Non Profit Switzerland

Banana Accounting is a complete, flexible and universal accounting software, ideal for associations because it does not require professional accounting skills to achieve a state-of-the-art accounting management: transactions and accounts can always be modified, corrected or deleted, as in Excel. You can use Banana Accounting worry free both in Switzerland and abroad.

Associations appreciate the ready-made template files and the Banana Extensions, made for specific needs, that can be downloaded for free.

Choose the Banana Accounting template that best suits your needs and personalize it as you want

Once you have entered your transactions you can get professional reports and printouts for associations and much more in just a few clicks:

- Print membership list, addresses and labels (using the CC3 cost center)

- Projects or events management

- Donations statement for associations

- Subscription request to members printouts

- Invoicing

- Invoices with the Swiss QR code and reference number (NEW - It is currently released in the Experimental version of Banana Accounting).

- Invoices with the Swiss QR code with empty amount and address (NEW - It is currently released in the Experimental version of Banana Accounting).

- Different reports

- Balance sheet and income statement

- Accounts details (cards)

- Journal

Vorlagen Non-Profit (Schweiz)

Banana Buchhaltung stellt einen bereits gebrauchsfertigen Musterkontenplan mit den notwendigen Einstellungen für die Buchführung von Vereinen und gemeinnützigen Organisationen zur Verfügung. Dieser basiert auf dem von swissaccounting.ch (vormals veb.ch) veröffentlichten spezifischen Kontenplan.

Nachdem die Buchhaltungsdatei erstellt wurde, kann der Kontenplan an die individuellen Bedürfnisse angepasst werden, indem Konten und Gruppen hinzugefügt oder gelöscht werden.

Verfügbare Dateivorlagen

Die vollständige Liste der für Schweizer Vereine verfügbaren Dateivorlagen finden Sie auf unserer Webseite unter Vorlagen.

Doppelte Buchhaltung

Komplette und professionelle Buchhaltungsart.

- Kontenplan für Vereine - komplett

Ideal für einen strukturierten Verein, der seine Buchhaltung umfassend und professionell wie ein Unternehmen führen möchte. Der Kontenplan enthält alle Konten gemäss dem Standard.

Die vorgeschlagene Vorlage dient auch als Referenz, falls zusätzliche Konten hinzugefügt werden müssen. - Kontenplan für Vereine - reduziert

Ideal für kleinere Vereine mit normaler Geschäftstätigkeit. Diese Vorlage enthält nur die Hauptgruppen und wesentlichen Konten. - Vereine mit MwSt

Vereine, die eine gewerbliche Tätigkeit ausüben und der MWST-Pflicht unterliegen, können diese Vorlage verwenden. Sie enthält alle notwendigen Funktionen und Berechnungsparameter zur Verwaltung der Mehrwertsteuer.- Diese Dateivorlage ist bereits für die MWST-Verwaltung vorbereitet.

- Weitere Informationen: Eidgenössichen Steuerverwaltung (ESTV)

- Vereine mit Fremdwährungen

Einnahmen-Ausgaben-Rechnung

Für die Buchhaltung nach der Einnahmen-Ausgaben-Methode, inklusive Bilanz und einer Prognose der Einnahmen und Ausgaben.

Cash Manager (Kassenbuch)

Für die einfache Verwaltung einer Buchhaltung nach der Einnahmen-Ausgaben-Methode, mit Bilanz und Prognose der Einnahmen und Ausgaben.

Struktur der Kontenpläne

Der Kontenplan für Vereine in Banana Buchhaltung basiert auf dem Schweizer Kontenplan für KMU, der von swissaccounting.ch (vormals veb.ch) gefördert und entwickelt wurde.

Den vollständigen Kontenplan für Vereine - komplett können Sie auf unserer Webseite herunterladen.

Struktur der Bilanz

- Die Aktiven sind wie folgt unterteilt:

- Umlaufvermögen (10)

- Anlagevermögen (14).

- Die Passiven sind wie folgt unterteilt:

- Kurzfristiges Fremdkapital (20)

Langfristiges Fremdkapital (24) - Fondskapital (27)

- Eigenkapital (28).

- Kurzfristiges Fremdkapital (20)

Erfolgsrechnung

Die Erfolgsrechnung ist in Ertrag und Aufwand unterteilt.

- Die Erträge sind wie folgt unterteilt:

- Mitgliederbeiträge (300)

- Erhaltene Zuwendungen (310)

- Erlöse aus Aktivitäten und Leistungen (330)

- Übrige Erlöse (360)

- Die Kosten sind wie folgt unterteilt:

- Aufwand für Aktivitäten und Leistungen (4)

- Personalaufwand (5)

- Übriger und administrativer Vereinsaufwand (6)

- Abschreibungen und Wertberichtigungen (68)

- Finanzaufwand und Finanzertrag (69)

- Direkte Steuern (89)

Kosten- und Profitstellen sowie Segmente

Die Kontenpläne von Banana Buchhaltung enthalten Kosten- und Profitstellen, um die Buchhaltung gezielt zu strukturieren.

- Mit der Kostenstelle KS3 (;) werden die Mitglieder verwaltet.

- Sie ermöglicht die Erfassung von Mitgliederadressen sowie die Nachverfolgung geleisteter Zahlungen.

- Die spezifische Banana-Erweiterung "Spendenbescheinigung im Verein" ermöglicht das Erstellen und Drucken von Spendenbescheinigungen.

- Mit der Kostenstelle KS1 (.) werden Projekte verwaltet.

- Segmente (:) ermöglichen eine detaillierte Verwaltung verschiedener Sektoren innerhalb des Vereins.

Referenzen

Der Kontenplan basiert auf dem von swissaccounting.ch (vormals veb.ch) veröffentlichten Schema. SwissAccounting ist der grösste Schweizer Verband im Bereich der Rechnungslegung und hat den Schweizer Kontenrahmen KMU entwickelt, der als Standard für Unternehmen in der Schweiz gilt.

- Broschüre für Vereine und Struktur des Musterkontenplans

Ein umfassendes Dokument für Vereinsverantwortliche (verfügbar nur auf Deutsch).

Unterteilung nach Sektionen

Vereine, die eine separate Berichterstattung nach Sektionen benötigen, können die Segment-Funktion nutzen.

Liste der Konten und Gruppen

Nachfolgend werden alle im Modell enthaltenen Konten und Gruppen zu Referenzzwecken angezeigt.

| Sektion | Gruppe | Konto | Beschreibung | BKlasse | Summ. in |

| * | BILANZ | ||||

| 1 | AKTIVEN | ||||

| Umlaufvermögen | 10 | ||||

| 1000 | Kasse | 1 | 10 | ||

| 1020 | Bankguthaben (inkl. PostFinance) | 1 | 10 | ||

| 1060 | Wertschriften kurzfristig gehalten | 1 | 10 | ||

| 1100 | Forderungen aus Lieferungen und Leistungen (Debitoren) | 1 | 10 | ||

| 1109 | Delkredere | 1 | 10 | ||

| 1140 | Kurzfristige Darlehen / Vorschüsse | 1 | 10 | ||

| 1176 | Verrechnungssteuerguthaben | 1 | 10 | ||

| 1190 | Sonstige kurzfristige Forderungen | 1 | 10 | ||

| 1200 | Vorräte | 1 | 10 | ||

| 1300 | Aktive Rechnungsabgrenzungen | 1 | 10 | ||

| 10 | Total Umlaufvermögen | 1 | |||

| Anlagevermögen | 14 | ||||

| 1400 | Wertschriften | 1 | 14 | ||

| 1440 | Darlehen langfristig | 1 | 14 | ||

| 1441 | Übrige langfristige Forderungen | 1 | 14 | ||

| 1500 | Mobile Sachanlagen (wie Maschinen, Apparate, Mobiliar, PC) | 1 | 14 | ||

| 1600 | Liegenschaften | 1 | 14 | ||

| 14 | Total Anlagevermögen | 1 | |||

| 1 | TOTAL AKTIVEN | 00 | |||

| 2 | PASSIVEN | ||||

| Kurzfristiges Fremdkapital | 20 | ||||

| 2000 | Verbindlichkeiten aus Lieferungen und Leistungen (Kreditoren) | 2 | 20 | ||

| 2100 | Bankverbindlichkeiten | 2 | 20 | ||

| 2140 | Übrige verzinsliche Verbindlichkeiten | 2 | 20 | ||

| 2210 | Sonstige kurzfristige Verbindlichkeiten | 2 | 20 | ||

| 2300 | Passive Rechnungsabgrenzungen | 2 | 20 | ||

| 20 | Total Kurzfristiges Fremdkapital | 2 | |||

| Langfristiges Fremdkapital | 24 | ||||

| 2400 | Bankverbindlichkeiten langfristig | 2 | 24 | ||

| 2450 | Darlehen und Hypotheken | 2 | 24 | ||

| 2499 | Übrige langfristige Verbindlichkeiten | 2 | 24 | ||

| 2600 | Rückstellungen | 2 | 24 | ||

| 24 | Total Langfristiges Fremdkapital | 2 | |||

| Fondskapital | 27 | ||||

| 2700 | Fonds von Spenden | 2 | 27 | ||

| 2710 | Fonds vom Verein gebildet | 2 | 27 | ||

| 27 | Totale Fondskapital | 2 | |||

| Eigenkapital | 28 | ||||

| 2850 | Vereinsvermögen | 2 | 28 | ||

| 2851 | Gewinnvortrag oder Verlustvortrag | 2 | 28 | ||

| 289 | Jahresgewinn oder Jahresverlust | 28 | |||

| 28 | Total Eigenkapital | 2 | |||

| 2 | TOTAL PASSIVEN | 00 | |||

| * | ERFOLGSRECHNUNG | ||||

| 4 | |||||

| ERTRAG | |||||

| Mitgliederbeiträge | 300 | ||||

| 3000 | Mitgliederbeiträge | 4 | 300 | ||

| 3010 | Beiträge Aktivmitglieder | 4 | 300 | ||

| 3011 | Beiträge Passivmitglieder | 4 | 300 | ||

| 3012 | ......... | 4 | 300 | ||

| 3015 | Freiwillige Beiträge von Mitgliedern | 4 | 300 | ||

| 3020 | Gönnerbeiträge | 4 | 300 | ||

| 300 | Total Mitgliederbeiträge | 3 | |||

| Erhaltene Zuwendungen | 310 | ||||

| 3100 | Spenden von Privaten | 4 | 310 | ||

| 3110 | Legate und Vermächtnisse | 4 | 310 | ||

| 3120 | Spenden/Subventionen der öffentlichen Hand (wie J+S, Sport-Toto) | 4 | 310 | ||

| 3130 | Einnahmen aus Sammelaktionen | 4 | 310 | ||

| 310 | Total Erhaltene Zuwendungen | 3 | |||

| Erlöse aus Aktivitäten und Leistungen | 330 | ||||

| 3300 | Erlöse aus Waren- und Materialverkäufen | 4 | 330 | ||

| 3310 | Erlöse aus Dienstleistungen | 4 | 330 | ||

| 3320 | Erlöse aus Veranstaltungen | 4 | 330 | ||

| 3330 | Kurs- und Teilnahmegebühren | 4 | 330 | ||

| 3340 | Mieteinnahmen (Material, Clubhaus) | 4 | 330 | ||

| 330 | Total Erlöse aus Aktivitäten und Leistungen | 3 | |||

| Übrige Erlöse | 360 | ||||

| 3600 | Inserate, Werbe- und Sponsoringeinnahmen | 4 | 360 | ||

| 3610 | Ertrag eigene Liegenschaften | 4 | 360 | ||

| 3620 | Sonstige Erlöse | 4 | 360 | ||

| 360 | Total Übrige Erlöse | 3 | |||

| 3 | TOTAL ERTRAG | 02 | |||

| AUFWAND | |||||

| Aufwand für Aktivitäten und Leistungen | 4 | ||||

| 4000 | Waren- und Materialaufwand | 3 | 4 | ||

| 4400 | Aufwand für bezogene Dienstleistungen | 3 | 4 | ||

| 4500 | Leistungen für Vereinszweck (z.B. Mannschaftsaufwand Aktive Herren, Damen, Junioren) | 3 | 4 | ||

