In this article

Introduction

Banana Accounting allows you to manage the customers both on an accrual or cash method. A detailed explanation is available at the page Accounting with accrual or cash method.

The following explains how to set up separate accounts for each customer and a group for customers, so that you can have a list of separate invoices per customer available.

In case you only have few invoices and don't want to keep a detail per customer, you may also keep one single account only to record all customer invoices. The list of invoices will thus apply for all customers and not for any single customer.

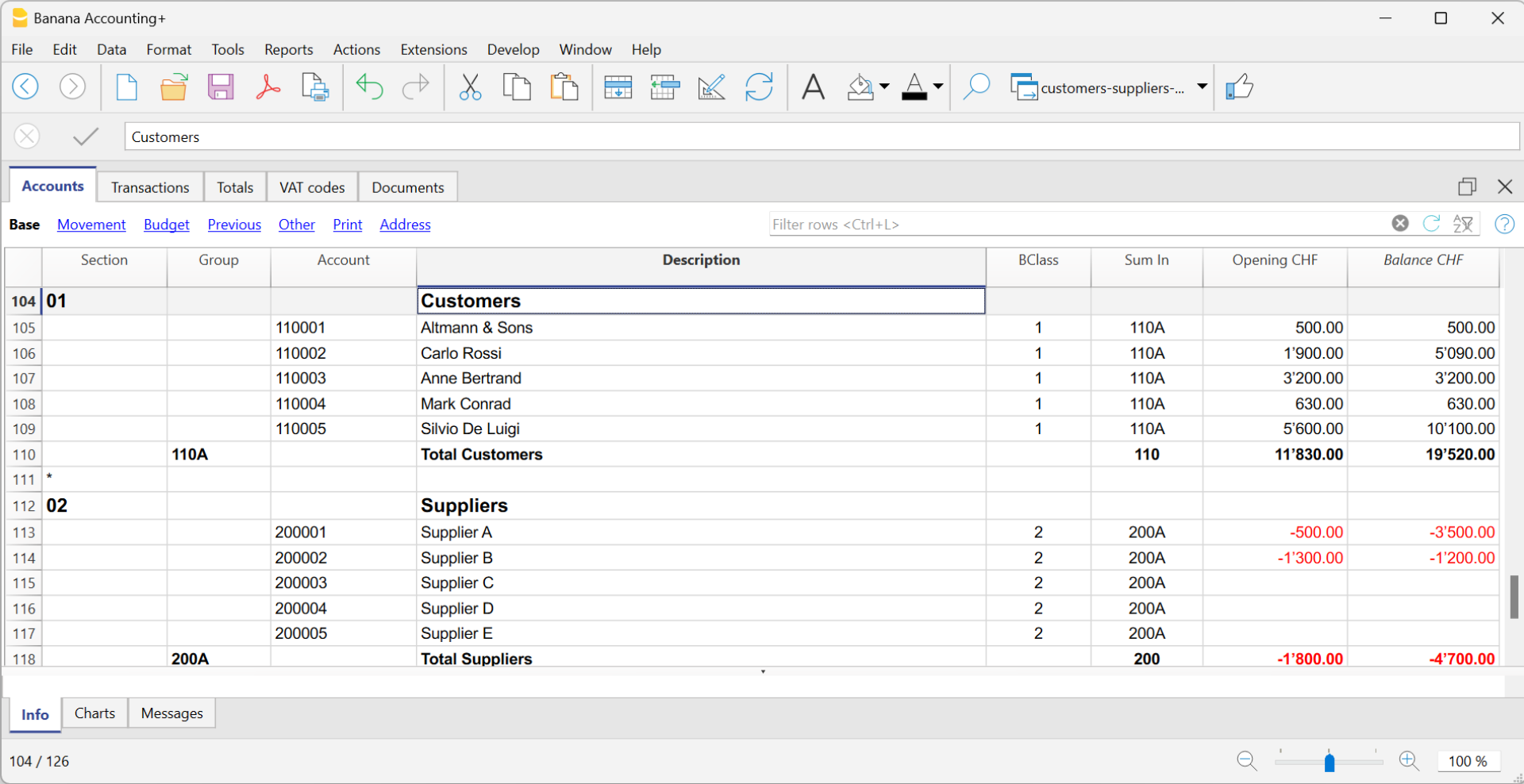

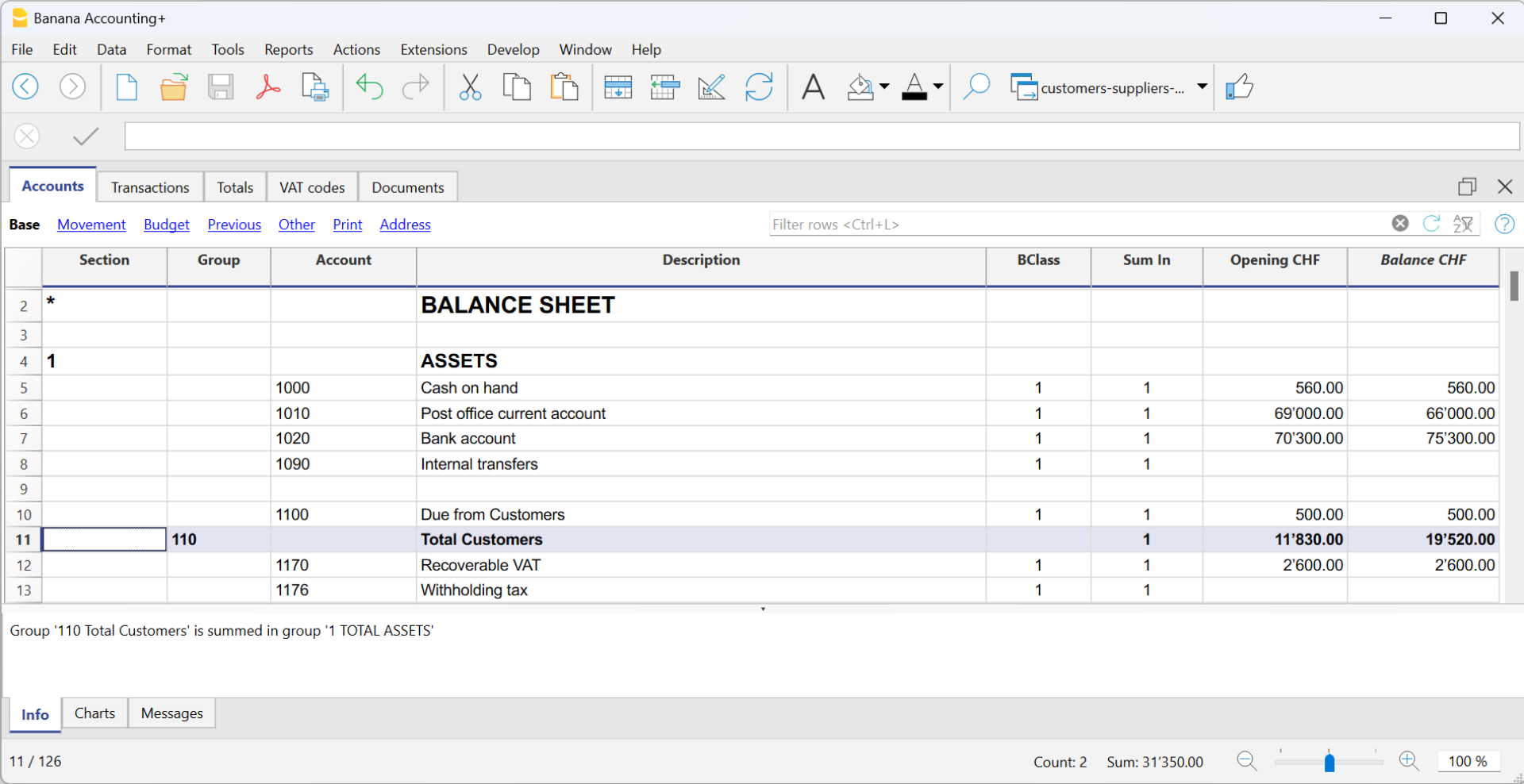

Setting up the Customers' register

The customer ledger with its accounts and/or groups is inserted at the end of the chart of accounts with a separate section.

The following settings must be added to create the ledger:

- A * section (header) (see Sections)

- A 01 section for the Customers (see Sections)

- The Customers accounts that are required (see Adding a new account). Each customer will be allocated one row in the Chart of Accounts and a his/her single account number. Account numbers is at your discretion (see Accounts) it is however advisable to use numbers only, especially for the management of payments.

- A group where all customer accounts are totaled.

- This group, in turn, is totaled into a group present in the Assets.

Alternatively, customer accounts and/or groups can be entered directly in the assets section.

- The total for Customers will be totaled in the summary group 110A of the Sum in column.

- The same code or number used in the Sum in column (110A), must be used in the Assets Group column, in the row corresponding to the Total Customers of the Balance Sheet.

- The groups' numbering can be freely chosen (see Groups).

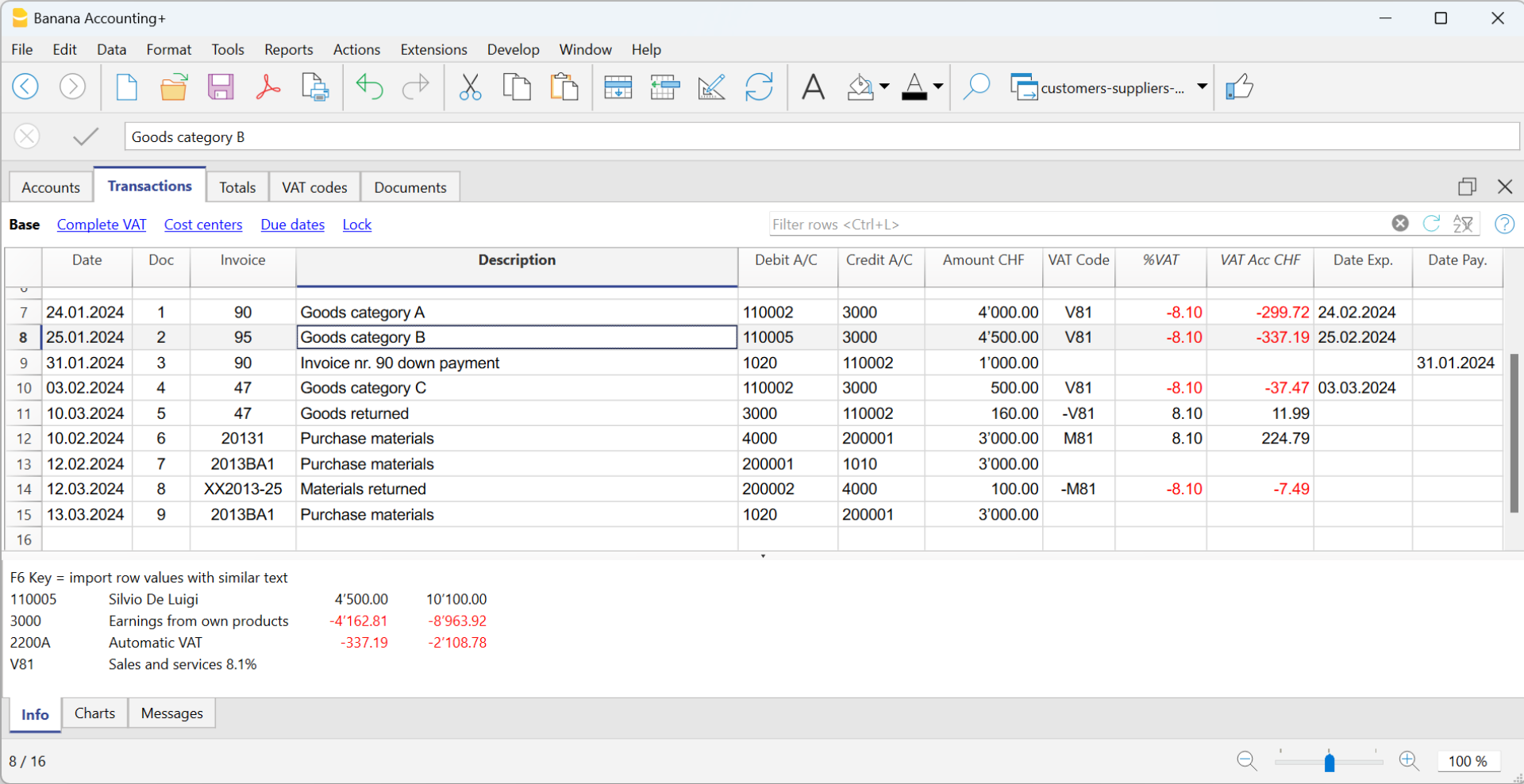

Recording an issued invoice

The issued invoice is registered by entering the following data in the respective columns:

- Date of the invoice and any document number

- Invoice number - It is very important to enter the invoice number in the Invoice column, because it is used to automate the various customer reports and to automatically close the customer's open invoice when recording the payment.

- Customer account in Debit and Revenue account in Credit

- The VAT code corresponding to the sale.

Recording a payment

There are two ways to record the collection of a customer invoice:

- Manual recording of customer invoice collection.

- Automatic recording with data import from account statement in ISO 20022 format.

The collection of a customer invoice is recorded by entering the following data in the respective columns:

- In the Date column enter the transaction date

- In the Type column enter 11 (customer payment)

Note: If an advance payment is to be recorded by the customer and is to appear on the invoice, the cell in the Type column must remain empty. - In the Invoice column enter the paid invoice number.

- With a double-click on the cell, the program will show a list of all open invoices.

Alternatively, you may also press the F2 button. If the F2 button doesn't work, you need to activate your customers/suppliers settings, by entering your customers register group, via the Reports menu → Customers → Settings. - Select the number of the paid invoice. The program will automatically enter:

- In the Description column, the payment description

- In the the Credit account column, the customer account number

- In the Amount column, the invoice amount.

If the entered amount does not include VAT and the customers are set up as cost centers, you must configure the cost centers correctly to use the amount with VAT in File and accounting properties (basic data), VAT/Sales tax tab. See also VAT amount with cost and profit centers.

- With a double-click on the cell, the program will show a list of all open invoices.

- In the Debit column, you must manually enter the conra account (the bank account where the amount has been credited).

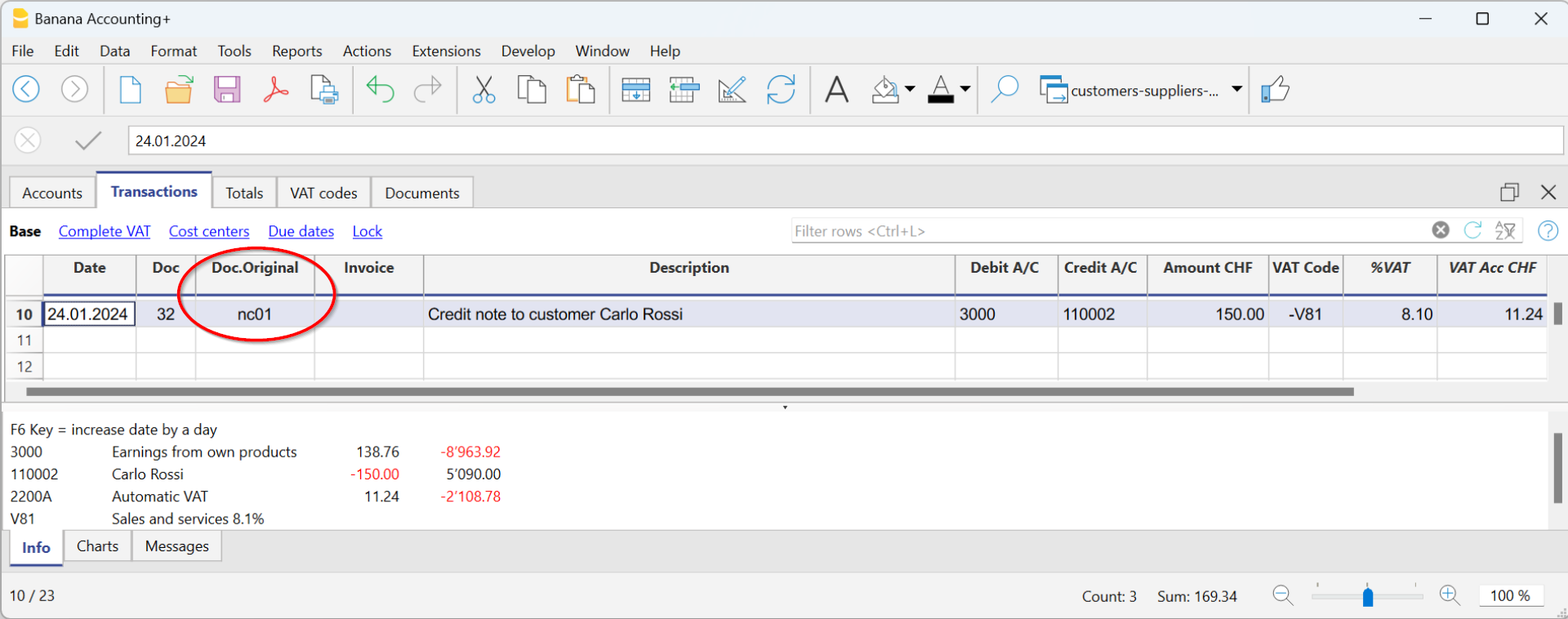

Recording a credit note

In order for the amount to be deducted from the initial invoice, the same invoice number must be used.

- If the adjustment document (for example a credit note) has a different numbering that you still need to keep available, write this reference in another column, for example Doc Original.

- Enter data for the columns Date, Doc., Original Doc, Description

- The VAT Code must be preceded by the minus sign "-" so that the VAT operation is reversed, or use a specific VAT Code for debit notes (set in the VAT Codes table).

Note: to print the credit note to be sent to the customer, it is necessary to indicate in the DocType: 12 column, see Entering a credit note.