In this article

▶ Video: How to start a Cash Manager (Cash book) file. Learn how to enter and monitor the movements of your money of your cash account.

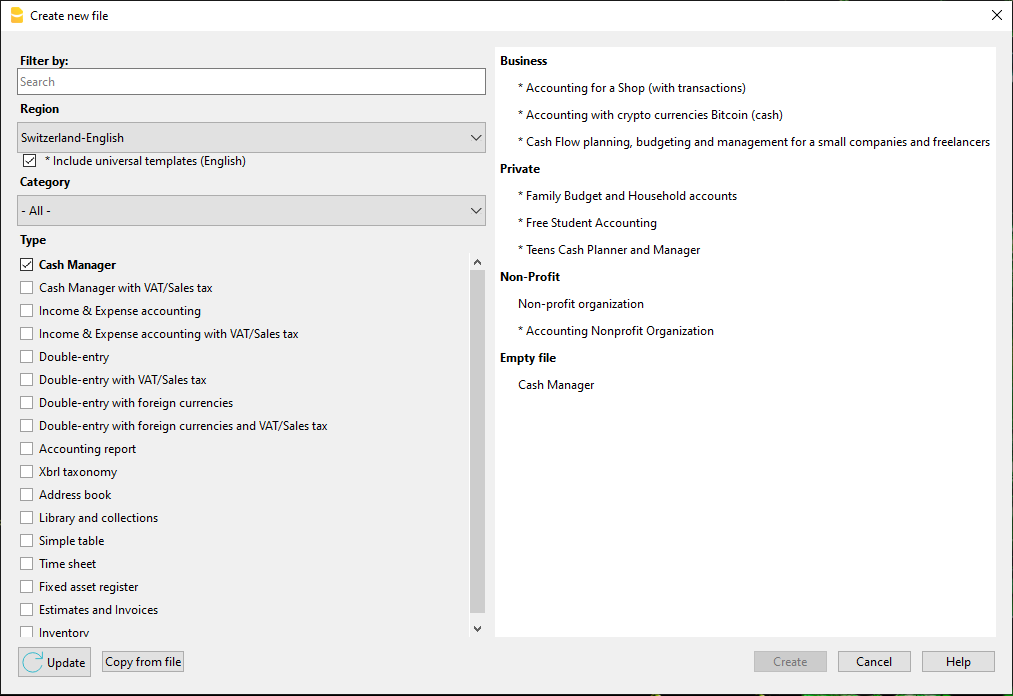

Creating an accounting file, starting from a template

Here is how to start choosing a template directly from the program:

- File menu → New command

- Select the Region, the category and the accounting type (with or without VAT).

- From the list of the templates that appears, select the template that is closest to your own needs.

- Click on the Create button.

You can search for a template by entering a keyword in the Search box; the program displays the templates containing the keyword entered.

It is equally possible to start from a blank file, by activating the Create blank file option. In any case, in order to facilitate the start and avoid grouping errors, we recommend that you always start from an existing template

Further information is available on the Create New File page.

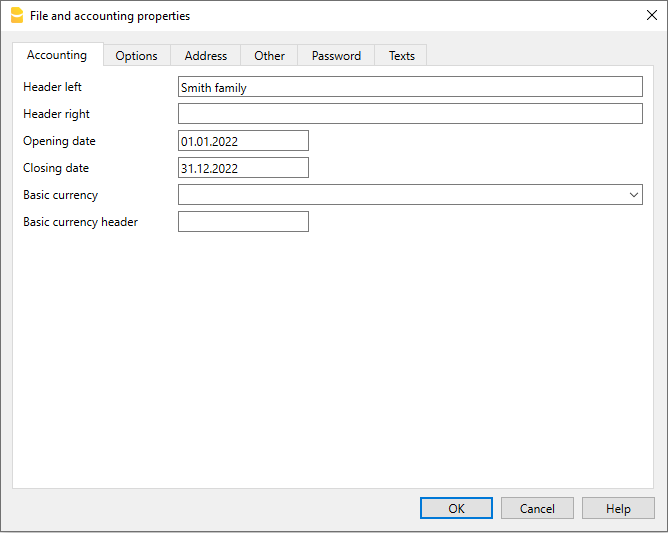

Setting up the File properties

Set up your own data from the File and Accounting properties command and save with your own file name.