| 4900 | Aufwand eigene Liegenschaften (ohne Zinsen) | 3 | 4 | ||

| 4 | Total Aufwand für Aktivitäten und Leistungen | 4-5-6 | |||

| Personalaufwand | 5 | ||||

| 5000 | Lohnaufwand | 3 | 5 | ||

| 5700 | Sozialversicherungsaufwand | 3 | 5 | ||

| 5800 | Übriger Personalaufwand | 3 | 5 | ||

| 5 | Total Personalaufwand | 4-5-6 | |||

| Übriger und admin. Vereinsaufwand | 6 | ||||

| 6000 | Raumaufwand (Mieten) | 3 | 6 | ||

| 6100 | Unterhalt und Reparaturen | 3 | 6 | ||

| 6200 | Fahrzeug- und Transportaufwand | 3 | 6 | ||

| 6300 | Sachversicherungen, Abgaben und Gebühren | 3 | 6 | ||

| 6400 | Energie- und Entsorgungsaufwand | 3 | 6 | ||

| 6500 | Büromaterial, Drucksachen, Fotokopien, Fachliteratur | 3 | 6 | ||

| 6510 | Telefon, Internet, Porti | 3 | 6 | ||

| 6530 | Sekretariats-, Buchführungs- und Revisionsaufwand | 3 | 6 | ||

| 6540 | Aufwand, Entschädigungen und Spesen Vorstand und Organe | 3 | 6 | ||

| 6541 | Aufwand Vereinsversammlung | 3 | 6 | ||

| 6542 | Aufwand Vorstandssitzungen | 3 | 6 | ||

| 6570 | Informatik- und Internetaufwand | 3 | 6 | ||

| 6600 | Werbe- und Marketingaufwand | 3 | 6 | ||

| 6660 | Beiträge, Spenden, Vergabungen | 3 | 6 | ||

| 6700 | Sonstiger Vereinsaufwand | 3 | 6 | ||

| 6 | Total Übriger und admin. Vereinsaufwand | 4-5-6 | |||

| Abschreibungen und Wertberichtigungen | 68 | ||||

| 6800 | Abschreibungen und Wertberichtigungen | 3 | 68 | ||

| 68 | Totale Abschreibungen und Wertberichtigungen | 4-5-6 | |||

| Finanzergebnis | 69 | ||||

| 6900 | Zinsaufwand | 3 | 69 | ||

| 6902 | Hypothekar- und Baurechtszinsen | 3 | 69 | ||

| 6940 | Spesen und Gebühren | 3 | 69 | ||

| 6942 | Kursverluste Vermögensanlagen | 3 | 69 | ||

| 6950 | Vermögenserträge (Zinserträge und Dividenden) | 4 | 69 | ||

| 6993 | Kursgewinne Vermögensanlagen | 4 | 69 | ||

| 69 | Total Finanzergebnis | 4-5-6 | |||

| Direkte Steuern | 89 | ||||

| 8900 | Direkte Steuern | 3 | 89 | ||

| 89 | Total Direkte Steuern | 4-5-6 | |||

| 4-5-6 | TOTAL AUFWAND | 02 | |||

| 02 | Verlust(+)/Gewinn(-) der Erfolgsrechnung | 289 | |||

| 00 | Differenz muss Null sein (leere Zelle) | ||||

| * | KOSTEN- UND PROFITSTELLEN | ||||

| 03 | |||||

| Mitglieder | |||||

| ;001 | Mitglied 1 | MG | |||

| ;002 | Mitglied 2 | MG | |||

| ;003 | Mitglied 3 | MG | |||

| MG | Total Mitglieder | ||||

| Projekte | PR | ||||

| .P1 | Projekt 1 | PR | |||

| .P2 | Projekt 2 | PR | |||

| PR | Total Projekt | ||||

| * | SEGMENTE | ||||

| : | Segment | ||||

| :AD | Aktive Damen | ||||

| :AH | Aktive Herren | ||||

| :AJ | Aktive Junioren | ||||

Cash Manager Associations (avec écritures)

Cash Manager Associations (avec écritures) caterinaIncome & Expense Accounting Non-profit organization

Income & Expense Accounting Non-profit organization caterinaEinnahmen/Ausgaben für Vereine | MWST

Einnahmen/Ausgaben für Vereine | MWST Svjetlana AnticTutorial: Rechnungen an Mitglieder in der Einnahmen-Ausgaben-Rechnung

Tutorial: Rechnungen an Mitglieder in der Einnahmen-Ausgaben-RechnungDie Informationen zur Verwendung der Mitgliederfunktionen sind identisch mit denen im Tutorial Rechnungen an Mitglieder für die Zahlung von Mitgliedsbeiträgen.

Der einzige Unterschied liegt in der Buchführungsart, die auf der Vorlage Einnahmen-Ausgaben-Rechnung basiert.

Um dies zu ändern, wählen Sie einfach die Buchhaltungsart, die auf dem Modell Einnahmen-Ausgaben basiert.

- Sie können die Konten und Kategorien jederzeit anpassen, um sie an Ihre spezifischen Bedürfnisse anzupassen.

- Die Tabellen Konten und Kategorien bieten eine sofortige Übersicht über die Salden jedes Kontos und jeder Kategorie, sodass Sie stets den Überblick über Ihre finanzielle Situation behalten.

- Mit der Einrichtung einer Mitgliederliste können Sie Rechnungen für Ihre Mitglieder ausstellen, die automatisch in der Buchhaltung erfasst werden.

- Sie können die Erfassung von Buchungen beschleunigen, indem Sie Bankdaten importieren und Regeln nutzen. Beim Import einer Transaktion geben Sie ein Schlüsselwort (Regel) ein, das automatisch die restlichen Buchungsdetails ergänzt (z.B. Gegenkonto, Kostenstelle ...). Bei zukünftigen Importen erkennt das Programm das Schlüsselwort und vervollständigt die Buchung automatisch. Dadurch wird die Arbeitszeit erheblich reduziert und Fehler werden minimiert.

Durch das Öffnen der Datei dieses Tutorials können Sie Tests durchführen oder sie sogar als Grundlage für Ihre eigene Buchhaltungsdatei nutzen – (indem Sie manuell Buchungen und Anfangssalden löschen).

Für einige Funktionen ist ein Abonnement des Advanced-Plans von Banana Buchhaltung Plus erforderlich – beispielsweise für die Nutzung der neuen Regeln, Filter und der temporären Zeilen-Sortierung. Sehen Sie sich alle Funktionen des Advanced-Plans an.

Erstellen Sie Ihre Datei

- Öffnen Sie das Modell mit der Banana Buchhaltung Plus WebApp

- Verwenden Sie den Befehl Datei > Eigenschaften (Stammdaten), um den Zeitraum, den Namen Ihres Unternehmens und die Basiswährung festzulegen.

- Speichern Sie die Datei mit dem Menübefehl Datei > Speichern unter. Es empfiehlt sich, den Firmennamen und das Jahr im Dateinamen anzugeben (z.B. Verein...-20xx.ac2).

ACHTUNG: Wenn Sie den Browser schliessen, ohne zu speichern, gehen die eingegebenen Daten verloren. Speichern Sie die Datei immer auf Ihrem Computer.

In unserer Dokumentation finden Sie ausführliche Erklärungen zu verschiedenen Themen, um Ihre Buchhaltung optimal zu verwalten:

Non-profit organization | Double-Entry Accounting

Non-profit organization | Double-Entry AccountingThe model was created on the basis of the information on www.swissaccounting.ch (formerly www.veb.ch). The chart of accounts is structured according to the ideas of Herbert Mattle and Dieter Pfaff.

On the following web page https://www.swissaccounting-vereine.org/rechnungswesen (in German) you will find the PDF document, useful information for optimal financial and accounting management, compliance with legal and insurance regulations.

Information on associations can also be found on the Confederation's website at the following link: https://www.kmu.admin.ch/kmu/en/home/concrete-know-how/setting-up-sme/starting-business/choosing-legal-structure/associations.html

Set up your file

- Create a new file from this template (Template ID +10943) using one of the methods explained.

- From the menu File > File properties, set the period and company name.

- From the menu File > Save As, save the file. It is useful to indicate in the file name, the name of the association and the year. For example 'Association XX-2022.ac2'.

See also Organise your accounting files locally, online or in cloud.

Accounts table

In the Accounts table, when you open the template we propose, you will find the balance sheet and profit and loss accounts already set up. For more interesting intermediate totals and details, the main groups are divided into various subgroups. You can customise the whole plan according to your needs.

The balance sheet accounts are divided into groups and subgroups: Current Assets, Fixed Assets, Total Assets; Short-Term Debts, Long-Term Debts, Funds and Equity. The Profit and Loss Account is in scalar form. There are cost and profit centres to manage members and projects and segments to manage the various sectors.

Assets

Assets are divided into the following main groups:

- Current assets.

- Fixed assets.

Liabilities

Liabilities are divided into three main groups:

- Short-term debt capital.

- Long-term debt capital.

- Equity capital.

In the Accounts table, Opening column, enter the opening balance for each account.

With the transition to the new year, the opening balance is reported automatically, from the menu Actions > Create New Year.

After each entry, the columns of the Accounts table are updated immediately, so you have a clear and immediate overview of the financial situation.

Profit and Loss Account

The profit and loss account is divided into Revenue and Expenses with the following subgroups:

Revenues

- Membership fees

- Income from contributions

- Revenues from activities and services

- Other income

Costs

- Costs for activities and services

- Personnel costs

- Administrative costs

- Depreciation and value adjustments

- Financial costs and revenues

- Direct Taxes

Other Elements of the Chart of Accounts

Profit centres are set up at the end of the Chart of Accounts in order to have all the details for the following groups:

- Membership list, managed with CC3 (;) - Allows you to have details for each member, as well as print out subscriptions and donation certificates.

