Contabilidade de partidas dobradas com multimoeda

A contabilidade multimoeda baseia-se no método das partidas dobradas, consentindo também a gestão de contas e movimentos com moedas estrangeiras.

Os tópicos são comuns à contabilidade de partidas dobradas. De maneira a encontrar informações mais detalhadas, aconselhamos consultar a página de Contabilidade de partidas dobradas.

Características

- Contabilidade de partidas dobradas com contas e movimentos com moeda estrangeira

- Utilizo de qualquer moeda, códigos de moedas standard ou definidos livremente (para usar qualquer moeda virtual)

- Moeda com algarismos decimais configuráveis de 0 a 28. Geralmente usam-se 2 algarismos decimais, mas pode-se configurar a contabilidade para usar 0 algarismos decimais, ou 3 algarismos decimais (Tunisia) ou mais se se usa para cryptomoedas. 9 algarismos decimais (Bitcoin) o 18 (Ethereum)

- Cálculo automatico de câmbio, em base à taxa inserida na Tabela Taxas de câmbio

- Cálculo automatico das diferenças de câmbio

- Balanços, Contas económicas e relatórios, também numa segunda moeda

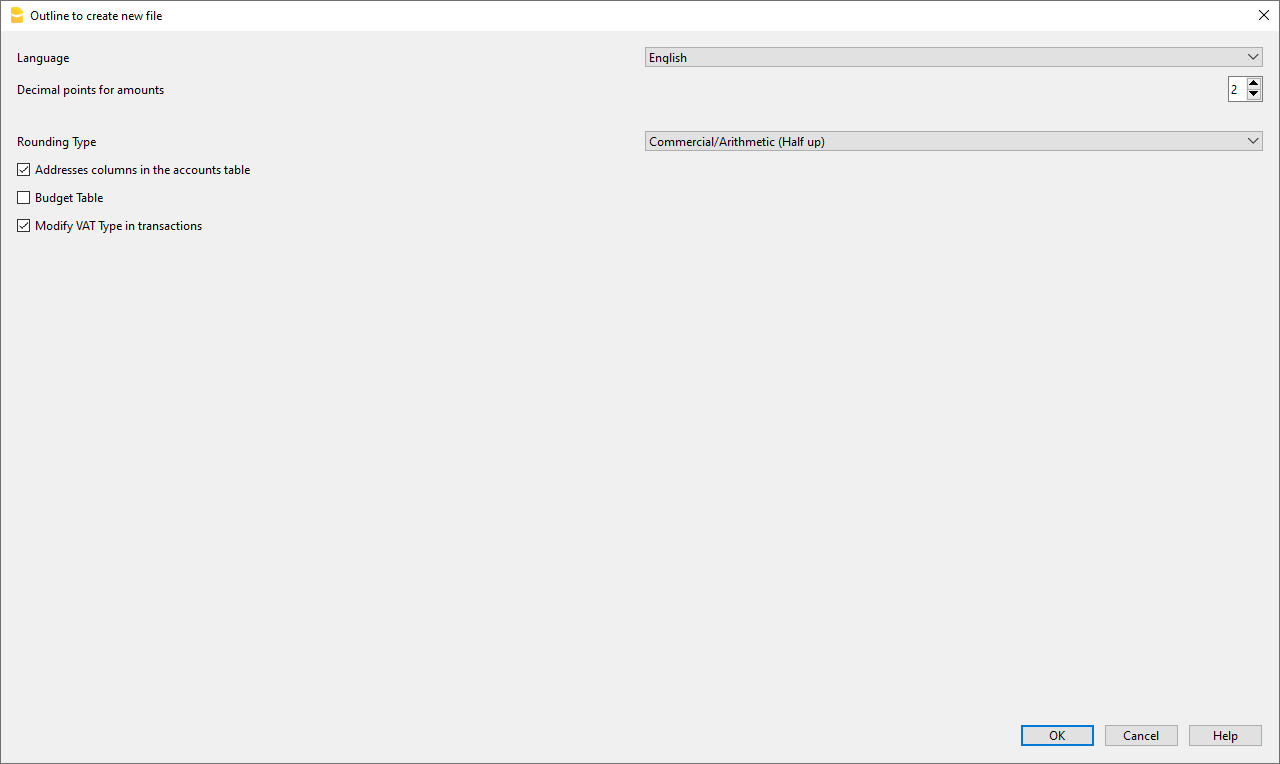

Para passar de uma contabilidade normal a uma com as multimoedas, veja o comando Convertir para novo arquivo.

Informações

Plano de contas, propriedade de contas e tabela câmbios

É aconselhado escolher um plano de contabilidade, partindo dum exemplo já existente no Banana Contabilidade e modificá-lo segundo as próprias necessidades. É fundamental que no plano de contabilidade estejam configuradas as Contas em moeda estrangeira e as Contas utéis e despesas de câmbio.

- Configurar o plano de contas

- Grupos e subgrupos

- Propriedades de conta - secção moeda estrangeira

- Configurar a Tabela Taxas de câmbio

Lançamentos

As operações de contabilidade têm que ser usadas como os lançamentos da contabilidade de partidas dobradas

Impressões

Convertir a contabilidade dobrada numa multimoeda

Veja a página Convertir em nuovo arquivo para adicionar as funcionalidade multimoeda à contabilidade dobrada.

Como começar uma contabilidade multimoeda

Criar uma contabilidade partindo de um modelo

Siga os seguintes passos:

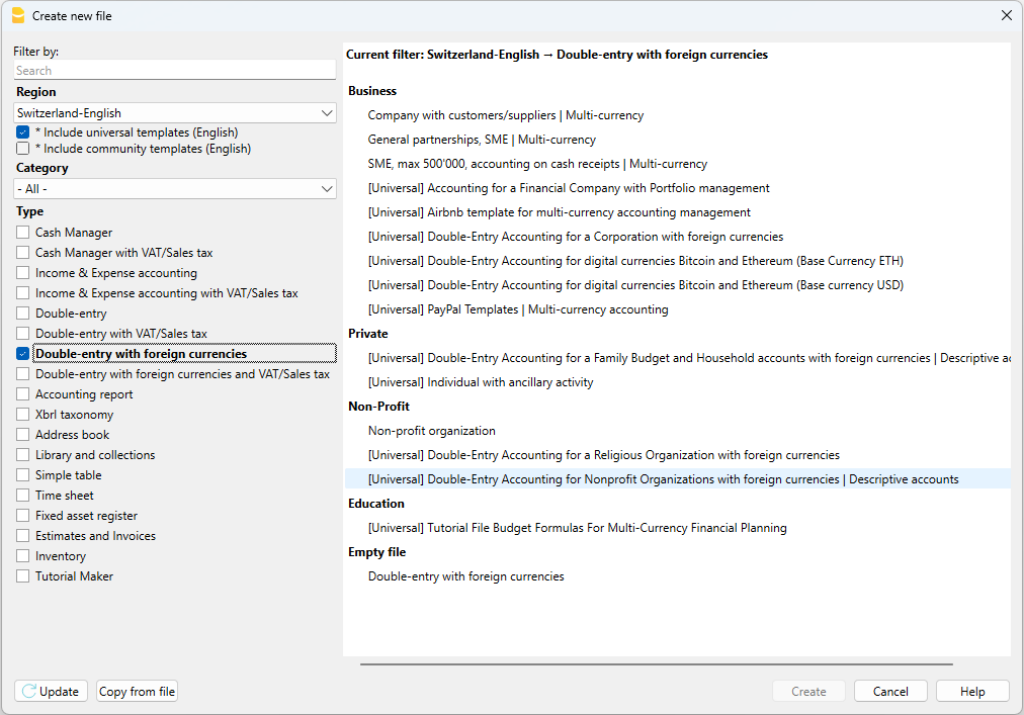

- Menu Arquivo, comando Novo

- Selecionar a Região, a categoria e o tipo de contabilidade

- Da lista de modelos que aparece, escolha aquele que melhor se adapta às suas exigências

- Clicar no botão Criar.

Na caixa Procurar, ao inserir uma palavra-chave, o programa visualiza os modelos que contêm a palavra-chave.

Também é possível iniciar com um arquivo vazio, selecionando a opção Criar arquivo vazio. No entanto, para facilitar o início e evitar erros de agrupamento, aconselhamos começar sempre com um modelo existente.

Mais informações sobre como criar un novo arquivo estão disponíveis na página Criar um novo arquivo.

Configurar as Propriedades do arquivo

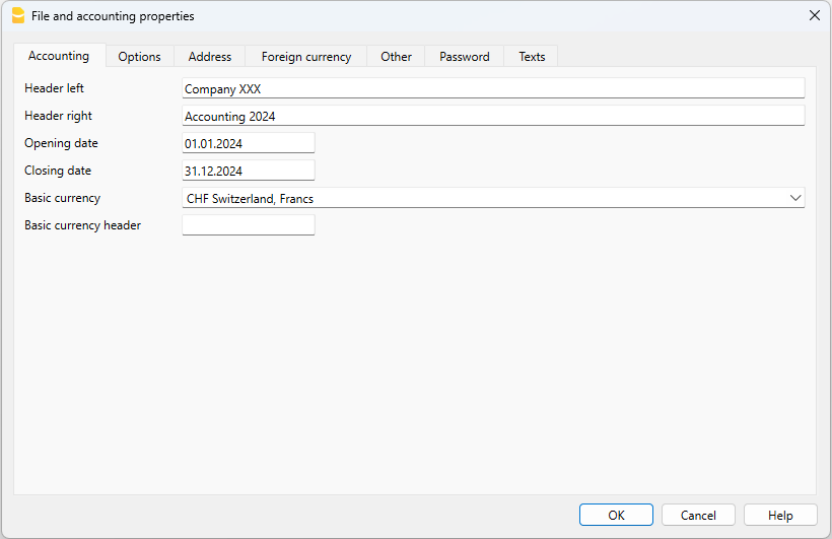

No menu Arquivo, comando Propriedades do arquivo

Secção Contabilidade

- Indicar o nome da empresa que aparecerà no cabeçalho das impressões e de outros dados.

- Escolher da lista ou inserir as iniciais da moeda para a contabilidade.

Salvar no disco

Com o comando Arquivo → Salvar como..., guarde os dados e atribua um nome ao ficheiro. Aperecerà o dialogo tipico do seu sistema operativo.

- É aconselhado usar o nome da empresa, seguido do ano "empresa-2020.ac2" para o distinguir de outros arquivos de contabilidade.

- Pode guardar quantos arquivos precisar, cada um com o seu próprio nome.

- Pode escolher o percurso e o suporte (guardar num disco, pen USB o cloud).

Se espera ter também documentos ligados à contabilidade do ano corrente, sugerimos criar uma pasta separada para cada ano de contabilidade para reunir todos os arquivos.

Uso do programa em geral

Banana Contabilidade foi inspirado no Excel. O modo de uso e os comandos são o mais semelhante possível aos do Microsoft Office.

Para informações sobre o uso, inviamo-lo a explicação na página Interface.

A contabilidade é mantida ao interno de tabelas e são usadas todas da mesma maneira.

