In this article

The Cost and Profit Centres of Banana Accounting Plus are used to analyse and monitor the performance of different areas or divisions of a company: organisational units, departments and branches, even if they are not related to each other. They allow records to be catalogued according to different criteria than normal accounts. The main objective is to minimise operating costs and optimise revenues, while guaranteeing the quality and efficiency of services.In Banana Accounting Plus, the cost and profit centre feature is available in all accounting applications.

Cost centers and profit centers are used solely for internal information purposes to monitor and control operating costs; therefore, they are not included in the Financial Statements.

▶ Video: Cost and profit centers

If you wish to have a Balance sheet broken down by projects, sectors or branches, we recommend using Segments.

Registering transactions in cost/profit centers

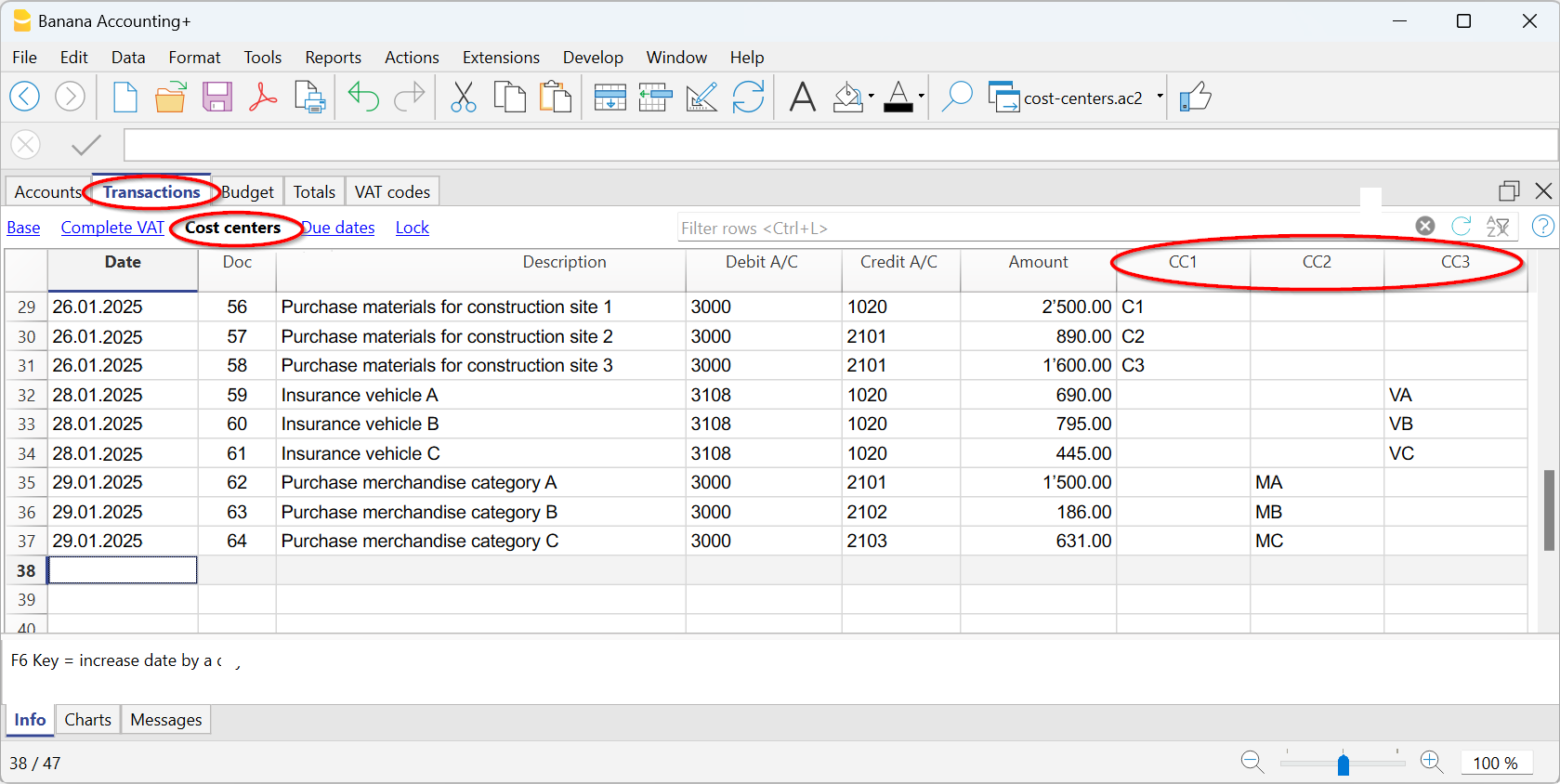

In Banana Accounting, cost/profit centers are recorded in the Transactions table, specifying the accounts related to the cost/profit centers in the appropriate columns, as set in the Accounts table. Cost centers are attributed to the transaction row and can be used simultaneously with segments.

Here are the most frequent uses:

- Cataloging specific expenses

- Events and manifestations

- Clients, suppliers, members

- Additional details for certain expenses (e.g., accessory expenses)

The columns for entering data are located in the Cost Centers view. If they are not visible, you can display them from any view via the menu Data > Columns setup. Three different columns are available: CC1, CC2, CC3, each of which is independent of the others.

For registration, proceed by entering:

- The date, the description, and other usual elements

- The Debit and Credit account

- The amount and any applicable VAT code

- In the appropriate column (CC1, CC2, CC3), enter the cost/profit center account without the preceding punctuation.

- To record a credit on the cost/profit center, precede the cost center with a minus sign.

In the Income/Expenses accounting and the Cash Manager, you can set the option Record (+/-) cost centers as categories so that the cost centers follow the sign of the category.

If an overall amount needs to be divided among multiple cost/profit centers at the same level, multiple transaction rows must be created. Each row specifies the amount to be allocated to the cost/profit center and the relevant account.

