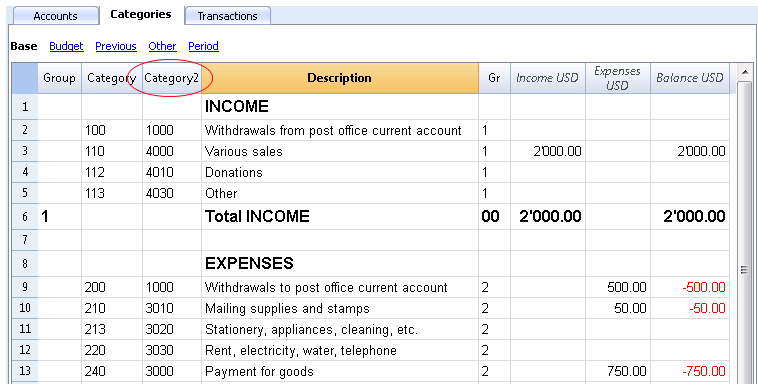

You will always have, at a glance, an updated and global situation of your business. Every time that you enter a transaction your balances will automatically update.

|

|

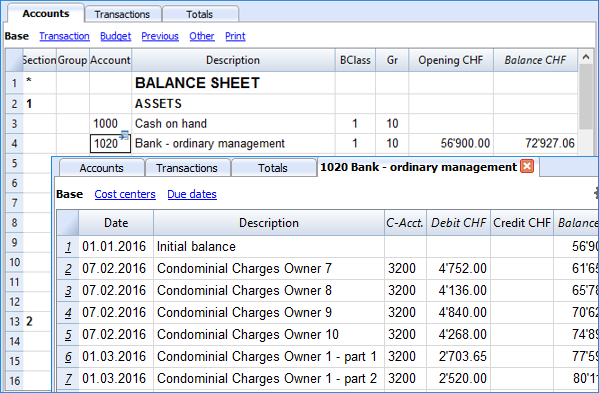

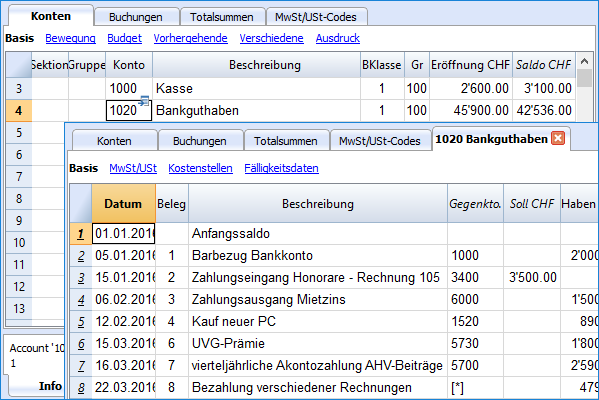

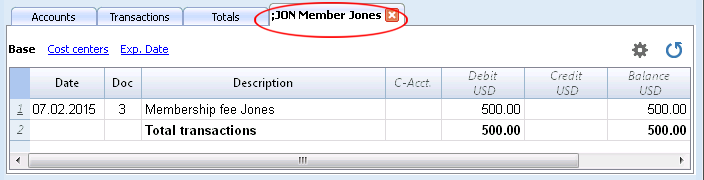

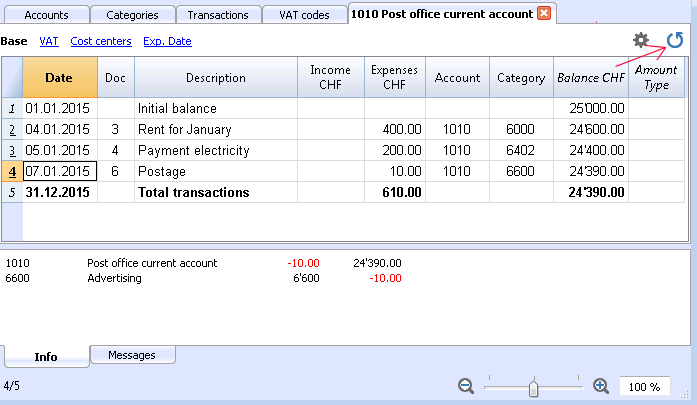

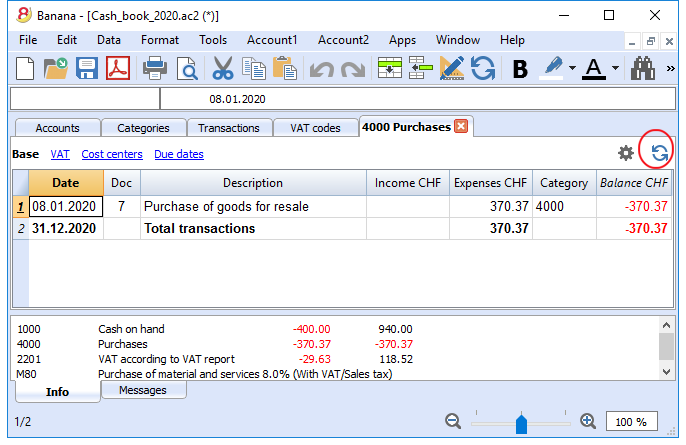

Account details just one click away |

|

|

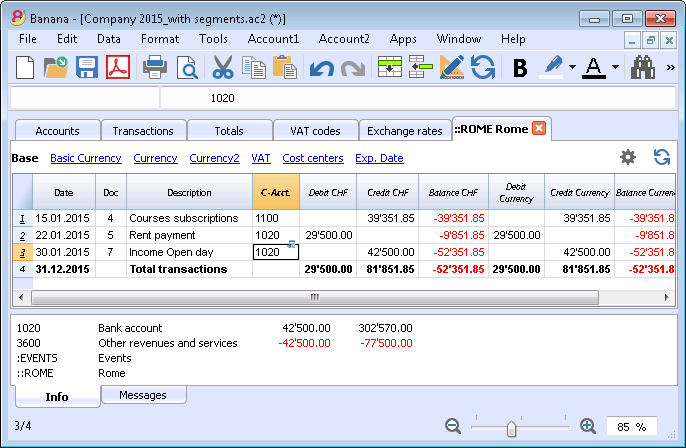

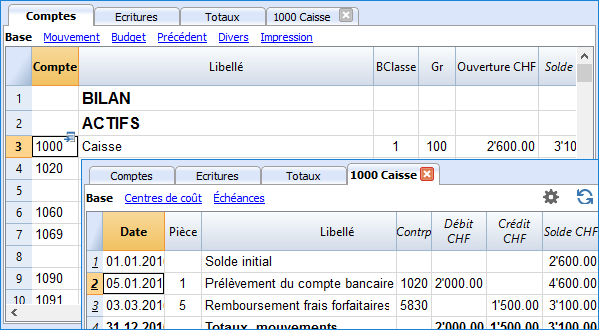

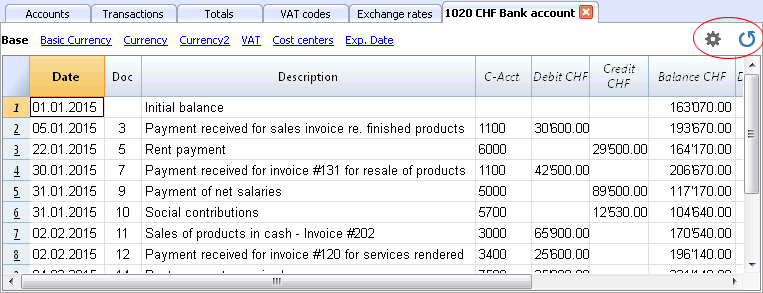

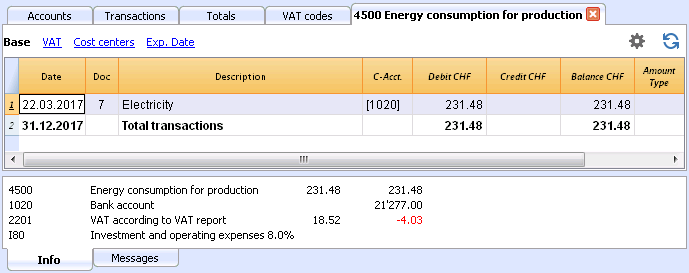

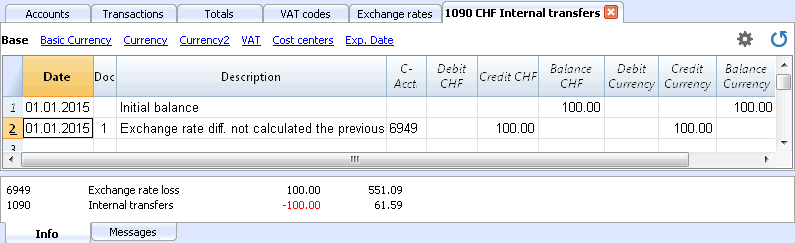

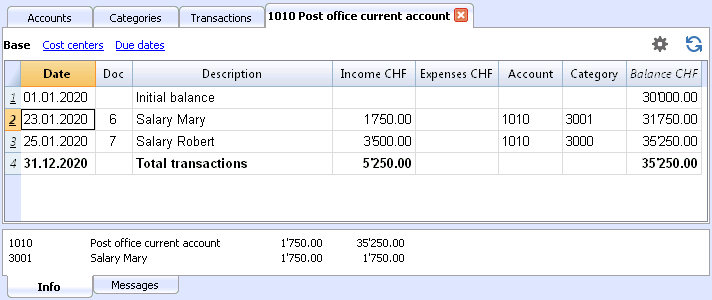

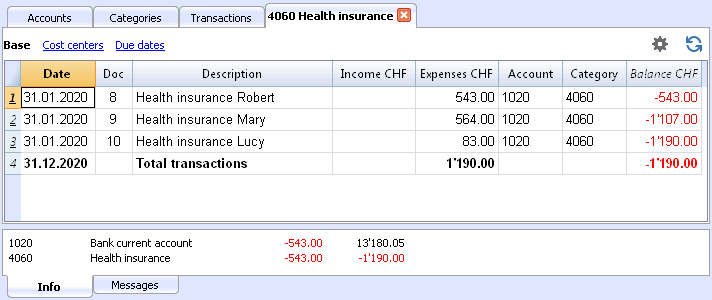

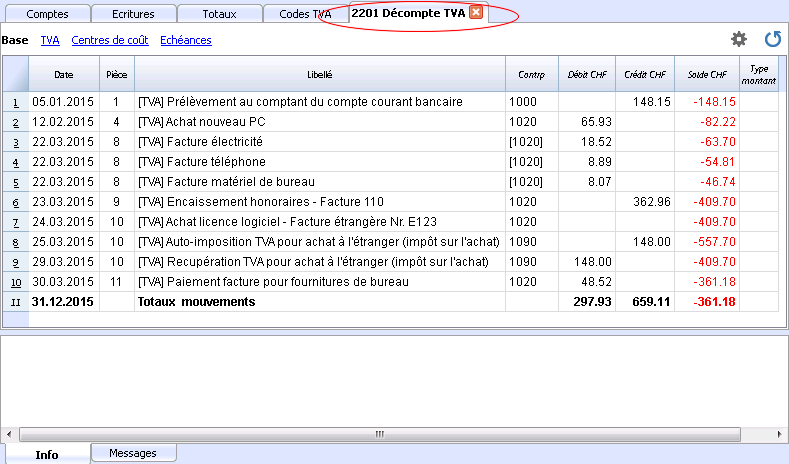

If you want to see a detailed situation of any account, category or group, you just need to click on the small blue arrow that appears in the top-right corner of the account number cell. The account card can be printed or saved in PDF format. You can also obtain your account card for a specific period. You can print a single account card, all of them, or just some selected ones.

|

|

Use cost centers and segments to manage projects, specific business sectors or activities |

|

|

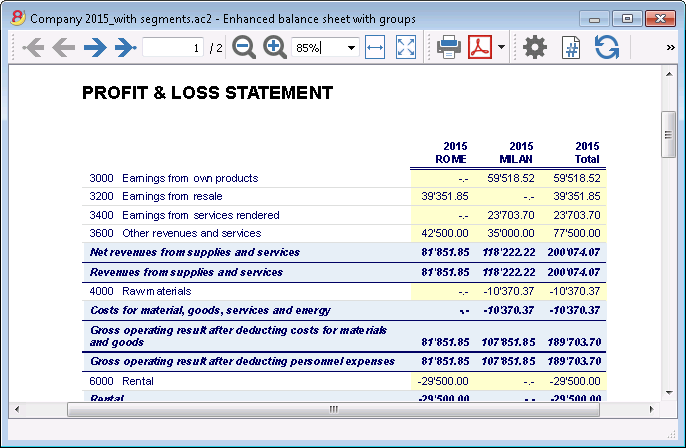

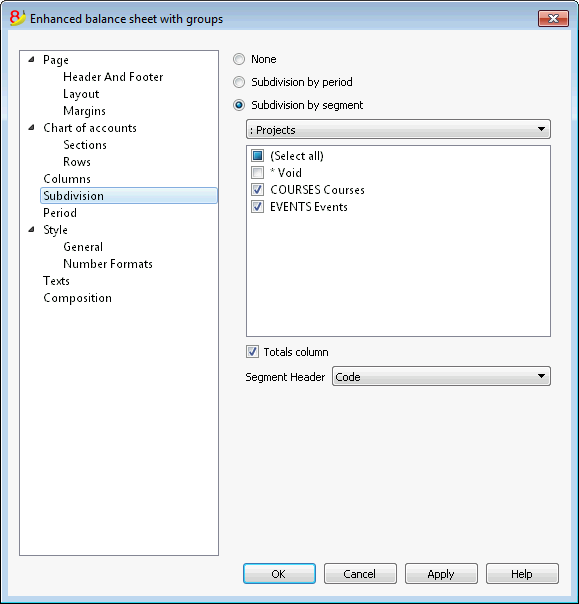

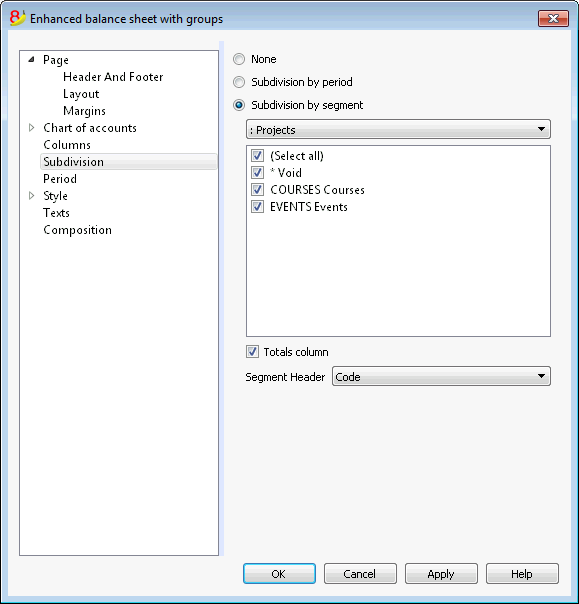

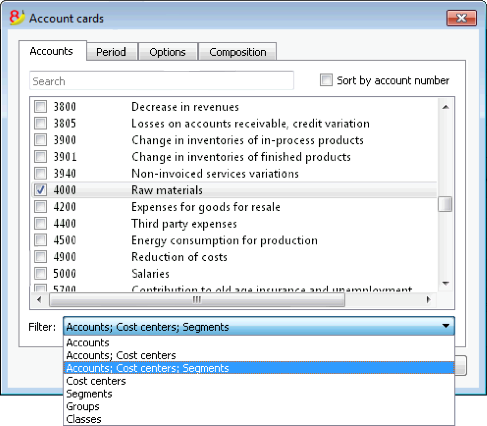

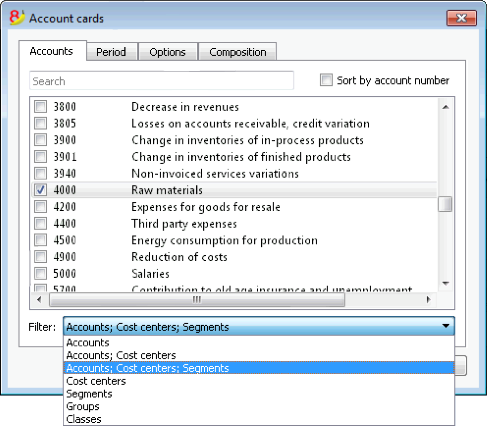

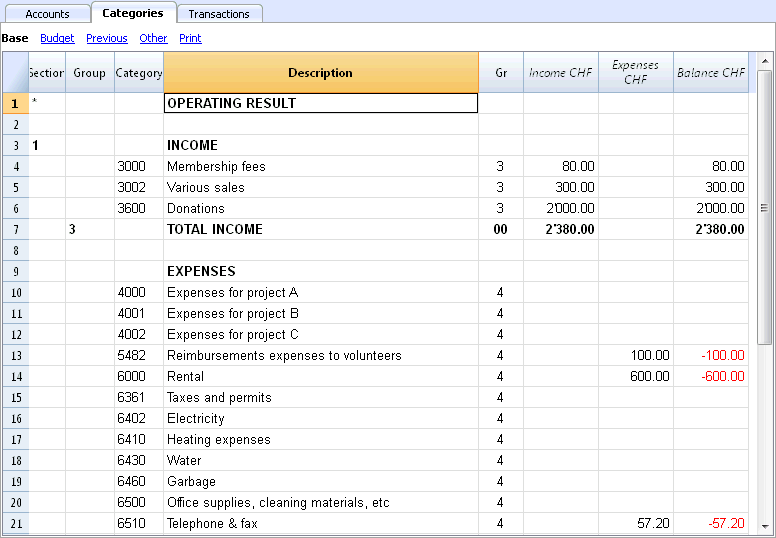

Using Segments and Cost centers, Banana Accounting allows you to manage specific activities or project in a detailed and precise way, without changing the structure of your chart of accounts. You will be able to know, in each moment, how a certain project is going and you can print out detailed reports.

|

|

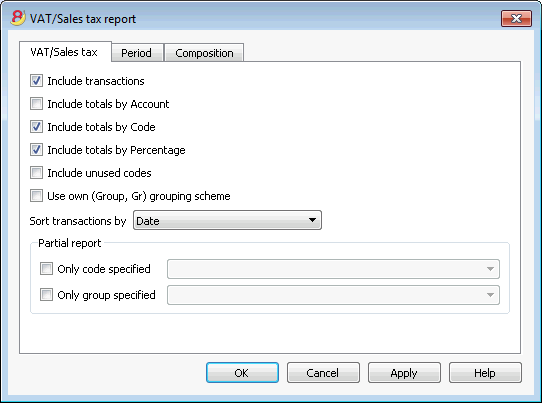

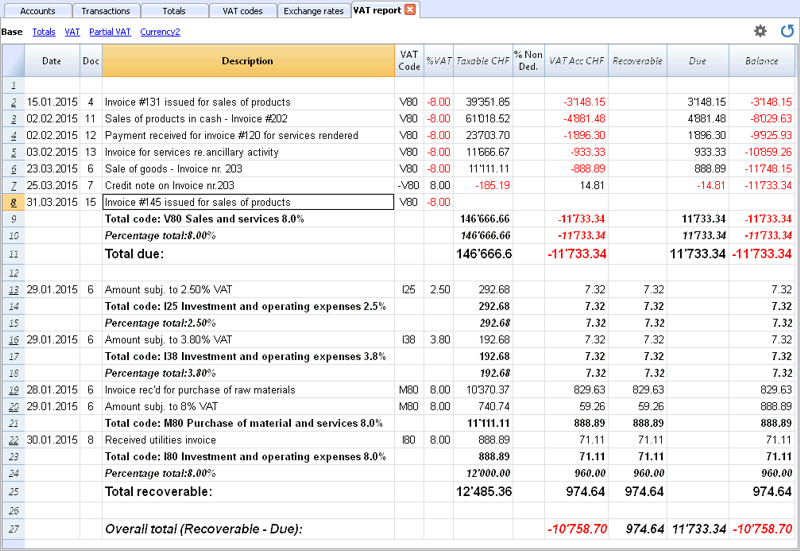

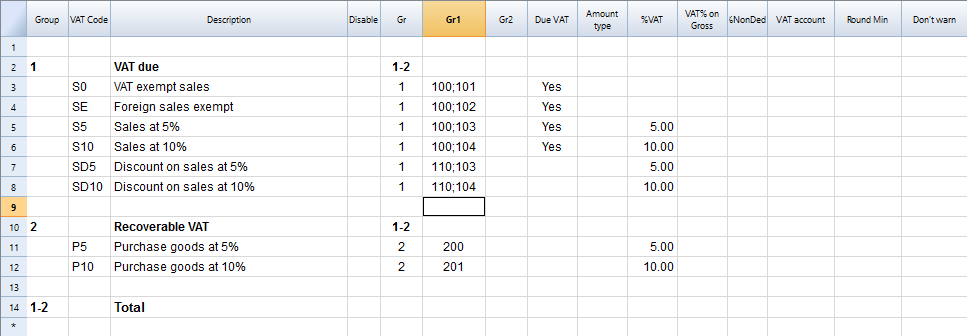

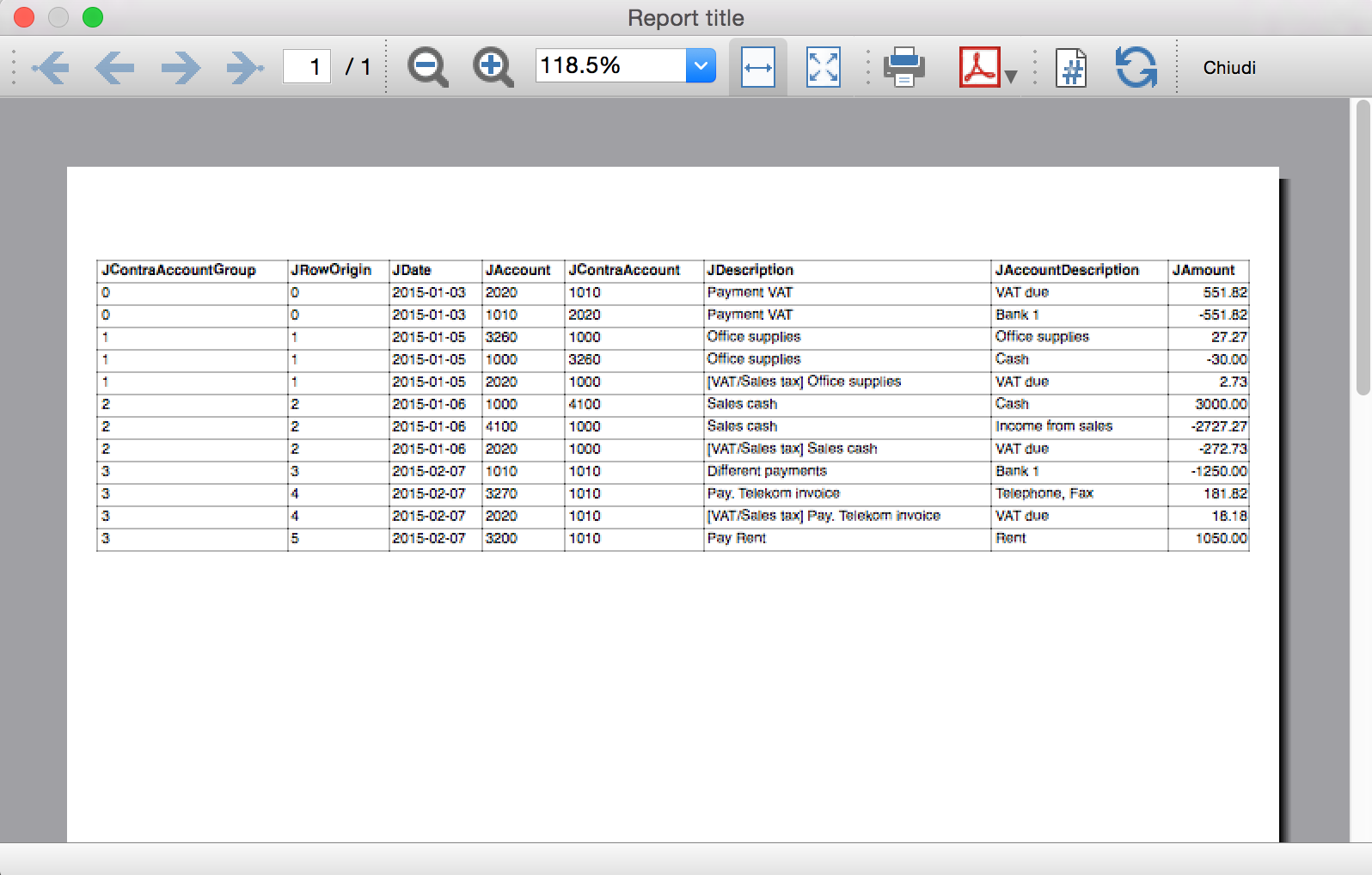

Easier VAT management |

|

|

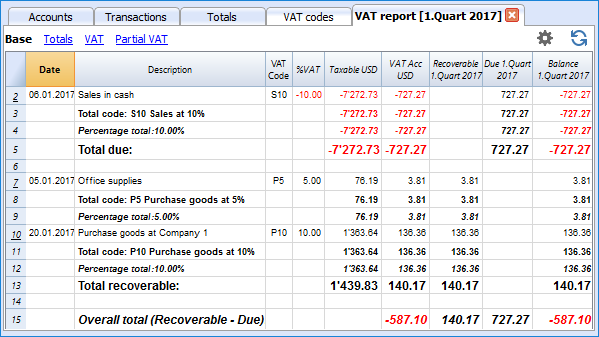

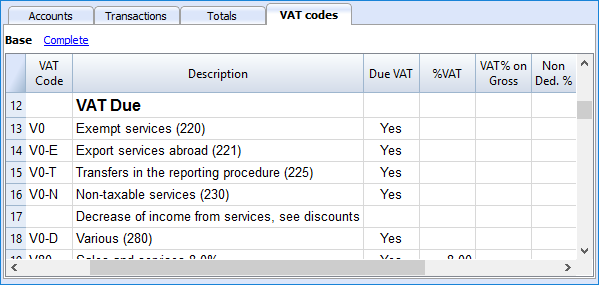

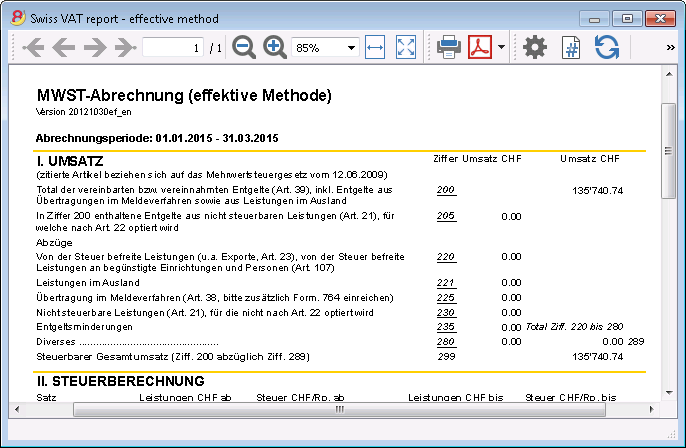

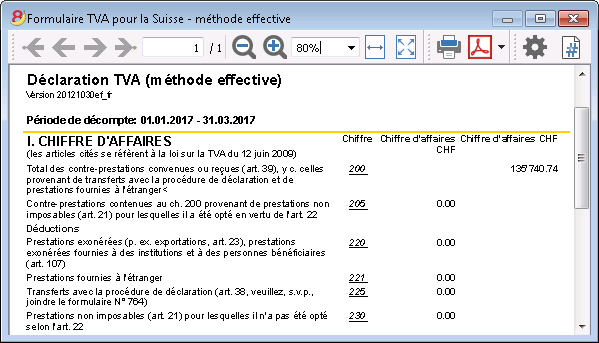

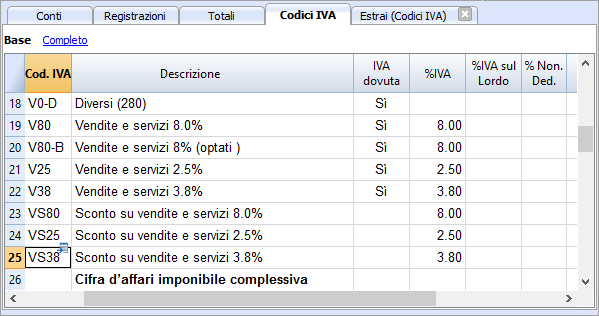

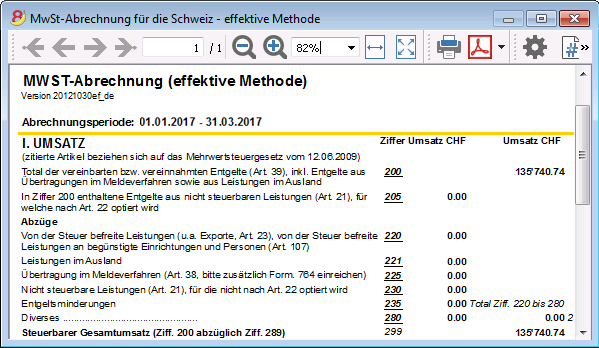

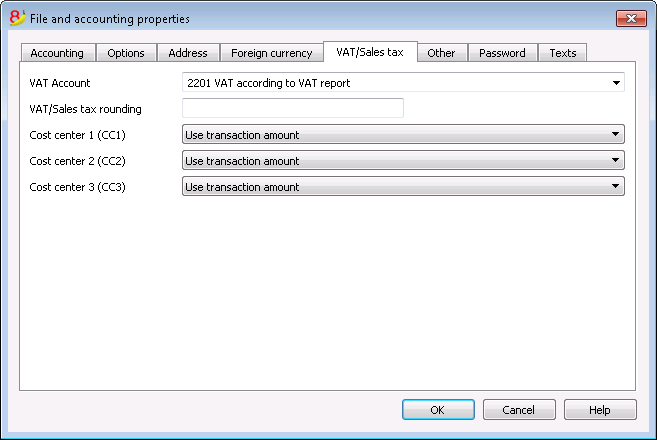

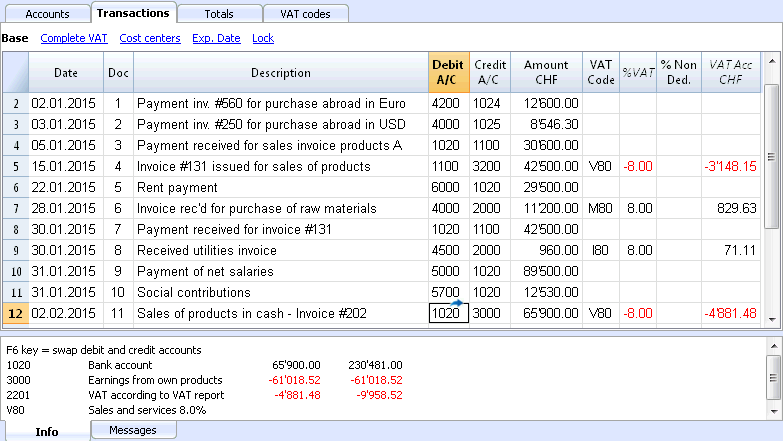

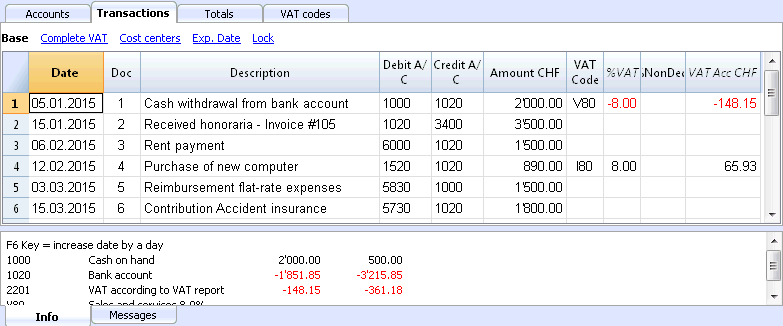

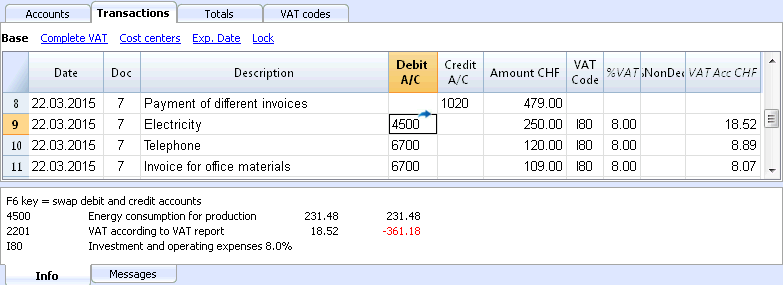

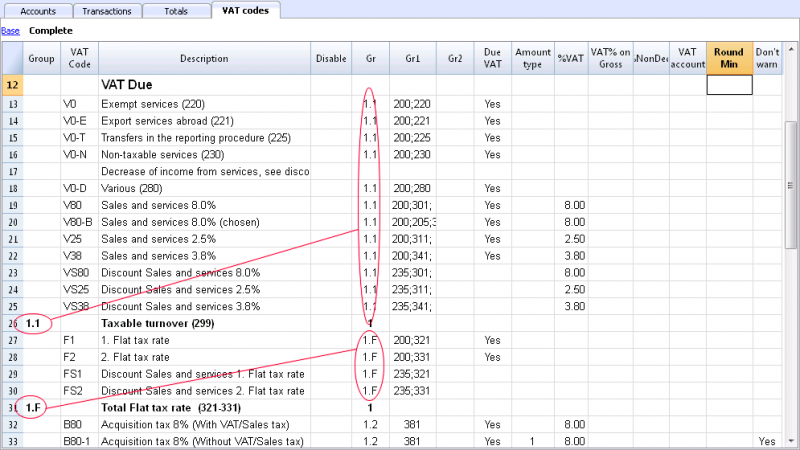

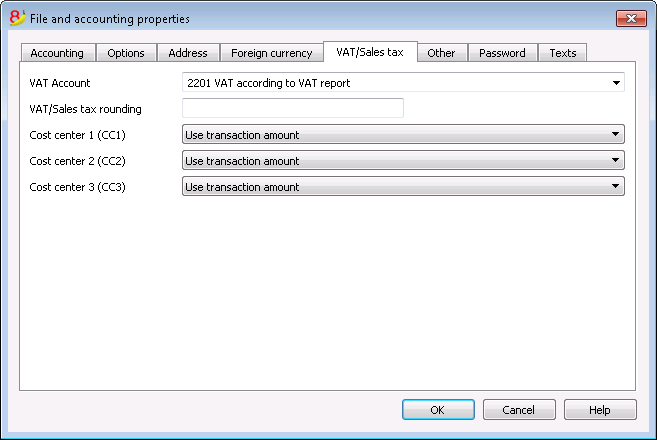

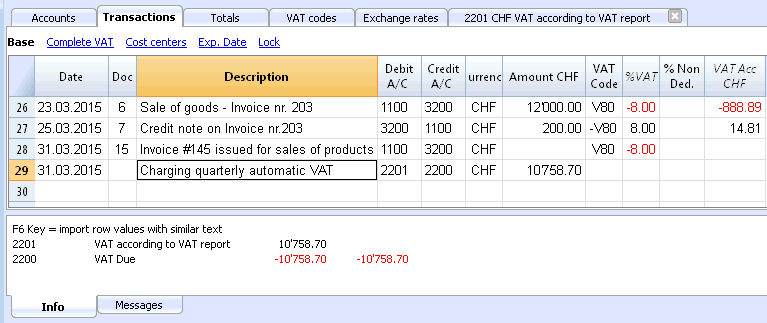

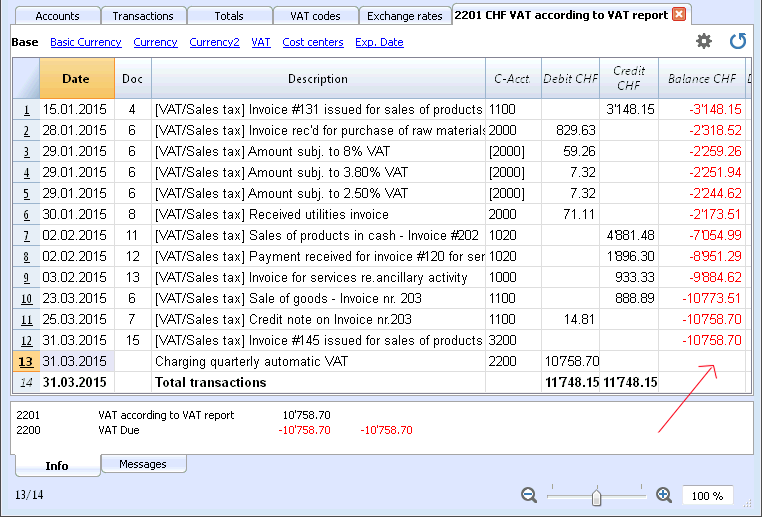

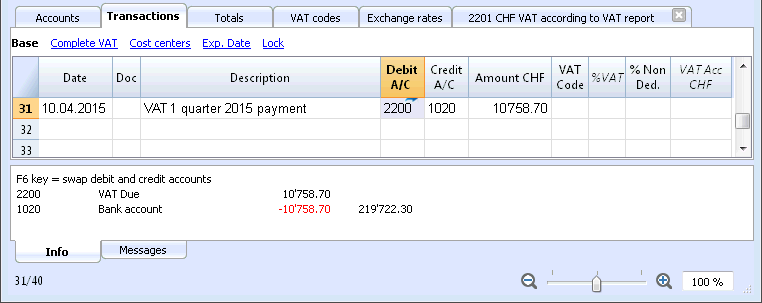

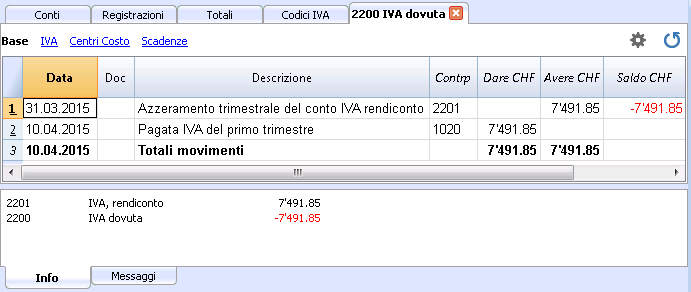

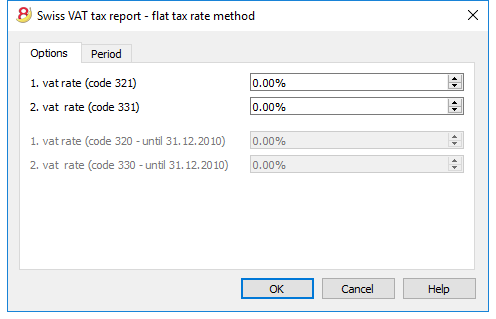

If you need to manage the VAT, choose a template that already has it or convert your existing file adding the VAT option. All VAT calculations and the VAT reports are automatic. For Switzerland the program already prepares a facsimile of the official form both for the effective method and the flat tax rate method.

