Rules for the automatic completion of imported transactions

Artificial Intelligence (AI) is increasingly used in automation systems. In collaboration with our users, we have developed an automatic completion system for imported transactions based on predefined rules.

This feature automates and simplifies the accounting entry process, saving time and reducing data entry errors.

Rules are predefined transactions that include all the information necessary to automatically complete accounting operations accurately and quickly.

Below is the introductory video on Rules, as well as videos on how to create Rules:

- ▶ Video: Import and automatically complete transactions (introduction) - 0'55"

- ▶ Video: Rules for completing imported transactions (Apply rules dialog) - 7'26"

- ▶ Video: Rules for completing imported transactions (Recurring Transactions table) - 3'34"

To use the automatic completion Rules, the Advanced plan and the version 10.1 or higher of Banana Accounting Plus are required.

What are Rules?

Rules are pre-set transaction lines, containing useful information for the program to:

- Identify imported transactions to complete

If you enter Description in the column"Swisscom", the rule will apply to imported transactions that contain "Swisscom" in the description. - Specify elements to complete the entry

- In the Debit Account column, enter the account "Phone expenses".

- In the VAT column, enter the code "M81".

Completion rules are saved in the Recurring Transactions Table. You can enter and modify them directly in the table or use the Add/Modify Rules dialog during the rule application phase.

What are the purposes of Rules?

Normally, when you import bank movements into the Transactions table, you must manually complete the transactions by entering the Debit or Credit account, VAT code, Cost centers, or other information.

Example: when you import an outgoing transaction indicating a payment to the company "Swisscom," you must complete the Debit Account column with "Phone expenses" and the VAT Code column with "M81."

With the creation of Rules, imported movements are entered and completed automatically by the program, without any manual entry.

Depending on the method used for rule creation, these can be created either before or during the import. Once created, the Rules are also valid for all subsequent imports.

Workflow procedure

- Import bank transactions

The program creates transaction lines with date, description, amount, account, document number, and exchange rates. - Create the rule using one of the available methods.

- In the Transactions table, the program automatically completes all imported movements with counterpart, VAT codes, Cost centers, and more.

- In the Recurring Transactions table, the program saves transactions with the Rules.

Methods for creating Rules

We have created a system that provides various methods for creating Rules. You can choose how you prefer to work:

- Rules from the Transactions table.

- Rules from the Recurring Transactions table.

- Rules from the Apply rules dialog.

The benefits of rules

The benefits of the completion system are immediately evident:

- Complete transactions in just a few seconds.

- High control and precision.

- Avoid errors and omissions.

- You can easily delegate the task of importing data into accounting.

- You can see how specific transactions were recorded.

- The auditor can define how to record certain transactions.

- Immediate operation, even without a learning database.

- You can add, modify, and delete rules at any time.

Transition to the new year

When you create the file for the new year from the Actions > Create new year menu, all the Rules in the Recurring Transactions table are carried over and included in the new file.

When you import bank statement movements, the Rules are immediately applied.

You can add new Rules and adapt existing ones to new needs, such as VAT changes, adding or removing accounts.

Copying Rules from one file to another

When creating a new file, you can copy rules from one file to another, starting from the Recurring Transactions table:

- Go to the Recurring Transactions table.

Check the column arrangement to ensure they are identical in both files. - Select the rows of the Rules you want to copy.

- Copy the rows from the Edit > Copy rows menu, or with the Ctrl + C keyboard shortcut.

- Paste the copied rows into the Recurring Transactions table in the new file from the Edit > Insert copied rows menu, or with the Ctrl + V keyboard shortcut.

Rules vs. Artificial Intelligence

Artificial Intelligence (AI) is increasingly being used in automation systems.

In collaboration with our users, we have developed a system for the automatic completion of imported entries based on Rules. We believe this is a much more effective approach because:

Rules follow a deterministic logic, whereas Artificial Intelligence uses a probabilistic approach that involves a series of risks in accounting and tax contexts.

Rules offer a very high degree of control and precision.

For example, payments made to insurance companies can be accurately assigned to an account based on the contract number.All the rules form a valuable knowledge base.

They are listed in the Recurring Entries table, can be easily modified (for example when VAT changes) and serve as a reference and control tool. You can, for instance:If you do not remember, see how certain transactions have been recorded.

Explain to people who are responsible for accounting how to record various transactions.

Define for the auditor how certain transactions should be recorded.

Adapt the rules if VAT codes change or if accounts, cost centers, or other elements are added or removed.

Delete rules that are no longer applicable.

Copy and paste the rules into another accounting system and adapt them to specific needs.

They do not require a learning phase and work perfectly even for payments that occur only once or a few times a year.

Rules can be immediately adapted to regulatory changes. Artificial Intelligence, on the other hand, learns from the past and thus tends to repeat previous actions even if the situation has changed.

Currently unavailable features

These functions, while requested by some users, are not currently available:

- Ability to change the transaction text to shorten and simplify it.

- For multi-line transactions, the ability to use formulas that calculate amounts based on the imported transaction amount.

- Ability to apply a rule based on the transaction date (condition: Date column).

How the rules for completing imported transactions work in 3 steps

The following explains the procedure for how Rules work and how they are applied.

The process can be summarized in three steps:

- Import bank transactions into the Transactions table.

- Create the rules.

- Apply the rules for the automatic completion of transactions.

