In this article

Customer management in Banana Accounting Plus allows you to record, organise, and manage customer information and allows you to keep track of customer transactions and payments, payment due dates, and contact information. You can track customer payments, update the payment status of issued invoices as well as enter and print invoices.

Customer management is a feature available in all accounting applications of Banana Accounting Plus, but it is especially used in double-entry accounting.

Please also visit Supplier management

Recording customer transactions

The Transactions table is the heart of Banana Accounting and is used to record all transactions, including customer transactions, simply by entering the customer's account. You work quickly because you can select, copy and paste customer transactions that have already been entered previously. If you make mistakes you can correct them so it is easy to record:

There are columns for entering various information, as:

- The date of the transaction, due date, expectation date and payment date.

- The Invoice Number.

- The Debit and Credit Account where to indicate the customer account and the counterpart.

- The amount.

- The VAT codes for the automatic calculation of VAT.

- Links to digital documents (e.g. the invoice issued to the customer, or notes in pdf).

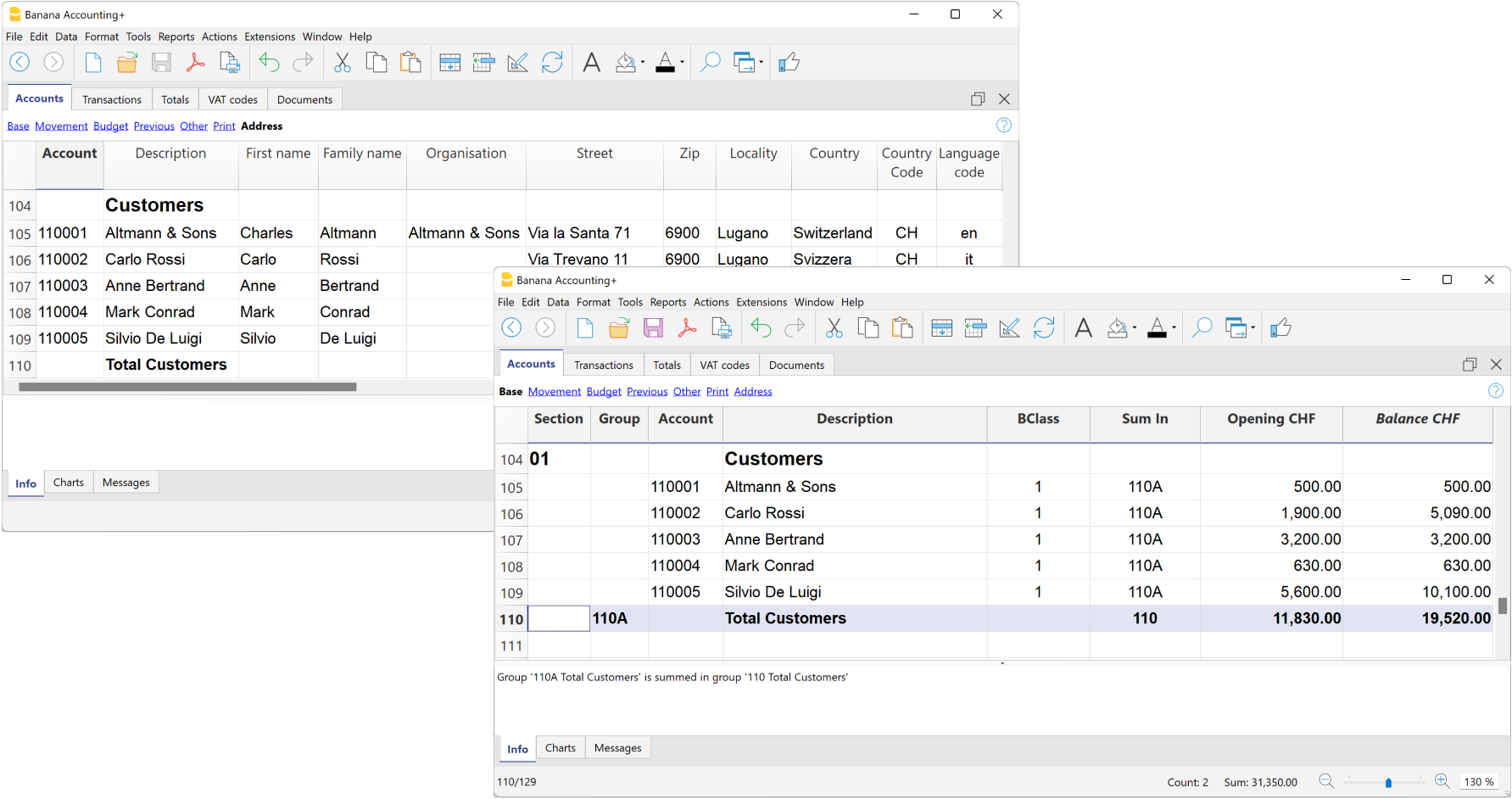

Customer accounts

Customer accounts are used to record all transactions relating to the customers of a company.

The main functions of customer accounts are as follows:

- Create an account for each customer and keep track of all transactions made.

- Record the invoices issued for each customer.

- Record customer payments and associate them with the invoices issued.

In Banana Accounting:

- Customer accounts and addresses (first name, surname, company name, address, customer language, VAT number, etc.) are set up in the Accounts table.

- Account movements on the accounts are entered in the Transactions table.

- After each entry, all customer account balances (Accounts table) are automatically updated and you immediately have an overview of the outstanding balances.

Recording issued invoices

The invoice is used for accounting and tax purposes, as it allows you to accurately record the company's revenues and expenses, and to calculate sales or purchase tax.

If you issue invoices in Word, Excel or other programs, you can record the issuance in accounting so that you know what the customer owes and, if necessary, send reminders.

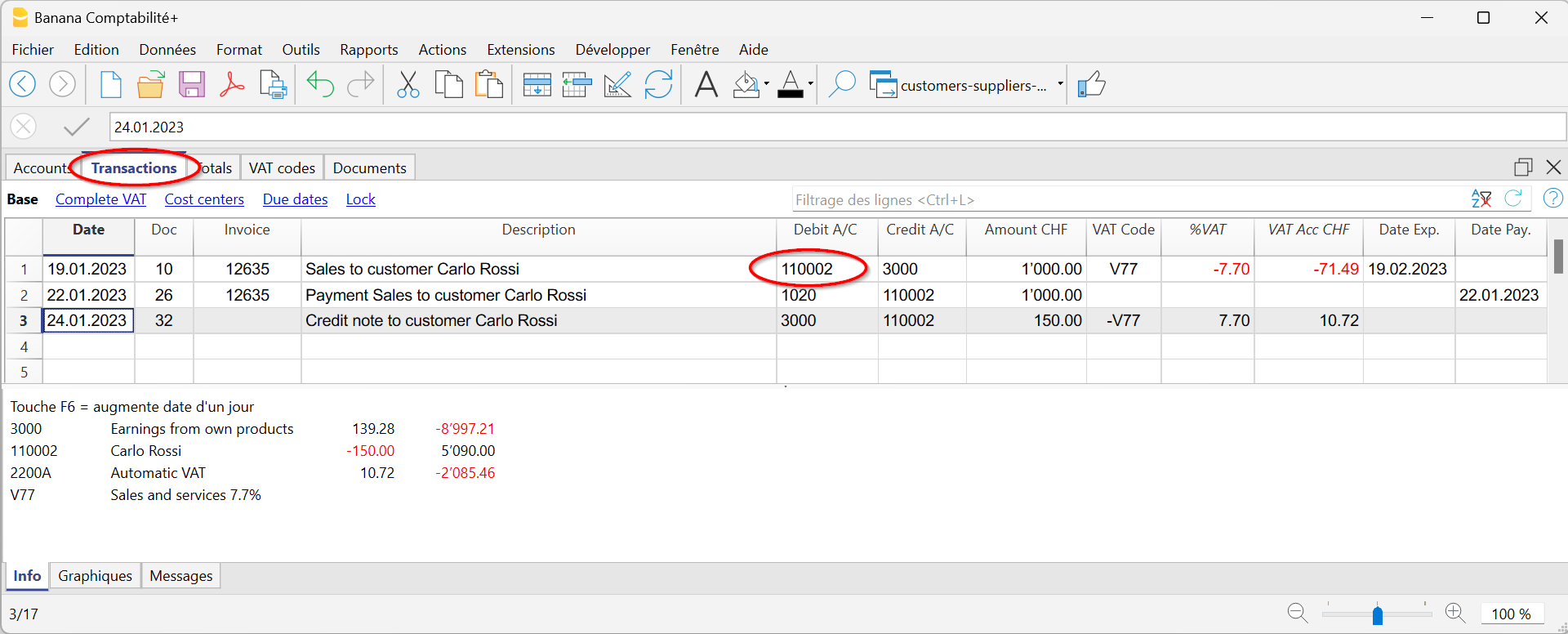

In Banana Accounting, the invoices are recorded in the Transactions table:

- By entering the date and description

- By entering an invoice number

- By recording in the Debit account the customer's account and in the Credit account the revenue

- By entering the VAT code for sales or services. The calculations and VAT amounts are entered automatically.

When the invoice is posted, the programme automatically creates the invoice and prints it out.

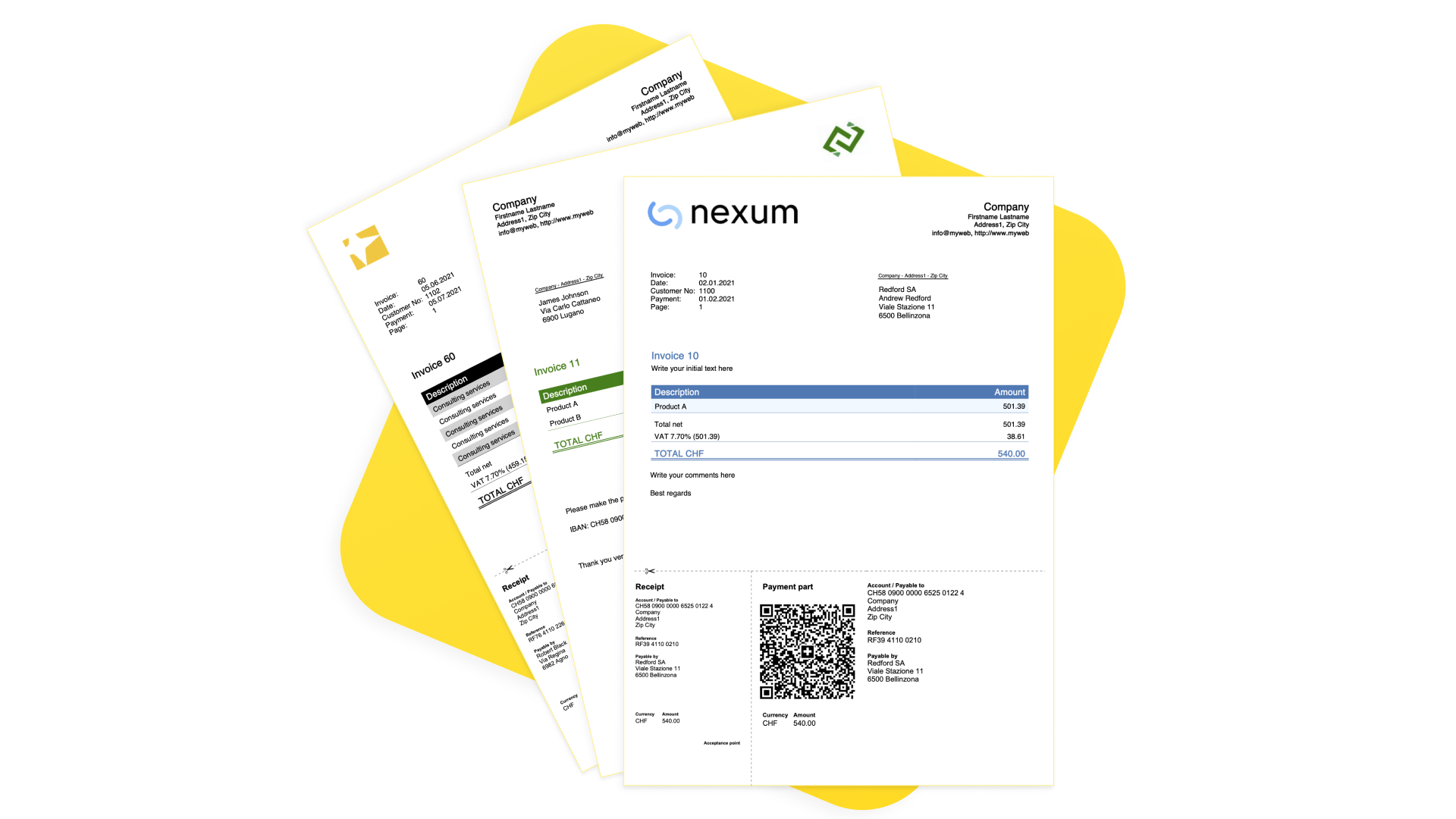

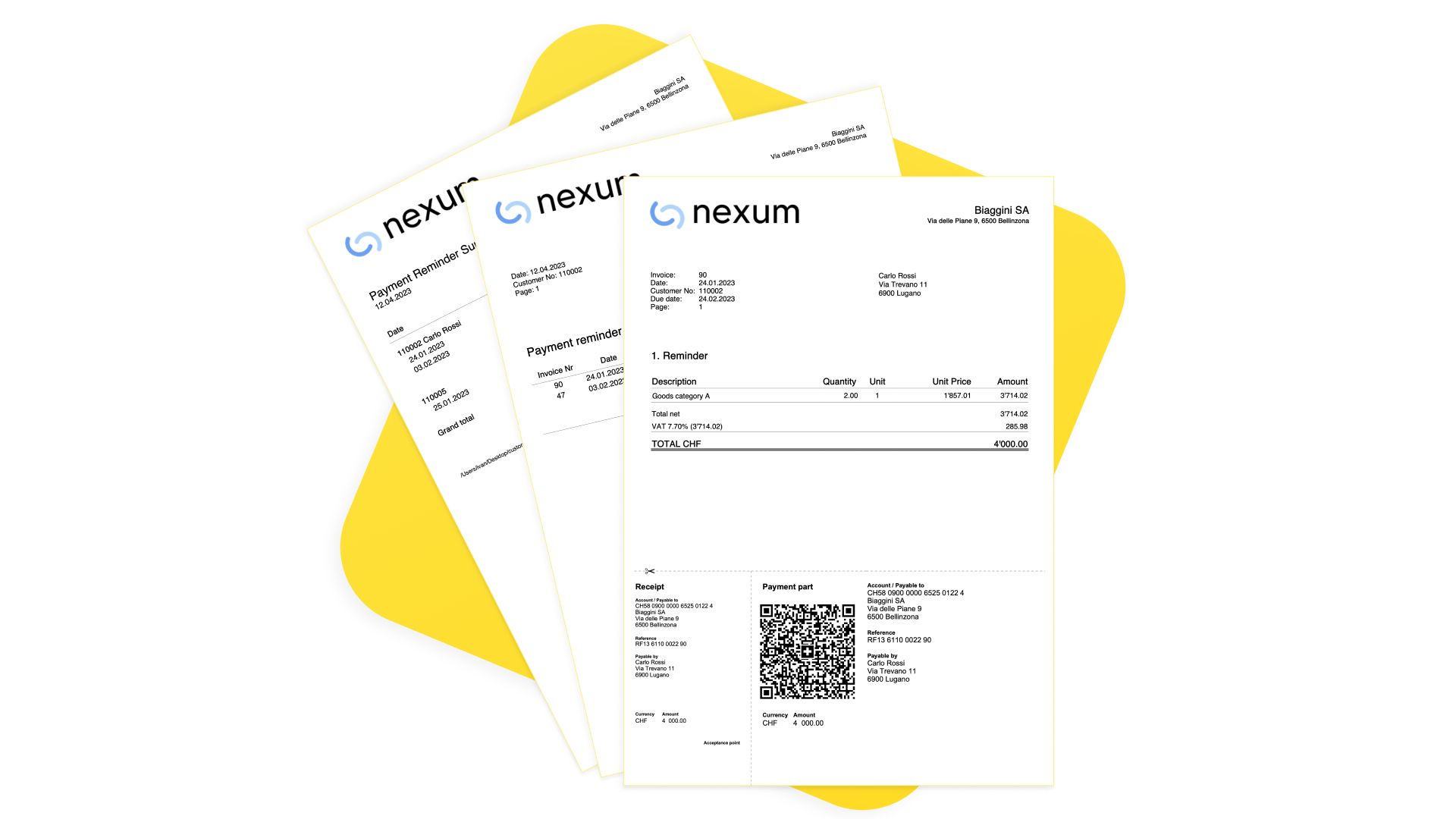

Creating and printing invoices

Directly in the Transactions table, you can also enter transactions to create invoices as simple entries in the Transactions table.

By entering the Debit and Credit account, in addition to printing the invoice, you have the accounting of the invoice in the accounting file at the same time.

From the menu, Reports > Customers > Print Invoices, you can:

- Preview and print the invoice.

- Choose the Print Layout and set other information to customise the printout, such as the QR Code.

More customisation is possible with the Advanced plan.

