Universal: Templates and Extensions

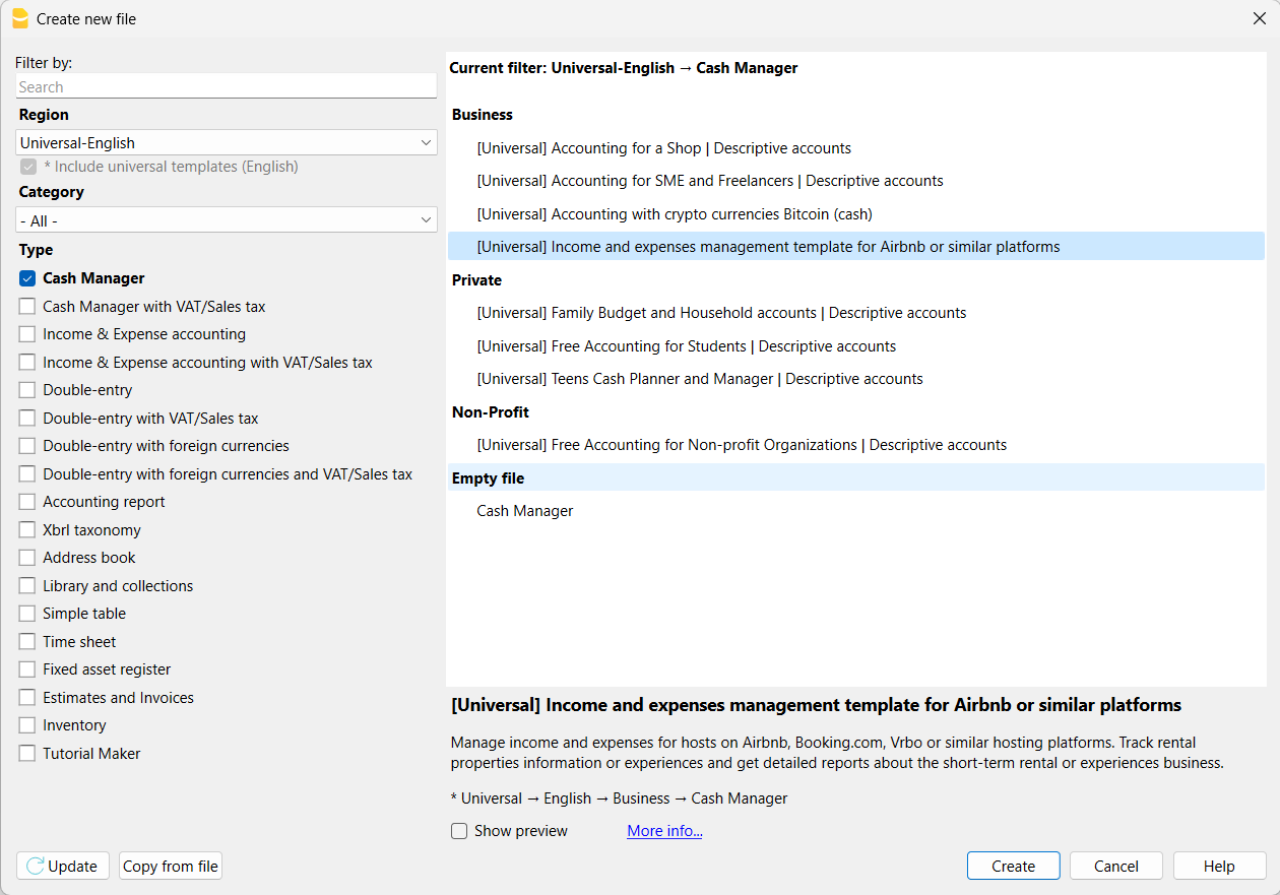

Alongside country-specific options, we also offer Universal template.

These are Banana's ready-to-use file templates, easily adaptable to your country or preferences, with descriptive accounts for better understanding.

Instead of numerical accounts, universal templates have descriptive accounts. Instead of a number or a code, you then find a short description. This system makes accounting simpler and more intuitive.

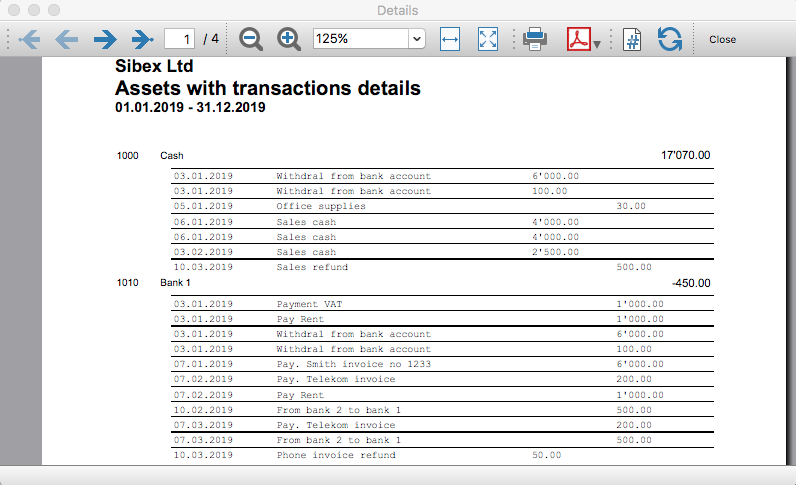

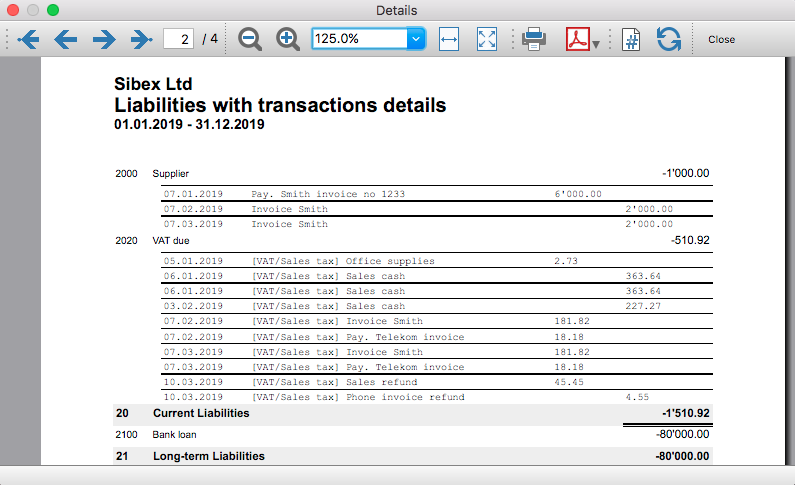

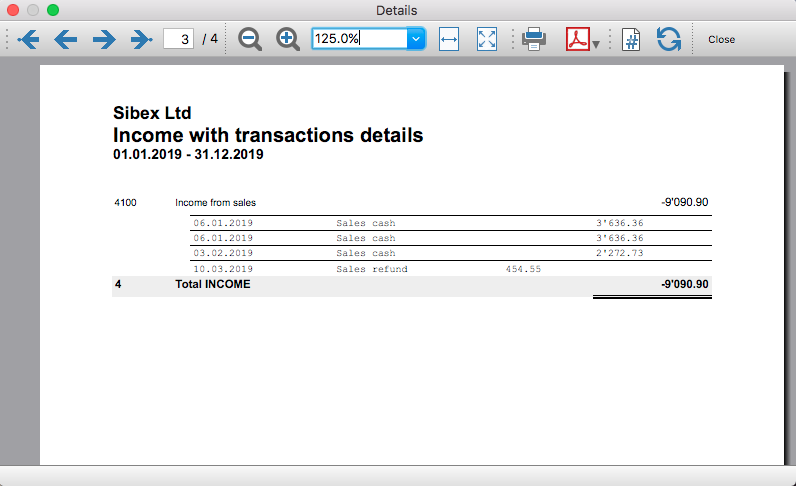

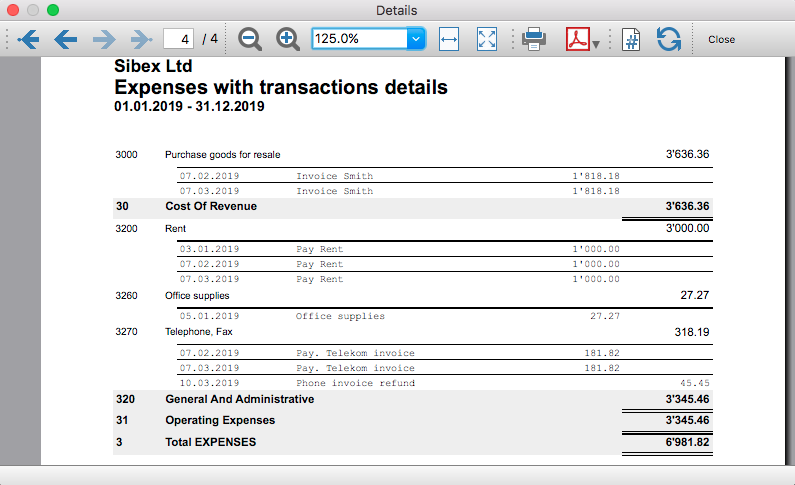

Here is an example of a chart of accounts for an income and expenses accounting file:

Business (Universal)

Universal Accounting Templates No VAT

商店会计

商店会计 feiSimple Accounting for a Shop

Simple Accounting for a Shop michaelBuchhaltung Restaurant (Einnahmen / Ausgaben)

Buchhaltung Restaurant (Einnahmen / Ausgaben)

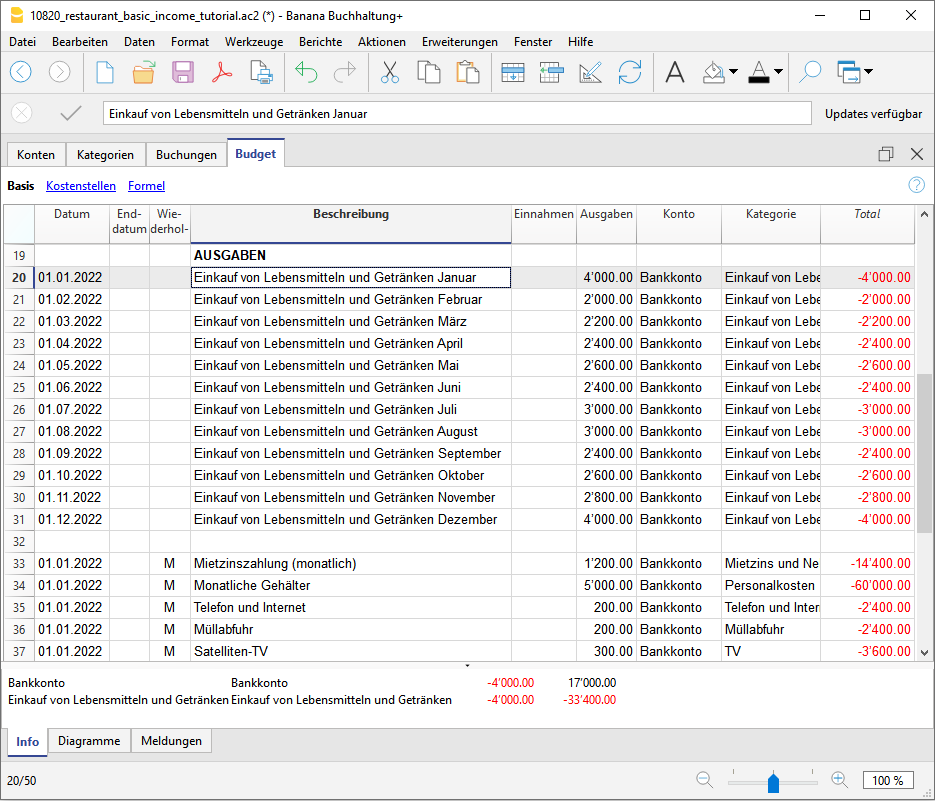

Budget für ein Restaurant erstellen

Bei allen Aktivitäten ist es wichtig, das ganze Jahr über mit Gelassenheit über die Wirtschafts- und Finanzlage zu entscheiden und vor allem die Möglichkeit zu haben, rechtzeitig eingreifen zu können, bevor es zu spät ist. Aus diesem Grunde hat Banana Buchhaltung in ihren Modellen die Vorlage "Budget" vorgesehen, mit welcher Sie das Budget Ihres Restaurants erstellen können.

Wir möchten Sie bei der Erstellung des Budgets Schritt für Schritt unterstützen und Sie müssen dafür nur die folgenden Anweisungen befolgen. Es geht einfach und schnell, so dass Sie sich sofort auf die Führung Ihres Unternehmens und die Betreuung Ihrer Kunden konzentrieren können!

1. Einnahmen eingeben

Es müssen die fixen Einnahmen eingegeben werden und um eine Vorstellung davon zu haben, kann man sich auf die Einnahmen des Vorjahres stützen.

Meistens bestehen die Einnahmen aus:

- Lebensmittelverkäufe

- Getränkeverkäufe

Bei Restaurants ist es sehr sinnvoll, den Umsatz von Speisen und Getränken pro Monat zu teilen, da er je nach Feiertag und Jahreszeit stark variieren kann. Natürlich können Sie die Verkaufsartikel frei anpassen und z.B. je nach Art der Speisen und Getränke detailliert gestalten.

Ausserdem kann es auch Erträge geben, die nicht mit dem Kerngeschäft zusammenhängen:

- Renditen aus Immobilien

- Zinserträge aus Bank- und Postkonten

Eine Anleitung, wie Sie die Budgetdaten technisch ins Banana Programm eingeben können, finden Sie auf unserer Webseite Tabelle Budget.

2. Einfügen von festen und variablen Ausgaben

Es müssen alle Ausgaben aufgelistet werden, welche im Laufe des Jahres zu erwarten sind. Auch hier können Sie sich auf die Ausgaben des Vorjahres stützen und sich überlegen ob es eventuelle Änderungen geben wird und die entsprechenden Beträge anpassen.

Die Hauptausgaben können sein:

- Einkauf von Waren oder Rohstoffen (Lebensmittel und Getränke)

- Gehälter

- Ausrüstung

- Sozialversicherungsbeiträge

- Personalversicherung

- Maschinen- und Sachversicherung

- Miete oder Hypothek und Zinsen

- Steuern und Abgaben

- Licht, Wasser und Gas

- Telefon- und Internetgebühren

- Reinigung

- Werbung

In Bezug auf die Ausgaben für Lebensmittel und Getränke ist es auch sehr nützlich, die Kosten monatlich zu teilen.

3. Einnahmen und Ausgaben überprüfen

Nachdem Sie alle Ein- und Ausgänge zusammengestellt haben, ist es an der Zeit, sie zu vergleichen, um herauszufinden, ob der Gewinn der als Hauptziel gesetzt wurde, erreicht werden kann.

Um einen Vergleich zu machen, müssen Sie einen Budgetbericht haben: Wenn Sie unser Modell der Banana Buchhaltung verwenden, gehen Sie einfach zu Berichte → Formatierte Bilanz nach Gruppen und wählen Sie ein gewünschtes Budget aus (in diesem Fall ist das jährliche Budget am hilfreichsten).

Durch die Überprüfung des Budgets können Sie kontrollieren, wie sich die Liquidität, die Schulden und das Gesamtvermögen auf der Grundlage der budgetierten Ausgaben und Einnahmen belaufen werden.

Dadurch, dass Sie einen Überblick über Ihre Ausgaben und Einnahmen haben, wird ersichtlich, ob Sie einige Ausgaben oder Einnahmen überschätzt oder unterschätzt haben.

Sollte ein wahrscheinlicher Verlust resultieren, ist es ratsam, sofort Sparmassnahmen zu ergreifen, indem Sie die verschiedenen Ausgaben, die Sie aufgelistet haben, überdenken und die Beträge ändern.

4. Überprüfung mit Bilanz am Jahresende

Am Ende des Jahres, wenn alle Bewegungen erfasst wurden, können Sie einen Bericht erstellen, der Ihnen die Beträge aller Konten im Endbestand anzeigt und mit den "budgetierten" vergleicht. Sie können mit Sicherheit überprüfen, ob Ihre zu Beginn des Jahres erstellte Schätzung zuverlässig war und ob Sie den am Anfang des Jahres erwarteten Gewinn erreichen konnten.

Um einen Vergleich vom geschätztem Wert mit dem Endsaldo zu erhalten, gehen Sie in das Menü Berichte, klicken Sie auf Formatierte Bilanz nach Gruppen und wählen Sie Jährlicher Ausdruck mit Budgetvergleich.

Sollte es grosse Differenzen geben, können Sie überprüfen, bei welchen Ein- oder Ausgaben Sie sich geirrt haben und die Beträge im Budget des neuen Jahres korrigieren.