1. Import bank transactions

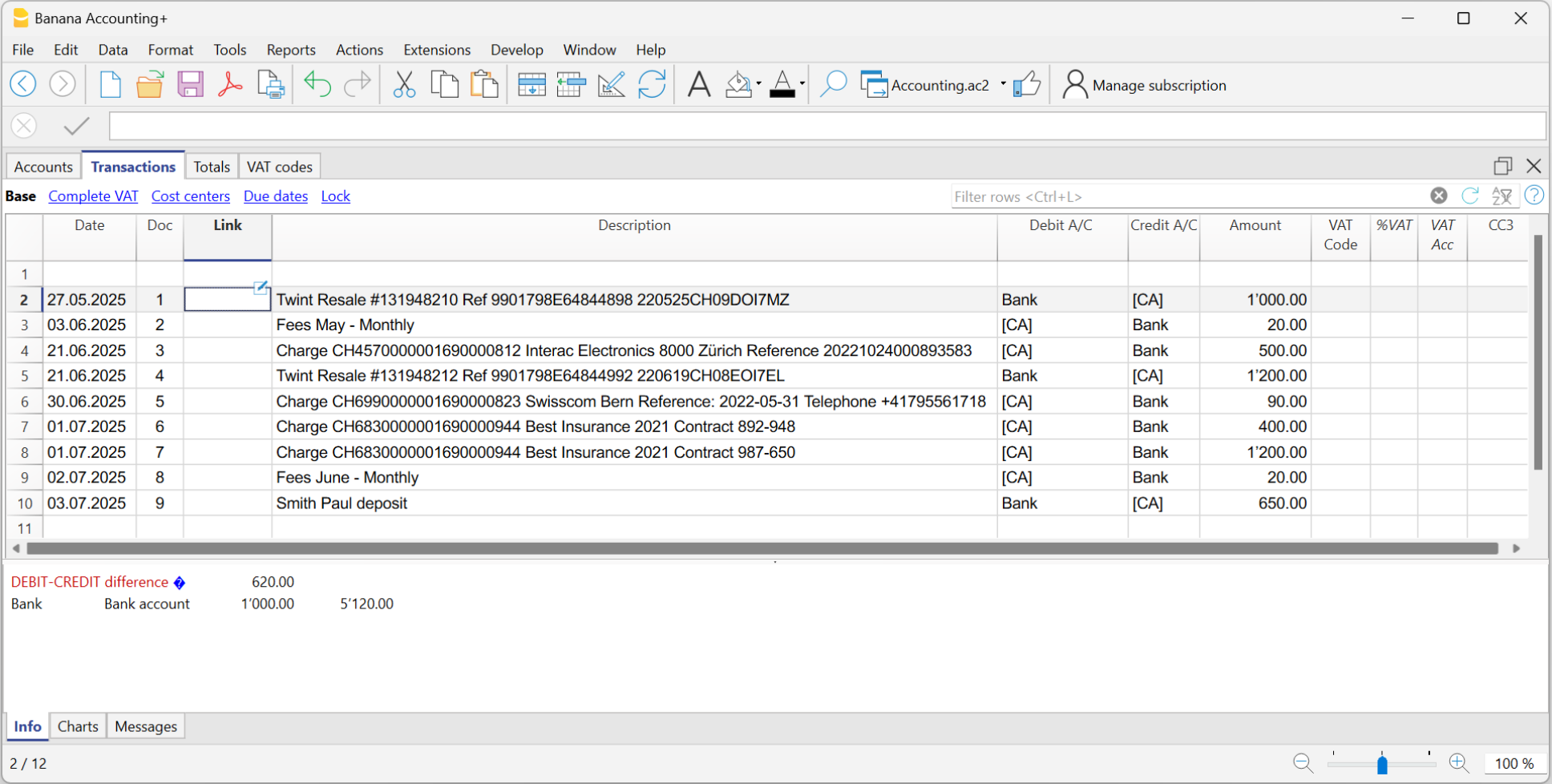

When bank transactions are imported, the program inserts a temporary counteraccount [CA]. Typically, the completion of contra accounts must be done manually for each entry.

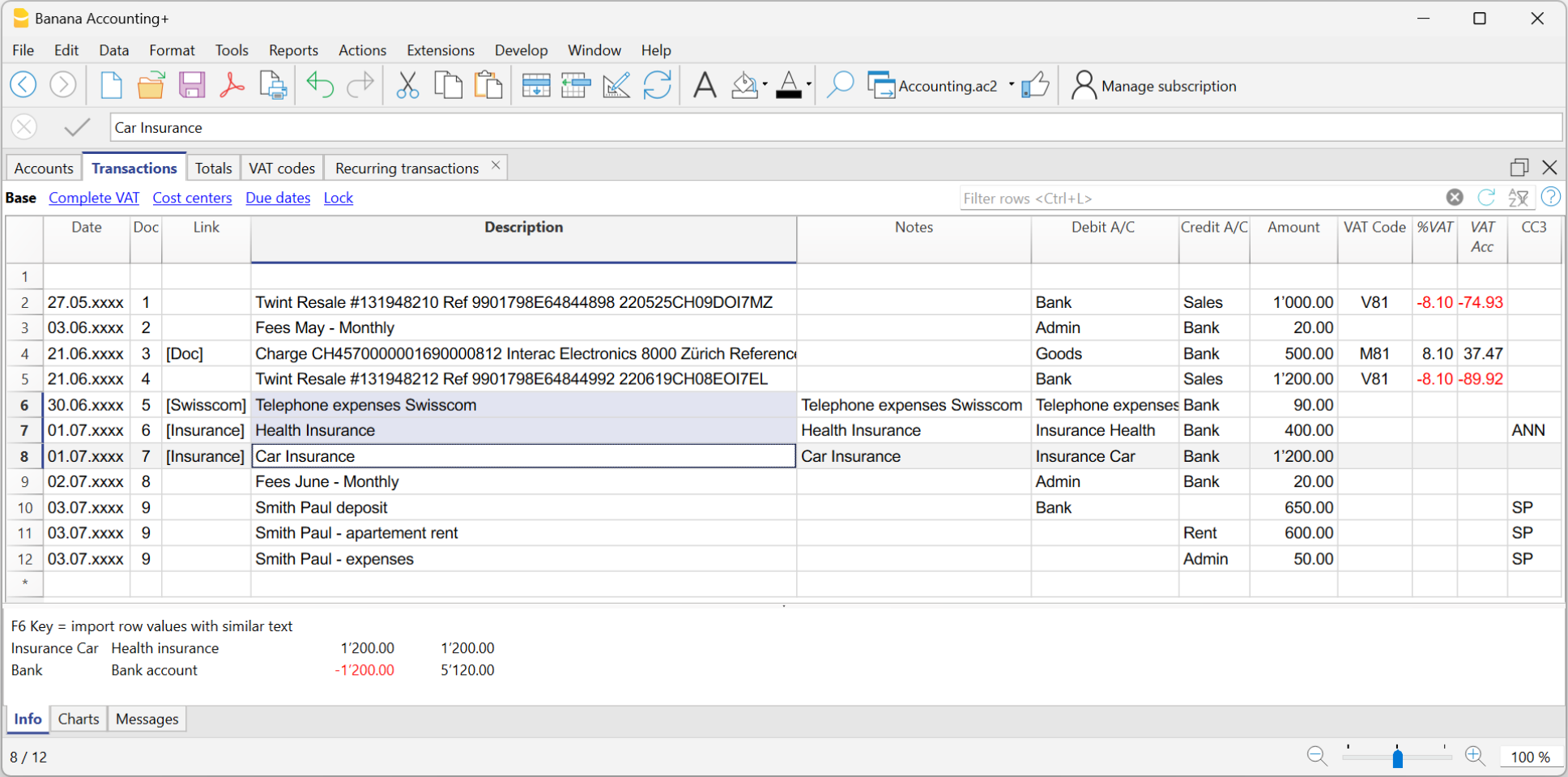

In the example figure, in the Transactions table, it can be seen that:

- (1) - The cells have the same temporary contra account, related to sales via Twint.

- (2) - The cell has a temporary contra account related to monthly expenses for May.

- (3) - The cell has a temporary contra account related to Swisscom telephone expenses.

- (4) - The cell has a temporary contra account related to insurance costs, policy number 892-948.

- (5) - The cell has a temporary contra account related to insurance costs, policy number 987-650.

2. Creating the Rules

The Rules are used to automatically complete all temporary contra accounts of imported transactions, adding VAT codes, cost centers, links, and more.

The rules are template transactions that are already complete, found in the Recurring transactions table, where:

- The Description column contains the text (one or more keywords) that the imported transaction must include.

- The Debit Account and Credit Account columns contain the Contra account that will replace the temporary one.

We have created a system that provides different methods for creating the Rules:

- Rules from the Apply Rules dialog

- Rules from the Transactions table

- Rules from the Recurring transactions table

Regardless of the method used, the created Rules are saved in the Recurring Transactions table.