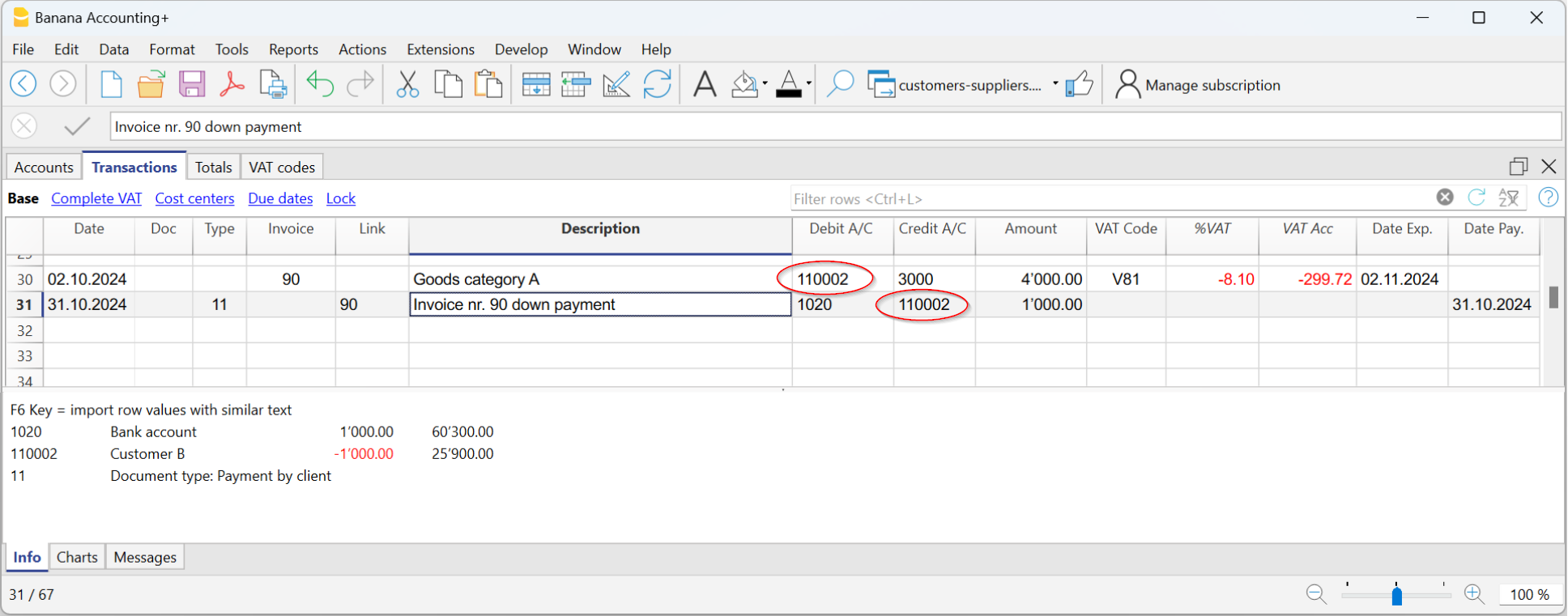

Recording collections

In Banana Accounting, collections are recorded in the Transactions Table in one of the following ways:

- Manually:

- The date and description are recorded

- In the Invoice column, by entering the customer's account, a drop-down menu displays the invoices still open, simply select the invoice collected and press the Enter key, the program automatically enters the customer's account in Credit, and the amount of the invoice. Then simply enter the cash account in Debit to complete the transaction.

- Importing Data from Account Statements with Rules

- The programme imports data from ISO 20022 account statements and with the use of Rules the programme enters the complete entry, entering all data, without manual intervention.

Open invoices

Open invoices per customer are issued invoices that remain open or outstanding because the customer has yet to make full payment.

Open invoices per customer can be managed via an accounting ledger that keeps track of invoices issued, payment due dates and payments received. In this way, the seller can monitor the financial situation of each customer and send payment reminders if invoices remain open for too long.

It is important to note that open invoices per customer can affect the liquidity of the seller's company, as the money tied up in these invoices has not yet been collected.