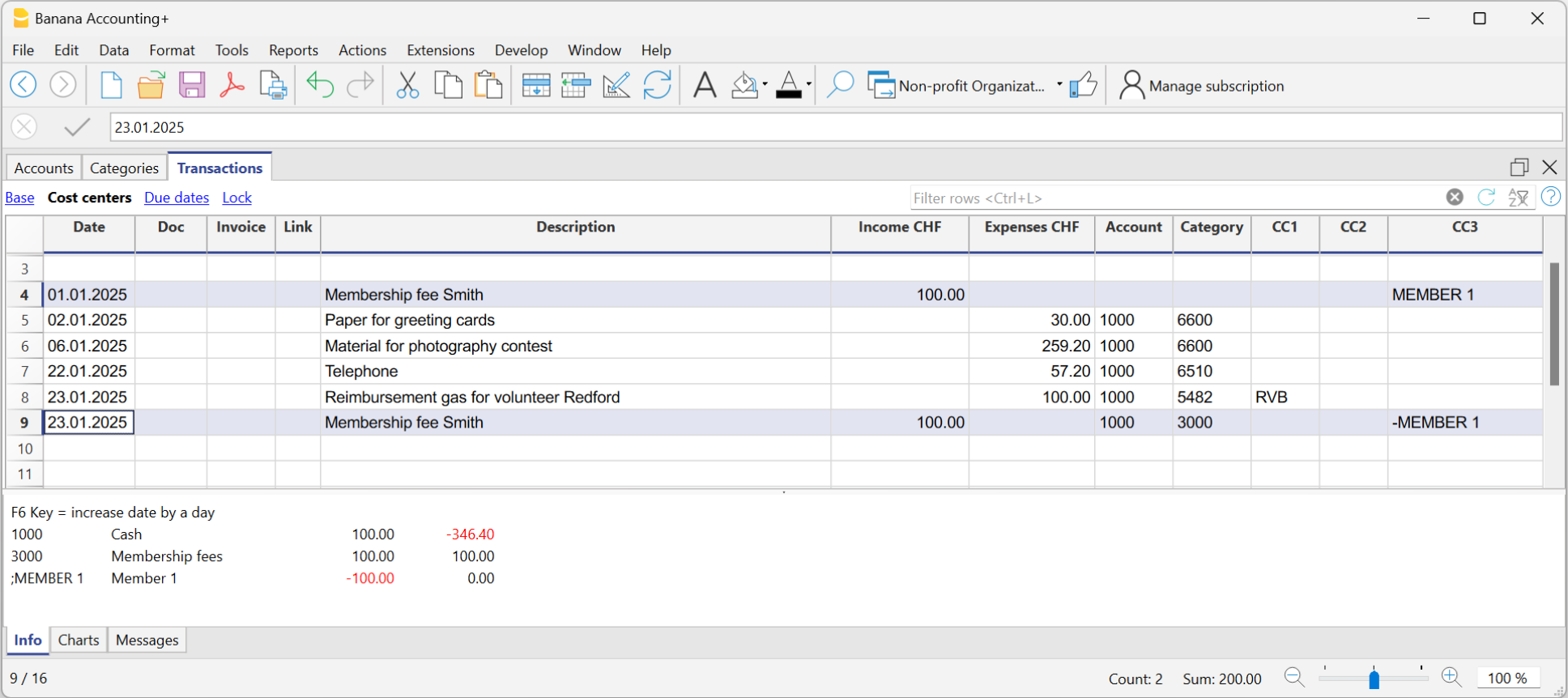

Recording cost centers in the Income & Expense Accounting and Cash Manager

In the Income & Expense accounting, cost centers can be set either in the Accounts table or in the Categories table, depending on the purpose for which they are created:

- Cost/profit centers related to customers/suppliers or to members/donors should be set in the Accounts table.

- Cost/profit centers related to expenses or revenues (such as refunds to members, events, projects, etc.) should be set in the Categories table.

To record an entry in a cost/profit center, simply enter the abbreviation or number defined in the Accounts table in the column designated as the cost/profit center.

When an amount needs to be reversed from a cost/profit center, it must be entered in the corresponding column with a minus sign (-) in front of the center’s abbreviation/number.

In the example:

- In the member 1 profit center, the CC3 column contains the abbreviation MEMBER 1 to indicate the credit for the membership fee owed by member 1.

- When member 1’s fee is collected, the CC3 column contains -MEMBER 1, so that the payment is recorded in member 1’s account and the credit owed by member 1 is thus zeroed out.

In the Income & Expense accounting and in Cash Manager, you can enable the option Record (+/-) cost centers like the category so that cost centers follow the category's sign.

However, be cautious when using this option, because if there are transactions that always go into the income or expenses column, while for the cost/profit centers the amount should be reversed, the program will sum up the amounts in the related cost/profit center ledgers.

In the previous example, the membership fee (credit and payment) is recorded in the income column for both entries. However, in the MEMBER 1 profit center, you need to reverse the amount to zero out the credit for member 1.

In this case, if you use the Record (+/-) cost centers like the category option, the balance in the corresponding profit center ledger would be incorrect. Since in both transactions the amount is always recorded in the Income column, in the corresponding profit center ledger it would be added instead of reversed, which is necessary to zero out the credit for member 1. Therefore, in these cases, you should not use this option, but rather manually place a minus sign before the cost/profit center.

It is therefore recommended to use this option only in cases where you are certain that the amount recorded in the cost/profit center aligns with the category.

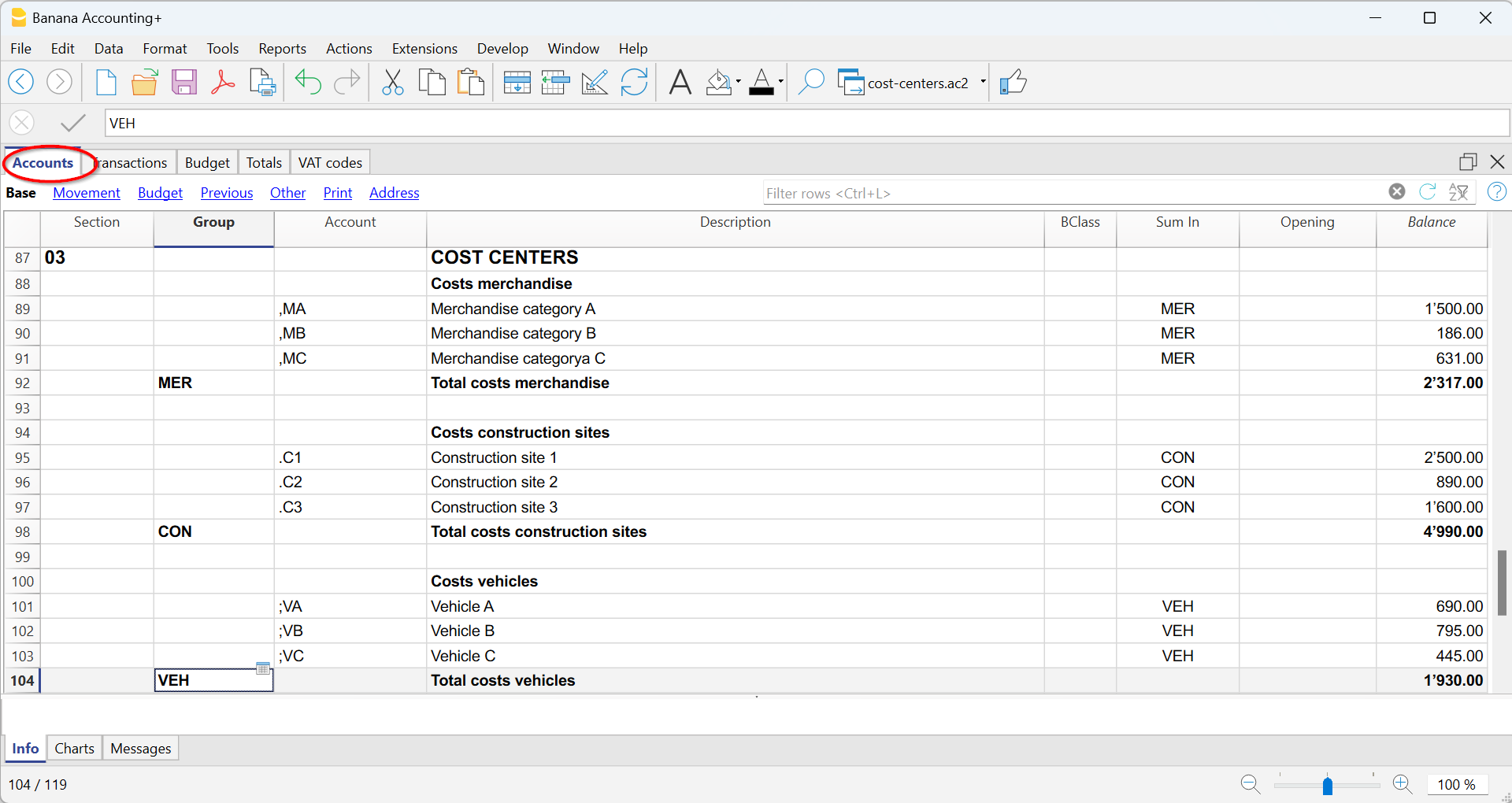

Accounts of cost/profit Centers

The accounts of cost centers are set up in the Accounts table, except for the Cash Manager, where they are set up only in the Categories table.

- The Cost and Profit centers (CC) are accounts, preceded by the ".", "," and ";" signs

- There are three levels of cost centers:

- CC1 preceded by a period "."

- CC2 preceded by a comma ","

- CC3 preceded by a semicolon ";"

- Each level is independent of the other.

- For each level, there can be an unlimited number of cost and profit centers.

- A superior level can be used without using an inferior one.

- Cost center codes can be alphabetic or numeric.

- Cost centers can have their own grouping, different to that of normal accounts.

For the same level of cost centers, subgroups can be created. Be careful not to mix cost center groups with other groups of a different level or with normal accounts or segments. - Each cost and profit center has its own account card, complete with transactions and balances.

- A transaction on the cost center is independent of the account recorded in debit or credit.

It is possible to record on cost centers even if there is no account in the debit and credit column (as in the case of customer/supplier ledger with VAT on cash basis).

Setting up cost centers in the Accounts table

To set up the cost/profit centers in the Accounts table, proceed as follows:

- Create a specific section for the cost centers at the end of the chart of accounts:

- Enter a Section with an asterisk * for a section change and in the Description column, enter the title cost and profit centers.

- In the next row, on the Section column enter 03 and 04 for a profit center and the related description.

- Add rows for the cost center:

- In the Group column, enter the group to which the cost center account is assigned

- In the Account column, Add the cost or profit centers:

- With a preceding dot (.) for transactions in the CC1 column.

- With a comma (,) for bookings in the CC2 column.

- With a semicolon (;) for transactions in the CC3 column.

- In the Gr column, indicate the group into which the amounts are to be totaled.

- In a Multi-currency accounting, the account currency is also specified.

- Add the cost center groups

- In one and the same group, total only for one specific level.

- As for normal accounts, different levels can be created.

VAT amount with cost and profit Centers

In the File and accounting properties command, in the VAT tab you can set the amount of cost centers with the following options:

- Use transaction amount - The amount of the cost center is registered according the transaction amount

- Use amount excluding VAT - The amount of the cost center is registered net of VAT.

- Use amount including VAT - The amount of the cost center is registered including VAT.

Account card cost center

The cost center is treated as any other account, so each cost center has its own account card with account balance and account transactions.

Unlike all other accounts, the cost center account does not have a contra account. If you want to view the contra account we recommend using the Segments.

In order to view all cost center account cards, click on the menu Reports > Account/Category cards > Cost centers (Filter option).

Differences between Cost/Profit Centers and Segments

Cost and profit centers are units where costs or profits are assigned and accumulated with the purpose of monitoring a specific business area (departments, divisions, projects, operational units, or even specific machinery) to improve efficiency and expense management, and they serve an internal control function.

Segments, on the other hand, are assigned to a part of the business activity for external reporting purposes and strategic analysis. They are used to analyze profits and other financial metrics across different business areas, sectors, subsidiaries, projects, markets, customers, and other business dimensions to assess their economic performance

- Cost centers CC3 in Banana Accounting are used to manage Customers and Suppliers with VAT on a cash basis and to manage Members in non-profit organizations.

Differences in Settings and Transactions

In Banana Accounting, the settings and transactions for cost/profit centers and segments differ as follows:

Accounts Table

- Up to 3 cost/profit centers (CC1, CC2, CC3) can be set up, and each can have an unlimited number of cost/profit centers. They are entered in the Account column of the Accounts table with a comma, a period, and a semicolon (respectively, CC1, CC2, CC3) before the account number (or account code).

- Segments can be set up to 10 levels, and each level can have an unlimited number of segments. They are entered in the Account column of the Accounts table, with a double colon (:, ::, :::, etc.) before the code or number that defines the segment.

Transactions Table

- Cost/profit centers are recorded only in the CC1, CC2, CC3 columns of the Cost Centers view. The account is recorded without any punctuation in front.

- To record on the credit side of a cost/profit center, the cost center must be preceded by a minus sign.

Segments are recorded in the Debit and Credit columns, after the main account (e.g., 4000:P1). This means that the amount recorded in the Amount column is assigned to both the 4000 account and the P1 segment. Alternatively, they can be recorded in the specific Segment column of the Accounts table. - Segment amounts follow the debit and credit designation of the accounts.

Reports

- With Cost/Profit Centers, it is not possible to generate a Balance Sheet and an accounting report.

- Using Cost/Profit Centers, you can obtain an account statement for each cost and profit center.

- In the Accounts table, you can view the totalization of the different groups of cost and profit centers.

- With Segments, it is possible to generate a balance sheet with the breakdown of levels, showing the profit or loss for each segment.

- In the Accounts table, the total of the different segment groups is also visible, and you can view the account cards for the various Segments. Accounting reports are also possible.

- With Segments, you can also obtain a multi-level Report that combines accounts and segments, but specific extensions must be used.

Related documents: