In this article

The Income and Expense Accounting is exclusive to Banana Accounting Plus and is designed for those who are not accounting specialists.

Thanks to the intuitive interface, you can easily enter your income and expenses, and generate professional reports in just a few clicks, even if you’ve never done accounting before. You always have everything under control: your data is clear, organized, and visible in the table.

Ideal for those new to accounting

This type of accounting is based on a table and column structure, similar to Excel, but specifically designed for accounting management. There’s no need to enter formulas: everything is made to be intuitive and straightforward. You can edit and correct the data at any time, without worrying about making mistakes.

A versatile solution ideal for:

- Micro businesses and freelancers

- Associations, foundations, and guardianships

- Families and individuals

- Accounting management of projects or real estate

Everything you need to get started right away

Easily enter income and expenses

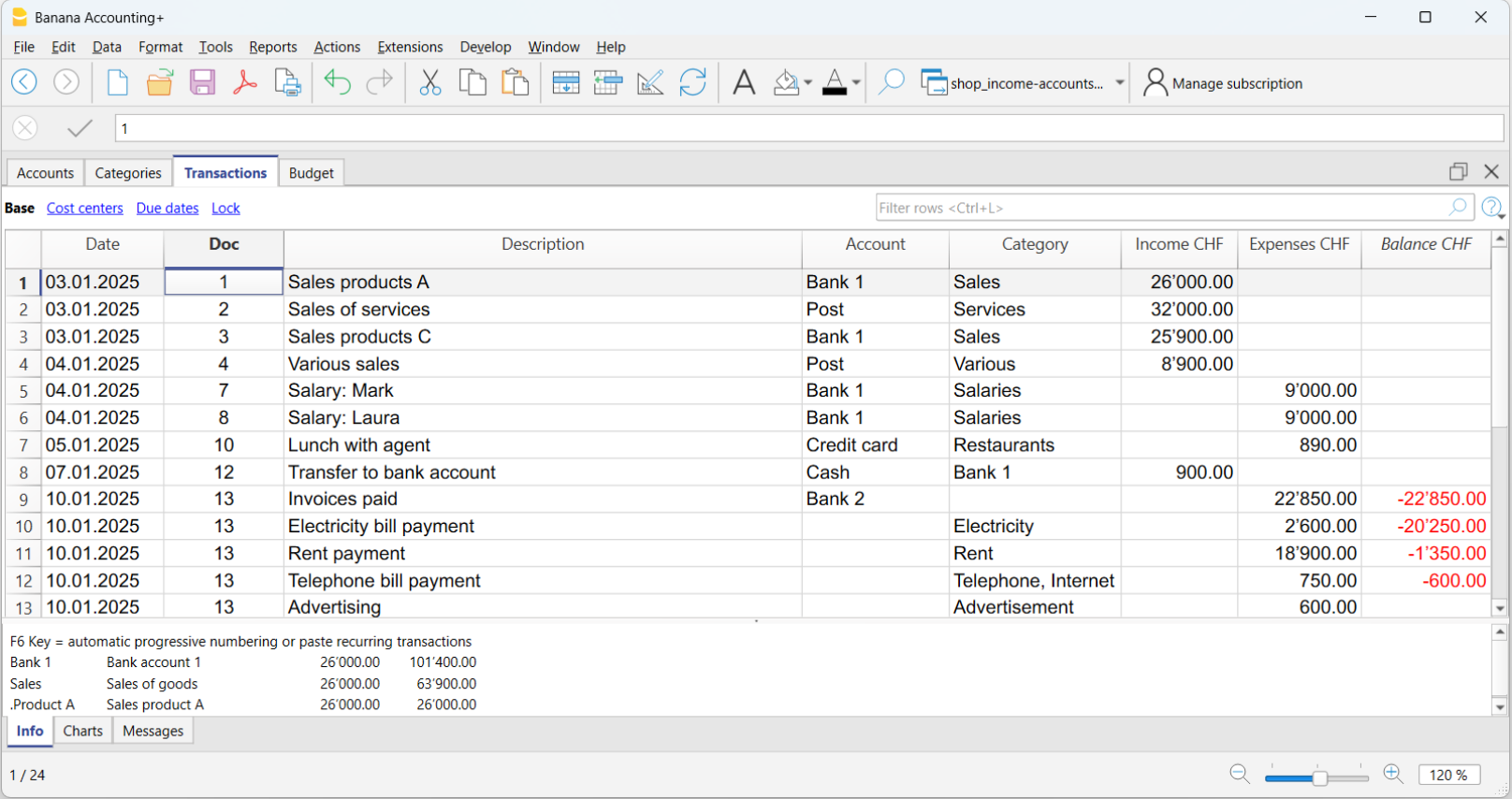

Recording income and expenses is very simple. In the Transactions table you’ll find all the columns ready for you to enter data in a clear and organized way. You just need to enter:

- The date

- Optional document number and link to the digital document

- The amount received or spent

- The account where the money comes from or is going to (cash, bank, post)

- The category, which represents the reason for the income or expense (rent, phone bills, etc.)

The program takes care of the rest!

At any time, you can correct and edit the data you've entered, copy and paste data, highlight rows with colors, filter rows by keyword, and much more. All entered data remains always visible both in the Transactions table and in the account and category cards.

To work faster, check the page Speed up data entry.