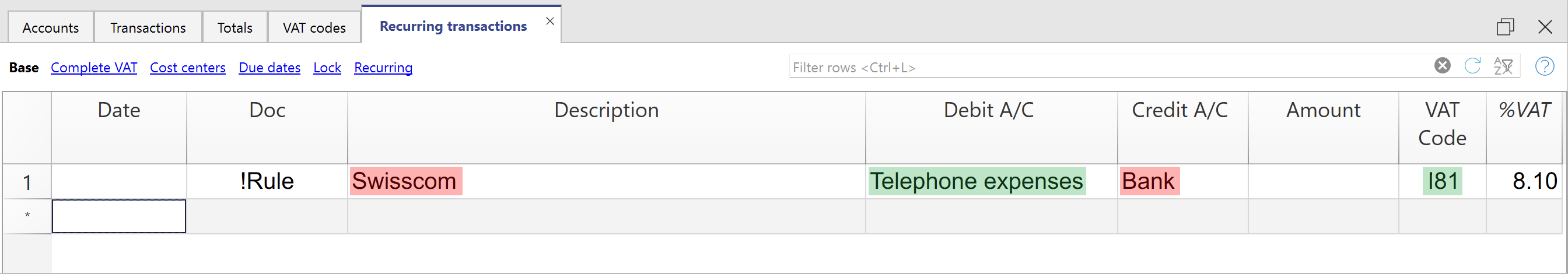

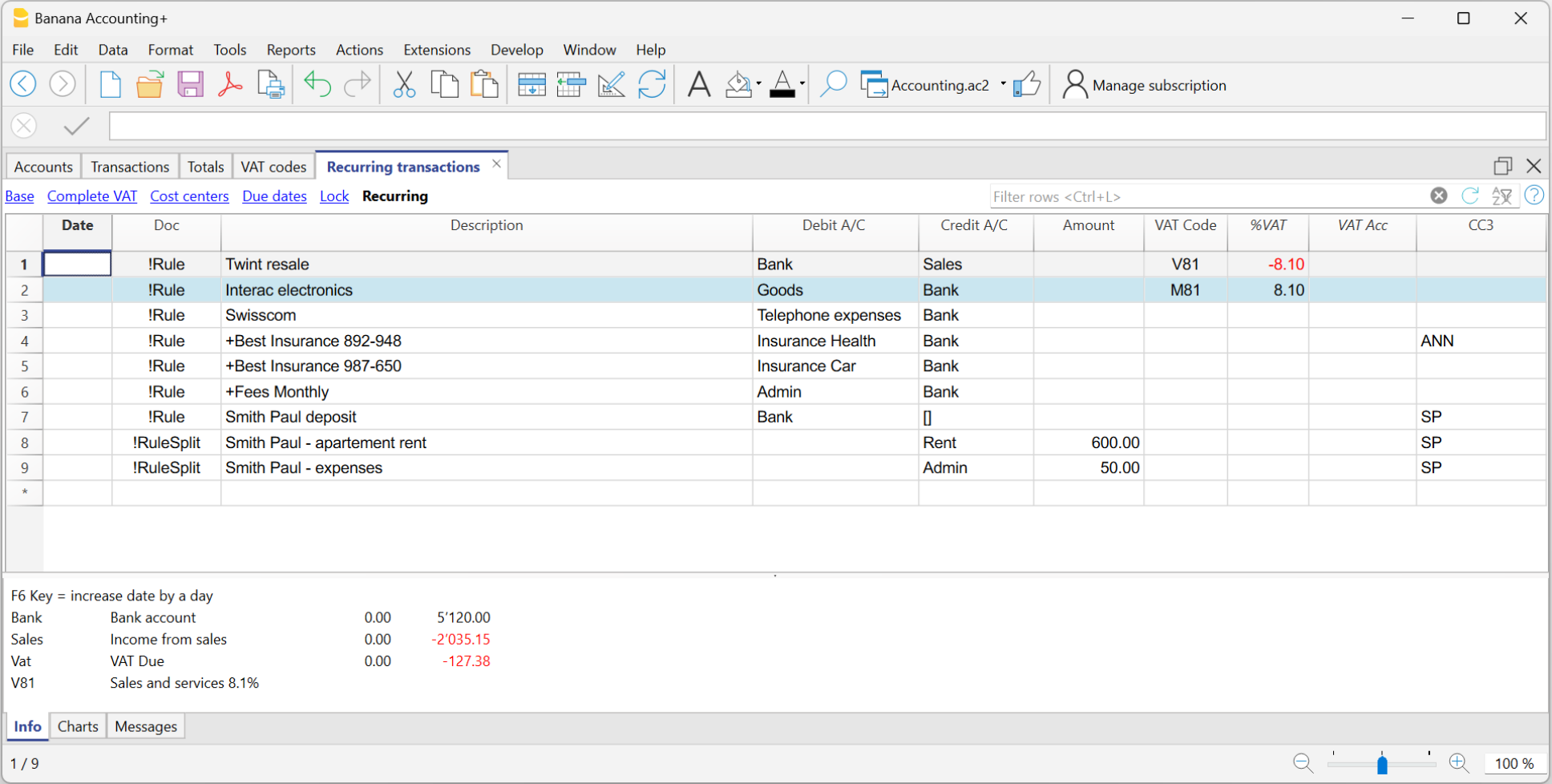

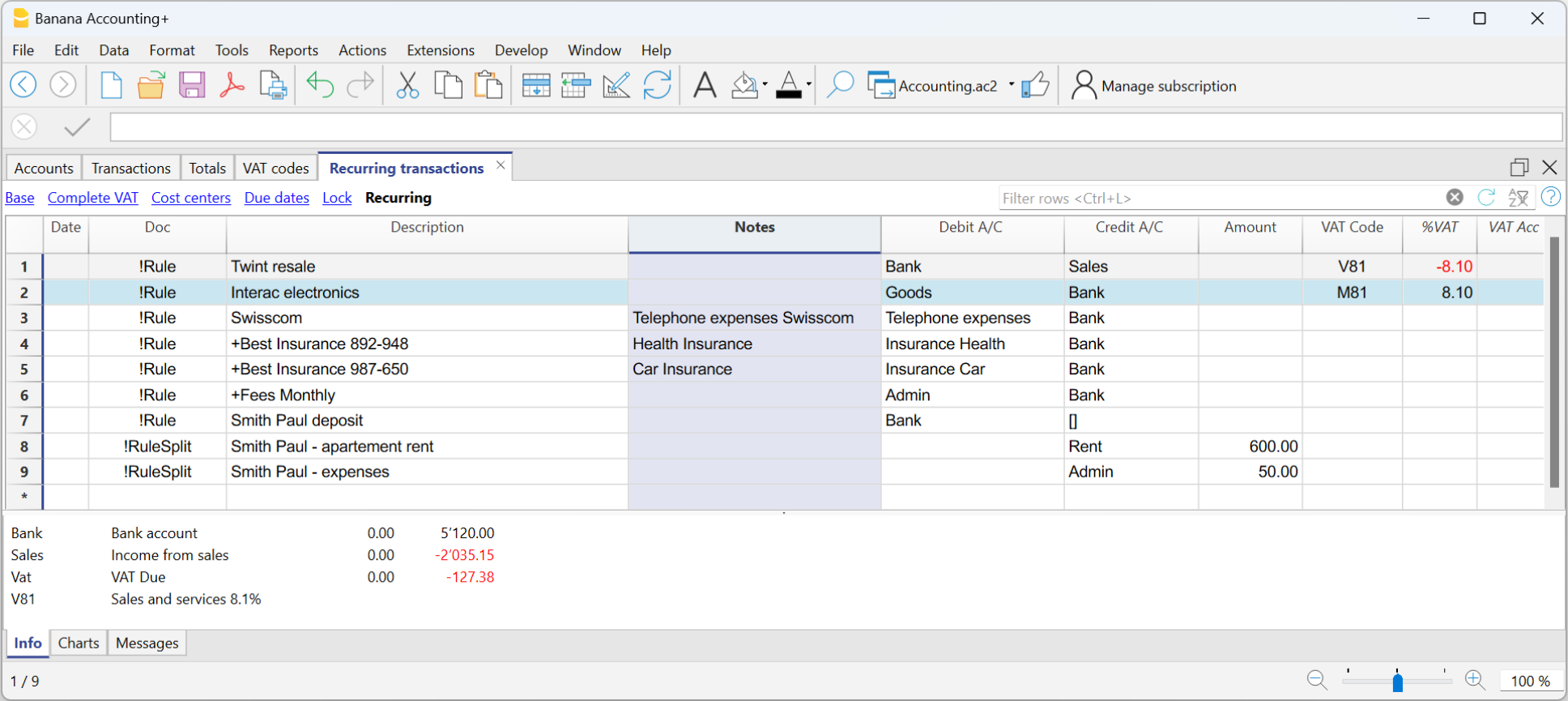

In the example, in the Recurring Transactions table, a Rule has been created for the following transactions:

- (1) - For the "Twint" transactions, the rule replaces the temporary contra account with the "Sales" account. The VAT code has also been added.

- (2) - For the "Interac Electronics" transaction, the rule replaces the temporary contra account with the "Goods" account. The VAT code has also been added.

- (3) - For the "Swisscom" transaction, the rule replaces the temporary contra account with the "Admin" account.

- (4) - For the "Best insurance" transaction with policy number "892-948", the rule replaces the temporary contra account with the "Insurance Health" account.

- (5) - For the "Best insurance" transaction with policy number "987-650", the rule replaces the temporary contra account with the "Insurance Car" account.

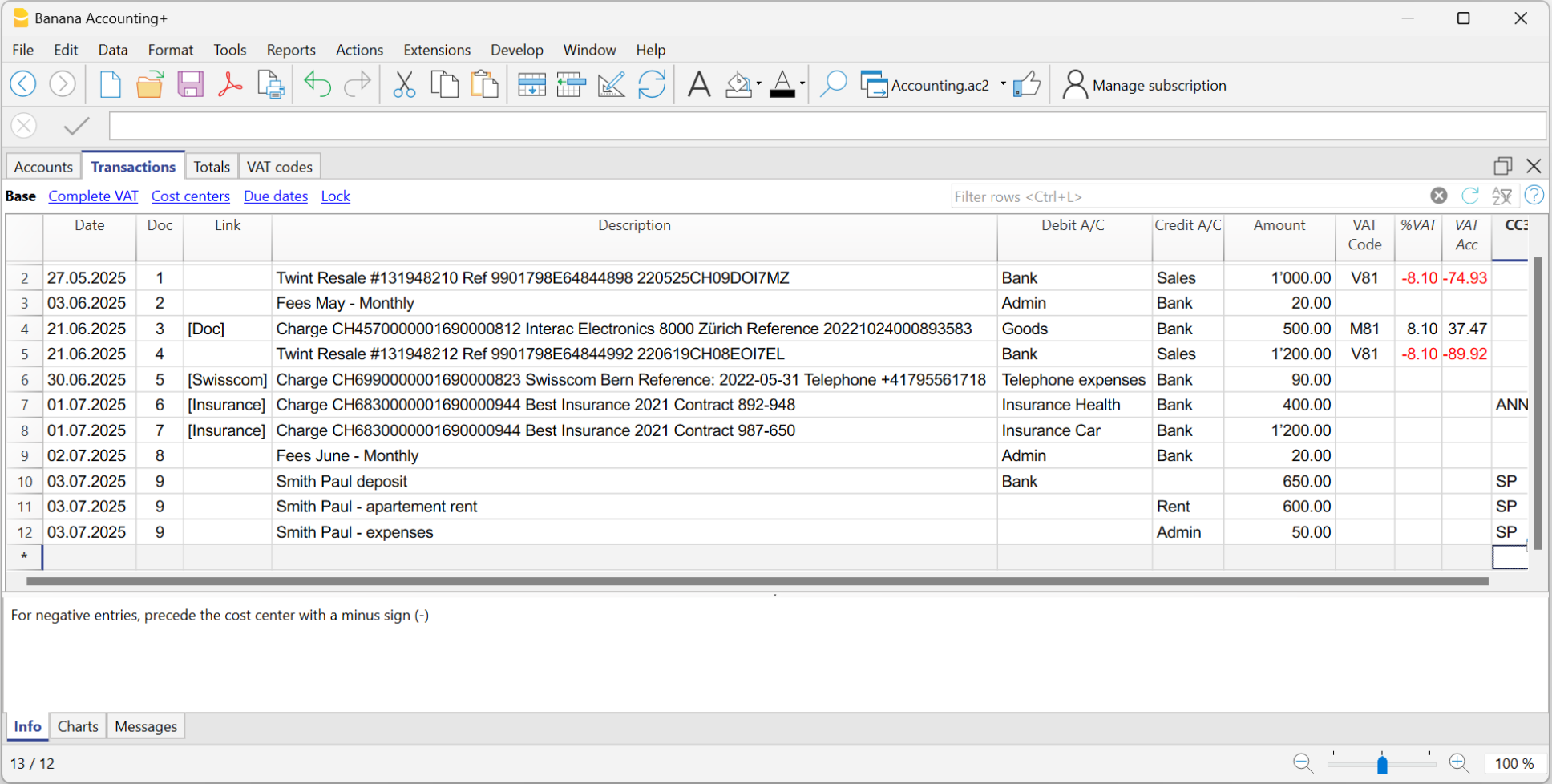

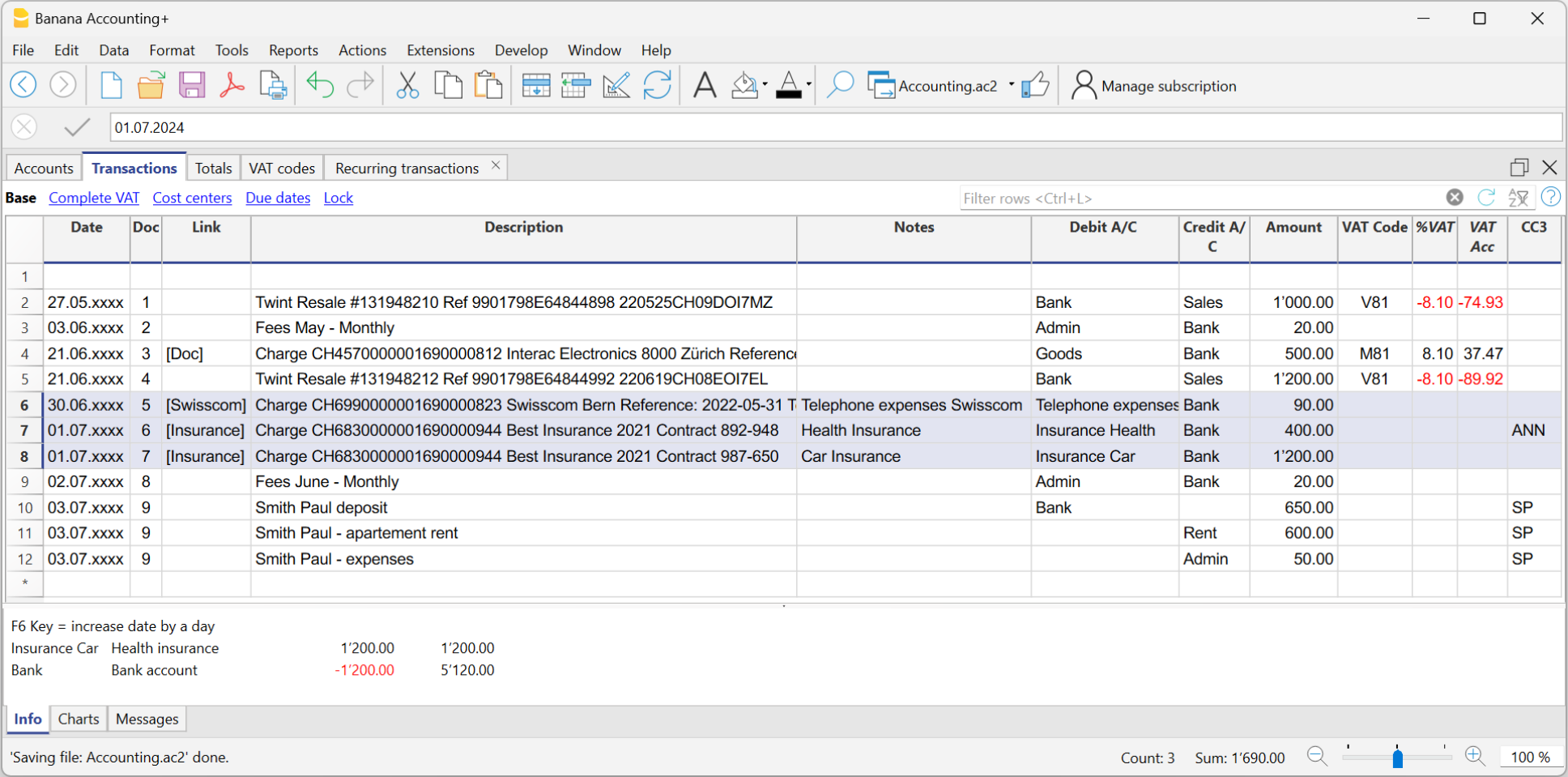

3. Applying the Rules for Automatic Completion (Result)

In the Transactions table, the program completes the imported transactions by adding the contra account, VAT code, etc., regardless of the method used for creating the Rules.

In the example, in the Transactions table, the imported transactions have been automatically completed:

- (1) - For the "Twint" transactions, the temporary contra account has been replaced with the "Sales" account and completed with the VAT code.

- (2) - For the "Interac Electronics" transaction, the temporary contra account has been replaced with the "Goods" account and completed with the VAT code.

- (3) - For the "Swisscom" transaction, the temporary contra account has been replaced with the "Admin" account.

- (4) - For the "Best insurance" transaction with policy number "892-948", the temporary contra account has been replaced with the "Insurance Health" account.

- (5) - For the "Best insurance" transaction with policy number "987-650", the temporary contra account has been replaced with the "Insurance Car" account.

Additionally, the program recognizes the transactions with the VAT code and completes all the columns related to VAT (VAT account and amounts).

Create Rules from the Apply Rules Dialog

One of the methods for creating Rules is from the Apply Rules dialog. The main advantages are as follows:

- You can see all imported transactions.

- The imported transactions are divided into incoming and outgoing transactions, with Rules and without Rules.

- For each group of identical transactions, the Rule being applied is shown in bold.

- Rules that are duplicated or in conflict are highlighted.

- You can add new rules and modify or delete existing ones.

- By changing the conditions of a Rule (description, amount, account), you can immediately see the list of transactions that comply with it.

- You can decide which rules to activate and which to deactivate.

Below is the complete procedure for creating Rules from the Apply Rules dialog.

1. Give the command Import into accounting

Before accessing the Apply Rules dialog, you must first import bank, postal, or other transactions as follows:

- Use the command from the Actions menu > Import into accounting > Transactions

- Select the appropriate format and indicate the path where the file with your bank statement data is located

- In the dialog that opens:

- Enter the account related to the statement from which you are importing the transactions (bank, postal service, etc.).

- Specify the start and end dates for the period of the transactions to import.

- Indicate the temporary contra account if you want it to be different from the default "[CA]".

You can use any account, and if you write it in square brackets, it will not be accounted for. - Activate the Apply Rules option (available only with the Advanced plan of Banana Accounting Plus).

- Confirm with OK.

2. Dialogue Apply Rules

The program opens the Apply Rules dialog.

In this dialog, you will find:

- The temporary contra account you entered previously or the default one "[CA]".

- The bank account entered, where all transactions imported from your bank or postal account are recorded.

- The imported transactions from the bank account, divided into:

- Incoming transactions without rules (Money In without rules).

- Outgoing transactions without rules (Money Out without rules).

- Incoming transactions with rules (Money In with rules).

- Outgoing transactions with rules (Money Out with rules).

3. Create new rules

To create new Rules:

- Position yourself on one of the transactions for which you want to create a rule.

- Go to the right-hand side until you see "...".

- Click on Add New Rule.

The 'Add Rule' dialogue appears.

