In diesem Artikel

Um Buchungen mit Mehrwertsteuer/Umsatzsteuer in Banana Buchhaltung zu erfassen, müssen Sie eine Einnahmen-Ausgaben-Vorlage mit aktivierter Option 'MWST/USt-Verwaltung' verwenden.

Diese Vorlagen enthalten bereits alle notwendigen Einstellungen:

- Die Tabelle Konten umfasst die Standardkonten für die Schweizer MWST-Abrechnung sowie das Konto für die geschuldete MWST.

- Über das Menü Datei > Eigenschaften (Stammdaten) > Registerkarte 'MWST/USt' ist das Abrechnungskonto MWST (automatisch) hinterlegt.

- Die Tabelle MWST/USt-Codes enthält bereits aktuelle MWST/USt-Codes entsprechend den geltenden Vorschriften.

Bewegungen mit MWST/USt erfassen

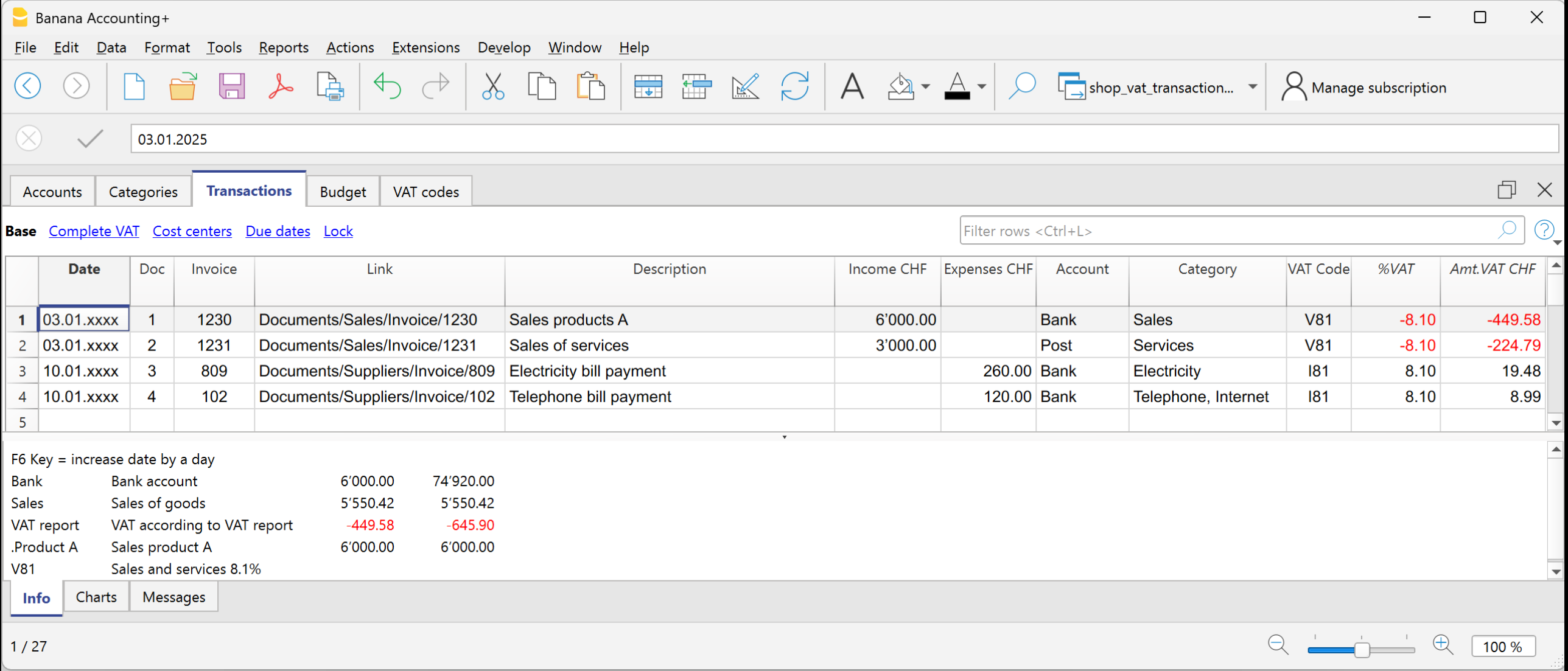

In der Tabelle Buchungen stehen spezielle Spalten für MWST/USt zur Verfügung. Aktivieren Sie die Ansicht Komplett, um alle relevanten Spalten anzuzeigen.

Für jede Buchung geben Sie Folgendes ein:

- Datum → Das Datum des Belegs (z.B. Rechnung, Quittung usw.).

- Beleg → Die Belegnummer (falls vorhanden).

- Rechnungsnummer → Die Rechnungsnummer des Kunden oder Lieferanten.

- DokLink (Verknüpfung) → Pfad zur PDF-Datei des Dokuments.

- Beschreibung → Kurzer Text zur Beschreibung der Transaktion (z.B. Warenverkauf, Mietzahlung).

- Einnahme/Ausgabe → Der erhaltene oder bezahlte Betrag.

- Konto → Ein Konto aus der Konten-Tabelle, das mit der Buchung verknüpft ist (z.B. Kasse, Bank).

- Kategorie → Beschreibt den Grund für die Einnahme oder Ausgabe. Die Kategorie (z.B. Verkäufe, Mieten) wird aus der Kategorien-Tabelle ausgewählt.

- MWST/USt-Code → Gibt den anzuwendenden Steuersatz an:

- V81 → Verkäufe

- M81 → Einkäufe im Zusammenhang mit der Haupttätigkeit

- I81 → Einkäufe im Zusammenhang mit Investitionen oder allgemeinen Kosten

MWST/USt-Code automatisieren

Um die Buchungserfassung zu beschleunigen, kann der MWST/USt-Code automatisch eingefügt werden.

So gehen Sie vor:

- Öffnen Sie die Tabelle Konten bzw. Kategorien.

- Öffnen Sie das Menü Daten > Spalten einrichten und aktivieren Sie die Spalte MWST/USt-Code.

- Tragen Sie in den gewünschten Zeilen den passenden MWST/USt-Code ein. Der verwendete Code muss in der Tabelle MWST/USt-Codes vorhanden sein.

Beispiele für die Schweiz:- Bei Konten für Vermögensgüter-Einkäufe → I81

- Bei Verkaufskategorien → V81

- Bei Einkaufskategorien → M81 oder I81

Sobald Sie diese Codes hinterlegt haben, erkennt das Programm beim Erfassen von Buchungen automatisch das verwendete Konto oder die Kategorie – und trägt den entsprechenden MWST/USt-Code automatisch ein. Die Berechnung der MWST/USt-Werte erfolgt sofort.

Weiterführende Informationen

- MWST/USt-Zusammenfassung

- MWST-Verwaltung Schweiz

- Verschiedene Schweizer MWST-Buchungsfälle (basierend auf der doppelten Buchhaltung)

- Schweizer MWST-Abrechnungen → Nur im Advanced-Aboplan verfügbar.