In this article

Create a new file

It is generally easier to set out from a preset template, rather than a new empty file.

We therefore recommend that you proceed as follows:

File menu→ New→ Fixed asset register

Choose the template you find available and customize the accounts and groups, according to their amortisable assets.

Set up the Items table

In the Items table, define the list of goods and the groups to which they belong.

Enter other transactions

In the Transactions table you can also enter other rows to change the historical, accounting and fiscal values.

Automatically create amortisation rows

Via the Actions → Create amortisation rows command, the program creates the amortisation rows for the individual assets according to the specified parameters. If necessary, values that have been calculated automatically can be changed.

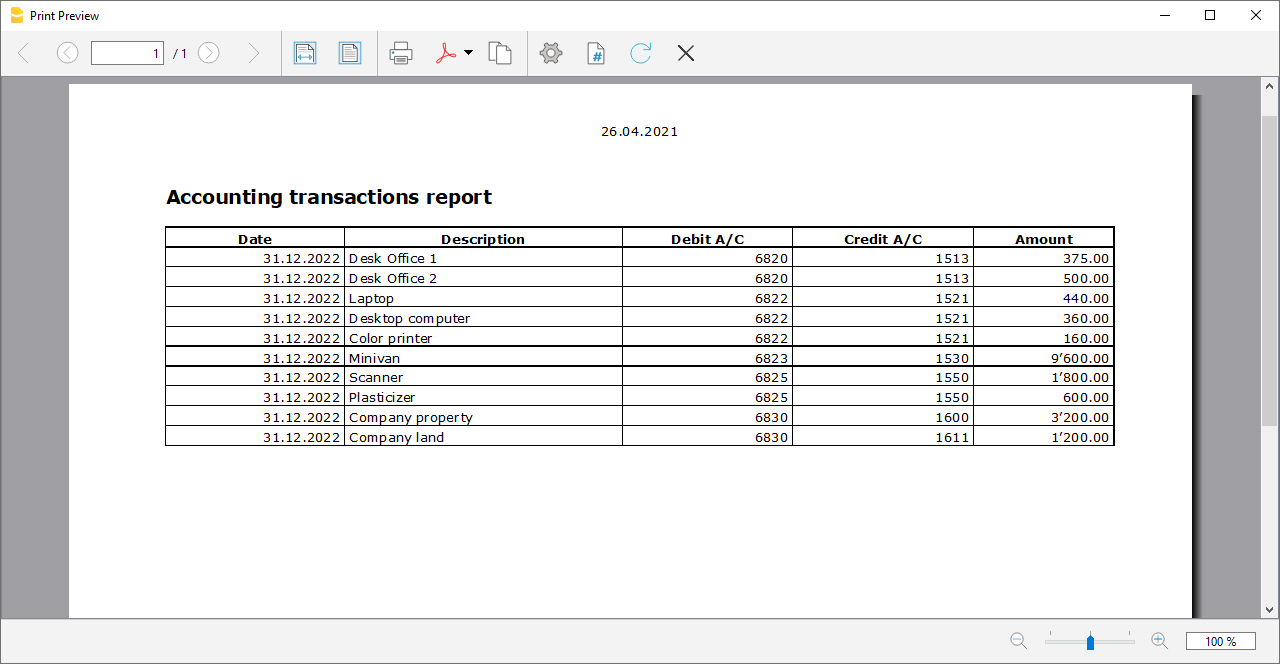

Printouts

You can print, copy and export everything you see on the screen as pdf format as well as access specific prints commands.

Import amortisations into Accounting file

Amortisations can be transferred into the accounting file:

- Select Import into accounting → Transactions command from the Actions menu.

- If another accounting software is used, the amortisation transactions must be resumed manually according to the printouts.

With the Printout accounting transactions, you can check which values will be imported. This printout is also handy, if you use other software, as you can easily enter the transactions into your program.

Historical value of an asset

Several possible steps related to the management of an asset are listed below:

Purchase of a new asset

Let's take the purchase of an expensive computer acting as a corporate server, for example

- The purchase is first recorded in the accounting file of the relative account (computer, machinery, according to the account set up in the assets or in the specific subgroup).

- The purchased good is added as a new item in the amortisable goods register of the Items table, with the purchase value, the amortisation parameters and the account number, present in the assets and the amortisation (contra) account, present in the expenses of the income statement.

- It is advisable to create a group in the Fixed assets register where all the items of the same kind will be totaled in the Items table, (e.g. computer or machine group where the values of the computer or machine A, B, C ... will be totaled) . The total value of the group of items must correspond to the total value of the corresponding specific accounts (computer or machinery present in the accounts. This way it will be possible to check that the values match.

Amortisation at the end of the year (or monthly if desired)

- With the Create amortisation rows command, the program creates a amortisation row for each asset.

If accelerated amortisation is planned for an asset, a second amortisation row is created with an additional amortisation value.

The accelerated amortisation percentage is set in the Items table, Amrt.2% column, relative to the asset whose accelerated amortisation is expected. If the Amrt.2% column is not visible, it must be set up via the Data menu → Columns Setup→ Option AmortisationPercentage2. - The amortisation list is printed.

- Amortisation for the year is imported into Banana Accounting.

- Check that the book value of the Computer or Machinery group in the Items table is identical to that of the computer or machinery accounts of your accounting.

If the values do not match, it means that there have been purchases or disposals that have not been registered.

Asset development

- The following year, equipment for a major expansion of the computer or machinery is purchased .

- The purchase is recorded in the computer or machinery account.

- A row is created in the transactions table of the amortisation register, with the purchase date, the Posting type 11, and the purchase amount entered in the Purchase variation column

- Amortisation at the end of the following year

- Via the Create amortisation rows command you let the program create a amortisation row for each asset.

- If the amortisation amount calculated by the program for the computer or machinery is incorrect, you can adjust the transaction row and enter the correct value.

- The amortisation list is printed.

- Amortisation for the year is imported into Banana Accounting.

- Check that the book value of the Computer or Machinery group in the Items table is identical to that of the computer or machinery accounts of your accounting.