In this article

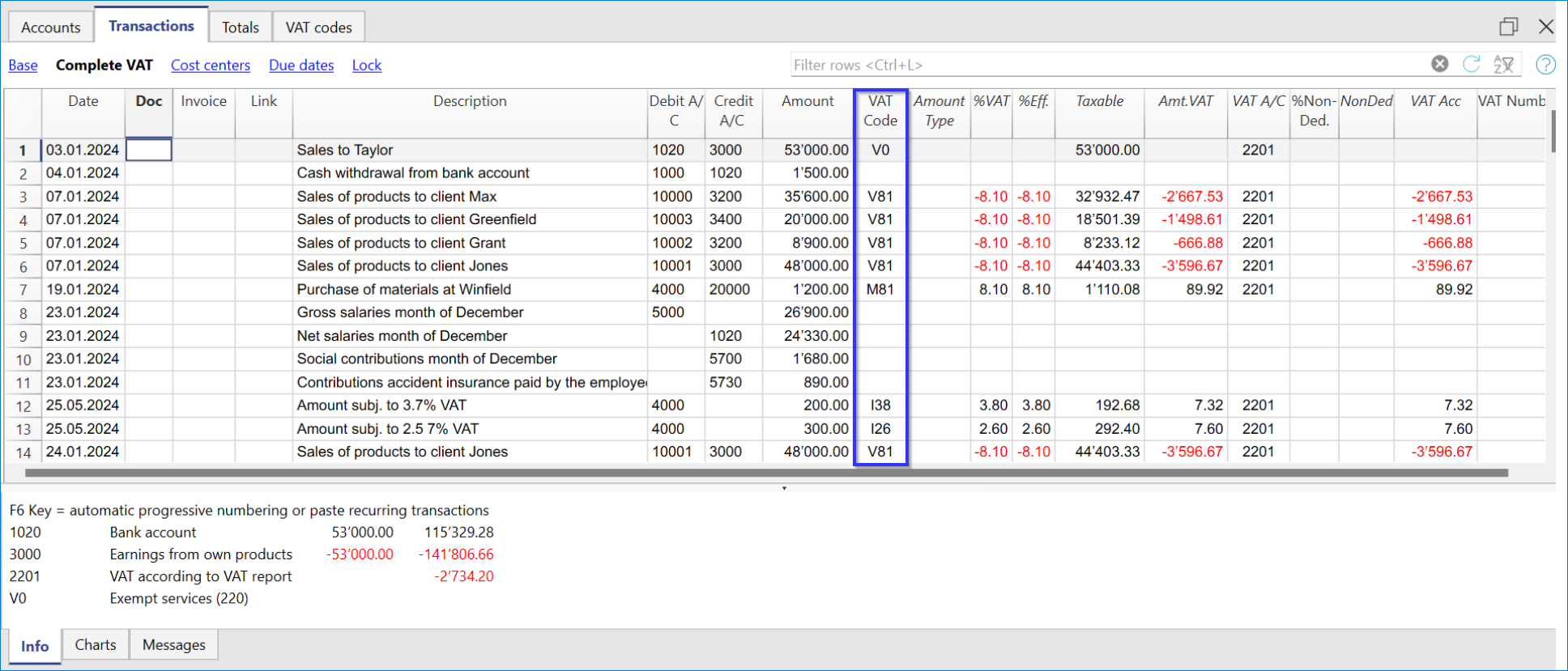

Before entering transactions with VAT, you must keep in mind all the information on the Transactions page.

Entering a VAT transaction is very easy:

- Enter the date, document number and invoice number in the respective columns

- Enter the description, the Debit account and the Credit account

- Enter the gross amount (including VAT)

- Enter the VAT code provided for the type of transaction (purchases, sales, investments...) and present in the VAT Codes Table.

How to correct VAT transactions

In case of an error in a transaction with VAT, it is possible to correct it directly on the transaction row, provided that no VAT declaration has been submitted or no accounting lock has been executed.

If however your accounting file is locked or if you have already sent your VAT declaration, you cannot simply delete the wrong transaction, but you need to operate some cancellation-transaction and then re-enter the correct transaction.

In order to rectify VAT operation(s), you need to:

- Make a new transaction by inverting the Debit and Credit accounts used in the wrong transaction.

- Enter the same amount.

- Enter the same VAT code but preceded by the minus sign (ex.: -V81).

- Enter a new transaction with the correct accounts, amount and VAT code.

Depending on the entity of the mistake, you should consider informing your local VAT office; usually they ask you to download a specific form for correcting mistakes in the previous VAT period that you already declared.

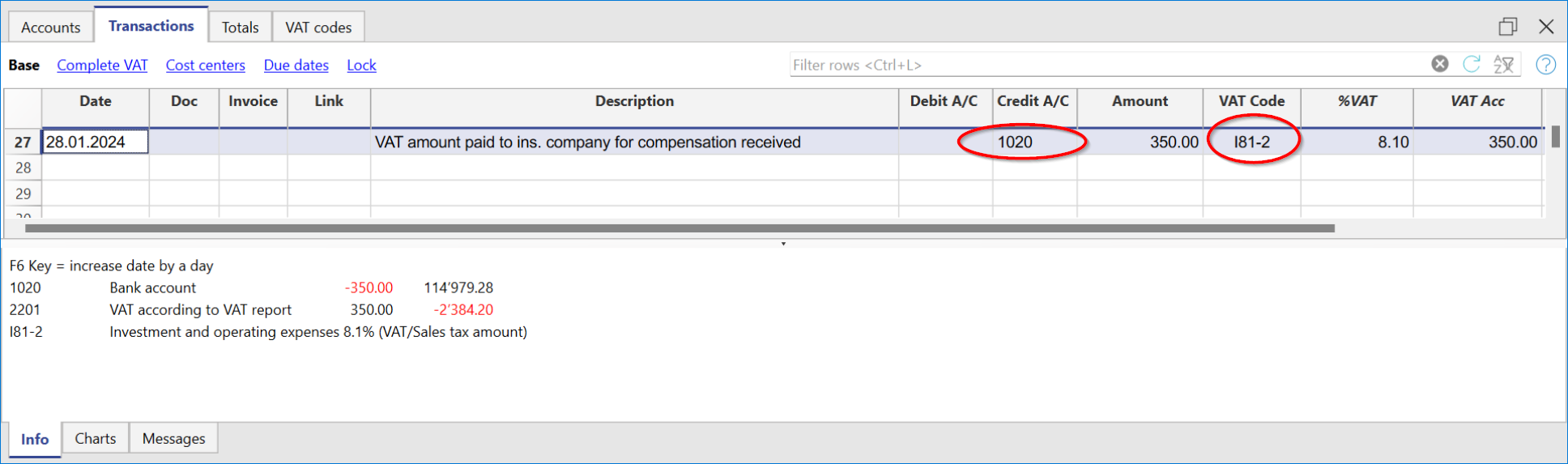

How to only enter the VAT amount

There are cases where only the VAT amount needs to be recorded, such as when you receive compensation from the car insurance.

In these cases, you can proceed as follows:

- Enter the date, document number and description in the appropriate columns.

- In the Credit A/C column enter the account used to pay the VAT amount (the Debit A/C column remains empty).

- In the Amount column enter the VAT amount to be paid.

- In the VAT code column enter the VAT code I81-2 (the code that refers to 100% amount VAT).