In this article

In the printout of invoices integrated in accounting, the total VAT amount corresponds to the sum of the individual VAT transactions that make up the invoice. Since the individual VAT transactions are rounded to the nearest cent, there may be a difference compared to the VAT calculated on the total invoice amount.

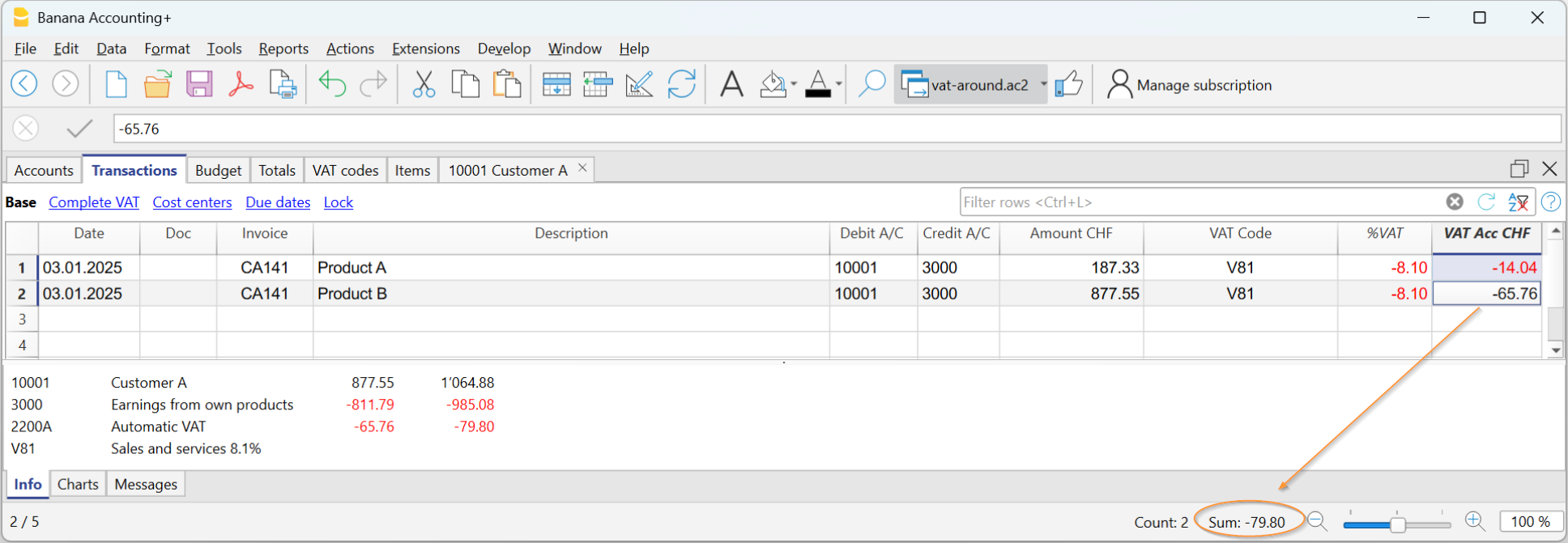

To better understand, let's consider the following example:

- Row 1: 8.1% of CHF 187.33 = Rounded: CHF 14.04

- Row 2: 8.1% of CHF 875.00 = Rounded: CHF 65.76

- Total: 8.1% of CHF 1064.88 = Rounded: CHF 79.80

The invoice shows a VAT amount of CHF 79.80 instead of CHF 79.79 (amount calculated directly on the total of 1064.88). In fact, the amount of CHF 79.80 corresponds to the sum of VAT individually calculated for each item (CHF 14.04 + CHF 65.76).

This logic is adopted to avoid discrepancies between the VAT amounts recorded in accounting and those shown on the invoice. In this way, the total VAT in accounting matches the one printed on the invoice.