En este artículo

Banana Accounting is a professional, international, and flexible software that adapts to different needs. It is outstanding as a tool for reconstructing economic and financial scenarios.

It is similar to Excel, so it is easy to use and allows you to quickly and effectively import and categorize transactions.

Unlike Excel, Banana Accounting uses the double-entry method, offering the ability to verify data consistency, simplify reconciliation, and significantly reduce errors or discrepancies. It automatically generates balance sheets, income statements, and transaction ledgers, making results easy to understand for those working in financial and legal fields. It also allows you to export the data back to Excel or other tools for further analysis.

This documentation introduces the topic of Forensic Accounting and gives a general overview of how to use Banana Accounting for financial investigations, with links to explore specific topics in more detail.

Forensic accounting

Forensic Accounting is the application of accounting and auditing techniques to legal, judicial, and investigative matters. The goal is to reconstruct the financial truth when data is missing, incomplete, manipulated, or suspicious. Financial investigations often analyze existing accounting records and require a solid understanding of accounting practices. They are usually conducted by experienced accountants, often with specific training.

The popularity of crime investigation series like CSI has led to associating the term "forensic" mainly with crimes such as fraud or money laundering. In reality, it also includes the collection of evidence and investigations in civil matters, such as shareholder or inheritance disputes, or in tax cases like overdue taxes.

Forensic accounting includes all investigative activities related to reconstructing financial situations, such as:

- Legal audits, assessments, financial consulting, damage quantification, and analysis.

- Bankruptcies, company liquidations, and financial restructurings.

- Disputes between partners, inheritance transfers, or checks during due diligence.

- Legal and tax compliance failures.

- Fraud, bankruptcy, or money laundering.

- Monitoring the use of funds, illegal expenses, and corruption.

- Lack of access to or problems with the original IT system.

Accounting for Forensic Accounting

Many financial investigations, such as the search for fraud or excessive withdrawals by managers, are based on existing accounting records. However, there are situations where the accounting must be reconstructed. In these cases, we talk about “accounting for forensic accounting,” meaning accounting used for forensic purposes. A specific accounting system may be necessary when no records exist, when existing ones are suspected to be incomplete or inaccurate, when analyzing a specific business sector, or when reconstructing the financial situation of an entity or person.

Investigations usually focus on specific aspects and do not always require detailed bookkeeping that complies with business or tax needs. Accounting software and ERP systems used in businesses are often too complex and rigid. This is why many turn to Excel, which allows for quick data collection and analysis using filters and tools. Excel is useful but lacks the consistency of accounting software and requires great care, especially when using formulas. Moreover, it does not allow for categorizing transactions based on accounting logic, making reconciliation and identifying missing transactions more difficult.

Excel is very useful for internal analysis, but when companies need to present data to third parties, it is preferable to use standard double-entry accounting reports, such as balance sheets, income statements, and other common reports, whose structure is widely understood. Forensic investigations also require presenting data in a way that is easily understandable to experts and judges, and that allows for verification. In some cases, custom-built tables may be helpful, but whenever possible—even for limited situations—presenting accounts in the standard double-entry format is more professional.

Banana Accounting is particularly suitable for reconstructing financial and accounting situations:

- Fast data import and categorization.

- Based on double-entry accounting, it automatically checks data consistency and reduces the risk of errors or discrepancies.

- Easier communication thanks to the automatic generation of balance sheets, income statements, and account statements.

- Use of accounting data as a base for further analysis and reporting via Excel or other tools.

Data collection and preliminary assessments

When faced with potentially critical situations, it is not advisable to immediately file a complaint or start a lawsuit. It is essential to first get a clearer picture. You need to gather the main elements for a preliminary assessment, with the goal of understanding whether suspicious situations really exist and to estimate their impact. This documentation and the initial analyses form the basis for discussions with legal, business, or tax consultants, helping to evaluate various aspects and decide how to proceed.

Excel can be used, but with Banana Accounting you generally get reliable results in less time. Bank data can be imported quickly and classified according to accounting logic using deterministic rules. In a short time, you can generate a balance sheet and income statement with a clear overview of bank transactions and income/expense categories. Even if it is only a preliminary investigation, having structured information is very useful. Not only does it give a more professional impression of the work done, but the accounting data can also be easily categorized using other criteria or expanded for further insights.

Local data management

Unlike other accounting software that operates only in the cloud, Banana Accounting allows you to choose where to save and store your accounting file. This way, you can keep your data locally without uploading it to cloud systems, avoiding the need for specific authorizations. Accounting records can be easily linked to digital supporting documents stored on your computer, allowing you to quickly and thoroughly check the reason for specific expenses during data analysis.