- Projects, managed with in CC1 (.) - Allows you to have the details for each project.

- Business Sectors, managed with Segments - To know which segment sector was most interesting and generated the most profit.

Liquidity Planning

Liquidity is the main pillar of the Association: it allows you to carry out your activities in order to reach the set objectives; to foresee in advance how much liquidity there will be, minimising risks; and to constantly check if you are in line with the budget approved by the members' assembly.

Banana Accounting gives you the possibility to create both the liquidity planning and the economic budget.

You can discover the various functions of the Forecast in our Documentation:

Enter the Budget transactions

The budget is to be inserted in the Budget table, based on the double-entry accounting methodology. You use the same chart of accounts already available for general accounting. All you have to do is to start recording the operations that usually follow one another over the months, by entering only one entry. You must also record those transactions that you will have once a year or that repeat in quarters. There is a Repeat column in the table which, depending on the period option you enter, allows the programme to automatically calculate the total with all the details.

When you enter the transactions, it also records the accounts, in debit and in credit, as if you were entering the actual accounts. In this way, using all the accounts available in the chart of accounts, you will have all the movements in the cash accounts, other asset accounts and the profit and loss account.

We advise you to start with the following entries to get an overview:

For revenues it is more difficult to make forecasts. We advise you to enter the amounts based on the revenues of the same period of the previous year, evaluating the events that will take place or focusing on other special events, such as the purchase of new equipment or other investments.

You will always have to record in the budget table, using the profit and loss and cash accounts.

Budget Account Tab

If you enter your Budget you can have all the data grouped for each cost or revenue item in the relevant tabs, just like the actual data recorded.

You will thus be able to see all the details of each account sheet or group and constantly check whether the budgeted data are in line with the booked data, thanks also to the graph which provides you with an immediate view for making comparisons.

To activate one or more cards in the Budget, proceed as follows:

- Menu Reports > Account cards > activate Budget transactions

Cost and revenue forecast

As soon as you have finished your forecast transactions, by viewing the budget and profit and loss account you will know what the impact on liquidity will be. You can always go back to the forecast table and change the amounts for the positions you consider appropriate.

Cash flow planning is a very valid and successful strategy that allows you to more wisely evaluate your decisions regarding the association's activities.

To get the Financial Planning Budget, click onto:

Reports Menu > Enhanced balance sheet with groups > column section, activate in the Budget Balance.

Cost and revenue forecast

In the Profit and Loss Account you can see the impact of your forecast on costs and revenues and whether with the budgeted revenues you will be able to cover your costs.

To get the financial planning budget, click onto:

Reports Menu > Enhanced Balance sheet with Groups > column section, activate in the Estimated Profit and Loss Account.

Register final movements

In the Transactions table you enter all daily transactions. If you want to speed up the entry process, we recommend using the various Banana functions:

- The Auto-Complete Fast Entry function allows you to automatically retrieve previously entered data

- The Recurring Transactions function (Actions menu) allows you to store repetitive transactions in a special table

- Importing data from bank statements allows you to automatically resume all bank movements.

- You can link each entry with the corresponding justification in digital format, and with a simple click you can view the document.

- See also Accounting documents files and digital receipts to better organise your documents.

- Use the Sort Transactions by Date command to sort the rows in date order.

- Use the Print/Preview command to print or export the journal in PDF format.

Enhanced Balance sheet

To view the Balance sheet click on the Report menu and then click on the Enhanced Balance sheet or the Enhanced Balance sheet with Groups command. You can customise the report with the columns you wish to see, such as having the column for your budget or having reports by period.

- The Enhanced Balance sheet report displays all accounts without any subgroups.

- The Enhanced Balance sheet with groups displays all accounts even with subgroups.

Check balances against the budget

When the final figures have been recorded, you can view the Balance Sheet and Income Statement and compare them with the budget. Keeping an eye on the comparison is a great way to check whether everything is proceeding as you have budgeted, or whether you need to adjust some amounts to get closer to the book values and not compromise the forecast in the following months.

To get the final and budgeted balance sheet with comparison, click onto:

Report Menu > Enhanced Balance Sheet with Groups > Columns section, activate in the Balance Sheet and Income Statement Current, Budget and Difference.

Invoices to members for annual membership fees

Invoices to members for annual membership feesInitial settings

To get started quickly, we recommend that you download the template presented at the top of this page, or take it directly from the program, as follows:

- From the File menu > New

- Choose Region

- Choose as accounting Type, double-entry accounting

- Select the Template Association - invoices

- Save the file with a name

Enter the association's basic data

In the File menu > File properties > Accounting, enter your association's data, start and end date, and base currency.

In the Address section fill in the required data. This data is essential for the invoice headers.

Insert logo and define position of invoice headers

To insert the association logo and define the position of the various headers in the invoice go to File menu > Logo setup.

For further details visit the Logo setup page.