Save to disk

Via the File→ Save As command, save the data and also assign a name to the file. The typical save dialog of your operating system is displayed.

- It is advisable to use the name of the company followed by the year "Company-20xx.ac2" to distinguish it from other accounting files.

- You can keep as many accounting files as you need and each one will have its own name.

- You can choose the path or support you want (save on drive, USB or cloud).

If you also expect to have documents linked to the current year's accounts, it is suggested that you create a separate directory for each accounting year where all the files are to be grouped. Please also visit the Organizing your files page.

Entering the opening balance of the account

Enter the account you wish to manage in the Accounts table of the Cash Manager and the initial amount in the Opening column. At the start of a new year, using the menu Actions → Create New Year ... command will automatically generate the opening balances to be carried over.

Only one account can be entered: if you need to manage more than one you need to use the Income / Expenses accounting.

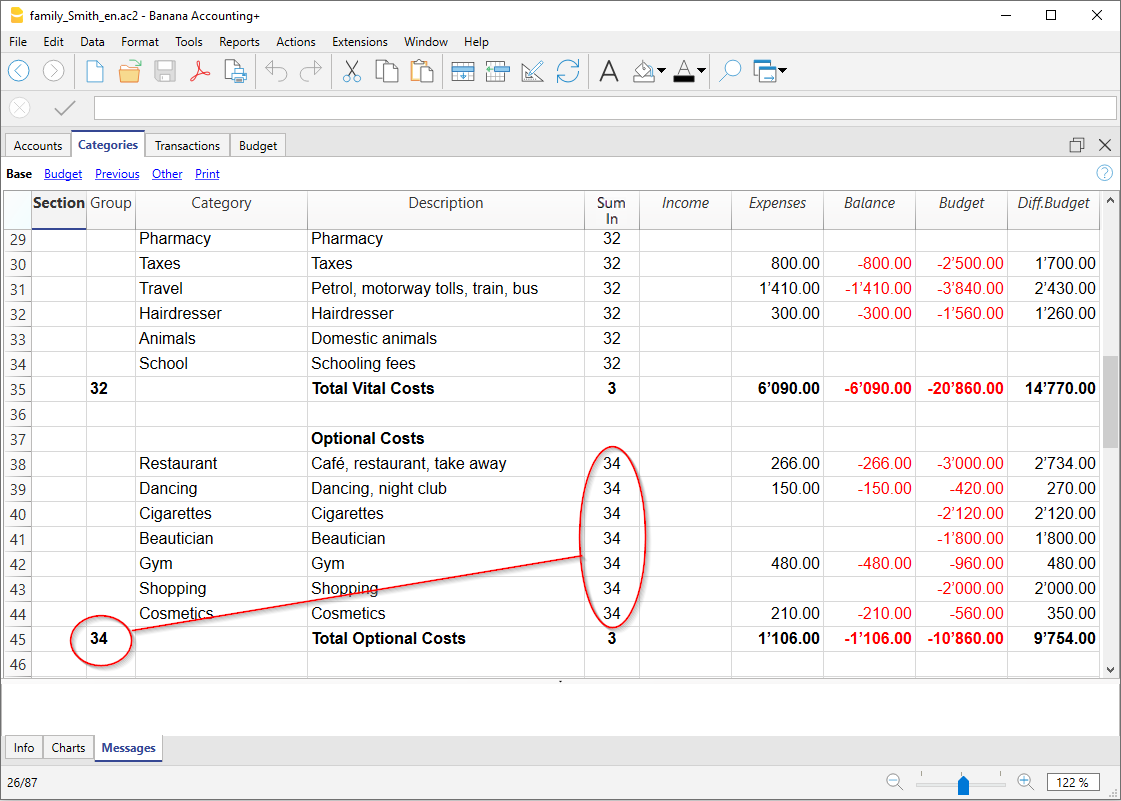

Customising the Categories table

In the Categories table, customize the income and expense categories, according to your own needs. It is possible to:

- Change the category numbers

- Change the description

- Add or delete categories

- Add or delete subgroups

All balances of the categories will determine the result of the accounting year (profit or loss) and must therefore not contain any balances at the start of the year.

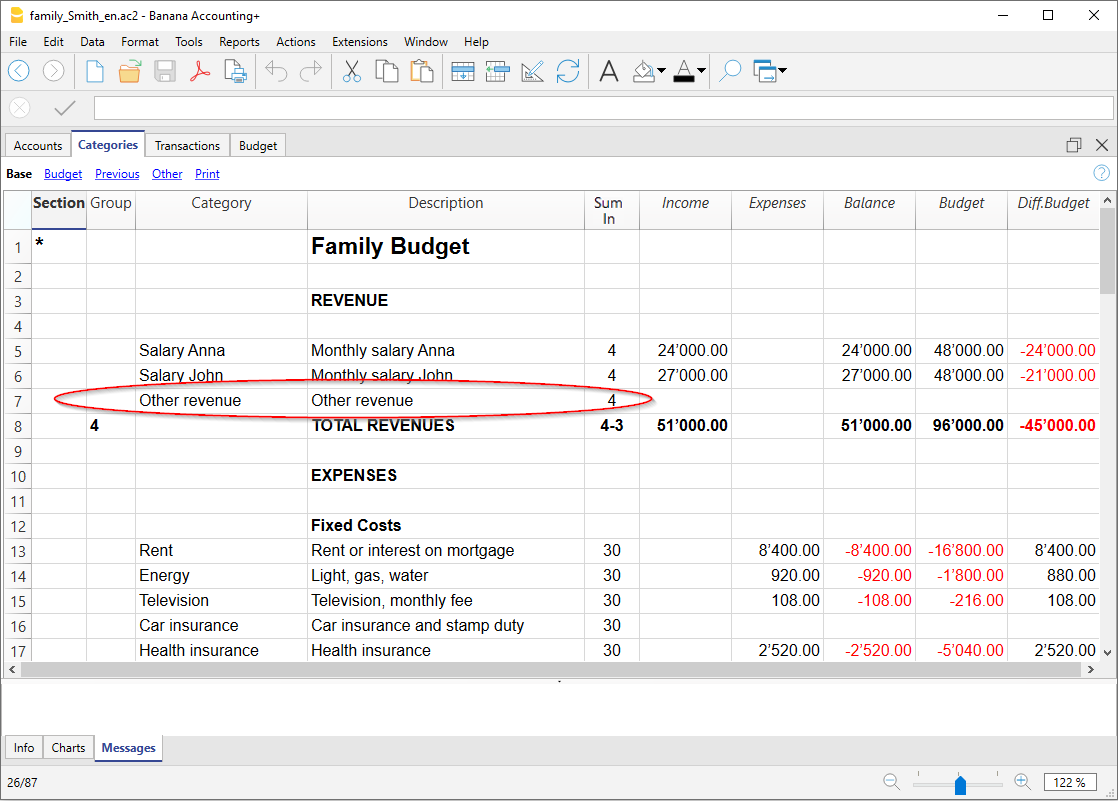

Add new categories

If new categories need to be added in an already existing group, proceed as follows:

- Add an empty row (Edit menu → Add rows ) before the Total of the Group

- Enter the category number or code in the Category column

- Enter the category description

- In the Sum in column add the same grouping code or number as the other categories belonging to the Group Total

Add subgroups

To add new subgroups, proceed as follows:

- Add an empty row (Edit menu → Add rows ... command) where you wish to add a new subgroup

- In the last empty row, in the Group column, enter a number or code for the totalisation group (in our example 31 - Other income)

- Enter the description that identifies the new subgroup

- In the Sum in column, enter the totalisation group (in our example 3 - Total sales).

