In this article

Accounts constitute the main structure on which all accounting is created. If you open one of the templates included in Banana Accounting, the accounts are already present in the Accounts table and contain all the settings needed to instantly record the transactions in the Transactions table.

The accounts in the Accounts table are divided as follows:

- Balance Sheet Accounts - Assets and Liabilities.

- Profit and Loss Accounts - Expenses and Income.

- Customer and Supplier master Data

- Account Cost and Profit centers - for managing projects or keeping the Customers / Suppliers register

- Segment Accounts - for managing business segments or branches.

The accounts' BClass

The BClass is essential for the correct total of amounts and balances. In the BClass column, each account must be assigned one of the following values, regardless of the account number or group to which it belongs:

- 1 - for Assets

- 2 - for Liabilities (in negative and in red)

- 3 - for Expenses

- 4 - for Income (in negative and in red).

Groups and subgroups do not have BClass, so the cell of the relevant column remains empty.

Revenues in Negative

In Banana Accounting, revenues appear with a negative sign in the Accounts table because the program follows the logic of double-entry bookkeeping:

- Logic of Signs

- Asset and Expense accounts increase in Debit → positive values.

- Liability, Equity, and Revenue accounts increase in Credit → negative values.

Therefore, revenues are negative because they increase in Credit. This does not mean that the company is making a loss; it simply reflects Banana’s way of keeping consistency between Debit and Credit.

- Impact on the Financial Statements

- In the Profit and Loss Statement, Banana calculates the difference: Revenues – Expenses.

- Even though revenues are recorded as negative in the table, in the reports they are shown as positive values, so the final result (profit or loss) is intuitive.

- Practical Advantage

- This method ensures that:

- The total of Debits = Credits.

- Ambiguity in sign usage is avoided in the transactions.

- The generated reports (Balance Sheet, Profit and Loss Statement, Cash Flow Statement) are accurate and easy to read for the user.

For more information, see the page Mathematical Basics.

BClass of off-balance sheet accounts

Off-balance sheet accounts are those whose amounts and balances do not fall within the totals of the balance sheet and income statement accounts. They are accounts that are entered in the chart of accounts to view guarantees and conditional commitments.

Off-balance sheet accounts must have the following BClass:

- 5 for Off Balance Sheet Assets

- 6 for Off Balance Sheet Liabilities

- 7 - 10 - for other Off Balance Sheet accounts

Add a new account or category

In the Accounts table, Base view, you can add new accounts (or new categories in the Income / Expense accounting).

Before adding an account or a category it is important to know:

- The account or category number can consist of numbers, letters and separator characters.

- There cannot be multiple accounts or categories with the same number.

- Each account must have a grouping (Gr) and a class (BClass).

To add an account or a category proceed as follows:

- Go to the row preceding the one where the new account or category will be inserted.

- Add a row with the Edit > Insert row command

- Fill in the respective columns the account or category number, the description, the BClass (1 for assets, 2 for liabilities, 3 for costs and 4 for revenues - only for double-entry accounting), the number of Gr which must be the same as the one entered for the accounts belonging to the same Group.

Warning: if you enter a transaction with an account that does not exist in the chart of accounts and only after creating the new account, you will initially receive an error message; to eliminate it, it is necessary to recalculate the accounting with the command Shift + F9 or through the menu Actions > Recalculate totals.

Rename an account

This is a very useful function because it allows you to change an account and simultaneously have it replaced in the Transactions table. It avoids having to change the account for each transaction that contained the previous account. In addition, it also allows you to rename a group or a VAT code.

- In the Accounts table go to the Account / Category or Group column, or to the VAT Code column of the VAT Codes table.

- Use the Data > Rename command.

- Indicate the new account number, group, category or VAT code.

The program automatically updates the Transactions table with the new VAT number or code.

Delete an account

If an accounting is already started, before deleting an account, make sure that it has not been used in the Transactions table or that it does not have an opening balance.

- Locate the row of the account that is to be deleted.

- Use the command Edit > Delete rows command.

After deleting an account or a category it is advisable to use the Actions > Recalculate totals command. If the deleted account or category is in use in transactions, the program reports an error message.

Opening balances of the accounts

The opening balance of an account is shown in the Opening column.

- Debit (Asset) balances are shown normally.

- Credit (Liabilities) balances are indicated with a minus sign (in negative) in front of the amount

- Typically, only the opening balances of the Asset and Liabilities accounts are indicated.

To carry over the opening balances automatically to the following year, see the Create New Year lesson.

Further details on opening balances are available on the Opening balances page.

Differences in opening balances

To have correct accounting, the total of the opening debit balances must match the total of the opening credit balances, so that there are no differences.

If the total does not correspond there will be a notification of the difference between the initial balances in the Info window.

If any account numbers have been changed and there are differences, perform the Full Accounting Recalculation.

When using Banana Accounting for the first time, to create the opening balance, it is necessary to manually enter the opening balances (Opening column), making sure to enter the balances of the Liabilities with the minus sign (-) in front of the amount.

Further details on opening balances are available on the:

- Differences in opening balances (Double-entry accounting).

- Differences in opening balances (Multi-currency accounting).

Customer and Supplier accounts

Customer and supplier accounts can be entered directly in the Balance Sheet sections, listing the accounts for each customer and supplier and creating two distinct totaling groups, one in the Assets for customers, the other in the Liabilities for suppliers. If the list of customers and suppliers is very extensive, it is possible to create a customers / suppliers ledger at the end of the chart of accounts.

There are several setting options:

- Setting up directly in the Financial Statements, listing customers and suppliers, respectively in the Assets and Liabilities.

- Setting up with the customers / suppliers register, at the end of the accounting plan, with the totalization reported in the financial statements. This setting is ideal for those who manage VAT with the accrual method.

- Setting up with cost and profit centers, at the end of the chart of accounts, without totaling in the balance sheet.

This setting is ideal for those who manage VAT with the cash method.

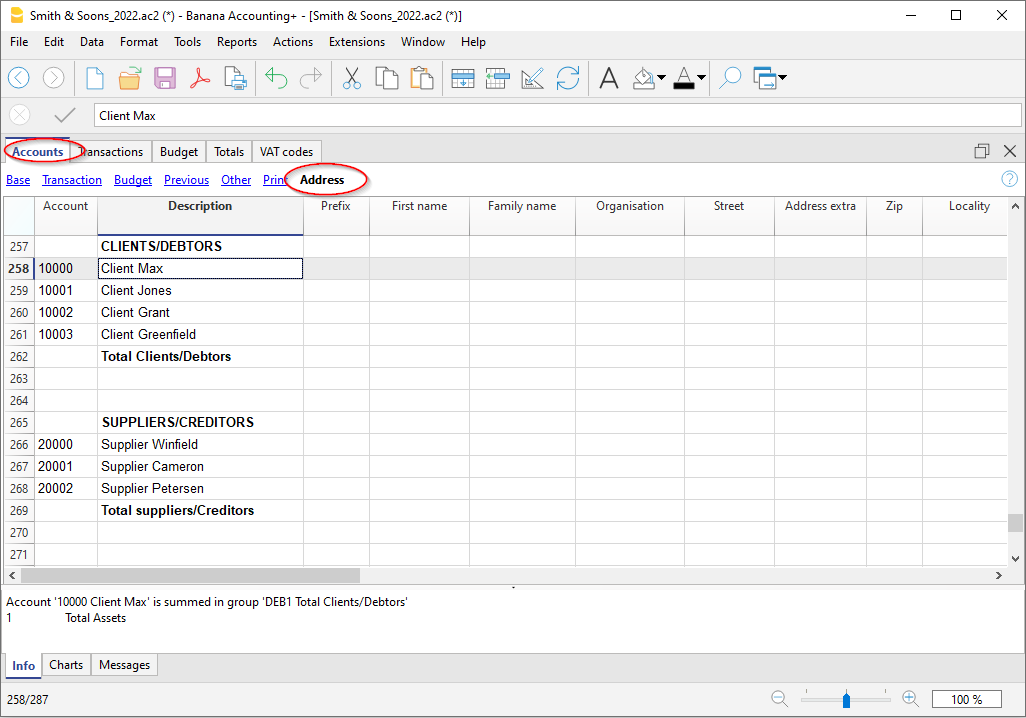

Accounts with addresses

In the Accounts table, Address view, there are columns to enter the addresses of customers, suppliers or members. If the columns of the address view are missing, you can add them:

The address columns are essential to be able to manage billing, reminders and the control of payments and collections.

More details are available on the Address page.

The Cost and Profit Centers accounts

They are ideal for project management, have precise details on a specific event or for any other need.

- Cost and profit centers

They are accounts that have the number preceded by a period ".", by a comma "," or by a semicolon ";" and are used to attribute the transaction amounts to additional accounts as well, with respect to the basic accounting ones.

All the amounts attributed to the cost and profit centers are separate from the Balance Sheet and the Income Statement and are entirely for information purposes.

The Segment Accounts

To have financial statements also of different sectors or activities in which the company operates.

- Segments

They are similar to sub-accounts that have the number preceded by a colon ":" and are used to attribute the accounting operations to sub-categories of accounts.