This feature can be especially useful in the preliminary analysis phase, not only for privacy reasons but also because it makes it easier to share information and reuse data in later stages.

Ideal for various fields

Banana Accounting is not a specialized forensic analysis software, but it can be extremely helpful for professionals such as:

- Accountants and auditors.

- Family offices.

- Fiduciary, financial, and real estate management firms.

- Lawyers and law firms.

- Restructuring specialists.

- Court-appointed or party-appointed technical consultants.

- Inspectors or experts working within legal teams.

- Departments of large organizations.

Similar to Excel

Banana Accounting is similar to Excel, does not require specific training, and offers great flexibility. It is therefore a very useful tool for reconstructing financial situations and managing accounting for forensic analysis.

- The accounting is a file that contains multiple tables.

- The tables are similar to Excel sheets: you can move freely, insert and select cells, copy and paste.

- You can create as many files as you want, each with its own settings.

- The file can be saved and moved wherever you want.

Try Banana Accounting with the WebApp

If you want to see how easy it is to collect and categorize accounting data:

- See how to get started with double-entry accounting, including a short explanatory video.

- Try the Banana Accounting WebApp, which runs directly in your browser (no registration required):

it’s the fastest way to test, set up an accounting file, and start entering data.

These links launch the WebApp and open one of the universal templates, not tied to any specific country:

To manage accounting regularly and completely, we recommend using the desktop version of Banana Accounting (to download and install on your computer). The Free plan of Banana Accounting lets you create accounting files and use most features, with a saving limit of 70 transactions. It's the ideal way to get started and see if the tool fits your needs.

Our customer service is available for more information. Our specialists can also advise you on how to proceed with data recovery or other specific needs.

Reconstructing the financial situation

Below you’ll find an explanation of how to use Banana Accounting to reconstruct accounting records for forensic accounting activities.

Keep in mind that reconstruction can be done in two phases:

- Preliminary data collection and analysis to assess the situation.

- Data collection and analysis with more specific goals.

The financial reconstruction, whether preliminary or final, is generally structured as follows:

- Defining the objectives of the investigation.

- Collecting documents, bank statements, and other financial information.

- Re-entering transactions into an accounting system, completing and categorizing them.

- Verifying, evaluating, and analyzing the data.

- Presenting the financial information.

- Economic and legal evaluations, with preparation of reports.

Create accounting starting from a template

What makes Banana Accounting particularly suitable for forensic accounting is that it is a professional international accounting tool, not designed solely for corporate accounting. It is modular, so you can have double-entry accounting setups for foundations, associations, individuals, in different currencies and languages. For simpler situations, you can also use the income & expense method, which can still manage the balance sheet.

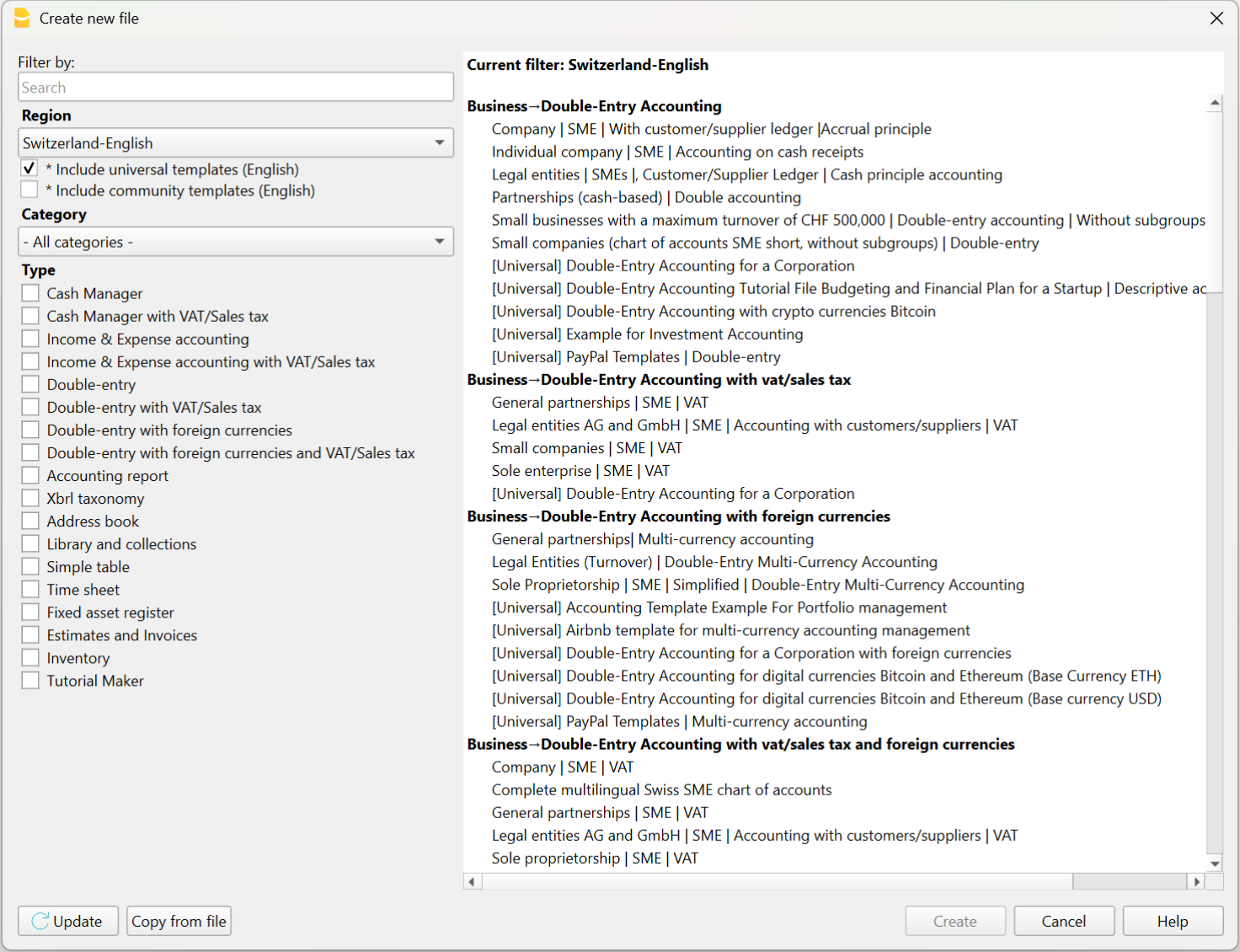

To start a new accounting file, use a preconfigured template for a specific purpose:

- Menu File > New.

A dialog will appear where you can choose a template by region and type of accounting. - Templates for specific regions.

These are set up according to national accounting standards.

The chart of accounts usually has numerical account IDs. - Universal templates.

These are for more general use. The account IDs are usually descriptive text.

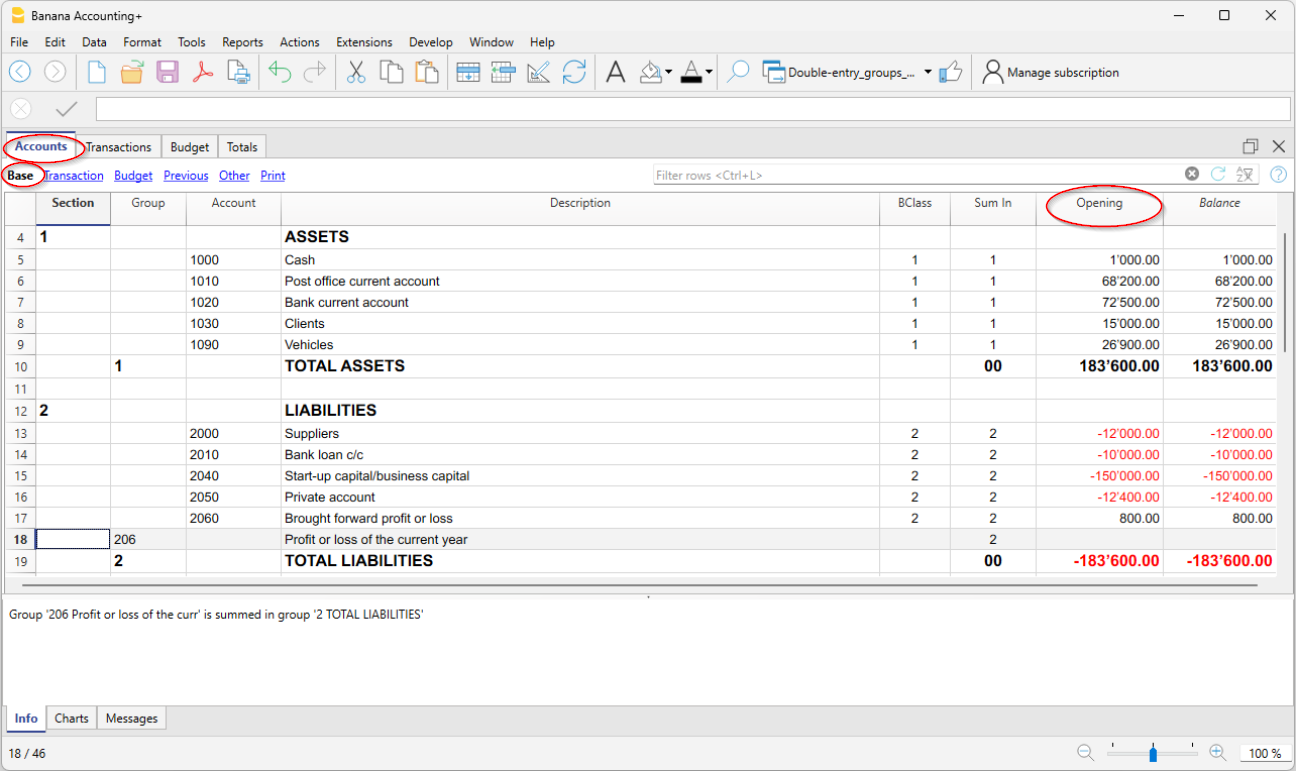

Chart of accounts and opening balances

After choosing the template that best suits your needs, you will need to customize the Accounts table by modifying, adding, or removing accounts. You can adjust the chart of accounts and grouping structure at any time.

You can create account plans with grouping structures that reflect those used in existing accounting systems managed with other software.

If you're reconstructing an accounting file, you will likely need to enter opening balances using the “Opening” column in the Accounts table.

Note that in Banana Accounting’s double-entry system, amounts are displayed according to the logic of accounting programs, so Debit amounts are positive and Credit amounts are negative. Opening balances in Credit must therefore be entered as negative values.

Entering and importing transactions

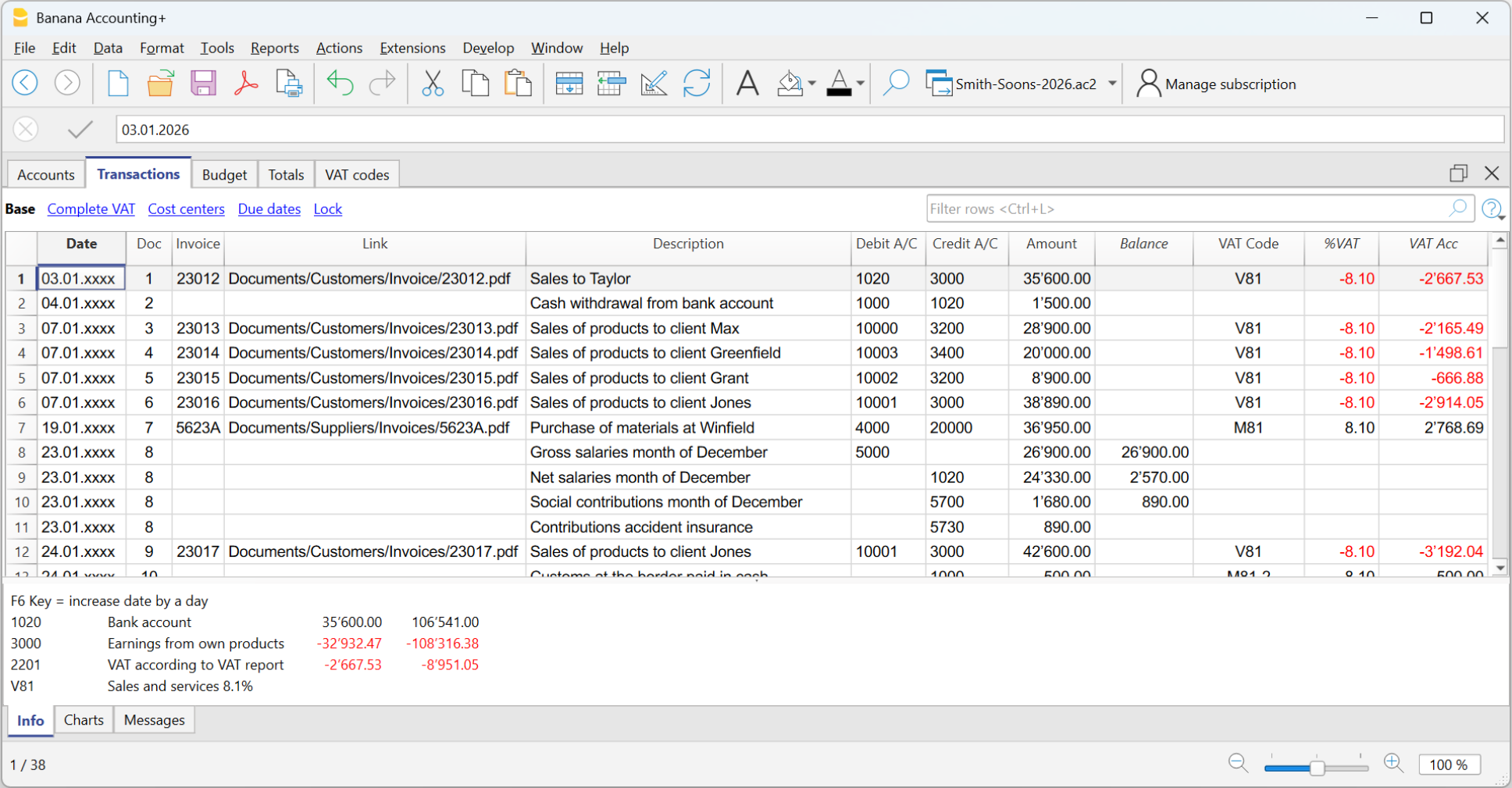

In the Transactions table you enter accounting transactions:

- You can enter and edit them manually.

- In the Recurring Transactions table you can set up repeating entries.

- You can copy and paste from Excel or other programs. See Importing data from other programs.

- You can import from CSV or other file formats.

- You can import digital bank statements.

- Several import extensions are available.

- You can create Import Rules that automatically complete the offset account and other elements.

In just a short time, your accounting is done! When you enter or import transactions, the software will alert you to any errors or differences.

Banana Accounting was designed for small businesses, but in theory, there are no limits to the number of transactions or accounts you can manage. The software keeps all data in memory, so performance depends on your computer’s RAM and processor. Some clients successfully manage very large accounting files, with tens of thousands of accounts and hundreds of thousands of entries.

Automatic transaction categorization

Banana Accounting provides a deterministic rule system, configured by the accountant, to automatically categorize and complete transactions imported from bank statements. Thanks to these rules, you can quickly process large volumes of data. The applied rules are always visible in the Recurring Transactions table, where they can be printed and reviewed by auditors. Still, it is good practice to always check individual account statements.

There are many tools that digitize paper documents and, through artificial intelligence, extract information, analyze, and categorize content based on probabilistic logic. These tools can be very helpful and save time. However, it's important to note that categorization based on probabilistic logic is not a reliable source and always requires thorough verification.

AI-based tools often allow data export in CSV or Excel format, so you can easily import the data into Banana Accounting for manual review, corrections, and completion.

Review and add additional information

Once transactions are imported, you can review, edit, and complete them manually with the information you need:

- You can highlight and color rows, bold them, or change font size.

- Using the Data > Arrange Columns menu:

- You can show pre-configured columns (e.g. Notes, Links),

- You can add new types of columns.

- You can add links to supporting digital documents.

- You can use:

- Cost and profit centers – to categorize transactions in different ways.

- Segments – to divide activity by areas, branches, or other categories.

Filtering and other useful features

There are many useful features that allow you to analyze and complete data quickly, including:

- The Balance column in the Transactions table indicates if there is an imbalance between Debit and Credit, due to account coding errors or unbalanced multi-account entries.

- The Temporary row filter function shows only the rows containing a specific text. There is also advanced syntax available for more powerful searches.

When the filter is active, you can edit transaction content, select, copy, and paste cells just like in Excel. - With Temporary row sorting, you can view rows in ascending or descending order based on a column. You can remove the temporary sort to return to the original order.

- Find and replace.

- The Copy rows command copies the selection with column headers. When you paste into Excel, the headers are already included so you can easily apply filters or create pivot tables.

- The Check accounting tool rechecks the chart of accounts and all entries and alerts you if there are errors or discrepancies.

Balance sheet and Account cards

The main advantage of Banana Accounting compared to Excel is that, once transactions are entered, you automatically get the Balance Sheet, the Income Statement, and the account cards for each account.

In the Accounts table, you have an immediate view of all accounts and groups, with updated movements and balances. This way you instantly see the current situation of your Balance Sheet and Income Statement. Of course, it’s essential to verify that bank balances match those in your accounting.

Additional accounting features

At any time, you can adapt your accounting setup and add or remove features. See:

Extensions

Banana Accounting, like Excel, provides a programming language that allows you to perform all kinds of processing.

It is commonly used to create custom reports, but it can also be used, for example, to create import extensions or modify existing data:

- Create extensions for Banana Accounting

- Information on importing data into Banana Accounting

- Information on exporting data from Banana Accounting

We have also created ChatGPT assistants to help you create extensions for generating reports. The extensions run locally in Banana, so you don’t need to send your data to the cloud AI assistant.