Delete categories or subgroups

Select the categories or subgroups you wish to delete and proceed with in the Edit menu → Delete rows ... command.

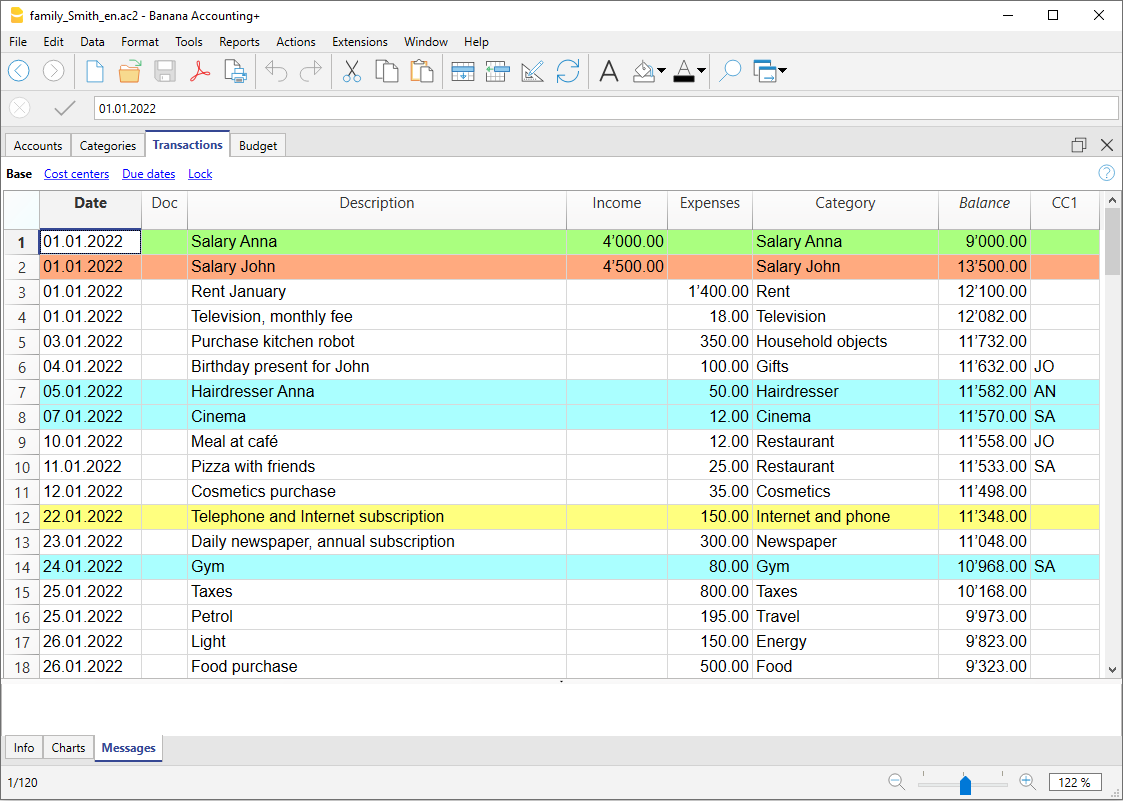

Transactions

In the Transactions table, income and expense transactions are entered, indicating the category to which the income or expense is attributed.

Speeding up the recording of the transactions

In order to speed up the recording of your transactions, you can use:

- The Smart fill function that allows the automatic auto-complete of data that have already been entered at an earlier date.

- The Recurring transactions function (Actions menu), used to memorize recurring transactions into a separate table.

- Import of your bank or postal account statement.

Make visible the Balance column in the Transactions table

The new Balance column is a very useful feature: it allows you to immediately spot possible differences.

The Balance column is not visible by default: you can make it visible via the Data → Columns setup menu.

- Watch the Video: Using the Balance column to spot differences

- More information on the Balance column

Transactions with VAT

In order to enter transactions with VAT please proceed as follows:

- from the File menu, choose New command and choose as Type the Cash Manager with VAT/Sales tax

- Choose one of the existing templates for your nation.

In order to enter transactions with VAT, please refer to the Transactions page.

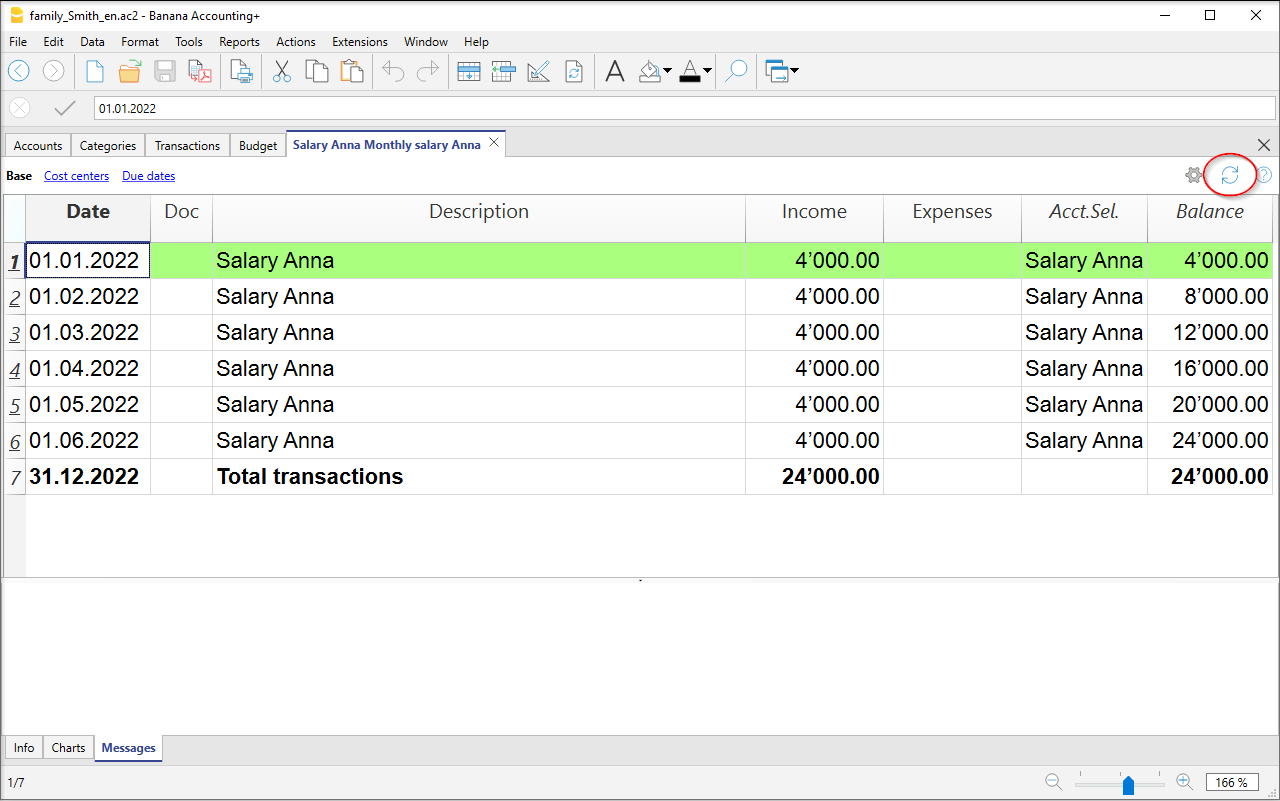

The Category or Group card

The Category or Group card allows you to have a complete list of accounting entries relating to the same category or group.