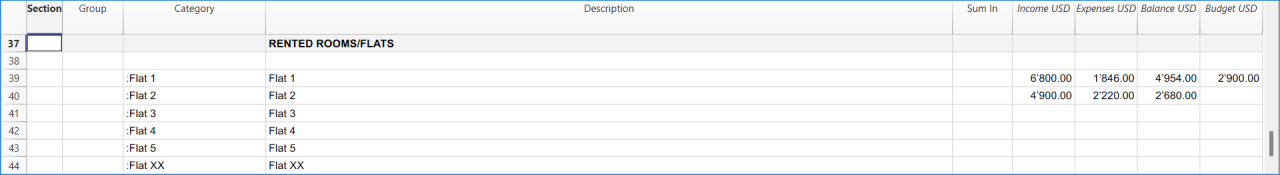

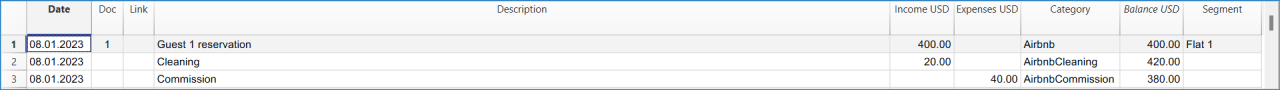

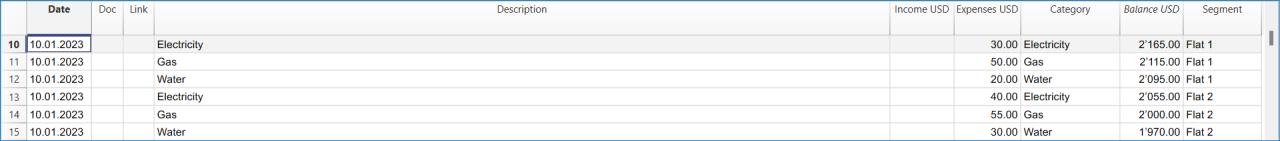

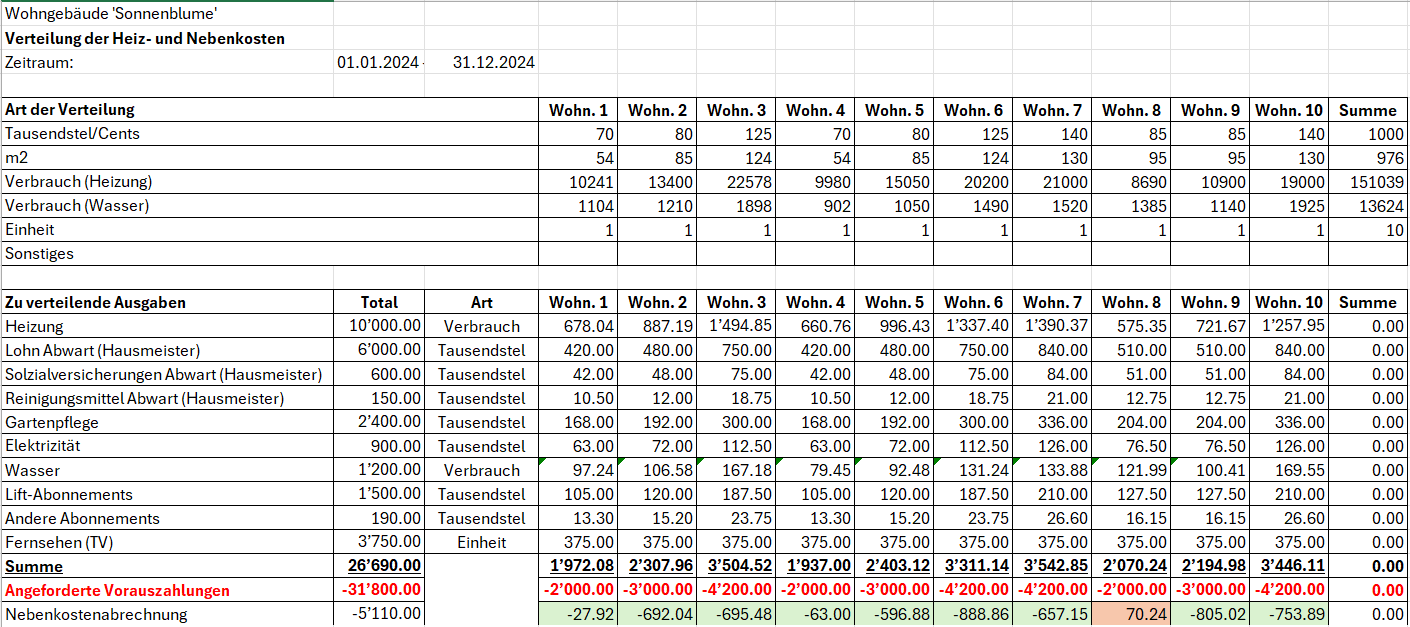

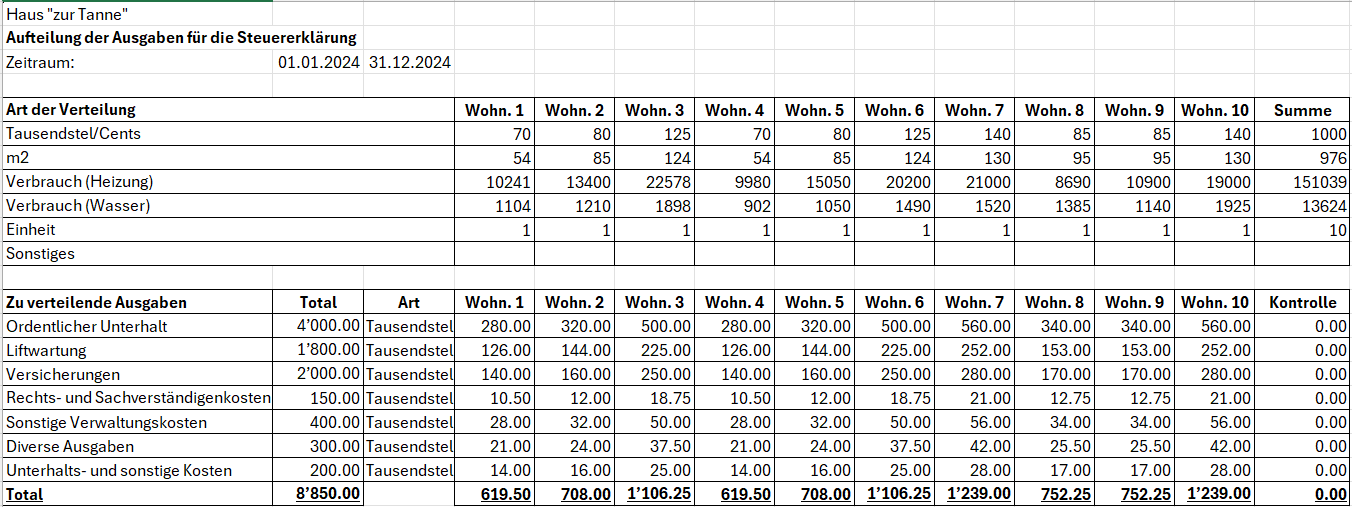

Income & Expense Accounting for Property Management

Income & Expense Accounting for Property Management michaelIncome & Expense Accounting for a Corporation

Income & Expense Accounting for a Corporation michaelYacht, Boats, Cruises Income & Expense Accounting Log Book with Budget and Cash Plan

Yacht, Boats, Cruises Income & Expense Accounting Log Book with Budget and Cash PlanTrack yacht or sailboat expenses and revenues. No need of accounting experience.

Easy to use Accounting software for Yacht. Predefined account file with chart of account, with comprehensive list of expenses (Engine, Crew, Administrative, Guests) and Revenues, that can be easily adapted for your specific needs.

This accounting template provides.

- Predefined account chart with Expenses (Engine, Crew, Administrative, Guests) and Revenues that can be easily adapted for your specific needs.

- Cost and revenues subdivision also by cruise.

Comptabilité multidevise pour PME

Comptabilité multidevise pour PMEModèle idéal pour la gestion de la comptabilité des sociétés anonymes. Le plan comptable est structuré selon le schéma PME et présente les registres clients/fournisseurs. Il y a des comptes en devises étrangères et des centres de coûts.

Comptabilité pour sociétés anonymes

Comptabilité pour sociétés anonymes caterinaComptabilité pour sociétés de personnes morales avec les registres clients/fournisseurs

Comptabilité pour sociétés de personnes morales avec les registres clients/fournisseursModèle idéal pour la gestion de la comptabilité des sociétés anonymes. Le plan comptable est structuré conformément au régime des PME. Il y a des centres de coûts.

Comptabilité pour sociétés de personnes morales avec les registres clients/fournisseurs

Comptabilité pour sociétés de personnes morales avec les registres clients/fournisseursModèle idéal pour la gestion de la comptabilité de personnes morales. Le plan comptable est structuré conformément au régime des PME. Il y a des centres de coûts et la gestion des clients et fournisseurs.

Comptabilité pour Entreprise jusqu'à 500'000 CHF chiffre d'affaires

Comptabilité pour Entreprise jusqu'à 500'000 CHF chiffre d'affairesPlan comptable structuré pour gérer une entreprise dont le chiffre d'affaires annuel n'excède pas 500'000 CHF. Avec TVA et des centres de coûts.

公司会计 (含中英文报表)

公司会计 (含中英文报表) feiComptabilité pour Entreprises Individuelles

Comptabilité pour Entreprises IndividuellesPour gérer les comptes d'une petite entreprise individuelle. Le plan comptable est structuré avec des groupes et sousgroupes et centres de coût.

Comptabilité pour Entreprises individuelles

Comptabilité pour Entreprises individuellesPour gérer les comptes d'une petite entreprise individuelle avec TVA et centres de coût.

Double-Entry Accounting for a Corporation

Double-Entry Accounting for a Corporation michaelContabilità Ristorante (Multi-Moneta)

Contabilità Ristorante (Multi-Moneta)Come fare il preventivo per un ristorante

Segui passo per passo la nostra guida alla pagina Come fare il preventivo per un ristorante che ti insegna come creare e gestire un budget familiare.

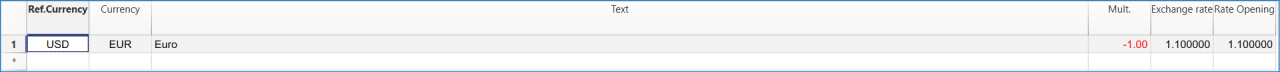

Double-Entry Accounting for a Corporation with foreign currencies

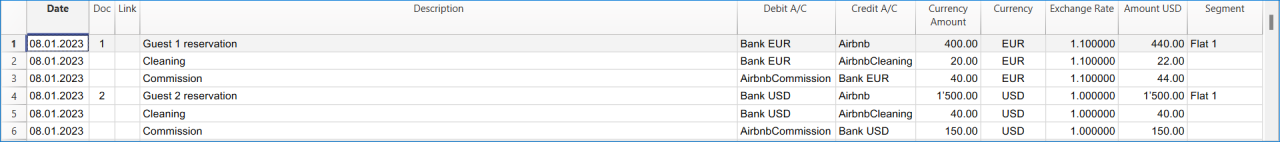

Double-Entry Accounting for a Corporation with foreign currencies michaelPayPal Templates | Multi-currency accounting

PayPal Templates | Multi-currency accountingPayPal import transactions

Banana has an import filter that allows you to directly import the PayPal transaction data into your accounting files.

The attached files are predefined with the accounts so that you can immediately start using it.

There are two template example files that you can download and open in Banana:

- Multi currency accounting with EUR as a Basic Currency

- Multi currency accounting with USD as a Basic Currency

Files suitable for

These example files are especially suitable in case you have PayPal transactions in different currencies and especially if you have set up your PayPal account to use and keep different currencies (see also PayPal template for Double-entry accounting) .

The imported transactions will automatically be imported to the currency account, so that you can see all transactions separately and have a balance in the currency.

Even if you use another accounting software, you will find that is very efficient to keep a separate accounting in Banana and keep your PayPal accounting in it. Instead of recording all transctions in your accounting solution, you can keep a separated accounting in Banana and once a month or when needed, only record the summary movement for the period in your accounting solution .

Further adapting the file

The file can easily be adapted to suit your needs.

Adding new accounts and new currencies

-

In the Accounts table, add new accounts for other currencies or for different Income or Expense types.

-

Add new currencies in the Exchange rates Table

Changing to another basic currency

This file can easily be converted into one with another Basic Currency

- Change the Basic currency in the Accounting properties.

- Adapt the Exchange Rates table with the appropriate currencies and exchange rates.

- In the Accounts table, change the currency for the accounts that need to be in Basic currency.

Add VAT/Sales Tax, change language or convert into another type

Use the Convert to new file command to add more options or change the accounting file settings.

Universal Accounting Templates VAT

商店会计

商店会计 feiDouble-Entry Accounting for a Corporation with VAT/Sales tax

Double-Entry Accounting for a Corporation with VAT/Sales tax michaelLibro de caja para un Comercio con IVA (con transacciones)

Libro de caja para un Comercio con IVA (con transacciones) barbaraDouble-Entry Accounting for a Corporation with foreign currencies and VAT/Sales tax

Double-Entry Accounting for a Corporation with foreign currencies and VAT/Sales tax michael公司 (含中英文报表)

公司 (含中英文报表)使用Banana财务会计软件,做专业的复式记账会计,一键生成资产负债表,损益表。多语言多汇率,使用中文做账一键点击生成外文报表。

创建您的文件

- 从该模板开始,创建一个新文件(模板编号+10680),使用在文中所解释的任何一种方式。

- 文件菜单→文件和账户属性命令,设置公司名称,会计期间及本位币。

- 文件菜单→另存为命令保存文件。以公司名称和年份作为文件名很有用。

例如“公司-2020.ac2”

文件和账户属性

- 账套

此标签可以编辑账套的信息,账套名称,开账日期和结账日期,以及记账本位币。 - 选项

此标签可以激活会计发生业务所需的功能。 - 地址

此标签中可以填入该会计账套的公司或个人信息,这些信息会做为本公司信息显示在给客户开具的发票中。 - 外汇

此标签中选择汇兑损益的会计科目代码。 - 增值税

此标签中选择应交增值税的会计科目代码。 - 其它

此标签中选择做账的语言和出报表的语言。 - 密码

此标签中设置账套密码。 - 文字

此标签中可以输入额外的信息,比如会计的名字。

编辑账户表

账户表格内显示有资产负债表及损益表的账户。

- 资产负债表显示所有资产账户的余额,即资产和负债。资产与负债之间的差额决定了个人资本。

- 损益表显示所有收入和费用的账户,它们的差额决定会计年度的损益状况。

所有的账户都可以根据您的需求进行客制化的编辑。例如,可以更改账号或摘要,可以在期初列内输入初始的余额,可以添加账户并且删除那些不需要的账户。

创建您的预算

在预算表格内,您可以输入指定年份的预估收入和费用。

- 列出每月费用和收入

例如,在办公室的租金中输入日期,重复,摘要,费用,借方账户,贷方账户和金额。

也可以会月收入执行相同的操作,并输入预估的收入。

输入会计发生业务

在会计发生业务表格中,输入实际的会计发生业务。

- 日期

- 摘要

- 借方账户

输入相对应的账户科目 - 贷方账户

输入相对应的账户科目 - 金额

对所有的会计发生业务执行同样的操作。

导入银行对账单

为了加快这些操作的进程,您可以导入银行对账单的数据并将其链接到数字收据。可以使用报表菜单→导入到账套命令。

报告和预算的比较

在输入会计发生业务后,程序将自动更新账户余额,您可以立即将其与预算余额进行比较。可随时查看并比较过去,现在和未来的会计数据。

外贸公司 (含中英文报表)

外贸公司 (含中英文报表) feiUniversal Business plan templates

Free Cash Flow Planning, Budgeting And Management For Freelance And Small Companies

Free Cash Flow Planning, Budgeting And Management For Freelance And Small CompaniesCreating a cash flow forecast with Banana Accounting is like creating it with Excel, but faster, more secure and completely free. Thanks to the ready-to-use template, you start right away, just enter the data.

You know in advance how much liquidity you have and how long it will last, when and what expenses you will face and what income you can count on. You can simulate the reduction of expenses and see what effect it has on your liquidity and profitability, understand future sales volumes and whether your capital will be enough.

We have prepared this guide to help you make your cash flow forecast and solve your financial problems. If you follow it in detail you will succeed, because you can always modify and correct it, so it's easy to update your forecasts.

Create your file

- Create a new file, starting from this template (Template ID +11044), using one of the methods explained.

- With the command File → File properties sets the period, the company name and the basic currency.

- With the command File → Save as save the file. It is useful to enter the company name and year in the file name.

For example "company-2020.ac2".

See also Organize accounting files locally, online or in the cloud

Adapt accounts and categories tables

Before creating your own cash flow, you need to quickly adapt your account and categories to your specific needs.

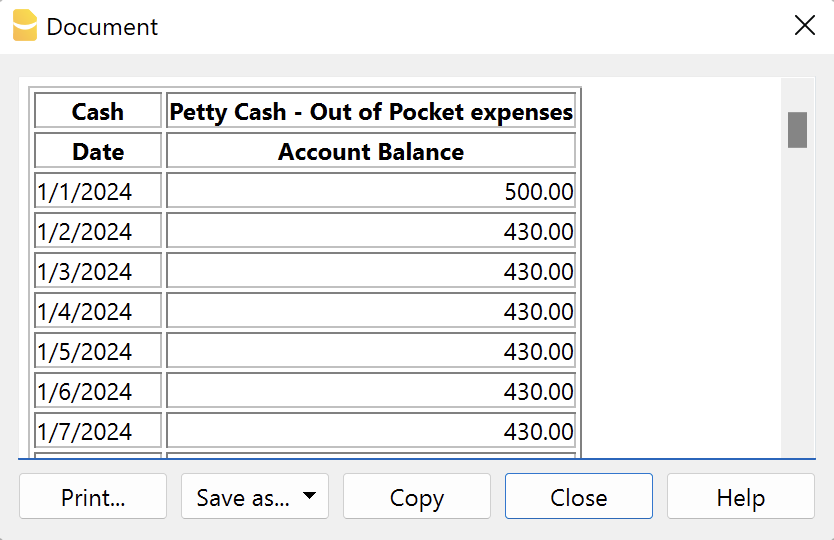

Accounts table

The Accounts table only shows the Cash account, or rather, the liquidity in your possession. You can customize it by changing the account name, description and opening balance.

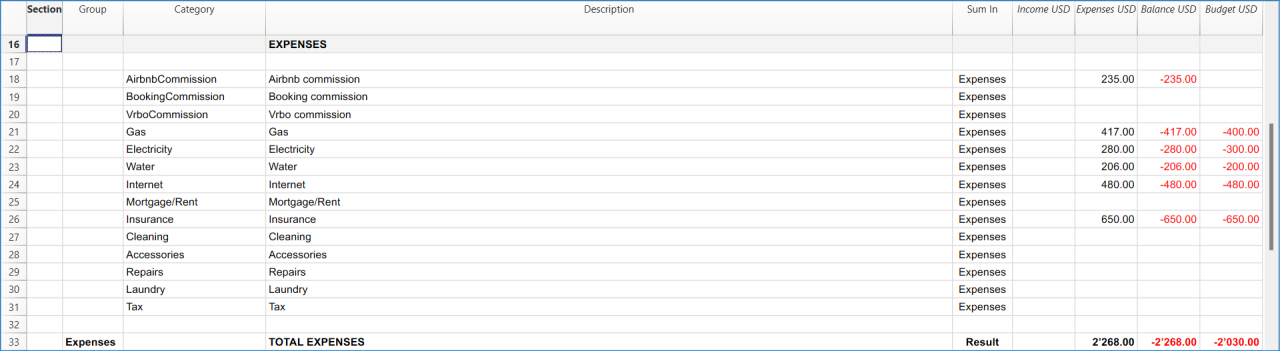

Categories table

This table contains the income and expense categories and the change in capital. You can edit these categories by adding new items, changing the category name, changing the order and deleting categories that you don’t need. At any time, you can see the updated balances of each category.

With the useful Capital In & Capital Out sections you can register:

- Loan injections and reimbursements

- Owners injections and disbursements

- Sales and purchases of fixed assets

To know at any time how much the current cash flow will be (when you will start to entering daily transactions), you only have to look at the value in the row "Net Cash Change". In this way you will know at a glance if you are having an Inflow or an Outflow and the exact amount.

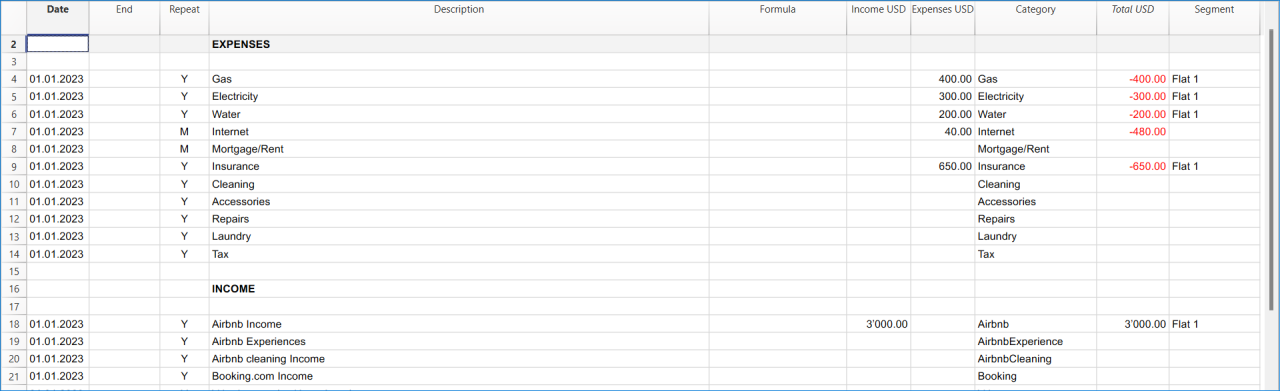

Create your cash flow forecast

The interesting innovation of Banana Accounting is the possibility to create cash flow forecasts to control liquidity and make timely decisions for your business.

For this reason, we now recommend that you create your own cash flow forecast. Go to the Budget table: this table contains all the cash inflows and outflows that you will have during the year.

To create the forecast correctly, follow these simple steps:

- Insert operating income

- Insert operating expenses

- Insert capital in

- Insert capital out

Insert operating income

Start by listing all the operating income you have and the amount of it. Cash sales is the main income, but there are others depending on your activity.

Operating Income may include:

- Cash sales

- Miscellaneous cash receipts

- Collections from customer credit accounts

- Interests

To insert a transaction in the budget you must enter the date (when you expect to have that income), the end date (if needed), the repetition (how often this income is repeated, if weekly, monthly or annual), the description, the amount in the income column and the income category.

In the template you will already find typical ready transactions where you can quickly enter only the amounts. You can still insert new transactions, edit and delete them.

To be as precise as possible with the estimate, look at last year’s values, rounding down the amount when you want to be more cautious.

Tips:

- Only rely on assured income

- Group the income according to their repetition (weekly, monthly, annual, …)

Insert operating expenses

Now it’s time to list all the operating costs. As you did for the income, here you have to estimate expenses by looking at last year’s values, but rounding up the amounts when you want to be more cautious. It’s always better to make an inaccurate forecast at the beginning of the year, than to have surprises of higher expenses.

Operating costs may include:

- Salaries

- Payroll

- Rent

- Insurances

- Advertising and promotion

- Utilities

- Travels

- Telephone

- Bank charges

- Interests

- …

Tip:

- Group the expenses according to their repetition (weekly, monthly, annual, …)

Insert capital in & out

This section is very useful to have a net cash flow forecast and not just an operational one. You must then enter the expected capital in and out transactions, the investments and disinvestments in fixed assets.

Capital In may include:

- Loan injections

- Cash injections by owners

- Sales of fixed assets

Capital Out may include:

- Loan reimbursements

- Cash disbursements to owners

- Purchases of fixed assets

Control your cash flow forecast

It’s important to know right away whether your business, thanks to your estimates, generates a positive cash flow or not. Are you curious, aren’t you? The generation of the forecast report will give you the answer!

To do this check is very easy: just go to Reports → Enhanced statement with groups, and from the list that appears choose the Yearly forecast report. Press OK to view the forecast report.

A goal of any activity is certainly to have a positive cash flow, because only this allows it to survive, or rather to pay suppliers, reimburse debts, ... Check the Net cash change item (at the bottom of the report) and make sure that you have a positive result (Inflow). If so, you can be happy, because you are managing your business well!

On the other hand, if you have a negative net cash flow (Outflow), it means that unfortunately your business has difficulties to manage liquidity. What you need to do in this case is first of all to recheck well both your estimated income and expenses, if there are any adjustments to be made or errors to be corrected, that improve the cash flow. If you still have a negative cash flow, you need to think about actions to be taken to improve liquidity management from next year or when the forecast period starts. Most likely you will have to try to reduce your operating expenses.

In addition to the annual forecast, always in Reports → Enhanced statement with groups, to have even more detailed control over the liquidity trend (for example how it behaves during the year), you can choose monthly, quarterly and 4-years reports, or create your own report.

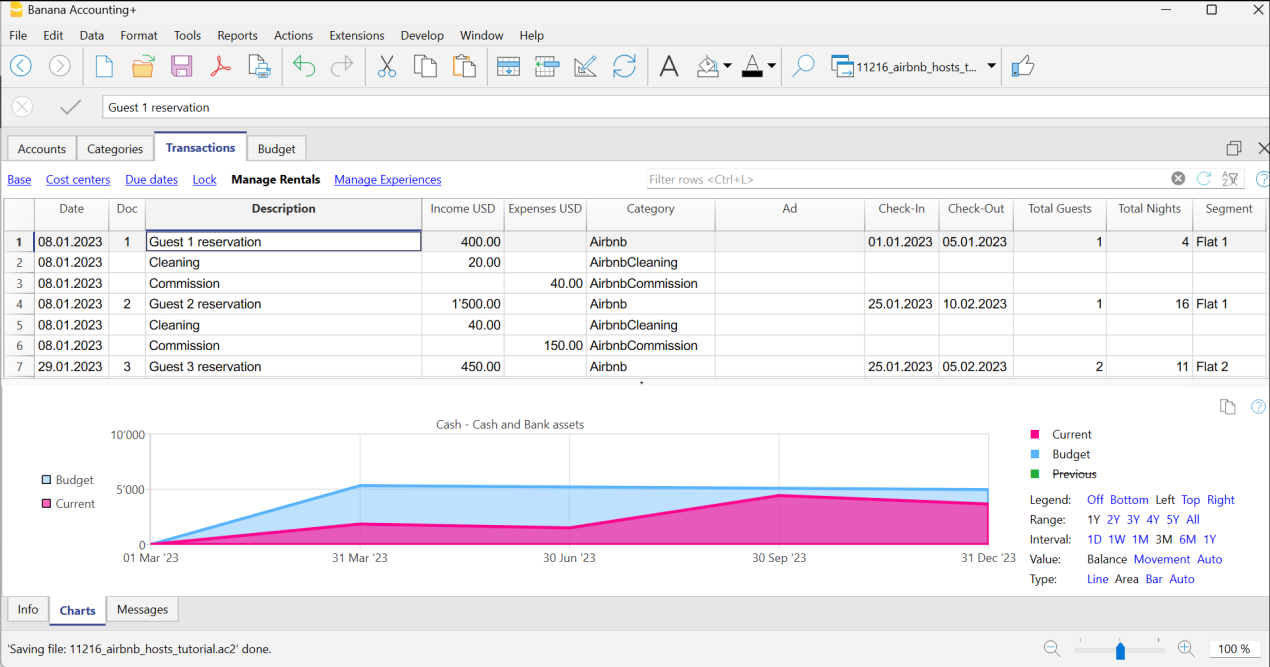

Enter the transactions

With the cash flow forecast under control, you can start register the various real liquidity transactions and compare them from time to time with the expected values.

Insert the liquidity transactions

Daily transactions must be inserted in the Transactions table. Making a registration is the same process as you did for the forecast in the budget table (the only difference is you don’t have the repeat column). There are also some examples in the table that you can delete and edit.

Check the movements with account cards

When you gradually enter your transactions, could be useful to check how the cash account or a particular expense category has evolved over time. To do this you can view the respective Account/Category Card.

For example, by selecting the Cash account card you will have a summary of all its movements. By also clicking on the chart option at the bottom, you have an even more immediate view of the account's performance.

Tip: Check your Cash account at least once a month to see immediately how it is progressing and compare it with past months.

Check the difference between balance and budget

For more control over your performance, you can go to the Account or Categories table, selecting the Budget view and look at the Diff.Budget column, which shows you the difference between the real balances and the values you had budgeted. In this way you have an additional indicator to understand if you are following the budget well and to take better decisions.

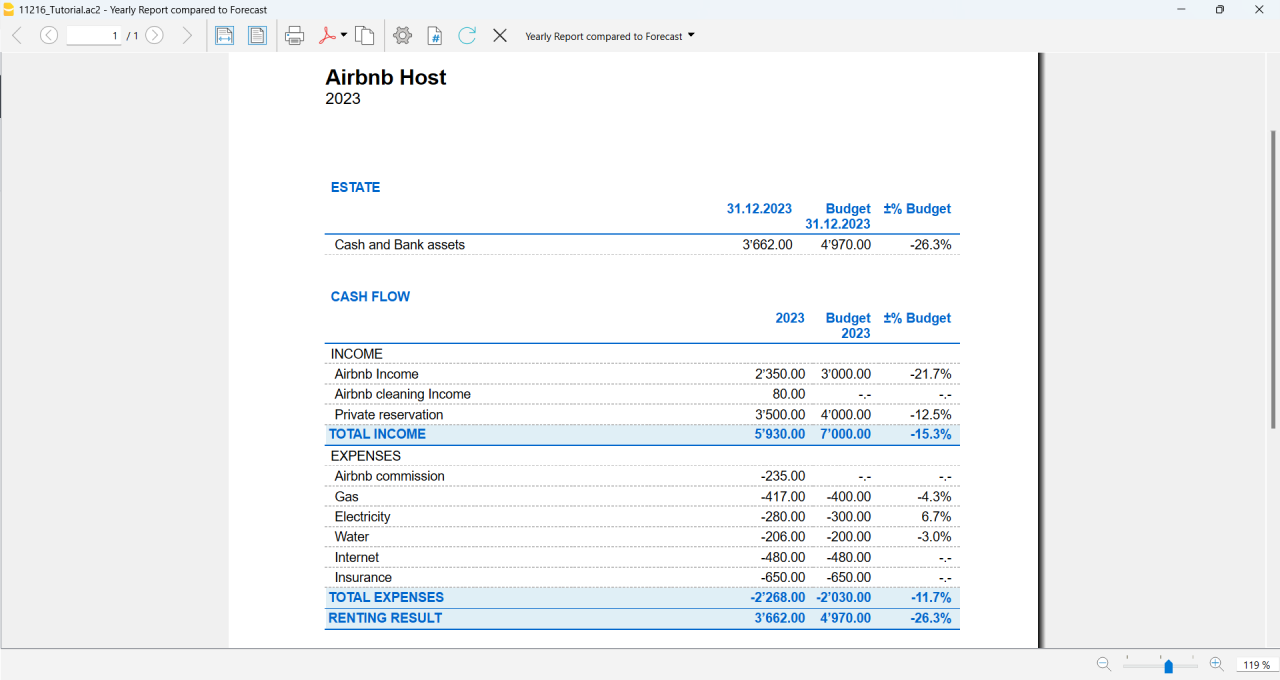

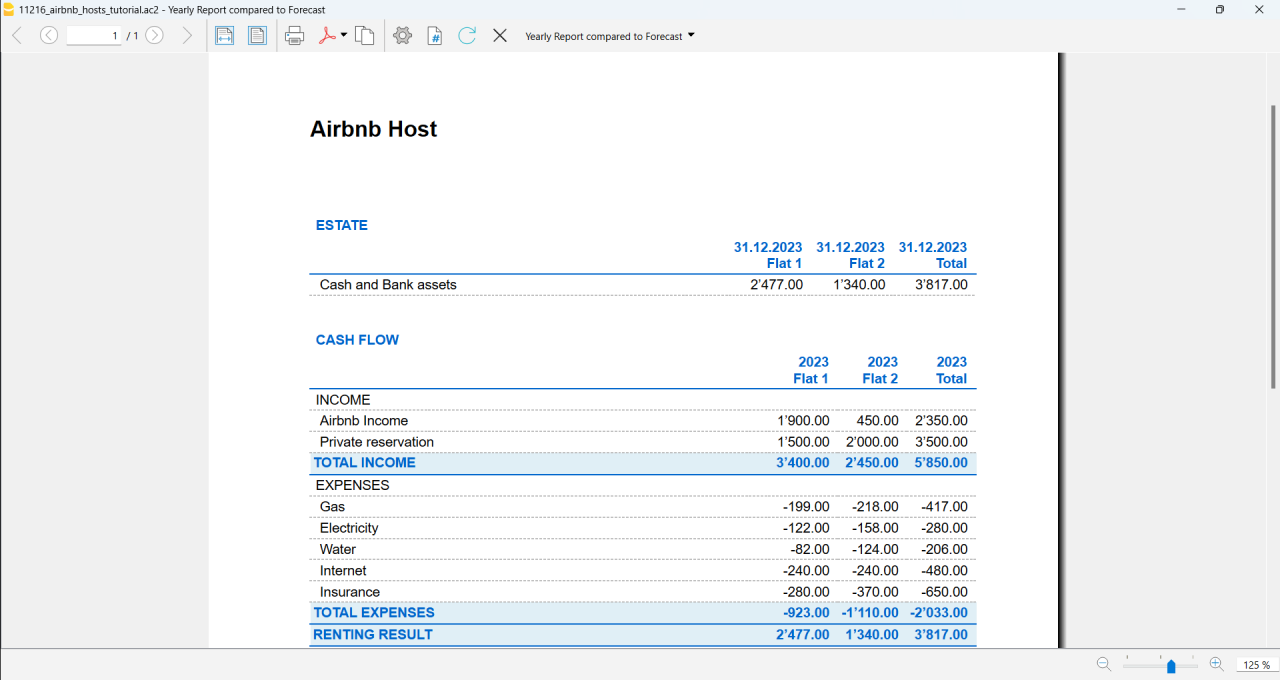

Compare the forecast with the report

During the year you can compare at any time your current situation with the forecast, to understand if and where you are spending more, in order to take decisions in advance. At the end of the year you can make the final comparison between the actual report and the forecast to see if you have achieved the expected net cash flow.

Create the control report from the menu Reports → Enhanced statement with groups → Yearly report compared to forecast.

If you want to have a more precise and targeted view, you can create reports with monthly subdivision, which also include the difference between the balance and budget value of each month. This gives you an overview of the months in which you had the most liquidity difficulties and those in which you earned the most.

You are arrived at the end of the year, so you will now have to re-plan the next one creating a new cash flow forecast, exactly as you have done up to now. Don't stop, only in this way will you see your cash flow improve more and more!

Financial Planning for a Startup | Income and Expense accounting

Financial Planning for a Startup | Income and Expense accountingNote: For this business plan template, the management of a bar or restaurant has been taken as an example, since it is an activity that all people are familiar with and is therefore ideal to understand the functioning of Banana Accounting. Obviously, the template can also be used for other types of activities (Startups) for which you want to do financial and liquidity planning.

Financial and liquidity planning for Luke's Coffeehouse

This section will explain how to set up a financial plan for a new entrepreneurial activity, according to the income and expense accounting model.

Consult the Benefits and Features of Financial Planning section for further information.

Luke plans to open a Coffeehouse in 2022 and is preparing a Financial Plan, including all the necessary details.

- The financing of his project includes his proper means and a loan from a third person.

- In January 2022 he rents the premises, redecorates and furnishes them and starts his commercial activity.

- The Financial Planning is established for the period running from January 2022 through to December 2025.

By entering the detail of the various expenses and income, Luke will be able to generate and print financial statements (cash and other) showing his expenses and revenues, as well as the financial performance for the year, by quarter or any other subdivision of period of his choosing.

The evolution of his bank account balance, in particular, will allow him to track wether the available liquidity will be sufficient for his activity.

Example File

Download the template file and open it with Banana Accounting Plus Software (for further information consult the following template link).

Enter your expected Income and Expense estimates into the Budget table and the financial plan and liquidity projections will immediately be available.

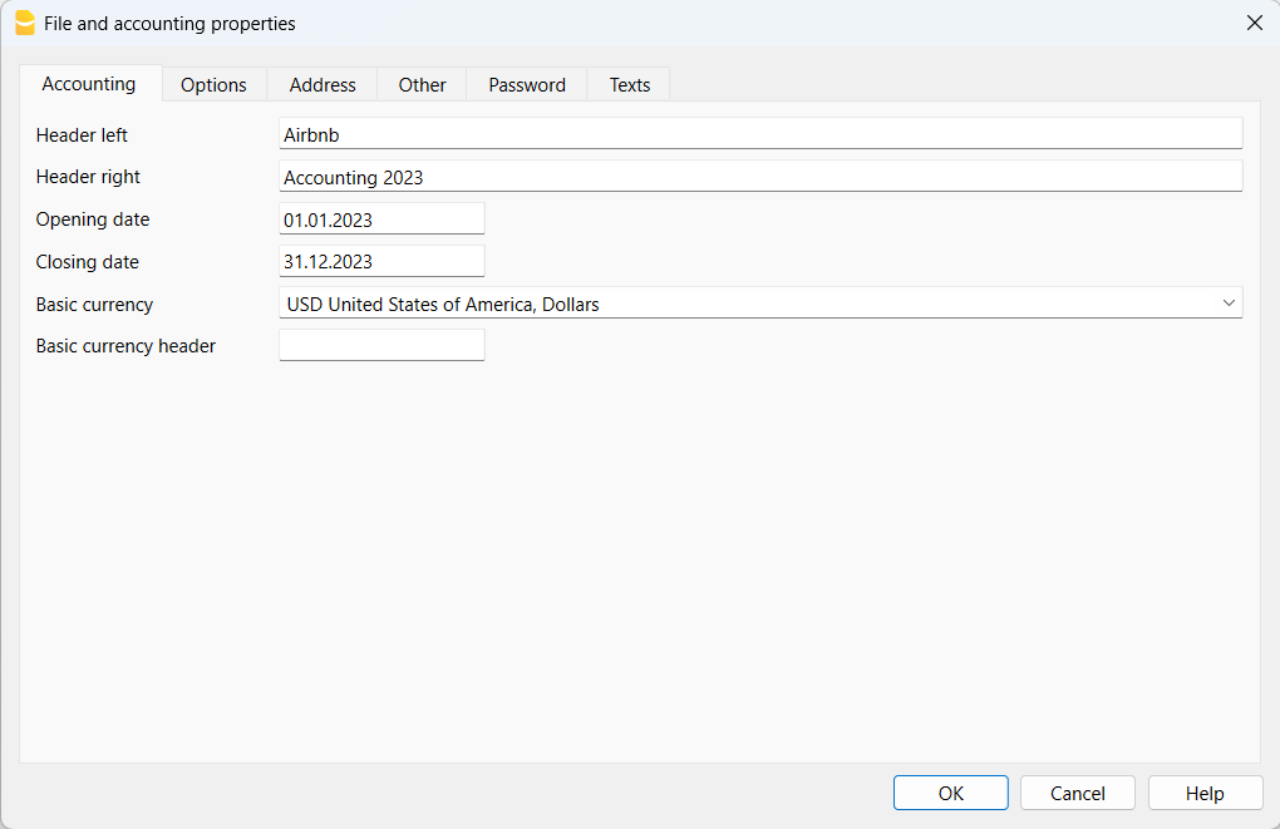

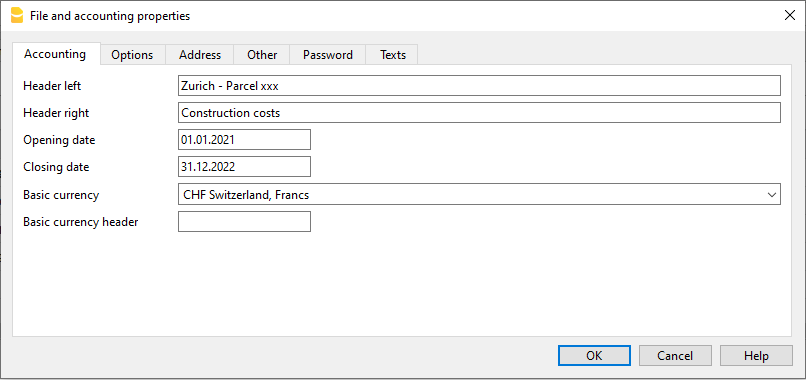

File properties

In the File and accounting properties menu, enter your general data.

Opening date is 1st of January 2022 and closing date December 31st 2022.

This is also the period of calculation that will be used for the Total in your Budget column.

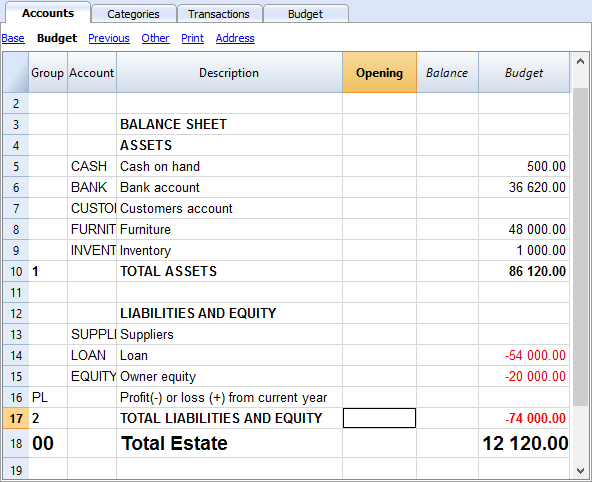

The Chart of Accounts

The following example will explain the functioning of the Budget table.

- The Chart of Accounts is is simplified to it's essence.

- Comprehensive name for accounts are used to illustrate the use of Banana Accounting Plus.

- Opening. The activity starts from scratch, so there are no opening balances.

- Budget. This is the overall budget at the end of the accounting period.

As you see, this represents the balance sheet and income statement at the end of the budgeting period.

If your activity is less complex, you may alter your Chart of Accounts accordingly.

If you require a more structured Chart of Accounts, it is recommended to set off with one of Banana Accounting Plus's Chart of Accounts templates and then add the Budget table.

The Accounts table

Enter your Balance Sheet data (Assets and Liabilities) here.

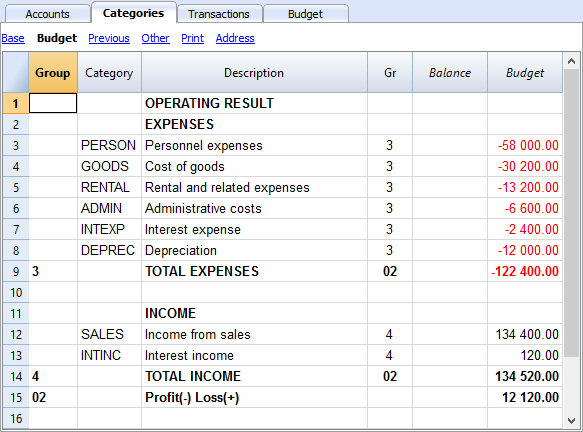

The Categories table

Enter your Operating data (Expenses and Income) here.

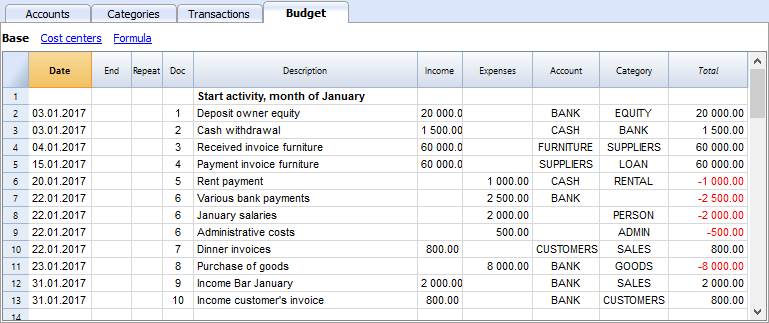

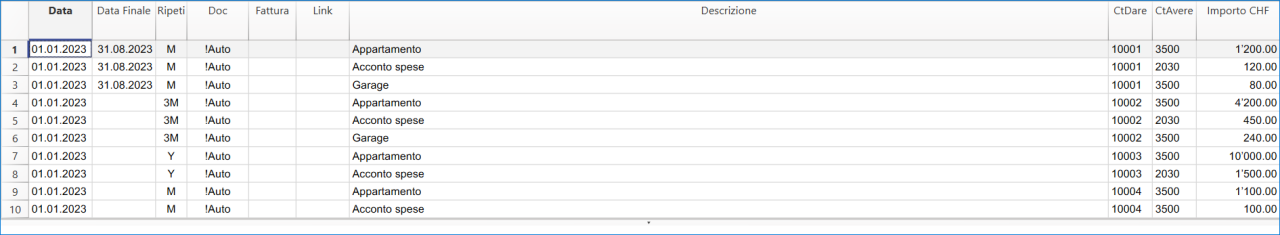

The Budget table

The Budget table (check explanations about the use of columns), is where data relative to your Financial Planning are entered.

Financial Planning is set up by entering forecasts such as income and expenses in the Budget table. The budget table offers some additional columns that make Financial Planning easier, such as:

- Repeat.

Entering “M” = Monthly will return your operation for each following month.

If left blank, the operation will only take place once. - End (Data).

Used in conjunction with Repeat, this will determine the last date when the operation will be repeated. - Total.

The total amount recorded in the current year.

Transactions for January

Those are identical to entering in the transactions table, because there is no Repeat yet.

This is the first month of running the Coffeehouse and there are the registration of the owner's equity, the payment of the furniture and the accession to a loan.

The entering in the below screenshot, such as first month's rent, were included as non-repetitive recordings, to illustrate some simple recordings that contain no Repeat.

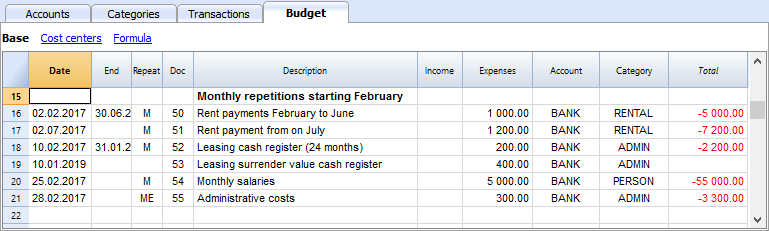

Repetitive transactions for February

Operations that are occurring on a monthly basis are entered in February.

- The rent from January to June is of 1'000 per month and increases to 1'200 as per July.

- Doc 5:

The first rent was paid cash. There will probably also be the downpayment of a guarantee. - Doc. 50:

The rent of 1'000 is budgeted from February to June.- On February 2 the rent is paid from the BANK account.

In the following months the payment of the rent will figure on to 2nd day of each month. - The End date is the 30th of June.

The last rent of 1'000 will be on the 2nd of June. - Repeat. M = monthly.

- Total 5,000 (5 x 1'000), automatically calculated, is the total amount for the transaction during this period.

- On February 2 the rent is paid from the BANK account.

- Doc 51:

Rent is budgeted from July onwards.- Date 2nd of July.

In the following months the payment of the rent of 1'200 will figure on to 2nd day of each month. - End

As no date is indicated, this expense will be repeated for all the following months and years. - Repeat. M = monthly.

- Total 7'200 (6 x 1'200) is automatically calculated.

Represents six months' rent from July to December.

- Date 2nd of July.

- Doc 5:

- Doc. 52.

The leasing of the Cash Register.- Date is 10th of February.

- End (of lease) January 31st 2019. When the last installment on the lease is due.

- Repeat. M = monthly.

The operation will be repeated each month, the last time in January 2019. - Account the BANK.

- Category Administrative expenses.

- Amount 200.00 monthly lease rate.

- Total 2'200 (200 x 11 months).

- Doc. 53.

Payment towards the lease redemption.

This operation only takes place in 2019, but is included here, because it is linked to the monthly lease.- Date is 10th February 2019.

- Account the BANK.

- Category Administrative expenses.

- Amount 400.00 the release amount.

- Total empty because there is no expenditure in the current year.

- Doc. 54:

Monthly salaries.

- Date: 25th of February.

- Repeat. M = monthly.

The operation will be repeated on the 25th of each month to come. - Total 55'000 (5 x 11 months).

- Doc. 55.

Administrative expenses (this is an approximation: for a correct budgeting, entering for each separate expense will be necessary).- Date 28th of February.

- Repeat is ME = Month End.

The operation will be repeated every month on the last day of the month.

In March it will be on 31st, April 30nd and so on. - Amount 300.00

- Total 3'300 (300 x 11 months)

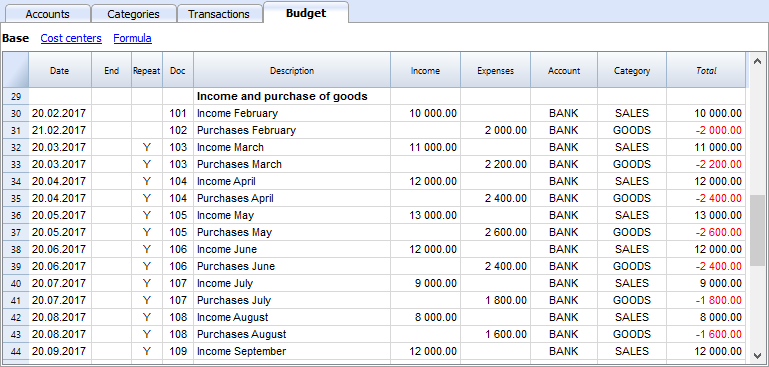

Budgeting for income and purchase of goods

Income and goods purchases are itemized below as monthly amounts, taking into account that there might be important monthly fluctuations.

It might prove more appropriate to use separate turnover figures for drinks or/and food.

February's Repeat column is empty, as we expect a higher figure for he next year and this will be added at a later stage.

From March onwards, the turnover is considered to be representative for the years to come.

Calculations for Income and Expense will be calculated on a monthly basis by Banana 8 Accounting Software.

- Doc 101

Income indications for February

- Date 20th of February.

Income occurs on every day of a month. We choose a date towards mid-month as an approximated level of liquidity. - Repeat no repetition.

A higher figure is expected next year and will be recorded in the successive year. - Account Cash register receipts that are deposited in BANK.

- Category Provenance of SALES deposited.

- Amount 10'000.00.

- Total The next operation falls within next year, hence, the total represents one single amount.

- Date 20th of February.

- Doc 102

Indication of forecasted costs for goods, on a pro rata 20% monthly basis.

- Date 21st of February . The day after entering the sales transactions.

- Repeat no repetition.

The operation will be repeated on the 21st of each following month.

Therefore, cost of goods will be calculated each month as a percentage of purchases of sales account transactions. - Account Payments are settled via BANK.

- Category Purchase of GOODS.

- Doc 103

Two lines, which are similar to Doc 101 and 102, but for March.- Repeat Y= yearly. Turnover and costs for the month of March for subsequent years.

- Doc 104 through to Doc 112

Each 20th of the month projected sales for the different months of the year are indicated.

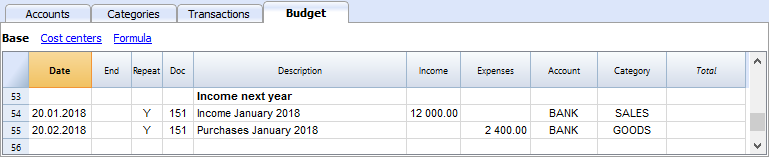

Following Years' Proceeds

Transactions can also be indicated for the following years.

These data will be used to establish budgets for the years to come.

The Total column will remain empty, as these values are out of scope and only refer to the current accounting period.

- Doc 151

Transaction entering similar to the previous year

- Date 20th of January

- Repeat Y = yearly

This will be repeated in the subsequent years. - Total empty (calculated automatically).

- The Total column remains empty, as these values are out of scope for current accounting period, and will not be indicated in the Total column which refers to the current period.

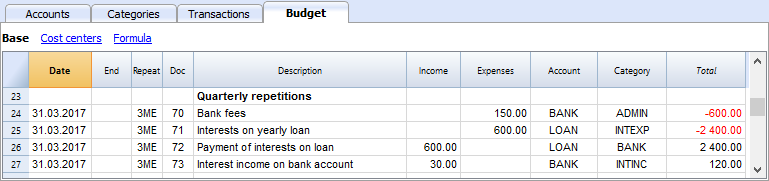

End of quarter

Indications of some typical entries that are repeated at the end of quarter.

- Doc 70

Indications of some typical entries that are repeated at the end of quarter.- Dat 31st of March.

- Repeat 3ME 3 Months End.

- Category ADMIN. Administrative costs, this would normally be financial bank charges.

- Amount 150 (Automatically calculated) by multiplying the quantity by the unit price.

- Total 600 (Automatically calculated) 150 quarterly until the end of the year.

- Doc 71

Interest on the loan that must be paid quarterly.- Date 31st of March

- Repeat 3ME 3 Months End.

- Account LOAN interest is added to the loan.

- Category INTEXP interest on loan.

- Amount interest for current quarter.

- Total interest for the current year.

- Doc 72

Interest accrued on the LOAN is payed from the Bank count.- Date 31st of March.

- Repeat 3ME 3 Months End.

- Account LOAN interest owned on liabilities.

- Category BANK account used for payment.

- Formula "interest“ content of variable interest (value saved in the operation Doc 71).

- Amount the result of the formula, i.e. the interest for this quarter.

- Total interest for the current year,

.

- Doc 73

Interest earned on current account with the Bank.- Date 31st of March.

- Repeat 3ME 3 Months End.

- Account BANK where interest is received.

- Category INTINC interest income.

- Amount is interest income for this quarter.

- Total interest for the current year,

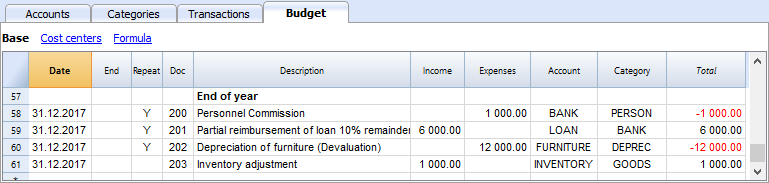

Year End

Some typical operations might take place at year end. Here, we use Repeat "Y" in order for them to be carried out for subsequent years.

- Doc 200

Attribution to staff of a 1% commission on annual sales at the end of the year.- Date 31st of december.

- Repeat Y= calculation is repeated each year.

- Account BANK

- Category PERSON Personnel expenses.

- Amount is the commission payed to the sales staff.

- Total identical to Amount.

- Doc 201

Reimbursement of 10% of the outstanding loan.- Date 31st of december.

- Repeat Y= calculation is repeated each year.

- Account LOAN account (reimbursement of your loan).

- Category BANK Bank account used for reimbursement.

- Amount 6'000 is the equivalent of 10% of your total Loan.

- Total identical to Amount.

- Doc 202

Used for depreciation for your furniture.

- Doc 203

Assessment of your Inventory value.

This is non-repetitive because the assessment will be based on asset values of your inventory at each year end.

Compositions

Use the create new compositions command to generate new compositions for the printout including print parameters already preset in Budget and enhanced for groups.

You can preset the prints configuration according to your requirements.

If you understand how compositions functions, you will be able use it with other commands and create prints or other adapted to your own purpose.

Reports in the Accounts table

In the Accounts tab, view Budget to access the updated budget amounts.

Financial and liquidity planning for the first year

Use Command

- Reports -> Quarterly forecast 1. evolution during the first year can be seen.

The composition that has been set up can be visualized as

- Breakdown by Period -> Quarter

These two prints will allow you to apprehend:

- The economic forecast (expenses and income) and budgeting of the current financial year.

- The detailed evolution of liquidity in your bank's current account.

Modifying or Creating a new composition will give you a breakdown by month.

As per month

Financial and liquidity planning for a four year period

Use Command

- Reports -> Forecast 4 years

This will display the predefined composition for:

- Period from 01/01/2017 to 31/12/2020

In this report, you can specify a period that differs from the accounting period.

The program will then project the data for the specified period. - Subdivision per year.

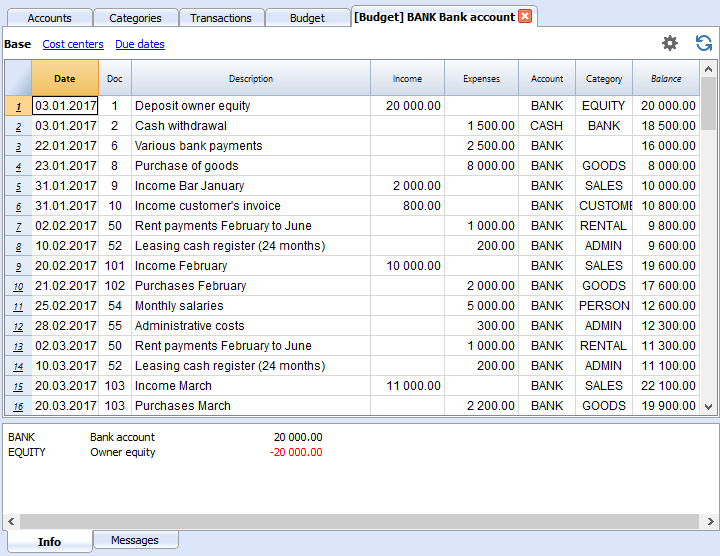

Account Card

After opening the Budget table, click on the BANK cell and all budgeted transactions contained in the account card will be displayed.

Double-Entry Accounting Tutorial File Budgeting and Financial Plan for a Startup

Double-Entry Accounting Tutorial File Budgeting and Financial Plan for a StartupWhether you're planning to start a new business, or setting up a business plan, it is of the utmost importance to manage your liquidity projections. Especially at the beginning of a new activity, this could easily happen to land yourself in financial difficulties.

Banana Accounting software offers you the possibility to set up your financial planning and liquidity projections, allowing monitoring on a daily basis, with a high degree of accuracy. It allows you to project your accounting into the future and manage the years ahead of you in your ledger.

Note: For this business plan template, the management of a bar or restaurant has been taken as an example, since it is an activity that all people are familiar with and is therefore ideal to understand the functioning of Banana Accounting. Obviously, the template can also be used for other types of activities (Startups) for which you want to do financial and liquidity planning.

Financial planning and liquidity management of Luke's Restaurant

This section will explain how to set up a financial plan for a new entrepreneurial activity, according to the double-entry accounting model.

Consult the Benefits and Features of Financial Planning section for further information.

Luke plans to open a restaurant in 2022 and is preparing a financial plan, including all the necessary details.

- The financing of his project includes his proper means and a loan from a third person.

- In January 2022, he rents the premises, redecorates and furnishes them and starts his commercial activity.

- The Financial Planning is established for the period from January 2022 to December 2025.

Below you have an example of a monthly planning that Banana Accounting can make easy for you:

Economical forecasting and liquidity management

This model will help you to learn about the different features of Financial planning in Banana Accounting software. Some features, such as formulas, will be used in more advanced cases. The possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

- Use of budgeted transactions

- Repetitive transactions

- Using Quantities and Price

- Using Formulas

- Using Variables

- Calculation of interest on Asset and Liability Accounts

- Carrying forward of account balances

- Carrying forward of transactions recording

- Budgeting for one financial year divided by quarter, including results and liquidity projection

- Budgeting for several financial years, including results and liquidity projection

The File Properties

Opening date is 1st of January 2022 and closing date December 31st 2022.

This is also the period of calculation that will be used for the Total column in your Budget.

The Chart of Accounts

This example is intended to explain the functioning of your Budget table of forecasts.

- The Chart of Accounts, reduced to it's essence.

- Comprehensive name for accounts are used to illustrate the use of Banana Accounting software.

- Opening Basic Currency. The activity starts from scratch, so there are no opening balances.

- Budget Basic Currency. It's the overall budget at the end of the accounting period. Notice that this represents the balance sheet and income statement at the end of the budgeting period.

Create your own Chart of Accounts

The Chart of Accounts defines the elements of Expenses, Income and Investments. In case you want to subdivide the expenses more in detail, you need to add other accounts.

Rather than starting with a very simple Chart of Accounts and add on accounts and groups, it is recommended to start with a more structured Chart of Accounts. Banana Accounting software offers different Charts of Accounts templates, and it is recommended to choose and adapt the one closest to your needs and then add the Budget tab .

The Budget table

The budget table (see also explanation on columns) is where you insert recordings relative to the planning.

The financial plan is inserted via normal entering in double-entry bookkeeping in the Budget table. The budget table provides additional columns that greatly facilitate the preparation of the financial plan.

- Repeat

If you specify "M" = Monthly, for example, this will generate monthly registration for all subsequent months.

If the cell is left empty, the operation will be performed only once. - End (Date)

Used in combination with Repeat, setting the last date when the operation will occur. - Total

The total amount recorded in the current year. - Quantity, Price

Allows for indication of the combination of values on the basis of which the amount will be calculated. - Formula

Allows you to specify a formula for calculating the amount.

The formula has priority for the calculation of the amount.

Transactions for January

Those are identical to entering in the transactions table, because there is no Repeat yet.

This is the first month of the Coffeehouse's exploitation and these are the registrations of the owner's equity, payment of the furniture and the accession to a loan.

The entering shown in the below screenshot, such as first month's rent, were included as not repetitive recordings, to illustrate some simple recordings that contain no Repeat.

Repetitive transactions for February

In February, enter the transactions that will occur on a monthly basis

- The rent from January to June is of 1'000 per month and increases to 1'200 as per July.

- Doc 5:

The first rent was paid cash. There will probably also be the payment of a guarantee. - Doc. 50:

The rent of 1'000 is budgeted rom February to June.- On 2nd Februar the rent is paid from the bank account.

In the following months the payment of the rent will figure on to 2nd of each month. - End Date is 30th June.

The last rent of 1'000 will be on 2nd June. - Repeat. M = monthly.

- Total 5'000 (5 x 1'000, automatically calculated) is the total amount for the transactions during this period.

- On 2nd Februar the rent is paid from the bank account.

- Doc 51:

Rent Budgeted from July onward.- Date 2nd July.

In the following months the payment of the rent of 1'200 will figure on to 2nd of each month. - End

As no date is indicated, this expense will be repeated for all the following months and years. - Repeat. M = monthly.

- Total 7'200 (5 x 1,200), automatically calculated.

Represents six months' rent from July to December.

- Date 2nd July.

- Doc 5:

- Doc. 52.

The leasing for the cash register.- Date is 10th of February.

- End (of lease) January 31st 2024. When the last installment on the lease is due.

- Repeat M = monthly.

The operation will be repeated each month, the last time in January 2024. - Debit A/C Administrative fees.

- Credit A/C BANK (used for payment).

- Amount 200.00 monthly lease rate.

- Total 2,200 (200 x 11 months).

- Doc. 53.

Payment towards the lease redemption.

This operation only takes place in 2024, but is included here, because it is linked to the monthly lease.- Date is 10th February 2024.

- Debit A/C Administrative fees.

- Credit A/C BANK (used for payment).

- Amount 400.00 the release amount.

- Total empty because there is no expenditure in the current year.

- Doc. 54:

Monthly salaries.- Date: 25th February.

- Repeat. M = monthly.

The operation will be repeated on the 25th of each month to come.. - Total 55,000 (5'000 x 11 months).

- Doc. 55.

Administrative expenses (this is an approximation: for a correct budgeting entering for each separate expense will be necessary).- Date is 28th February.

- Repeat is ME = Month End.

The operation will be repeated every month on the last day of the month.

In March it will be on 31st, in April 30th and so on. - Amount 300.00.

- Total 3,300 (300 x 11 months).

Budgeting for income and purchase of goods

Depending on the type of business activity, the most appropriate way to specify the revenues must be chosen.

Income and goods purchases are itemized below as monthly amounts, taking into account that there might be important monthly fluctuations.

It might prove more appropriate to use separate turnover figures for drinks or/and food.

February's Repeat column is empty, as we expect a higher figure for he next year and this will be added at a later stage.

From March onward the turnover is considered to be representative for the years to come.

Indications of forecast income and merchandise costs, calculated on a monthly basis.

- Doc 101

Income indications for February- Date: 20th February.

Income occurs on every day of a month. We choose a date towards mid-month as an approximated level for liquidity. - Repeat Empty (no repetition).

A higher figure is expected next year and will be recorded in the successive year.. - Debit A/C Cash register receipts that are deposited in BANK.

- Credit A/C Provenance of receipts in SALES account.

- Amount 10'000.00.

- Total 10'000.00 The next operation falls within next year, hence the total represents one single amount.

- Date: 20th February.

- Doc 102

Indications of forecast costs for goods, on 20%a pro rata monthly basis.- Date 21st February. The day after the entering of the sales transaction.

- Repeat no repetition.

The operation will be repeated on the 21st of each following month. Therefore, each month cost for goods will be calculated as a percentage of purchases of sales account transactions. - Debit A/C GOODS costs to be recorded in goods Account.

- Credit A/C BANK payment of goods costs through the bank.

- Doc 103

Two lines, which are similar to Doc 101 and 102, but for March.- Repeat Y=Yearly. Turnover and costs for the month of March for subsequent years.

- Doc 104 through to Doc 112: Each 20th of the month projected sales for the different months of the year are indicated.

Following Years' Proceeds

Transactions can also be indicated for the following years..

These data will be used to establish budgets for the years to come.

The Total column will remain empty, as these values are out of scope and only refer to the current accounting period.

- Doc 151

Transaction entering similar to the previous year- Date 20th January.

- Repeat Y = Yearly.

This will be repeated in the subsequent years. - Total empty (calculated automatically). The Total column will remain empty, as these values are out of scope and only refer to the current accounting period.

End of quarter

Indications of some typical entries that are repeated at the end of a quarter.

- Doc 70

Here's an example for the use of the quantity and price column.

Known bank charges are 50 per month and we indicate the amount for a 3 months period.- Date 31st March.

- Repeat 3ME=3 Months End.

- Debit A/C ADMIN. Administrative costs, this would normally be financial bank charges.

- Credit A/C BANK. Administrative costs.

- Amount 150 (Automatically calculated) by multiplying the quantity by the unit price.

- Total 600 (Automatically calculated) 150 quarterly until the end of the year.

- Doc 71

Interest on the loan that must be paid quarterly.- Date 31st March.

- Repeat 3ME=3 Months End.

- Debit A/C INTEXP interest expense on liabilities.

- Credit A/C LOAN interests are added to the loan.

- Amount interest for current quarter.

- Total interest for the current year.

- Doc 72

Interest accrued on the LOAN are payed from the Bank count.- Date 31st March 31.

- Repeat 3ME=3 Months End.

- Debit A/C LOAN interest expense account.

- Credit A/C BANK the account used to pay interest.

- Amount the result of the formula, i.e the interest for this quarter.

- Total total interests for the current year.

- Doc 73

Interest earned on current account with the Bank.- Date 31st March 31.

- Repeat 3ME=3 Months End.

- Debit AC BANK Bank account.

- Credit A/C INTINC interest income.

- Amount interest income for this quarter.

- Total total interest for the current year.

Year End

These are some year-end operations. Here we use Repeat "Y" in order for them to be carried out for subsequent years.

- Doc 200

Attribution to staff of a 1% commission on annual sales at the end of the year.- Date 31st December.

- Repeat Y= calculation is repeated each year.

- Debit A/C PERSON Personnel expenses.

- Credit A/C BANK Bank account.

- Amount is the commission payed to the sales staff.

- Total identical to Amount.

- Doc 201

Reimbursement of 10% of he outstanding loan- Date 31st December.

- Repeat Y calculation will be repeated each year.

- Debit A/C LOAN Loan account (your liability).

- Credit A/C BANK Bank account used for reimbursement.

- Amount 6'000 is the equivalent of 10% of your total Loan.

- Total identical to Amount.

- Doc 202

Use for the amortization of your furniture. - Doc 203

Use for adjustment of your inventory.

This is non-repetitive, because the assessment should be based on the asset values of your inventory.

Customization

Use the create new customization command to generate new customization for the printout including print parameters already preset in Budget and enhanced for groups.

You can preset the prints configuration according to your requirements.

If you understand how customization works, you will be able to use it with other commands and create prints or other adapted to your own purpose.

Reports in the Accounts table

In the Accounts tab, view Budget to access the updated budget amounts.

Financial and liquidity planning for the first year

With Command

- Reports → Enhanced balance sheet with groups → Quarterly forecast 1st year, the evolution during the first year can be seen.

The customization that has been set up can be visualized

- Breakdown by Period → Quarter

These two prints will allow you to apprehend:

-

The economic forecast (expenses and income) and budgeting of current financial year..

- The detailed evolution of liquidity in your bank's current account.

Modifying or Creating a new customization will give you a breakdown by month.

By month

Financial and liquidity planning for a four year period

With Command

- Reports →Enhanced balance sheet with groups → Budget 4 years

This will display the predefined customization for:

- Period from 01/01/2022 to 31/12/2025

In this report, you can specify a period that differs from the accounting period. The program will then project the data for the specified period. - Subdivision per year.

Account card

After opening the Budget table, click on the BANK cell and all budgeted transactions contained in the account card will be displayed.

Tutorial file for amortisation and interest calculation with budget's formulas

Tutorial file for amortisation and interest calculation with budget's formulasThe possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

Tutorial file for using Formulas for Budgeting and Financial Planning

Tutorial file for using Formulas for Budgeting and Financial PlanningThe possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

This file contains examples of how to use the Formula tab in the Budget table, as well as the Quantity and Unit price columns.

For explanations about the use of the Budget table and columns consult Budget table page.

Keep in mind that calculations are made in chronological order and not according to the sequence in which your budget registrations were entered.

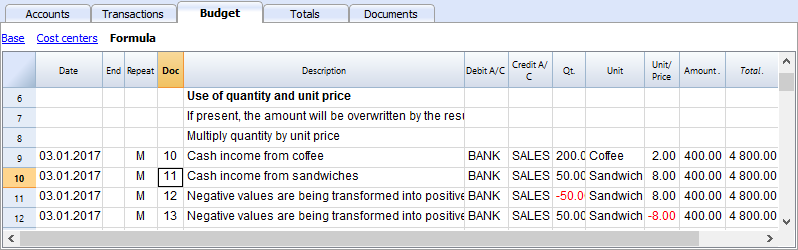

Use of Quantity and Unit price columns

In the Formula view you will see the Qt. (quantity) and Unit/Price columns.

- Doc 10. The Qt column. The number (Unit column) of coffees sold in one month at the price of (Unit/price column) and total income from coffee sales (Amount column).

- Values in the Qt and Unit/Price columns can also be entered as a negative number, but the amount will be shown as a positive value.

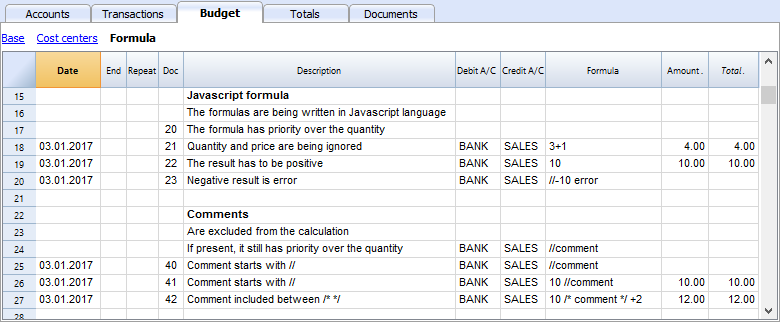

Formula in JavaScript language

The Formula column allows you to enter calculations expressed in JavaScript language.

- If the result of the formula is a number it will be shown as Amount in the respective column.

- Doc. 21+22. You may specify numbers or mathematical expressions.

- Doc 40 e 41. "//" indicates that a comment is entered.

- Doc 42. Text entered between /* e */ are treated as comment and not part of the formula.

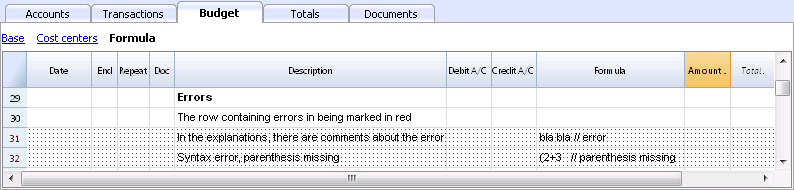

Formula errors

In case of errors, when you enter data:

- The row containing the error is highlighted in red.

- An error text is shown in the “message” window.

In order to avoid constant acoustic signals and popping up of error message windows, the errors have been treated as a comment in the example file (they start with "//").

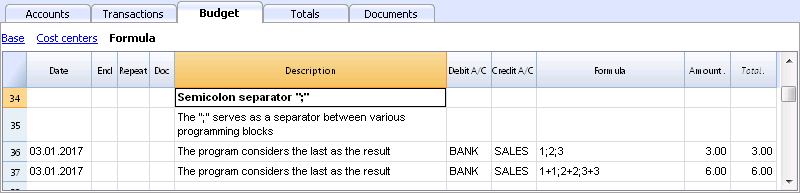

Semicolon separator ";"

JavaScript uses ";" to terminate each line of command. You may concatenate mathematical expressions into one line. The return value will be the result of the last expression.

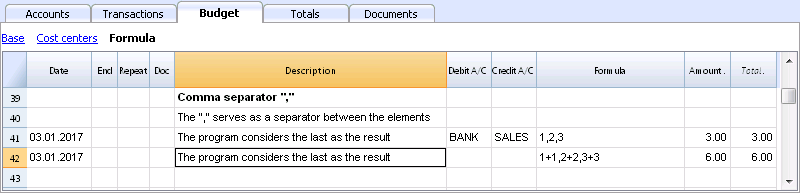

Comma separator ","

In JavaScript, comma is used as a separator between the different expressions in a function. The result value will be the result of the last expression.

Do not use the comma as a decimal separator, because in the formula it will be considered as an expression separator, and therefore numeric values will be truncated.

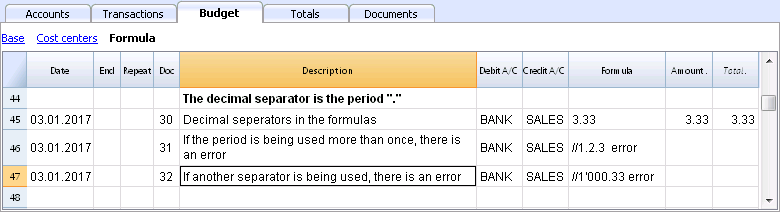

Full stop separator for decimals "."

JavaScript uses full stop "." as a separator for decimals. Regardless of the settings for decimals in your operating system preferences, full stop will always be used.

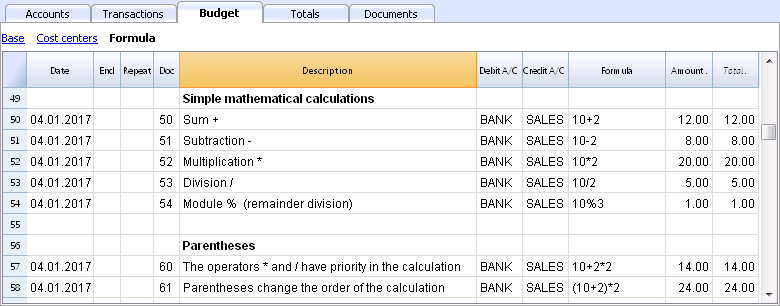

Calculations with simple numbers

You can compound mathematical calculations with simple numbers in the Formula column.

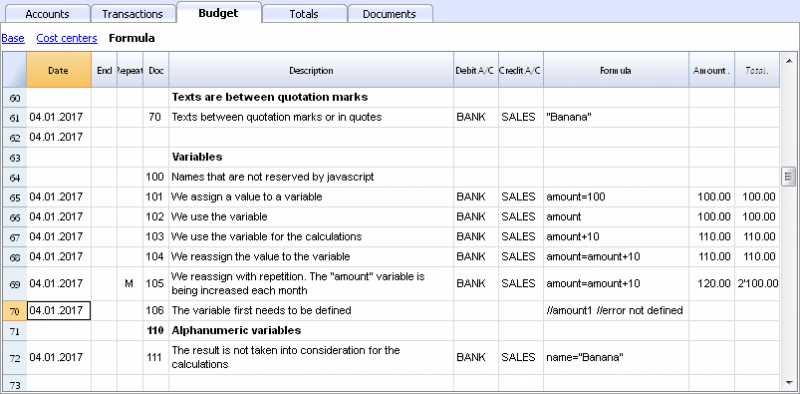

Texts and variables

- Text is contained between quotation marks, as quotes.

- Variables are the elements that mention the values that have been assigned.

- The name of the variable must start with a letter or an underscore.

- First of all, variables must be defined via a “variablename = 100” assigned punctuation.

Examples:

- Doc 70.

"Banana" between quotation marks is a text - Doc 101.

A value of 100 is assigned to the variable. - Doc 102.

The content of the Amount variable will be used. - Doc 103.

The content of the Amount variable will be used, with an increment of 10. - Doc 104.

The content of the Amount variable is assigned to the Amount variable with an increment of 10. The Amount variable will be equal to 110. - Doc 105.

The Formula will be applied on a monthly basis “Repeat=M”- For the first time 110+10 = 120

- For second time 120 + 10 = 130, and so on.

- Doc 106.

If no comment is entered, an error message will signal that Amount1 has not been defined. - Doc 110.

The name “Banana” is assigned to the text Variable.

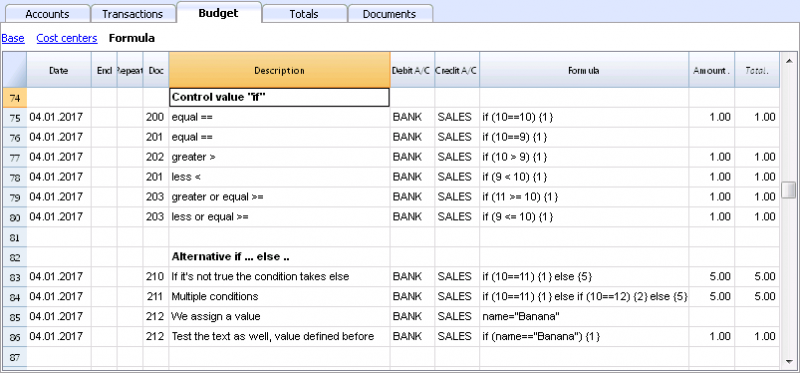

Controls for if .. then .. else flows

You can use all the conditional expressions of JavaScript. The subject is broad and we suggest you to refer to the documentation on the JavaScript language.

In this regard we only want to point out that in JavaScript:

- The equal sign "=" is used to assign a value to a variable "a = 10"

- On the contrary, for comparison, two successive equal signs are used "==". If (10 == 10) {1};

- Doc 200-203

If the criteria given in round brackets after the word "if" is true "(10 == 10)", then the Amount column the result of the next expression contained in curly brackets "{1}" will be shown.

If it is not true "(10 == 9)" the amount will be zero.

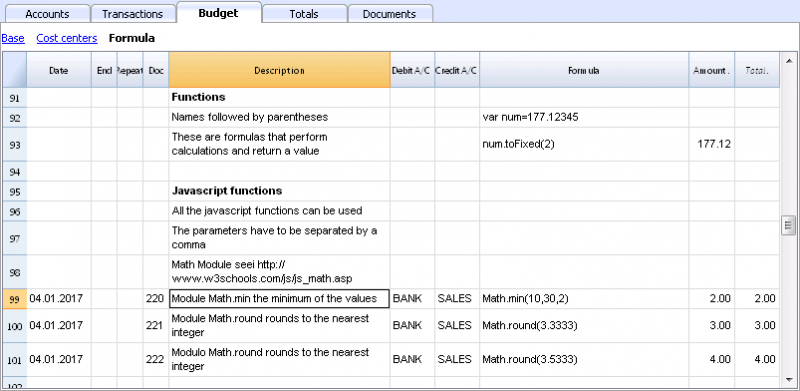

Properties and Functions

Predefined JavaScript functions, such as Module Math.library, can be used (see examples Doc 220-222).

To call up a function, indicate it's name followed by the parameters of the function, indicated between brackets.

- Doc 220.

Math.min(10, 30, 2) will return the minimum value of the values specified between commas.

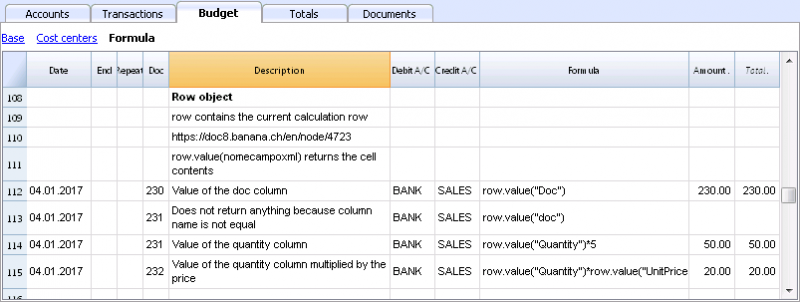

“Row object” for current row

Row object is of the Banana.Document.Row type an refers to the current row.

Specifying the name of a column via the Value function, will return the content of that specific column.

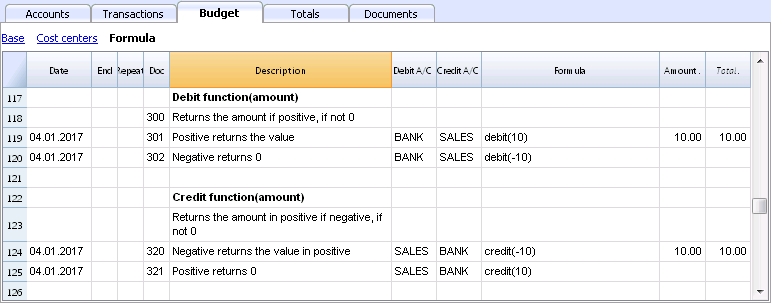

Predefined Debit and Credit functions

Formula only allows for positive values.

- The debit function returns the value entered as a parameter if it is positive.

- The credit function returns the value with as inverted, if the entered value is negative.

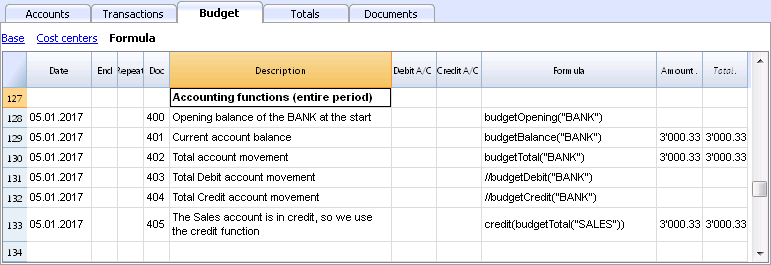

Accounting functions for the entire period

Without indication of a defined period, the use of specific Budget functions will return the values relative to the present situation.

Please note and remember, that data in rows is processed sequentially, so there will be no subsequent values to the line being processed.

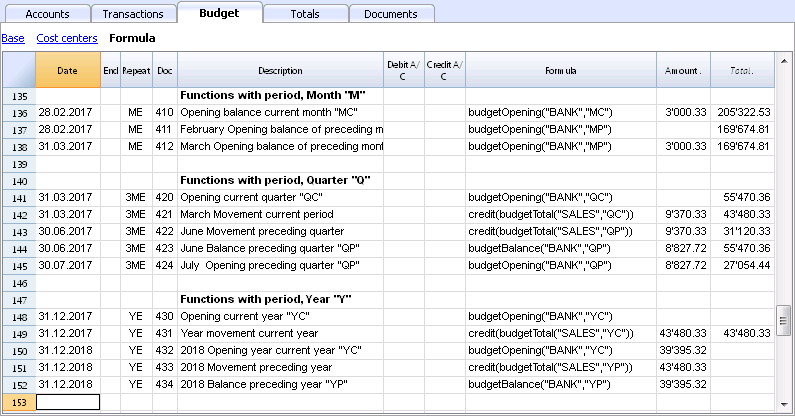

Use of accounting functions for a defined period

Use of accounting functions for a defined period.

The budgetBalance function for the current period will always be the same as the function for the entire period, as the budgetBalance function returns the balance at the end of the period and the last row processed is also the last of the current period.

he budgetOpening and budgetTotal functions, on the contrary, take the initial date into account so it's indication is necessary.

Interest calculation function

The budgetInterest function calculates interest at entering date, on the indicated account on an actual days count basis (365/365.

When calculating interest for the current month, you must indicate month end as the date.

- Doc 500.

The second parameter represents the interest rate, 5 meaning 5%. If debit interest is due, calculation will be effectuated for the corresponding days. - Doc 520.

If credit interest is due, calculation will be effectuated for the corresponding days. This will show as a negative towards the BANK account.

Functions for calculating tax on profit

- Doc 600.

The tax on profit is calculated on the movement in the "budgetTotal" period of the final group of the Profit & Loss statement (in this case the 02).

credit (budgetTotal ("Gr = 02", "YC")) * 0.10- You obtain the group movement in the current year

budgetTotal ("Gr = 02", "YC") - The credit () function returns the value only if it is negative and converts it to positive.

credit (budgetTotal ("Gr = 02", "YC")) - The result is multiplied by 0.10 (percentage 10%)

- In the Debit account, the Tax account of the Profit & Loss statement must be indicated.

- In the Credit account, you must indicate the Bank account or the Treasury credit account.

- You obtain the group movement in the current year

User-defined Functions

In the Documents table, a "_budget.js" file is added where you can define functions in Javascript that can be called in the formula column.

Calculating tax on profit with progressive rate

- Doc 610

The profit is first calculated and assigned to the variable - Doc 611

The profit is passed on to the calcTaxes() function that applies the tax percentage based on the amount and returns the tax amount to be paid.

Other user-defined functions

- Doc 620

The test () function is called, which is also defined in the budget_js document, which simply returns a value.

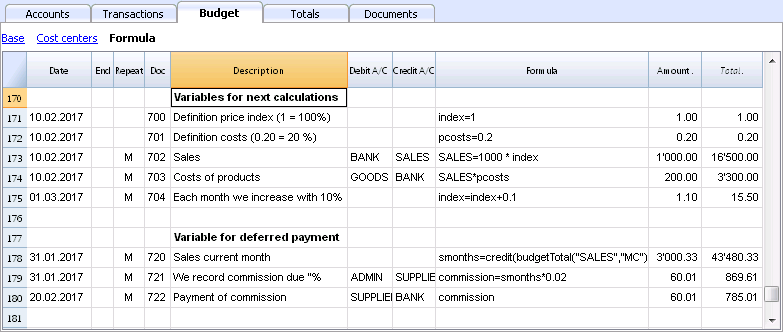

Use of Variables for next calculations

Variables are very useful for storing values for next calculations.

- Doc 700-704.

Indexation of sales.- Doc 700.

Fixation of the index at 1 (100%).

Debit A/C and Credit A/C are not used here, as this row is only used for Definition of the Price index. - Doc 701.

pscosts variable is used for calculation of acquisition cost (0.2=20%) - Doc 702.

Sales are a 1000 multiple of the price index value. - Doc 704.

As per 1st of March the index will be increased by 0.1 (=10%).

As per this date, value of sales will increase in a monthly progression.

- Doc 700.

- Doc 720-722

Monthly sales figures are assigned to months function. Sales commissions are then calculated

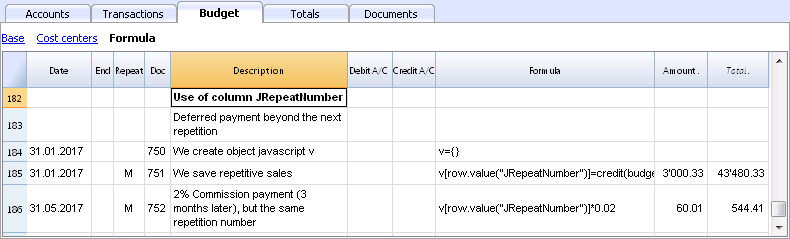

JrepeatNumber Column

When Rows contain a Repeat, insert the Repeat number in the Formula cell as JrepeatNumber.

- First repeat value is 0.

- Second repeat value is 1, and so on.

Use JRepeatNumber when Repeat doesn't allow you to overwrite predefined Variables.

By using JrepeatNumber as a parameter for your object, sequences are registered and can be called at a later stage,

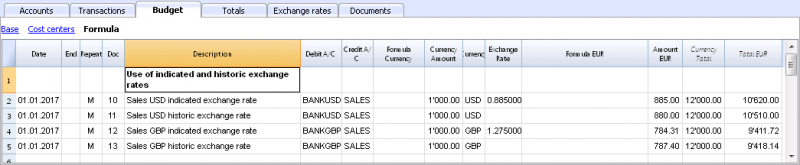

Tutorial File Budget Formulas For Multi-Currency Financial Planning

Tutorial File Budget Formulas For Multi-Currency Financial PlanningThe possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

This example will explain how to use formulas specific to double-entry bookkeeping with multi-currency functionalities.

Documentation on use of formula in the Budget table.

Amount calculation in base currency

The formula will calculate the value in the account's currency first and then the relative value in the base currency.

Exchange rates and historical rates

- Doc 10 and 12.

If an exchange rate is indicated in the exchange rate column, the program will calculate the amount in the base currency (EUR in this case) using the exchange rate indicated in this row. - Doc 11 and 13.

If there is no exchange rate indicated, the program will apply the exchange rate in the Exchange rates table for this calculation as well as for the successive operation in the case a Repeat function is applied.

-

If historical exchange rates are defined in the Exchange rates table, via adding a date, the program will apply the exchange relative to the date or the previous, most recent one.

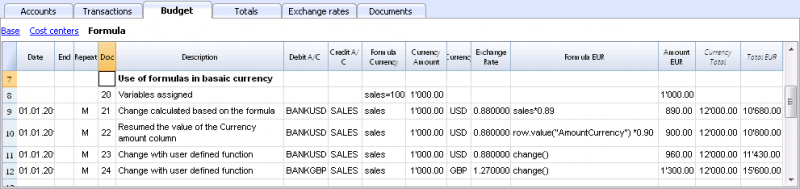

Use of formulas in the base currency

All formulas available in the Budget table can be used in the Formula column.

The following examples show the value in the base currency (EUR) calculated according to a Formula.

- Doc 21.

The sales value is multiplied according to the Formula EUR value. The exchange rate in the corresponding column will be ignored. - Doc 22.

As in the previous example, but for the value of "AmountCurrency" which is the result of the formula. - Doc 23.

In the “budget.js” document we have defined an exchange rate function calculating the value on the basis of the contents in the row.

With these functions it is possible to create exchange rate simulations.

Example for Exchange rate function

The USD exchange rate is established on a monthly basis.

A constant exchange rate is used for GBP instead.

The function will result as the amount of AmountCurrency multiplied by the exchange rate.

function cambio() {

var importo = row.value("AmountCurrency");

var cambio = 1;

var moneta = row.value("ExchangeCurrency");

var data = Banana.Converter.toDate(row.value("JDate"));

var mese = data.getMonth() + 1;

if (moneta == "USD") {

cambio = 0.95;

if (mese == 1)

cambio = 0.96;

else if (mese == 2)

cambio = 0.97;

}

if (moneta == "GBP") {

cambio = 1.30;

}

return importo * cambio;

}

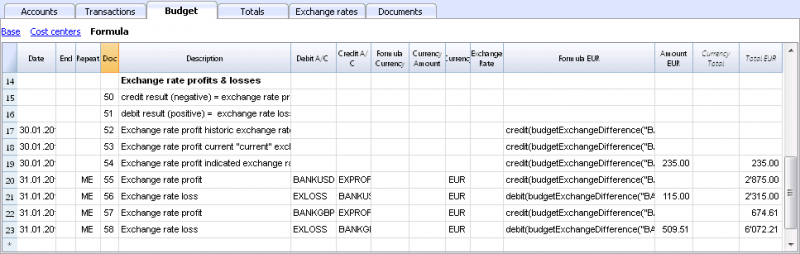

Formulas for calculation of exchange rate differences

For further information on calculation of exchange rate differences please refer to information about transactions in multi currency and to the Create exchange rate differences command.

- The currency is always the base currency.

- Amounts must not be entered in the account's currency.

- Exchange rate is left blank and will be ignored, even if a value is entered.

- The budgetExchangeDifference function calculates the exchange rate difference for an account. This value represents the non realized exchange rate profit or loss.

.- The function will return a positive value if it is an exchange rate loss and a negative (credit) in case of exchange rate profit.

Exchange rate profit and exchange rate loss need to be entered in two different rows.

-

The resulting amount represents the revaluation necessary in the base currency to ensure that the account balance in the base currency matches the balance of the account in the currency converted at the exchange rate used for the calculation of exchange rate differences.

- The function will return a positive value if it is an exchange rate loss and a negative (credit) in case of exchange rate profit.

- The first parameter "CUSD" of the budgetExchangeDifferences function is the account in foreign currency for which the exchange rate difference will be calculated.

- The second parameter is the exchange rate to be applied.

- If no exchange rate is indicated, the historical exchange rate relative to the date of the entered transaction is applied.

- When "current" is used, the exchange in the Exchange rate tables with no date will be used.

- An exchange my also be indicated. A point "." must be used as a decimal separator.

credit(budgetExchangeDifference("CUSD"))

credit(budgetExchangeDifference("CUSD", "current"))

credit(budgetExchangeDifference("CUSD", "0.95"))

