Swiss VAT management

Banana Accounting Plus is designed to handle VAT according to the regulations of the Federal Tax Administration. The Swiss VAT Report 2024, is created automatically thanks to the following extensions, integrated into Banana Accounting Plus:

- Effective Method - VAT Extension 2024 - See page in German, French or Italian

- Net tax rate Method - VAT Extension 2024 - See page in German, French or Italian

These extensions allow you to obtain the official Swiss VAT Report, both with the 2018 and 2024 rates. The extensions also allow you to create the XML file for data transmission on the Federal Tax Administration portal.

In order to use the 2024 VAT extensions, the following steps are necessary:

- Subscribe to the Advanced plan of Banana Accounting Plus

- Download the latest program release

- Update your VAT Codes table (for users with an existing file)

If you have a previous Banana version, update your program and plan.

All Swiss VAT documentation has been updated to comply with the new VAT regulations for 2024. In the VAT Codes table the new 2024 rates have been added, all the while also retaining the 2018 VAT codes and rates, to allow you to submit your VAT Report both with the 2023 and 2024 rates.

If you already have your Banana Accounting Plus file, find you how to make the transition to 2024 VAT Rates and how to update your VAT Codes table with the new rates.

Recording transactions with VAT

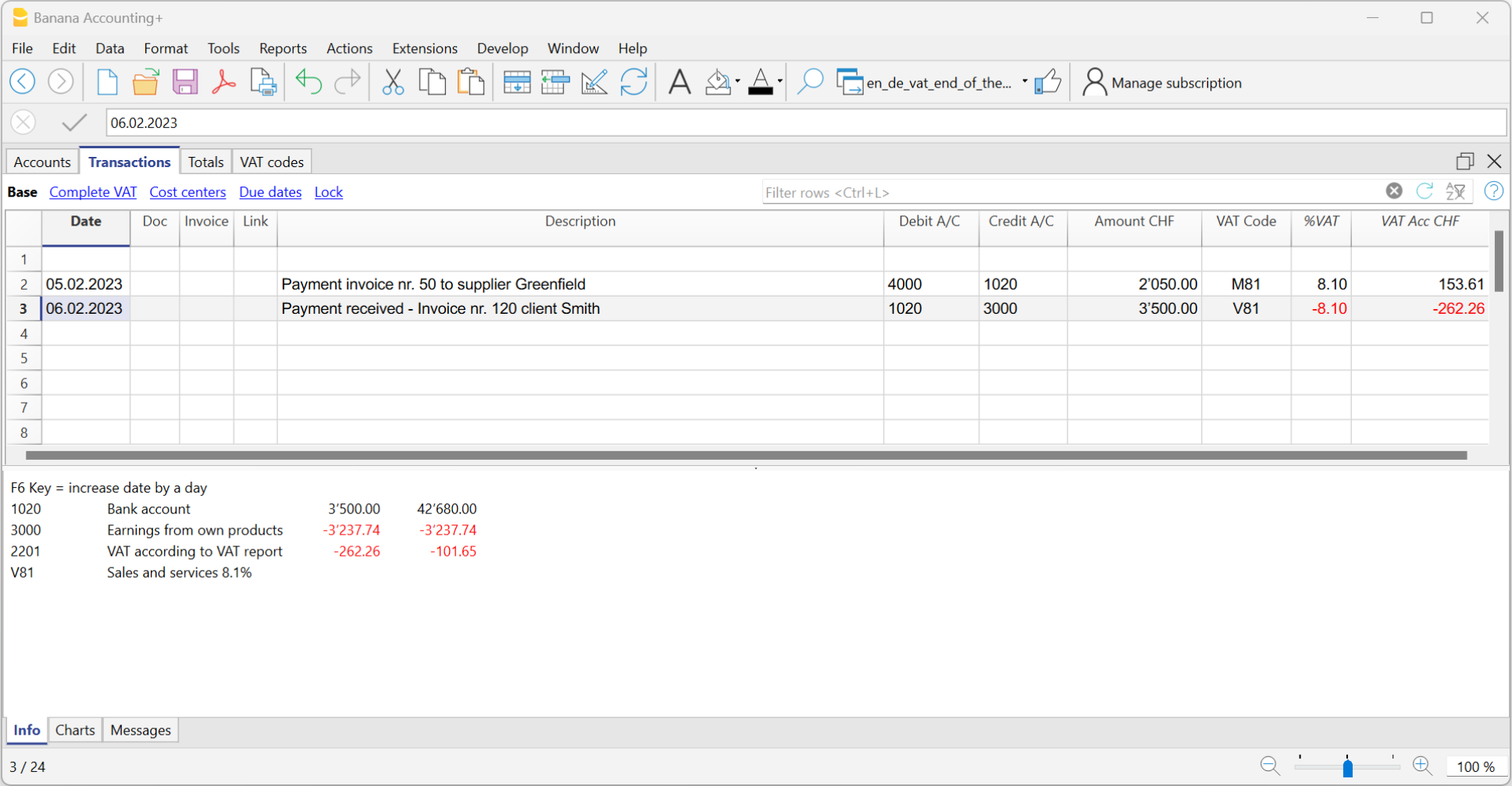

With Banana Accounting, recording transactions with VAT is extremely simple due to its complete automation. VAT transactions are registered in the Transactions table, which serves as the central hub of the entire accounting process. For each VAT transaction, you need to enter the corresponding VAT code, indicating whether it's a sale or purchase and referring to the applicable VAT rates.

The software provides several pre-configured columns, and you have the flexibility to customize their display according to your preferences.

Additionally, the program offers the following functionalities:

Types of accounting

There are two types:

- On the issued invoices

It implies keeping a Clients and Suppliers register.

The costs and revenues, with the relative VAT code, are recorded when the invoice is issued and received.

More information is available on the page How to manage Supplier and Customers with VAT on turnover.

- On cash received

It is not mandatory to keep a Clients and Suppliers register, but if you wish to have one anyway, it is important to set it up with cost centers.

The costs and the revenues, with the relevant VAT code, are registered at the moment of collection or payment.

Further information can be found on the page Clients and suppliers with VAT, using the Cash principle.

Calculation method

To calculate the VAT amounts and generate the VAT report to be sent to the FTA, it is necessary to have costs and revenues in CHF base currency.

There are two methods of calculation:

- Effective method report

Provides for the deduction of the VAT paid on purchases (VAT due - recoverable VAT).

- Net tax rate method

The VAT to be paid to the FTA is calculated according to the granted rates.

Does not provide for the deduction of VAT paid on purchases.

Electronic transmission of the VAT Report

With the new extensions of Banana Accounting, in addition to the VAT Report facsimile, it is possible to export the data in XML format to be transmitted to the online portal of the Federal Tax Administration (FTA).

In the Extensions menu there are:

All users that have versions prior to Banana Accounting Plus, in order to use the electronic submission procedure, must update the program and subscription plan.

All VAT Reports can be saved in PDF format and securely archived.

Banana VAT Summary (VAT Journal)

In addition to VAT extensions, Banana Accounting Plus can generate VAT summaries based on the period and other parameters.

VAT summaries are useful for understanding the movement of VAT (VAT payable, recoverable, and to be paid) and enable effective control. In the event of audits by tax authorities, VAT summaries provide targeted details to facilitate the verification process.

For more information, please visit the VAT Summary page.

All VAT summaries can be saved in PDF format and securely archived.

VAT year-end reconciliation

Regarding the annual correction statement, which contains any differences found at the end of the year compared to the already submitted statements, Banana does not allow for a comparison of the calculated tax with the previously transmitted statements because the program does not save the total calculated tax from previous calculations. Therefore, the user must manually calculate the tax difference and communicate it to the AFC using the appropriate form.

Useful links

Current VAT rates

In Switzerland, VAT rates changed as of 1 January 2024. Below you will find the new rates for both the actual method and the net rate method.

VAT rates for the effective method

From 2024 the new VAT rates came into force as indicated in the following table:

| Until December 31, 2023 | From January 1, 2024 |

|---|---|---|

| Normal rate: | 7,7 % | 8,1 % |

| Reduced rate: | 2,5 % | 2,6 % |

| Special rate for accommodation: | 3,7 % | 3,8 % |

Further details are available on the website of the Federal Tax Administration page.

Invoicing

- In the case of services in return which must be declared before 1 July 2023, but which relate to supplies for 2024, these must be declared at the old tax rate and can be adjusted in the statement for the 3rd quarter 2023 or the 2nd half 2023.

- The services in return declared after 1 July 2023, which concern services relating to 2024, can be declared with the new VAT form 2024, using the new VAT rates.

VAT Codes 2024

At the end of 2023 and for 2024 the different rates can be used in parallel.

- The VAT Codes table already contains the VAT codes with the relative rates for both 2023 and 2024

- In order to update the VAT code table, the simplest way is to import the VAT codes into your accounting.

VAT rates for the net tax rate method

The new VAT rates for the net tax rate method are the following:

| Net tax rates until December 31, 2023 | Net tax rates from January 1, 2024 |

|---|---|

| 0,1 % | 0,1 % |

| 0,6 % | 0,6 % |

| 1,2 % | 1,3 % |

| 2,0 % | 2,1 % |

| 2,8 % | 3,0 % |

| 3,5 % | 3,7 % |

| 4,3 % | 4,5 % |

| 5,1 % | 5,3 % |

| 5,9 % | 6,2 % |

| 6,5 % | 6,8 % |

The list of VAT codes is already provided with the relative codes for the final rates:

- F1 and F2 codes must be set up for services invoiced with 2024 rates

- F3 and F4 codes must be set up for services up to 31.12.2023.

These codes have not set the rate in the table. There are two ways of calculating:

VAT Extension 2024, Program update and subscription plan

On this page, you will find the main updates regarding the changes and plans of Banana Accounting for managing VAT with the new 2025 VAT returns.

From 2025, mandatory online VAT return submission

The Federal Tax Administration states that from January 1, 2025, all Swiss companies subject to VAT must handle their initial registration and submit their VAT return electronically via the ePortal.

Banana Accounting Plus, to keep up with the new VAT changes, already allows you to prepare the 2025 VAT returns with the new extensions in BETA version:

The new VAT extensions, in addition to preparing the 2025 VAT form, generate the XML file for VAT return submission on the FTA portal. They include the balance tax rates added with the latest VAT changes in 2025.

The 2024 VAT extensions are still available. However, they do not include the additional balance tax rates introduced with the latest changes:

To use the 2024/2025 VAT extensions, you need:

Upgrade to the Advanced plan from the Professional plan

If you are still using an older version of Banana Accounting Plus or you have the Professional Plan, we recommend upgrading to the Advanced Plan of Banana Accounting. You will have access to the new extensions to quickly create VAT returns, saving time otherwise spent manually calculating and entering amounts on the VAT portal.

Upgrade to the Advanced Plan of Banana Plus

You only pay the difference between the two plans

Useful links

Updating the Swiss VAT Codes table

It is necessary to have downloaded and installed the latest version of Banana Accounting Plus.

Import updated VAT codes

All users who have their own coding for VAT codes must update the VAT Codes table according to the new rates with their respective reference figures. We recommend consulting the VAT Codes table in Banana Accounting Plus.

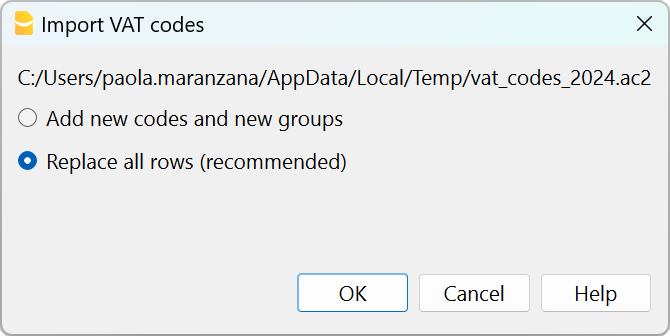

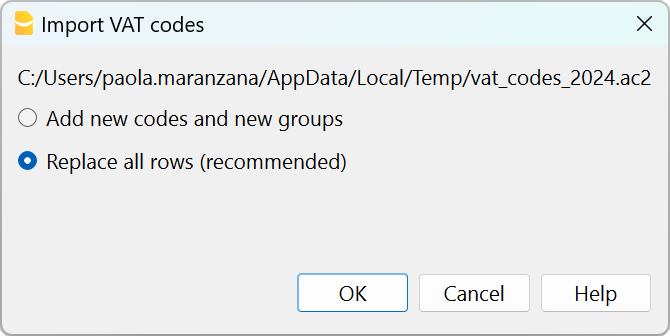

To update the VAT Codes table in your accounting file, proceed as follows:

- Make a backup copy of your file to be safe

- Open your accounting file

- Select from the menu Actions > Import to accounting > Import VAT codes

- Select Switzerland New VAT Rates 2024

- Confirm by clicking on the OK button

- From the dialog that appears there are two options:

- Add new codes and new groups

To be used when you want to maintain your VAT codes. In this case the program adds the new VAT codes leaving the existing ones unchanged. If the VAT codes to be added already exist in the table, but have a different rate or grouping, they will be inserted by adding '-1' to the name. - Replace all rows (recommended choice)

Use this command if you don't need to maintain the existing VAT code page.

In this case, the VAT code table is completely replaced with the new table.

Existing VAT accounts are retained and need to be reviewed after the update. The default VAT account can be changed via the File Properties dialog (basic data).

- Add new codes and new groups

- Check the accounting

From Actions menu > Check accounting.

If there are incorrect VAT codes in the transactions table, you need to update them according to the new VAT Codes table.

To replace the old VAT codes in the Transactions table, you can use the command from the menu Data > Search and replace.

If the VAT codes have also been entered in the Accounts table, to associate the VAT codes to the accounts, these must be updated.

Update the VAT Codes table in the Estimates and Invoices application

It is not possible to automatically update the VAT Codes table in the Estimates and Invoices application, as explained in the previous paragraphs.

ID codes and percentage VAT rates must be updated manually each time there are changes.

Alternatively, you can also follow this procedure:

- Open a new Banana template for Estimates and Invoices, which has updated VAT codes

- Go to the VAT Codes table

- Copy and paste the entire table from the template to your Estimates and Invoices file.

For more details, refer to the VAT Codes table in Estimates and Invoices page.

VAT Codes Table History

Current versions

- VAT Codes Table 2024 (02.04.2025 id=vatcodes-che-2024.20250402)

- VAT Codes Table 2025 (12.03.2025, id=vatcodes-che-2025.20250312)

Outdated versions

- VAT Codes Table 2024 20230614 (14.06.2023, id=vatcodes-che-2024.20230614)

- VAT Codes Table 2018 (10.12.2021, id=vatcodes-che-2018.20211210)

Changes to VAT Rules from 2025

As of January 1, 2025, significant changes have been introduced to the VAT law. Below is a summary of the main updates:

- Mandatory electronic processing of VAT data.

- Introduction of more than two VAT rates for the flat-rate and balance methods.

- Option to choose annual VAT reporting.

Full details are available in the documentation of the Federal Tax Administration.

Changes and Updates in Banana+

- Electronic processing is already possible with the VAT Reporting Effective Method and Net tax rate extensions.

- If you use more than 4 VAT rates with the net tax rate / flat rate method, follow the instructions to enter the additional codes in the VAT Codes table.

- For the new calculation of the net tax rate / flat rate, we are awaiting the publication of the specifications eCH-0217 E-MWST 2.0. As soon as they are available, we will update the relevant extensions and documentation.

- For the annual report, it is possible to make advance payments. Currently, these advances are not displayed in the VAT report but are managed exclusively in accounting, as their integration into the VAT report is too complex.

VAT effective method

Swiss VAT Report effective method 2024/2025

Swiss VAT Report effective method 2024/2025This page is not available in English at the moment.

Please consult the relative pages in German, French or Italian.

Swiss VAT Report effective method 2025 [BETA]

VAT net tax rate method

Swiss VAT Report net tax rate method 2024/2025

Swiss VAT Report net tax rate method 2024/2025This page is not available in English at the moment.

Please consult the relative pages in German, French or Italian.

Swiss VAT Report net tax rate method 2025 [BETA]

Transaction without VAT breakdown

The method with VAT breakdown described below is the one we recommend, because it is the simplest and fully automated.

Before proceeding with the filling in of the VAT statement (facsimile and XML file) it is necessary to:

- Check that the VAT Codes table is updated.

- Check that there is a Yes in the VAT Codes table in the VAT due column.

- In the Transactions table, post the transactions, indicating the code for the balance rate. No percentage will appear and no VAT amount will be indicated.

VAT facsimile and XML file for forwarding to the FTA

At the end of the period, the extension Swiss VAT: net tax rate method must be used to process the VAT facsimile statement and the XML file to be forwarded to the FTA.

Extensions are installed via the Extensions menu > Manage Extensions command.

VAT codes for the net rate (figures 322, 332 up till 2023, 323, 333 from 2024)

Starting from 01.01.2024, the VAT codes for the balance rate are indicated with F1 and F2, FS1, FS2 those relating to discounts.

For the year 2023, the existing ones will remain valid. These codes can also be renamed.

It is important to know that:

- No percentage is entered in the VAT% column (empty cell)

- In the Transactions table there will be no breakdown and indication of the VAT amount.

The GR1 column shows the figures of the VAT form where the amounts are totaled.

When the amounts are to be totaled with several digits, these are separated by a semicolon.

Transactions without VAT breakdown

Figures 322, 332 up till 2023, 323, 333 from 2024

Each time sales are recorded, the code "F1" for the 1st rate and F2 for the 2nd rate must be entered.

If there is a discount, use the FS1 or FS2 code. These codes are valid from 01.01.2024.

For year 2023, the VAT codes remain the same ( F3,F4,FS3,FS4).

Credit notes and adjustments

When there are reversals or adjustments, it is necessary to reverse the debit and credit accounts and indicate the code with the minus sign in front of "-F1".

The program decreases the VAT amount of the credit note when calculating the VAT report at the end of the period .

Accounting settlement and payment

- The VAT to be paid to the Federal Tax Administration, which appears in the form (under number 500) must be recorded in the accounts as a decrease in revenue, using the VAT due account as a counter-entry.

- For the registration of the VAT payment, the VAT due account is canceled, which will have a zero balance, and as a counterpart there will be a liquidity account that will decrease.

VAT codes for net rate (numbers 470 - 471) - Exports declared using form no. 1050 and 1055

These are two VAT codes that apply in special situations and please refer to the relevant explanation of the Federal Tax Administration.

The above figures refer to exports that have been noted and declared using form no. 1050 and 1055.

Transactions for VAT codes F1050 - F1055 (Figures 470 - 471)

In the Transactions table, you must enter the total amount of VAT on the purchase and apply the type 2 VAT code (100% VAT amount - F1050, F1055).

The program reports the VAT amounts to numbers 470 - 471 of the VAT Form.

Transactions with VAT breakdown

This system is used when you want to have the immediate breakdown of VAT for each transaction in the Transactions table .

It is important to know:

- If this method is used, attention must be paid to the fact that the final VAT is calculated on the invoice amount already including VAT, therefore on the total turnover.

- The VAT deduction that is made in the account will not be the same as the VAT amount invoiced to the customer. These situations can be confusing, so we recommend using this method only if you have a good understanding of VAT mechanisms.

How to proceed

Before proceeding with the processing of the VAT statement (facsimile and XML file) it is necessary to:

- Check if the VAT Codes table is updated.

- In the VAT Codes table, enter your tax rates relating to codes F1, F2, FS1, FS2 (sample rates have been entered in the following window).

- In the Transactions table, enter the transactions, indicating the code for the balance rate. The VAT balance percentage and the amount separated from the revenue account will appear.

VAT facsimile and XML file for the FTA

At the end of the period, to process the VAT facsimile statement and the XML file to be forwarded to the FTA, use the Swiss VAT: net tax rate method extension.

Extensions are installed via the Extensions menu > Manage Extensions command.

VAT codes for the net rate (figures 322, 332 up to 2023, 323, 333 from 2024)

From 01.01.2024, the VAT codes for the flat tax rate are indicated with F1, F2 and FS1, FS2 those relating to discounts.

For 2023, the existing ones (F3, F4 e FS3, FS4) will remain valid. These codes can also be renamed.

Important: by default the value "YES" must appear in the "% VAT on Gross" column, as shown in the following screen:

See the information below for more details.

See the information below for more details.

Registration with VAT breakdown

Figures 322, 332 up to 2023, 323, 333 from 2024

When registering, the program breaks down the related VAT amount for each individual transaction and it registers it to the VAT account statement.

VAT payment at the end of the period

At the end of the period, after calculating the VAT to be paid, a transaction must be made to transfer the balance from the VAT account to the VAT account to be paid.

The VAT return account, after this transaction, will have zero as a balance.

When the VAT is paid, the payable VAT account will be registered onto the debit account and a liquidity account will be registered in the credit account.

2024/2025 Swiss VAT Codes description in Banana Accounting+

Swiss VAT codes changed as of 1 January 2024. Below you will find what changed in the Banana Accounting Plus programme

Changes due to the 2024 rates

New codes have been added to the VAT Codes table for the VAT rates for 2024 (8.1, 2.6, 3.8).

In particular, new codes have been added for the calculation of the tax on the VAT form, Section II, for transactions subject to VAT from 01.01.2024; the VAT codes relating to the old rates and valid for transactions subject to VAT up to 31.12.2023 remain unchanged.

For the newly added VAT Codes, the references for the figures that must appear on the VAT form as of 01.01.2024 have been inserted. The figure references for the previous VAT Codes valid until 31.12.2023 remain unchanged.

For more information, please consult the detailed description of the VAT codes on this page.

For users of Banana Accounting 9 or previous versions

Those who have previous versions of Banana Accounting can add the VAT codes manually, but it is not possible to create the paper or XML facsimile for the automatic forwarding of the data to the FTA. We recommend upgrading to Banana Accounting Plus, Advanced plan.

If you have updated the VAT Codes table, the table is set as follows:

- V = Sales (200)

- VS = Discount sales and services (235)

- B = Acquisition tax (383 - 382)

- M = Expenses for material and services (400)

- I = Investments and other operating expenses (405)

- K= Corrections (410, 415, 420)

- Z = Not considered (910)

Gr1 Grouping

The GR1 column (visible in the Complete view) shows the figures of the VAT form, where the amounts are grouped according to the relevant VAT code.

For the programme, these indications are essential for the preparation of the VAT form (facsimile) and the Xml file for the electronic submission of VAT data on the portal of the Federal Administration.

There are VAT codes that must appear in several boxes for the figures on the form. For example, the sales taxable amount must appear in digit 200 (Turnover figure) and also in digit 303 (Tax calculation). In these cases, the figures separated by a semicolon (200;303) are entered in column Gr1.

If a VAT code, which is present in the table VAT Codes, is used in the table Recording and does not have a grouping in the column GR1, when printing the VAT form, the programme will report an error. If a VAT code is not to appear in any figure on the VAT form, 'xxx' must be indicated in column Gr1; thus no error is reported.

Gr1 codes till end of 2023 and from 2024

In the VAT form with the Effective method, in the Calculation of tax part, there are boxes up to 31.12.2023 (302, 312, 342, 382) and boxes from 1.1.2024 (303, 313, 343, 383).

In the VAT Form for Flat Tax Rate method, there are boxes up to 31.12.2023 (321, 331, 381) and boxes from 1.1.2024 (322, 332, 382) in the Calculation of tax part.

The Print VAT Form command inserts the values of the boxes according to the figure contained in Gr1. If a new code is added, the VAT form reference figure must therefore be entered correctly.

Turnover / Taxable Amount

Initial letter V is used for codes relating to Turnover.

Reference 200 - Total amount of agreed or collected consideration

All transactions related to turnover, whether subject or not to VAT, must be reported here. Exempt sales are to be indicated with the appropriate VAT code.

Codes for exempt transactions or supplies provided abroad must be grouped in reference 200 and simultaneously reported in the relative deduction reference number.

The VAT codes related to turnover are:

- V81, V26, V38 (valid from 01.01.2024)

- V77, V25-N, V37 (valid until 31.12.2023).

Sales subject to VAT must be grouped not only in the figure 200 but also in the respective positions according to the rate (302, 303, 312, 342, 343, 382, 383).

Reference 205 - Consideration exempt from tax where option for taxation has been exercised

These transactions must be indicated under reference number 200, but must also figure under reference no 205.

They carry a VAT code that is identical to a VAT sales code, with the additional indication in the Gr1 column that they also must be grouped in the ref 205.