In this dialog, you need to enter:

- In the Description, the text (keyword) that the program uses to find the matching Rule in the imported transactions.

Example:- Best Insurance Contract 892-948

applies to lines that contain exactly the specified text. - +Best Insurance Contract 892-948

applies to lines that contain the words "Best Insurance" and "892-948" in any position.

- Best Insurance Contract 892-948

- The contra account, used to replace the temporary contra account.

- Any other information (Cost centers, VAT codes, etc.).

The program shows the transactions found based on the entered conditions to which the new rule will be applied. In the example, we have a single transaction.

- Confirm with OK.

4. Confirm Apply Rules

In the Apply Rules dialog, you will see:

- The row of the created Rule ("NEW") where the data of the temporary counteraccount [CA] and the other information entered in the rule are indicated.

- Below are the lines of the transactions to which the rule has been applied.

You can decide when to execute the Apply Rules command:

- You can apply the rules selectively and continue working on the others.

- You can exit the dialog and return later.

- You can cancel the operation of applying the rules and repeat it later.

- The Apply Rules command also saves any changes you made to the rules.

By clicking on the buttons:

- Apply Rules:

- The program adds the new Rules to the Recurring transactions table.

- The program completes the transactions in the Transactions table.

- The dialog remains open so you can add the rules to the other transactions.

- OK

- Confirms the applied rules and closes the dialog.

- Confirms the applied rules and closes the dialog.

Undo changes made

Once the dialogue is closed, you will see the completed transactions in the Transactions table.

If you wish, you can undo the changes you have made:

- Menu Edit > Undo edit

- With the Cancel button (green arrow).

To also cancel the import of the data, you need to repeat the Cancel command a second time.

Complete other transactions with Temporary contra account

After importing bank transactions, the aim is to complete all transactions so that there are no more transactions with Temporary contra accounts [CA].

You can manually complete the remaining transactions. This is useful for special cases that do not tend to repeat.

You can create new rules by chosing one of the following methods:

Adding information to completed transactions with rules

It is possible to add supplementary information to the Rules through the Recurring Transactions table.

Auto-completion rules from the Apply Rules dialogue

The Apply Rules window offers an excellent level of control over changes to accounting transactions because it shows a preview of existing rules, with an indication of which transactions match each one and which transactions do not yet match any rules. You then have the option of creating new rules, modifying or deleting existing ones.

▶ Video: Rules for completing imported transactions (Apply Rules dialogue)

The dialogue may be displayed:

- From the Import Transactions dialogue, when the Apply Rules option is checked

Rules are only applied to imported rows

- From the Actions menu > Recurring transactions > Apply rules...

Rules are applied to the entire contents of the Transactions table

The Apply Rules dialogue, coupled with the import of banking data, becomes a crucial tool for setting up all repetitive records. In this dialogue window, when faced with multiple repetitive transactions of the same type, it suffices to set the rule for just one of the transactions, and the rules are automatically applied to all other transactions in the dialogue, eliminating the need to set the rule again.

Once the rules are confirmed, all transactions are listed in the Transactions table, ensuring consistency and accuracy in records of the same type, and speed in accounting for all transactions.

This dialogue box is divided into three sections:

Apply rules to transactions with...

- Temporary contra account:

This field is mandatory.

It filters all imported transactions that contain that specific contra account, e.g. [CA], which was indicated in the Import transactions dialogue. - Account:

Filters all imported transactions that contain a specific account, usually a bank account or [A], which has been indicated in the Import Transactions Dialogue.