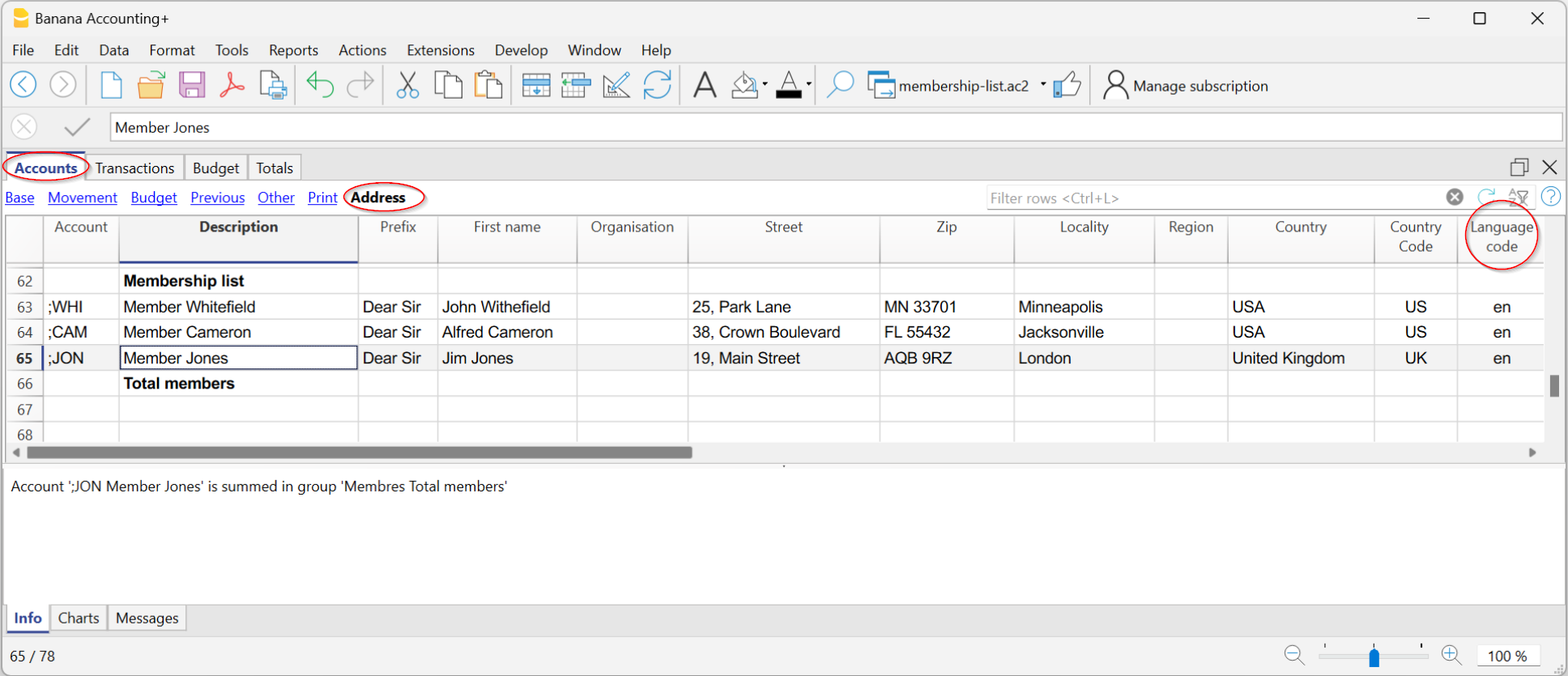

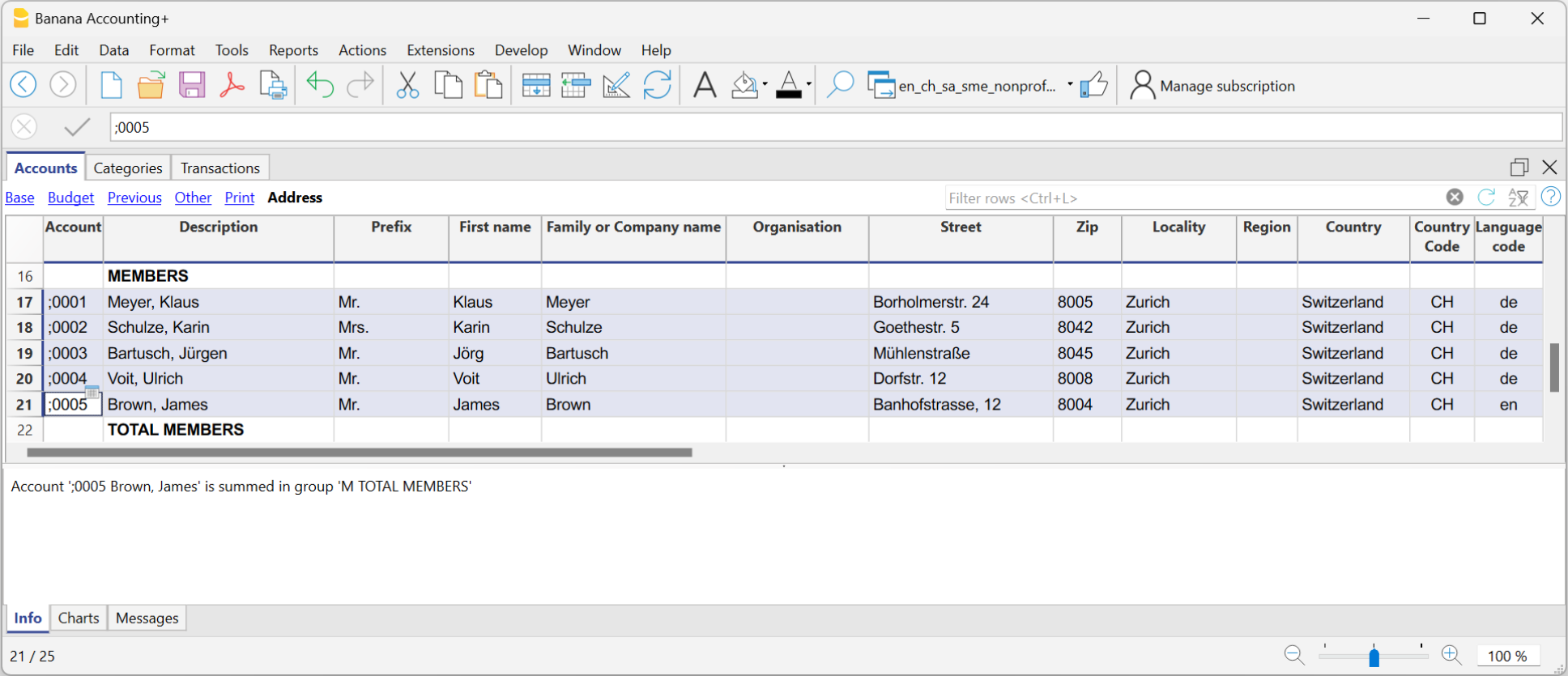

Enter Members' Data

In the Accounts table, at the end of the chart of accounts enter all members of the association using cost centre CC3, the one with the semicolon.

In the Address view fill in the various columns with the members' data. For each member you can define the invoice language in the Language column.

If you have chosen a different template that does not have the Address view, you can activate it from the Tools menu > Add/Remove new functionalities > Add Address columns in Accounts table and fill in the various columns with the required data.

Set Members' Group

Once the list of members with the totalisation group has been created, it is necessary to indicate the group in the invoice settings:

From the Reports menu > Customers > Settings, select the members' totalisation group. In our tutorial, TM (Total members) is indicated.

Prepare and print invoices to members

Enter the invoice data in the Transactions table. Simply enter the following data:

- Date

- Description

- Invoice number (essential for printing the invoice)

- The amount of the membership fee

- In column CC3 enter the cost centre relating to the member you defined at the end of the chart of accounts, but without the semicolon.

- The Debit and Credit columns remain empty.

You are now ready to print invoices. Proceed as follows:

- From the Reports menu > Customers > Print invoices, access the dialogue where you can indicate the invoice(s) to be printed, choose the layout and change settings for customisation.

In the Options section you can enter notes for the member and choose the language

Invoice

Additional Information:

- Invoice layout with Swiss QR Code (Banana+)

- Import ISO 20022 file (see paragraph Country specifications) and use the Bank Statement Camt ISO 20022 Switzerland extension (Banana+) for which you enter the parameters.

Double-Entry Accounting with VAT for Non-profit organization (chart of accounts SME short)

Double-Entry Accounting with VAT for Non-profit organization (chart of accounts SME short) Svjetlana AnticMulti-Currency Accounting for Non-profit organization (chart of accounts SME short)

Multi-Currency Accounting for Non-profit organization (chart of accounts SME short) caterinaMulti-Currency Accounting with VAT for Non-profit organization (chart of accounts SME short)

Multi-Currency Accounting with VAT for Non-profit organization (chart of accounts SME short) caterinaGAAP FER 21 Templates

The chart of accounts we offer is set up according to the NGO model, as published in the PDF manual by the FGC (Fédération Genevoise de Coopération), where the SWISS GAAP RPC standards are presented and the proper accounting practices are explained.

Gemeinnützige Nonprofit-Organisationen | Vorlage gemäss den Swiss GAAP FER 21 Normen | Doppelte Buchhaltung

Gemeinnützige Nonprofit-Organisationen | Vorlage gemäss den Swiss GAAP FER 21 Normen | Doppelte BuchhaltungDer von uns vorgeschlagene Kontenplan ist nach dem NGO-Modell (Non-Governmental Organisations bzw. Nichtregierungsorganisation) aufgebaut, das im PDF-Handbuch der FGC (Fédération genevoise de coopération) veröffentlicht ist, in dem die SWISS GAAP RPC-Standards vorgestellt und die korrekte Buchführung erläutert werden.

Referenzen:

Enthält auch Kostenstellen, um Mitglieder, Projekte und Segmente zu verwalten.

In unserer Dokumentation finden Sie alle Informationen und Erkenntnisse, die Sie benötigen, um Ihre Buchhaltung optimal zu führen:

Gemeinnützige Nonprofit-Organisationen | Vorlage gemäss den Swiss GAAP FER 21 Normen | Doppelte Buchhaltung mit Fremdwährungen

Gemeinnützige Nonprofit-Organisationen | Vorlage gemäss den Swiss GAAP FER 21 Normen | Doppelte Buchhaltung mit FremdwährungenDer von uns vorgeschlagene Kontenplan ist nach dem NGO-Modell (Non-Governmental Organisations bzw. Nichtregierungsorganisation) aufgebaut, das im PDF-Handbuch der FGC (Fédération genevoise de coopération) veröffentlicht ist, in dem die SWISS GAAP RPC-Standards vorgestellt und die korrekte Buchführung erläutert werden.

Referenzen:

https://fgc.federeso.ch/sites/default/files/fgc_manuel_rpc21.pdf

In unserer Dokumentation finden Sie alle Informationen und Erkenntnisse, die Sie benötigen, um Ihre Buchhaltung optimal zu führen:

Membership list

The following example files are available to start from:

Banana Accounting allows you to set up the list of members with address data and a number of other settings that enable automatic:

- Invoicing to members (use integrated invoicing)

- Members' account cards with all movements and balances.

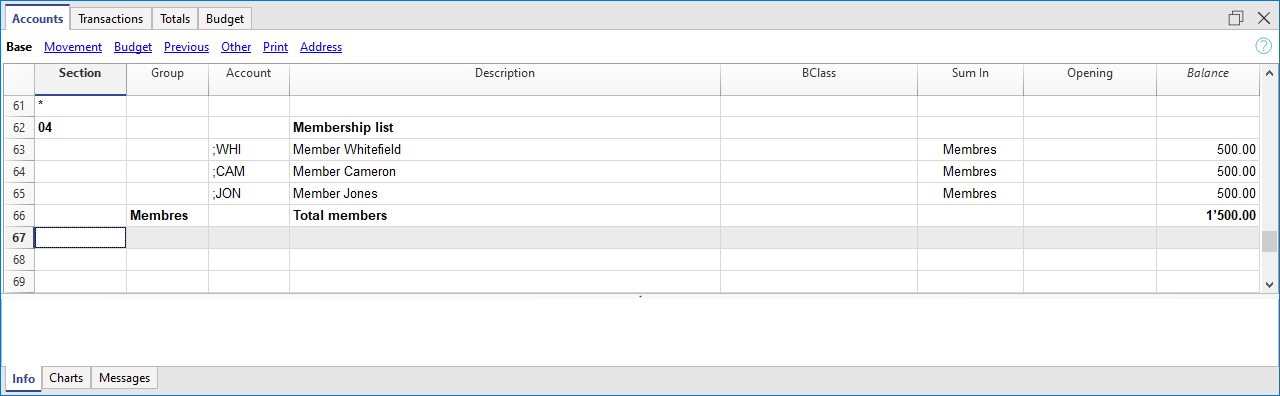

Setting up members' accounts - cash accounting

The associations that manage cash-based accounting must set up partner accounts with cost center CC3 (;). Social tax is thus recorded as revenue at the time of payment. The partner's code serves as additional information to that of the accounting. The list of partners is entered in the Accounts table at the end of the chart of accounts:

- In the Section column, enter an asterisk for the section change.

- In the Section column of the next row, enter 04 as revenue.

- Use cost center CC3 (;) for each partner account.

Entering Address Data

Member data such as address, telephone, email are entered in the appropriate columns, which are visible in the Address view. If the Address view is not visible, add it from the menu Tools > Add / Remove functionalities > Add address column in the Account table.

Payments and other transactions related to partners are recorded in the Registration table. If the partners have been set up with cost center CC3, record as follows:

- Enter the date and document number.

- Enter the description.

- In the Debit column, enter the bank account, and in the Credit column, enter the revenue account Donation.

- In the CC3 column, enter the partner's account without punctuation.

If the CC3 column is not visible, click on the Data menu > Columns setup > CC3, and activate "Visible" in the small box at the bottom of the dialog box.

The transactions and balance of each partner can be viewed through the account card by clicking on the small blue icon in the cell or by accessing the menu Report > Account Cards.

With the entered registrations, both in the presence of cost center CC3 and the ledger, it is possible to create invoices for the payment of social contributions:

- From the menu Report > Clients > Print invoices, you can access the dialogue window for customization and printing of invoices.

For further information, refer to the tutorial Invoicing to members for annual membership fees.

Member donation statement

If the income is recorded with information related to the partner, it then becomes possible to use the extension to print donation statements. This automatically prepares a letter with the payments to the partners.

Print member list

- Select the rows of members in the Accounts table that you want to print.

- Go to File > Print and check Print selection.

Exporting member data

If you need a selection of data for specific members to send specific communications, emails, or other purposes, you can:

- Use the Extract Rows command.

- Copy and paste the data from Banana Accounting into Excel.

- Export the data to CSV or Excel.

Associations managing revenue-based accounting can include members as regular balance sheet accounts directly in the active accounts or as a separate ledger at the end of the chart of accounts.

The social tax is recorded as revenue at the time the invoice is issued (or at the beginning of the accounting period) with a debit to the member's account. When the payment is made, the member's account is credited.

Detailed instructions on how to set up member accounts in this case are identical to those for setting up the Customer ledger.

Registration and Invoicing of membership fees with member ledger

When members are set up with the ledger, to record membership fees in the Registration table, follow these steps:

- Enter the date and document number.

- Enter the description and invoice number.

- In the Debit column, enter the member's account and in the Credit column, enter the revenue account Donation.

Donation statement for associations

Banana Accounting allows you to create and print donation statements in a letter form for Swiss associations in a very simple way, with no need of external tools such as Word.

This extension is available exclusively in the Integrated invoicing.

For more information please visit the pages:

- Donations statement for Swiss associations (Banana+)

- Donations statement for Swiss associations (Banana 9)

Banana Accounting example files are also available:

Related documents:

QR invoices to members

Banana Accounting Plus allows you to create QR-coded invoices for Switzerland, including the letters to be sent to members.

More information can be found at the following links:

- QR-code Invoices to members for annual membership fees

- Letter with Swiss QR slip to be sent to members

- Bulk QR-Invoices from Excel data list - Advanced plan only

With the Advanced plan of Banana Accounting Plus you can create more customisations and get free support for up to 3 cases per year.

Free text letter

The extension allows you to create a free text letter for the members registered in Banana Accounting Plus (Accounts table).

For more information visit the page:

Letters to members with mail merge of Word

Banana Accounting allows you to export data, which can be used to create documents in Word. For example, you can create letters of request for payment of associative fees where addresses are inserted thanks to the Word mail merge command.

Suppose we want to write a letter to be sent to each member: the content of the letter will be the same for all, but the address must be different for each letter. To avoid editing all addresses manually, we can use the Word mail merge feature .

Below we explain how to use the function with Windows, for Mac please refer to the relevant documentation of Word.

Use the following steps:

- Create a Membership list in Banana Accounting (Income & Expense Accounting or Double-entry accounting file).

- Export the address lines from Banana Accounting in HTML format.

- Use the Print merge feature of Word.

Reference documentation

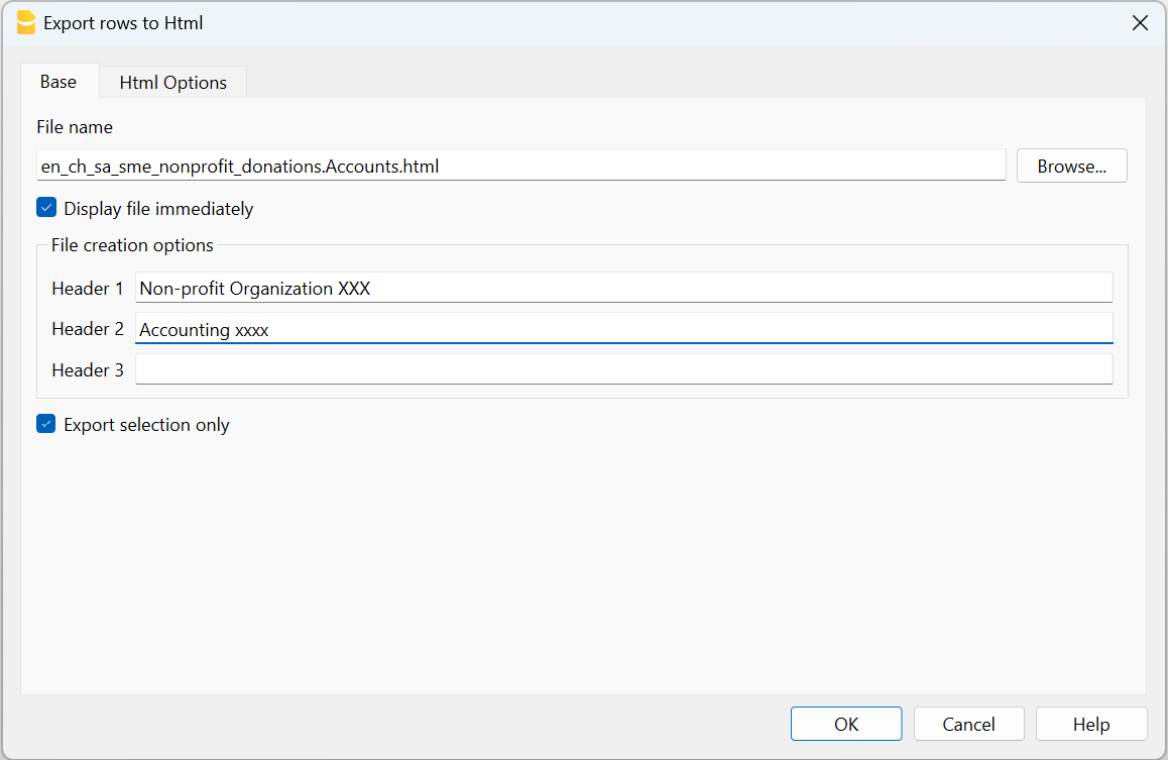

Export address lines from Banana Accounting in HTML format

The first step is to export addresses from Banana Accounting in html format, so that Word can read and use them:

- In the Accounts table select Address view.

- Select the lines of the addresses that you wish to export.

- From the Data menu select > Export rows > Export rows to Html

- In the dialog window:

- Enter the file name

- Click Browse... to select the file save location

- Insert a text in Header 1. The other fields are optional

- Make sure the Export selection only zone option is checked.

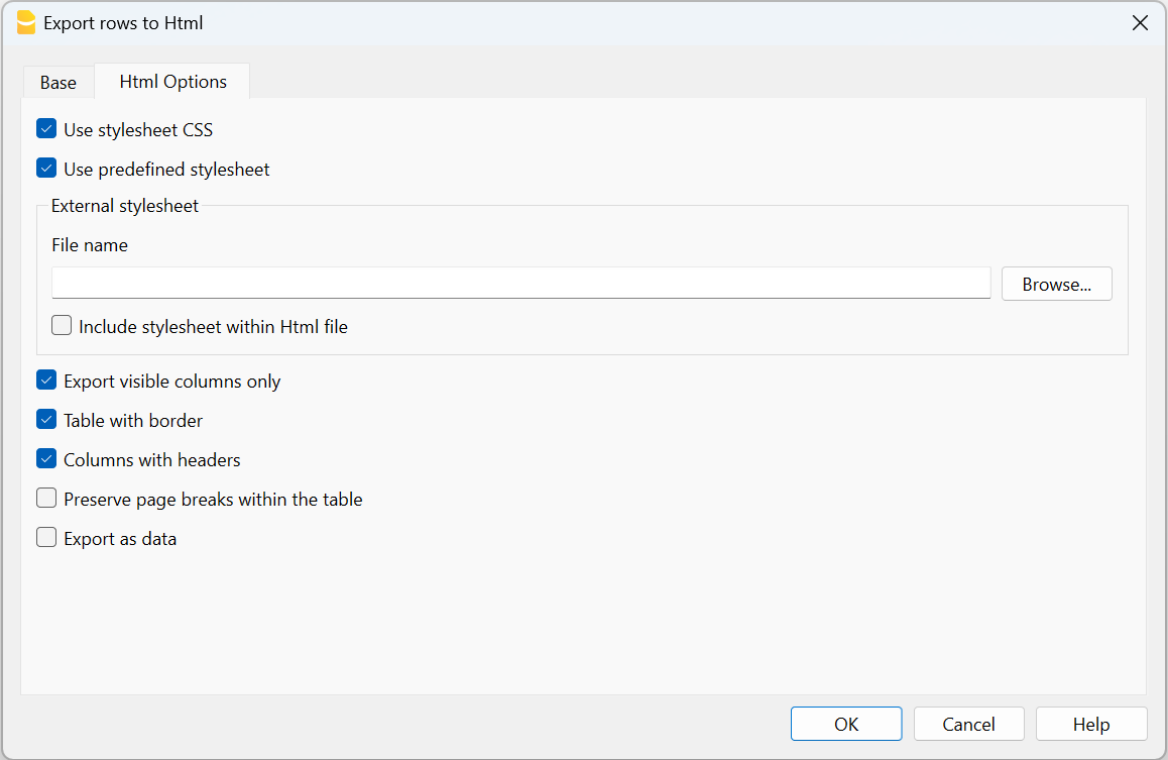

- Open the Html Options section and make sure the options are displaying as shown in the image below.

- Click OK to finalise the export of the lines in html format

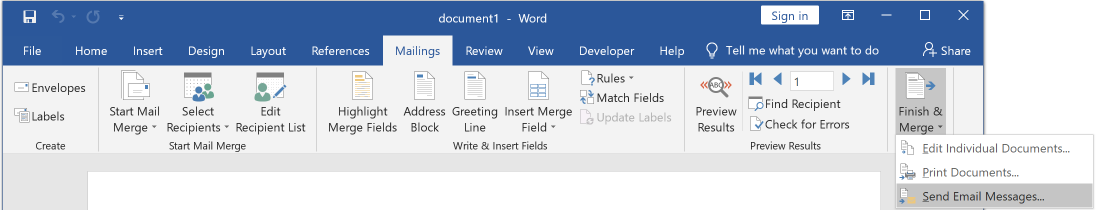

Use the mail merge feature of Word

After export of addresses in html format, you can start working with Word and use the mail merge feature.

The procedure to follow is described below, but we recommend that you visit the Microsoft

- Create the letter:

- open Microsoft Word

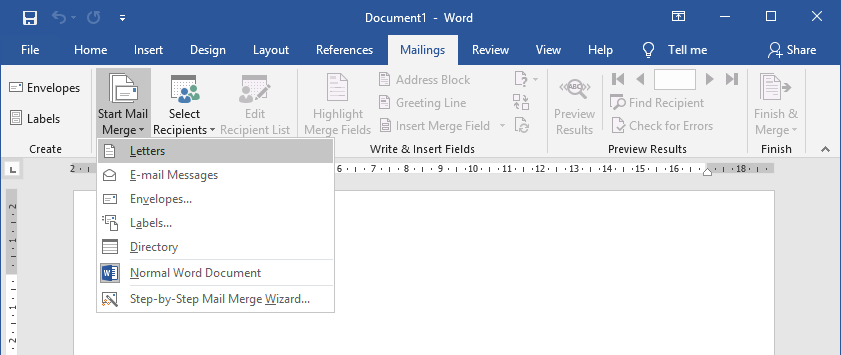

- select the Mailings tab

- select Start Mail Merge

- select Letters

- type in the content of the letter in Word inserting the text that will be repeated for each document.

- Link the exported addresses of the HTML file to the Word document:

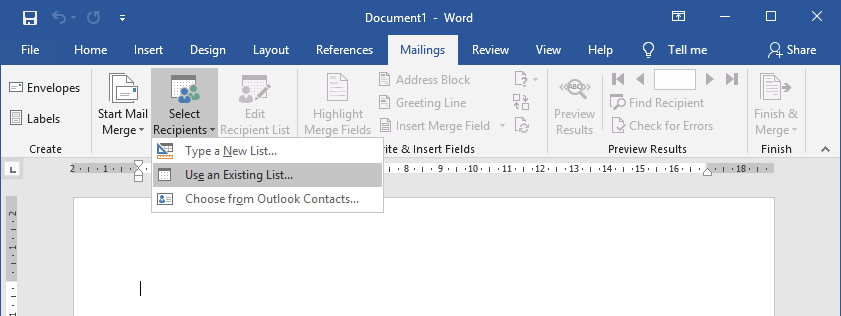

- in the Mailings tab select Select Recipients

- select Use an existing list

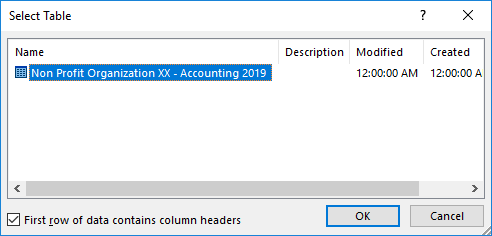

- select the .html file exported from Banana

- confirm with OK in the appearing window

- Add the addresses:

- Place the cursor where you want the address to be inserted in the Word document, (for example, at the top of the page)

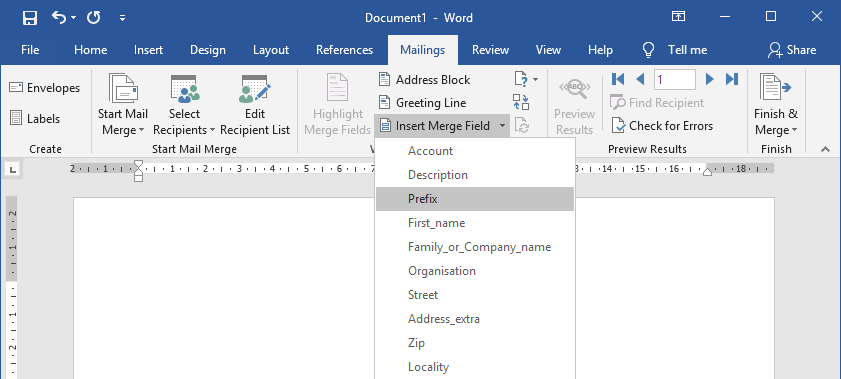

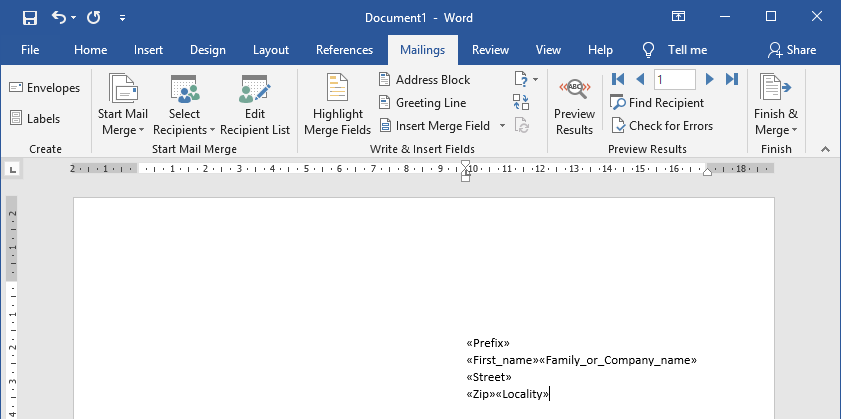

- In the Mailings tab select Insert Merge Field

- One by one, select the address fields you wish to add

- Check with Preview Results using the forward

and back

and back  darts

darts

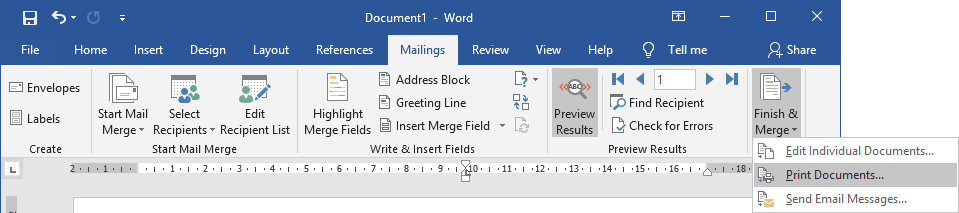

- Print the letters:

- select Finish & Merge > Print Documents... to print all letters

- select Finish & Merge > Edit individual Documents... and All to eventually modify and save the letters

- Send messages by email:

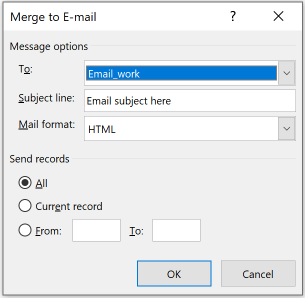

As an alternative to step 4, you can choose to send letters by email.

For each member will be used the email address specified in the address view in Banana Accounting. If there are no email addresses you need to add them, and eventually export again the address lines in HTML format so that the exported file also contains the email addresses.

It is also necessary to install and use Outlook as email program. It's not possible to use the web version. More information at Use mail merge to send bulk email messages.

To send email messages:- select Finish & Merge > Send Email Messages...

- In the field "To" select Email_work (the column used in Banana Accounting for entering the email address).

- In the field "Subject line" enter the subject text of the email.

- In the "Mail Format" field select HTML (default setting).

- Select All to send the email to all members.

- Confirm with OK.

- select Finish & Merge > Send Email Messages...