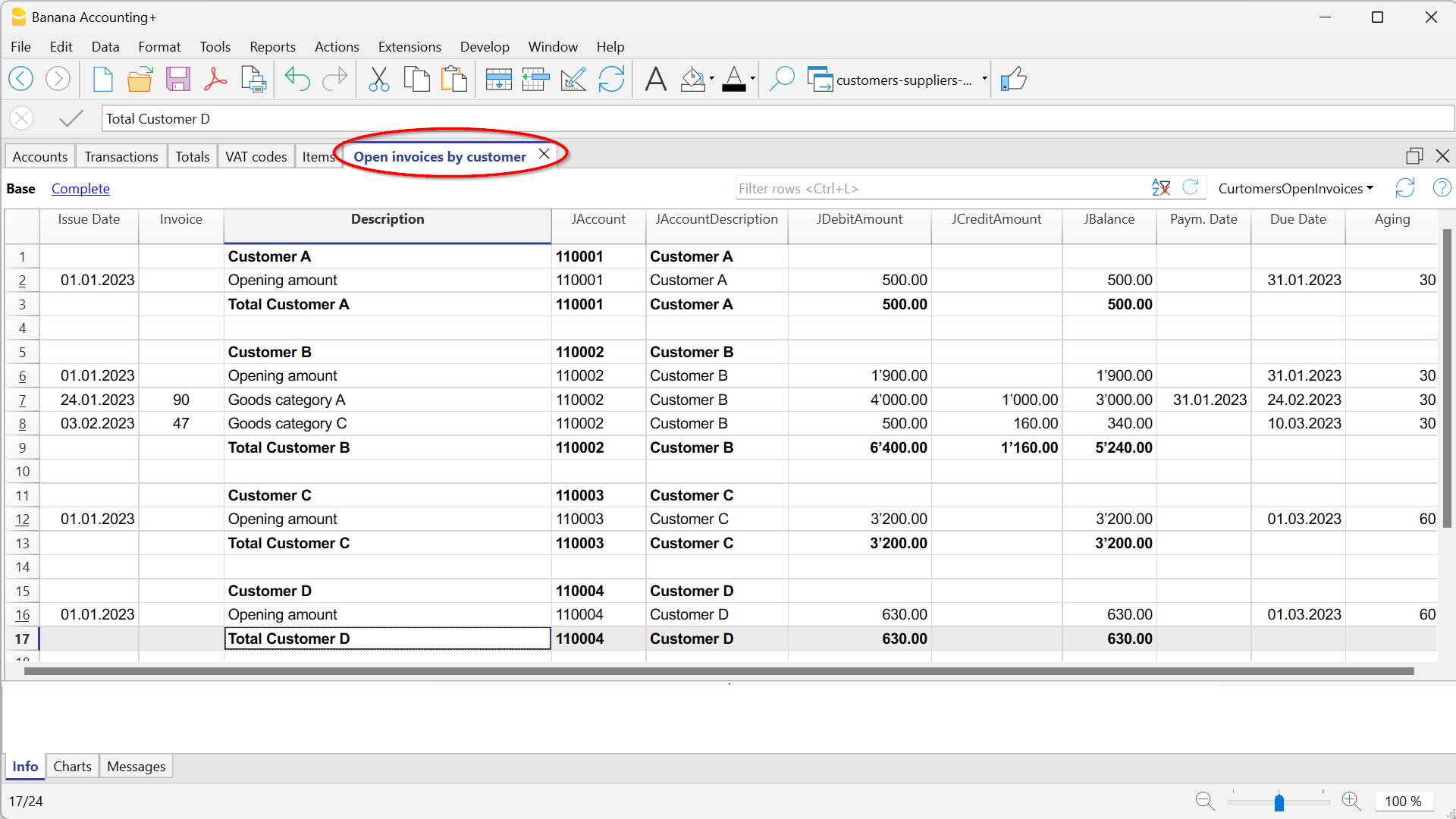

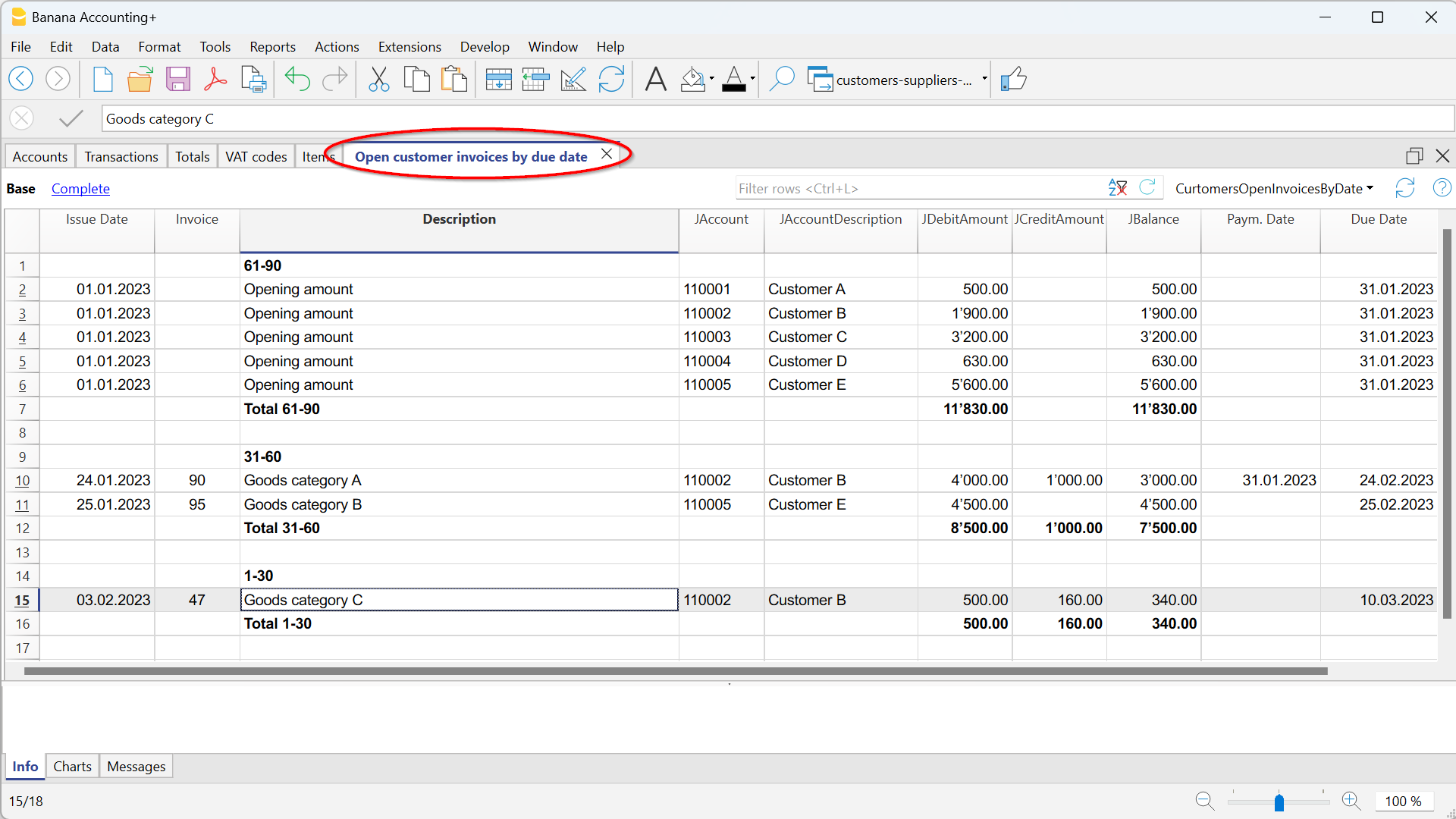

Banana Accounting automatically generates an open invoice report where you can immediately see which invoices are still outstanding and from which customer, as well as the total amount of outstanding invoices.

There are two types of reports:

- Open invoices by customer, where all open invoices for each customer are listed.