- To open an category or group card you click once on the account number cell and then click once on the small blue arrow appearing in the upper right corner of the cell.

- To open multiple category or group cards you must select the Account cards command from Reports menu.

- To update the category or group cards, following changes in the Transactions table, you must click on the two circular arrows symbol, located at the top right corner of the account card.

Account cards per period

To open an category cards with account balances referring to a predefined period, click on the Reports menu, Account/Category cards ...command and click Period selected in the Period tab to insert your selected period. Visit the Period page for further information.

Print the Category card

To print a Category card, open it from any table (Accounts or Transactions) and start printing from the File menu.

To print out several or all the Account/category cards , click Reports menu, select Account/category cards and select the accounts/categories you wish to print. The filter in the window allows you to select automatic selection of all categories, cost centers, segments, groups etc ... Visit the Account Cards page for further information.

Enhanced Statement

To view the Enhanced Statement and the Enhanced Statement with groups, choose the Report menu → Enhanced statement or Enhanced statement with groups command. You can also obtain statements by period.

- The Enhanced statement displays all accounts and categories without any subgroups

- The Enhanced statement with groups displays all accounts and categories also with subgroups

Archive data in PDF format

At the end of the year, when the accounting is done, corrected and revised, you can store all accounting data with the Create PDF dossier command from the File menu.