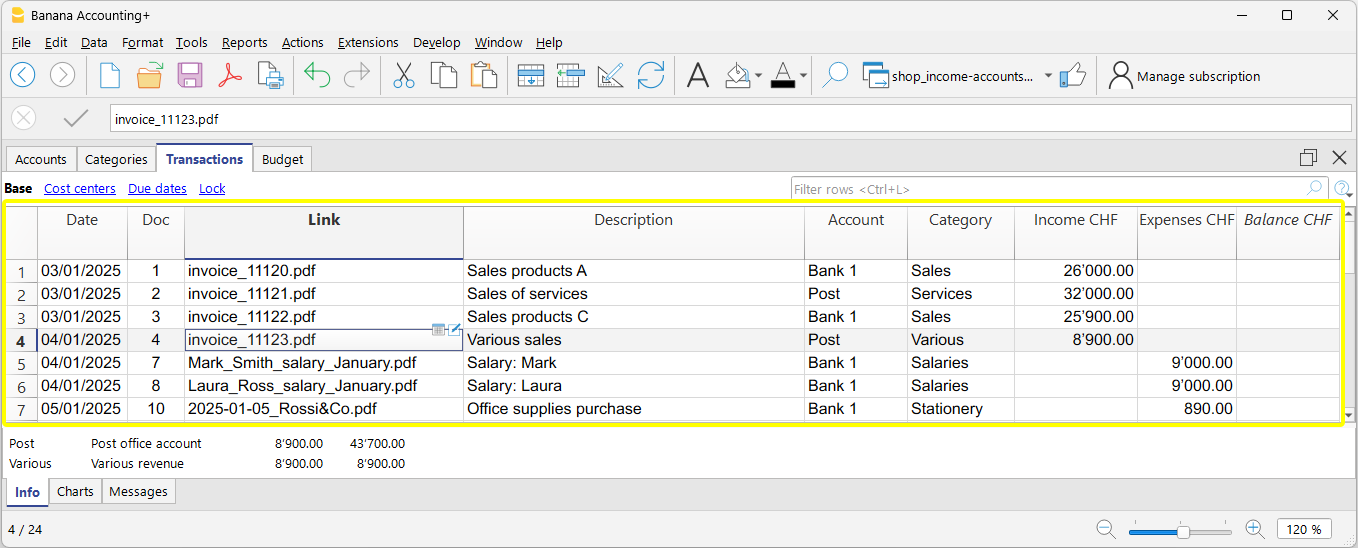

All your documents at your fingertips

Thanks to the Link column, visible in the Transactions table, you can directly attach a receipt or PDF invoice to each transaction, providing the following advantages:

- Instant access to documents, without having to search for them manually.

- Optimal preparation for tax inspections or audits by authorities.

- Easier collaboration with your accountant, who can see documents already linked to the accounting transactions.

Import your bank transactions

Despite its simplicity, with the Income / Expense accounting you can import transactions from your bank, postal accounts, and credit cards, taking full advantage of the power of professional accounting software. Additionally, by using Rules, you can instantly have a complete and accurate accounting.

You save time, avoid mistakes, and ensure that your data is always up to date and accurate from the start.

Automated checks

Many features check for errors and discrepancies to ensure your accounting is always correct. This allows you to work with greater peace of mind and confidence, knowing your accounting is always consistent, accurate, and ready for any audits or reviews.

Automatic and ready-to-print reports

A report is a document that neatly shows all the money coming in and going out over a period of time. It’s like a summary that helps you understand where the money comes from and how it was spent.

After each transaction, the program automatically updates all the balances of Accounts and Categories, automatically generating professional reports.

The report created by Banana puts everything together, in order, to help you monitor your finances and know whether you are in surplus (money left over) or deficit (you spent more than you earned).

Available report types

From the Report menu, you can choose from:

- The Enhanced statement displays all accounts and categories without subgroups

- The Enhanced statement with groups displays all accounts and categories including subgroups

- Period reports are also available.

Additional printouts

Also from the Report menu, you can access the following printouts:

- Journal – printout of the transactions in the Transactions table

- Account cards (ledgers) – details of the transactions of one or more accounts or categories with totals

Expand features at your own pace

With Banana Accounting Plus, you can start simply and, when needed, move on to more advanced features without changing your working method. For example:

- You can add Cost centers and Segments to analyze in detail projects, departments, or activities, without needing to create new accounts or categories. Using the same report layout, you can check which sectors are most profitable and which generate costs that can be optimized.

- As you become more familiar with accounting and your business grows, you can choose to switch from Income / Expense accounting to double-entry accounting. With the Convert to new file function, your data is automatically transferred to a double-entry accounting file, preserving your work.

Common information for double-entry accounting

In the Income and Expense documentation pages, you will find detailed and specific information. For all general features, please refer to the double-entry accounting documentation. In particular:

Examples of Income / Expense Accounting Templates

Banana Accounting includes a series of templates with predefined chart of accounts, designed to help you get started quickly based on your activity or needs.

Universal templates are standard models but easily adaptable for any country.

Income and Expense Templates for Micro-businesses

- Accounting for Business (Switzerland)

- Accounting for Freelancer (Switzerland)

- Income and Expense Accounting for Yacht (Universal)

Income and Expense Templates for Associations and Non-Profit Organizations

- Parish with Numeric Accounts (Universal)

Income and Expense Templates for Individuals and Families

- Household Budget and Home Accounts (Universal)

- Family Accounting (Switzerland)

- Easily manage your vacation expenses (Universal)

Start now with Income and Expense Accounting!

The Income and Expense Accounting of Banana Accounting Plus is a unique tool that allows you to immediately start your business with full control, meeting the reporting requirements set by the authorities, at a minimal cost! It is the only tool that gives you the flexibility to grow and change without losing your work and without wasting time and resources.