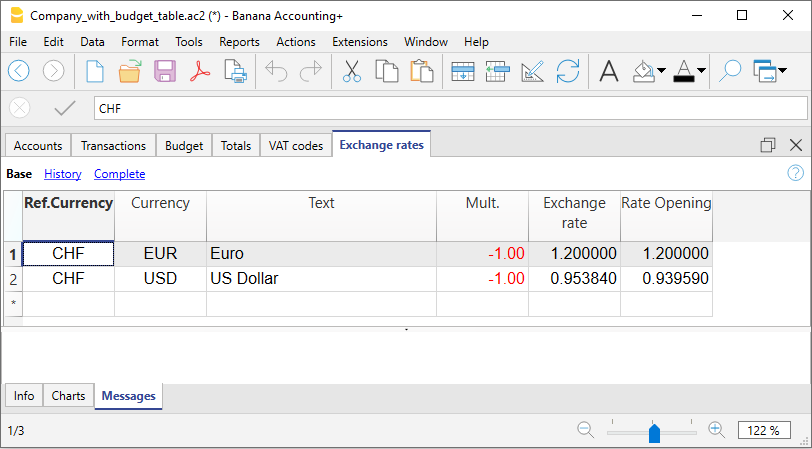

A tabela Taxas de Câmbio

Na tabela Taxas de Câmbio configuram-se as iniciais da moeda, que serão usadas na tabela contas e lançamentos.

Personalizar o plano de contas

Na Tabela Contas moeda estrangeira, é possível personalizar o plano contábil segundo as próprias exigências:

- Adicionar e eliminar contas existentes (adicionar linha)

- Mudar os números de conta, a descrição (ex: inserir o nome do ccb do próprio Banco), inserir outros grupos, etc.

- Para criar subgrupos, consultar a seguinte página Grupos.

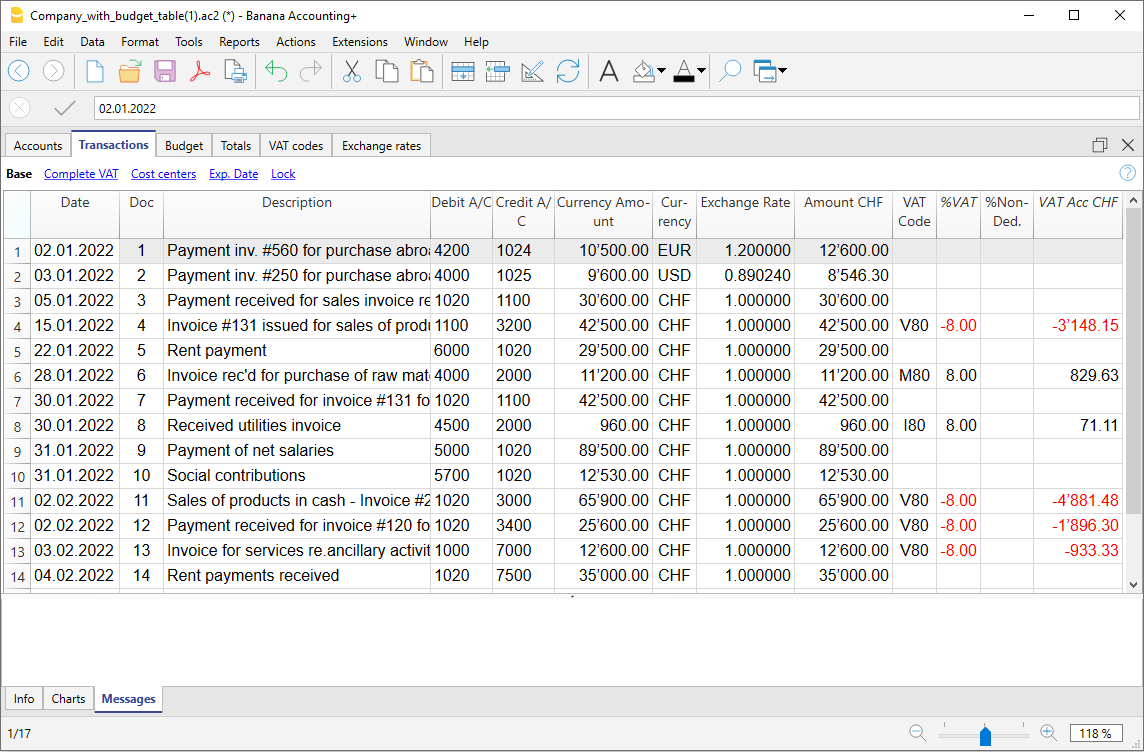

A tabela Lançamentos

Os lançamentos em multimoeda têm que ser inseridas na tabela Lançamentos e fazem parte do Livro Jornal.

Acelerar a inserção dos Lançamentos

Para acelerar a inserção dos lançamentos utiliza-se:

- a função de Emissão de dados com preenchimento automático que consente recuperar automaticamente dados já inseridos previamente

- a função dos Lançamentos repetitivos (menu Conta2) que permite memorizar numa tabela os lançamentos repetitivos

- a importação de dados do extrato bancário ou postal.

Controlo faturas clientes e fornecedores

Banana permite ter sob controlo as faturas para pagar e aquelas por receber. Consulte:

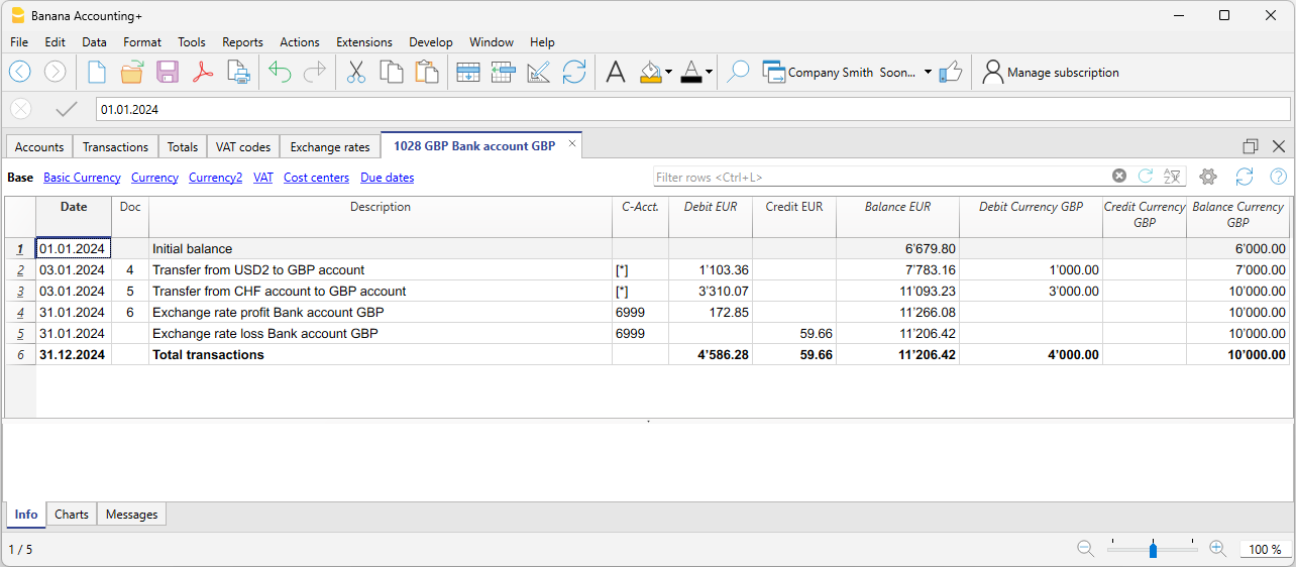

As fichas Conta

A ficha conta relata automaticamente todos os movimentos registados numa mesma conta (ex: caixa, banco, clientes, etc.).

Para visualizar a razão de uma conta, basta posicionar o mouse no número de conta e clicar no símbolo azul que aparece.

Fichas conta por período

Para visualizar as razões de conta com os saldos referidos num determinado período, ocorre clicar no menu Conta1, comando Razão por conta e na secção Período ativar Período selecionado, inserindo a data de começo e de fim do período.

Para mais informações, consulte a página Periodo.

Imprimir as fichas de conta

Para imprimir uma ficha conta, basta visualizar a ficha a partir de qualquer tabela (Contas ou Lançamentos) e acionar a impressão no menu Arquivo.

Para imprimir várias ou todas as fichas conta, clicar no menu Conta1, comando Razão por contas e selecionar as fichas conta para imprimir. Através do filtro presente na janela, pode-se fazer uma seleção automatica de todas as contas, os centros de custo, os segmentos, os grupos, etc.

Mais informações estão disponíveis na página Razões por conta.

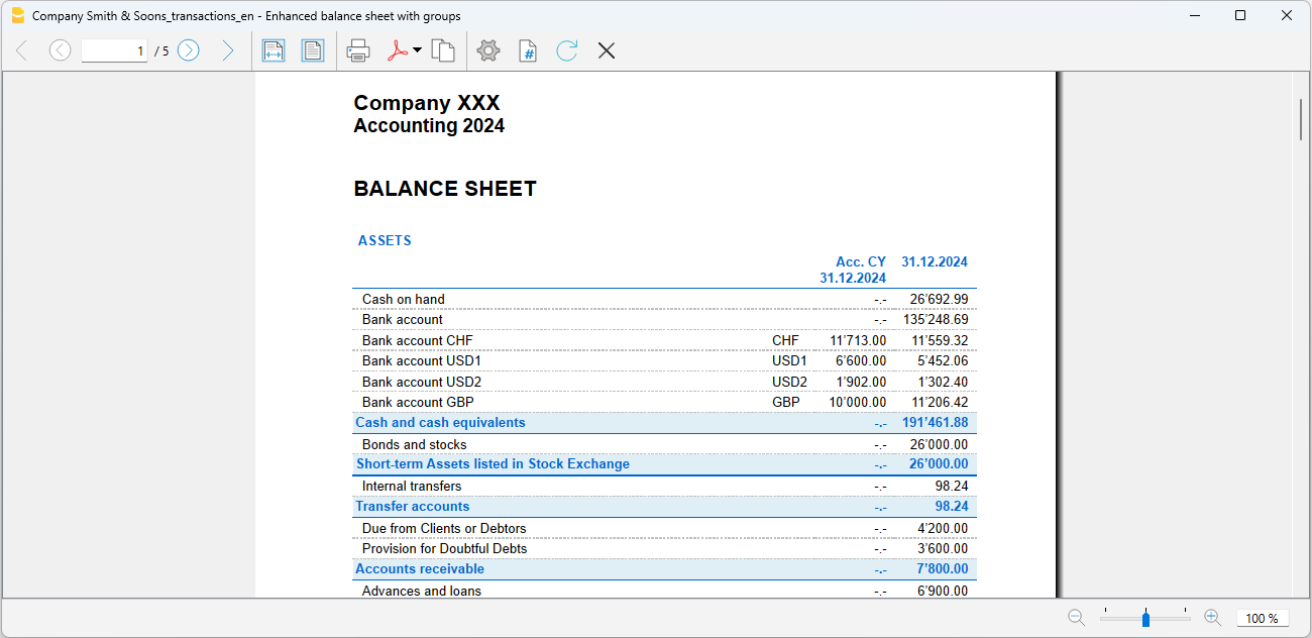

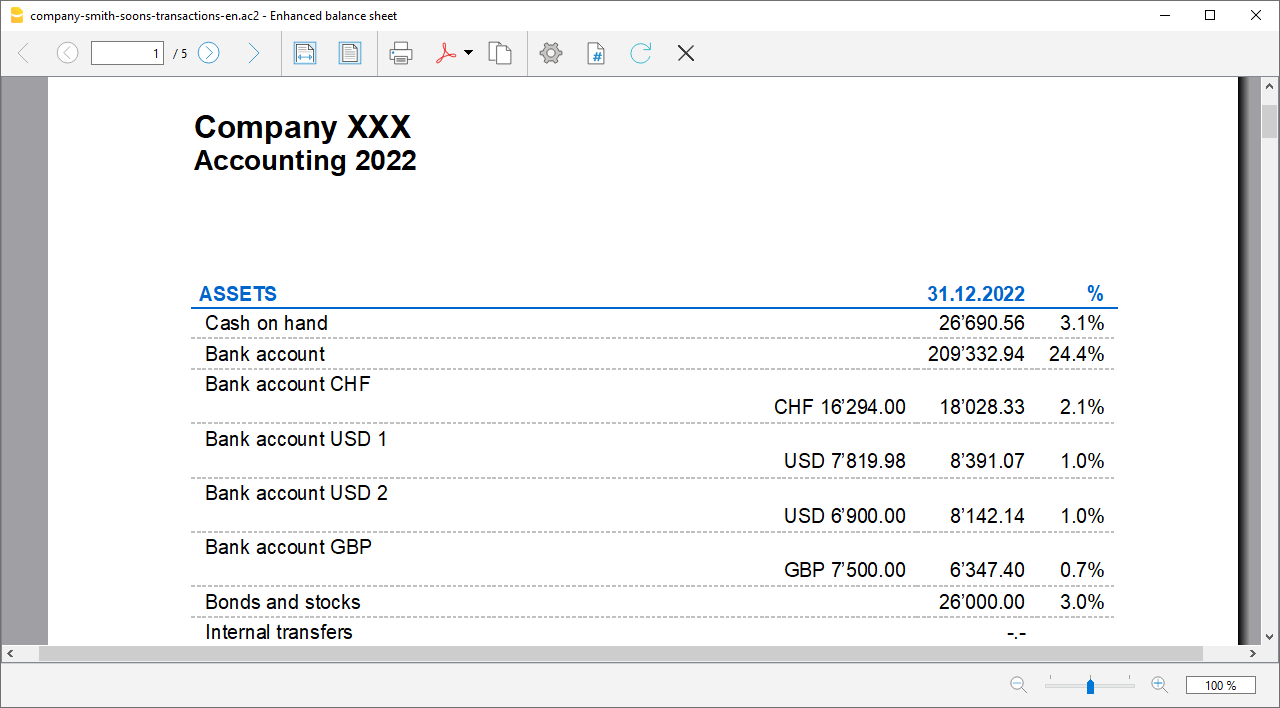

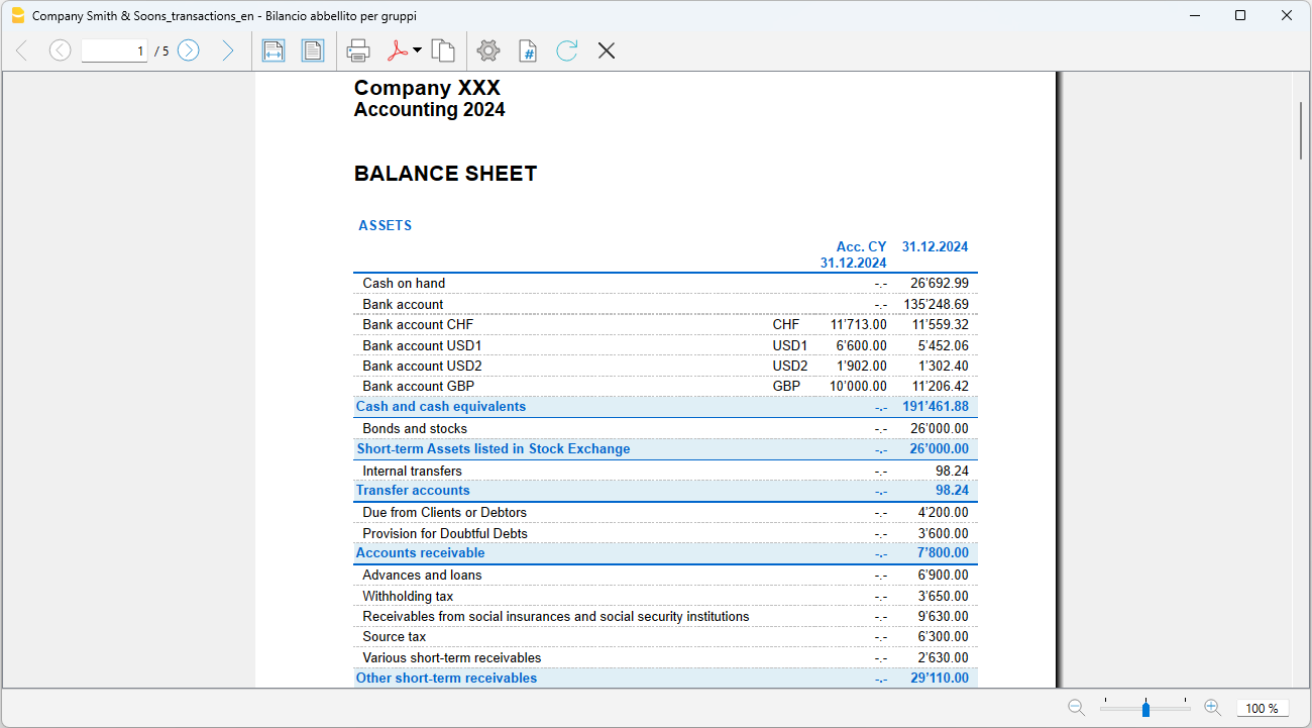

O Balanço e o Demonstrativo de Lucros e Perdas

O Balanço visualiza os saldos de todas as contas patrimoniais, Ativas e Passivas. A diferença entra Ativos e Passivos determina o Capital próprio.

A visualização e a impressão do Balanço faz-se a partir do menu Conta1, comando Balanço Patrimonial analítico ou Balanço Patrimonial por grupos.

- O comando Balanço Patrimonial Analítico cataloga simplesmente todas as contas sem distinção de Grupos e Subgrupos

- O comando Balanço Patrimonial por grupos cataloga as contas con a separação dos grupos e subgrupos; além disso, apresenta tantas funcionalidades para personalizar as apresentações que não são previstas no Balanço Patrimonial Analítico.

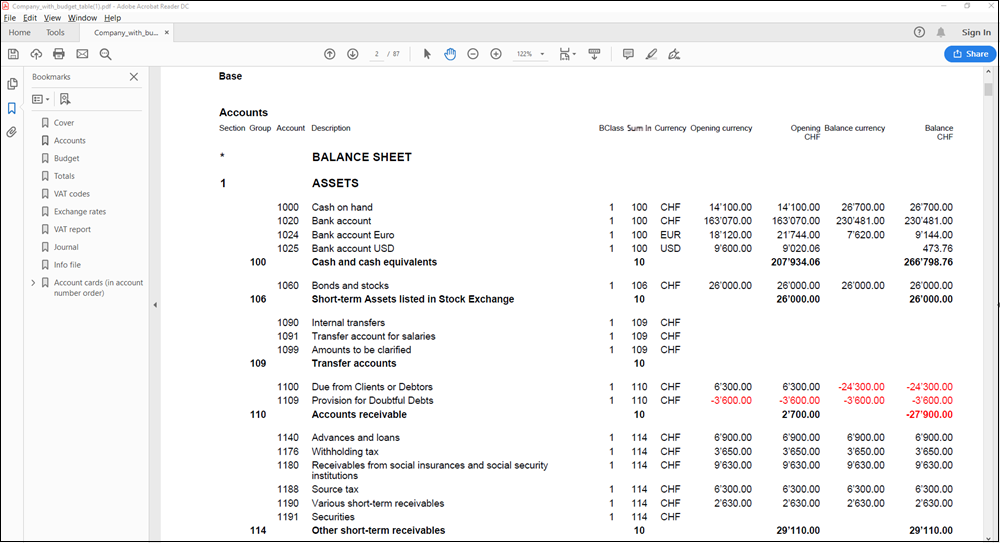

Armazenamento de dados em PDF

Ao fim do ano, quando toda a contabilidade estiver completada, corrigida e revista, pode-se armazenar todos os dados da contabilidade com o comando Criar PDF, no menu Arquivo.

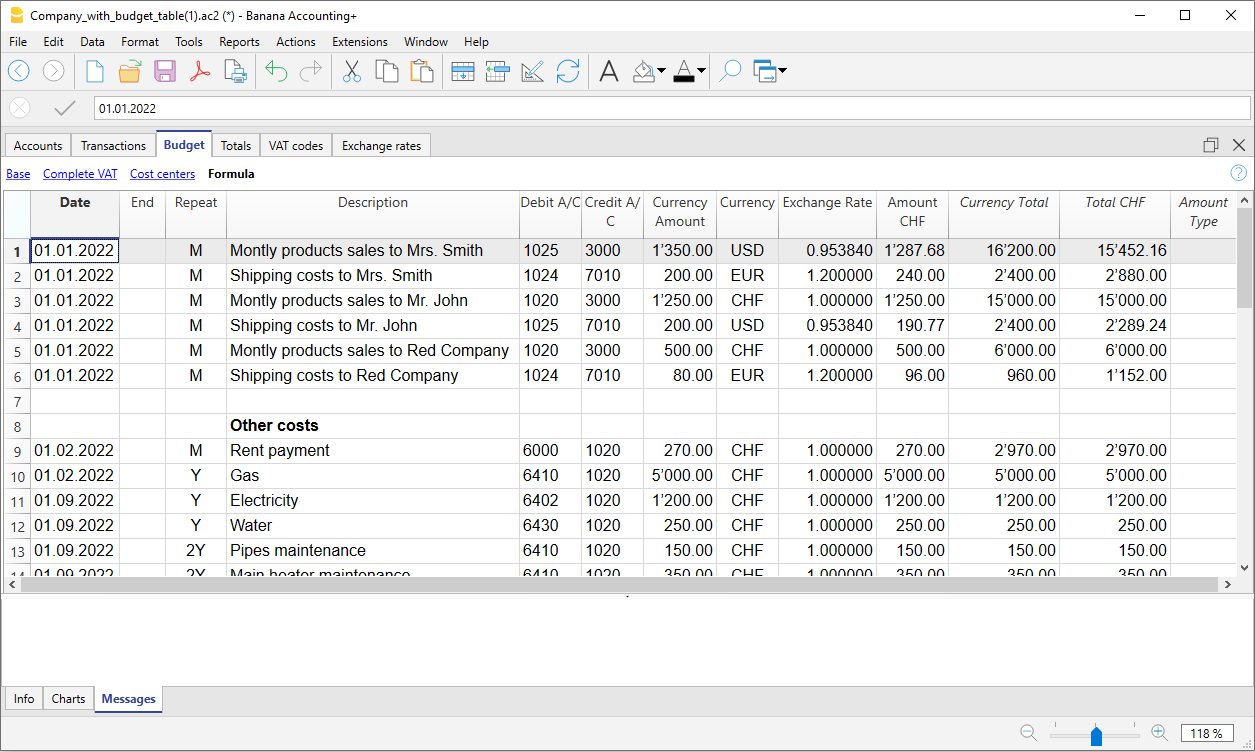

O Orçamento

Antes de começar um ano de contabilidade, pode-se criar um orçamento com possíveis despesas e receitas, de modo a ter sob controlo a situação económica e financiária da própria empresa.

O orçamento pode ser configurado de duas maneiras diferentes:

- Na tabela Contas, coluna Orçamento. Em cada conta é indicado o montante do orçamento anual.

Neste caso, quando se elabora o Orçamento no menu Conta1, comando Balanço Patrimonial por grupos, a coluna do orçamento descreve os montantes que se referem ao ano inteiro. - Na tabela Orçamento, que se ativa no menu Ferramentas, comando Adicionar novas funcionalidades.

Nesta tabela registram-se todos os orçamentos de despesas e de receitas com lançamentos. Caso se ative esta tabela, a coluna Orçamento da tabela Contas é desativada automaticamente.

Neste caso pode-se configurar um orçamento detalhado que tenha em conta possíveis variações durante o ano e nos diversos períodos do ano.

Mais informações disponíveis na página Orçamento.

Characteristics of the Multi-currency accounting

Thanks to Banana Multi-currency accounting, you can easily work on an international level, in the language you want and with the foreign currency accounts you need. Again, the structure is that of spreadsheets, similar to Excel and with all the resources of the other Banana applications. The functions are based on the Double-entry accounting methodology. Should you need to manage VAT you can activate the VAT features at any time.

It will prove particularly interesting for those who have foreign operations, for associations that generally operate all over the world or run projects and simply for those who require accounts in foreign currency in their bookkeeping.

The multiple functions of Multi-currency

- Manage as many accounts as you wish in foreign currency

You don't need to have separate managements to handle accounts in other currencies. In the same Chart of Accounts used for your accounting, enter the accounts in foreign currency, set the exchange rates in the exchange rate table for exchange differences and you are ready to transact. - You can set any currency, standard or freely defined curdrency codes (to use any digital currency).

- Decimals for currencies can be set from 0 to 28. Generally 2 decimals are used, but the accounting can be set to use 0 decimals, or 3 decimals (Tunisia) or more if it is used for crypto currencies. 9 decimal (Bitcoin) or 18 (Ethereum)

- Same methodology as double-entry accounting

You will work with the same double-entry accounting method, therefore register the debit and credit and you will have all the reports and details of a professional accounting. - Automatic exchange rate calculation

The moment you create a foreign currency account, you will not need to calculate the equivalent in foreign currency manually, the program automatically calculates the exchange rate. You can enter the exchange rate either by updating the exchange rate in the Exchange rate table or directly in the Transactions table in the Exchange rate column. - Transactions in different currencies

You are able to enter all necessary cases of transactions in foreign currency, including transfers and those that do not include the basic currency. This allows for complex operations to be carried out in your accounting. - Complete reports with balance sheet, income statement

Accounts of both the balances in foreign currency and of the equivalent value in the basic currency (national currency) will be displayed in the Balance Sheet and Income Statement.

If you have foreign business relationships and you need to present the Balance Sheet and Income statement in a second currency, this is possible without creating separate reports in Excel, just go to the Accounts table, select the Currency2 tab and you will have the display of all the accounts in the second currency and as well as in the basic currency.- Watch the video tutorial that shows how to create and print the Enhanced Balance Sheet with groups.

- Account cards with amounts in foreign currency and basic currency

The account cards can be viewed with the columns of the amounts in basic and foreign currency. This allows you to evaluate the balances in both currencies. - Free exchange rates in the Exchange table

You can set the exchange rates for various needs: variable exchange rates, fixed exchange rates, different exchange rates for the same currency, for example to manage investments and without affecting accounts with the same currency. - Automatic exchange rate differences

When you need to calculate the exchange rate differences, just update the exchange rate in the Exchange rate table and use the relative command; the differences will be entered in the Transactions table automatically. - Budgets are also possible with the Multi-currency

In the Multi-currency accounting file you can also budget the liquidity of the accounts in a foreign currency, as well as all the budgets related to the Balance Sheet and Income aspects. You can print Budgets and forecast reports, or combine them, with the columns of the Budget, Balance Sheet and relative variations. - Automatic check for unrecorded exchange differences

When using the Check Accounting command, you will no longer have unrecorded exchange differences, because if they exist, they will be reported. This function is particularly important to avoid having exchange rate differences in the opening balances when you create the new year. - Financial statements, economic accounts and reports, also in a second currency.

Multi-currency accounting, based on the double entry has many other characteristics identical to the double-entry accounting, which you can refer to on the following page:

Theory of multi-currency accounting

In this section, the basic theoretical notions about currency exchange are being explained.

Exchange rates and accounting issues

Every nation has its own currency and to obtain another currency it is necessary to buy it using the appropriate exchange rate. The price of a currency, as compared to another one is called the exchange rate. To exchange money means to convert the amounts of one currency into another. The exchange (exchange rate) varies constantly and indicates the rate of conversion.

For example, on January 1st

- 1 Euro (EUR) was equal to 1,22637 US Dollar (USD)

- 1 US Dollar was equal to 0,81529 Euro

- 1 EUR was equal to 1,08222 Swiss Franc (CHF)

- 1 EUR was equal to 126,52 Japanese Yen (JPY)

Basic Currency

Amounts referring to different currencies cannot be totaled directly. It is necessary to have a basic currency to refer to and to be used for the totals.

The central point of accounting is that the totals of the “Debit” balances must correspond to the totals of the “Credit” balances. To verify that the accounting is balanced, there must be a single currency with which to do the totals.

If there are different currencies, the basic currency must be indicated before anything else. Once the basic currency has been selected and some transactions have been executed, the basic currency can no longer be altered. To change the basic currency, the accounting must be closed and another one created with a different basic currency.

The basic currency is also used to establish the Balance Sheet and to calculate the profit or loss of the period.

Each amount has its equivalent in basic currency

To be able to add the totals and verify that the operations balance, it is necessary to have the equivalent in basic currency for every transaction. This way you can check that the total of the Debit entries is the same as the total of the Credit ones.

If the basic currency is EUR and there are transactions in USD, there needs to be an exchange value in Euros for every transaction in US Dollars. All the EUR amounts will be totaled to verify the accounting balances.

Account currency

Each account has its own currency symbol which indicates in which currency the account will be managed.

You must therefore indicate what the currency of the account will be. Each account will then have its own balance expressed in its own currency.

Only transactions in that currency will be permitted on this account. If the account is in EUR, then there can only be EUR entries on this account; if the account is in USD, then there can only be entries in USD currency on this account.

When you have to manage entries in YEN, then you have to have an account whose symbol is the YEN.

Account Balance in basic currency

For each account, alongside the balance in the account’s own currency, the balance in basic currency will also be kept, in order to calculate the balance sheet in basic currency.

The account card for the USD bank account has to correspond exactly to the bank statement as far as the USD amounts are concerned.

The value in basic currency will always be specified for each accounting entry. If the account is in USD, in the entries there will also be its value in EUR, beyond the amounts in USD. The EUR balance will be determined by the sum of all the entries expressed in EUR. The actual balance in basic currency will depend on the exchange rate factors used to calculate the exchange value of each single entry to EUR.

If on a given day you take the actual balance in USD and convert it to EUR at the prevailing daily exchange rate, you will get an exchange value that differs from the balance of the account in basic currency. This difference is due to the fact that the exchange rate used for entries on a daily basis is different from the actual daily exchange rate.

Thus there is a difference between the actual value at the daily exchange rate and the accounting balance in basic currency. This accounting difference is called the exchange rate difference.

The difference between the balance in basic currency and the calculated value has to be registered, when the accounting is closed, as an exchange rate profit or loss.

Balances in another currency (currency2)

All the accounting reports will be calculated in basic currency. If you take the basic currency values and change them into another currency, you will get the balance in another currency. The program has a Currency2 column where all the values are automatically entered and presented in the currency specified as Currency2. The logic for the conversion of the amounts is the following:

- If Currency2 is the same as the account or operation currency, then the original value will be used.

- If the account is in USD and Currency2 is USD, the USD amount will be used.

- In all other cases the basic currency amount will be used and changed into Currency2.

- The daily exchange rate is used. Even for past entries, the exchange value in Currency2 will be expressed on the basis of the most recent exchange rate, and not on the historical one used on the day of the entry.

You need to pay attention to the fact that a balance converted to another currency will show small differences in the totals. Often the converted value of a total is not equal to the sum of split exchange values, as can be seen from the following example:

|

Basic currency EUR |

Currency 2 USD |

|

|

Cash |

1.08 |

1.42 |

|

Bank |

1.08 |

1.42 |

|

Total Assets |

2.16 |

2.84 |

|

Personal capital |

2.16 |

2.85 |

|

Total Liabilities |

2.16 |

2.85 |

In the basic currency, total assets are equal to total liabilities. It is permitted to present a Balance Sheet that contains differences only if they are understandable and if it is indicated that they were due to calculations from another currency.

Accounts table, Currency 2 view

Converting currencies

Open a multi-currency model of Banana Accounting Plus

Learn more about the multi-currency feature of Banana Accounting Plus

Below, we explain the theory of how exchange rates work.

Variability of exchange rates

The purchase/sale of currencies occurs in a free market. The price (exchange rate) is based on the law of supply and demand. The differences in the exchange value can be more or less important according to the fluctuations of the exchange rate.

The exchange rates in the following examples, are not the actual daily ones, but are fictitious to explain the problematic.

| Date | Exchange rate EUR/USD | Equivalent in EUR of USD 1000.00 | Equivalent value difference compared to 01-01 |

| 01-01 | 1.32030 | 1'320.03 | |

| 31-03 | 1.33350 | 1'333.50 | 13.47 |

| 30-06 | 1.34750 | 1'347.50 | 27.47 |

| 30-09 | 1.42720 | 1'427.20 | 107.17 |

The exchange rate

The exchange rate refers to the basic currency. There are always two different exchange values between two currencies, according to the currency that is used as the basic currency.

For the USD and Euro currency, there are therefore two different exchange rates:

- If the basic currency of the exchange is EUR then the exchange rate is 1.32030

1 Euro (EUR) corresponds to 1.32030 US Dollars (USD) - If the basic currency of the exchange is USD then the exchange rate is 0.75800

1 US Dollar corresponds to 0.75800 Euros

In the current document, the Euro will be regularly used as the basic currency, to which other currencies will be compared.

Inverse exchange rate

Having the exchange of EUR/USD at 1.32030, it is possible to find the exchange rate of USD/EUR by dividing 1 by the exchange rate.

| Exchange rate | Inverse exchange rate 1/exchange rate | Inverse exchange rate rounded to 6 digits |

| EUR/USD 1.32030 | 0.75800 | 0.758000 |

The exchange values calculated with an inverse exchange can turn out to be different from the original one due to rounding.

| Exchange rate | Inverse exchange rate | Exchange value 10000 x original exchange rate | Exchange value 10000 x inverse exchange rate | Difference |

| EUR/USD 1.32030 | 0.75800 | 13'203.00 | 13'192.61 | 10.39 |

Don't use inverse exchanges rates in order to avoid differences.

For the transition to the Euro, for example, the use of inverse exchange rates was prohibited.

Multiplier

There are currencies that have very large exchange rate values.

Always on January 1st

- 1 US Dollar = 670,800 Turkish Lira

- 1 Turkish Lira (TRL) = 0.00000149 US Dollar (USD)

Instead of using that many zeros, it can be said that

- 1000 Turkish Lira (TRL) = 0.00149 US Dollar (USD)

In this case, the multiplier is 1000 instead of 1.

Preciseness

As a rule, an exchange rate is specified with a preciseness of at least 6 figures after the decimal.

There are, however, cases where it is necessary be more precise.

- 1 Turkish Lira (TRL) = 0.00000149 US Dollar (USD)

When the preciseness is changed and the exchange is rounded in a different way, the amounts also change. The preciseness with which the exchange is specified is very important.

Minimum denomination

Especially for paper money, minimum denominations are used. As a rule the lowest denomination for Swiss francs is five centimes (0.05). When an exchange occurs, for example EUR/CHF:

1 EUR = 1.60970 CHF

| EUR | Exchange rate | Actual exchange value in CHF | Rounded to lowest CHF denomination | Difference | Effective exchange rate |

| 10.00 | 1.60970 | 16.09 | 16.10 | 0.01 | 1.61 |

Calculation of exchange rates and values

When the Euro is the basic currency

The exchange factor for EUR/USD is 1.32030

1 Euro (EUR) is equal to 1.32030 US Dollars (USD).

Calculation of the exchange value:

Multiply the basic currency amount by the exchange factor:

EUR 100 x 1.32030 = USD 132.03

Calculate the basic currency amount:

Divide the destination currency by the exchange rate:

USD 132.03 / 1.32030 = EUR 100

Calculate the exchange factor:

Divide the basic currency amount by the destination currency amount:

Exchange rates for purchases and sales

Banks carry out the purchase and sale of currencies and include a transaction margin. They apply different exchange rates depending on whether a determined currency is being bought or sold.

Sale: the bank receives domestic money and provides (sells) foreign money.

Purchase: the bank receives (purchases) foreign money and provides domestic money.

Currency exchange and banknotes exchange (premium)

Currency exchange: exchange for scriptural transactions (from one account to the other).

Banknote exchange: exchange for banknotes.

Premium: commission for converting a scriptural amount to cash.

To exchange currency, the banks maintain a lesser margin (the difference between purchase/sale) compared to exchanging banknotes. When a scriptural value is to be transformed (credit on the account) into cash currency, the bank applies a commission, called a premium.

Differences when changing back to basic currency

When an amount is exchanged into another currency, it is expected that the reverse exchange will result as identical to the original amount .

| Basic amount | Exchange rate | Exchange value | Return |

| 100.00 | 1.32030 | 132.03 | 100.00 |

However, you do not always come up with the same amount when converting currency back. Because of rounding errors, there may be cases where the same return value cannot be obtained.

| Basic amount EUR | Exchange rate | Exchange value in USD | Return in EUR | Difference in EUR |

| 328.67 | 1.32030 | 433.94 | 328.66 | |

| 328.68 | 1.32030 | 433.95 | 328.67 | 0.01 |

| 328.69 | 1.32030 | 433.96 | 328.68 | 0.01 |

Differences of totals through splitting

The total exchange value of the components of an amount does not always result in the same exchange value as the overall amount.

In this example, the amount of 2.16 EUR produces an exchange value in USD of 2.85. By splitting the amount and adding the two exchange values, 2.84 will result.

| Amount in EUR | Exchange rate | Exchange value in USD |

| 2.16 | 1.32030 | 2.85

|

| 1.08 | 1.32030 | 1.42 |

| 1.08 | 1.32030 | 1.42 |

| Total 2.16 | 2.84 | |

| Difference | 0.01 |

These mathematic differences cannot be eliminated if they are not recorded properly.

Revaluations and exchange rate differences

Exchange rates vary all the time and therefore the exchange value to basic currency also varies. Between one period and another, there will inevitably be exchange rate differences.

Exchange rate differences are not accounting errors but simple adjustments of the values made necessary in order to keep the accounting figures in line with fluctuations.

As you open the accounting, the figures in the balance column are equal to those present in the opening column. When there are entries, these will update the figures in the balance column.

The calculated balance column contains the exchange value of the basic currency for the account balance, at the daily exchange rate (of the exchange rate table). The difference between the balance in basic currency and the calculated balance is the exchange rate difference.

|

|

Currency at opening |

Exchange value at opening in EUR |

Basic currency balance in EUR |

Calculate balance at 30.03.200xx in EUR |

Exchange rate difference |

||

|

Exchange rate |

|

|

1.32030 |

1.32030 |

1.30150 |

|

|

|

|

|

|

|

|

|

||

|

Cash |

EUR |

93.80 |

93.80 |

93.80 |

93.80 |

|

|

|

Bank |

USD |

100.00 |

75.74 |

75.74 |

76.83 |

1.09 |

|

|

Real estate |

EUR |

1'000.00 |

1'000.00 |

1'000.00 |

1'000.00 |

|

|

|

Total Assets |

|

|

1'169.54 |

1'169.54 |

1'170.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan |

USD |

-500.00 |

-378.70 |

-378.70 |

-384.17 |

-5.47 |

|

|

Personal capital |

EUR |

-790.84 |

790.84 |

-790.84 |

-790.84 |

|

|

|

Total Liabilities |

|

|

-1'169.54 |

-1'169.54 |

-1'175.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss |

|

|

|

|

-4.38 |

|

|

On March 30th the EUR/USD exchange rate is different from the one at the beginning of the year. In the above example, there were no accounting entries during the three-month period. The situation, from an accounting point of view, has not changed since the beginning of the year. Despite this the total of the updated balance, using the rate at the end of March, is different when compared to the beginning of the year. The credit bank balance and the loan in USD have a different value in EUR. There are therefore consequences for the accounting even though there have been no entries.

In the above example, you will notice that the Euro is now worth less against the dollar compared to the beginning of the year. The dollar is therefore worth more against the Euro.

The exchange value of the balance on the account in USD is greater than it was at the beginning of the year. You have a greater value of the asset and therefore a profit on the exchange rate.

On the liability side there is a USD 500.00 loan. Now the exchange value in EUR is greater compared to the value input at the beginning of the year. The value of the loan has increased and brings about a loss due to the exchange rate difference.

In the following example we shall use the hypothesis that there has been the opposite development. We imagine that the Euro has increased in value and is therefore worth more against the USD. The exchange value in EUR of an amount in dollars is less than the one at the beginning of the year.

|

|

|

Currency at opening |

Exchange value at opening EUR

|

Calculate balance at 30.03.20XX Eur (Hypothetical) |

Exchange rate difference |

|

Exchange rate |

|

|

1.32030 |

1.36150 |

|

|

|

|

|

|

|

|

|

Cash |

EUR |

93.80 |

93.80 |

93.80 |

|

|

Bank |

USD |

100.00 |

75.74 |

73.44 |

-2.30 |

|

Real estate |

EUR |

1'000.00 |

1'000.00 |

1'000.00 |

|

|

Total Assets |

|

|

1’169.54 |

1'167.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan |

USD |

-500.00 |

-378.70 |

-367.24 |

11.46 |

|

Personal capital |

EUR |

-790.84 |

-790.84 |

-790.84 |

|

|

Total Liabilities |

|

|

-1’169.54 |

-1'158.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit |

|

|

|

9.16 |

9.16 |

As a consequence of an increase in the Euro/dollar exchange rate, you have a USD bank deposit with an exchange value in EUR which is less than at the beginning of the year. The total worth has diminished and there is therefore a loss.

The USD loan has a lower exchange value in EUR. A lesser liability is an advantage for the company and there is thus an exchange rate profit.

Exchange rate profit

You have an exchange rate profit when:

- The exchange value of your assets increases (increase of the investments)

- The exchange value of the liabilities decreases (decrease of the loans).

Exchange rate losses

You have an exchange rate loss when:

- The exchange value of your assets decreases (decrease of the investments)

- The exchange value of the liabilities increases (increase of the loans).

Accounting features for exchange rate differences

Exchange rates can evolve in different ways. Often they rise, only to fall again. The principle rule for accounting is that the figures provided on the Balance Sheet must be true ones. When you present your Balance Sheet, the exchange values of foreign currency accounts must be made at the exchange rate on the day of presentation.

The exchange rate difference is calculated as if you had to definitively convert the amount to basic currency. In reality there is no definitive conversion so you are only dealing with a correction to the accounting.

Closing exchange rate

At the end of each year it is necessary to prepare the complete Balance Sheet. The exchange rates thus have to be updated with the closing exchange rates. It is also necessary to enter the exchange rate differences once and for all; if these are not entered, then there will be differences in the opening balances.

Entering exchange rate differences

|

|

|

Currency balance |

Account balance EUR |

Calculate balance at 30.03.xx EUR (hypothetical) |

Exchange rate difference |

|

Exchange |

|

|

1.32030 |

1.36150 |

|

|

|

|

|

|

|

|

|

Bank |

USD |

100.00 |

75.74 |

73.44 |

-2.30 |

|

|

|

|

|

|

|

|

Exchange rate difference |

EUR |

|

-2.30 |

|

|

|

|

|

|

|

|

|

|

Bank |

USD |

100.00 |

73.44 |

73.44 |

0.00 |

As can be seen from the above example, the bank balance is USD 100.00. For the accounting it has been valued at 75.74 EUR. Today’s actual value, though, is only EUR 73.44. There is a difference of EUR 2.30 EUR in basic currency. The entry must therefore decrease the EUR amount. You proceed with a transaction that debits the bank account and credits the exchange rate loss account by EUR 2.30.

As you can see, the actual bank account balance of USD 100.00 has not been altered. The entry only alters the basic currency balance.

When entering the exchange rate difference, you need to ascertain that the exchange value in basic currency corresponds to the actual exchange value, calculated at either the daily exchange rate or the closing one.

The figures in the account currency must not be altered. You must therefore proceed to make an entry that only alters the basic currency balance on the specific account.

You will have the exchange rate profit or loss account on the contra account.

Transactions at purchase exchange rates

Transactions valued at the purchase exchange rate

When the positions, valued with exchange rates at the time of purchase (historical) are increased or decreased, you will have to calculate the exchange rate of the exchange rate table, taking into account the development of the amounts of increase.

|

|

USD amount |

Exchange |

EUR exchange value |

Total USD |

Total EUR |

Historical Exchange |

|

Acquisition of shares |

100'000.00 |

0.9416 |

106'202.00 |

100'000.00 |

106'202.00 |

0.9416 |

|

Increase of shares |

50'000.00 |

0.8792 |

56'870.00 |

150'000.00 |

163'072.00 |

0.919839 |

Investments and special exchange rates

Investments valued at the exchange rate of the time purchase

Certain investments (shares, real estate abroad) are valued using the exchange rate of the time of purchase (historical exchange) and not the current one. The exchange rate profit and loss is not accounted for until it is actually realized. You must therefore make certain these accounts do not get valued using the current exchange rate.

In order to input a fixed historical exchange rate, you need to create an additional currency on the Accounts table (e.g. USD1) with a fixed exchange rate.

It is essential that in the Fixed column of the Exchange table, when viewed in Complete, for each currency with a fixed exchange rate, Yes must be inserted; otherwise, the currency and its related account are still revalued.

This currency will then only be used for this specific account ( ex: USD1) with a fixed rate.

If you have to make a transfer from the USD account to the USD1 account, you proceed exactly as if you were working with two different currencies. For this reason you will have to use a two-row entry.

Opening with special exchange rates

By inputting the opening balances in the Opening column, foreign currency amounts will be converted to basic currency at the opening exchange rate.

If this system does not prove flexible enough (i.e. you need various special rates or there are rounding differences) the opening can be done manually by making normal entries, indicating the amounts and the exchange rates you want for each account. In this case, the "Opening” column of the Accounts table will be left blank.

File properties multi-currency accounting

See also the File Properties (Basic Data) page for information about the other sections of the dialog.

Account for exchange rate profit

From the accounts list, select the account for the exchange rate profit present in the Chart of Accounts.

You can only choose from class 3 and 4 accounts that are in basic currency.

In the Accounts table, it is also possible to specify the exchange rate difference account for each individual account.

Account for exchange rate loss

From the accounts list, select the one for the exchange rate loss present in the Chart of Accounts.

Currency2

It is possible to select a second currency in order to view the balances in a currency different from the basic one.

It is possible to add new currencies that might be missing from the list, proceeding as follows:

- in the Exchange rates table enter a new row; in the Ref.Currency column enter the basic currency for your accounting file, in the Currency column enter your desired currency

- From the File menu > File and accounting properties command, in the Currency tab, the added currency will also be visible and it can be chosen as Currency2.

Decimal points Currency2

This is the number of decimal points to be used when rounding the amounts in currency2.

Conversion of amounts into Currency 2

Currency 2 is displayed in the Currency2 view of the Accounts table and used when you wish to have an estimate of all account balances, including those in base currency, in the foreign currency, defined as currency 2.

It serves for information purposes only, to know the values of the balance sheet and profit and loss account in a currency other than the base currency at a given time. The conversion is based on the exchange rate set in the exchange rate table, Exchange rate column. If the exchange rate in currency 2 is changed in the exchange rate table, the amounts in currency 2 will be recalculated.

The conversion may lead to differences between balances in currency and those in currency 2. More information can be found on the Exchange Rates page.

The conversion of the amounts into Currency 2 takes into account the currency of the account, with the following logic:

- If currency 2 is equal to the account currency, the amount in the account currency is used.

- Otherwise, if currency 2 is equal to the basic currency, the basic currency amount is used.

- Otherwise (if the amount is in any other currency) the amount in basic currency is converted into Currency 2 at the current exchange rate set in the Exchange rates table, therefore historical exchange rates are not used for the conversion.

Exchange rates table

In the Exchange Rates table, the basic currency (accounting currency) and foreign currencies with all their related parameters are entered.

Before setting up the Exchange Rates table, it is necessary to set up in the Accounts table, foreign currency accounts with their respective codes; you also need to define the basic currency in the File menu > File and accounting properties.

Exchange rates with and without date

There are two types of exchange rates:

- Exchange rates without date

For each currency used there must be an exchange rate line without date.

The exchange rate rows without a date are used as reference rates to convert foreign currencies into the basic currency according to the current exchange rate. They are used:- When there is no historical exchange rate (exchange rates with dates).

- At year end, to define official closing rates and calculate exchange rate differences (end of the accounting period).

During the closing process, it is mandatory to use exchange rate rows without a date in order to calculate exchange rate differences.

- Current exchange rate and closing exchange rate

- It is the exchange rate entered in the Exchange rate column; it is the current exchange rate or the closing exchange rate.

- This exchange rate is automatically used in the transactions, when there is no historical exchange (exchange rows with date).

If you modify the exchange rate in the Exchange rates table, the exchange rates and amounts previously used in the journal rows are not changed. - It is used for the calculation of the balance column calculated in the accounts table and for the conversion to Currency 2.

- Every time transactions in foreign currency are recorded, the resulting exchange rate differences are displayed in the Calculated Balance column of the Accounts table (Balances view). These differences are the foundation for calculating exchange rate differences and for the conversion into Currency 2.

- Closing exchange rate

- It is used as an exchange rate for exchange rate differences postings.

- It becomes the opening exchange rate when creating a new year.

- Opening exchange rate

It's the exchange rate entered in the Rate Opening column and it is used in the following cases:- When first creating a multi-currency file in Banana Accounting Plus

- When creating the new fiscal year, the opening exchange rate is automatically taken from the previous year's closing rate (in the Exchange Rate column).

The opening exchange rate is automatically used in the Accounts table to convert the opening amounts in foreign currency into the opening amounts in the basic currency of your accounting file.

If you need to edit the opening exchange rate, you must use the Recalculate accounting command.

- Current exchange rate and closing exchange rate

- Exchange rates with date (historical exchange rates)

When dates are entered in the Exchange Rates table, and foreign currency transactions are recorded in the Transactions table based on a date specified in the Exchange Rates table, the program selects the exchange rate with the date equal to or closest to but not exceeding the date of the transaction entry.

The program uses the historical exchange rate in these cases:- When entering transactions at a specific date and in the Exchange rates table there is an historical exchange rate.

- When creating exchange rate differences and specifying to use historical exchange rate.

In exchange rates with a date (historical exchange rates), no opening exchange rate should be indicated (Opening Rate column).

Columns of the Exchange rates table

All the columns available for the Exchange rates table are visible in the Complete view.

Date

Rows without a date are used as reference exchange rates by the program. Rows with a date are used as historical exchange rates.

Ref. Currency

It is the starting currency (basic currency) for the exchange (EUR in the example).

Currency

This is the destination currency (foreign currency). It's value is converted into the Reference currency.

Text

A text to indicate the foreign currency description

Fixed

True or false. If there is a fixed exchange rate, enter Yes in this column. In this case, for the foreign currency with a fixed exchange rate, the same rate is used consistently until it is modified. Typically, a fixed exchange rate is applied when there are accounts whose value should not undergo continuous fluctuations, such as real estate investments.

Mult. (Multiplier)

The multiplier is usually 1, 100 or 1000 and is used to obtain the effective exchange rate. The multiplier is used for currencies which have a very low unit value in order to avoid having to insert exchange rates with many zeros. In our templates, the negative multiplication (-1) is used in the Multiplier column of the Exchange rates table.

In this case:

- In the Ref. (Reference) Currency column, the base currency of the accounting system is entered

- In the Currency column, the foreign currency is entered.

When in the Ref. Currency and Currency columns the abbreviations of the currencies are reversed, the Multiplier 1 (positive exchange rate) must be entered in the column.

If transactions have already been made with the same currency, do not change the multiplier, otherwise the programme will report errors in the entries due to incorrect exchange rates.

Exchange rate

It is the current or closing exchange rate of the currency against the reference currency.

This is also used to calculate exchange rate differences. Before calculating exchange rate differences, it is necessary to update the rate in this column according to the official closing rate.

The exchange rate and the multiplier are being applied according to the following formulas

- With multiplier > 0

Currency amount = Ref. currency amount* (exchange rate / |mult.|)

- With multiplier < 0

Ref. currency amount = Currency amount * (exchange rate / |mult.|)

Opening Exchange rate

This is the exchange rate at the moment the accounting is opened. To be indicated only on a row without date.

- It is used to convert the opening amount of the foreign currencies into the opening amount of the accounting’s basic currency.

- Should be corresponding to the closing exchange rate of the preceding year.

When transitioning to the new fiscal year, the opening exchange rate is automatically updated based on the closing exchange rate from the previous year entered in the Exchange Rate column (Exchange rates table).

If the closing exchange rates are not equal to the opening exchange rates, the Assets and Liabilities might result into different totals; see Differences in the Opening Balances. - The opening exchange rate should never be changed in the course of the year, otherwise exchange rate differences are being created in the total of the opening balances.

- The opening exchange rate should not have a date.

Minimum

The minimum exchange rate accepted. If an inferior exchange rate is used for the transactions, there will be a warning.

Maximum

This column shows the maximum exchange rate accepted. If a superior exchange rate is used for the transactions, there will be a warning.

Decimal Points

The number of decimal points to be used when rounding the amounts of the foreign currency.

Modifications in the Exchange rate table

The current exchange rates for foreign currencies can be modified in the Exchange rates table, specifically in the Exchange rate column for rows without a date. In this scenario, when a transaction with an account in a foreign currency is entered in the Transactions table, the program automatically uses the exchange rate set in the Exchange rates table. If a change is made to an exchange rate in the Exchange rates table, there are no repercussions on previously entered transactions; the new exchange rate is applied to future transactions.

It is also possible to manually modify the exchange rate directly in the Transactions table by entering the desired rate in the Exchange rate column. This modification does not affect the exchange rate present in the Exchange rates table.

- Modification of the Opening exchange rate

If the opening exchange rate is modified, the next time you recalculate the accounting, the balances in basic currency of the accounts will be recalculated with the new exchange rate. Therefore, if you have opening balances, pay attention when modifying the Opening exchange rates.

If you modify the opening exchange rates and there are opening balances, it is important to recalculate the accounting. - Modification of the multiplier

- When changing the multiplier of a currency already used in the Transactions table, the program will report a warning as soon as the accounting is being recalculated. The transaction amount and the correct amount in the basic currency will have to be reentered.

- When the accounting is being recalculated, the opening balances in basic currency will be recalculated as a result.

Direct exchange rates

Direct exchange rates are those where the basic currency and the foreign currency are indicated on the same row.

In the example below, the direct exchange rate is EUR → USD.

Indirect exchange rates

Indirect exchange rates are those where a direct exchange between two currencies is not being indicated (not recommended).

The exchange rate is deducted by the program based on other combinations of entered exchange rates

Historical exchange rates

As explained above, if an exchange has a date, the program considers it to be a historical exchange rate.

In the cases indicated here, the program chooses the exchange rate with a date equal to or less than the date of the transaction row.

- When entering transactions, if there is a historical exchange rate, it is proposed and used as the default exchange rate.

- When the exchange rate differences transactions are created and the option to use the historical exchange rate is activated.

- In rows with a date, the opening exchange is not used.

If you import several historical exchange rates at the end of your accounting period, that is, when you have already entered accounting transactions, simply manually delete the transactions exchange rates (Exchange rate column, Transactions table) to make sure that the program uses the imported exchange rates instead of those entered in the transactions.

Monthly average exchange rate

When entering a monthly average exchange rate, this must be inserted manually in the Exchange rate table, in a row without date. In the Transactions table, for foreign currency accounts, the average exchange rate will always be included until it is updated again in the Exchange rate table.

For the monthly average exchange rate, we recommend consulting the page of the exchange rates proposed by the Swiss Confederation, available in Italian, French or German.

Incompatible exchange rates from previous versions

When the basic currency is entered as the reference currency, the exchange rates with a multiplier greater than 1 can present calculation differences between Banana Plus and the previous versions. In these rare cases, while opening an accounting file of a previous version, a warning message appears and the file is being opened as "read only".

- Open the file in Banana Plus and confirm the warning message;

- Recheck the accounting (Shift + F9);

- The warning messages "Transaction multiplier is not the same as the one in the Exchange rate table" can be ignored;

- Verify whether the balances and the result of the accounting period present differences compared to those displayed in earlier versions. If there are no differences, just save the accounting under a new name; otherwise, it is necessary to proceed as follows:

- In the Exchange rate table, correct the exchange rate by multiplying it with the value of the multiplier and define the multiplier as 1 for the exchange rates with a multiplier greater than 1. For example, if we have a multiplier of 100 and an exchange rate of 0.9944608, correct the exchange rate to 99.44608 and the multiplier to 1.

- Recheck the accounting (Shift + F9).

- The warning messages "Transaction multiplier is not the same as the one in the Exchange rate table" can be ignored, or it is possible to delete them by clicking, in the corresponding transaction row, on the amount in basic currency and by pressing the F6 key

- Verify whether the balances and the result of the accounting period correspond with the ones indicated in earlier versions

- Save the file under a new name

- At this time, you can define the exchange rates and the multiplier in the preferred format, reverse or direct, with or without multiplier, verifying the balances and the result of the accounting period after each modification.

Chart of accounts | multi-currency accounting

In contrast to Double-entry bookkeeping, Multi-currency Accounting has the Exchange rate table and columns for calculating foreign currency amounts and balances.

Grouping of the Accounts table

For the Accounts and Groups grouping system, please refer to the Grouping System page.

Setting the basic currency

The base currency is set from the menu File > Accounting properties

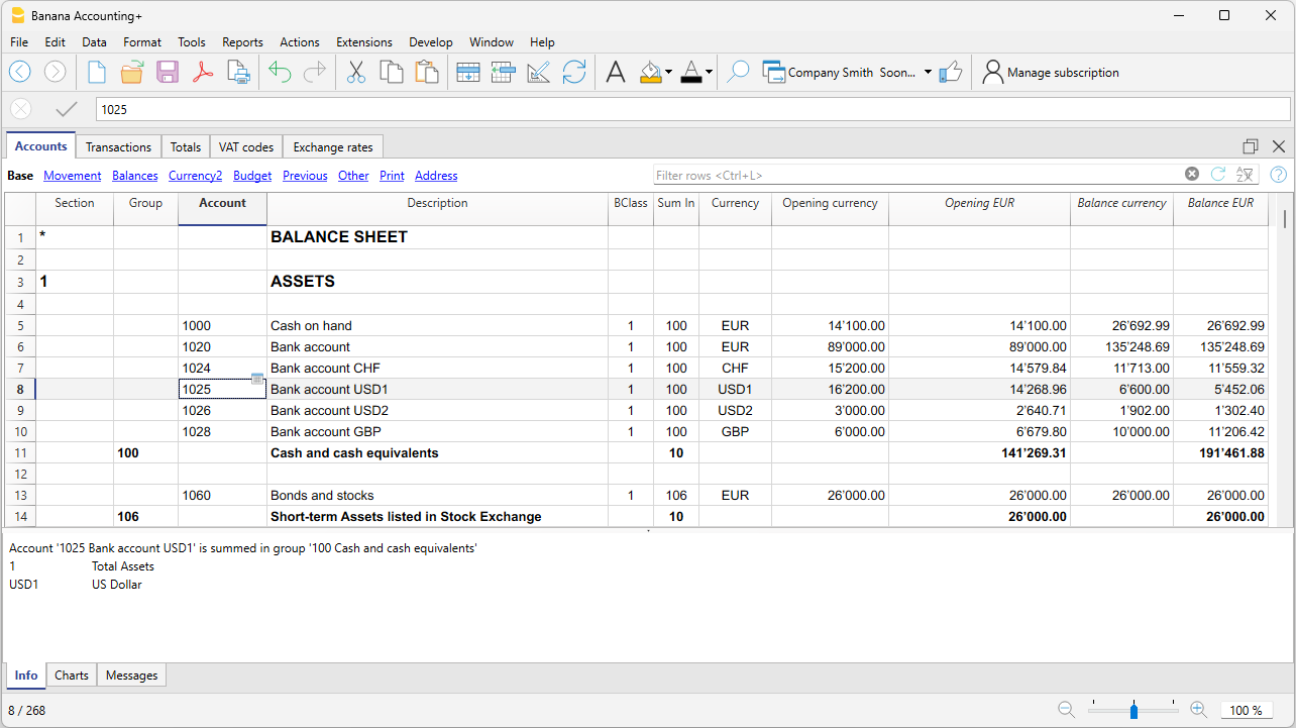

Account Currency

Each account has a currency abbreviation, which may be that of the base currency or a foreign currency abbreviation, indicated in the exchange rate table.

Assets and liabilities accounts can be set up in different foreign currencies in addition to the base currency (in the example EUR).

- Foreign Currency Accounts

Accounts in foreign currencies are set up in the Accounts table. In the Currency column , for each foreign currency account the currency code must be entered.

In the Exchange rate table, for each foreign currency, the abbreviations of the foreign currencies, set in the Accounts table, and the opening exchange rate must be entered.

In the example below, the base currency is EUR. The abbreviation of the base currency EUR appears in the column headings with the amounts in base currency.

- Accounts in base currency (accounting currency)

Accounts in base currency are set up in the Accounts table. In the Currency column, the abbreviation of the base currency must be entered.

Income and Expense accounts, other than in basic currency (EUR in the example), can also be set in different currencies.

Explanation of multi-currency accounting columns

Currency

Enter the symbol of the account currency. For foreign currency accounts, the symbol must also be present in the exchange rate table.

Opening currency

The initial balance is entered for each account, whether it is a basic or foreign currency account

Opening balance (basic currency)

- A protected column calculated by the program.

- The initial balance in basic currency is calculated by the program.

- For basic currency accounts, the opening balance in the Opening currency column is reported.

- For foreign currency accounts, the balance is converted according to the exchange rate in the exchange rate table.

Balance currency

- Protected column used by the program.

- The balance is calculated by the programme and corresponds to the sum of the opening balance (for accounts in foreign currency, this is the balance converted into the base currency) and the amounts of the transactions in base currency and in foreign currency (amounts converted according to an exchange rate, which can be found in the exchange rate table).

Balance

- Protected column used by the program.

- The balance is calculated by the program and corresponds to the sum of the opening balance (for accounts in foreign currency it is the balance converted into basic currency) and the amounts of the transactions in basic currency and in foreign currency (amounts converted according to an exchange rate present in the exchange rate table).

Calculated balance

- Protected column used by the program.

- This is the currency balance of the account converted at the current exchange rate (exchange rate from the exchange table of the undated row).

- In this column, the currency account balances converted to basic currency may differ from those in the Balance column, as exchange rate differences are present.

Exchange rate difference account

- Visible in the Other view.

- In this column, you can enter an exchange rate profit or loss account for a given account.

The account you enter will be used by the Create Exchange Rate Difference procedure instead of the exchange rate profit and loss accounts defined in the multi-currency file properties. - In the Exchange Rate Difference Account column you can specify:

- "0;0" This means that no exchange rate difference is to be calculated for this account.

It is used for historical exchange rates, which must not change. - Two accounts separated by semicolons, "Currency Exchange loss account; Currency Exchange rate profit", e.g. "6949;6999".

If there is a loss the first account will be used, if there is a profit the second. - "One account only" for example "6949".

This account will always be used whether there is an exchange rate profit or loss.

- "0;0" This means that no exchange rate difference is to be calculated for this account.

Opening balances

Information on how to enter opening balances in multi-currency accounting is available on the Opening balances page in multi-currency accounting.

Exchange Profit and Loss Accounts

In the chart of accounts, it is necessary to insert the predefined accounts for the exchange gain and loss to be reported in the File menu File properties → Foreign currency.

Accounts for exchange rate differences must have BClass 3 (Costs - Exchange Loss) or 4 (Revenue - Exchange Profit).

Revaluation accounts and historical exchange rates

Exchange rates are fluctuating. The actual value of the balance in the account currency varies therefore depending on the foreign exchange fluctuation.

The basic currency amount of an account is being calculated using the opening exchange rate and the exchange rates that are indicated in the transactions. Because this value corresponds to equivalent of today's exchange rate, it is necessary to revaluate the account.

The revaluation takes place by calculating the exchange rate differences. With the automatic calculation of exchange differences, the software enters an amount in basic currency (exchange difference) so that the balance in basic currency is equal to the counter value (calculated balance column).

There are accounts (related to investments, for example) for which a so-called historic exchange rate is being used. By an historical exchange rate, we mean an exchange rate that doesn't vary over time.

There are two ways to have currencies that do not vary:

- Create an additional currency code in the exchange rate table (e.g. USD2) to which the same exchange rate will always be attributed.

- In the currency description, indicate that this is a historical exchange rate.

- This currency must then be used for the account with the historical exchange rate and of course also in the entries for the account.

- For each new account with a different historical exchange rate, create a new currency symbol.

You can create as many currency symbols as you need for different accounts with historical exchange rates. - Change the exchange rate of the historical account if there are additional purchases or sales that require an adjustment of the value, while creating a transaction for the exchange rate profit or loss.

- Entering opening balances as Opening transactions.

- Instead of using the opening balances column, the opening balances are entered as transactions. You can assign the opening exchange rate you want.

- In the Account exchange difference column enter the value "0;0" indicating that the account should not be revalued.

Group totals in foreign currency

Normally, the columns with amounts in foreign currency don't have totals, as it makes little sense to calculate totals for values in a different currency.

If you have a group that includes only accounts in a specific currency, the currency symbol can be indicated at a group level and, in the Accounts table, the program totals these amounts. If there were to be accounts with various currency symbols, there would be no amount indicated (the program would not report an error either).

Transactions table multi-currency accounting

Explanations of the columns

In the Transactions Table of the multi-currency accounting, other than the columns of the double-entry accounting, there are the following extra columns:

- Currency amount

This is the amount of the currency specified in the column with the currency symbol.

This amount is used by the program to update the balance of the related account in currency. Currency

This is the currency symbol of the currency to which the amount refers.

The currency symbol has to be the one of the basic currency, specified in the File and accounting properties (File menu), or the currency symbol of an amount indicated in the Debit A/C or Credit A/C columns.You can also use a different currency as long as the indicated Debit A/C and the Credit A/C are basic currency accounts.In this case the amount in currency is used as a reference, but will not be used for accounting purposes- Exchange rate

Used to convert the foreign currency amount in its basic currency equivalent. - Amount in Basic currency

The transaction amount, expressed in basic currency.

This amount is used by the program to update the balance of the related account in basic currency. Exchange rate multiplier

Normally not visible in the view, this value is multiplied by the exchange rate.

Useful advice

- While being positioned on the Currency Amount column and pressing the F6 key, the program rewrites all values with the earlier explained logic, as if there were no values present. This feature is useful when the Debit A/C or the Credit A/C is modified.

- If there is a registration with a single account in basis currency (in 'Multiple transactions' - see Transaction types) and its value of the Currency column has been changed manually in a currency symbol of a foreign currency, it is necessary to be positioned on the cell of the Currency column and press the F6 key in order to update the exchange rate and calculate the amount in basic currency.

- Smart fill for the Exchange rate column

The program suggests several exchange rates, picking them up from the Exchange rates table or from exchange rates previously used in the transactions.

Types of transactions in multi-currency accounting

All amounts, whether in basic currency or foreign currency must always be entered in the Currency Amount column.

As regards the exchange rates, multiplier and historical exchange rates, please refer to the Exchange rates table page.

Attention: in the transaction examples, the basic currency is the Euro.

For each transaction, there are two accounts (debit account and credit account). In the program, only one foreign currency per transaction row can be used. So there can be the following direct combinations:

- Entries between two accounts in basic currency with the amount in basic currency (in the image, transactions n.1 in the Doc column). The account currency is the basic currency.

Entries between two accounts in basic currency with the amount in foreign currency (Doc 2)

The indicated accounts are in basic currency, but the currency symbol and the amount in currency, indicated in the transaction row, are not in basic currency, but in a different currency.To insert the different currency, the user has to manually change the currency symbol.

This is being used when one goes abroad and money is being exchanged in order to pay in local currency. In this case we do not have a specific account.

For the calculation of the balance (both accounts being in basic currency) only the amount of basic currency column is being used.- Entries between an account in foreign currency and one in basic currency (Doc 3)

The currency needs to be the one of the account in foreign currency.

For the calculation of the balance of the account in foreign currency, the program uses the amount in foreign currency and for the balance in basic currency, the program uses the amount in basic currency. - Entries between two accounts with the same foreign currency (Doc 4)

The currency needs to be the same as the account currency of both accounts (USD1 and USD2). In order to update the exchange rate and calculate the amount in basic currency, it is necessary to be positioned on the cell of the Currency column and press the F6 key. - Entries with two accounts in different foreign currencies (Doc 5)

For example, the bank makes an exchange operation between two foreign currencies:

In this case, the transaction needs to be recorded on two rows.

The amount in basic currency needs to be the same. It is useful to use an amount close to the current exchange rate to avoid excessive exchange rate differences.

In order for the amounts in basic currency to be equal, the amount in basic currency needs to be indicated manually, and the program will calculate the exchange rate. - Exchange rate differences (Doc 6)

The goal of this transaction is to realign the balance of the basic currency account with the equivalent of the Foreign currency account at today's exchange rate.

On the Foreign currency account, only the amount in basic currency related to the exchange rate differences is being recorded.

They are automatically generated with the Create transaction for exchange rate variation command.- For the exchange rate profits, the program automatically indicates the account to be revaluated in debit and the exchange rate profit account in credit. The exchange rate profit account is indicated in the File and Accounting properties (Basic Data), or in the specified account -> Exchange rate differences account column of the Other view (intended for one or several specific accounts).

- For the exchange rate losses, the program automatically indicates the account to be revaluated in credit and the exchange rate loss account in debit. The exchange rate loss account is indicated in the File and Accounting properties (Basic Data), or in the specified account -> Exchange rate differences account column of the Other view (intended for one or several specific accounts).

- The Currency amount is being left empty

- The Currency symbol is the basic currency

- In the Basic currency amount column, the amount of the revaluation of the account (profit or loss) is being indicated.

Establishing the exchange rate

The accountant is the one who decides which exchange rate to use for each single operation. Generally, the following rules are being applied:

- For normal operations, the exchange rate of the day is being used

- For buying or selling currency, the values indicated by a money exchange office or a bank are being used.

First the amount in foreign currency is being indicated in the program and then the amount in basic currency. The program calculates the exchange rate. The exchange rate indicated by the bank can be slightly different, because banks specify exchange rates with few figures after the decimal point and often round the amounts. - When several operations with the same exchange rate are being recorded, it is useful to update the exchange rate in the Exchange rates table, so that the program can automatically apply it.

- For operations from abroad that are subject to VAT, the national authority might impose a standard exchange rate. In this case, that exchange rate should be inserted in the Exchange rate column of the transaction

- To purchase real estate or equity investments, an historical exchange rate is being used. In that case, a currency symbol needs to be created in the Exchange rates table (for example USD1) with an historical exchange rate, that is not being subject to the fluctuations of the exchange rate.

One can create as many currency symbols as desired for all historical exchange rates.

Transactions with VAT

The VAT account and the account from which the VAT is being deducted have to be in basic currency. It is impossible to use a VAT code to deduct the VAT from a foreign currency account. In order to record operations with VAT that have accounts in foreign currency as their counterpart, two transaction rows have to be used:

- First, the amount of the purchase is being recorded on an Internal transfers account in basic currency and the related VAT code is being applied. The amount in basic currency has to be calculated using an exchange rate in accordance with the requirements of the Tax administration.

- In a second row, the balance of the Internal transfers account is being put to zero; as its counterpart, the account in foreign currency should be entered.

The amount used for this transaction, both in basic currency and in foreign currency, has to be excluding VAT. Obviously, the exchange rate that has to be used is the same one as the one being used in the preceding transaction.

In the example, the basic currency is the EUR. We are dealing with a national purchase, but paid from a foreign currency account (USD).

VAT and foreign currency transactions

In transactions with foreign currency accounts, it is possible to record VAT with a gross amount (Amount type 0, with VAT).

If you enter net values (Amount type 1, without VAT), the program indicates an error, because the calculation of the gross value would in many cases be incorrect due to the rounding up of VAT and of the exchange rate.

In these cases it is advisable to enter the gross value. See also the Explanations of the error.

Automatism while entering multi-currency transactions

When a new transaction is being entered, the data in the above mentioned columns have to be completed.

When some values of the transaction row are modified, the program completes the transaction with the predefined values. If these values do not satisfy the user's requirements, these have to be modified in the transaction row.

The modification of the values in the Exchange rates table have no effect on already entered transaction rows. Thus, when the exchange rate in the Exchange rates table is modified, this has no influence whatsoever on already inserted transactions.

- When the amount in currency is entered and there is either a Debit A/C or a Credit A/C, and no other values are entered, the program operates as follows:

- the currency symbol is retrieved from the account in use, giving priority to the account that is not in basic currency;

- the exchange rate, defined in the Exchange rates table, is applied with the following logic:

- the historical exchange rate is applied, with a date earlier or equal to the transaction date

- tf there is no historical exchange rate to be found, the exchange rate from the row without date is applied.

- the multiplier, defined in the Exchange rates table, is applied or the number 1 if it is the basic currency;

- the amount in basic currency is calculated.

- When the amount in currency is modified (and there are already other values present), the program operates as follows:

- the amount in basic currency is calculated with the existing exchange rate

- If the currency symbol is modified the program operates as follows:

- the exchange rate with the multiplier is applied and the amount in basic currency is calculated (like above)

- If the exchange rate is modified the program operates as follows:

- the amount in basic currency is calculated using the entered exchange rate

- When the amount in basic currency is modified the program operates as follows:

- the exchange rate is recalculated.

Info window

In the info window, the program indicates:

- Differences, if any, between the Debit and Credit total movements in basic currency

- Explanation on the different uses of the F6 key

For the accounts related to the transaction row on which one is positioned, the program always indicates in the Info windows:

- the account number

- the account description

- the transaction's amount in basic currency

- the current account balance in basic currency

- the account currency symbol

- the transaction's amount in the account currency (if different from the basic currency)

- the current account balance in currency (if different from the basic currency)

Transactions for opening balances

For multi-currency accounting, when entering the opening balances in the Accounts table, the program converts the amounts into basic currency, using the opening exchange rate defined in the Exchange rates table, Opening exchange rate column.

To use historical exchange rates as opening balances, you can create another currency symbol or create transactions in the Transactions table with the opening balances. This way you can use different exchange rates for different accounts.

- Enter a single transaction for each account with an opening balance (Assets and Liabilities), indicating the initial accounting date and the Debit or Credit account.

- In the DocType column enter the "01" value to indicate that it is an opening value.

- In the Banana Accounting reports or printouts this amount will be shown as opening balance.

- However the transaction doesn't update the Opening balance column in the Accounts table

When using opening transactions, please consider that:

- In order to avoid the revaluation of the accounts with the current exchange rate, in the Accounts table, enter the "0;0" value in Exchange rate difference account column

- The software allows you to add both some opening balances in the Accounts table and some opening transactions in the Transactions table (Assets and Liabilities).

In both cases the amounts are considered in the calculations and, if it is the same account, they are added together.

We do not recommend using the two methods simultaneously to avoid hard-to-find errors and differences. - Opening transactions must be entered manually.

Any debit and credit differences are shown as a transaction difference.

Data transfer from earlier versions

In version 4 or earlier, the absence of a currency symbol in the Transactions table was being interpreted as a transaction in basic currency.

In version 7 and in version 8, each transaction needs to have its own currency symbol. Therefore, when you update from version 4 to version 7 or 8, in the accounting file, the transactions without a currency symbol need to be completed. To do this, a new Currency column must be added to the Transactions table by executing the Columns setup command from the Data menu.

Transactions| Double entry accounting multicurrency

Types of Multi-Currency Transactions

With the multi-currency accounting application, it is also possible to record transactions involving accounts in foreign currencies. In the Transactions table, in addition to transactions in the base currency, foreign currency transactions are also entered: all the transaction elements are specified, including the amount and the account in foreign currency, and the exchange rate applied to the transaction. The amount in the base currency is calculated automatically based on the entered exchange rate.

All amounts, both in base currency and foreign currency, must always be entered in the 'Amount' column.

For information regarding exchange rates, multipliers, and historical rates, refer to the page Exchange rates table.

Note: in the transaction examples, the base currency is Euro.

Each transaction has two accounts (debit and credit). The program allows only one foreign currency per transaction row. The following direct combinations are possible:

- Transaction between two base currency accounts with amount in base currency (in the image, transaction no. 1 in column Doc 1)

The currency of both debit and credit accounts is the base currency. - Transaction between two base currency accounts with amount in foreign currency (Doc 2)

The debit and credit accounts are in base currency, but the currency code (currency column) and amount entered in the transaction row are in a foreign currency.

To enter the foreign currency, manually change the default base currency code.

This is used when traveling abroad and exchanging money to pay in local currency. In this case, there is no specific account in the accounting.

For balance calculation (as both are in base currency), only the base currency amount column is used. - Transaction between a foreign currency account and a base currency account (Doc 3)

The currency must match the foreign currency account.

To calculate the foreign currency account balance, the program uses the foreign currency amount, and for the base currency balance, it uses the base currency amount. - Transaction between two accounts with the same foreign currency (Doc 4)

The currency must match the accounts used (USD1 and USD2). To update the exchange rate, position on the Currency cell and press F6. - Transaction with two accounts that have different foreign currencies (Doc 5)

For example, the bank performs a currency exchange between two foreign currencies.

In this case, the transaction must be entered in two rows (with the same date).

The base currency amount must be identical. It's advisable to use a realistic exchange rate to avoid large exchange rate differences.

To ensure that the base currency amounts on both rows are the same, manually enter the base currency amount and let the program calculate the exchange rate. - Exchange rate difference transactions (Doc 6)

The purpose of this transaction is to realign the base currency balance with the foreign currency equivalent at the current exchange rate.

Only the base currency amount related to the exchange difference is recorded on the account.