The rule-based auto-completion system assumes that once the transactions have been completed, there is no longer any transaction containing the temporary contra account.

Imported data corresponding to rules or not

The window shows all transactions that have temporary contra accounts indicated above (e.g. [CA]). These are grouped in four main sections:

- Incoming transactions with rules

Transactions with positive change of account (credit) and with indication of the rule to which they correspond - Outgoing transactions with rules

Transactions with negative account variation (debit) and with indication of the rule to which they correspond - Incoming transactions without rules

Transactions with positive change of account (credit) and not belonging to any rule - Outgoing transactions without rules

Transactions with negative account variation (debit) and not belonging to any rule

Contextual commands

From the row of a transaction without a rule, a simple click or the three dots (...) to the right, or a right click anywhere on the row, opens a menu allowing you to:

- Add/Edit Rule

- Cancel an existing rule

- Change an overlapping rule

The commands at the bottom of the dialogue

- Expand All/Collapse All: displays or hides the elements of the Transactions.

- Display unused rules: checking this option displays all rules defined in the Recurring transactions table; if the option is not checked, the programme only displays rules that have matches.

- Display rows without rules: if this option is checked, all imported transactions are displayed; if the option is not checked, the programme only shows transactions that match a rule.

- Remove accounts between [ ]: in multi-row transactions, the import account is placed in square brackets [ ] in the detail rows. If this option is activated, the programme removes the import account from the detail rows.

Rules with transactions on multiple rows can only be defined in the Recurring transactions table. - OK: this button applies the active rules and closes the window.

- The temporary contra account is replaced in all transactions that have a match with a rule.

- New or changed rules are also saved in the Recurring Transactions table.

- Cancel: this button closes the window without applying the rules.

- If there have been changes to one or more rules, you will be asked for confirmation before closing the window.

- With this button you cannot undo the Apply Rules command; to do so, you must close this window and use the Undo command from the Edit menu.

- Apply Rules: this button applies the rules without closing the window.

- The temporary contra account is replaced in all transactions that have a match with a rule.

- Rules that are added or changed are saved in the Recurring transactions table.

- If you wish to undo changes, you must close the window and use the Undo command from the Edit menu.

Tips on how to use the Apply Rules window

The most effective way to work with the Apply Rules window is as follows:

- Check that the transactions matching rules are correct.

- Use the Apply Rules button to update the Transactions table with the selected rules.

- Add new rules for the remaining transactions and check that they are applied correctly.

- Use the Apply Rules button again.

- Repeat steps 3 and 4 until all recurring transactions are associated with rules.

Recurring transactions table

Rules are saved and may be edited in the Recurring transactions table.

You can complete or add rules also with transactions on multiple rows in the Recurring transactions table.

As time goes by, you will see that more and more imported transactions will have matches with rules; the more rules you add, the more your accounting work will be reduced.

Add/Edit Rules

From the Apply rules dialogue you may access the Add/Edit rule section as follows:

- By right-clicking on one of the transactions or rules:

- For transactions that already have a rule, you can choose Edit Rule or Delete Rule.

- For transactions that do not have a rule, you can choose Add New Rule.

Add New Rule example

The following example in the dialogue below is an outgoing transaction of the payment of a health insurance.

To add a new rule:

- Right-click on the movement row and choose Add New Rule.

- The dialogue Add rule appears.

- Fill in the fields available.

- Confirm with OK.

Add New Rule dialogue

The Add New Rule dialogue shows the data of the selected transaction from which you are creating the rule.

- Complete the rule with the matching parameters (conditions) and the rule completion parameters.

- All rules are saved in the Recurring Transactions table (rules for completion), where you can also:

- Edit, add and delete rules.

- Add any other column for completion, which is not available in this dialogue (e.g. Notes or DocLink columns).

- Colour the row if you want to highlight the imported transaction.

- Add transactions on multiple rows (SplitRule).

The Rule

- Rule type.

The programme, depending on the type of transaction, if in credit or debit on the bank account, sets the rule as Money in or Money out transaction. - Rule title.

It is optional, it is displayed in the Apply Rule dialogue.

Conditions

These are the elements that are used to check whether there is a match for each individual transaction.

- A match is given if all conditions are found.

- If a match is given, the entry is listed among the transactions with rule.

The description

In the description, enter the text to be searched in the text of the imported transaction. If the text is found the transaction will be considered suitable for applying the rule, if the other conditions are then met.

- Exact word or phrase

- If you write only Best Insurance 982-948 as a condition of the rule, only transactions containing those words in that exact order will be considered matches.

- If you write only Insurance, as a condition of the rule, all entries containing this exact word will be considered matches.

- All words (starting with the "+ "sign)

- If you write +Best Insurance 982-948 as a condition of the rule, all records containing these exact words, in any position, will be considered matches.

All words must be present in the description of the transaction.

The position of the words in the sentence is not relevant.

The "+" sign is not considered in the search.

- If you write +Best Insurance 982-948 as a condition of the rule, all records containing these exact words, in any position, will be considered matches.

- List of words (using |)

- If you enter "coffee|restaurant", the program searches for imported transactions that contain the word "coffee" or "restaurant".

- This mode is useful for identifying multiple categories without having to create separate searches.

- Upper and lower case

When searching for input text, no case difference is made.

The text you enter is applied to both upper and lower case text.

Amount

If you indicate an amount in the rule, only transactions with the same amount, as well as a match in the Description, will be considered as matches.

If you do not indicate any amount, any transaction of any amount that meets all other criteria will be treated as a match.

Account

In this field you will already find by default the account from which you imported the transactions. If you leave the account field empty, all transactions, imported from any account, that meet all other criteria will be considered as matches.

Actions

These are the elements used to complete the transaction row if a match is given.

If the contra account or other items to be completed are not present, you can abort the Apply rules command, add the missing account, and call up the Actions > Recurring transactions > Apply rules... command.

Contra account

Enter the account in your chart of accounts that is to be matched in the rule. In this example, the correct contra account is the Health Insurance account.

VAT

You can already enter in the rule the VAT code that the programme must add to each movement considered as a match.

CC1, CC2, CC3

You can already enter in the rule the Cost Centres that the programme must add to each movement considered as a match.

By confirming with the OK button, the new rule is saved. You will return to the previous window where the imported movements with and without rules are displayed again.

Matching Transactions

This table shows all imported transactions selected in the Apply Rules dialogue, which fall under this rule.

Buttons

- The Delete button, cancels the rule.

- The OK button, saves the rule data.

Be aware though that, until you do not give the command Apply Rules, the new rules won't be saved in the Recurring transactions table.

Rules from Transactions table

One of the methods provided for creating Rules is from the Transactions table. The main advantages are as follows:

- You work directly in the Transactions table that you already use regularly. You are already familiar with the table.

- You see all the columns.

- You create Rules simply by completing the imported transactions.

You complete the transactions manually only the first time when creating the Rules. For subsequent imports, the program applies the already created Rules to the new imported transactions. - Speed in creating Rules.

Select the rows with completed transactions and, with a single click, create all the rules in the Recurring Transactions table. You only need to modify the description of each rule to ensure a precise match for future transactions. - You do not need to insert Rules through additional dialogs.

- You do not need to manually enter all the Rule data in the Recurring Transactions table.

Below is the complete procedure for creating Rules from the Transactions table.

Import transactions

In the Transactions table, import transactions from bank, postal, or credit card statements.

Complete the imported transactions

For each imported transaction, enter the counterpart, VAT code, cost center, or other information.

When you import a transaction that needs to be recorded on multiple lines, the program inserts a single entry with the total amount and a temporary counterpart [CA].