|

|

Fast and easy

Impeccable journal |

|

|

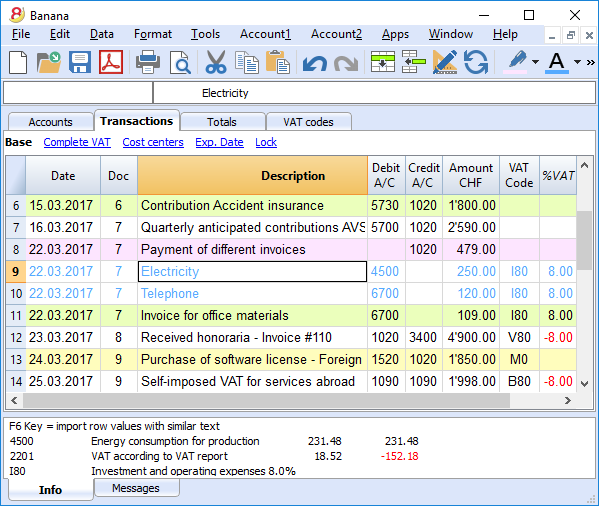

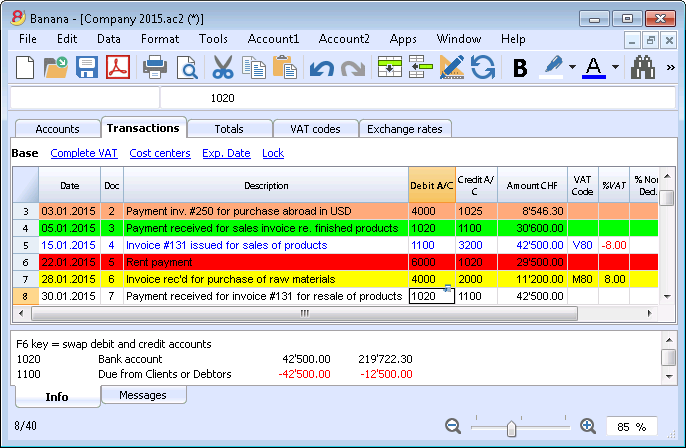

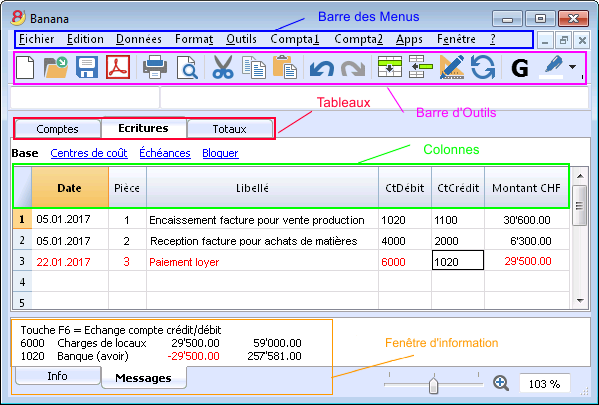

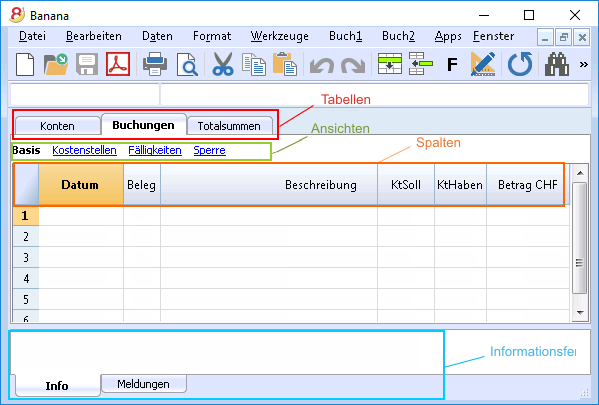

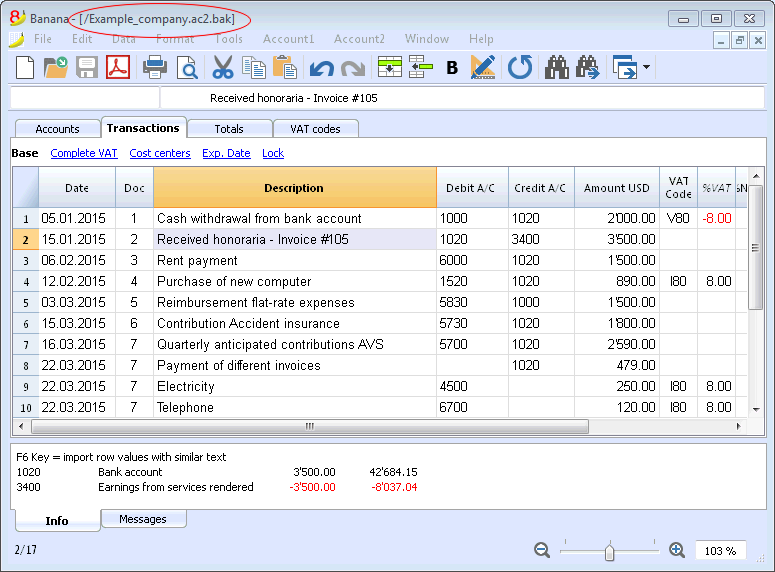

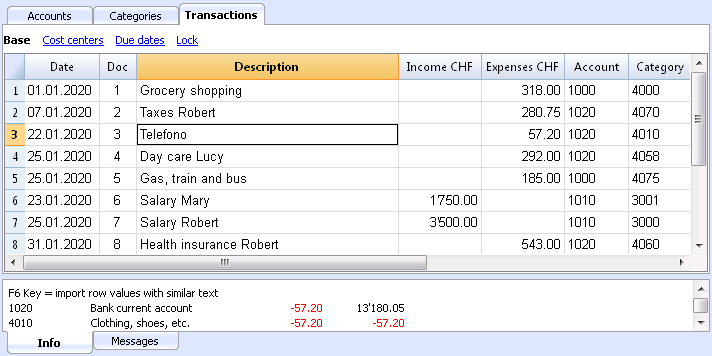

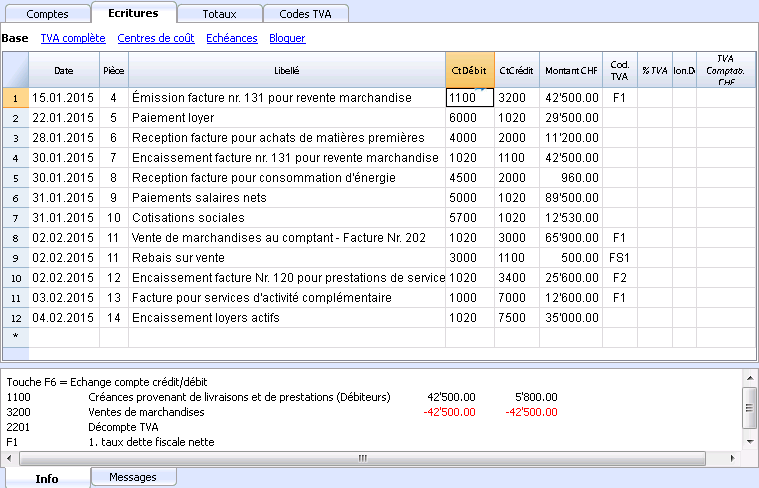

The Transactions table is in fact your journal. It is clearly organized and can be printed directly or saved in a PDF format. When you enter a transaction, all accounts totals will automatically be updated, so you can always have a global view of your business. You can also use colors, both in the text and row background, in order to highlight some entries and quickly find your data. |

|

Memorize and recall recurring transactions |

|

|

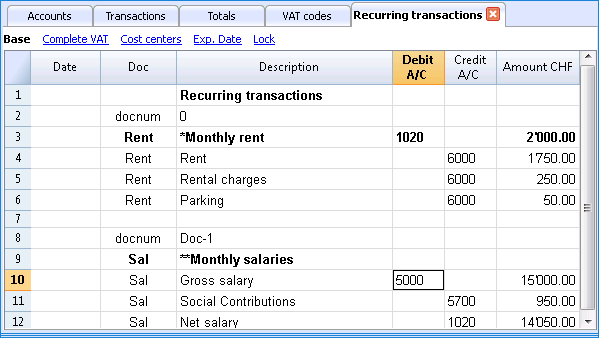

You can select your recurring transactions and save them in the Recurring transactions table; you can then automatically recall them when needed.

|

|

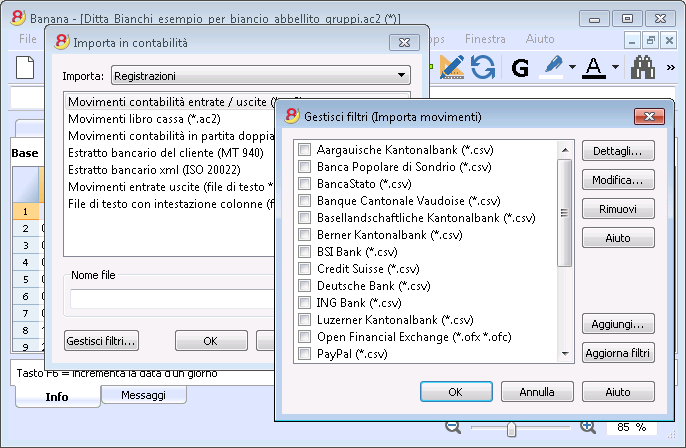

Import data from e-banking and credit card statements |

|

|

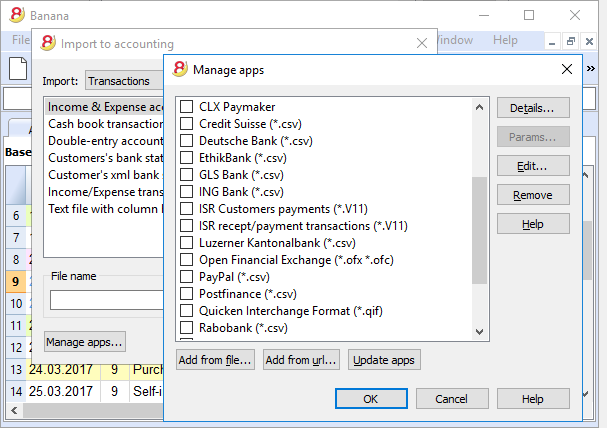

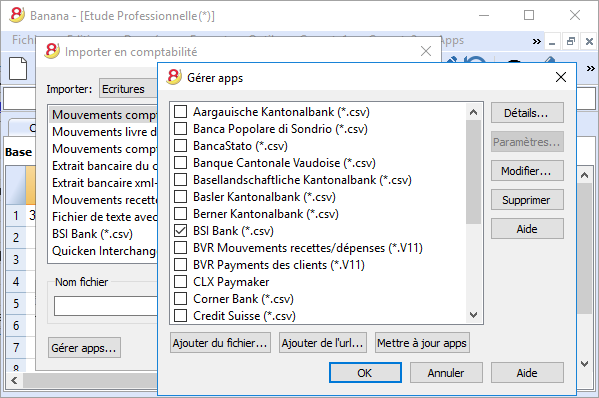

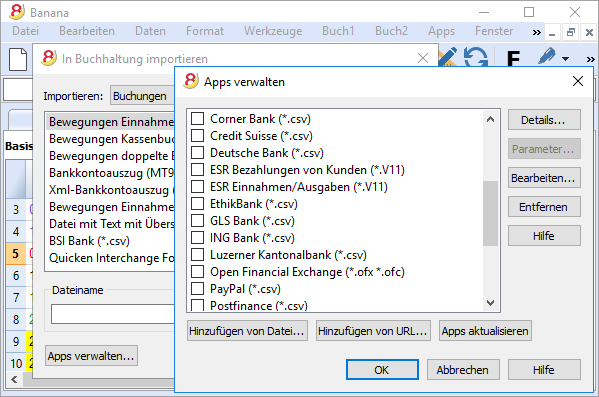

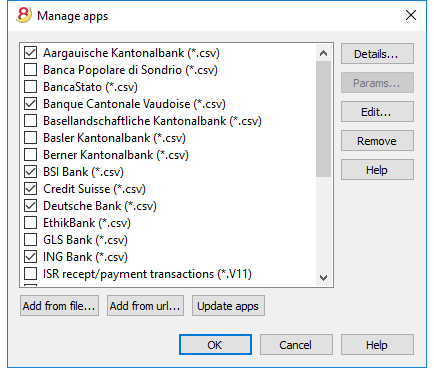

You can import your e-banking transactions or your credit card transactions directly into your Banana file, with no need of manually writing them. We now have import filters for all major banks and institutions, and they are constantly updated. If your bank doesn't appear in the list of the available filters, we can create one for you.

|

|

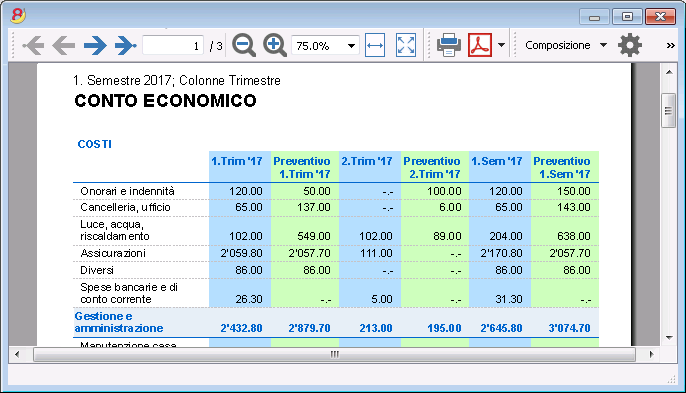

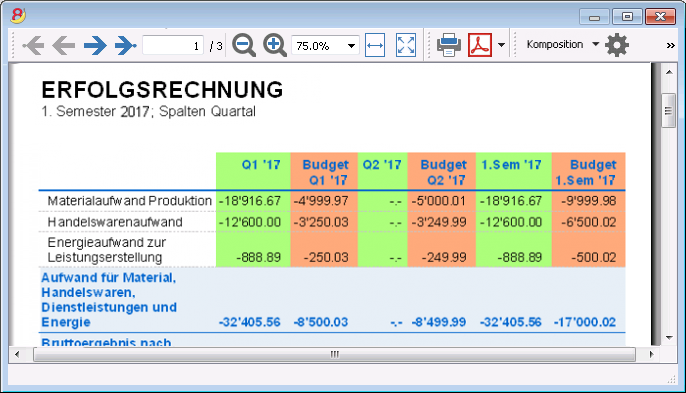

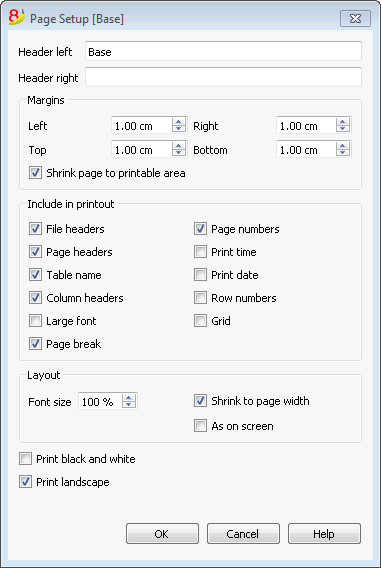

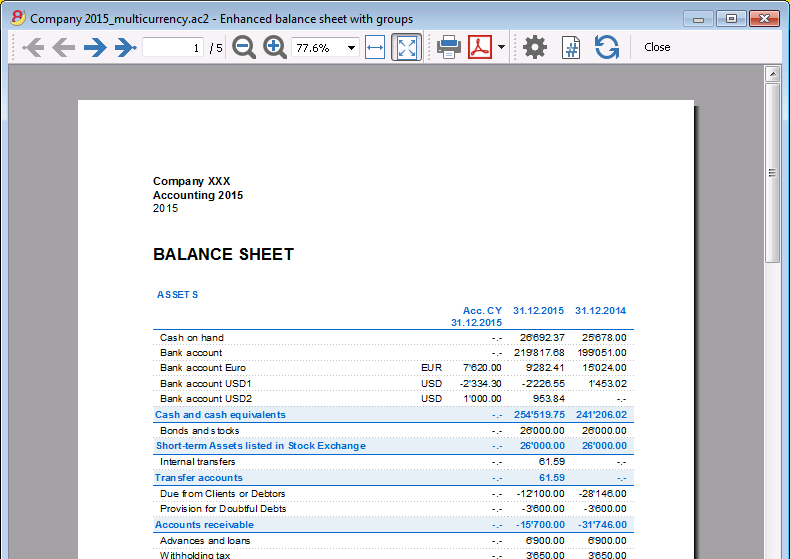

Immediate printouts and report - customizable settings |

|

|

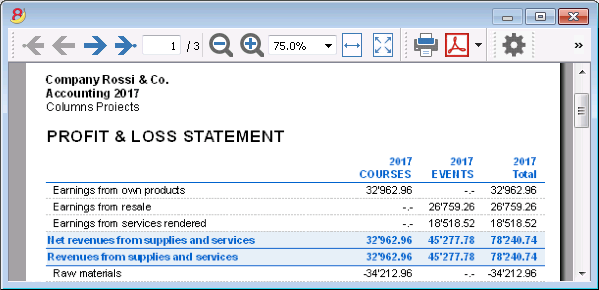

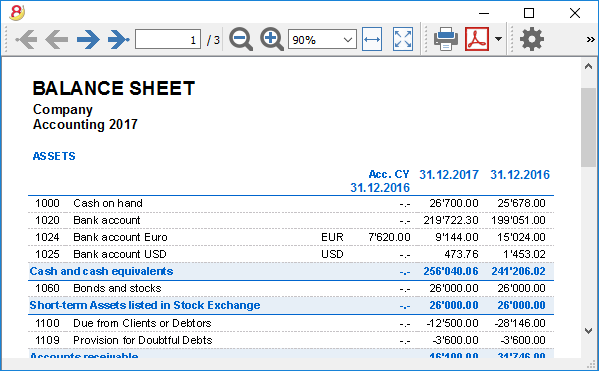

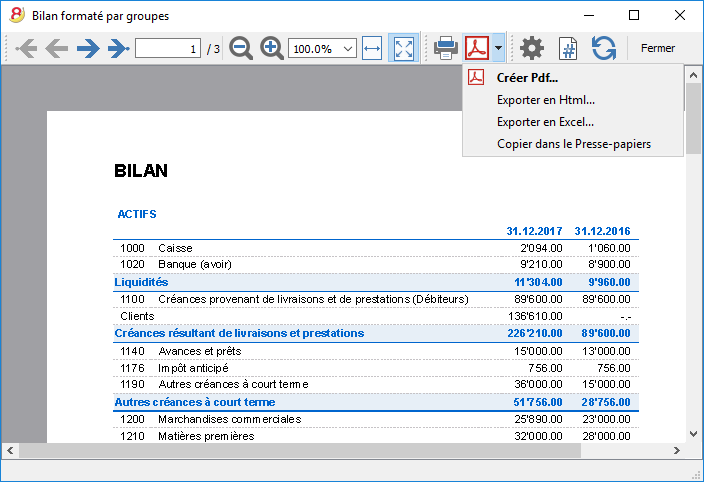

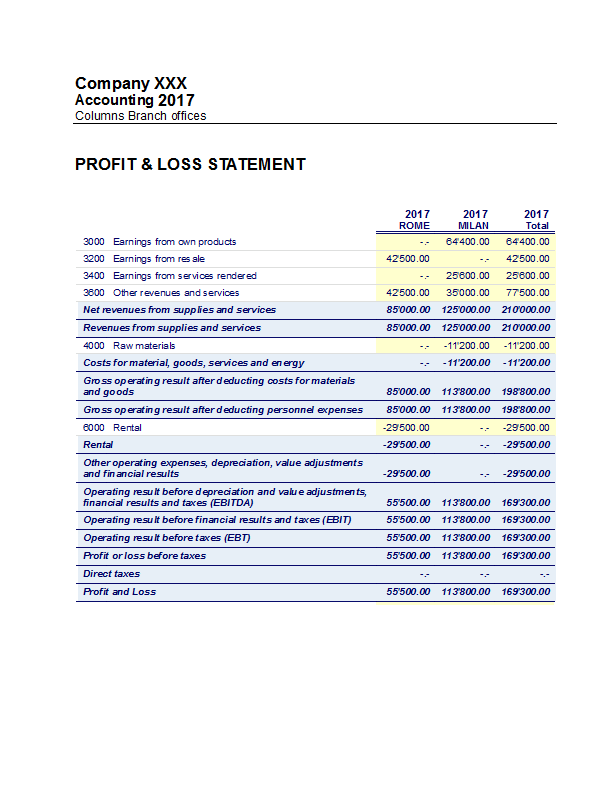

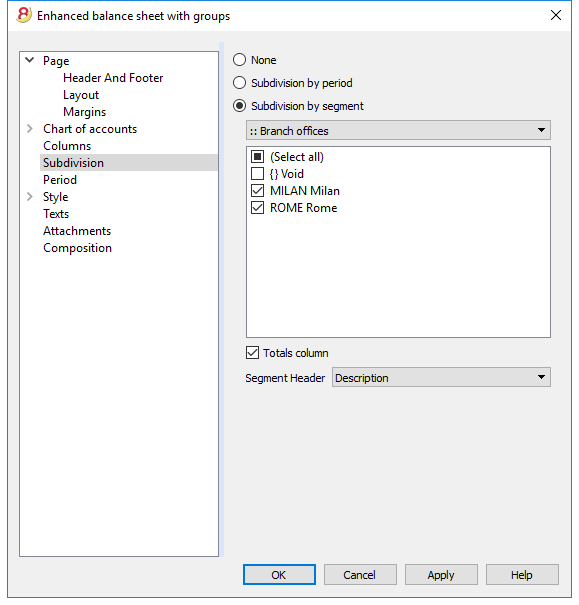

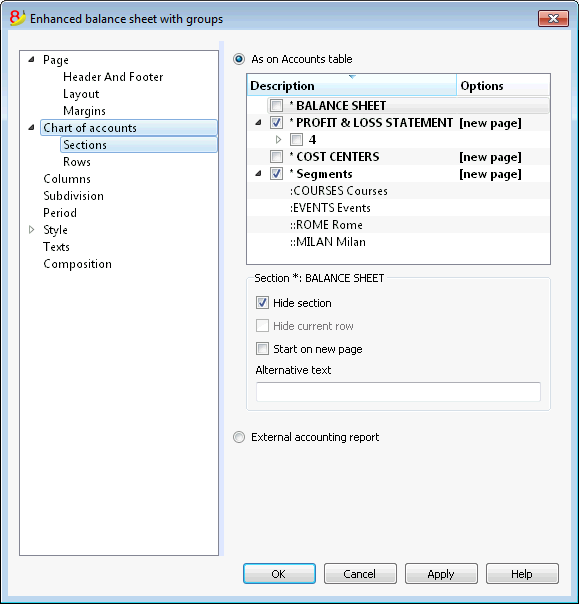

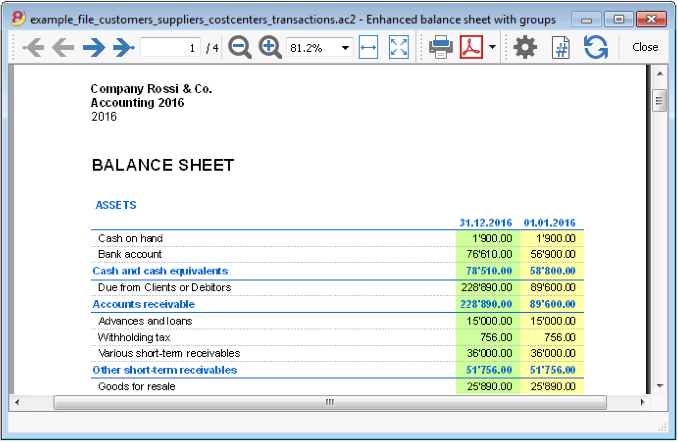

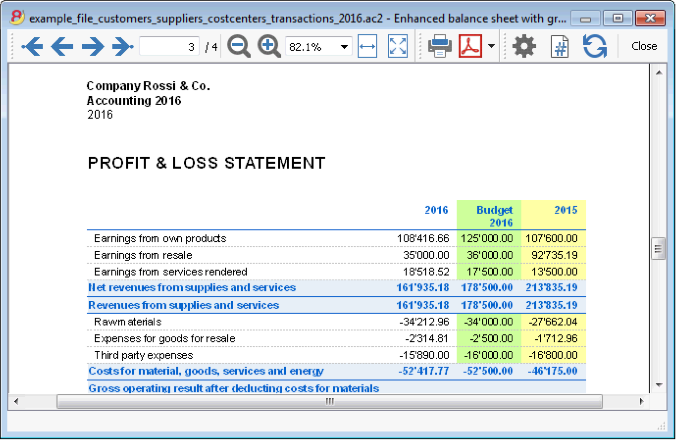

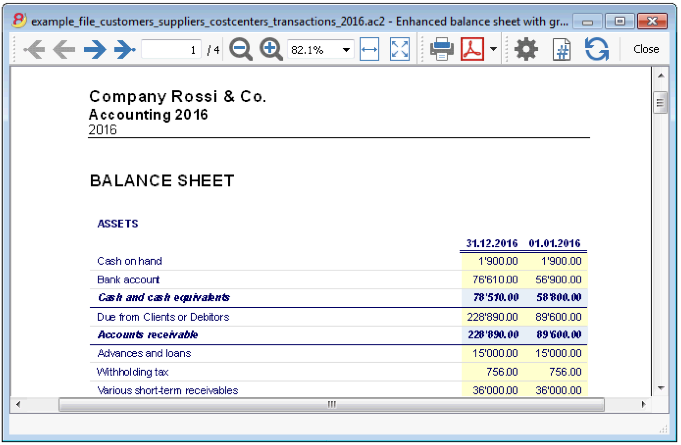

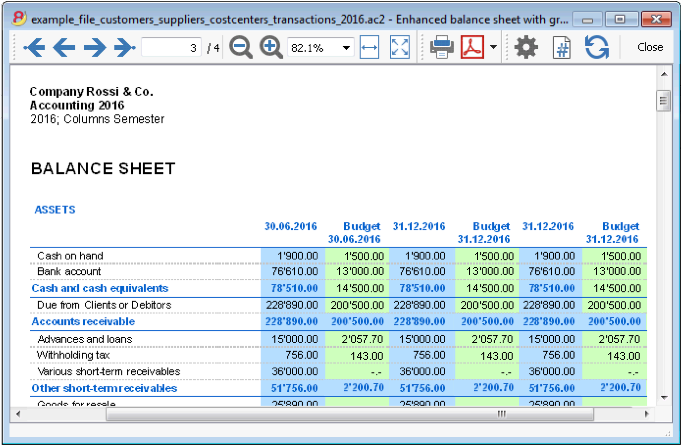

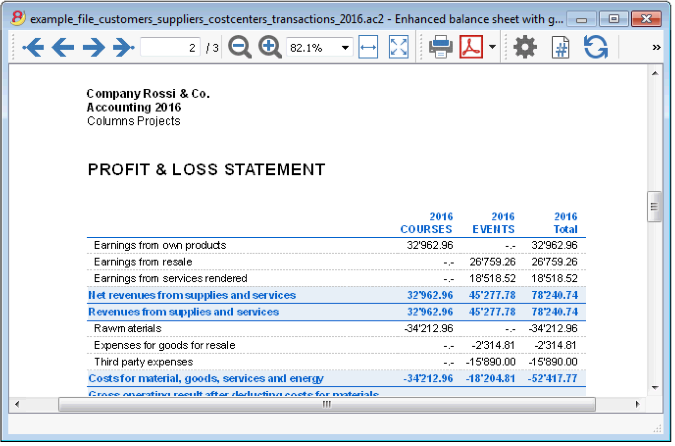

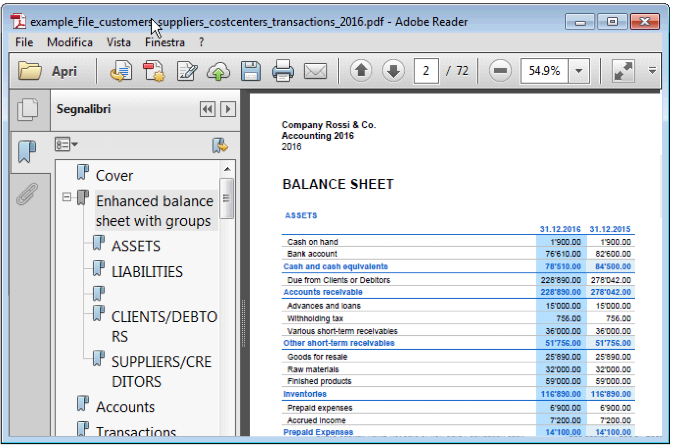

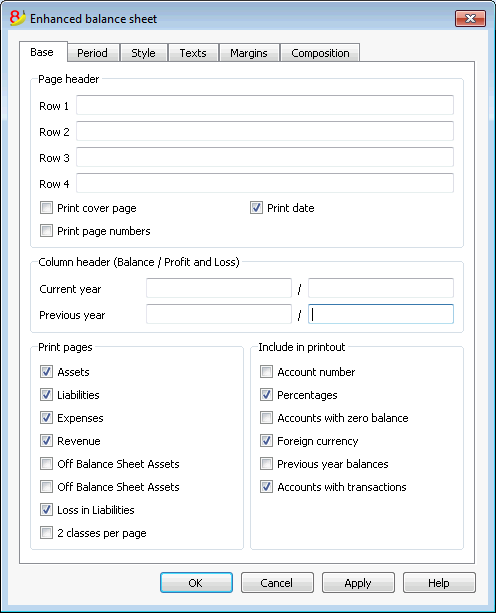

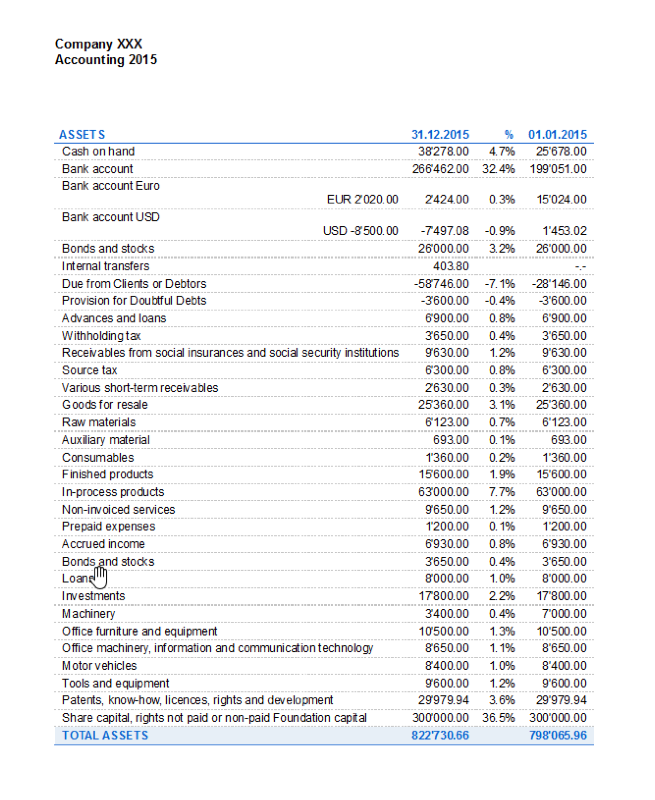

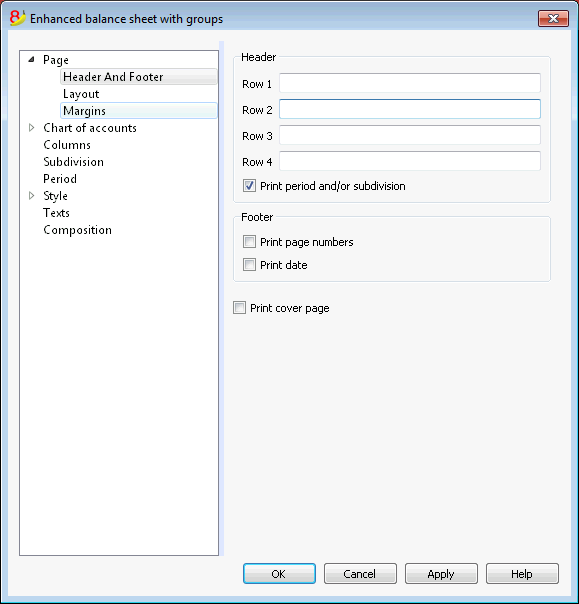

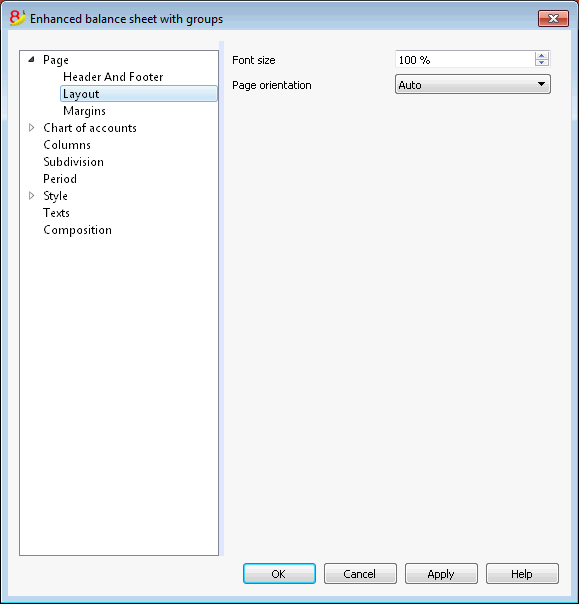

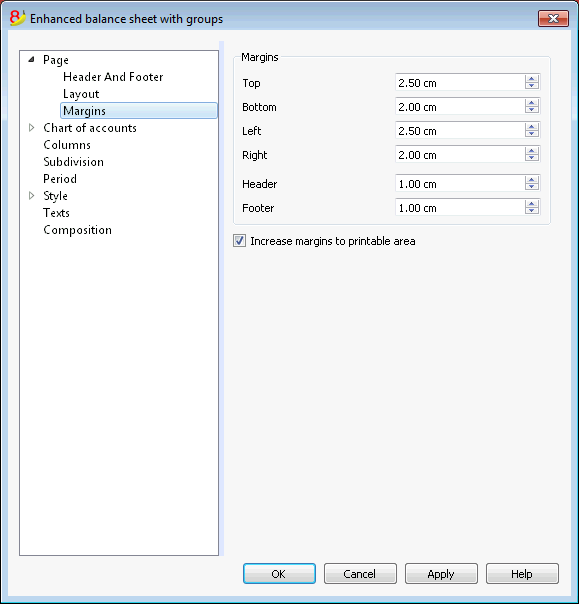

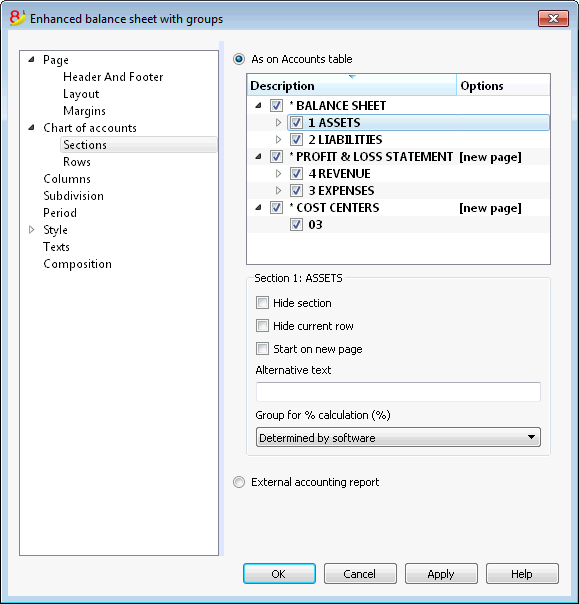

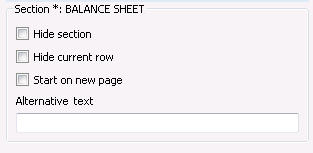

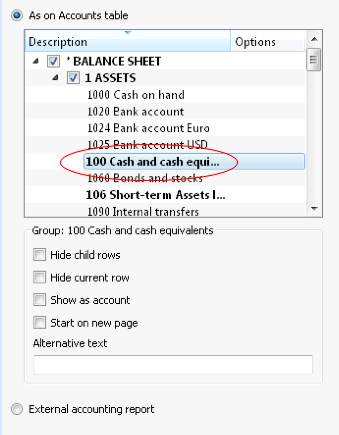

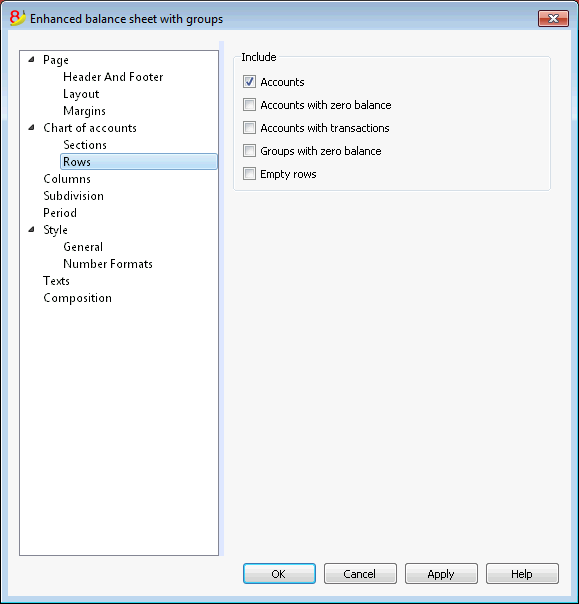

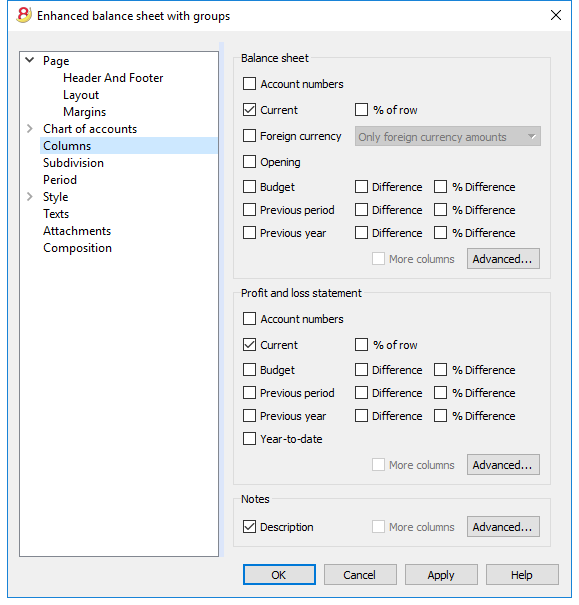

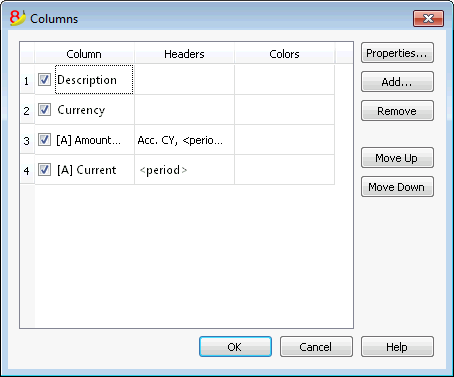

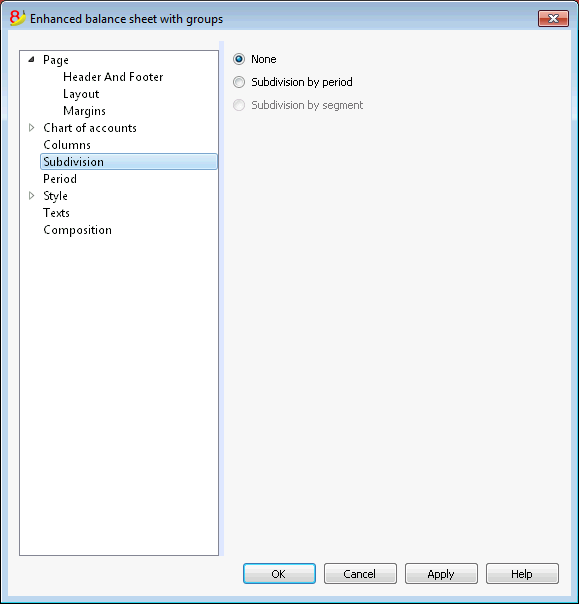

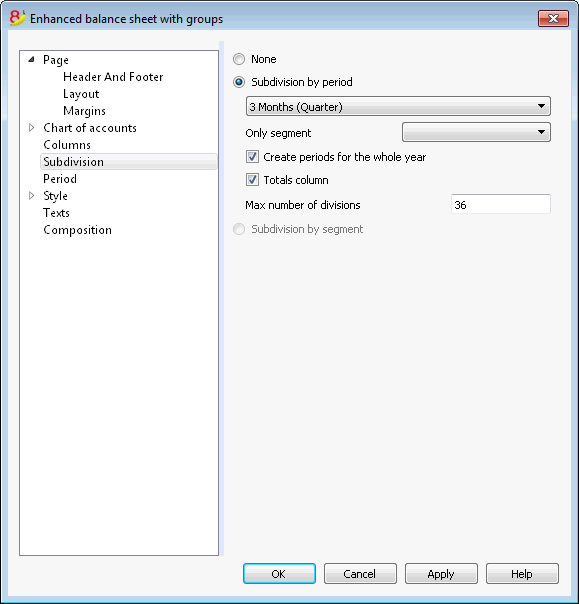

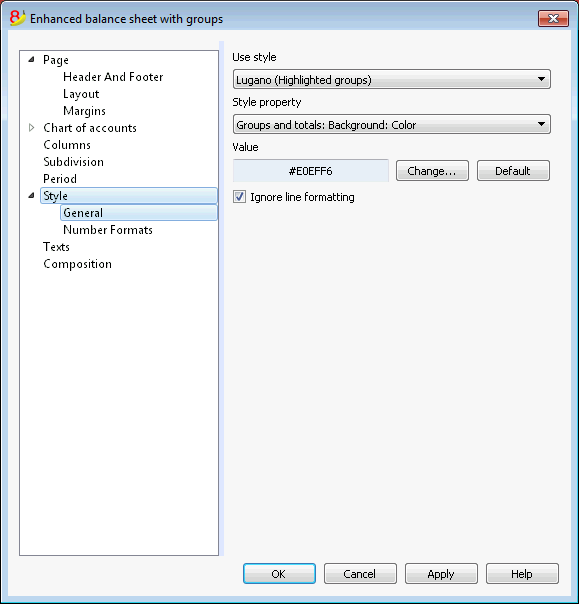

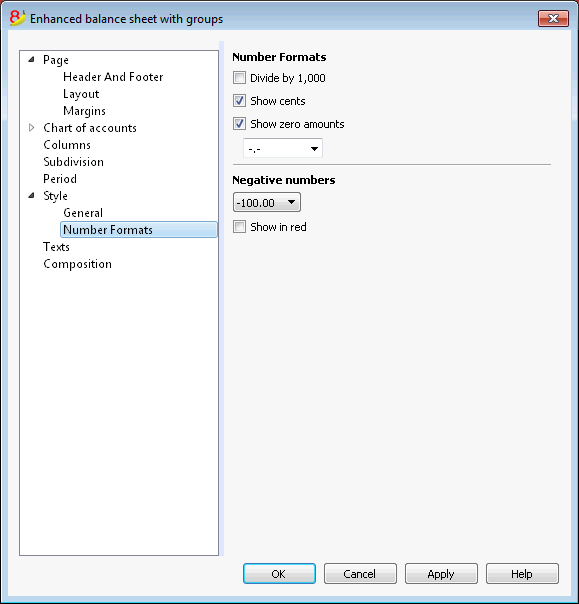

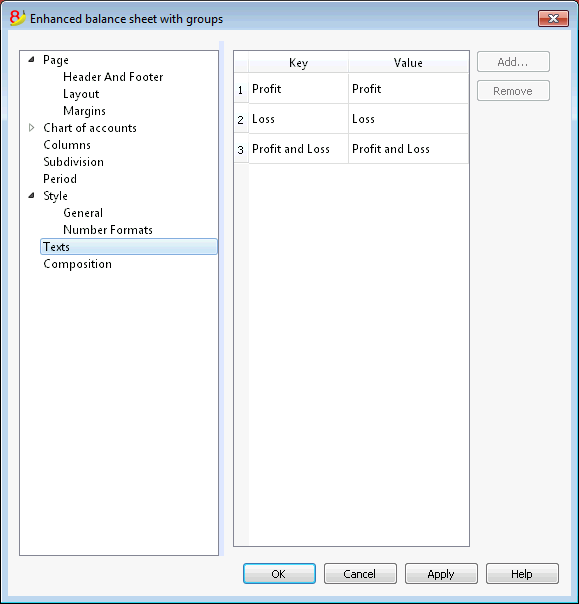

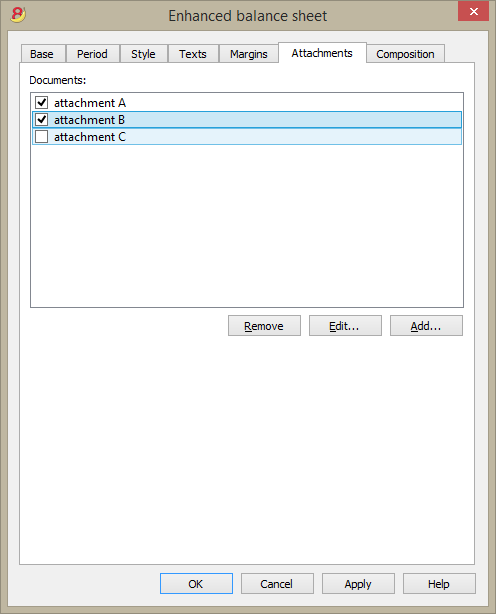

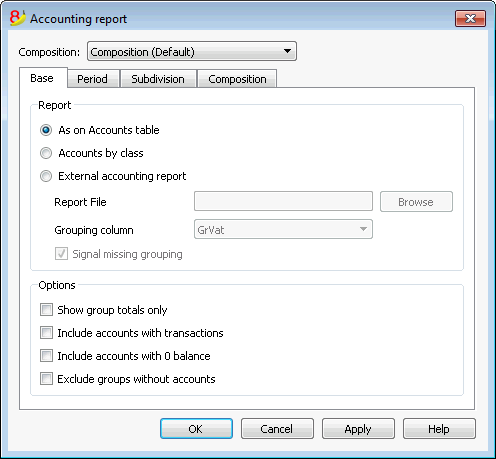

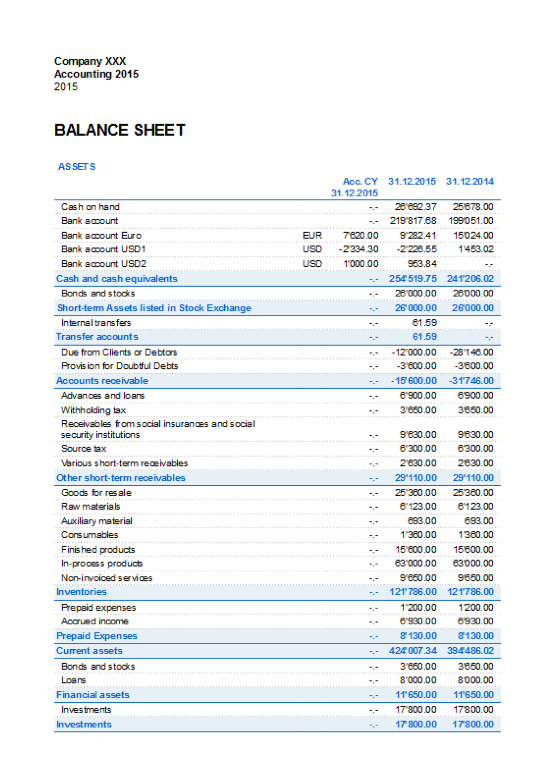

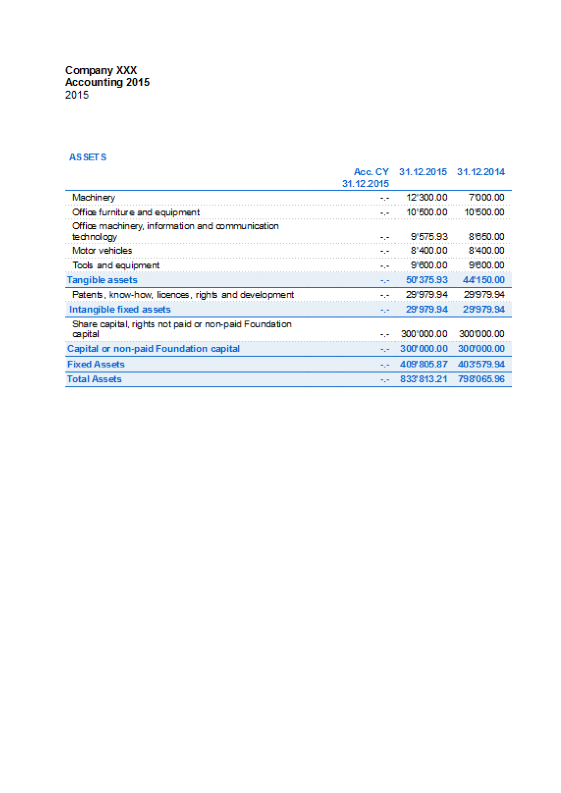

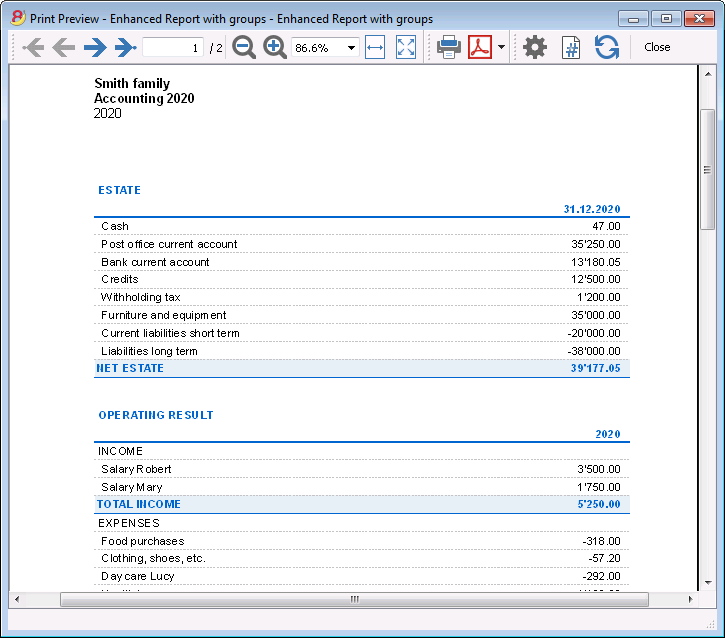

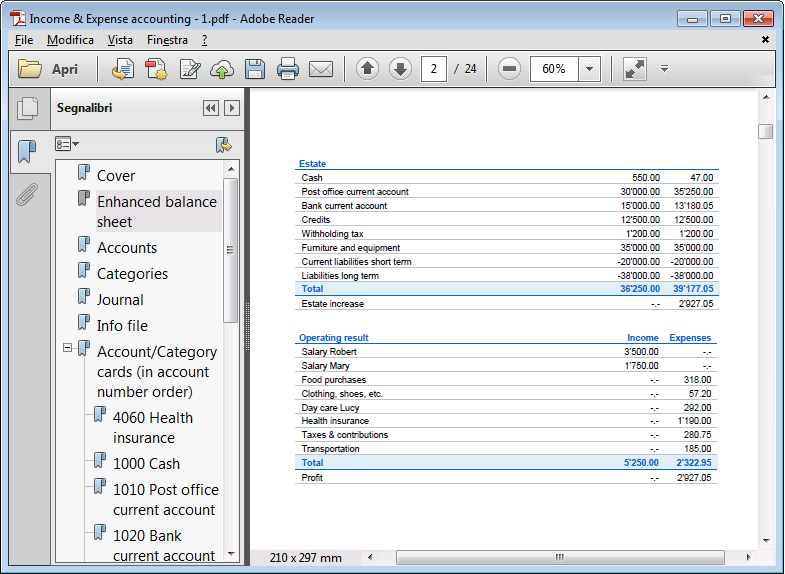

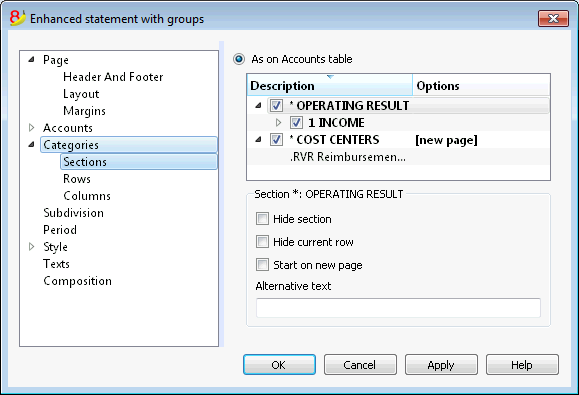

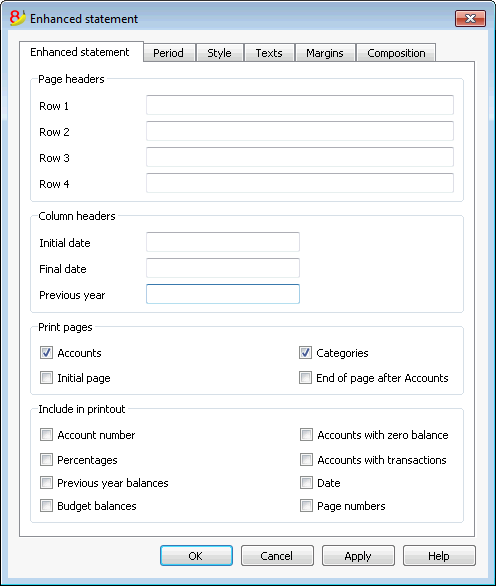

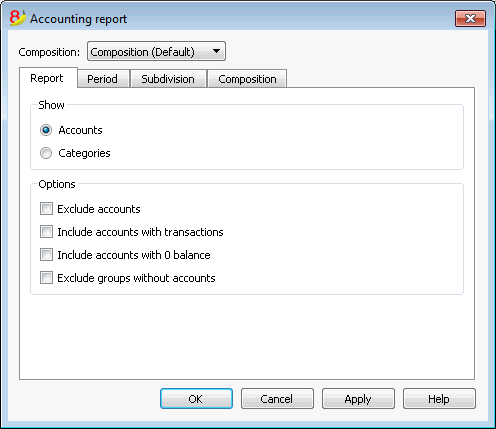

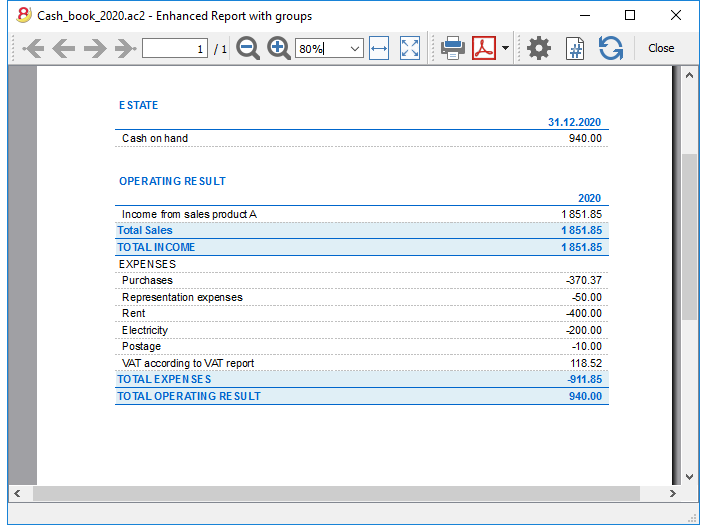

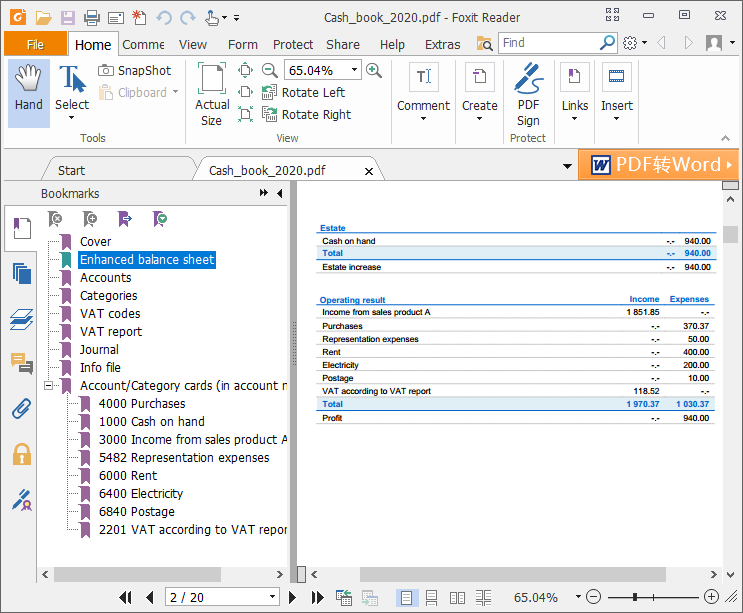

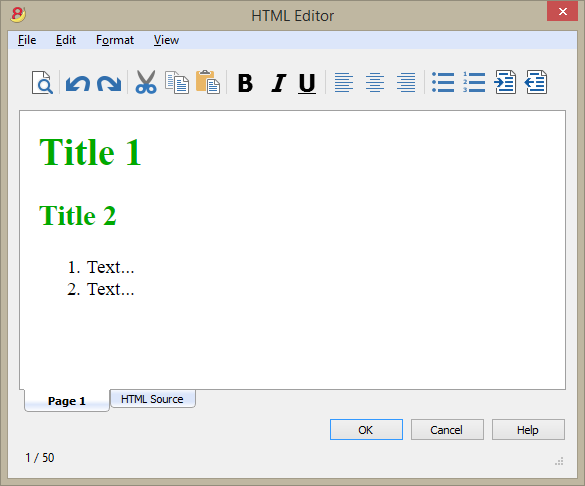

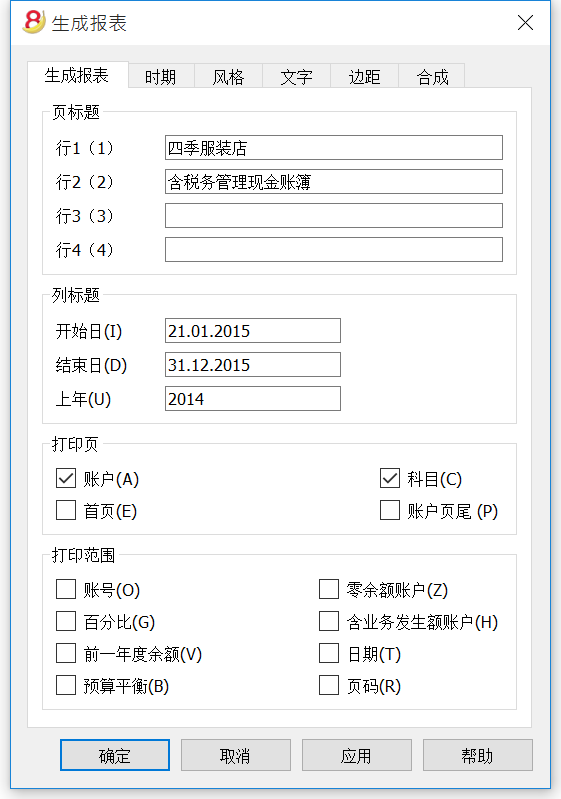

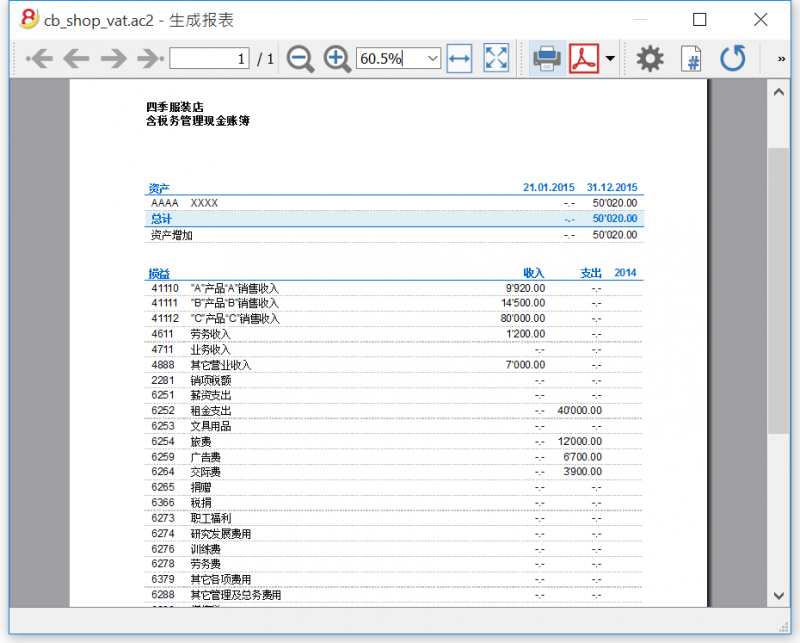

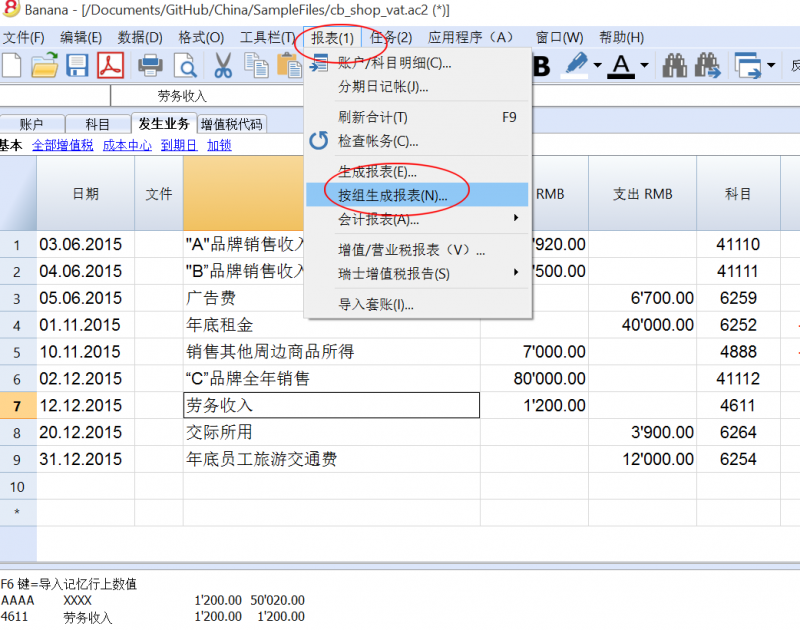

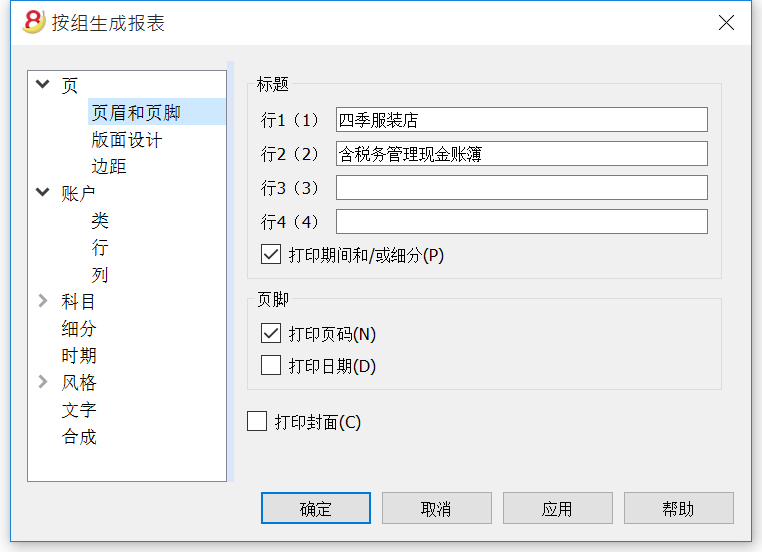

You can personalize the printouts of your Balance Sheet and Profit & Loss Statement. You can activate/deactivate several options in order to present your data just as you want; choose from different graphic styles, change colors, etc. You can play around and see the results in your Print preview. When printing your Balance sheet you can also include a text for the Swiss attachment |

|

Save your personal printing settings |

|

|

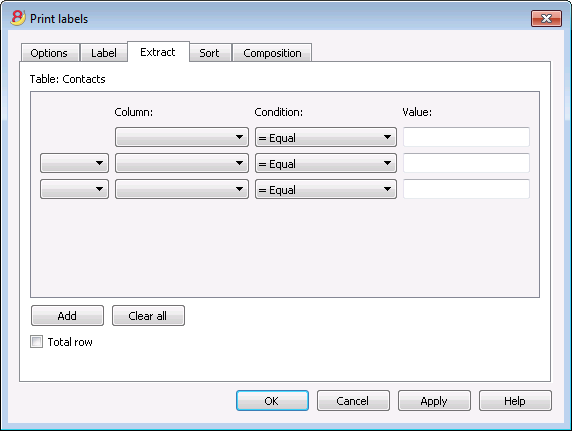

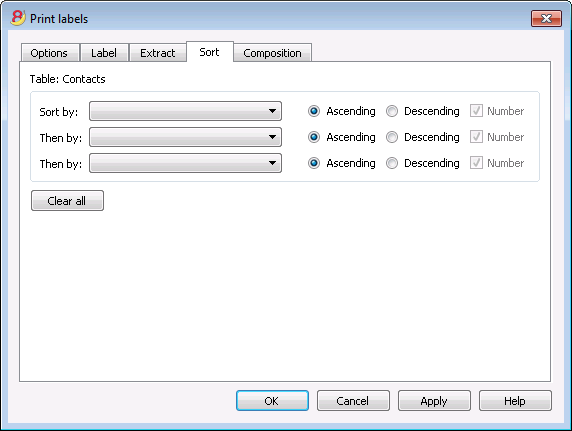

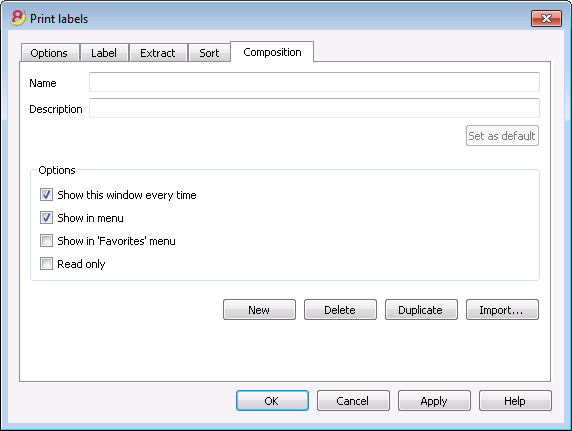

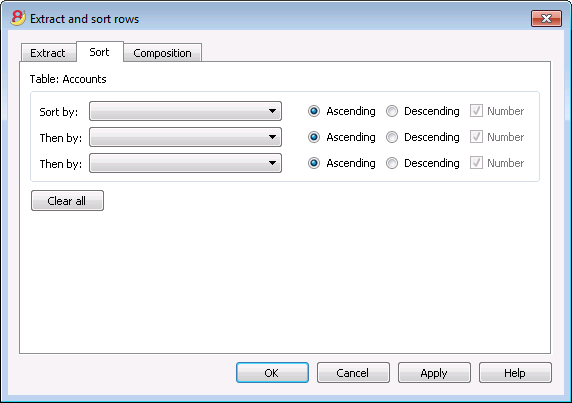

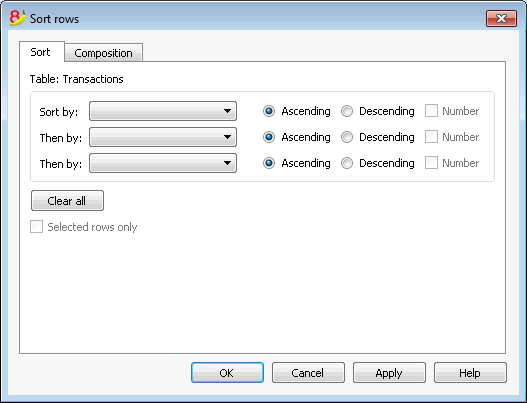

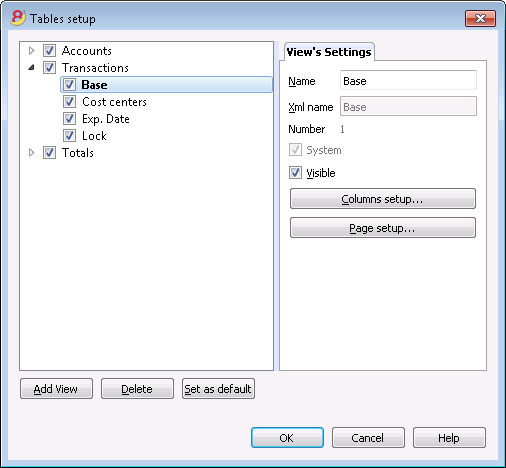

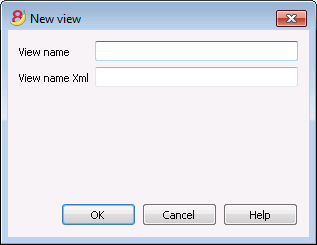

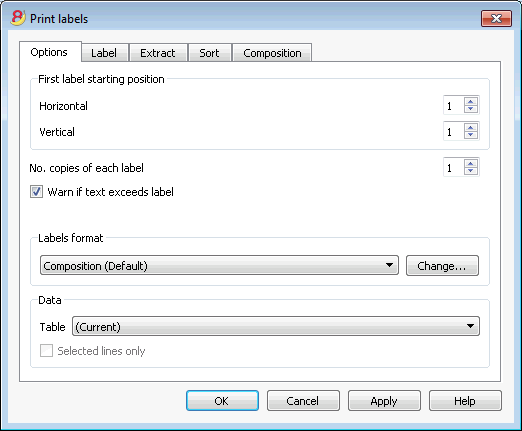

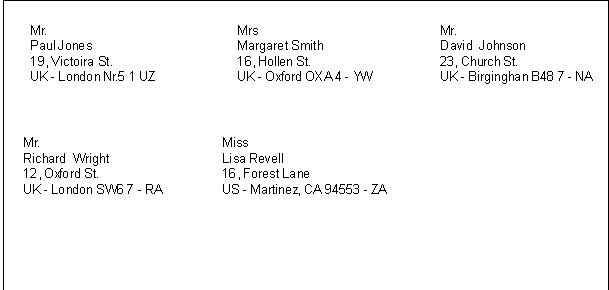

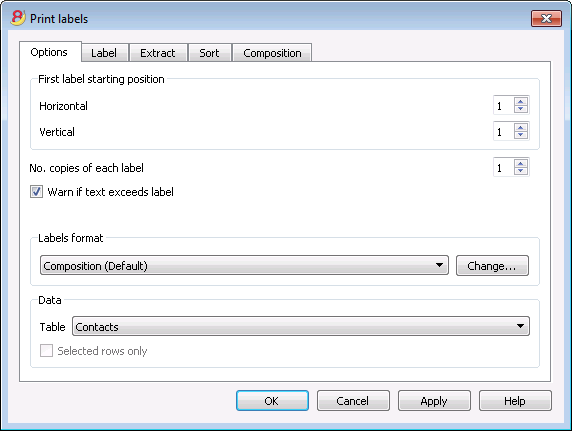

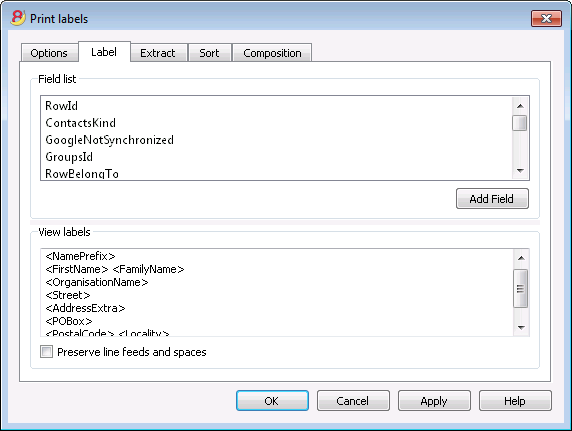

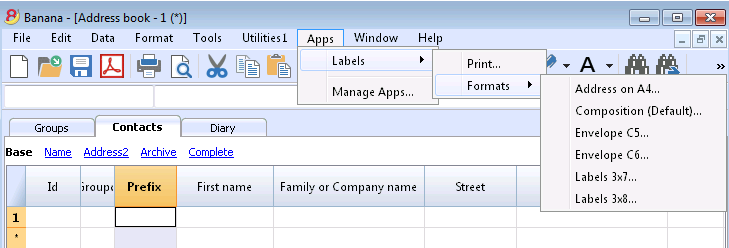

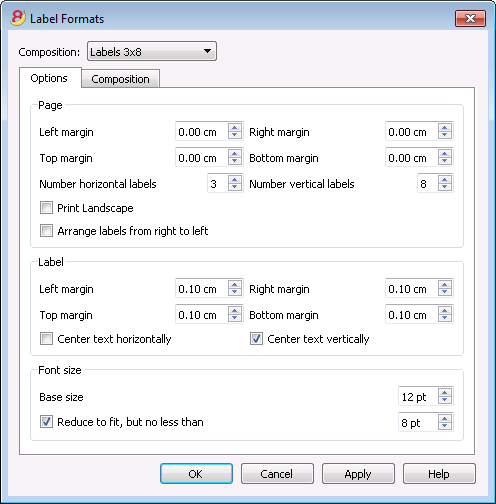

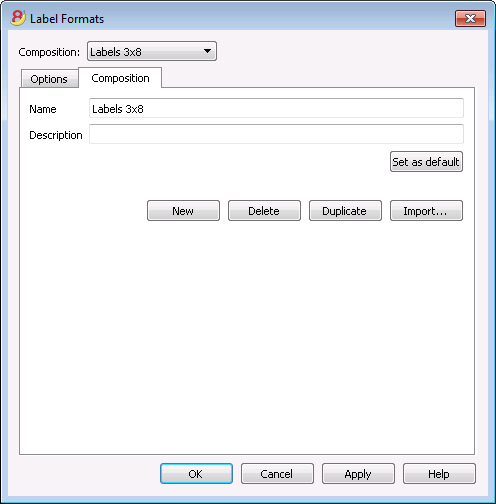

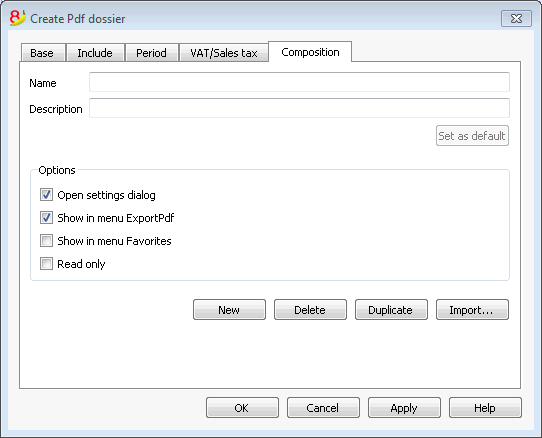

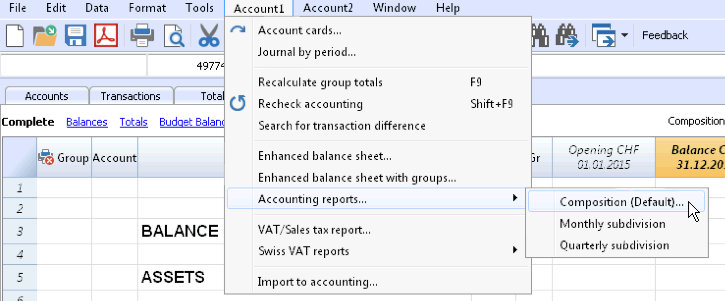

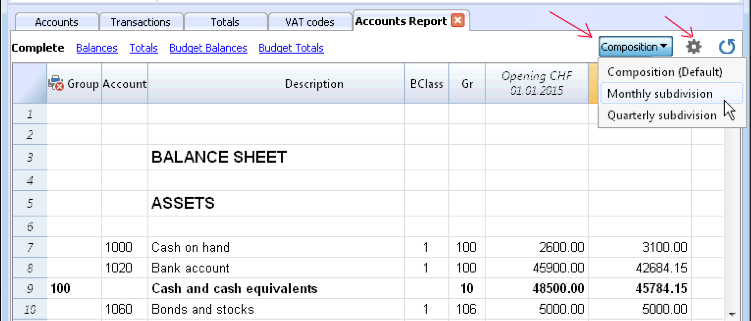

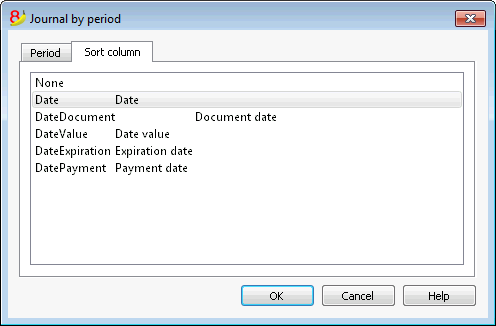

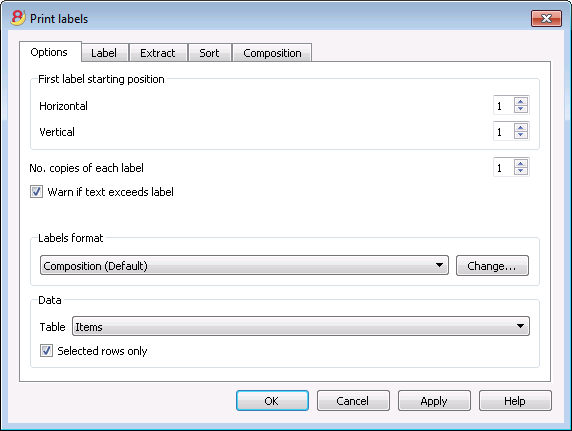

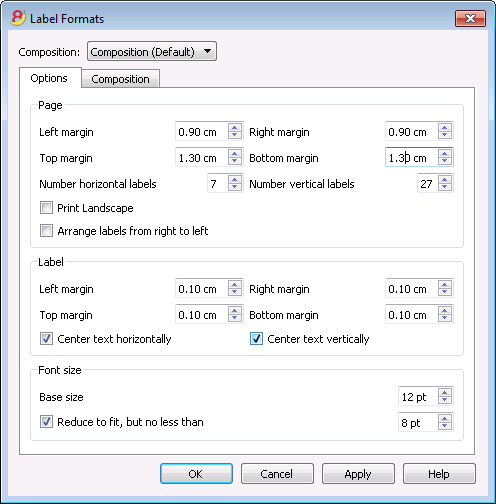

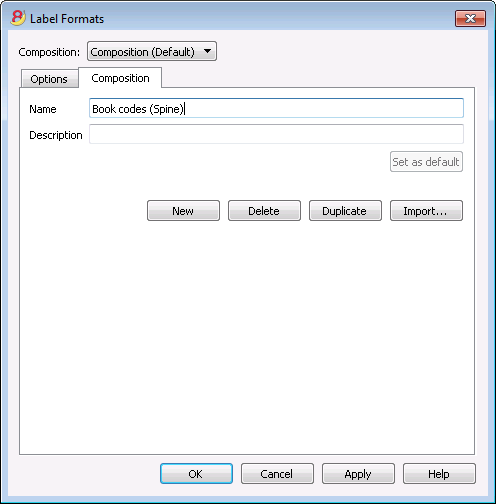

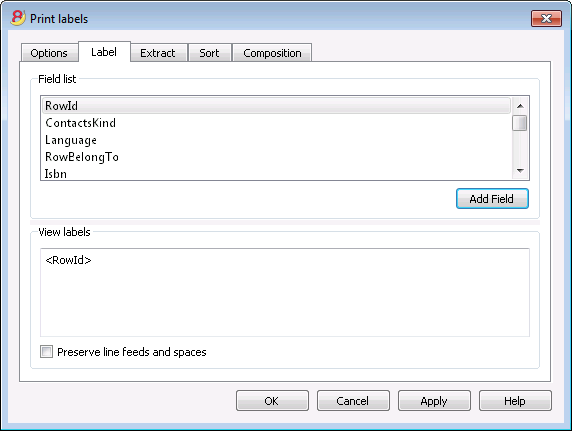

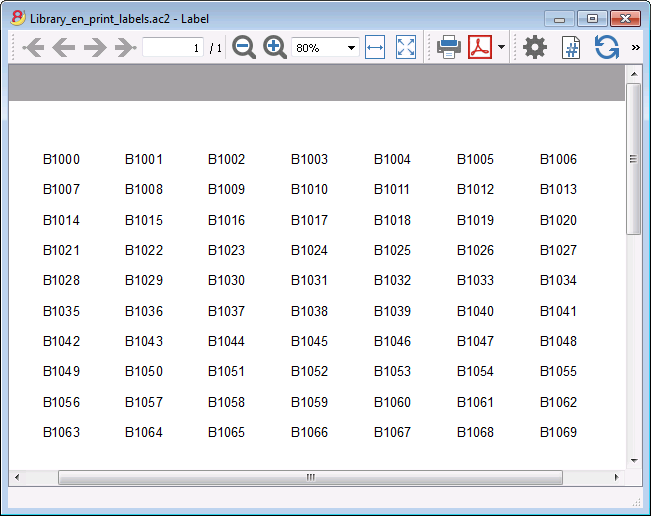

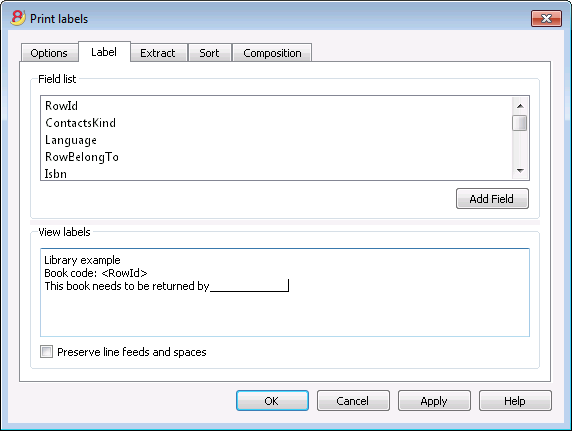

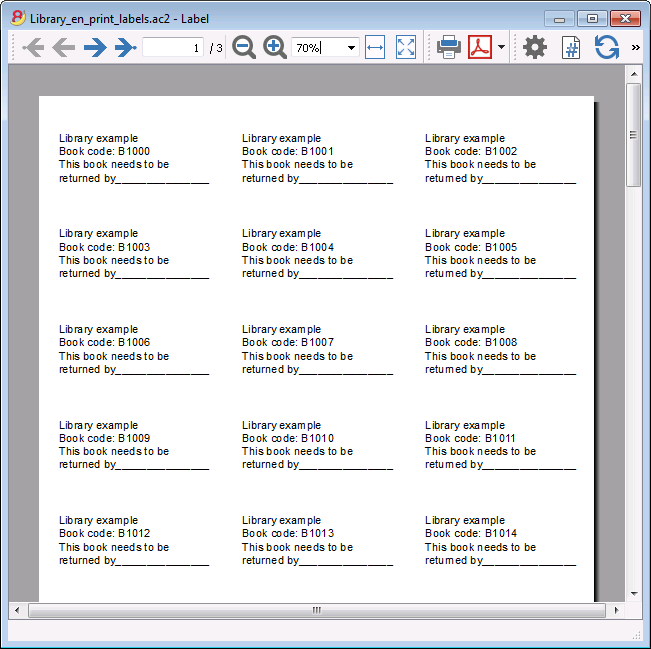

With the Compositions command, it is easy to setup custom printouts. You can save several printing settings for Balance sheet, Account details, extract and sort rows, addresses and labels, ...

|

|

Universal

Multi-language |

|

|

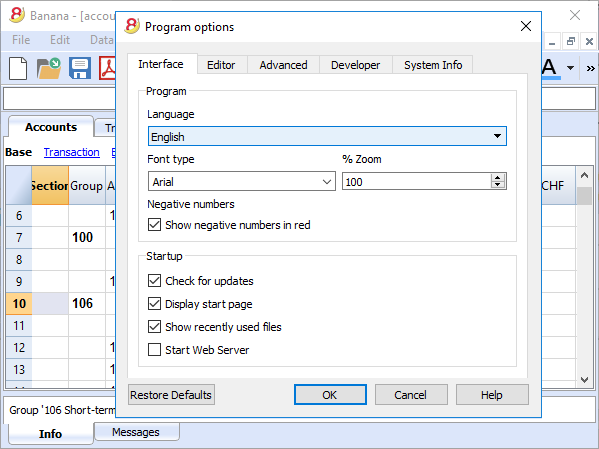

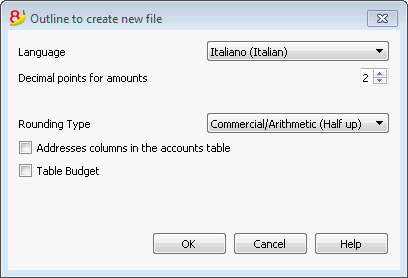

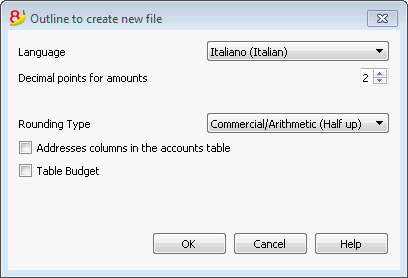

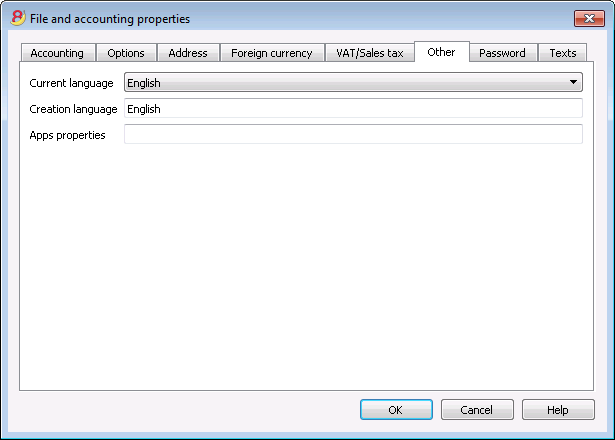

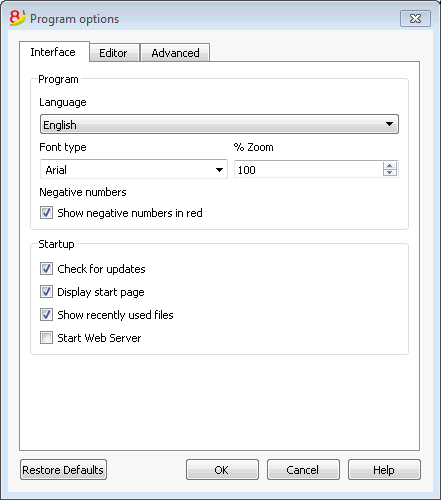

The program is available in several languages: English, Italian, German, French, Spanish, Portuguese, Dutch and Chinese. You can change the program language at any time. Each file can be created in a different language; in our template section on our website, you can choose files in different languages. In order to change the language of an existing file you need to convert it into a new file choosing the desired language. |

|

Multi-currency |

|

|

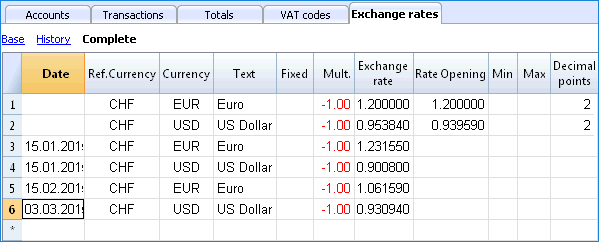

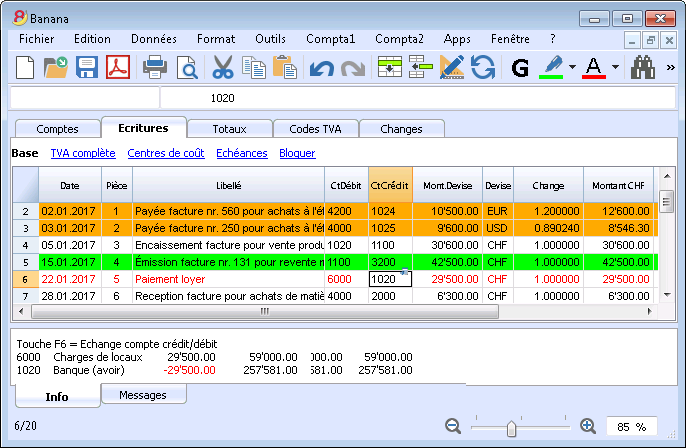

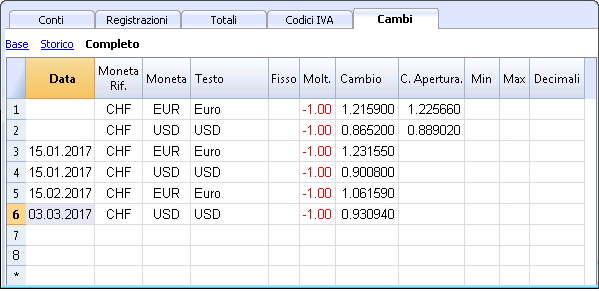

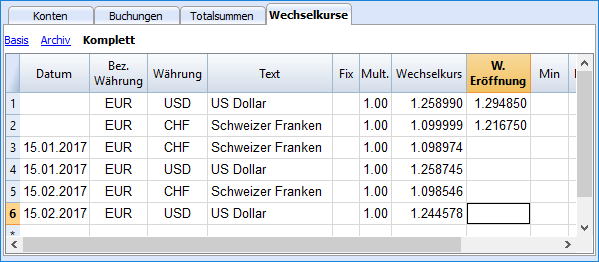

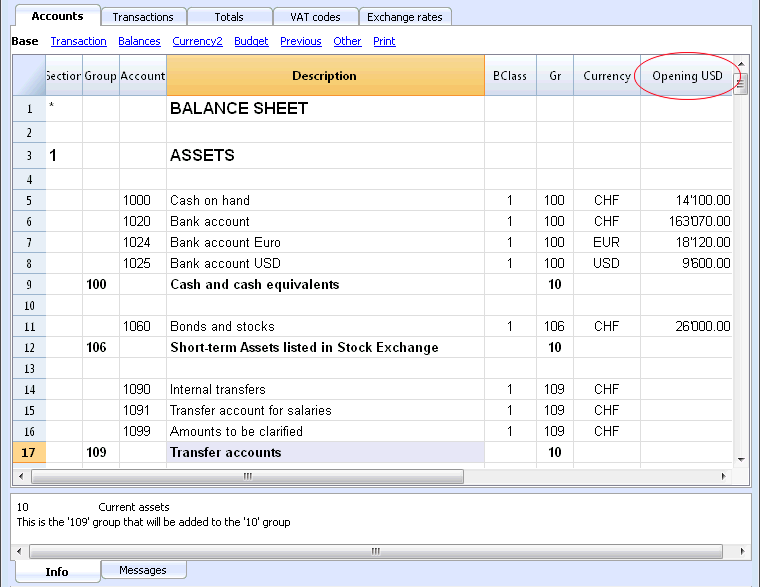

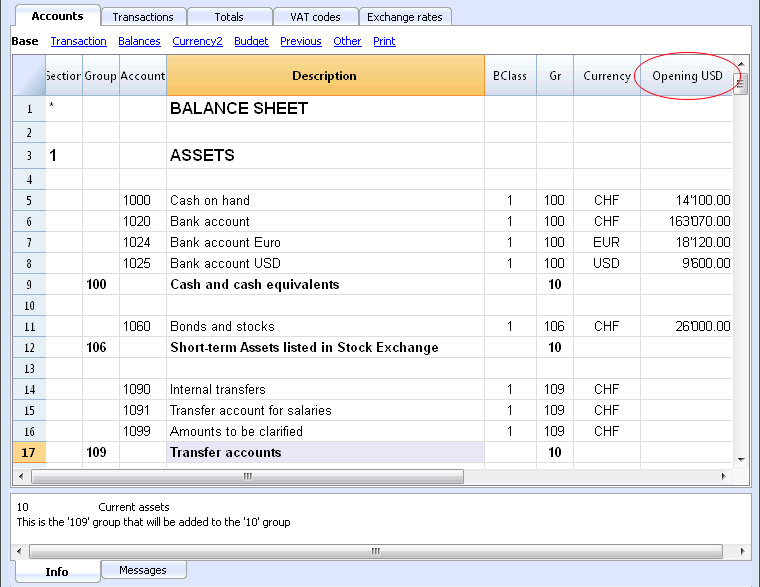

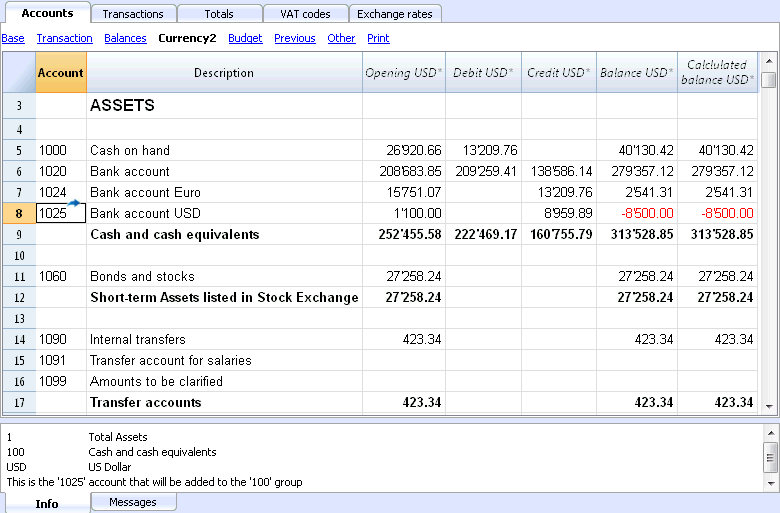

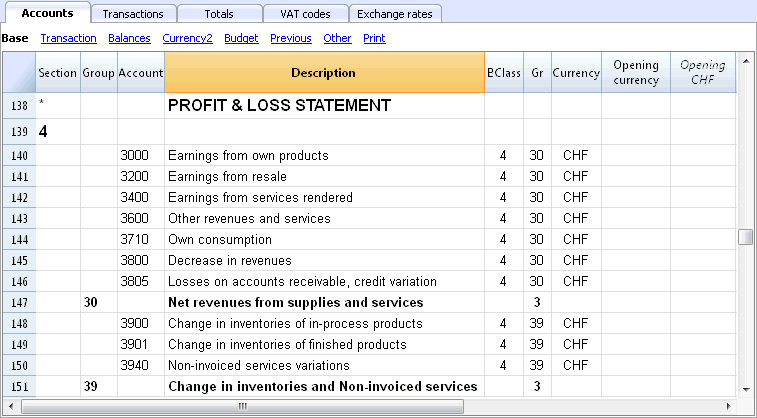

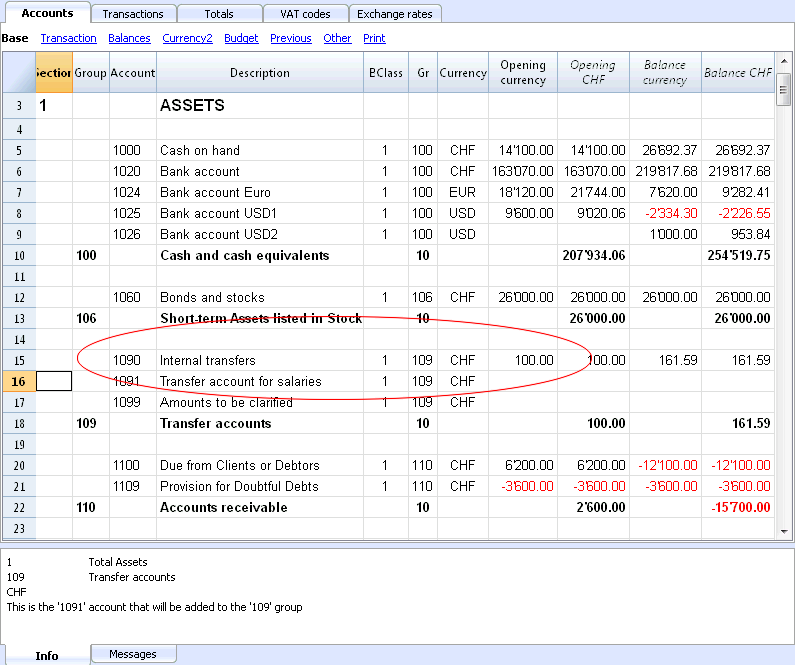

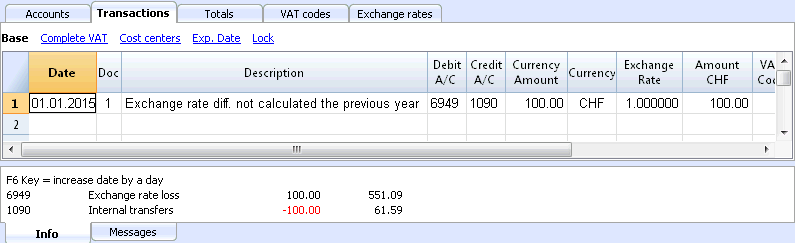

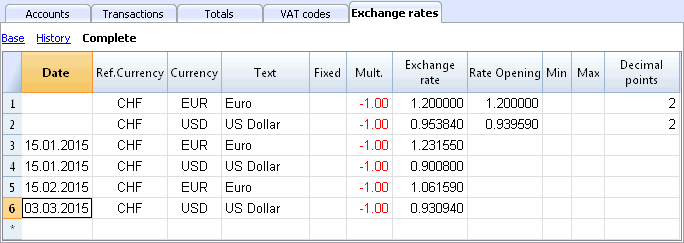

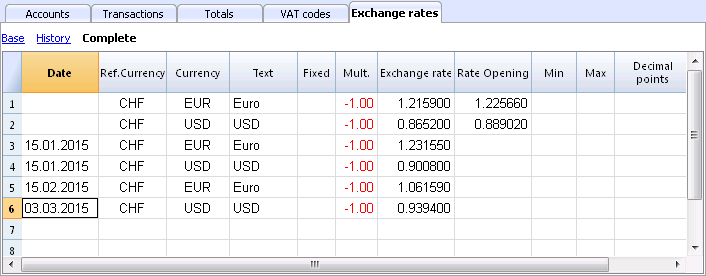

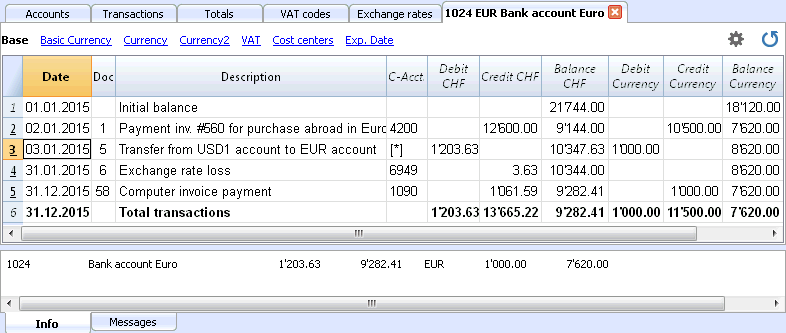

You can have as many accounts in foreign currencies as you need, and enter your exchange rates in the Exchange rates table. You can also keep an history log of your exchange rates. Exchange rate calculations and exchange rate differences are all done automatically. You can have your Balance sheet, your Profit and Loss statements and several reports in a second currency as well. |

|

Multi-mandate |

|

|

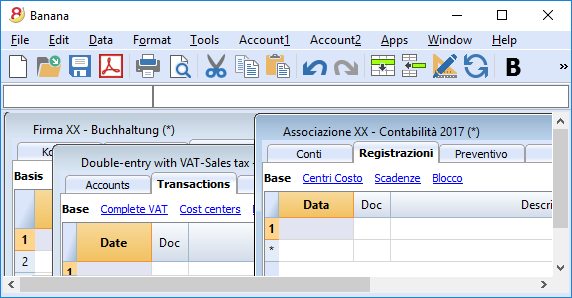

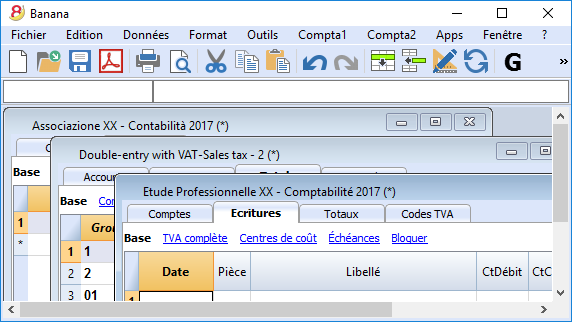

Banana Accounting has no limits on mandates. You can manage an unlimited number of mandates, each one with its personal settings: language, currency, VAT management, ... |

|

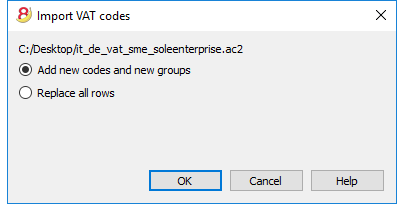

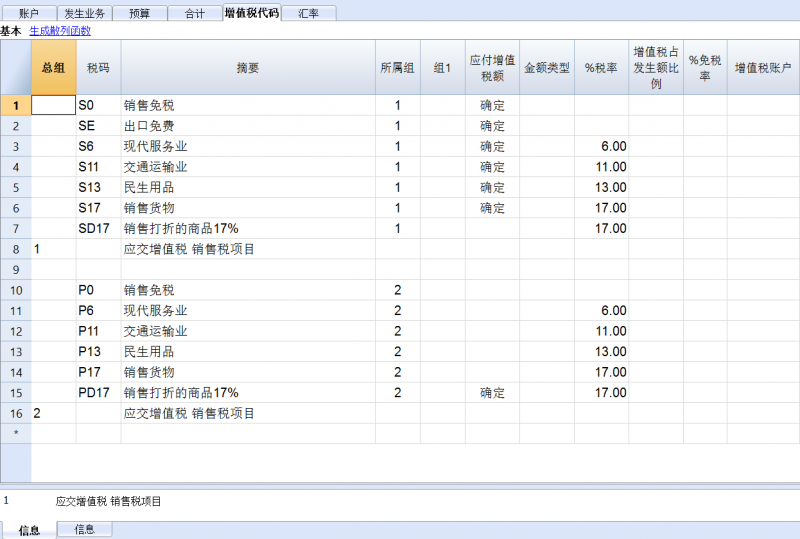

VAT codes by nation |

|

|

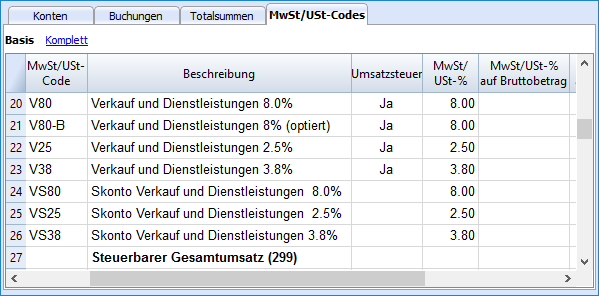

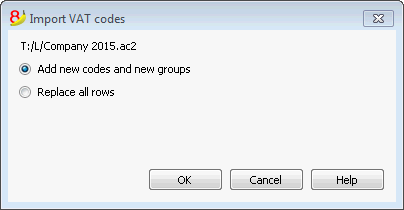

When creating a new file with the VAT/Sales tax management option, and you choose a specific nation, you will find a VAT Codes table that already contains all the VAT codes used in that nation. The VAT Codes table can however always be edited, in case you need specific codes or if some new legislation comes into effect. |

|

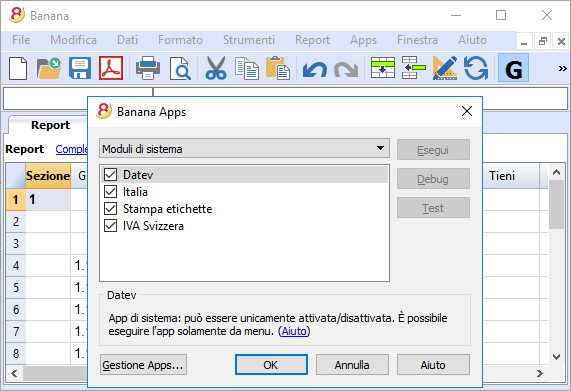

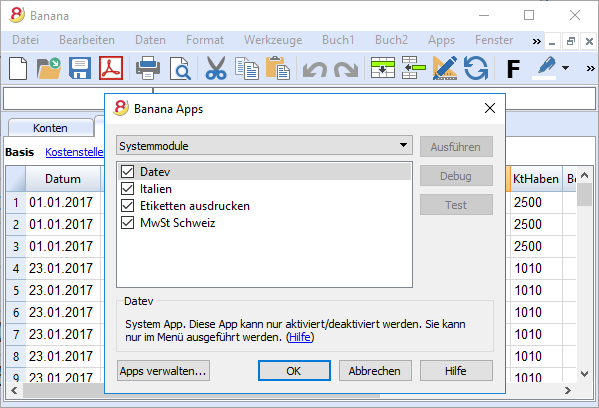

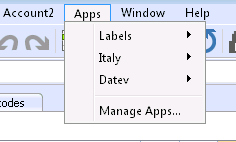

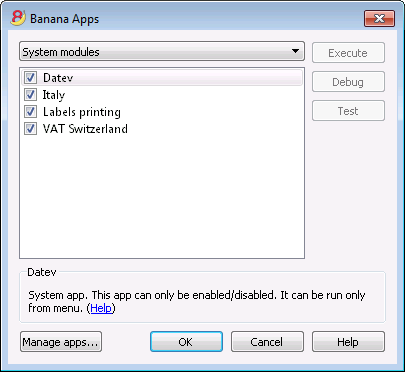

Specific Apps by nation |

|

|

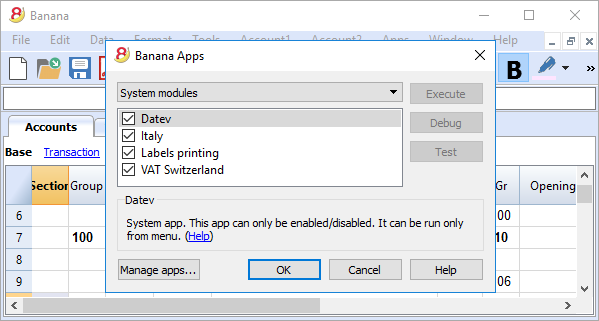

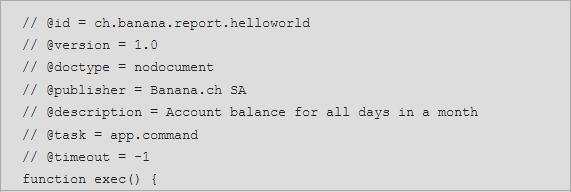

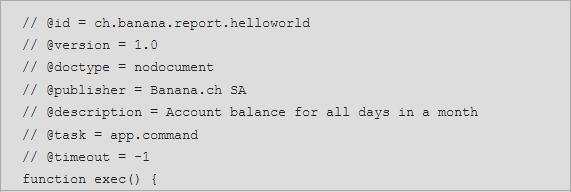

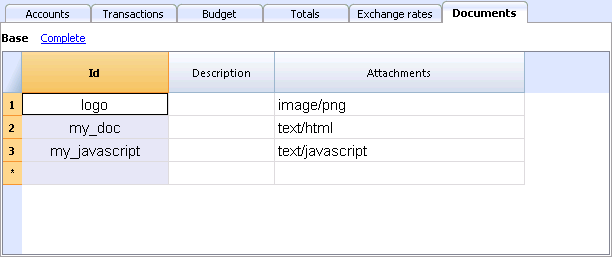

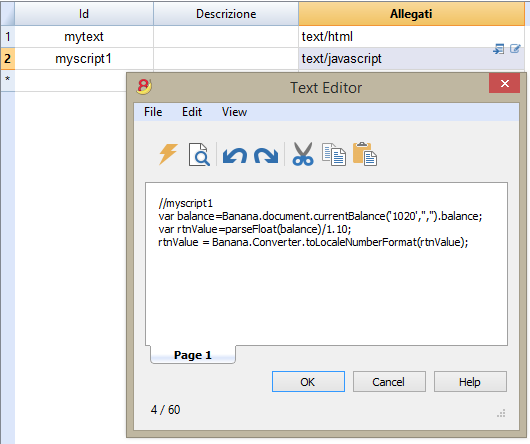

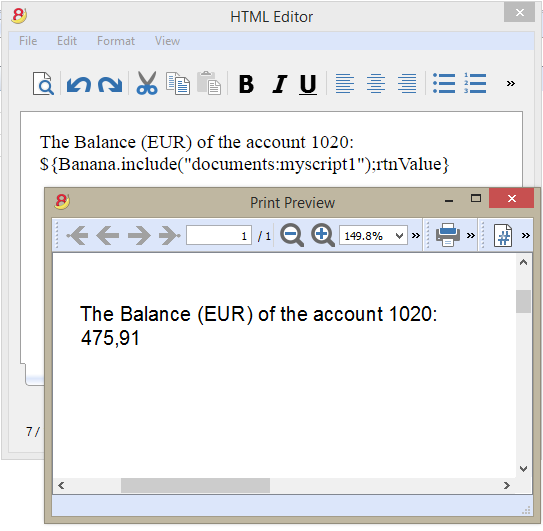

Banana Apps are applications that allow you to obtain specific printouts or reports from the Banana program; some Apps are already available for free, you just need to download them! You can also create your own Apps in order to have very specific report presentation, comply to specific local law requirements, such as for example the Swiss "curatele", or specific association's needs. |

|

Professional

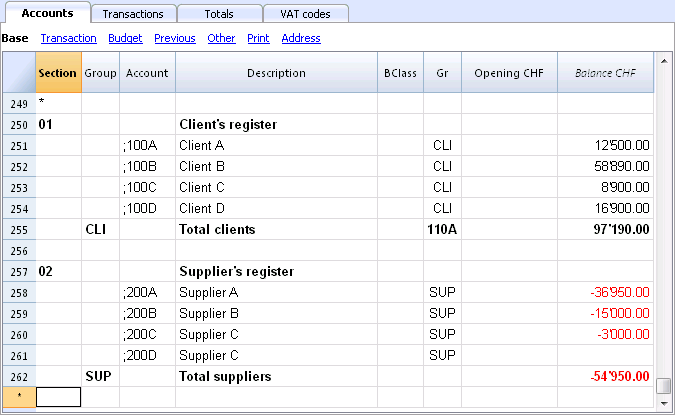

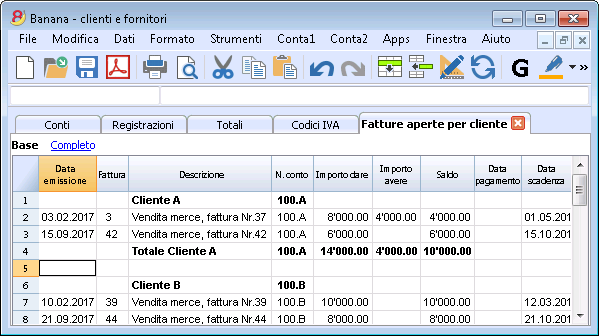

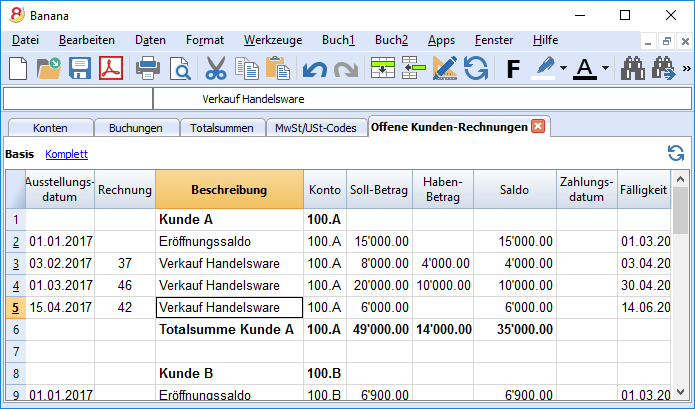

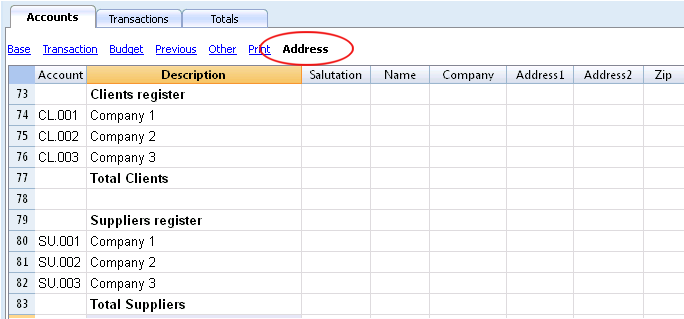

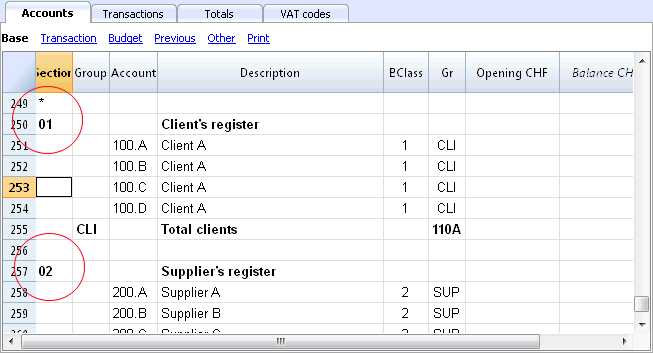

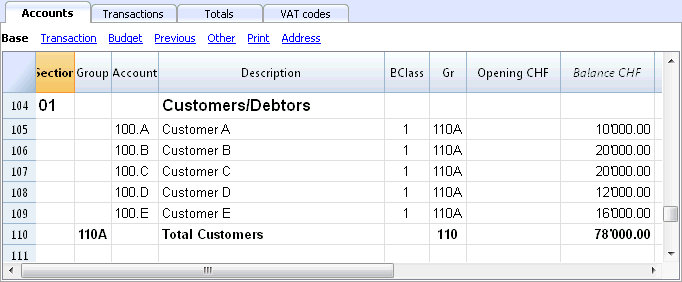

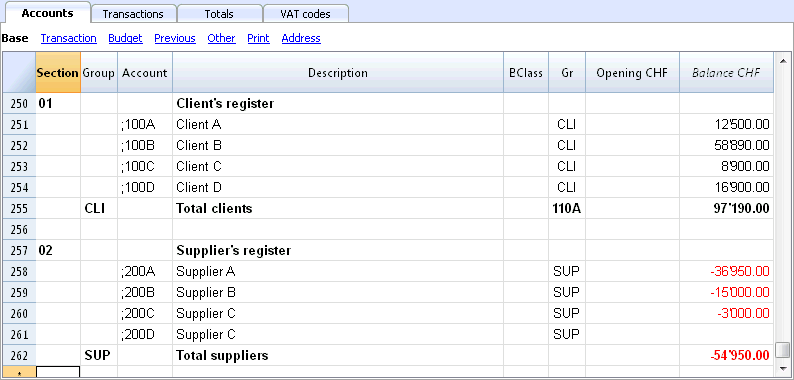

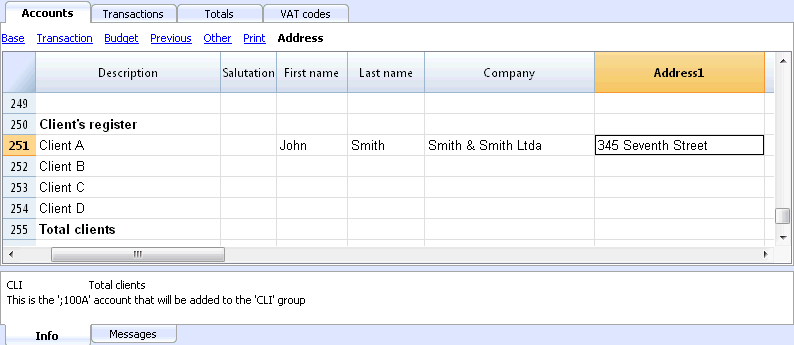

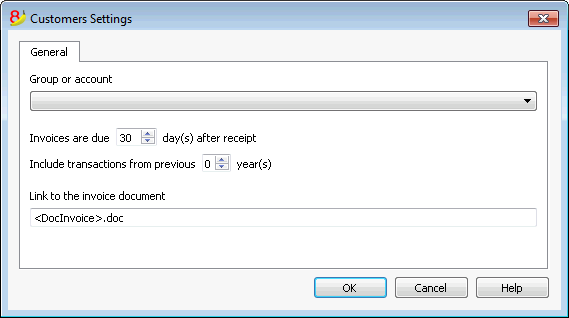

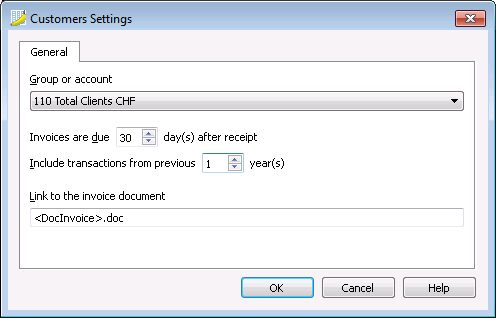

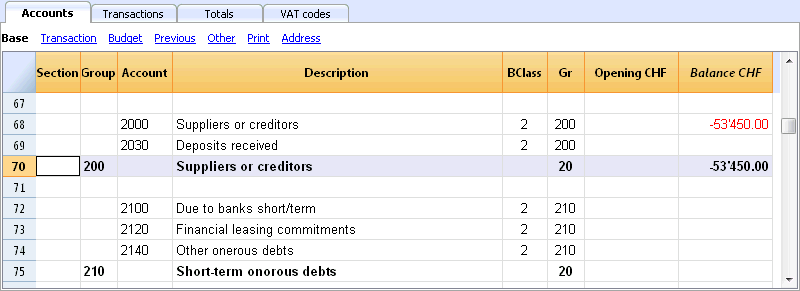

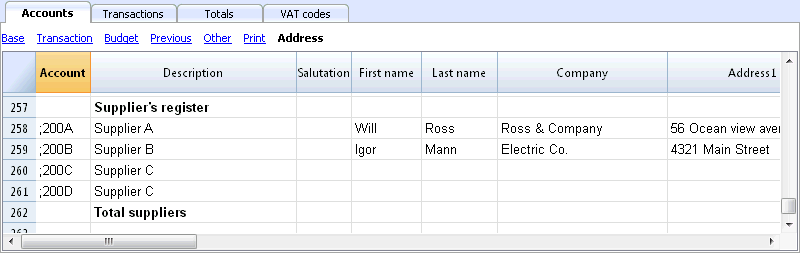

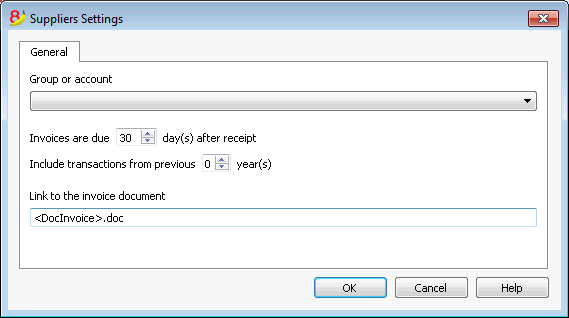

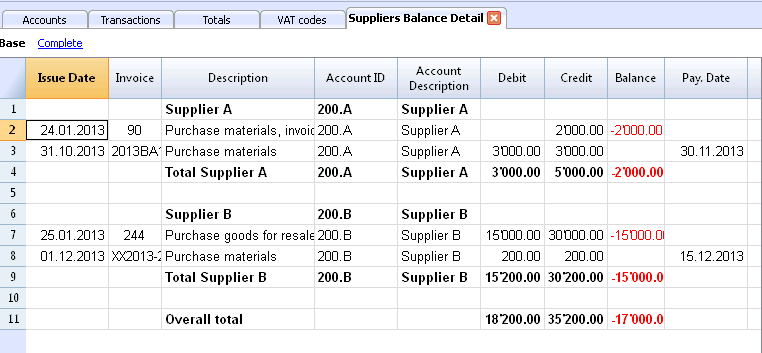

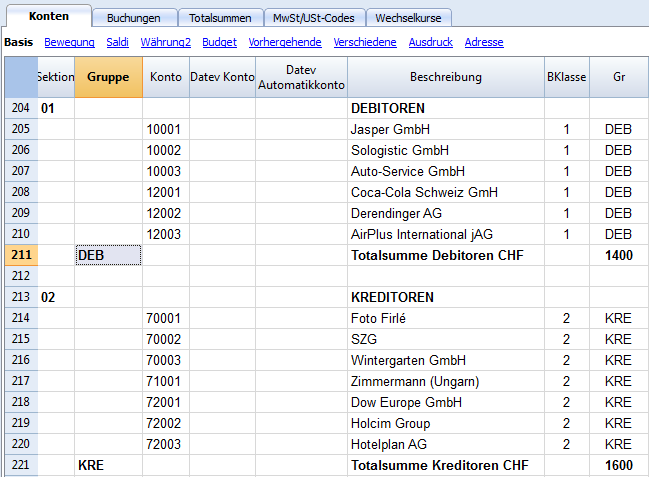

Clients and suppliers' management |

|

|

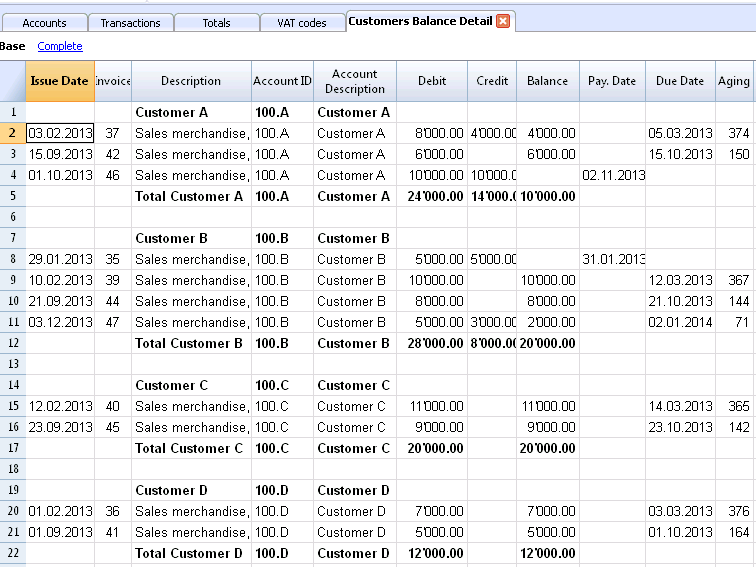

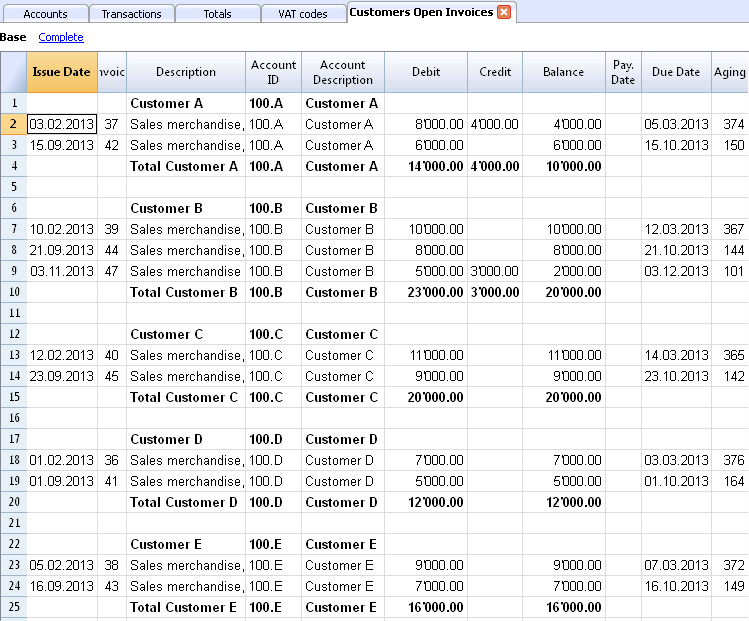

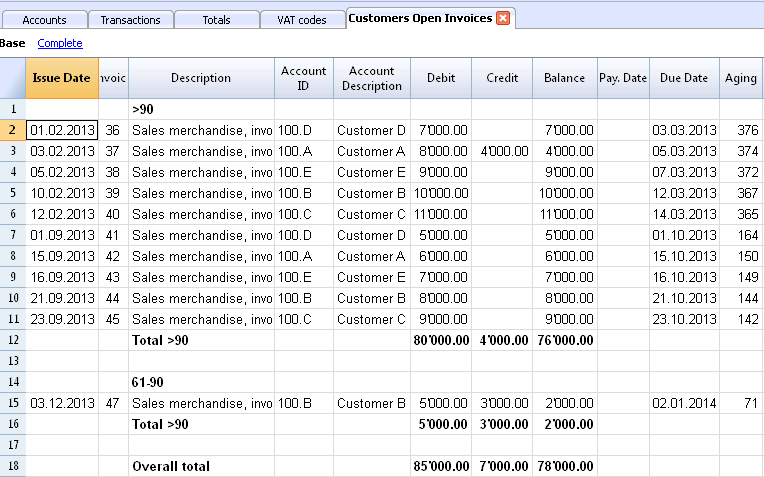

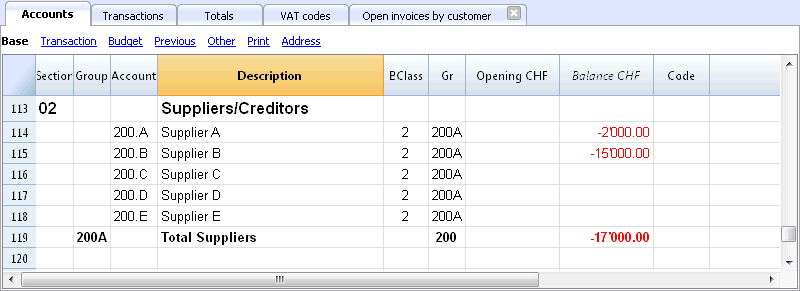

You can easily manage your Clients and Suppliers. You will be able to know, at any time, if you have expired or still unpaid invoices. You can also have the historic detail for each client or supplier. In the opening balances, you can go back to the invoices that determine the amounts. |

|

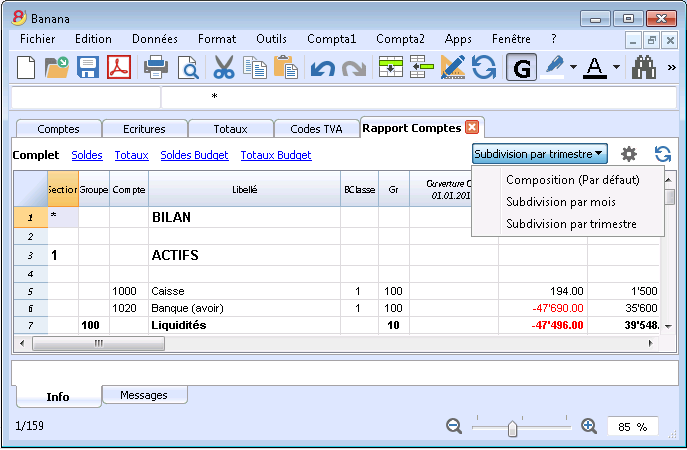

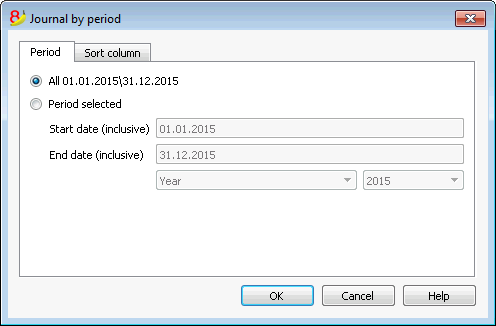

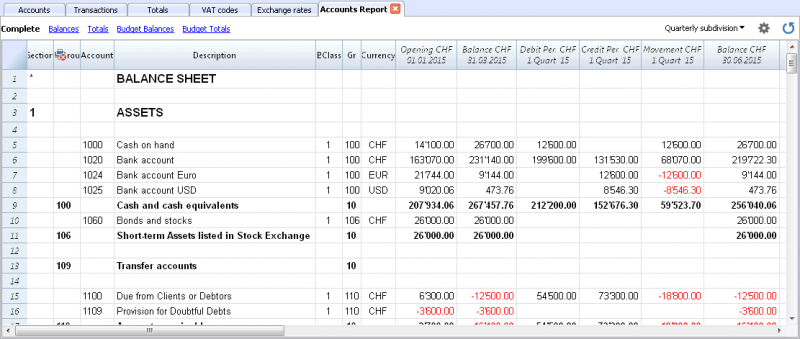

Countless reports, also by period |

|

|

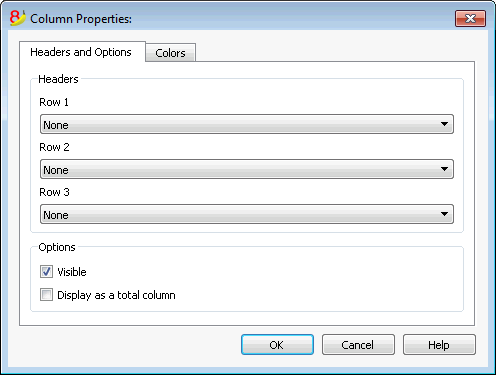

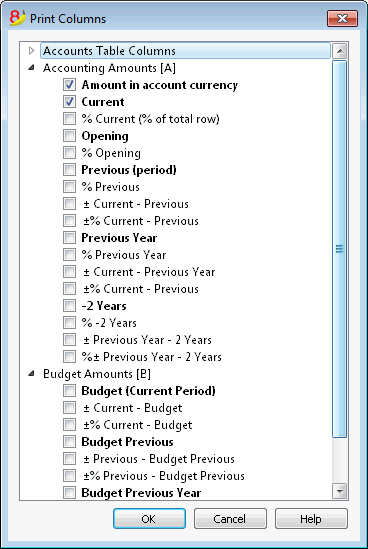

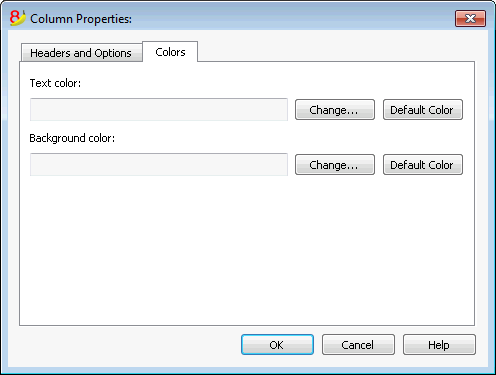

Reporting possibilities are endless. Choose the columns to display, change headers, change colors.

|

|

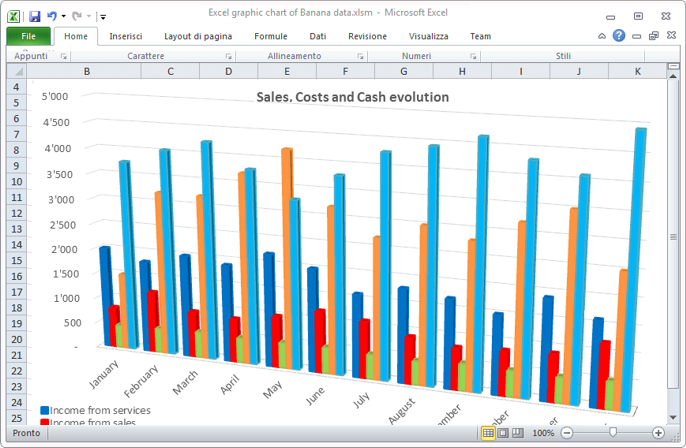

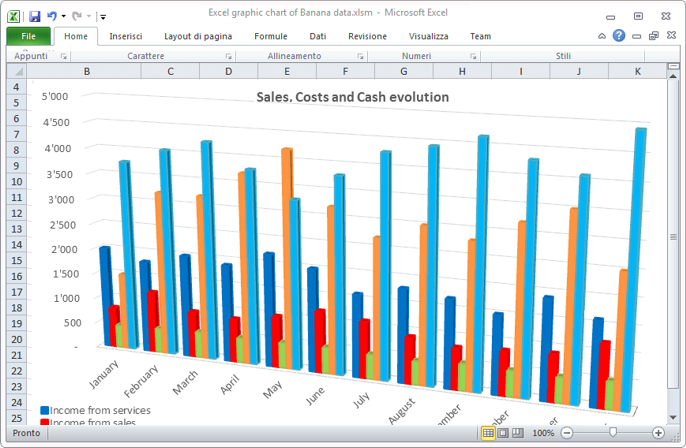

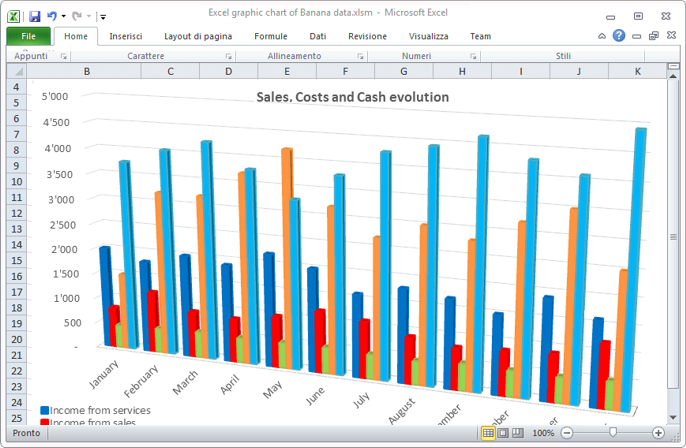

Excel data synchronization |

|

|

If you want your data in Excel, you do not have to copy, paste, or export any data anymore

|

|

Export data in different formats |

|

|

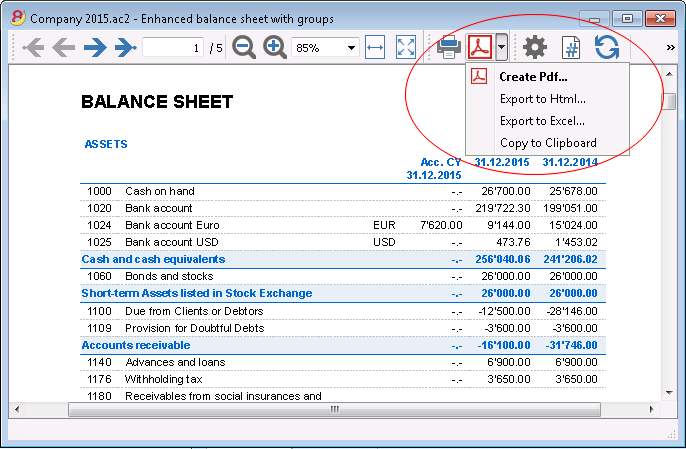

With Banana Accounting you can export data in various formats: Html, Excel, Xml, Txt. Export can be performed on a data selection or for the whole accounting file. You can also decide to export only specific rows.

|

|

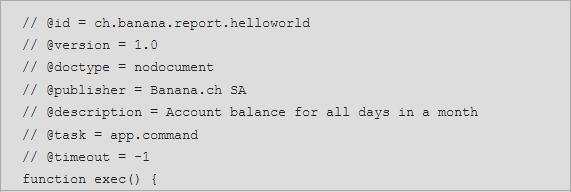

Custom Apps development |

|

|

If you need special printout, reports or some specific outputs, please contact us: we are available to create custom applications. |

|

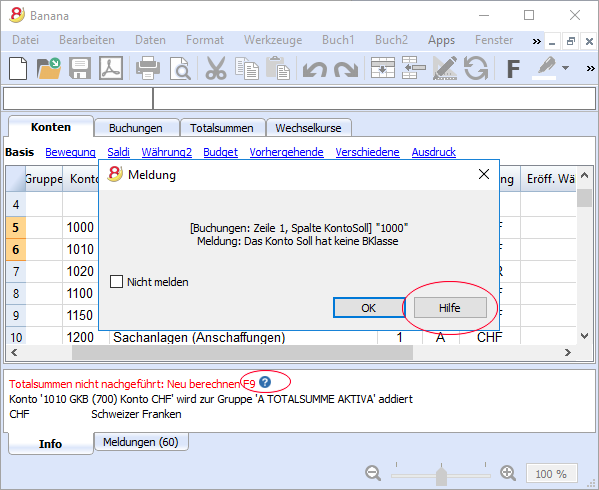

Automated checks |

|

|

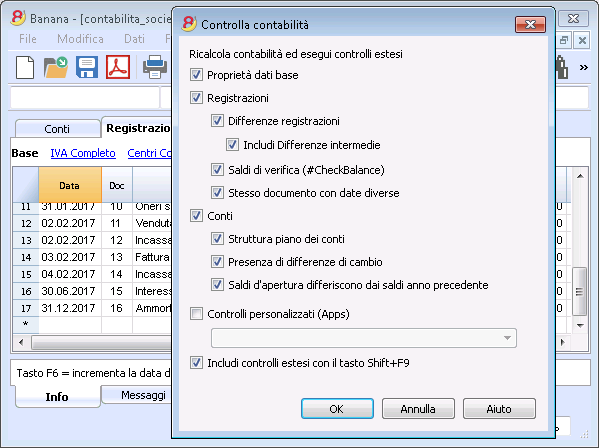

Any errors are reported automatically.

|

|

Security and certification

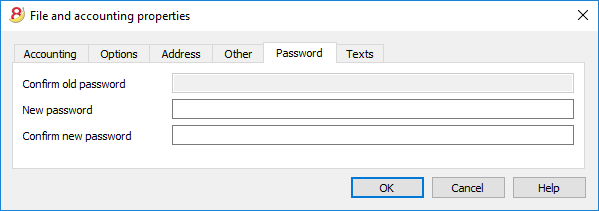

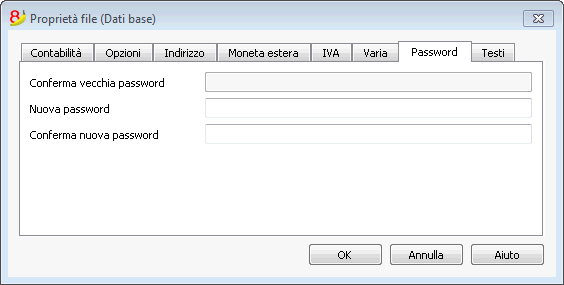

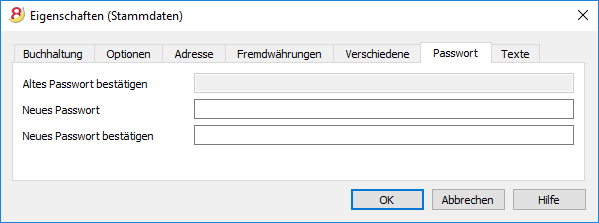

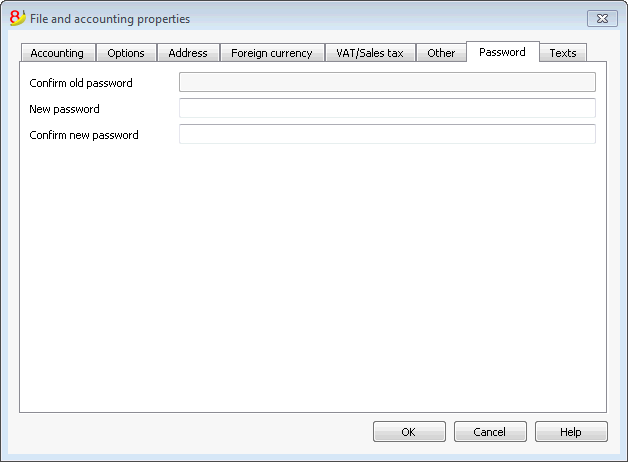

Password file protection |

|

|

Each file can be password protected. The password can be changed or deleted anytime.

|

|

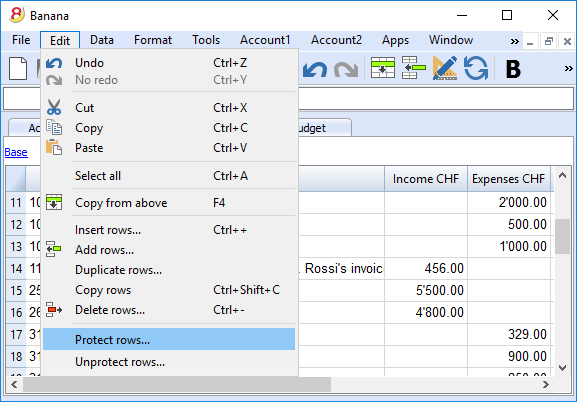

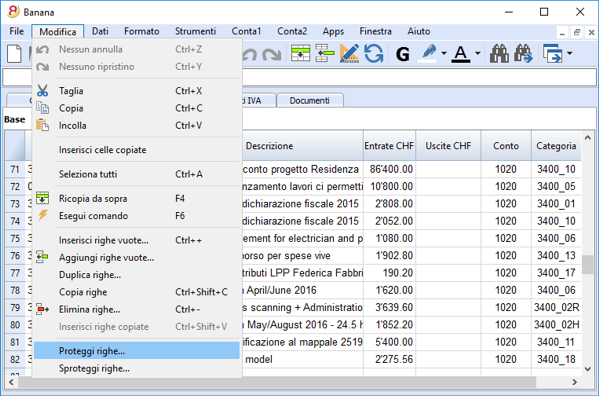

Rows protection |

|

|

In order to work more at ease, you can protect the rows that are already definitive in your file, to avoid tampering or accidental changes. Protected rows can be unprotected.

|

|

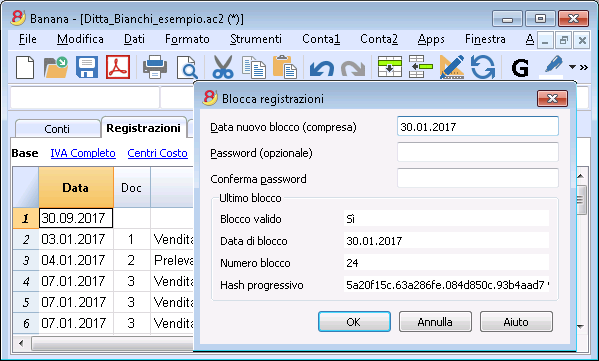

Transactions lock |

|

|

You can lock all or just some transactions; thanks to the digital certification, you can be certain that they haven't been changed. |

|

Data certification with blockchain system |

|

|

The integrity of the accounting data is guaranteed

|

|

Store your file in PDF format (or just parts of it) |

|

|

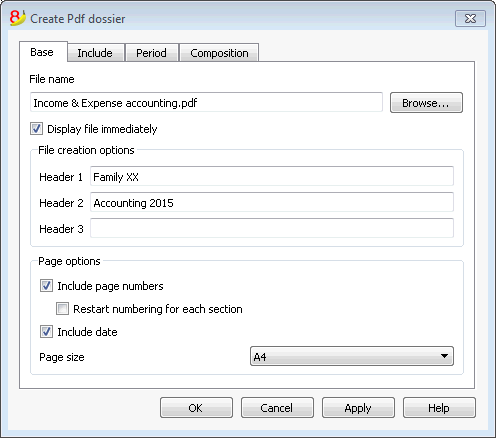

You can save all your file in PDF format, or choose what parts of it to print. |

|

Automatic Backups |

|

|

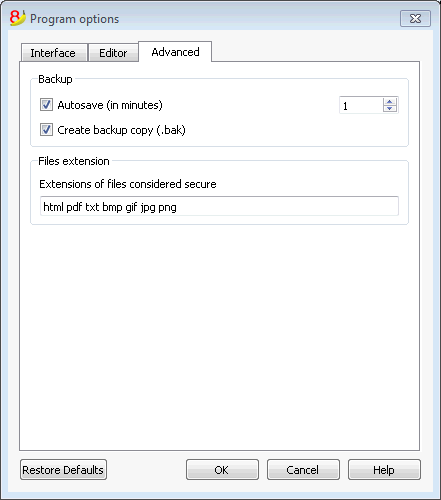

The program automatically saves, at a frequency in minutes that you can define, in a backup file.

|

|

Compatibility and sharing

Compatible with previous versions |

|

|

Banana Accounting 8 maintains the same usage patterns and compatibility with previous versions. Files created with previous versions can be opened and all data is fully maintained. |

|

For all operating systems |

|

|

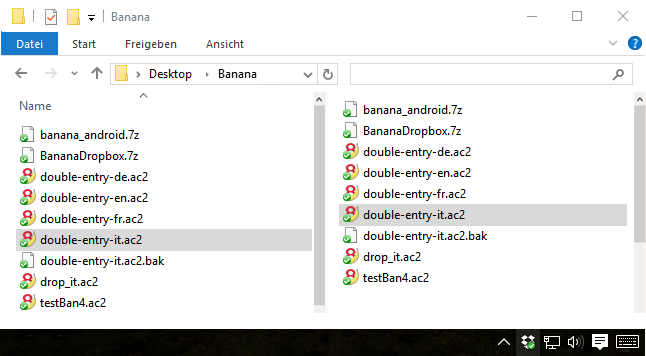

Banana Accounting 8 is available for Windows, Mac, Linux, Android and IOS. Banana files are interchangeable between different versions. |

|

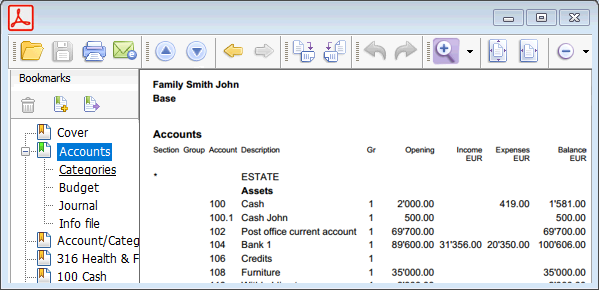

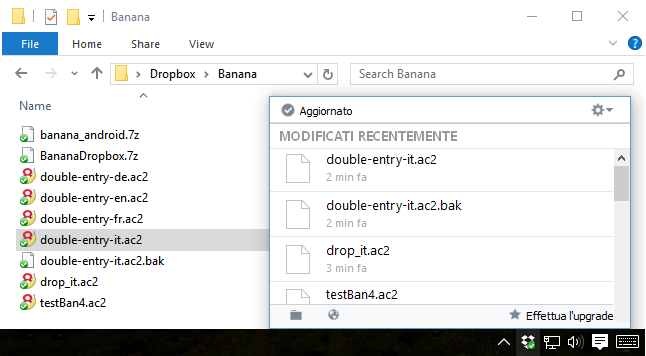

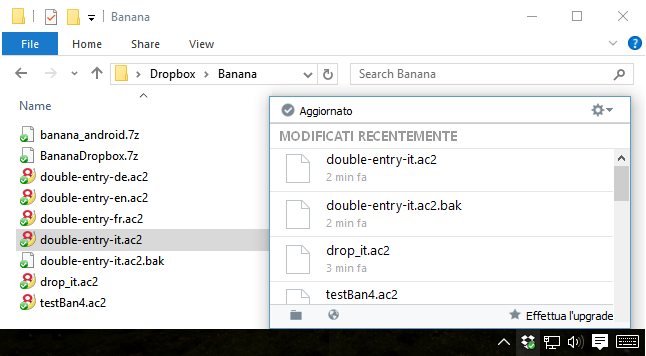

Cloud sharing |

|

|

Banana files can be saved on all Cloud systems: Dropbox, I-Cloud, Google Drive, ... so that you can access your accounting data anytime, anywhere. |

|

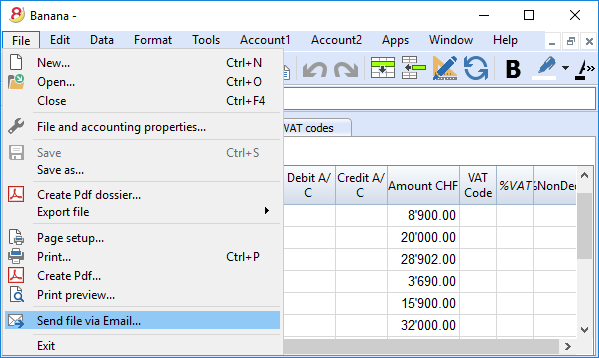

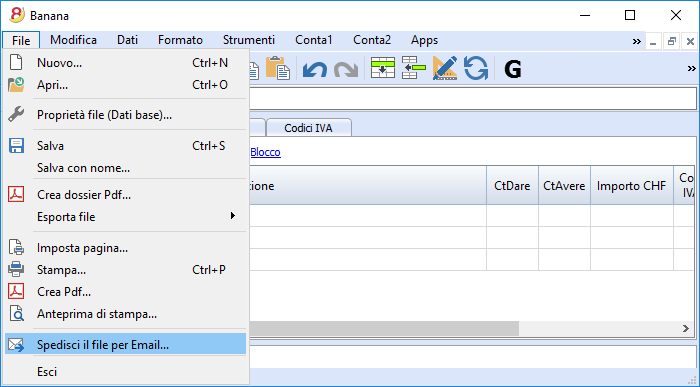

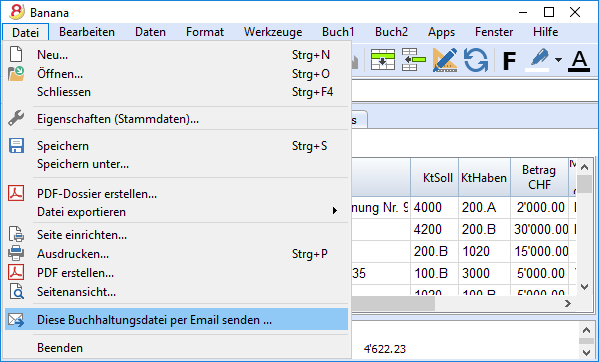

Send your Banana files by email |

|

|

Each Banana file can be sent by email, shared, saved on a USB stick, and so on.

|

|

360 degrees support

Online documentationMore than 500 pages of free online documentation, divided by topic, with step-by-step images and explanations. Direct link to the errorAny error is immediately reported. Free supportSupport by phone or email is free for 12 months from the date of purchase and for topics related to the use of the program. Technical Advanced SupportTechnical support and custom solutions development (Apps). |

|

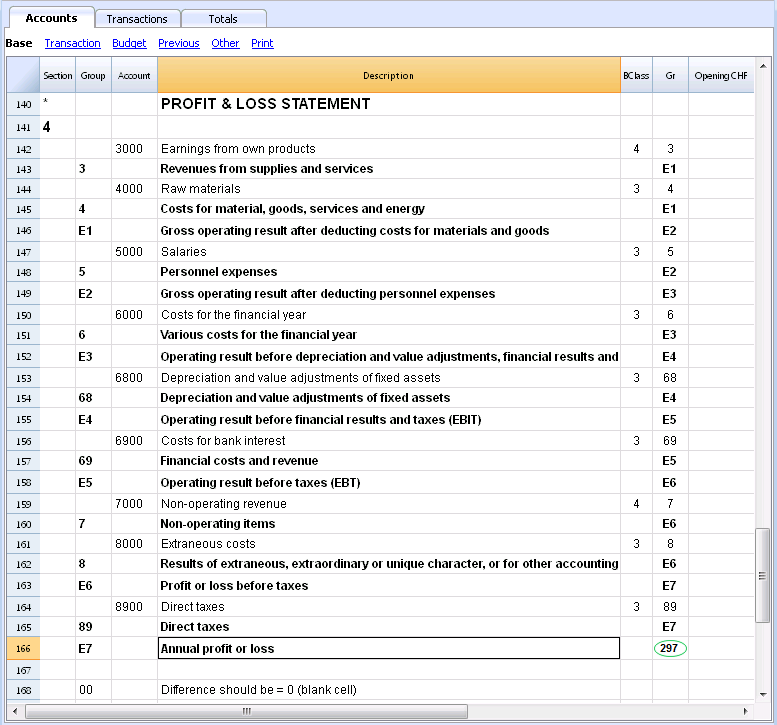

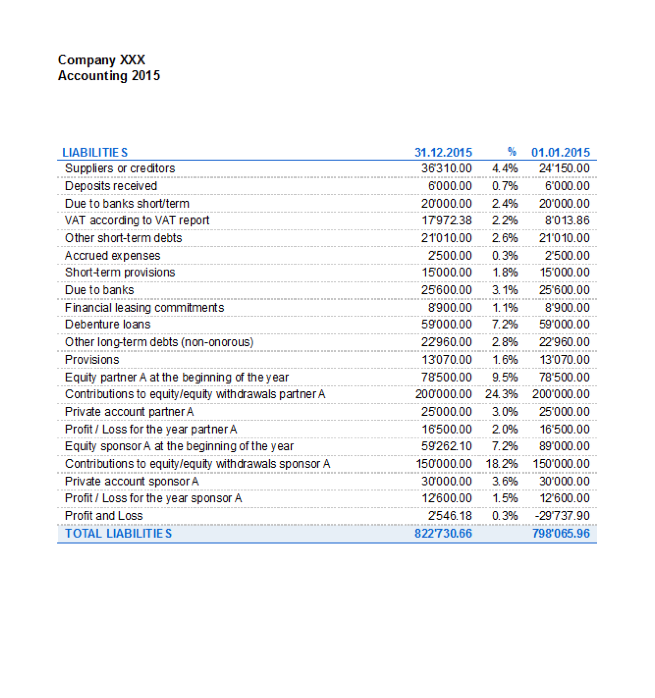

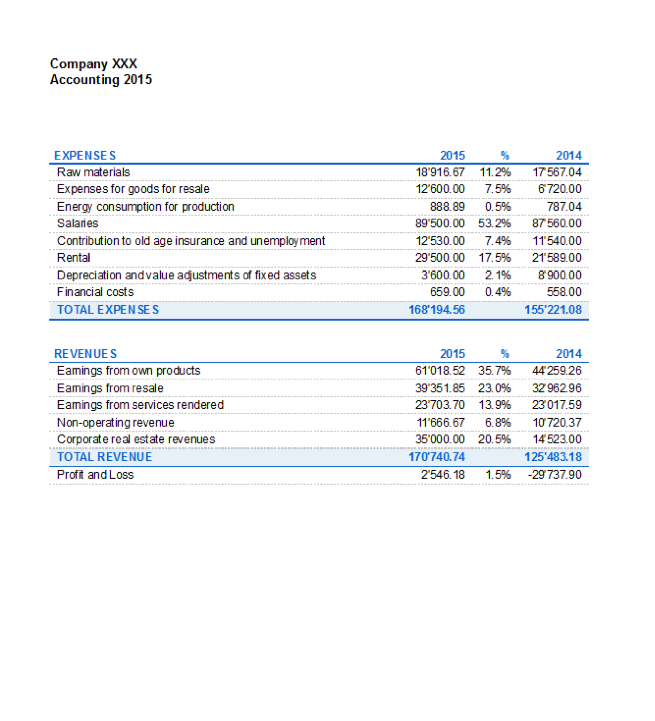

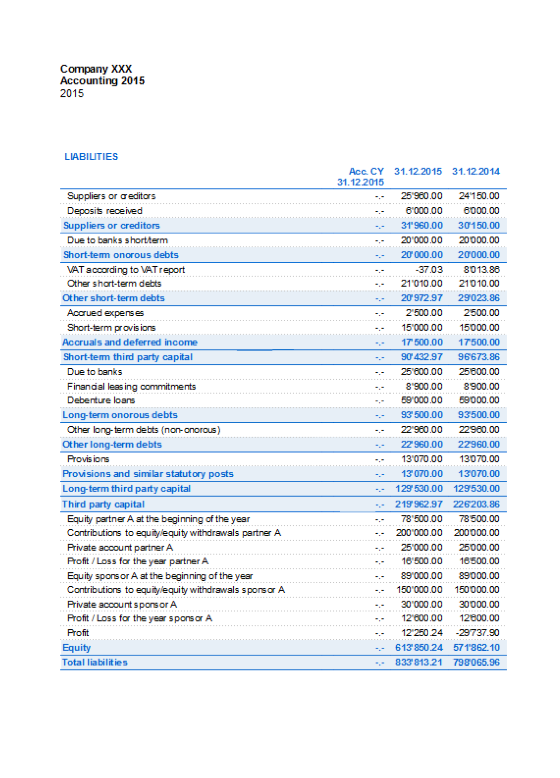

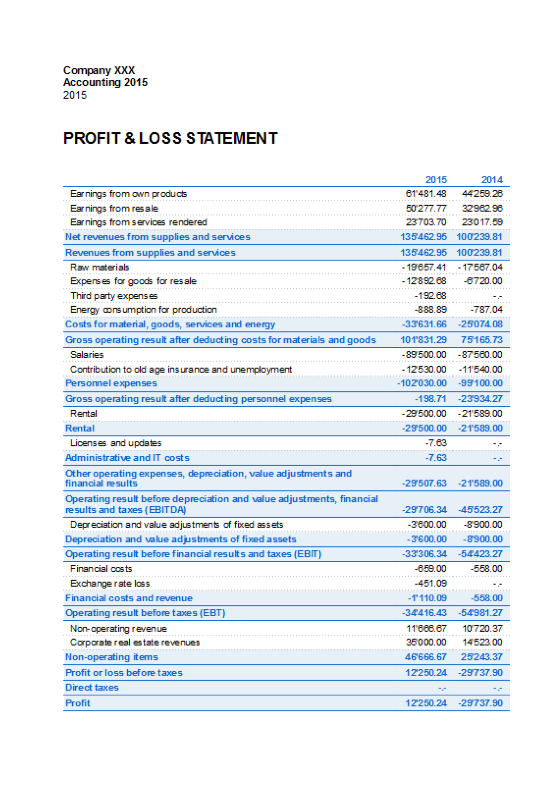

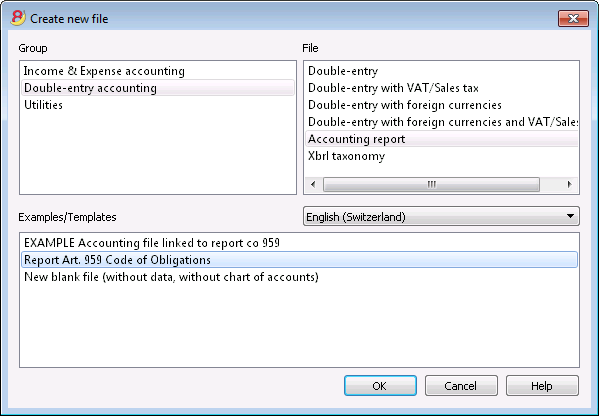

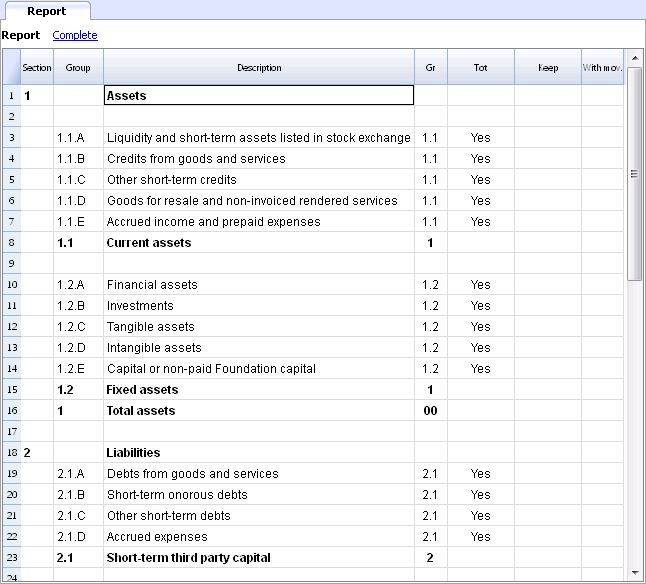

Switzerland: new regulations for reports

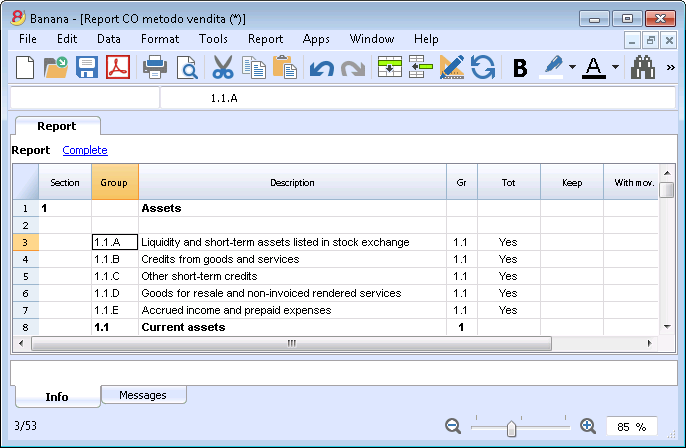

From the end of 2015, all companies registered in the Swiss Commercial Register, will have to present their accounting reports according to a new regulation, with the minimal Balance Sheet and Profit and Loss Statement organization prescribed by the Swiss Code of Obligations (rRt. 959a and 959b CO).

The new accounting plan templates that come with both Banana 7 and Banana 8 already meet the new requirements. If you created your new accounting file using one of the new Banana templates (chart of accounts), you will get printouts that are conform to the new regulations.

If you have an "old" accounting plan, you have two possibilities:

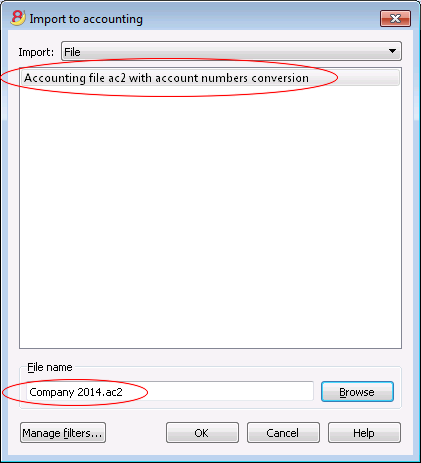

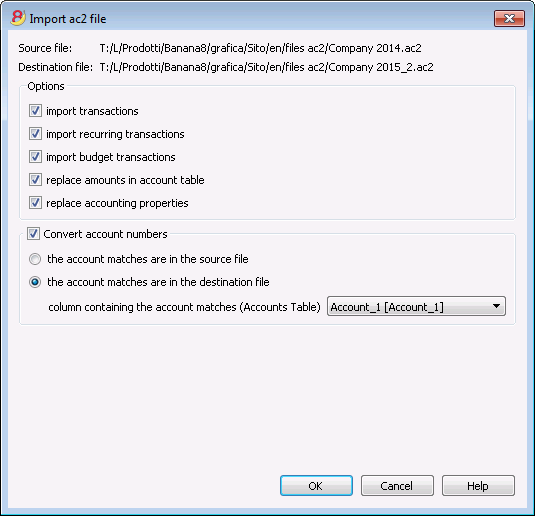

- Migrate to the new accounting plan and get your data from the existing accounting plan

- Create a new accounting file using a Banana template that uses the new organization (account numbers and groups)

- Add a new column in the accounting plan and enter for each account, the corresponding account number in your "old" accounting file

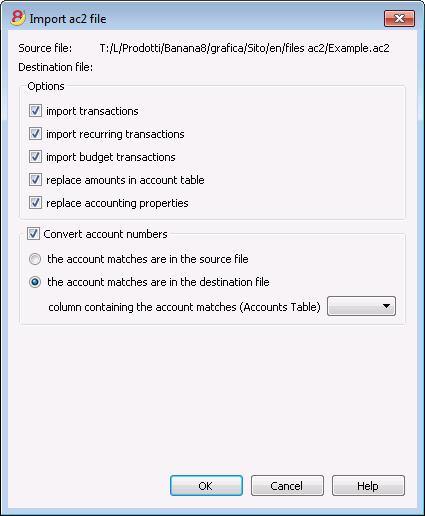

- Use the import feature in order to get and convert your data from your "old" accounting plan.

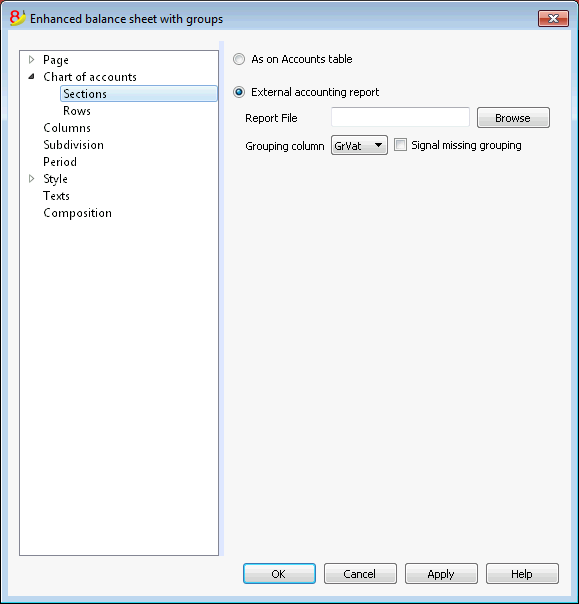

- Keep using your existing accounting plan and use an external file (already available in Banana 8) to get a report according to the new regulation when printing

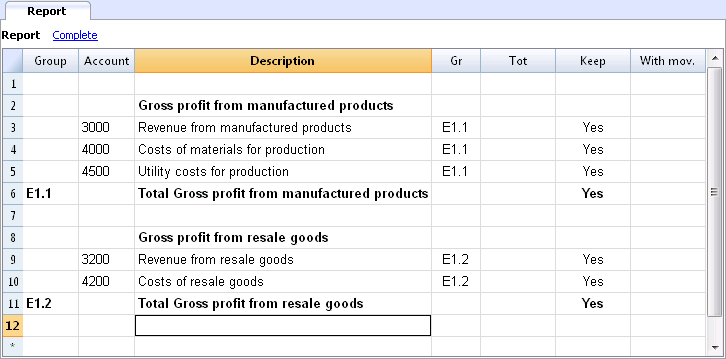

- Create a new Report file (Double-entry accounting -> Accounting Report -> Tenplates for Switzerland (English) -> Report art. 959 Swiss Code of Obligations)

- Save the file in the same directory where your accounting file is stored

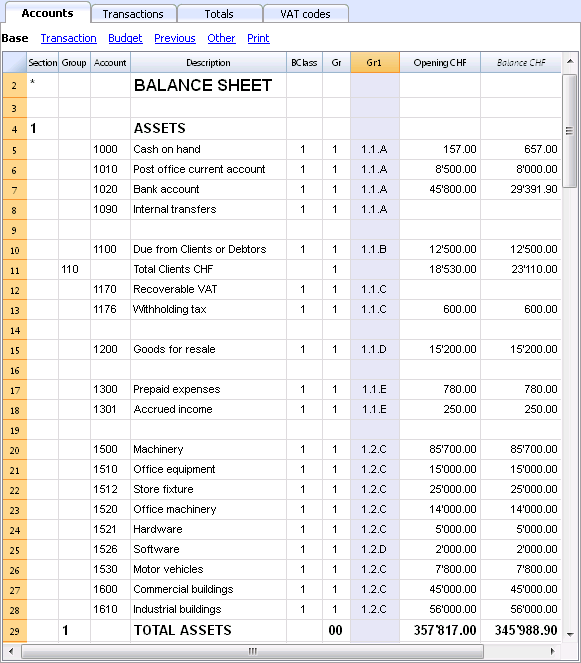

- Give to each account (in the Gr1 column) the group corresponding to the new regulations, as indicated in the Accounting report file (see explanations on the page External report file)

- Print the Balance Sheet and Profit and Loss Statement for fiscal purposes, by using the report file (for more information see the Enhanced Balance Sheet with groups page)

Further changes

The new regulations prescribe further changes. They also require that the Attachment to the Balance sheet should contain more detailed information. You can also decide to include some of the required details directly into the Balance Sheet and Profit and Loss statement, or you can enter the information in the attachment (for example for credits or debits towards the sharesholders or the members of the company).

These are important changes, with fiscal and legal implications.

We strongly advise you to check with your trustees, accountants, auditors and tax advisors in order to prepare the 2015 accounts presentation as prescribed.

In the following years you will simply need to follow the same organization.

What's new in version 8

Optimized for the new Windows 10, Mac und Linux Operating Systems

Banana Accounting 8 maintains the same use, it is compatible with previous versions, and introduces important new functions that our clients requested. The program now indicates whether there has been an interruption and whether there are data that have not been saved. More info...

Compatible with previous versions

Banana 8 uses the same format of the 5.12 version. Files edited with version 8 can therefore be read from previous versions.

Work with colors!

By coloring the rows (text or background), it is easier to see and find accounts and transactions.

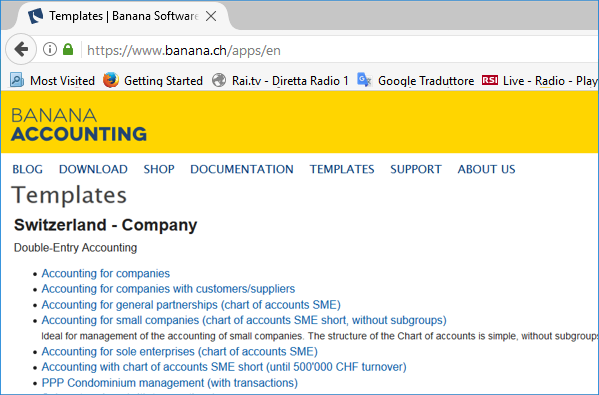

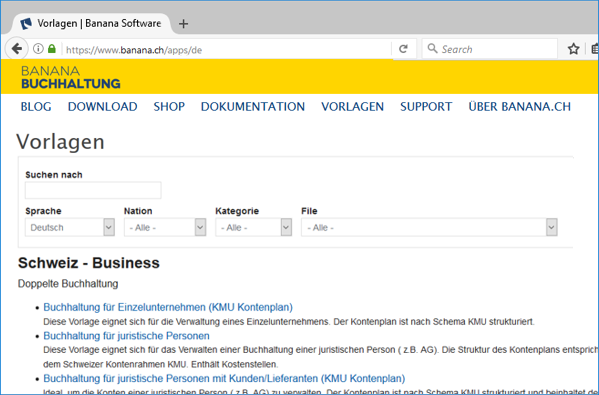

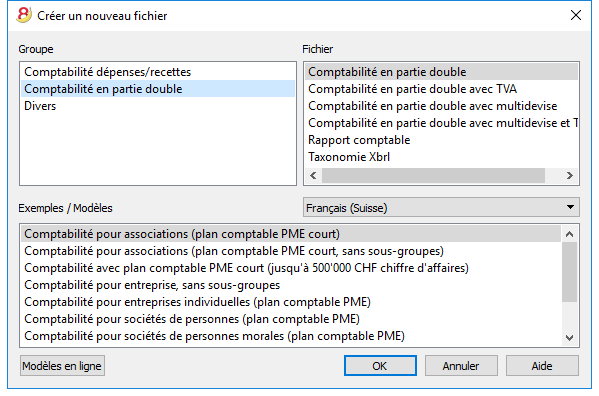

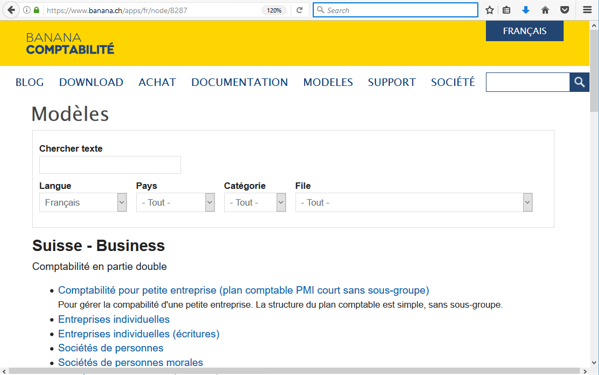

Accounting templates up to date

Several templates are available for the double-entry accounting, as well as for the income & expenses accounting and the cashbook, in several languages and for different nations.

Hi-quality accounting data

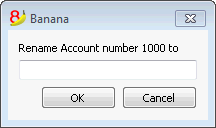

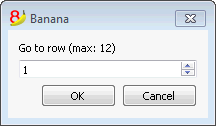

With Banana Accounting you can correct possible differences, transcription errors or change the Debit/Credit account, if wrongly entered.

Even if you are a non expert user, you can achieve a perfectly ordered accounting file, avoiding the cash going negative, and having your bank accounts match your bank reports.

Share your files

You can move your files and share them with Dropbox, I-Cloud, e-mail or USB stick.

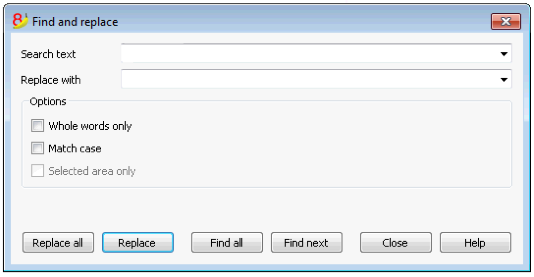

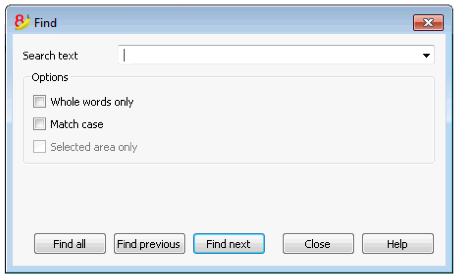

Find texts in a more efficient way

You can now find all the texts matching your search criteria and you can leave the Find window open for future searches.

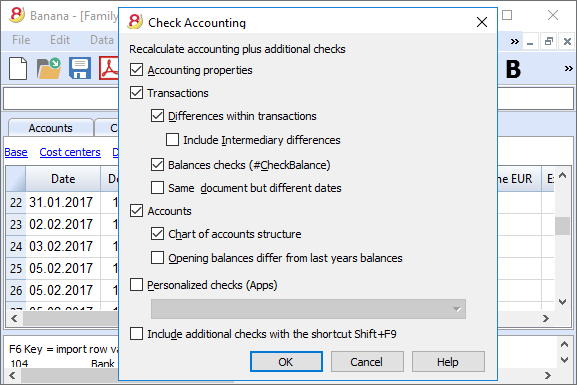

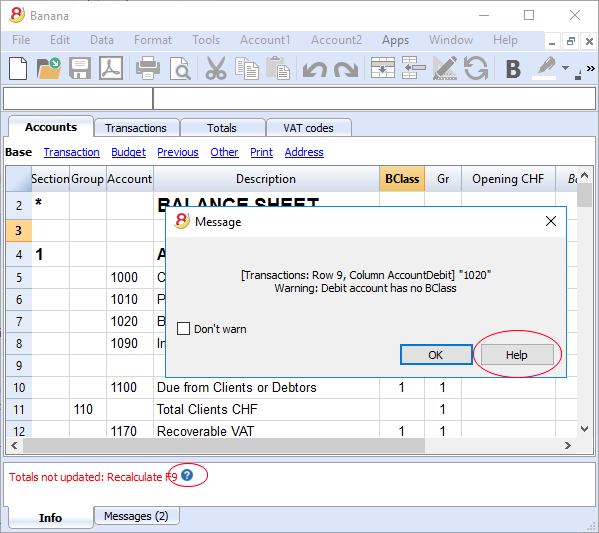

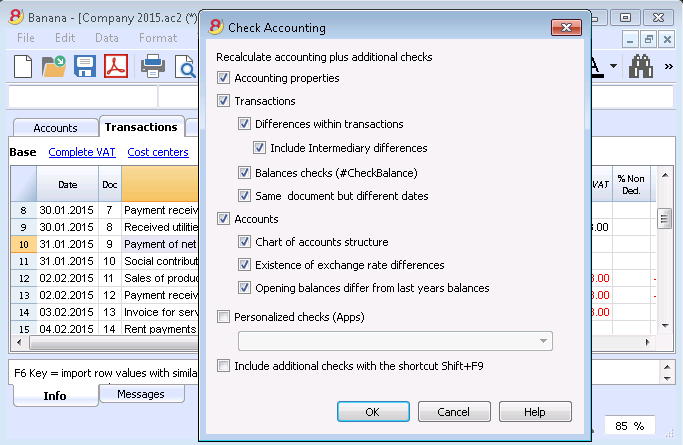

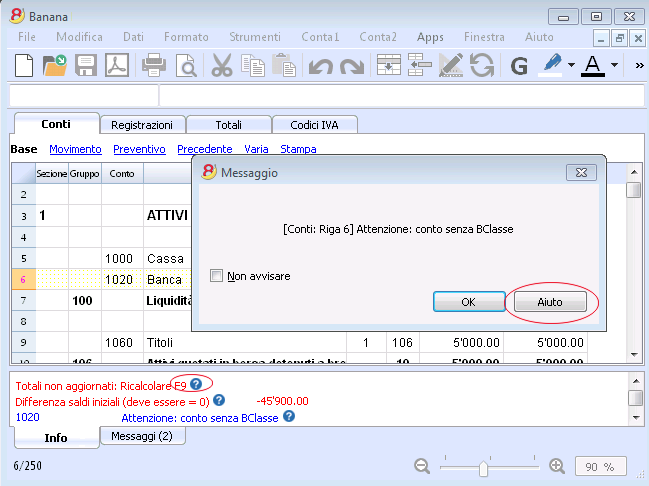

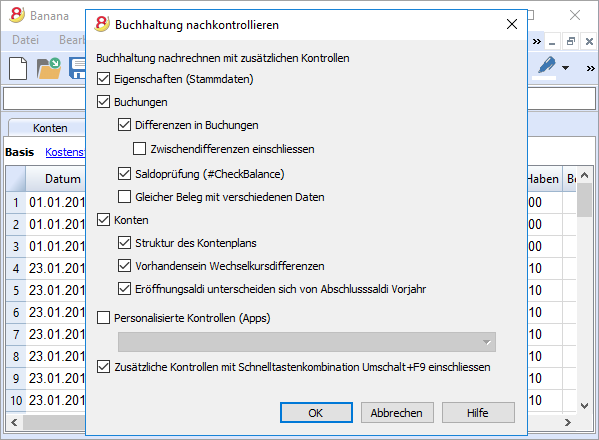

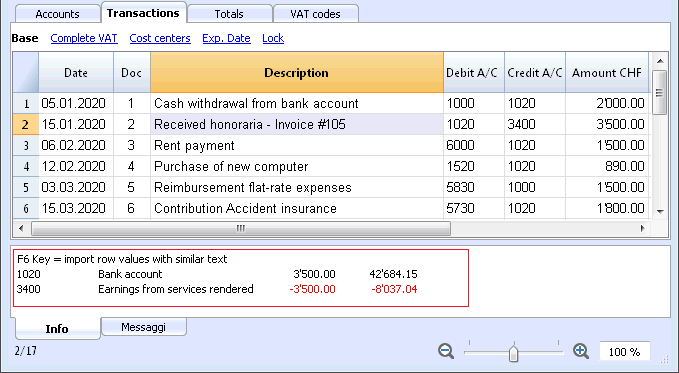

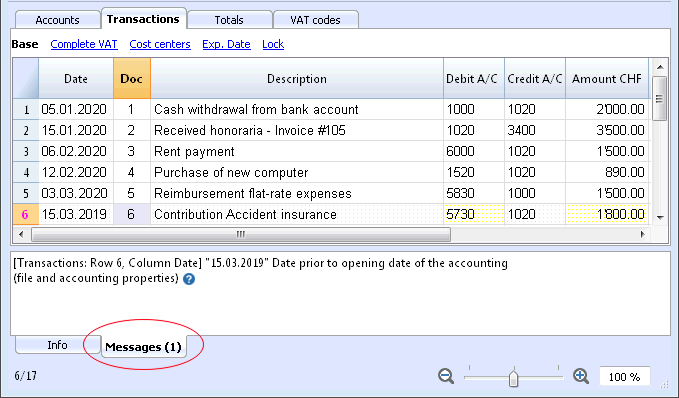

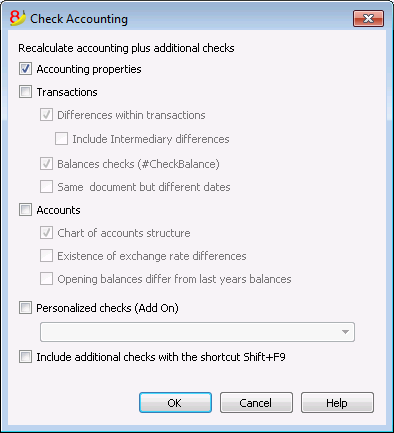

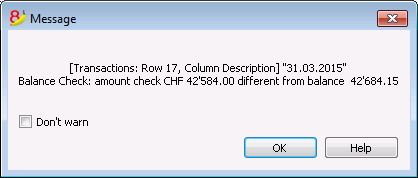

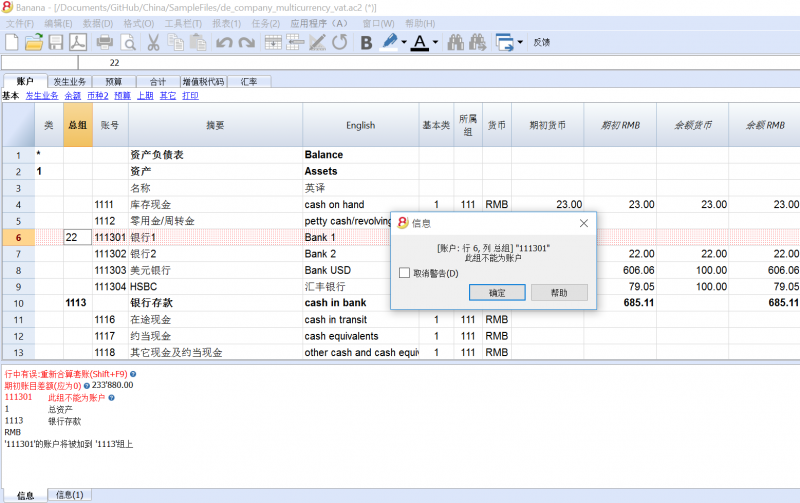

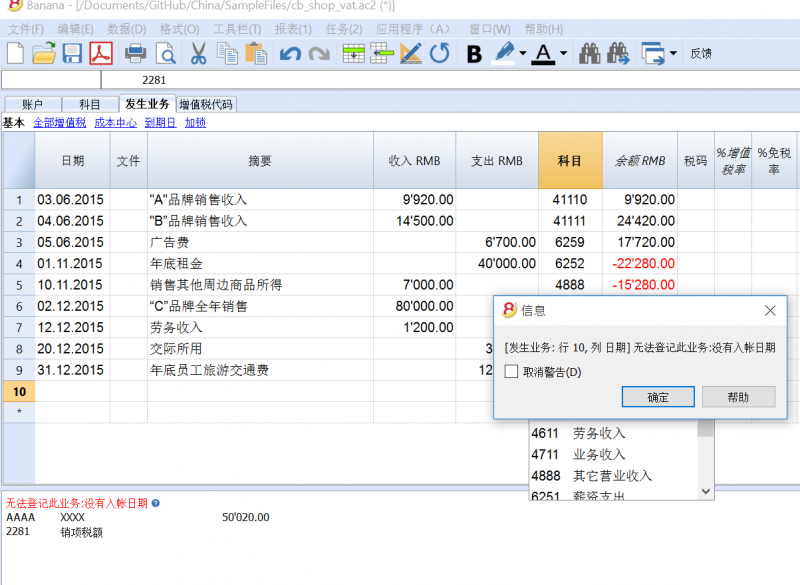

Advanced verification system

Forgot something? No problem, the Check accounting command, will instantly recalculate all your accounting file, and will alert your if possible errors or differences are found. By clicking on the  symbol, next to the error message (in the Info or Messages window), you will be directly connected to the NEW online page explaining the error message and suggesting possible causes and solutions.

symbol, next to the error message (in the Info or Messages window), you will be directly connected to the NEW online page explaining the error message and suggesting possible causes and solutions.

Handy online documentation

Every alert message has a direct link to the corresponding page at our online documentation. You will find useful tips and step by step instructions on how to best operate and to solve your problem.

Convert your accounting plan according to the new Swiss regulations

You can set a new accounting file using one of the new templates, and then automatically resume and convert your existing data, no longer complying with new regulations.

Print your report according to the new Swiss regulations

If you decide not to change your existing accounting plan structure, you can still print your report according to the new Swiss regulations, thanks to a Banana external accounting report file.

Balance sheet attachment

In the Balance sheet printouts you can also include a text for the attachment.

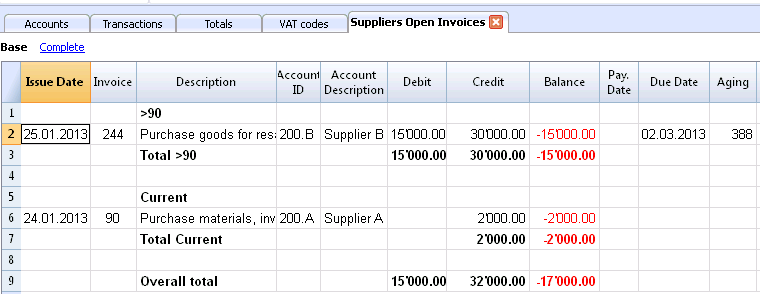

List of the customers/suppliers overdue invoices

The new functions for the Customers / Suppliers management, allow you to view the list of customers and suppliers overdue invoices.

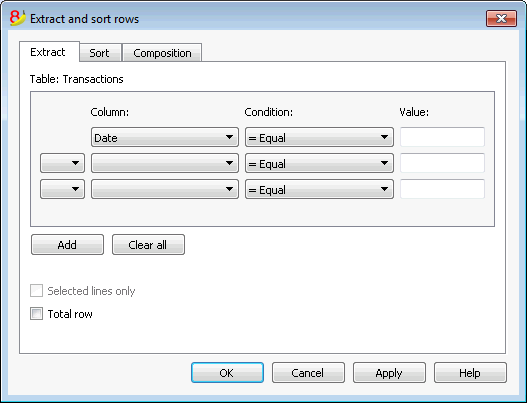

Easily create your customized printouts

With the Composition command it is easier to setup and save your customized printouts; you can also save your own settings to print Account cards, Extract and sort rows, Addresses and labels, ...

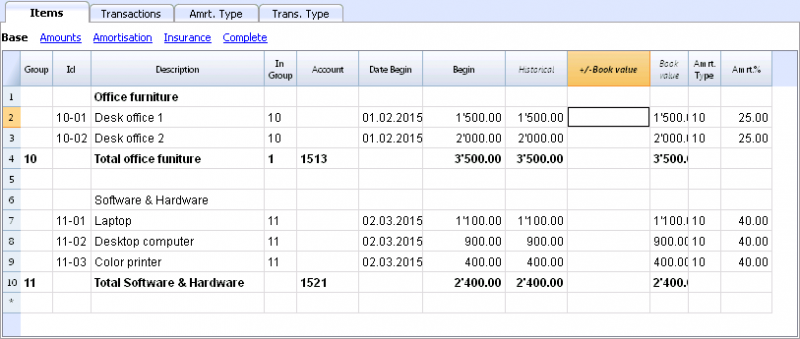

Business intelligence

Banana allows you to manage segments and cost centers.

You will have a much more precise and detailed view of each sector or project of your business.

Account cards also for groups, segments and classes

You can now obtain all movements of a segment, a group or a class, in their corresponding account card.

Plan your cash flow and your business

With the budget transactions you can now simulate in detail how your business and your cash flow will evolve.

Import your bank statements

You can import data from your bank statements or from external invoicing software.

Banana creates the transactions resuming the statement data.

Banana supports many different standard (ISO 20022) or specific (PayPal) formats.

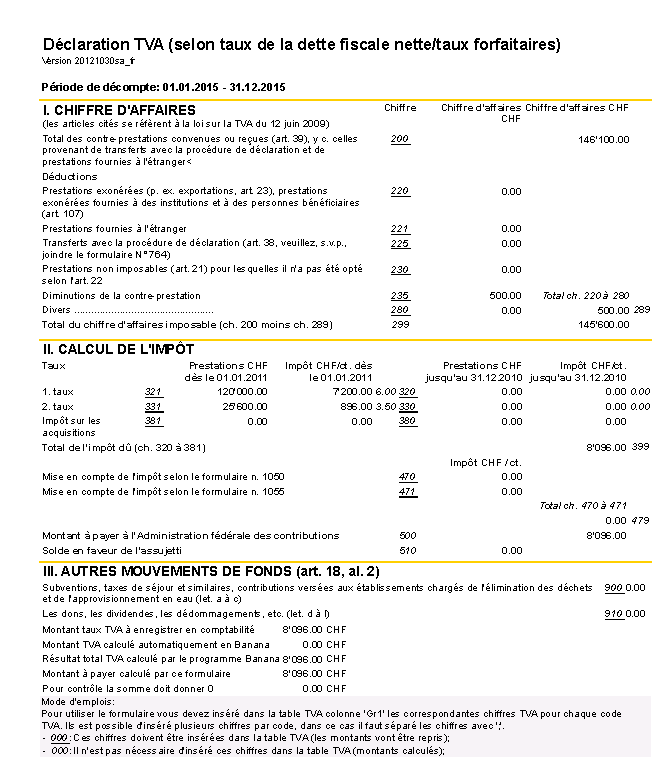

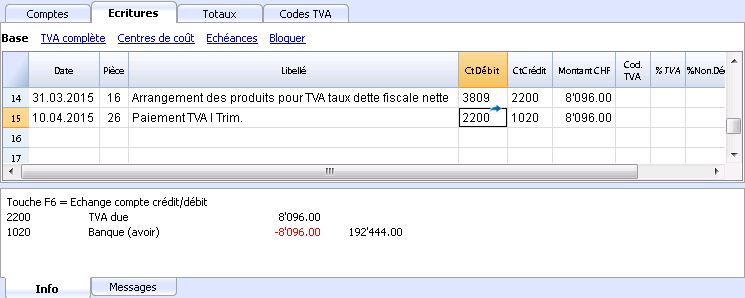

Manage your VAT in a simple way

All VAT calculations are automatic.

For Switzerland, the program prepares the fac-simile of the VAT report for the effective method or the flat tax rate method.

You just need to copy the amounts on the official form.

Dynamic link to Excel and graphics creation

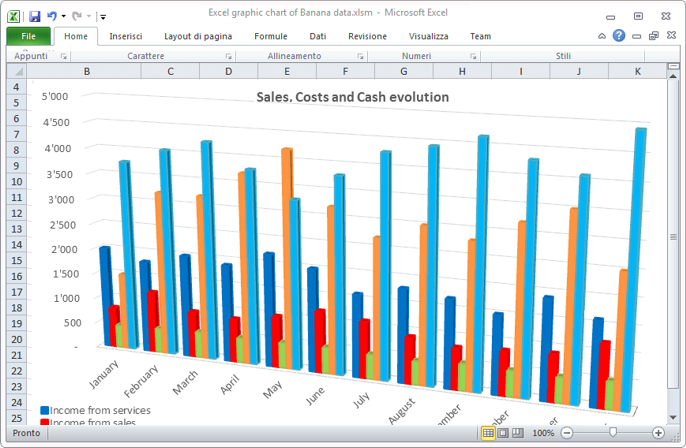

You can create Excel sheets and graphic presentations linked to your accounting file that automatically update themselves when your accounting data are changed.

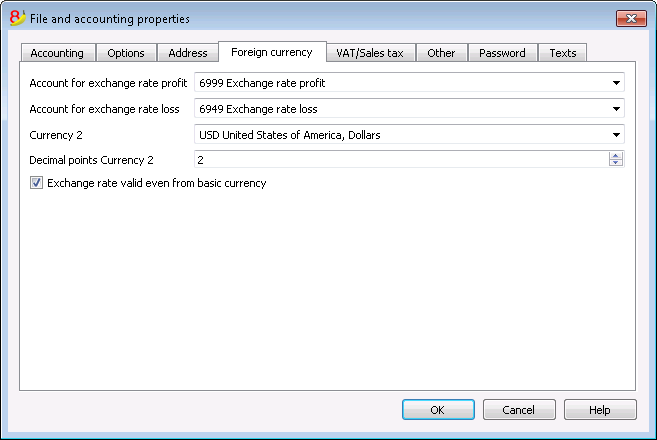

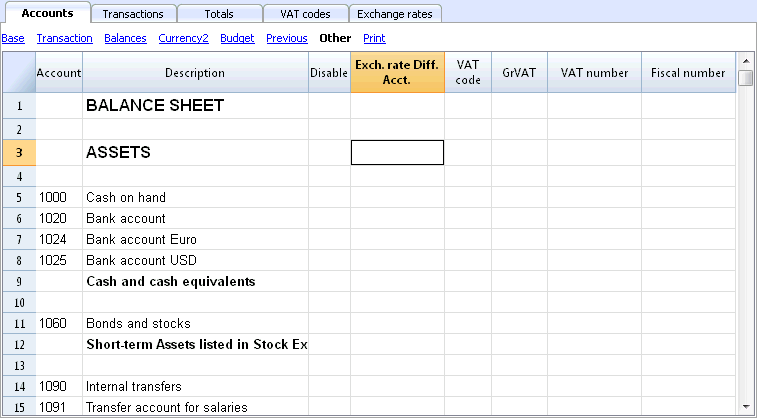

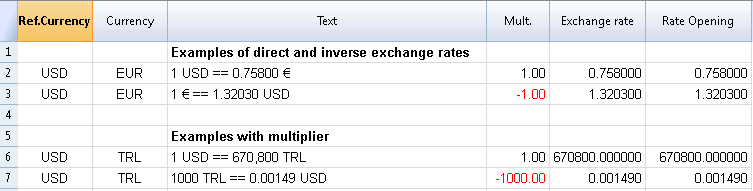

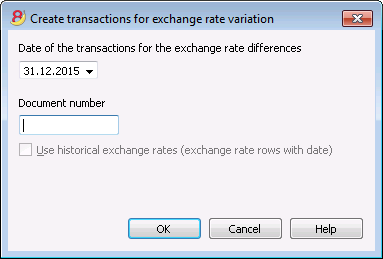

Multi-currency - Transactions for exchange rate variation at a specific date

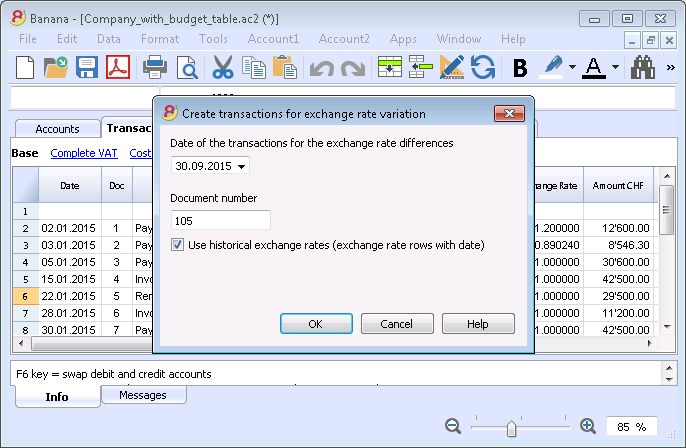

You can enter historic exchange rates that the program will use in the transactions in order to calculate the exchange rate variation differences at a specific date.

You can also specify, for each account, a different exchange rate difference account to be used.

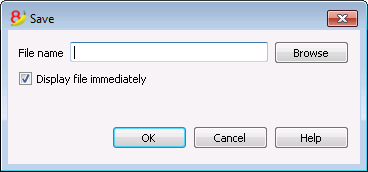

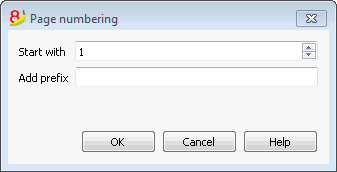

Save in Pdf from Preview

All printouts can be previewed and exported in Pdf format.

Export only specific data of the accounting file

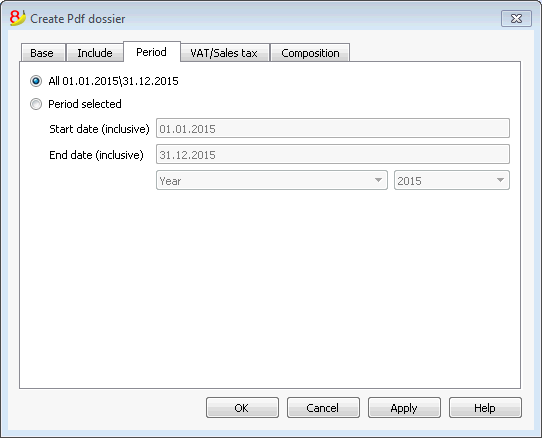

Store all your accounting data in a single Pdf file

At the end of the year you can create a Pdf file with all your accounting data: Balance sheet, Profit & Loss Statement, Transactions, Account cards, VAT report.

Get customized report with the new Banana Apps

You can download the Banana Accounting Apps or you can create your own, in order to obtain very specific presentations, required for example for specific regulations, for associations, controlled administrations, or in order to comply to a specific nation's regulations.

Digital certification of the accounting data

You can lock your transactions at a specific date and protect them with a password.

As required by the law, accounting data integrity is ensured by a top quality certification system (US Patent N.7.020 .640), the same used by electronic currencies like bitcoin.

It is now also possible to unlock transactions only partially.

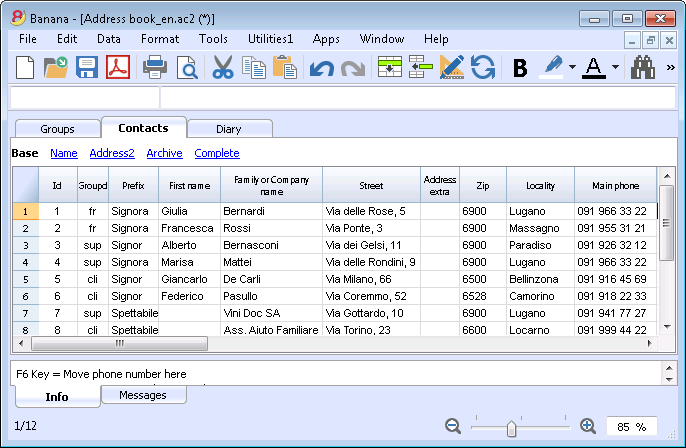

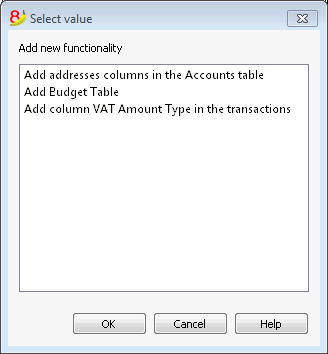

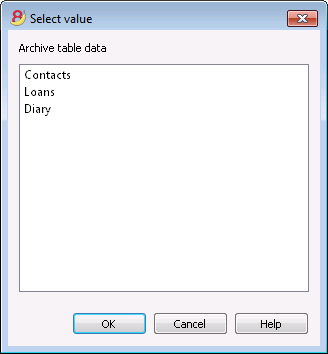

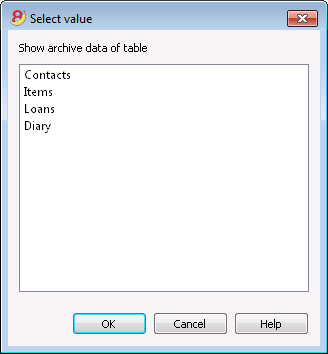

New Utilities application

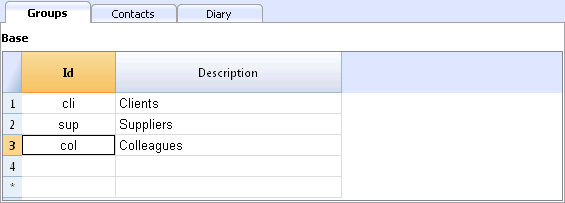

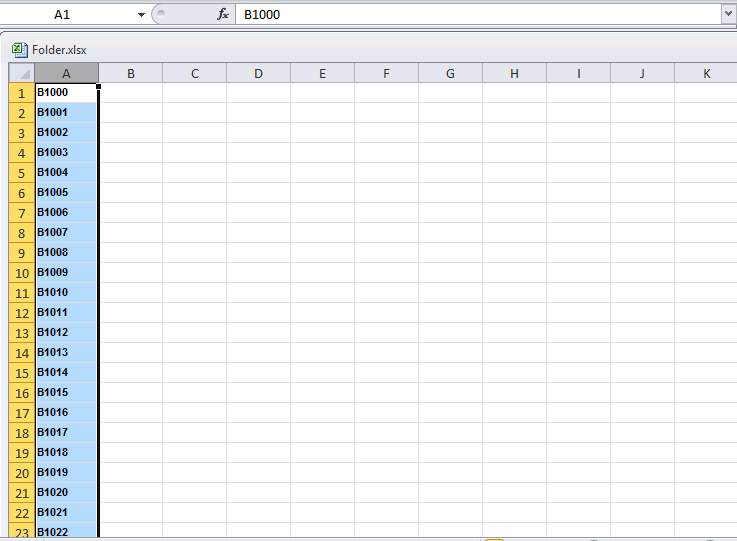

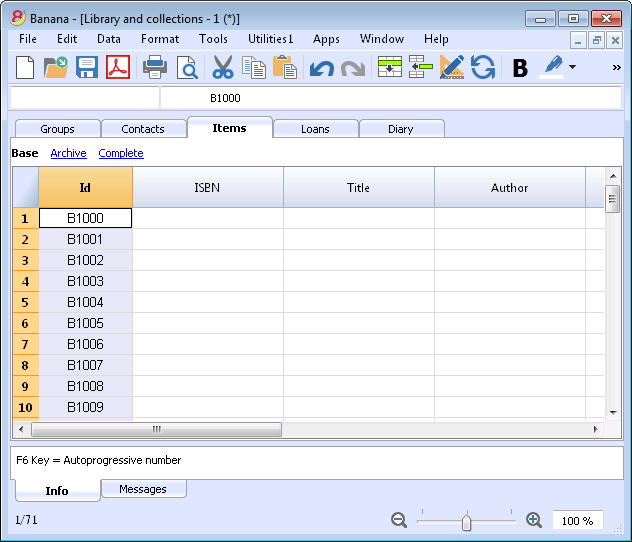

The Address book utility has a new table, and there is a new utility to manage Libraries and Diary.

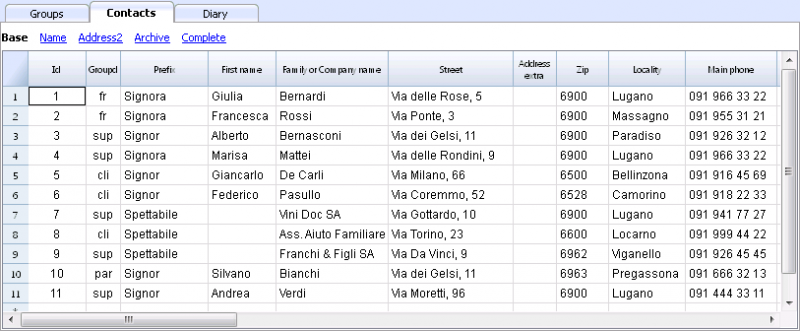

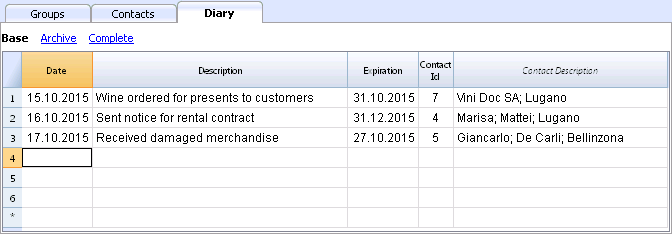

Address book - Link between Contacts data and diary

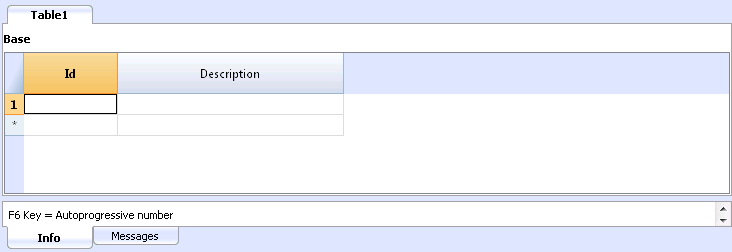

The new Groups table now allows you to classify your contacts in different groups (business contacts, family, etc.), while in the Diary table you can enter notes.

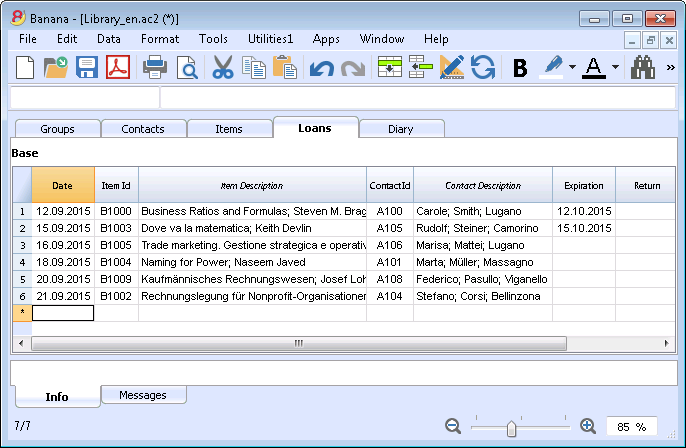

Manage books and collections items

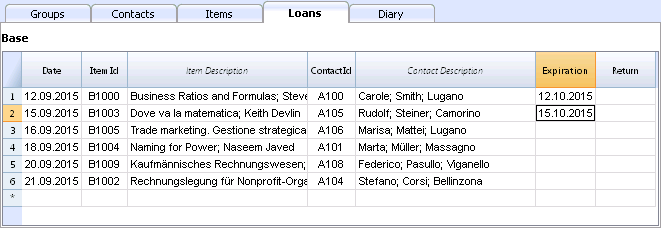

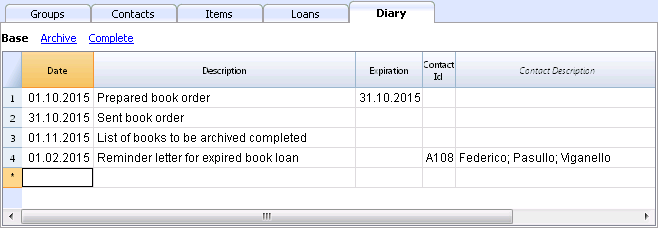

Thanks to the new Libraries utility you can manage books (private book collections, libraries), DVD (video stores), valuables collections, etc.

In the Books table you can enter the items with all the characteristics(Title, Author, etc.), while in the other tables you can manage the loans, the due dates and the archive.

and much more ....to find out!

Caractéristiques Banana 8

Banana Comptabilité est un logiciel international extrêmement polyvalent qui se prête très bien pour la tenue de la comptabilité dans n'importe quel pays.

C'est un logiciel idéal pour les petites réalités économiques.

PolyvalentIl s'adapte à vos nécessités et connaissances

| Facile et rapideCommencez immédiatement et épargner du temps chaque jour.

| UniverselUtilisé dans plus de 127 pays dans le monde.

|

ProfessionnelPrésentez votre activité de manière impeccable.

| Sûr et certifiéSécurité et protection maximale des données

| Compatibilité et partage

|

Support complet

| ||

Polyvalent

Choisissez parmi différentes méthodes comptables | |

Vous pouvez vous lancer avec la comptabilité que vous préférez, et ensuite changer, si c'est nécessaire tout en conservant vos données insérées:

Contient aussi différentes utilitaires:

|  |

Choisissez parmi plus de 500 modèles | |

Au lieu de créer votre fichier à partir de rien, utilisez un de nos nombreux modèles en ligne. Il sont disponibles gratuitement et déjà triés par langues, pays et activités. Pour de plus amples informations...

|  |

Organisez vos comptes à souhait | |

Vous pouvez adapter le plan comptable selon vos exigences, en ajoutant ou éliminant des comptes, créant des sous-groupes et différents niveaux de totalisation. Les résultats seront immédiatement visibles. Les changements dans le plan comptable sont toujours possibles même pendant l'année en cours. Vous pouvez aussi ajouter des colonnes supplémentaires ou changer l'ordre des colonnes existantes, autant dans le plan comptable que dans le tableau sur lequel vous insérez vos écritures. |  |

Situation toujours sous contrôle | |

En un clin d'oeil vous aurez toujours une vision ajournée et globale de votre activité. Chaque fois que vous insérez un mouvement comptable les soldes se mettent automatiquement à jour. Pour de plus amples informations...

|  |

Détails des comptes en un clic | |

Avec Banana, c'est très facile d'obtenir la fiche détaillée de chaque compte, catégorie ou groupe de comptes: il suffit de cliquer sur la petite flèche bleue-claire qui apparaît en haut à droite du numéro de compte. Même la fiche de compte peut être enregistrée en pdf ou imprimée, aussi pour une période précise. Vous pouvez imprimer toutes les fiches de compte ensemble, ou celles que vous aurez sélectionnées. Pour de plus amples informations...

|  |

Utilisez centres de coûts et segments pour gérer des projets, des secteurs ou des activités particulières | |

A travers les Segments et les Centres de coûts, Banana Comptabilité permet de gérer des activités ou des projets de façon précise et détaillée sans bouleverser l'organisation du plan comptable. Vous pourrez ainsi connaître à chaque instant les tendances d'un certain secteur ou projet et produire des impressions détaillées.

|  |

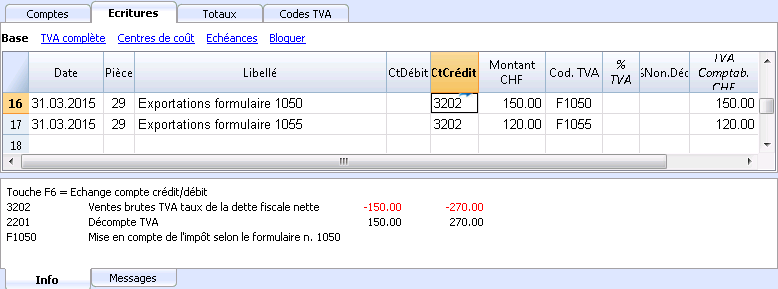

Gestion facilitée de la TVA | |

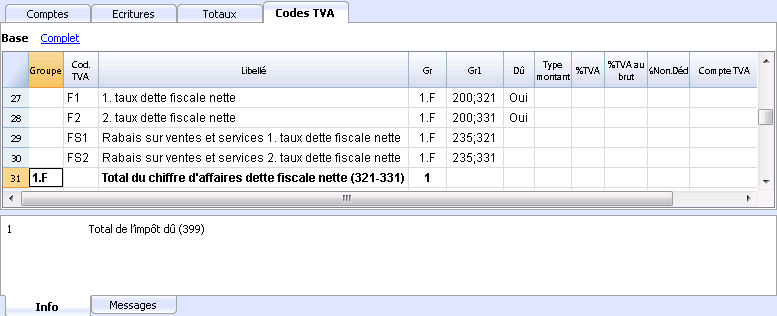

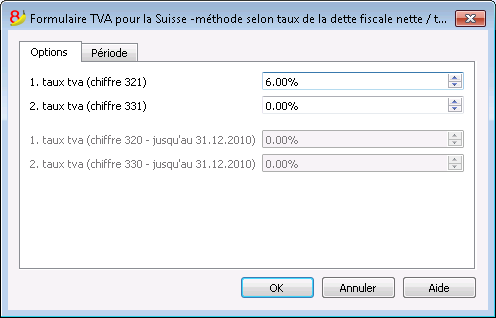

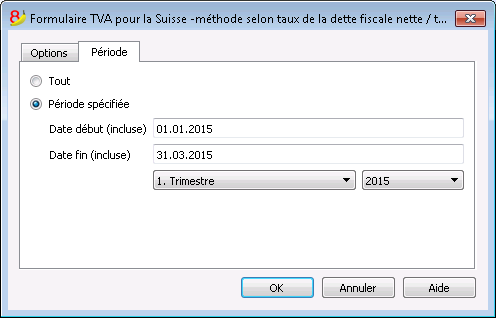

Si vous avez besoin d'une gestion avec TVA, choisissez un fichier déjà configuré avec TVA ou convertissez votre fichier existant en ajoutant l'option TVA. Tous les calculs pour la TVA sont automatiques. Le programme prépare, pour la Suisse (voir image), le facsimile du Formulaire TVA - méthode effective ou celui du Formulaire TVA - méthode taux de la dette fiscale nette et taux forfaitaires. Il ne vous suffira, ensuite, que de reporter les valeurs dans le Formulaire officiel. Rapports TVA automatiques.

|  |

Planification financière | |

Grâce au tableau Budget (que vous pouvez activer), écrivez directement les écritures du budget et indiquez-en la répétitivité. Le programme calculera automatiquement le budget annuel. Vous pouvez toujours comparer et imprimer le budget avec le statut actuel, même par période. |  |

Facile et rapide

Opérationnel en 3 étapes | |

En trois étapes simples vous êtes opérationnels et vous pouvez commencer à travailler:

... et votre comptabilité est en route! |  |

Interface similaire à Excel | |

L'interface graphique est très semblable à Excel et de ce fait, vous vous sentirez directement à l'aise. Dans son fonctionnement, Banana vous offre bien plus qu'une simple feuille de calcul, parce que, au fur et à mesure que vous insérez vos données, les totaux de tous les tableaux se mettent automatiquement à jour, et sur la base des données introduites, Banana crée aussitôt Bilan, Compte de Résultat et de très nombreux autres rapports. |  |

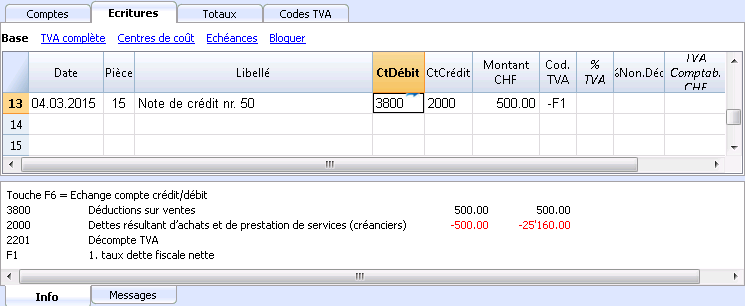

Journal parfaitement ordonné | |

Le tableau des Ecritures est, de facto, le Journal. Il est clair et bien ordonné et peut être directement imprimé ou sauvegardé en PDF. Vous pouvez aussi imprimer des périodes précises ou des lignes sélectionnées et disposer les colonnes à souhait. Lorsque vos introduisez un mouvement, les totaux des comptes se mettent automatiquement à jour, de sorte que vous ayez, en tout temps, une vision globale actuelle. Vous pouvez aussi utiliser les couleurs, autant dans le texte que dans le fond pour souligner les mouvements que vous devez facilement retracer.

|  |

Mémorisez et rappeler les écritures répétées | |

Vous pouvez sélectionner les lignes des écritures répétées et les enregistrer dans le tableau Ecritures répétées, pour ensuite les reprendre automatiquement quand vous en aurez besoin. Pour de plus amples informations...

|  |

Importez les données de la banque ou d'une carte de crédit | |

Vous pouvez importer directement dans votre fichier Banana les écritures de vos mouvements bancaires ou d'une carte de crédit sans devoir les réintroduire à la main. Nous proposons des filtres d'importation, constamment mis à jour, pour de plus grandes institutions. Si votre banque ne figure pas dans la liste, nous créerons pour vous le filtre adapté. Pour de plus amples informations...

|  |

Impressions et rapports immédiats avec configurations personnalisables | |

Personnalisez les impressions du Bilan et du Compte de Résultat. Vous pouvez activer/désactiver de nombreuses options pour présenter vos données à souhait; choisir parmi les différents styles graphiques, changer les couleurs, etc. Voir aussi le résultat de l'impression en aperçu. Dans les impressions du Bilan vous pouvez aussi inclure un texte pour les documents annexes.

|  |

Enregistrez vos configurations d'impression | |

Avec la commande Composition, il est facile de configurer des impressions personnalisables. Vous pouvez enregistrer différentes configurations d'impression pour les Bilans, Fiches de compte, Extraction et trier lignes, Adresses et étiquettes... Pour de plus amples informations...

