In this article

Credit Card with an accounting using the Cash principle

If no down payments are made on the credit card and the invoice is paid in full by the bank, you should record the credit card invoice at the time of payment when the costs should also be recorded.

You need to record on several rows:

- Enter the same date and the same Document No. for each transaction on all the rows that make up for the transaction.

- In the Debit column, enter one account per row, referring to the cost or investment of the credit card transaction.

- Enter the amount of each single transaction recorded in Debit.

- In the Credit column, enter the bank or post office account with which the invoice is paid.

- In the Amount column, enter the total amount paid on the credit card invoice.

- In the case of VAT liability, enter the VAT code for each row in the VAT Code column.

After recording all movements, check your credit card balance by opening the credit card account card.

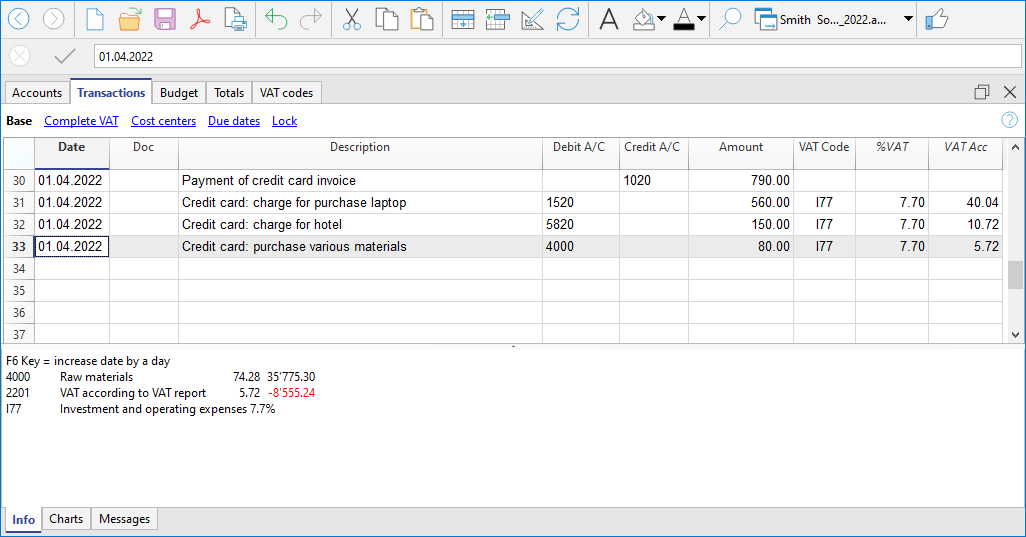

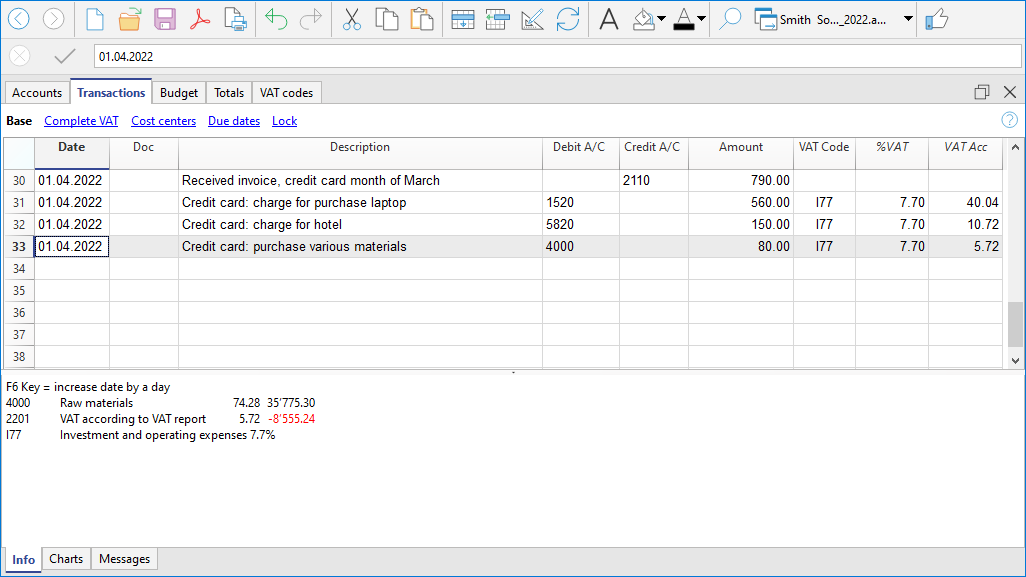

Credit card and turnover accounting

If the accounting postings are based on turnover, all costs related to credit card purchases are recorded upon receipt of the credit card invoice:

- Enter the same date and the same Document No. for each transaction for all the rows that make up for the transaction.

- All cost accounts are posted as a Debit. Each cost must be recorded on one row.

- In the Amount column, enter the amount of the single transaction recorded in Debit.

- Register your credit card account, as a Credit, as any supplier.

- In the Amount column, enter the total amount to be payed by the credit card.

- In the case of VAT liability, enter the VAT code for each row in the VAT Code column.

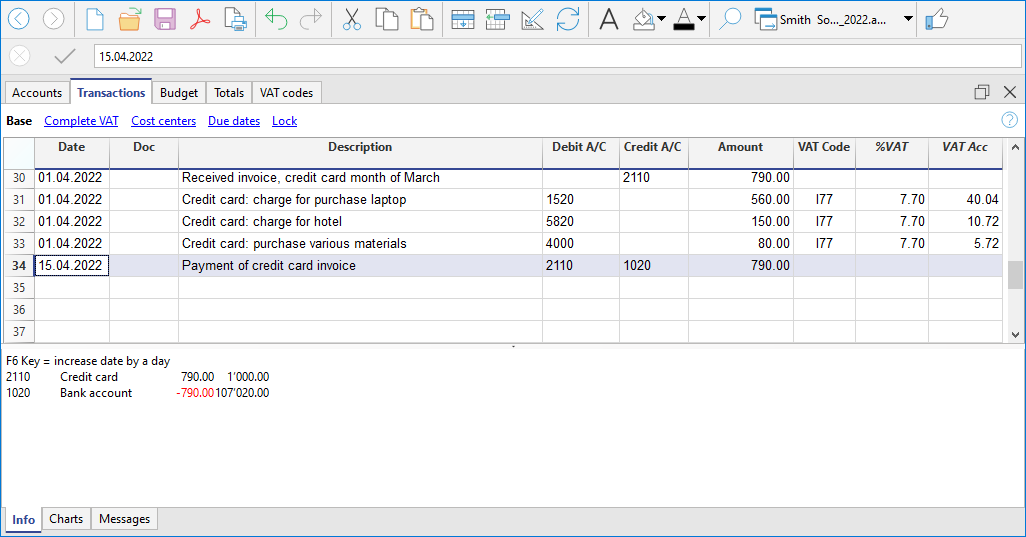

When the credit card bill is paid, enter the payment:

- As Debit in credit card account (the debt is extinguished).

- As Credit in the bank or post office account with which the invoice is paid.

- The total amount of the credit card paid is entered as the amount.