In order to be able to use this position, VAT codes must be replicated from reference number 200. For simplicity, the letter B has been added to the existing VAT codes.

The following codes must be used in the VAT codes tab:

- V77 (valid until 31.12.2023)

- V81 (valid from 01.01.2024).

Reference 299 - Taxable turnover

The taxable turnover is constituted by the turnover minus the non-taxable turnover (Deductions) (221, 225, 230, 235, 280).

Decrease in Turnover

For each non-taxable or non-VATable position, there is a VAT code with a percentage of 0 (due).

Reference 220 - Tax-exempt services

Use the following code:

- V0

Reference 221 - Services provided abroad

Purchase of goods and services abroad are intended (Article 23) or when the beneficiary is not subject to tax(Article 107).

Use the following code:

- V0-E

Reference 225 - Transfers via Notification Procedure

Transfers via notification procedure (Article 38; to be submitted with form No. 764).

The code to use is the following:

V0-T

Acquisition tax (Art. 45)

Reference 381 - 382 - Acquisition tax

Services that are obtained abroad, that do not carry any customs documents, must be subject to VAT as if they were sales.

For these cases, special VAT codes are needed to calculate VAT both as VAT due and as recoverable VAT.

The VAT codes to be used are:

- B81 for transactions with VAT code type 0 (VAT amount included), valid from 01.01.2024

- B81-1 for transactions with VAT code type 1 (VAT amount excluded), valid from 01.01.2024

- B81-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid from 01.01.2024

- B77 for transactions with VAT code type 0 (VAT amount included), valid until 31.12.2023

- B77-1 for transactions with VAT code type 1 (VAT amount excluded), valid until 31.12.2023

- B77-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid until 31.12.2023

Recoverable taxation

Recoverable VAT is reported in this part of the (refundable VAT).

Reference 400 - Input tax on Purchase of material and services

These are purchases of goods and services that are part of the company's core business.

The codes for recoverable taxation are:

- M81, M26, M38 (valid from 01.01.2024)

- M77 (valid until 31.12.2023)

In cases where VAT has been paid at customs and there exists an invoice with the VAT amount only, VAT code type 2 (Registration Amount = VAT amount) must be used. For these cases, the following code was set up:

- M81-2 (valid from 01.01.2024)

- M77-2 (valid until 31.12.2023).

For Amount type 1 (Amount of registration = Net Amount) use the following code:

- M81-1 (valid from 01.01.2024)

- M77-1 (valid until 31.12.2023)

Reference 405 - Input tax on Investment and operating costs

These are purchases for investments and operating costs that are not part of the 400 figure.

The VAT codes are:

- I81, I26, I38 (valid from 01.01.2024)

- I81-2 to be used for obtaining services abroad, in conjunction with the codes designated for calculating the purchase tax (see page VAT on foreign services)

- I77, I37 (valid until 31.12.2023).

It might be necessary to add further codes of Amount type 2, or Amount type 1 with different rates.

Purchases without VAT should not be included in the VAT return.

In some cases (eg clarity of the review) it may be useful to identify specific transactions without VAT.

The VAT codes are:

- M0 and I0, grouped with "xxx" in order to avoid generating an error message.

Corrections and reductions (recoverable tax)

It might not be necessary for the taxpayer to use these positions. If needed, use one of the codes grouped in the Correction and adjustments Group.

From an accounting point of view, correction transactions may essentially result in a reduction of VAT deductibility.

A registration must therefore be made for the deductible VAT adjustment (as a plus or minus).

Reference 410 - De-taxation (art. 32)

You can deduct the recoverable VAT paid in previous years.

The codes are:

- K81-A (valid from 01.01.2024)

- K77-A (valid until 31.12.2023).

Reference 415 Corrections of the input tax deduction, mixed use

In cases where merchandise has not been used for corporate or taxable purposes, it is not possible to recover all previous input tax VAT.

You can do this by always using the same purchase account (both credit and debit); in this way the purchase account will be increased by the amount of non-deductible VAT.

The codes are :

- K81-B (valid from 01.01.2024)

- K77-B (valid until 31.12.2023).

Reference 420 - Reduction of the input tax deduction

These are the transactions to be deducted from deductible VAT, such as subsidies.

This position must contain the same elements as the ones in reference 900.

The codes are:

- K81-D (valid from 01.01.2024)

- K77-D (valid until 31.12.2023).

Other cash flows of financial resources

In this part, the amounts relating to the base for the calculation for VAT must be reported..

These are transactions that are not part of the turnover and are not countervailing duties.

Reference 900 - Subsidies, tourist taxes and similar

Operations in reduction the deductible VAT, such as subsidies.

The code to use in these cases is:

- Z0-A

Reference 910 - Donations, dividends, compensation for damages etc.

Out of scope transactions. Donations, dividends and all other "receipts" that do not lead to a reduction of deductible VAT.

The code to use in these cases is:

- Z0

VAT Codes - Flat tax rate

As a result of the VAT rates for 2024, in Banana Accounting, the VAT rates have also been updated using the flat tax rate method.

Column GR1 shows the figures of the VAT form where the amounts are totalled. If the amounts are to be totalled in several digits, these are separated by a semicolon.

- F1 - code provided for sales subject to 1st rate (reference 200, 323), to be used from 01.01.2024

- F2 - code provided for sales subject to 2nd rate (reference 200, 333), to be used from 01.01.2024

- FS1 - code provided for discount on sales subject to 1. rate (reference 235, 323), to be used from 01.01.2024

- FS2 - code provided for discount on sales with 2. rate (reference 235, 333), to be used from 01.01.2024

- F3 code provided for sales subject to 1. rate (reference 200, 322), to be used until 31.12.2023

- F4 code provided for sales subject to 2nd rate (reference 200, 332), to be used until 31.12.2023

- FS3 code provided for discount on sales subject to 1st rate (reference 235, 322), to be used until 31.12.2023

- FS4 code provided for the discount on sales subject to the 2nd rate (reference 235, 332), to be used until 31.12.2023

- F1050 - code provided for exports which have been annotated and declared using form 1050 (reference 470)

- F1055 - code provided for exports which have been recorded and declared by means of form No. 1055 (reference 471).

Those who run previous versions, can download the updated file of the new VAT Codes table, or enter the missing codes.

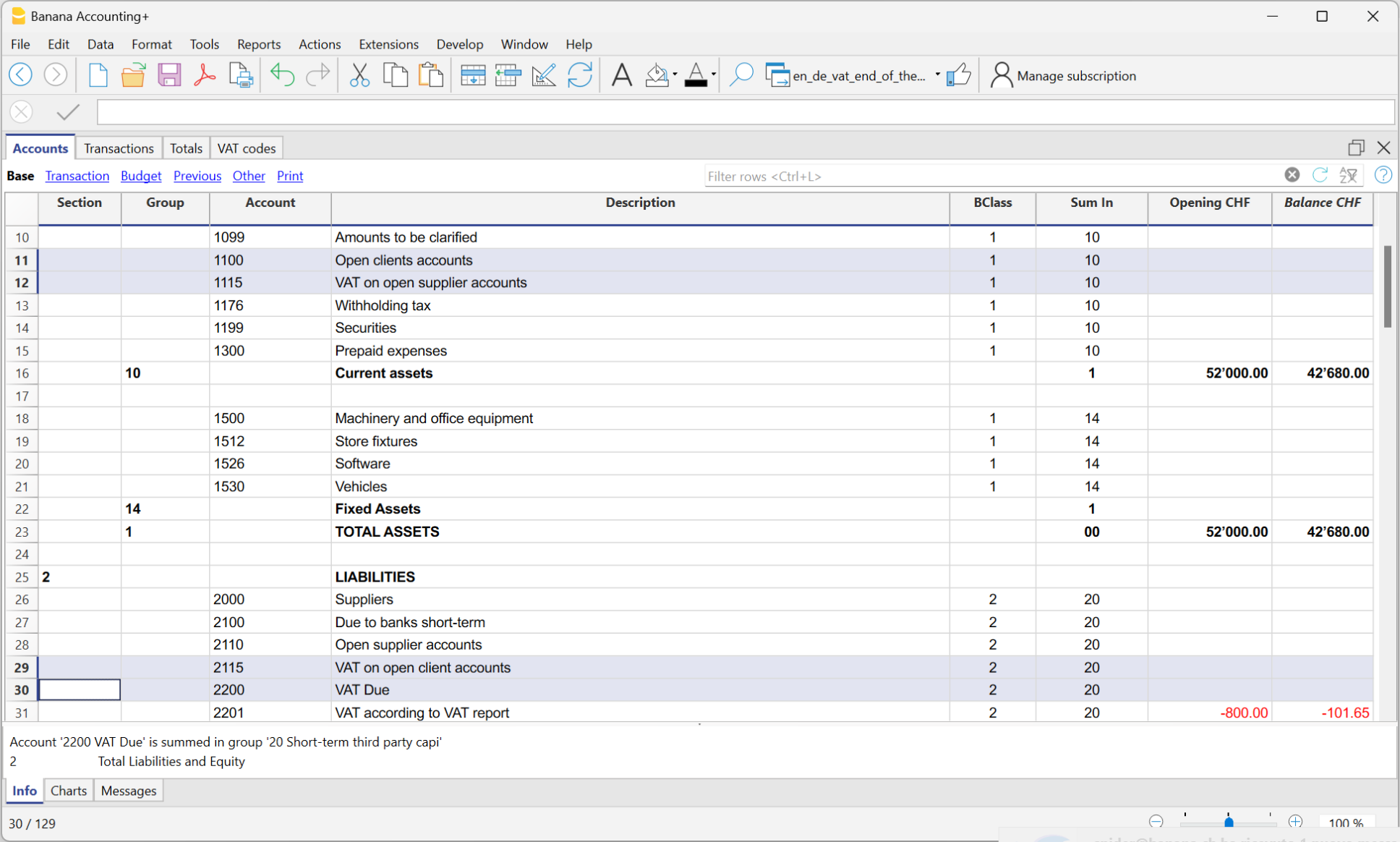

VAT account in the basic accounting data

All default Banana Accounting templates have the VAT account (2201) already set up in the File properties (File menu, VAT section). This allows the VAT calculations to be automated, so that all VAT amounts are accounted for in this account.

At the end of the quarter, the balance of this account represents the amount to be paid to the FTA (or to be recovered).

When the VAT Return account (2201) is set in the file properties, in the VAT Codes table, the VAT Account column must be empty.

If account 2201 is not set in the file properties, the previous VAT account 1, 2 and the VAT account due to each individual code can be set. In this case, the VAT is spread over three different accounts and at the end of the quarter the VAT accounts must be closed in order to determine the VAT payable to the FTA.

Submission of the VAT Report

The new 4 VAT form is available on the VAT portal. Here, you can input both the VAT data for 2023 and those with the 2024 tax rates.

VAT data can be submitted in one of the following ways:

Manually enter the VAT data in the AFC portal

- View and print out the VAT return facsimile and check that the data is correct.

- Log in to the Federal Tax Administration portal with your account details.

- Manually enter the data from the VAT Facsimile in the online VAT report.

- Check all data before sending.

- Proceed with the submission.

Online submission of VAT data with Xml file

From 2025, it is no longer possible to send the VAT report in paper format. Banana Accounting Plus is prepared according to the VAT rates in force since 2024 for the transmission of VAT data via Xml file.

For the creation of Xml files, please refer to the information at Swiss VAT Report 2024: effective method

Before entering the data on the FTA portal, proceed as follows:

- View and print the VAT Return facsimile and check that the data is correct.

- Create the XML file for the VAT for the quarter or the semester you are interested in. Ensure that the transmitted period is correct (see the next section).

- Log in to the Federal Tax Administration portal with your account data.

- Choose to import the data in XML format.

- Check the data automatically displayed in the online form against the data in the VAT facsimile.

- Validate the data and proceed with the submission.

Verification of the Transmitted Period

- If an invalid period is transmitted, the file will be rejected.

The valid periods, divided by method, are as follows:- Vat Net/Flat Rate Method: semi-annual and annual.

- Vat Effective Method: quarterly, semi-annual, and annual.

- If you recently registered as a VAT taxpayer, the reporting period does not necessarily start on 1st MM.YYYY but could, for example, start on 16th MM.YYYY.