|  |

International

Multilingue | |

Le programme est disponible en différentes langues: italien, anglais, français, allemand, portugais espagnol, néerlandais, chinois. Vous pouvez changer la langue du programme à tout moment. Chaque fichier peut même être créé dans une langue différente; et dans les différents modèles disponibles en ligne, vous pouvez choisir des fichiers parmi toutes ces langues. Pour changer la langue d'un fichier existant vous devez le convertir et choisir en option la langue souhaitée. Pour de plus amples informations...

|  |

Gestion multidevise | |

Vous pouvez introduire autant de comptes en devise étrangère que vous souhaitez, et introduire dans le tableau Changes le taux de change. Vous pouvez aussi conserver le taux historique des changes. Les calculs des changes et des différences de change sont tous automatiques. Vous pouvez aussi produire des Bilans, Comptes de Résultat et Rapports dans une deuxième devise étrangère. |  |

Multimandants | |

Banana Comptabilité n'a pas de limites en mandats. Vous pouvez ouvrir autant de mandats que vous voulez, chacun avec des confugurations personnalisées de langue, devise, TVA, etc. |  |

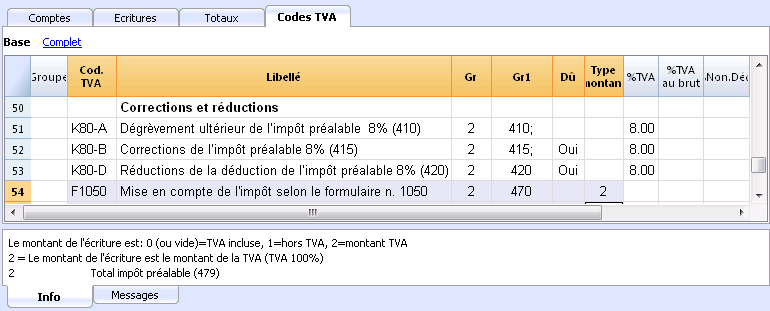

Codes TVA par pays | |

Quand vous créez un nouveau fichier avec option TVA et que vous choisissez le pays, vous trouverez déjà dans le tableau Codes TVA tous les codes TVA en vigueur pour le pays sélectionné. Le tableau Codes TVA peut, toutefois, toujours être intégré et modifié au cas où vous auriez besoin de codes particuliers ou si, dans le cours du temps, de nouveaux codes entreraient en vigueur. Pour de plus amples informations...

|  |

Apps spécifiques par pays | |

Les Apps de Banana sont des applications qui permettent d'obtenir des impressions et des rapports particuliers à partir du programme Banana Comptabilité; certaines sont déjà disponibles à titre gratuit, il vous suffit de les télécharger. Vous pouvez aussi en créer vous-mêmes pour obtenir des présentations de rapports très précis, exigés par des règlements particuliers comme celles des curatelles, des associations, ou pour qu'ils soient conformes aux normes d'un pays déterminé. Pour de plus amples informations...

|  |

Professionnel

Gestions des clients et fournisseurs | |

Gérez simplement les Clients et Fournisseurs. Vous pouvez connaître à tout moment quelles sont les factures expirées ou ouvertes. Il est aussi possible de visualiser l'historique pour connaître tous les détails d'un client ou d'un fournisseur. Dans les soldes initiaux vous pouvez remonter aux factures qui déterminent les montants.

|  |

D'innombrables rapports, même par périodes | |

Les possibilités des rapports sont infinies. Choisissez les colonnes à afficher, changez les en-têtes, les couleurs. Vous pouvez aussi créer des rapports externes à la comptabilité avec les regroupements que vous souhaitez. Pour de plus amples informations...

|  |

Synchronisation des données avec Excel | |

Pour obtenir vous données en Excel il n'est plus nécessaire de copier, coller ou exporter. Les fonctions ExcelSync permettent de récupérer les données de Banana en Excel et de créer des feuilles et des graphiques qui s'ajourneront automatiquement. Quand de nouvelles transactions viennent s'ajouter, les feuilles Excel seront automatiquement mises à jour et calculées. Pour Apple/Mac c'est fonction n'est pas disponible.

|  |

Exportation vers différents formats | |

Dans Banana comptabilité vous pouvez exporter des données vers différents formats: Html, Excel, Xml, Txt. L'exportation peut être exécutée sur une sélection de données ou sur tout le fichier comptable. Vous pouvez aussi décider d'exporter seulement quelques lignes. Pour de plus amples informations...

|  |

Développements d'Apps personnalisées | |

Si vous avez besoin d'impression ou de rapports particuliers ou de quelques outpout particuliers, contactez-nous: nous sommes à votre disposition pour créer des applications personnalisées. |  |

Vérifications automatisées | |

D'éventuelles erreurs sont automatiquement signalées. Vous pouvez aussi effectuer des contrôles étendus. Si des différences comptables ou dans les soldes initiaux s'affichent il y a une commande pour les tracer automatiquement dans le tableau Comptes et Ecritures.

|  |

Sûr et certifié

Protection de fichier avec un mot de passe | |

Chaque fichier peut être protégé avec un mot de passe. Ce mot de passe peut être modifié ou annulé à tout instant. Pour de plus amples informations...

|  |

Protection des lignes | |

Pour travailler plus sereinement, vous pouvez protéger certaines lignes de votre fichier, celles qui sont déjà définitives, pour ainsi éviter qu'elles soient accidentellement endommagées ou altérées Il est aussi possible d'enlever la protection des lignes protégées. Pour de plus amples informations...

|  |

Bloc des écritures | |

Vous pouvez bloquer toutes ou certaines écritures et avoir l'assurance qu'elles ne seront pas modifiées (certification numérique). Vous pouvez aussi seulement protéger les écritures pour empêcher qu'elles soient endommagées accidentellement. |  |

Certification des données au moyen d'un système de marquage digital | |

L'intégralité des données comptables est garantie par un système de certification d'avant-garde, (US Patent N.7,020,640), le même qui est utilisé par les monnaies électroniques telles que bitcoin.

|  |

Archivage du fichier en PDF (ou seulement quelques parties) | |

Vous pouvez enregistrer un fichier entier en format PDF, ou choisir dans le détail ce que vous voudriez faire apparaître dans l'impression. L'archivage en PDF de tout le fichier permet de toujours obtenir l'intégralité des données. Il y a tellement d'options. |  |

Sauvegardes (Backup) automatiques | |

Le programme enregistre automatiquement un fichier backup, selon une fréquence en minutes que vous pouvez définir. Si le programme ou l'ordinateur se bloquent, vous pouvez ainsi récupérer vos données en ouvrant ce fichier. Pour de plus amples informations...

|  |

Compatibilité et partage

Compatible avec les versions précédentes | |

Banna Comptabilité 8 conserve la même modalité d'utilisation et est compatible avec les versions précédentes. Ainsi, il est donc possible d'ouvrir sereinement des fichiers créés avec les versions précédentes avec la certitude que toutes les données seront reportées intégralement. |  |

Pour tous les systèmes d'exploitation | |

| Banana Comptabilité 8 est disponible dans les versions pour Windows, Mac et Linux, Android et IOS. Les fichiers Banana sont interchangeables entre les différentes versions. Pour de plus amples informations... |  |

Partage Cloud | |

Les fichiers Banana peuvent être enregistrés sur tous les systèmes Cloud: Dropbox, I-Cloud, Google Drive, .... de sorte que plus de personnes puissent accéder aux données comptables à n'importe quel moment et quelque soit l'endroit où les utilisateurs se trouvent.

|  |

Envoi des fichiers Banana par courriel | |

Tous les fichiers Banana peuvent être expédiés par courriel, partagés, et enregistrés sur un clé USB, etc. il existe aussi une commande pratique du menu Fichier qui crée automatiquement un message de courriel électronique avec votre fichier Banana an annexe, prêt à être envoyé.

|  |

Support à 360 degrés

Documentation en lignePlus de 500 pages de documentation en ligne gratuite triée par sujet, avec des images et des explications pas à pas. Link (lien) directement à l'erreurLes erreurs éventuelles sont aussitôt signalées. Support gratuitLe support téléphonique ou par courriel est gratuit pour une période de 12 mois à partir de la date d'achat pour des questions relatives à l'utilisation du programme. Support Technique AvancéSupport technique et développement de solutions personnalisées (Apps). |  |

Suisse: nouvelles normes pour les rapports

En Suisse, à la fin de l'année 2015, toutes les entreprises inscrites au Registre de commerce doivent présenter les rapports selon la structure minimale du Bilan et du Compte de Résultat, prevus par l'article 959 du Code des obligations (Art. 959a e 959b CO).

Les nouveaux plan comptables founis avec Banana 7 et Banana 8 reflètent déjà le système prévu. Celui qui crée - ou qui a créé - une nouvelle comptabilité avec les nouveaux plans comptables, a des rapport conformes à la loi.

Pour ceux qui ont des "anciens" plan comptables, il y a deux possibilités:

- Passer au nouveau plan comptable et reprendre les données de la comptabilité existante

- Créer une nouvelle comptabilité, en utilisant un modèle avec la nouvelle numérotation et les nouveaux regroupements

- Ajouter une colonne dans le plan des comptes, et y insérer, pour chaque nouveau compte, l' "ancien" numéro de compte.

- Utiliser la fonction d'importation pour reprendre et convertir les données provenantes du fichier de la comptabilité, créée selon "l'ancien système".

- Continuer d'utiliser la comptabilité avec le plan des comptes actuel et utiliser un fichier externe de la comptabilité avec une classification des comptes selon le nouveau système (déjà disponible dans Banana 8):

- Créer un nouveau fichier pour le Rapport

Comptabilité en partie double -> Rapport comptable -> Modèle Français (Suisse), Rapport art. 959 Code Suisse des obligations. - Enregistrer le fichier dans le même dossier où se trouve le fichier de la comptabilité.

- Attribuer à chaque compte (dans la colonne Gr1) le groupe référant à la classification selon les nouvelles dispositions, comme défini dans le Fichier rapport comptable, prévu par les nouvelles dispositions (voir page d'explication Fichier rapport externe)

- Imprimer, à des fins fiscales, le bilan et les compte de résultat, en utilisant le fichier du rapport (voir Bilan formaté par groupes).

- Créer un nouveau fichier pour le Rapport

D'autres changements

Les nouvelles normes prévoient encore d'autres changements. Elles exigent également que les notes au Bilan contiennent plus d'informations. Il est également possible d'insérer certains détails directment dans le Bilan/Compte de résultat, ou d'indiquer les informations demandées dans la pièce jointe (par example les dettes ou transitoires actifs envers les actionnaires et membres des organes de la société).

Il s'agit ici de changements importants, qui ont des conséquences fiscales et légales.

Nous vous encourageons de vous faire informer par votre fiduciaire, réviseur ou conseiller fiscal, afin de préparer les comptes 2015 conformément à la nouvelle réglementation.

Au cours des prochaines années, vous pouvez tout simplement continuer selon le système maintanent configuré.

Installing Banana

When downloading the program, it is automatically saved in your Download folder.

After you execute, if you don't indicate any other destination folder, the program will be installed by default into the Programs folder (Windows: C:\Programs; MAC OSX: /Applications; Linux: /bin).

The following pages explain how to install Banana Accounting in all operating systems.

For more information about the Banana files please visit the Save, copy and backup page.

System requirements

Banana Accounting 8 is available for Windows, Mac and Linux. For optimal performance, we recommend the following system requirements:

Banana 8 for Windows

- Windows 7, 8, 8.1, 10

(Windows Phone and RT are not supported) - 200 MB of disk space*

- Internet connection to access the Help function of the program

Banana 8 for Mac OS X

- Mac OSX 64bits 10.9, 10.10, 10.11, and macOS 10.12 "Sierra"

(iOS, IPad and 32 Bit are not supported) - Intel processor

(PowerPC processors are not supported) - 200 MB of disk space

- Internet connection to access the Help function of the program

Banana 8 for Linux

- Ubuntu 12.04 or more recent,

other distributions partially supported - Dependency: libc6 (>= 2.14), libstdc++6 (>= 3.4.15), libfontconfig1, libfreetype.6, libglib2.0-0, libgtk2.0-0, libz.1, libpng12-0

- 200 MB of disk space

- Internet connection to access the Help function of the program

Other information

- The indicated disk space requirement depends on the amount of transactions and accounts used in the accounting file. 3 MB is an average space for an accounting file with 200 accounts and 2000 transactions.

- There is no limitation to the number of files.

- The software is a single user program, just like Excel. Only one person at a time can edit a file.

- The Windows version can be installed on a server, and then be run on client computers.

- Th program can be used with Terminal Server or similar remote desktop technologies.

- Also see the Installing on a server page.

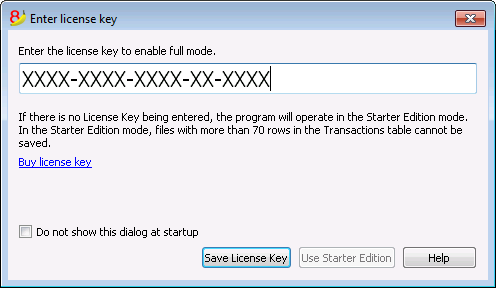

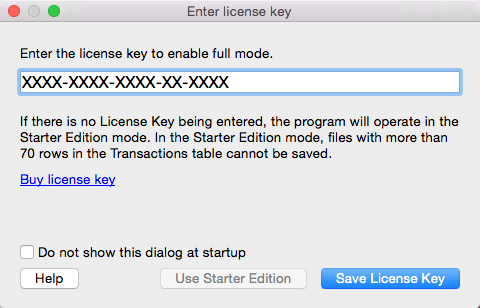

License key

Page content

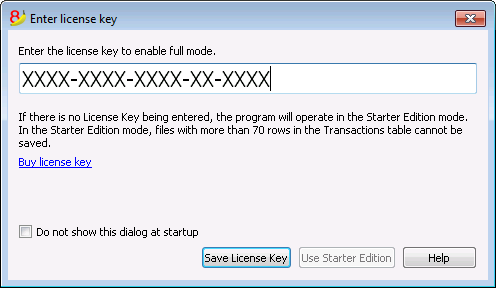

What is the license key?

It's a code that is being furnished when the program is purchased and that makes the program fully operational.

The license key is furnished in the following ways:

- in the box, printed on a yellow flyer

- sent by email when bought online with a credit card

- printed on the invoice (for those buying directly from us).

IMPORTANT: Keep the license key in a safe place. In case the license key gets lost, read our page Lost license key.

A different license key for Windows, Mac and Linux

According to the user's operating system, different license keys are being furnished.

If a license key for Mac is being entered on a computer with the Windows operating system (and the other way round), the program gives an error message that the license is invalid. Those who already have one or another Banana version, can buy version 8 for Windows, Mac and Linux at the upgrade price. As an alternative you can download and use for free the Beta version of Banana Accounting 9 (until April 30th 2018) and then purchase the full license of Banana Accounting 9.

Starter Edition mode at no cost

If you install the program without entering the license key, the program runs in Starter Edition mode.

With the Starter Edition mode, you can:

- Use the program in complete mode, entering up to 70 rows into the Transactions table.

If you have more than 70 rows in the Transaction table you won't be able to save or export the file, and in the print-outs the words "Starter Edition" will appear.

When the license key is being entered, Banana Accounting switches from the Starter Edition mode into the complete mode.

Entering the license key

- Open Banana Accounting

- Select the command Manage license keys from the Help menu

- Enter the license key number into the appropriate field

- Click on the Save license key button

- Confirm the operation if asked

Important: The license key is saved only for the current user of the computer.

Registration code

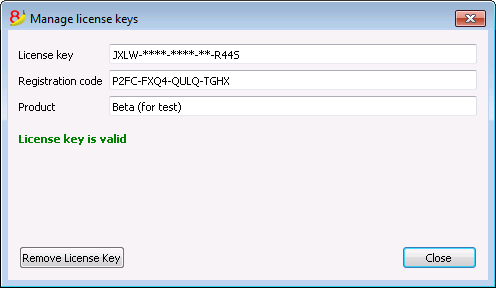

Once the license key has been entered and saved, the program displays the registration code and the following dialog appears in the Manage license keys (Help menu) window:

For security reasons the license key is partially hidden.

In case the user loses his license key, the registration code can be used to find the license key that he has entered.

It is important to copy this registration code and keep it in a safe place.

Modifying the license key

Before modifying an already entered license key, please save your open accounting files and close them; only the program remains open.

In order to modify a license key, you have to first remove the existing license key and then enter the new (different) license key.

Remove License Key

Click on the Remove license key button to remove the key.

By removing the license key, the program switches back to the Starter Edition mode.

Enter a new (different) license key

- Enter the new license key number into the appropriate field

- Click on the Save license key button

- Confirm the operation if asked

At the end of this operation, close the program and restart.

Lost license Key

For Banana Accounting 8 the recovery of the license key is considered technical support, which is charged at CHF 70.

It is only possible to recover the license key if you have the installation file of Banana Accounting 8. Banana.ch does not make available the installation files of previous versions (see page https://www.banana.ch/doc8/en/node/9014).

When contacting our technical service, send the registration code that can be found in the Manage License Keys window from the Help menu, or send us a screenprint of the same window as an attachment.

As an alternative to the recovery of the lost license key we recommend the switch to Banana Accounting Plus, available as an annual subscription for CHF 69.- or CHF 149.- (plan with advanced functions that also includes email and telephone support). It is possible to upgrade to Banana Accounting Plus even without the license key of the old version.

You also receive free months with the upgrade:

- Banana Accounting Plus features

- What's new in Banana Accounting Plus

- Banana Accounting Plus plans: choose the one that's best for you.

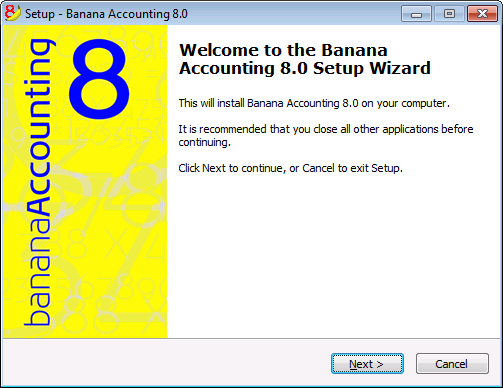

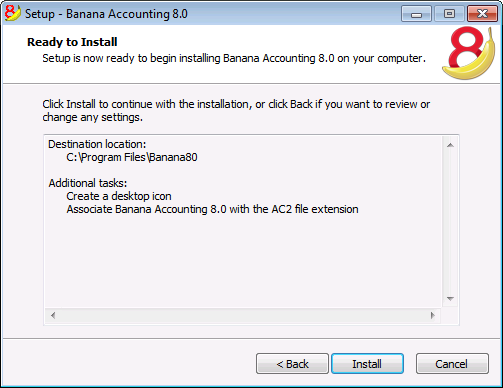

Installing under Windows

The program installation is a matter of minutes and it is all automatic.

By downloading the program, you accept the user license conditions.

Once the download is finished, just double-click on the file you downloaded.

By clicking on the Next button, you will be carried to the next window.

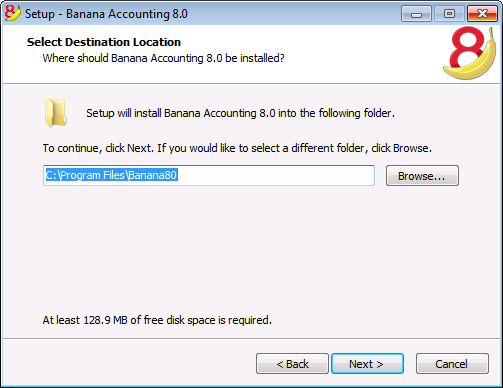

The software will be saved by default in the C:\Programmi Files\Banana80 folder. If you wish to save it in a different folder click on the Browse button and choose the desired path.

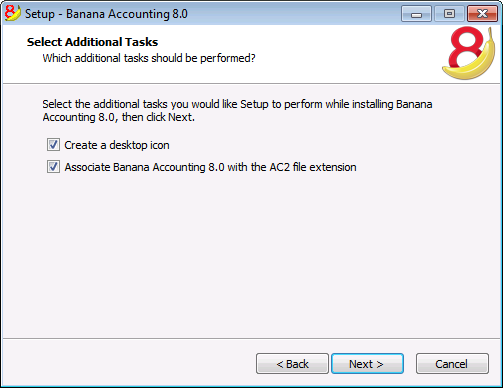

The program activates by default the Create a desktop icon and Associate Banana Accounting 8.0 with the AC2 file extension options; if you do not wish to have these options, simply uncheck them.

Click on the Install button to start the installation process.

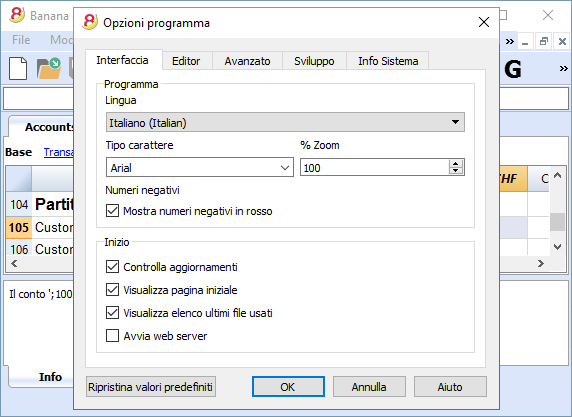

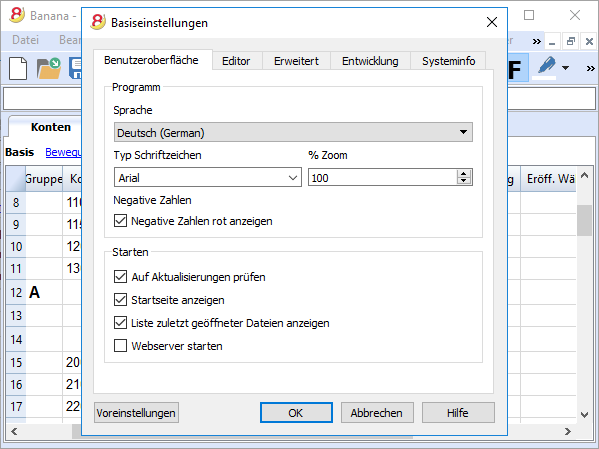

The program will be automatically installed in your operating system language; you will be able to change the program language anytime by choosing the Program options command from the Tools menu.

Entering the license key

After opening the program for the first time enter the license key and confirm with OK

By entering the license key into Banana Accounting, you go from the Starter Edition demo mode to the complete mode. If the license key is not entered, a message appears at the opening of the accounting file, warning the user that he is working in the Starter Edition mode.

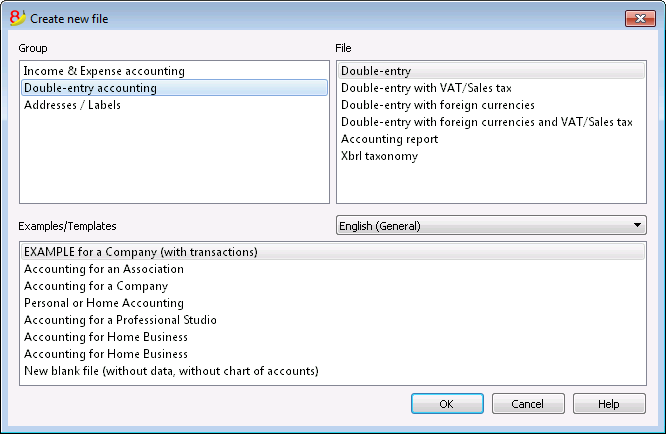

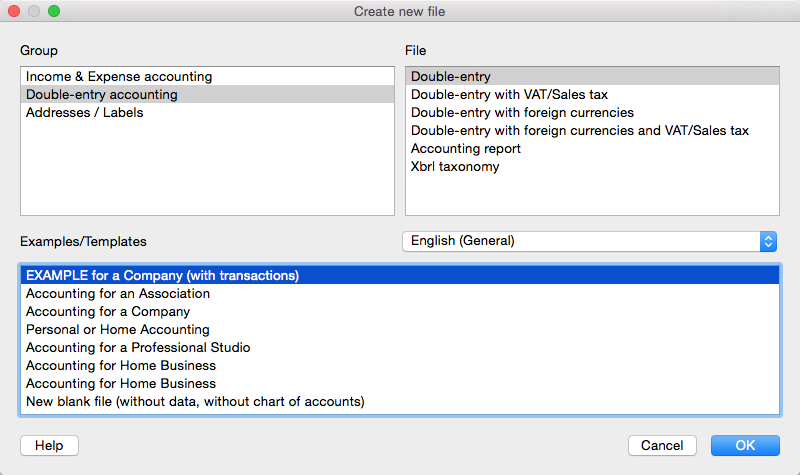

Open the software

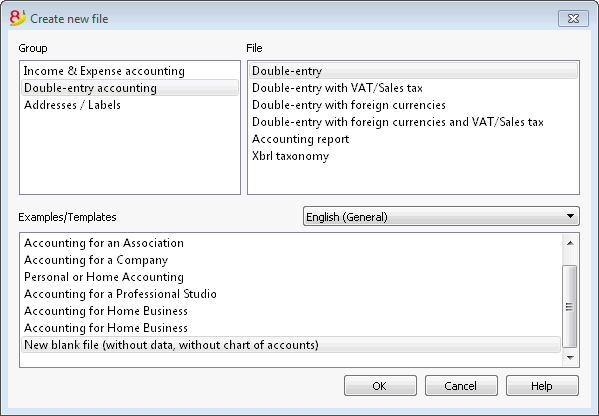

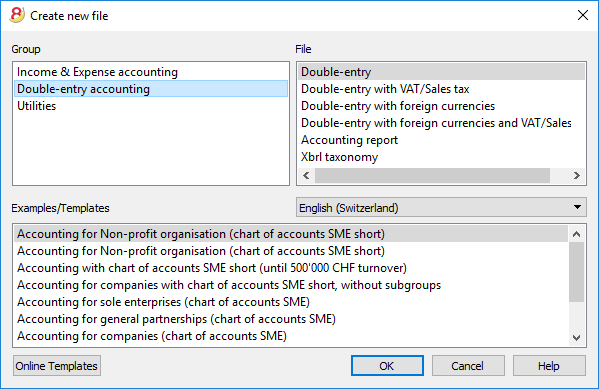

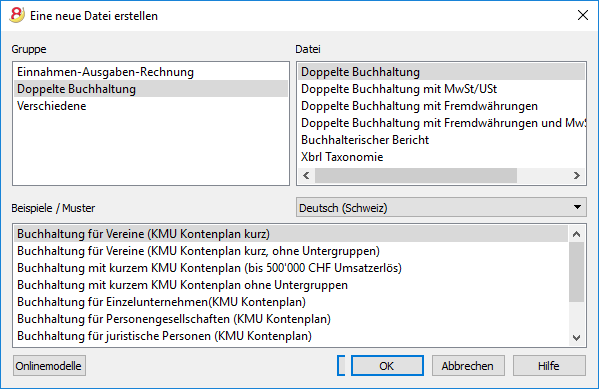

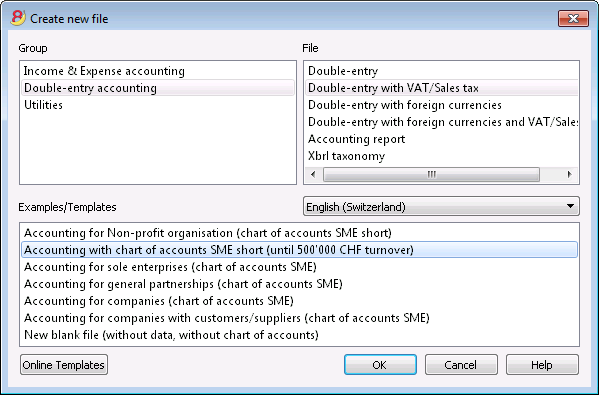

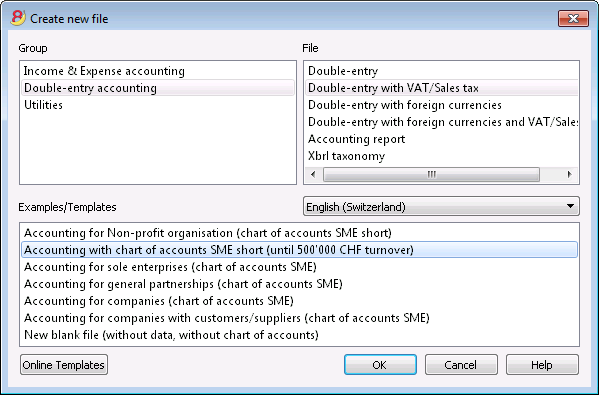

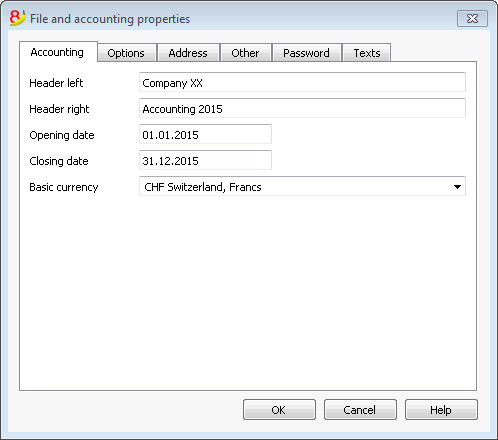

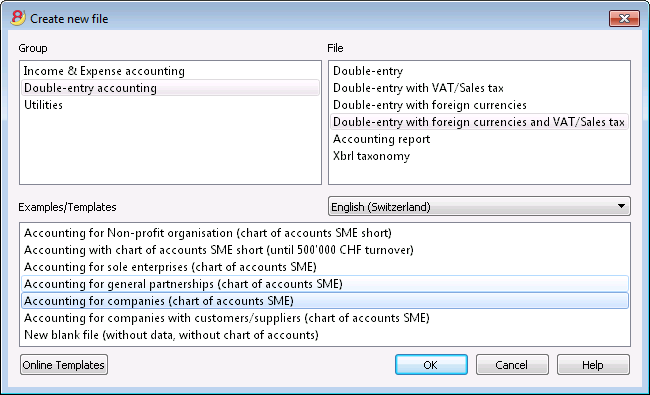

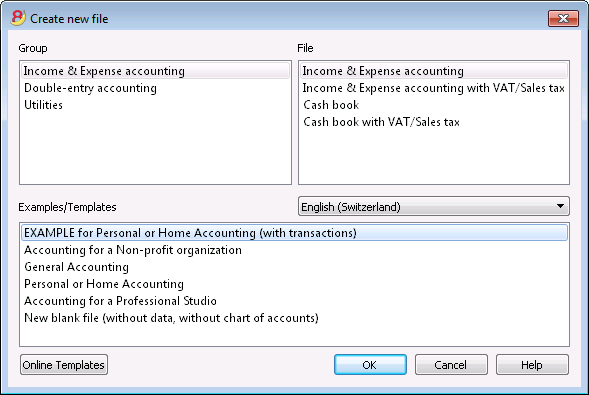

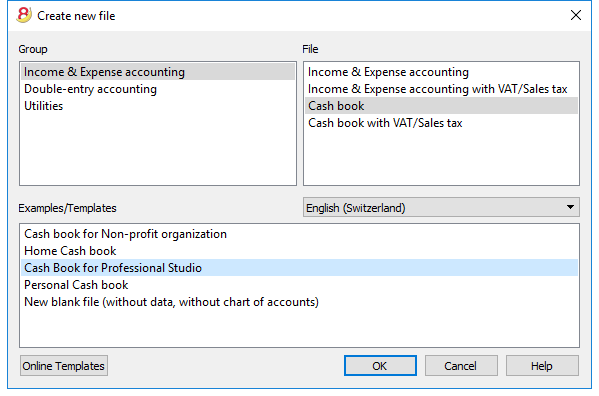

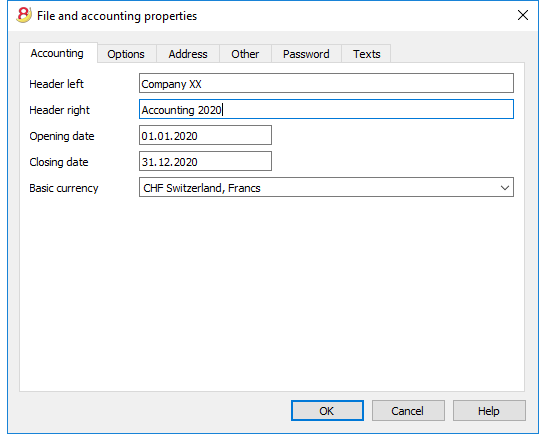

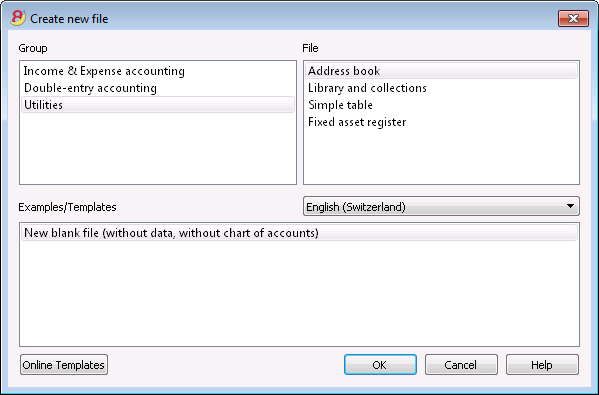

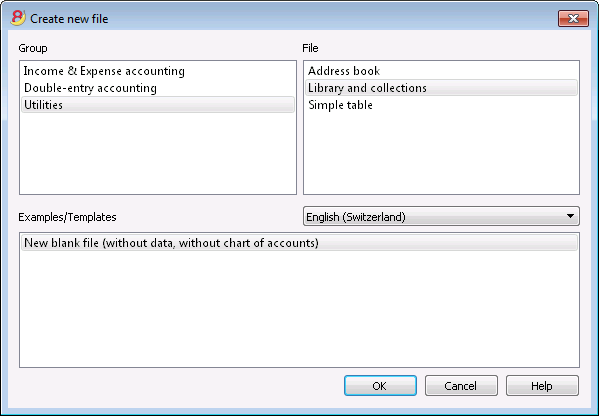

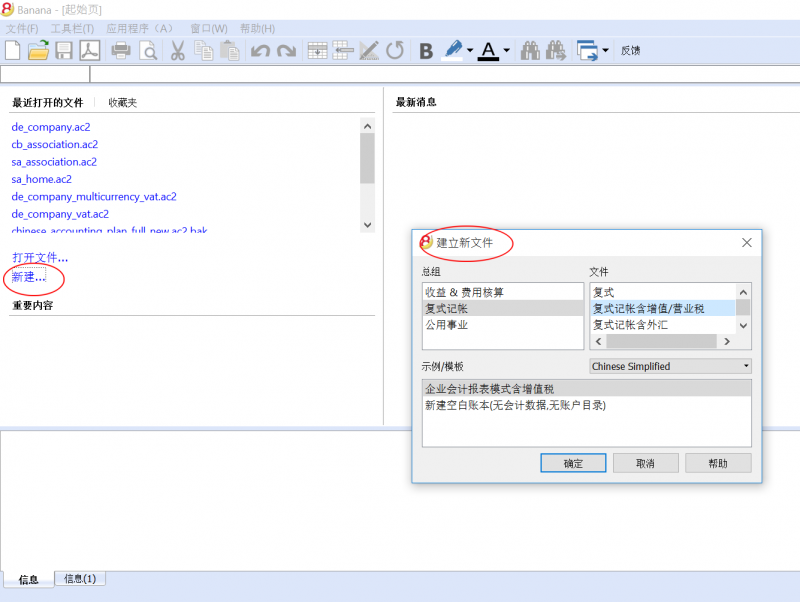

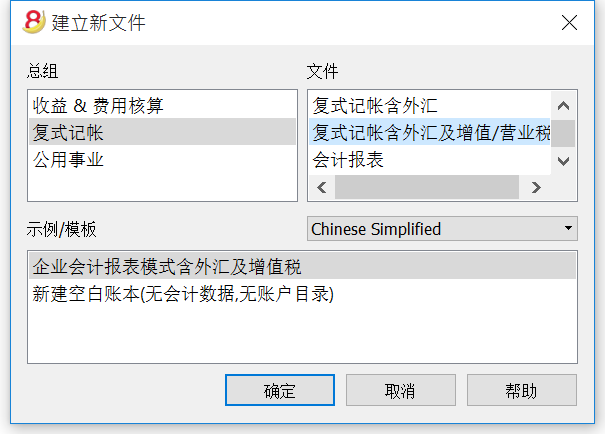

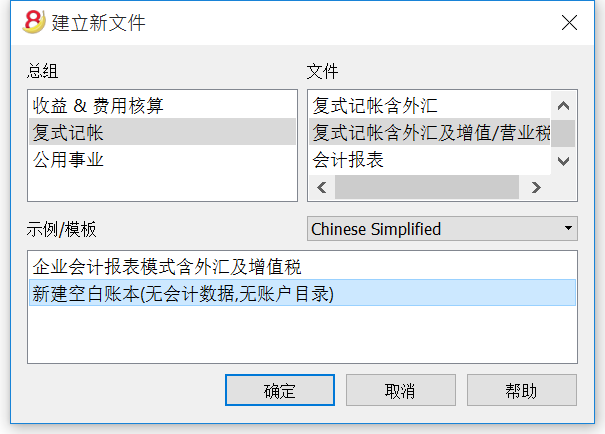

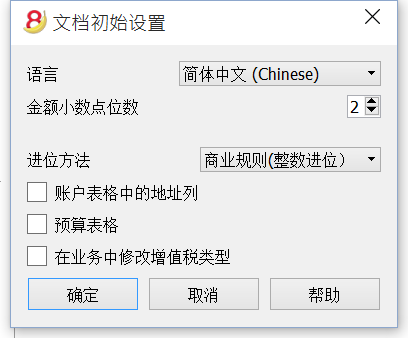

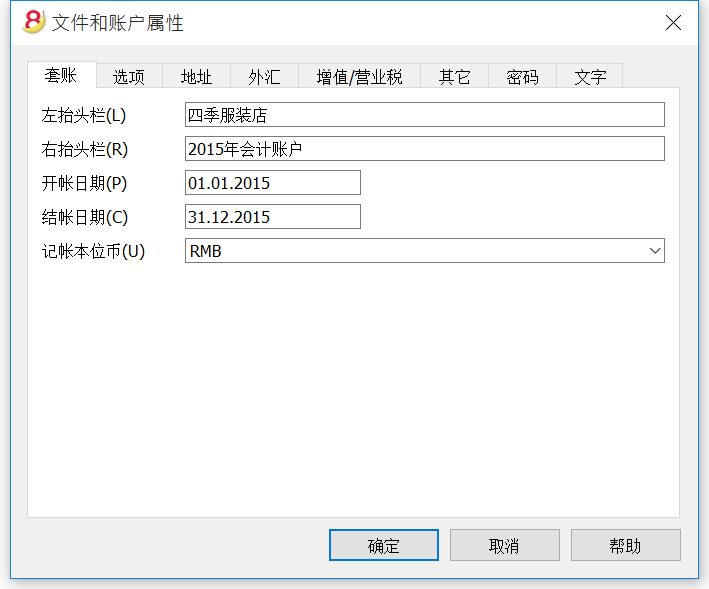

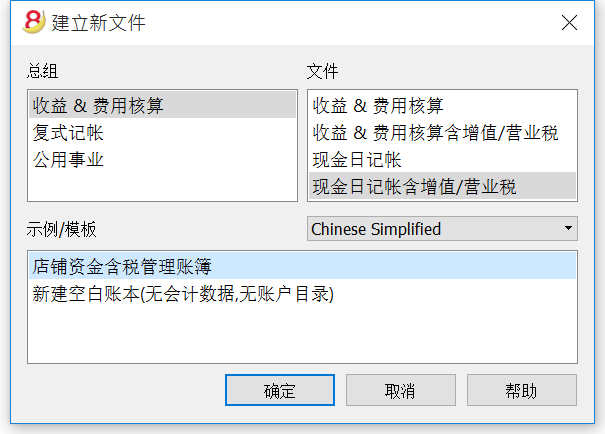

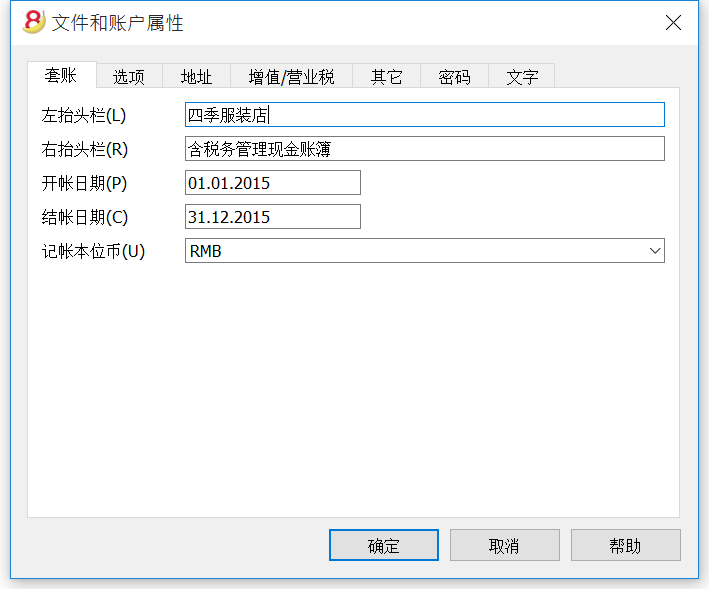

As soon as you open the software, choose the New command from the File menu. From the pop-up window you will be able to choose your accounting type, the option with or without VAT, the file language, and an example or template (or you can also open a blank file - not recommended)

Note: in order to uninstall the software, please select the Install/Uninstall applications from the Control Panel and then chose to remove Banana Accounting from the list.

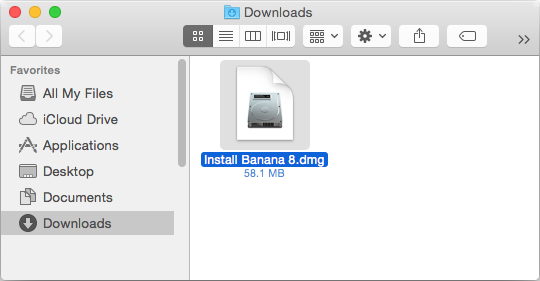

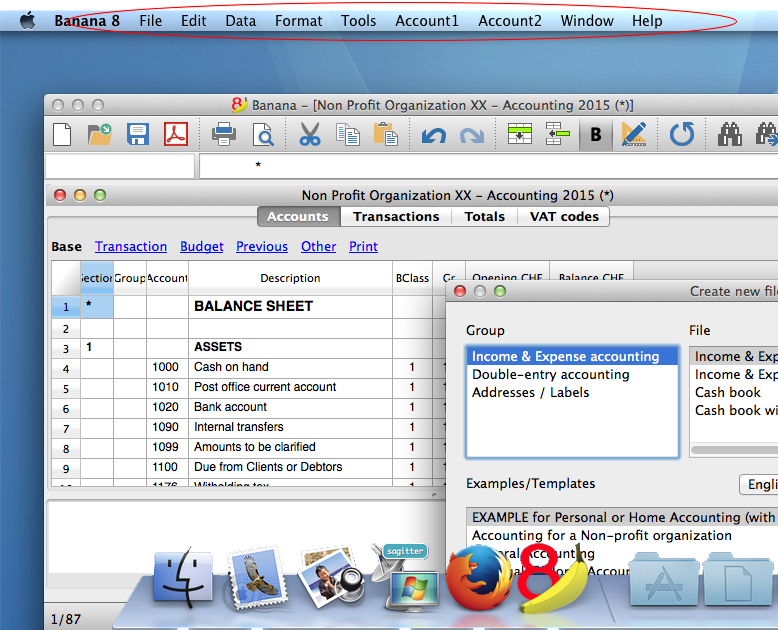

Installing under Mac

Installing the software is very easy, thanks to the autoinstall function.

By downloading the program, you accept the user license conditions.

Follow these steps:

Download the .dmg file by clicking on the Save file button.

After saving the file in your Download folder, double click on it.

Drag the Banana8 icon in the Applications folder

Banana Accounting 8 is now ready to be used. Double click on the Banana 8 icon from your Applications folder. The program is installed in your operating system language, but is always possible to change it from the Tools menu, using the Program options command.

Entering the license key

After opening the program for the first time, enter the license key and confirm by pressing the button Save license key.

Then launch the New command from the File menu. From the pop up window it is possible to choose the accounting type, the with or without VAT management option, the language and a template or example (or you can choose to open a blank file - not recommended).

In case of problems while installing the program: verify in Apple -> System Preferences, Security & Privacy, to have chosen the option "Anywhere" instead of "Mac App Store and identified developers". See also Apple's internet page.

NOTE: in order to uninstall the software, simply drag the Banana8 icon from the Applications folder to the Trash.

Installing under Linux

The program installation is very easy thanks to the native packages for Ubuntu and OpenSUSE.

When downloading the program, the user license conditions are automatically being accepted.

Packages .deb (Ubuntu) and .rpm (OpenSUSE)

- Download the package for your distribution

- Open the package with a double-click

- Follow the on-screen instructions

- Banana8 will be placed in the menu under Office applications

- Launch the program

- In order to enable the complete mode, insert and save the license key.

To uninstall the program, open the application Manager (Ubuntu Software Center, OpenSUSE Install/Remove software, ...), select the program and click Remove.

Packages .tgz

- Download the .tgz package

- Extract the .tgz package

- Run the file banana8/bin/banana8.sh

- In order to enable the complete mode, insert and save the license key.

To uninstall the program remove the folder containing Banana8. Be careful not to delete user data!

Advanced installing

Installing on a computer that is not connected to internet

- Use a computer that has an internet connection and download the installer that is suitable for the operating system of the computer on which the program will be installed.

- Copy the file to a USB key or a CD

- Enter the USB key into the computer where the program should be installed

- Launch the installer

- Start Banana Accounting and enter the license key.

Windows installation on a server or a USB key

Legal considerations

Remember that in order to execute Banana Accounting from multiple computers, you need to buy as many licenses as there are computers that use the program.

Banana with terminal server and package management systems

Banana accounting can, without any problem, be installed on a server, a terminal server, external disks or can be packaged for distribution, because:

-

Everything necessary to execute Banana Accounting is installed in the installation directory (exe, dll, examples)

-

Banana does not write in the system directories and the system registry

- The user settings are stored in the registry of each user

-

For each accountin, there is a single file that (as in Excel) can reside on a local disk, network, USB flash drive or a directory in DropBox, Google drive, or other similar systems

-

Banana is compatible with Remote Desktop systems or systems of software packaging for the installation

For more information on the files, see also File - Save.

Installation on a share folder or USB key

- Follow the normal installation procedure, usually the programm will be installed under C \ Program Files \ BananaXX \ (XX stands for the version number).

- Start the program BananaXX.exe "as Administrator"

- Enter and save the license key

- Copy the entire installation directory on the USB key, share folder or package management system.

For more information on this subject, contact our technical support.

Apple/Mac server installation

It is not possible to install Banana Accounting on Mac servers.

The program must be installed and the license key must be entered on each computer.

Of course, you can save the accounting files on a network disk.

Uninstalling Banana

Uninstalling Banana Accounting on Windows

- From the Start menu choose -> Control Panel

- Select -> Programs -> Uninstall a program

- Choose the program you wish to uninstall, for example a Banana Accounting old version

- Press the Uninstall button

By uninstalling Banana Accounting you will only deleting the program; your personal .ac2 files will not be modified.

Uninstalling Banana Accounting on Mac

- Go to the Finder

- Choose the Applications folder

- Choose the program you wish to uninstall, for example a Banana Accounting old version

- Drag the selected program into the Trash

By uninstalling Banana Accounting you will only deleting the program; your personal .ac2 files will not be modified.

Uninstalling Banana Accounting on Linux

For the details, we refer to our 'Installation under Linux' page: Packages .deb (Ubuntu) and .rpm (OpenSUSE) and Packages .tgz .

Troubleshooting

If you are experiencing a problem starting or using the application follow these steps:

- Install the latest version of the application;

- Install the latest version of the graphics driver:

Visit the manufacturer website, download the driver file and install it; - Consult the Support page;

- Take a look at the troubleshooting pages;

- Report the bug;

Banana 8 crashes while creating new year

Problem

In some very particular conditions, the program Banana 8 crashes while trying to create a new accounting year using the Create New Year command (Account2 Menu)

Solution

- Convert the file of the current year in which you are working (Tools menu -> Convert to new file).

- Create the new year (Account2 Menu -> Create new year) and save this file;

- No need to save the earlier converted file.

Then:

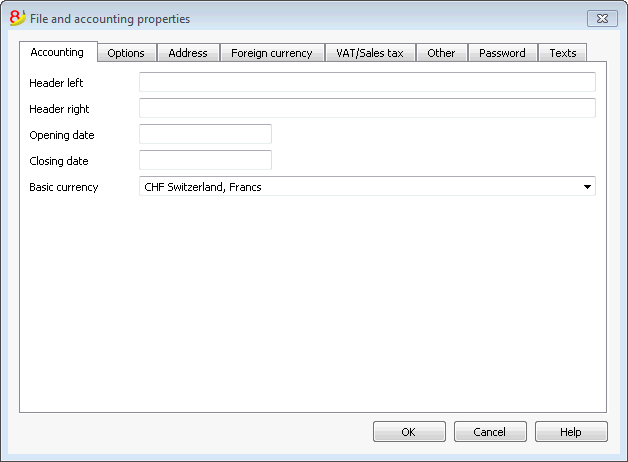

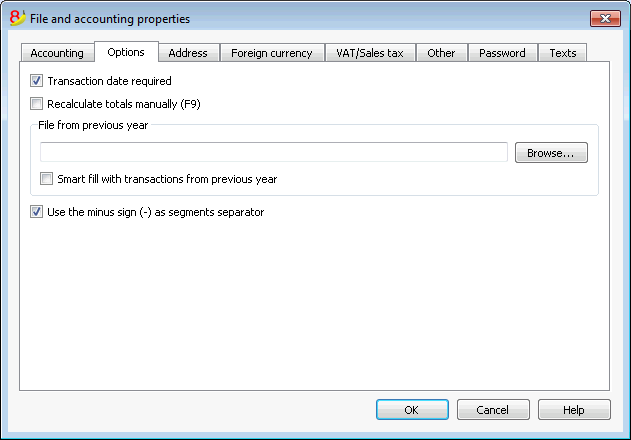

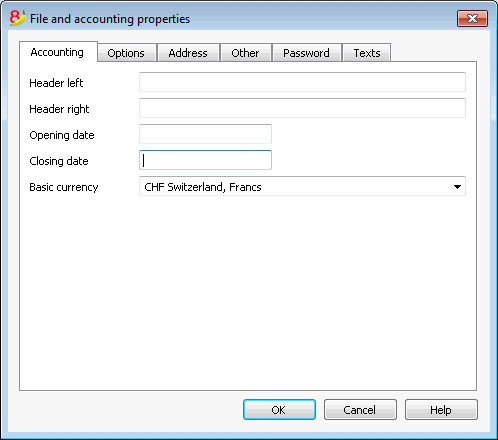

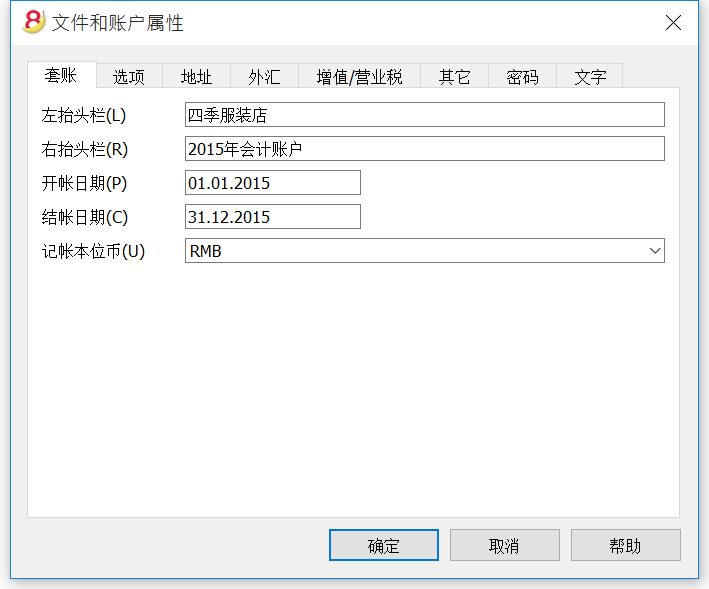

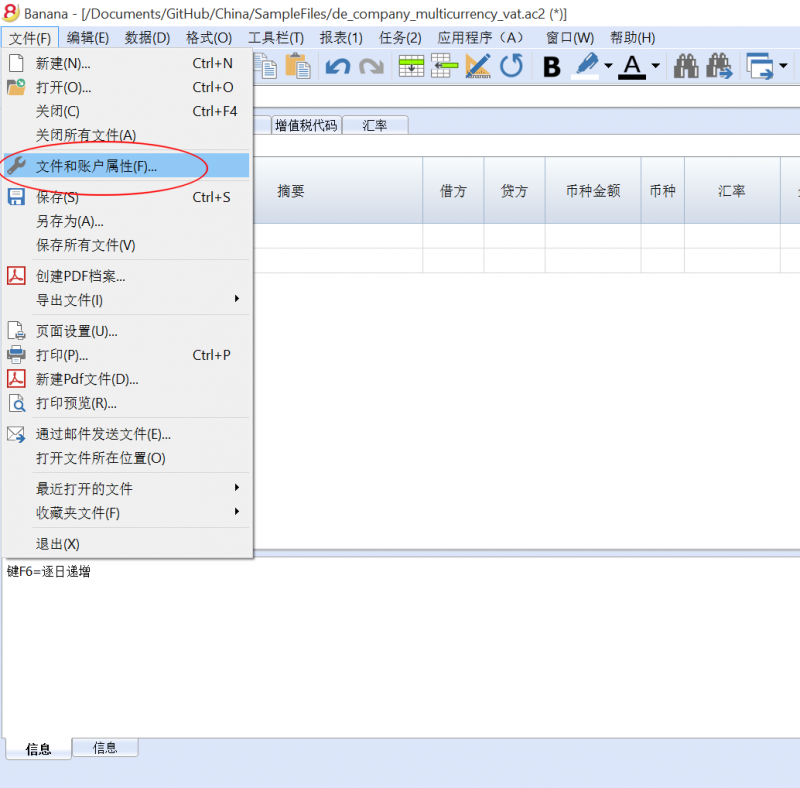

- In the file of the new year, under File Menu -> File and Accounting properties -> Options, define the correct path to the previous year.

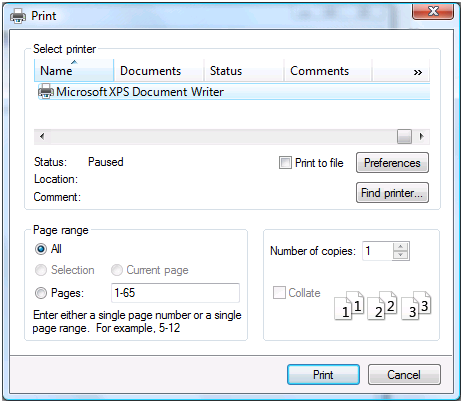

Banana8 and hang on printing troubleshooting

Problem

Banana 8 hangs the first or second time the print dialog is opened.

System

The 'Devices and Printers' configuration contains printers no longer attached to the system or printer drivers that are not up to date.

Affected OS: Windows 10, Windows 8, Windows 7

Solution

-

Open Start and select 'Devices and Printers'

-

Remove all printers no longer used or attached to the system

-

Update the drivers of all the remanining printers

Banana8 on Acer Notebooks troubleshooting

Problem

Banana 8 stop working some seconds after the main page of the program is showed.

System

The system is running on a Acer notebook

Affected machines: Acer aspire es 17

Affected OS: Windows 10, Windows 8

Solution

-

Open in Explorer the folder C:\Program files\Banana80

-

Create a new folder 'backup_dll'

-

Move the files 'libeay32.dll' and 'ssleay32.dll' to the folder 'backup_dll'

-

Restart the application

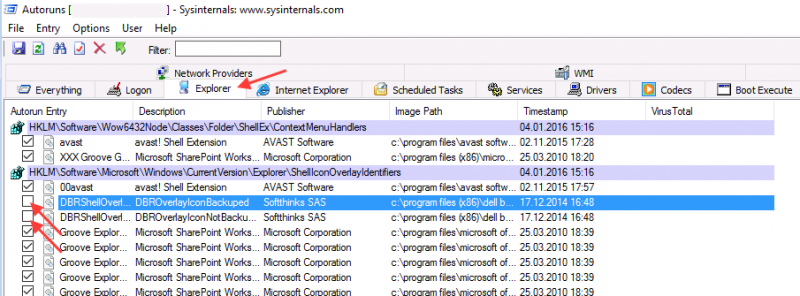

Banana8 on Dell Pc troubleshooting

Problem

Banana 8 stops working as soon an Open File Dialog or a Save File Dialog is opened.

System

The system is running on a Dell computer or notebook.

The software Dell Backup and Recovery (from Softthink) is installed and running on the system.

Affected OS: Windows 10, Windows 8, Windows 7

Affected systems: Dell computer

Solution A (recommended)

- Update Dell Backup and Recovery tools to version 1.9.2.8 or greater

- Check Dell User's Guides and Support pages on how to update your system

Solution B

-

Download the Autoruns for Windows - TechNet - Microsoft utility;

-

Expand the file Autoruns.zip;

-

Run the application Autoruns.exe as Administrator;

-

Select the "Explorer" tab;

-

Deselect all "DBRShellOverlay" entries from Softthinks SAS Publisher

-

Close Autoruns;

-

Restart Banana 8.

Notes

- In one case, after the changes in the registry, the customer had some problems running Internet explorer.

Those problems could be resolved by restoring the changes in the registry. - The number of "DBRShellOverlay" entries to be disable can be on some systems more than two, those entries have to be searched in all sections listed in the tab Explorer.

Resources

-

Dell Forum page "Backup and Recovery causing applications using Qt5 DLLs to crash": http://en.community.dell.com/support-forums/software-os/f/3526/t/19634253

Banana8 with old notebooks and windows 10 troubleshooting

Problem

Banana 8 stop working on startup. After the crash the message "LoadLibrary failed with error 87: Wrong parameter." is displayed.

System

The system is an old notebooks where windows 10 was installed afterwards.

The notebook's discrete graphic card is not officilally supported by windows 10.

Affected OS: Windows 10

Solution

- Update the graphic card driver

or

- Rename in folder C:\Windows\System32 the file "atig6pxx.dll" to "atig6pxx.dll.bak"

Banana8 with second monitor troubleshooting

Banana8 with second monitor troubleshootingProblem

Banana 8 stop working on startup.

System

The computer has an ATI Dispaly card with two attached monitors.

Affected OS: Windows 10, Windows 8, Windows 7

Solution

-

Remove (just an update is not enough) and install again the ATI driver;

-

Try to start the application on the AMD window / monitor.

-

Look for more solutions at: https://bugreports.qt.io/browse/QTBUG-50371

+

Resources

-

Qt bug reports: https://bugreports.qt.io/browse/QTBUG-50371

+

How to report a bug

Send us full details of the issue, giving as much detail as possible, this can include:

- For bugs:

- Steps to Reproduce:

Minimized, easy-to-follow steps that will trigger the described problem. Include any special setup steps; - Actual Results:

What the application did after performing the above steps; - Expected Results:

What the application should have done, if there was no bug; - The accounting file:

An example of an accounting file where the problem occur;

- Steps to Reproduce:

- For feature requests:

- A description of what you would like to achieve, and why.

A user story is an effective way of conveying this;

- A description of what you would like to achieve, and why.

You can submit your issue through our contact form.

Charakteristiken Banana 8

Banana Buchhaltung ist eine äusserst vielseitige internationale Software, die sich sehr gut für die Buchführung in jedem Land eignet.

Besonders ideal für kleine Geschäftseinheiten.

VielseitigPasst sich Ihren Bedürfnissen und Kenntnissen an.

|

Einfach und schnellBeginnen Sie sofort und sparen Sie tagtäglich Zeit.

|

UniversalFindet weltweit in über 127 Ländern Einsatz.

|

ProfessionellPräsentieren Sie Ihre Aktivität einwandfrei.

|

Sicher und zertifiziertMaximale Sicherheit und Datenschutz.

|

Kompatibilität und Austausch

|

Kompletter Support

|

||

Vielseitig

Wählen Sie zwischen verschiedenen Buchhaltungsmethoden |

|

|

Starten Sie mit der bevorzugten Buchhaltungsmethode und wechseln Sie sie bei Bedarf; bereits erfasste Daten bleiben erhalten:

Es stehen ausserdem mehrere Hilfsmittel zur Verfügung:

|

|

Organisieren Sie die Konten nach Ihrem Wunsch |

|

|

Sie können den Kontenplan Ihren persönlichen Bedürfnissen anpassen, indem Sie Konten hinzufügen oder löschen und Untergruppen sowie verschiedene Totalisierungsebenen hinzufügen. |

|

Haben Sie die Situation jederzeit unter Kontrolle |

|

|

Mit einem einzigen Blick haben Sie jederzeit einen umfassenden Überblick über die aktuelle Situation Ihre Tätigkeit.

|

|

Erhalten Sie die Kontendetails auf einen Klick |

|

|

In Banana Buchhaltung erhält man auf einfachste Art den detaillierten Auszug jedes Kontos, jeder Kategorie oder jeder Kontengruppe: Hierzu auf das kleine blaue Symbol klicken, das oben rechts in der Zelle erscheint, wenn Sie auf eine Zelle mit einer Konto-, Kategorienummer klicken. |

|

Verwenden Sie Segmente und Kostenstellen, um Projekte, Sektoren oder besondere Aktivitäten zu verwalten |

|

|

Mit Segmenten und Kostenstellen erlaubt Banana Buchhaltung Projekte, Sektoren oder Aktivitäten genau und detailliert zu verwalten, ohne die Kontenplanorganisation untereinanderzubringen. Sie wissen jederzeit über den Verlauf des gewissen Projektes, Sektors bzw. der gewissen Aktivität Bescheid und können detaillierte Ausdrucke erhalten.

|

|

Erleichterte MwSt/USt-Verwaltung |

|

|

Wird MwSt/USt-Verwaltung benötigt, wählen Sie bitte von Anfang an eine Datei mit MwSt/USt oder konvertieren Sie die bestehende Datei, um die MwSt/USt-Option hinzuzufügen. Alle Berechnungen für die MwSt/USt erfolgen automatisch. Das Programm bereitet für die Schweiz das Faksimile des MwSt-Abrechnungsformulares für die effektive Methode (siehe Abbildung) oder die Saldo-/Pauschalsteuersatzmethode auf. Sie müssen die darauf aufgeführten Werte nur noch auf das Originalformular übertragen. Umsatzsteuervoranmeldung (UStVA)Für die USt-Verwaltung für Deutschland und Österreich sehen Sie bitte die spezifischen Webseiten. |

|

Einfach und schnell

Excel-ähnliche Benutzeroberfläche |

|

|

Das Layout ist sehr ähnlich wie Excel, so dass Sie sich sofort damit vertraut fühlen. |

|

Perfekt geordnetes Buchungsjournal |

|

|

Die Tabelle Buchungen entspricht dem Buchungsjournal. Sie ist klar und geordnet und kann direkt gedruckt oder im PDF-Format gespeichert werden. Sie können auch spezifische Perioden oder ausgewählte Zeilen ausdrucken und dabei die Spalten nach Wunsch anordnen. Wenn Sie eine Bewegung eingeben, aktualisieren sich die Kontentotals automatisch. So haben Sie jederzeit eine aktuelle Gesamtübersicht. Sie können für den Text als auch dessen Hintergrund Farben verwenden, um Bewegungen für ein leichtes Wiederfinden hervorzuheben. |

|

Speichern Sie sich wiederholende Buchungen und verwenden Sie sie wieder |

|

|

Banana Buchhaltung bietet Ihnen die Möglichkeit, Zeilen von sich wiederholenden Buchungen in der Tabelle 'Sich wiederholende Buchungen' zu speichern, um sie bei Bedarf automatisch übernehmen zu können.

|

|

Importieren Sie die Daten der Bank oder Kreditkarte |

|

|

Sie können Ihre Bank- oder Kreditkartenbewegungen direkt in Ihre Banana Buchhaltungsdatei importieren und müssen sie somit nicht manuell erfassen. Die Finanzbuchhaltungssoftware Banana Buchhaltung verfügt für die grössten Institute über Importfilter, welche ständig angepasst werden; sollte sich Ihre Bank nicht auf der Liste befinden, erstellen wir Ihnen den geeigneten Filter.

|

|

Unmittelbare Ausdrucke und Berichte mit personalisierbaren Einstellungen |

|

|

Personalisieren Sie die Bilanz- und Erfolgsrechnungsausdrucke. Um die Daten nach Ihrem Wunsch zu präsentieren, können Sie zahlreiche Optionen aktivieren/deaktivieren. Wählen Sie zwischen diversen Grafikstilen aus, ändern Sie die Farben, usw. Sehen Sie das Resultat als Druckvorschau. In den Bilanzausdrucken können Sie auch einen Text für die Bilanzbeilage einschliessen.

|

|

Speichern Sie Ihre Einstellungen für den Ausdruck |

|

|

Mit dem Befehl Kompositionen können Sie sich auf einfachste Art personalisierte Ausdrucke einrichten. Dies erlaubt Ihnen, für Bilanzen, Kontoauszüge, Buchungen extrahieren und sortieren, Adressen und Etiketten etc. verschiedene Einstellungen zu speichern.

|

|

Universal

Mehrsprachig |

|

|

Das Programm ist in diversen Sprachen verfügbar: Deutsch, Italienisch, Englisch, Französisch, Holländisch, Spanisch, Portugiesisch und Chinesisch. Sie können die Programmsprache jederzeit wechseln. Auch jede einzelne Datei kann in einer anderen Sprache erstellt werden; in den verschiedenen online verfügbaren Vorlagen können Sie zwischen Dateien in allen Sprachen auswählen. Um die Sprache einer bereits bestehenden Datei zu ändern, müssen Sie diese konvertieren und als Option die gewünschte Sprache auswählen.

|

|

Verwaltung von Fremdwährungen |

|

|

Sie können soviele Konten in Fremdwährungen eingeben, wie Sie wünschen und in der Tabelle Wechselkurse die Wechselkurse erfassen. Sie haben die Möglichkeit, ein Wechselkursarchiv zu führen. Die Berechnung der Wechselkurse und der Wechselkursdifferenzen erfolgen alle automatisch. Sie können Bilanz, Erfolgsrechnung und Reports auch in einer zweiten Währung erstellen. |

|

Mandaten (Buchhaltungen) |

|

|

Banana Buchhaltung hat kein Limit für verwaltbare Mandanten. |

|

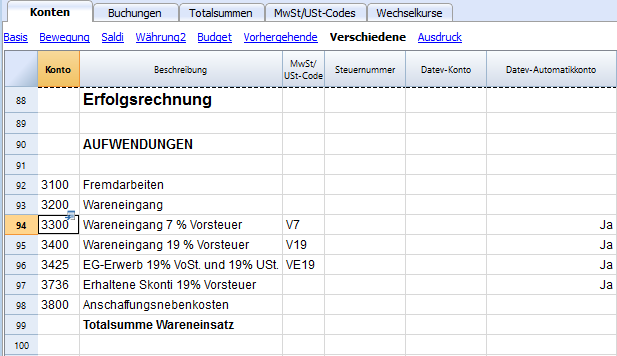

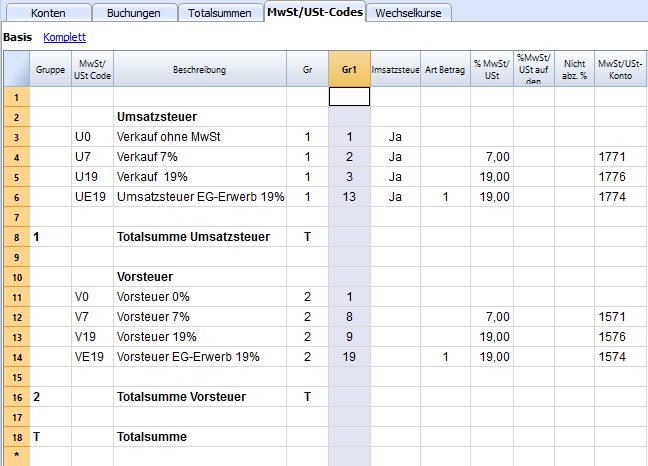

MwSt/USt-Codes für das Land |

|

|

Erstellen Sie einer neue Datei mit der Option MwSt/USt und wählen Sie das Land, so finden Sie in der Tabelle MwSt/USt-Codes bereits alle Codes, welche für das ausgewählte Land Gültigkeit haben. Die Tabelle MwSt/USt kann jederzeit integriert und modifiziert werden, falls spezielle MwSt/USt-Codes gebraucht würden oder im Laufe der Zeit neue Codes in Kraft treten sollten. |

|

Länderspezifische Apps |

|

|

Die Apps von Banana Buchhaltung sind Applikationen, welche zum Beispiel erlauben, mit dem Programm Banana Buchhaltung spezielle Ausdrucke und Reports zu erhalten; einige stehen bereits kostenlos zur Verfügung und Sie müssen Sie nur herunterladen! Sie können auch Ihre eigenen Apps kreieren, um dank diesen sehr spezifische Präsentationen der Erfolgsrechnungen zu erhalten, wie sie von speziellen Vorschriften verlangt werden (z.B. diejenigen von Vormundschaften oder Vereinen) oder um die Vorschriften eines bestimmten Landes zu erfüllen. |

|

Professionell

Verwaltung von Kunden und Lieferanten |

|

|

Verwalten Sie Kunden und Lieferanten auf einfachste Art. Sie können jederzeit wissen, welche Rechnungen offen und fällig sind. Um alle Details eines Kunden oder Lieferanten zu kennen, können Sie diverse Berichte und Ausdrucke erstellen. Sie können feststellen, aus welchen Beträgen sich die Eröffnungssaldi zusammensetzen.

|

|

Unzählige Berichte, auch für einen bestimmten Zeitraum |

|

|

Die Möglichkeiten für Berichte sind endlos. Wählen Sie die Spalten, welche angezeigt werden sollen, ändern Sie die Überschriften sowie ändern Sie die Farben. Sie können auch externe buchhalterische Berichte mit den gewünschten Gruppierungen erstellen.

|

|

Datensynchronisierung mit Excel |

|

|

Um in Excel über die Buchhaltungsdaten zu verfügen, müssen diese nicht mehr kopiert und eingefügt oder exportiert werden. Die ExcelSync-Funktionen erlauben, die Daten aus Ihrer Banana Buchhaltung zu übernehmen und Excelblätter und Grafiken zu erstellen, welche sich automatisch aktualisieren.

Werden in der Buchhaltungsdatei neue Transaktionen erfasst, aktualisieren und berechnen sich die Excelblätter automatisch.

Für Apple/Mac ist diese Funktion leider nicht verfügbar.

|

|

Export in verschiedene Formate |

|

|

Die Software Banana Buchhaltung erlaubt Ihnen, die Daten in verschiedene Formate zu exportieren: Html, Excel, Xml, Txt. Der Export kann für eine Auswahl von Daten oder die ganze Buchhaltungsdatei erfolgen. Sie können auch nur einige wenige Zeilen exportieren.

|

|

Entwicklung von benutzerdefinierten Apps |

|

|

Kontaktieren Sie uns bitte, falls Sie spezielle Ausdrucke, Reports oder irgend einen speziellen Output benötigen: Wir stehen Ihnen für die Entwicklung von benutzerdefinierten Apps zur Verfügung. Bitte teilen Sie uns Ihre Ideen und Bedürfnisse mit! |

|

Automatisierte Kontrollen |

|

|

Eventuelle Fehler werden automatisch gemeldet. Werden buchhalterische Differenzen oder Differenzen in den Anfangssaldi gemeldet, gibt es einen Befehl, um diese automatisch in der Tabelle Konten oder Buchungen zu finden.

|

|

Sicher und zertifiziert

Dateischutz mit Passwort |

|

|

Jede Datei kann mit einem Passwort geschützt werden. Das Passwort kann jederzeit geändert oder gelöscht werden.

|

|

Buchungen sperren |

|

|

Sie können alle oder einige Buchungen sperren, um die Sicherheit zu haben, dass diese nicht geändert werden (digitale Zertifizierung). Sie können die Buchungen auch nur schützen, um unabsichtliche Änderungen zu verhindern. |

|

Datenzertifizierung mit Blockchain-System |

|

|

Die Datenintegrität wird von einem Avantgarde-Zertifizierungssystem (US-Patent Nr. 7,020,640) garantiert; dasselbe, das auch für elektronische Währungen wie Bitcoin verwendet wird.

|

|

Kompatibilität und Austausch

Kompatibilität mit den Vorgängerversionen |

|

|

Banana Buchaltung 8 hält dieselbe Verwendungsart und Kompatibilität bei wie die Vorgängerversionen und ist mit diesen kompatibel. Mit Vorgängerversionen erstellte Dateien können geöffnet werden und alle darin enthaltenen Daten werden vollständig übernommen. |

|

Für alle Betriebssysteme |

|

|

Banana Buchhaltung 8 ist in den Versionen für Windows, Mac, Linux, Android und iOS verfügbar. Die Banana Buchhaltungsdateien können zwischen den unterschiedlichen Versionen ausgetauscht werden. |

|

Cloud-Datenaustausch |

|

|

Die Banana Buchhaltungsdateien können in allen Cloud-Systemen gespeichert werden: Dropbox, i-Cloud, Google Drive, .... so dass mehrere Personen jederzeit und überall auf die Buchhaltungsdaten zugreifen können. |

|

Versand von Banana-Dateien per Email |

|

|

Jede Banana Buchhaltungsdatei kann per Email (als Beilage) versandt werden, geteilt werden oder auf einem USB-Stick gespeichert werden. Im Menü Datei steht ein praktischer Befehl zur Verfügung, der automatisch eine Email-Nachricht mit Ihrer Datei in der Beilage erstellt, welche bereit zum Versand ist.

|

|

360-Grad-Support

Online-DokumentationEs stehen Ihnen kostenlos über 500 Seiten Online-Dokumentation zur Verfügung. Sie ist nach Themen unterteilt, mit Bildern dokumentiert und enthält Schritt-für-Schritt-Anleitungen. Direkter Link zum FehlerEventuelle Fehler werden sofort gemeldet. Kostenloser SupportBei Fragen im Zusammenhang mit der Nutzung des Programms steht Ihnen der technische Support per Email oder Telefon 12 Monate lang (ab Kaufdatum) kostenlos zur Verfügung. Technical Advanced SupportTechnische Unterstützung und Entwicklung von benutzerspezifischen Lösungen (Apps). |

|

Schweiz: Neue Normen für Berichte

In der Schweiz müssen ab Ende 2015 alle im Handelsregister eingetragenen Firmen die Berichte mit den vom Obligationenrecht (Art. 959a und 959b OR) vorhergesehenen Mindestanforderungen der Bilanz und Erfolgsrechnung präsentieren.

Die mit Banana 7 und Banana 8 zur Verfügung gestellten neuen Kontenpläne entsprechen bereits der vorgesehenen Systematik. Wurde eine neue Buchhaltung erstellt oder erstellt man eine neue Buchhaltung und verwendet dabei die neuen Kontenpläne, verfügt man über konforme Berichte.

Für diejenigen, die über einen "alten" Kontenplan verfügen, gibt es zwei Möglichkeiten:

- Auf den neuen Kontenplan übergehen und Daten der bestehenden Buchhaltung übernehmen

- Eine neue Buchhaltung erstellen. Hierbei einen Beispiel/Muster-Kontenplan mit neuer Nummerierung sowie neuer Gruppierung verwenden.

- In der Tabelle Konten eine neue Spalte 'Konto_1' einfügen und für jedes neue Konto das entsprechende "alte" Konto einfügen.

- Importfunktion verwenden, um die nach "alter" Systematik erstellten Daten der ursprünglichen Datei zu übernehmen und zu konvertieren.

- Weiterhin die Buchhaltung mit aktuellem Kontenplan benutzen und für die Präsentation die bereits in Banana 8 vorhandene Datei 'Buchhalterischen Bericht' mit Klassifizierung der Konten nach neuem Schema verwenden:

- Für den Bericht eine neue Datei erstellen:

Doppelte Buchhaltung, Buchhalterischer Bericht, Beispiele/Muster: Deutsch (Schweiz, Report Art. 959 Obligationenrecht). - Datei im Ordner speichern, in dem sich die Buchhaltungsdatei befindet.

- Für jedes Konto in der Spalte 'Gr1' die entsprechende Gruppe der Klassifizierung aufgrund den neuen Vorschriften (wie in der Datei des Buchhalterischen Berichtes definiert) zuweisen. Siehe Anleitung Berichtsdatei für Bilanz gemäss Art. 959 des Obligationenrechts.

- Für steuerliche Zwecke Bilanz und Erfolgsrechnung mittels der Datei 'Buchhalterischem Bericht' ausdrucken. Siehe Anleitung Formatierte Bilanz nach Gruppen.

- Für den Bericht eine neue Datei erstellen:

Weitere Änderungen

Die neuen Vorschriften sehen weitere Änderungen vor. Sie verlangen ausserdem, dass der Anhang der Bilanz weitere Informationen enthält. Es kann gewählt werden, ob bestimmte Details direkt in der Bilanz und Erfolgsrechnung eingefügt werden sollen, oder ob die verlangen Positionen im Anhang aufgeführt werden (z.B. die Forderungen oder Kredite gegenüber Aktionären oder Mitgliedern der Gesellschaftsorgane).

Es handelt sich um wichtige Änderungen mit steuerlichen und rechtlichen Folgen.

Bitte erkundigen Sie sich bei Ihrem Treuhänder, Revisor oder Steuerberater, um sicherzustellen, die notwendigen Vorkehrungen zu treffen, dass die Präsentation des Geschäftsresultates 2015 den neuen Vorschriften entspricht.

In den kommenden Jahren muss einfach weiterhin nach dem festgelegten Muster gearbeitet werden.

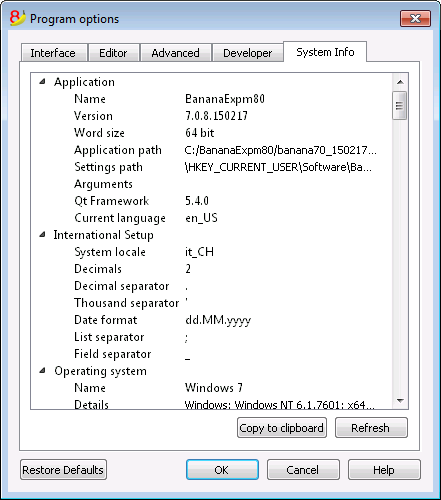

Technical data

Applications and accounting types

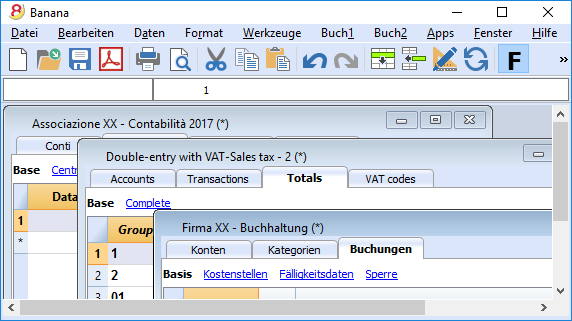

Banana is a native application for Windows, Linux and Mac and includes functions that allows the user to manage different types of accounting files:

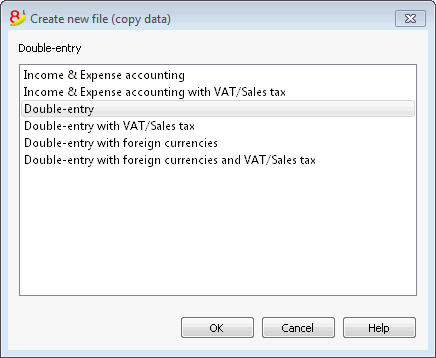

Income & Expense accounting

- Income & Expense accounting (income and expenses of several accounts)

- Cash book (income and expenses of one single account)

Double-entry accounting

- Double-entry accounting

- Multi-currency accounting

Labels

Every application can be set up with or without VAT/Sales tax and includes:

- Accounting plans divided by language

- Accounting plans with VAT

- Specific accounting plans for different countries

- Accounting plans for small companies (for the family, non-profit organizations, professional studios, shopkeepers, churches, etc.)

All the different types show a resemblance with the Microsoft Office software and operate in a similar way: windows, tables, data selection, copy and paste, find and replace data, undo and redo operation, printouts with various options, data protection, password, etc.

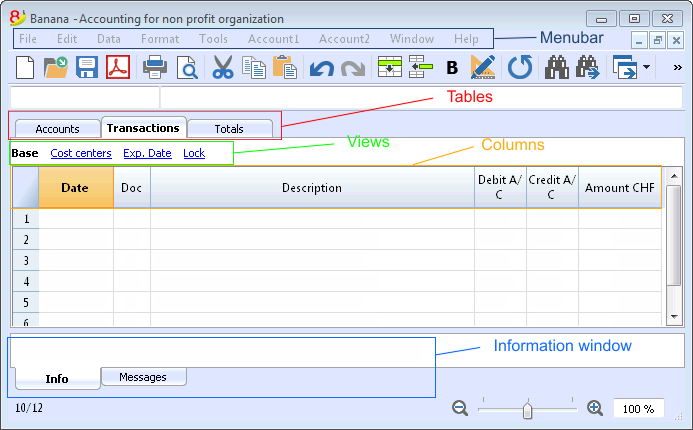

Main interface/Accounting/ Files

- Multilingual: English, Italian, German, French, Spanish, Portugese and Dutch NEW

- Main graphic interface easier and more user friendly - computers with small screens such as notebooks will benefit the most NEW

- Management of multiple accountings: there are no limits with regard to the amount of accounting files that can be managed

- Every file contains an accounting. There is no limit to the amount of files

- Every file can be saved, moved or copied on whichever type of support (local files, network, CD, USB sticks)

- Favorite files list - it allows to access your most used files with a single click NEW

- Possibility of protecting the Composition settings NEW

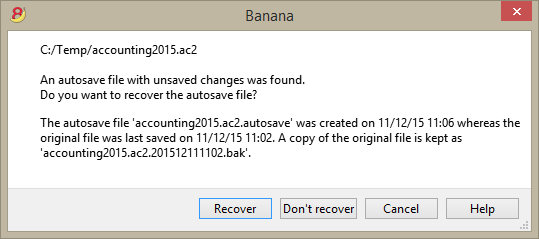

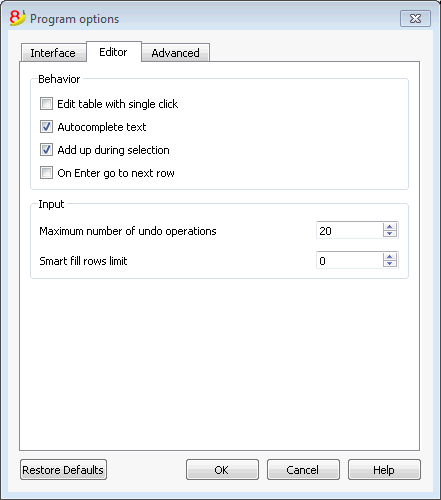

- Autosave of the work in a temporary file (Auto backup + file name)

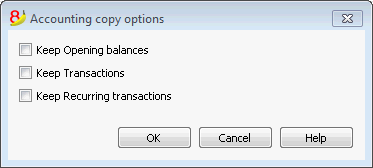

- Possibility of creating a copy of a file, with or without the transactions

- Every file of a specific type can be converted into another type

- For each accounting type, the set up of the currency can be selected by the user

- With the Open command from the File menu, the folder, in which the current accounting has been saved, will be opened. NEW

Accounts/Categories

- All the Charts of accounts for Switzerland have been updated according to the new legal regulations NEW

- Unlimited number of accounts/categories

- Numeric or alphanumeric accounts up to 256 characters

- Free setup of groupings and totaling (up to a 100 levels of totaling)

- Automatic totals recalculation (possibility of switching it to manual)

- Account/category numbers can be adapted to any kind of national requirement

- Accounts can be added or cancelled at any moment

- Double clicking on an acount/category number doesn't open the account card anymore (it goes into editing mode instead). In order to open the account card you need to click on the little blue arrow in the top right corner of the cell NEW

- From the account/category card, by double clicking in the row number (underlined as a link), you can open the Transactions table at the corresponding row, so it can be edited NEW

- Opening balance, actual balance

- Budget and difference between budget and balance (for the entire accounting period)

- Transactions and balance by period

- Balance of the previous year and difference with the previous year

- Account cards, complete or by period, with indication of the balancing entry

- Multi-currency: accounts in more than one currency

- Display of the amounts in the account currency as well as in basic currency

Transactions

- Unlimited number of transactions

- Corrections are also possible with no need to make a reverse transaction

- Possibility of editing texts directly in the cell NEW

- Smart fill (automatic completion of already used texts) directy from the cell, with possibility of filtering the texts NEW