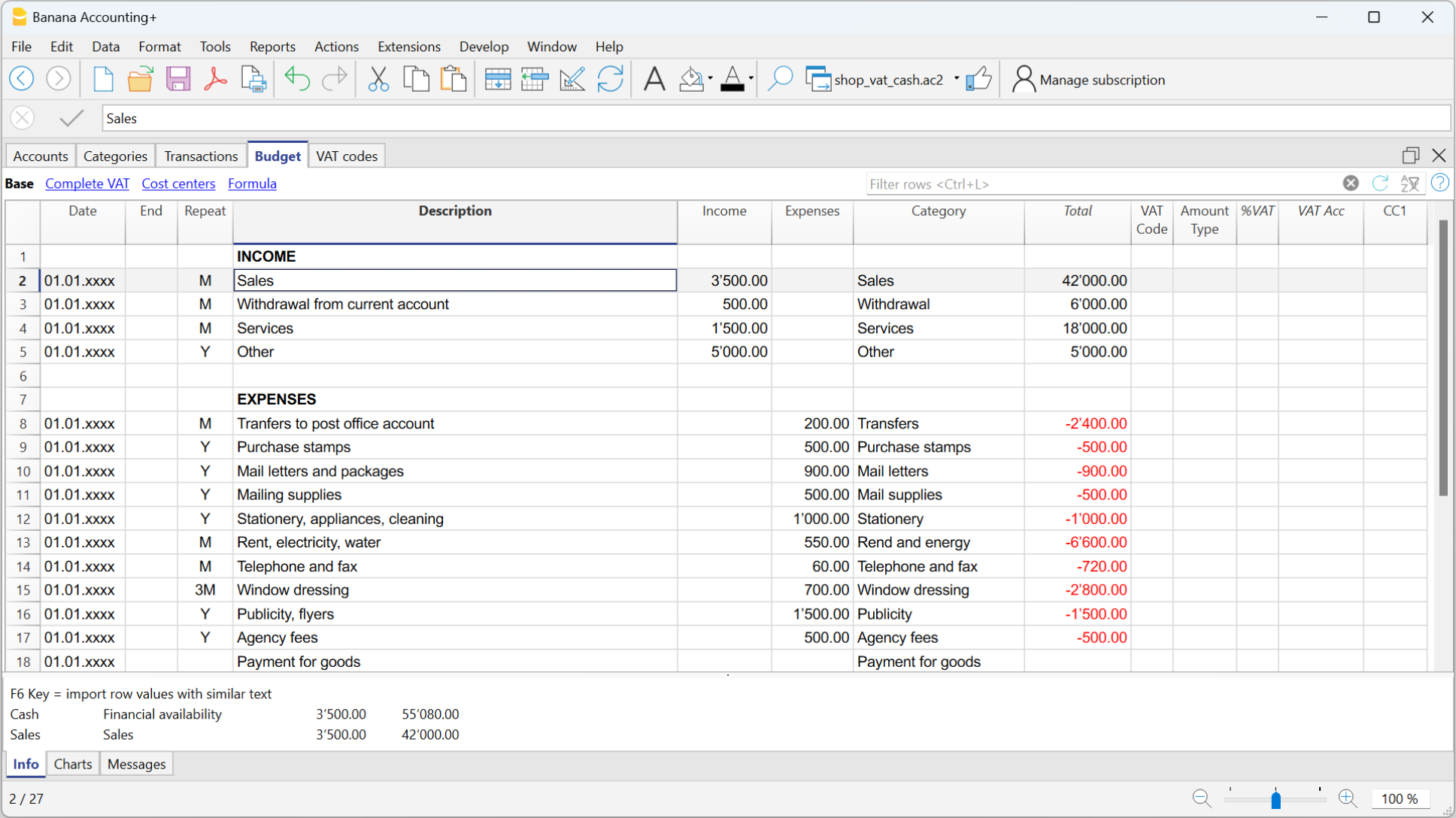

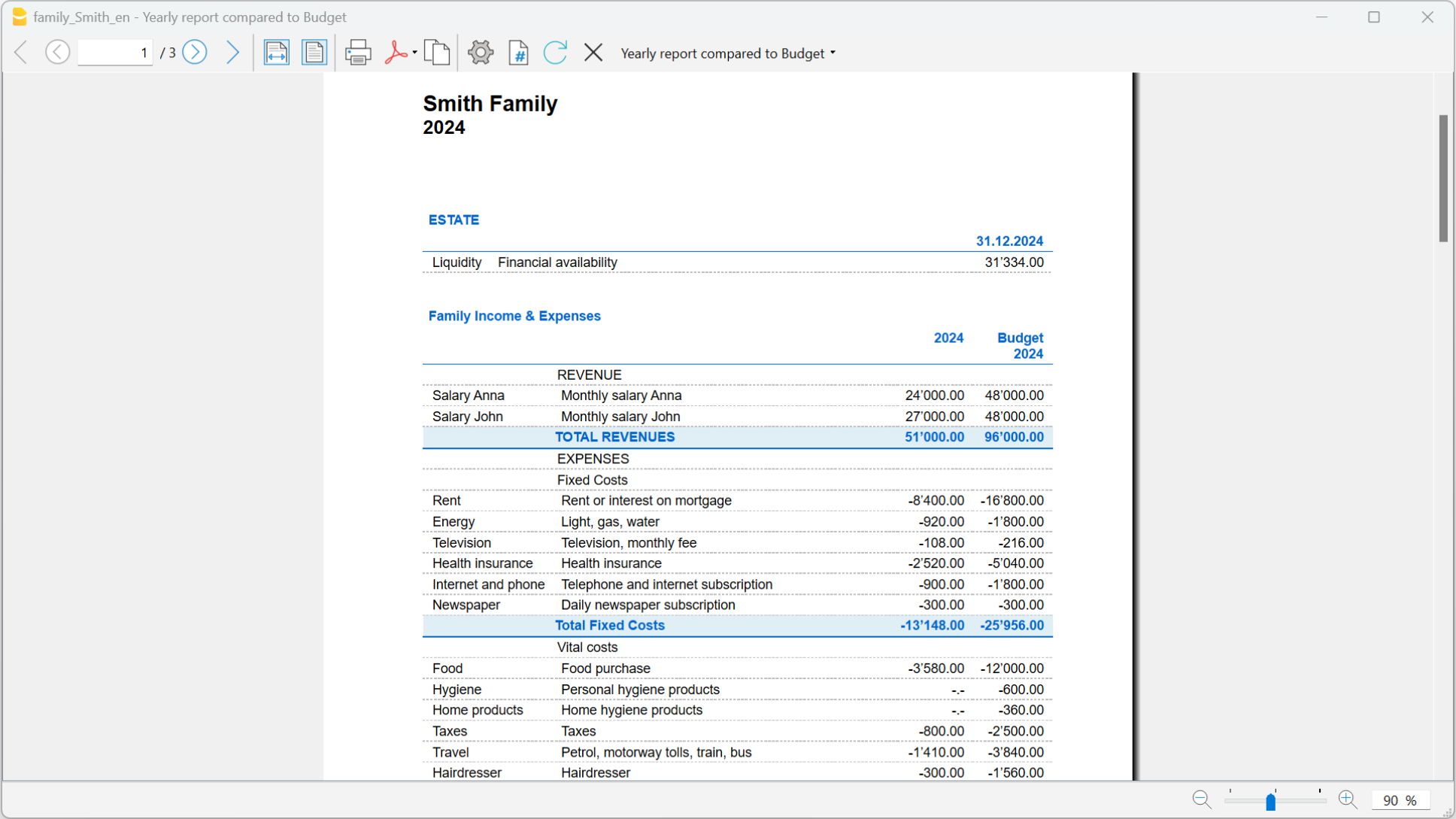

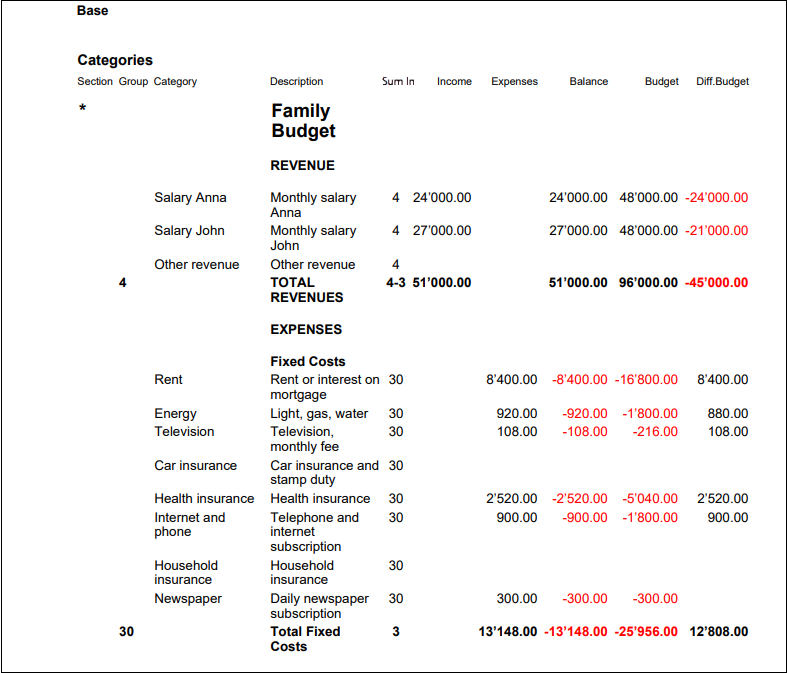

The Budget

Before starting your accounting year, you can create a budget with your assumed expenses and revenue, in order to have control over the financial and economic situation of your company.

The budget can be set in two different ways:

- From the Budget column of the Categories table. For each account the yearly budget is indicated.

In this case, when you process the Budget from the Reports menu, Enhanced statement with groups command, the Budget column shows the amounts that relate to the entire year. - From the Budget table, that you need to manually activate using the Tools menu → Add new functionalities → Add Budget table command.

In this table all estimates are entered as budget transactions, either income or expenses. If you activate this table, the Budget column of the Accounts table is automatically deactivated.

In the Budget table you can setup a detailed budget that takes into account possible variations during the year and in different periods of the year.