Proceed as follows:

- Remove the temporary counterpart account [CA] from the transaction.

- Insert new rows following the transaction. For each row, enter the complete transaction with description, counterpart, amount, any VAT code, and cost center.

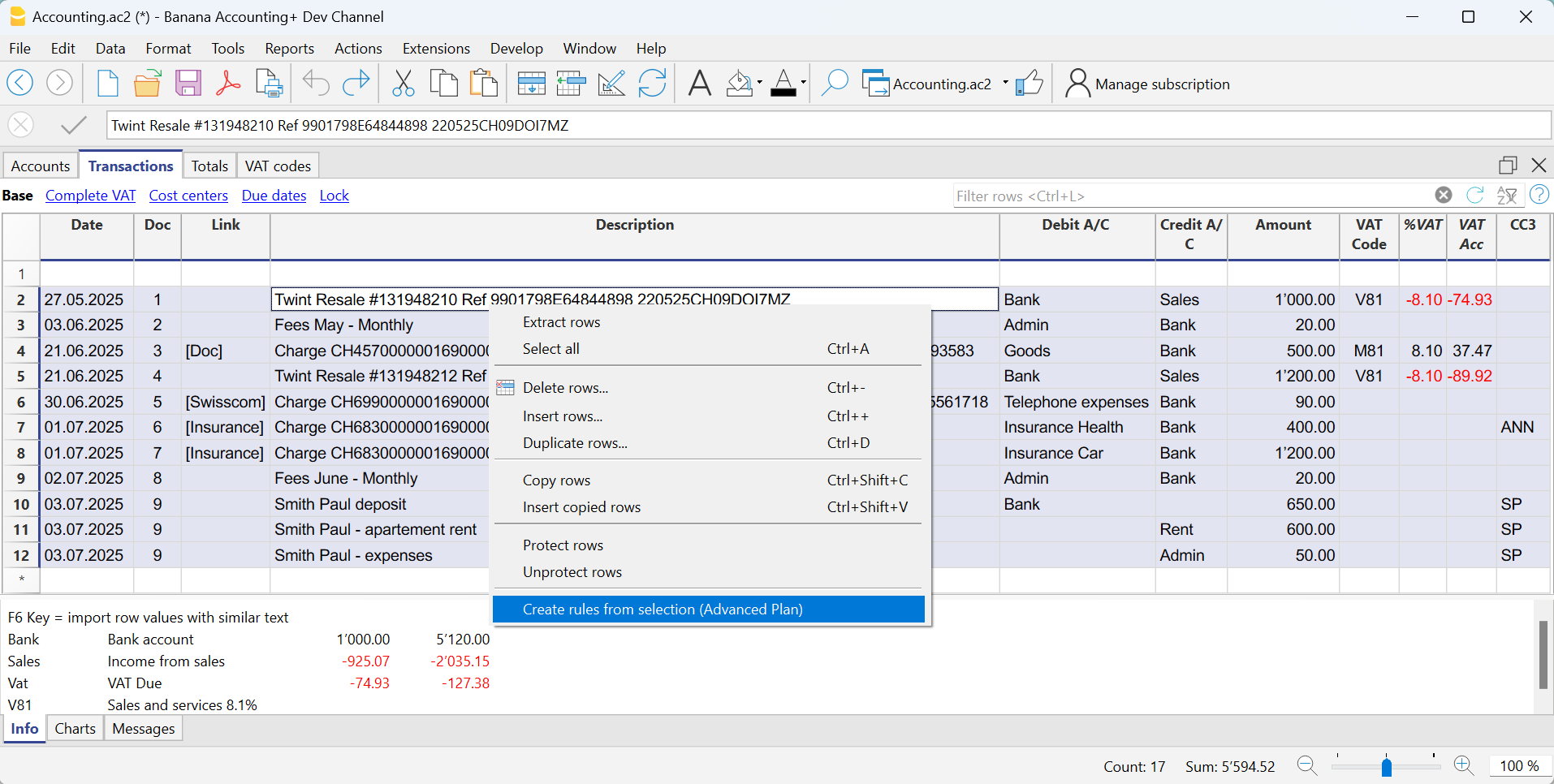

Create Rules

Starting from the completed transactions, you can create Rules:

- Select from the Transactions table the entries to which you want to apply Rules.

- Right-click on a transaction without rules > Create rule from transaction.

Alternatively, go to the Actions menu > Recurring Transactions > Create rule from transaction.

All selected transactions are transferred to the Recurring Transactions table, as they were completed in the Transactions table.

Complete the Rules

In the Recurring Transactions table, you need to complete the Rules:

- Edit the Description column.

- Modify the text of the description to search for in the imported bank statement transactions. Initially, the program automatically uses the description found in the imported transaction.

Replace this text with one or more keywords so that the program can find matches in the description of the imported transaction (e.g., + Best Insurance). - For multi-line transactions, edit the Doc column.

In the first row of the transaction, enter empty square brackets [] in the counterpart column.

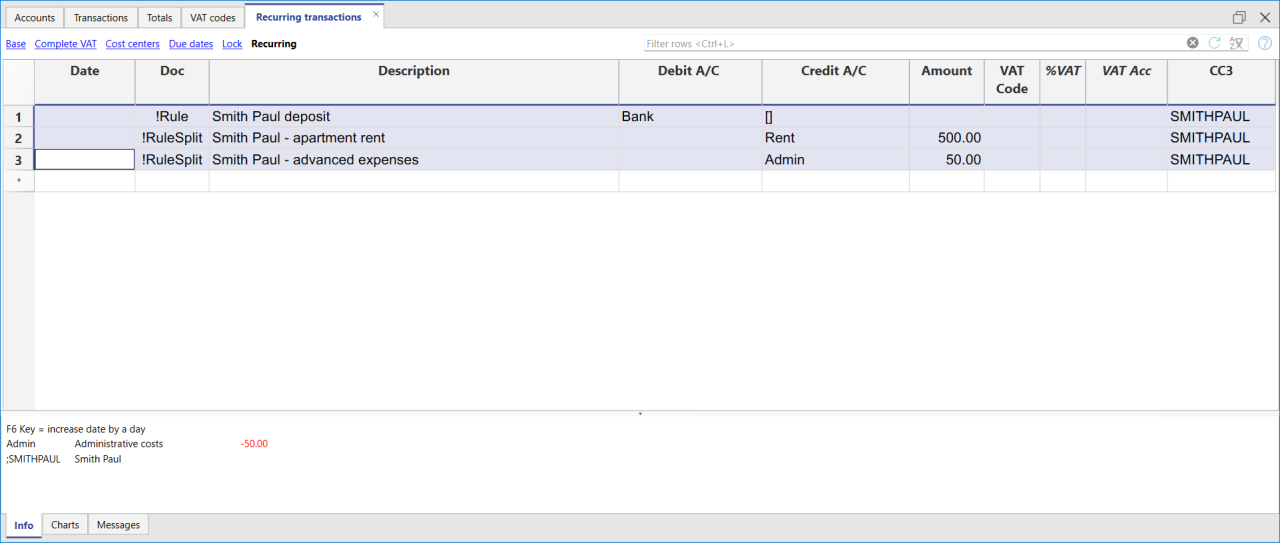

In subsequent rows, enter !RuleSplit in the Doc column (see rows 7,8,9 in the image below).

The explained procedure only needs to be performed the first time to set up the Rules. For future imports, the Rules found are applied automatically. You only need to complete the new imported transactions without a rule using the same procedure.

To find all imported transactions in the Transactions table that do not have a rule, you can use the Row filter function, entering the text "[CA]".

Recurring Transactions table Rules

One of the methods provided for creating Rules is from the Recurring Transactions table via the menu Actions > Recurring Transactions > Recurring Transactions Table.

The main advantages are as follows:

- You work directly in the Recurring Transactions table where all the Rules are saved.

- Once you have manually created all the Rules, you can import the transactions and directly apply the Rules.

- You can see all the Rules that have been created.

- You can add, modify, and delete Rules directly.

- You don’t need to use additional dialogs to add, modify, or delete Rules.

- You can define Rules for transactions across multiple rows.

- You can add digital document annotations.

- You can color the rows so that the color is carried over to the transactions in the Recurring Transactions table.

▶ Video: Rules for completing imported transactions (table Recurring transactions)

The Columns Used by the Rules

The Recurring transactions table defines the rules for the completion of imported transactions.

- Correspondence columns that contain the data for searching matches in the imported transactions.

- Doc column

- Description column

- Amount column

- Debit or Credit Account columns ( Double entry accounting) or Account and Category columns ( Income and Expense accounting).

- Substitution columns which need to be completed with additional information

- Link column

- VAT codes column

- Cost centres column (CC1, CC2, CC3)

The Doc column

For a rule to exist, there must be either the following texts in the Doc column:

- !Rule.

To show that it is a rule - !RuleSplit

To show that the rule should create transactions on multiple rows (Split rows) .

The Description column

The Description column must contain the text to be searched for in the description of the imported rows:

- The exact word or phrase

- If you write Best Insurance 982-948, as a condition of the rule, all transactions containing this exact phrase will be regarded as matches.

- If you write only Insurance, as a condition of the rule, all transactions containing this exact word will be considered as matches

- All words (starting with + at the beginning)

If you write +Best Insurance 982-948, as a condition of the rule, all transactions containing these words, in any position, will be considered as matches.- All words must be present in the description of the transaction.

- The position of the words in the sentence is not relevant.

- The '+' sign is not considered in the search.

- Upper and lower case

No difference is made between upper and lower case when searching for input text.

The text you enter is applied to both upper and lower case text. - [Rule name]

When a description starts with text in square brackets, this is used as the name of the rule. To be used for better identification of rules.

Attention: DO NOT use the entire text from the bank statement as the description, as it is unique to that specific transaction.

The Debit and Credit account columns

In the Debit and Credit columns, enter the accounts from the chart of accounts to record the transaction.

The Amount column

The Amount column can contain a specific amount to be searched for in the imported transactions. This condition is optional.

If the name of a debtor or creditor, as shown on the bank statement, is specified in the Description column and the amount is not provided, the rule will apply to any amount of the transaction.

Enter the VAT Code that should be included in the imported transaction. The program will automatically fill in all the VAT-related columns.

The CC1, CC2 o CC3 columns

Enter the Cost Center that should be included in the imported transaction.

The Notes column

Add additional information that should be included in the imported transaction.

The DocLink column

In this column, it is not possible to insert a specific link to a document because each transaction will have its own document. However, you can add an annotation in square brackets (e.g., "[Doc]") to distinguish the rows that need to be associated with a digital document.

Once the transactions are imported, it may be necessary to link them to accounting documents. To speed up this process, it is recommended to proceed as follows:

- In the DocLink column of the Recurring Transactions table, use text enclosed in square brackets [ ].

- Within the square brackets, enter the text that should be searched for in the name of the supporting document file.

- In the Transactions table, the transactions are imported with the text in square brackets in the Link column.

- In the Transactions table, use the Row Filter function and enter the text "!link![ ]". This will display all the rows in the Link column that contain square brackets where a link to the supporting document needs to be added.

- When editing the Link column in the Transactions table, the program will show, in the auto-completion, the files of supporting documents that have not yet been linked to a transaction and contain the text entered between the square brackets.

For example, if you enter "[invoice]," the program will display all the unlinked files containing the text "invoice" in the cell.

It is possible that after importing transactions with the Rules, some transactions may need to be manually completed with additional information.

To quickly find the transactions that need to be completed, you can use one of the following methods:

- Using the Notes Column

To quickly locate the transactions that need to be completed, we recommend adding temporary search texts that can be used to filter the transactions. For example:- In the Notes column of the Recurring Transactions table, or in any other column of the Rule row (except for those predefined for the Rule), enter a hashtag, such as #city.

- In the Row Filter function of the Transactions table, enter the same hashtag. This will display the rows that you need to complete.

- Coloring Rule Rows

You can color the Rule rows in the Recurring Transactions table. The row color will be transferred to the Transactions table and used to highlight the transactions to which the rule is applied.

To identify only the colored rows, you can use the Row Filter function by entering the text "!_co!"

Split -row transactions

Normally, when you import transactions from a bank statement with the Rule, a single counterpart account is recorded. If the total amount of the counterpart needs to be split across multiple counterpart accounts, you can create a multi-row Rule.

For example:

- You regularly receive a payment of 550 that must be recorded on three different accounts and therefore on three rows:

- (550) rent collection (no contra-account, as this involves recording the global amount split over three rows)

- (500) flat rent (contra account rent)

- (50) extra expenses (contra-account for extra expenses) .

To create a multi-row Rule:

- The first row corresponds to the total amount collected.

- In the Doc column, enter the text !Rule.

- In the Description column, enter the text to search for in the imported transactions.

- In the counterpart column, enter square brackets [].

In the following rows: - In the Doc column, enter the text !RuleSplit.

- In the Description column, enter the text to search for in the imported transactions.

- In the counterpart column, enter the counterpart accounts.

- In all other columns, input the values that should be included in the additional rows. In this example, we have added the tenant’s Cost Center.

In the following example, you can see the tenant’s Cost Center.

In the example of a multi-row rent transaction, it is assumed that the collected amount is always 550. If the collected amount is different from 550, the transaction will need to be completed manually.

Modifying Rules in the Recurring Transactions Table

All completion Rules saved in the Recurring Transactions table, even if they were created from the Apply Rules dialog, can be modified, deleted, or new ones can be created in anticipation of a future import without a Rule.

Copying rules in bulk from one file to another

From the Recurring transactions table it is possible to copy rule rows in bulk and paste them into another Banana file.

Create a New Year with Rules

When you create a new year using the command Actions > Create New Year, the existing Rules in the Recurring Transactions table are automatically carried over to the new year's file.

Set a Different Description from the Imported One

All imported transactions display the description from the bank statement in the Description column of the Transactions table. Typically, these descriptions are very detailed.

It is not possible to automatically change this description at the time of import.

If you wish to change the imported description, you can use the Notes column in the Recurring Transactions table.

Note: if the Notes column is already used for your own annotations, it cannot be used to modify the description.

If the Notes column is not being used, proceed as follows:

- Display the Recurring Transactions table.

- Make the Notes column visible by going to the menu Data > Columns set up > check the Notes column.

- In the Notes column, enter the description text that you want to appear in the Transactions table (Description column).

Repeat this step for each desired transaction.

Import the transactions - After importing into the Transactions table, make the Notes column visible (menu Data > Columns setup > check the Notes column)

The Notes column will display the notes defined in the Recurring Transactions table.

- For each transaction, copy the content from the Notes column and paste it into the Description column.

- For each transaction, copy the content from the Notes column and paste it into the Description column.

In the Recurring Transactions table, it is not possible to directly add custom columns.

To use a custom column in the Recurring Transactions table, you need to add the custom column to the Transactions table.

Once the column is added to the Transactions table, it will also be visible in the Recurring Transactions table and can be used to set a different description from the imported one.

Therefore, the insertion procedure is the same as described in the section Set a Different Description from the Imported One - Notes Column.