In this article

Artificial Intelligence (AI) is increasingly used in automation systems. In collaboration with our users, we have developed an automatic completion system for imported transactions based on predefined rules.

This feature automates and simplifies the accounting entry process, saving time and reducing data entry errors.

Rules are predefined transactions that include all the information necessary to automatically complete accounting operations accurately and quickly.

Below is the introductory video on Rules, as well as videos on how to create Rules:

- ▶ Video: Import and automatically complete transactions (introduction) - 0'55"

- ▶ Video: Rules for completing imported transactions (Apply rules dialog) - 7'26"

- ▶ Video: Rules for completing imported transactions (Recurring Transactions table) - 3'34"

To use the automatic completion Rules, the Advanced plan and the version 10.1 or higher of Banana Accounting Plus are required.

What are Rules?

Rules are pre-set transaction lines, containing useful information for the program to:

- Identify imported transactions to complete

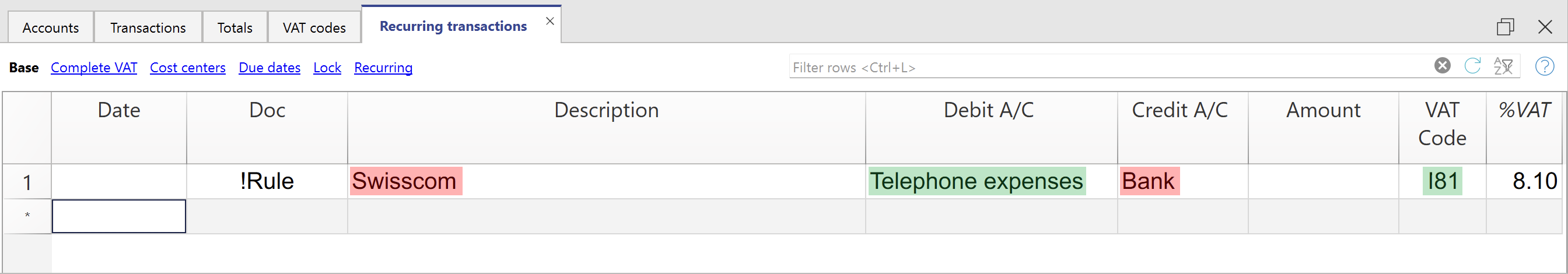

If you enter Description in the column"Swisscom", the rule will apply to imported transactions that contain "Swisscom" in the description. - Specify elements to complete the entry

- In the Debit Account column, enter the account "Phone expenses".

- In the VAT column, enter the code "I81".

Completion rules are saved in the Recurring Transactions Table. You can enter and modify them directly in the table or use the Add/Modify Rules dialog during the rule application phase.

What are the purposes of Rules?

Normally, when you import bank movements into the Transactions table, you must manually complete the transactions by entering the Debit or Credit account, VAT code, Cost centers, or other information.

Example: when you import an outgoing transaction indicating a payment to the company "Swisscom," you must complete the Debit Account column with "Phone expenses" and the VAT Code column with "I81."

With the creation of Rules, imported movements are entered and completed automatically by the program, without any manual entry.

Depending on the method used for rule creation, these can be created either before or during the import. Once created, the Rules are also valid for all subsequent imports.

Workflow procedure

- Import bank transactions

The program creates transaction lines with date, description, amount, account, document number, and exchange rates. - Create the rule using one of the available methods.

- In the Transactions table, the program automatically completes all imported movements with counterpart, VAT codes, Cost centers, and more.

- In the Recurring Transactions table, the program saves transactions with the Rules.

Methods for creating Rules

We have created a system that provides various methods for creating Rules. You can choose how you prefer to work:

- Rules from the Transactions table.

- Rules from the Recurring Transactions table.

- Rules from the Apply rules dialog.

The benefits of rules

The benefits of the completion system are immediately evident:

- Complete transactions in just a few seconds.

- High control and precision.

- Avoid errors and omissions.

- You can easily delegate the task of importing data into accounting.

- You can see how specific transactions were recorded.

- The auditor can define how to record certain transactions.

- Immediate operation, even without a learning database.

- You can add, modify, and delete rules at any time.

Transition to the new year

When you create the file for the new year from the Actions > Create new year menu, all the Rules in the Recurring Transactions table are carried over and included in the new file.

When you import bank statement movements, the Rules are immediately applied.

You can add new Rules and adapt existing ones to new needs, such as VAT changes, adding or removing accounts.

Copying Rules from one file to another

When creating a new file, you can copy rules from one file to another, starting from the Recurring Transactions table:

- Go to the Recurring Transactions table.

Check the column arrangement to ensure they are identical in both files. - Select the rows of the Rules you want to copy.

- Copy the rows from the Edit > Copy rows menu, or with the Ctrl + C keyboard shortcut.

- Paste the copied rows into the Recurring Transactions table in the new file from the Edit > Insert copied rows menu, or with the Ctrl + V keyboard shortcut.

Rules vs. Artificial Intelligence

Artificial Intelligence (AI) is increasingly being used in automation systems.

In collaboration with our users, we have developed a system for the automatic completion of imported entries based on Rules. We believe this is a much more effective approach because:

Rules follow a deterministic logic, whereas Artificial Intelligence uses a probabilistic approach that involves a series of risks in accounting and tax contexts.

Rules offer a very high degree of control and precision.

For example, payments made to insurance companies can be accurately assigned to an account based on the contract number.All the rules form a valuable knowledge base.

They are listed in the Recurring Entries table, can be easily modified (for example when VAT changes) and serve as a reference and control tool. You can, for instance:If you do not remember, see how certain transactions have been recorded.

Explain to people who are responsible for accounting how to record various transactions.

Define for the auditor how certain transactions should be recorded.

Adapt the rules if VAT codes change or if accounts, cost centers, or other elements are added or removed.

Delete rules that are no longer applicable.

Copy and paste the rules into another accounting system and adapt them to specific needs.

They do not require a learning phase and work perfectly even for payments that occur only once or a few times a year.

Rules can be immediately adapted to regulatory changes. Artificial Intelligence, on the other hand, learns from the past and thus tends to repeat previous actions even if the situation has changed.

Currently unavailable features

These functions, while requested by some users, are not currently available:

- Ability to change the transaction text to shorten and simplify it.

- For multi-line transactions, the ability to use formulas that calculate amounts based on the imported transaction amount.

- Ability to apply a rule based on the transaction date (condition: Date column).