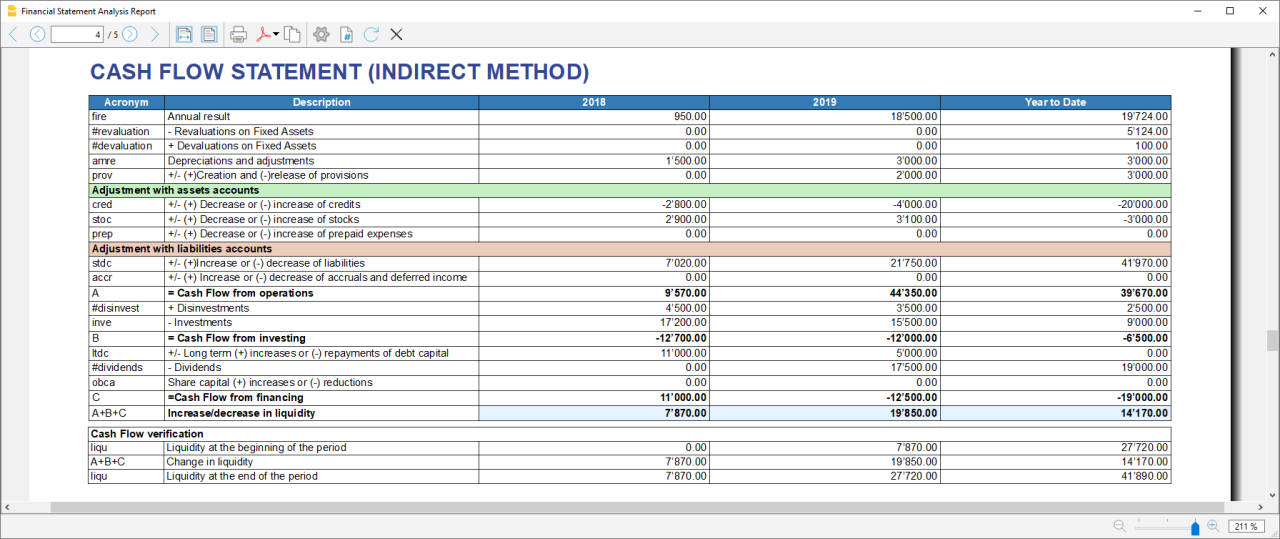

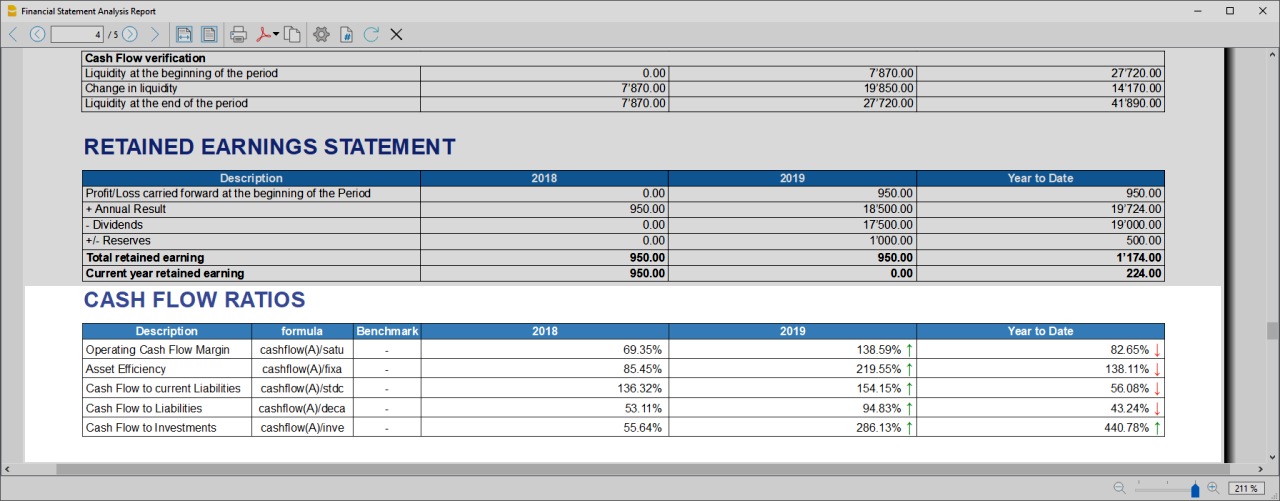

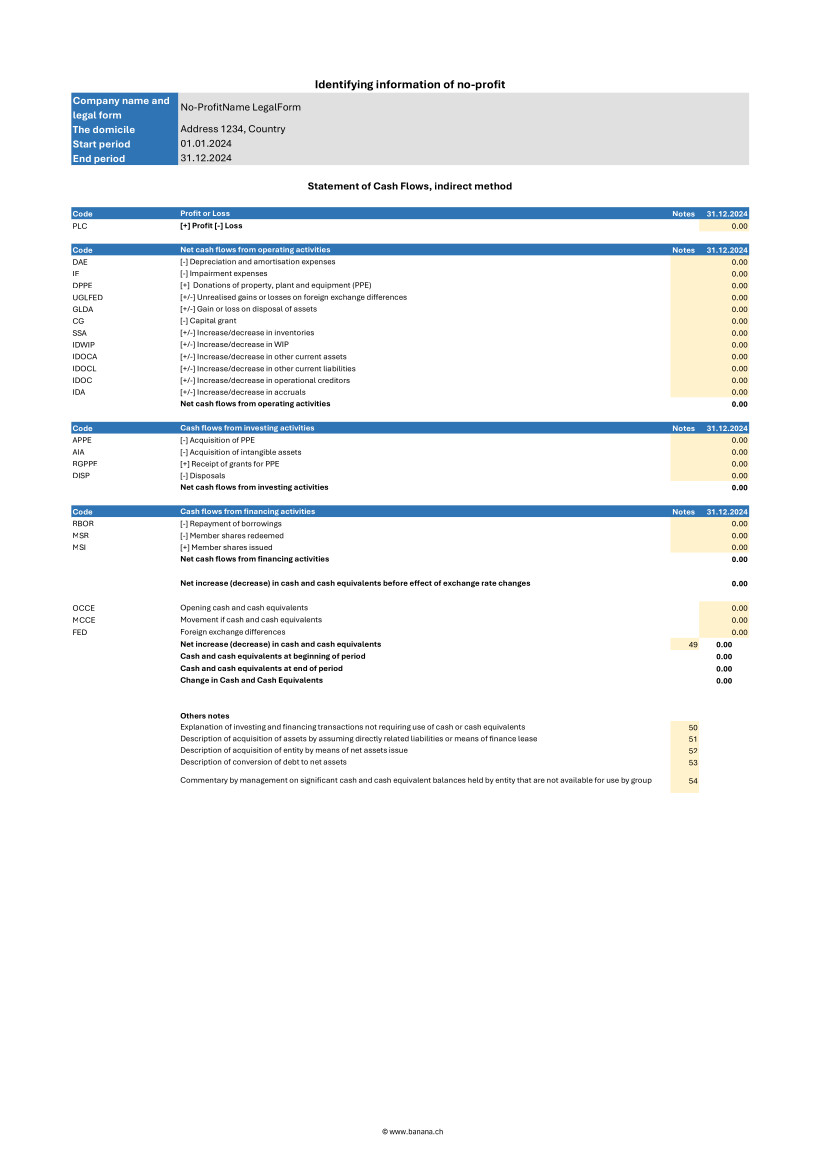

Cash Flow Statements and Financial Ratios [BETA]

Cash Flow Statements and Financial Ratios [BETA]Easily add advanced financial reporting and charts to your existing double entry accounting. It works with any accounting plan, the first time you enter your groups/accounts in the settings dialog, and then all calculations and reporting will be done automatically. This extension is available in Banana Accounting Plus only with the Advanced plan. Update now!

How to start

First time setup:

- Open Banana Accounting Plus

- Open your existing Banana double entry accounting file.

- Go to the Extensions menu → Manage Extensions... command and install the Cash Flow Statements and financial Ratios extension.

- Map you accounting plan.

- Extensions menu → Cash Flow and Financial Ratio → Settings.

- Under Grouping enter the groups you have in your accounting plan in the predefined groups.

The extension uses a standard, simplified Balance and Profit and loss structure, that allows to automatically calculate the Financial Ratios. - Click OK to verify your data.

Check the Ignore warnings/errors if you want to save the data and complete the grouping later.

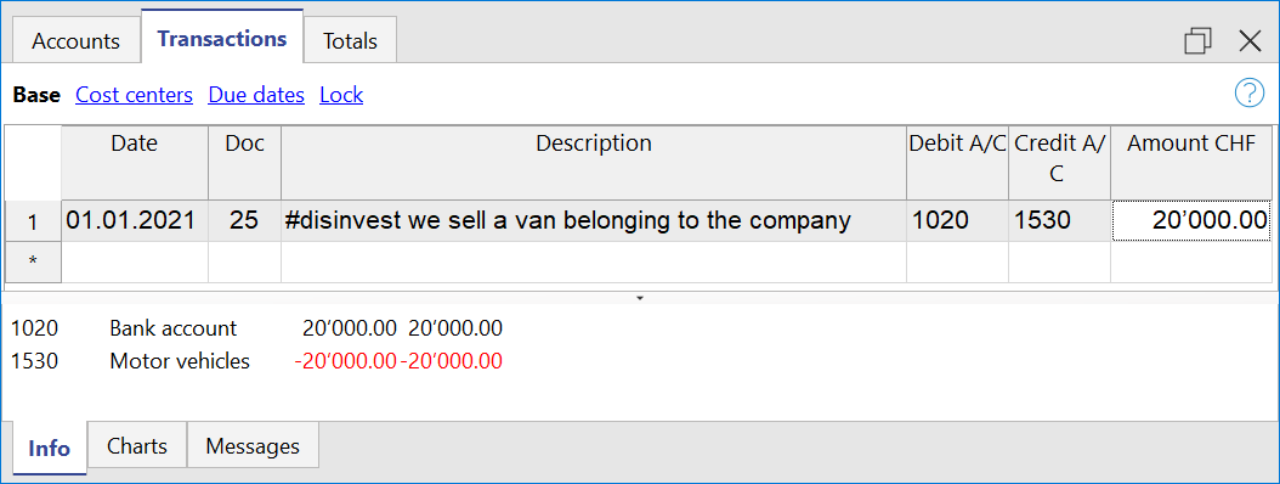

- Add information to some special transactions (dividends, change in reserve, disinvestment, investments) they can be identified for the Cash Flow Statements.

Run the reports (at any time).

- Open your Banana double entry accounting file.

- Menu Extensions → Cash Flow and Financial Ratio

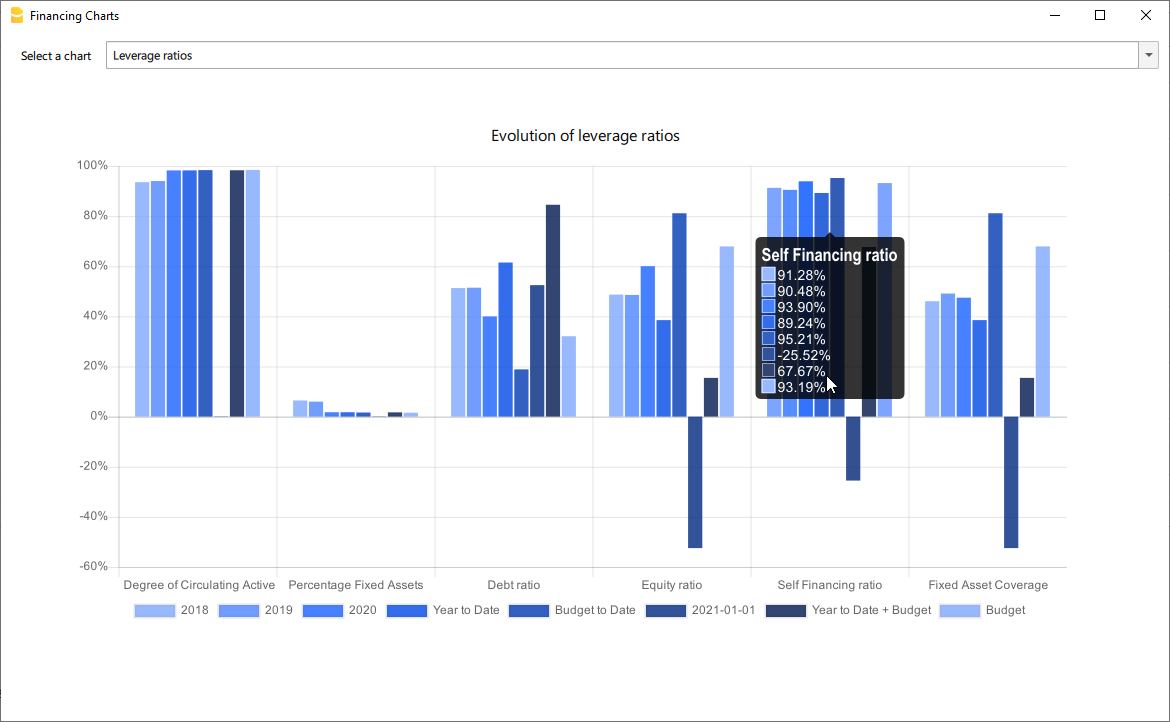

- Financial Charts

- Financial Reports

Available reports and charts

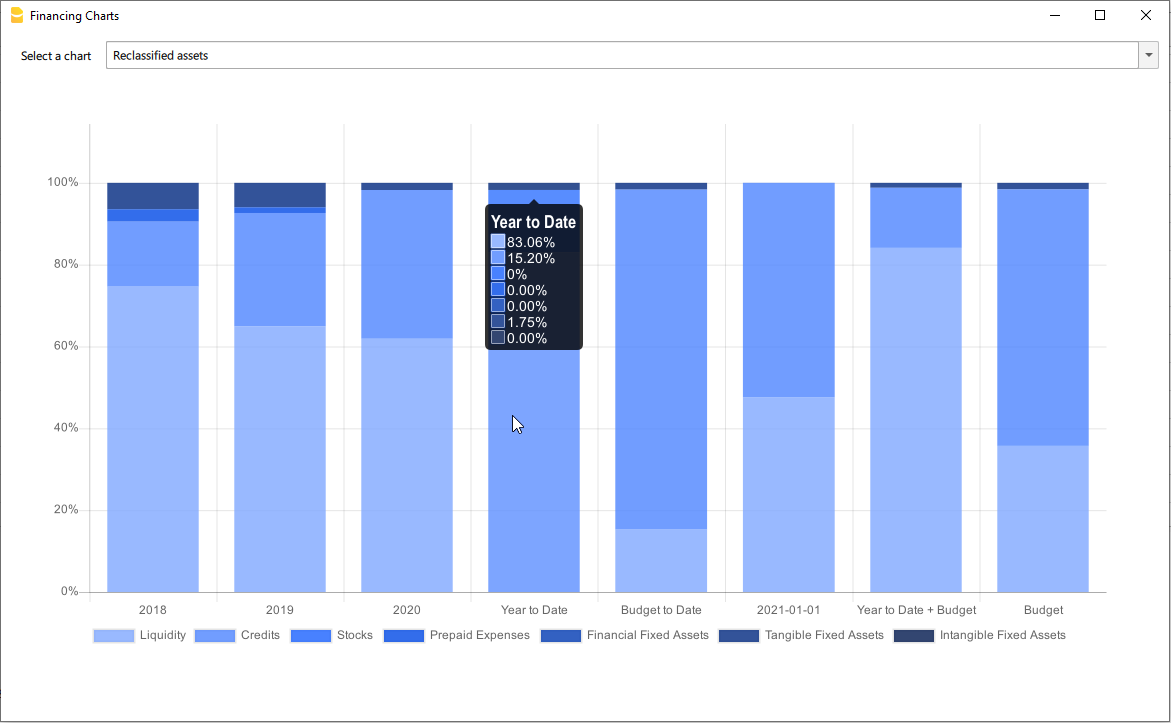

- Reclassification and checks

- Reclassified balance sheet

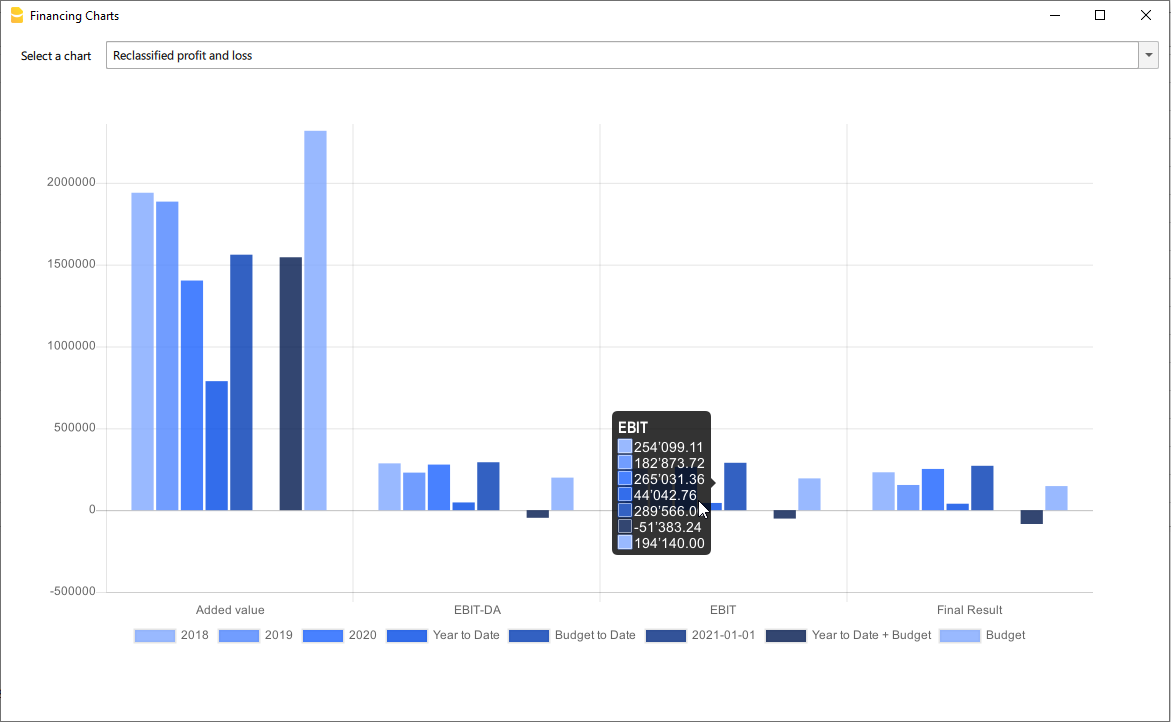

- Reclassified Profit and Loss Statement

- Control sums

- Cashflow Statement

- Cash Flow statement based on the indirect method.

- Cash Flow ratios.

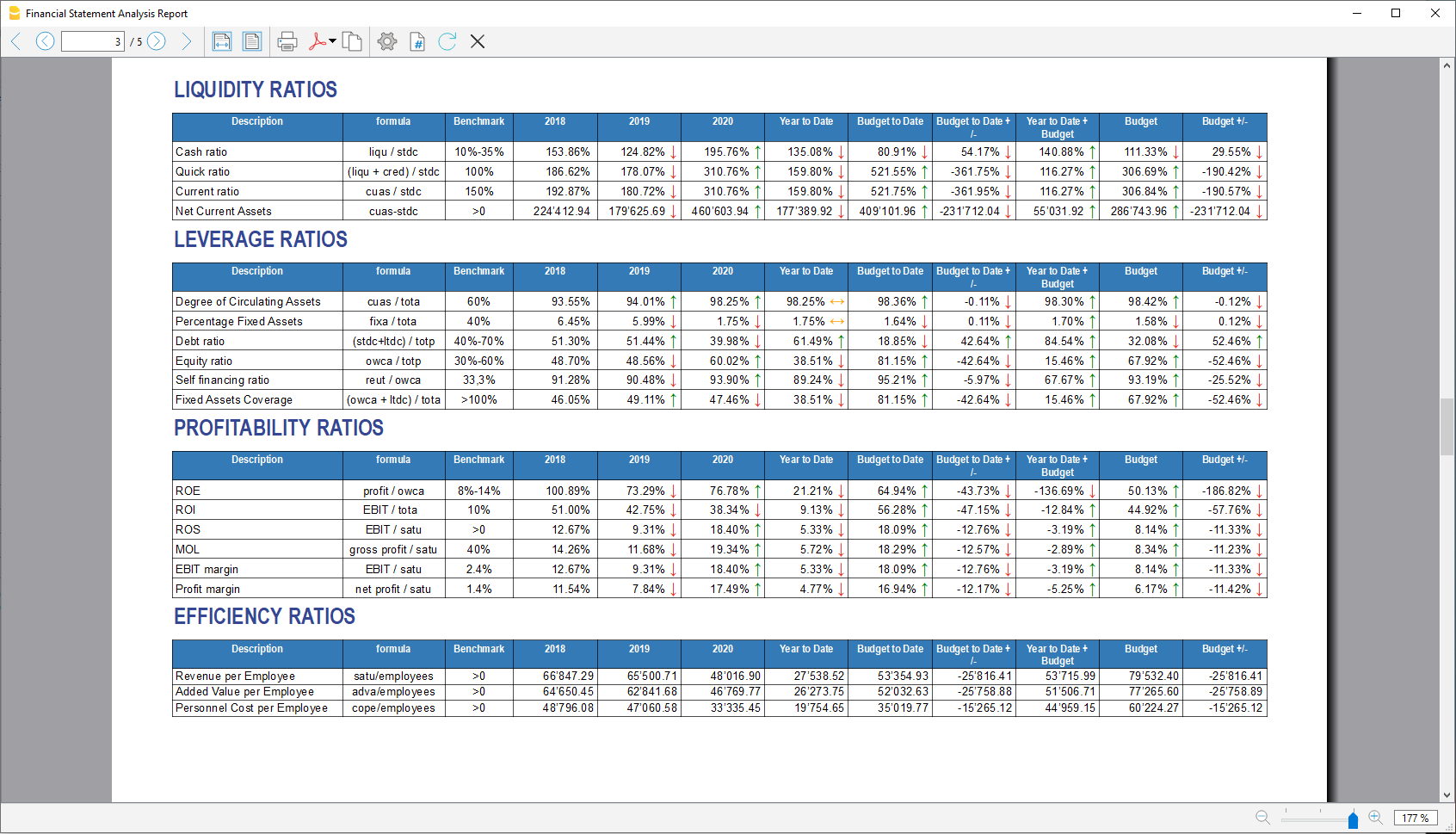

- Financial ratios and analysis

- Liquidity ratios:

- Financing ratios

- Profitability ratios

- Efficiency ratios

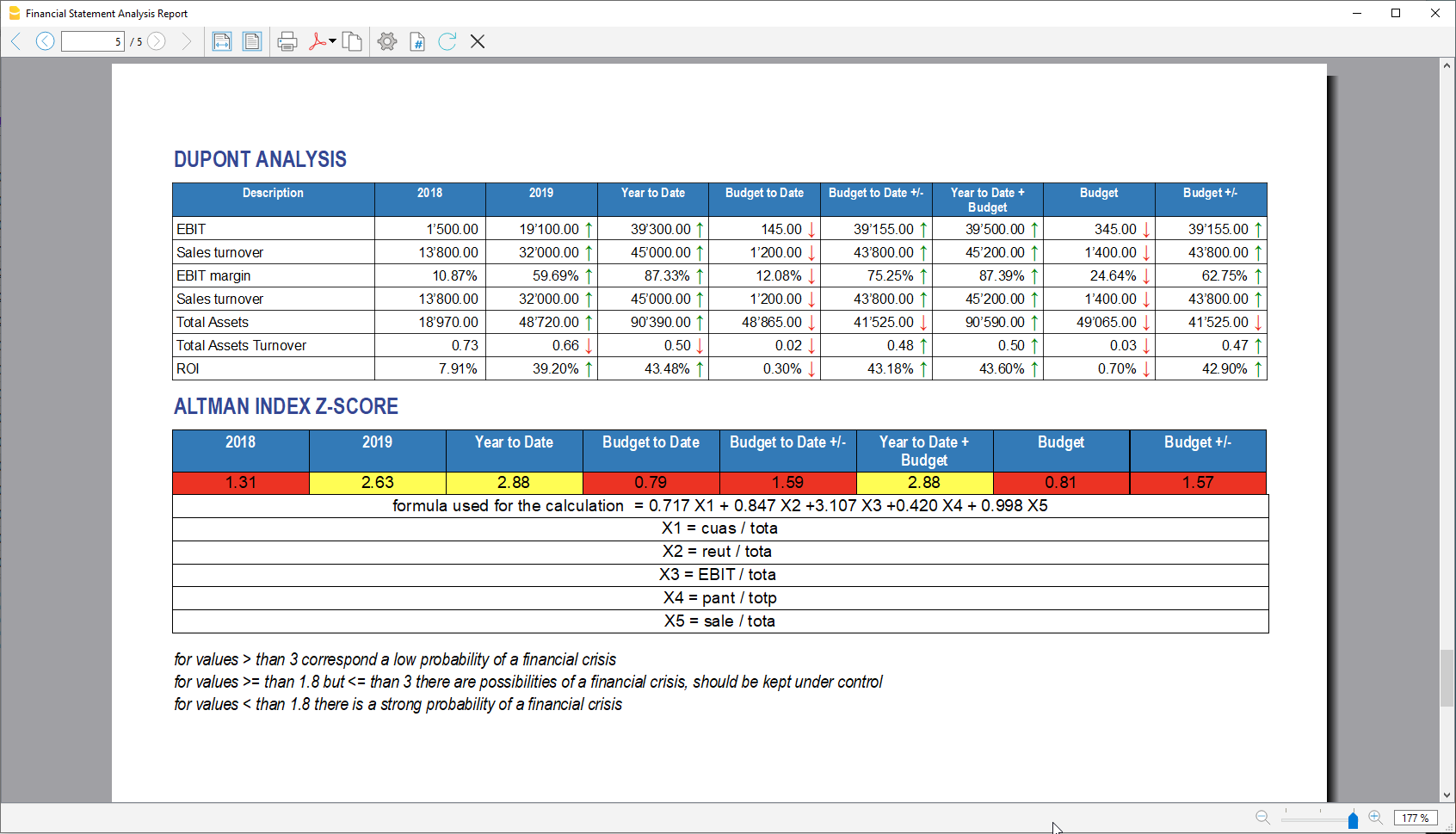

- Dupont Analysis

- Altman index

- Charts

- Evolution of ratios over time

- Evolution of the Reclassified balance sheet

- Evolution of the elements of the Reclassified Profit and Loss Statement.

Prerequisites

In order to be able to use this extension you have to:

- Use Banana Accounting Plus with the Advanced plan. We recommend using the Dev-Channel, some features or functionality present in the insider version may not yet be accessible in the regular version of Banana.

- Open a Double-entry accounting file.

It is important that the various accounting years files included in the analysis have the chart of accounts set up in the same way, at least as far as references to groups are concerned.

For example, if I want to analyze the accounting years: 2018, 2019, 2020, and I set up group 100 in the Liquidity grouping. I need to make sure that for all three years the group is the same.

Try the extension now

You have the opportunity to use a test accounting file with some random entries to get an idea of the extension's functionality. The file already includes the extension, so you don't even have to download it

You can test it by editing the transactions, the chart of accounts or the various settings in the dialog.

The accounting file does not exceed 70 transactions, so you can also try it out with the free or professional version and upgrade to the Advanced plan later.

Compare historical data over more years and forecast data with current year.

Introduction

What is exactly the financial statement analysis?

Financial statement analysis is an accounting tool that provides an assessment of a company's economic, financial and asset condition. It is based on the financial statements and reports the data. It contains the profits and losses of a company and therefore serves to derive the general performance of the company.

Why is this activity very important for your SME ?

Until recently there were few SMEs that often used a financial statement analysis as larger companies could use it.

Today, times have changed. Reading the numbers well can make a difference within the strategy and management of an enterprise. Understanding which products it is worth investing in and which jobs can be neglected determines the difference between the growth or decline of a company.

This activity can be a source of interest for various subjects, external or internal to the company. Entities or external individuals can analyse their solvency profile (current or potential lenders), capacity to provide an adequate return on capital (for those who want to buy shares for example) or even just obtain information on the company's situation with respect to competition in the sector.

Through the comparative balance sheet analysis of the various elements available, it is possible to arrive at the following formulation of a "judgement" on the health of the company in all its dimensions:

- Economic

- Asset

- Financial

How it works

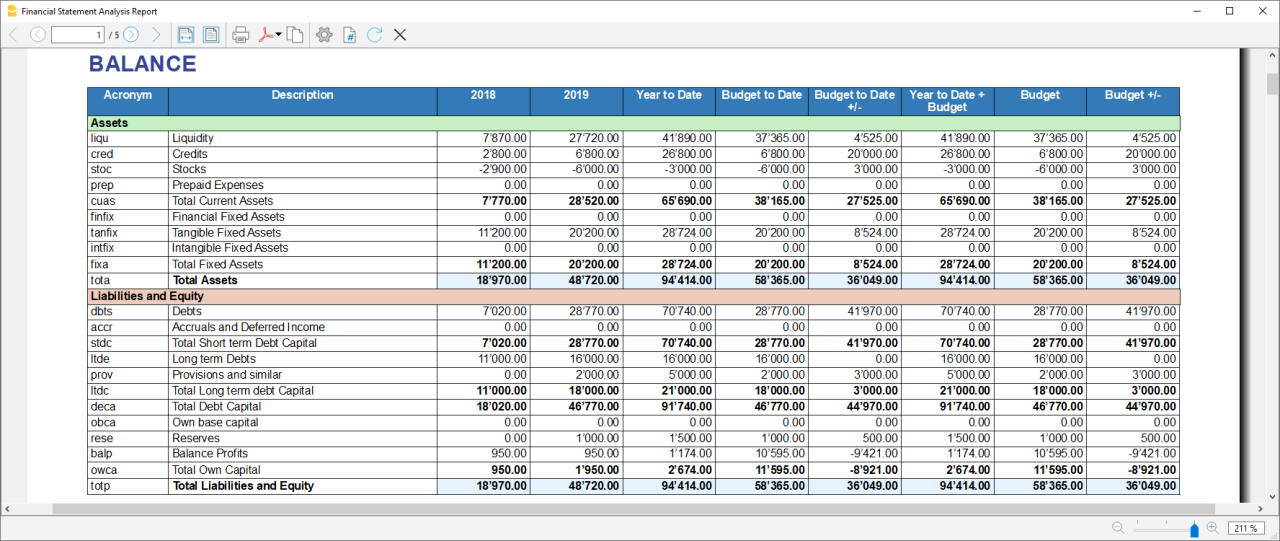

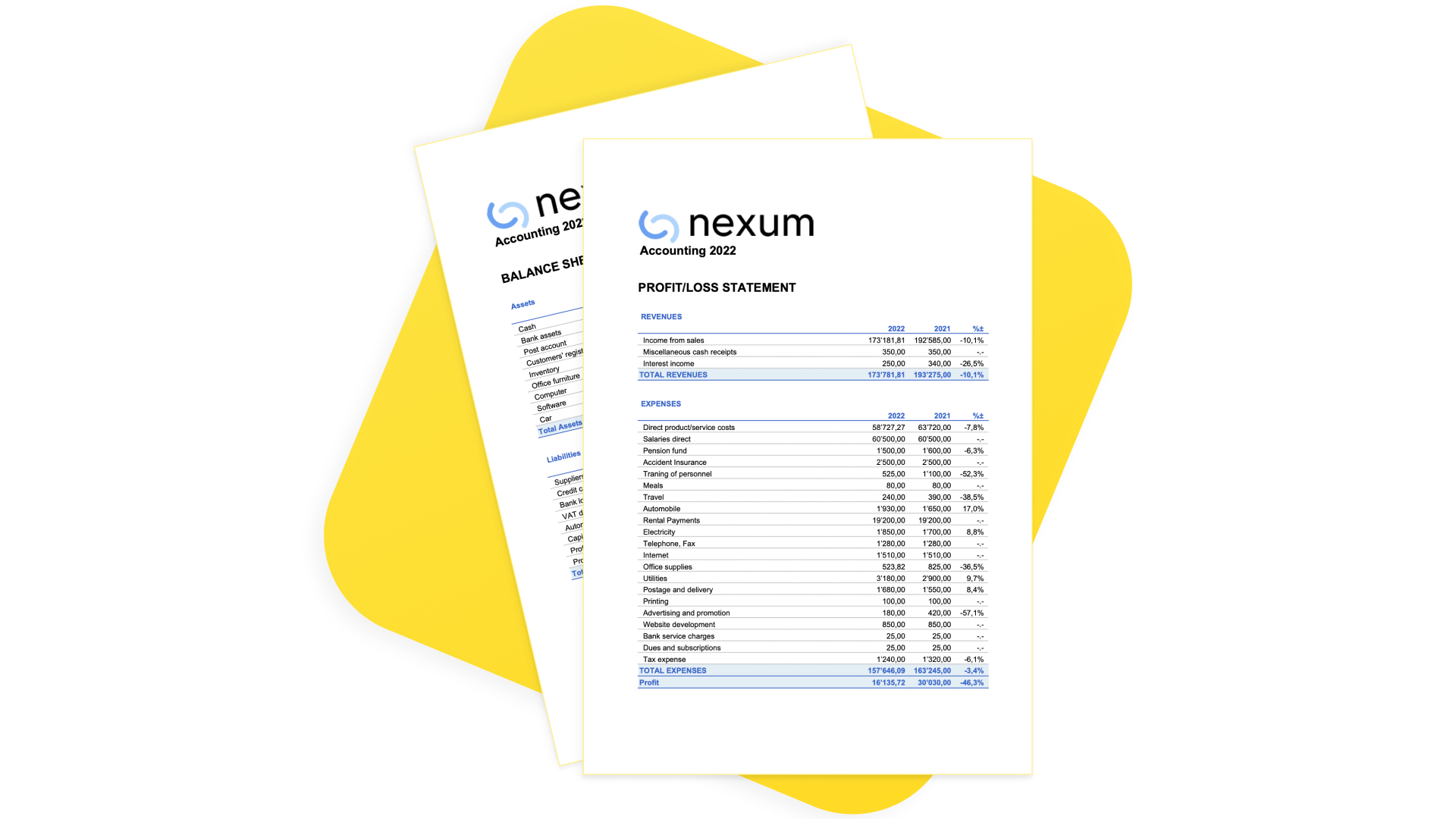

The financial statement analysis is based on two fundamental documents for a company:

- The Balance sheet

- The Profit and loss statement

In order to perform a correct analysis, it is always necessary to start from the reclassification of the accounts, which includes 3 phases in particular.

- Group the account items into groups

- Order such groups

- Bringing out intermediate results

The reclassification allows for a slightly cleaner first view of the company's situation and is already useful information can be obtained from it.

Analysis by Indexes

Once the intermediate results have been obtained, it is possible to proceed with the calculation of the indices useful for the analysis. The financial statements analysis by means of indexes is a very powerful tool that allows you to use indicators capable of providing a very concise assessment of one's own situation.

How should the data be interpreted?

Better results in terms of interpretation and evaluation are therefore achieved by analysing a series of balance sheets and studying the trend over time of the significant balance sheet ratios, so as to understand in which management is moving the company (dynamic financial statements analysis).

How do I evaluate them?

- Temporal evolution

- Comparison with average values of the sector

- Comparison with "normal" values i.e. with the benchmark

- Comparison with objectives

Response to results

This is the last activity of the analysis cycle, where the "relay" passes into the hands of those who deal with the Management of the Company, with data that speak clearly, the Manager will have to plan how to proceed using the right Project Management techniques.

The report contain errors?

If you notice incorrect data within the report or find that for some reason the calculated amounts do not match, please follow the steps below:

- Check that the data in your accounts are correct.

- Check that you have set up the groups correctly in the settings dialog.

If the errors persist, contact us via our feedback form and send us an example accounting file (*.ac2), even with little data, but allowing us to reproduce the possible problem and correct it.

Multi-language

The extension is available in the following languages:

- English

- Italian

- French (translation currently not complete)

- German (translation currently not complete)

And will adapt according to the language in which the application is set up. For all other languages, the standard version in English will be displayed.

Save your analysis

You can save the report in the following formats:

- Html

- Excel

- Latex

Settings Dialog

Dialog is accesible:

- By going to the Extensions menu→Cash Flow Statements and financial Ratios →Financial Reports.

- By going to the Extensions menu→Cash Flow Statements and financial Ratios →Settings.

Set up the groups

The first and most important step is to enter the groups or accounts number you are using in your account table.

Once you enter the groups the report and calculations are all done automatically, except for some specific transactions for the Cash Flow Statement.

- Groups must be entered manually

- Groups must be separated by a semi-colon ';'

- Both groups and accounts can be entered

- It is important to make sure that you include elements that exist in your chart of accounts, if are entered groups or accounts that do not exist in your chart of accounts, a message will be displayed on the row of the grouping concerned, returning those elements for which a match was not found in the chart of accounts. Once corrected, you only need to run the dialogue again and the message will disappear.

- By default, the groups within the dialogue refer to the Swiss SME chart of accounts, and it is possible to return to the base scenario by clicking the Restore Defaults button. Beware, however, that in this way the customisations made will be lost, and will be replaced with the default values.

.png?raw=true)

All the necessary elements must be inserted within the different groupings defined in the dialogue (Liquidity, Fixed Asset,Owned base capital,...).

Assets

They show the total employment of a company, so the investments to which the company has allocated

the means found in carrying out its activity.

- Liquidity: Must include groups or accounts that define liquidity in the company, such as cash or bank

- Credits: Must include groups or accounts within which are recorded all the operations

concerning money due to buyers who didn’t paid yet for their purchases - Stocks: Must include groups or accounts with all goods for resale in the ordinary course of business.

- Fixed assets: Must include groups or accounts containing fixed assets elements, as:

- Buildings

- Computer equipment

- Computer software

- Furniture and fixtures

- Intangible assets

- Land

- Leasehold improvements

- Machinery

- Vehicles

Liabilities and Equity

Shows where company's resources come from. In general, the funds at the company's disposal are

classified in a way to distinguish between own funds (which flow into equity) and those from third parties.

- Short-term debt capital: Must include groups or accounts representing the company commitments that must be fulfilled, without any particular cancellation, in the current year.

- Long term debt capital: Must include groups or accounts containing that kind of capital that the company can have at its disposal for several years, on a fixed basis, and that can usually only be withdrawn within a set time limit.

- Own Base capital: Must include groups or accounts those group referring to the company's own capital.

- Reserves and Profits: Must include groups or accounts within which are recorded the amounts to be paid to reserves or designated as profits.

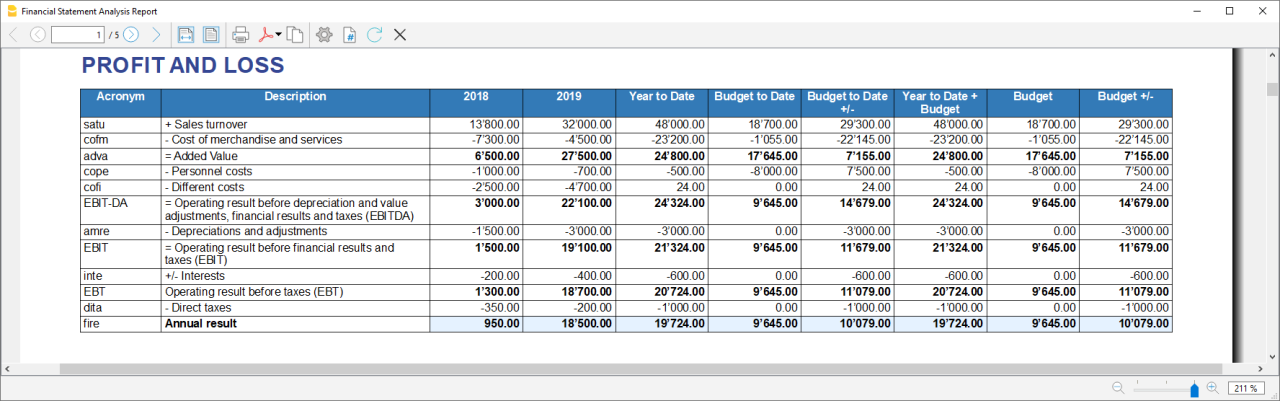

Revenues

Indicates what is produced by the company during a financial year. Whether it is an increase in the value of products or semi-finished products in the course of production or services in progress, revenue from the sale of products or services or the increase in the value of fixed assets thanks to own resources, all these heterogeneous factors add up.

- Sales turnover: Must include groups or accounts within which is recorded what is produced by the company during a financial year. Whether it is an increase in the value of products or semi-finished products in the course of production or services in progress.

Costs

- Costs of Merchandise and services: Must include those groups or accounts in which all costs relating to goods and services consumed during the annual financial year are recorded.

- Personnel Costs: Must include all those accounts referring to a cost due to personnel, such as:

- Salaries

- Social charges

- Severance Pay

- Pension and similar treatment

- Other costs

- Different Costs: Must include all other groups or accounts relating to costs during the operating period.

- Interests: Must include groups or accounts containing the costs of financing sources, such as bank interest payable or interest on loans.

- Depreciation and Adjustments: Must include groups or accounts where are registered possible revaluations and write-downs of equity investments, as well as of financial fixed assets and securities included in current assets that are not equity investments.

- Final Result: The group containing the difference between the costs and the revenues at the end of the year.