- Submitting a report for a period from 01.01.20YY to 30.09.20YY, thus covering multiple periods, will result in the file being rejected.

Net or gross sales

When manually entering data into the AFC portal, it is important to correctly choose the net setting at the top of the form.

If, on the other hand, you directly submit the XML file generated by Banana Accounting Plus, the information is already included in the file itself through the <eCH-0217:grossOrNet> tag.

Error Messages

This extension does not work with your current version of Banana Accounting.

This extension works from version Banana Accounting Plus 10.1 or higher, Advanced plan.

The VAT number of your company is invalid or missing.

Set or correct it with the File menu > File properties (Basic data) > Address tab.

The VAT number must consist of 9 digits. You can also indicate the text CHE, the important thing is that you indicate the 9 digits. For example, you can write CHE-211.311.311 or 211.311.311.

The VAT number must be entered in the File Properties (Basic Data) dialogue, Address tab, VAT field, via the menu command File > File Properties (Basic Data).

At digit xxx the rate xxx is not allowed. Check VAT code xxx

For the digits 302, 303, 312, 313, 342, 343, 382 and 383, the VAT rates are checked according to what the Federal Tax Administration has published (VAT rates from 1 January 2024).

Transition from net tax rate method to the effective method

To correctly transition from the net tax rate method to the effective method in Banana Accounting, follow these steps:

Verify the VAT Codes table

- Ensure that the VAT Codes table is the default one provided by the program.

The default table contains all the necessary codes for both thenet tax rate method and the effective method. - If the table is not updated, it must be updated following the instructions on the webpage: Update VAT Codes Table 2024.

Update the Accounts table

- Add the following accounts:

- 2201 VAT Report (automatic VAT account).

- 2200 VAT Due (VAT to be paid to the AFC).

Update File Properties

- Set account 2201 VAT Report in the following path:

File > File and accounting properties (Basic data) > VAT.

Transactions Table

- For transactions with VAT, use the VAT codes provided for the effective method.

For the quarterly VAT declaration, use the extension VAT Effective Method (available only with the Advanced plan).

Transactions with VAT

Supplier customers with VAT on turnover

Set up the accounts of the ledger

To set up the Customers / Suppliers register consult the Customers setup with the accrual method page.

VAT registration on turnover

With the system of VAT on turnover, the Customers / Suppliers register will be kept. Therefore, the invoices issued and received are recorded, posting the costs and revenues and entering the corresponding VAT code.

Clients and suppliers with VAT, using the Cash principle

With the system of the VAT on cash received, there is no provision for entering transactions on the clients/suppliers accounts, for the expenses and income are being entered at the moment the payment is made or received. Only at that moment, the VAT code is being entered. However, in spite of this rule, it is still possible to enter the issued and received invoices by using the cost centers.

Procedure:

- Insert the clients' and suppliers' accounts as cost center CC3, defined with the semicolon in two different groupings, one for clients, another one for suppliers.

Entering the invoices of clients and suppliers

For the issued and received invoices:

- Position yourself in the Transactions table, Cost centers view;

- Enter the date, the document number and the invoice number in the respective columns;

- Enter the description;

- Enter the amount of the issued or received invoice in the Amount column, the Debit and Credit columns have to remain empty.

- Enter the cost or profit center in the CC3 column: in positive when it concerns an invoice issued to a client; preceded by the minus sign (in negative) when it is an invoice received from a supplier.

When the payment for an invoice is received or made:

- Position yourself in the Transactions table, Cost centers view;

- Enter the date, the document number and the invoice number in the respective columns;

- Enter the description;

- If it concerns a payment received, enter a liquidity account in the Debit column and a revenue account in the Credit column;

When it's about a payment that has been made, enter an expense account in the Debit column and a liquidity account in the Credit column; - Enter the amount;

- Enter the appropriate VAT code;

- Enter the cost or profit center in the CC3 column, preceded by the minus sign (in negative) when it is a payment received (customer) and in positive when it concerns a payment made to a supplier.

In the Account card of the cost center, the transactions of the customer or supplier are being displayed.

Related documents

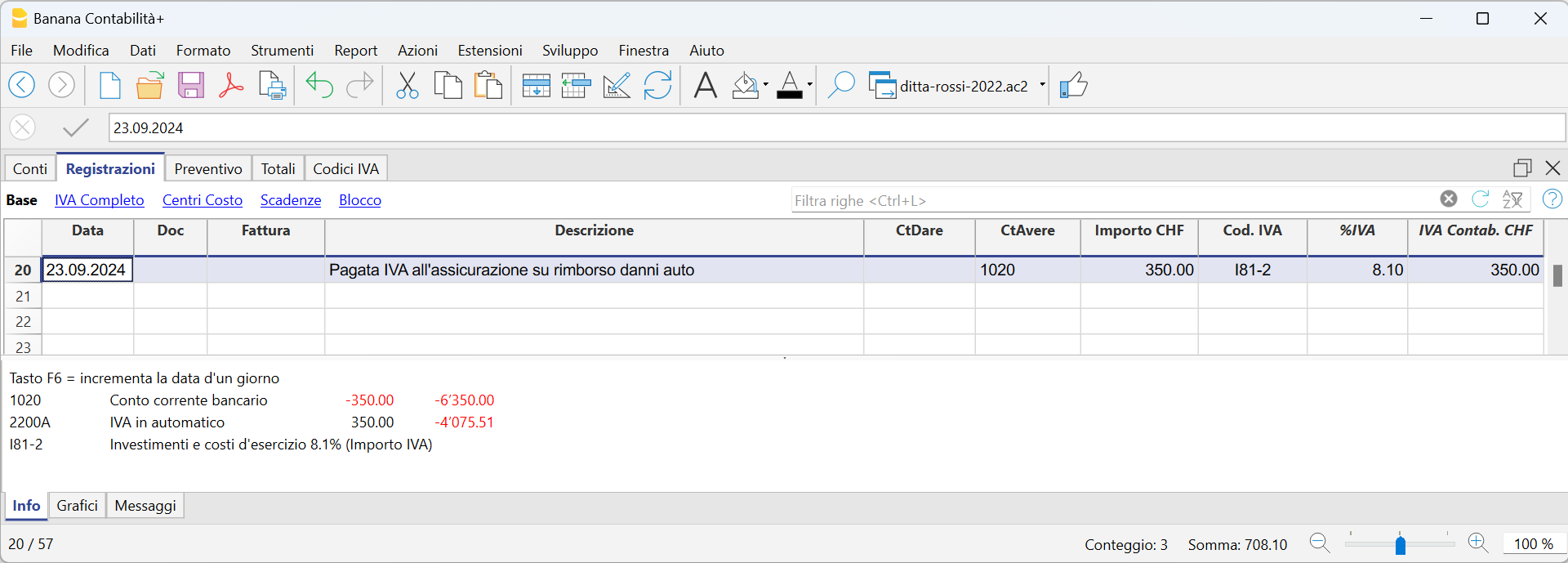

How to record only the VAT amount

There are cases where you only need to record the VAT amount, such as when you receive compensation from your car insurance.

You record as follows:

- Enter the date, document number and the description in the columns provided.

- In the Credit column, enter the account with which the VAT amount is paid (the Debit account remains empty)

- In the Amount column, enter the VAT amount to be paid

- In the VAT code column, enter the VAT code I77-2 (VAT code relating to the VAT amount 100%)

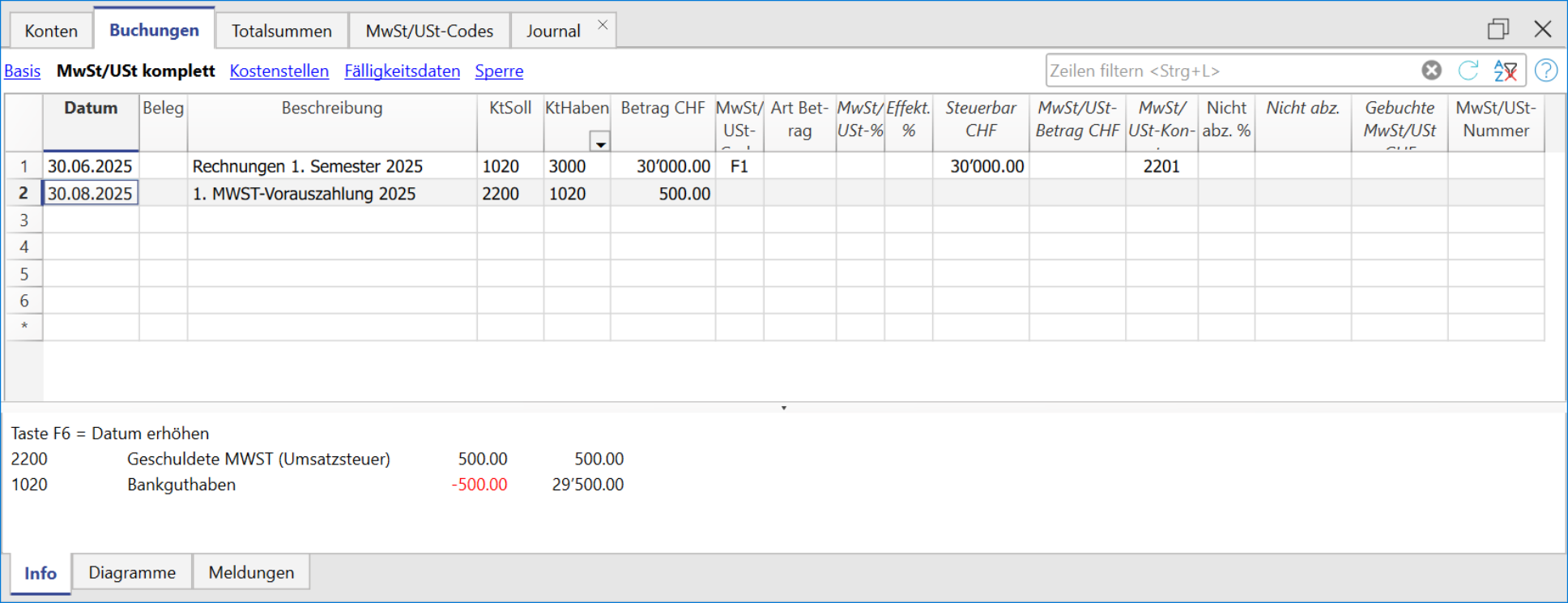

Jahresabrechnung und Vorauszahlungen der MWST nach der effektiven Methode

Eine Vorauszahlung buchen

Wenn Sie eine Vorauszahlung (Akonto) leisten, sollte diese korrekt in Ihrer Buchhaltung erfasst werden, um die Übersicht über bereits geleistete Zahlungen an die ESTV zu behalten. Es wird empfohlen, ein separates MWST-Konto zu verwenden, das nicht mit dem automatischen MWST-Konto verknüpft ist.

Die Buchung sollte wie folgt erfolgen:

- Geben Sie das Datum und eine Beschreibung ein.

- In der Spalte Soll tragen Sie das MWST-Konto ein.

Es wird empfohlen, ein spezielles MWST-Konto für Akontozahlungen und den Zahlungsausgleich zu verwenden. - In der Spalte Haben geben Sie das Bankkonto an, über das die Zahlung erfolgt.

- In der Spalte Betrag erfassen Sie den überwiesenen Betrag.

Beispiel für die Buchung einer Akontozahlung:

Abschlussbuchung und Zahlung

Beispiel einer Abschlussbuchung unter Berücksichtigung der Akontozahlungen:

Kontoauszug - MWST 'Konto'

Jahresabrechnung und Vorauszahlungen für die MWST-Abrechnungsmethode mit Saldo-/Pauschalsteuersatz

Eine Vorauszahlung buchen

Wenn Sie eine Vorauszahlung (Akonto) leisten, sollte diese korrekt in Ihrer Buchhaltung erfasst werden, um die Übersicht über bereits geleistete Zahlungen an die ESTV zu behalten. Es wird empfohlen, ein separates MWST-Konto zu verwenden, das nicht mit dem automatischen MWST-Konto verknüpft ist.

Die Buchung sollte wie folgt erfolgen:

- Geben Sie das Datum und eine Beschreibung ein.

- In der Spalte Soll tragen Sie das MWST-Konto ein.

Es wird empfohlen, ein spezielles MWST-Konto für Akontozahlungen und den Zahlungsausgleich zu verwenden. - In der Spalte Haben geben Sie das Bankkonto ein, über das die Zahlung erfolgt.

- In der Spalte Betrag erfassen Sie den überwiesenen Betrag.

Beispiel für die Buchung einer Akontozahlung:

- In der ersten Zeile wurde der Gesamtbetrag der ausgestellten und bereits bezahlten Rechnungen erfasst. Der MWST-Code F1 kennzeichnet den MWST-Betrag, der im Formular berechnet wird.

- In der zweiten Zeile wurde die Akontozahlung erfasst, die von der Eidgenössischen Steuerverwaltung (ESTV) festgelegt wurde. Diese Akontozahlung wird nicht im MWST-Formular ausgewiesen.

Abschlussbuchung und Zahlung

Für die Abschlussbuchungen verweisen wir auf die entsprechende Dokumentation:

Beispiel einer Abschlussbuchung ohne MWST-Zerlegung unter Berücksichtigung der Akontozahlungen:

Kontoauszug - Geschuldete MWST

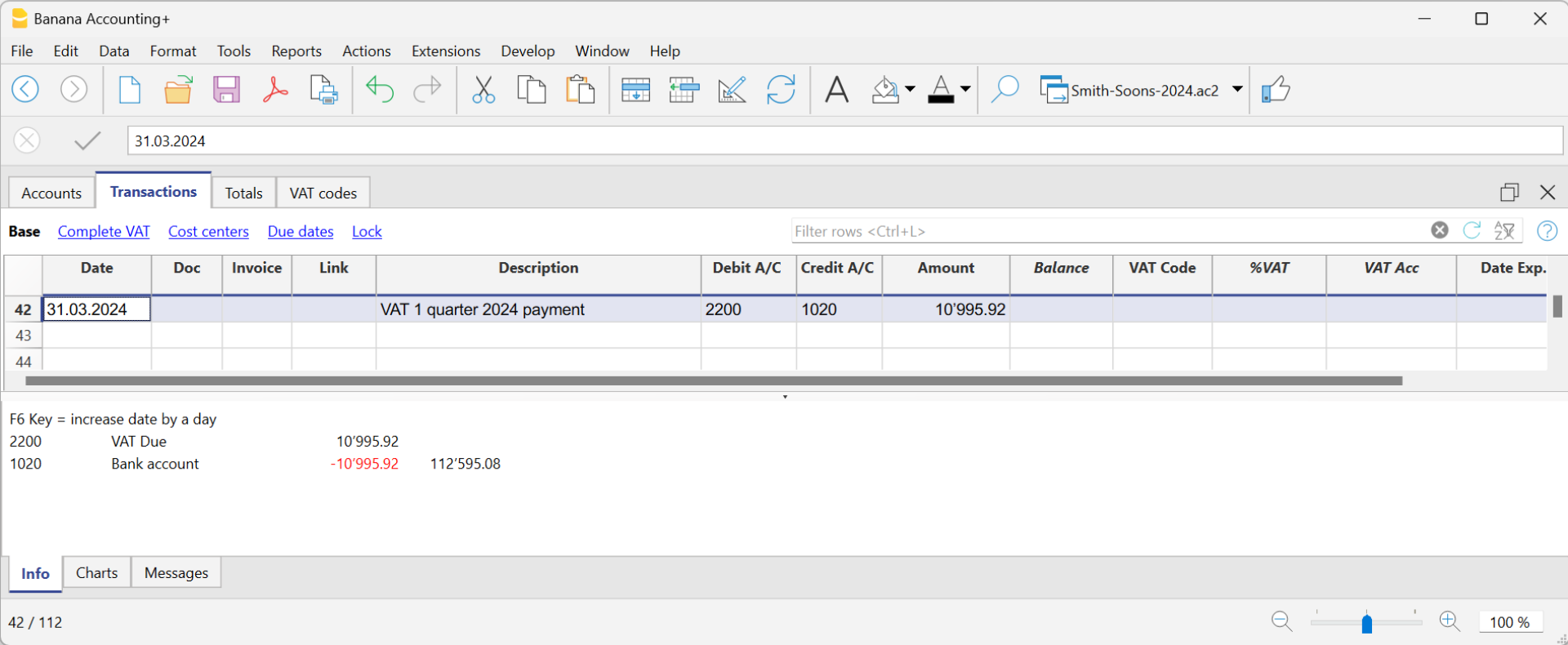

Periodic VAT Return and Payment

Reset of Account 2201, VAT Return

At the end of the period, the balance of account 2201 VAT Return (automatic VAT account) must be reset with a reversal entry by entering:

- In the Debit column: account 2201 VAT Return

- In the Credit column: account 2200 VAT Payable

This operation involves:

- Reset of the balance of account 2201, VAT Return (automatic VAT account).

- Transfer of the VAT balance to the VAT due account (or Treasury VAT account).

- If this results in a VAT debit, the VAT balance is posted in Credit of the VAT due account; in Debit of the "VAT according to VAT report" account, the balance is set to zero.

- If this results in a VAT credit, the VAT balance is posted in Debit of the VAT due account; in Credit of the "VAT according to VAT report" account, the balance is set to zero.

Transaction for charging the quarter balance to the Due VAT account

VAT balance payment

When the VAT amount is paid to the FTA (Federal Tax Administration), the balance in the VAT Due account resets to zero.

For the transaction:

- Enter the Date, Document number, and Description in the respective columns.

- In the Debit column, enter the VAT Due account.

- In the Credit column, enter the liquidity account.

- In the Amount column, enter the VAT Due amount paid.

With this system, it is possible to monitor the balance for each quarter, and in case of an error, identify the period in which the balance no longer matches.

Ledger of account 2200 VAT Payable after the payment entry

Note

The procedure explained refers to the payment of VAT recorded using the effective method and also applies to the flat-rate VAT method with VAT breakdown.

For those who have recorded VAT using the balance rate method without VAT breakdown, specific information can be found on the web page Accounting Adjustment and VAT Payment.

VAT due account card after the payment

How to register a VAT credit (Switzerland)

If at the end of a period, when calculating the VAT declaration, the previous VAT is bigger than the due VAT, your VAT report has a Debit balance.

To reset the "VAT according to VAT report" account to zero, you need to enter a transaction as follows:

- put in Debit A/C the VAT Due account

- put in Credit A/C the "VAT according to VAT report" account

Usually, in Switzerland the VAT credit is reimbursed to the company, without having to move the credit to the following period.

When your VAT is reimbursed, you need to enter a transaction as follows:

- put in Debit A/C your liquidity account

- put in Credit A/C your Due VAT account (where the balance should go to zero).

Entering VAT at customs for import

VAT paid in cash at import

Goods purchased abroad must be declared at customs and paid for in cash on the spot.

Customs issues a customs clearance document indicating the taxable amount and the VAT amount paid. VAT paid at customs can be recovered by VAT payers.

In order to recover the VAT paid at customs, the user needs to operate as follows:

To recover the VAT, register as follows:

- In the Debit column the cash account. The Debit column remains empty.

- In the Amount column, the amount paid in customs is recorded.

- In the VAT Code column, a VAT code type 2 (M77-2) is entered, which allows the VAT amount to be recorded at 100%.

Note

New codes can be added to the VAT Codes table. If you need the 2.5% VAT code, for customs VAT recovery, simply add a new code, e.g. M25-2, completing the same grouping in the column Sum in, GR1, the amount type 2 and entering 2.5 as the rate.

In the Transactions table, enter the cash account in credit, the paid VAT amount and the corresponding VAT code.

The program calculates the VAT amount at 100%, without creating differences in the recordings.

VAT paid at import by the shipping company

The procedure is the same as the previous one, except for the fact that the transaction extends itself over several rows, since, at the moment the shipper's invoice is being paid, the shipping costs and/or the customs clearance may be included.

Example:

Payment of the shipper's invoice for a total of CHF 359.- CHF 150 of which shipping costs, and CHF 209 for VAT advanced at customs.

VAT on services obtained abroad-Reverse charge- CH

All services obtained abroad must be included in the Swiss VAT report. Unlike the import of goods that are being cleared at customs, for services obtained abroad there are no customs papers, but the VAT for this type of operation must be calculated and recovered. This self-imposition and recovery operation is called Reverse Charge.

The simplified Reverse Charge operation is a new feature of Banana Accounting Plus. Thanks to the possibility of inserting in the same cell of the VAT code both the code for self-imposition and the code for recovery, it is very easy to register.

Codes to be used

In the VAT codes table, there are specific codes to be used for services obtained abroad: codes B81-1 and M81-1 or I81-1.

They are two codes with Amount type 1, where the VAT is calculated on the Net amount (without VAT).

In detail:

- the B81-1 code calculates a VAT debit amount

It is important that in the Complete view> the column Don't Warn is activated "Yes", otherwise you get an error message. - the M81-1 or I81-1 code calculates a VAT credit amount

How to enter a transaction

The entry is made by applying in the VAT code column, a double code B81-1 (self input) and I81-1 (or M81-1).

By entering the double code, the programme registers both the VAT due and the recoverable VAT in the account 2201 VAT return.

VAT on services obtained in a foreign currency

When the recording of services abroad involves a foreign currency account, the Reverse Charge must be registered onto two lines:

- Register foreign purchases in foreign currency without entering any VAT code.

- On the next line, to be able to register the Reverse Charge, register:

- In the Currency column register the amount converted to base currency.

- In the Debit and Credit column a giro account (1090) is registered.

- In the VAT Code column apply the double code B81-1 for self-imposition and M81-1 or I81-1 for recovery.

- At the end of the entries the claering account must be zero.

VAT on services obtained abroad with the Swiss flat tax rate VAT method

When adopting the Swiss flat tax rate VAT method, you need to register the purchase with the B81-1 VAT code for self-imposition.

You don't need to enter the VAT recovery transaction, as this method doesn't allow any deduction on purchases, including those occurred abroad.

VAT on cash received and transitory assets/liabilities at the end of year

There are two methods, established by the Federal Tax Administration, for the collection of the Value Added Tax (VAT):

- Turnover method - the determination of the VAT amount occurs when the suppliers' invoices are received and when invoices are issued to customers. This method involves managing both customers and suppliers.

- Method based on cash received - the determination of the VAT occurs when customer invoices are collected and supplier invoices are paid.

Recording Invoices with VAT on Cash Received

- Throughout the fiscal year, customers and suppliers should not be recorded. Only at the year-end are open items recognized, namely, invoices from customers and suppliers that remain uncollected and unpaid, respectively, as of December 31st.

- Costs and revenues must be recorded at the time of payment or collection.

- The VAT code must be entered on the same line as the cost or revenue.

Example showing how to enter transactions during the year

Customers and Suppliers with VAT on Cash Received

If you want to equally manage customers/suppliers, you can use the profit and cost centers. In this case, the clients/suppliers management remains separated from the Balance Sheet.

As for the transitory assets or liabilities (invoices issued for income/expenses, but not yet received or paid), only at the end of the year, carrying forward of the outstanding invoices of suppliers and clients is allowed. These issues are defined by the VAT regulations (Instructions for VAT, at marginal number 964, page 217).

Starting from here, we present you one of the possible solutions:

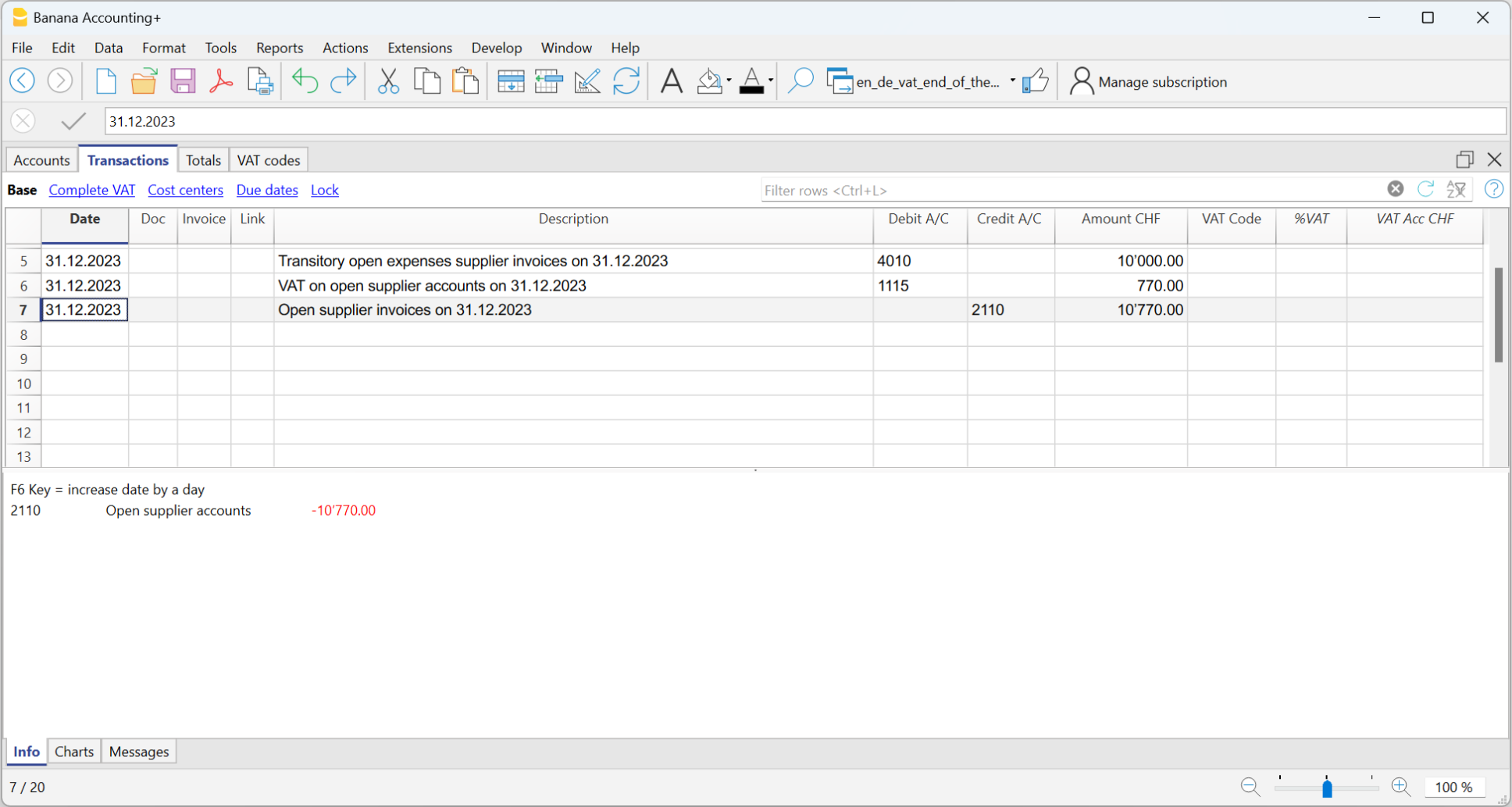

Transitory assets or liabilities as at the end of the year

At the end of the year, in order to exactly establish the profit or the loss of the accounting year, one needs to enter the transitory assets or liabilities:

- Invoices issued to customers but not yet collected.

- Invoices received from suppliers but not yet paid.

- Work in progress, to be collected or paid in the following year.

When recording suspense of open items, caution should be taken not to include the VAT code on costs and revenues. Recoverable VAT and due VAT should be reported in the VAT statement for the first quarter of the following year.

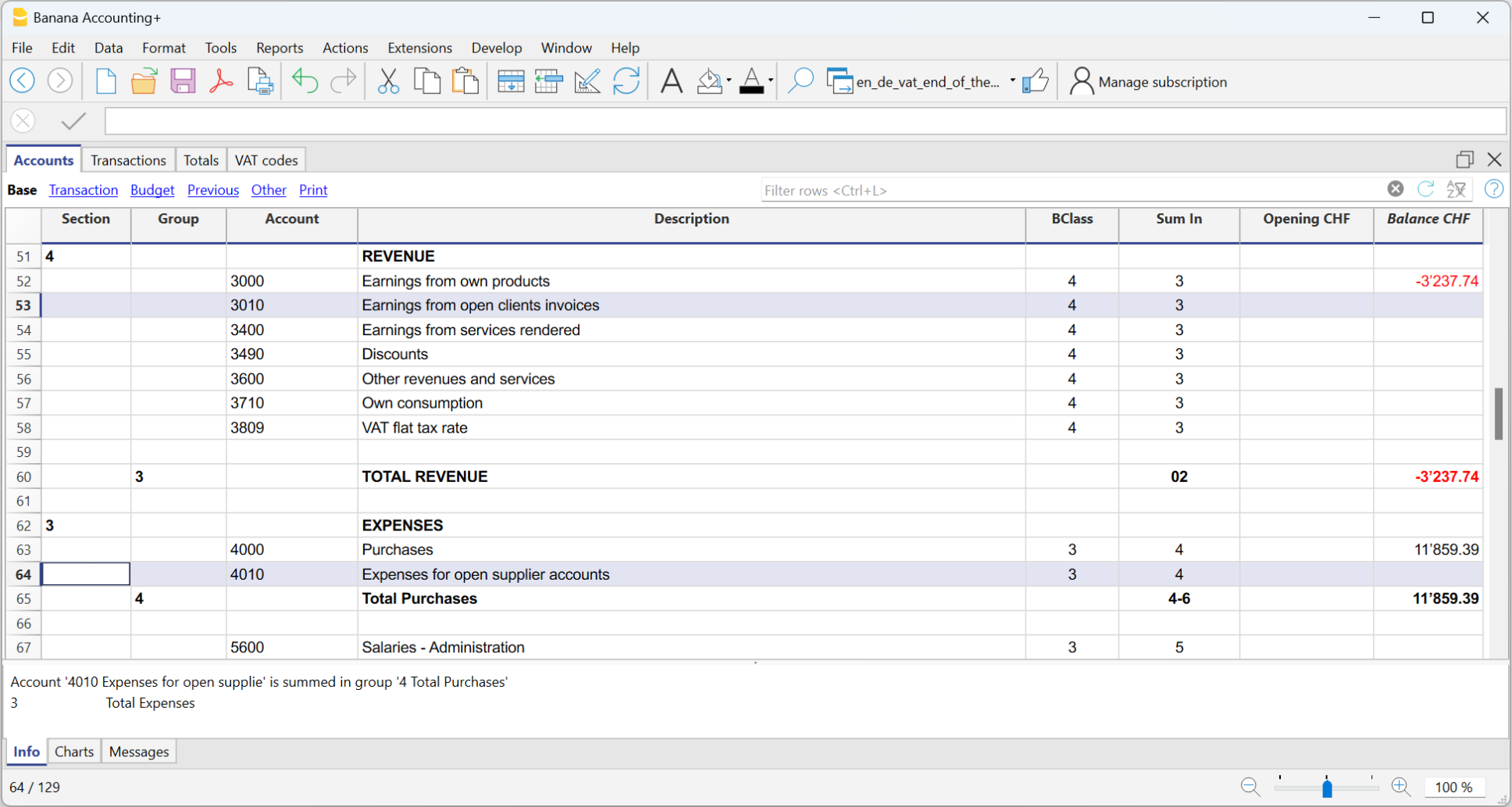

The accounts for transitory invoices

To capture only the net portion of costs and revenues (excluding VAT) at the end of the year and record it correctly, it is necessary to open the following accounts:

In the Assets and Liabilities

- In the Assets, open the account "Open client accounts"

- In the Liabilities, open the account "VAT on open client accounts"

- In the Liabilities, open the account "Open supplier accounts"

- In the Assets, open the account "VAT on open supplier accounts"

In the expenses and income

In the income statement, open the following accounts

- In the expenses, open the account "Expenses for open supplier accounts"

- In the income, open the account "Income for open client invoices"

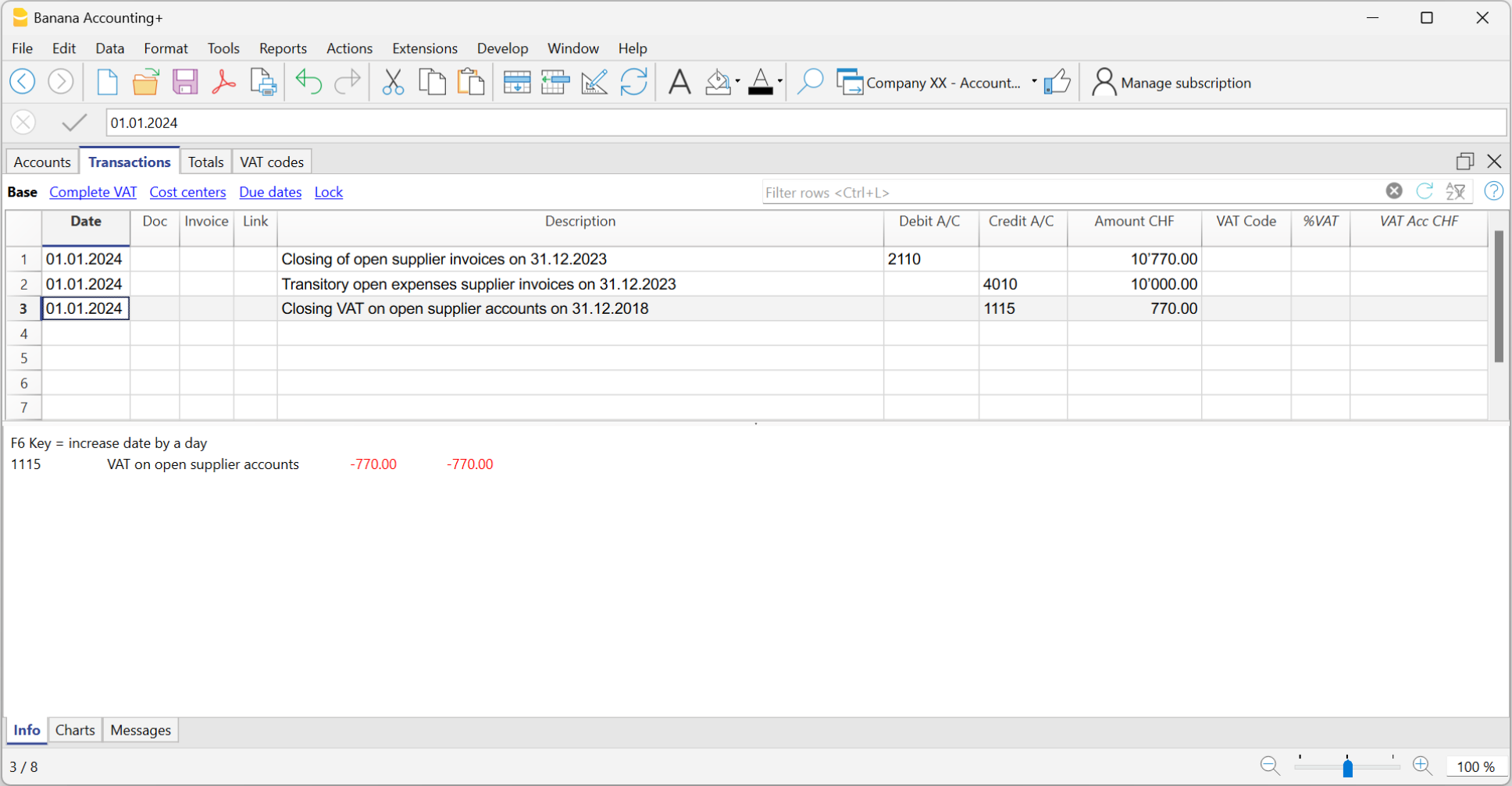

How to register transitory supplier invoices

At the end of the year, open invoices from suppliers received as of December 31 are recorded as follows:

- Enter in the Debit column on the account Expenses for open supplier accounts the expense without VAT in the Amount column, without VAT code.

- Enter in Debit column in the following row, on the account VAT on open supplier accounts and in the Amount column,the recoverable VAT amount.

- Enter in Credit column in the following row, on the account Open supplier accounts and in the Amount column the total amount (VAT included)

Closing transitory invoices

To close open items on January 1st of the following year, reverse the transactions made on December 31st as follows:

- Enter in the Debit column, on the account Open suppliers accounts the total amount (VAT included).

- Enter in the Credit column on the following row, the Transitory open expenses supplier invoices and in the Amount column the expense without VAT, without VAT code.

- Enter in the Credit column on the following row, the account VAT on open supplier accounts and in the Amount column the recoverable VAT amount.

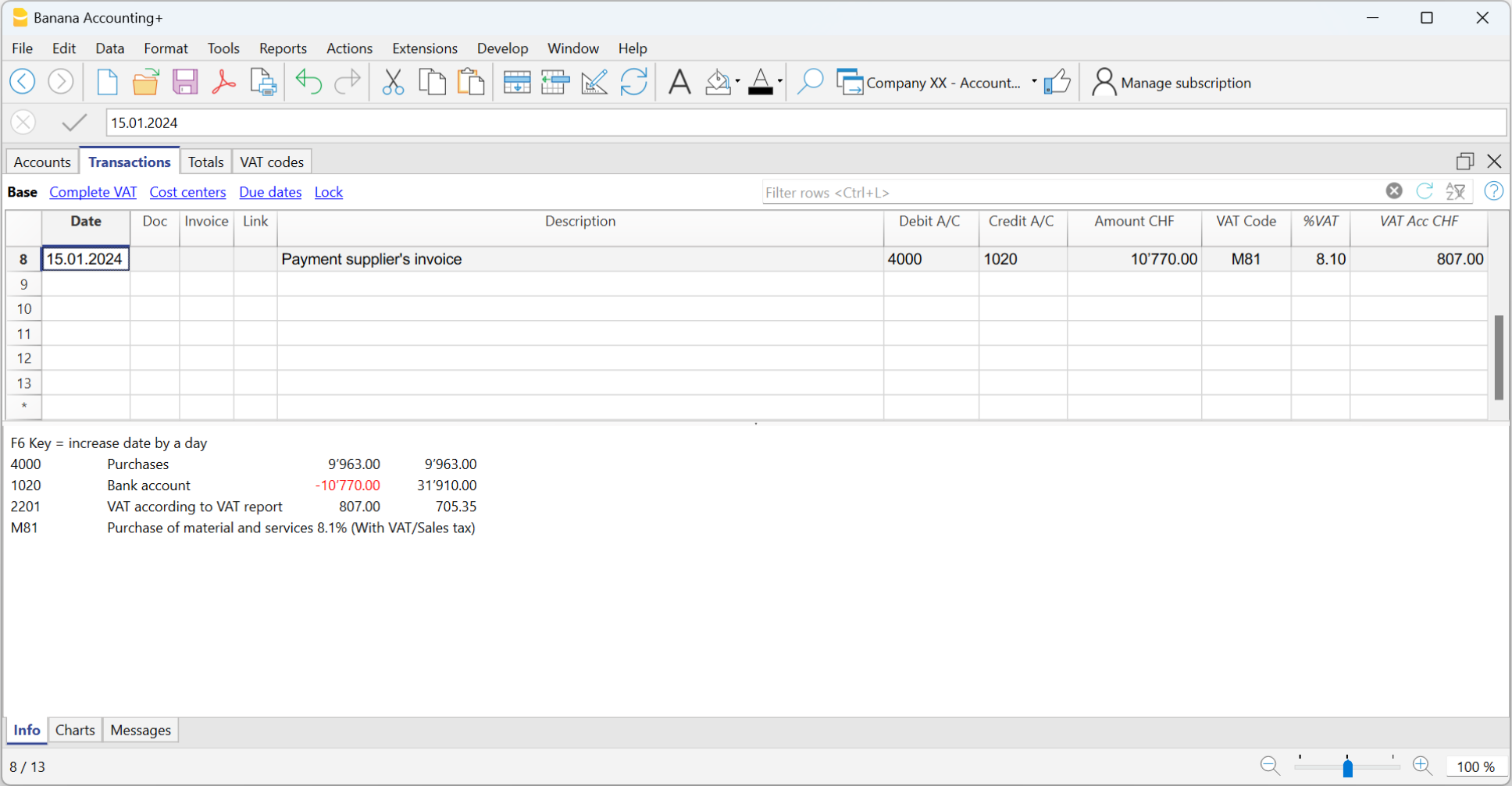

When the supplier's invoice is paid, the user has to enter the transaction as shown in the example at the beginning of this page, by inserting the VAT code as usual.

How to register the transitory client invoices

For the transitory client invoices, the same procedure needs to be applied, by entering on the preconfigured accounts related to the open client accounts.

Print invoice with VAT

VAT calculation and rounding on the Invoice

In the printing of invoices integrated into accounting, the total VAT amount corresponds to the sum of the individual VAT transactions that make up the same invoice. Since each VAT entry is rounded to the nearest cent, there may be a difference compared to the VAT calculated on the total invoice amount.

To better understand, let's consider the following example:

- Line 1: 7.7% of CHF 187.50 = CHF 14.4375 -> Rounded: CHF 14.44

- Line 2: 7.7% of CHF 875.00 = CHF 67.375 -> Rounded: CHF 67.38

- Total: 7.7% of CHF 1062.50 = CHF 81.8125 -> Rounded: CHF 81.81

On the invoice, a VAT amount of CHF 81.82 is printed instead of CHF 81.81. In fact, the amount of CHF 81.82 corresponds to the sum of the VAT calculated individually for each item (CHF 14.44 + CHF 67.38).

This logic is adopted to avoid discrepancies between the VAT amounts recorded in accounting and those shown on the invoice. In this way, the total VAT in accounting matches that reported on the invoice.

Net VAT and VAT management on a cash basis

In Banana Accounting it is possible to manage customers using both the turnover and the cash received method. However, as far as invoice printing is concerned, there are some limitations if in accounting you record the amounts net and at the same time use the cash received method.

If we want to create invoices, it is not possible to enter amounts net of VAT with the method on the cash received because, when the invoice is issued, the VAT codes must be written between square brackets and the VAT is not calculated but is only an indication for the printing of the document.

Management based on turnover

| ||

| Gross Amount | Net amount | |

| Effective VAT method | ✓ | ✓ |

| VAT Flat tax rate method | ✓ | ✗ |

Management based on cash received

More details can be found at the following page : https://www.banana.ch/doc10/en/node/9739 | ||

| Gross Amount | Net amount | |

| Effective VAT method | ✓ | ✗ |

| VAT Flat tax rate method | ✓ | ✗ |

Examples with transactions to create invoices and enter them into the accounting for both the effective VAT method and the VAT Flat tax rate method:

VAT management CHF- EU

Companies that have to make VAT/Sales tax declarations in Switzerland and the EU must keep two accounting files.

- One main file for Switzerland/Liechtenstein with all accounting transactions.

More information under Swiss VAT management- Purchases and sales in Europe must be registered with the VAT codes for export or import.

- At the time of the periodic VAT calculation for the EU (with the auxiliary file), the VAT debt is also registered in this main accounting file using no VAT code.

- An auxiliary file for European VAT management

- The basic currency is EUR

- The chart of accounts corresponds to that of the main file (this allows you to copy and paste records).

- VAT/Sales tax table with the VAT codes and rates necessary for your own situation in Europe.

When doing business with only a single nation, the VAT/Sales tax table for that nation and the automatic VAT accounting scripts can be used.

See our web pages: Germany, Austria, Italy, Holland and our webpages with templates for various other nations. - Enter the appropriate amount and VAT code in the transactions

- For the periodic VAT declaration in the EU, use the VAT/Sales tax report command (Reports Menu; Account1 menu in the old version) and total the amounts as necessary on the VAT form of the European nation in which the VAT declaration is made.

Please consult your tax advisor to ensure that this solution meets all the specific requirements of the tax authority in the EU

VAT Report 2024

Banana Accounting Plus provides the extensions to obtain the 2024 VAT Report (paper facsimile or Xml file) for both the effective method and the flat tax rate method.

The Banana Accounting Plus extensions to obtain the VAT Report from 2024 only work with the Advanced plan

The documentation in English is only partial: the full documentation is available in German, French or Italian.

We provide two distinct extensions to obtain both the paper facsimile or the Xml file of the VAT Report:

- Effective Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

- Flat tax rate Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

The VAT Report, paper facsimile, in Banana Accounting Plus, Advanced plan, allows you to declare the amounts with the 2018 rates and those from 2024.

For users of Banana Accounting 9 or earlier versions

If you have Banana Accounting 9 or earlier, in order to be able to prepare the paper facsimile of the VAT Return or have the Xml file for the electronic submission of data to the FTA, you need to upgrade to the new version of Banana Accounting Plus, Advanced plan.

If you do not wish to switch to the new version, you can still manage VAT; from Banana Accounting you can obtain the VAT Summary and enter the data manually on the paper form or on the FTA website.

More information can be found on the page Update Programme and Plan.

Transition to 2024 VAT rates

From 1st January 2024, the new VAT rates in Switzerland are applied.

Updating your accounting file with the VAT Codes 2024

To be able to record VAT movements with the new rates, you must first update the VAT Codes 2024 table in your accounting files.

- Download the latest version of Banana Accounting Plus (to easily update the VAT Codes table).

- Update the VAT Codes table with the 2024 rates

Before updating VAT Codes, however, we recommend that you make back-up copies of your accounting files, in case you need to revert to previous versions.

2024 VAT Extensions to obtain the VAT Report

The documentation in English is only partial: the full documentation is available in German, French or Italian.

We provide two distinct extensions:

- Effective Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

- Flat tax rate Method - VAT Extension 2024/2018 - See documentation in German, French or Italian

The 2024 extensions allow reporting using both the rates in force as of 2018 (e.g. 7.7%) and those in force as of 2024 (e.g. 8.1%).

The Swiss VAT extensions 2024 are installed automatically and replace the Swiss VAT extensions 2018.

Banana Accounting Plus Advanced Plan

The Swiss VAT extensions 2024 require Banana Accounting Plus, Advanced plan.

- Those who use the Professional or Free plans, from 1 July 2024 will receive a notice that the Advanced plan is required. More information...

VAT extension incompatibility notice 2024 for Banana 9 users

- In Banana Accounting 9 (and previous versions), the new Swiss VAT 2024 extensions are warning that they are no longer compatible. More information...

How to keep using the 2018 VAT extension

- The Swiss VAT 2018 extensions are still available. However, they must be reinstalled manually. More information...

Useful Links

2024 Swiss VAT Codes description in Banana Accounting+

Swiss VAT codes changed as of 1 January 2024. Below you will find what changed in the Banana Accounting Plus programme

Changes due to the 2024 rates

New codes have been added to the VAT Codes table for the VAT rates for 2024 (8.1, 2.6, 3.8).

In particular, new codes have been added for the calculation of the tax on the VAT form, Section II, for transactions subject to VAT from 01.01.2024; the VAT codes relating to the old rates and valid for transactions subject to VAT up to 31.12.2023 remain unchanged.

For the newly added VAT Codes, the references for the figures that must appear on the VAT form as of 01.01.2024 have been inserted. The figure references for the previous VAT Codes valid until 31.12.2023 remain unchanged.

For more information, please consult the detailed description of the VAT codes on this page.

For users of Banana Accounting 9 or previous versions

Those who have previous versions of Banana Accounting can add the VAT codes manually, but it is not possible to create the paper or XML facsimile for the automatic forwarding of the data to the FTA. We recommend upgrading to Banana Accounting Plus, Advanced plan.

If you have updated the VAT Codes table, the table is set as follows:

- V = Sales (200)

- VS = Discount sales and services (235)

- B = Acquisition tax (383 - 382)

- M = Expenses for material and services (400)

- I = Investments and other operating expenses (405)

- K= Corrections (410, 415, 420)

- Z = Not considered (910)

Gr1 Grouping

The GR1 column (visible in the Complete view) shows the figures of the VAT form, where the amounts are grouped according to the relevant VAT code.

For the programme, these indications are essential for the preparation of the VAT form (facsimile) and the Xml file for the electronic submission of VAT data on the portal of the Federal Administration.

There are VAT codes that must appear in several boxes for the figures on the form. For example, the sales taxable amount must appear in digit 200 (Turnover figure) and also in digit 303 (Tax calculation). In these cases, the figures separated by a semicolon (200;303) are entered in column Gr1.

If a VAT code, which is present in the table VAT Codes, is used in the table Recording and does not have a grouping in the column GR1, when printing the VAT form, the programme will report an error. If a VAT code is not to appear in any figure on the VAT form, 'xxx' must be indicated in column Gr1; thus no error is reported.

Gr1 codes till end of 2023 and from 2024

In the VAT form with the Effective method, in the Calculation of tax part, there are boxes up to 31.12.2023 (302, 312, 342, 382) and boxes from 1.1.2024 (303, 313, 343, 383).

In the VAT Form for Flat Tax Rate method, there are boxes up to 31.12.2023 (321, 331, 381) and boxes from 1.1.2024 (322, 332, 382) in the Calculation of tax part.

The Print VAT Form command inserts the values of the boxes according to the figure contained in Gr1. If a new code is added, the VAT form reference figure must therefore be entered correctly.

Turnover / Taxable Amount

Initial letter V is used for codes relating to Turnover.

Reference 200 - Total amount of agreed or collected consideration

All transactions related to turnover, whether subject or not to VAT, must be reported here. Exempt sales are to be indicated with the appropriate VAT code.

Codes for exempt transactions or supplies provided abroad must be grouped in reference 200 and simultaneously reported in the relative deduction reference number.

The VAT codes related to turnover are:

- V81, V26, V38 (valid from 01.01.2024)

- V77, V25-N, V37 (valid until 31.12.2023).

Sales subject to VAT must be grouped not only in the figure 200 but also in the respective positions according to the rate (302, 303, 312, 342, 343, 382, 383).

Reference 205 - Consideration exempt from tax where option for taxation has been exercised

These transactions must be indicated under reference number 200, but must also figure under reference no 205.

They carry a VAT code that is identical to a VAT sales code, with the additional indication in the Gr1 column that they also must be grouped in the ref 205.

In order to be able to use this position, VAT codes must be replicated from reference number 200. For simplicity, the letter B has been added to the existing VAT codes.

The following codes must be used in the VAT codes tab:

- V77 (valid until 31.12.2023)

- V81 (valid from 01.01.2024).

Reference 299 - Taxable turnover

The taxable turnover is constituted by the turnover minus the non-taxable turnover (Deductions) (221, 225, 230, 235, 280).

Decrease in Turnover

For each non-taxable or non-VATable position, there is a VAT code with a percentage of 0 (due).

Reference 220 - Tax-exempt services

Use the following code:

- V0

Reference 221 - Services provided abroad

Purchase of goods and services abroad are intended (Article 23) or when the beneficiary is not subject to tax(Article 107).

Use the following code:

- V0-E

Reference 225 - Transfers via Notification Procedure

Transfers via notification procedure (Article 38; to be submitted with form No. 764).

The code to use is the following:

V0-T

Acquisition tax (Art. 45)

Reference 381 - 382 - Acquisition tax

Services that are obtained abroad, that do not carry any customs documents, must be subject to VAT as if they were sales.

For these cases, special VAT codes are needed to calculate VAT both as VAT due and as recoverable VAT.

The VAT codes to be used are:

- B81 for transactions with VAT code type 0 (VAT amount included), valid from 01.01.2024

- B81-1 for transactions with VAT code type 1 (VAT amount excluded), valid from 01.01.2024

- B81-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid from 01.01.2024

- B77 for transactions with VAT code type 0 (VAT amount included), valid until 31.12.2023

- B77-1 for transactions with VAT code type 1 (VAT amount excluded), valid until 31.12.2023

- B77-2 for transactions with VAT code type amount 2 (VAT amount 100%), valid until 31.12.2023

Recoverable taxation

Recoverable VAT is reported in this part of the (refundable VAT).

Reference 400 - Input tax on Purchase of material and services

These are purchases of goods and services that are part of the company's core business.

The codes for recoverable taxation are:

- M81, M26, M38 (valid from 01.01.2024)

- M77 (valid until 31.12.2023)

In cases where VAT has been paid at customs and there exists an invoice with the VAT amount only, VAT code type 2 (Registration Amount = VAT amount) must be used. For these cases, the following code was set up:

- M81-2 (valid from 01.01.2024)

- M77-2 (valid until 31.12.2023).

For Amount type 1 (Amount of registration = Net Amount) use the following code:

- M81-1 (valid from 01.01.2024)

- M77-1 (valid until 31.12.2023)

Reference 405 - Input tax on Investment and operating costs

These are purchases for investments and operating costs that are not part of the 400 figure.

The VAT codes are:

- I81, I26, I38 (valid from 01.01.2024)

- I81-2 to be used for obtaining services abroad, in conjunction with the codes designated for calculating the purchase tax (see page VAT on foreign services)

- I77, I37 (valid until 31.12.2023).

It might be necessary to add further codes of Amount type 2, or Amount type 1 with different rates.

Purchases without VAT should not be included in the VAT return.

In some cases (eg clarity of the review) it may be useful to identify specific transactions without VAT.

The VAT codes are:

- M0 and I0, grouped with "xxx" in order to avoid generating an error message.

Corrections and reductions (recoverable tax)

It might not be necessary for the taxpayer to use these positions. If needed, use one of the codes grouped in the Correction and adjustments Group.

From an accounting point of view, correction transactions may essentially result in a reduction of VAT deductibility.

A registration must therefore be made for the deductible VAT adjustment (as a plus or minus).

Reference 410 - De-taxation (art. 32)

You can deduct the recoverable VAT paid in previous years.

The codes are:

- K81-A (valid from 01.01.2024)

- K77-A (valid until 31.12.2023).

Reference 415 Corrections of the input tax deduction, mixed use

In cases where merchandise has not been used for corporate or taxable purposes, it is not possible to recover all previous input tax VAT.

You can do this by always using the same purchase account (both credit and debit); in this way the purchase account will be increased by the amount of non-deductible VAT.

The codes are :

- K81-B (valid from 01.01.2024)

- K77-B (valid until 31.12.2023).

Reference 420 - Reduction of the input tax deduction

These are the transactions to be deducted from deductible VAT, such as subsidies.

This position must contain the same elements as the ones in reference 900.

The codes are:

- K81-D (valid from 01.01.2024)

- K77-D (valid until 31.12.2023).

Other cash flows of financial resources

In this part, the amounts relating to the base for the calculation for VAT must be reported..

These are transactions that are not part of the turnover and are not countervailing duties.

Reference 900 - Subsidies, tourist taxes and similar

Operations in reduction the deductible VAT, such as subsidies.

The code to use in these cases is:

- Z0-A

Reference 910 - Donations, dividends, compensation for damages etc.

Out of scope transactions. Donations, dividends and all other "receipts" that do not lead to a reduction of deductible VAT.

The code to use in these cases is:

- Z0

VAT Codes - Flat tax rate

As a result of the VAT rates for 2024, in Banana Accounting, the VAT rates have also been updated using the flat tax rate method.

Column GR1 shows the figures of the VAT form where the amounts are totalled. If the amounts are to be totalled in several digits, these are separated by a semicolon.

- F1 - code provided for sales subject to 1st rate (reference 200, 323), to be used from 01.01.2024

- F2 - code provided for sales subject to 2nd rate (reference 200, 333), to be used from 01.01.2024

- FS1 - code provided for discount on sales subject to 1. rate (reference 235, 323), to be used from 01.01.2024

- FS2 - code provided for discount on sales with 2. rate (reference 235, 333), to be used from 01.01.2024

- F3 code provided for sales subject to 1. rate (reference 200, 322), to be used until 31.12.2023

- F4 code provided for sales subject to 2nd rate (reference 200, 332), to be used until 31.12.2023

- FS3 code provided for discount on sales subject to 1st rate (reference 235, 322), to be used until 31.12.2023

- FS4 code provided for the discount on sales subject to the 2nd rate (reference 235, 332), to be used until 31.12.2023

- F1050 - code provided for exports which have been annotated and declared using form 1050 (reference 470)

- F1055 - code provided for exports which have been recorded and declared by means of form No. 1055 (reference 471).

Those who run previous versions, can download the updated file of the new VAT Codes table, or enter the missing codes.

VAT account in the basic accounting data

All default Banana Accounting templates have the VAT account (2201) already set up in the File properties (File menu, VAT section). This allows the VAT calculations to be automated, so that all VAT amounts are accounted for in this account.

At the end of the quarter, the balance of this account represents the amount to be paid to the FTA (or to be recovered).

When the VAT Return account (2201) is set in the file properties, in the VAT Codes table, the VAT Account column must be empty.

If account 2201 is not set in the file properties, the previous VAT account 1, 2 and the VAT account due to each individual code can be set. In this case, the VAT is spread over three different accounts and at the end of the quarter the VAT accounts must be closed in order to determine the VAT payable to the FTA.

Updating the VAT Codes table with the 2024 VAT rates

It is necessary to have downloaded and installed the latest version of Banana Accounting Plus.

Import 2024 VAT codes

All users who have their own coding for VAT codes must update the VAT Codes table according to the new rates with their respective reference figures. We recommend consulting the VAT Codes table in Banana Accounting Plus.

To update the VAT Codes table in your accounting file, proceed as follows:

- Make a backup copy of your file to be safe

- Open your accounting file

- Select from the menu Actions > Import to accounting > Import VAT codes

- Select Switzerland New VAT Rates 2024

- Confirm by clicking on the OK button

- From the dialog that appears there are two options:

- Add new codes and new groups

To be used when you want to maintain your VAT codes. In this case the program adds the new VAT codes leaving the existing ones unchanged. If the VAT codes to be added already exist in the table, but have a different rate or grouping, they will be inserted by adding '-1' to the name. - Replace all rows (recommended choice)

Use this command if you don't need to maintain the existing VAT code page.

In this case, the VAT code table is completely replaced with the new table.

Existing VAT accounts are retained and need to be reviewed after the update. The default VAT account can be changed via the File Properties dialog (basic data).

- Add new codes and new groups

- Check the accounting

From Actions menu > Check accounting.

If there are incorrect VAT codes in the transactions table, you need to update them according to the new VAT Codes table.

To replace the old VAT codes in the Transactions table, you can use the command from the menu Data > Search and replace.

If the VAT codes have also been entered in the Accounts table, to associate the VAT codes to the accounts, these must be updated.

Update the VAT Codes table in the Estimates and Invoices application

It is not possible to automatically update the VAT Codes table in the Estimates and Invoices application, as explained in the previous paragraphs.

ID codes and percentage VAT rates must be updated manually each time there are changes.

Alternatively, you can also follow this procedure:

- Open a new Banana template for Estimates and Invoices, which has updated VAT codes

- Go to the VAT Codes table

- Copy and paste the entire table from the template to your Estimates and Invoices file.

For more details, refer to the VAT Codes table in Estimates and Invoices page.

VAT Extension 2024, Program update and subscription plan

On this page you will find the main news concerning the Swiss VAT rates that came into force on 1 January, 2024, as well as the latest current requirements and forecasts for the future.

Upgrading to the Advaced plan from the Professional plan

The Swiss VAT 2018 extension does not allow you to set up VAT Reports with the new rates. It is therefore automatically replaced with the 2024 extension, which allows you to set up VAT Reports with both 2018 and 2024 rates. If you have the Professional plan of Banana Accounting Plus, when trying to create the VAT Report, a message appears announcing that the Advanced plan is required.

Switch to the Advanced plan of Banana Plus

You only pay the difference between the two plans

As an alternative you can continue with the Professional or Free plan, manually reinstalling the 2018 VAT extension to get VAT Reports until the end of 2023. For 2024, you can create the VAT Summary on Banana (VAT journal by rate type) and then fill out the VAT Report manually.

Switching to the Advanced plan from the Free plan

The Swiss VAT 2018 extension does not allow you to set up VAT Reports with the new rates. It is therefore automatically replaced with the 2024 extension, which allows you to set up VAT Reports with both 2018 and 2024 rates. In order to create the VAT Report, as of July 1, 2024, the Advanced plan is required.

Purchase the Advanced plan of Banana Accounting Plus

Message of incompatibility for Banana 9 users

Banana Accounting 9 and earlier versions are no longer updated. Banana 9 allows the installation of the 2024 VAT extensions, but you will be notified that the extension is not compatible. There are two options:

- Switch to the Advanced plan of Banana Accounting Plus and use the VAT 2024 extension right away.

- Continue using Banana Accounting 9, manually reinstalling the 2018 VAT extension to get VAT Reports until the end of 2023. For 2024, you can create the VAT Summary on Banana (VAT journal by rate type) and then fill out the VAT Report manually.

The advantages of the Advanced plan of Banana Accounting Plus

Banana Accounting Plus, Advanced plan, offers all the functionalities required to prepare the online VAT Report.

Compared to the previous versions, Banana Accounting Plus also brings several improvements and new features; the Advanced plan in particular includes functions that automate and speed up bookkeeping, designed precisely for those who need to take care of several tasks and do not have much time.