- Open invoices by due date, where open invoices are listed in order of due date.

The due date of an invoice can be set in different ways. More information can be found on the following page Due dates and payment terms

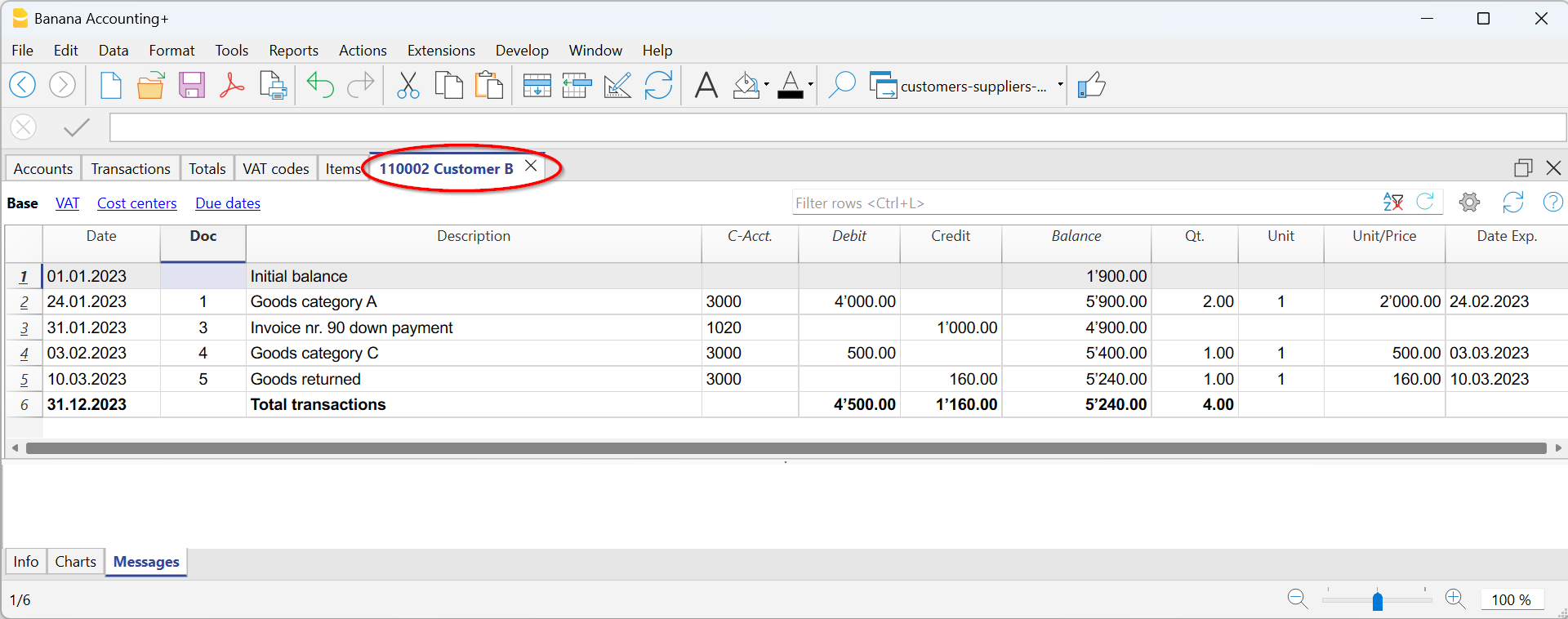

Account card

Account cards are documents used in accounting that record the financial transactions of a company. Each card represents a specific account in the company's general ledger and contains detailed information on the transactions involving that account, such as the date of the financial transaction, the type of transaction, the amount and the description of the transaction.

In Banana accounting, on the basis of the data entered in the Transactions table, the programme automatically prepares the Account card for each customer, where the opening balance, all transactions and relative closing balance are shown. You can also have the account card by period.

Reminders

Payment reminders are used to request customers to pay overdue or outstanding invoices.

Through the function of payment reminders you speed up the payment process from customers, reducing delays, and at the same time effectively manage cash flow.

Banana Accounting provides functions to:

- Identify overdue or outstanding invoices.

- Generate payment reminders.

- Customise payment reminders.

In Banana Accounting Plus you can print recalls in two different ways:

- With Reminder layouts

- Print reminder summary (list of overdue invoices).

- Print without QR payment slip.

- Limited customisations.

- Function available in Banana Accounting Plus - any plan (excluding Free plan limitations).

- With Invoice layout

- Print with QR payment slip.

- Layout customisations.

- Requires Banana Accounting Plus Dev-Channel version and Advanced plan.

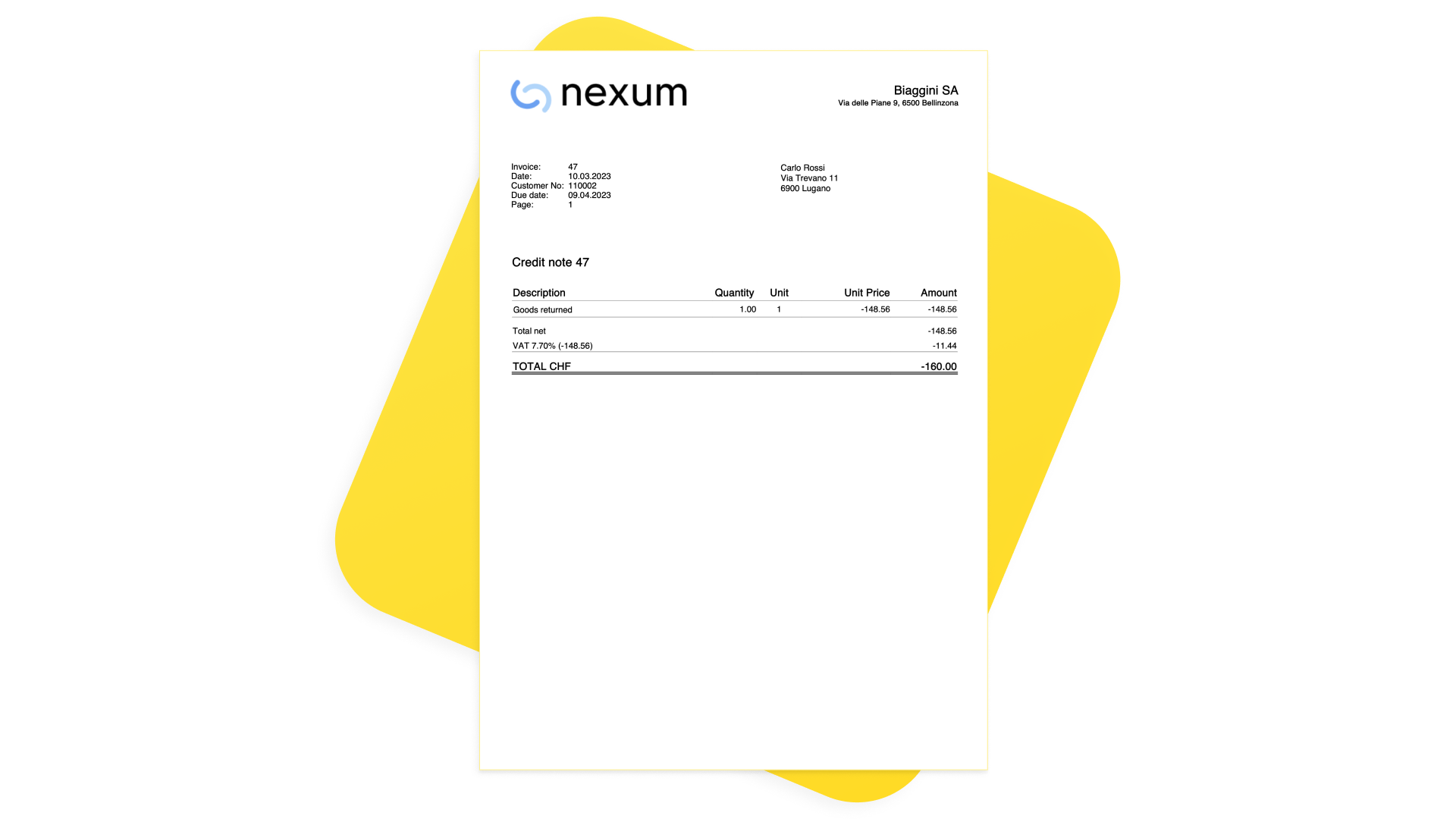

Credit notes

A credit note is an accounting document used to correct or cancel an invoice already issued. It may be issued for a number of reasons:

- Reimbursement of an overpayment

- Reduction in the price of a product or service

- Product return

- Correction of an invoicing error

In Banana Accounting you account for credit notes in the Transactions table, entering the revenue account in the Debit account and the customer account in the Credit account; the VAT code must be entered with a minus sign in front, so that the VAT amount is reversed at the same time.

The programme uses the accounting entry of the credit note to automatically create a printout of the credit note.

Setting up and using the customers and invoices features

- Setting up accounting on actual bills issued (accrual principal) or

- Setting up accounting on a collected cash basis.

- Setting up Customers settings.

- Setting up the Transactions table and entering the invoices.

- Reports for open, overdue and issued invoices.

- Generating invoices.

Notes

- Multi-currency accounts: reports are based on the customer's account currency balances; possible exchange rate differences will not be taken into account.

In the Issued invoices table, the recordings of exchange rate differences are also listed, whereas only the customer's currency amount is used in other printouts.

Example file

Customers' register and checking of open invoices

Directly in the accounting you can:

- Prepare customers' accounts, with the related addresses and other customers' data.

- Add to the transactions:

- the data related to the issued invoices (invoice number, customer, amount, due date).

- the data related to the payment for the invoices and the issuing of credit notes, if any.

- Retrieve the list of your Payments schedule

Other features available: